Telecoms Diversification Taskforce: findings and report

Published 20 April 2021

Chair’s letter to the Secretary of State

Dear Secretary of State,

Telecoms Diversification Taskforce findings and report

Last August you asked me to chair an expert Taskforce for around six months to identify solutions and opportunities to diversify the supply market for 5G. Since the Taskforce was established, the Government has published its 5G Supply Chain Diversification Strategy, alongside the introduction of the Telecommunications (Security) Bill. Together these set out the Government’s intention to ensure the security of UK telecoms networks and its approach to build a healthy, innovative and competitive supply market moving forward.

The Diversification Taskforce has taken the Government’s strategy as the basis for its work and has focused on how to deliver the ambitions that the Government has set out. The attached report outlines our findings and recommendations in four key areas - telecoms standards; regulatory policy; accelerating the adoption of Open RAN; and long-term research and innovation to build UK capability. These recommendations are supported by more detailed work plans that I have shared with your officials. The report also highlights a number of broader areas where the Government should consider taking action.

The Government indicated in its own strategy that it expected to look at areas beyond the mobile access network - which was the immediate focus given the issues identified in the Telecoms Supply Chain Review - and the report highlights potential future areas of concern, which I know your team is looking at as part of its ongoing work. I am extremely grateful to all the members of the Taskforce for their hard work and expertise in producing this report, and I am pleased that you have indicated that the Government will continue to have an external advisory body as this work progresses.

I would also like to extend my thanks to the technical advisors from the National Cyber Security Centre and Ofcom for supporting me in this work and the team at DCMS for their hard work and excellent support to the Taskforce.

Lord Livingston of Parkhead

Introduction

Background

1. This report takes as its starting point the Government’s 5G Supply Chain Diversification Strategy (November 2020) and sets out recommendations for targeted actions to deliver the Government’s ambitions. It also includes broader recommendations on actions that will be needed if the Government is to be successful in implementing its strategy and driving change at pace.

Taskforce Objectives and Approach

2. For the past six months the Taskforce has considered practical actions that the Government should take to achieve its short and long-term diversification ambitions. In line with the 5G Supply Chain Diversification Strategy, the Taskforce has focused on diversification challenges and opportunities within 5G mobile access networks.[footnote 1]

Recommendations are set out across four key strategic priorities:

-

Establishing influence in telecoms standards setting bodies to encourage best practice in security and open networks.

-

Creating the right environment for diversification through government and regulatory policy interventions.

-

Identifying interventions and investment to accelerate the development and adoption of Open RAN technology.

-

Identifying opportunities to invest in long-term research and innovation to build UK Capability for current and future generations of telecoms technology.

3. The issues that have created both a lack of diversity and a relatively low degree of UK involvement in the supply chain have been many decades in the making. It is important to recognise that whilst there are some actions that should be conducted at pace and will have a meaningful impact in the short and medium term, other measures such as the UK’s increased involvement in standards setting bodies will require a longer-term consistent commitment from the Government beyond the end of this Parliament, and will need to be considered together with broader telecoms and technology priorities, and approaches to procurement to build supply chain diversity and resilience.

4. Significantly, as the 5G Supply Chain Diversification Strategy makes clear, the UK represents a relatively small part of the global demand for telecoms infrastructure. It is therefore essential that the UK coordinates its efforts with like-minded nations and focuses investment in areas that can succeed on an international, not national scale. There is no UK only solution to diversification. The Government’s intent to use the G7 Presidency as a means to kick start this international effort is very welcome.

5. It should also be recognised that imposing solutions on UK operators at the cost of higher prices, slower rollout or less capability for their customers would represent a high burden for the UK. The Taskforce’s recommendations therefore seek to propose actions that will aid and support the future vitality of the telecoms industry by helping them to adopt new technologies that will represent the future of the industry not its past.

6. The Government’s strategy included support for incumbent vendors as one of its three central strands. The Taskforce recognises that incumbent 5G vendors have an important role to play in maintaining a resilient 5G network while also driving progress in research and development and standards-setting to help create the conditions for a more open and innovative 5G and next generation market. The Taskforce felt that a number of the actions set out below - including on standardisation and creating an R&D ecosystem - would support incumbent vendors in the UK. It noted that the Government is taking forward actions directly with the incumbents but did not believe that at this point it was necessary to provide substantive direct financial assistance to incumbent vendors.

7. Finally, and in order to ensure a comprehensive and balanced range of views were considered, the Taskforce sought external input from a wide range of stakeholders including Mobile Network Operators (MNOs), telecoms vendors and suppliers in the broader supply chain.

Report structure

8. This report begins by outlining a number of key recommendations and cross-cutting issues for the Government to consider, before setting out recommendations across the four identified strategic priority areas.

Key recommendations and cross-cutting issues

9. Diversification will require specific and targeted interventions in order to stimulate the supply market, de-risk the integration of new suppliers into operator networks and to lay the foundations for long-term market growth and increased vendor competition. The recommendations that follow in this report propose measures for such interventions.

