Project Gigabit Delivery Plan - summer update 2022

Published 30 August 2022

Woman on laptop at home

Ministerial foreword

Portrait of Rt. Hon. Nadine Dorries, Secretary of State for the Department of Digital, Culture, Media and Sport

This government is on a mission. We want our country to become a world leader in connectivity, increasing our productivity and competitiveness, boosting our economy in the wake of Covid, and meeting the future demands of our people and our businesses.

Our £5 billion investment in Project Gigabit is the cornerstone for upgrading the UK’s broadband infrastructure. It will help to level up the UK, enhancing people’s life chances, boosting education and job prospects, connecting disparate communities and future-proofing our country for many decades to come.

In the last 12 months the percentage of premises across the UK that can access gigabit connectivity has increased rapidly from 39% to 70%. This is a significant milestone in the progress of our important work and I am proud it has been achieved this summer.

In the months since our spring update, I’ve enjoyed seeing for myself the difference Project Gigabit is making across the UK.

Secretary of State for the Department of Digital, Culture, Media and Sport Nadine Dorries talking to a student at Whitley Village School

In July, I travelled to Cheshire and met teachers and pupils at Whitley Village School, a small primary school where gigabit-capable connectivity has transformed the learning environment. Teaching has been revolutionised by digital technology and we need to make sure all pupils can benefit from the opportunity it brings. While visiting Whitley I was pleased to announce £82 million of joint DCMS and Department for Education (DfE) funding to connect a further 3,000 rural schools, and around 500,000 primary pupils, with lightning-fast gigabit broadband. Such connectivity will transform young lives - children’s opportunities in school should not be predetermined or limited by where they grow up.

Secretary of State for the Department of Digital, Culture, Media and Sport Nadine Dorries at the Royal Cornwall Show

In June, I was at the Royal Cornwall Show, addressing a Country Land and Business Association event and meeting local provider Wildanet. Cornwall is one of the first areas that will benefit from our Gigabit contracts - we’re currently inviting broadband companies to bid for contracts with a funding value of £36 million to bring fast connections to up to 19,000 homes and businesses in many of the hard-to-reach areas of the county.

But it’s really all about delivery from here on in. The first Project Gigabit contract, North Dorset, was signed this August, with more soon to follow in North Northumberland and Teesdale. This is an important moment: it is government investment in rural or otherwise hard-to-reach communities, helping the commercial sector to install at a local level and meeting our levelling-up promises.

As more contracts are awarded in the coming months, we’re also pressing ahead with launching more procurements. Our market engagement is key to their success, and I look forward to seeing suppliers set out their plans and then delivering the connections that will bring benefits to people in hard-to-reach areas in all parts of the UK.

BDUK’s work alongside local councils, suppliers and other key stakeholders remains absolutely key, and the UK continues to enjoy a buoyant telecoms sector: since May, £5 billion has been invested in the market, and more than 25 suppliers have announced or finalised new gigabit-capable broadband deployment plans. We will continue to work closely with them to achieve 85% gigabit coverage by 2025, and as close to 100% as soon as possible thereafter.

It is an extremely exciting time for the sector. I am very proud of the pivotal role BDUK is playing in delivering for the public, and we have recently appointed a new permanent chair, Simon Blagden CBE, to lead the agency as it delivers our critical digital infrastructure projects. This will help us to continue to do what we do best - boosting communities, levelling-up regions and supporting people to thrive wherever they work, learn or live.

Rt Hon. Nadine Dorries MP

Secretary of State for Digital, Culture, Media and Sport

Summary

Across the UK, 70% (ThinkBroadband, August 2022) of premises can now access gigabit-capable broadband, and we remain on track to meet the target of at least 85% gigabit-capable coverage by 2025.

Key achievements in the last quarter:

The UK has now hit 70% gigabit capable coverage according to independent website ThinkBroadband. This puts the UK on track for reaching 85% gigabit capable connectivity by the end of 2025, and is up from 42.4% in August 2021

On 25 August we signed the first Project Gigabit contract in North Dorset with the broadband supplier Wessex Internet. Up to 7,000 premises will be connected across the county. It marks a significant moment for Project Gigabit, as the first in a long pipeline of contracts to be signed and work commencing on delivering improved digital connectivity across hard-to-reach communities. In the coming months, we expect to award further contracts in Teesdale and North Northumberland

We launched a local procurement and a regional procurement in Hampshire, and two local procurements in Shropshire, that will extend gigabit-capable connectivity to up to 118,000 premises

We announced a joint £82 million investment with the Department for Education to help connect 3,000 schools to gigabit-capable broadband

We published new research on the use of our Gigabit Broadband Voucher Scheme by small and medium sized enterprises (SMEs) which found over 80% reported an increase in productivity as a result of their upgraded connection, and 70% said the upgrade helped them adapt and continue to do business during the pandemic

To date, over 73,000 vouchers have been used to connect premises to a gigabit-capable broadband connection under the Gigabit Broadband Voucher Scheme

We published our 2021 to 2022 Performance Report. From next year, this will be included in our Annual Report and Accounts, and will report on our performance against our Corporate Plan, published in April 2022

Progress towards a gigabit UK

To help provide clarity on the rate and breakdown of gigabit-capable broadband growth, the following graphs outline the overall gigabit-capable coverage across the devolved nations and regions, in urban and rural areas, by supplier, and by residential and business premises. This information is based on two broadband coverage data sources:

