NDA Annual Report and Accounts 2017 to 2018

Published 12 July 2018

PERFORMANCE REPORT

Chairman’s Statement

Tom Smith, Chairman

Our performance

Our role in cleaning up the legacy from the UK’s first generation of nuclear facilities remains a vitally important task for the nation, and we are committed to pursuing our mission with an absolute focus on safety and environmental responsibility.

I am pleased that the government acknowledges the significance of our mission with ongoing public funding, which rightly requires us to manage our budget with care, ensuring maximum benefit for the taxpayer.

Our on-the-ground activities have been carried out effectively. Spending has remained below the annual limit set by government, and excellent progress has been made on some of our highly hazardous facilities at Sellafield and Dounreay. Bradwell will be the first of our Magnox reactors to enter the passive care and maintenance phase towards the end of this year.

At all of our 17 sites, I am impressed by the all-round commitment to push forward with decommissioning work, and by the passion for solving challenges that shines through as I meet members of the workforce.

It is also clear to me that many people who live and work around our sites are very supportive of the mission, but rightly continue to scrutinise and challenge our performance. Equally, I am struck by the strong partnerships with local communities. These enable us to work constructively in allocating funding from our socio-economic budget to joint initiatives aimed at sustaining economies, helping to prepare communities for the eventual loss of a major employer.

The Group’s safety record has also improved after last year’s increase in incidents, and the Board wants to see continuing progress in this priority area.

Magnox inquiries

During the year, reports on our failings in the Magnox procurement were published by the National Audit Office and the Public Accounts Committee, while the independent Holliday Inquiry published interim findings. All have highlighted the shortcomings in our approach to awarding the Magnox contract and failures in the post-contract award consolidation phase.

We have embarked on a period of careful analysis of our strengths and weaknesses, particularly those that contributed to the Magnox failings. This will continue for some time yet, beyond the publication of the final Magnox Inquiry report.

We are determined to emerge as a more effective, efficient and capable organisation. To achieve that, we need both to adopt the recommendations from independent scrutiny and to implement the internal cultural and organisational changes we are currently making under the leadership of our Board, CEO David Peattie and the Executive Team.

Board changes

I welcome Candida Morley to the Board as a new non-executive director. Candida joined us as a representative from our shareholder UKGI in November 2017.

Thanks

I would like to close by thanking everyone involved in the NDA mission, including the workforce, our regulators, government sponsors and the many stakeholders who live around our sites. We depend on their continued support and challenge to carry out our work, and look forward to continuing our many partnerships in pursuit of our nuclear clean-up mission.

Tom Smith

NDA Chairman

Chief Executive’s Review

David Peattie, Chief Executive Officer

The NDA was established in 2005 to oversee the safe and efficient clean-up of the nation’s nuclear legacy.

Our mission remains unchanged, as does the relentless focus on cleaning up and decommissioning the UK’s civil nuclear sites and delivering value for the taxpayer, with the safety and security of people and the environment at the forefront of our minds.

My vision now is to build a stronger NDA Group, where all parts of our business are working together with a collective focus on delivering the mission more efficiently. Changes to the way we work and manage ourselves will be the most significant since our organisation was created in 2005.

These changes will incorporate learning from the Magnox competition and contract, but their main aim will be to improve delivery and provide a foundation for long-term success.

Throughout this time of challenge and change, our skilled and professional workforce has remained focused on delivering the mission, reaching some important milestones during last year.

For the very first time at Sellafield, our largest and most complex site, we’re beginning to retrieve radioactive waste from parts of the site that date back to the very beginning of the nuclear industry.

At Dounreay, a vital programme began to remove metallic casings that have been held for decades in the Dounreay Fast Reactor. Decommissioning the reactors is a major step towards cleaning up and ultimately closing the site.

Over the next year the Magnox site in Bradwell, Essex, will become the first NDA site to enter a state of care and maintenance after all mobile hazards, and the vast majority of the buildings, have been cleared.

I am pleased to report that last year we continued to make good progress in the transfer of spent nuclear fuel from some of our other sites to Sellafield, where it can be safely managed in the most appropriate way.

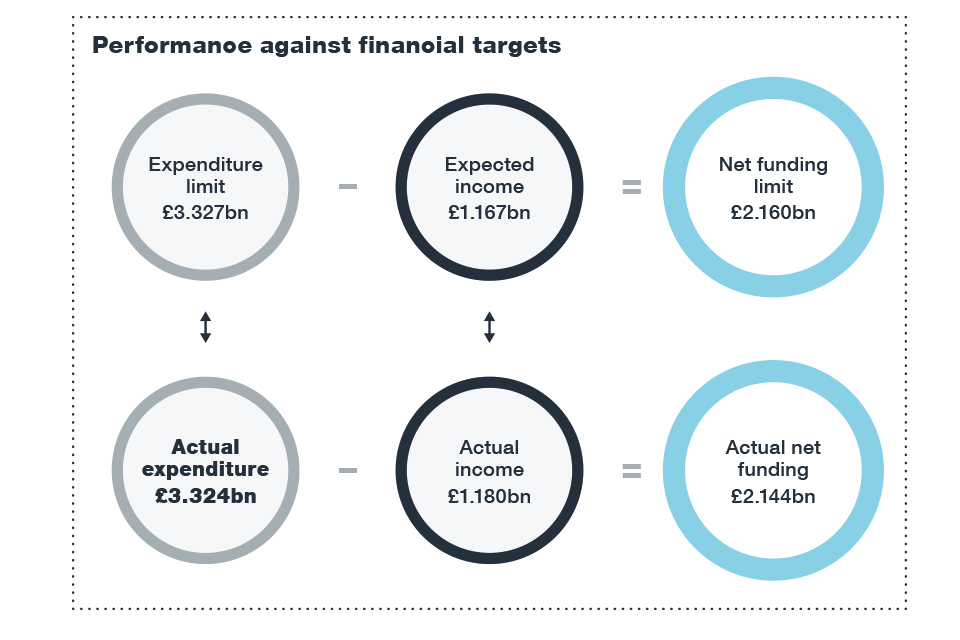

Spending was kept below the annual limit set by government and we exceeded revenue targets, generating £1.2 billion of revenue to offset significant taxpayer contributions of £2.1 billion. This is a result of some outstanding work by our commercial colleagues around the businesses for which I am grateful.

Last year’s safety statistics were the best we have seen for 3 years. I’d like to thank everyone who has responded to the demand for improved safety performance.

As I visit our sites, from the very north of Scotland to the far south of England, I am constantly impressed by the expertise and dedication of our workforce.

Our work is dependent on collaboration, not just with our sites and supply chain, but with our government department, regulators, stakeholders and crucially our communities. We are grateful for their continued support and look forward to accepting their challenge of continuing to work in partnership.

With support also comes scrutiny, which is only right and proper for a public sector organisation, and this year has seen unprecedented levels of interest as a result of the Magnox competition and contract. An independent inquiry into the issues is expected to conclude later this year. We will welcome its findings as a further opportunity to learn from the mistakes and ensure they cannot happen again.

In building a stronger NDA, I made 3 key executive appointments last year. Kate Ellis joined as Commercial Director, bringing a wealth of commercial experience from previous roles with the Ministry of Justice and BP. Neil Hewlett was appointed as General Counsel to offer valuable legal advice to the Executive and Board and, most recently, Alan Cumming took up the new position of Director of Nuclear Operations. Alan brings extensive experience in nuclear, waste and petrochemicals.

Priorities for the coming year include establishing new arrangements for managing the work at the Magnox sites, following the planned termination of CFP in September 2019, completing preparations for the start of the siting process for a national geological disposal facility for radioactive wastes, Bradwell entering care and maintenance, concluding the movement of materials from Dounreay to Sellafield, and removing the final piece of Magnox fuel from the last Magnox reactor at Wylfa, on Anglesey in North Wales.

It will be another busy year and I thank you in advance for your continued support.

David Peattie

Accounting Officer and

Chief Executive Officer

The NDA Group

The NDA mission

We are dealing with one of the most complex, long-term, environmental challenges in Europe. We are responsible for decommissioning 17 nuclear sites spread across England, Wales and Scotland, some dating back to the 1940s, plus associated liabilities and assets. This includes the first generation of Magnox power stations, various research and fuel facilities and our largest, most complex site, Sellafield.

