Section 3: background and methodology

Published 23 September 2020

4. Background, definitions and methodology

4.1 What is Scottish Income Tax?

Background

The Scotland Act 2012 gave the Scottish Parliament the power to set a Scottish rate of Income Tax (SRIT). SRIT applies to non-saving non-dividend (NSND) income. It allows the Scottish Government (SG) to change the amount of Income Tax that Scottish taxpayers pay and, as a result, the amount that the SG had to spend in Scotland.

SRIT replaced 10 percentage points of each of the main UK rates of tax for the tax year commencing 6 April 2016. In that year the UK Basic, Higher and Additional rates for NSND income were reduced by 10 pence in the pound for Scottish taxpayers. This reduction was replaced by a Scottish rate set at 10 percentage points, so the overall rates paid by Scottish taxpayers remained the same as elsewhere in the UK.

The Scotland Act 2016 extended these powers, enabling the Scottish Parliament to set the tax band thresholds (excluding the Personal Allowance) as well as the rates. This applies to all NSND income of Scottish taxpayers and took effect from 6 April 2017.

Who is a Scottish taxpayer?

The definition of a Scottish taxpayer is based on where an individual resides in the course of a tax year. Scottish taxpayer status applies for a whole tax year – it is not possible to be a Scottish taxpayer for part of a tax year.

For most taxpayers, the location where they live will be obvious, but there will be less straightforward cases – for example, where people have more than one home, or have moved into or out of Scotland during the year. HM Revenue and Customs (HMRC) has provided guidance to help in these circumstances.

The location of a person’s employer is not relevant. So, for example, someone who works in Scotland, but has their home elsewhere in the UK, will not be a Scottish taxpayer.

For an individual to be a Scottish taxpayer, they must be UK resident for tax purposes – an individual who is not UK tax resident cannot be a Scottish taxpayer.

Detailed guidance to whom Scottish Income Tax will apply

How do the tax systems on NSND income compare for Scottish and Rest of UK taxpayers?

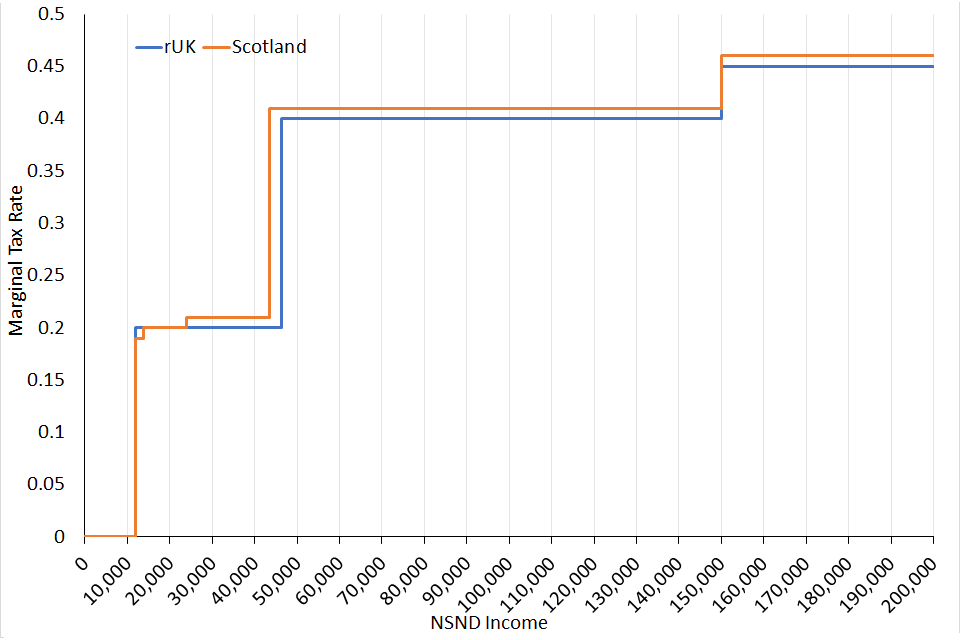

Figure 5a: Marginal Income Tax for Scottish and rUK taxpayers - 2018 to 2019 (the information used to create this graph is repeated in Table 5a and Table 5b below).

