Classifying footwear for import and export

Get help to classify footwear and parts of footwear for import and export.

This guide refers to chapters and headings in the UK Integrated Online Tariff. For Northern Ireland imports, or if this guide does not include your item, read the ‘more information section’ in this guide.

Chapter 64 includes footwear, soles and uppers made of:

- textiles

- leather

- rubber or plastics

This includes woven fabrics and other textile products with an external layer of visible rubber or plastics.

Footwear is classified by:

- material of the upper and outer sole — except asbestos

- type and purpose

- whether the shoe covers the ankle

- shoe size, whether the insole length is over or under 24 centimetres (cm) — it does not consider whether the footwear is for an adult or child

- heel height

- intended wearer

Uppers

The upper is the part of footwear above the sole. It covers the sides and top of the foot. It does not include the tongue or any collar padding.

The upper is determined by the material covering the greatest external surface area. Add-ons and reinforcements are not considered, like:

- ankle patches

- edging

- ornamentation

- buckles

- tabs

- eyelet stays

Reinforcements

Reinforcements are parts attached to the outside of the upper for strength. These are made of material suitable for uppers, like leather or plastic patches — not lining material.

If the attachment covers only a small area of lining material, it’s treated as part of the upper, and not a reinforcement.

To find out which parts are reinforcements or form the upper, you may need to cut the external material to see what’s under it.

Outer sole

The outer sole is the part of footwear that touches the ground in use, except any separate heel attached.

To decide what the outer sole is made of, you need to find out what material has the most contact with the ground. Ignore add-ons like:

- spikes

- bars

- nails

- protectors

Footwear made from leather and textile

To find the correct commodity code for certain footwear items, you need to know the main material of the upper.

Some shoes are made from a mix of textile, leather and lining material. The upper is determined by the material covering the greatest external surface area. Lining material is not considered to be a material suitable for uppers.

Where the material with the most external area of the upper is:

- leather — footwear is classified under heading 6403

- textile — footwear is classified under heading 6404

Check under all the leather sections of a shoe before decide what the main material is. This guidance can help you check leather from textile for each section of the shoe.

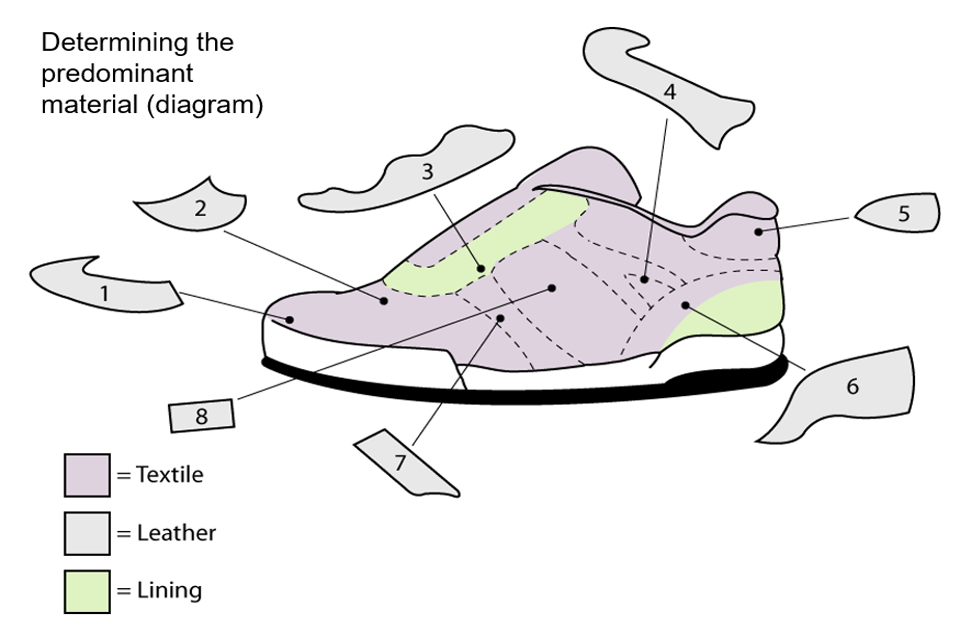

Shoe with an upper mostly made of textile

Diagram showing parts of a trainer, labelled as follows: 1. Toe cap 2. Toe vamp 3. Eye stay 4. Section overlapping the eye stay 5. Back section 6. Heel counter 7. Side section 8. Logo

Toe caps and vamps

If you remove the leather toe cap and vamp and find textile material under it:

- the textile is considered the viable upper

- the toe cap and vamp are treated as reinforcements

The eye stay and heel counter

The eye stay and heel counter are considered viable uppers if you remove them and find lining material with only a small section of textile.