Taking a group-wide view, our core objective is to decommission these sites safely, securely, cost-effectively and in a manner that protects the environment.

Our remit includes developing an underground Geological Disposal Facility (GDF) as a permanent repository for the UK’s higher activity waste.

We also have a range of supplementary responsibilities including developing the supply chain, research and development, skills, socioeconomic support for local communities and stakeholder engagement.

Spending Review

Under the latest government Spending Review in 2015, we were allocated more than £11 billion of grant funding over 5 years which, together with our projected income, will enable us to continue making broad progress across the Group.

We are committed to maximizing efficiencies, along with all public sector organisations, and are taking measures to save £1 billion over this 5-year period.

This will be achieved through technical and programme innovations and efficiency improvements.

How the Group operates

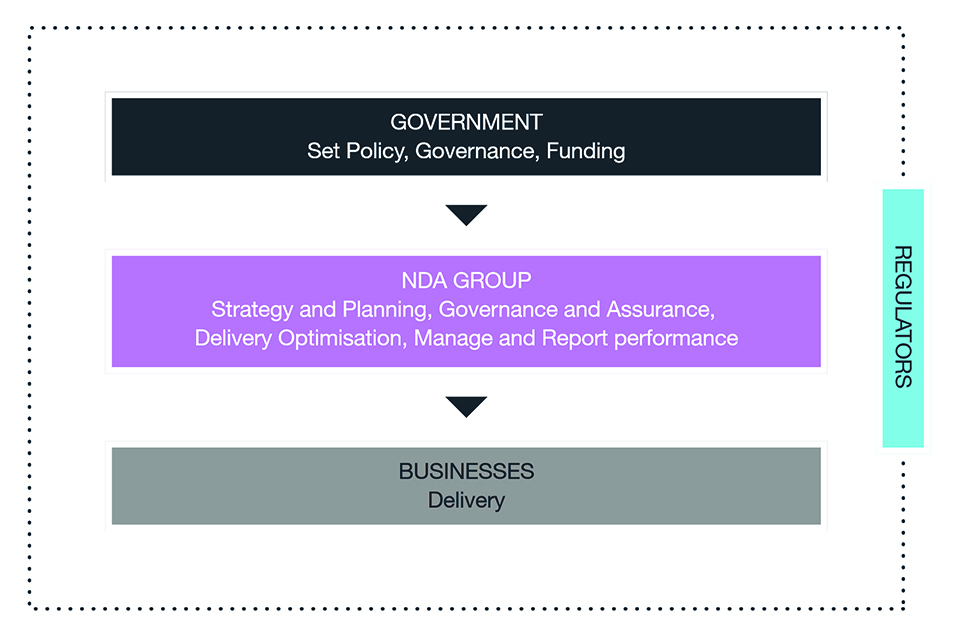

NDA operating structure

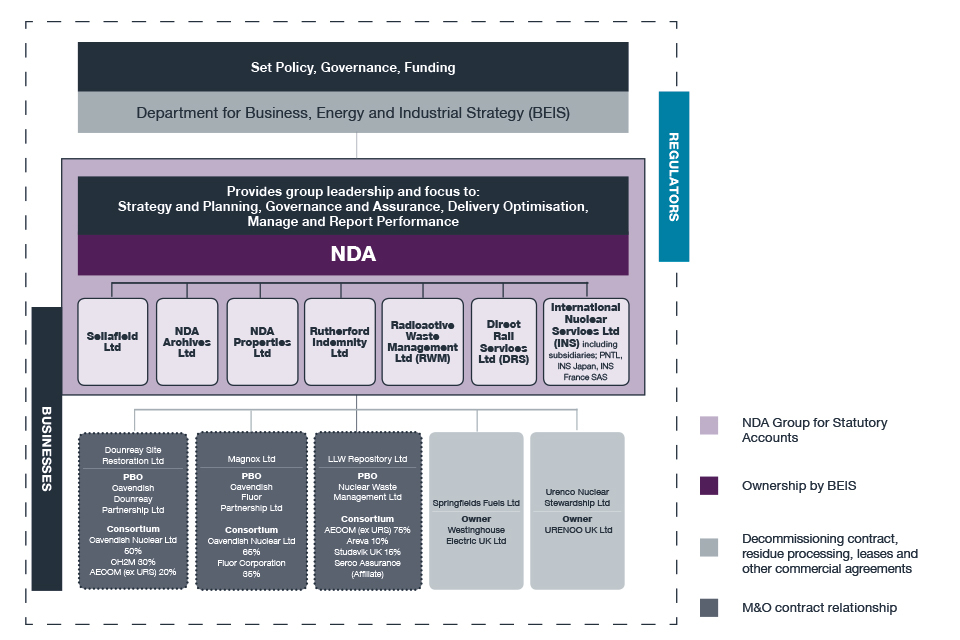

The NDA is a non-departmental public body (NDPB) created through the Energy Act 2004 and sponsored by the Department for Business, Energy and Industrial Strategy (BEIS).

Our plans must be approved by the Department and Scottish Ministers, who also provide a policy framework for the NDA.

Site activities are closely regulated by:

- the Office for Nuclear Regulation (ONR)

- the Environment Agency (EA)

- the Scottish Environment Protection Agency (SEPA)

- Natural Resources Wales (NRW)

- Department for Transport (DfT).

Their views are an important part of our considerations and we seek to involve them in open dialogue.

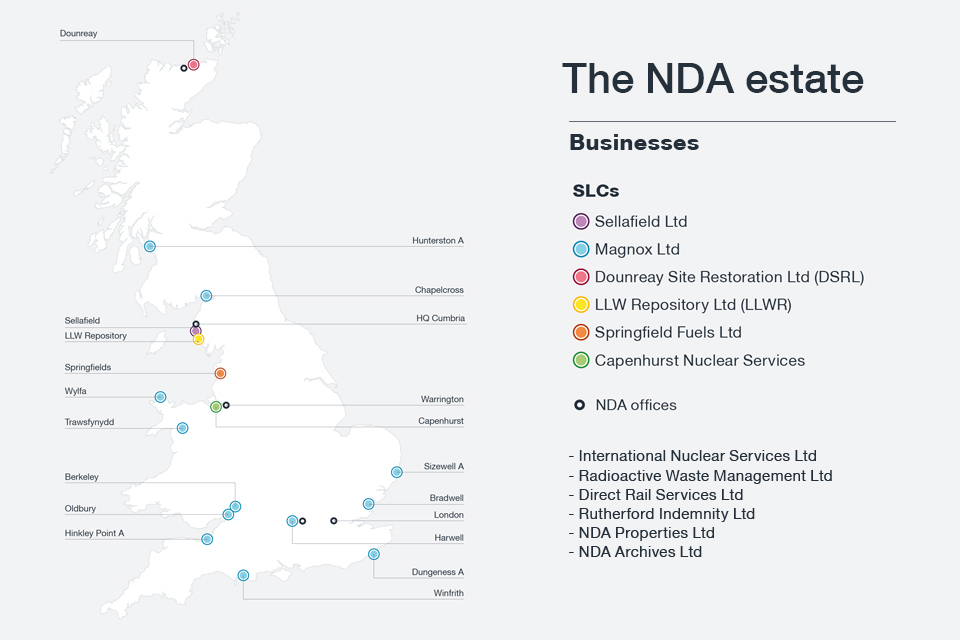

The NDA estate

The NDA estate

16,000 employees across the estate

1,046 hectares of nuclear licensed land

17 sites across the UK

12 businesses

Diagram of how the NDA operates

The NDA Corporate Centre

The NDA Corporate Centre, in its group leadership role, focuses on the following:

Health, Safety, Security, Environment: underpinning everything is our commitment to uphold the highest standards of health, safety, security and environmental responsibility, together with an open, transparent approach to secure the trust of our stakeholders.

Strategy and Planning: Our strategy, which is updated every 5 years, provides the framework for delivering our mission on behalf of government. Our plans set out how we will deliver the key outcomes required, in the right timeframe and within the funding agreed with government.