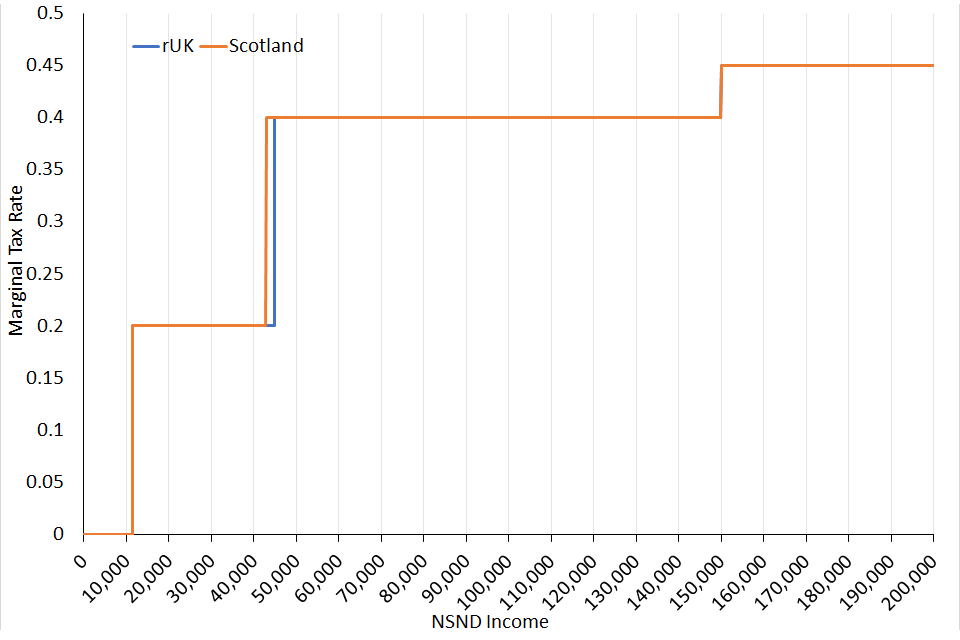

Figure 5b: Marginal Income Tax for Scottish and rUK taxpayers - 2017 to 2018 (the information used to create this graph is repeated in Table 5a and Table 5b below).

Table 5a: Thresholds: Scottish and Rest of UK Income Tax

| Tax band threshold | Scottish Income Tax 2017-18 | Rest of UK Income Tax 2017-18 | Scottish Income Tax 2018-19 | Rest of UK Income Tax 2018-19 |

|---|---|---|---|---|

| Personal Allowance | £11,500 | £11,500 | £11,850 | £11,850 |

| Basic rate threshold | N/A | N/A | £13,850 | N/A |

| Intermediate rate threshold | N/A | N/A | £24,000 | N/A |

| Higher rate threshold | £43,000 | £45,000 | £43,430 | £46,350 |

| Additional rate threshold | £150,000 | £150,000 | £150,000 | £150,000 |

Table 5b: Tax rates: Scottish and rUK Income Tax

| Tax band rate | Scottish Income Tax 2017-18 | Rest of UK Income Tax 2017-18 | Scottish Income Tax 2018-19 | Rest of UK Income Tax 2018-19 |

|---|---|---|---|---|

| Starter rate | N/A | N/A | 19% | N/A |

| Basic rate | 20% | 20% | 20% | 20% |

| Intermediate rate | N/A | N/A | 21% | N/A |

| Higher rate | 40% | 40% | 41% | 40% |

| Additional rate | 45% | 45% | 46% | 45% |

In 2018 to 2019 SIT was changed to introduce 2 new tax bands, the Starter rate (19%) and the Intermediate rate (21%) either side of the Basic rate (20%). The Higher and Additional rates of tax were also increased by 1% for Scottish taxpayers increasing from 40% and 45% to 41% and 46% respectively. Additionally, the HRT for Rest of UK (rUK) has risen to £46,350, whereas for Scotland the HRT was set at £43,430. These changes are likely to have contributed to the faster growth of NSND Income Tax for Scottish taxpayers between 2017 to 2018 and 2018 to 2019 compared to rUK.