10. The overall view of the Taskforce is that direct funding for operators to adopt new vendors or Open RAN into their networks is unlikely to be a sustainable approach to achieving diversification in the long term, based on the Taskforce’s view of current market conditions. Instead, the Government can derive best value for money by directing funding to support R&D (or incentivising R&D activity in this area), catalysing the UK ecosystem and removing barriers to entry. The Government needs to consider the case for funding activities that move the market in the right direction, but should be careful and measured in how it does so to ensure it prioritises promoting healthy, sustainable and competitive behaviours where the UK can participate in the supply chain.

11. In addition to the specific measures proposed, the Government should take steps to ensure policy interventions and investment can be most effective: greater cross-government coordination of telecoms activity; clear signposting for prospective suppliers and investors; and bringing more clarity to the role and responsibility of the regulator with regards to diversification.

12. Currently telecoms activity, particularly research and testing, is fragmented and there is no central coordinating mechanism, so coordination of cross government activity is key. We have identified close to 20 existing or planned programmes that could be relevant to driving diversification and bringing new suppliers into the UK market. While the Department for Digital, Culture, Media and Sport (DCMS) retains the overall lead on telecoms policy, a significant proportion of this activity is led and funded by the Department for Business, Energy and Industrial Strategy (BEIS) and its external bodies such as UK Research and Innovation (UKRI) and Innovate UK. Telecoms relevant projects are led also by organisations such as Ofcom, and the UK Space Agency, while programmes delivering or procuring infrastructure are led by a range of departments including the Home Office (for Emergency Services Network) and the Cabinet Office. It is also unclear how government funded programmes and projects fit into the wider ecosystem including university research departments and privately funded R&D labs. This raises the questions of i) how to coordinate the Government’s strategy and policy development to align thinking and make best use of funding and ii) how to best signpost suppliers or investors to funding opportunities.

13. On the former - in some instances this approach makes sense and is appropriate and proportionate. However, it can contribute to siloed and duplicated activity and presents a confusing picture for those looking to invest in the UK market. Our engagement has confirmed that this experience is shared widely across the sector and that a clear, signposted system is required to address this. The Taskforce recommends the Government establish an oversight function to join-up all cross-government telecoms activity relating to diversification, to coordinate opportunities to align strategies and rationalise the landscape.

14. On the latter - viewed through an external lens, while it may be appropriate for suppliers to maintain relationships with multiple elements of government, this could be improved through a central process that can better steer, direct, and join-up this engagement. This central process would also create a clearer path for suppliers, whether early stage UK companies, or international companies looking to enter the UK market. We recommend that to complement the coordination function in paragraph 13, the Government establishes a simple ‘front door’ function to steer suppliers and operators to the right place to assist them in ways that would be relevant to the diversification agenda. This will ease the burden on suppliers, particularly smaller organisations, and ultimately lead to more effective engagement and matching of suppliers and innovators with relevant government initiatives and funding or other commercial opportunities.

15. The Government is right to focus on enabling supply and demand side measures to support diversification rather than regulation at this stage. As part of this, Ofcom has a critical role to play in fostering the market conditions that encourage and enable operators to diversify. The Taskforce believes that this will require Ofcom to address diversification as a strategic priority, alongside its other duties and functions. This could include, for instance, facilitating discussions between MNOs in order to align network requirements and roadmaps; introducing a regulatory sandbox to support new entrants; and seeking to limit the need for suppliers to meet UK specific technical requirements. Moving at pace to create these conditions will be critical to the UK taking a leading position on diversification and in the development and deployment of technologies such as Open RAN.

16. The Government should make clear that diversification is a key priority for Ofcom to consider alongside its other duties and responsibilities. In the first instance Ofcom should, alongside DCMS, set out its intention to treat diversification as a strategic priority. In the medium term, the Government should provide clarity to Ofcom of its duties in this regard. One mechanism that DCMS may want to consider is to include diversification within Ofcom’s Statement of Strategic Priorities (this is consistent with the recommendation of the Science and Technology Committee).

17. In addition to the specific and targeted findings and recommendations that the Taskforce has identified and which are set out in the sections which follow, there are a number of cross-cutting issues relevant to the implementation of the Government’s Diversification Strategy. In all cases these are issues which extend beyond the scope of the mobile access network and indeed, in some cases, telecoms generally. As such they should be considered in the context of the Government’s broader agenda. These wider cross-cutting issues are set out below.

Education and skills

18. If the UK is to become a leader in the development and adoption of the next generation of telecoms technologies, the availability of skills and expertise will be a critical factor. Telecoms is not a single technical discipline and expertise will be required across a number of disciplines including Communication Technologies (hardware and software), particularly in engineering, IT, security and AI. Currently in the UK, there are skills gaps across all these sectors and severe lack of combined expertise across them. The Government should invest in the skills pipeline required to maintain and build upon existing expertise, to ensure strategic advantage in the sector. Additionally there is a need for a national approach to skills and training - from secondary stage schooling, vocational qualifications, through to undergraduate study and beyond. The importance of this has been highlighted by other technological developments – cyber security, artificial intelligence, big data, and the internet of things – where significant effort has been expended to ensure that skills catch up with the demands of these sectors. It is worth noting the UK’s effort to build world-class skills in cyber which is being enabled by strong leadership from the Government aided by national agencies and centres. Building a strong and sustainable foundation of suitable telecoms skills is central to supporting, growing and driving innovation of technologies and services, and the UK’s role in the telecoms ecosystem.

