UKTI inward investment report 2013-2014 (online viewing)

Published 18 July 2014

1. Foreword: Lord Livingston, Minister of State for Trade and Investment

Lord Livingston, UK Minister for Trade and Investment

This is our first UKTI Inward Investment Annual Report since I became Minister. I am pleased that these results are so positive.

We want to be the number one destination for Foreign Direct Investment (FDI) projects in Europe, and have again achieved that position. Last year the UK brought in a record number of FDI projects, which are estimated to create the highest number of new jobs since 2001.

This excellent performance demonstrates the effectiveness of this Government’s plans to deliver growth. It shows that our strategy to attract investors here by creating one of the most business-friendly environments in the world is the right one. And it is proof that foreign investors have confidence in the UK as a place to do business.

The impact of inward investment is real. Each investment brings new jobs or protects existing ones, improves our position in a highly competitive global marketplace, and contributes to economic growth. This is a real partnership with business which benefits us all.

We can do more. We intend to attract more investments that create significant numbers of jobs, exports and value add. We will strive to make the UK the number one choice for investment from emerging markets, to innovate and find new ways to attract new investors. We will also continue to work with existing investors to help them grow their presence in the UK and contribute even more to our economy.

The strong performance evidenced in this Report gives me confidence that we can continue to lead Europe in attracting investment from around the globe.

2. Managing Director’s report: Michael Boyd

Michael Boyd, Managing Director, Investment Group, UKTI

I am delighted to report that the UK has exceeded 2012/13’s strong performance by attracting a record number of inward investment projects during 2013/14.

UKTI recorded 1,773 FDI projects landing in the UK last year, up from 1,559 in 2012/13. These projects are estimated to bring with them over 111,000 new and safeguarded jobs. UKTI and its partners supported 1,462 of those projects. The leading industry group for both projects and jobs was advanced manufacturing, with 418 and 37,204 respectively.

These results are a testament to the hard work and dedication of UKTI Investment staff in the UK and around the world, and our partner organisations across the UK, in identifying leads and working with companies to ensure they choose the UK to grow in. We work as one team to provide the best services and advice to potential investors.

In 2013/14 we introduced new measures to identify and land higher-value and better-quality foreign investments, without compromising on numbers. We expanded our operations from 34 to 51 markets. Our Investment Organisations, which we expanded to new sectors last year, provide focus on key sectors aligned with our Industrial Strategies, utilising the skills of business leaders with high credibility in those sectors. And we were hugely successful in attracting investment into infrastructure, attracting almost £24 billion of commitments.

Our recent strategy refresh gives new focus to investors who are able to export once here, and to bringing companies and industries back to these shores. We should not rest on our laurels, but these results show that the future for inward investment in the UK is bright.

3. A year of strong performance: global context

3.1 The economic recovery is gathering pace.

The recovery in the global economy has broadly strengthened during 2013, with the International Monetary Fund estimating growth of 3 percent in the world’s output last year. The UK’s economic performance was one of the strongest among the European countries. During the last year, the UK recorded growth in GDP of 1.8 percent, outpacing the Eurozone average of -0.4 percent, Germany’s 0.5 percent and France’s 0.3 percent.

The World Investment Report 2014, published by the United Nations Conference on Trade and Development (UNCTAD), showed some recovery in global Foreign Direct Investment (FDI) flows. The global FDI inflows increased by 9 percent in 2013, to US$1,452 billion. The estimated value of FDI inflows into the UK was US$37.1 billion.

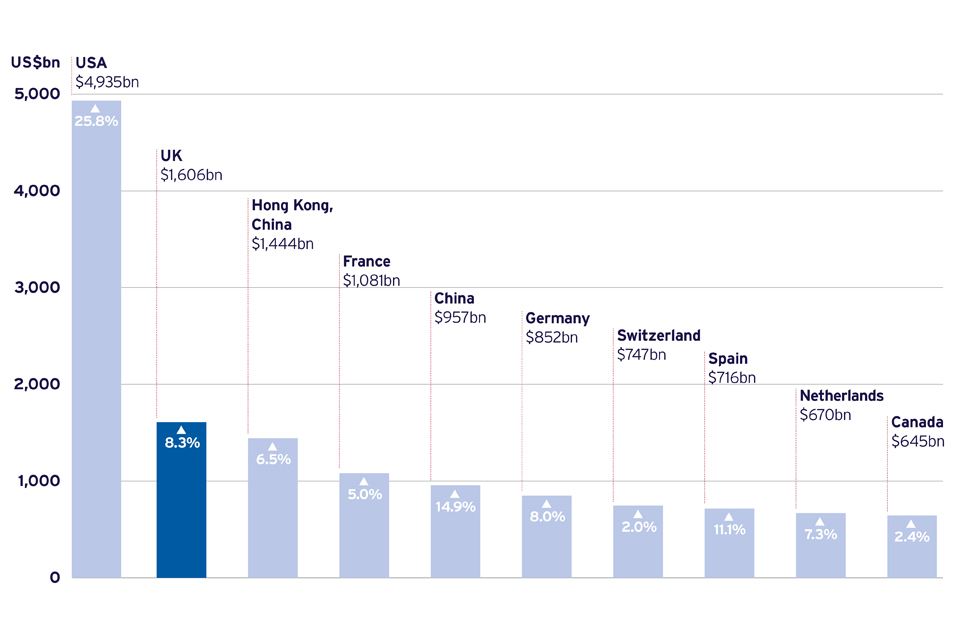

According to UNCTAD, the UK is the number one country for inward FDI stock in Europe, and only the second in the world after the USA.

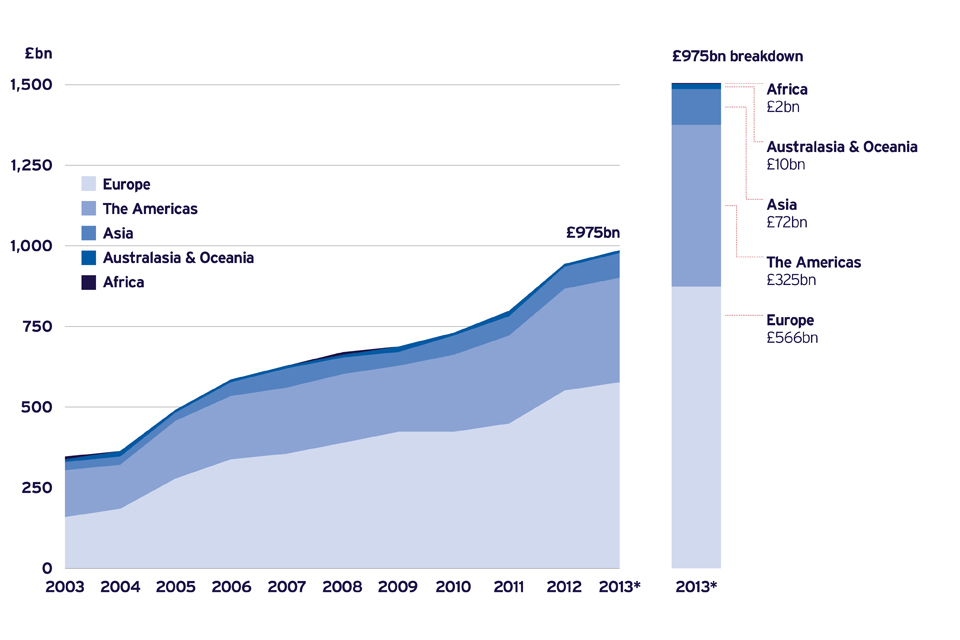

The value of UK inward FDI stock is estimated to have increased by 8.3 percent during the last year, reaching a record level of US$1,606 billion (£975 billion). FDI stock is a stable measure of FDI, and demonstrates the long-term interest of foreign investors, and their confidence and commitment to the UK economy.

