BDUK’s 2021 to 2022 Performance Report

Published 29 July 2022

A couple watching something on their laptop, sat on the floor whilst eating a pizza

Foreword by Lord Agnew, Interim Non-Executive Chair

Portrait of Lord Agnew

I was pleased to be appointed as the Interim Chair of Building Digital UK in April 2022.

BDUK is delivering two of the UK’s most significant infrastructure projects.

Project Gigabit, launched in April 2021, is a £5 billion programme to roll out lightning-fast gigabit broadband to hard to reach areas throughout the UK, and the Shared Rural Network is a £1 billion deal with the mobile network operators to improve 4G mobile coverage.

These major investments will help to level up the UK. This will enhance people’s life chances, boost education and job prospects, connect disparate communities and future-proof our country for many decades to come. They are, to quote the Secretary of State, “a leap forward akin to the Industrial Revolution.”

This report reflects the work of BDUK before I joined, and before it became an Executive Agency in April 2022. In my time as Chair I have seen the difference that enhanced digital connectivity brings.

Our goal is to maximise access to gigabit connectivity as quickly as possible, both through stimulating the commercial market to go further, and via BDUK’s range of interventions. I am pleased that in the last 12 months the percentage of premises that can access gigabit connectivity has increased from 38.8% to 66.5%.

I am delighted to endorse this report. It showcases how communities from Perth in Scotland to Padstow in Cornwall are already benefiting from gigabit-capable connections to their homes, businesses, schools, hospitals and libraries. My priority has been to press BDUK to strive to go further and faster where possible, and as an Executive Agency, build on its foundations to deliver the digital infrastructure that is critical for people and businesses across the UK.

Chief Executive’s Introduction

Portrait of Paul Norris

I am proud to lead Building Digital UK, an organisation with a clear mission: to ensure that homes and businesses across the UK can access fast and reliable digital connectivity. Our achievements to date have been significant and our impact measurable and tangible: hundreds of thousands of premises able to access high-speed broadband, providing homes, businesses and public buildings with future-proofed connections.

In April 2022, BDUK became an Executive Agency of DCMS, with a new corporate governance structure and a new Head Office in the heart of vibrant Manchester. In April 2022 we published our first Corporate Plan, which sets out our objectives and delivery targets that will contribute towards meeting the government’s targets of 95% mobile landmass coverage across the UK, and at least 85% gigabit-capable coverage by 2025, getting as close to 100% as soon as possible thereafter.

Following the end of 2022 to 2023, BDUK will be publishing our own Annual Report and Accounts, reporting on our performance against our objectives and delivery targets as set out in our Corporate Plan. For 2021 to 2022, our activity will be reported through DCMS’s Annual Report and Accounts. However, as a new Executive Agency I believe we should be transparent about our performance during tax year 2021 to 2022 and so we are publishing this one-off, standalone Performance Report that documents our performance and progress over the past year.

Our two core programmes, Project Gigabit and the Shared Rural Network, are a joint mission and require collaboration with local bodies, devolved authorities and the private sector. I would like to thank our partners for helping us to deliver the real-world benefits that can be seen throughout this report.

We have made a good start. Gigabit coverage has increased significantly over the past year, and mobile 4G coverage continues to grow. Beyond the numbers you will see in the report, we have also laid the foundations by preparing the contracts that will deliver improved digital connectivity over the next three years and beyond. There is much still to do, but I look forward to meeting the challenges that we will undoubtedly face, and seeing the difference that our work makes to people in all parts of the UK.

Performance Overview

This section provides a summary of Building Digital UK’s (BDUK) performance in tax year 2021 to 2022, the progress we have made against our objectives and how we have performed in the past year. In future years, our Performance Report will be included in our Annual Report and Accounts.

This report includes a summary of our Project Gigabit programme business case.

Our Purpose

BDUK’s mission is to ensure that homes and businesses across the UK can access fast and reliable digital connectivity.

In March 2021, we launched Project Gigabit, a £5 billion programme to extend gigabit connectivity to hard to reach areas of the UK, building on successful legacy programmes including Superfast and Rural Gigabit Connectivity.

In parallel, through the £1 billion Shared Rural Network programme, BDUK is working with the four mobile network operators to deliver 4G coverage to 95% of the UK’s landmass by the end of 2025.