When the textile does not extend under the whole leather eye stay, the leather section is considered the viable upper.

If you remove the leather section (which sometimes overlaps with the eye stay) and find it’s sewn on top of textile, the textile must be considered the viable upper.

If the leather section overlaps the eye stay, it cannot also be counted as the viable upper. As the eye stay has already been considered a viable upper. The leather section is treated as reinforcement.

Back section

If you remove the small leather section at the back of the shoe and find textile under it:

- the textile is considered the viable upper

- the leather section is treated as reinforcement

Side sections and logo

If you remove the leather side sections and the logo and find textile under it:

- the textile is considered the viable upper

- the leather sections and logo are treated as reinforcements

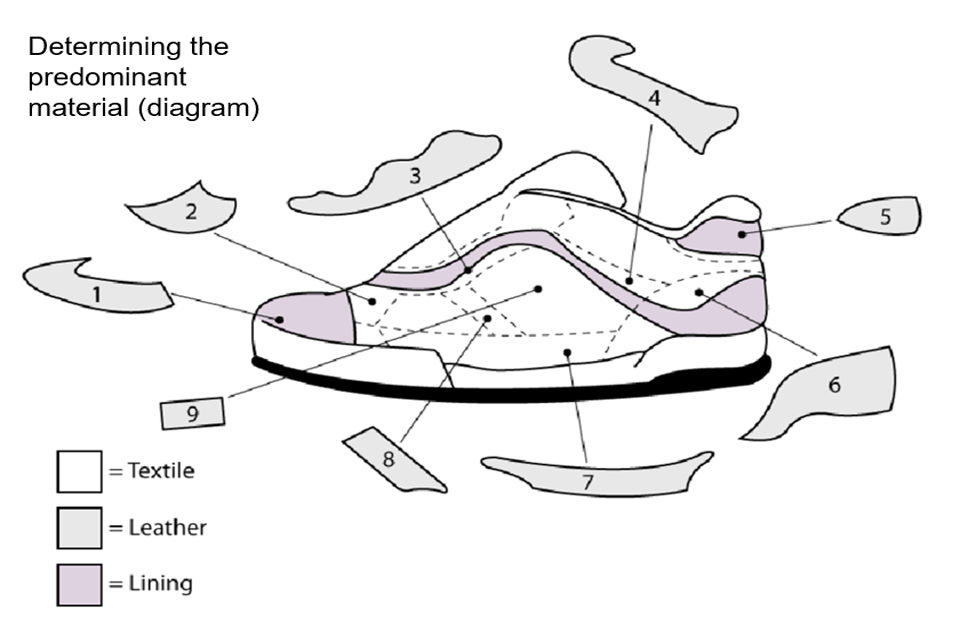

Shoe with an upper mostly made of leather

Diagram showing parts of a trainer, labelled as follows: 1. Toe cap 2. Toe vamp 3. Eye stay 4. Section overlapping the eye stay 5. Back section 6. Heel counter 7. Large side section 8. Small side section 9. Logo

Toe caps and vamps

If you remove the leather toe cap and vamp and find limited lining material under it, the leather pieces are considered to be viable uppers.

The eye stay and heel counter

The leather eye stay and heel counter are considered viable uppers if you remove them and find only lining material.

When you find this under the eye stay, it means the textile upper material is not one long piece. Leather has been used to cover the areas where the textile pieces do not meet. The leather sections must be considered viable uppers.

Back section

If you remove the small leather section at the back of the shoe and find textile under it:

- the textile is considered the viable upper

- the leather section is treated as reinforcement

Side sections and logo

If you remove the large leather side section and find the textile material does not go all the way down to the sole area, the leather is considered a viable upper.

If the small leather side section or logo is removed and you find textile under it, the textile is considered a viable upper.

