Crime against businesses: findings from the 2021 Commercial Victimisation Survey

Updated 28 June 2022

Applies to England and Wales

Frequency of release: Annual

Forthcoming release: To be announced

Home Office responsible statistician: John Flatley

Press enquiries: pressoffice@homeoffice.gov.uk

020 7035 3535

Public enquiries: crimeandpolicestats@homeoffice.gov.uk

Personal Information Charter: Personal information charter - Home Office - GOV.UK (www.gov.uk)

This bulletin reports on prevalence, frequency and impact of crime experienced by businesses in the Wholesale and retail sector between April 2020 and March 2021, the first year of the Covid-19 pandemic.

Key results

The 2021 Commercial Victimisation Survey (CVS) estimated that 38% of business premises in the Wholesale and retail sector in England and Wales had been a victim of crime between April 2020 and March 2021. This is similar to the 2018 prevalence rate (40%), though lower than the 2012 prevalence rate (53%).

The most common type of crime experienced by premises in the sector was theft (27%), followed by assaults or threats (12%) and burglary (10%).

Theft by a customer was the most prevalent type of theft and also the most frequently experienced type of crime, with 11% of business premises experiencing this crime type more than once a day.

Retail premises (30%) were more likely to experience theft compared with wholesale premises (17%) and they also experienced this crime type more frequently.

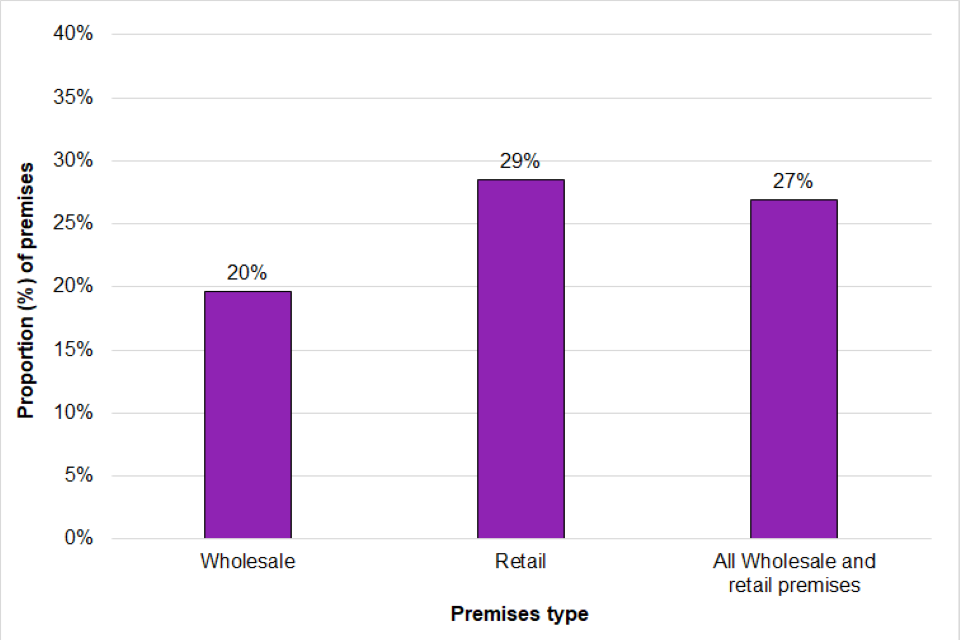

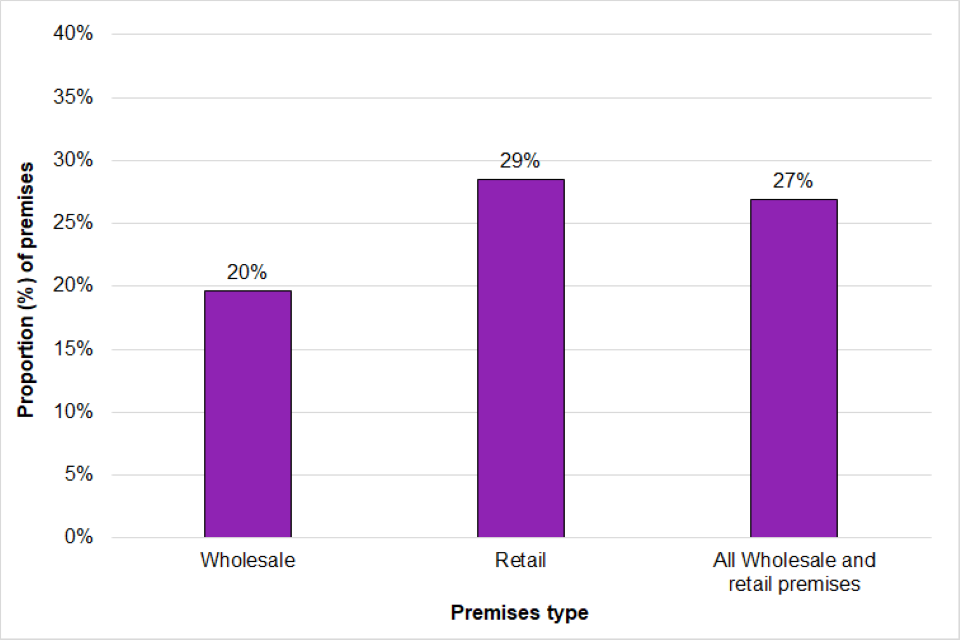

Over a quarter (27%) of premises reported installing crime prevention measures as a result of the Covid-19 outbreak. A greater proportion of retail premises installed measures as a result of the pandemic compared to wholesale premises (Figure 3.1).

Proportion of wholesale and retail premises where crime prevention measures were installed during the Covid-19 pandemic, April 2020 to March 2021, England and Wales

Notes: Unweighted bases: Wholesale - 201 premises. Retail - 1,025 premises.

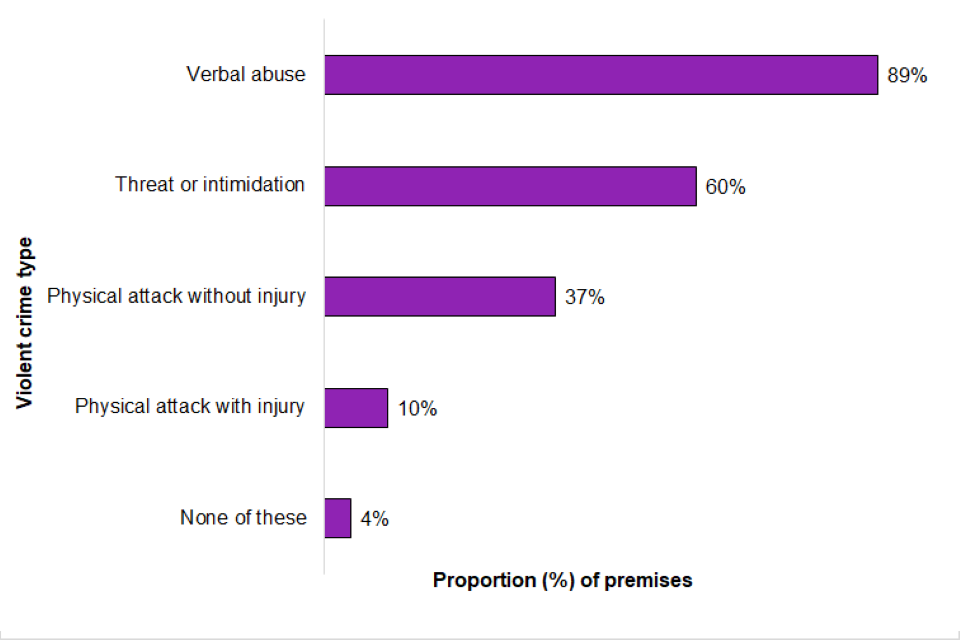

Of the respondents from wholesale and retail premises where staff experienced violent crimes, almost nine in ten (89%) reported experiencing verbal abuse, and one in ten (10%) physical attacks with injury.

Conventions used in figures and tables

Table abbreviations

‘0’ indicates less than 0.5 (this does not apply when figures are presented to one decimal point).

‘n/a’ indicates that the question was not applicable or not asked in that particular year.

‘[u]’ indicates that figures are not reported because the unweighted base number of respondents is below 50 and therefore the quality of resulting estimates is not deemed sufficient for publication.

‘..’ indicates that there were no respondents in the category shown.

Unweighted base

All CVS percentages and rates presented in the tables are based on data weighted to compensate for differential non-response. Tables show the unweighted base, which represents the number of business premises interviewed in the specified group.

Percentages

Row or column percentages may not add to 100% due to rounding.

Most CVS tables present cell percentages where the figures refer to the percentage of business premises that have the attribute being discussed and the complementary percentage, to add to 100%, is not shown.

A percentage may be quoted in the text for a single category that is identifiable in the tables only by summing two or more component percentages. To avoid rounding errors, the percentage has been recalculated for the single category and therefore may differ by one percentage point from the sum of the percentages derived from the tables.

‘No answers’ (missing values)

All CVS analysis excludes ‘don’t know’ or ‘refusals’ unless otherwise specified.