Key achievements

Project Gigabit

Between April 2021 and March 2022, gigabit-capable coverage grew 27 percentage points, from 38.8% to 66.5%.[footnote 1] Combined with a thriving commercial market that delivered to more homes and businesses than expected, Project Gigabit delivered gigabit-capable coverage to 144,000 premises between April 2021 and March 2022, equivalent to 0.46% of all UK premises. This exceeded the 120,000 premises target for the same period, set out in our most recent Corporate Plan.

By the end of March 2022, BDUK had delivered gigabit connectivity to 741,000 premises, exceeding our minimum target of 720,000 premises.

During this period, we have also put in place the foundations for Project Gigabit’s delivery to 2025 and beyond, launching the first seven procurements for our Project Gigabit contracts. These initial contracts alone are worth over £300 million to connect up to 200,000 premises.

Shared Rural Network

Mobile coverage across the UK increased in 2021, rising to 92%. Our Shared Rural Network programme is delivering against its objective to raise 4G coverage to 95% nationwide, with 46 new masts deployed by mobile network operators as part of their programme commitments.

All of the major procurements for the Extended Area Service project - upgrading masts being built as part of the Home Office’s Emergency Services Network - have now been completed, and BDUK has approved 10 pilot sites, with delivery planned to start in 2022 to 2023.

Worker in Hi Vis, looking out to the countryside whist holding a tablet

Performance Analysis

BDUK published its first Corporate Plan as an Executive Agency in April 2022, setting out our purpose and objectives for 2022 to 2023 and beyond. This Performance Analysis reports our performance for the year before BDUK launched as a new Executive Agency and reports the performance of our two programmes: Project Gigabit and the Shared Rural Network.

Project Gigabit: Delivering gigabit-capable connectivity to premises outside of commercial suppliers’ plans

Headline achievements

In the year between April 2021 and March 2022, BDUK passed 144,000 premises through its subsidies, ahead of the minimum trajectory set out in our Corporate Plan. This includes 95,900 premises whose connections were previously classed as sub-superfast.

Every UK nation has benefited and will continue to benefit from our subsidies. 5,600 premises were passed in Scotland, 12,100 in Wales, and 31,400 in Northern Ireland.

Throughout our delivery between April 2021 and March 2022, we continued to focus where possible on reaching those most in need. Our Superfast programme (which specifically targets premises with sub-superfast connections) and our vouchers projects (which are issued disproportionately for harder-to-reach premises) contributed to 140,200 of these premises passed.

During the same year, we also started the data collection process for more than 95% of the UK, which is the first stage of our procurement process. We launched seven procurements for our Project Gigabit contracts, with a value of over £300 million, to connect up to 200,000 premises. These and future contracts, the first of which is set to be awarded and start delivering connections in the year between April 2022 and March 2023, will deliver the majority of the premises we will pass through our interventions, as we accelerate delivery to reach 99% gigabit coverage as soon as possible.

Delivery performance

Premises passed

In the year ending 31 March 2022, BDUK delivered gigabit-capable broadband to 144,000 premises. This is ahead of the 120,000 premises target for 2021 to 2022, set out in our Corporate Plan. In total, by the end of March 2022, BDUK delivered gigabit-capable broadband to 741,000 premises, ahead of the target of 720,000 premises.

Table 1 below shows the number of premises passed by BDUK interventions against the targets included in our Corporate Plan.

Table 1: Premises passed against the corporate plan minimum trajectory

| By end March 2021 | April 2021 to March 2022 | April 2022 to March 2023 | April 2023 to March 2024 | April 2024 to March 2025 | April 2025 to December 2025 | |

|---|---|---|---|---|---|---|

| Minimum target premises passed for BDUK interventions | 600,000 | 120,000 | 110,000 | 225,000 | 280,000 | 225,000 |

| Actual premises passed by BDUK interventions | 597,000 | 144,000 | ||||

| Cumulative minimum target premises passed for BDUK interventions | 600,000 | 720,000 | ||||

| Cumulative actual premises passed by BDUK interventions | 597,000 | 741,000 | ||||

| Cumulative per cent premises passed by BDUK interventions (cumulative) | 2% | 2% | 3% | 3% | 4% | 5% |

| Total % premises passed (includes market delivery) | 38.8% | 66.5% | 71% | 75% | 80% | 85% |

BDUK has four main interventions for delivering gigabit connectivity:

-

Superfast contracts - where our funding is used to extend existing projects under the Superfast Broadband Programme to deliver gigabit-capable connectivity.