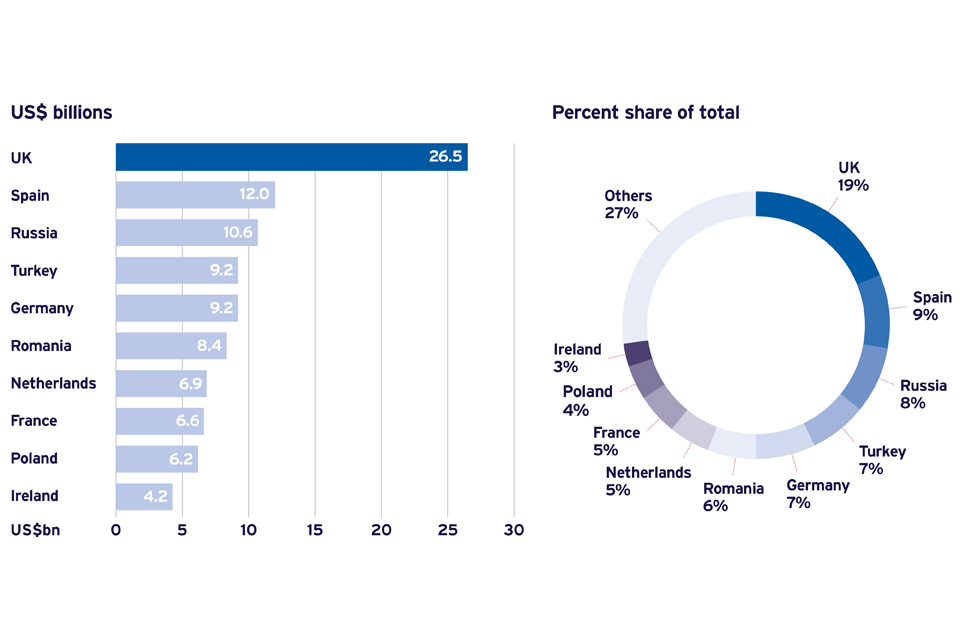

Countries with the largest inward FDI stock (2013, US$ billion and annual change) Source: 2014 World Investment Report, UNCTAD (June, 2014)

The UK not only recorded growth in the value of inward FDI stock of 8.3 percent, it also increased its relative share of the total accumulated FDI stock in European Union (EU) countries by about US$17 billion, reaching 19 percent as of the end of 2013. Other major economies in Europe have a significantly lower share of total European inward FDI stock (eg France 13 percent, Germany 10 percent).

UKTI has an internal ambition to contribute towards increasing the value of UK’s inward FDI stock to £1.5 trillion by 2020.

3.2 UK FDI stock as a percentage of GDP has increased

The latest results from the UNCTAD report show that the value of foreign-held assets in the UK has also increased in terms of the size of the economy, reaching 63.3 percent of GDP by the end of 2013. This is over 3 percent higher than in the previous year, demonstrating the openness and internationalisation of the UK economy, and the role of foreign investment in the UK’s economic recovery and growth. It compares to the EU average of 49.4 percent, Germany’s 23.4 percent, France’s 39.5 percent, and Spain’s 52.7percent.

Graph illustration [Sources of UK inward FDI stock by region Source: ONS and UNCTAD. * 2012 ONS source country proportions applied on 2013 UNCTAD estimate (1.6468 US$/£ used, IMF)]

3.3 European investors remain the main contributors to UK FDI stock

European investors remain the largest holders of FDI stock in the UK (58 percent), while the USA is the largest single source country (29 percent). Other large source markets for UK FDI stock are the Netherlands (15 percent), France (8 percent) and Germany (7 percent).

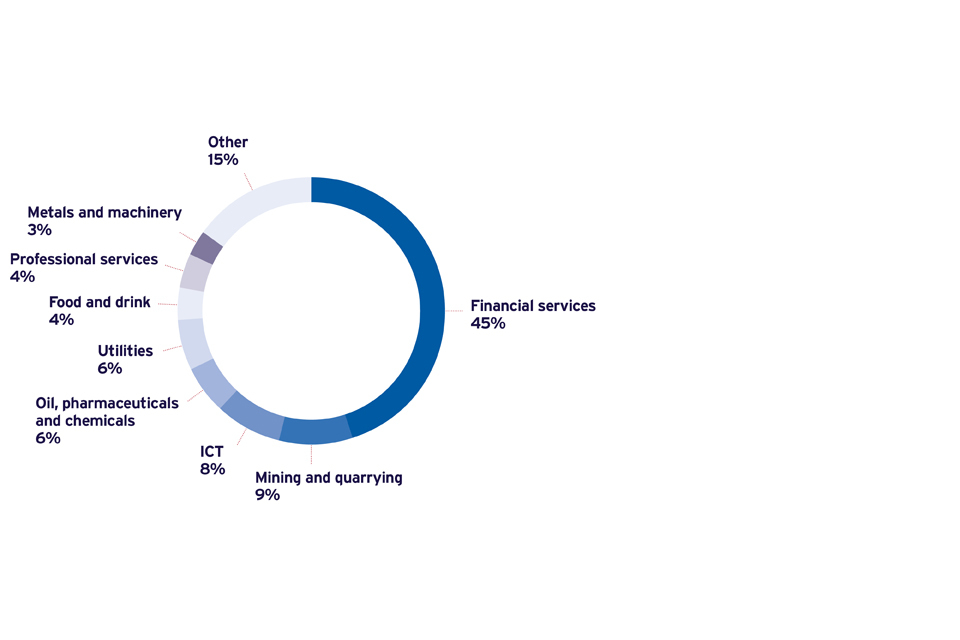

3.4 The services sector holds the largest FDI stock

According to the Office for National Statistics (ONS), the UK’s inward FDI stock is spread across a range of industry sectors. The largest concentration is in financial services (45 percent), followed by mining (9 percent), ICT (8 percent) and oil, pharmaceuticals and chemicals (6 percent).

Graph illustration [Sources of UK inward FDI stock by region Source: ONS and UNCTAD. * 2012 ONS source country proportions applied on 2013 UNCTAD estimate (1.6468 US$/£ used, IMF)]

3.5 The UK is attracting the largest number of FDI projects in Europe

The UK’s strong results in gaining FDI stock are reinforced by the country’s performance in attracting FDI projects.

