UK House Price Index summary: July 2018

Published 19 September 2018

1. Headline statistics for July 2018

the average price of a property in the UK was

£231,422

the annual price change for a property in the UK was

3.1%

the monthly price change for a property in the UK was

1.2%

the monthly index figure (January 2015 = 100) for the UK was

121.4

Estimates for the most recent months are provisional and are likely to be updated as more data is incorporated into the index. Read Revisions to the UK HPI data.

Next publication of UK HPI

The August 2018 UK HPI will be published at 9.30am on Wednesday 17 October 2018. See the calendar of release dates.

2. Economic statement

UK house prices rose by 3.1% in the year to July 2018, down slightly from 3.2% in the year to June 2018. This is the lowest UK annual rate since August 2013 when it was 3.0%.

House prices grew fastest in the North West region, increasing by 5.6% in the year to July 2018, followed by the South West and the West Midlands, both increasing by 4.4% over the year. House prices in London fell by 0.7% in the year to July 2018, down from an increase of 0.3% in the previous month.

The Royal Institution of Chartered Surveyors’ (RICS) UK Residential Market Survey for July 2018 report their newly agreed sales net balance remained close to zero for the fourth month in succession, consistent with a broadly stable housing market when viewed at the national level. Price expectations remain positive for the next twelve months. Their 12-month sales expectations series is negative, and at its lowest level since October last year.

UK Property Transaction Statistics for July 2018 showed that on a seasonally adjusted basis, the number of transactions on residential properties with a value of £40,000 or greater was 99,270. This is 3.2% lower compared with a year ago. Between June and July 2018, transactions decreased by 0.8%.

The number of mortgages approved for house purchase fell a little in July 2018, to 65,000, close to their average over the past 6 months, but decreased by 6.1% when compared to July 2017. Mortgage approvals are projected to remain stable in the near term as reported in the Bank of England August Inflation Report. Mortgage approvals, as published in the Bank of England Money and Credit report are seen to be a leading indicator of transactions volumes.

3. Price changes

3.1 Annual price change

Annual price change for UK by country over the past 5 years

Annual price change for UK by country over the past 5 years

Download this chart’s data (CSV, 1KB)

Average house prices in the UK increased by 3.1% in the year to July 2018 (down slightly from 3.2% in June 2018).

At the country level, the largest annual price growth was recorded in Wales, where house prices increased by 4.2% over the year to July 2018.

Scotland saw house prices increase by 3.2% over the last 12 months.

In England, the average price increased by 3.0% over the year.

The average price in Northern Ireland increased by 4.4% over the year to quarter 2 (April to June) 2018.

3.2 Average price by country and government office region

Price, monthly change and annual change by country and government office region

| Country and government office region | Price | Monthly change | Annual change |

|---|---|---|---|

| England | £248,611 | 1.2% | 3.0% |

| Northern Ireland (Quarter 2 - 2018) | £132,795 | -1.0% | 4.4% |

| Scotland | £152,245 | 1.4% | 3.2% |

| Wales | £157,368 | -0.2% | 4.2% |

| East Midlands | £188,716 | -0.2% | 3.0% |

| East of England | £294,603 | 1.3% | 2.4% |

| London | £484,926 | 0.6% | -0.7% |

| North East | £131,505 | 2.6% | 2.8% |

| North West | £165,529 | 3.4% | 5.6% |

| South East | £327,002 | 0.4% | 1.8% |

| South West | £259,971 | 2.4% | 4.4% |

| West Midlands Region | £195,447 | 0.6% | 4.4% |

| Yorkshire and The Humber | £161,712 | 0.4% | 3.3% |

Download this table’s data (CSV, 1KB)

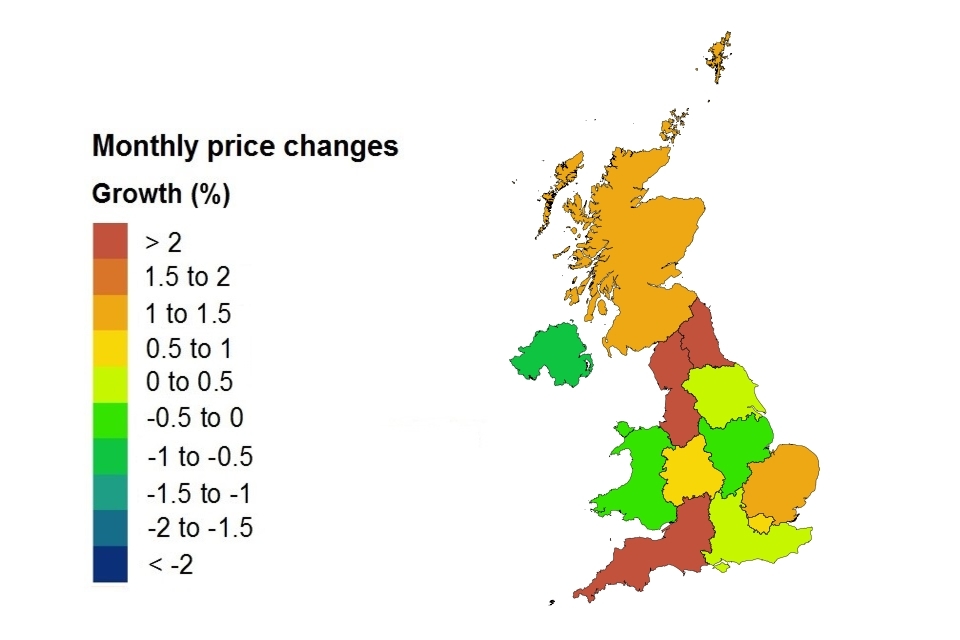

Price changes by country and government office region

Price changes by country and government office region

On a seasonally adjusted basis, average house prices in the UK increased by 0.3% between June 2018 and July 2018, compared with an increase of 0.5% in average prices during the same period a year earlier (June 2017 and July 2017).