-

Vouchers - small grants which can be claimed by eligible residential and business customers in target areas to cover the additional costs of a supplier extending networks to their premises.

-

Hubs - grants to connect local public services in hard to reach areas, such as schools, libraries, and GP surgeries.

-

Gigabit contracts (starting in the year 2022 to 2023) - subsidies to suppliers to build gigabit-capable infrastructure to premises that will not be reached by the market’s commercial plans.

Between April 2021 and March 2022:

-

Our Superfast contracts passed 95,300 premises

-

We passed 45,000 premises through vouchers

-

We connected over 3,800 schools, surgeries, libraries, and other public buildings through our Local Full Fibre Network, Rural Gigabit Connectivity, and GigaHubs programmes

Table 2 below shows the breakdown of premises passed by intervention.

Table 2: Premises passed by product (rounded to nearest 100)

| Intervention Approach | Premises Passed by 31 March 2021 | Premises Passed between April 2021 and March 2022 | Total |

|---|---|---|---|

| Superfast Programme | 529,900 | 95,300 | 625,200 |

| Vouchers | 65,200 | 45,000 | 110,100 |

| Hubs | 1,900 | 3,800 | 5,700 |

| Total | 597,000 | 144,000 | 741,000 |

| Minimum target | 600,000 | 120,000 | 720,000 |

BDUK is due to award the first of our Project Gigabit contracts in the year ending March 2023. The timeframe for delivery will depend on the appointed suppliers’ plans, including the extent of survey work and any mobilisation activity required.

Rurality of our subsidies

Between April 2021 and March 2022, we passed 128,300 rural premises through our Superfast, vouchers and hubs interventions. Up to 89% of the premises benefitting from BDUK subsidies were rural, compared to 21% of premises across the UK.

Table 3: Rural premises passed (rounded to nearest 100)

| Premises Type | Premises Passed between April 2021 and March 2022 |

|---|---|

| Rural premises | 128,300 |

| % of BDUK’s subsidies for 2021-22 | 89% |

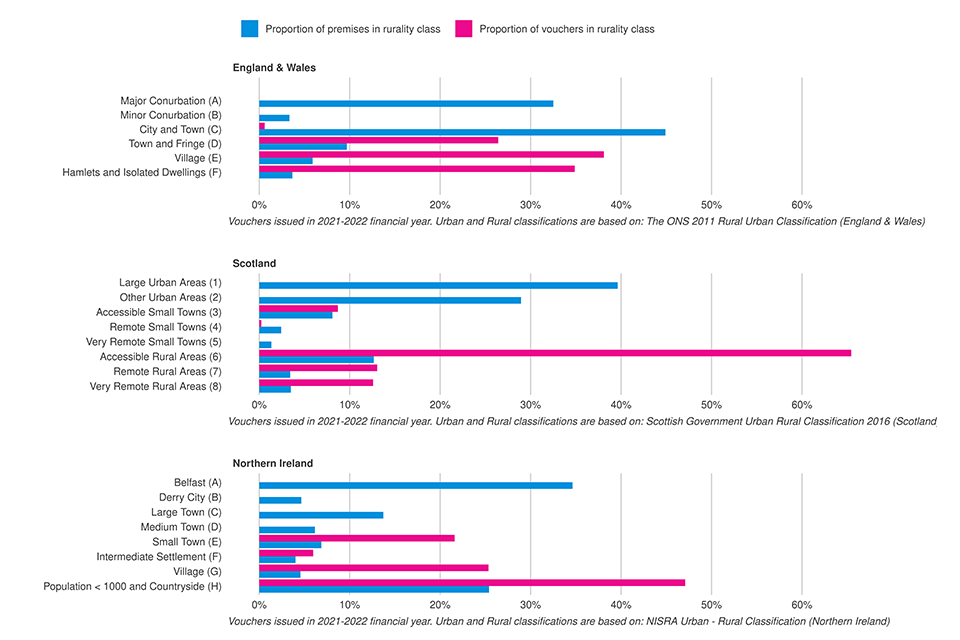

Our analysis of vouchers issued between April 2021 and March 2022 in Chart 1 shows that the majority of vouchers were issued in the most rural parts of England, Wales, Scotland and Northern Ireland.