Governance and Assurance: Our governance regime discharges legal, regulatory and public service responsibilities to protect the interests of government and taxpayers, employees and stakeholders. We undertake appropriate assurance to ensure the NDA and our businesses deliver the outcomes required to achieve our mission.

Delivery Optimisation: We seek the optimum mix of businesses to deliver our mission. These range from PBO-led Site Licence Companies (SLCs) through to NDA-owned subsidiaries and affiliates. NDA’s strategic overview enables optimized and prioritised Group-wide decisions over the short and long-term.

Manage and Report Performance: We conduct Quarterly Performance Review meetings with our businesses which drive discipline around targets, clarity around direction and culture and hold the businesses to account. We report to government and stakeholders on the performance of the businesses through various mechanisms including the Annual Report and Accounts.

To achieve our mission, we’ve adopted the principles of simplification, standardisation, discipline and focus in all we do.

The NDA Corporate Centre key activities 2017 to 2018

The NDA sets the Group-wide strategy, contract manages the operation of the businesses and provides performance assurance across the Group to ensure value is delivered for the taxpayer.

The businesses are responsible for running day-to-day activities at site level, delivering progress for the NDA Group, while a range of businesses operate the specialist services needed to support our work.

This section covers progress towards key milestones and activities outlined in our 2017 to 2020 Business Plan. Key milestones and activities are agreed at the start of each financial year and are grouped by strategic theme.

| Status | Description |

|---|---|

| ACHIEVED | The key milestone or activity has been achieved during the financial year 2017 to 2018 or satisfactory progress is being made towards achievement of longer term milestone. |

| MISSED TARGET | The key milestone or activity was due for completion before 31 March 2018 and as at that date there had been a delay against the planned schedule and the target has been missed. |

| DEFERRED | Activity deferred due to re-prioritisation and/or reallocation of funding. |

Summary of Performance from 2017 to 2020 Business Plan

| Target | Status | Comments |

|---|---|---|

| Nuclear Materials | ||

| Work with government to develop a long-term management solution for separated plutonium in the UK. | ACHIEVED | |

| Integrated Waste Management | ||

| Publish the Radioactive Waste Strategy. | ACHIEVED | |

| Alternative disposal routes integrated project. | ACHIEVED | |

| Critical Enablers | ||

| Provide support to government on nuclear new build decommissioning plans. | ACHIEVED | |

| Magnox Limited, DSRL and LLWR - monitor performance against the targets and milestones selected. | ACHIEVED | |

| Ongoing performance tracking of the Sellafield Baseline Plan. | ACHIEVED | |

| Monitoring of delivery against the Sellafield Transformation programme. | ACHIEVED | |

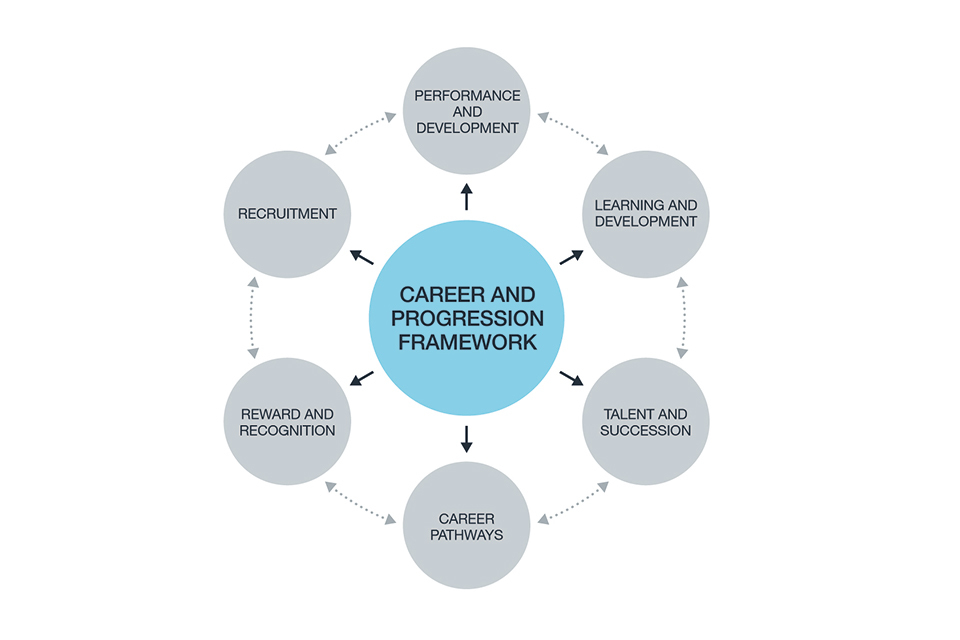

| Implementation of our strategic people delivery plan to enable resource planning, skills development and flexibility and mobility across the estate. | ACHIEVED | |

| Support Small and Medium Enterprise organisations by increasing overall spend with them in line with the government Growth Agenda. | ACHIEVED | |

| Working to embed the capability to proactively protect, detect, respond and recover against current and evolving cyber threats. | ACHIEVED | |

| Publish a detailed socio-economic policy. | DEFERRED | A report on socio-economic spend in 2016 to 2017 was published on our website. Policy will be updated in 2018-19. |

| Regulatory Matters | ||

| Continue working with regulators and government to determine institutional controls appropriate to restoration of nuclear sites. | ACHIEVED |

Other key achievements for NDA Corporate Centre for 2017 to 2018

- achievement of a Waste Substitution deal with SOGIN of Italy, resulting in £182 million revenue to the taxpayer

- recruitment of additional capability for the Corporate Centre, in particular filling the new executive roles of Commercial Director, Director of Nuclear Operations and General Counsel

- agreement reached with Cavendish Fluor Partnership on the work to be performed on the Magnox sites during the contract’s remaining 2 years to 31 August 2019

- support given to the Magnox Inquiry, 2 NAO reports and a PAC hearing in a professional and transparent manner

- third term of the PBO contract for LLWR awarded to UK Nuclear Waste Management Ltd

- support given to government in the development and implementation of a policy response to the UK’s planned exit of Euratom to allow continuation of international nuclear commerce and UK safeguards

- official opening of Nucleus (The Nuclear and Caithness Archives) by The Princess Royal

The Mission - our challenge

Our mission is to deliver safe, sustainable and publicly acceptable solutions to the challenge of nuclear clean-up and waste management, decommissioning 17 nuclear sites across the UK. We break down the mission into 4 key areas, enabling work to be clearly defined and prioritised, and where opportunities for efficiencies can be explored. These areas have numerous interdependencies.

However, the most urgent task is dealing with sites’ highest hazard materials: spent fuel, nuclear materials and highly radioactive wastes. Once this inventory has been made safe, the redundant nuclear facilities can be dismantled and demolished.

Case Studies

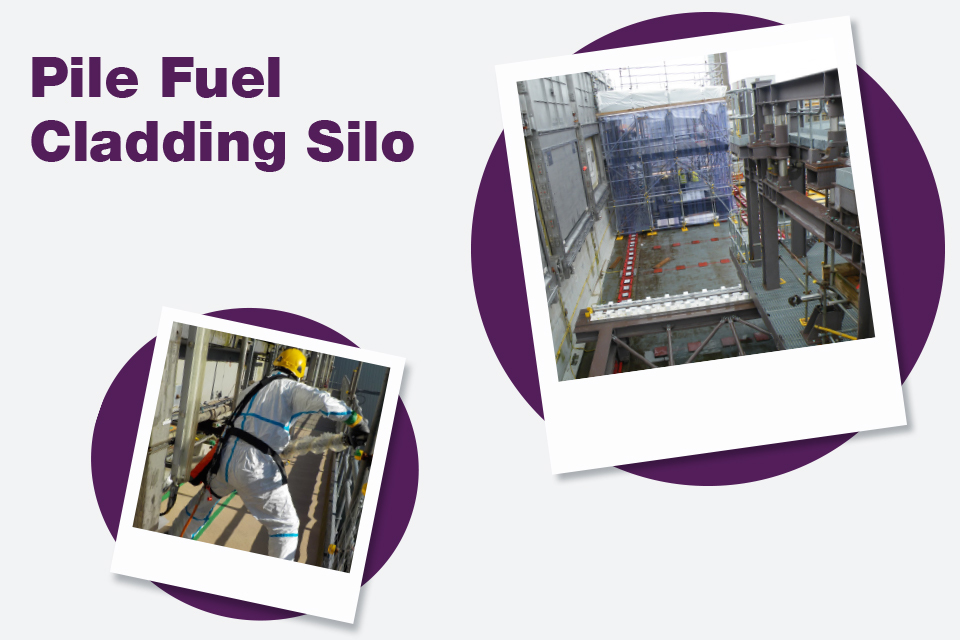

Pile Fuel Cladding Silo

PRIORITY: Retrievals

Sellafield's Pile Fuel Cladding Silo

The Pile Fuel Cladding Silo (PFCS) is one of the oldest and most hazardous facilities at Sellafield. After extensive preparatory work spanning many years, the last 12 months have brought huge progress in laying the ground for the start of waste retrievals, now scheduled to start earlier than originally forecast.

