Total income of DCMS-funded cultural institutions 2019/20

Updated 23 December 2021

Applies to England

Released: 4 March 2021

Geographic coverage: England

DCMS directly funds 19 cultural organisations via Grant in Aid. These include Arts Council England and their National Portfolio Organisations, the British Film Institute, British Library, Historic England and the 15 sponsored national museums and galleries.

The data for this report cover income for these organisations for the 2019/20 financial year, that is, April 2019 to March 2020. This includes two weeks where cultural organisations closed as part of the first national lockdown in response to COVID-19 in mid-March 2020.

Analysis of visitor numbers during this period has shown that the overall trend of an increase in visitor numbers for 2019/20 from 2018/19 changed to a decrease as a result of global restrictions due to the pandemic. It is possible that a reduction in visitors, including those from overseas as travel restrictions and lockdowns were introduced, may have affected the ‘other income’ segment as this includes income from admissions and retail sales. Some museums and galleries also had to cancel large charity events scheduled for the end of March, which may have affected their fundraising income.

This report has been streamlined, partly due to COVID-19 related resourcing constraints. All breakdowns provided in previous years are available in the associated tables. We welcome feedback on the amended format of this report. This should be sent to evidence@dcms.gov.uk.

1. Summary

In 2019/20, the total income of DCMS-funded cultural organisations was £3.6 billion, a 2.3% decrease from 2018/19 when adjusted for inflation[footnote 1].

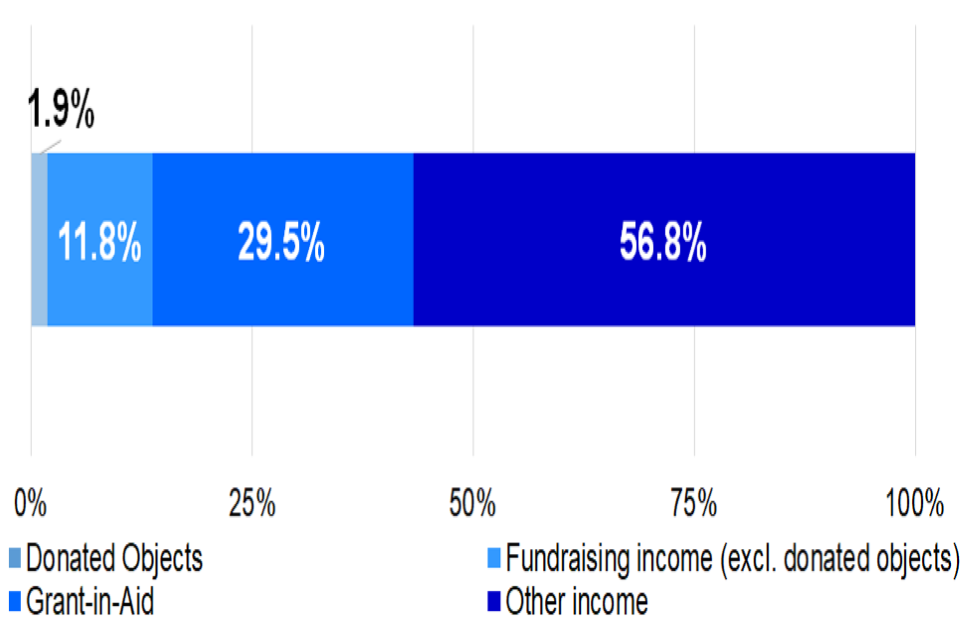

Of this:

- 29.5% (£1.1 billion) was accounted for by Grant-in-Aid

- 11.8% (£0.4 billion) was accounted for by fundraising income (charitable giving) excluding donated objects

- 1.9% (£66.3 million) was accounted for by donated objects

- 56.8% (£2.0 billion) was accounted for by other income[footnote 2]

See Annex A for the definition of each type of income.

Figure 1: Summary of total income of DCMS-funded cultural organisations 2019/20 See Annex A for the definition of each type of income.

2. Grant-in-Aid

Grant-in-Aid is money provided by central government departments to arms-length bodies in support of the general objectives of the organisation. In 2019/20, DCMS-funded cultural organisations received a total of £1,055 million in Grant-in-Aid. This is a decrease of 1.7% from 2018/19, after adjusting for inflation[footnote 3].

The ratio of fundraising income to Grant-in-Aid was 46.3%, meaning that for every £1 of Grant-in-Aid DCMS-funded cultural organisations received in 2019/20, they generated an additional 46.3 pence in fundraising income. This compares to generated fundraising income of an additional 44.2 pence per £1 in Grant-in-Aid in 2018/19[footnote 4].

When donated objects are excluded from the fundraising income total, the ratio of fundraising income to Grant-in-Aid decreases to 40.0%, 2.3 percentage points higher than in 2018/19 (37.7%).

The DCMS-funded cultural organisations have a variety of funding models, reflecting their diversity of size, type and purpose. The proportion of Grant-in-Aid to total income ranged from 26.0% to 99.4%. The average proportion of Grant-in-Aid to total income over all institutions was 29.5%.