Chart 1: Rurality of vouchers issued across the nations between April 2021 and March 2022:

Chart to show the rurality of vouchers issued across the nations in 2021-22

Gigabit delivery in focus

The Crooklands Hotel is a rural independent family run business in rural Cumbria. Up until last year, the hotel struggled with a 8Mbps connection, and about a 1Mbps wireless connection that could not cover the full span of the property, and basic tasks were unachievable.

A decent Wi-Fi service has also become a basic expectation for guests, and the hotel feared if they were not able to offer that, it would severely impact their business.

The installation of gigabit broadband in early 2021 has transformed the business. Using the Gigabit Broadband Voucher Scheme, and connected by B4RN, the hotel can now access speeds of at least 900Mbps. This has allowed them to offer improved broadband services to all guests, including their conference suite. They have also been able to create a website, run social media pages, and carry out online administrative functions including online orders and bookings which has all led to improved business.

The front of Crooklands Hotel

Premises passed by nation and region

Table 4, below, shows the premises passed by BDUK’s interventions by nation and English region.

Our hubs and vouchers programmes connected homes, businesses and public sector buildings in each of the nations. Superfast contracts continue to deliver good fibre coverage across the devolved administrations. Northern Ireland’s Project Stratum helped the nation reach 82% gigabit-capable connectivity by March 2022,[footnote 2] while Superfast Cymru in Wales and R100 in Scotland have also continued to deliver throughout the year ending 31 March 2022.

Table 4: Premises passed by nation and region (rounded to nearest 100)

| Nation / Region | Premises Passed between April 2021 and March 2022 |

|---|---|

| Scotland | 5,600 |

| Wales | 12,100 |

| Northern Ireland | 31,400 |

| England | 94,900 |

| of which | |

| North East | 3,600 |

| North West | 6,600 |

| Yorkshire and the Humber | 6,800 |

| East Midlands | 15,700 |

| West Midlands | 5,400 |

| East of England | 23,600 |

| London | 300 |

| South East | 20,000 |

| South West | 12,900 |

Gigabit delivery in focus

Built in 1888, Theatr Colwyn in Colwyn Bay, Conwy, is probably the oldest working theatre and cinema in the UK, and the oldest civic theatre in Wales.

In May 2021, as a result of a neighbourhood Local Full Fibre Network project, the theatre’s internet speeds increased from 10Mbps to 80Mbps.

Access to gigabit-capable broadband has enabled the theatre to benefit significantly - the majority of its films arrive via a server over broadband and download time has decreased dramatically. This in turn has reduced Theatr Colwyn’s carbon footprint as it no longer has to rely on courier services to deliver hard copies of the films to their location on the Welsh coast.

Theatr Colwyn is also able to live stream certain events , such as meetings and Gallery events, and during the pandemic it showcased a recorded performance of a pantomime to an audience in their homes, which in turn generated some much-needed income.

Sub-superfast premises passed (rounded to nearest 100)

Between April 2021 and March 2022, our interventions passed 95,900 premises that were previously classed as having speeds below 30 Mbps (sub-superfast).

Table 5: Sub-superfast premises passed by BDUK subsidies (rounded to nearest 100)

| April 2021 to March 2022 | |

|---|---|

| Premises passed by a BDUK subsidy that previously had a connection of <30 Mbps | 95,900 |

| % of BDUK’s subsidies between April 2021 and March 2022 | 67% |

The focus on these premises reflects our approach to target those most in need. Between April 2021 to March 2022, the percentage of sub-superfast premises across the UK fell from 3.3% to 2.8%.[footnote 3] This is consistent with the large majority (67%) of BDUK’s delivery in 2021/22 to sub-superfast premises in areas with particularly poor broadband speeds.

Gigabit delivery in focus

Growing Together Radcliffe is an umbrella body for a number of community groups in Radcliffe, within the Bury borough of Greater Manchester. A church in Radcliffe acts as a community centre, hosting a number of different services for the local community, including a cafe and a new digital hub. In November 2021, it was connected with fast, reliable, gigabit-capable broadband that benefits the whole community.

Local residents can now connect the internet using their own devices or by borrowing one; residents are also able to check emails, apply for jobs and even support their children with online homework.

