Cyber security breaches survey 2024

Published 9 April 2024

The Cyber Security Breaches Survey is a research study for UK cyber resilience, aligning with the National Cyber Strategy. It is primarily used to inform government policy on cyber security, making the UK cyberspace a secure place to do business. The study explores the policies, processes and approach to cyber security, for businesses, charities and educational institutions. It also considers the different cyber attacks and cyber crimes these organisations face, as well as how these organisations are impacted and respond.

For this latest release, the quantitative survey was carried out in winter 2023/24 and the qualitative element in early 2024.

Lead analyst

Maddy Ell

Responsible statistician

Saman Rizvi

Enquiries:

Summary

Identification of cyber security breaches and attacks

Cyber security breaches and attacks remain a common threat.

Half of businesses (50%) and around a third of charities (32%) report having experienced some form of cyber security breach or attack in the last 12 months. This is much higher for medium businesses (70%), large businesses (74%) and high-income charities with £500,000 or more in annual income (66%).

By far the most common type of breach or attack is phishing (84% of businesses and 83% of charities). This is followed, to a much lesser extent, by others impersonating organisations in emails or online (35% of businesses and 37% of charities) and then viruses or other malware (17% of businesses and 14% of charities).

Among those identifying any breaches or attacks, we estimate the single most disruptive breach from the last 12 months cost each business, of any size, an average of approximately £1,205. For medium and large businesses, this was approximately £10,830. For charities, it was approximately £460. More information on costs can be found in chapter 4.

There were some changes this year to the question that seeks to capture the overall incidence of cyber attacks and breaches. Due to these changes, it is not possible to make direct comparisons between 2023 and 2024.

Cyber hygiene

The most common cyber threats are relatively unsophisticated, so government guidance advises businesses and charities to protect themselves using a set of “cyber hygiene” measures. A majority of businesses and charities have a broad range of these measures in place. The most common are updated malware protection, password policies, cloud back-ups, restricted admin rights and network firewalls - each administered by at least seven in ten businesses and around half of charities or more. Compared to 2023, the deployment of various controls and procedures has risen slightly among businesses:

- using up-to-date malware protection (up from 76% to 83%)

- restricting admin rights (up from 67% to 73%)

- network firewalls (up from 66% to 75%)

- agreed processes for phishing emails (up from 48% to 54%).

These trends represent a partial reversal of the pattern seen in the previous three years of the survey, where some areas had seen consistent declines among businesses. The changes mainly reflect shifts in the micro business population and, to a lesser extent, small and medium businesses.

Risk management and supply chains

Businesses are more likely than charities to take actions to identify cyber risks. Larger businesses (defined as medium and large businesses as opposed to smaller business that cover micro and small business) are the most advanced in this regard.

31% of businesses and 26% of charities have undertaken cyber security risk assessments in the last year - rising to 63% of medium businesses and 72% of large businesses.

A third of businesses (33%) deployed security monitoring tools, rising to 63% of medium businesses and 71% of large businesses. The proportion was lower among charities (23%).

Around four in ten businesses (43%) and a third of charities (34%) report being insured against cyber security risks rising to 62% of medium businesses and 54% of large businesses (i.e. cyber insurance is more common in medium businesses than large ones). Compared to the 2023 survey, the proportion of businesses with some form of insurance has increased from 37% to 43%, while the proportion has remained stable among charities.

Just over one in ten businesses say they review the risks posed by their immediate suppliers (11%, vs. 9% of charities). More medium businesses (28%) and large businesses (48%) review immediate supplier risks.

The qualitative interviews suggest that organisations have an increasing awareness of the cyber security risks posed by supply chains. Despite this, organisations, particularly at the smaller end, tend to have limited formal procedures in place to manage cyber risks from wider supply chains.

Board engagement and corporate governance

Board engagement and corporate governance approaches towards cyber security tend to be more sophisticated in larger organisations. Levels of activity have remained stable compared with 2023.

Three-quarters of businesses (75%) and more than six in 10 charities (63%) report that cyber security is a high priority for their senior management. This proportion is higher among larger businesses (93% of medium businesses and 98% of large businesses, vs. 75% overall). The same is true for high-income charities (93% of those with income of £500,000 or more, vs. 63% overall).

The proportion that say cyber security is a high priority has remained stable since 2023, following an apparent decrease in prioritisation in 2023. The qualitative interviews suggest that, despite economic conditions, many organisations have continued to invest either the same amount or more in cyber security over the last 12 months. This is in part a response to the perceived increase in the number of cyber-attacks and their sophistication.

Three in ten businesses and charities (both 30%) have board members or trustees explicitly responsible for cyber security as part of their job role - rising to 51% of medium businesses and 63% of large businesses. There has been no change in the overall figures since 2023.

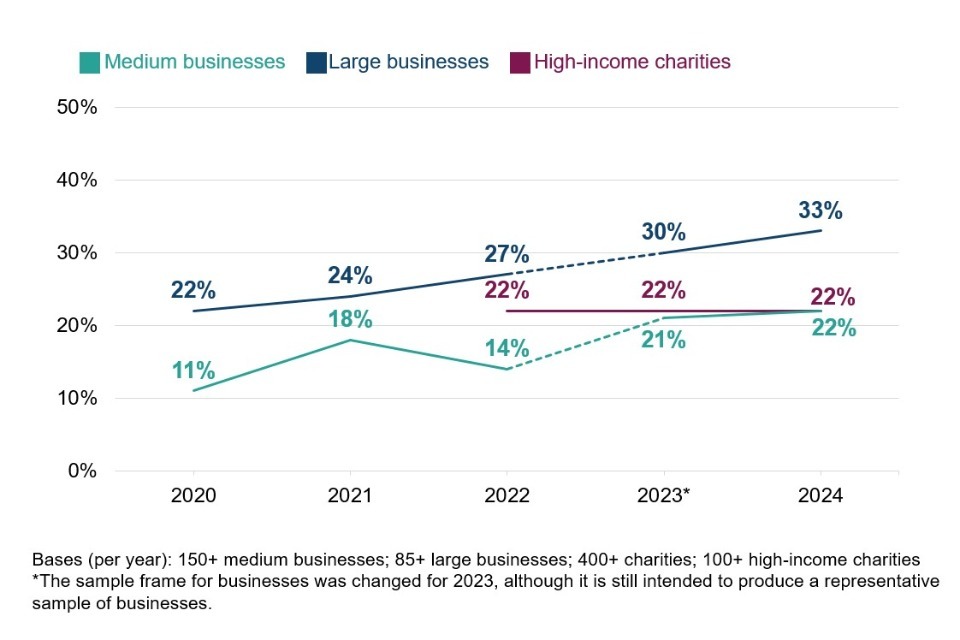

22% of medium businesses and 33% of large businesses have heard of the NCSC’s Board Toolkit rising from 11% and 22% respectively in 2020 (when it was introduced).

58% of medium businesses, 66% of large businesses and 47% of high-income charities have a formal cyber security strategy in place. The figures for both businesses and charities are higher than in 2023 with significant changes seen for medium businesses and charities.

Qualitative data shows a similar set of issues to previous years that prevent boards from engaging more in cyber security, including a lack of knowledge, training and time. It also highlights a contrast between more structured board engagement in larger organisations, compared with more informal approaches in smaller organisations, where responsibility was often passed onto external contractors.

Cyber accreditations and following guidance

The proportion of businesses seeking external information or guidance on cyber security has fallen since 2023. In addition, a sizeable proportion of organisations, including larger organisations, continue to be unaware of government guidance such as the 10 Steps to Cyber Security, and the government-endorsed Cyber Essentials standard. Linked to this, relatively few organisations at present are adhering to recognised standards or accreditations.

Four in ten businesses (41%) and charities (39%) report seeking information or guidance on cyber security from outside their organisation in the past year, most commonly from external cyber security consultants, IT consultants or IT service providers. The figure for businesses is lower than in 2023 (49%), while there has been no change among charities.

13% of businesses and 18% of charities are aware of the 10 Steps guidance - rising to 37% of medium businesses and 44% of large businesses. Nevertheless, 39% of businesses and 32% of charities have taken action on 5 or more of the 10 Steps. This is much more common in medium businesses (80%) and large businesses (91%). Just 3% of businesses and charities have enacted all 10 Steps, increasing to 14% of medium businesses and 27% of large businesses.

12% of businesses and 11% of charities are aware of the Cyber Essentials scheme, consistent with 2023 but representing a decline over last 2-3 years. Awareness is higher among medium businesses (43%) and large businesses (59%). Although only 3% of businesses and charities report adhering to Cyber Essentials, a higher proportion (22% of businesses and 14% of charities) report having technical controls in all five of the areas covered by Cyber Essentials.

Qualitative findings suggest the desire to seek external accreditation can be due to client demand, pressure from board members, a motivation to enforce a positive change in staff culture, and peace of mind for stakeholders.

Incident response

While a large majority of organisations say that they will take several actions following a cyber incident, in reality a minority have agreed processes already in place to support this. These findings are consistent with previous years.

The most common processes, mentioned by around a third of businesses and charities, are having specific roles and responsibilities assigned to individuals, having guidance on external reporting, and guidance on internal reporting.

Formal incident response plans are not widespread (22% of businesses and 19% of charities have them). This rises to 55% of medium-sized businesses, 73% of large businesses and 50% of high-income charities.