£250 million reduced project cost

3 years earlier start to waste retrievals

Metallic radioactive waste has lain undisturbed inside the PFCS for around 50 years. When the 6 tall chambers were first constructed, just after World War 2, to receive spent fuel from the UK’s experimental nuclear weapons programme, no-one even considered how they would be emptied or dismantled.

The ‘cladding’, or metal casings, accumulated over decades after being shaved off uranium fuel rods discharged from the Windscale Pile Reactors, and then later from Magnox power stations. Tipped in from the top, the PFCS was full by the 1960s and contains around 4,000 cubic metres of Intermediate Level Waste (ILW).

Gaining access to the sealed concrete compartments has been an incredible engineering journey involving years of planning and preparation, hundreds of dedicated people and many millions of pounds of investment. The congested area around the 21-metre tall facility means engineering options are restricted. An extra complication is the atmosphere inside the silo, which is controlled by argon gas to reduce fire risk. The radiation hazard and argon atmosphere mean remotely operated equipment will be required for all the waste retrieval work.

A reinforced concrete superstructure has been built alongside the PFCS to manage all the work and enable the deployment of equipment.

In December 2017, the last of 6 holes was cut behind the massive stainless steel doors - each as heavy as 150 adults – that had been installed on each compartment during the previous year.

Cutting the holes and removing the concrete wall blocks will enable a retrievals system to reach in and lift out the waste.

Bradwell

PRIORITY: Decontamination and Demolition

NDA's site: Bradwell

Bradwell is in the final stages of preparations for the passive care and maintenance period, when all near-term decommissioning will be complete.

2018 Only the 2 reactor buildings, the weather-proofed pond structures and ILW store will remain.

10 years The remaining Magnox sites will all reach the care and maintenance stage in the next 10 years.

More than 200 tonnes of metallic radioactive debris have been successfully dealt with at Bradwell, adding to the momentum that will take the site into the closed care and maintenance phase in 2018.

Bradwell will be the UK’s first Magnox reactor site to reach this milestone, dormant, protected against the weather and awaiting final dismantling in around 80 years.

As part of preparations for care and maintenance, the metallic FED was subject to a range of treatments over a number of years.

The FED, classified as Intermediate Level Waste (ILW) consisted largely of the magnesium alloy cladding, shaved off the uranium fuel, plus associated springs and other metallic parts. The initial plan was to dissolve the FED in an acid solution at a purpose-built on-site plant, reducing volumes by 90% or more. This followed the successful introduction of a dissolution process at Dungeness A, where the technique was pioneered using the site’s own FED and a different acid solution.

Technical issues delayed the process at Bradwell, however, 65 tonnes eventually underwent dissolution. Meanwhile, an innovative collaboration between Magnox Ltd, the Low Level Waste Repository Ltd (LLWR) and specialist contractor Tradebe-Inutec enabled 140 tonnes to be re-classified from ILW to LLW following additional treatment, allowing it to be sent for disposal at LLWR.

Following completion of the FED programme, all ILW generated on-site has now been processed and is housed in the new Interim Storage Facility until a permanent disposal option is developed for the UK’s higher-activity radioactive waste.

The combination of approaches has shortened the re-scheduled FED treatment programme, reducing hazards at the site. If remaining activities progress as forecast, it is now expected that Bradwell will enter care and maintenance in late 2018.

This huge achievement will mark the start of a progressive programme of Magnox sites reaching care and maintenance over the coming years.

A further major achievement at Bradwell was demolition of the complex associated with the spent fuel ponds, following a 4-year decontamination programme. The remaining pond buildings on the site will be encased in weatherproof cladding in preparation for care and maintenance. Both reactors have already been clad in weatherproof aluminium.

Bradwell will be only 3 years behind the ambitious 2015 target date, brought forward from 2027 and set as part of the Magnox Optimised Decommissioning Programme which aimed to accelerate timescales across the fleet of former power stations, with Bradwell being one of two ‘lead and learn’ sites.

Dounreay

PRIORITY: Retrievals

NDA's site: Dounreay

Dounreay led the UK’s post-war experiments with fast reactors, which were intended to breed new fuel while generating electricity. Work on fast breeder reactors was eventually discontinued and the site is now dealing with the legacy.

Work is now under way to overcome a decades-old challenge that has hampered decommissioning of the Dounreay Fast Reactor (DFR) in Scotland.

Decommissioning the 60-year-old DFR is one of the most technically challenging projects across the NDA Group. When the sphere-shaped experimental reactor closed in 1977, most of the core uranium fuel was removed. But follow-up work came to a halt when, in the zone surrounding the core, some metallic casings were found to be swollen and jammed. Almost 1,000 – around two-thirds of the total - had to be left in place. The stainless steel casings, known as breeder elements, contained natural uranium and were designed to produce more fuel for use in other reactors.

When the damage was discovered, decommissioning effectively stopped for 20 years. But fresh momentum was given to the task by the decision, in 1998, to close down Dounreay and the creation of the NDA a few years later. After an exhaustive process to design and test equipment that must be operated remotely, the elements are finally being removed. This followed extensive research and development trials inside the plant and at a test rig on the outskirts of Thurso.

The removal work is expected to take about 3 years, allowing a start to be made on dismantling the landmark reactor, with completion estimated to be achieved by 2025.

Preparatory work included the destruction of almost 60 tonnes of highly reactive liquid metal coolant, in which the breeder elements were immersed. This difficult, hazardous programme took more than 10 years and required construction of a specially designed plant.

After removal, the elements are being transferred to a purpose-built facility, where they are cut open to remove the uranium, cleansed of any traces of liquid metal and packaged in containers for dispatch to Sellafield. About 40 tonnes of breeder elements recovered previously have already been sent to Sellafield.

About the Dounreay Fast Reactor (DFR)

When the DFR was built in the 1950s, there was a world-wide shortage of uranium for electricity generation. It became the world’s first fast reactor to provide electricity to a national grid, providing enough power for a small town like Thurso (population approximately 9,000).

DFR’s reactor core was surrounded by a blanket of natural uranium elements that, when exposed to the effects of the radiation, would ‘breed’ to create a new fuel, plutonium. The UK government eventually decided, in the late 1980s, to phase out the fast breeder programme.

DFR was one of only two power-generating fast reactors ever built in the UK, both at Dounreay and its decommissioning is one of the most significant challenges in the UK today. When the breeder material is all removed, the reactor and its circuits will be dismantled, followed by final decontamination of the structures. The dome and associated structures will then be demolished.

Winfrith Lasersnake

PRIORITY: Decontamination and Demolition

LaserSnake: the laser-cutting robotic snake at Winfrith

A laser-cutting robotic snake has been put to work on the highly radioactive core of a nuclear reactor for the very first time.

Using surgical precision, the long, flexible LaserSnake arm passed through a narrow opening to slice through a 400mm diameter vessel attached to the core of Winfrith’s redundant Dragon reactor.

LaserSnake was called into action by the Winfrith team when it became clear that removing the waste gas heat exchanger, known as the Purge Gas Pre-Cooler (PGPC), would pose problems: one end was joined to the core in the high radiation area behind 3 metres of concrete shielding and steel plates, while the other end extended outside the shielding.