The community centre now runs a session called ‘Very Adult Learning’, which provides information to adults on digital skills, from connecting to the internet to accessing NHS websites and completing prescriptions.

Two women working together on a shared computer

Shared Rural Network programme: Improving 4G mobile internet connectivity

Headline achievements

The first phase of the Shared Rural Network programme involves the four mobile network operators investing in a shared network of new and existing phone masts to help tackle Partial Not Spots, which are areas where there is currently coverage from at least one, but not all, mobile operators. Between April 2021 and March 2022, 46 new masts were built by the mobile network operators, as the industry-funded phase continued to make progress towards tackling Partial Not Spots.

Since the Shared Rural Network was agreed in March 2020, the industry has delivered 850 upgrades to existing masts. BDUK is now actively supporting planning applications for Partial Not Spot sites and has so far provided supportive statements for 21 sites, with three approved.

The second part of the programme, running in parallel, is aimed at reducing Total Not Spots, which are areas where there is currently no coverage from any mobile operator. This government-funded element of the programme involves upgrades to Extended Area Service masts being built as part of the Home Office’s Emergency Services Network.

Between April 2021 to March 2022, the Extended Area Service project moved steadily from mobilisation into delivery. All of the major procurements for the project have been completed, and BDUK had approved 10 pilot sites by the end of March 2022.

Digital Mobile Spectrum Ltd (DMSL) is delivering the Total Not Spot element of the programme on behalf of the mobile network operators, managing the procurement process and grant neutrally. In tax year 2021 to 2022, DMSL also finalised two key procurement contracts for our Total Not Spot projects.

We also conducted a consultation to identify existing mobile network infrastructure in target areas, and a Government response will be published later in 2022.

Delivery performance

In 2021, 4G mobile coverage across the UK grew by one percentage point and now stands at 92%, progressing the UK closer to the Shared Rural Network’s 95% objective.

Table 8: Mobile coverage across the UK and nations, 2020 to 2022

| January 2020 | January 2021 | January 2022 | |

|---|---|---|---|

| UK 4G Landmass coverage | 91% | 91% | 92% |

| England 4G Landmass Coverage | 97% | 97% | 98% |

| Scotland 4G Landmass Coverage | 80% | 81% | 82% |

| Wales 4G Landmass Coverage | 89% | 90% | 90% |

| NI 4G Landmass Coverage | 97% | 97% | 97% |

Source: Ofcom Connected Nations

Appendix 1: Data tables and notes

All numbers rounded to the nearest 100.

Table A1: Gigabit coverage provided by BDUK in uncommercial areas for the preceding financial year, measured in ‘premises passed’ and with reference to forecast for the year, as set out in its Corporate Plan.

| Year | Premises Passed* | Corporate Plan Minimum Delivery Forecast |

|---|---|---|

| Between 1 April 2021 and 31 March 2022 | 144,000 | 120,000 |

| By 31 March 2021 | 597,000 | 600,000 |

*Definitions of premises passed are included in the definitions and data notes below.

Table A2: Gigabit coverage provided by BDUK in uncommercial areas for the preceding financial year in each Nation.

| Nation | Premises Passed between 1 April 2021 and 31 March 2022 |

|---|---|

| England | 94,900 |

| Scotland | 5,600 |

| Wales | 12,100 |

| Northern Ireland | 31,400 |

Table A3: Gigabit coverage provided by BDUK in uncommercial areas for the preceding financial year in each English Region.

| Region | Premises Passed between 1 April 2021 and 31 March 2022 |

|---|---|

| North East | 3,600 |

| North West | 6,600 |

| Yorkshire and The Humber | 6,800 |

| East Midlands | 15,700 |

| West Midlands | 5,400 |

| East of England | 23,600 |

| London | 300 |

| South East | 20,000 |

| South West | 12,900 |

Table A4: Gigabit coverage provided by BDUK in uncommercial areas for the preceding financial year benefiting rural premises.

| Premises Type | Premises Passed between 1 April 2021 and 31 March 2022 |

|---|---|

| Rural premises | 128,300 |

| All premises | 144,000 |

Table A5: Gigabit coverage provided by BDUK in uncommercial areas for the preceding financial year benefiting premises previously without superfast broadband.