Executive Summary

Key findings

- the 2021 CVS estimated that 38% of business premises (151,000 premises) in the Wholesale and retail sector in England and Wales had been a victim of crime between April 2020 and March 2021, which is similar to the 2018 prevalence rate (40%), though lower than in 2012 (53%)

- theft was the most prevalent crime type, experienced by 27% of premises, followed by assaults or threats (12%) and burglary (10%)

- theft by a customer was the most prevalent type of theft (as in previous years) and was also the most frequently experienced of all crime types, with 11% of business premises that experienced this crime type reporting that it occurred more than once a day

- in line with previous surveys, ‘food and groceries’ were the most commonly stolen items (39% of premises compared with 33% in 2018)

- nearly half (46%) of respondents reported that they thought that levels of violence and assaults experienced at their premises had gone up during the Covid-19 pandemic, whereas 42% stated that levels had remained the same and the remaining 12% thought they had gone down

- of the respondents at premises that experienced violent crimes, almost nine in ten (89%) reported experiencing verbal abuse, and one in ten (10%) reported that staff had experienced physical attacks with injury - prevalence for these types of violence was similar for small independent retailers (83% and 12% respectively)

- the prevalence rate for fraud showed an apparent fall in the 2021 CVS (from 10% in 2018 to 6% in 2021), which is in line with falls seen in fraud against businesses in the same period, as reported by UK Finance and Cifas

- theft by customer was the least well reported crime type, with 58% of respondents saying that such crimes at their premise were reported to the police, while burglary with entry had one of the highest reporting rates, at 93%

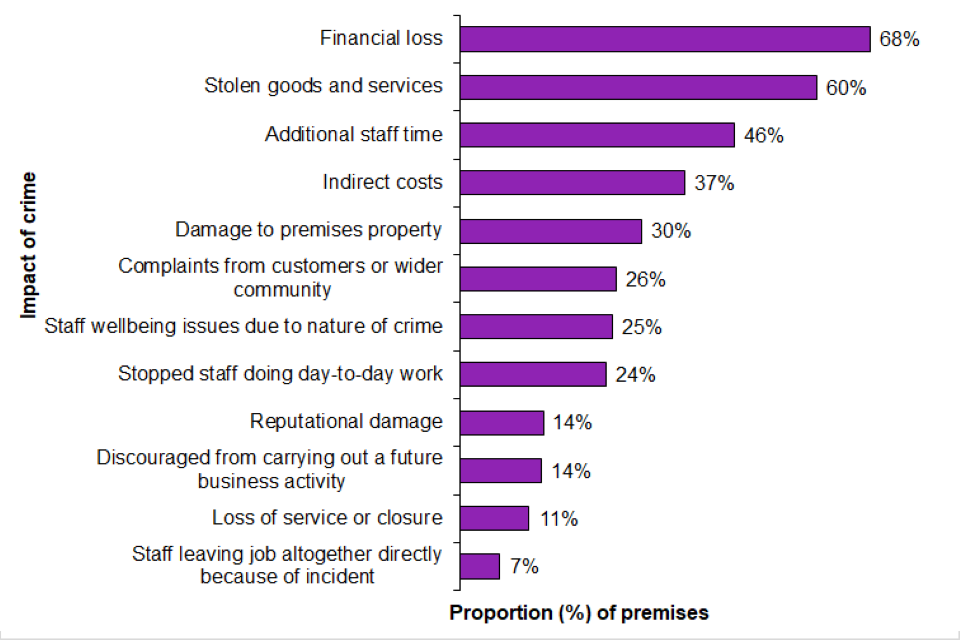

- the most common impacts of crime reported by respondents at premises that experienced crime included: financial loss (68%), stolen goods and services (60%) and additional staff time needed to deal with the incident (46%)

- at over a quarter (27%) of premises, respondents reported installing crime prevention measures in response to concerns about the impact of the pandemic and the related regulations on crime levels

1. Introduction

Background

This bulletin presents findings from the 2021 Commercial Victimisation Survey (CVS), a survey that examines the extent of crime against business premises in England and Wales. The CVS was previously run in 1994, 2002 and then each year since 2012, focusing on a selection of sectors defined by the UK Standard Industrial Classification 2007 (SIC).

The survey was paused in 2019 while a review was undertaken to consider whether changes were needed to better meet user needs. Following this user consultation, a decision was made that the coverage of the CVS would expand to all commercial business sectors to provide a better understanding of the extent of crime affecting businesses in England and Wales. The revised survey was due to launch in 2020 but was then delayed due to the Covid-19 pandemic.

Plans to expand coverage were put on hold until 2022. In the interim, a 2021 CVS was run as a standalone survey, covering the Wholesale and retail sector only. This sector includes retailers, wholesalers and motor vehicle trade and repair businesses and was selected as many premises in this sector, especially essential shops, remained largely open during the pandemic, while other business sector premises had closed, in some cases with staff working at home. The 2021 CVS was set up to provide estimates of the impact of crime against businesses in the sector during the first year of the pandemic, a period of unprecedented social and economic challenges for businesses globally.

The 2021 survey set out with a target to obtain interviews with 4,000 premises. However, this was not achieved due to difficulties contacting businesses during the pandemic and a reluctance from respondents to take part during such a challenging time. The unadjusted response rate was relatively low compared with previous years[footnote 1] and a total of 2,284 interviews were completed. Despite the low response rate, the final sample was still higher for this sector than in previous years, when 3 or 4 sectors were surveyed each year, with a target of either 1,000 or 2,000 interviews for the Wholesale and retail sector each year.

The sample of small independent retailers was boosted to enable more robust analysis of a sub-sector which was of particular interest to users of the CVS. The target was for a quarter of the overall target (i.e. 1,000 interviews) to be completed by small independent retailers. Due to the low response rate, only 477 interviews were completed. The small sample size meant some detailed analysis was not possible, however available findings are reported in Section 8.

Table 1.1: Sector coverage and sample size

| Wholesale and retail | Small independent retailers | Total | |

|---|---|---|---|

| 1-9 employees | 1,075 | 450 | 1,525 |

| 10-49 employees | 413 | 27 | 440 |

| 50+ employees | 319 | 0 | 319 |

| All sizes | 1,807 | 477 | 2,284 |

Notes: Wholesale and retail sector includes 230 small independent retailers that were selected in the main sample.

Although the Interdepartmental Business Register (IDBR), the sampling frame for the survey, covers 99% of UK businesses, there will be some small businesses[footnote 2] and recently started businesses that are not included.

The reference period was revised in the 2021 CVS to capture all crime experienced by premises in the Wholesale and retail sector during the first year of the pandemic. As such, respondents were asked about crime experienced between April 2020 and March 2021. This contrasted with previous surveys, when respondents were asked about crime experienced in the 12 months prior to the time of interview, with fieldwork typically carried out between September and December each year.

It was not possible to adjust the data for earlier years to produce a comparable dataset of crimes experienced within the financial year. As such, data are not directly comparable to those from previous years; nor will they be comparable with those collected in future surveys (more information on this below).

The 2021 questionnaire was reviewed in consultation with the CVS Expert Reference Group (ERG)[footnote 3]. One of the key changes made to the questionnaire was with the incidence data questions being replaced by frequency of crime questions. It was felt that the previous incidence data had spurious accuracy being based often on very rough estimates provided by respondents. The frequency data (how often a business premise experienced victimisation) was thought to provide a more discriminating measure of the impact of crime against businesses. Additionally, questions were added to collect Covid-19 related data, including around whether respondents perceived crime levels to have increased, decreased or stayed the same since the start of the pandemic.

The 2022 CVS sample will revert to the plan following the 2019 consultation and is intended to cover businesses from all commercial sectors. The reference period will also return to that used previously, i.e. crime experienced in the 12 months prior to interview. This will enable more meaningful comparisons with CVS data prior to 2021.

Online data collection

In the 2021 CVS, two large retailers submitted responses for an additional 145 premises selected in the sample via their Head Offices. Their data were submitted using an Excel data collection sheet. These large retailers each provided partial returns though both completed the ‘Violence and Assaults’ section. In this section, respondents were asked if they had experienced a range of violent crimes between April 2020 and March 2021. Those who had experienced any of these crime types were asked which was the most commonly experienced. Data for the additional 145 premises have been added to the main dataset for this section.

As the Violence and Assaults section comprises a larger base sample than other sections, an additional set of weights was created for this set of questions. For more information on weighting, please see the Technical Report.

Terminology

Within the analyses presented in this bulletin, and its associated tables, there are two key measures of the extent of business crime:

Number of victims – this is the total number of business premises that had been victims of crime estimated by the survey (for crime types covered by the survey). This is weighted (i.e. scaled-up) to the population of business premises as a whole, which the sample was designed to represent.

Prevalence rate – also referred to as the victimisation rate. This is the estimated number of business premises that were victims of crime, divided by the total number of premises in that sector, multiplied by 100 to give percentages. This gives the proportion of business premises that were victims.

Throughout the report, we refer to business size, which is related to the number of staff employed at the premises (as opposed to turnover, for example). For the purposes of this report, a small business was defined as one with 1-9 employees, a medium sized business as having 10-49 employees, and a large business as having 50 or more employees at that site.

To maximise the breadth of content of the survey, while minimising the burden for respondents, two topic areas were each randomly assigned to half of the respondents surveyed. One of these topics was ‘Attitudes to Crime and the Police’ and the other was ‘Crime Prevention’.

Computer misuse[footnote 4] questions were asked of respondents that said their business had a computer. Online crime covered a range of possible offences carried out over computer networks including:

- hacking or unauthorised access: having a computer, network or server accessed without permission

- computer viruses or malware: having computers infected with files or programmes intended to cause harm

- staff receiving fraudulent emails

Confidence intervals and significance testing

To analyse the responses to a sample survey such as the CVS, it is important to account for the level of uncertainty around estimates based on a survey sample, rather than a census of the whole population of business premises in England and Wales. To compare estimated levels of crime between different groups, confidence intervals (error margins) at the 95% level were produced around the survey estimates. Where confidence intervals around two independent estimates of the same measure (e.g. between premise size groups) do not overlap, the difference between the values is said to be statistically significant. It is important to note that the opposite is not always true, i.e. overlapping confidence intervals do not always indicate a lack of statistical significance.

In CVS publications for earlier years, significance testing was carried out to compare estimates to those from previous years and interpret trends. As the 2021 CVS data are not directly comparable with those from previous years, significance testing was not carried out for this publication.

For further detail on these statistical tools, see the Technical Annex.

Data tables

The 2021 CVS Headline Tables include breakdowns, by sub-sector, size band, country (breakdowns for England and Wales separately), and location (urban or rural) for the following:

- the total number of premises that experienced crime (prevalence, or victim count)

- the proportion of premises that experienced crime (prevalence rate, or victimisation rate)

The ‘Bulletin Tables’ and ‘Additional Tables’ also provide information on prevalence, frequency of crime, impact of Covid-19 on crime, impact of crime on businesses, crime prevention, reporting rates and perceptions of crime and the police.

