Scottish Green Freeports: set up phase guidance

Published 27 April 2023

Applies to Scotland

1. The setup phase

1.1.1 The two prospective Green Freeports in Scotland have now moved to the next phase of designation (the ‘setup phase’).

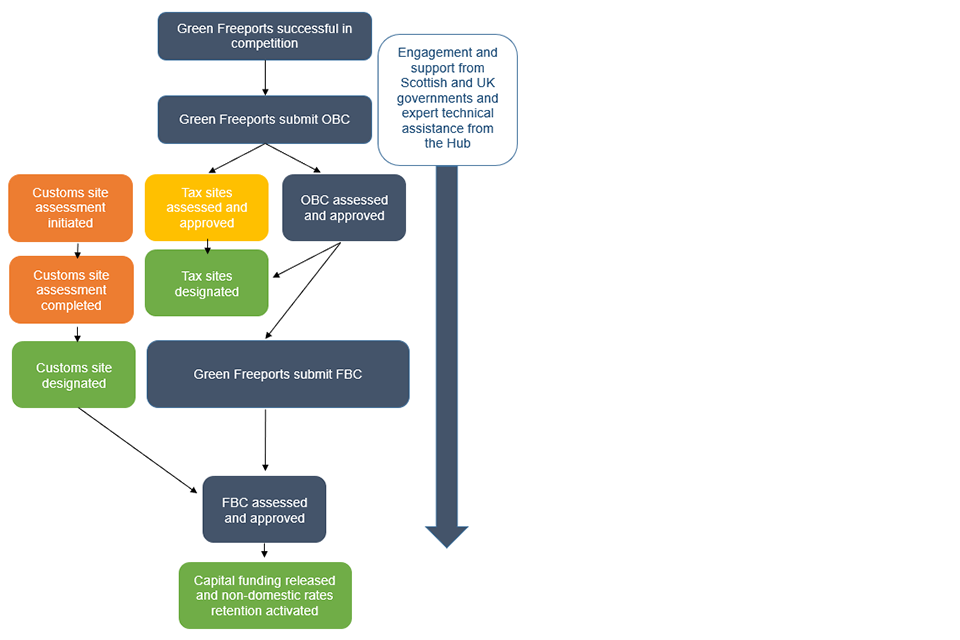

1.1.2 Three processes must be completed in this phase:

- government approval of Outline Business Case (OBC) and Full Business Case (FBC) – ‘the Business Case Process’

- government approval of proposed tax sites – ‘the Tax Site Process’

- government approval of proposed customs sites – ‘the Customs Site Process’

A high-level process map in Annex A provides an overview of the processes.

1.1.3 The 3 processes are linked and aligned: through the Business Case Process, the strategic vision, economic impact, and delivery structures for the tax and customs sites will be scrutinised. Conversely, the Tax and Customs Processes will enable the activation of key policy levers and hence the delivery of the Green Freeport vision as articulated in the Business Case. Consequently, a Green Freeport’s tax sites will not be designated until its OBC has been approved and at least one customs site will need to have been designated before the FBC can be approved.

2. The three processes

2.1 The business case process

2.1.1 Through their OBCs, prospective Green Freeports will articulate their overarching strategic vision for the Green Freeport as a whole. This will involve significant development of the content of the original Green Freeport bid in line with its core principles.

2.1.2 The FBC will be an iteration of the OBC, rather than a distinct document, and will involve finalising and elaborating on the content of the OBC and addressing all Scottish and UK government (‘the governments’) feedback on it. However, the governments expect the majority of the work to take place at the OBC stage.

2.1.3 The Business Case process will serve to assure both governments that Green Freeports will effectively manage public funds, in the form of seed capital funding, and help set Green Freeports up to succeed. Full details on the Business Case Process are provided at Section 13.

2.2 The tax site process

2.2.1 Building on the initial assessment of Green Freeport bids, the Tax Site Process will verify that proposed tax sites adhere to the criteria set out in the Bidding Prospectus, in terms of both physical size and shape and potential to meet the policy objectives. Green Freeports must provide a map of each tax site at Annex A of the OBC.

2.2.2 This is important to ensure that the selected tax sites maximise the benefits of the Green Freeport whilst minimising any deadweight or displacement and the case provided by the prospective Green Freeports will help the governments, and Green Freeport governing bodies, evidence the value of the policy.

2.2.3 A Green Freeport’s tax sites will not be approved until its OBC has been and government reserves the right not to proceed with the designation of a prospective Green Freeport tax site that: it deems to not meet the criteria set out in the Bidding Prospectus; does not represent good value for money, or an optimal, effective or deliverable use of the tax site powers; or if the OBC has been conditionally approved subject to as yet un-fulfilled conditions relating to that tax site.

2.2.4 The Tax Site Process will not introduce additional criteria beyond those outlined in the Bidding Prospectus. Please see Sections 5 and 14 for further guidance.

2.3 The Customs Site Process

2.3.1 Each Green Freeport customs site will need to be approved by HMRC prior to designation. This will involve HMRC checks to ensure the operator is legitimate, the location is secured, and that the businesses operating within the customs site are complying with relevant security standards.

2.3.2 Businesses wishing to access the customs benefits of a Green Freeport will need a separate Green Freeport Business Authorisation from HMRC. Further information can be accessed here.

2.4 Guidance

2.4.1 The purpose of this document is to inform prospective Green Freeports’ work over the coming months by setting out:

- how the business case, tax, and customs processes will operate (Sections 2 and 14)

- further detail on the policy and delivery models, to help inform the development of Green Freeport proposals (Sections 3 to 11)

- both governments’ expectations for the content of the OBC and FBC (Section 13)

- the support available to Green Freeports as they undertake the setup phase (Section 15)

2.4.2 Business Cases should be developed using this guidance document and in line with The Green Book. Business Cases that are better aligned with the governments’ expectations are likely to be approved more quickly.

2.4.3 Green Freeports should also refer to the following supplementary guidance:

- links to technical guidance for the Green Freeport tax measures and reliefs will be published on GOV.UK on or before the date the respective relief/allowance is available to claim

- additional guidance on operating a Green Freeport customs site

3. Seed capital funding

3.1.1 Green Freeports will have the opportunity to access a maximum of £25m of seed capital funding upon approval of an FBC and agreement of a Memorandum of Understanding (see 3.1.11), although all funding is subject to the outcome of future Spending Reviews.

3.1.2 Seed capital will be awarded via a non-competitive process, whereby prospective Green Freeports will set out a range of options as part of the economic case of their OBCs. The value of seed capital awarded will be based on an assessment of the strength of each proposed option, the quality of those business cases and the proposals strategic fit with the policy, and affordability constraints given the programme budget envelope. The amount awarded to one Green Freeport will not affect the amount awarded to another.

3.1.3 Seed capital funding will be used to contribute to the governments’ objectives for Green Freeports and address the 3 pillars of the Scottish Government’s Infrastructure Investment Plan, which outlines the Scottish Government’s strategic approach to delivering the National Infrastructure Mission. The three pillars are: enabling the transition to net zero and environmental sustainability; driving inclusive economic growth; and building resilient sustainable places.

3.1.4 Seed capital funding should primarily be spent on:

- land assembly and site remediation – for example, preparing or decontaminating brownfield land within tax or customs sites.

- small-scale transport infrastructure to connect sites within the Green Freeport to each other, the immediate surroundings or other economic assets within the Outer Boundary or the wider Travel to Work Area - for example, building road or rail junctions or extensions to increase access to a tax or customs site.

3.1.5 However, seed capital funding may be spent on other capital works that strongly align with the Green Freeport’s objectives, such as digital or skills (for example, improving internet connectivity or building a training college), in exceptional circumstances. These would be cases where:

- there are especially clear and well-evidenced expected benefits, in line with the Green Freeport policy objectives.