| Premises Type | Premises Passed between 1 April 2021 and 31 March 2022] |

|---|---|

| Estimated number of premises previously without superfast broadband | 95,900 |

| All premises | 144,000 |

Table A6: Gigabit coverage enabled by each intervention approach (i.e. existing superfast contracts, new gigabit procurements, vouchers).

| Intervention Approach | Premises Passed by 31 March 2021 | Premises Passed in between 1 April 2021 and 31 March 2022 |

|---|---|---|

| Superfast Programme | 529,900 | 95,300 |

| Vouchers | 65,200 | 45,000 |

| Hubs | 1,900 | 3,800 |

Definitions and Data Notes

| Data item | Definitions and notes |

|---|---|

| Premises passed | Premises are classified as passed by gigabit-capable broadband if it is possible to access a gigabit-capable service for the standard price and be connected in the standard timescale. |

| Superfast delivery | Performance reporting draws from performance reports provided by suppliers and validated by local bodies. Total includes all delivery reported to BDUK referencing a premises as either Technically Ready for Service (TRFS) or Customer Ready for Service (CRFS) within relevant date ranges, with an FTTP connection or gigabit-capable technology. Performance from Superfast contracts includes some premises that prior to subsidy were classified as having, or expected to soon benefit from, a commercial Next Generation Access (NGA) / 30mbps connection. The inclusion of these spillover premises reflects the low likelihood of these premises receiving a gigabit-capable connection at that time without the infrastructure subsidised by the Superfast contract. Additional information is available for Phase 3 contracts than for Phase 1 and 2 controls. To confirm the low likelihood of Phase 3 premises receiving a gigabit connection at that time, premises have been removed from the reporting where they have been identified as having either an FTTP or a 100mbps+ connection through the Subsidy Control assessment prior to the commencement of the contract or a 100mbps+ NGA connection in September 2020 Ofcom Connected Nations records. Following this approach, approximately 54,000 spillover premises have been included in performance reporting from Phase 3 contracts. There are approximately 7,000 premises where the local body has validated the delivery but the performance report does not hold the date the connection was provided. These premises passed have been attributed to delivery before 31 March 2021 because these premises were delivered through Phase 1 and Phase 2 Superfast contracts. The database also includes approximately 10,000 premises with common addresses and postcodes. These premises have been included in performance reporting because delivery here has been reported and validated by relevant Local Bodies. |

| Vouchers delivery | Performance reflects all vouchers connected and paid based on the date when payment was approved (Payment Customer Approved Date) and the availability of a beneficiary address and postcode or UPRN. Performance also reflects an estimate for the additional non-commercial premises passed as a result of the broader scope of voucher projects. This estimate draws on BDUK analysis of supplier UPRN level build plans, provided when submitting voucher projects. It is applied to vouchers on the basis of the projects for which they are part. BDUK is reviewing the methodology for reporting the number of premises passed by vouchers in 2022/23. |

| Hubs delivery | Performance reflects delivery of three interventions: • Rural Gigabit Connectivity (RGC) programme - RGC public sector buildings noted as delivered when the site is connected and becomes gigabit-capable. This is based on management information returns from local bodies and suppliers that are then aggregated by BDUK delivery teams. All sites in the programme have received a gigabit-capable connection and management information has tracked an address and postcode or UPRN for each site. • Local Full Fibre Networks (LFFN) programme - performance reflects aggregated tracking by BDUK. UPRNs for public sector buildings tracked in supplementary Management Information for 85% of buildings, but connection dates are not available for analysis at this geographic level. Aggregate LFFN delivery figures have been adjusted down to exclude approximately 900 public sector assets that are not premises or buildings and are therefore excluded from this performance report. • Gigahubs - performance was tracked manually for this performance report given the very low level of delivery prior to April 2022. Each hub is expected to result in (at least) one premises passed by a gigabit-capable connection. This is a conservative assumption as hubs are intended to stimulate local build. |

| Geographic breakdowns of premises | Premises have been allocated between nations and regions as well as to rural classifications based on the postcode of the delivery point or the UPRN. For LFFN, where postcodes and UPRNs are not available, we have used the project location to allocate between regions. |