Private Networks

19. As it stands today, market concentration in the UK’s mobile private networks is not at the same critical level as in our public networks. Indeed the private network market comprises a greater variety and vibrancy of suppliers, some of which are UK based. However, as 5G technology continues to develop and more of its applications and use cases come to the fore, the role, significance and commercial value of private networks in the overall market is likely to increase.

20. This raises a pertinent question about the approach to ensuring security and resilience within our private networks - and the need to maintain the level of diversity and security found within today’s private networks into the future.

21. The Government should seek to clarify its position with regard to diversity, security and the broader legal framework for these networks and consider the need for appropriate guidance. Additionally, private networks should be assessed for suitability in playing a substantial role in assisting diversification of the wider public networks. They may present opportunities to use live testbeds analogous to public networks, which enable new vendors to demonstrate the capability of their solutions and de-risk the onboarding process for public network operators.

Intellectual Property

22. Intellectual property (IP) and Standard Essential Patents (SEPs) have potential to serve as considerable barriers to diversification as technology suppliers staunchly protect their investment and designs. While these practices and their commercial drivers are not unique to the telecoms sector, the Government should consider appropriate measures given the significant role IP plays in the development of telecoms equipment. This issue is complex and has to be set within legal frameworks and international agreements.

23. Government could consider IP both in the domestic and international contexts, supporting actions which will ensure that patents related to international telecoms standards are valid. This will include activities such as schemes for testing the essentiality of patents.

24. Government may also want to seek to augment and bolster existing reputable bodies in this space, such as the GSM Association (GSMA) and facilitate industry cooperation for example by re-activating the industry’s ability to test the essentiality of patents.

International

25. The Taskforce’s work across the different workstreams has highlighted the fundamental importance of collaboration with international partners and the need for a targeted international engagement strategy. This strategy should be underpinned by objectives to: build support for telecoms diversification with a wide range of international partners; position the UK as a thought leader on this issue; and identify tangible opportunities for collaboration with international partners.

26. The UK is well positioned to take on a leadership role on telecoms diversification. The publication of the 5G Diversification Strategy is a crucial first step that provides the Government with a basis with which to engage key international partners bilaterally on this issue whilst the debate internationally is still developing.

27. Engagement should not be limited to bilateral opportunities, however, and the Government should seek to drive this agenda onto the international stage via multilateral fora. Building international relationships will produce tangible opportunities for joint working on a number of areas, including standards, R&D and supply chain. The UK’s G7 Presidency is a unique opportunity to begin to build multi-country consensus for the long-term vision set out in the UK’s diversification strategy. If the Government is to move the dial towards the UK’s long-term vision for the market, it will require buy-in and support from a critical mass of nations.

Recommendations from the four strategic priority areas

Influencing telecoms standards

28. The Government’s 5G Supply Chain Diversification Strategy sets out that standards are critical to drive meaningful diversification in the supply of telecoms equipment.

29. The current system of standards setting is not working for the UK or its allies in delivering diverse, secure and resilient telecoms network equipment. There is an opportunity for the UK to take a lead in this area, working with other like-minded nations to enhance our strategic capability in shaping future telecoms technologies and global market dynamics. The Taskforce recommends a UK-led, but internationally focused, industry solution enabled and supported by the Government. This will require long-term commitment to consistent representation, cooperation, guidance and funding.

30. The Taskforce has considered what is needed to deliver a pragmatic yet ambitious approach to driving meaningful change in this complex area. The Government needs to take a methodical, multifaceted approach to better understand the existing standards landscape, coordinate the UK position, grow our influence internationally and in the longer term enable the emergence of a new and more functional system. The key strands of work that are proposed fall under four headings:

-

Improving capacity to monitor standards activity.

-

Growing influence and impact within existing structures.

-

Developing and delivering a strategic approach.

-

Promoting new systems and structures.

Improving capacity to monitor standards activity

31. The ongoing monitoring and tracking of activity in the telecoms space is critical to begin to understand where the greatest challenges and opportunities lie. The Government has a key role to play in coordinating national activity on telecoms standards across government and with industry, academia and organisations such as Ofcom, British Standards Institution (BSI) and the National Cyber Security Centre (NCSC). The Government should ensure the involvement of relevant ‘vertical’ sectors that are impacted today and in the future by telecoms standards.

32. To advance this, the Government should, within the next few months, establish a function with responsibility for monitoring and tracking recommendations and standards activity in the telecoms space. This function should coordinate input to international telecoms recommendations and standards across Government, industry and academia, focused initially on areas most relevant to the diversification agenda such as open network interfaces. The function should work with members of the Taskforce to develop a permanent capability, which will evolve into a new self-sustaining, free-standing body over time.

Growing influence and impact within existing structures

33. It is clear that immediate action is required to ensure that existing telecoms recommendations and standards for interfaces are accessible to the widest range of industry participants.

34.Government, industry and academia must step up their influence and impact in key telecoms recommendations and standards bodies, enabling greater influencing of both technical standards and overarching governance. To drive this activity, the Government should ensure industry understands the importance of this agenda and set out how different stakeholders can best pull together to deliver greater outcomes on standards (with support from Government as needed).