- the investment would not otherwise be forthcoming and/or this would unlock a particularly high level of private sector match funding.

- the investment is well aligned with wider skills/digital initiatives and will not duplicate or fragment this work.

3.1.6 Business Cases will be approved by the Green Freeport Programme Board which has joint representation from the governments. We expect that any funding provided will be matched or part-matched by private sector investment, local authority borrowing and co-funding from other public bodies where relevant.

3.1.7 Business Cases must show how the proposed uses of the seed capital funding:

- require public investment and would not materialise or would deliver the policy objectives to a significantly lesser degree without it

- will maximise the impact of other Green Freeport levers (for example, by addressing marginal viability gaps for a tax site)

- can be delivered at pace – we expect seed capital funding to be used for projects deliverable in the short-term and that longer-term public investment projects within the Green Freeport will be financed using retained non-domestic rates

- align with wider investments, initiatives, or strategies in the Green Freeport geography such as Regional Economic Strategies, Local Development Plans, Skills Development Scotland strategic plans, spatial strategies and national, regional and local transport plans (see Section 4)

- support clean growth where possible and are compatible with both governments’ Net Zero ambitions (see Section 9)

3.1.8 Capital funding will be paid to the accountable body in each Green Freeport coalition in annual tranches. The accountable body will be responsible for ensuring that all relevant regulations and best practice standards (including those governing public procurement) will be met in the use of seed capital and that Value for Money and the policy objectives will be delivered. To achieve this, the accountable body should take the individual seed capital projects through local assurance/business case processes and these should be detailed in the business case submitted to the governments.

3.1.9 The projects should nonetheless be set out in detail in the business case submitted to the governments, including the approaches that will be taken to procurement, contract management, and risk transfer to provide assurance that all relevant regulations and best practice standards will be met and that VfM and the policy objectives will be delivered. Much of this information may be drawn from existing procurement policies and these may be submitted as annexes.

3.1.10 Prospective Green Freeports are required to show in their Business Cases that subsidy control has been considered by the accountable body with regards to the use of capital and revenue funding as well as non-domestic rates relief and retention and demonstrate how any associated risks will be managed. This should draw on the subsidy control guidance for public authorities.

3.1.11 We expect to make the first payment to each Green Freeport shortly after its FBC has been approved and a Memorandum of Understanding agreed with the governments formalising the commitments and content in the FBC. Subsequent payments will be subject to annual assurance reviews which will focus on overall Green Freeport delivery.

4. Complementary initiatives

4.1.1 Green Freeports are one regenerative tool among many and impact can be maximised by aligning a Green Freeport with other public interventions in the local area.

4.1.2 One of the factors critical to Green Freeports’ successful delivery is the development of a strong value proposition, including the availability of appropriate skills, infrastructure, and land to investors. Therefore, the most successful Green Freeports will be those complemented by initiatives in each of these areas.

4.1.3 Green Freeport interventions should build on and complement other local growth funding. If the Green Freeport geography is in receipt of any of the below funds, they should set out the strategic links between their Green Freeport and the fund, including how knowledge and partnerships developed through the delivery of the fund will inform Green Freeport delivery:

- City and Growth Deals

- Levelling Up Fund

- Community Renewal Fund

- other local growth funding

4.1.4 We expect prospective Green Freeports to develop, and fund (through retained non-domestic rates, for example) or seek funding for, proposals that align with the governments’ policy objectives. This includes, but is not limited to, initiatives in the following areas:

- Regeneration – A key goal of Green Freeports is regeneration; aligning regenerative interventions and supporting emerging industrial clusters will increase impact.

- Fair Work – Supporting the creation of high-quality employment opportunities, attracting companies to locate in the area, and embedding fair work practices in line with the Scottish Government’s Fair Work First approach.

- Skills – Enhancing the local skills base and aligning the skills available in the local labour market, including support for upskilling, to investors and sectors being targeted.

- Net Zero – Green Freeports must support the Scottish and UK governments’ climate change ambitions and Scotland’s National Just Transition Outcomes while increasing the job opportunities in green sectors.

- Trade and investment – Green Freeports should be hubs for global trade and investment, further internationalising our economy, generating sustainable trade growth and enabling trade processes to become easier and more efficient.

- Innovation – Green Freeports should focus private and public-sector investment in research and development; be dynamic environments that bring together innovators to collaborate in new ways, while offering controlled spaces to develop new ideas and technologies; and draw on existing innovation support systems.

- Transportation – The ability of Green Freeports to deliver the policy objectives of increased trade throughput and investment will both rely on suitable and sustainable transport infrastructure being in place, as a key component of the Green Freeport’s value proposition to exporters and investors

- Land remediation – Green Freeport tax measures should be targeted at underdeveloped land, which in many cases will require remediation or assembly to become viable for prospective investors.

- Mitigating displacement – Initiatives to mitigate against displacement of economic activity from elsewhere will be key to demonstrating the additionality of the Green Freeport.

5. Tax

5.1 Purpose and scope

5.1.1 The Green Freeport tax measures will be a key driver of the programme’s impact and have been designed with the intention of helping sites attract private investment and deliver the objectives of the Green Freeports policy. Green Freeports and their partners, including tax site landowners and investors, should be clear on the policy intent underpinning the tax reliefs and understand that they will be asked to demonstrate the appropriateness of their proposed tax sites (including robustly evidencing underdevelopment and investment viability gaps). They must also outline the concrete and specific steps they will take to ensure the tax sites deliver on the policy objectives to the greatest degree possible.

5.1.2 The governments recognise landowner sovereignty and that in most cases the Green Freeport itself will not be a landowner and so will not enjoy direct control over tax site land. However, to the extent that tax sites are in receipt of government support in the form of tax relief and that this support is an inseparable part of a wider Green Freeport package, the governments and the wider Green Freeport coalition has a legitimate interest in what takes place on those sites. Green Freeports must therefore set out a suitably robust strategy for managing their tax sites that, whilst recognising landowner sovereignty, gives the governments, wider Green Freeport partners, and local populations confidence that the Green Freeport tax reliefs will deliver investment that:

- aligns with the Green Freeport’s strategic focus (i.e., it belongs to the target sector(s) so will contribute to clustering)

- is creating new economic activity, rather than displacing it from elsewhere, and would not have otherwise invested (i.e., they constitute additionality)

- and has as many of the following characteristics as possible:

- brings high-quality, high-GVA jobs

- carries with it high innovation and research and development potential

- is likely to drive increased trade throughput

- contributes to the local skills ecosystem (for example, through apprenticeships)

- has high social value

- contributes to the decarbonisation of the Green Freeport

- contributes to the operating costs of the Green Freeport

5.1.3 Green Freeports’ tax site management strategies must set out in detail how (against what criteria and by whom) investment will be appraised for its alignment with the above considerations and the specific and concrete steps that will be taken (by the Green Freeport governing body and by landowners) to encourage well-aligned investment and prevent poorly aligned investment. Green Freeports will be expected to monitor and report on the efficacy of their tax site management strategies.

5.1.4 The governments consider the use of contractual agreements, formalising the obligations of landowners and the Green Freeport governing body under the tax site strategy, to be best practice and can support with the development of these agreements. Alternative arrangements must be fully justified, and a compelling case made that they can provide the equivalent level of confidence in the delivery of the policy objectives.

5.1.5 As outlined in the Bidding Prospectus, the Green Freeports offer will be subject to our domestic and international subsidy control obligations. Businesses located in designated tax sites will need to fulfil any requirements in place to ensure compliance with those obligations in advance of, during, and after claiming relief.