| Premises passed with a gigabit connection between 1 April 2021 and 31 March 2022 previously without superfast broadband | Phase 1 and Phase 2 Superfast contracts were solely targeted at premises identified as sub-superfast following a State aid compliant mapping process so all premises passed have been categorised as sub-superfast. Some spillover premises may have not been previously without superfast broadband, but, for Phase 1 and Phase 2 Superfast contracts, it is not possible to identify which individual premises were the direct target of the programme and which were spillover premises. Phase 3 Superfast contracts were solely targeted at premises identified as sub-superfast following a State aid compliant mapping process so directly subsidised premises passed have been categorised as sub-superfast, spillover premises have been categorised as not sub-superfast. For vouchers and hubs products, the extent to which premises passed were previously without a superfast broadband connection has been estimated based on available UPRN records and matching to historic UPRN data from Ofcom’s Connected Nations. These UPRN records are only available from nine large suppliers (which are estimated to provide 86% of gigabit connections in the UK). It is not possible to confirm whether premises passed by hub or voucher products had a previous superfast broadband connection from another supplier. For voucher products, an additional check was made based on the speed reported by the voucher supplier prior to their upgrade. |

Further information on each of the products being reported here is available from GOV.UK.

Appendix 2: Project Gigabit Programme business case summary

Following HM Treasury approvals of the Project Gigabit Programme Business Case in February 2022, we have provided a summary of the business case below.

Introduction

This Project Gigabit Programme Business Case sets out the rationale for investment of supply side and demand-led products to upgrade broadband infrastructure to gigabit capable technology, unlocking development in areas that are not commercially viable without government intervention.

The Programme Business Case follows the Green Book five case model, which is summarised below.

Strategic case

The two objectives for Project Gigabit are:

-

To maximise gigabit-capable build in the final 20% by 2025, achieving at least 85% coverage - with 80% delivered by the market, and at least 5% by BDUK interventions - and seek to accelerate gigabit roll-out further to get as close to 100% coverage as soon as possible.

-

Prioritise early delivery of gigabit-capable networks to premises without 30Mbps.

These objectives will be achieved through a combination of four interventions:

-

Gigabit Infrastructure Subsidy contracts, offering suppliers the chance to subsidise multiple premises over a single contiguous area

-

Extensions to existing Superfast contracts, extending out delivery of gigabit-capable connections to premises that are currently sub-superfast.

-

Vouchers, a demand-led intervention people and businesses can apply for to help plug gaps in gigabit connectivity in rural areas

-

Hubs, which local bodies offer as projects to connect key public services in uncommercial areas (like schools, surgeries and libraries)

Each of these interventions will work with each other through our product mix approach. This means that the suitable interventions are chosen and integrated in each area (rather than a single intervention being used across an entire region).

Delivery of this infrastructure will:

-

Support the economy and boost employment through increased productivity

-

Provide critical national infrastructure, meeting demand now and ready to meet future demand

-

Improve, as a priority, services to those with sub-30Mbps speeds improving productivity and retaining and attracting young, talented people and families to rural areas

-

Optimise social and wellbeing benefits – providing reliable connectivity for rural businesses and residents

-

Maintain (and improve) UK international competitiveness - facilitating growth and increasing UK exports

-

Improve mobile internet connectivity

Economic case

The economic case qualitatively assesses a range of potential programme options to deliver gigabit capable connectivity. Three options were initially assessed:

- Option 1: The do nothing/status quo option

This is the baseline option included under Green Book guidance.

- Option 2: Project scope includes purely uncommercial premises

Under this option, public investment is deployed to deliver gigabit capable connectivity only in the final 9% of premises (90 to 99th percentiles). This option depends on being able to forecast the barrier between “hold-up”, up to where the market is expected to build over the longer term, and uncommercial areas, and accurately identify the boundary at individual premises level to be included in the procurements.

- Option 3: Project scope includes hold up and uncommercial premises (Preferred)

Under this option, public investment is focused on the final 19% of premises (80 to 99th percentiles). This encompasses the uncommercial premises targeted by Option 2 and the hold-up areas (80 to 89th percentiles) that both previous options assume will ultimately be covered by the provisions of the European Electronic Communications Code (EECC).