35. In the short term this means the Government’s new function should:

- identify the specific telecoms standards and recommendations organisations or domains that are most influential

- explore ways in which the UK and its allies may want to amend or influence the governance and operational frameworks of standards groups/bodies

- develop practical mechanisms through which we will increase and amplify our presence and voice

- coordinate the landscape of UK experts actively involved in standards development in this field and the formal and informal standards bodies in which they are working, nationally and internationally

36. A broader factor for the Government to consider - across a range of telecoms priorities - is that there is a limit to the necessary, available expertise in international telecoms and broader internet standards. There is not a lack of UK talent, but it needs to be steered and mentored into the standards domain such that the UK has a long-term sustainable ecosystem of individuals operating within international standards and recommendations bodies. In the longer term the Government needs to consider how to build and maintain this pipeline.

Developing and delivering a strategic approach

37. Telecoms technologies are designed, deployed and maintained on a long-term horizon. Therefore it is crucial to ensure that the UK has a broader, longer-term vision beyond this or the next generation of technology. The China Standards 2035 plan seeks to cement Chinese positions as dominant in international standards work, both in governance bodies and across individual technical standards. The UK and its allies must look to meet this challenge.

38. This requires a holistic approach that looks beyond the RAN to all elements of the network and to broader digital standards as the cyber and physical world continue to merge. Equally, equipment procurement is a further mechanism which can shape the security and resilience of the telecoms network, and which may be influenced through domestic standards and regulations in parallel with global industry standards controlling technical specifications.

39. Therefore the Government should start work now to develop a long-term telecoms standards strategy, which will consider all elements of the network. The strategy needs to be cognisant of the broader technology standards that may be relevant in future networks and recognise that the development of telecoms standards stretch well beyond the telecoms industry.

Promoting new systems and structures

40. While today the vast majority of the telecoms market is aligned under a single global standard setting process, we should be realistic about future scenarios. This requires assessment of the situation in the telecoms market and the emerging geopolitics, to consider the steps the UK can take to pre-empt any risks of a pullback from a global approach. There is growing evidence that other countries are already positioning their industries to secure long-term control of national markets.

41. Therefore the Government should consider a new free-standing body with the support of like-minded countries to be used as a platform to share policy and technical positions: the Digital Infrastructure Recommendations and Standards Alliance (DIRSA). This new body would facilitate balanced government and industry participation and provide a vehicle for the UK to demonstrate international standards leadership in security and resilience for telecoms infrastructure. Its initial focus should be on ensuring the security, resilience, openness and interoperability of telecoms radio access equipment. Members would seek to coordinate, influence and develop guidance for recommendations and standards within the relevant bodies - and as such DIRSA would not be a standards making body itself.

Policy and regulatory measures

42. The 5G Supply Chain Diversification Strategy set out the Government’s intention to attract new vendors into the UK market. The Taskforce has concluded that, as Huawei gradually exits the UK’s 5G market, the UK should create the conditions that will attract the entry of at least one, and ideally two, additional ‘scale’ vendors. The Government should consider established suppliers that have a presence in other markets, but should promote the introduction of new suppliers in line with its stated aim to move toward open and interoperable networks. Such suppliers should be encouraged to establish R&D facilities in the UK as part of the Government’s ambition to build UK capability.

43. The Government should set out a clear ambition for the deployment of equipment from alternative suppliers, or from Open RAN solutions, to a meaningful proportion of the network - and clarify its intent to ensure these alternative suppliers should form an integral part of the UK’s urban networks in the longer term. We recommend the Government sets a challenging ambition to work toward a significant portion of equipment within mobile operators’ networks being supplied by new suppliers and/or through open architectures. The Taskforce believes 25% by the mid 2020s should be the initial aspiration for mobile operators.

44. As part of this, the Government should convene the four UK MNOs and seek commitments with regards to their 5G supplier diversity and open architecture adoption. This should be on a long timescale – perhaps five to ten years and recognise that individual operators will have their own considerations as they develop plans for 5G deployment and the replacement of Huawei equipment in line with the position set out by the Government. The Government’s objective must be to have the operators adopt and publish their supplier diversity and open architecture roadmaps.

45. Beyond this, the Taskforce has identified a range of policy measures that will help to foster the market conditions to drive diversification, by removing barriers to entry for new suppliers where they exist, and creating the right investment environment for both operators and suppliers. These are set out below.

