UK House Price Index Wales: May 2018

Published 18 July 2018

Applies to Wales

1. Headline statistics for May 2018

the average price of a property in Wales was

£148,894

the annual price change of a property for Wales was

1.0%

the monthly price change of a property for Wales was

-3.0%

the index figure for Wales (January 2015 = 100) was

109.4

Estimates for the most recent months are provisional and are likely to be updated as more data is incorporated into the index. Read the revision policies.

Next publication of UK HPI

The June 2018 UK HPI will be published at 9.30am on Wednesday 15 August 2018. See the calendar of release dates.

2. Economic statement

Wales house prices grew by 1.0% in the year to May 2018, down from 2.4% in the year to April 2018. Wales house prices are growing slower than the UK annual rate of 3.0% in the year to May 2018. On a seasonally adjusted basis, average house prices in Wales decreased by 2.5% between April 2018 and May 2018, compared with a decrease of 1.5% during the same period a year earlier (April 2017 and May 2017).

The UK Property Transaction Statistics for May 2018 showed that on a non-seasonally adjusted basis, in Q1 2018, the number of transactions on residential properties with a value of £40,000 or greater in Wales was 11,780. This is down 5.4% compared to Q1 2017.

In Wales, detached houses showed the biggest increase, rising by 2.0% in the year to May 2018 to £226,000. The average price of Flats and maisonettes decreased by 3.6% in the year to May 2018 to £106,000. This is the only property type where prices fell over the year.

House prices have increased over the last year in 18 out of 22 local authority areas. The local authority showing the largest growth in the year to May 2018 was Newport, where prices increased by 9.9% to stand at £173,000.

Cardiff and the Vale of Glamorgan were the only Welsh local authorities to report an increase in their volume of transactions in the year to March 2018. Since April 2018, Land Transaction Tax replaced UK Stamp Duty Land Tax in Wales (SDLT). Land Transaction Tax is broadly consistent with SDLT however, the residential tax rates differ. Generally, for transactions between £125,000 and £400,000 LTT is lower than SDLT while for transactions above £400,000 LLT is higher than SDLT. For cheaper properties, tax would have been lower if the transaction was delayed, being liable for LTT. For transactions above £400,000, the tax would have been lower if the transaction was brought forward so SDLT was paid. The increase in sales volumes in March 2018 for some local authorities may be due to those purchasing more expensive properties looking to complete before the introduction of the new system. Overall, as more transactions in Wales tend to be in the lower price bands this may reduce transactions before April 2018 and perhaps increase them immediately afterwards.

As with other indicators in the Housing Market, which typically fluctuate from month to month, it is important not to put too much weight on one month’s set of house price data.

3. Price change

3.1 Annual price change

Annual price change for Wales over the past 5 years

annual price change for Wales over the past 5 years

Download this table’s data (CSV, 1KB)

In Wales, the average price increased by 1.0% in the year to May 2018 (down from 2.4% in April 2018).

Annual price change by local authority for Wales

Low numbers of sales transactions in some local authorities can lead to volatility in the series.

While we make efforts to account for this volatility, the change in price in these local levels can be influenced by the type and number of properties sold in any given period.

Geographies with low number of sales transactions should be analysed in the context of their longer-term trends rather than focusing on monthly movements.