Please note that some estimates used in the bulletin are not formally presented in the published data tables. These figures can either be derived by users from the raw CVS data published via the UK Data Service[footnote 5], or requested directly from the Home Office in Open Document Spreadsheet (ODS) format. Please see the ‘Further Information’ section below for contact details.

2. Prevalence and frequency of crime

Key results:

- the 2021 Commercial Victimisation Survey (CVS) estimated that 38% of business premises (151,000 premises) in the Wholesale and retail sector in England and Wales had been a victim of crime between April 2020 and March 2021, which was similar to the 2018 prevalence rate (40%), though lower than the 2012 prevalence rate (53%)

- theft was the most experienced crime type with over a quarter of premises having experienced it (27% or 107,000 premises), followed by assaults and threats (12% or 46,000 premises) and burglary (10%, or 40,000 premises)

- theft by customers was the most commonly experienced type of theft, with respondents at a quarter of premises (25% or 98,000 premises) experiencing it

- theft by customers was also the most frequently occurring crime, with 28% of respondents who experienced this crime type reporting that incidents occurred roughly once a week or once a day and another 11% reporting having experienced an incident several times a day

- the prevalence of being a victim of fraud showed an apparent fall from 10% in 2018 to 6% in 2021 which is in line with reductions seen in fraud against businesses in the same period, as reported by UK Finance and Cifas

- retail premises experienced theft more frequently than wholesale premises with respondents at around two in ten retail premises that experienced theft (22%) reporting having experienced it roughly once a day or more, compared with 9% of wholesale premises

- in line with previous surveys, ‘food and groceries’ were the most commonly stolen items (39% of premises compared with 33% in 2018)

- alcohol and clothing have then switched positions since 2018, with alcohol now the second most commonly stolen item (25% compared with 20% in 2018), followed by clothing (14% compared with 20% in 2018)

- as seen in previous years, at 77% the prevalence rate of theft by customer for supermarkets was higher than that for other food and beverage retailers (39%) and clothes retailers (38%)

The findings from the 2021 Commercial Victimisation Survey (CVS) are drawn from 2,284 interviews conducted with respondents from premises in the Wholesale and retail sector about their experience of a range of crime types between April 2020 to March 2021. Those who reported having been a victim of crime were asked how frequently they had experienced any of the types of crimes they had mentioned.

The frequency of crime questions were newly introduced in the 2021 CVS, therefore estimates for previous years are not available. They replaced the previous questions on numbers of incidents, which were often very rough estimates. The new frequency questions were designed to be more simplistic to answer, with respondents being asked to choose between one of six categories:

- once only

- several times a year

- roughly once a month

- roughly once a week

- roughly once a day

- several times a day

In the 2021 CVS, Head Office representatives for an additional two large retailers (that provided data on 145 premises) were asked about experience of crime at these premises, with both providing responses to the ‘Violence and Assaults’ section of the questionnaire. Where the additional data have been included, this is stated in the commentary and related tables.

The Wholesale and retail sector has been included in each of the eight years during which the CVS has been run, as it is one of the largest sectors and is known to experience high volumes of the crimes covered by the survey.

Due to changes in the crime reference period, estimates from this year’s survey cannot be directly compared with those from previous years. However, where available, estimates for previous years are provided in the commentary, to provide context. Data tables for previous years are available on the ‘Crime against businesses statistics’ page on Gov.UK.

For most findings presented, the sample size is too small to produce sub-national estimates and data are shown for England and Wales as a whole, however prevalence data for England and Wales have been presented separately.

Extent of crime against wholesale and retail premises

Whilst not directly comparable, the proportion of premises experiencing crime is similar to that seen in previous years, during which the trend remained relatively flat. In the Wholesale and retail sector, 38% of premises (151,000 premises) experienced crime in the year ending March 2021 (Table 2.1). This is in line with the 2018 prevalence rate (40%, or 147,000 premises), though lower than the 2012 prevalence rate (53%, or 206,000 premises).

Table 2.1: Proportion of Wholesale and retail premises that experienced crime, by crime type, April 2020 to March 2021, England and Wales

| Crime type | England | Wales | England and Wales |

|---|---|---|---|

| Theft (by customer, by employees, by others, by unknown) | 27% | 29% | 27% |

| Assault and threats | 11% | 18% | 12% |

| Burglary (including attempts) | 10% | 6% | 10% |

| Vandalism | 9% | 7% | 9% |

| Robbery (including attempts) | 7% | 5% | 7% |

| Fraud (by employees, by others, by unknown) | 6% | 1% | 6% |

| Vehicle-related theft (of/from including attempts) | 2% | 0% | 2% |

| All | 39% | 35% | 38% |

Source: Home Office, Crime against businesses: headline findings from the CVS 2021

Notes: Unweighted base 2,284 premises.

The overall prevalence rate for wholesale and retail premises in England was not significantly different to that experienced by premises in Wales, with 39% of premises (141,000 premises) in England experiencing crime in the period between April 2020 and March 2021 compared with 35% of premises in Wales (around 9,000 premises). This was true for most crime types, with the exception of fraud, where 6% of premises in England experienced this crime type, compared with 1% of premises in Wales.

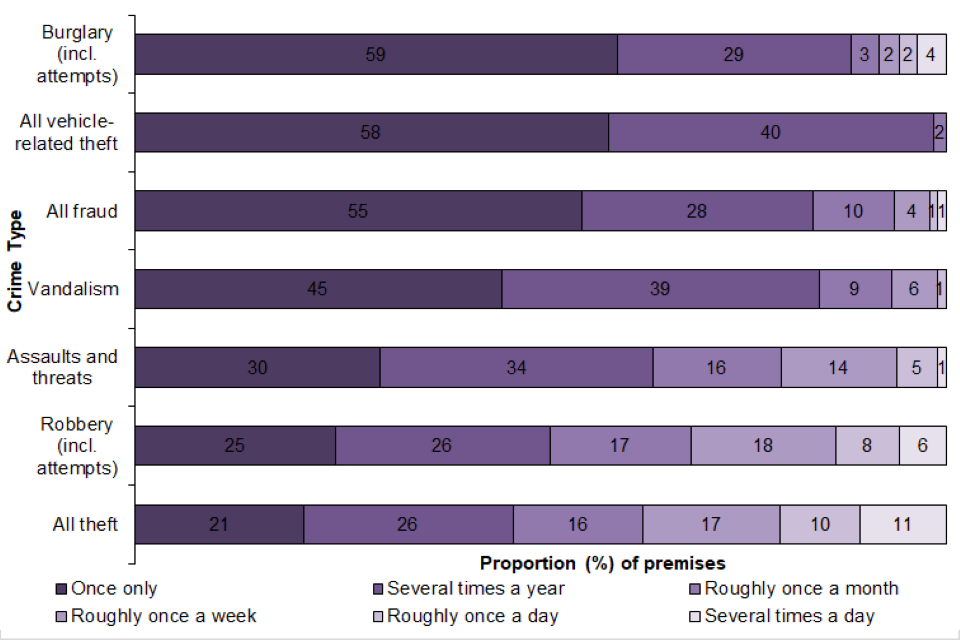

Frequency data were collected by crime type and cannot be aggregated for an ‘all crime’ breakdown. Figure 2.1 shows how frequently respondents reported experiencing each crime type, with commentary by crime type below.

Figure 2.1: Proportion of wholesale and retail premises that experienced crime, by frequency and crime type, April 2020 and March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes: Due to rounding, percentages may not total 100%.

Theft

As in previous survey years, theft was the most prevalent crime type, experienced by over a quarter of premises (27%, or 107,000 premises in 2021 compared with 24%, or 90,000 premises in 2018). As expected, and in line with previous survey years, theft by customers was the most common type of theft experienced (by 25% or 98,000 premises). In 2018, 21%, or 77,000 premises experienced theft by a customer.

Thefts by customer, for the Wholesale and retail sector, largely comprises shoplifting incidents. Looking at levels of shoplifting offences recorded by the police in England and Wales[footnote 6], these peaked in the year to March 2018 and then decreased in the following years. A large fall (of 36%) was seen in the year to March 2021, following closures of non-essential shops during the first year of the pandemic. Recently published figures for the year to September 2021[footnote 7] showed early signs that levels are starting to return to pre-pandemic levels (around 250,000 shoplifting offences recorded in the year to September 2021 compared with around 230,000 in the year to March 2021.

As well as being the most prevalent crime type, theft by customers was also one of the most frequently experienced crime types in the sector. Respondents at over a quarter of premises (28%) that experienced the crime reported that incidents occurred roughly once a week or once a day while respondents at another 11% of these premises reported experiencing an incident several times a day. Of the remaining respondents, 16% reported experiencing theft by customers roughly once a month, 27% several times a year, and 17% reported experiencing the crime only once in the reporting period. (See Table A1 - 2021 CVS Additional Tables).

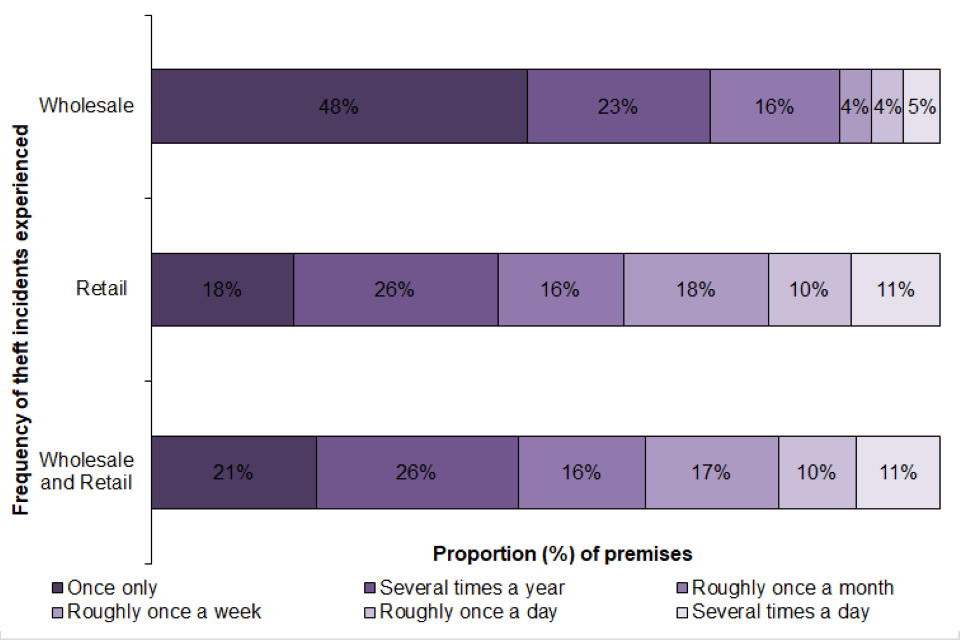

Retail premises were more likely to experience theft than wholesale premises and they also experienced it more frequently. The relatively small sample size for wholesale premises means that comparisons between wholesale and retail premises are only possible for theft offences, being the most widely experienced crime type.