Removing barriers to diversification

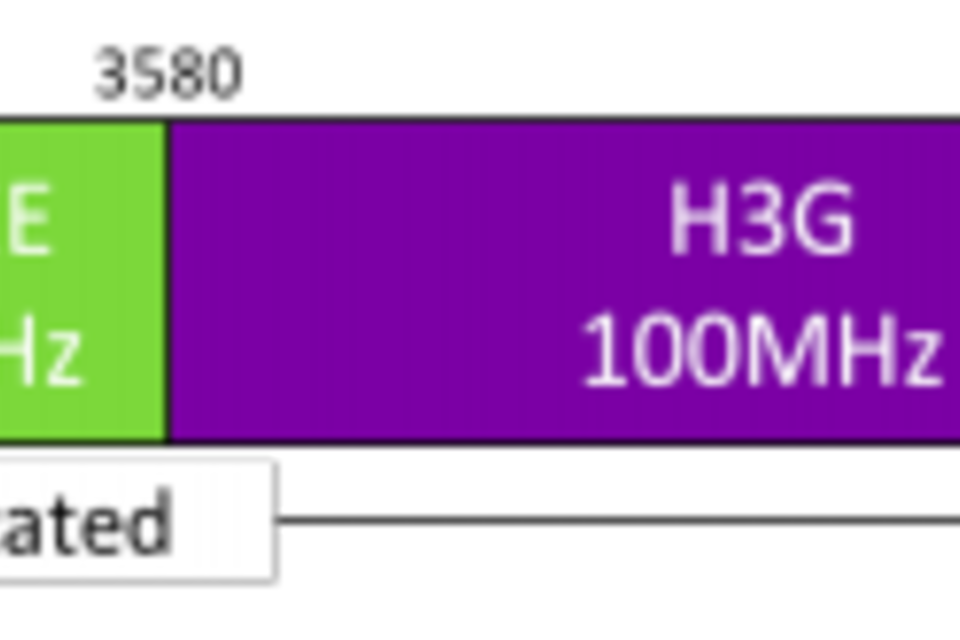

46. If auction negotiations are unsuccessful in defragmenting the UK’s 3.4 - 3.8GHz 5G spectrum, the Government should consider the case for facilitating defragmentation. Deployment of equipment across fragmented spectrum holdings represents an additional cost to network deployment, by making less efficient use of the spectrum itself or by requiring operators to deploy more equipment. While technical solutions may exist, such as carrier aggregation, these represent a further cost and are likely to favour the solutions provided by the incumbent suppliers.

47. Allocation of contiguous spectrum in the 3.4 - 3.8 GHz 5G band is becoming the norm across international markets. For example, the EU has issued guidance that member states should aim to ensure defragmentation of the 3.4 - 3.8 GHz 5G band. As its nearest market in terms of technical specification, the UK should seek to continue to align with Europe where possible in order to remove any potential spectrum-related reasons why vendors must undertake significant customisations to their product in order to be fit for use in the UK. The most viable non-incumbent scale vendors have little to no regional presence, and see the UK - while a comparatively small market - as an important strategic entry point into the wider regional market. If the UK fails to do this, it risks becoming an isolated and specialised market with a greater threshold to entry for new suppliers.

48. In the UK, some of the spectrum in the 3.4 - 3.8 GHz band has already been licensed and is held by mobile operators as set out below. The ongoing auction will allocate the remainder of this spectrum in the band, but in doing so may result in fragmented holdings for some network operators.

49. In recognition of this, following the principal stage of the auction, winning bidders of 3.6-3.8 GHz spectrum will have an opportunity to participate in a negotiation period to determine their assignments in the 3.6-3.8 GHz band. The outcome of any successful negotiation agreement would be a first step towards defragmenting the band. After the auction, there will be an opportunity to enter into trades of new and existing holdings of spectrum across the 3.4 - 3.8 GHz band in order to defragment the band. Without these actions, the primary UK 5G spectrum band will remain fragmented and this risks creating barriers for new suppliers and Open RAN to compete with incumbent solutions. In this event, the Government should consider what role it can and should play in facilitating defragmentation.

50.The Government should convene UK operators and broader stakeholders to set out a proposal for the sunsetting of both 3G and 2G networks. The UK environment poses particular challenges to new vendors due to the ongoing requirement for and support of 2G, 3G, 4G and 5G networks. In the ‘single RAN’ solutions favoured by UK operators, vendors have to support today’s network technologies (4G and 5G) and older generations (2G and 3G). This imposes additional complexity on vendors considering entry to the UK marketplace and some neither have nor wish to develop solutions for technologies that are being phased out elsewhere. The phasing out of these older services has been completed or in process in a number of other countries (e.g. Australia, Canada, USA, Japan, South Korea). The Government should set out this proposal no later than Q3 2021.

Enabling diversification

51. The Government should consider incentivising adoption of interoperable solutions by the UK operators. This is a ‘moment in time’ opportunity for the active acceleration and promotion of diversification in UK networks. Whilst there is a trend towards technologies like Open RAN, there remains the challenge of moving operators to adapt their deployment model from the one that has persisted for decades to a new, more complex model. This will need Government support, particularly if this new technology is to be adopted at an accelerated pace. Such support could be:

- exploring the role of R&D tax reliefs for operators who are introducing Open RAN in their network

- using existing publicly-funded projects such as the Shared Rural Network to subsidise large scale Open RAN deployment, and demonstrate its commitment to open deployments

- identifying demand from the broader public sector - such as Local Government and community organisations providing connectivity solutions - and utilising these to scale the adoption of Open RAN

52. The Government should work with Ofcom to introduce a ‘Permission to Experiment’ (regulatory sandbox) arrangement for operators as they begin to deploy equipment from new vendors and/or Open RAN solutions. As UK operators and prospective suppliers embark on diversification, technology from new vendors will require a period of experimentation and trials in the production environment. A practical reality of this will be, for short periods of time and in specific trial locations, there could be a reduced level of service for a particular network. Appropriate relaxation or forbearance and guidance on expected levels of service - for a limited time period and geographical extent, and with joint specification of goals and assessment criteria[footnote 2] - would speed the production deployment of new technologies including Open RAN-based solutions here in the UK.