Note that the Northern Ireland figure represents a three-month change and is not comparable with the other regions and countries.

3.3 Average price by property type

Average monthly price by property type

| Property type | July 2018 | July 2017 | Difference |

|---|---|---|---|

| Detached | £352,138 | £336,591 | 4.6% |

| Semi-detached | £216,785 | £209,936 | 3.3% |

| Terraced | £187,247 | £181,158 | 3.4% |

| Flat or maisonette | £207,639 | £206,308 | 0.6% |

| All | £231,422 | £224,554 | 3.1% |

Download this table’s data (CSV, 1KB)

4. Sales volumes

The amount of time between the sale of a property and the registration of this information varies. It typically ranges between 2 weeks and 2 months but can be longer. Volume figures for the most recent two months are not yet at a reliable level for reporting, so they are not included in the report. Published transactions for recent months will increase as later registered transactions are incorporated into the index.

Sales volume data is also available by property status (new build and existing property) and funding status (cash and mortgage) in our downloadable data tables. Transactions involving the creation of a new register, such as new builds, are more complex and require more time to process. Read Revisions to the UK HPI data for more information.

4.1 Sales volumes

Number of sales volumes by country

| Country | May 2018 | May 2017 | Difference |

|---|---|---|---|

| England | 58,073 | 69,176 | -16.1% |

| Northern Ireland (Quarter 2 - 2018) | 5,308 | 6,099 | -13.0% |

| Scotland | 7,993 | 8,529 | -6.3% |

| Wales | 3,368 | 3,933 | -14.4% |

Note: The annual % change in the ‘Difference’ column will be influenced primarily by level of completeness of the latest month’s data reported and does not necessarily reflect the genuine trends.

Download this table’s data (CSV, 1KB)

The estimate for May 2018 is calculated based on around 85% of the final registered transactions. The number of property transactions for May 2018 will increase as more transactions are incorporated into the index.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period) report that on a non-seasonally adjusted basis, volume transactions fell by 1.4% in England, 3.3% in Scotland and 3.6% in Wales in the year to May 2018.

4.2 Sales volumes for the UK over the past 5 years

Sales volumes for 2014 to 2018 by country: May

Sales volumes for 2014 to 2018 by country: May

Download this table’s data (CSV, 1KB)

In May 2018, the number of property transactions completed in the UK decreased by 14.8% when compared to May 2017. Compared to April 2018, the number of property transactions completed in the UK increased by 6.2%.

The estimate for May 2018 is calculated based on around 85% of the final registered transactions. The number of property transactions for May 2018 will increase as more transactions are incorporated into the index. See our Revisions Policy for more information.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period), report that on a seasonally adjusted basis, UK volume transactions fell by 0.8% in the year to May 2018.

5. Property status for UK

New build and existing resold property

| Property status | Average price May 2018 | Monthly change | Annual change |

|---|---|---|---|

| New build | £290,728 | 1.2% | 7.7% |

| Existing resold property | £223,349 | 0.7% | 3.3% |

Download this table’s data (CSV, 1KB)

Note: since October 2017 release, amendments have been made to our estimation model when calculating our provisional estimate. Find out further information and the impact of this change in methods used to produce the UK HPI.

6. Buyer status for Great Britain

First time buyer and former owner occupier

For Great Britain only, Northern Ireland data is not available for buyer status.

| Type of buyer | Average price July 2018 | Monthly change | Annual change |

|---|---|---|---|

| First time buyer | £195,057 | 1.1% | 2.6% |

| Former owner occupier | £268,850 | 1.3% | 3.4% |

Download this table’s data (CSV, 1KB)

7. Funding status for Great Britain

Cash and mortgage

For Great Britain only, Northern Ireland data is not available for funding status.

| Funding status | Average price July 2018 | Monthly change | Annual change |

|---|---|---|---|

| Cash | £221,467 | 1.6% | 3.2% |

| Mortgage | £241,068 | 1.0% | 3.0% |

Download this table’s data (CSV, 1KB)

8. Access the data

Download the data as CSV files or access it with our UK HPI tool.

Data revisions

View any revisions to previously published data in the data downloads or find out more about revisions in our guidance About the UK HPI.

9. About the UK House Price Index

The UK House Price Index (UK HPI) is calculated by the Office for National Statistics and Land & Property Services Northern Ireland. Find out about the methodology used to create the UK HPI.

Data for the UK House Price Index is provided by HM Land Registry, Registers of Scotland, The Land & Property Services/Northern Ireland Statistics & Research Agency and the Valuation Office Agency.

Find out more about the UK House Price Index.

10. Contact

Eileen Morrison, Data Services Team Leader, HM Land Registry

Email eileen.morrison@landregistry.gov.uk

Telephone 0300 006 5288

Aimee North, Head of Housing Market Indices, Office for National Statistics

Email aimee.north@ons.gov.uk

Telephone 01633 456400

Ciara Cunningham, Statistician for the Northern Ireland HPI

Email ciara.cunningham@finance-ni.gov.uk

Telephone 028 90 336035

Anne MacDonald, Land & Property Data Team, Registers of Scotland

Email Anne.MacDonald@ros.gov.uk

Telephone 0131 378 4991