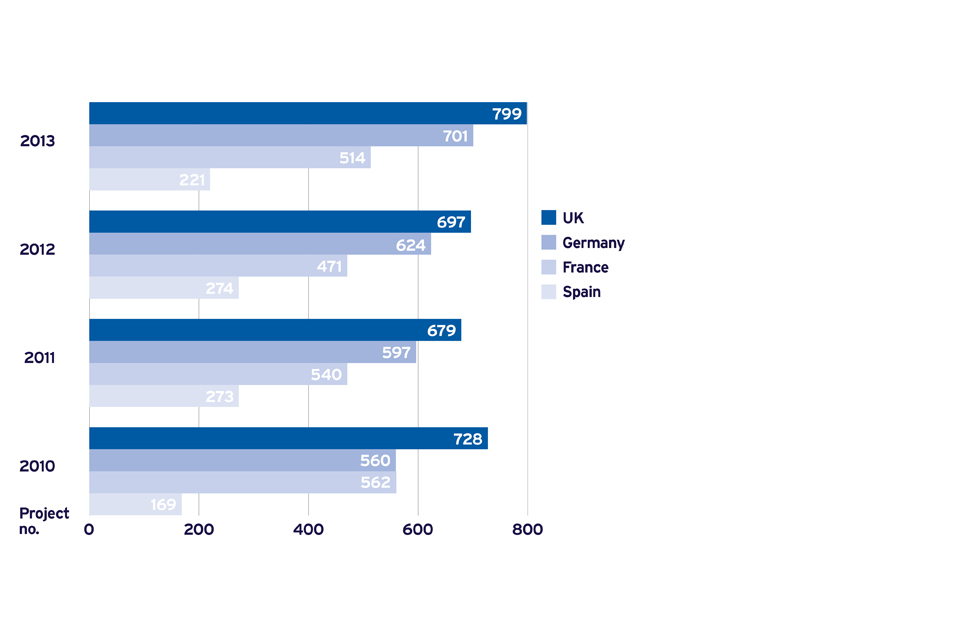

The UK’s performance during 2013 has also been impressive when measured by the number of FDI project announcements. Two major independent organisations – EY and the Financial Times (FT) – track and report on foreign investment announcements.

Both confirmed that the UK attracted the largest number of FDI projects in Europe during 2013, strengthening its lead position as the most attractive destination for FDI in Europe.

EY’s Attractiveness Survey Report showed that the UK attracted the highest number of FDI projects in Europe in 2013, and increased its market share from 18 percent in 2012 to 20 percent in 2013. The UK has been ahead of its main European competitors over the past few years.

Distribution of FDI stock across UK sectors Source: ONS, 2014. Estimates as of end 2012

Top 10 recipients of FDI projects in Europe by estimated value of capital investments in 2013 Source: FT, fDi Report, 2014

3.6 The UK is the largest recipient of capital investment in Europe

The UK not only attracts the largest number of FDI projects, but we are also first in terms of the estimated value of capital investment. According to the FT’s fDi Report, almost 20 percent of the total value of capital investments that are destined for Europe land in the UK. The total value of “greenfield” FDI projects recorded by the FT in the UK during 2013 was US$26.5 billion.

3.7 Outlook for 2014

Overall, the UK’s performance in the global FDI market has been strong. The UK has strengthened its lead position in the world, as one of the most preferred destinations for foreign investment in Europe.

The economic outlook for 2014 is positive, with the UK economy estimated to grow by about 2.5–3 percent. Strong economic performance and recovery prospects should provide further confidence to foreign investors, in choosing the UK as their preferred location for starting or expanding a business. Independent sources, such as the FT fDi Report, anticipate a particularly strong performance from the UK during 2014.

4. UK inward investment: results for 2013/14

4.1 Strongest performance recorded in UK

During 2013/14 the UK continued to consolidate its lead position in the global FDI market by attracting more inward investment projects than ever previously recorded. UK Trade & Investment (UKTI) official results, which include wider types of investment and also those which are not announced by companies, echo the results released by independent international organisations, confirming that 2013/14 was an exceptionally strong year for attracting inward investment projects.

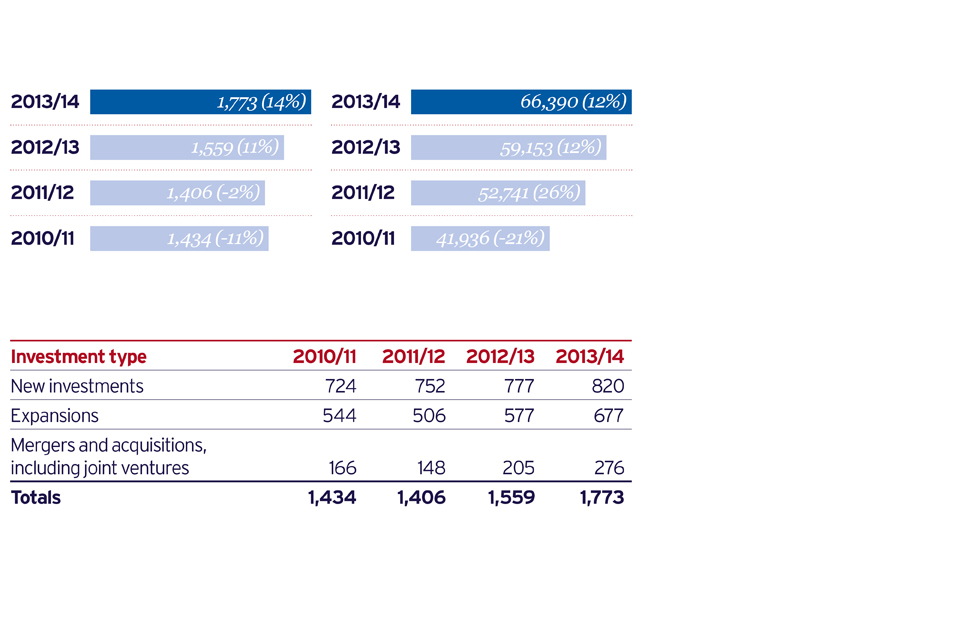

UKTI recorded an unprecedented number of FDI projects – 1,773 – an increase of nearly 14 percent on 2012/13 figures, which in themselves had shown a marked increase on the previous year. UKTI and its partners across the UK played an active role in securing 1,462 projects, over 82 percent of the total. UKTI’s focus on attracting higher-value and better-quality investment will ensure that the benefits of these investment projects are maximised for all parts of the UK.

Over 66,000 new jobs* were created by international companies investing in the UK economy during the last year, an impressive 12 percent increase over the previous year. This is the highest number of new jobs recorded since 2000/01. Coupled with nearly 45,000 jobs safeguarded by additional investment into UK operations, FDI contributed over 111,000 jobs to the UK economy in the 2013/14 financial year. The number of safeguarded jobs reported during 2013/14 was significantly lower than last year, showing a more healthy balance of new and safeguarded jobs associated with FDI projects.

The lower number of safeguarded jobs suggests there have been fewer existing jobs at risk with UK businesses involved in foreign investments.

Major European recipients of FDI projects Source: EY Attractiveness Survey, June 2014. Based on announced FDI projects and capturing only certain types of investment

FDI projects in the UK (left) New jobs created in the UK (right) Types of investment (bottom)

4.2 Existing investors continue to thrive in a growing UK economy

The growth of investment projects in the UK was driven by unprecedented numbers of expansions of existing investments recorded over the financial year.

An increase of over 17 percent year-on-year – to 677 projects, the highest ever recorded – confirms the trend reported last year, of the growing confidence that existing investors have in the UK as their preferred destination for expanding their business.

Growing numbers of expansion projects also show the effectiveness of the strengthened approach that UKTI and its partners have been adopting over recent years, in terms of account management activities. New investments also saw a healthy rise of just over 6 percent, to 820 projects, which in itself is a record for new investments recorded in the UK. There have also been increased numbers of mergers and acquisition-type investments recorded during the last year.

