Social Impact Investment Forum: outputs and actions

Updated 30 July 2013

1. Executive summary

Across the G8 countries, there is growing awareness of the potential of social impact investment. The G8 Social Impact Investment Forum, held in London on 6 June 2013, discussed how to move the social impact investment market towards global scale and sustainability.

This paper outlines some of the ideas and themes from the day’s discussions. It sets out the perspectives shared, the challenges identified and the actions agreed which will help build an international market.

Three important themes emerged from the day:

- The need to build a global social impact investment community that is collaborative and open to new actors. This will be supported by a new Social Impact Investment Taskforce and a working group of development finance institutions focusing on social impact investment and international development.

- The need to create common frameworks to understand the potential of the market and move towards standardisation in impact measurement. This will be supported by an OECD report on global developments in social impact investment and a working group of experts on impact measurement.

- The need to develop and share best practice, both in governmental policy and more broadly amongst market actors. This will be supported through the Global Learning Exchange on social impact investment and the identification of a set of principles for policy makers in this market.

2. Introduction

Prime Minister David Cameron spoke at the Social Impact Investment Forum.

David Cameron speaks at the Social Impact Investment Forum

Read a transcript of his speech. He said:

We’ve got a great idea here that can transform our societies by using the power of finance to tackle the most difficult social problems … the potential for social investment is that big.

There is increasing support for the idea and practice of social impact investment. The G8 Social Impact Investment Forum explored how to leverage this momentum and move the social impact investment market towards global scale and sustainability.

This event – the first to use the G8 platform to discuss social impact investment – brought together 150 leaders in social impact investment including senior politicians, government officials, major philanthropists, business and finance executives, social entrepreneurs and academics and provided an opportunity to consider the steps needed to enable the market to operate on a global scale.

The aim of the day was to begin the process of catalysing the global market for social impact investment. With both pioneers and newer players present, the discussions focused on the potential of social impact investment as a source of growth, innovation and finance for tackling deep social problems. Above all, the Forum highlighted a shared ambition to grow the market through increased collaboration and the development of common frameworks.

You can download a full agenda of the day (pdf). A Storify also captures much of the excitement and energy of the event.

George Soros (Soros Fund Management and the Open Society Foundations) spoke about social investment.

George Soros spoke at the G8 Social Impact Investment Forum:

George Soros said, “this is about pulling forward tomorrow’s benefits in order to alleviate today’s poverty.”

3. Building a global community

The social impact investment market forms new relationships across a range of actors. Delegates agreed that existing collaboration between sectors and countries provides a strong foundation for a global social impact investment market and noted the need to be open to new actors.