5.1.6 All technical guidance for the operation of Green Freeport tax measures and eligibility will be published on gov.uk on or before the date the respective relief/allowance is available to claim. You can view the following published guidance on gov.uk for eligibility:

- claiming National Insurance relief in Green Freeport tax sites

- claiming the enhanced capital allowance relief in Green Freeport tax sites

- claiming enhanced structures and buildings allowance relief in Green Freeport tax sites

5.1.7 HMRC, local authorities and other government departments are unable to provide individual tax advice regarding a business’ eligibility to tax reliefs available in Green Freeport tax sites and if they are unsure whether they will qualify for a relief it is essential to obtain independent legal advice.

5.2 Changes to tax sites

5.2.1 We may require changes to tax sites where these are needed to meet the requirements set out in this guidance and the Bidding Prospectus. Revised proposals will be developed with Green Freeports.

5.2.2 Green Freeports may suggest minor changes, which will need to be agreed with the governments, where there is a strong case, in line with the policy objectives, for doing so and the revised site(s) meet the requirements set out in this guidance and the Bidding Prospectus. All proposed changes will be assessed on a case-by-case basis.

5.2.3 More substantial changes will only be considered where there is an exceptionally strong case, which shows the change(s) will significantly increase the ability of the proposal to deliver the policy objectives.

6. Non-domestic rates retention

6.1 Purpose and scope

6.1.1 Local authorities will be permitted to retain the non-domestic rates growth on Green Freeport tax sites above an agreed, pre-designation baseline, minus a displacement factor to be agreed between the local authorities and the governments (see 6.1.8). This retention will be guaranteed for 25 years, giving local authorities the certainty, they need to borrow to invest in regeneration and infrastructure that will support further growth. Information on the administration of the retention scheme will be set out in the Green Freeports Non-Domestic Rates Retention guidance.

6.1.2 This non-domestic rates retention is a consequence of Green Freeport status and therefore the governments expect all non-domestic rates retained on Green Freeport tax sites will be used for purposes associated with the Green Freeport. Exclusions will only be by exception, including any proposed provisions relating to counterfactual non-domestic rates growth that would be retained locally in the absence of the Green Freeport.

6.1.3 The local authority/authorities will remain accountable for the use of the retained non-domestic rates (as public funds), and the strategic direction for the use of retained non-domestic rates should be set by the Green Freeport governing body.

6.1.4 The pooling of retained non-domestic rates from Green Freeport tax sites by local authorities is considered, by the governments, to be the approach most likely to enable the policy objectives to be realised. Pooling of retained non-domestic rates across local authorities can enable expenditure to be made where it is most impactful, which may not be in the local authority or authorities in which the revenue has been raised. Where alternative arrangements are proposed, these should be fully justified in terms of the policy objectives.

6.1.5 Retained non-domestic rates should be used to promote the Green Freeport’s objectives within the Green Freeport geography or wider Travel to Work Area and for activity that: would not otherwise occur; demonstrably requires public funding; and is most appropriately funded from retained non-domestic rates, rather than other public funding pots.

6.1.6 Income from retained non-domestic rates growth should primarily be used to fund:

- Green Freeport operating costs

- physical and/or digital infrastructure that will facilitate investment in the Green Freeport area

- land assembly and/or site remediation works that will facilitate investment in the Green Freeport area.

- skills and workforce development

- innovation initiatives

- regeneration and/or the development of ‘live work play’ assets within the Green Freeport Travel to Work Area.

- mitigating any displacement and/or negative externalities associated with the Green Freeport

- activity in support of the Green Freeport’s Net Zero ambitions

- the delivery of Green Freeport-specific planning measures

6.1.7 Alternative proposed uses of retained non-domestic rates should be clearly articulated and justified.

6.1.8 While the location of proposed tax sites should be chosen with the intention of minimising displacement of economic activity from wider local areas, a small amount of displacement may nevertheless occur. Green Freeport governing bodies should propose appropriate displacement factors for their tax sites to be considered when calculating the non-domestic rates to be retained. This displacement factor should match the assumption for displacement used in the Economic Case.

7. Planning

7.1 Purpose and scope

7.1.1 A key outcome for the Green Freeports policy is increased investment within and around Green Freeport geographies. The governments expect Green Freeports to be delivered at pace. A planning policy environment which supports this ambition is important and business cases that include innovative and forward leaning development proposals are therefore strongly encouraged. Green Freeports should play an active role in supporting their planning authorities to explore such options.

7.1.2 The Scottish Government has consulted on amending permitted development rights for ports in Scotland to ensure a level playing field with those located in England. Following this consultation, a statutory instrument bringing the changes into effect was laid in the Scottish Parliament on 10 February and came into force on 31 March.

7.1.3 A number of place-based tools could be used to inform the delivery of appropriate development in Green Freeport areas by providing greater planning certainty and enabling streamlined decision-making. These include Simplified Planning Zones and processing agreements, and new mechanisms like Masterplan Consent Areas (MCAs). The Planning (Scotland) Act 2019 introduces new powers for planning authorities to designate Masterplan Consent Areas. Building on existing provisions for Simplified Planning Zones, MCAs are intended to be a proactive tool for planning authorities to use to promote investment. Such tools may enable planning authorities to take a more strategic approach to Green Freeport development. The Scottish Government has committed to commencing work on the required regulations for planning authorities to prepare MCA schemes in 2023, as part of its ongoing planning reform work programme. We would expect Green Freeports to support any costs associated with the delivery of these types of measures through, for example, retained non-domestic rates or business contributions.

8. Customs

8.1 Purpose and scope

8.1.1 The Green Freeports customs model has been designed to support businesses within the Green Freeport area to engage in international trade and has a key role to play in helping Green Freeports achieve the policy objective of becoming hubs for global trade and investment.

8.1.2 The model builds on existing customs facilitations of tariff and nontariff benefits, making Green Freeports attractive for businesses and supporting them to boost their international competitiveness. Green Freeports and businesses within them can take advantage of the flexibility in the customs model, which permits multiple customs sites with economic links to ports.

8.1.3 Businesses importing non-GB goods into a Green Freeport customs site will benefit from the following:

Tariff benefits:

- duty suspension – i.e., no import duties to be paid on non-GB goods brought into a customs site, until they enter the GB domestic market

- duty flexibility – where declaring goods to the GB market, the ability to calculate import duties based on the value of inputs or finished product, whichever is most beneficial to the business (unless goods are subject to anti-dumping duties, in which case duties are calculated on inputs to avoid circumvention)

- duty exemption for re-exports – unless subject to duty drawback clauses under the relevant Free Trade Agreement, no import duty is paid

Non-tariff benefits:

- simplified import declarations - either:

- a declaration to the Green Freeport procedure at the port using a simplified declaration under a Green Freeport business authorisation. This is separate from the existing Simplified Customs Declaration Procedures

- movement from the port to the Green Freeport customs site via Internal Movements in Temporary Storage (iMiTS) with declaration “by conduct” into the site

- no supplementary declarations needed for goods declared to the Green Freeport procedure under a Green Freeport business authorisation

- movement “by conduct” between Customs sites within a Green Freeport or between UK Freeport Customs Sites where a business authorisation is held. This also includes movement between Green Freeports and Freeports in England and Wales, once operational.

- ability to move from another special procedure to the new Green Freeport procedure using declaration “by conduct”

- all covered by a single authorisation, meaning less contact with HMRC

8.1.4 For each customs site, a single ‘Customs Site Operator’ (CSO) must be authorised by HMRC before the site can operate. Businesses must then be authorised to use the Green Freeport special procedure on the customs site. Multiple businesses can be authorised to operate under a single CSO within a customs site or the CSO can act as both the operator and the business.

8.1.5 A prospective CSO must have the support of the Green Freeport governing body to apply for authorisation by HMRC before HMRC will consider its application. Green Freeports should define clear and transparent processes and criteria, rooted in their objectives, for deciding whether to support a prospective CSO application.