Waterproof footwear made of rubber or plastics

This footwear is classified under heading 6401 and includes:

- certain snow boots

- overshoes (like galoshes)

- ski-boots

The uppers are not fixed to the sole and not made by:

- stitching

- riveting

- nailing

- screwing

- plugging

Waterproof footwear can be made by:

- press moulding

- injection moulding

- slush moulding

- rotational casting

- dip moulding

- vulcanising

- bonding and vulcanising

- high frequency welding

- cementing

Other footwear made of rubber or plastics

This footwear is classified under heading 6402 and includes:

- ski-boots with several moulded parts, hinged by parts such as rivets

- slippers without quarter or counter, with uppers attached to the sole by stitching — the upper must be made in one piece or ways other than stitching

- sandals with straps across the instep and a counter or heel strap attached to the sole

- non-waterproof footwear made in one piece, like bathing slippers

Example

Footwear with an outer sole and upper made of plastics, with sole and heel combined (height less than 3cm). A single piece of material is used to form the sole and the raised side parts of the upper. The other part of the upper consists of a plastic strap attached across the foot to the side parts by 4 horizontal plugs.

Footwear with outer soles of rubber, plastics, leather or composition leather

With uppers of textile

This footwear is classified under heading 6404.

With uppers of leather

This footwear is classified under heading 6403.

Sandals

These are footwear where the front part of the upper (the vamp) consists of either straps or material with one or more pieces cut out of it.

Sandals can be classified under various subheadings, depending on the materials used to make the upper and the outer sole.

When both the outer soles and the uppers are made of plastic or rubber, the sandals are classified under subheading:

- 6402 99 10 when the uppers are made of rubber

- 6402 99 31 or 6402 99 39 when the uppers are made of plastic

When both the outer soles and the uppers are made of leather, the correct subheading for the sandals will depend on properties including size. They can be classified under subheadings:

- 6403 59 11

- 6403 59 31

- 6403 59 35

- 6403 59 39

When the outer soles are made of plastic or rubber and the uppers are made of leather, the correct subheading for the sandals will depend on properties including size. They can be classified under subheadings:

- 6403 99 11

- 6403 99 31

- 6403 99 33

- 6403 99 36

- 6403 99 38

When the uppers are made of a textile material and the outer soles are made of rubber or plastic, the sandals are classified under subheading 6404 19 90.

When the uppers are made of a textile material and the outer soles are made of leather, the sandals are classified under subheading 6404 20 90.

Leisure wear shoes

These are classified under subheading 6403 99 93, if they have:

- a plastic sole — a hard-plastic plate attached by screws under the arc of the shoe

- an upper made of leather (which makes up the greater part of the external surface), plastic and man-made fibre

- a whole vamp without metal protectors at the front

- an insole length of 24cm or more

Sports footwear

This footwear can be classified under headings:

- 6402

- 6403

- 6404

Footwear under subheadings 6402 19 00, 6403 19 00 and 6404 11 00 include:

- skating boots

- snow boots

- wrestling or boxing boots

- cycling shoes

- tennis shoes

- basketball shoes

- gym shoes

- training shoes

Footwear under subheadings 6402 12 10, 6403 12 00 and 6404 11 00 include:

- ski boots

- cross-country ski footwear

Snowboard boots are under subheadings:

- 6402 12 90

- 6403 12 00

- 6404 11 00

To be classified as sports footwear, the goods must be either:

- designed for a sporting activity and include various features

- designed so these features can be attached

Sports footwear features include:

- spikes

- sprigs

- stops

- clips

- bar

Trainers do not classify as sports footwear unless they’re ‘tennis shoes, basketball shoes, gym shoes, training shoes and the like’.

Tennis, basketball, gym, and training shoes

This covers shoes for sporting activities by their shape, cut, look, material, and designed for either:

- only a specific sporting activity — not just walking

- running, jumping, quick turns and abrupt stops

For example, freestyle rock climbing shoes and flexible gymnastic or dancing slippers.

The sole must have features to absorb shock from the impact of sports movements. For example, air or gas pads in the heel.

The shoe must have:

- an outer sole with a specific structure that either:

- supports turning

- is shaped as a typical running sole (lower in front than in the heel)

- an upper for movements to give stability and balance to the foot

The material of the upper, reinforcements, padding and lining can support this and protect the foot. For example, a reinforced toecap to protect toes.

Not sports footwear

Footwear worn mainly or only for non-sporting activities are not classified as sports footwear. This includes:

- walking

- trekking

- hiking

- mountain climbing

- white water canoeing

Other footwear

Footwear having outer soles and uppers made from materials not covered under headings 6401 to 6404, are classified under heading 6405.