| Local authorities | May 2018 | May 2017 | Difference |

|---|---|---|---|

| Blaenau Gwent | £82,630 | £80,183 | 3.1% |

| Bridgend | £150,668 | £141,842 | 6.2% |

| Caerphilly | £127,566 | £124,648 | 2.3% |

| Cardiff | £201,233 | £193,612 | 3.9% |

| Carmarthenshire | £138,499 | £134,193 | 3.2% |

| Ceredigion | £177,366 | £177,169 | 0.1% |

| Conwy | £150,049 | £154,963 | -3.2% |

| Denbighshire | £145,380 | £143,480 | 1.3% |

| Flintshire | £164,152 | £159,268 | 3.1% |

| Gwynedd | £141,784 | £148,802 | -4.7% |

| Isle of Anglesey | £167,453 | £167,111 | 0.2% |

| Merthyr Tydfil | £95,258 | £94,104 | 1.2% |

| Monmouthshire | £245,648 | £231,411 | 6.2% |

| Neath Port Talbot | £107,230 | £106,800 | 0.4% |

| Newport | £172,770 | £157,163 | 9.9% |

| Pembrokeshire | £159,647 | £163,639 | -2.4% |

| Powys | £184,822 | £168,827 | 9.5% |

| Rhondda Cynon Taf | £102,684 | £102,722 | 0.0% |

| Swansea | £140,886 | £138,521 | 1.7% |

| Torfaen | £133,253 | £126,828 | 5.1% |

| Vale of Glamorgan | £217,949 | £206,523 | 5.5% |

| Wrexham | £157,356 | £153,307 | 2.6% |

| Wales | £148,894 | £147,428 | 1.0% |

Download this table’s data (CSV, 1KB)

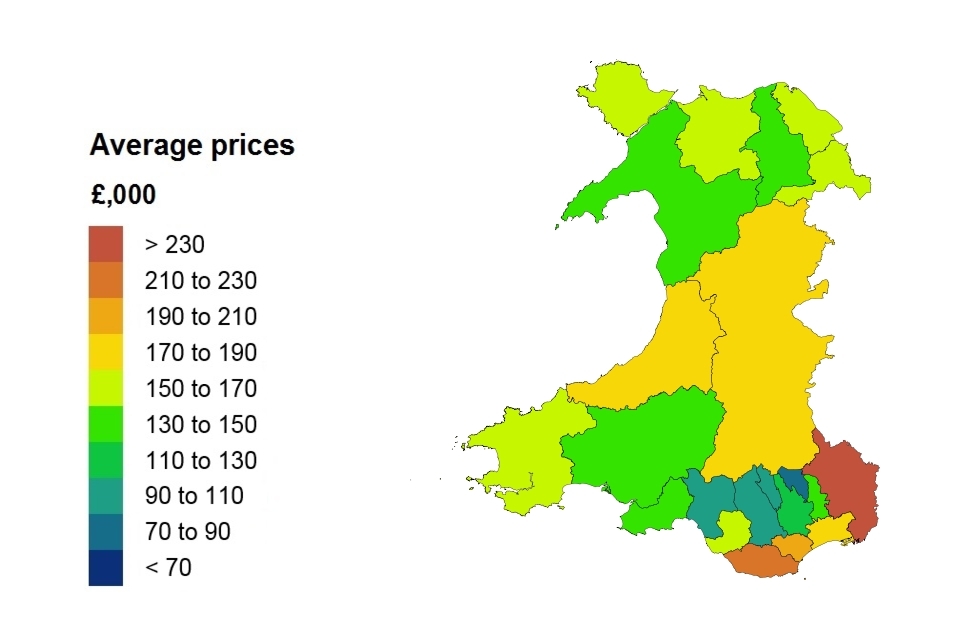

Average price by local authority for Wales

average price by local authority for Wales

In May 2018, the most expensive area to live in was Monmouthshire, where the cost of an average house was £246,000. In contrast, the cheapest area to purchase a property was Blaenau Gwent, where an average house cost £83,000.

3.2 Average price change by property type

Average price change by property type for Wales

| Property type | May 2018 | May 2017 | Difference |

|---|---|---|---|

| Detached | £225,804 | £221,407 | 2.0% |

| Semi-detached | £144,379 | £141,980 | 1.7% |

| Terraced | £114,329 | £113,598 | 0.6% |

| Flat or maisonette | £105,580 | £109,576 | -3.6% |

| All | £148,894 | £147,428 | 1.0% |

Download this table’s data (CSV, 1KB)

4. Sales volumes

Due to a period of 2 to 8 weeks between completion and registration of sales, volume figures for the most recent two months are not yet at a reliable level for reporting, so they are not included in the report.

Sales volume data is also available by property status (new build and existing property) and funding status (cash and mortgage) in our downloadable data tables. Transactions involving the creation of a new register, such as new builds, are more complex and require more time to process. Read Revisions to the UK HPI data for more information.