-

Independent website ThinkBroadband.com, which provides the most up-to-date information on national coverage, and is used to provide national and regional coverage statistics. This was sourced on 17 August and represents the latest coverage snapshot up to that date

-

Ofcom data collected in January 2022 for its Connected Nations May 2022 report, which is the most up-to-date source of coverage broken down by residential and business premises, as well as rural and urban premises.[footnote 1]

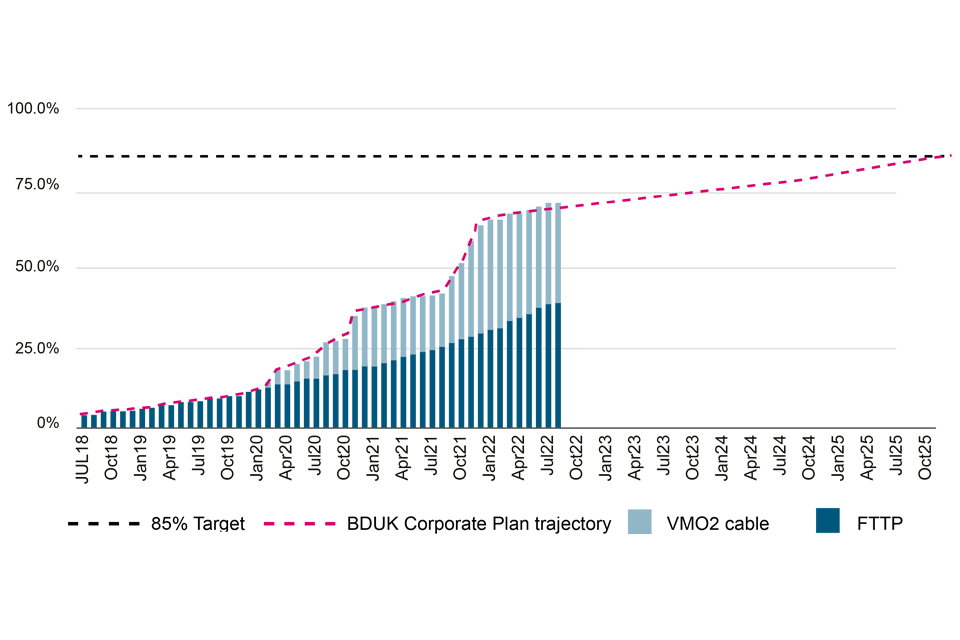

Gigabit coverage across the UK continues to grow with 70% of premises now able to access gigabit-capable broadband (ThinkBroadband, August 2022). The graph below shows how gigabit coverage has increased since July 2018 and our forecast trajectory, combining BDUK and commercial delivery, towards our 85% gigabit-capable coverage target.

UK gigabit-capable coverage by type with trajectory [Source: DCMS analysis, ThinkBroadband. Data is accurate as of 17 August 2022.]

Graph of UK gigabit-capable coverage by type with trajectory

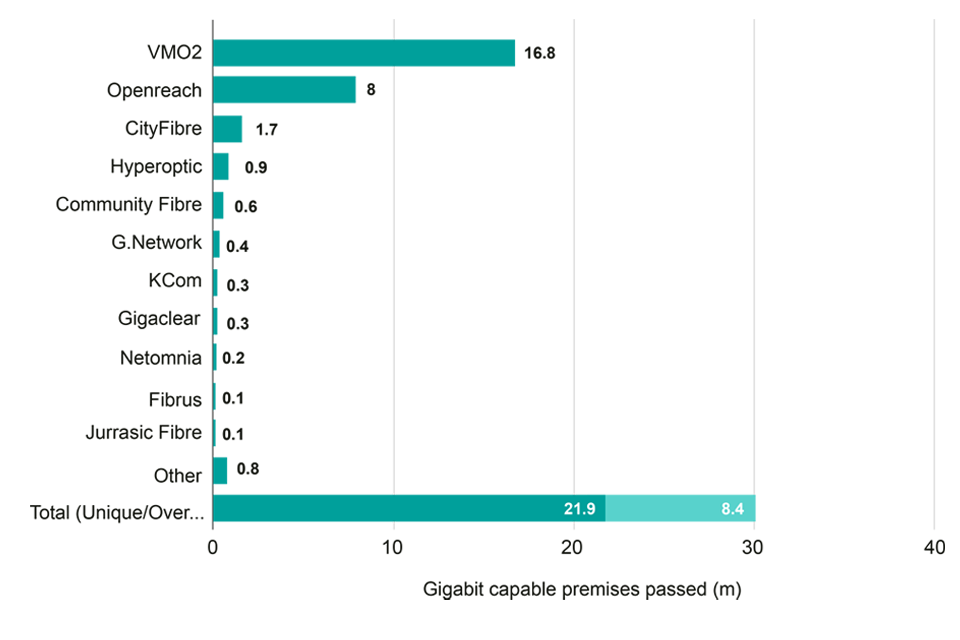

The chart below shows the number of premises passed with gigabit-capable broadband by supplier (rounded). Since we presented this data in the last update, Openreach has added a further 800,000 premises, G.Network a further 200,000 premises and Gigaclear a further 100,000. While VMO2 have been building fibre connections, they have been doing so mostly over the top of their existing gigabit-capable cable and therefore these additional premises connected add little to these figures. The data for this chart is reliant on reporting by operators who do so quarterly; this chart therefore represents the premises passed at the end of quarter one for the 2022 financial year.