3.1 Collaboration and market champions

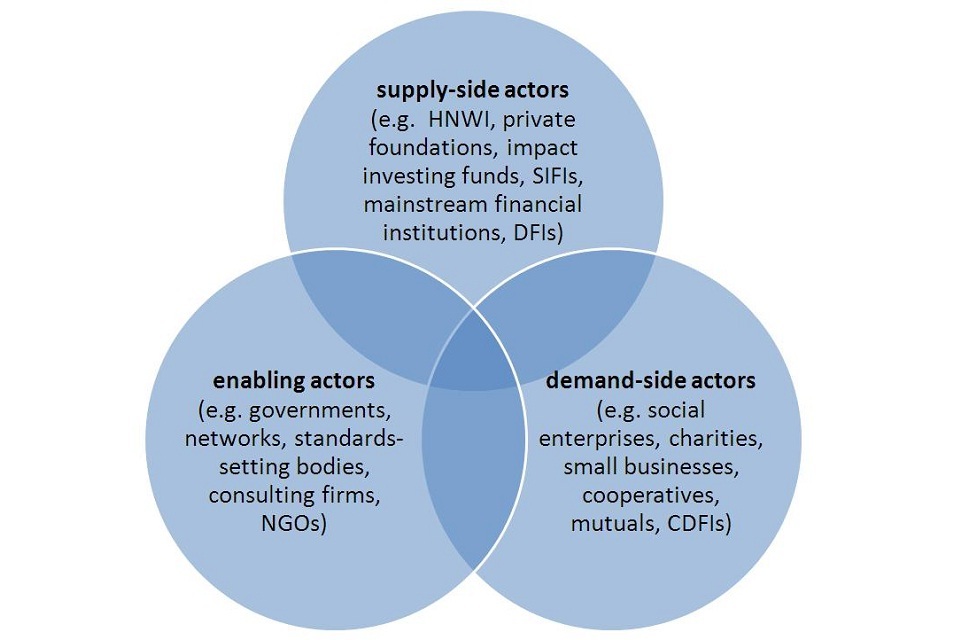

Social impact investment brings together a diverse group of actors with different goals, expectations and ways of working. A key message from the Forum was that, while roles may overlap, actors must play to their strengths to encourage market growth.

Venn diagram showing the interaction between supply-side, demand-side and enabling actors

For supply-side actors, this meant investing money and resources in social ventures in a way that would meets investors’ capital and risk profile and would be appropriate to the development stage of the social venture. For demand-side actors, it meant finding new models to deliver impact and new markets for social ventures. Finally, for enabling actors it meant taking action to help build the market ecosystem.

The Forum identified that collaboration is crucial for ensuring that these roles are complementary. Delegates emphasised the importance of ongoing communication and collaboration as the market develops. Jonathan Greenblatt (The White House Office of Social Innovation and Civic Participation) called this a need for “active dialogue” and noted that without it, there is a risk that actors could be stuck in their silos, slowing market development. Working together was seen as crucial to boosting innovation and accelerating the growth of the market.

Finally, delegates agreed that new actors and new regions will drive market growth. Discussion acknowledged that markets are at different stages of development across the G8 and that, in order to grow a global market, there is a need to be open to new actors both within domestic markets and in new countries. It was also observed that in certain countries, such as the UK, market champions have been a useful way of accelerating market growth.

Agreed actions

| Formation of a Social Impact Investment Taskforce |

|---|

| To respond to the need for increased global collaboration and market champions, Prime Minister David Cameron announced the formation of an international Social Impact Investment Taskforce. |

The aim of the Taskforce will be to help catalyse the development of the global social impact investment market. To achieve this, the Taskforce has been asked to oversee delivery of the initiatives announced at the G8 Forum, and to identify what more can be done to accelerate the field.

Its primary functions will be:

- maintaining oversight of the voluntary initiatives announced on 6 June and their supporting working groups

- embedding discourse on social impact investment in future government-level discussions

- advocating consistency in approaches to developing the infrastructure required for a global social impact investment market

- building engagement across the market, including with industry, foundations and civil society

The Taskforce is made up of government, industry and civil society representatives. Sir Ronald Cohen, co-founder and former Chair of Apax Partners and Chair of Big Society Capital, will act as the first Chair of the Taskforce. Sir Ronald Cohen has already published his initial thoughts about the Taskforce.

3.2 New social impact investors in international development

Delegates agreed that social impact investment has the capacity to change the lives of the poor in developing countries. Much discussion focused on how actors can better use the tools of social impact investment to encourage economic development in developing countries.

The Rt Hon Justine Greening MP (UK Secretary of State for International Development) spoke at the forum.

She said:

Impact investment has the potential to transform the way investment is made into enterprises that can provide much needed jobs and access to the services we take for granted such as education, health, water and sanitation. We believe that there are large pools of capital currently sitting on the side-lines that could be mobilised to invest alongside us.

Panellists identified an opportunity to leverage the capabilities of development finance institutions (DFIs). For example, in 2012 the US Overseas Private Investment Company (OPIC) approved up to £187 million in financing for six new impact investment funds and UK’s DFI (CDC) announced it would be managing a £75 million fund on behalf of the UK’s Department for International Development (DFID). Delegates encouraged other DFIs, and the international financial institutions, to consider the potential of social impact investment and to work to develop more sophisticated financial instruments.