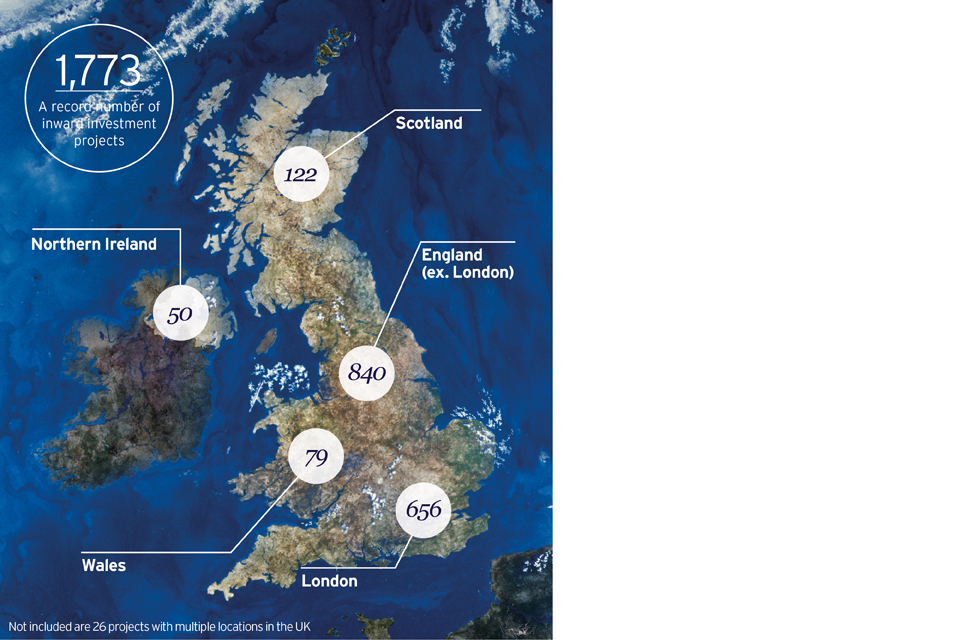

4.3 Strong performance across the UK

All the nations of the United Kingdom saw growth in the number of FDI projects reported last year. England, including London, saw an increase of 11 percent, Scotland 10 percent, Wales 18 percent and Northern Ireland an impressive 32 percent.

These investments have created or safeguarded many jobs across all parts of the UK. On average, each investment project is estimated to have created or safeguarded 63 jobs. Individual investments in Wales and Scotland, on average, had the largest impact in terms of creation or safeguarding of jobs (132 and 87 jobs per project respectively). Each investment in Northern Ireland is associated with 77 jobs, while projects landing in London are estimated to have created or safeguarded on average 44 jobs per project.

The spread of foreign investments across all parts of the UK demonstrates the strength and attractiveness of the UK in the global FDI market.

Map showing distribution of investment projects in the UK

5. Strong global investment figures

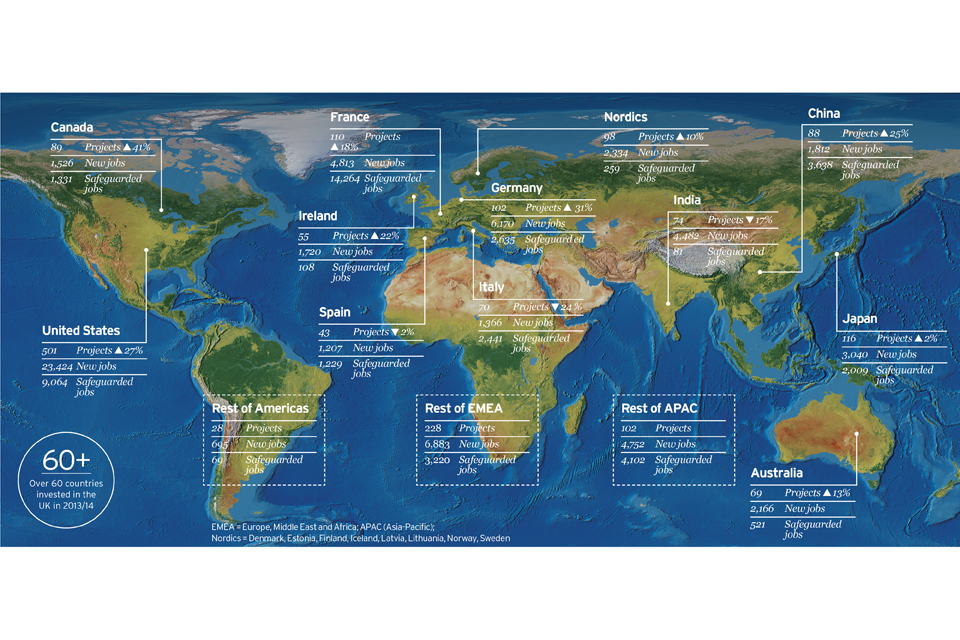

Investment projects from over sixty countries were recorded in 2013/14. There were strong investment figures from all global regions.

Map showing top source markets for FDI projects into the UK

As expected, the USA led the way as the largest source of FDI projects for the UK, generating 501 projects, up 27 percent. This is consistent with the FDI stock figures, which also confirm the USA as the largest source of UK inward FDI. Canadian investment also reached new heights, with 89 projects, up an encouraging 41 percent.

European companies also demonstrated increased interest in the UK. The two largest European contributors to FDI in the UK were France and Germany, both delivering over 100 projects, representing rises of 18 percent and 31 percent respectively. Added to this was a strong showing from the Nordic region, which recorded a figure just short of 100 for the year. Spain and Italy were slightly down, as companies from these countries slowed the number of investments into the UK. This was compensated for by the continued growth of Ireland, which accounted for an impressive 55 projects.

Activity from the Asia Pacific region was slow to start, but Japan again showed itself to be the key investment partner, delivering 116 projects across a variety of sectors. China too showed commitment to the UK economy, with 88 projects.

6. Investment from emerging markets is growing

During 2013/14 investments from emerging markets have shown continued growth. Turkey (15 projects), Poland (14 projects), South Africa (11 projects), UAE (8 projects), Brazil (10 projects) and Mexico (9 projects) are all markets which have demonstrated a year-on-year increase in investment into the UK.

UKTI realises the huge potential that exists in emerging markets, and continues to focus on these markets to support future growth. During 2013/14 UKTI expanded its operations in four key emerging markets through new, innovative public-private partnerships, increasing the total number of countries where UKTI operates from 34 to 51. The impact of this new, strengthened presence in emerging markets will begin to be apparent from 2014/15 onwards.

UKTI realises the huge potential that exists in emerging markets, and continues to focus on these markets to support future growth.

7. Performance by individual sectors and industry groups

Foreign investments have continued to play an important role in strengthening competitiveness of many key sectors and industries across the UK economy. Last year, the advanced manufacturing industry group, which includes individual sectors such as automotive, aerospace and advanced engineering, has delivered the highest number of investment projects and jobs.

In terms of individual sectors, software and computer services once again accounted for the largest number of investment projects in a single sector (229 projects). Other well-performing individual sectors were the financial services (159 projects) and business and consumer services (128 projects). All individual sectors are included within one of the six industry groups, which align closely with the priorities of the Investment Organisations to support the Industrial Strategy.

Energy and infrastructure and financial services lead the way in growth.

There has been a significant rise in energy and infrastructure projects this year, with the number of investments in this industry group rising by nearly a quarter in 2013/14. These investments are estimated to have brought with them a total of 31,261 jobs, the second largest after the advanced manufacturing group. A similar strong increase in the number of investment projects was recorded for the financial and professional services industry group, bringing with them a total of 21,661 jobs.

Illustrations showingFDI performance by individual sectors

8. The nature of investment

FDI continued to play an important part in promoting R&D activities in the UK. Over 310 projects were reported to have an R&D element involved, and 324 investments were reported to have the UK site as being responsible for some headquarters function. Most of the projects recorded by UKTI involved services (545 projects), while 394 were associated with some manufacturing activities.