The flexible robotic snake, developed by OC Robotics and The Welding Institute with R&D funding from the NDA, seemed perfect: controlled from a distance by specialist operators, LaserSnake can squeeze through a small access hole, manoeuvre easily inside a very confined space and cut multiple layers with its high-powered laser. This allowed the work to be carried out inside the existing radiation shielding of the reactor.

Further research and trials were needed first, however. Although LaserSnake had been deployed to cut up Sellafield vessels, the thick pipework and complex internal geometry of the PGPC, as well as limited access from one side only, provided an additional challenge.

Two mock-ups were constructed enabling comprehensive testing and a series of rehearsals to take place, before LaserSnake was installed outside the shielding to make the cuts, accessing the space via a 200mm drilled hole.

On site, less than 3 hours of actual cutting time was needed to free the PGPC from the reactor core, where it had been for 50 years. It was then carefully removed using rigging, pulleys and manpower. Magnox Senior Project Manager Andy Philps said:

The ability of the LaserSnake to perform ‘keyhole surgery’ on the reactor core meant that the work could be carried out using existing protective shielding. This avoided the significant cost, of at least £200,000, plus around 4 weeks of time and the dose associated with building additional infrastructure, enabling us to remove this component earlier than originally planned.

What’s more, we believe it’s the first time that laser-cutting technology has been deployed directly on the core of a nuclear reactor.

The NDA’s Head of Technology Melanie Brownridge said:

This is an excellent example of how early NDA R&D funding support enabled the technology to grow from an exploration of whether laser-cutting could actually be adapted for nuclear into a system that, with further funding and collaborative working, is now mature and being successfully deployed on a number of our sites.

Dragon, a prototype high-temperature reactor cooled by helium, was developed in the 1960s as a joint European project involving 13 countries. After opening in 1964, it operated until 1975 when it was closed and defueled before being put into a passive care and maintenance regime. In 2011, decommissioning began in earnest. All that now remains is the reactor core contained in a pressure vessel surrounded by the concrete biological shield, 7 steel containment plates and an outer containment building.

Under the current programme, it is expected that the reactor core will be removed by 2021 and the facility demolished to ground level by 2022.

Financial Overview

David Batters, Chief Financial Office: "This year over £3 billion has been spent on tackling the nuclear legacy and good progress has been made across the NDA Group"

Headlines:

- a total of £3.3 billion spent in the year

- £1.2 billion income

- meaning a net total of £2.1 billion funded by the government

- movements in provisions, other balance sheet items and adjustments totaled £70.1 billion

equals £72.2bn net comprehensive expenditure

The NDA has again kept expenditure within the strict funding boundaries agreed by Parliament, and in line with the Spending Review totals agreed in 2015. Over the year, we have spent £3.3 billion, making strong progress across the Group.

This year, through careful financial management we would have generated a budgetary surplus of £212 million. We have agreed with HM Treasury that £196 million of this will be carried forward to address budget pressures in future years, and the remaining £16 million has been returned to HM Treasury.

A change in the discount rates mandated by HM Treasury was the principal reason behind a £70 billion increase in the discounted nuclear provision. The underlying undiscounted provision has increased in the year by £2 billion.

We continue to drive value for money in our own expenditure, with the cost of running the NDA itself at £44 million. This represents 1.3% of the overall NDA budget and includes continued investment in research and socio-economic initiatives.

This figure can be expected to increase next year as the NDA starts to invest in new capacity and capability to improve oversight of expenditure and procurement across the Group.

The Spending Review settlement required a commitment from the NDA to deliver efficiency savings of £1 billion, and it is pleasing to say that good progress is being made towards achievement of that target.