Philanthropists were also seen to have a big role to play. Forum delegates set out the need to harness the unique role of philanthropic foundations. Panellists identified the role for philanthropy in providing the high-risk, long-term (‘patient’) capital that is crucial to social innovation. Amongst others, Dr Chris West (Shell Foundation) called on foundations to be the leaders in providing this type of capital, alongside existing activities such as short-term, low-risk project financing.

Dr Judith Rodin (Rockefeller Foundation) said:

In East Asia and the Pacific, there is more than $10 trillion in combined assets among high-net-worth individuals in the region. Mobilising even just 1% of that through impact investing could make a tremendous difference to the hundreds of millions who lack access to education, clean water and health care.

The Forum also examined the need to build platforms and partnerships in the developing world. Panellists discussed how emerging markets are widening the pool of potential social impact investors. Examples include new high-net-worth individuals and sovereign wealth funds. At the same time social enterprises, such as Sproxil in Ghana which uses mobile technology to combat counterfeit medicine, are growing throughout South Asia, Africa and Latin America.

Delegates spoke of the need to connect social enterprises with investors to build more and better social impact investment platforms in the developing world. Investors were asked to set realistic goals for social entrepreneurs and to be more financially innovative when working with early stage social ventures, especially in developing countries.

Agreed actions

| Formation of a DFI Working Group on Social Impact Investment |

|---|

| To respond to the need for new social impact investment in international development, a development finance institution working group on social impact investment will be convened on a regular basis. |

The aim of the Working Group will be to provide a forum for DFIs to share their approaches to social impact investment and to learn from one another. It will report to the Social Impact Investment Taskforce.

By serving as an informal community of practice, the Working Group will accelerate the development of social impact investment programs for those DFIs that are already active and increase coordination within the DFI community.

This Working Group is made up of the world’s key DFIs (including the DFIs of the G8 countries, interested DFIs from other countries and multilateral institutions). The UK’s DFI, CDC, will act as the first Chair of the Working Group.

4. Creating common frameworks

Global activity in social impact investment is growing rapidly. So too is collective understanding about how the market operates and how to measure impact. Delegates agreed that common frameworks are crucial to developing a global social impact investment ecosystem.

4.1 A better understanding of the potential of the market

Elizabeth Littlefield (OPIC) described the recent growth of social impact investment as “nothing short of revolutionary”. In a poll taken at the end of the day, 85% of delegates agreed that social impact investment offers more hope than hype.

Two clear areas emerged where strategic research will be pivotal in driving market growth.

The first area was around the breadth of impact. Panellists identified a need to understand better where social impact investment can be most useful. Discussion focused on the wide-ranging potential of social entrepreneurs. Announcing a new round of funding for the Small Business Investment Company Early Stage Fund, Karen Mills (US Small Business Administration) noted that:

by increasing the amount we are investing in both early stage and impact investing, we are injecting new energy and momentum into our economy and leveraging the greatest driver of innovation and job creation in the world—the entrepreneur.

Interviews with social ventures highlighted that the ultimate outcomes of social impact investment are diverse. Several organisations that featured in the day’s discussions are at the forefront of such innovation: they range from d.light (a social enterprise which has provided 17.5 million people from the developing world with solar lanterns since 2007) to auticon (a social enterprise which builds on the particular skills of people with autism and deploys them as IT consultants in large and medium-sized organisations) and to HCT Group (a community transport social enterprise which reinvest its profits into community transport services).

The second was around the depth of impact. Panellists identified a need for a better picture of the effectiveness of social impact investment. One response announced on the day was Global Development Innovation Ventures (GDIV) – a joint initiative of the US Agency for International Development (USAID) and DFID. GDIV will pilot, test and scale cost-effective development solutions with the potential to reach millions of people in developing countries. By adopting an investment strategy that is based on evidence of impact and cost-effectiveness, GDIV aims to take innovative ideas to scale.

The Forum showed that a strong evidence base around social impact investment is critical to increasing government and investor engagement with the market, and encouraging a global market to develop.