Premises passed (million) by a gigabit-capable network, broken down by supplier [Source: Operator Reports. Data is accurate as of 17 August 2022.]

Graph of premises passed (million) by a gigabit-capable network, broken down by supplier.

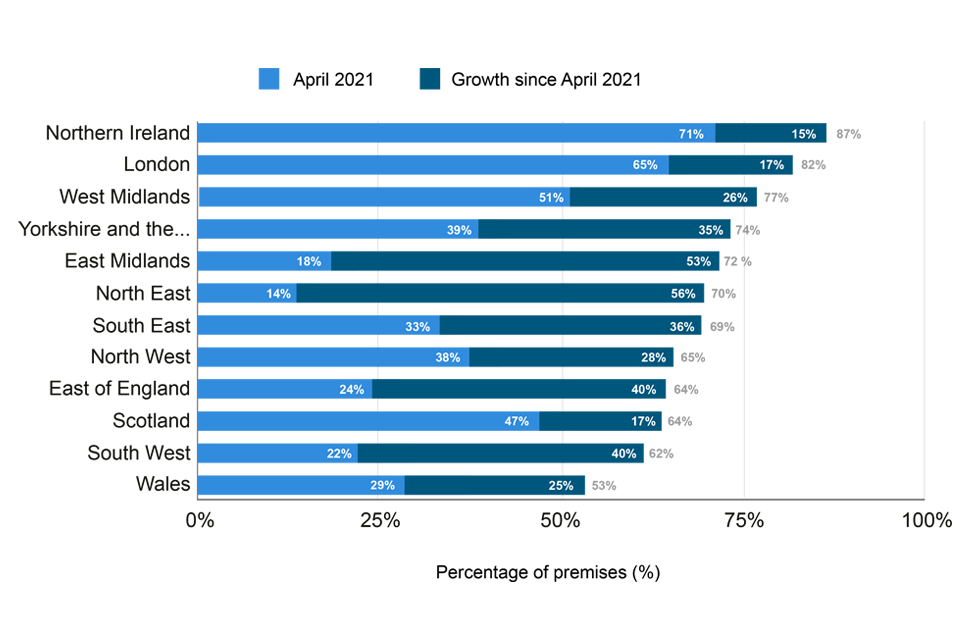

The graph below shows gigabit-capable broadband coverage across the devolved nations and the regions of England, since the launch of Project Gigabit (with rounding used).

Gigabit-capable coverage by region and devolved nation [Source: ThinkBroadband. Data accurate as of 17 August 2022.]

Graph of gigabit-capable coverage by region and devolved nation

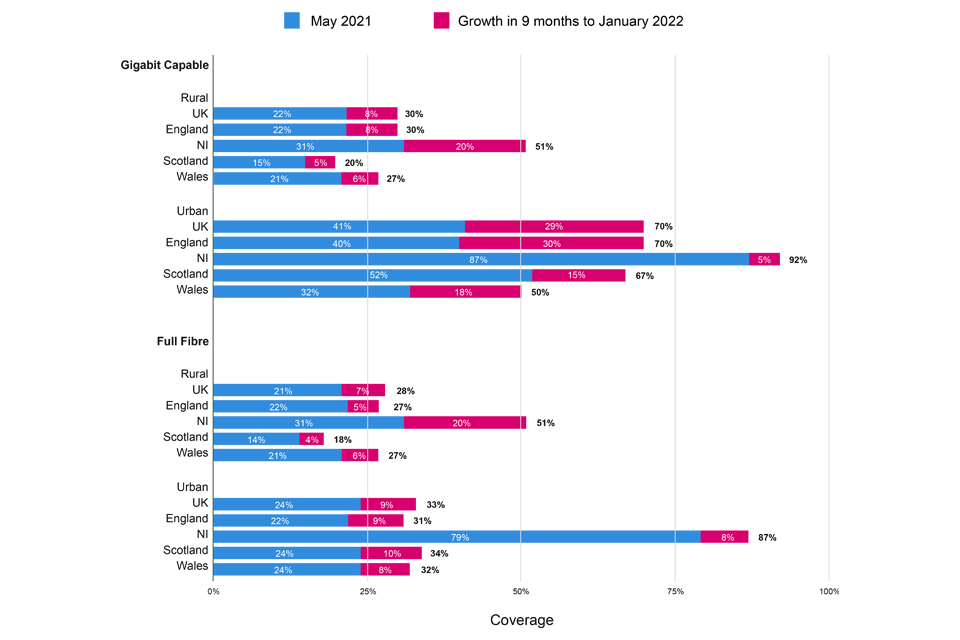

The data underpinning the following graphs below has not changed since the spring update. This is because Ofcom, which produces the data, had not released its latest Connected Nations Update at the time of publication. We will provide an updated analysis of the latest data in our next update.

This graph shows the coverage of gigabit-capable and full fibre broadband across the UK and devolved nations, broken down by rural and urban premises since the start of Project Gigabit (May 2021 to January 2022).