David Batters

Chief Financial Officer

26 June 2018

Performance against financial targets

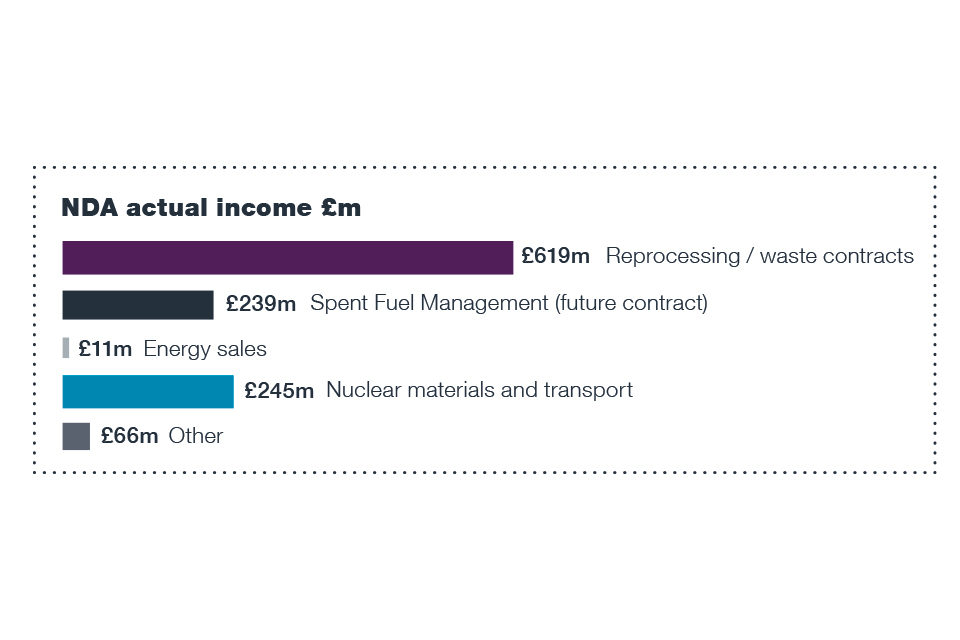

NDA actual income

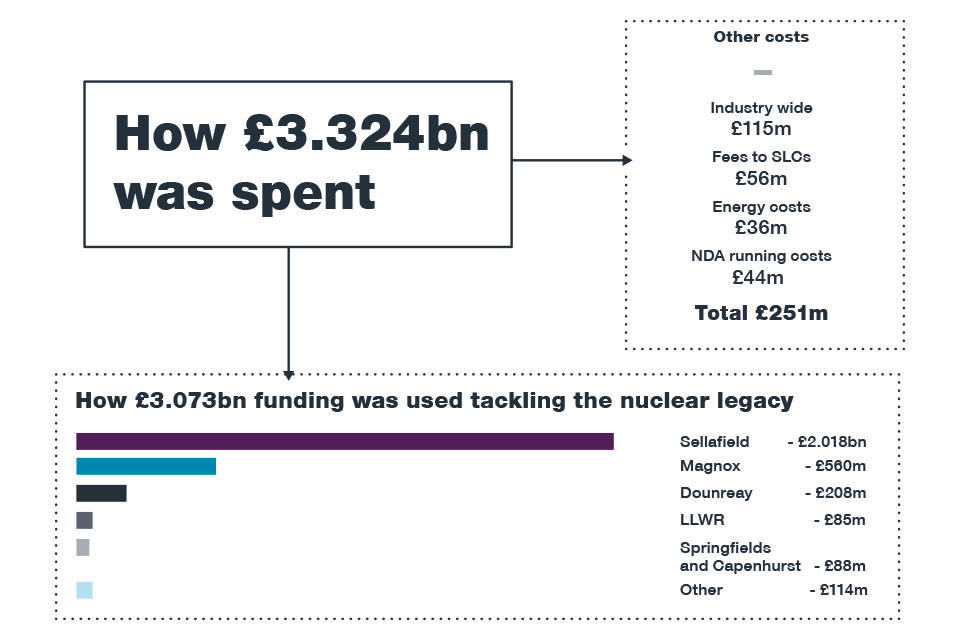

NDA expenditure

Financial Summary 2017 to 2018

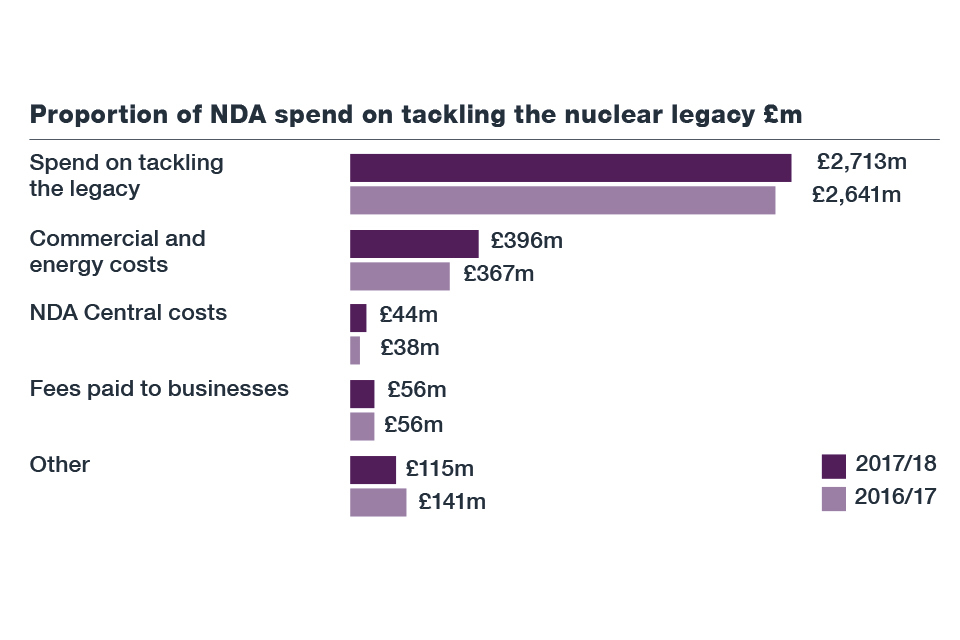

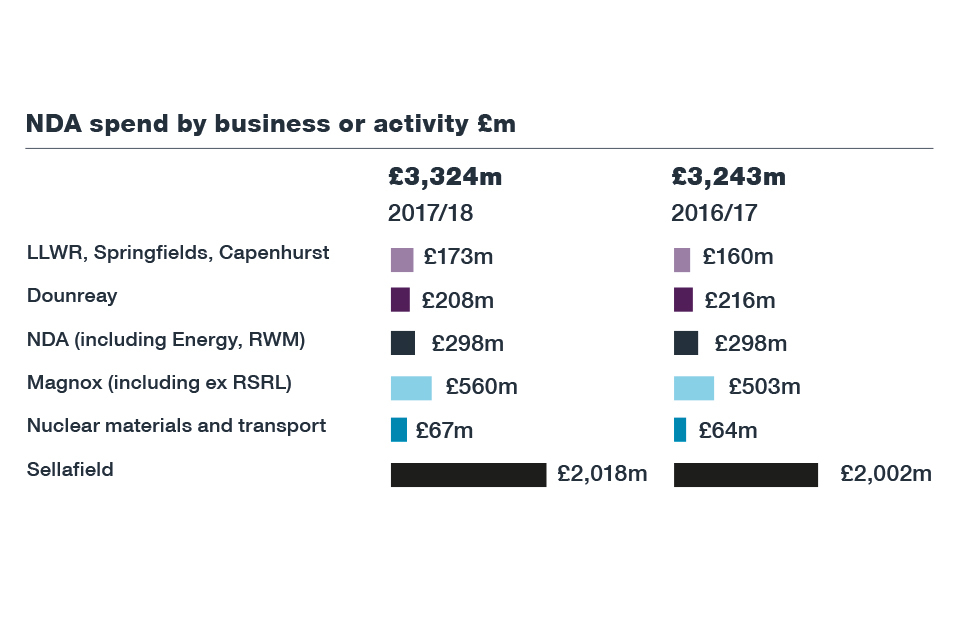

NDA spend on tackling the legacy (2017 to 2018)

The bulk of the NDA’s budget is directed towards tackling the nuclear legacy, by funding our businesses decommissioning work. The remainder funds commercial operations, industry-wide costs, fees to businesses and the NDA’s own running costs.

NDA spend on tackling the legacy

NDA spend by business (2017 to 2018)

Spend in 2017 to 2018 was £3.3 billion. More than 60% of this was spent at Sellafield, reflecting the priority given to the site.

Expenditure at Sellafield has increased during NDA’s existence and now stands at £2 billion per year.

NDA spend by business or activity

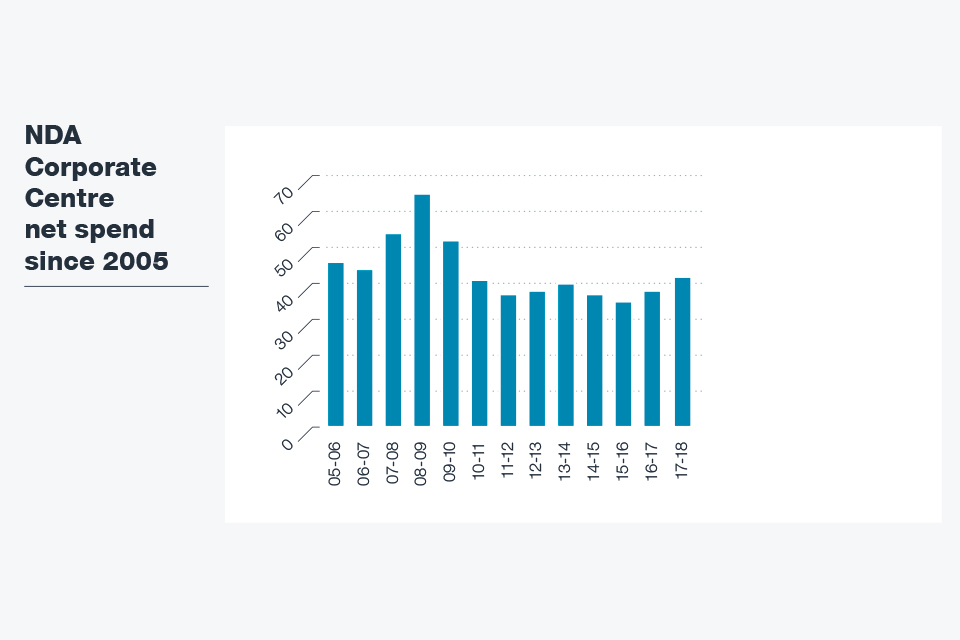

NDA Corporate Centre net spend (2017 to 2018)

NDA’s own net running costs were £41 million (2016 to 2017 £38 million) after deduction of £3 million of income (2016 to 2017 £3 million). This net spend represents around 1.2% of overall expenditure.

NDA Corporate Centre net spend

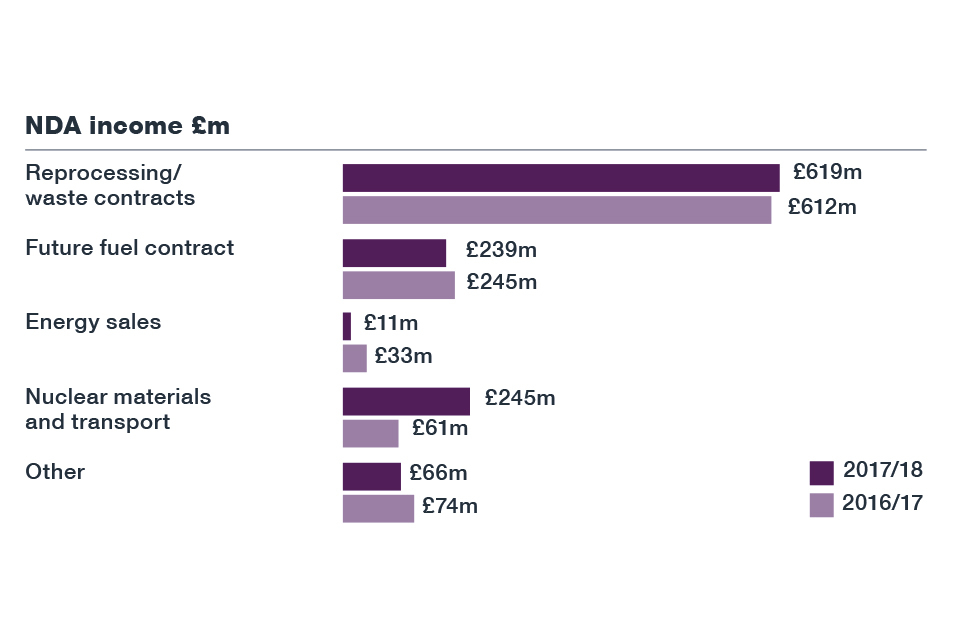

NDA’s income (2017 to 2018)

NDA income was almost £1.2 billion in the year, with 73% arising from reprocessing and management of spent fuels and waste.