53. The Government should coordinate 5G specifications and requirements across UK MNOs and agree a subset (or profile) of 3GPP standards. Developing equipment to support a wider set of features to meet the needs of specific operators and specific geographies adds to the complexity that new vendors must overcome to enter any new market such as the UK. Agreeing a profile would enable vendors to focus and target their development roadmaps.[footnote 3] Ofcom will need to play a role in helping to facilitate these discussions in order to overcome real or apparent competition law concerns.

Securing supply chains

54. The Government should consider introducing ‘provenance’ standards on vendors so that network operators can understand and maintain records of the source country and vendors of the products they deploy into UK 5G networks. It could include a requirement for operators to declare to the Government any critical dependencies (i.e. single-sourced components) within their vendors’ supply chains. This obligation would include details of the source of sub-components of each product, and would expose supply chain single points of dependence.

55. Furthermore, it is important for the Government to provide guidance to operators and vendors on whether Open RAN suppliers - both hardware and software - from markets and regions that may be considered as presenting a strategic or security risk - are permissible for UK network deployment. An early signal on this will be important in order for industry to ensure that appropriate R&D activity and ecosystem development is put in train.

56. Post-Huawei removal, the UK will be dependent on just two suppliers for 5G technology, and there is a risk that all operators may select the same vendor to deploy 5G in a single geographical area (e.g. London, Manchester or Glasgow, etc.). If a supplier’s equipment failed due to, for example, a flawed software upgrade or vulnerability, it could result in an entire area’s connectivity being lost. It is recommended that to increase resilience across geographies, the Government should work closely with the four MNOs and establish oversight of deployment plans for 5G RAN by vendor type to promote diversity within major geographical areas.

Research, Development and Innovation

57. Research, development and innovation are central to the development of new telecoms solutions and technologies and a major competitive advantage for incumbent vendors. Therefore, R&D activity and investment is vital in driving diversification.

58. As set out in paragraph 12, there is also a lot of existing R&D activity ongoing in the telecoms space, but there is a need for the Government to ensure better coordination and governance of these activities. This will ensure the streamlining of existing capabilities and more effectively enable the sector to identify and address gaps to better accelerate research and innovation.

59. The UK should orient its R&D activity toward two key strategic priorities; first to accelerate the development and deployment of Open RAN and/or alternative deployment models; second to identify opportunities for the UK to establish expertise and capability across the telecoms supply chain. The Taskforce has considered both of these objectives and focused its findings on 1) what can be done in the short term, to accelerate Open RAN development and deployment and 2) in the longer term, what are the opportunities for growing UK expertise through long-term strategic research and innovation. These recommendations are set out below.

Accelerating Open RAN development

60. To date, Open RAN has been deployed in a very limited scale by a new ecosystem of vendors who have much less presence in the UK market than the traditional incumbents. In addition, and by the nature of Open RAN itself, there is a significant amount of complexity in the delivery of interoperable solutions. To accelerate the availability of viable Open RAN suppliers, the Government will need to support R&D, testing and piloting of Open RAN based components and solutions.

61. As the Government sets out to fund R&D and work with international partners in this area, the Taskforce has identified five key areas in the Open RAN roadmap that need to be addressed to foster a thriving Open RAN ecosystem as a viable alternative to traditional deployments.

Product development and engineering

62. The Government should invest in product development and engineering in the UK’s areas of expertise. A lot of product development will happen overseas, beyond the scope of the UK’s ability to influence the technology roadmap and establish a leadership position in Open RAN. However, the Government should convene UK based suppliers to develop a coordinated investment and acceleration programme of key technologies that UK investment can influence, and in turn target investment toward proposals that will aim to have products ready as soon as possible, so that Open RAN can start being deployed in dense urban environments on an accelerated timescale.

63. Priority areas for development where the UK has good capability are:

-

Radio architecture: consisting of Radio Frequency (RF), analog silicon design, and power amplifier chipset design and manufacturing: these components represent the key to unlocking Open RAN performance and efficiency. They are also areas where the UK can not only make a material difference to the development of Open RAN, but can also build crucial strategic capability.

-

Operating system and management ‘apps’: Software as a Service (SaaS) solutions will play an increasingly important role in the future of telecoms. By investing in the UK’s software expertise in order to build state-of-the-art software that will underpin new telecoms architectures, the UK has the capacity to play a strong role in a fast growing market.

64. Such investment will not only help increase the UK produced elements of future networks but also provide support for UK based companies to gain a greater part of the value chain in international markets.

65. The Government should establish a challenge-led fund to accelerate suppliers’ product development for Open RAN in line with a collective set of performance requirements for UK operators. Prospective new suppliers will be required to cater to the particular needs of operators within the UK’s unique environment. In some cases this will also require additional investment in and tailoring of solutions over and above the UK’s basic requirements, in order to maintain competition and service differentiation between operators. The Government can streamline adoption by ensuring that new suppliers have the funding to perform the necessary R&D to meet the operators’ performance requirements.