Looking ahead

The UK has seen strong levels of FDI flowing into the economy. The unprecedented number of investment projects landing in the UK, together with a commensurate number of new jobs being created, will continue to contribute towards economic recovery and growth over the coming years.

The future also appears to be strong, with initiatives in a number of emerging markets feeding the pipeline of investment projects. This, together with a more strengthened focus on sector strategy and growth, which is being developed by the Investment Organisations, will bring substantial value to the economy and consolidate the UK’s position as a global centre for business, trade and investment.

9. Building for the future

Given the vital role that the UK’s infrastructure and urban environment plays in our economic growth and quality of life, UKTI has been strongly focused on attracting overseas investment into infrastructure development and regeneration projects.

The quality of the UK’s infrastructure and its urban environment is central to the nation’s development, helping to create jobs and raise living standards. In 2013/14, UKTI made a major contribution to these goals by attracting commitments worth £23.8 billion from overseas investors, who are putting their money into projects to develop our infrastructure and regenerate our cities.

Some of these investment projects (to the value of £1.45 billion) have already begun, delivering tangible benefits for the UK economy.

The Government is committed to equipping the UK with world-class infrastructure, to ensure that we remain globally competitive. The National Infrastructure Plan sets out our strategic approach to delivering against this commitment over the next decade and beyond.

It includes radical new policies for our energy sector – such as Electricity Market Reform – and targeted action to unlock and stimulate private sector investment, which is expected to contribute the majority of the capital that is required.

UKTI has responded energetically to this challenge by forming the Institutional Investment & Infrastructure Team and the Regeneration Investment Organisation. Together, they are developing strategic relationships with investors and developers, to realise investment and create thousands of jobs in the energy, transport, environment and regeneration sectors. UKTI has matched developers with investors, supported investors in establishing a presence in the UK, explained the UK’s business, tax and legal environment and the planning system, and fostered government-to-government collaboration.

9.1 UKTI supported investments

In 2013/14, UKTI supported a range of investments.

Hinkley Point

The first new nuclear power station to be built in the UK for 20 years. Hinkley Point will generate around 7 percent of the UK’s electricity.The project is estimated to need 5,600 construction workers at the peak of activity, and create 900 permanent jobs. EDF Energy has obtained Development Consent and other licenses/ permits for the station, and has reached agreement with Government on the key commercial terms. EDF is expected to take its final investment decision on the £16 billion project once final agreement has been reached with shareholders and Government, and once State Aid clearance has been received from the European Commission.

Royal Albert Docks

China’s Advanced Business Parks have committed £1 billion to the regeneration of the Docks in the East End of London.

The project will transform a 35-acre derelict industrial site into a new and vibrant business hub to complement the City and Canary Wharf. The new hub is expected to employ 20,000 people and provide a £6 billion boost to the UK economy.

London Array

La Caisse, one of Canada’s leading pension funds, has invested £644 million into London Array, the world’s largest offshore windfarm. The windfarm will provide clean energy to 500,000 people.

La Caisse’s investment follows that of other major overseas investors, including DONG Energy, E.ON and Masdar.

Nine Elms

Wanda, the Chinese conglomerate, has committed £790 million to the purchase and redevelopment of One Nine Elms into a mixed-use complex, including a major hotel, offices and 1,000 homes.

The larger Nine Elms site, including the new US Embassy, is set to be the location for the world’s largest urban regeneration project, creating 25,000 new jobs.

Airport City Manchester

Chinese investor Beijing Construction Engineering Group (BCEG), along with the Manchester Airports Group, Carillion and the Greater Manchester Pension Fund, has committed £800 million to the development of a new office, manufacturing, logistics and leisure city around Manchester Airport. The project will create 20,000 new jobs.

We anticipate further success in 2014/15. The pipeline of investment opportunities is strong, and UKTI will continue to turn these opportunities into successful investment projects, delivering additional jobs and other benefits for the UK economy.

Airport City Manchester development

10. Attracting the innovators

How do we encourage entrepreneurs from around the world to base their operations in the UK? Two of UKTI’s exciting programmes have been doing just that.

10.1 The Global Entrepreneur Programme

UKTI’s flagship Global Entrepreneur Programme (GEP) is an accelerator focused on attracting overseas-based entrepreneurs with innovation-rich businesses to grow from a UK strategic hub.

As a vehicle for FDI, the GEP has achieved over 280 successes (ie entrepreneurs and companies relocating to, and expanding from, the UK) in the last four years. GEP client companies have raised over £1 billion of equity investment, and created over 2,000 high-value jobs.

The GEP exceeded its target for 2013/14, delivering 65 high-value investment successes, including software to support creative, digital and internet-based business, clean technology supporting a diverse range of applications, such as in wind energy and next-generation lighting, and engineering supporting aerospace, construction and chemical production.

The GEP team consists of internationally successful entrepreneurs (we call them “dealmakers”), who work part-time for the GEP, with the remainder of their time being spent building their own businesses.

Their impressive global networks and track records in international business enable them to help entrepreneurs, and their early-stage companies, to expand from their UK hubs.

Attracting technology entrepreneurs and their businesses to the UK is particularly beneficial, as they are key drivers of innovation and provide important contributions to productivity improvement, job creation and economic growth.

Winds of change

2-B Energy from the Netherlands is a company which designs and manufactures an innovative, two-blade offshore wind turbine. 2-B’s technology represents a complete rethink of offshore wind technology, opening up a new pathway to lower¬ cost energy. Their new design reduces the lifetime cost of energy by 30–40 percent.

GEP’s UK-based cleantech dealmaker helped the company founders to shape and execute their growth strategy. This included developing a successful bid to the Department of Energy & Climate Change, which resulted in the company securing £3.2 million in grant funding. GEP’s specialised support has now helped 2-B Energy to secure an investment of approximately £22 million, to build and commission a commercial-scale machine for their first customer, and to prepare for the establishment of a manufacturing facility in the UK. 2-B will create 12 high-value jobs in Scotland this year.

Mikael Jakobssen, COO of 2-B Energy, says: “GEP’s unstinting support has ensured that our vision of delivering offshore wind energy at the lowest possible cost will be pursued in the UK. Having an experienced entrepreneur to share insights and champion our project in their networks, both locally and globally, has been instrumental in our recent success.”

10.2 Sirius Programme

Launched in September 2013, UKTI’s Sirius Programme seeks to encourage the world’s brightest graduate talent, who have world-class start-up ideas, to relocate and establish a business in the UK.

The launch of the Sirius competition, at the UKTI Graduate Entrepreneurs’ Festival in Manchester, was attended by over 150 young entrepreneurs. The competition itself received over 1,500 individual applications, from graduates from 93 countries.

53 winning teams (comprising 158 graduates) were selected during September 2013 and January 2014, and they are now in the process of relocating to the UK to establish their businesses and start their acceleration phase.

The Sirius Programme seeks to enhance the UK’s reputation as the global connection point for entrepreneurs, attracting top-quality graduates from the world’s leading business, technology, science and engineering schools, who will create wealth, jobs and new technology in the UK.

The second phase of the Sirius competition was launched on 8 May 2014, and will build on the success of the first in attracting new graduate talent and ideas. When the second phase of the competition was launched, the Sirius website received 7,000 hits in its first week, demonstrating the reach of the programme.

The Sirius Programme seeks to enhance the UK’s reputation as the global connection point for entrepreneurs.

11. Building on success

Managing relationships with existing investors is central to UKTI’s efforts to help grow the economy and create jobs and prosperity.