4.2 Why are we producing these statistics?

The SIT outturn in HMRC’s Annual Report determines the SG’s Income Tax revenues while the equivalent outturn for Income Tax on NSND income for rUK taxpayers in these statistics is used by HM Treasury (HMT) to determine the SG’s Block Grant. For Block Grant purposes the total outturn figures presented in HMRC’s Annual Report and this publication are final.

These statistics are being published to give more information about the 2018 to 2019 Scottish Income Tax (SIT) outturn.

4.3 What is the relationship between these statistics and other personal tax statistics and information?

There are other publications which show similar statistics to what is shown in this SIT publication. It is important to understand how these other statistics relate to what is being released here and highlight differences in coverage or data used to compile each set of statistics.

The following publications are explained below:

- Devolved tax and spending forecasts - Office for Budget Responsibility (OBR)

- Scotland’s Economic and Fiscal forecasts - Scottish Fiscal Commission (SFC)

- Personal Income Statistics - Survey of Personal Incomes (SPI)

- Earnings and Employment Statistics - PAYE Real Time Information (RTI)

- Income Tax Receipts Publication

OBR: Devolved tax and spending forecasts

The OBR was established in 2010 to provide independent and authoritative analysis of the UK’s public finances. Alongside the UK Government’s Budgets and other fiscal statements, they produce forecasts for the economy and the public finances. They publish these in their Economic and Fiscal Outlook (EFO).

Since 2012, the OBR have also forecasted the tax streams that are devolved to the Scottish Parliament. The OBR publish devolved tax and spending forecasts alongside each EFO that are consistent with their main UK forecasts. The Treasury draws on the OBR’s tax forecasts when making spending settlements for the Scottish Government in accordance with their fiscal framework.

In the EFO, the OBR forecast based on the national accounts with Self Assessment (SA) treated when it is received. Whilst in the OBR Devolved tax and spending publication, and in the statistics set out here, SA is treated on a liabilities basis.

The latest OBR devolved forecasts of SIT were published in March 2020. This shows the OBR forecast of SIT for 2018 to 2019 to be £11,700 million and the rUK NSND equivalent to be £162,300 million.

OBR Devolved tax and spending forecasts

SFC: Scotland’s Economic and Fiscal forecasts

The SFC was established in 2017 and is Scotland’s official and independent budget forecaster. The SFC reports to the Scottish Parliament. The SFC produces 5-year forecasts of SG tax revenues and social security expenditure, and of the Scottish economy.

The SFC publication ‘Scotland’s Economic and Fiscal Forecasts’ details their forecasts of devolved taxes including devolved Income Tax. This publication also provides an explanation of how the SFC and OBR forecasts, as well as the outturn presented in this SIT publication, are used to adjust Scotland’s Budget.

The latest SFC Economic and Fiscal Forecasts publication was released in February 2020. This shows the SFC forecast of SIT to be £11,378 million for 2018 to 2019.

SFC Economic and Fiscal forecasts

SPI: Personal Income Statistics

HMRC release an annual publication from the SPI which shows statistics for taxpayers’ personal incomes. This publication provides breakdowns to highlight the number of individuals with different sources of income and subject to certain reliefs.

In March 2020 HMRC published the annual Personal Income statistics for 2017 to 2018 which are based on the SPI. The data used in the SPI publication is different to the data used in this publication on Scottish Income Tax.