Agreed action

| An OECD Report on Global Developments in Social Impact Investment |

|---|

| To respond to the need for a better understanding of the potential of the market, the OECD has agreed to undertake a detailed report on global developments in social impact investment. |

In order to scope the size of the market, this report will provide an authoritative common resource for governments and industry to assess what can be done to build a global social impact investment market.

The OECD report will recognise and scope the key components of the evolving social impact investment field and examine any parallels with the evolution of capital markets in order to identify relevant implications. In addition, it will look at the size and growth of the market, alongside an analysis of the key products, funds and structures that make up the market.

The work will involve research and data collection on social impact investment markets in G8 and other OECD and non-OECD countries. The work on the OECD report will be informed by other initiatives announced at the G8 Forum, including the Social Impact Investment Taskforce, the Working Group on Impact Measurement and the Global Learning Exchange.

The OECD will aim to deliver a preliminary report covering G8 countries by September 2014.

4.2 Transparency and standardisation in impact measurement

Prime Minister David Cameron outlined the need for improved impact measurement, noting:

It is not enough just to incentivise social investment. We need a robust way of measuring their value and in doing so connecting businesses that deliver social and environmental value with investors seeking both a social and financial return.

Delegates agreed that while work around impact assessment has increased in recent years, there is more to do. The day’s discussions brought out two particular themes.

First, there is a need to build greater capacity among social ventures to measure social outcomes. According to Peter Holbrook (Social Enterprise UK), “we are beginning to see the mainstreaming of the social in business transaction and there is also a growing awareness by civil society organisations that they need to be more entrepreneurial.”

While there was general agreement that impact should be measured, participants noted that the objectives behind measurement, and the capacity for doing so, can differ across sectors. Panellists suggested a need for cross-sector conversations around the realities of impact assessment for social ventures and the requirements for social impact investors.

Second, the Forum set out the need for a common set of tools on social impact measurement for investors. Panellists agreed that there had been improvement in recent years, aided by a longer track record of social impact investment. However they also acknowledged that a robust system for the measurement of social impact is a prerequisite for bringing social impact investment into the mainstream. As Colin Grassie (Deutsche Bank) pointed out, “investments with single, mid-digit returns and measurable social outcomes are great products. Every model portfolio should hold such assets.”

Watch panel discussion from the Forum on demonstrating the role of the social impact economy

G8 Social Impact Investment Forum - The role of the social impact economy

Nick O’Donohoe (Big Society Capital) said: “I hope that today represents a milestone – to persuade people that social investment is an idea whose time has come.”

The discussions made clear that bringing social impact investment into the mainstream will require a common language of impact assessment. Panellists referred to a number of systems to measure impact that are at different stages of development. In addition, Forum delegates pointed out that there are other initiatives, such as the International Finance Corporation’s work around inclusive business, which share some features of social impact investment. They noted that there is also a need to measure the results of these initiatives. Overall, although it will take time, Forum delegates agreed that complementarity between impact assessment systems will be a key driver of market growth.

Delegates at the G8 Forum were unanimous that shared standards are crucial to the accelerated development of the market, as they will lead to better benchmarking, a rise in the amount of performance data and a clearer path to investment for mainstream financial institutions.

Agreed action

| Formation of a Working Group of Experts on Impact Measurement |

|---|

| To respond to the need for greater transparency in impact measurement, G8 countries have agreed to form a working group of experts on impact measurement. |

The aim of the Working Group will be to ensure existing impact measurement terms and frameworks complement each other, with a view to moving towards consistency and consensus. It will report to the Social Impact Investment Taskforce.

The Working Group will maintain an active dialogue with social ventures and investors and will work towards the development of recognised international standards in social impact investment.

The Working Group will be composed of leading experts on impact measurement from across the G8 countries.

5. Developing and sharing best practice

Given the diverse nature of social impact investment, sharing knowledge is crucial to building a global market. Delegates agreed that this includes exchanging lessons learned, encouraging open data and working together on new ideas.