NDA Income

Financial Summary: since 2005

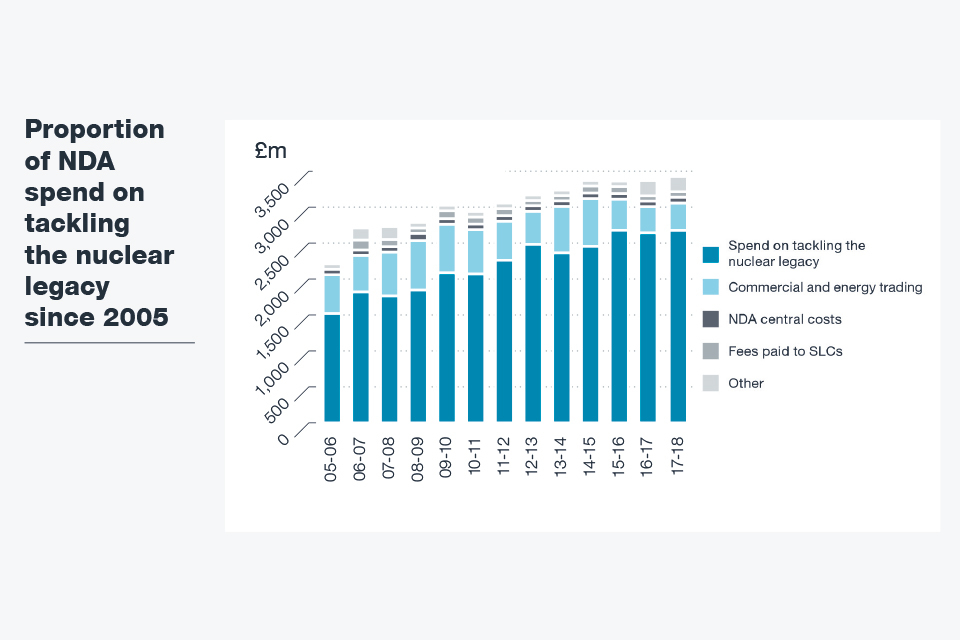

NDA spend on tackling the legacy (since 2005)

The proportion of NDA expenditure tackling the nuclear legacy has increased since 2005, with a corresponding reduction in commercial costs as commercial operations wind down.

Proportion of NDA spend on tackling legacy since 2005

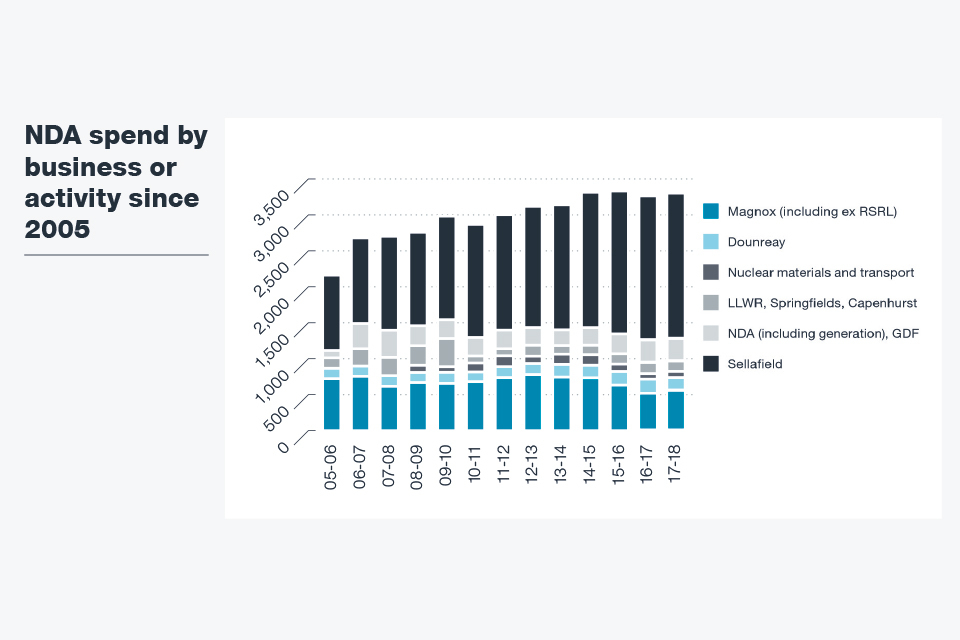

NDA spend by business (since 2005)

Sellafield has always been the NDA’s largest area of spend, and has been increasingly prioritised in recent years as funding is directed towards the Group’s highest hazards.

NDA spend by business or activity since 2005

NDA Corporate Centre net spend (since 2005)

NDA’s annual net running costs (after deduction of around £3 million of income) are in the region of £40 million.

NDA Corporate Centre net spend since 2005

NDA’s income (since 2005)

In recent years, electricity generation income has reduced. Reprocessing and management of spent fuels and waste are now the dominant source of income.

NDA income since 2012

Nuclear Provision

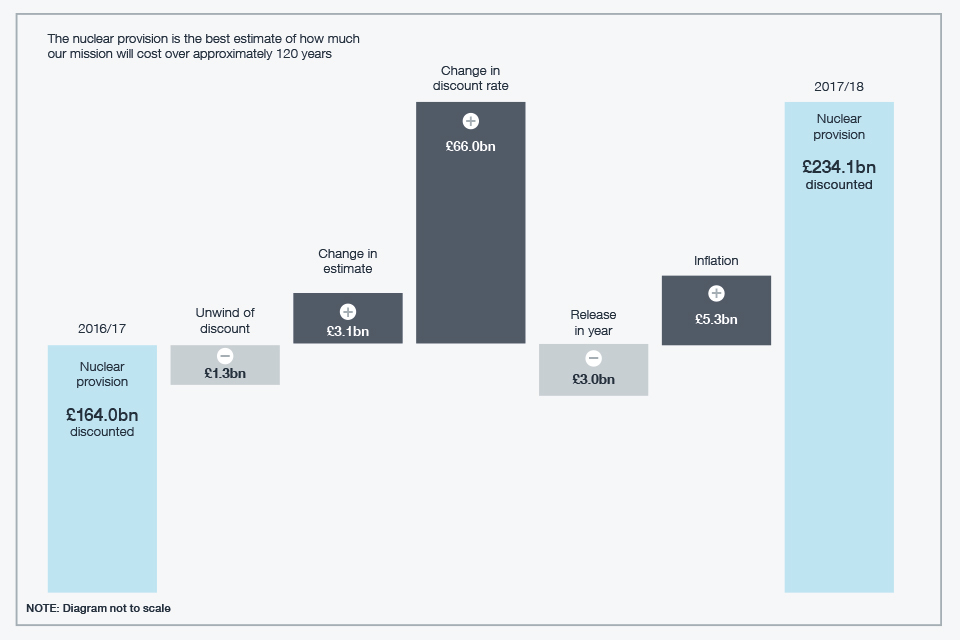

The Nuclear Provision is a single point number in the Statement of Financial Position which represents the discounted estimated cost of the decommissioning mission.

The NDA management’s best estimate of the future costs of the Group is based on an assumed inventory of materials, using strategies for retrieval and disposal over several decades. Each of these elements (quantity, method and time to treat) is uncertain in its own right, as is the cost of developing the necessary technology and plans to deal with these activities. The quality of the forecast becomes less certain as time goes out, and acceptable standards of clean-up and end states may change.

It is important to understand the basis of this estimate and the inherent uncertainty around it, and therefore that it is simply a single point in a credible range of potential outcomes. For more detail see Appendix A.

Changes in 2017 to 2018 estimate - Authority

The key drivers in the change in value of the nuclear provision are inflation and discount rates. The discounted nuclear provision at the end of 2016 to 2017 was £164.0 billion. Since then the movements have been:

- the value provided for 2017 to 2018 released to match work done - £3.0 billion

- increases due to inflation + £5.3 billion

- unwinding of the existing discount applied to the provision every year - £1.3 billion

- the impact of the changes in discount rates + £66.0 billion

- cost estimate changes which increase the liability estimate by a net + £3.1 billion

These movements bring the 2017 to 2018 estimate to £234.1 billion discounted.