The SPI is a sample of around 750,000 individuals in either SA or PAYE. The SPI is designed to measure total income and the total tax impact on the Exchequer and therefore includes the tax impact of Relief at Source (RAS) payments to pension providers and Gift Aid payments to charities. It also measures liability and takes no account of some tax not being collected.

Statistics about personal incomes

There is a further HMRC publication, ‘Income Tax Statistics and Distributions’, which provides projections for future tax years based on the SPI. The projections in that publication reflect announced changes to the Income Tax system and use determinants from the OBR to model tax liabilities in future years. The latest publication of this series was released in June 2020 and provides projections for tax years 2018 to 2019 and 2020 to 2021 based on the 2017 to 2018 SPI.

Income statisitics and distributions

The statistics presented in these 2 publications are not expected to be consistent with what is shown in this SIT publication, due to sampling variation, the measurement differences described above and the fact that projections are a forecast of how tax liabilities may evolve for future years.

The 2018 to 2019 Personal Income Statistics publication is not due to be published until February/March 2021 with the accompanying Income Tax Statistics and Distributions publications expected to follow in May/June 2021.

RTI: Earnings and Employment Statistics from PAYE Real Time Information

HMRC started publishing statistics on earnings and employment using data from PAYE RTI in 2018. Since December 2019 these have been published jointly with the Office for National Statistics (ONS), with monthly estimates of payrolled employees and their pay, including early estimates for payrolled employment and median pay for the most recent month.

HMRC and ONS joint publication on Earnings and Employment

The statistics in the RTI Earnings and Employment publication are different to the RTI statistics shown in Table 4 of this SIT publication, although both are compiled from the same source of data. Some of the key differences are:

- the RTI publication only presents information relating to employees only and excludes data on payments made to occupational pensioners

- the RTI publication uses calendarisation and imputation

- the RTI publication includes seasonally adjusted and not seasonally adjusted data

- the RTI publication only presents statistics for number of employees and their pay. On the other hand, this release shows tax collected via PAYE, which may include collection of tax due on other income collected via the PAYE tax code. This can arise from savings or dividend income and other charges such as the High Income Child Benefit Charge (HICBC)

For further details on the methodology used for the RTI Earnings and Employment Statistics publication, see the ONS article below, from December 2019.

RTI Earnings and Employment Statistics methodology

Income Tax Receipts Publication

HMRC publish an annual National Statistics publication on Income Tax Receipts. The statistics presented in this SIT publication show tax liabilities for specific tax years.

Statistics for Income Tax receipts

Liabilities are amounts of tax due on incomes arising in a given tax year, whereas receipts show amounts paid and collected in a given year. Due to lags in the Income Tax payment regimes, particularly for SA, liabilities and receipts for the same year can differ significantly.

Liabilities and receipts will also differ for other reasons, for example when over or underpayments occur which are repaid or recovered in a later year altering total receipts in that year in a way unrelated to tax liabilities for that year.

If you require statistics about the Income Tax liability on non-savings non-dividend income, and how SIT compares to the rUK equivalent, then the information you require is contained within this publication.

4.4 Publication and revision strategy

The SIT outturn data presented in this publication is the final outturn for these tax years and the total Income Tax for NSND income presented will be used to determine the SG’s income tax revenues.

HMRC routinely shares RTI data with the SFC and OBR to assist their monitoring and forecasting purposes.

We plan to publish these new statistics annually, when the HMRC Annual Report and Accounts is published.

4.4.1 Revisions to methodology in Table 2

As with all experimental statistical publications, we are constantly reviewing methodologies, in particular where there are areas of estimation. We engage with a wide range of stakeholders to continually refine methodologies to produce estimates with a greater level of certainty.

Some components of the SIT outturn statistics are produced using estimation, and so with feedback from stakeholders, we have tested and applied an improved methodology for calculating figures that are produced in Table 2 of this SIT publication.