5.1 The role of government in fostering the growth of the market

Delegates highlighted the unique role that government plays in the social impact investment market as a customer, investor and regulator. In a poll taken on the day, 32% of delegates agreed that government has the greatest potential to catalyse the market – this was second only to the 38% of delegates who considered that it needed to be a collaborative effort. As the Rt Hon Iain Duncan-Smith MP (UK Secretary of State for Work and Pensions) said, “I believe it is also government’s job to help grow the social investment market. Crucial to doing so is an understanding of what works – so that money can flow to those interventions that get results.”

For many governments, as Mario Calderini (Politecnico di Torino) pointed out, the priority is deciding which governmental department should oversee the impact investing agenda.

Governments face common challenges in building the market. Panellists identified a need to develop clear principles of intent for growing their social impact investment markets.

One principle that was discussed was the need for ambition. Delegates agreed that mainstreaming social impact investment requires boldness on the part of social ventures, investors and policymakers. Investors need to be prepared to accept changing business plans and even failure, as non-risky projects will never deliver change at scale. As Prime Minister David Cameron said of the creation of Big Society Capital, “we had to be bold here to make this work. A few million pounds was never going to be enough.”

Panellists also identified the need for patience. A mature social impact investment market requires nurturing growth capital for start-up social ventures and a track record of social value creation and financial sustainability. Recognising that most current investments are for 10-15 years, delegates noted that developing the right ecosystem and a track record will take time. Rajat Nag (Asian Development Bank) asked the G8 countries to give long-term support to the market, noting “without long-term support, it will be another short-lived fad.”

G8 Social Impact Investment Forum - The role of the social impact economy

Benoît Hamon (French Minister Delegate for the Social and Mutually-Supportive Economy) said:

I welcome the fact that the United Kingdom has put this subject on the G8 agenda; it highlights the extremely topical nature of issues related to the financing of the social and mutually-supportive economy and the convergence of commitment levels.

Finally, delegates all recognised that social impact investment is not a silver bullet. As Jonathan Greenblatt (The White House Office of Social Innovation and Civic Participation) noted in his discussion of the policy principles announced as part of the National Impact Initiative, “we must allow impact investing to complement our policy initiatives – but it is not a substitute for sound public policy”.

Agreed action

| Commitment to Identify Principles for Policy Makers in Social Impact Investment |

|---|

| To respond to the need for guiding frameworks for government, the Social Impact Investment Taskforce has committed to identify a set of Principles for policymakers looking to foster the emerging market for social impact investment. |

The aim of the Principles will be to help develop a best practice approach to policy research, design and implementation.

Building on the existing work in this area, the Social Impact Investment Taskforce will work with ventures, investors and policymakers from across the G8 countries to identify and refine best practice principles for policy in social impact investment. The Taskforce will aim to publish the Principles within its first year of operation.

5.2 Open data and shared learning

Throughout the day, it became clear that both ‘learning by doing’ and building on ‘what works’ are crucial in a nascent but fast-growing market such as social impact investment.

While these concepts have application in all areas of social impact investment, a particular need emerged for shared learning around the continuum of capital available to social ventures at each stage of their journey from start-up to scale. Nick O’Donohoe (Big Society Capital) pointed to the need for shared learning between social impact investors in order to strike a balance between start-up investment that creates sustainability, and that which creates dependency.

Delegates emphasised the need for increased early stage, high-risk capital. Some noted that there is often a gap between the capacity of major philanthropic foundations to provide high-risk, long-term capital and their appetite to do so. Some considered that shared learning between foundations around social impact investment could help bridge this gap.

G8 Social Impact Investment Forum - Increasing Cross-Border Initiatives

Ted Anderson (MaRS Centre for Impact, Canada) said: “We need to draw closely on the experience of others, and have the humility to do so.”

Clever deployment of commercial capital is also important. While the increasing interest of mainstream finance was seen as positive, delegates recognised that commercial finance is not appropriate for all social ventures. Better collaboration around ‘what works’ in capital allocation was seen as a way of helping social ventures move along the capital curve in a smooth and helpful manner.

Nick Hurd MP (UK Minister for Civil Society) said:

Most of us understand the potential of private capital, but there remain huge challenges and the hard yards are ahead – is there an appetite for us to work together to build this into an international movement?