About 56% of all investment projects recorded in 2013/14 have come from existing investors, through either expansions of existing UK sites or new investments. Last year we recorded 647 expansions and 30 retention projects, which are estimated to have brought with them over 58,000 new and safeguarded jobs. In addition, they provide us with an invaluable business perspective, as we work to keep the UK an attractive and competitive location for overseas companies.

UKTI’s global network is fully focused on supporting these companies in growing their business in the UK, and exporting into other markets.

Our Strategic Relationship Management (SRM) programme, which was created in 2011, was established to improve the coherence and focus of the UK’s relationship with the major investors and exporters that are crucial to our economy. The SRM approach recognises the complex and diffuse relationships that large companies have with Government, and, for the first time, has brought together teams of officials from across Whitehall, to form networks, led by a designated Contact Minister, that work with each company. These networks help to consider the interests and priorities of the individual companies involved, and to agree a long-term strategy for generating continued economic benefit from the UK’s major wealth creators.

Since 2011, over £16.5 billion has been invested in the UK by companies included in the SRM programme, creating or safeguarding over 35,000 jobs. When investment by UK companies (ie not Foreign Direct Investment) and major acquisitions are also included, this increases to £33.3 billion. These figures reveal just how important these companies are, and demonstrate why we have placed such importance on developing the Government’s relationship with them.

Our survey shows that this approach is working. 87 percent of companies who responded reported an improved relationship with the Government, and three quarters of them thought that SRM had encouraged different Government Departments to work together more cohesively. Increasing investment from these companies is a cross-Government team effort: SRM is increasingly embedded in the normal operation of Government Departments, and 80 percent of companies recognise that officials have an increased understanding of their organisation’s priorities as a result of SRM.

Since 2011, over £16.5 billion has been invested in the UK by companies included in the SRM programme, creating or safeguarding over 35,000 jobs.

Siemens’ £310 million investment in offshore wind manufacturing in Hull is a good example of what the strategic approach can deliver. This involved close work across a number of Government Departments, and with Siemens. We used SRM structures and processes, led by the Department for Business, Innovation and Skills (BIS) and the Department of Energy & Climate Change (DECC), to develop our collective knowledge of how Siemens operates. This was crucial to how Government influenced and partnered with the company. Siemens UK, and the wider SRM network, spent four years on this investment to win it for the UK over other European competitors, creating 1,000 direct jobs in an area of low employment.

Outside of the SRM programme, UKTI is active with numerous other investors, across all sectors and all types and size of investment. For example, with support from UKTI, US technology company Nvidia opened its UK mobile technology engineering facility in Bristol last year. This is where Nvidia design and develop their modem technology for smartphones and tablets.

The company have been investing in R&D and highly skilled engineering jobs in the area since 2011. The Bristol-based team has doubled in size to nearly 200 people, with plans to recruit dozens more later this year.

The rationale for stronger relationships with existing investors is self-evident: UKTI’s focus in this area is reaping rewards for the UK economy.

12. Best of both worlds: Investment Organisations (IO)

The Investment Organisations (IOs) are UKTI’s hybrid public/private sector teams, seeking to secure the highest-value inward investment in those sectors, vital to the UK economy, that the Government has prioritised as part of its Industrial Strategy.

The IOs can trace their development back to the Government team that oversaw the development of Tech City, a technology cluster located in East London (and now the third-largest of its kind in the world).

To drive investment in the technology sector and attract businesses to the UK, a specialist team was brought together, with private sector expertise contributing to the strategic direction of UKTI.

The Tech City Investment Organisation was set up in April 2011. So successful did it prove to be – organisations with a presence in Tech City now include Google, Intel, Cisco, University College London and Imperial College London – that the model has subsequently been applied to other sectors. Seven IOs are now established (not counting the original Tech City one) – in life sciences, agri-tech, financial services, the automotive sector, regeneration, offshore wind, and innovation.

With senior industry figures as their CEOs, IOs combine industry know-how, contacts and credibility with Government support, to pull in potential investors from overseas. Although they were set up to deal with investment only, the IOs have been so successful that from 1 April 2014, they are now also dealing with trade, supporting businesses who want to use the UK as a springboard to expand into international markets.

But what are the different challenges that each Investment Organisation faces in its particular sector? What are the particular strengths of the UK in each sector that the IOs can point to, to attract investors? And what have the IOs already achieved, in the short time since they were established?

12.1 Life sciences – better for the economy, better for patients

“Health challenges unite the world,” says Dr Mark Treherne, who is CEO of the Life Sciences Organisation (LSO), the first IO to be set up following the success of Tech City.

Across the globe, governments have to deal with issues such as an ageing population: “We don’t know what the cost of global warming may be, but we can estimate the cost of an ageing population for health services. To deal with it, we will need innovative medical care. And given the excellence of British R&D, there are huge opportunities for the UK here. Innovation will be the solution: we need to make sure that that innovation takes place in the UK.”

The LSO was set up in 2012 to support overseas investment into the UK in the life sciences, from the earliest R&D collaborations through to clinical trials, commercial operations and partnerships.

The aims of the Government’s ten-year Life Science Strategy are to enable the UK to become the global hub for the sector, to continue to ensure that the UK is the location of choice for investment, and to sustain the UK’s position as one of the global leaders in the life sciences.

As Mark Treherne explains, “our role is to align the UK’s capabilities with market opportunities. But while our aim is to achieve economic growth for the whole of the UK, we have another primary objective: to help improve patient outcomes.”

Proteus Digital Health

In March 2014 it was announced that leading digital medicines company Proteus Digital Health is bringing its digital health technology and global operations and manufacturing to the UK.

Proteus is working to create a new category of products, services and data systems that have the potential to improve the effectiveness of existing pharmaceutical treatments. Called digital medicines, these new pharmaceuticals will contain a tiny sensor that communicates with a patch on a patient’s body, to deliver vital information about an individual’s medication-taking behaviour and how their body is responding to therapy.

Proteus intends to employ 200 highly skilled individuals at its first international manufacturing site in the UK. The international manufacturing facility will serve as a new hub for the global digital medicines industry, transferring significant investment and know-how to the UK.

The Life Sciences Organisation, working with NHS England, helped to bring the partnership about.

In the life sciences, the UK can offer investors a streamlined regulatory environment, with a quick route to market for innovations, as well as access to anonymised patient data and patients for clinical trials. For patients, ultimately this means better access to more effective treatments.

The focus of the LSO in the past year has very much been on building up the manufacturing supply chain in the UK, helping businesses to see the UK as the place to create the drugs and other treatments of tomorrow. In its work the LSO plays a strong co-ordinating role, especially with the Global Medical Excellence Cluster in the UK, as well as with the NHS, health authorities, universities, and the major pharmaceutical companies.

Life sciences is an extremely competitive global environment. The industry is changing, but in adapting to stay competitive in this challenging environment, the UK can capitalise on its many strengths: not just its world-class science base and talented researchers, but also the NHS, which represents an important potential market for new treatments, as well as being a vast source of clinical data. “We’re genuinely world-class,” says Mark Treherne, “but the world doesn’t stand still.”

The latest proposition for investors that the LSO is developing will highlight the strengths of the UK in medicines manufacturing. And recent months have seen a renewed focus on securing investment from some of the emerging economies – in particular from China.

From bench to bedside, the LSO is making it easier to deliver healthcare innovation in the UK.