Slippers and other indoor footwear

This includes:

- mules

- ballet slippers

- ballroom dancing shoes

- other indoor footwear

The sole of a slipper is the material that’s both durable and has the most contact with the ground.

If the outer sole is made of plastic or rubber, covered by a thin textile layer that’s not durable, the slipper is considered to have a ‘plastic or rubber’ sole, ignoring the thin textile layer.

A slipper with a plastic or rubber sole with a textile covering is only classified under heading 6405 if the textile proves to be durable.

One way to prove this is a Martindale abrasion test. This checks durability and abrasion resistance and simulates natural wear. The test proves a textile durable if it has no worse than moderate wear after 51,000 revolutions. This test is only for textiles.

In some cases, the outer sole is whole or part covered with a thicker, more durable textile material with a rubber or plastic tread for grip. If the slippers have a tread on top of a textile layer and the tread has more contact with ground than the textile, the slipper has a ‘plastic or rubber’ sole.

If a thin layer of textile covers the tread, that textile must also prove to be durable. If tests show the textile covering is not durable, the slipper has a ‘plastic or rubber’ sole.

Parts of footwear

Footwear parts classified under heading 6406 can be made of any material, except asbestos.

Parts include:

- uppers (and those attached to soles other than outer soles)

- leather pieces used for making footwear, cut to the approximate shape of uppers

- parts of uppers, such as:

- vamps

- toecaps

- linings

- inner, middle and outer soles

- insoles for gluing on the surface of inner soles

- arch supports

- heels, including glue-on, nail-on and screw on types

- parts of heels, such as top pieces

- parts of sports footwear, such as

- studs

- spikes

- articles that cover the whole or part of the leg and sometimes part of the foot, but not the whole foot, for example:

- leggings

- leg warmers

- fittings that can be worn inside footwear, such as removable insoles and internal heel cushions

Footwear not classified in chapter 64

Footwear made from textile with no separate sole attached

This footwear is classified under chapter 61 and 62. This includes:

- socks

- stockings

- tights

Worn footwear (with signs of wear)

This footwear is classified under heading 6309. It must be presented in bulk packings such as:

- bales

- sacks

Orthopaedic footwear

This footwear is classified under heading 9021, as long as either:

- made to measure

- mass-produced, presented singly and not in pairs and designed to fit either foot equally

Disposable foot or shoe coverings

If these are made of flimsy material like paper or polythene, with no separate sole, classify by the material they’re made of.

Other footwear not classified in chapter 64

These include:

- footwear, parts, and accessories made of asbestos — classified under heading 6812

- toy footwear (usually made from moulded plastic, with no separate outer sole) — classified under heading 9503

- shin guards, cricket pads, and similar protective sportswear — classified under heading 9506

- ice and roller skates, and all other skating boots with attached skates — classified under heading 9506

Footwear add-ons and reinforcements

The following are not classified as footwear parts, but can be used in footwear manufacturing:

- protectors, eyelets, hooks, buckles and ornaments — classified under heading 8308

- braid, pompoms and other trimmings — classified under heading 5808

- woven shoe laces — classified under heading 6307

- buttons, press fasteners, snap fasteners, press studs, zips — classified under Chapter 96

Get more information

If your item is not covered in detail for imports to Great Britain (England, Scotland and Wales), you can search the UK Integrated Online Trade Tariff.

If you’re importing goods into Northern Ireland from outside the UK and the EU, and the goods are:

- not ‘at risk’ of onward movement to the EU, also use the Online Trade Tariff

- at risk of onward movement to the EU, use the Northern Ireland Online Tariff

If this guidance does cover your item, you’ll still need to find the full commodity code to use in your declaration on the appropriate tariff.

You can find more ways to help you find a commodity code by referring to the links in this section.

Updates to this page

-

The information for classifying sandals for import and export has been updated.

-

Information has been updated about specific sports footwear. Trainers are not considered sports footwear, unless covered under ‘tennis shoes, basketball shoes, gym shoes, training shoes and the like’. Information about shoes for rhythmic gymnastics classified under subheading 6403 59 91 has been removed.

-

The page has been updated with information about the classification of slippers and other types of indoor footwear.

-

The further information section has been updated to show the change of contact details.

-

First published.