Figure 2.2 shows that respondents at around two in ten retail premises (22%) reported that they experienced theft roughly once a day or more, compared with around one in ten (9%) for those at wholesale premises. Furthermore, respondents at almost half (48%) of wholesale premises reported experiencing theft only once in the year compared with 18% of those at retail premises

Figure 2.2: Frequency of theft incidents for wholesale and retail premises, April 2020 to March 2021, England and Wales

Source: Home Office - Crime against businesses: bulletin tables in CVS 2021

Notes:

- Unweighted bases: Wholesale – 62 premises, Retail – 650 premises. Additionally, not represented on the chart, there were 1,717 respondents that did not experience any theft between April 2020 and March 2021 or did not know or refused to answer the question.

- Due to rounding, percentages may not total 100%.

As might be expected, supermarkets experienced higher prevalence rates for theft by customers than all other premises in the Wholesale and retail sector. In the period between April 2020 and March 2021, the CVS estimated that 77% of supermarkets were victims of theft by customers, compared with 22% of all other wholesale and retail premises. This was a similar pattern to estimates from the 2018 CVS which showed that 66% of supermarkets were victims of theft by customers, compared with 18% of all other wholesale and retail premises. In the 2021 CVS, the prevalence rate for supermarkets was also higher than other premise types such as other food and beverage retailers (39%) and clothes retailers (38%) (See Table A4 - Crime against businesses: additional tables in CVS 2021).

To give some insight into the types of items stolen between April 2020 and March 2021, the CVS asked victims of theft by customers to name the three most commonly stolen items (or type of items). As in previous years, the most frequent category was “food or groceries”, accounting for over a third of all responses (39% in 2021, compared with 33% in 2018). The next most common categories were alcohol (25% in 2021; 20% in 2018) and clothing (14% in 2021; 20% in 2018). (See Table A5 - Crime against businesses: additional tables in CVS 2021).

Burglary

Burglary (including attempts) was experienced by one in ten premises (10%, or 40,000 premises) which is in line with prevalence rates in the 2018 CVS, which showed that 11% of premises in the wholesale and retail sector had experienced burglary.

Despite being the third most prevalent crime, most respondents for premises that experienced burglary reported that the crime did not occur often. Just over one in ten premises that experienced burglary (12%) reported that the crime had occurred once a month or more. (See Table A1 - Crime against businesses: additional tables in CVS 2021).

Police recorded crime data for England and Wales for business and community burglary offences in the year to March 2021 showed a fall of 39% compared with the previous year[footnote 8]. Falls were also seen in attempted and aggravated business and community burglary offences.

Violence

Assaults and threats were the second most prevalent crime in the 2021 CVS, with 12% or 46,000 premises experiencing this type of crime. Respondents at most premises reported that assaults or threats occurred several times a year (34%) but a similar proportion (30%) stated they experienced assaults or threats roughly once a month to once a week. Only 6% reported experiencing assaults or threats roughly once a day to several times a day. The remaining 30% reported experiencing the crime only once. (See Table A1 - Crime against businesses: additional tables in CVS 2021). The British Retail Consortium (BRC) Crime Report 2021[footnote 9] stated that, on average, there were 455 violent or abusive incidents every day of the year in year ending March 2020, the year before the pandemic.

Although robbery is a theft offence, it is included within the ‘Violence and assaults’ module of the 2021 CVS, as it is a type of theft that often involves violence or the threat of it. Whilst respondents at only 7% of premises reported experiencing robbery (including attempts), of those, almost a third (31%) reported that the crime occurred roughly once a week or more, making it one of the more frequently experienced crime types. However, over half of respondents (51%) reported experiencing robbery only once or several times a year. The remaining 17% reported experiencing robbery (including attempts) roughly once a month (See Table A1 - Crime against businesses: additional tables in CVS 2021).

Further commentary on violence and assaults can be found in Section 4.

Fraud

The 2021 CVS estimated that around 6% of premises (or 22,000 premises) in the Wholesale and retail sector experienced fraud. This was an apparent fall from 10% in 2018, which is in line with falls seen in fraud against businesses in the same period, as reported by UK Finance and Cifas. The 2021 CVS showed that premises in the sector were most likely to experience retail fraud (48%) and debit or credit fraud (45%) (See Table A6 - Crime against businesses: additional tables in CVS 2021).

Although the CVS indicates that fraud is a relatively low volume crime, caution is needed when interpreting findings for this crime type, as respondents might not know if the premise has been a victim of fraud or not, with such crimes often being handled by Head Offices. It is also worth noting that fraud incidents can often have a large financial impact on businesses. The Association of Convenience Stores (ACS) Crime Report 2022[footnote 10] reports that the cost of fraud to convenience stores alone in 2022 was around £11 million.

For fraud, respondents at only a small proportion of premises (2%) that experienced it reported that it occurred between once a day to several times a day, but over half of respondents (55%) reported that the crime occurred only once.

Online crime

In the 2021 CVS, respondents who used any computers at their premises were asked whether they had been victims of a computer misuse incident. The CVS estimated that 7%, or 25,000 premises, experienced computer misuse incidents. The most prevalent computer misuse subcategory was fraudulent email attempts with 5%, or 19,000 premises experiencing this type of incident in 2021 (See Table H1 and H2 – Crime against businesses: headline findings from the CVS 2021).

Anti-social behaviour (ASB)

Anti-social behaviour (ASB) was experienced by only 14% of premises in the sector overall (15% of retail premises and 9% of wholesale premises). The most commonly reported types of anti-social behaviour included: groups hanging about on the street (35%), being intimidated, threatened, or verbally abused or harassed (24%), and street drinking, underage drinking, or drunken behaviour (23%). (See Tables A7 and A8 - Crime against businesses: additional tables in CVS 2021).

Vandalism and property damage

Business premises with more than 50 employees experienced higher rates of deliberate damage, including graffiti or arson, compared with premises that had fewer than 9 employees (25% and 7% respectively). The majority of premises (92%) that had experienced deliberate damage were those located in urban areas.

Of the premises that had fallen victim to vandalism and property damage, over half (58%) experienced damage to any part of the building and around two in ten (23%) experienced damage to the equipment or stock (See Table A9 - Crime against businesses: additional tables in CVS 2021). Respondents at the majority of businesses (83%) reported that they were unaware of the motivation for the incident.

Prevalence by business size and location

Prevalence rates tended to be higher for premises with more employees. This was consistent across all crime types, with premises with 50 or more employees experiencing greater rates of victimisation than those with 10 to 49 or 1 to 9 employees. This is in line with findings from previous surveys and is perhaps to be expected, with larger businesses having more employees and customers, larger premises, and a higher turnover, and therefore a greater chance of being victimised.

The nature of the business and its location are shown to have influenced the likelihood of victimisation. Retail premises were statistically significantly more likely to experience crime compared with wholesale premises. For instance, 41% of respondents from retail premises reported experiencing crime compared with 29% of those from wholesale premises. Furthermore, 41% of respondents at premises sited in an urban area experienced crime compared with 29% of those in a rural area. This pattern was seen across all crime types.

Focusing on the retail sector, one of the greatest differences in the rate of crime by business size was seen in theft by customers. For retail premises with 50 or more employees, 66% experienced theft by customers compared with 21% of retail premises with 1 to 9 employees. Similarly, larger retail premises were more likely to experience assaults or threats. For retail premises with 50 or more employees, 45% reported that they had experienced this crime type, compared with 9% of those with 1 to 9 employees.

3. Impact of Covid-19

Key results:

- respondents at the majority of premises reported that the level of burglary, fraud and anti-social behaviour stayed the same during the first year of the pandemic (59%, 52% and 47% respectively)

- for almost half of premises (46%), respondents reported an increase in levels of violence and assaults since the pandemic began, while a slightly lower proportion of respondents (42%) reported they had remained the same at their premises and the remaining 12% reported the crime had gone down

- respondents at six in ten premises (61%) reported that they had experienced verbal abuse, 22% threat or intimidation, and 13% physical attack without injury, all incidents which they believed were related to the pandemic

- at over a quarter (27%) of premises, respondents reported installing crime prevention measures in response to concerns about the impact of the pandemic and the related regulations on crime levels

Between April 2020 and March 2021, the Wholesale and retail sector needed to adapt to running their premises during the Covid-19 pandemic. Premises contended with lockdown restrictions and other policy measures introduced to reduce the risk of spreading the virus (e.g., social distancing and face coverings). As part of the 2021 CVS, respondents were asked about their experiences of running their business during the pandemic. This included questions on the effect of the pandemic on their organisation’s experience of crime, including whether or not they thought the pandemic directly contributed to crime levels, and if they had felt the need to introduce crime prevention measures as a result.

Types of impact

As part of the survey, respondents were asked to describe the impact of the pandemic on crime against their business. This was an open response question in which respondents could describe a number of different impacts. Respondents at around one in five premises described experiencing less crime (19%) and similar proportion reported no change in crime levels (18%). However, 10% reported a general increase in crime. Other impacts mentioned included an increase in shoplifting and theft (cited by 11% of premises), non-crime related impacts (10%), an increase in verbal abuse (7%) and a change in customer attitudes (i.e., agitation, impatience and tension; also 7%). (See Table A10 - Crime against businesses: additional tables in CVS 2021).