External reporting of breaches remains uncommon. Among those identifying breaches or attacks, 34% of businesses and 37% of charities reported their most disruptive breach outside their organisation. Many of these cases simply involve organisations reporting breaches to their external cyber security or IT providers and no one else.

The qualitative interviews highlighted several challenges organisations might face when dealing with cyber incidents. In smaller organisations, there was a strong reliance on DSPs for incident response, such as IT providers and cloud storage providers. This was linked with a lack of in-house expertise or capacity. In larger organisations, the challenges were often more related to a disconnect between IT or cyber teams and wider staff, including senior managers.

Cyber crime

Some cyber security breaches and attacks do not constitute cyber crimes under the Computer Misuse Act 1990 and the Home Office Counting Rules. Therefore, the statistics on prevalence and financial cost of cyber crime differ from the equivalent estimates for all cyber security breaches or attacks (as described above). They should be considered as a distinct set of figures, specifically for crimes committed against organisations, so are a subset of all breaches and attacks.

This survey includes questions on cyber crime and cyber-facilitated fraud. Changes to the questions were made in order to strengthen the reliability of the more experimental data from the 2023 survey. Due to these changes, it is not possible to make direct comparisons between 2023 and 2024. The new 2024 data should also still be considered experimental.

An estimated 22% of businesses and 14% of charities have experienced cyber crime in the last 12 months, rising to 45% of medium businesses, 58% of large businesses and 37% of high-income charities. Looked at another way, among the 50% businesses and 32% of charities identifying any cyber security breaches or attacks, just over two-fifths (44% for businesses and 42% for charities) ended up being victims of cyber crime.

Phishing is by far the most common type of cyber crime in terms of prevalence (90% of businesses and 94% of charities who experienced at least one type of cyber crime). The least commonly identified types of cyber crime are ransomware and denial of service attacks (2% or less of businesses and charities who experienced cyber crime in each case). When removing phishing-related cyber crimes, we estimate that 3% of businesses and 2% of charities have experienced at least one non-phishing cyber crime in the last 12 months.

A total of 3% of businesses and 1% of charities have been victims of fraud as a result of cyber crime. The proportion is higher among large businesses (7%).

We estimate that UK businesses have experienced approximately 7.78 million cyber crimes of all types and approximately 116,000 non-phishing cyber crimes in the last 12 months. For UK charities, the estimate is approximately 924,000 cyber crimes of all types in the last 12 months. It should be noted that these estimates of scale will have a relatively wide margin of error.

The average (mean) annual cost of cyber crime for businesses is estimated at approximately £1,120 per victim (this excludes crimes where the only activity was phishing).

Chapter 1: Introduction

1.1 Code of practice for statistics

The Cyber Security Breaches Survey is an official statistic and has been produced to the standards set out in the Code of Practice for Statistics.

1.2 Background

Publication date: 9 April 2024

Geographic coverage: United Kingdom

The Department for Science, Innovation and Technology (DSIT), in partnership with the Home Office, commissioned the Cyber Security Breaches Survey of UK businesses, charities and education institutions as part of the National Cyber Security Programme.[footnote 1] The findings of this survey provide a comprehensive description of cyber security for a representative sample of UK organisations, which provides a snapshot of UK cyber resilience at this point in time. It tells us about the cyber threats’ organisations face and the actions they are taking to stay secure. It also supports the government to shape future policy in this area, in line with the National Cyber Strategy 2022.

To increase the value of these statistics, the study now includes estimates of cyber crime, and fraud that occurred as a result of cyber crime (see Chapter 6). Whilst questions on cyber crime were included in the 2023 survey, they were significantly changed for the 2024 survey and so there is no baseline for comparison. These statistics should ideally be considered alongside other related evidence on computer misuse, such as the general public statistics from the Crime Survey for England and Wales (CSEW). The Cyber Security Breaches Survey adds to the broad picture from these other surveys by looking at these types of crimes across businesses and charities.

The research was conducted by the independent research organisation, Ipsos. The project requirements and reporting are approved by Department for Science, Innovation and Technology and the Home Office. The 2024 publication includes coverage of the following areas:

- prioritisation, information seeking (including use of government guidance) and decision making on cyber security, including among organisations’ management boards

- cyber security approaches, covering risk management (including cyber insurance and supply chain risks), technical controls, staff training and responsibilities and governance

- the cyber threat landscape, including identification of cyber security breaches or attacks, their outcomes and impacts, their estimated financial cost

- incident response approaches and reporting of cyber security breaches or attacks

- the prevalence, nature, scale and financial costs of cyber crime, as well as the prevalence, nature and scale of fraud that occurred as a result of cyber crime

This 2024 publication follows previous surveys in this series, published annually since 2016. In each publication year, the quantitative fieldwork has taken place in the winter of the preceding year (for example, September 2023 to January 2024, for this latest survey).

This Statistical Release focuses on the business and charity outcomes. The results for educational institutions have been included in a separate Education Annex.

1.3 Methodology

As in previous years, there were two strands to the Cyber Security Breaches Survey:

- We undertook a random probability telephone and online survey of 2,000 UK businesses, 1,004 UK registered charities and 430 education institutions from 7 September 2023 to 19 January 2024. The data for businesses and charities have been weighted to be statistically representative of these two populations.

- We carried out 44 in-depth interviews between December 2023 and January 2024, to gain further qualitative insights from some of the organisations that answered the survey.

Sole traders and public-sector organisations are outside the scope of the survey. In addition, businesses with no IT capacity or online presence were deemed ineligible. These exclusions are consistent with previous years, and the survey is considered comparable across years.

The educational institutions, covered in the separate Education Annex, comprise 185 primary schools, 171 secondary schools, 43 further education colleges and 31 higher education institutions.

More technical details and a copy of the questionnaire are available in the separately published Technical Annex.

1.4 Changes since the 2023 study

The core approach for the 2024 study - data collected from organisations via a random-probability survey, predominantly conducted by telephone is unchanged from the previous years. As such, we continue to make comparisons to previous years with the exceptions noted below.

Whilst there were no changes to the methodology between 2023 and 2024, there were some changes to the questionnaire. Key changes include modifications to the questions capturing breaches or attacks; wording changes throughout e.g. switching from ‘infected’ to ‘targeted’ and significant changes to the cyber crime questions. The significant changes made to the cyber crime questions were done primarily to reduce complexity of the overall section of the survey.

Respondents were guided through a series of questions which determine what the principle crime was (not relying on respondent to recall order of events) and avoid double counting. This was intended to prevent respondents from contradicting themselves and thus improve data quality. Full details of the questionnaire’s changes are covered in the Technical Annex. Due to these changes, it is not possible to make direct comparisons between 2024 and previous years on incidence of cyber breaches or attacks and on the cyber crime questions.

1.5 Interpretation of findings

How to interpret the quantitative data

The survey results are subject to margins of error, which vary with the size of the sample and the percentage figure concerned. For all percentage[footnote 2] results, subgroup differences have been highlighted only where statistically significant (at the 95% level of confidence).[footnote 3] This includes comparison by size, sector, and previous years. By extension, where we do not comment on differences across years, for example in line charts, this is specifically because they are not statistically significant differences. There is a further guide to statistical reliability at the end of this release.

As noted throughout the report, the survey questionnaire included both ‘prompted’ and ‘unprompted’ questions. A prompted question is where the respondent is given a list of possible answers and is asked to choose from this list. An unprompted question asks the respondent to answer in their own words. In general, a prompted question is more appropriate where the possible answers are more clearly defined or known in advance, whereas an unprompted question is more exploratory and produces a wider range of answers.

Subgroup definitions and conventions

For businesses, analysis by size splits the population into micro businesses (1 to 9 employees), small businesses (10 to 49 employees), medium businesses (50 to 249 employees) and large businesses (250 employees or more).

For charities, analysis by size is primarily considered in terms of annual income band, specifically looking at the subgroups of high-income charities (with annual incomes of £500,000 or more) and very high-income charities (£5 million or more). Throughout the report we primarily report on High-Income Charities (with annual incomes of £500,000 or more).

Due to the relatively small sample sizes for certain business sectors, these have been grouped with similar sectors for more robust analysis. Business sector groupings referred to across this report, and their respective SIC 2007 sectors, are:

- administration and real estate (L and N)

- agriculture, forestry, and fishing (A)

- construction (F)

- education (P)[footnote 4]

- health, social care, and social work (Q)

- entertainment, service, and membership organisations (R and S)

- finance and insurance (K)

- food and hospitality (I)

- information and communications (J)

- utilities and production (including manufacturing) (B, C, D and E)

- professional, scientific and technical (M)

- retail and wholesale (including vehicle sales and repairs) (G)

- transport and storage (H).

Analysis of organisation cyber security split by geographical region is considered to be out of the scope of this reporting. While we may occasionally provide data specific for UK regions (at International Territorial Level 1), we recommend caution in attributing these differences to actions taken or not taken by that region regional differences may also be attributable to the size and sector profile of the sample in that region.

Where figures in charts do not add to 100%, or to an associated net score, this is due to rounding of percentages or because the questions allow more than one response.