Gigabit-capable coverage across the devolved nations broken down by rurality and type of infrastructure [Source: Ofcom, Connected Nations Report, May 2022. Data accurate as of January 2022]

Graph of gigabit-capable coverage across the devolved nations broken down by rurality and type of infrastructure

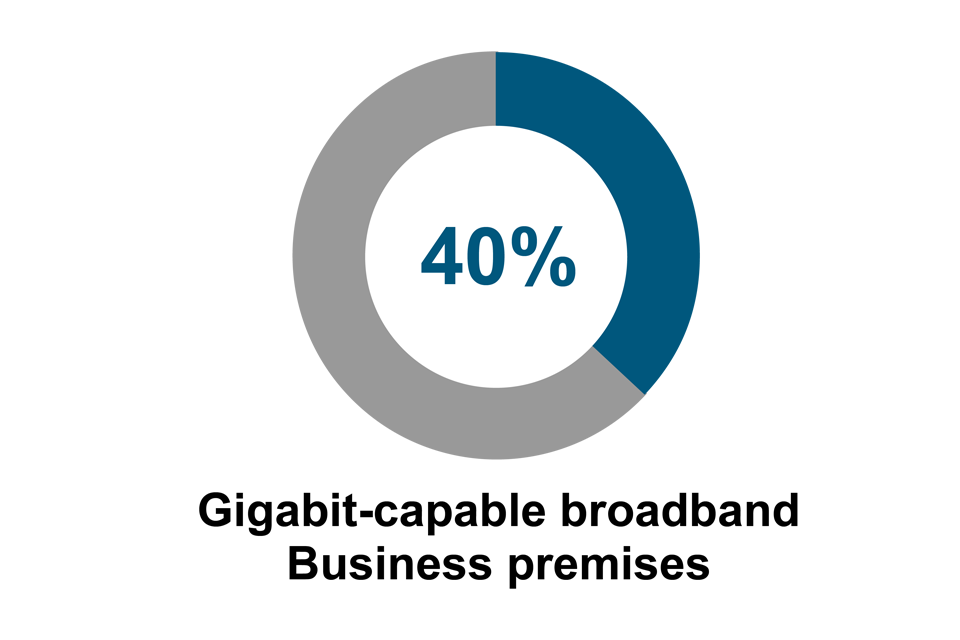

The chart below shows how in January 2022 (the latest date for which this information was collected by Ofcom), 40% of businesses premises had access to gigabit capability.

Gigabit-capable coverage by residential and business premises - [Source: Ofcom, Connected Nations Report, May 2022. Data accurate as of January 2022]

Pie chart of gigabit-capable coverage by residential and business premises

Update on Project Gigabit Delivery Plans

Project Gigabit Procurements

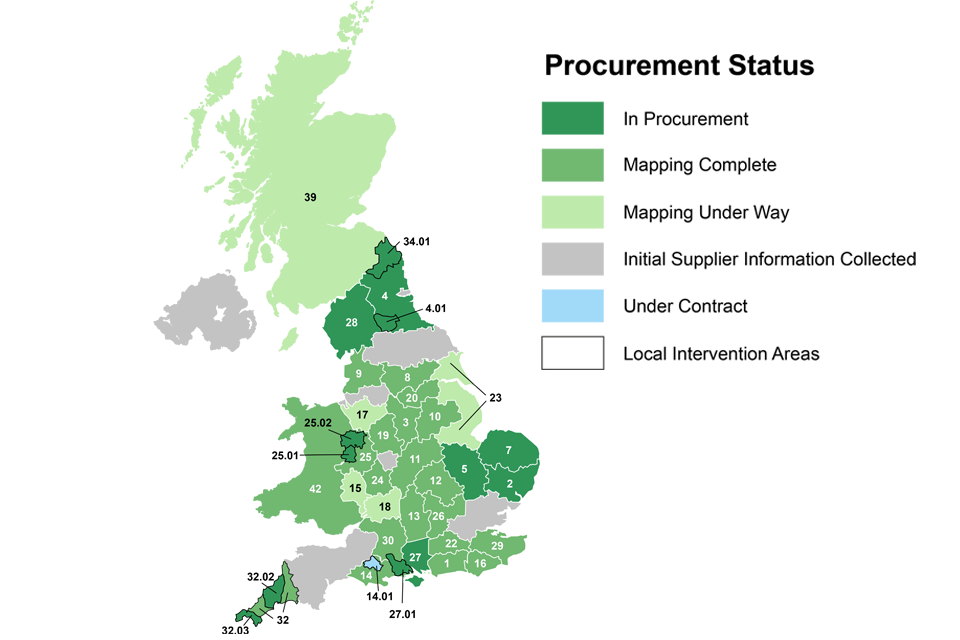

Project Gigabit Procurement Progress [Source: BDUK. Data is accurate August 2022.]

Total value of procurements launched to date

Over £690 million

Premises to be passed with gigabit-capable broadband

Up to 498,000

The commercial deployment of gigabit-capable broadband continues to extend further across the UK, and BDUK is responding flexibly, taking into account changes in the commerciality of premises in proposed procurement areas wherever possible.

In August, we signed the first local Project Gigabit contract, in North Dorset (Lot 14.01), with Wessex Internet. The contract is to connect up to 7,000 premises. We also expect to imminently announce contracts in Teesdale (Lot 4.01) and North Northumberland (Lot 34.01).