Change in crime levels

The 2021 CVS also asked respondents whether they thought levels of burglary, fraud, violence and assaults and anti-social behaviour (ASB) had gone up, down or remained the same at their premise since the beginning of the pandemic. It is important to note that these data relate to the respondent’s perception rather than data on recorded numbers of incidents.

Table 3.1 shows that the majority of premises reported that the level of burglary, fraud and ASB had stayed the same during the pandemic (59%, 52% and 47% respectively). Comparing with available police data for the year to March 2021, business and community burglary offences recorded by police forces in England and Wales showed a fall of 39% compared with the previous year[footnote 11]. Available police data also showed falls in attempted and aggravated business and community burglary offences. Action Fraud data for consumer and retail fraud increased by 30%, though this includes fraud committed against individuals as well as businesses. ASB incidents recorded by the police increased by 48% compared with the previous year, though again, this included all incidents, not just those committed against business premises.

With regard to violence and assaults, the 2021 CVS showed that 46% of respondents thought that there had been an increase since the pandemic began, but a similar proportion (42%) reported that levels had remained the same. A smaller proportion of respondents felt that there had been an increase in burglary, fraud, and ASB (ranging between 30%-37% of premises; Table 3.1)

Table 3.1: Proportion of Wholesale and retail premises by respondents’ perception of the change in levels of crime against the business premise during the Covid-19 pandemic, by crime type, April 2020 to March 2021, England and Wales

| Type of crime | Gone down | Stayed the same | Gone up | Unweighted base |

|---|---|---|---|---|

| Burglary | 11% | 59% | 30% | 295 |

| Fruad | 12% | 52% | 37% | 183 |

| Violence and assaults | 12% | 42% | 46% | 422 |

| Anti-social behaviour | 17% | 47% | 36% | 380 |

Source: Home Office, Crime against businesses: headline findings from the CVS 2021

Notes: Due to rounding, percentages may not total 100%.

Violent crime triggers

The most commonly perceived triggers of violent crime experienced during the pandemic were: opposition to Covid-19 safety requirements (e.g. face masks, social distancing, and sanitising) which was mentioned by respondents at 38% of premises, encountering a thief (15%), confronting suspicious behaviour (13%) and impatience over queuing (12%) (See Table A11 - Crime against businesses: additional tables in CVS 2021). This pattern was consistent across all business sizes. These findings also reflect the Association of Convenience Stores (ACS) crime report[footnote 12] which reported that the most common causes of Covid-related abuse were reminding customers to wear face coverings and social distancing rules.

Respondents were also asked if they believed that any form of violent crime they had experienced was directly related to regulations introduced during the pandemic. Almost two-thirds (61%) of premises reported that they had experienced verbal abuse that they believed was related to Covid regulations, 22% threat or intimidation, and 13% physical attack without injury (See Table A12 - Crime against businesses: additional tables in CVS 2021).

In the 2021 CVS, where the sample size was large enough to allow for comparison, it was more common for respondents at larger businesses to say they had experienced such behaviours. For instance, staff at 69% of premises with 50 or more employees experienced verbal abuse compared with 55% of premises with 1 to 9 employees. (See Table A12 - Crime against businesses: additional tables in CVS 2021).

Further evidence on the experience of smaller retailers can be found in the Association of Convenience Stores (ACS) Crime Report 2021[footnote 13], reporting on data for 2021:

“Convenience stores are essential businesses that have remained open during the coronavirus pandemic to feed their communities. Unfortunately, retailers and their staff have still faced abuse, including horrific incidents of Covid related threats where staff members have been coughed and spat at.

The main trigger for Covid related abuse is linked to reminding customers to wear face coverings.”

Further commentary on violence and assaults can be found in Section 4.

Crime prevention

Respondents at 27% of premises reported installing crime prevention measures at the premise as a result of the Covid-19 outbreak (Figure 3.1). A greater proportion of respondents from retail premises reported installing crime prevention measures compared with those from wholesale premises (29% and 20% respectively). The survey did not capture further detail on the reasons behind this, which may have included, among others, fear of possible increasing crime levels and reduced staff numbers at premises during the pandemic. The responses varied by business size, with 47% of premises with more than 50 employees having had crime prevention measures installed compared with 31% of premises with 10 to 49 employees and 25% of premises with 1 to 9 employees.

Figure 3.1: Proportion of wholesale and retail premises where crime prevention measures were introduced during the Covid-19 pandemic, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes: Unweighted bases: wholesale – 201 premises, retail – 1,025 premises.

The most common crime prevention measures premises introduced were asking staff to monitor the premises as part of their role (mentioned by 68% of those who had installed new measures), installing alarms or gates (14% and 10% respectively), and using their own security guard or contracting a security guard (9% and 8% respectively). (See Table A13 - Crime against businesses: additional tables in CVS 2021).

Further commentary on crime prevention can be found in Section 6.

4. Violence and Assaults

Key results:

- the proportion of premises that experienced assaults and threats, robbery[footnote 14], or both, was 14% (or 53,000 premises)

- for premises that had experienced violent crimes, the most prevalent types reported by respondents were verbal abuse (89% of premises), followed by threat or intimidation (60% of premises)

- there was a further 10% of respondents who reported that staff at their premises had experienced physical attacks with injury

- the most commonly cited circumstances in which incidents of violence were experienced included: encountering a store thief (26% of premises), confronting suspicious behaviour (21%) and asking customers to comply with Covid–19 safety requirements (21%)

This section presents additional findings from the Violence and Assaults module of the 2021 CVS. Only respondents that said their premise had experienced assaults and threats, robbery (including attempts), or both of these crime types are included. This equated to 14% of all premises covered by the survey (or 53,000 premises). In addition, as outlined in Section 1, the two large retailers that provided additional data from their Head Offices for 145 premises that were included in the main sample, both provided data for this section of the questionnaire. As such, these data have been added to the main dataset, providing a total base sample of 2,429 premises. The findings in this section are drawn from this larger total sample.

As reported in Section 2, assaults and threats continue to be one of the most prevalent types of crime experienced by business premises in the Wholesale and retail sector (12% of premises). Respondents at the majority of premises (34%) that experienced assault and threats reported that the crime occurred several times a year but a similar proportion (30%) stated that staff experienced assaults or threats roughly once a month to once a week. The 2018 CVS[footnote 15] estimated that there were 1,600 incidents of assaults and threats per 1,000 premises in 2018, which continued the rising trend seen since the 2016 CVS (500 incidents per 1,000 premises).

Although robbery is a theft offence, it is included in the violence and assaults section of the 2021 CVS, as it is a crime type that often involves assault. The proportion of premises where respondents reported experiencing robbery (including attempts) was 7% and almost a third of these (31%) reported that the crime occurred roughly once a week or more. The combined proportion of premises that experienced assaults and threats, robbery, or both, was 14% (or 53,000 premises).

In the 2021 CVS, respondents at premises that had experienced violent crimes (including robbery and attempted robbery) were asked further questions about the nature and circumstances of their victimisation. As shown in Figure 4.1 below, staff at around nine in ten premises (89%) experienced verbal abuse. At six in ten premises (60%) staff experienced threat or intimidation and at nearly four in ten (37%), staff experienced physical attacks without injury. Staff at one in ten premises (10%) experienced physical attacks with injury.

Figure 4.1: Proportion of wholesale and retail premises that experienced violent crime by violent crime type, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes:

- Unweighted base: 504 premises.

- Respondents could give more than one answer to this question.

The most prevalent types of violence were also reported to be the most frequently occurring. Respondents at the majority of premises that experienced violent crime said that verbal abuse was the most common type experienced (86%), followed by threat or intimidation (9%), and physical attack (5%). (See Table A15 - Crime against businesses: additional tables in CVS 2021).

The most commonly cited circumstances in which incidents of violence were experienced included: encountering a store thief (26%), confronting suspicious behaviour (21%) or asking customers to comply with Covid–19 safety requirements on face masks and social distancing (21%) (See Table A16 - Crime against businesses: additional tables in CVS 2021).

Similar findings were reported in other retail crime surveys run in 2021, including the Union of Shop, Distributive and Allied Workers (USDAW) Campaign To End Violence and Abuse Against Retail Workers Survey Results 2021[footnote 16]. They stated:

“9 out of 10 workers reported verbal abuse. 64% received threats of violence and 12% were physically assaulted during the year. In 2020 the figures were 89% abused, 60% threatened and 9% physically attacked.”

These proportions appear similar to those indicated by the 2021 CVS, though the proportions in the USDAW report are based on all respondents, whereas the CVS proportions are based on the subset of respondents who had reported experiencing violence and assaults at their business premise (14% of respondents).

The Crime Report 2021[footnote 17] by the Association of Convenience Stores (ACS) estimated that there were 40,000 incidents of violence towards retail staff in 2021 and 1.26 million incidents of verbal abuse.

Violent crime is a great concern for the sector. After theft by customers it was the second most negatively impacting crime, as reported by 13% of premises (see Section 5 for further commentary on the cost and impacts of crime). In the British Retail Consortium (BRC) 2021 Crime Survey[footnote 18], which reported on data for the year ending March 2020 (the year before the pandemic), members were asked about the three most significant threats for their business over the next two years. Almost seven in ten (69%) premises identified violence against staff as the main threat, with nearly nine in ten (88%) identifying it as one of the top three threats.

The remainder of this section is based on data excluding the two large retailers, as these questions were based on data where the representative at only one or neither of the large retailers responded. Respondents at nearly three quarters (74%) of premises that experienced violent crime reported that the incident wasn’t motivated by anything in particular. However, around one in ten (15%) said that it was motivated by race, ethnicity or nationality (See Table A17 - Crime against businesses: additional tables in CVS 2021).