How to interpret the qualitative data

The qualitative findings offer more nuanced insights into the attitudes and behaviours of businesses and charities with regards to cyber security. The findings reported here represent common themes emerging across multiple interviews. Insights and verbatim quotes from individual organisations are used to illustrate findings that emerged more broadly across interviews. However, as with any qualitative findings, these examples are not intended to be statistically representative.

1.6 Acknowledgements

Ipsos UK, DSIT and the Home Office would like to thank all the organisations and individuals who participated in the survey. We would also like to thank the organisations who supported the survey development work, endorsed the fieldwork, and encouraged organisations to participate, including:

- the Association of British Insurers (ABI)

- the Charity Commission for England and Wales

- the Charity Commission for Northern Ireland

- Jisc, a not-for-profit company that provides digital infrastructure, services, and guidance for UK further and higher education institutions

- the Office for National Statistics (ONS)

- the Office of the Scottish Charity Regulator (OSCR)

- TechUK

- UCISA (formerly known as the Universities and Colleges Information Systems Association).

Chapter 2: Awareness and attitudes

This chapter explores:

- prioritisation of cyber security within organisations

- receiving and reacting to information and guidance about cyber security

- qualitative data on how organisations make decisions on cyber security.

2.1 Perceived importance of cyber security

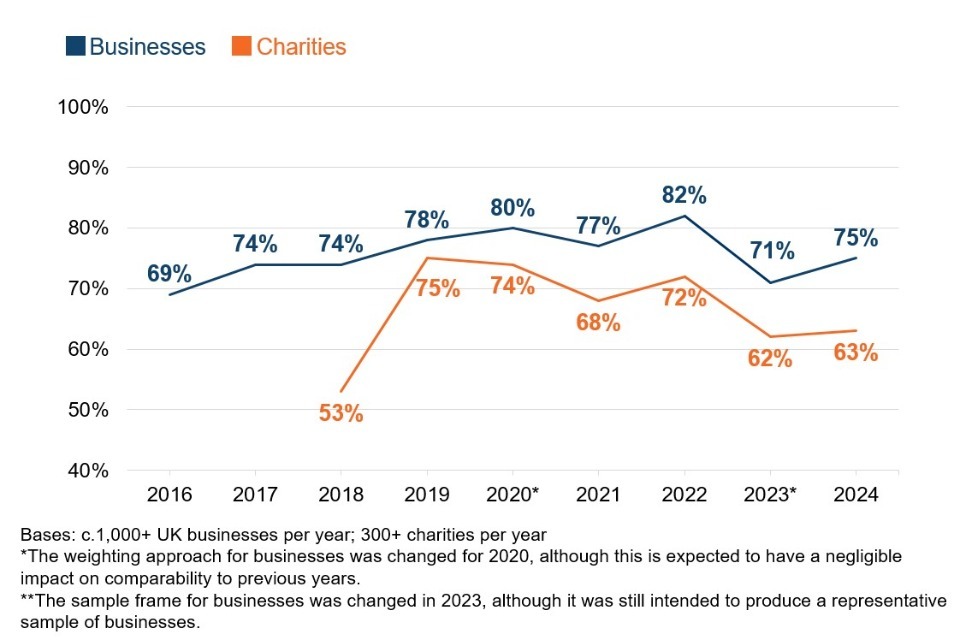

Three-quarters of businesses (75%) and more than six in 10 charities (63%) report that cyber security is a high priority for their senior management (Figure 2.1).

In interpreting this question, note that in smaller organisations, the individuals responsible for cyber security i.e. the ones who completed this survey tend to be senior management, so are answering with regards to their own views. In larger organisations, these individuals may not be part of senior management, so their answers will reflect their own perceptions of their senior management team’s views.

Figure 2.1: Extent to which cyber security is seen as a high or low priority for directors, trustees, and other senior managers

| Organisation Type | % Very High | % Fairly High | % Fairly Low | % Very Low | % Don’t Know | - |

|---|---|---|---|---|---|---|

| Businesses Overall | 35 | 40 | 17 | 7 | 1 | |

| Charities Overall | 29 | 33 | 22 | 12 | 3 |

Bases: 991 UK businesses; 456 charities

Among businesses, there has been a shift in the proportion saying cyber security is a “fairly” high priority (e.g. from 35% of businesses last year, to 40% this year). The proportions of businesses saying it is a very high priority is consistent with last year (36% last year and 35% this year). In 2023, as evidenced by the qualitative interviews, it was felt that cyber security had moved down the agenda among the businesses where it was already seen as a more marginal priority, and among businesses that typically have the fewest resources to deploy. The qualitative findings this year point towards an increased awareness of the risks that are faced when not prioritising cyber security, which could explain the increase in businesses this year rating it as a high priority.

It is more common for larger businesses to say that cyber security is a high priority (93% of medium businesses and 98% of large businesses, vs. 75% overall). The same is true for high-income charities (93% of those with income of £500,000 or more, vs. 63% overall). This continues the pattern seen since 2020, where larger organisations tend to treat cyber security more seriously, and consequently allocate more resources to it.

Businesses in the following sectors tend to treat cyber security as a higher priority than others:

- information and communications (65% a “very” high priority)

- finance and insurance (61% say it is a “very” high priority)

- health, social care and social work (62% a “very” high priority).

Unlike in previous years, where food and hospitality businesses tended to regard cyber security as a lower priority than those in other sectors, they now regard cyber security as a higher priority in line with businesses overall (72% vs. 75% of businesses overall).

By contrast, businesses in the agriculture sector tend to regard cyber security as a lower priority than those in other sectors (59% say it is a high priority, vs. 75% of businesses overall).

Whilst in the 2023 CSBS business in the South East tended to place a higher prioritisation on cyber security than the average UK business (80% said it is a high priority, vs. 71% overall), in 2024 the region with the highest prioritisation on cyber security vs. total businesses is the North West (83% said it is a high priority, vs. 75% overall).

Trends over time

Figures 2.2 shows how the prioritisation score has changed over time. For businesses, the apparent drop in prioritisation of cyber security in 2023 (71% saying it was a high priority) is somewhat reversed with 75% now rating it as a high priority, more in line with previous years of the survey.

The drop among charities rating cyber security as a high priority in 2023 has been maintained in 2024 (it is now 63%, in line with 62% in 2023 and both down from 72% in 2022).

Figure 2.2 Percentage of organisations over time where cyber security is seen as a high priority for directors, trustees, and other senior managers

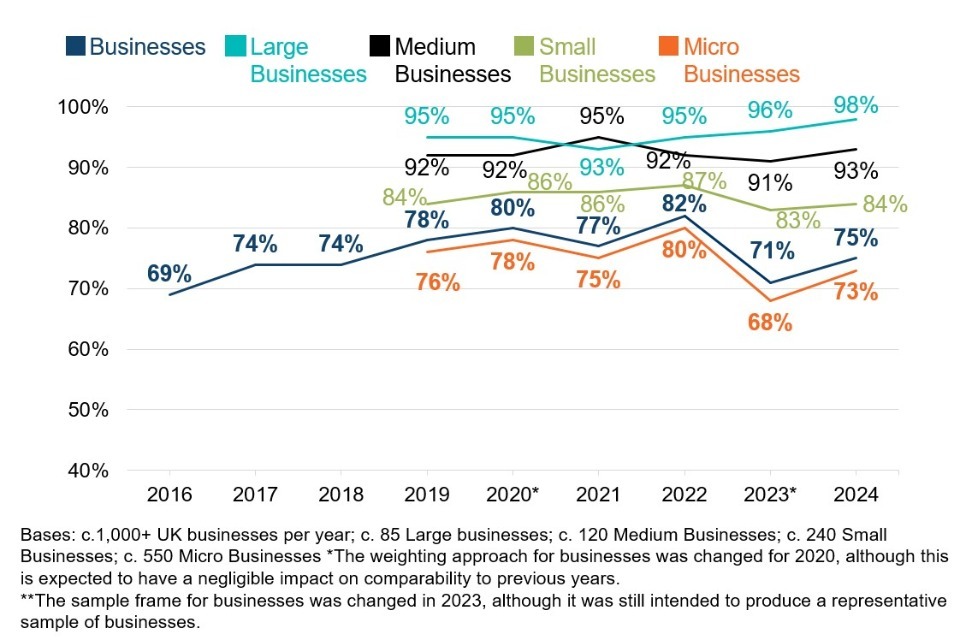

The increase in prioritisation of cyber security is found across all sizes of businesses however, no changes are statistically significant:

- 73% of micro businesses say it is a high priority (vs. 68% in 2023)

- 84% of small businesses say it is a high priority (vs. 83% in 2023)

- 93% of medium businesses say this (vs. 91% in 2023)

- 98% of large businesses say this (vs. 96% in 2023).

Figure 2.3 Percentage of business organisations over time where cyber security is seen as a high priority for directors, trustees, and other senior managers

Qualitative insights on cyber security prioritisation in the current economic environment

The qualitative interviews suggest that, despite economic conditions, many organisations have continued to invest either the same amount or more in cyber security over the last 12 months. There was a sense across the interviews that cyber security was still high on the priority list and, in some cases, has grown in importance.

“We have been resilient; I don’t feel it [current economic condition] has had a huge impact. Cyber security is not going to be de-prioritised.”