3. Fundraising income (charitable giving, excl. donated objects)

In 2019/20, DCMS-funded cultural organisations generated a total of £422 million through fundraising income (excluding donated objects). This is an increase of 3.8% in real terms[footnote 5] from 2018/19. This number fluctuates year on year, and can be influenced by specific fundraising campaigns.

The proportion of fundraising income to total income ranged from 0.6% to 42.7%. The overall average was 11.8%.

4. Fundraising income (donated objects)

In 2019/20, DCMS-funded cultural organisations collectively received £66.3 million in the form of donated objects, an increase of 71.2% from the previous year after adjusting for inflation[footnote 6].

The proportion of income from donated objects to total income ranged from 0.1% to an unusually high 37.8%. The average over all the institutions was 1.7%.

The value of donated objects varies considerably over time, and between institutions. In the case of some organisations, a one off ‘star’ donation can dramatically increase this figure, whereas several institutions do not, or rarely, receive donated objects. Caution should therefore be taken when making comparisons.

5. Other income

In 2019/20, DCMS-funded cultural organisations generated a total of £2.0 billion through other activities such as trading, investment income and admission fees. This is a decrease of 3.8% from 2018/19, after adjusting for inflation[footnote 7].

Among the DCMS-Sponsored cultural bodies, the proportion of other income to total income ranges from 9.1% (as a result of the high value of donated goods received) to 68.9%. The average for all institutions was 56.8% of total income.

For full details of the funding sources, see the tables accompanying this release.

6. Data sources

The data presented in this report is collected from the DCMS-funded cultural organisations annual reports and accounts. The Grant-in-Aid figures are obtained from the DCMS annual report and accounts and this excludes other public funding including the DCMS/Wolfson Museums and Galleries Improvement fund and the National Lottery Heritage fund.

Data for the Arts Council England’s National Portfolio Organisations (NPOs) (formerly known as Regularly Funded Organisations, RFOs) is based on the NPO annual survey. The Arts Council England provides funding through Grant-in-Aid and National Lottery to a portfolio of organisations which includes museums, libraries and arts organisations. The latest figures reported are from the annual survey of the 828 organisations that will be funded from April 2018 to March 2022 by Arts Council England.

6.1 Provisional figures used in the report

The income figures for the Royal Armouries are provisional and may be subject to change when final auditing of the accounts has been completed.

7. Annex A: Technical Note

This statistics release is an Official Statistic and has been produced to the high professional standards set out in the Code of Practice for Statistics. For more information, see the Code of Practice.

On 1st April 2015, English Heritage split into two organisations: Historic England and English Heritage Trust. Comparisons between 2015/16 or 2016/17 and other years are therefore not possible. As of 2017/18 Historic England’s fundraising income reached a level that is comparable with those of other funded cultural organisations and is therefore now included in the report.

Grant-in-Aid is money given to organisations that operate at arms length from the sponsoring government department. The sponsoring department doesn’t impose detailed expenditure controls as it would with a grant.

Fundraising income (charitable giving) does not include any money received from a publicly funded organisation, central government grants, investment income or lottery grant funding. It is defined as any money or gift received from an individual, charity or private company in one of the following forms:

- Donations, legacies, bequests and similar income

- Donated objects (also identified separately)

- Sponsorship

- Donations from connected charities + other donations

- Capital grants and donations (not from public bodies)

- Membership schemes

Other income is constituted of any other forms of income not included in the definitions for fundraising income and Grant-in-Aid. This is summarised as:

- Trading income

- Investment income

- Admissions & exhibition fees

- Development funds

- Activities for generating funds

The following cultural organisations do not have values for donated objects. This is because:

- The Museum of the Home accepts donated objects which fit within the collecting policy of the museum. Objects which have a value of over £1,000 are added to the museum’s collection and accounts, however no objects with a value of over £1,000 have been donated since accounting records began.

- The Sir John Soane’s Museum receives donated objects on rare occasions and no financial value is ascribed to these in the Museum’s accounts.

- The founding bequest for the Wallace Collection prevents the museum from adding donated objects to their collection.

The responsible statistician is Rachel Moyce. For enquiries on this release, please contact evidence@dcms.gov.uk.

The next update to this release is scheduled for late 2021 and will present the financial figures for 2020/21.

DCMS aims to continuously improve the quality of estimates and better meet user needs. Feedback on this report should be sent to DCMS via email at evidence@dcms.gov.uk.

-

Data from Her Majesty’s Treasury on the UK gross domestic product (GDP) deflator at current market prices was used to convert between current and 2018/19 prices. ↩

-

The other income category is constituted of other forms of income which include trading income, investment income, admissions & exhibition fees, development funds and other activities for generating funds. These are not included in the definitions for fundraising income and Grant-in-Aid. See further details in Annex A point 5. ↩

-

See footnote 1. ↩

-

This ratio has been amended from last year’s release (44.6%) following revisions to the fundraising income figures for a number of organisations. See published table for more information. ↩

-

See footnote 1. ↩

-

See footnote 1. ↩

-

See footnote 1. ↩