8.1.6 Green Freeports are expected to proactively engage with potential CSO and end user businesses to deliver customs sites that will contribute to the Green Freeport achieving its objectives. This should include exploring how customs sites can be used to support supply chain colocation and clustering around the Green Freeport tax sites and how they can be used to extend Green Freeport customs benefits to businesses that have not previously been able to access these trade facilitations or engage in international trade at all.

8.2 Site operator authorisation

8.2.1 HMRC has published guidance on the responsibilities of Green Freeport CSO, the customs site authorisation process, and how customs sites will operate. [footnote 1]

8.2.2 As set out in the Bidding Prospectus, Green Freeports are required to have at least one customs site. Prospective Green Freeports must therefore ensure that at least one prospective CSO, with a realistic proposition, has completed HMRC’s registration of interest form and begun conversations with HMRC about getting their site(s) designated; this is a condition of OBC approval. At least one customs site within the Green Freeport will need to be designated by HMRC before the FBC can be approved.

8.2.3 For a customs site to be designated, HMRC must be satisfied that the conditions set by them have been met by the applicant CSO. These conditions include the site having provisions for the necessary infrastructure (e.g., IT systems), meeting security standards (e.g., perimeter security and controlled access), and complying with reporting requirements. Further guidance on this is available. The time taken for customs sites to be authorised and designated will depend on how quickly the applicant CSO can successfully meet the requirements and having the necessary measures put in place. If customs sites are not ready in time, this will delay FBC approval.

8.2.4 Customs sites will not be authorised unless they demonstrate an economic need for the authorisation, for example by providing clear evidence of businesses wanting to operate in the customs site and making use of the Freeports customs procedure available within a reasonable timeframe (a reasonable timeframe is defined as within 12 months from the time of designation of the customs site, unless a strong case can be made for slower delivery timescales and is subsequently approved by HMRC).

8.2.5 The Green Freeport CSO will be jointly and severally liable with the declarant for any import duty arising in instances where a breach of the operator’s conditions of designation occurs and which leads to import duty liability arising.

8.3 Changes to customs sites

8.3.1 The governments expect Green Freeports to aim to deliver all of the customs sites outlined in the original Green Freeport bid as soon as possible and to set out timescales for the delivery of each site in the Business Case. However, it is appreciated that Green Freeports’ strategic and commercial circumstances may evolve and that plans (as articulated in the original Green Freeport bid or in the Business Case) may need to change accordingly. The Business Case should explain and justify any reduction in the number or size of customs sites or delays to delivery as compared to the original bid. Where a site cannot currently be delivered, the Business Case should set out what conditions would need to be met for this to become possible.

8.3.2 Where circumstances change and these are likely to lead to a reduction in the number or size of customs sites or delays to delivery, Green Freeports should engage their lead government contacts in the first instance.

8.3.3 Designation Orders for customs sites are geographically linked. If changes are approved to the area covered by the Designation Order, the relevant permissions from HMRC and HMT will need to be sought and will need an amended CEMA Designation Order. Under the terms of the Orders, the Operator will also need to seek permission from HMRC for the construction of new buildings on site.

8.3.4 Prospective Green Freeports are welcome to propose customs sites additional to those included in the original bid during the setup and delivery phases and should contact their lead government contacts, before submitting a registration of interest to HMRC. The rationale for further sites will be assessed on a case-by-case basis.

9. Net Zero

9.1 Scope and purpose

9.1.1 Green Freeports and the businesses within them will play an important role in Scotland and the UK’s path to net zero by adopting high environmental standards and through attracting investment in green industries, creating green jobs and reducing greenhouse gas emissions. Green Freeports will contribute to realising the outcomes set out in Scotland’s National Performance Framework in accordance with Scotland’s Climate Change Plan. This means supporting Scotland’s just transition to a net zero economy by 2045, reducing emissions and responding to climate change in a way that is fair for Scotland’s workers and communities.

9.1.2 Both governments expect prospective Green Freeports to contribute towards net zero ambitions and, where appropriate, to be in line with local and/or sectoral carbon emissions targets.

9.1.3 Green Freeports and the businesses within them, where appropriate, may wish to seek wider funding available through both governments to support their decarbonisation efforts such as:

- the Net Zero Hydrogen Fund

- the Zero Emission Vessels and Infrastructure Fund

- the CCUS Cluster Sequencing Competition

- the Scottish Industrial Energy Transformation Fund

- Zero Emission Mobility Innovation Fund

- Emerging Energy Technologies Fund - Hydrogen Innovation Scheme

9.1.4 Green Freeport investments, especially those supported by Green Freeports seed capital, should therefore support clean growth and the just transition to net zero where possible and, as a minimum, must not conflict with the achievement of Scotland’s legal commitment to cut greenhouse gas emissions to net zero by 2045 or UK’s legal commitment to cut greenhouse gas emissions to net zero by 2050.

9.1.5 We expect prospective Green Freeports to be ambitious about net zero and envisage 3 levels that they might aspire to:

- Minimum standard: Development of a robust decarbonisation plan and creation of a steering group with local partners which includes the setting of carbon emissions reduction targets towards net zero for business sites associated with the customs and tax sites within the Outer Boundary of the Green Freeport and additional infrastructure associated with the sites.

- Medium level: Able to demonstrate emissions reduction towards net zero across all aspects of the target sectors across the wider region by alignment with relevant local net zero plans, including both business and public sector emissions.

- Higher Ambition: Acting as an exemplar whereby working with local partners delivers a net zero emissions target for the area covered by the Green Freeport’s outer boundary and wider region significantly ahead of 2045.

9.1.6 All three levels of ambition will require:

- ongoing monitoring and assessment of progress towards net zero (i.e., ‘carbon performance benefits realisation’) within the Green Freeport geography. This should demonstrate an understanding of the main sources of direct and indirect emissions within the area and how these are currently being measured

- clear milestones, targets, and deadlines for achieving net zero emissions (these should reflect interim targets) and a plan for monitoring progress against them and reporting on them to the governments and local partners in accordance with any extant statutory reporting deadlines

- a plan for engaging and collaborating with relevant local partners

- a plan for how the carbon emissions of investments funded by Green Freeports seed capital will be minimised at the start and reduced to net zero by 2045

- a plan for investing and attracting further investment in Clean Growth/Net Zero technologies and supply chains

- a plan for providing an increased number of jobs or improvement in the skills base in the green economy

- a sustainable procurement policy as defined in the Procurement Reform (Scotland) Act 2014. e.g. using PAS 2080, demonstrating compliance with the balanced scorecard, any applicable procurement policy notes)

9.1.7 At the OBC stage prospective Green Freeports are required to provide a high level draft decarbonisation plan at Annex E. This should be fully developed at the FBC stage, when prospective Green Freeports are expected to provide a detailed robust decarbonisation plan at Annex E. The plan must meet the requirements set out below and set the Green Freeport’s level of ambition on Net Zero (see Section 9.1.5 and 9.1.6).

9.1.8 In accordance with HM Treasury Green Book requirements, the carbon emissions impact of the Green Freeport should be estimated and included in the OBC economic case.

9.1.9 A review of the Green Book was published by HM Treasury in November 2020 that included updated guidance on the appraisal of projects, programmes and policies based on their alignment with net zero carbon emissions targets. Sections 3.6 to 3.7 of the updated guidance include the requirement to include the carbon emissions impact from all projects in the economic case:

3.6 Furthermore, even where progressing the net zero target is not the primary objective of a proposal, appraisers should consider whether it acts as a relevant constraint. Any environmental or carbon emissions impacts should also be captured in the economic case.

3.7 Carbon emissions should be assessed using the approach set out in BEIS Carbon Values. These values are calculated as the cost of removing an additional tonne of emissions from the atmosphere calibrated to a path of emissions consistent with meeting the UK’s legal targets.