We have launched a local procurement and regional procurement in Hampshire (Lot 27 and Lot 27.01) and two local procurements in Shropshire (Lot 25.01 and 25.02), extending gigabit-capable connectivity to up to 118,000 premises. Following extensive engagement with suppliers we have identified there is currently a high likelihood that procurements in Shropshire (Lot 25), Staffordshire (Lot 19) and the eastern part of Hertfordshire (part of Lot 26) will not be successful. Procurements in these areas have been deferred to review options for successful delivery.

The regional procurement for Cumbria (Lot 28) is in the final stage of evaluation, and we expect to award the contract in September. We have also received responses to the first stage of our regional procurements for Norfolk (Lot 7) and Suffolk (Lot 2).

We have now received responses back from the second stage of the procurement process for two further regional procurements in Cambridgeshire and adjacent areas (Lot 5) and the North East of England (Lot 4) and final responses for the two local procurements in Cornwall (Lot 32.02 and 32.03).

We have completed Public Reviews in Leicestershire and Warwickshire (Lot 11), Nottinghamshire and West Lincolnshire (Lot 10), South Yorkshire (Lot 20), and West Yorkshire and parts of North Yorkshire (Lot 8).

Market testing is underway for West Sussex (Lot 1), Oxfordshire and West Berkshire (Lot 13), Worcestershire (Lot 24), Kent (Lot 29) and Buckinghamshire, Hertfordshire and East of Berkshire (Lot 26, excluding the eastern parts of Hertfordshire), and we plan to launch procurements for these areas in the Autumn.

Thirty six suppliers were invited to submit responses for the second National Rolling Open Market Review which closed on 14 June. We will use these responses as the basis for developing initial intervention areas for Cheshire (Lot 17), Devon and Somerset (Lot 7), Herefordshire (Lot 15), Gloucestershire (Lot 18, Lincolnshire and East Riding (Lot 23), Dorset (Lot 14), Essex (Lot 21) and Northern North Yorkshire (Lot 23), with Public Reviews for these areas following later in the year.

We have previously highlighted the potential for a Cross-Regional Supplier framework procurement as an additional route to market to appoint suppliers with national delivery capability. Over the past few months we have re-engaged the market about putting in place such a framework. These discussions are ongoing and we will be issuing further market engagement information in due course.

Project Gigabit Intervention Areas Map

Project Gigabit Intervention Areas Map and key

Gigabit Vouchers

We have now issued over 106,000 vouchers worth more than £214 million through the Gigabit Broadband Voucher Scheme and previous iterations. To date, over 73,000 of these vouchers have been used to connect premises to gigabit-capable broadband.

Public Sector Hub upgrades

We continue to connect eligible public sector buildings with fast, reliable broadband, bringing gigabit-capable networks into the heart of communities in hard-to-reach parts of the UK.[footnote 2]

In July, BDUK and the Department for Education (DfE) announced a joint £82 million investment to help connect up to 3,000 schools in England to gigabit-capable broadband over the next three years. It will enable an estimated 500,000 primary school pupils to access the internet with no interruptions, even if multiple classes are using it at the same time. Over the coming months, DfE will lead an engagement exercise with eligible schools, and the procurement process is due to begin in the autumn term.

We are also taking forward a GigaHubs project in Leicestershire that will connect 50 public sector sites including schools, libraries, recycling centres and offices to gigabit-capable broadband. The project is expected to be completed by 2024 and once these sites have been upgraded, the surrounding community will then be able to benefit.

Project Gigabit in action: A new way of learning

Whitley Village School is a small rural primary school situated just outside of Warrington. The school is quite isolated so having a strong internet connection is vital to deliver online learning for students.

When Head of School, Russell David, first started his role in 2019 the internet connectivity was poor. Frustrated teachers and students couldn’t even complete the simplest of tasks, such as streaming a video in assembly. The lack of decent broadband was a massive impediment to improving working practices and efficiency.

Since the school received their gigabit-capable connection in July 2021 through the GigaHubs project they’ve been able to update their IT infrastructure, allowing teachers and pupils to stream learning content on devices from anywhere in the school. The students are even able to complete science lessons outside as the internet connection lets them record results digitally.

Having a reliable internet connection has transformed computing for the school and the way that they are able to teach. The school is now even planning to start podcasting. Russell said the progress that the children have made has been phenomenal, progress that could never have been possible without gigabit broadband.

Photo of Whitley Village School

Project Gigabit across the Union

Scotland

BDUK is working with the Scottish Government on the potential for Project Gigabit procurement activity in Scotland. Levels and areas of current and planned gigabit-capable broadband coverage are being identified and analysed following the Open Market Review that concluded in March. We will continue to engage with suppliers to clarify areas of market failure in Scotland and identify those areas which are eligible for Project Gigabit subsidy.

We are also working with Highlands and Islands Enterprise and Highland Council, with the support of the Scottish Government, to identify where Project Gigabit might support the Inverness and Highland City Region Deal and improve digital connectivity in the region.

Meanwhile, the Scottish Government’s R100 superfast programme continues to deliver gigabit coverage in Scotland . Following the UK government’s £12.5 million investment into R100 in 2021, the UK Government has recently contributed a further £16 million investment into the R100 South (£6.6 million) and North (£9.4 million) contracts, alongside a £20.2 million investment from the Scottish Government. This means a further 2,600 premises across the South, as well as the Western and Northern islands of Scotland, will receive access to a gigabit connection.