The changes to the methodology are to do with the way breakdowns of tax paid at each rate by different taxpayers is calculated. The reason for the methodological change is due to the alternative methodology improving those the estimates.

The changes to the methodology are only applicable to the distribution of taxpayers and tax at each tax rate. The changes to methodology do not affect the total NSND estimates for SIT or rUK Income Tax.

The change in methodology is also applied to the 2016 to 2017 and 2017 to 2018 tax years, and the figures produced in Table 2 have been revised, from what was published in July 2019, to reflect these changes in methodology.

4.5 Outturn data methodology

The methodology set out in this section reflects the methodology for calculating the SIT outturn which has been agreed between the SG and HMRC.

The final SIT and rUK outturn figures reflect accrued revenue and have been calculated using actual liabilities data together with some estimation where actual data is unavailable. Details of this for each of the 6 components of the outturn figure is explained below.

Total SIT/rUK NSND outturn =

- +SA Established liability

- +PAYE established liability

- +Estimated further liability

- -Adjustment for uncollectable amounts

- -RAS pension relief

- -Gift Aid

The methods for SIT and rUK outturn are the same except for PAYE established liabilities where a different method was applied for rUK cases due to data availability.

The methodology for 2018 to 2019 follows the same approach as used for 2016 to 2017 and 2017 to 2018 but has been updated to reflect the new Scottish and rUK tax regimes. This includes the introduction of the Scottish Starter and Intermediate rate tax bands and the rate increase for Higher and Top rate Scottish taxpayers.

4.5.1 SA Established Liability

Income Tax liability is established for all individuals in SA once their SA return has been received and their tax calculation has been conducted.

This includes any individual who is required to file a SA return who also has an employment or occupational pension for which tax is deducted at source through PAYE.

The established liability for those who submit an SA return is calculated for each taxpayer identified in SA by summing the Income Tax due at each tax rate on NSND income and then reducing it by a share of reliefs.

4.5.1(a) Reliefs

Income Tax reliefs reduce the total amount of Income Tax an individual is liable to pay.

Some reliefs, such as relief for qualifying distributions and refinance relief for landlords, can only be claimed when an individual has a specific source of income. In calculating the SA established liability such reliefs are prioritised to the appropriate stream of income before any excess is apportioned to other streams of income.

All other reliefs, such as marriage allowance, married couples’ allowance and relief for gift aid payments, can be claimed irrespective of what income sources an individual has. These “generic” reliefs are applied proportionately to tax due on savings/dividend income and tax due on NSND income based on the level of gross Income Tax liability.

4.5.1(b) Other SA charges and Create Return Charges

There are other charges which can be raised against an individual in SA through investigations/assessments or via a “Create Return Charge” (CRC) when an individual has failed to submit their return.

These additional charges, if known when data is being compiled, are also included when determining the SA established Income Tax liability.

4.5.1(c) Scottish share

The total SA established SIT liability is then calculated by summing the NSND liability, net of reliefs, across each Scottish taxpayer in SA.

The rUK established SA liability is calculated in a similar way but summing across all rUK taxpayers.

4.5.2 PAYE Established Liability

PAYE established liability includes:

- liabilities for individuals who are reconciled in PAYE, and

- PAYE settlement agreements

4.5.2(a) Liabilities from PAYE reconciliations

For individuals who are in PAYE but have not been issued with a notice to file in SA, their Income Tax liability is established when their PAYE account is reconciled.

A bespoke data extract of all Scottish taxpayer accounts in National Insurance and PAYE Service (NPS) for each tax year was commissioned specifically to assist in compiling the SIT outturn figure required for HMRC’s Annual Report and Accounts.

This provided the liability for NSND income, net of reliefs, for all Scottish taxpayers by tax rate.

4.5.2(b) rUK PAYE established

However, for rUK taxpayers no equivalent data extract currently exists. Therefore, the rUK NSND PAYE established liability has been compiled in a different way from that of Scottish taxpayers.