Of the premises that experienced violent crime, respondents at 15% of premises reported at least one occasion in the reference year where the offender(s) had a weapon. Where a weapon was used, it was most commonly a knife (58%) and tools (27%) (however these estimates were based on responses from only 28 premises so should be treated with caution) (Table A18 - Crime against businesses: additional tables in CVS 2021). A similar proportion of knife incidents was reported in the ACS Crime Report 2021[footnote 19], which stated that a knife was the weapon used in 53% of incidents involving a weapon in 2021. The BRC Crime Survey 2021[footnote 20] estimated that 45 incidents a day involved a weapon in the year ending March 2020 (the year before the pandemic).

For the majority of premises (87%) that experienced violent incidents, these did not result in physical injury to staff. By deduction, this means that one or more staff at 13% of premises were physically injured as the result of a violent incident. Most employees (88%) who suffered from a violent crime didn’t need to take time off work. However, by deduction again, this means that (12%) did have to take some time off work as a result of the assault. (Table A19 - Crime against businesses: additional tables in CVS 2021).

5. Cost and impact of crime

Key results:

- almost half (45%) of respondents identified theft by customers as the most negatively impacting crime, 13% reported assault and threats, and another 8% cited theft by unknown persons

- the most common impacts of crime reported by respondents included financial loss (68%), stolen goods and services (60%) and additional staff time needed to deal with the incident (46%)

- financially, a larger proportion of retail premises were more negatively impacted by crime than wholesale premises with respondents at 7% of retail premises estimating that all the crime experienced caused a serious or severe financial impact, compared with 2% of wholesale premises

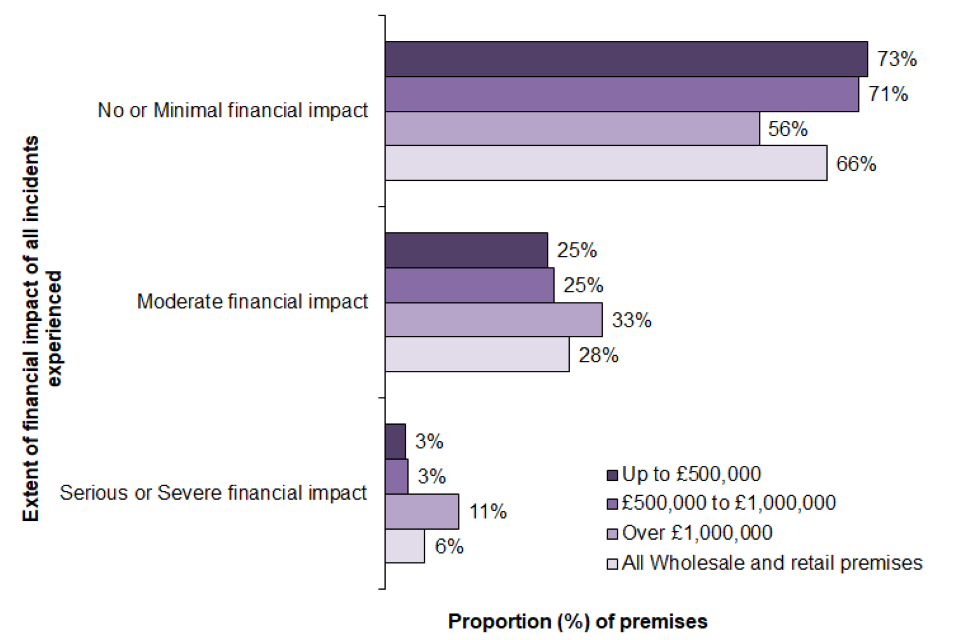

- respondents at one in ten (11%) business premises with an annual turnover above £1 million reported a serious or severe financial impact compared with 3% of business premises with an annual turnover of up to £500,000

The 2021 CVS introduced a new set of questions on impact of crime. These replaced previous questions on cost of crime, where respondents were asked to estimate the value of items stolen. These were often very rough estimates. The intention of the impact questions was to provide a more useful measure of the impact of crime on businesses and expand the evidence beyond just the cost impact.

Impacts of crime

As shown in Figure 5.1, the majority of premises in the Wholesale and retail sector experienced some financial loss (68%) and stolen goods and services (60%)[footnote 21] as a result of crimes they experienced. Other common impacts of crime included: additional staff time being needed to deal with the incident (cited by 46% of premises), indirect costs (37%) and damage to premises and property (30%). Fewer businesses experienced loss of staff (7%), or loss of service or closure (11%).

Figure 5.1: Most common ways wholesale and retail premises were adversely affected by crime, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes: Unweighted base: 1,047. Respondents could give more than one response to this question.

Respondents at premises that had experienced ASB were also asked to report the impacts the crime had on their premises. The most commonly reported impacts included: staff being upset or disrupted (30%), customers being ’put-off’ (24%), and the behaviour being a general nuisance or inconvenience (17%), but 22% of premises suggested that ASB had no impact on their premises (See Table A20 - Crime against businesses: additional tables in CVS 2021).

If a premise had experienced crime, respondents were also asked about the extent to which the victimisation had an overall impact on their business. Respondents were asked to choose between one of four categories: not at all, to a small extent, to a moderate extent and to a great extent. This encompassed the combined impact of direct and indirect costs, staff wellbeing and viability of the business. Theft by unknown persons was most likely to impact businesses to a great extent (13% of respondents that experienced the crime), followed by theft by customers (11%), and robbery (including attempts; also 11%). Despite these findings, respondents at most premises reported that if they experienced a crime, it had impacted on their business to a small extent (between 35% and 60%, dependent on the crime type). (See Table A21 - Crime against businesses: additional tables in CVS 2021).

When respondents were asked which crime type had the greatest negative impact on their business, 45% of respondents identified theft by customers, 13% mentioned assault and threats, and another 8% cited theft by unknown persons (Table A22 - Crime against businesses: additional tables in CVS 2021). It is perhaps not surprising that theft by customer had the most negative impact, as it was the most prevalent crime type (see Section 2). The British Retail Consortium’s (BRC) ‘Crime Survey 2021’[footnote 22] results reported on findings for the year ending March 2020 and showed that theft by customer accounted for 95% of the cost of retail crime, in the year before the pandemic.

The Association of Convenience Stores (ACS) Crime Report 2021[footnote 23] reported on data for 2021 and showed that there were 1.1 million incidents of customer theft over the last year. According to the report, incidents have remained level over the past year, with offenders targeting essential businesses, including convenience stores, that have remained open throughout the pandemic.

In the 2021 CVS, when respondents reported the crime that had the most negative impact on their business, they were then asked to identify the types of impacts it had. Of those that reported theft by customers to be the most negatively impacting crime, most of these premises suggested this was because they experienced financial loss or stolen goods or services (68% and 62% respectively)[footnote 24].

Although less prevalent than theft, assaults and threats were seen to be one of the most disruptive crime types, namely due to the impact on staff. Respondents at over half of premises that experienced assaults and threats (55%) reported that the crime required additional staff time to deal with the incident. The same proportion (55%) also stated it caused staff wellbeing issues and 44% reported that assaults and threats stopped staff doing day-to-day work (Table A23 – Crime against businesses: additional tables in CVS 2021).

Financial impact of crime

As part of the 2021 CVS, respondents were asked to consider the costs and damages caused by all crime, theft, and fraud and estimate the resulting financial impact. Of the 38% of premises that experienced any crime during April 2020 and March 2021, 6% of respondents reported that all the incidents they experienced resulted in a severe or serious financial impact. A quarter (27%) reported a moderate financial impact, while 42% reported minimal financial impact. The remaining 24% estimated that they experienced no financial impact.

The financial impact of theft showed a similar pattern to all crime, likely due to theft being the most prevalent crime type. Based on the 27% of premises that experienced theft, only 10% experienced a serious or severe financial impact as a result. The majority experienced minimal or no financial impact (46% and 15% respectively).

As referenced in Section 2, it is possible that fraud is under-estimated in the CVS, as such incidents are often handled by Head Offices rather than at premise-level. Fraud was experienced by 6% of premises in the 2021 CVS. Fraud appeared to have a greater impact than theft and all crime, with 13% of premises reporting that fraud caused a serious or severe financial impact, 38% reporting minimal financial impact, 36% reporting moderate financial impact and the remaining 12% reporting no financial impact (See Table A26 - Crime against businesses: additional tables in CVS 2021).

A serious or severe financial impact was more commonly associated with larger premises. Of the premises with 50 or more employees, 17% of premises experienced a serious or severe financial impact compared with 10% of premises with 10 to 49 employees, and 4% of premises with 1 to 9 employees (See Table A24 -Crime against businesses: additional tables in CVS 2021). This finding appears counter-intuitive, as it was expected that smaller businesses would experience a greater financial impact from crime than larger businesses, with larger businesses more likely to have a higher turnover and therefore be able to subsume financial losses more easily. It is possible that respondents have equated financial loss with financial impact, when the intention of the financial impact questions was to measure impact relative to the premise’s turnover. If these set of questions remains in future CVS, further cognitive interviewing should be carried out to test respondents’ understanding of these questions.

Comparison of financial impact between wholesale and retail premises for all crime suggested that a larger proportion of retail premises experienced greater financial impacts than wholesale premises, but this difference was not statistically significant. For retail premises, 66% of respondents reported no or minimal financial impact, 27% reported moderate financial impact and 7% reported serious or sever financial impact (Table 5.1). Comparative figures for wholesale premises were 69%, 29% and 2%, respectively (Table 5.2).

Table 5.1: Proportion of retail premises that experienced crime, by financial impact and number of employees, April 2020 to March 2021, England and Wales

| Extent of financial impact | 1-9 employees | 10 to 49 employees | 50 or more employees | All Retail premises |

|---|---|---|---|---|

| No financial impact | 29% | 10% | 7% | 23% |

| Minimal financial impact | 45% | 40% | 30% | 43% |

| Moderate financial impact | 21% | 39% | 45% | 27% |

| Serious financial impact | 4% | 7% | 16% | 5% |

| Severe financial impact | 1% | 4% | 3% | 2% |

| Unweighted bases | 451 | 229 | 196 | 876 |

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes: Due to rounding, percentages may not total 100%.