Gigabit vouchers projects are being actively delivered in Scotland with over 2,500 vouchers funding connections under the Gigabit Broadband Voucher Scheme, of which over 160 benefitted from the Scottish Government’s top up funding.

Wales

Current and planned gigabit-capable coverage across Wales is being analysed following the Public Review which closed in May. The Welsh Government will now take forward the market engagement process, with support from BDUK, to identify potential Intervention Areas.

The Welsh Government’s Superfast Cymru programme continues to deliver gigabit-capable infrastructure in Wales. The Superfast Cymru programme has provided access to gigabit-capable infrastructure for over 77,000 premises. Remaining delivery will provide up to a further 37,000 premises with access to gigabit-capable infrastructure by the end of the financial year 2022 to 2023.

Gigabit vouchers projects are being actively delivered in Wales with over 2,390 vouchers connecting homes and businesses in hard-to-reach parts of Wales between 2018 and June 2022. A further 2,950 vouchers have been issued.

Northern Ireland

At 86% gigabit-capable coverage (ThinkBroadband, August 2022), Northern Ireland has the best connectivity out of all the nations of the UK. We are working with the Department of Economy to scope out the next phase of activity in Northern Ireland under Project Gigabit, which will run alongside delivery of Project Stratum. The Northern Ireland Gigabit Open Market Review is scheduled to launch in early Autumn 2022.

Connecting businesses to gigabit-capable broadband with Vouchers

Fast and reliable digital connectivity can be a catalyst to increased growth and productivity by helping businesses reach new markets, and streamline business processes.

BDUK continues to evaluate the effectiveness of vouchers. This helps us to understand how gigabit-capable connectivity is benefiting local businesses, such as those being connected through Project Gigabit. As part of our latest evaluation, BDUK conducted a survey of over 1,700 small and medium sized enterprises that had received gigabit-capable broadband through vouchers between 2017 and 2021. These businesses span a broad range of sectors, from scientific and information and communications technology (ICT) focussed areas to land-based sectors such as agriculture, forestry and fishing.

Over 80% of the small and medium sized enterprises surveyed reported an increase in productivity as a result of their upgraded connection, with the majority using improved connectivity to access digital tools such as cloud storage, video conferencing, high volume file data transfer and accounting services. Over 40% of businesses reported that they were able to reduce business travel and gain new customers as a result of the connection, and nearly half are adopting more flexible working and business practices. Critically, 70% of businesses say the upgrade helped them to adapt and continue to do business during the pandemic.

For more details on the survey, read our detailed write up here.

Relevant policy, legislative and regulatory updates

Very Hard To Reach Premises

DCMS continues to assess available policy options for premises in remote areas that are unlikely to be reached through Project Gigabit procurements due to their rurality and the potential cost and complexity of providing them with Gigabit service. These are referred to as Very Hard to Reach premises (VHTR). As part of its assessment DCMS is considering all available technology types and will publish further details on policy proposals in due course.

Following the publication in February of the government’s response to a Call for Evidence on this topic, the department has been engaging with stakeholders and other government departments to better understand the requirements these premises have and how improved connectivity can be best achieved in a manner that best meets common objectives.

In the meantime, some premises that might have otherwise been expected to be Very Hard to Reach Premises are already being connected to Gigabit services by UK government initiatives and, in some cases, commercial activity by suppliers with a particular rural focus. Others have been able to access improved broadband through wireless networks.

Barrier Busting

In June 2022, DCMS published its response to the consultation on the implementing regulations for the Telecommunications Infrastructure (Leasehold Property) Act. The Act will provide a process that broadband suppliers can use to gain access rights to multi-dwelling premises for a defined period when an occupant has requested a service and the landlord has not responded to the supplier’s request for access. It has been reported that around 40% of industry requests for access go without any response. The Act will prevent a situation where a leaseholder is unable to receive a service due to the silence of their landowner. The regulations will be laid before Parliament as soon as Parliamentary time allows.

The Product Security and Telecommunications Infrastructure Bill continues to make its way through Parliament, completing Committee stage in the Lords on 29 June. The Electronic Communications Code (‘the Code’) - which regulates agreements between landowners and telecoms operators relating to the installation of telecoms apparatus on private and public land - was reformed in 2017. Further updates are needed to realise the aim of those reforms, optimise the use of existing apparatus and networks and support delivery of the government’s digital connectivity ambitions. The Bill amends the Code to encourage faster and more collaborative negotiations for the installation and maintenance of telecoms equipment on private land. We expect to receive Royal Assent later in this Parliamentary session.

We also continue to develop the final policy for ensuring all new build developments are built with gigabit-capable broadband. The response to our recent consultation on this issue, which closed at the end of February, will be published soon and the regulations laid as soon as Parliamentary time allows.

Update on commercial investment in UK gigabit infrastructure

There continues to be significant progress in both commercial investment and delivery of gigabit-capable broadband. Since May 2022, over £5 billion has been invested in the market, including a substantial debt-raise by CityFibre (£4.9 billion), investment from Freedom Fibre (£100 million), as well as further funding for F & W Networks (£25 million).

In terms of premises passed announcements, Openreach (8 million), Hyperoptic (900,000), G.Network (400,000), KCOM (300,000), F&W Networks (150,000), Jurassic Fibre (100,000), Wight Fibre (40,000), BeFibre (14,000), Pine Media (7,600), Alncom (7,000) and Country Connect (2,750) have revealed the overall progress of their deployment in the last three months.