12.2 Green shoots: UKTI Agri-tech Organisation

Though it was only set up in 2013, the team at the UKTI Agri-tech Organisation have already had some notable successes, including working with BP, AB Sugar and DuPont to bring the £350 million Vivergo bioethanol plant to Hull. The Vivergo plant, which is now the UK’s biggest bioethanol producer, will generate 420 million litres of the renewable transport fuel a year at full capacity, as well as creating as a by-product some 500,000 tonnes a year of protein-rich animal feed for the UK market, enough to feed around a fifth of the UK’s dairy herd.

As Professor Janet Bainbridge, Head of UKTI Agri-tech Organisation, explains, “in the agri-tech sector, our main challenge is that, while we have an excellent research base in the UK, we’re not world-leaders in the commercial uptake of that research. That’s at the heart of what we do: introducing great research to companies that are interested in commercialising it, bringing in money to the UK and creating jobs.”

12.3 Across the Board – Financial Services Organisation (FSO)

The UKTI Financial Services Organisation (FSO) started life in 2013 as the Financial Services Investment Organisation, before trade was added to its remit in April 2014.

In the 2013 Budget, the Chancellor of the Exchequer, George Osborne, announced the establishment of the Financial Services Trade and Investment Board (FSTIB), whose job is to promote external trade, attract inward investment, and lift barriers to market access in the UK’s financial services sector. Building on the UK’s status as a global financial centre, the FSO’s role is to deliver on the objectives set out by the FSTIB.

The FSO is headed by Sue Langley, former Executive Director of Lloyds of London. “As the world’s leading global financial services centre and the most internationally focused marketplace in the world, the UKTI Financial Services Organisation is operating in a crowded space.

At the forefront of the minds of the FSO is how best to work in tandem with our partners within the financial services sector, so that all can best reap the rewards of working together.

We work with 73 financial services organisations: this is a big industry, employing more than two million people. The FSO seeks to promote the UK as a place to invest in, and trade from, adding real value, while not duplicating the work of the many different stakeholders.”

Through FSTIB, the public and private sectors have been able to come together, to identify trade and investment priorities. As well as HM Treasury, the Department for Business, Innovation and Skills, the Foreign & Commonwealth Office, UKTI, and businesses within the industry are represented on the Board through TheCityUK.

Building on the UK’s status as a global financial centre, the FSO’s role is to deliver on the objectives set out by FSTIB.

Elevated view of River Thames, City of London - financial district at dusk: Source, iStock/©

China’s gateway in London

With the help of the Financial Services Organisation, a new fund was launched in January 2013 which, for the first time, gives investors access to Chinese stock markets in Renminbi (RMB) through the London Stock Exchange.

The launch demonstrates the growing ties between the asset management industries in the UK and China. London’s role as a leading global financial centre, and its reputation for cutting-edge financial innovation, make it the ideal location to provide such a service.

Key areas have already been identified, where the efforts of these various bodies can be co-ordinated. Investment management is a priority, as is insurance. Other initiatives currently being considered by the FSTIB Board are concerned with Islamic finance, and financial technology.

And already, according to Sue Langley, there has been tangible evidence of groups working together, to share information and find synergies in what they do. “We’ve been sitting down with the Corporation of London, TheCityUK and the Treasury to co-ordinate our visits and events schedules. That might sound like a minor thing, but it makes a real difference – it ensures that the UK’s sales force in financial services doesn’t all turn up at the same time in the same place.

“Our main message is that the UK is one of the world’s main centres of financial services, and we’re well-placed to continue being so. We can provide a single point of contact if you’re looking to invest in the UK, or potentially to export from here – we can put you in touch with the right people. For the past few months we’ve been building our team, putting our strategy in place. We’ve put in place our investment pipeline, which goes from working out who our key partners are and identifying potential investors, through to businesses committing themselves to the UK. The next stage is all about delivering.”

12.4 Driving trade and investment – the Automotive Investment Organisation (AIO)

The Automotive Investment Organisation (AIO) was launched in June 2013, with the aim of promoting the UK automotive sector, and in particular increasing foreign investment in the automotive supply chain and R&D in the UK.

The AIO takes strategic direction from the Automotive Council, which brings the Government and the UK automotive industry together, to co-ordinate efforts to promote the UK as a compelling investment proposition, and as a strong candidate for developing new technologies, for example, around low carbon vehicles.

The AIO’s CEO is Joe Greenwell, formerly CEO and Chairman of Jaguar Land Rover, and Chairman of Ford UK. He says, “The AIO arose out of the Automotive Council’s objective of developing low carbon vehicles, and of revitalising the UK supply chain. We work with manufacturers – we ask what commodities they would like to source locally. Many prefer proximity if it can be done competitively: extended supply chains mean costs, risk of disruption, and loss of flexibility. My team can identify who makes what bits in the automotive industry, and so who the major manufacturers might be interested in working with. Part of the AIO’s mission is to help UK businesses win back their place as Tier 1, 2 and 3 suppliers, and so continue the revival in UK automotive manufacturing – we’re revitalising and reigniting a capability in manufacturing and innovation that never really went away.”

One of the AIO’s primary objectives is to build on the sound relationships that already exist with multinational manufacturers in the UK. “They have their UK HQs,” says Joe Greenwell, “but we’re building relationships with their global HQs. And in our advocacy of the UK as a place to invest in and trade from, we’re focusing particularly on attracting high-value manufacturing. The new Advanced Propulsion Centre, for example – which will see £1 billion of Government and industry money being invested over the next ten years –demonstrates our world-leading capability in low carbon automotive, intelligent mobility. These are areas where the UK has real skill sets.”

Indeed, developing skills in the automotive industry has been a major element in the AIO’s strategy. “We and the Automotive Council have developed an industry partnership in skills development. From internships, traineeships, and promoting the industry to young people as a hotbed of leading-edge technology, through to postdocs and Continuing Professional Development, we now have a roadmap for galvanising skills capability in the automotive sector. This is the first thing that potential investors say to us – ‘where will we source our technically skilled people from?’ But we’re able to present the UK now as a real technology proposition. We’re attracting interest.”

According to Joe Greenwell, selling the strengths of UK automotive around the world is helped by a number of factors. “First, there’s our inherent capability, with world-leading infrastructure, universities and innovation – the fact that eight of the 11 Formula One teams are based here, for example. But there’s also focused funding in things like the High Value Manufacturing and Intelligent Transport Catapults, building up the capabilities of UK manufacturing. And there’s policy coherence behind all this – building up the UK’s innovation firepower through tax credits for R&D, for example. That all makes it easier to promote the UK as a great place to grow.”

BorgWarner

BorgWarner are a major US manufacturer of turbochargers. With the help of the Automotive Investment Organisation and Bradford City Council, the company have launched an R&D collaboration programme with the University of Huddersfield, including setting up an MSc in Turbocharger Engineering. The AIO and BCC also assisted BorgWarner with a successful Regional Growth Fund bid, as a result of which they have been able to establish a Turbocharger Centre of Excellence in the UK. Due to the recent developments, BorgWarner signed a contract to provide its leading turbocharging technologies for Jaguar Land Rover’s (JLR’s) new family of four-cylinder gasoline and diesel engines, launching in 2015. The JLR contract is the first step in expanding the company’s product proposition for passenger vehicles. BorgWarner invited the AIO to ‘cut the ribbon’ on the new Centre. Together, these projects are a multi-million pound investment creating hundreds of jobs.

One of the AIO’s primary objectives is to build on the sound relationships that already exist with multinational manufacturers in the UK.