The rUK PAYE established figure is estimated by making use of data from RTI and scaling RTI receipts for rUK taxpayers based on the relationship between the PAYE established liability and RTI receipts for Scottish taxpayers.

The method assumes that for non-SA individuals in PAYE the propensity for Scottish taxpayers to over or under pay tax is the same as for rUK taxpayers.

This rate of over/under paying is applied to the RTI receipts data of rUK non-SA taxpayers to estimate the level of rUK PAYE established liability.

4.5.2(c) PAYE settlement agreements

The established PAYE amount includes a share of liabilities raised through PAYE Settlement Agreements (PSA).

A PSA allows an employer to make one annual payment to cover all the tax and National Insurance due on minor, irregular or impracticable expenses or benefits for their employees.

The expenses and benefits reflected in the PSA are not recorded through payroll and are not required to be included on end of year P11D forms, in which other employment expenses and benefits are reported to HMRC.

The Scottish share is determined by using RTI data to determine the share of tax collected by employers through PAYE schemes which have a PSA.

4.5.3 Estimated further liability

In addition to the established liability the final outturn figure includes an estimate for:

- liabilities from late filed SA returns

- liabilities realised from compliance activity, and

- liabilities from unreconciled PAYE cases

These are included within the outturn component ‘Estimated further liability’.

4.5.3(a) Late filed SA returns

The value of late filed SA returns has been estimated for each tax year by examining a 10% sample of SA data to determine the pattern of SA filing in the preceding 5 tax years. It is assumed that the average growth of liabilities for these years will be similar to how the liabilities will grow for the years presented in these statistics.

4.5.3(b) Scottish share for late filed SA returns

Taxpayers with a Scottish postcode were used as a proxy for Scottish taxpayers in these years, as no Scottish indicator exists before SIT was introduced.

Only taxpayers with a Scottish postcode were used to determine the estimated further liability for the SIT outturn. Similarly, only taxpayers with a non-Scottish postcode were used to determine the rUK ‘Estimated further liability’.

4.5.3(c) Liabilities from compliance activity

Included in the estimated further liability is an amount to reflect SA Settlement Agreements not recorded through SA, which are raised as part of compliance investigations. The Scottish and rUK NSND share of this is assumed to be the same proportion as observed in the SA established liability.

4.5.3(d) Liabilities from unreconciled PAYE cases

In 2017 to 2018 there was an increase in the number of unreconciled PAYE accounts at April 2019 with almost 400,000 cases unreconciled when these outturn figures were compiled. An estimate for the liability of these cases has been included in the 2017 to 2018 ‘Estimated further liability’ component.

Almost all PAYE cases are normally reconciled within 12 months of the end of the tax year. However, complex tax affairs or operational changes means that HMRC occasionally delays some customers’ end of year reconciliations to prevent them receiving an incorrect tax calculation or accounting update. As the cause of these delays may vary each year, appropriate methodologies for estimating the value of these unreconciled PAYE cases are identified via consultation with business experts each year. For 2017 to 2018, the value has been estimated by identifying the unreconciled cases and using tax receipt data from RTI.

4.5.4 Adjustment for uncollectable amounts

4.5.4(a) Uncollected SA amounts

This amount has been estimated based on the same sample of HMRC taxpayer data over the previous 5 tax years used to establish the late filed SA returns for the ‘Estimated further liability’ component.

The adjustment for uncollected amounts for each tax year is then estimated by applying the average from these historic collection rates to the known established and unestablished SA liability figures. This is completed separately for Scottish and rUK taxpayers to calculate specific uncollected amounts for each.

4.5.4(b) Uncollected PAYE amounts

Not all tax due is collected by HMRC and some is subsequently remitted or written off when it cannot be recovered.

This component reflects the amount written off from PAYE employers when they have failed to pay all the Income Tax they were expected to.