Systems integration

66. The Government should support the developing systems integrator ecosystem in the UK. As maintaining seamless interoperability and integration between components from different suppliers takes on increased criticality in an Open RAN environment, so will the need for choice amongst systems integration ‘suppliers’. Most of the systems integrators currently operating in the UK are international companies with a base in the UK. Ensuring that the UK’s R&D tax relief schemes are competitive will allow the existing ecosystem to thrive, and encourage international companies to set up and expand their regional development and testing facilities in the UK.

67. The Government should invest in projects aimed at early development and growth of systems integration skills in the UK. Such projects will ensure it builds a competitive advantage in this domain, and as an early element of its ambition to build UK capability.

Verification testing

68. The Government should ensure that the increased complexity of verification testing does not represent a disincentive to operators in pursuing Open RAN-type solutions. Today MNOs undertake robust and extensive testing of new software and hardware components before introducing them into their live networks. The introduction of new suppliers, particularly in an evolving architecture, will place additional and more complex testing requirements on operators. The Government could consider support for the cost of testing and integrating Open RAN equipment into operator networks.

69. The Government should ensure that it provides independent testing facilities that can help reduce the burden of verification testing on operators. The planned UK Telecommunications Laboratory should provide independent security testing of market-ready products against sufficiently representative networks, smoothing the path for new market entrants and de-risking deployment of open interface equipment for operators. On the other hand, SONIC[footnote 4] should enable collaborative interoperability and integration testing at the pre-commercial stage, so that suppliers have the opportunity to develop pre-integrated, open solutions before pitching to the operators. As mentioned in Paragraph 14, a clear ‘front door’ to guide the availability and use of these facilities particularly for new or smaller suppliers would be of assistance.

Performance improvement and network integration

70. The Government should consider where investment can support urban Open RAN trials in 2022. One of the key challenges of Open RAN is successfully deploying it in capacity demanding environments including dense urban. An urban Open RAN trial could help to demonstrate performance in an urban setting, and to facilitate network integration. Government investment can help such a trial happen sooner in the UK, establishing leadership in the technology and accessing the learnings from it quicker.

71. The Government should work with Local Government and community organisations to deploy open, interoperable networking. Local authorities, connected places (‘smart cities’) and community organisations seeking to deploy telecoms infrastructure should be encouraged to prioritise Open RAN as the preferred deployment method for their 5G networks.

Support

72. The operator/supplier relationship is necessarily a very close one, and therefore prospective suppliers will likely need to have a presence in the region in order to be able to demonstrate and refine alignment with their buyer’s requirements. The Government should consider quick options to attract and incentivise Open RAN suppliers to establish an operational base within the UK. This local base also means that suppliers have boots on the ground to offer effective maintenance and support services, which is a crucial consideration for operators seeking to procure a solution. DCMS should work closely with the Department for International Trade (DIT) to develop compelling onshoring and investment opportunities.

Long-Term Strategic Research and Innovation

73. The Government has been clear that as part of its efforts on diversification, the UK will show global leadership in rebalancing critical elements of the supply chain and in shaping the roadmap for the deployment of future generations of telecoms networks, including looking ahead to 6G.

74. The UK’s telecoms legacy and strength in R&D and innovation mean the UK has the potential to establish itself as a key player in the telecoms equipment global ecosystem. To capitalise on this potential, a coordinated and strategic approach to R&D and innovation is needed - backed by investment and targeted cooperation with like-minded international partners.

75. Building UK capability is critical to guarantee that UK networks, now and in the future, are resilient in an increasingly interconnected world. Re-establishing the UK as a key player in the telecoms supply chain should be done with a view towards developing secure networks based on a strong skills and talent pipeline in the UK, as well as creating economic opportunities to support the Government’s Industrial Strategy objectives and ambitions to become a science and technology superpower, and building strategic advantage for the UK in this area.

Recommended technology priority areas for strategic advantage

76. A number of specific technologies have been identified as priorities for further research and as strategically significant for the future of the UK telecoms networks and global supply chains. To identify these priority areas, a range of factors were considered including: the potential market opportunity; strategic opportunity to shape global standards; critical technologies with a weak existing supply chain (e.g. liability to economic or security disruption from unstable suppliers); critical technologies that need to be provided by partner countries; and technology where domestic provision is critical to national security.

77. Of these, one has been identified as being a critical capability that requires a sovereign capability to ensure the security and resilience of our networks and several others that should be explored in order for the UK to establish strategic advantage.

Time Distribution

78. Time distribution for synchronization is the only technology that has been identified by the Taskforce where future domestic provision is likely to be critical to CNI resilience. Telecoms systems, among other Critical National Infrastructure systems, need to have a consistently available, accurate time. Today, almost all systems use GNSS-based timing signals to do this. Loss of GNSS-based timing would have a significant impact on the systems which rely on accurate timing, including some telecoms systems.

79. The telecoms industry is better equipped than others to deal with the timing concern – most systems have back-up internal clocks that would be expected to provide time synchronization in the event of loss of GPS (BT, for example, uses high quality atomic clocks for timing). The telecoms sector has done a lot of work with timing experts to understand reliance on timing over recent years, however, next generation telecoms technologies are likely to rely on very accurate, synchronised time signals and assured, primary sources are likely to be necessary. Much of this is currently being led by the National Physical Laboratory who are looking at this issue and working closely with both industry and Government, however and continued support of their work would be useful. The Government should continue to invest in and develop domestic capability in this area.