9.1.10 The Green Book update in March 2022 incorporated recent associated HM Treasury guidance on valuing carbon, including the following clarification:

Greenhouse gas (GHG) emissions occur as a result of many decisions to create assets or provide public services, particularly where direct energy consumption is required. They may also result from the energy required to produce basic input materials used in construction. The creation of GHGs has a social cost based on its contribution to climate change.

To estimate the social cost of an intervention it is necessary to include the costs of emitting GHGs. Energy efficiency has a direct social value, in addition to the value of a reduction in GHGs, as the energy saved itself has a direct benefit to society (similarly, activities that create extra demand for energy have a direct energy cost).

9.1.11 The following key points are drawn from Green Book carbon requirements for the completion of Green Freeport OBCs:

- The whole life carbon emissions impact for proposed Green Freeports should be assessed and quantified, e.g. in tonnes of carbon dioxide equivalent. The level of detail will increase from Outline to Full Business Case; however carbon estimation is expected at both stages (whenever cost can be estimated, so can carbon to a similar degree of accuracy);

- The carbon emissions impact should be converted to an economic value using the approach set out using the BEIS Carbon Values. This calculated value represents the cost of removing the carbon emissions predicted to result from the project from the atmosphere, also known as the ‘abatement’ cost;

- The carbon emissions impact economic value for options appraised within the business case should be included in the OBC (and FBC) Benefit Cost Ratio (BCR) calculations within the Economic Case.

9.1.12 HM Treasury Green Book carbon requirements for business cases are currently being applied across the Scottish City Region and Growth Deals with technical support from the Scottish Government. Similar support is anticipated to be available for authors of Green Freeport business cases. Further detail on the application of Scottish Deal requirements is available in an associated guidance document.

10. Trade and Investment

10.1 Scope and purpose

10.1.1 Establishing Green Freeports as hubs for global trade and investment is a key policy objective of the Scottish Green Freeport programme and is a foundational activity that underpins the realisation of the other three programme objectives. The economic impact that trade and international investment has on host economies is well established and includes the establishment of new industries, the leveraging and enhancement of existing economic activity, increased quality of opportunity for employment, higher wages, productivity gains, increased exports, and regeneration of communities.

10.1.2 Green Freeports will therefore, as part of their overall economic strategy, need to define and develop at the OBC stage a considered and deliverable trade and investment (T&I) strategy that sets out the place of T&I within the short-, medium- and long-term economic plan to deliver a sustainable Green Freeport. This strategy will demonstrate how the Green Freeport will engage with and attract overseas investors and support businesses within the Green Freeport area to trade internationally. This strategy should be rooted in a strong vision at both Green Freeport and site-level and should complement and align with wider activities, including landowners’ own marketing and regional and national investment promotion and export support functions. The Green Freeport and its constituent parties will need to exercise ownership in developing and delivering this strategy, but can expect government support alongside this, where additive, as detailed below. The T&I strategy should define sectorial and regional priorities (markets), it should also show how and where the Green Freeports will interface with Scottish and UK government bodies in the promotion of the Green Freeports. The strategy should also define the resources and governance structures within the Green Freeports to support T&I activities.

10.1.3 Green Freeports should at an early stage, and in advance of OBC submission, review and deepen the relevant content from their original bids, considering which sectors, supply chain components, and markets would form a credible focus for the Green Freeport’s investment attraction activity given the strengths of the local area and Green Freeport tax sites (including consideration of local infrastructure, existing supply chains, and labour markets). The OBC should provide supporting evidence for the Green Freeport’s sectorial choices, aligned with statistical data on the barriers to success in the delivery of the Green Freeport’s T&I ambitions. This may include local skills, supply chain gaps and technology gaps that might restrict investment into the Green Freeport.

10.2 Implementation

10.2.1 Trade and Investment support is provided primarily in Scotland through the delivery of the Scottish Government’s internationalisation plans, in Scotland: A Trading Nation Shaping Scotland’s Economy: Inward Investment Plan and Investing with Purpose: Global Capital Investment Plan. These evidence-based strategies identify Scotland’s strengths and prioritised opportunities for economic development and are underpinned by a values-led and aligned approach to trade and investment articulated in the Scottish Government’s Vision for Trade.

10.2.2 The Scottish Government and its enterprise agencies (EAs), including Scottish Development International (SDI) on behalf of the EAs, will work with the Department Business and Trade (DBT) to provide support on:

- Capacity building:

- ensure Green Freeports take full advantage of existing services in Scotland and from DBT, as signposted by the EAs and DBT’s Scotland and Freeports teams

- provide strategic advice to Green Freeports throughout the development of the OBC and FBC

- Promotional strategy:

- support the Green Freeports in the formulation of a unique investment proposition, rooted in the Green Freeport’s strengths, objectives, and the characteristics of its sites

- support the Green Freeports in the development of associated marketing collateral and integrate this into existing government investment promotion campaigns, including DBT’s GREAT campaign, the UK’s Investment Atlas, and SG’s Scotland is Now, and the operations of DBT and SDI’s international network

- support Green Freeports to develop an investor communications and engagement plan and to maximise communications opportunities, including at high-profile domestic and international events and through the governments’ communication channels and visits

11. Innovation

11.1 Purpose and scope

11.1.1 Creating an innovative ecosystem within Green Freeports is key to achieving all four objectives of the Scottish Green Freeport Programme. Green Freeports should be dynamic environments that bring together business and academic innovators to collaborate in new ways, while offering spaces to develop and trial new ideas and technologies.

11.1.2 Innovation is also the cornerstone of sustained economic growth in industry. It allows business to develop and adapt. Supporting the capacity of business within Green Freeports to invest in R&D, including developing the necessary local skills, will be key to the growth of sectoral clusters targeted by Green Freeports. Ultimately this will also lead to local job creation, supporting the main policy objective for Scottish Green Freeports.

11.1.3 Furthermore, to meet Net Zero targets unprecedented innovation will be required. Green Freeports have a key role to play in driving the transition of port operations and port-adjacent manufacturing towards decarbonisation and Net Zero, supporting the development and adoption of low carbon technologies within the port environment and beyond.

11.1.4 The Scottish Government’s National Innovation Strategy will be published in due course and will set out a 10-year vision for Scotland becoming one of the most innovative nations in the world. It will set the Scottish Government’s priorities for innovation and will set out a number of actions to improve our innovation performance, grow our economy, create jobs and bring in investment. The strategy will identify areas where Scotland has the opportunity to become a world leader and will set out a cluster building approach that will allow us to work with those areas to support them in their ambitions and provide tailored packages of support.

11.2 Implementation

11.2.1 Green Freeport innovation strategies should complement, and add value to, the current innovation ecosystem and focus private and public-sector investment in research and development. They should also demonstrate alignment with existing regional and national innovation priorities and strategies, including the Scottish Government’s National Innovation Strategy, UK government’s R&D Roadmap, Innovation Strategy and the Integrated Review.

11.2.2 It is important that Green Freeports are also connected to and complement existing innovation support mechanisms and should consider how their innovation activity can be linked to and draw in support from national (Scottish and UK) innovation support systems. These can include:

- Innovate UK and the funding and business support it offers

- the Scottish Government and its Enterprise Agencies who provide a wide range of innovation funding and support across Scotland

- our university and college sectors who are vital parts of our national innovation system, engaging with, developing and translating new knowledge into the economy

- Innovation Centres, research centres and innovation assets who support companies with product, process and productivity challenges

- Regional Economic Partnerships (REPs) who have knowledge and experience to advise on strategic economic opportunities that will require harnessing investment across public and private sectors

- innovative local businesses

11.2.3 All Green Freeport partners should seek opportunities to access wider innovation funding, examples of which are set out below, and should identify a pipeline of complimentary investment opportunities in and around the Green Freeport geography that have the potential to support the Green Freeport to realise its innovation objectives.