Table 5.2: Proportion of wholesale premises that experienced crime, by financial impact and number of employees, April 2020 to March 2021, England and Wales

| Extent of financial impact | 1-9 employees | 10 or more employees | All Wholesale premises |

|---|---|---|---|

| No financial impact | 33% | 26% | 31% |

| Minimal financial impact | 32% | 53% | 37% |

| Moderate financial impact | 35% | 14% | 29% |

| Serious financial impact | 0% | 3% | 1% |

| Severe financial impact | 0% | 5% | 1% |

| Unweighted bases | 64 | 65 | 129 |

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes:

- Due to rounding, percentages may not total 100%.

- Medium and large sized premises categories have been combined due to small sample size.

In line with all crime, when considering wholesale and retail premises separately, theft was thought to have caused a greater financial impact for retail premises than for wholesale premises (11% of retail premises experienced serious or severe financial impact compared with 4% of wholesale premises). In addition, fewer retail premises experienced no financial impact from theft (14% of retail premises compared with 27% of wholesale ones) (Table A25 - Crime against businesses: additional tables in CVS 2021).

When breaking the data down further by retail and wholesale premises and business size, some differences could be seen. Larger retailers were more likely to experience moderate to severe financial impacts than small retailers (63% of large retailers, 50% of medium-sized retailers and 26% of small retailers (Table 5.1). The reverse was seen with wholesalers, where small wholesalers were more likely to experience moderate to severe financial impacts than larger wholesalers (35% of small wholesalers compared with 22% of medium to large sized wholesalers) (Table 5.2).

Considering financial impact by premise turnover, a serious or severe financial impact was experienced by a greater proportion of premises with a higher annual turnover, though the difference was not statistically significant (Figure 5.2). An estimated 11% of premises that reported an annual turnover of over £1 million experienced serious or severe financial impacts, compared with just 3% of premises with a turnover of £500,000 to £1 million and 3% of those with a turnover of up to £500,000.

Figure 5.2: Proportion of wholesale and retail premises that experienced crime, by financial impact and premises-reported annual turnover, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes:

- Unweighted base: Up to £500,000 – 229 premises, £500,000 to £1,000,000 – 73 premises, Over £1,000,000 – 299 premises.

- Due to rounding percentages may not total 100%.

Questions on costs of items stolen in incidents of theft were removed from the 2021 CVS as respondents were often only able to provide very rough estimates. In the 2018 CVS bulletin[footnote 25], it was estimated that the median total costs of all incidents per victim in the 12 months prior to interview was £626, compared with £237 in the 2012 CVS, and £500 in the 2017 CVS.

In future surveys, data could be collected on monetary losses to compare financial losses more accurately. Furthermore, a larger sample could allow for further investigation into why larger premises are experiencing greater financial impact. This might be possible by examining premises by business size, nature of the premise or their location.

The British Retail Consortium (BRC) Crime Survey 2021[footnote 26] estimated that crime against member retailers cost the industry £1.3 billion in the year ending March 2020, the year before the pandemic, and that £935 million of this was attributed to customer theft.

The Association of Convenience Stores (ACS) Crime Report 2021[footnote 27] reported that crime cost £3,025 per convenience store in 2021, with a large proportion of this being due to shop theft (£1,360 per convenience store).

6. Crime prevention

Key results:

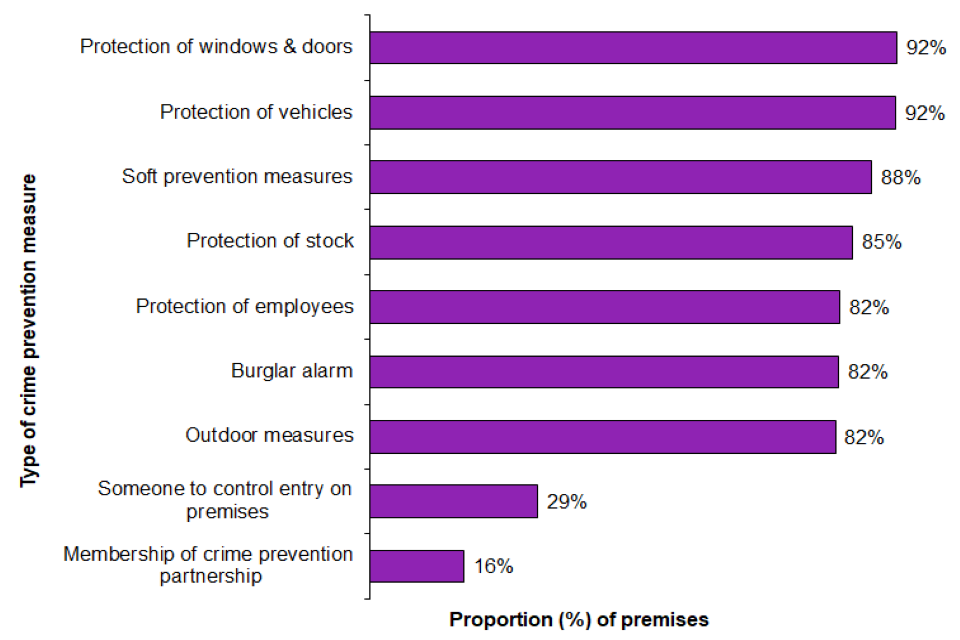

- the majority of businesses had crime prevention measures such as protection of windows and doors (92%), protection of vehicles (92%), or protection of stock (85%)

- respondents at most businesses (88%) reported employing some form of soft prevention measure including: training staff in vigilance (41%), limiting numbers on premises (32%), and ID checks for customers and visitors (36%)

- generally, premises that had crime prevention measures in place experienced higher levels of victimisation, for example, 30% of premises with stock protection measures experienced theft (all theft) compared with 9% of premises without the measure

The 2021 CVS randomly assigned questions on crime prevention to half of the sample. Respondents in this half of the sample were asked whether or not they had a range of crime prevention measures in place at their premises. The other half of the respondents were asked about their attitudes to crime and the police (see Section 7).

The 2021 CVS found that the most common crime prevention measures installed at wholesale and retail premises were “protection of windows and doors” (92% of premises), “protection of vehicles (92%), “soft prevention measures” (88%), and “protection of stock” (85%) (Figure 6.1). “Soft prevention measures” includes measures such as: training staff in vigilance (41%), limiting numbers on premises (32%), and ID checks for customers and visitors (36%).

This pattern was similar across premise location and type of premises (See Tables A27 and A28 of Crime against businesses: additional tables in CVS 2021). While not directly comparable, these findings were similar to previous CVS years, with the exception of protection of vehicles. In the 2018 CVS only 46% of wholesale and retail premises had vehicle protection measures compared with 92% in this year’s survey. Although this figure is a lot higher compared with the 2018 CVS figure, it needs to be monitored as this increase could be a pandemic effect. It is too early to say if this marks a change in the trend series.

Figure 6.1: Proportion of premises that reported having installed a crime prevention measure, by type of crime prevention measure, Wholesale and retail sector, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes: Proportions relate only to those premises that were asked the crime prevention measure questions. Respondents could give more than one answer to the question.

It is not possible to evaluate the effectiveness of crime prevention measures as the survey did not ask when the measures were installed (for example, before or after the incident of crime). Further, without a comparable control group of premises that did not install the same measures at the same time, it is not possible to assess the preventative impact of different measures.

Each crime prevention measure is designed to prevent particular types of crime. Data from the 2021 CVS can be used to assess levels of crime experienced at business premises in the context of the type of crime prevention measure installed. For instance, burglaries may be prevented by burglar alarms, outdoor protection measures, protection measures on doors and windows, and stock protection. As above, premises may choose to install such measures in response to previous victimisation, or the perceived threat of crime in the location in which the premises is sited. A selection of prevention measures has been matched to the crime types they are expected to prevent, and this is presented below.

For the Wholesale and retail sector in general, premises that had crime prevention measures in place experienced higher levels of victimisation. Whilst not directly comparable, this finding is consistent with previous surveys. For example, the 2021 CVS showed:

- protection on doors and windows: 9% of premises with the measure experienced burglary with entry compared with 3% of premises without the measure

- protection of stock measures: 30% of premises with the measure experienced theft (all theft) compared with 9% of premises without the measure

A lower likelihood of crime was associated with very few of the measures. A smaller proportion (3%) of premises with vehicle protection measures experienced theft from a vehicle compared with premises without the measure (4%). Moreover, 2% of premises with soft prevention measures experienced theft by an employee compared with 3% of those without such measures (see Table A29 - Crime against businesses: additional tables in CVS 2021). It was not possible to compare premises by the nature of the business or its location, and by types of measure installed, as the sample was not large enough. However, it was possible to consider victimisation of retail premises and urban premises based on whether or not they had prevention measures installed.

For both retail premises and urban premises in the Wholesale and retail sector, the 2021 CVS data showed that those with crime prevention measures in place were at a higher risk of victimisation. This is likely to reflect that the premises with crime prevention measures installed are more likely to be at a higher perceived risk of crime or experience more crime, either because of their location or the value of goods held at the premise, or because of prior victimisation. (See Tables A30 and A31 - Crime against businesses: additional tables in CVS 2021).

As reported in Section 3, crime prevention measures were installed at 27% of wholesale and retail premises as a result of the Covid-19 outbreak. According to the Association of Convenience Stores (ACS)[footnote 28], the cost to this group of retailers in 2021 was £175 million and the measures included the introduction of perspex screens and additional guarding support.

7. Attitudes to crime and the police

Key results:

- respondents at more than half (53%) of businesses said that all crimes had to be reported or logged internally

- incidents of customer theft (58%) were less likely to be reported to the police compared with incidents of burglary with entry and robbery (inc. attempts) (at 93% and 89% respectively)

- of the businesses where staff had not reported crime incidents to the police, around one third of respondents (37%) said that the incident was too trivial to report

- respondents at around one in five business premises cited police lack of interest in reported crimes (22%) as one of the main reasons for feeling dissatisfied with how the police service responded to crimes in their area

- for the majority of premises (68%), respondents said that they were very or fairly confident with police responding effectively if they experience a crime in the next twelve months though consequently, the remaining third (32%) said that they were not very or not at all confident with the likely police response if they were to experience a crime

The 2021 CVS randomly assigned questions on attitudes to crime and the police to half of the sample. Respondents in this half of the sample were asked about reporting policies and their levels of satisfaction with the police. The other half of the respondents were asked about crime prevention (see Section 6).