12.5 The regeneration game: Regeneration Investment Organisation (RIO)

The Regeneration Investment Organisation (RIO) is all about helping foreign investors to identify and fund regeneration projects across the UK.

It presents investors with a coherent offer, making clear what projects are available, what Government incentives might be on the cards, and what local partners they might work with. And it encourages them to look beyond London and the South East, helping to bring investment and jobs to the whole of the UK.

As Chair of RIO, Sir Michael Bear, former Lord Mayor of the City of London and Director of Balfour Beatty and Hammerson explains, “we’re doing something slightly different from the other Investment Organisations, in that our focus is so much on the supply side. There’s a global market for regeneration projects – many different cities and regions pitch regeneration projects that you can invest in. Our job is to point investors towards credible development opportunities throughout the UK.“

One of the challenges that the RIO faces is to encourage UK-based developers and local authorities to get their investment strategies clear, and to focus on what a particular locality can offer that makes it distinctive. Nahid Majid Chief Operating Officer of RIO explains further, “what sets Birmingham, say, apart from Barcelona or Berlin, as an investment prospect? We’re encouraging local authorities to think more like investors, so that they can be less reliant on public funding models.”

This can involve some challenging conversations. RIO acts as a kind of honest broker in this area. “We challenge investors too, encouraging them to be realistic about the UK market for regeneration projects. We get across the message to investors that they may not be able to get 120 hectares within the M25, say, but that there are other options – perhaps entering into a joint venture, for example.”

RIO has only been operating since November 2013, but already it has had a number of successes, helping to secure significant investments in regeneration projects around the country. RIO’s dedicated regional team and development experts provide guidance to local authorities and developers on how to improve their offer. And by applying set criteria in choosing what to promote as an “investible project”, RIO works with a transparency that gives potential investors confidence.

“Already, developers are queuing up to work with us,” says Nahid Majid, “and we’ve had great feedback from investors.Wehave£6billionofpossibleprojects currently under discussion. And we have an online platform – www. ukti-regeneration.co.uk – which puts developers, local authorities and potential investors in touch with each other.”

Flying start

RIO has been working to manage the relationship between the Beijing Construction Engineering Group and other partners in a joint venture to develop Airport City Manchester, which will be an £800 million, globally connected business destination. RIO also helped to bring about a new £700 million foreign sourced investment deal, which will see regeneration specialists Sigma Capital Group working with international investors Gatehouse Bank, to build up to 6,600 new privately rented homes in the UK. Sites for an initial 2,000 homes have already been identified in Liverpool and Greater Manchester.

13. The UK’s inward investment offer

2013/14 has been a successful year, not only in terms of maintaining the UK’s lead position in the global FDI market, but also for reinforcing and promoting local assets and capabilities in all parts of the UK to make them more attractive and competitive as destinations for foreign investors.

By working closely with all investment partners across the UK, UKTI promotes a nationally strong offer to maintain our global competitiveness, while playing to the particular strengths of individual parts of the UK. UKTI aims to ensure that all investment promotion activities contribute to wider economic strategies and policies, such as the Industrial Strategy and the promotion of centres of academic, R&D or manufacturing excellence across a whole range of industries, including automotive, life sciences and the information economy.

UKTI’s comprehensive global network of experts and connections helps all types of investors to identify their ideal business location. Our advisers and partners are vital in providing insight into market opportunities and local sector expertise, and in opening doors to the wider business community right across the UK. In order to promote the richness of this local offer to potential and existing inward investors in a “one-stop-shop”, UKTI has created a new web portal, the Local Investment Showcase, at www.localinvestuk.com.

Our advisers and partners are vital in providing insight into market opportunities and local sector expertise and in opening doors to the wider business community right across the UK.

13.1 Wolf Minerals and Heart of South West Local Enterprise Partnership

UKTI worked with the Heart of South West LEP to support the delivery of an important investment project to the Plymouth area. Wolf Minerals is an Australian-headquartered company specialising in metal exploration and development. In March 2014 work was started on the re-opening of Hemerdon Tungsten mine near Plymouth, Devon – a £123 million investment which is estimated to create 200 jobs. UKTI worked in a virtual team to provide strategy advice and help to facilitate solutions, with the Heart of South West LEP, and with strong support from Devon County Council, to resolve a series of significant issues – particularly in relation to planning, environmental permits and regulation. The mine will be one of the largest tungsten mines in the world, and is expected to generate £1 billion in exports over its lifetime.

13.2 Elecnor Deimos and Science Vale Oxfordshire Enterprise Zone

UKTI worked with Oxfordshire LEP to deliver a knowledge-intensive project in the Science Vale Oxford Enterprise Zone. Elecnor Deimos develops the technological activity for Spain’s Elecnor Group, which provides engineering solutions and advanced systems in the fields of space and new technology. Its expertise includes new services utilising satellite data. Elecnor Deimos was keen to be located close to the European Space Agency in the UK, and in November 2013 agreed to establish a facility in the Space Applications Catapult in Harwell, part of the Science Vale Oxford Enterprise Zone, which will eventually employ 50 staff.

UKTI and the Oxfordshire LEP worked together to introduce senior management from Elecnor Deimos to staff in a range of key organisations, including the UK Space Agency and the Space Applications Catapult, and supplied the company with compelling data for presentation to the board in order to gain support for the investment.

Elecnor Deimos was keen to be located close to the European Space Agency in the UK and in November 2013 agreed to establish a facility in the Space Applications Catapult in Harwell.

13.3 Vattenfall investing in Wales

UKTI worked with the Welsh Government to bring low carbon generation schemes to South Wales.

Swedish power company Vattenfall, one of Europe’s largest generators of electricity and heat, operates almost 900 wind power turbines across northern Europe. Vattenfall invested in Wales with an onshore wind project between Neath and Aberdare. Wales’s renewable energy capacity will increase by a third when the 76-turbine Pen y Cymmoedd wind farm is operational in 2016.

This is the largest onshore project in England and Wales and, with latest contract announcements already issued, nearly £45 million of business has been awarded to Welsh companies. Vattenfall has a history of working with the Welsh Government. UKTI manages the relationship across Vattenfall’s UK operations and with the senior management team in Sweden.

13.4 Clear2Pay and Scottish Development International (SDI)

UKTI and SDI worked closely with Clear2Pay, a Belgian payments technology company, to expand their workforce in Scotland and position the Dunfermline operation as a global hub to support growth in their Open Test Solutions Division.

The expansion created 29 jobs and attracted global roles to relocate to Scotland to lead research, development and testing. SDI provided regional selective assistance to support the investment.

13.5 Convergys makes additional investment in Northern Ireland

Invest Northern Ireland helped secure a £5 million investment by Convergys Corporation to Londonderry. The US-based firm is opening a 333 person contact centre in Londonderry to service its client EE, as it continues to invest in customer service and create jobs in the UK. The support of Invest Northern Ireland was vital in securing the investment, as was the attendance by representatives of Convergys and EE at the post-G8 Northern Ireland Investment Conference held last October. Not only were the companies impressed by the skills, talent and infrastructure in the region, but they also took part in a roundtable discussion with Prime Minister David Cameron to specifically discuss the benefits of Northern Ireland as a high skilled and cost-effective investment location.

14. Contact information

To benefit from the outstanding commercial opportunities in the UK, please contact the UKTI Investment Hub.

Enquiries for overseas companies looking to set up in the UK

Email enquiries@ukti-invest.com

Contact form https://www.contactus....

Telephone: +44 (0)207 000 9012

Overseas companies can contact the Investment Services Team for information about setting up in the UK including the help that is available.