Delegates also recognised that there is potential to develop the depth and variety of financial instruments available to match the growing interest in the market. This will require asset owners and managers to be innovative and to share their experiences with other potential social impact investors.

Agreed action

| A Global Learning Exchange on Social Impact Investment |

|---|

| To respond to the need for an increase in the sharing of data and learning, the UK announced that it will work in partnership with the World Economic Forum and Impact Investing Policy Collaborative to establish a Global Learning Exchange on social impact investment. |

This multi-stakeholder exchange – which will be open to investors, entrepreneurs and policy makers from around the world – will focus on sharing ‘what works’ in social impact investment. It will provide existing networks with a shared platform to debate and create ideas as well as inviting new voices to the field.

The exchange will be:

- educational: providing a forum for the exchange of ideas and best practice in social impact investment

- collaborative: engaging civic, business, political, academic and other leaders of society

- transparent: open and constructive in its findings, and making its work freely available

The Global Learning Exchange will launch in autumn 2013.

6. Breakout sessions

6.1 Innovation in public service delivery: Social impact bonds in the UK

Social impact bonds (SIBs) are innovative financial instruments which promise returns to private investors if social outcomes are achieved. The UK pioneered the development of SIBs in 2010. There are now 13 SIB agreements in place with the majority of these already delivering services.

In this session, representatives from the Department for Work and Pensions, Essex County Council and the Cabinet Office discussed their experiences in developing and delivering social impact bonds.

Further information on the UK government’s work on SIBs is available here. Read further information on the DWP’s Innovation Fund.

6.2 Recommendations to drive innovation in public service delivery

- continuing evaluation is an important way of capturing best practice and improving service delivery

- SIBs can be complicated – policymakers need to work to make the arrangement as simple as possible

- SIBs are best used where there is most need and potential for impact

6.3 Innovation in international development: Acumen

With increased public attention and more funds coming in, the social impact investment sector is at a crucial juncture in its evolution. Acumen, one of the world’s leading impact investors, has 12 years’ experience operating in South Asia and Sub-Saharan Africa. In this session, Sasha Dichter and Vinay Nair from Acumen focused on the need for patient capital in impact investment, alongside the need for the market to grow as broadly and deeply as possible. They recognised that increased transparency in impact measurement will be a crucial part of growing impact investment.

6.4 Recommendations to drive innovation in international development:

- invest with grants and technical assistance to develop the sector

- encourage innovation in financial products

- support increased transparency by social ventures in order to better demonstrate and assess impact

6.5 Innovation in business: ‘Breakthrough Capitalism’ and Nike’s involvement in LAUNCH

LAUNCH is a strategic collaboration between Nike, NASA, the US Department of State and USAID which aims to identify, showcase and support innovators whose ideas, technologies and programmes have the potential to create a better world. Through a series of meetings, events and an annual forum, LAUNCH has introduced technologies, programs and ideas that are solving urgent challenges facing our society.

In this session, Nike discussed lessons learnt from LAUNCH with Volans, a business consultancy whose “Breakthrough Capitalism” programme explores how business leaders can be an effective force for change.

6.6 Recommendations to drive innovation in business

- actively promote transparency in supply chains and processes, through using open data platforms

- encourage collaboration between all aspects of the supply chain and move away from a silo-approach

- develop a leadership position by taking risks and sharing lessons

7. Announcements made at the G8 Social Impact Investment Forum

7.1 International

Social Impact Investment Taskforce

An international Social Impact Investment Taskforce – the first of its kind to bring together both key government officials and industry representatives – will help drive an effective global social impact investment market. The Taskforce will oversee the voluntary initiatives and will be chaired by Sir Ronald Cohen, founder and chair of the Big Society Capital.

Voluntary initiatives to build the global social impact investment market

G8 governments agreed to a number of voluntary initiatives, including:

- an OECD report on the market

- a DFI working group

- a working group of experts on impact measurement

Global Learning Exchange

The UK Government, the World Economic Forum and Impact Investing Policy Collaborative will establish a multi-stakeholder exchange focusing on sharing best practice in social impact investment. The Global Learning Exchange will combine an online forum a regular series of meetings around the world.