Over 25 suppliers have also announced or finalised new gigabit-capable broadband deployment plans including; BeFibre, Brsk, CityFibre, Connect Fibre, Connexin, FullFibre, Gigaclear, Go Fibre, Grain, Jurassic Fibre, Lightning Fibre, Lit Fibre, Lothian Broadband, MS3, Netomnia, Ogi, Open Infra, Openreach, ITS, RunFibre, Stix Internet, Truespeed, Virgin Media O2, Voneus, Wessex Internet, Wildanet, YouFibre and Zzoomm.

Finally, new applicants continue to request Ofcom for Code Powers to deploy fibre infrastructure including Last Mile Telecom, BAI Communications Infrastructure, E-volve Solutions and GCI Network Solutions, Connect InfraCo, Fibrus Networks and WHP Estates.

Annex

Project Gigabit Procurement Pipeline

Live contracts:

| Local or Regional procurement | Area/Lot Number | Contract award date | Supplier | Number of uncommercial premises in the contract area | Contract value (£ million) |

|---|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | August 2022 | Wessex Internet | 7,000 | £6.3 million |

Live procurements:

| Local or Regional Supplier procurement | Area/Lot Number | Procurement start date | Estimated contract award date subject to change | Estimated number of uncommercial premises in the procurement area subject to change | Indicative Contract Value (£ million) subject to change |

|---|---|---|---|---|---|

| Local | North Northumberland (Lot 34.01) | 11 January 2022 | August 2022* | 3,900 | £7.3 million |

| Local | Teesdale (Lot 4.01) | 11 January 2022 | August 2022* | 4,100 | £6.6 million |

| Local | Cornwall (Lot 32.03) | 17 March 2022 | October 2022 | 9,750 | £18 million |

| Local | Cornwall and Isles of Scilly (Lot 32.02) | 28 April 2022 | January 2023 | 9,500 | £18 million |

| Local | Lot 27 Hampshire (Lot 27.01) | 7 July 2022 | April to June 2023 | 10,500 | £14.5 million |

| Local | Lot 25 Shropshire (25.01) | 15 July 2022 | April to June 2023 | 7,300 | £10.8 million |

| Local | Lot 25 Shropshire (25.02) | 15 July 2022 | April to June 2023 | 12,200 | £24 million |

| Regional | Cumbria (Lot 28) | 20 October 2021 | September 2022 | 60,800 | £109.2 million |

| Regional | North East England (Lot 4) | 18 January 2022 | November 2022 | 61,800 | £89.6 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | 7 January 2022 | November 2022 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | 28 April 2022 | March 2023 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | 28 April 2022 | March 2023 | 87,200 | £100.4 million |

| Regional | Hampshire (Lot 27) | 25 July 2022 | April to June 2023 | 88,600 | £104.1 million |

*These procurements have now been completed. At the time of publication, BDUK is finalising the contract with the preferred supplier.

Upcoming procurements:

The table below shows the procurements in the pipeline posted on the GOV.UK website, alongside DCMS’s other upcoming commercial opportunities. This pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

| Local or Regional Supplier procurement | Area/Lot Number | Procurement start date | Estimated contract award date subject to change | Estimated number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change |

|---|---|---|---|---|---|

| Regional | Lot 25 Shropshire** | TBC | TBC | 20,700 | £30 - £40 million |

| Regional | Lot 24 Worcestershire | September to November 2022 | July to September 2023 | 45,600 | £50 to 84 million |

| Regional | Lot 13 Oxfordshire and West Berkshire | September to November 2022 | July to September 2023 | 67,000 | £67 to 14 million |

| Regional | Lot 29 Kent | September to Nov 2022 | July to September 2023 | 109,500 | £119 to 203 million |

| Regional | Lot 26 Buckinghamshire, Hertfordshire and East of Berkshire | September to November 2022 | July to September 2023 | 137,100 | £140 to 237 million |

| Regional | Lot 19 Staffordshire** | TBC | TBC | 70,800 | £72 to 123 million |

| Regional | Lot 1 West Sussex | September to November 2022 | July to September 2023 | 56,700 | £66 to 112 million |

| Regional | Lot 16 East Sussex | December 2022 to February 2023 | October to December 2023 | 41,200 | £49 to 83 million |

| Regional | Lot 12 Bedfordshire, Northamptonshire and Milton Keynes | December 2022 to February 2023 | October to December 2023 | 81,300 | £84 to 144 million |

| Regional | Lot 3 Derbyshire | December 2022 to February 2023 | October to December 2023 | 57,000 | £64 to 110 million |

| Regional | Lot 30 Wiltshire and South Gloucestershire | December 2022 to February 2023 | October to December 2023 | 84,800 | £85 to 145 million |

| Regional | Lot 9 Lancashire | December 2022 to February 2023 | October to December 2023 | 82,000 | £90 to 153 million |

| Regional | Lot 22 Surrey | December 2022 to February 2023 | October to December 2023 | 99,400 | £101 to 171 million |

| Regional | Lot 11 Leicestershire and Warwickshire | February to April 2023 | November 2023 to January 2024 | 112,900 | £114 to 194 million |

| Regional | Lot 10 Nottinghamshire and West of Lincolnshire | February to April 2023 | November 2023 to January 2024 | 89,700 | £90 to 152 million |