Broader strategic advantage

80. The taskforce has identified a further nine technologies that should be considered for further research. These include technologies which will be key to future telecom networks and where there is potential for the UK to develop a globally competitive capability. Delivering on these recommendations will require sustained investment and coordination across government and the telecoms sector as a whole.

81. These nine priorities can broadly be categorised into three areas:

-

Telecom-specific hardware and software solutions which are current and emerging core telecom functions: (1) synchronised networking; (2) software defined and self-organising Open RAN; (3) software defined open networking and cloud-based solutions; and (4) end-to-end networks including convergence across IoT, cellular, optical, satellite, computing.

-

Cross-cutting technologies that will play an increasingly important role in the design and operation of telecoms networks: (5) data analytics and AI for network infrastructure and service platforms; (6) internet of senses; and (7) Quantum Communications and Quantum Internet.

-

Emerging socio-political issues that can be addressed via telecoms and/or need to be considered in the design of future networks. Primarily these are (8) network native security, privacy and trust and (9) Net Zero for telecoms in line with the UK and UN Sustainable Development goals.

82. From the above list, it is recommended that the Government prioritises funding research and investment across the following technologies. These are technologies that will be important to future networks; build on existing UK Capability (meaning the UK would not be starting from scratch); and present potential lucrative economic opportunities:

- Software Defined and self-organising Open RAN

- Software defined open networking

- Edge Computing

- Network Convergence

- Internet of Senses

- Quantum Internet

- Net Zero telecoms

83. The UK should work in collaboration with other countries to coordinate and shape the development of adequate capability across all these technologies. Where the UK may not choose to pursue full domestic capability, it should reliably be available from a partner(s).

Future generations of networks

84. Telecom technologies and generations have a long lead in time and while 5G deployment is in its early stages, the technology that makes it possible has been in development for close to 10 years. If the UK wants to play a role in defining the standards, specifications and guiding principles for 6G and beyond it needs to take steps in the near future to position itself in this race. This will be critical in order to build competitive advantage but also to ensure high levels of security, openness and competition are central to technology roadmap. Here the Government may want to consider opportunities beyond the supply chain itself, and explore opportunities in the use and application of future generations of networks.

85. To take this forward, the Government should establish a programme for the research and development of 6G networks and for future ‘network-of-networks’. This should be developed in partnership with industry - operators and suppliers, academia, SMEs and start-ups. It should aim to create new opportunities for open innovation and collaborative R&D that will become the foundation for new UK supply chains. Early testbeds and facilities should focus on creating real network conditions, work toward terabit level connectivity, and including real and emulated network traffic. This will drive inward investment by creating opportunities for cross-industry collaboration on pre-commercial development of future core telecoms networks capabilities.

86. Key to this will be building on the UK’s existing world leading academic research base and research laboratories. The links however between research and innovation must be strengthened to enable the acceleration of research through incubation to commercialisation. The UK must enable: (1) efficient translation of research to innovation in order to develop a sustainable, home grown telecoms supply chain (2) a single point of coordination for contract research to the UK telecoms industry.

87. As part of this - and in line with some of the priorities set out above - the Government should explore ways to cultivate cross-cutting R&D between telecoms and other emerging technologies. We propose that the Government invests directly in a programme that will perform translational and contract research working in tandem with leading universities, industry and technology incubation organisations. This recommendation, for example, could be taken on by an existing organisation to focus on supporting technologies with early Technology Readiness Levels (TRLs) and SMEs in the field. This kind of organisation will support effective translation at lower TRLs and will serve to foster the long-term growth of the sector.

Role of Taskforce going forward

88. The Telecoms Supply Chain Review and 5G Supply Chain Diversification Strategy are both world leading assessments of the risks, challenges and opportunities within the telecoms supply chain today. Both have demonstrated the value of expert analysis and the need to make assessments about our critical national infrastructure by considering the full range of factors - technological, economic and commercial and geostrategic.

89. As the next generations of technologies develop, we must remain alert to new challenges and opportunities this will bring. The work of this Taskforce has highlighted the benefit of bringing together government, industry and the academic and research community to guide and inform national and international responses and it will be important to continue to take this collaborative approach.

90. Therefore, the Taskforce recommends that, as it moves into the implementation phase, the Government retains an external advisory group in some capacity to scrutinise the implementation of its strategy; assess and monitor its success; and to shape further work as the Government assesses the need for diversity across the broader supply chain.

-

An assessment of diversification requirements in broader network elements, such as fixed access and the core, should be priorities for the Taskforce moving forward. ↩

-

Mitigations must be specified and agreed in advance to support the UK emergency services and other critical services ↩

-

This approach can be amplified in benefit if the initiative is coordinated across states – Europe-wide would be a major advantage for new entrant vendors. ↩

-

The SmartRAN Open Network Interoperability Centre (SONIC) was announced as part of DCMS’ 5G Supply Chain Diversification Strategy, a joint activity between Digital Catapult and Ofcom to create a platform for existing and emerging suppliers to test interoperability and integration of open and software centric networking solutions, starting with Open RAN. ↩