11.2.4 The governments also expect Green Freeports, through their approaches to tax site management (see Section 5.1 above), to actively encourage investment into tax sites that has high innovation and research and development potential.

11.2.5 The governments will support Green Freeports’ innovation ambitions through:

- strategic advice - the governments will: proactively promote funding and policy opportunities to Green Freeports; provide access to relevant teams across both governments; support the development and delivery of Green Freeports’ innovation strategies and communications plans; and provide sector-specific advice and information

- the FREN – Green Freeports will have access to the Freeports Regulation Engagement Network (FREN). The FREN is a network of Freeports and regulators, facilitated by the Department for Science, Innovation and Technology. The FREN operates where there is a clear regulatory barrier to innovation and will aim to provide a channel for Green Freeport governing bodies to engage with regulators. It aims to help firms operating in Freeports and Green Freeports to overcome the regulatory challenges of developing, testing and applying new ideas and technologies. FREN exists to promote opportunities for innovation. It will look to share best practices and lessons learned on enabling innovation through regulation across Freeports and Green Freeports and provide support on regulatory issues, by sharing guidance and existing best practices. Where appropriate, it will seek to work with regulators and establish new regulatory flexibilities to promote the development of new technologies.

11.2.6 Innovate UK: Innovate UK’s Manager for Scotland will be able to provide ongoing connection between Innovate UK and Green Freeports leadership. This may include supporting events that will inspire innovation within Green Freeports and upskilling the Green Freeports where necessary to connect them to existing innovation networks and support (e.g., Innovate UK - KTN, Innovate UK EDGE, Catapults). Green Freeports and the businesses within them, who will play a critical role in the innovation ecosystem of the Green Freeport, may also take advantage of the existing innovation support available through both the governments. This includes, but is not limited to:

- The official Scottish Government “FindBusinessSupport” portal which provides the ability to search for support across Scotland. Scottish Enterprise have developed a searchable database of innovation funding and can provide support to help companies develop applications.

- UKRI’s website outlines current UKRI funding opportunities. Green Freeports should review current UK Government guidance on how to apply for innovation funding. Green Freeports may also be eligible for other, non-UKRI government funding innovation programmes.

- The Innovate UK Knowledge Transfer Network (KTN) is a key delivery partner of Innovate UK and UKRI, providing a unique capability in the UK to support innovation collaboration across business sectors and throughout the UK. The Innovate UK KTN supports collaboration between innovative businesses seeking to connect with partners, customers, suppliers, and the research base in order for them to grow. Some ambitious and innovative SMEs within the Green Freeport may also qualify for support from Innovate UKEDGE, which complements Innovate UK project funding with intensive, specialist-led support for ambitious businesses, providing them with the leadership and management skills they require to scale-up, commercialise, access new markets, and internationalise. Scottish Enterprise are delivering the IUK Edge programme in Scotland.

- The Innovation Hub, established in collaboration between Innovate UK and the British Business Bank, aims to reduce complexity. It can be used to identify available innovation funding and support, including Innovate UK funding for businesses to help them commercialise their ideas.

12. Delivery

12.1 Governance

12.1.1 Effective governance arrangements will be critical to the successful delivery of Green Freeports. Through the Setup Phase, the governments will seek reassurance that these are in place. This will include an initial governance submission setting out arrangements for the duration of the Setup Phase and which will be a precondition of the release of any capacity funding and then a detailed articulation of the long-term, Delivery Phase governance of the Green Freeport through the OBC and FBC. Green Freeports should build on the arrangements originally set out in their bids, but the governments reserve the right to request changes to these.

12.1.2 We expect a high level of continuity between Setup and Delivery Phase governance. Where differences between the two are proposed, Green Freeports should clearly identify, justify, and provide timescales for any changes to governance arrangements for the delivery phase (e.g. new board members, creation of subcommittees, incorporation) or, if no changes are proposed, explain how the existing arrangements meet the demands of that phase summarised at Sections 5a and 5b of the FBC.

12.1.3 The FBC should provide a finalised, detailed statement of the Green Freeport’s long-term governance arrangements and either show that these are already in place or provide a clear plan for implementing them within an appropriate timeframe. It should be cognisant of how the demands on the Green Freeport governing body will change over time (e.g. given the Green Freeport will need to be self-financing in the medium term and how it will evolve accordingly as well as the need to facilitate private sector leadership or a meaningful partnership between private and public sector partners.

12.2 Responsibilities

12.2.1 The Green Freeport governing body is accountable to both governments for the delivery of the Green Freeport proposal as set out in the Business Case. Some elements of delivery will fall directly under the governing body’s control (for example, the governing body and executive team may be directly responsible for marketing and investment promotion activities), whereas others will not (for example, customs sites will be operated by individual CSOs).

12.2.2 The Business Case must make clear where delivery responsibility lies for each aspect of the Green Freeport proposal. This includes, but may not be limited to, planning, innovation, trade and investment promotion, tax site delivery and operation, customs site delivery and operation, the use of retained non-domestic rates, skills and regeneration, alignment with wider initiatives, stakeholder engagement, security and compliance, Net Zero, risk management, and M&E and reporting. Where responsibility does not sit with the Green Freeport governing body, it is incumbent upon the governing body to put in place the necessary mechanisms (e.g. subcommittees within the Green Freeport’s governance structure or commercial agreements) to hold partners to account for delivery.

12.2.3 The governments expect Green Freeport governing bodies to deliver on the content of their FBCs and will agree an MoU with them following FBC approval confirming this expectation and hold Green Freeport governing bodies to account through annual assurance reviews. However, the governments do understand that Green Freeports’ strategic and commercial realities may change over time and that plans may need to evolve accordingly. Green Freeports should discuss any proposed significant changes to their delivery plans with their lead government contacts in the first instance; these will then be subject to a formal change request process.

Memberships

12.2.4 It is crucial that the right partners are involved in the right ways in the Green Freeport’s long-term governance and management arrangements to ensure the above responsibilities can be successfully discharged.

12.2.5 In addition to setting out where accountability and responsibility for all elements of delivery sit, the Business Case must show why the parties involved in the Green Freeport governance and management structure are the right ones and their roles are appropriate.

12.2.6 Green Freeport governing bodies should not exceed 12 members except where there is a strong case for a wider board, which should be made in the Business Case if applicable. Boards should comprise a good balance between the public and private sectors and should continue to feature the key members listed in the Bidding Prospectus, namely:

- a chair

- the port(s)

- the lead local authority (accountable body)

- key landowners (e.g., those owning tax site land) and investors (e.g., anchor tenants)

- all local authorities responsible for statutory powers required for Green Freeport delivery.

12.2.7 Any changes in membership for the delivery phase should be clearly identified and justified in reference to the evolving purpose of the board.

12.2.8 The Business Case must set out the processes and timescales for appointment of a permanent chair, recruitment of delivery/executive team staff, and any procurement/outsourcing of support for governance or delivery roles.

Corporate structure

12.2.9 The Business Case must set out the corporate structure that the Green Freeport will adopt for the delivery phase (for example, company limited by guarantee, Special Purpose Vehicle, unincorporated joint venture) and explain why this structure is most appropriate. This structure should be established as quickly as is appropriate and feasible.

12.2.10 Key documentation setting out this structure (e.g. articles of association, schedules of delegation, terms of reference, contracts, charters, or partnership agreements) and relevant policies (recruitment and remuneration policies, a conflict-of-interest policy, a diversity and inclusion statement, in-kind/related party charges policy, etc.) should be provided in the Business Case.