| Regional | Lot 8 West Yorkshire and parts of North Yorkshire | February to April 2023 | November 2023 to January 2024 | 125,200 | £128 -to 218 million |

| Regional | Lot 20 South Yorkshire | February to April 2023 | November 2023 to January 2024 | 56,800 | £59 to 103 million |

| Regional | Lot 17 Cheshire | April to June 2023 | January to March 2024 | 74,300 | £85 to 144 million |

| Regional | Lot 6 Devon and Somerset | April 2023 | January to March 2024 | 159,600 | £198 to 337 million |

| Regional | Lot 15 Herefordshire | April to June 2023 | January to March 2024 | 23,700 | £30 to 60 million |

| Regional | Lot 18 Gloucestershire | April to June 2023 | January to March 2024 | 44,700 | £40 to 80 million |

| Regional | Lot 23 Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding | April to June 2023 | January to March 2024 | 105,700 | £106 to 180 million |

| Regional | Lot 14 Dorset | July to September 2023 | April to June 2024 | 56,500 | £62 to 105 million |

| Regional | Lot 21 Essex | July to September 2023 | April to June 2024 | 78,400 | £79 to 135 million |

| Regional | Lot 31 Northern North Yorkshire | July to September 2023 | April to June 2024 | 28,200 | £25 to 42 million |

**Following significant soft market testing and pre-procurement market engagement with suppliers in Shropshire and Staffordshire we have established that there is currently no interest from the market in responding to our proposed regional procurements in these areas. We have also had similar feedback in relation to the eastern part of Hertfordshire. We are therefore deferring the launch of the regional procurements in these areas and are actively looking at options to provide coverage in these areas at a later date. In July, we successfully launched two local procurements in Shropshire which will deliver coverage to up to 19,500 premises.

If you are a supplier who wishes to view and/or register interest for any of the opportunities under Project Gigabit, all details can be found online here. The procurement documents are available for unrestricted and full direct access, free of charge, at https://bduk.force.com/s/Welcome.

Additional information can be obtained from the above-mentioned address.

Tenders or requests to participate must be submitted to the above-mentioned address.

Gigabit Vouchers Issued/Claimed

| Year | Vouchers Issued but not yet connected | Vouchers used to fund a connection | Total |

|---|---|---|---|

| 2017 to 2018 | 0 | 40 | 40 |

| 2018 to 2019 | 0 | 6900 | 6,900 |

| 2019 to 2020 | 0 | 15,900 | 15,900 |

| 2020 to 2021 | 4,400 | 18,400 | 22,800 |

| 2021 to 2022 (p) | 17,300 | 22,900 | 40,300 |

| 2022 to 2023 (p) | 11,700 | 8,900 | 20,600 |

| TOTAL | 33,400 | 73,100 | 106,500 |

Source: BDUK - as of August 2022

(p) - Provisional

Notes:

-

These delivery figures are provisional and will be confirmed in BDUK’s 2023 Performance Report

-

Vouchers issued but not yet connected, reflects vouchers that have been issued to suppliers/beneficiaries but is yet to be claimed/connected. This is different from the measure reported in the Spring update which showed the number of vouchers that were issued that year, many of which have since been connected.

-

Vouchers used to fund a connection - reflects all vouchers connected and paid based on the date when payment was approved (Payment Customer Approved Date) and the availability of a beneficiary address and postcode or UPRN

-

Figures above exclude cancelled vouchers (vouchers issued but not then claimed to fund a connection). BDUK has corrected an internal reporting error in the provisional figures reported in the spring update involving voucher adjustments; the new figures are more accurate and represent a total reduction of 897 across all years.

Public Sector Hubs

| Year | Rural Gigabit Connectivity | LFFN | Gigahubs | Total |

|---|---|---|---|---|

| 2017 to 2018 | 0 | 0 | 0 | 0 |

| 2018 to 2019 | 0 | 0 | 0 | 0 |

| 2019 to 2020 | 21 | 0 | 0 | 21 |

| 2020 to 2021 | 200 | 1700 | 0 | 1900 |

| 2021 to 2022 | 800 | 3900 | 7 | 4600 |

| 2022 to 2023 (p) | 1 | 0 | 6 | 7 |

| Total | 1021 | 5600 | 13 | 6600 |

(p) - Provisional

Source: BDUK - as of August 2022

Notes:

-

These delivery figures are provisional and will be confirmed in BDUK’s 2023 Performance Report.

-

This provisional reporting includes public sector buildings and assets such as CCTV cameras and roadside cabinets. These non-building assets were excluded from BDUK’s recent 2022 Performance Report and will be identified and excluded prior to final reporting in the 2023 Performance Report.

-

Rural Gigabit Connectivity (RGC) programme - RGC public sector buildings noted as delivered when the site is connected and becomes gigabit-capable. This is based on management information returns from local bodies and suppliers that are then aggregated by BDUK delivery teams. All sites in the programme have received a gigabit-capable connection and management information has tracked an address and postcode or UPRN for each site.

-

Local Full Fibre Networks (LFFN) programme - performance reflects aggregated tracking by BDUK. UPRNs for public sector buildings tracked in supplementary Management Information for 85% of buildings, but connection dates are not available for analysis at this geographic level.

-

Gigahubs, performance was tracked manually for this performance report given the very low level of delivery