Global Development Innovation Ventures (GDIV)

GDIV is a joint initiative of the USAID and DFID. GDIV is a global investment platform that will source ideas from all over the world, apply evidence-based staged financing and bring those ideas to scale.

The Global Social Entrepreneur Network

Supported by the UK government and led by UnLtd, the GSEN aims to create a worldwide network for social entrepreneur support agencies. It will share learning and best practice around how to stimulate and best support social entrepreneurs.

7.2 Domestic

US Small Business Investment Company (SBIC) Early Stage Fund

The US Small Business Administration (SBA) will open a new round of solicitation for its SBIC Early Stage Investment Fund that will increase the amount available for investment. The SBA has also raised the amount of SBIC leverage that impact investing funds can receive.

Help for communities to buy local assets

Big Society Capital (BSC) and the Big Lottery Fund (BLF) are developing a £50 million Community Assets Fund (pdf) to provide grants and loans to help communities through the phases of local ownership. This is part of a commitment from BSC and BLF to provide £250 million over the rest of this decade to help communities to own local assets.

Consultation on social investment tax relief

In the 2013 Budget, the UK government announced a new tax relief for private investment in social enterprise. The government’s aim in introducing this new tax relief is to encourage private investment in social enterprise. The consultation for the tax relief (open until September 2013) was launched at the G8 Forum.

Launch of the Social Stock Exchange

The Social Stock Exchange (SSE) is designed to connect publicly listed social impact businesses with investors seeking to generate positive impact alongside a financial return. The SSE is supported by the London Stock Exchange Group, City of London Corporation, Big Society Capital and the Rockefeller Foundation.

8. Looking ahead

G8 Social Impact Investment Forum - Francis Maude

The Rt Hon Francis Maude MP (UK Minister for the Cabinet Office and Paymaster General) said:

The right thing for the G8 to be doing is to pick up ideas which are capable of generating multiple benefits around the world … we hope there will be an enthusiastic take up of these ideas, and we stand willing to share early stage learning around this.

The Forum highlighted the considerable progress made within the social impact investment market as well as the challenges that remain.

Collectively, delegates set out priorities for governments, investors, mainstream business and social ventures seeking to build domestic markets and to develop the architecture necessary for a mature global market. Panellists recognised a number of shared needs: to build a broader community; to further develop common frameworks; and to better share best practice.

G8 countries committed to respond to these needs. The initiatives set out in this paper represent initial steps that help accelerate the global market. These actions have been complemented by offers from mainstream financial institutions and business to further support this important agenda.

The Social Impact Investment Taskforce has been asked to oversee delivery of these initiatives and to identify what more can be done to accelerate the field. It will issue an initial report on its activities in September 2014. The Taskforce will also seek to provide input into future G8 and G20 events, including Russia 2014 (G8), Australia 2014 (G20), Germany 2015 (G8) and Turkey 2015 (G20). Alongside this, there remains a continued domestic challenge. Forum delegates affirmed that a sustainable global market needs robust domestic markets. This will require active leadership from countries to grow these markets and to continue to translate interest into action.

G8 Social Impact Investment Forum - Sir Ronald Cohen

Sir Ronald Cohen (Chair, The Portland Trust and Big Society Trust) said:

The Taskforce will provide a policy framework for developing impact investment into a powerful, global force that will transform our societies.

9. Annexes

9.1 Letter from industry

In a letter distributed at the G8 Social Impact Investment Forum in London on 6 June 2013, more than 90 institutional signatories applaud UK Prime Minister David Cameron and officials from G8 countries for their proactive step to embrace the promise of impact investing.

Read the letter, ‘Investors support G8 efforts to catalyse impact investing’ (pdf)

9.2 G8 Social Impact Investment Forum Agenda

Download a full agenda for the day here.

9.3 List of delegates by organisation

Download a list of the organisations that attended the G8 Social Impact Investment Forum (pdf).