12.2.11 If a prospective Green Freeport believes the favoured corporate structure cannot or should not be established prior to FBC submission, they should justify this in their Business Case and provide a clear plan for doing so as well as a detailed statement of the how it will operate and the agreements that will underpin it. Rationales will be assessed on a case-by-case basis.

12.3 Resourcing

12.3.1 Green Freeport delivery is locally led and so Green Freeports will be self-funded in the medium term and the Business Case must set out a credible financial plan for achieving this. The governments will work with Green Freeports to help them develop their commercial models, but Green Freeports are expected to consider as a minimum the following options:

- longer-term commitments of financial support from Green Freeport partners.

- charges to those benefitting from Green Freeport incentives (e.g., a ground rent on tax sites).

- offering paid-for soft support services or hard infrastructure to businesses within the Green Freeport area.

- the Green Freeport operating a customs site/customs sites (or subcontracting their operation) on a commercial basis.

- administering a share of the retained non-domestic rates investment fund on a commercial basis.

12.3.2 Funding arrangements are expected to reflect Green Freeports’ character as a partnership between the public and private sectors and should not therefore be overly reliant on public funding.

12.3.3 To support Green Freeports through the Setup Phase and to establish their medium-term commercial and financial models and subject to the outcomes of future Spending Reviews, up to £1 million of short-term capacity funding will be made available to prospective Green Freeports (up to 2025/26; see Section 15.2 for details).

12.3.4 This funding should be used to establish the long-term capability of the Green Freeport, including by meeting costs associated with setting up the Green Freeport’s governance, corporate structure, and executive team. Where Green Freeports are considering using some this funding for contracted support, they should consider whether it would be more efficient to make use of the Hub (see Section 15.3) and will be required to evidence suitable longer-term capability or demonstrate how this will be developed.

12.3.5 We expect private and public sector Green Freeport coalition partners to contribute match funding (cash or in-kind) to supplement central capacity funding in the short-term and to fully fund the operation of the Green Freeport once that funding stops.

12.4 Monitoring and evaluation

12.4.1 To ensure the impact of the programme can be measured, progress monitored and the accountability of public money, the governments will develop a series of frameworks. These include:

- Performance Management and Assurance Framework

- M&E Framework, including Indicators and Guidance

- Site Delivery Framework

12.4.2 An independent evaluation provider will assist in developing the Green Freeports M&E programme. They will be responsible for designing and carrying out the programme-level M&E, assisting on M&E activities and data collection, and ongoing M&E learning and support for the programme. The M&E of Green Freeports will include a combination of process, impact, and VfM evaluation, and will be in line with key principles and practice from the Magenta Book 2020. The M&E of Scottish Green Freeports will likely build upon the plans for the English Freeports M&E, which is described in the Freeports Programme monitoring and evaluation strategy.

12.4.3 Scottish Green Freeports may wish to carry out a local evaluation with a different focus to the programme M&E, however, this is not mandatory.

12.4.4 As part of the programme monitoring, evaluation and assurance requirements, it is expected Green Freeports will be required:

- to engage monthly with their government lead contacts to provide qualitative progress updates

- formally report quarterly on the progress of Green Freeport sites and seed capital projects in a format agreed with their government lead contacts. This will include providing data on the expenditure of public money, the status of sites and projects, risks and delivery milestones

- formally report twice a year on a list of core M&E indicators. These indicators will primarily cover activities, inputs (the resources committed and activities undertaken) and outputs (what is delivered or produced) but may also include outcomes. This reporting will feed into the programme-level evaluation, as well as ongoing monitoring. This process will be as light-touch as possible. Green Freeports will only report on indicators that need to be collected at the Green Freeport level. Other data required for programme M&E will be collected centrally from administrative datasets. The evaluation provider may also conduct qualitative primary level data collection through interviews, focus groups and surveys. The full list of M&E indicators including frequency, definition, metrics, evidence, and baseline requirements will be provided in subsequent M&E guidance

- participate in an annual conversation with the governments to frame the evidence collected through the formal reporting and present updates on the implementation and delivery of the Green Freeport

12.4.5 The release of seed capital funding each year will be subject to Green Freeports satisfactorily completing the reporting and assurance process in full. As part of the assurance regime, each year by 30 November, it is expected the Chief Finance Officer of the Accountable Body will be required to supply the following (templates will be provided), covering the period up to 30 September:

- a written statement detailing the checks that the Chief Finance Officer (or deputies) has taken to assure themselves that the Green Freeport Governing Body has in place the processes that ensure proper administration of financial affairs relating to Green Freeports, ensuring propriety, regularity and value for money are being achieved and that the processes in place are functioning effectively. It should also detail the main concerns or risks identified, and the recommendations made to mitigate those risks

- a letter of assurance to the Scottish Government Accounting Officer confirming that, having considered all the relevant information, they are of the opinion that the financial affairs of the Green Freeport are being properly administered

- details of the checks and assessments completed against the Green Freeport governing body to ensure regular and proper financial decision making

12.4.6 This reporting will ensure the governments are able to effectively monitor the progress of Green Freeports, manage and mitigate risks, ensure VfM, provide accountability for public money and the delivery of a public policy and share lessons learnt and good practice during the lifetime of the programme.

12.4.7 Reporting is likely to take place on the following cycles:

| Frequency | Reporting Period | Due date |

|---|---|---|

| Quarterly site and project progress, financial and risk data | Q1 1 April to 30 June (Q1) Q2 1 July to 30 September (Q2) Q3 1 October to 31 December (Q3) Q4 1 January to 31 March (Q4) |

To be agreed between the Green Freeport and the governments. |

| Bi-annual Indicator reporting | 1 April to 30 September (H1) | 30 November |

| Bi-annual Indicator reporting | 1 November to 31 March (H2) | 31 May |

| Annual Indicator reporting | 1 April to 31 March | 31 May |

12.4.8 Green Freeports will be required to coordinate and resource the formal data reporting and primary level data collection in the Green Freeport. The process/system for reporting will be confirmed in due course. Reporting templates will be provided.

12.4.9 Green Freeports will be required to collect some data from end users (ports, local authorities, landowners, businesses) and so should ensure that reporting and data sharing agreements are set up between them and the Green Freeport Governing Body. These agreements should include an understanding that data will also be shared with the governments and the evaluation provider for M&E purposes.

12.4.10 It is expected that Green Freeports will also be required to collect information on businesses operating in their tax sites.

12.4.11 It is understood some information may be commercially sensitive. The governments and the evaluation provider will work closely with all users to determine the most appropriate data needed for the evaluation. Consideration will be taken to where this is commercially sensitive and appropriate data sharing arrangements set up.

12.4.12 The collection and reporting of this information will play a key role in the evaluation of the Green Freeport measures, including the tax reliefs in advance of their expiration dates.

12.5 Security and illicit activity

12.5.1 The governments are committed to ensuring Green Freeports uphold the UK’s high standards for security and combatting illicit activity and honour the obligations set out in the OECD Code of Conduct for Clean Free Trade Zones and the UK’s Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 and registering with a government-approved supervisory authority to follow anti-money laundering regulations.

12.5.2 Prospective Green Freeports should be cognisant of the following: (1) Green Freeport status may generate certain new security and illicit activity risks, for example those associated with Green Freeport customs sites, tax sites, and infrastructure projects; (2) Green Freeport status may also accentuate some existing risks (e.g., increased port throughput may affect port security risks); and (3) Extant port security risks, even if unaffected by Green Freeport status, constitute reputational risks to the individual Green Freeport and the Green Freeport programme given the high profile of the Green Freeports policy and the reputation of some international Freeport models as hotbeds for illicit activity.