The uncollected amount is estimated by analysing data for the last 4 years, then a forecast is created based on the pattern demonstrated from this data. This gives an estimate of how much PAYE Income Tax (at a UK level) is expected to be remitted or written off in the future for each tax year.

The Scottish share of this uncollected amount is determined by analysing PAYE schemes whom are known to have had an amount remitted or written off for that specific year.

RTI data is then analysed for each of these PAYE schemes to calculate what proportion of total tax collected by these schemes is in respect of Scottish/ rUK taxpayers.

4.5.5 RAS pension relief

When an individual pays into a pension scheme the scheme treats this as being received net of basic rate tax and reclaims that basic rate tax relief back from HMRC to add to the member’s pension pot.

This adjustment in the outturn calculation reflects the Basic rate tax being passed to the pension provider and no longer held as Income Tax by the exchequer.

The RAS for pension contributions in this SIT calculation is determined by using information from annual returns made by pension schemes which show the amount of gross contributions made by scheme members in the appropriate tax year.

The proportion relating to Scottish taxpayers is calculated by identifying individual contributions made by scheme members who have a Scottish postcode held on the pension contribution data.

4.5.6 Gift Aid

When a taxpayer makes a charitable donation, the charity can claim basic rate tax relief from HMRC on the value of the donation.

This adjustment in the outturn calculation reflects the Basic rate tax being passed to the charity and no longer held as Income Tax by the exchequer.

Charities can back date claims for this Basic rate tax by up to 4 years. Therefore, the value which will ultimately relate to a specific tax year has been estimated using previous years data.

The Scottish share has been estimated as an average of Scotland’s share of the UK population and Scotland’s share of total UK Income as measured by the SPI. Scottish cases were identified based on postcode as the Scottish indicator did not exist before Scottish Income Tax was introduced.

4.6 HMRC RTI for PAYE methodology

The estimates in Table 4 have been sourced from data held on HMRC’s PAYE RTI administrative system. The RTI administrative system covers all individuals who have a live employment open on a PAYE Scheme.

Most people pay Income Tax through PAYE. This is the system that employers or pension providers use to take Income Tax and National Insurance contributions before they pay an employee’s wages or pension. An employee’s tax code tells the employer how much Income Tax to deduct.

Under RTI, employers are required to send HMRC information about tax and other deductions made through the PAYE system every time an employee is paid. Since April 2014, all employers have been required to report in real time with around 2.3 million PAYE schemes covering a total of 45 million employees and pensioners reporting through RTI. This provides HMRC with a rich source of data, which can be used to better inform public understanding of the labour market.

Individuals who pay tax through the SA system are included in these statistics if they are also employed and paid via PAYE. Individuals with more complex financial affairs (for example the self-employed or those who have a high income) may also pay or be refunded Income Tax and National Insurance (NI) through SA. Individuals in SA who are not in the PAYE system will not be included in these statistics.

HMRC provides Table 4 to the SG each month for SIT from the RTI data to aid in year monitoring.

Production of in-year monitoring of Scottish tax receipts, provided in Table 4 of this publication, has the following caveats.

- the sum of these figures will not equate to the final SIT outturn and are only intended to be an indication of part of SIT (from employments covered by PAYE)

- RTI data does not include all income reported through Self Assessment such as profits from self-employment or income from property and thus only provides a partial picture of NSND Income Tax liabilities in Scotland

- Income Tax due on other sources of income such as savings interest may be collected through PAYE using a process known as coding out. This process is also used to collect amounts due for some non-Income Tax charges, such as HICBC. Coded out tax amounts are included in RTI data and therefore appear in these figures

- RTI data in-year is subject to amendments throughout the year, and any end-of-year updates that may occur are not included

- these figures are pre-reconciliation and provisional

- the NPS flag is taken as a snapshot in time and this means that as taxpayers change residential address during the year, their status and therefore the figures may change