4.1 Sales volumes by local authority

Sales volumes for Wales by local authority

| Local authorities | March 2018 | March 2017 | Difference |

|---|---|---|---|

| Blaenau Gwent | 58 | 61 | -4.9% |

| Bridgend | 150 | 211 | -28.9% |

| Caerphilly | 167 | 194 | -13.9% |

| Cardiff | 450 | 446 | 0.9% |

| Carmarthenshire | 217 | 247 | -12.1% |

| Ceredigion | 60 | 65 | -7.7% |

| Conwy | 153 | 195 | -21.5% |

| Denbighshire | 97 | 116 | -16.4% |

| Flintshire | 161 | 171 | -5.8% |

| Gwynedd | 131 | 150 | -12.7% |

| Isle of Anglesey | 72 | 87 | -17.2% |

| Merthyr Tydfil | 41 | 65 | -36.9% |

| Monmouthshire | 121 | 122 | -0.8% |

| Neath Port Talbot | 131 | 175 | -25.1% |

| Newport | 179 | 258 | -30.6% |

| Pembrokeshire | 132 | 169 | -21.9% |

| Powys | 127 | 157 | -19.1% |

| Rhondda Cynon Taf | 259 | 297 | -12.8% |

| Swansea | 233 | 295 | -21.0% |

| Torfaen | 110 | 120 | -8.3% |

| Vale of Glamorgan | 177 | 171 | 3.5% |

| Wrexham | 126 | 137 | -8.0% |

| Wales | 3,368 | 3,909 | -13.8% |

Download this table’s data (CSV, 1KB)

4.2 Sales volumes

Sales volumes for Wales over the past 5 years

| Date | Sales volumes for Wales |

|---|---|

| March 2014 | 3,214 |

| March 2015 | 3,274 |

| March 2016 | 5,744 |

| March 2017 | 3,909 |

| March 2018 | 3,368 |

Download this chart’s data (CSV, 1KB)

5. Property status

New build and existing resold property for Wales

| Property status | Average price March 2018 | Monthly change | Annual change |

|---|---|---|---|

| New build | £208,824 | 0.6% | 7.9% |

| Existing resold property | £151,650 | 1.0% | 4.6% |

Download this table’s data (CSV, 1KB)

Note: since the October 2017 release, amendments have been made to our estimation model when calculating our provisional estimate. Find out further information and the impact of this change in methods used to produce the UK HPI.

6. Buyer status

First time buyer and former owner occupier for Wales

| Type of buyer | Average price May 2018 | Monthly change | Annual change |

|---|---|---|---|

| First time buyer | £128,339 | -3.2% | 0.6% |

| Former owner occupier | £172,940 | -2.7% | 1.5% |

Download this table’s data (CSV, 1KB)

7. Funding status

Cash and mortgage indicator for Wales

| Funding status | Average price May 2018 | Monthly change | Annual change |

|---|---|---|---|

| Cash | £143,896 | -3.6% | 0.1% |

| Mortgage | £151,866 | -2.6% | 1.5% |

Download this table’s data (CSV, 1KB)

8. Repossession sales volume

Due to a period of 2 to 8 weeks between completion and registration of sales, repossession volume figures for the most recent two months are not yet complete, so they are not included in the report.

Repossession sales volume

| Country | Repossession sales volume March 2018 |

|---|---|

| Wales | 57 |

Download the data for England and Wales (CSV, 7KB)

9. Access the data

Download the data as CSV files or access it with our UK HPI tool.

Data revisions

View any revisions to previously published data in the data downloads or find out more about revisions in our guidance About the UK HPI.

10. About the UK House Price Index

The UK House Price Index (UK HPI) is calculated by the Office for National Statistics and Land & Property Services Northern Ireland. Find out about the methodology used to create the UK HPI.

Data for the UK House Price Index is provided by HM Land Registry, Registers of Scotland, The Land & Property Services/Northern Ireland Statistics & Research Agency and the Valuation Office Agency.

Find out more about the UK House Price Index.

11. Contact for Wales queries

Eileen Morrison, Data Services Team Leader, HM Land Registry

Email eileen.morrison@landregistry.gov.uk

Telephone 0300 006 5288