The estimated benefits for gigabit connectivity include:

-

Enabling public sector efficiency, including enabling e-health services and ensuring efficient public sector delivery

-

Reducing the digital divide and providing public value, such as improving wellbeing and delivering consumer savings

-

Reducing environmental impacts through the use of cloud services and reducing the need to travel

-

Stimulating the broadband market by stimulating private sector investment, having a more reliable broadband network and enabling other technologies like 5G

-

Driving growth in the UK economy by increasing productivity, creating new business, and reducing unemployment

Public sector efficiency and driving growth in the UK economy is a key DCMS strategic objective and features in the department’s Outcome Delivery Plan (“Increase economic growth and productivity through improved digital connectivity”).

Both Option 2 and 3 show a positive Net Present Value. The estimated Net Present Value of Option 3 is £14.3 billion, which is slightly smaller than Option 2 at £14.6 billion. Option 3 is preferred because it gives more certainty around the programme’s completion date (2030) and gigabit connectivity for premises in the 80 to 90th percentiles.

Commercial case

Project Gigabit’s four interventions each have separate commercial arrangements.

- Gigabit Infrastructure Subsidy procurements

Split across three contract types: local (up to 10,000 premises), regional (up to 100,000 premises), and cross-regional (up to 500,000 premises). The composition of the intervention areas within each of these contracts will be made up of areas identified as uncommercial through the collection and analysis of supplier data. The three different routes provide flexibility of delivery in response to market conditions.

- Superfast Extension

By extending existing Phase 3 Superfast contracts, we are able to deliver to sub-Superfast premises through Project Gigabit.

- Vouchers and hubs

Vouchers and hubs are both grant-based subsidies. Vouchers are micro-grants for Small and Medium Enterprises or members of the public to connect their premises. Hubs are grants for local authorities to connect public services.

Financial case

The Financial case demonstrates that the government’s £5 billion Project Gigabit is affordable. The profile for the current Spending Review period (SR21) is shown in the table below:

| £million | 1 April 2022 to 31 March 2023 | 1 April 2023 to to 31 March 2024 | 1 April 2024 to 31 March 2025 |

|---|---|---|---|

| Project Gigabit SR21 capital profile | £157.3 | £381.7 | £437.8 |

Capital and Resource profiles for upcoming years will continue to be published in BDUK’s annual Corporate Plan.

Management case

The management case describes the arrangements for programme management and delivery.

Project Gigabit is classified as a tier A major programme on the Government’s Major Project Portfolio. This means that BDUK and Project Gigabit will be subjected to formal major project governance, as well as internal and external assurance (external from the Independent Projects Authority).

As an Executive Agency BDUK is governed by the BDUK Board, which operates under the provisions of a Framework Document approved by Ministers. Accountability for BDUK activities and decision-making rests with BDUK’s Chief Executive Officer.

The Permanent Secretary, as the Principal Accounting Officer (PAO) for BDUK, designates the CEO as Accounting Officer and Senior Responsible Owner. The CEO is therefore responsible for ensuring regularity, propriety and value for money, as well as programme delivery. The BDUK Corporate Plan, published in April 2022, outlines the governance framework for BDUK as an Executive Agency.

Risk management arrangements are in place to identify, manage and mitigate programme risks and are overseen by the second line Risk, Compliance and Governance function and the Project Management Office, which carries out monthly reviews. The BDUK Board’s Audit and Risk Assurance Committee also provides oversight of the risk management approach.

The key risks to successful delivery of Project Gigabit include:

-

There could be a large number of premises with higher than expected build costs.

-

There could be limited supplier interest or capacity to undertake BDUK build because commercial build is prioritised or because of macroeconomic factors (such as a market downturn).

-

There could be barriers that slow down delivery of new gigabit connectivity build (e.g. wayleaves).

-

Local partners may be unable to provide the required support through the procurement process.

-

Lack of data governance could lead to non-compliance with contractual requirements, legislation or DCMS policies.

-

Expansions (or retractions) of supplier build plans after procurements are announced could delay the start of interventions or otherwise lead to procurement failure.

BDUK’s Risk, Compliance & Governance function regularly reviews Project Gigabit’s risks and mitigations.

The benefits realisation strategy follows the BDUK benefits realisation framework, organising benefits into five core categories:

-

Driving growth in the economy

-

Enabling public sector efficiency

-

Reducing the digital divide and providing public value

-

Reducing environmental impact

-

Stimulating the broadband market

Project Gigabit will be evaluated to ensure lessons are learnt and captured to feed into future operational delivery and assess the extent to which the programme has delivered its anticipated benefits.