Business Systems and IT Project Manager, Medium Sized Business

There were exceptions - a few smaller organisations and charities said their budgets had been cut which meant they had to cut back on their cyber security spend. As a result, these organisations tended to take a reactive approach, where they would look at individual cyber security problems as and when they arose. For example, one medium sized organisation said they are having to rely on internal teams to provide staff training because they don’t have the budget to spend on something more comprehensive:

“Have to be more savvy as an IT team. Using Teams for staff webinars, emails, things we can do for free. Do not have money to purchase more comprehensive training. All budgets have been slashed.”

Head of IT Operations, Medium Sized Business

Another theme emerging from the interviews was the number of cyber attacks had increased because the difficult economic conditions were driving opportunists to take advantage. Often, interviewees who mentioned a rise in cyber-attacks referred to an increase in phishing risks. Because of this, some organisations said they have become more vigilant and have invested more in cyber security as a result.

“I think the [risks] are only growing in that there are more threats and actors out there, and investment is required to keep pace with that.”

Business Systems and IT Project Manager, Medium Sized Business

“We’re acutely aware of the cost of living and people doing whatever they can to financially gain for it there’s surely a rise in opportunistic cyber criminals.”

Operations and IT lead, Medium Income Charity

The qualitative interviews also highlighted that phishing attacks have become more sophisticated because of an advancement in technology. One small business said they had an unsuccessful phishing attempt where the attacker had pretended to be their CEO. Their concern was that while the IT team can quickly identify the signs of phishing attack, the wider team may not be as quick to recognise these.

“We’ve had a couple of unusual ones where they’ve actually spoofed the website, the branding, the person brilliantly. But then the general wording of the email just doesn’t read right”.

Head of IT, Medium Sized Business

“In harder economic conditions, the level of attacks is going up. So, we have to be doubly certain and be extra cautious about social engineering sophisticated attacks.”

Finance Director, High Income Charity

2.2 Involvement of senior management

How often are senior managers updated on cyber security?

Figure 2.4 breaks down how often senior managers get updates on the state of cyber security and any actions being taken. It shows that updates tend to be more frequent in businesses than in charities, continuing a trend from previous years.

As with last year, this question was restricted to medium and large businesses, and to high-income charities. Nearly two-thirds of medium businesses (63%) and almost eight in ten large businesses (78%) update their senior team at least quarterly, as do nearly two-thirds of high-income charities (63%). Four-fifths of businesses (79% of medium businesses and 87% of large businesses) and a similar proportion of charities (86%) say senior managers are updated at least once a year.[footnote 5]

Figure 2.4 How often directors, trustees or other senior managers are given an update on any actions taken around cyber security

| Organisation | % Monthly or more frequently | % Quarterly | % Annually | % Less than once a year | % Each time there is a breach or attack | % Don’t know | - |

|---|---|---|---|---|---|---|---|

| Medium businesses | 40 | 23 | 15 | 3 | 5 | 10 | |

| Large businesses | 55 | 22 | 9 | 1 | 1 | 10 | |

| High-Income charities | 26 | 37 | 23 | 4 | 3 | 4 |

Bases: 264 medium businesses; 170 large businesses; 335 high-income charities

The results for medium and large businesses are similar to last year. However, there has been an increase in the proportion of high-income charities updating senior managers at least quarterly (63% vs. 54% in 2023) and at least annually (86% vs. 80% in 2023). Whilst 29% of high-income charities updated senior managers on a quarterly basis in 2023, 37% are doing so this year, suggesting that among high-income charities senior management discussion of cyber security is now a more common activity.

Board responsibilities

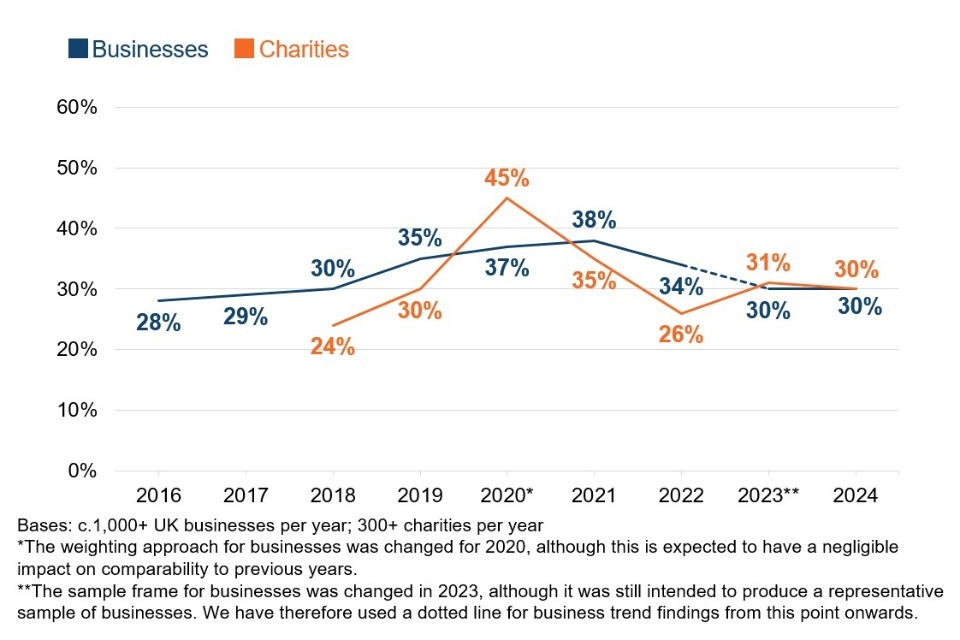

Three in ten businesses (30%) and the same proportion of charities (30%) have board members or trustees taking explicit responsibility for cyber security as part of their job (Figure 2.5). This is across all organisations (i.e. not just those that have a formal management board) – although all registered charities have boards of trustees.

As might be expected, board-level responsibility is much more common in larger businesses, where the management board is likely to be larger. Around two-thirds of large businesses (63%) have a board member responsible for cyber security (vs. 30% of businesses overall). Similarly, low-income charities (those with an income of less than £100,000) were less likely to have a board member responsible for cyber security (28%) than those with an income of more than £100,000 (38%).

Figure 2.5 Percentage of organisations with board members or trustees that have responsibility for cyber security

Bases: 2,000 UK Businesses; 1,060 micro businesses; 506 small businesses; 264 medium businesses; 170 large businesses; 124 information and communications businesses; 142 finance and insurance businesses; 221 professional, scientific and technical businesses; 1,004 charities

Information and communications businesses (60%), finance and insurance businesses (52%) and professional, scientific and technical businesses (42%) are each more likely than average to have board members taking responsibility for cyber security. These sectors, which tend to prioritise cyber security more, were also above average in the 2023, 2022 and 2021 surveys. At the other end of the scale, businesses in agriculture (15%), construction (20%), entertainment, service or membership organisations (22%), and food and hospitality (22%) are among the least likely to have board members assigned this role.

Trends over time

Figure 2.6 shows the trend over time for board members taking on cyber security responsibilities. Among businesses overall, the same proportion had board members taking on cyber security responsibilities in 2024 and 2023 (30%).

Among medium and large businesses, the decline observed amongst those businesses regarding having board members has been reversed and is back to 2021 levels, with a significantly higher proportion of medium (51% vs. 41% in 2023) and large businesses (63% vs. 53% in 2023) now having board members with responsibility for cyber security.

Among charities, this year’s result sustains the increase between 2022 and 2023 (30% this year and 31% in 2023 vs. 26% in 2022).

Figure 2.6 Percentage of organisations over time with board members or trustees with responsibility for cyber security

Qualitative insights on formal versus informal board engagement

As seen in previous years, the qualitative interviews suggest that individuals taking day-to-day responsibility for cyber security highly value engagement from senior board members. This senior engagement helps them secure the buy-in of wider staff (e.g. when cyber security directives came with the backing of senior management), to challenge and improve their own approaches, and to get quicker approval for new measures.

“They are very supportive and understanding, they are very aware of the consequences.”

IT and Digital Services Manager, High Income Charity

“It’s on their radar and they’re astute. They agree with what we suggest most of the time. With spending decisions, it’s largely their job to decide the benefit, but we don’t get much pushback from them.”

Director of Operations, Medium Income Charity

However, there were several recurring reasons to explain why board members did not engage, including a lack of understanding or interest in cyber security relative to the day-to-day operations of the organisation, a lack of training, a lack of time and a perception that their kind of organisation was not facing an especially high risk from cyber-attacks.

“I was supposed to be attending a board meeting to talk about cyber security, but the meeting filled up with lots of things and funnily enough the thing that got pushed off the agenda was the cyber security piece”.

Data and Insight Manager, High Income Charity

The findings suggest board engagement becomes more structured and formal as organisations grow. Some of the larger organisations had regular cyber security reports going to the board, had cyber security as a standing agenda item at board meetings (or at a subcommittee level just below the board), or reviewed cyber security as part of a regular look at their risk register.

By contrast, in small and medium-sized organisations, the approaches for keeping boards informed tended to be more informal. Several of these interviewees mentioned discussing cyber security with senior managers in an ad hoc and reactive manner, i.e. only when specific issues arose. One small charity suggested their board would only need to hear about cyber security when they needed to make spending decisions or an IT upgrade for board approval. Another medium sized architecture firm said they hoped that by obtaining the ISO accreditation, they would be able to implement a more regular reporting system on cyber security. At the moment, they are reporting reactively to specific events.