Reporting policies

Premises have their own reporting policies to determine which incidents or crimes should be reported internally and which of these should be reported to the police.

When asked about internal company reporting policies, just over half of the respondents selected for this module (53%) said that all crimes had to be reported or logged internally. Just over two-fifths (42%) said that it depended on the circumstances as to whether crime was recorded internally, and the remaining 5% said that no crime had to be reported internally (See Table A32 – Crime against businesses: additional tables in CVS 2021).

Businesses were also asked about their general reporting practices of customer theft, with more than half of respondents (55%) reporting that it depended on the circumstances, or the item stolen. Of those who said it depended on the circumstances, some of the most common factors that influenced whether they reported a theft incident to the police included: if a high value item was stolen (64% of those premises gave this as a reason) if it involved violence towards staff (cited by 26%) or if it involved damage to the property (cited by 11%).

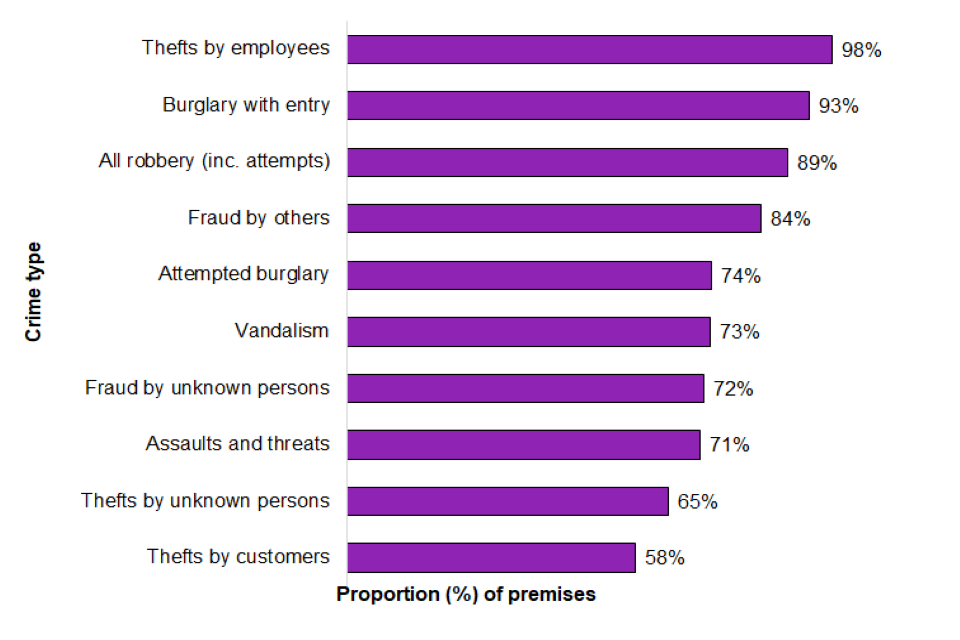

Respondents at premises that had experienced any crime in the period between April 2020 to March 2021 were also asked whether or not staff had reported any incidents to the police. As seen in previous years, the CVS showed considerable variation by the type of offence (Figure 7.1).

Figure 7.1 : Proportion of premises who had experienced crime and had reported any crime incident to the police, for selected crime types, Wholesale and retail sector, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: headline findings from the CVS 2021

Note: Some categories are not shown due to having an unweighted base of fewer than 50 respondents and therefore the quality of resulting estimates is not deemed sufficient for publication.

Theft by employees had a low prevalence rate in the 2021 CVS (2%) but such incidents were the most likely to be reported to the police (98%). This is likely due to the nature of these crimes representing a breach of trust for the employer and therefore treated as a serious incident.

Incidents of burglary or robbery (including attempts) were more likely to be reported than any other crime, with 93% of respondents at premises reporting incidents of burglary with entry and 89% reporting incidents of robbery (including attempts) to the police. The high reporting rates for these crime types are likely to reflect the perceived seriousness of these crimes and in addition, the need for victims to obtain a crime reference number from the police to make an insurance claim. In contrast, reporting rates were lower for incidents of assaults and threats (71%). They were also lower for theft by unknown person, at 65%, though this is perhaps to be expected for this crime type, when the thief could not be identified (See Table H11 - Crime against businesses: headline findings from the CVS 2021).

Reporting rates in the previous CVS years relate to reporting of the most recent incident only. For burglary, attempted burglary and robbery, these were also fairly well reported in 2018 (at 82%, 62% and 70% respectively).

According to the 2021 CVS, thefts by customers (58%) were less frequently reported to the police compared with other crime types. This may reflect a range of factors, including: the lower value of goods stolen, the seriousness of the crime or the perception that the police would not be able to identify the offender.

The 2018 CVS showed that staff at 42% of premises reported the most recent incident of theft to the police and those at 45% of premises reported all incidents of theft by customers to the police (2018 CVS Comparison tables). The most recent incident of theft by customers was also less well reported to the police compared with other crime types, having fluctuated between 34% and 44% since the 2012 CVS.

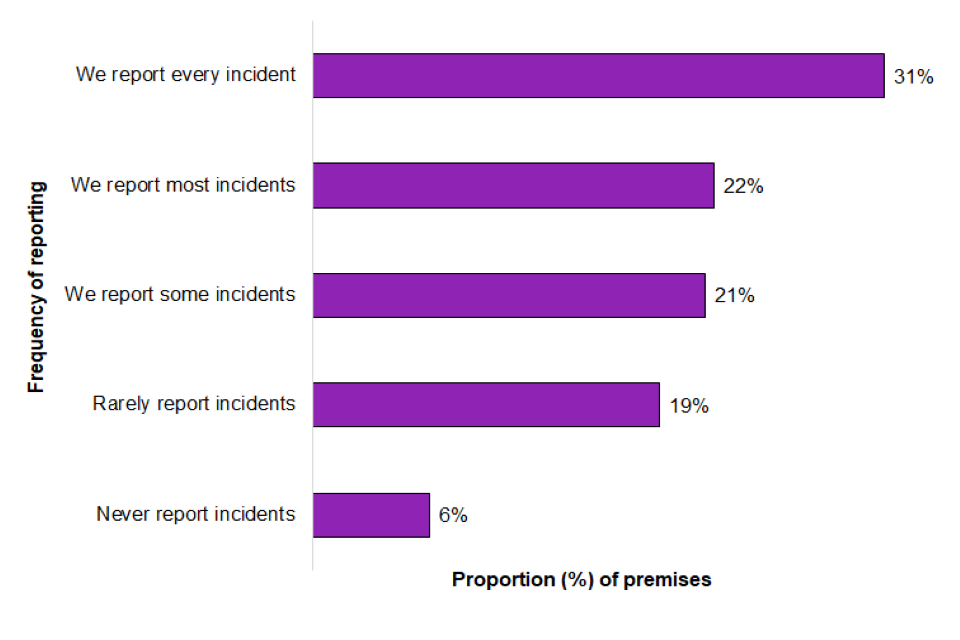

Respondents who said that staff had reported incidents to the police were also asked how often incidents had been reported in the last year. Around half (53%) said that every or most incidents that their premises had experienced had been reported to the police, whereas a quarter (25%) said that staff rarely or never reported any incident during that period. A further 21% said that they reported some incidents.

Figure 7.2: Proportion of premises where staff reported crime incidents to the police, April 2020 to March 2021, England and Wales

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

Notes:

- Unweighted base: 380.

- Due to rounding percentages may not total 100%.

Of respondents from businesses where staff had not reported crime incidents to the police, just over a third of them (37%) said that they thought the incident was too trivial to report. Almost two in ten (17%) responded that there was no point or need to do so and a further 14% said that there was no loss or damage (See Table A35 – Crime against businesses: additional tables in CVS 2021).

Respondents who said that their premise had been a victim of fraud were then asked to say how many fraud incidents out of the ten staff at their organisation reported to the police or Action Fraud. Almost one in ten (8%) said that staff had reported all incidents to the police or Action Fraud and almost half (49%) said they reported some incidents, but not all. The remaining 43% said that they had not reported any fraud incidents.

Perception of the police

Respondents were asked for their perception of the police response to all the crimes staff reported between April 2020 to March 2021. As shown in Table 7.1 below, four in ten (40%) responded that the police routinely attended the scene of the crime and around three in ten (29%) reported that they were given a crime reference number. Suspects’ arrests were reported by 6% of respondents. Nearly two in ten (18%) said that the police did nothing or very little. Respondents also said that the police acknowledged receipt of the report (16%) or checked CCTV footage (12%).

Table 7.1: Police response to any crime incident experienced by employee size and premises, April 2020 to March 2021, England and Wales

| Police response | 1-9 employees | 10 to 49 employees | 50 or more employees | All W&R premises |

|---|---|---|---|---|

| Attend scene of a crime | 40% | 37% | 51% | 40% |

| Given a crime reference number | 28% | 29% | 34% | 29% |

| Nothing or very little | 21% | 14% | 12% | 18% |

| Acknowlege reciept of report | 16% | 15% | 13% | 16% |

| Checked CCTV footage | 9% | 18% | 11% | 12% |

| Arrested suspects | 7% | 3% | 16% | 6% |

| Follow up contact, phone call, email, or letter | 3% | 9% | 5% | 5% |

| Took statements | 4% | 7% | 3% | 5% |

Source: Home Office, Crime against businesses: bulletin tables in CVS 2021

The level of satisfaction with the police response to reported incidents was mixed. Almost five in ten respondents (47%) said that they were very or fairly satisfied with how the police responded to any crime staff reported at their premises, whereas another five in ten (53%) were a bit or very dissatisfied.

Similarly, when respondents were asked about their satisfaction with the police more generally, with regard to the way police deal with crime problems facing businesses in their area, 55% said that they were very or fairly satisfied, and 45% said that they were a bit or very dissatisfied with the response.