12.5.3 Therefore, the governments require prospective Green Freeports to conduct a security and illicit activity risk assessment with local partners and security stakeholders and demonstrate through their Business Cases that adequate structures and processes are in place for managing all three types of risk. The assessment should encompass risks associated with the Green Freeport ports, tax sites, customs sites and capital works and identify:

- where responsibility for each lies (e.g., with the port operator, with the customs site operator, etc.)

- any mitigations that are already in place (e.g., existing procedures within ports for managing security risks)

- any new, additional mitigations that are required

12.5.4 This must, as a minimum, make clear where responsibility lies for any new, Green Freeport-related risks and their mitigations and include a body within the Green Freeport’s governance structure that brings relevant security stakeholders together on a regular basis to review the security and illicit activity risk assessment. Arrangements should build on, rather than duplicate, existing security provisions. Should their Business Cases fail to do so, prospective Green Freeports and associated stakeholders will need to work with the governments and local enforcement agencies to implement appropriate governance arrangements and risk assessments.

12.5.5 Green Freeports will be required to undergo an annual audit of security measures in place and any breaches, conducted in partnership with the governments. The practicalities of the annual security review will be confirmed following FBC approval, but a higher quality risk assessment in the FBC is expected to result in a more straightforward process. This review of security arrangements will be separate from ongoing HMRC compliance processes to audit Customs Site Operator compliance.

12.5.6 If further costs associated with mitigating security risks are identified through the risk assessment process (e.g., a need for additional policing is discovered), the Financial Case should set out how these costs could be met from within the Green Freeport coalition and the prospective Green Freeport should discuss these with both governments.

12.5.7 Independently, Green Freeport customs site operators will also need to be authorised by HMRC, in accordance with the process set out at the ‘Apply to be a Freeport customs site operator’ GOV.UK page.

13. The Outline and Full Business Case

13.1 Outline Business Case (OBC) content

13.1.1 The governments expect OBCs to adhere to a structure, which closely mirrors the standard Green Book Five Case Model (PDF, 1.82 MB)

13.1.2 A strong OBC gives the reader a good understanding of the Green Freeports objectives and the activities that will achieve these (the Strategic Case), the benefits and costs of the possible intervention options (the Economic Case), how the Green Freeports interventions will be financed (the Financial Case), how contracts and procurement will be handled (the Commercial Case), and how successful delivery of the Green Freeport will be ensured (the Management Case).

13.1.3 The OBC should be written in plain, jargon-free English and should be frank and realistic about the benefits, risks, and challenges associated with delivering the Green Freeport, avoiding optimism bias.

13.1.4 The OBC should be no more than 85 pages, excluding annexes and the FBC no more than 110 pages, excluding annexes. Green Freeports are encouraged to adhere to the page limits but will not be penalised for slightly exceeding this. All of the information requested in the OBC guidance and form should be provided and the key information should be included in the main body of the OBC, but detail such as tables of figures can be supplied as annexes. The level of information requested at the OBC stage under each case gives a good indication of how to weight the page count across the cases, but we will not mandate particular lengths for different sections.

13.2 Full Business Case (FBC) content

13.2.1 Through the FBC, prospective Green Freeports must:

- address all OBC actions. This includes critical actions, which must be completed prior to OBC approval and will be communicated as OBC assessment progresses, and substantive actions, which can be addressed in the FBC and will be communicated in the OBC approval letter

- update the content of the OBC, to ensure the most up-to-date and detailed information available is provided throughout. The FBC should not substantially depart from the OBC and changes should be discussed with prospective government lead contacts ahead of submission

- provide some information that was not needed at the OBC stage, detailed below

13.2.2 The FBC should therefore be an iteration of the OBC, rather than a distinct document. It should be the definitive source of all information requested as part of the Business Case Process and so should contain all the content of the OBC – updated and amended as required by this guidance and governments’ feedback – as well as the additional content required at the FBC stage

13.3 Submission process

13.3.1 Prospective Green Freeports should complete the OBC and FBC returns as Word documents, using the forms provided, and submit via email to their lead government contacts and the Green Freeports mailbox greenfreeports@gov.scot by the deadlines to be notified. The OBC must have been signed off by the Green Freeport governing body, including by the accountable body, prior to submission. The FBC must have been signed off by the Green Freeport governing body, SRO, and lead authority Chief Financial Officer prior to submission and confirmation of this should be provided at the point of submission.

13.3.2 The governments will only begin assessing business cases that are complete and of a suitably high standard. We will return any that fail an initial threshold assessment to prospective Green Freeports for further work.

13.3.3 We are keen to work collaboratively with prospective Green Freeports as they develop their business cases and so prospective Green Freeports should agree a sequence of regular review and feedback sessions with their lead contact. These sessions will be an opportunity to ensure the business case is developing as expected and will reduce the likelihood of significant revisions being needed following submission. We may also bring the two prospective Green Freeports together with government policy experts to share advice and best practice and answer questions about the process.

13.4 Assessment process

13.4.1 Business cases will be assessed by a cross-government panel of policy experts and analysts against the requirements set out in this guidance and the OBC and FBC forms provided. This is expected to take around 6-8 weeks.

13.4.2 We will write to prospective Green Freeports following the OBC assessment either:

- Formally signing off the Business Case, and at OBC stage issuing feedback to be incorporated into the FBC or

- Setting out the key changes needed for formal OBC/FBC signoff and a deadline for completing them.

13.4.3 The governments reserve the right not to proceed with the designation of a prospective Green Freeport that they deem to be making insufficient progress or unlikely to suitably realise the policy objectives. However, they will not ‘fail’ business cases that do not initially receive signoff and will work collaboratively with prospective Green Freeports to make necessary changes to the business case so long as there remains a realistic possibility of them completing the setup phase to a reasonable timescale.

13.4.4 Green Freeport lead contacts will provide feedback on draft OBCs ahead of submission and, where possible, will feed back during OBC assessment so that Green Freeports can begin to action changes. During this period, Green Freeports should also begin considering the requirements of the FBC stage and work in preparation for this.

13.4.5 Green Freeports should share a draft version of their FBCs with their lead contact for comment at least three weeks before submission The governments may conditionally approve FBCs, identifying key actions that need to be undertaken prior to the release of any seed capital funding. There are likely to be standard conditions all Green Freeports must meet annually ahead of the payment of capital and revenue grants, including confirmation from the lead local authority that:

- all necessary legal powers and local and/or third-party funding contributions are in place to deliver the capital projects

- the Green Freeport will meet all M&E requirements and work collaboratively with the evaluation provider

- the Green Freeport will engage with the annual audit of security measures

13.4.6 Following the approval of a Green Freeport’s FBC, we will agree an MoU with local Green Freeport partners covering: (1) the role and responsibilities of the accountable body; (2) the role and responsibilities of the Green Freeport Governing Body; and (3) the planned use of retained non-domestic rates by the Green Freeport.

13.4.7 The MoU(s) will formalise the expectation that the Green Freeport Governing Body delivers the Green Freeport proposition as articulated in the FBC. However, we appreciate that Green Freeports’ commercial and strategic contexts may change, and plans may need to evolve accordingly. There will therefore be provision for the MoU(s) to be amended as needed and agreed.

13.5 Summary of requirements for OBC and FBC

13.5.1 The following table provides a summary of what should be demonstrated and included in the OBC and FBC.

| Section | Summary of what should be demonstrated and included in OBC | Summary of what should be demonstrated and included in FBC |

|---|---|---|

| 1. Strategic Case | ||

| 1a. Strategic rationale | Strategic context incl. economic rationale; why Green Freeport is correct intervention; interdependencies | Update OBC content if the position has changed materially. |

| 1b. Strategic focus | Analysis of key strengths and weaknesses; focus sectors and markets | Deepen OBC analysis |

| 1c. Interventions and levers | ||

| 1ci1. Seed capital | Activities to be funded by seed capital and justifications for them | Provide more detail on activities to be funded by seed capital |