Often, in these cases, it was clear that boards were placing a great deal of trust either in their internal IT leads, or in their external IT providers they assumed these individuals would flag any serious issues with them. There was a sense among some of the small businesses interviewed that the problem of cyber security had been passed onto external contractors, resulting in senior managers disengaging from the topic and failing to understand the actions being taken, both internally and externally.

2.3 Sources of information

Overall proportion seeking cyber security information or guidance

External sources of information and guidance on cyber security include government sources, third-party cyber security or IT providers, and trade bodies, as well as information found through an internet search or from the media. Around four in ten businesses (41%) and charities (39%) report actively seeking information or guidance on cyber security from outside their organisation in the past year.

For charities this result mirrors the previous iterations of the study in 2023 and 2022, however, for businesses this result represents a significant decrease from 2023 (when 49% of businesses sought information or guidance on cyber security from outside their organisation). There has been a steady decrease in the proportion of businesses seeking external information or guidance since it peaked in 2018 and 2019 (59%), which was seen in the lead up to, and following the implementation of the General Data Protection Regulation (GDPR). For charities, it has remained around the same level since 2018 (when 36% of charities had sought external information or guidance).

As Figure 2.7 illustrates, external information is less often sought in micro businesses. There is a similar pattern among charities only a third (34%) of charities with incomes under £100,000 have sought external information compared to three-quarters (76%) of high-income charities with incomes of £500,000 or more, and 39% of charities overall.

The sectors where businesses are most likely to seek out external information are finance and insurance (61%), admin and real estate (58%) and the professional, scientific and technical sector (54%).

Figure 2.7 Proportion of organisations that have sought external information or guidance in the last 12 months on the cyber security threats faced by their organisation

Bases: 991 UK businesses; 532 micro businesses; 245 small businesses; 129 medium businesses; 85 large businesses; 76 finance and insurance businesses; 106 professional, scientific and technical businesses; 456 charities

Only one in 20 businesses (6%) and one in ten charities (9%) seek information internally within their organisations. This is in line with last year (when it was 8% of businesses and 12% of charities doing so).

As might be expected, internal information seeking is higher within large businesses (17%), which are more likely to employ cyber security specialists. This is higher than in both medium businesses (12%) and high-income charities (11%).

Where do organisations get information and guidance?

As in previous years, the most common individual sources of information and guidance are:

- external cyber security consultants, IT consultants or IT service providers (mentioned by 23% of businesses and 16% of charities)

- any government or public sector source, including government websites, regulators, and other public bodies (3% of businesses and 4% charities)

- general online searching (4% of businesses and 3% of charities).

To note, this question is unprompted for those doing the survey by telephone (the vast majority), while those doing it online look at a prompted response list, meaning that the responses here are top of mind and initially where organisations go to first.

A wide range of individual sources are mentioned, with relatively low proportions for each. For example, just 1% of businesses and 2% of charities mention the National Cyber Security Centre (NCSC) by name, in line with 2023 (2% of businesses and charities mentioned it). This highlights that organisations are not going to official sources for advice and more likely to rely on IT consultants which are more likely to cost more for organisations.

There are a small number of further differences by size, or between businesses and charities that should be noted, particularly around the use of external cyber security consultants, IT consultants or IT service providers:

- Seeking information and guidance from external consultants or providers is most common among medium businesses (45%) higher than among large businesses (35%) and continuing the pattern from previous years. It reflects that these businesses may recognise the need for more cyber security expertise, but have to procure it externally, rather than employing experts internally like many large businesses.

- Among micro businesses, the most common sources are also external security/ IT consultants (21%). The next most common response is online searching (4%).

- Among charities, fewer than one in twenty (3%) mention charity-specific sources such as their relevant Charity Commission.[footnote 6]

Awareness of government guidance, initiatives, and communications

The question around information sources in the previous subsection tends to under-represent actual awareness of government communications on cyber security, as it is asked unprompted for individuals doing the telephone survey. In these kinds of unprompted questions, individuals often do not recall specific things they have seen and heard. We therefore ask organisations, in a later set of prompted questions, whether they have heard of specific initiatives or communications campaigns before. These include:

- the national Cyber Aware communications campaign, which offers tips and advice to protect individuals and small businesses against cyber crime

- the 10 Steps to Cyber Security guidance, which summarises how organisations can protect themselves by managing cyber risk

- the government-endorsed Cyber Essentials scheme, which enables organisations to be certified independently for having implemented technical good-practice in cyber security.

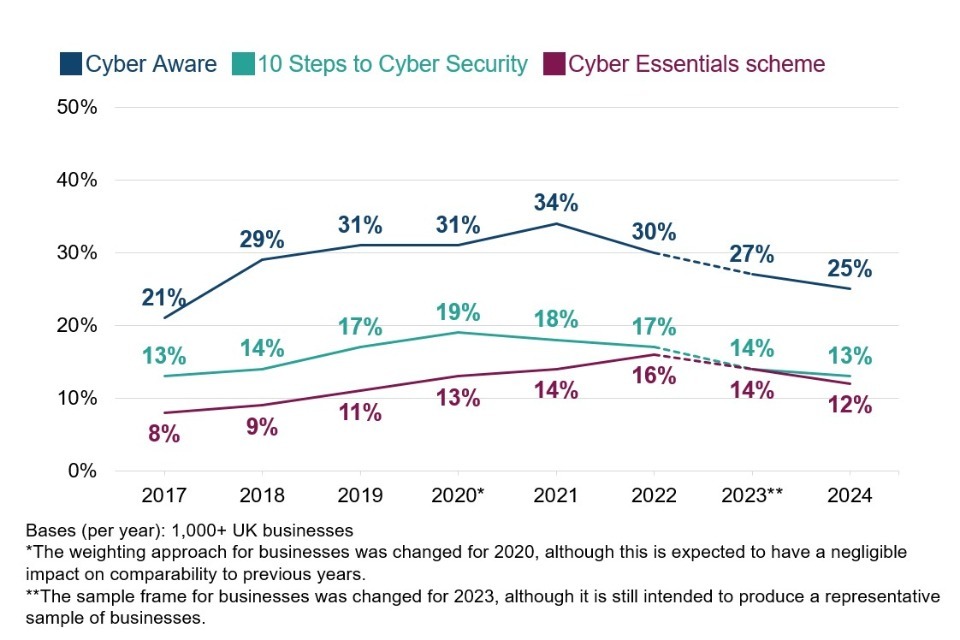

As Figure 2.8 shows, Cyber Aware is the most commonly recognised of these. However, initiatives or campaign awareness, only a minority of businesses and charities have heard of any of them.

Figure 2.8 Percentage of organisations aware of the following government guidance, initiatives, or communication campaigns

| Organisation type | Businesses | Charities |

|---|---|---|

| Cyber Aware campaign | 25% | 30% |

| 10 Steps to Cyber Security guidance | 13% | 18% |

| Cyber Essentials scheme | 12% | 11% |

Bases: 1,009 UK businesses; 548 charities

Medium and large businesses are substantially more aware of these guidance packages:

- 45% of medium businesses and 57% of large businesses have heard of Cyber Aware (vs. 25% overall)

- 37% of medium businesses and 44% of large businesses are aware of the 10 Steps guidance (vs. 13% overall)

- 43% of medium businesses and 59% of large businesses are aware of Cyber Essentials (vs. 12% of all businesses).

In a similar pattern, high-income charities are also substantially more aware of these guidance packages:

- 44% of high-income charities have heard of Cyber Aware (vs. 30% overall)

- 41% of high-income charities are aware of the 10 Steps guidance (vs. 18% overall)

- 38% of high-income charities are aware of Cyber Essentials (vs. 11% of all businesses).

As in previous years, there is little difference between UK nations and regions when it comes to awareness of these different schemes or campaigns.

Trends over time

Figure 2.9 illustrates that business awareness of these schemes and initiatives is close to the previous survey, although there is a pattern of declining awareness of all three initiatives over the last two to three years - with significant declines seen since 2022. Fewer charities also report having heard of Cyber Essentials compared to the previous year (11% this year vs. 15% in 2023).

Figure 2.9 Percentage of businesses over time aware of the following government guidance, initiatives, or communication campaigns

The decline in awareness for Cyber Aware since 2022 is driven by a decline among Micro and Small business. There was a significant decline in awareness for Cyber Aware among Micro businesses since 2021 from 34% to 24% in 2024 and a similar, and significant, decline among small business since 2021 from 38% to 28% in 2024. Similarly, the decline in awareness seen for 10 Steps to Cyber Security is driven by a decline Micro and Small business, but to a lesser extent.

Guidance targeted at specific types of organisations

Since 2020, the survey has asked about NCSC guidance that is directed to specific sizes of business or towards charities. This includes:

- the NCSC’s Small Business Guide and Small Charity Guide, which outline more basic steps that these smaller organisations can take to protect themselves

- the NCSC’s Board Toolkit, which helps management boards to understand their obligations, and to discuss cyber security with the technical experts in their organisation.

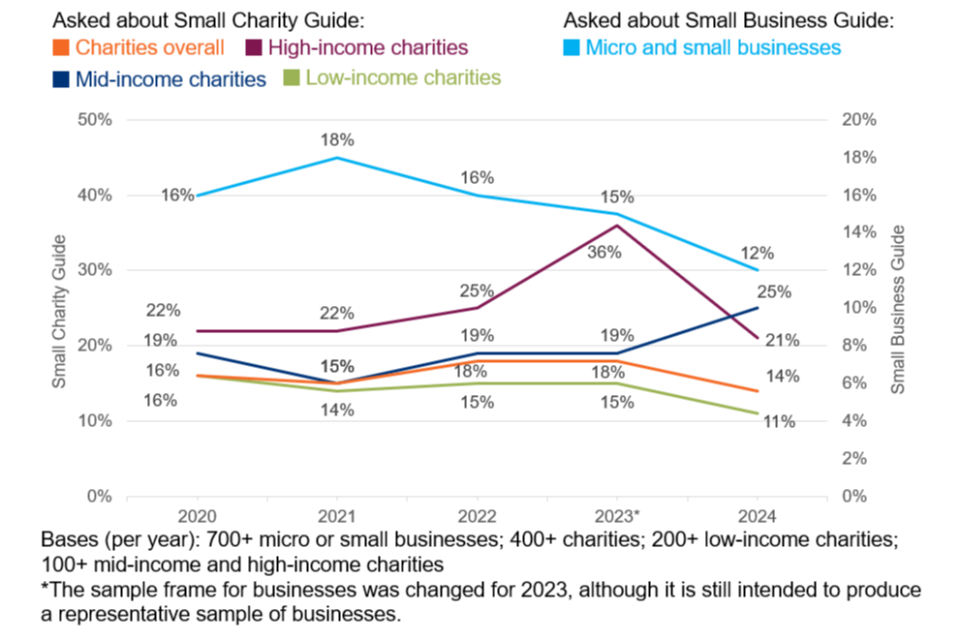

Figure 2.10 shows that around one in eight micro and small businesses (12%) have heard of the Small Business Guide. This is similar between micro businesses (11%) and small businesses (13%), which was also the pattern in previous years. Whilst this does not represent a significant drop from last year in awareness among micro and small businesses (15% in 2023), it does point towards steadily declining awareness of the small business guide over the last three years.

Around one in seven charities (14%) have heard of the Small Charity Guide. This result for charities overall has been relatively consistent across years. However, as Figure 2.9 shows, the result for high-income charities increased last year, with more than a third of these charities (36%) aware of the Small Charity Guide. It is also important to note the increase seen among mid-income level charities seeing an increase this year in awareness of the Small Charity Guide.

Figure 2.10 Percentage of businesses and charities over time aware of the Small Business Guide and Small Charity Guide

The Board Toolkit was specifically explored with medium and large businesses in the survey, as well as high-income charities (from the 2021 study onwards). Among medium and large businesses, as Figure 2.11 shows, awareness of the Toolkit has been on the rise, particularly amongst large businesses, since it was first published in 2020. However, the majority of medium and large businesses and high-income charities remain unaware of it.

Figure 2.11 Percentage of medium and large businesses, and charities over time aware of the Board Toolkit

Broadly, these findings suggest that larger organisations are increasing their engagement with cyber security, and any stagnation (e.g. drops in awareness of the Cyber Aware campaign) is more localised among micro and small businesses.

Impact of government information and guidance

A total of 39% of businesses and 44% of charities recall seeing, when prompted, at least one of the government communications or guidance covered in the previous section. This is consistent with 2023. The survey then asks a random sub-sample of these organisations an unprompted question about the changes they have made to their cyber security measures as a result of what they have seen. Just under half of the selected businesses and charities (43% and 44% respectively) report making at least one change. The figure for businesses making changes has decreased since 2023 (when it was 54%).

Large businesses are significantly more likely to have acted on seeing government initiatives or campaigns (60%, vs 44% of all businesses made at least one change). Around six in ten high-income charities report having done so on seeing this guidance (63%, vs. 44% of charities overall made at least one change).

In terms of the specific changes made, there are a wide variety of unprompted responses given. No single response appears that frequently. The most notable changes are:

- 25% of businesses and 29% of charities which recall seeing these government communications report making changes of a technical nature (e.g. to firewalls, malware protections, user access or monitoring)

- 13% of businesses and 14% of charities have made governance-related changes (e.g. increased spending, or updated policies or documentation)

- 18% of businesses and 15% of charities say they have made changes regarding staffing (e.g. employing new cyber security staff), outsourcing or training.

The top unprompted individual response categories are:

- changing or updating firewalls or system configurations (10% of businesses and 8% of charities)

- staff training and communications (8% and 11%)

- changing or updating antivirus or antimalware software (7% and 4%)

- outsourced cyber security/hired external provider (8% and 2%).

Chapter 3: Approaches to cyber security

This chapter looks at the various ways in which organisations are dealing with cyber security.

This covers topics such as:

- risk management (including supplier risks)

- reporting cyber risks

- cyber insurance

- technical controls

- training and awareness raising

- staffing and outsourcing

- governance approaches and policies.

We then explore the extent to which organisations are meeting the requirements set out in government-endorsed Cyber Essentials scheme and the government’s 10 Steps to Cyber Security guidance.

3.1 Identifying, managing, and minimising cyber risks

Actions taken to identify risks

Organisations can take a range of actions to identify cyber security risks, including monitoring, risk assessment, audits, and testing. They are not necessarily expected to be doing all these things the appropriate level of action depends on their own risk profiles.

Figure 3.1 shows the six actions covered by the survey. Deploying security monitoring tools and undertaking risk assessments continue to be the most common actions undertaken by both businesses and charities - although businesses are significantly more likely to be using monitoring tools than charities (33% vs. 23%).

Figure 3.1: Percentage of organisations that have carried out the following activities to identify cyber security risks in the last 12 months

| Organisation type | Businesses | Charities |

|---|---|---|

| Any of the listed activities | 51% | 40% |

| Used specific tools designed for security monitoring | 33% | 23% |

| Risk assessment covering cyber security risks | 31% | 26% |

| Tested staff (e.g. with mock phishing exercises) | 18% | 14% |

| Carried out a cyber security vulnerability audit | 17% | 12% |

| Penetration testing | 11% | 8% |

| Invested in threat intelligence | 10% | 6% |

Bases: 2,000 UK businesses; 1,004 charities

Each one of these actions is more common in larger organisations. Over eight in ten medium businesses (83%), nine in ten large businesses (92%) and over eight in ten high-income charities (86%) have carried out at least one of the listed activities. As specific examples:

- 63% of medium businesses and 71% of large businesses have used security monitoring tools

- similarly, 63% and 72% respectively have undertaken cyber security-related risk assessments.

Among these subgroups, in line with the wider business and charity populations, investing in threat intelligence remains the least common activity. This is undertaken by around four in ten (42%) of large businesses, while every other activity is carried out by between 60-70% of large businesses.

How organisations undertake audits and implement their findings

Among the 17% of businesses that undertake cyber security vulnerability audits, a third only undertake internal audits (31%), a slightly larger proportion only have external audits (41%) and a fifth (21%) carry out both.

The way that businesses undertake audits continues to be strongly linked to size:

- micro, small and medium businesses are most likely to solely use external contractors to undertake audits (42% of micro businesses, 41% of small businesses, and 35% of medium businesses)

- large businesses, likely having greater financial and personnel capacity, are more likely to state that audits have been undertaken both internally and externally (57%).

A similar proportion of charities have carried out cyber security vulnerability audits (12%, vs. 17% of businesses). The charities undertaking audits are, contrary to the average business, most likely to solely use internal staff for this (43%). They are less likely to do so via both internal and external contractors (28%), or just externally (20%).

Reviewing supplier risks

Suppliers can pose various risks to an organisation’s cyber security, for example:

- third-party access to an organisation’s systems

- suppliers storing the personal data or intellectual property of a client organisation

- phishing attacks, viruses or other malware originating from suppliers.

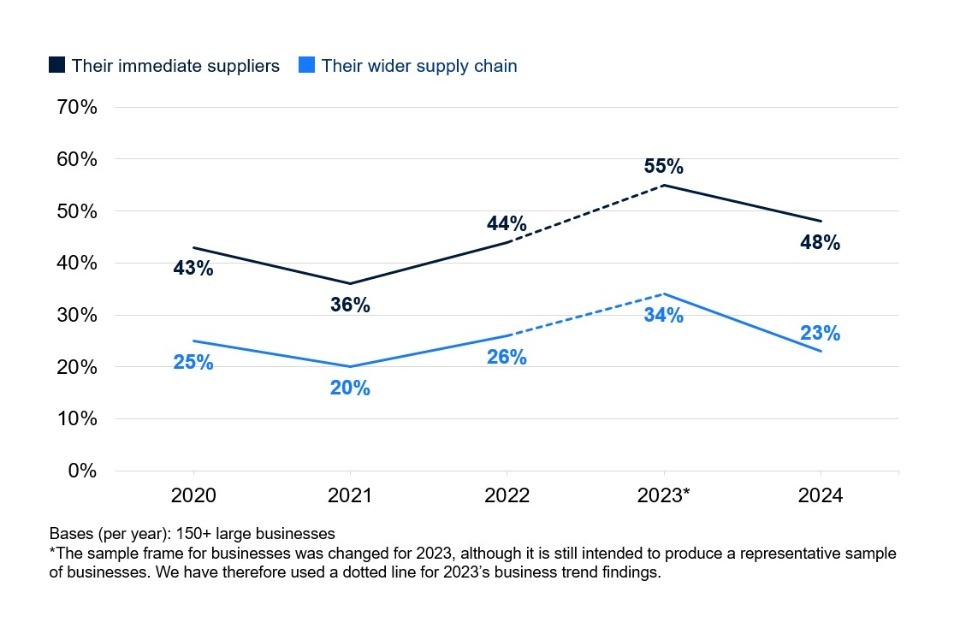

Despite this, relatively few businesses or charities are taking steps to formally review the risks posed by their immediate suppliers and wider supply chain. Just over one in ten businesses say they review the risks posed by their immediate suppliers (11%) and under one in ten are looking at their wider supply chain (6%). Among charities, the respective figures are slightly lower (9% look at their immediate suppliers and 4% at their wider supply chain).

As Figure 3.2 shows, the overall figures mask the wide variation by size and type of organisation. Possibly reflecting a more complex supply chain, over a quarter of medium businesses (28%) and nearly half of large businesses (48%) review the cyber security risks posed by their immediate suppliers, in comparison to 9% of micro business and 18% of small businesses. It is still relatively rare for larger businesses to review their wider supply chain (15% and 23% respectively do so).

Among charities, over a third of high-income charities have reviewed immediate supplier risks (36%, vs. 9% overall). However, only 15% of these high-income charities have reviewed their wider supply chains.

Figure 3.2: Percentage of organisations that have carried out work to formally review the potential cyber security risks presented by the following groups of suppliers

| Organisation type | Their immediate suppliers | Their wider supply chain |

|---|---|---|

| Businesses overall | 11% | 6% |

| Micro businesses | 9% | 5% |

| Small businesses | 18% | 8% |

| Medium businesses | 28% | 15% |

| Large businesses | 48% | 23% |

| Charities overall | 9% | 4% |

Bases: 2,000 UK businesses; 1,058 micro businesses; 504 small businesses; 264 medium businesses; 170 large businesses; 1,004 charities

Trends over time

This question has been asked since the 2020 study. As Figure 3.3 shows, among large businesses specifically, the proportions saying they review both their immediate supplier and their wider supply chain risks have decreased since last year, when they reached their peak proportions. For businesses, this figure is still higher than in 2021. However, the chart shows no clear longer-term trend for businesses or charities.

Figure 3.3: Percentage of large businesses over time that have carried out work to formally review the potential cyber security risks presented by the following groups of suppliers

Qualitative insights on broad supply chain risks

The qualitative interviews suggest that organisations have an increasing awareness of the cyber security risks posed by supply chains. Despite this, organisations, particularly at the smaller end, tend to have limited formal procedure in place to manage cyber risks from wider supply chains. Some organisations recognised that there were supply chain risks but acknowledged they have not yet done the work to fully protect themselves. For instance, one high-income charity mentioned that they are working on bringing in a more formalised cyber security approach to suppliers.

“A third-party liaison is coming in very soon to think specifically about this [supply chain risks] we want to be in a place where we have to give explicit permission to people to access our internal software and systems.”

Director of Operations, High Income Charity

At the more sophisticated end, organisations dealt with supplier risks in a variety of ways. Examples included contractual arrangements, supplier questionnaires, suppliers having to attain external accreditations (e.g. ISO 27001), regular meetings with key suppliers, adding supplier risks to risk registers, and logging of data flows with suppliers on data protection registers. At the other end of the scale, there were a small number of examples of more informal supply chain cyber risk management, including emailing suppliers ad hoc to ask what they have in place. One high income charity said they would not discuss much, other than sharing a data protection contract with the supplier to sign.

“We have data protection contracts but aside from that, not much”

Finance Director, High Income Charity

The ongoing monitoring of suppliers, post-procurement, appeared to be less common. This was often put down to a lack of formal processes, and conversations about cyber security only happening at the start of the contract. Many organisations felt they simply had to trust suppliers to comply with contracts, and that it was difficult to extract further information if suppliers or partners were not forthcoming.

“There is a reliance on them informing us if they have an attack.”

Operations Executive, Small Business

“We have no formalised supply chain risk assessment. But we have a risk management framework around onboarding new providers.”

Cyber and Information Security Manager, Small Business

Regardless of the type of supplier, there was a sense that conversations about cyber security tended to happen at the beginning of the contract. Some organisations felt it would be awkward to start having discussions about cyber security with suppliers who they have worked with for many years. Other organisations didn’t feel that it was necessary to have regular conversations with their supplier because the contract should ensure they will stick to their word.

“We have these longstanding relationships; we know them, and they know what their permission levels are… no one individual can make devastating changes to our internal systems”

Director of Operations, Medium Income Charity

“The primary communication would be onboarding process relating to the technical things. For example, ensuring they have the right accreditation, and asking right questions to make sure that they are both aligned. The contract promises to provide the service we require.”

Cyber and Information Security Manager, Small Business

Qualitative insights on Digital Service Providers (DSPs)

The qualitative interviews also looked at perceptions of the risks posed by Digital Service Providers (DSPs), such as cloud service providers. Organisations tend to have a broad understanding of who their DSPs are and how essential they are for their work. However, when organisations were asked about the reasons for choosing a certain supplier, and the levels of risks associated with them, there was a sense that cyber security was not the priority.

Among the interviewees that did discuss the topic, this covered a wide range of DSPs, including general IT service providers (including hardware and software maintenance), cloud storage providers, network monitoring, threat identification, and training providers.

Cyber security was not commonly raised as a consideration when choosing a DSP. Instead, the focus centred more on track record and cost. Some organisations said that the DSPs were chosen a number of years ago, often when cyber security risks were not as prominent as they are currently.

“I inherited the DPS’s from my predecessor, so I’m in too deep to move. Doubt Cyber Security was involved when they were engaged initially.”

Director, Small Business

“Choosing the DSP was way before my time. Cyber security not originally discussed with them (5 years ago), but it is now.”

Operations Executive, Small Business

There was often an assumption that the DSP would be responsible for the risks and management of cyber security and would, at a minimum, be keeping back-ups in case of any data loss or disruption. As such, there was a great deal of trust placed in the DSPs that organisations had chosen, especially if they were household name companies like Microsoft or Google. There was an acknowledgement that DSPs took on a high level of responsibility.

“Haven’t thought about [the risks] really. But not a big threat I would say. They seem very good and professional and always have an answer. They’ve always struck me as well covered in that regard and if I’ve asked questions they’ve always answered well.”

Business Manager, Medium Income Charity

“We do not really worry about it. Like I said, Microsoft is a huge renowned DSP so we are aware that data breaches would be slim to none. We have never had to reach them before so there is not much to tell you.”

Senior Specialist IT, Medium Sized Business

3.2 Cyber security strategies

As Figure 3.4 shows, large businesses are more likely to have a formal cyber security strategy in place - that is, a document underpinning all policies and processes relating to cyber security.

There is a significant increase among medium businesses with respect to having a formal cyber security strategy in place (rising from 49% to 58%). Likewise, the proportion of charities that have a formal cyber security strategy in place has risen from a third (36%) last year to roughly half (47%) this year.

Figure 3.4 Organisations that have a formal cyber security strategy

Bases: 264 medium businesses; 170 large businesses; 335 high-income charities

Among the larger organisations that do have a cyber security strategy in place, around eight in ten of this business (80%) and three-quarters of charities (74%) report that this has been reviewed by senior executives or trustees within the last 12 months.

3.3 Insurance against cyber security breaches

Which organisations are insured?

Four in ten businesses (43%) and a third of charities (34%) report being insured against cyber security risks in some way. In most cases, as Figure 3.5 shows, cyber security insurance is an addition to a wider insurance policy only 8% of businesses and 5% of charities have a specific cyber security insurance policy. Larger businesses (25% of medium businesses and 26% of large businesses) are more likely to have a specific policy in place.

Like previous years, medium businesses are the most likely to have some form of cyber insurance (62%, vs. 54% of large businesses and 41% of micro or 49% of small businesses). This could be because medium businesses are more likely to be able to afford insurance than smaller businesses but may not have the skills or tools to be able to address all cyber security risks internally like larger businesses.

It is worth noting the high level of uncertainty that remains, in line with previous years, at this question. One-fifth of business (19%) and charities (18%) do not know if their employer has any form of cyber security insurance, despite the survey being carried out with the individual identified by the organisation as having most responsibility for cyber security.

Figure 3.5 Percentage of organisations that have the following types of insurance against cyber security risks

| Organisation type | Cyber security cover as part of a wider insurance policy | A specific cyber security insurance policy |

|---|---|---|

| Businesses overall | 35% | 8% |

| Micro businesses | 35% | 6% |

| Small businesses | 38% | 11% |

| Medium businesses | 38% | 25% |

| Large businesses | 29% | 26% |

| Charities overall | 29% | 5% |

Bases: 991 UK Businesses; 532 micro businesses; 245 small businesses; 129 medium business; 85 large businesses; 456 charities

Trends over time

Compared to the 2023 survey, the proportion of businesses with some form of insurance has increased from 37% to 43%, an equal proportion to that in the 2022 survey (also 43%). The increase is driven by higher inclusion of cyber security cover as part of a wider insurance policy amongst micro businesses (up from 29% to 35%) and small businesses (up from 33% to 38%).

The proportion of charities with some form of insurance has remained consistent when compared to the 2023 survey (34% this year, vs. 33% last year).

3.4 Technical cyber security controls

Each year, we ask whether organisations have a range of technical rules and controls in place to help minimise the risk of cyber security breaches. The full list is shown in Figure 3.6. Many of these are basic good practice controls taken from government guidance such as the 10 Steps to Cyber Security or the requirements for Cyber Essentials certification.

A clear majority of businesses and charities have a broad range of basic rules and controls in place. The most frequently deployed rules or controls involve cloud back-ups, updated malware protection, passwords, network firewalls and restricted admin rights, each administered by two-thirds or more of businesses. The least common rules and controls are two-factor authentication (2FA), user monitoring, separated Wi-Fi networks, applying software updates and use of Virtual Private Networks (VPNs). For most rules and controls, businesses are more likely to have them in place than charities (with exact percentages included in Figure 3.6). The two areas where a more substantial number of large businesses do not have technical rules and controls are in backing up data by other means (66%) and only allowing access via organisation-owned devices (71%).

Figure 3.6 Percentage of organisations that have the following rules or controls in place

| Rules or controls in place | Businesses | Charities |

|---|---|---|

| Up-to-date malware protection | 83% | 65% |

| A password policy that ensures that users set strong passwords | 72% | 54% |

| Backing up data securely via a cloud service | 71% | 54% |

| Restricting IT admin and access rights to specific users | 73% | 65% |

| Firewalls that cover the entire IT network, as well as individual devices | 75% | 48% |

| Security controls on organisation-owned devices (e.g. laptops) | 58% | 44% |

| Only allowing access via organisation-owned devices | 61% | 34% |

| An agreed process for staff to follow with fraudulent emails or websites | 54% | 35% |

| Rules for storing and moving personal data securely | 48% | 47% |

| Backing up data securely via other means | 55% | 41% |

| Any Two-Factor Authentication (2FA) for networks/applications | 39% | 33% |

| Separate Wi-Fi networks for staff and visitors | 35% | 25% |

| Monitoring of user activity | 30% | 29% |

| A virtual private network, or VPN, for staff connecting remotely | 32% | 18% |

| A policy to apply software security updates within 14 days | 34% | 20% |

Bases: 2,000 UK Businesses, 1,004 charities

Medium and large businesses are more likely than average to have each of these technical rules and controls in place. Specifically, across large businesses, around nine in ten have adopted each of the following:

- restricting admin rights (96%)

- password policies (96%)

- security controls on their devices (93%)

- up-to-date malware protection (93%)

- network firewalls (93%)

- separate Wi-Fi for staff and visitors (93%).

- data backups, either via the cloud or other means (92%)

- VPNs (88%)

Trends over time

Compared to 2023, the deployment of various controls and procedures has risen slightly among businesses:

- using up-to-date malware protection (up from 76% to 83% among businesses, similar to the 83% of businesses in the 2022 survey)

- restricting admin rights (up from 67% to 73%)

- network firewalls (up from 66% to 75%)

- agreed processes for phishing emails (up from 48% to 54%).

In the previous three years of the survey (2021, 2022, 2023), some of these areas had seen consistent declines among businesses, including password policies (79% in 2021; 75% in 2022; 70% in 2023; and 72% in 2024), network firewalls (78% in 2021; 74% in 2022; 66% in 2023; and 75% in 2024) and restricted admin rights (75% in 2021; 72% in 2022; 67% in 2023; and 73% in 2024). However, the increases seen this year represent a partial reversal of this trend.

It is important to note that these trends (the decline from 2021-2023 and the partial reversal in 2024) mainly reflect shifts in micro businesses and, to a lesser extent, small and medium businesses over time. On each of the technical controls in Figure 3.6, large businesses remain in line with where they were in 2023. The proportion of charities who deploy these various controls and procedures has also remained relatively consistent since 2023.

3.5 Staff training and awareness raising

This survey does not explore cyber security skills and training in detail, given that there is another annual government study dealing with this topic - the cyber security skills series. Nevertheless, staff training is an important aspect of the 10 Steps to Cyber Security guidance, so we continue to estimate the proportion of organisations that have undertaken training or awareness raising activities around cyber security in the past year.

Our results (Figure 3.7) show that in the last 12 months, around a fifth of businesses (18%) and charities (18%) have provided some form of staff training.Half of all medium businesses (52%), four-fifths of large businesses (74% which is a decline vs 2023 of 77%) and half (52%) of high-income charities provided this training.

Figure 3.7 Percentage of organisations that have had training or awareness raising sessions on cyber security in the last 12 months

| Businesses overall | 18% |

| Micro businesses | 14% |

| Small businesses | 30% |

| Medium businesses | 52% |

| Large businesses | 74% |

| Charities overall | 18% |

Bases: 2,000 UK businesses; 1,058 micro businesses; 504 small businesses; 264 medium businesses; 170 large businesses; 1,004 charities

Trends over time

Since the 2021 survey, the proportion of medium and large businesses running training has consistently increased. For example, it was 47% for large businesses in 2021, compared to 61% in 2022, 77% in 2023, and 80% in 2024. The result for high-income charities has also risen (from 35% in 2021, to 45% in 2022 49% in 2023, and 52% in 2024).

3.6 Responsibility for cyber security

The job titles of those completing the survey, who are identified by their organisation as being the individual most responsible for cyber security, provide an insight as to the likely seniority and influence of these individuals.

These results do not necessarily show the definitive proportion of organisations that have, for example, a Chief Information Officer (CIO) or Chief Information Security Officer (CISO). In organisations with these functions, we may have been directed to another senior individual with more day-to-day responsibility for cyber security, such as a senior IT colleague.

Generally, the larger the organisation, the more specific the job title of the individual covering cyber security matters. The findings outlined here are all in line with the previous year (2023), when this was first asked:

- In micro businesses, it is most likely to be a Chief Executive (23%), business owner (17%), or another senior management role (15%). Very few micro businesses have someone specifically in an IT-role looking after cyber security matters (2%).

- In small businesses, the most common job roles were general office managers (28%), Chief Executives (13%) or those with another (unspecified) senior management role (16%).

- In half of large businesses, it is either the IT director (25%) or an IT manager, technician or administrator (22%), looking after cyber security. The respective figures for medium sized businesses are 14% and 17%.

- In three in ten charities (32%), a trustee performs this function. Within high-income charities (with an income of £500,000 or more), 12% of interviews were completed by an IT Director, similar to the proportion among medium businesses.

3.7 Outsourcing of cyber security functions

Four in ten businesses (43%) and a quarter of charities (23%) have an external cyber security provider. These overall figures are broadly consistent with those recorded in the previous three years of the survey.

As Figure 3.8 shows, outsourcing of cyber security is substantially higher among small and medium businesses, as opposed to micro and large businesses. This pattern has also been evidenced in previous years. It is possible that large businesses are relying more on internal cyber security expertise than on outsourcing, while small and medium businesses perhaps cannot afford to recruit specialists to the same extent.

Figure 3.8 Percentage of organisations that have an external cyber security provider

| Businesses overall | 43% |

| Micro businesses | 39% |

| Small businesses | 56% |

| Medium businesses | 66% |

| Large businesses | 40% |

| Charities overall | 23% |

Bases: 2,000 UK businesses; 1,060 micro businesses; 506 small businesses; 264 medium businesses; 170 large businesses; 1,004 charities

3.8 Cyber security policies and other documentation

Do organisations formally document their approaches?

A third of businesses (33%) and charities (32%) report having formal cyber security policies in place. To note, these may be part of a wider policy within the organisation, such as the IT policy. A similar proportion of businesses (31%), and a smaller proportion of charities (22%) have a business continuity plan that covers cyber security.

Figure 3.9 shows strong differences by size, with the majority of medium and large businesses having each form of documentation.

Figure 3.9 Percentage of organisations that have the following kinds of documentation

| Organisation type | A formal policy or policies covering cyber security risks | A business continuity plan that covers cyber security |

|---|---|---|

| Businesses overall | 33% | 31% |

| Micro businesses | 28% | 27% |

| Small businesses | 51% | 44% |

| Medium businesses | 77% | 67% |

| Large businesses | 85% | 77% |

| Charities overall | 32% | 22% |

Bases: 2,000 UK businesses; 1,058 micro businesses; 504 small businesses; 264 medium businesses; 170 large businesses; 1,004 charities

When were policies last reviewed?

Of the 33% of businesses and 32% of charities that have cyber security policies in place, over four in ten (44%) of those businesses and a similar proportion (43%) of those charities reviewed these policies within the last six months (Figure 3.10). For businesses, the figure is similar to the last three years, however, is still significantly lower than 2020 when 52% said they had reviewed policies or documentation in the past six months.

Figure 3.10: When organisations last created, updated, or reviewed their cyber security policies or documentation

| Organisation type | % in last 3 months | % 3 to under 6 months ago | % 6 to under 12 months ago | % 12 to under 24 months ago | % 24 months ago or earlier | % don’t know | - |

|---|---|---|---|---|---|---|---|

| Businesses overall | 28 | 16 | 32 | 13 | 2 | 9 | |

| Charities overall | 23 | 20 | 30 | 13 | 5 | 10 |

Bases: 658 businesses with cyber security policies; 329 charities

What is covered in cyber security policies?