Movements in the nuclear provision, the best estimate of how much our mission will cost over approximately 120 years

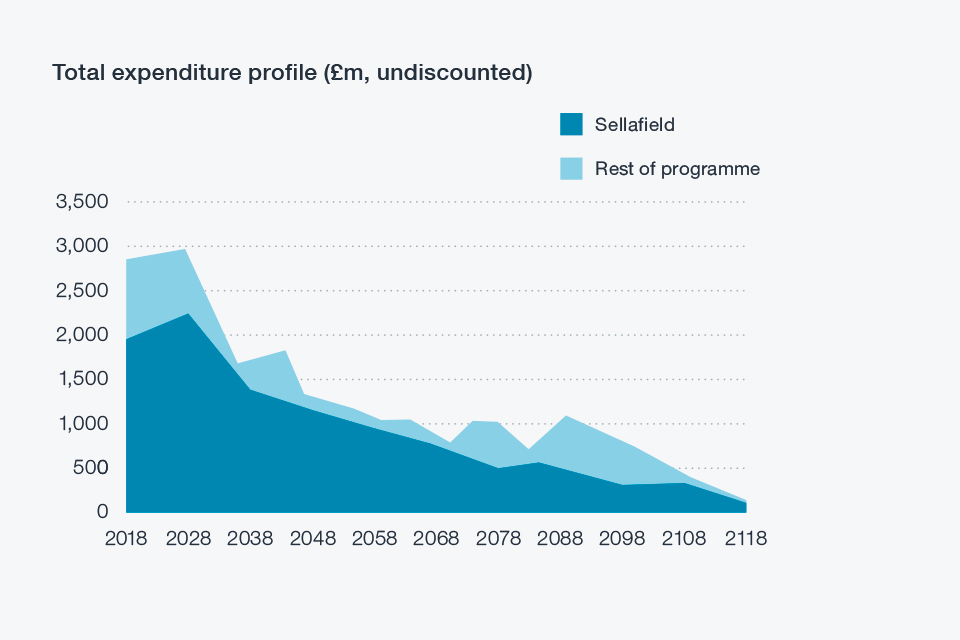

Total expenditure profile (£m, undiscounted)

The graph above shows the undiscounted expenditure profile for future years (excluding NDA administrative and other non-programme costs, and some commercial costs) from lifetime cost projections from each of the businesses.

The expenditure profile illustrates a downward trend in expenditure over the next 50 years, following a short-term peak over the next 10 years, as sites enter into care and maintenance with subsequent increases in expenditure in the period from 2070 when final site clearance work on Magnox sites is undertaken.

| 2016 to 2017 undiscounted £m | 2016 to 2017 discounted £m | Unwind of discount £m | Discount rate change £m | Released in year £m | Inflation £m | Other cost change £m | Movement discounted £m | 2017 to 2018 undiscounted £m | 2017 to 2018 discounted £m | |

|---|---|---|---|---|---|---|---|---|---|---|

| Magnox Limited | 15,150 | 23,728 | -219 | 13,873 | -707 | 764 | -673 | 13,038 | 14,667 | 36,766 |

| Sellafield Limited | 89,627 | 119,930 | -912 | 42,179 | -1,995 | 3,895 | 2,792 | 45,959 | 91,385 | 165,889 |

| Dounreay Site Restoration Limited | 2,378 | 2,697 | -20 | 110 | -182 | 86 | 0 | -6 | 2,271 | 2,691 |

| LLW Repository Limited | 576 | 759 | -7 | 235 | -23 | 25 | 255 | 485 | 557 | 1,244 |

| INS Contracts | 43 | 52 | 0 | 9 | 0 | 2 | -2 | 9 | 43 | 61 |

| Springfields | 595 | 881 | -9 | 491 | -39 | 28 | 141 | 612 | 681 | 1,493 |

| Capenhurst | 968 | 1,201 | -11 | 288 | -54 | 38 | 778 | 1,039 | 1,533 | 2,240 |

| Geological Disposal Facility | 9,655 | 14,750 | -108 | 8,780 | -32 | 483 | -191 | 8,932 | 9,817 | 23,682 |

| Authority | 118,992 | 163,998 | -1,286 | 65,965 | -3,032 | 5,321 | 3,100 | 70,068 | 120,954 | 234,066 |

| NDA Group companies | 131 | 147 | 0 | 8 | 0 | 5 | 10 | 23 | 143 | 170 |

| Group provision adjustment | -640 | -640 | 0 | 0 | 0 | 0 | -27 | -27 | -667 | -667 |

| NDA Group | 118,483 | 163,505 | -1,286 | 65,973 | -3,032 | 5,326 | 3,083 | 70,064 | 120,430 | 233,569 |

Health, Safety, Security Safeguards and Environment Report

The safety of people, protection of the environment and security of nuclear materials and information are NDA’s overriding priorities and dictate our approach to all activities across the Group.

We expect good performance in environment, health, safety and security that reflects both international standards and policies, and relevant good practice from UK industry. While legal responsibilities rest with the businesses and contractors who work in the NDA Group, it is NDA’s duty to have particular regard for the safety of people handling hazardous substances, the protection of the environment and security. We take our responsibilities seriously, and we hold those who fail to meet our expectations to account.

In addition, as the direct employer of some 220 people across multiple locations, we have responsibilities for the safety and wellbeing of our staff, the security of information that we use, and our own impact on the environment.

In November 2017, we launched the ‘NDA HSE FLASH SHARE’. This is an alert system that is used to communicate HSE events to all NDA businesses.

Safety performance in the NDA Group

We use a suite of metrics, targets and performance indicators to understand safety performance. We also visit sites to carry out safety reviews and discuss safety with managers, workers and trade union representatives. The results are reported to the NDA Executive and NDA Safety and Security Committee, a sub-committee of the NDA Board, and the findings raised with businesses and Parent Body Organisations.

On conventional safety, all parts of the Group saw improvements in safety performance. Accident rates (Recordable Incident Rate and RIDDOR events) were lower than last year, and we saw fewer events with the potential for serious injury.

In May 2018, we were advised by the Office for Nuclear Regulation (ONR) that they would prosecute Sellafield Ltd over an INES2 event (1 of 3 reported in 2016 to 2017), where a worker was contaminated. While we were reassured that ONR’s decision did not signal a change in regulatory strategy relating to Sellafield, the event and the outcome of the prosecution are clearly of concern, and we will monitor Sellafield’s response. The INES scale is used to communicate the safety significance of events associated with sources of radiation. The INES rating is determined by the highest of 3 scores: off-site effects, on-site effects, and degradation of defence in depth. Defence in depth is a fundamental concept in nuclear safety where multiple, independent, redundant, layers of protection respond to failures. INES2 events have limited impact on people and the environment, but are judged more serious than INES1 ‘anomalies’.

Despite a serious chemical safety event at Sellafield, we are pleased to note generally high standards of process safety, good reporting and, following our second Health and Safety Laboratory (HSL) Safety Climate Survey, improvement in safety culture.

Sellafield

The site ended 2017 to 2018 with a Recordable Incident Rate of 0.27 (0.29 in 2016 to 2017) which compares well with the best performing private and public sector organisations of similar size. One event at the site was of particular concern. On 3 October 2017 a routine audit of a laboratory that handles radioactive materials found a partially filled 500ml bottle of Tetrahydrofuran (THF), a flammable chemical known to degrade over time into an unstable form. The chemical should have been disposed of one month after opening, but had been in storage for some years.

In the interests of safety, Sellafield sought expert assistance and Army Explosive Ordnance Disposal (EOD) attended site to destroy the THF with a controlled explosion. The event was subsequently rated INES1 (Anomaly).

We coordinated a search for similar chemicals at all NDA sites, including other organisations that share our sites, and, at the request of Springfields Fuels Ltd, Army EOD attended the Springfields site to destroy a different chemical.

It is very important that our businesses and NDA learn from these events and to reinforce our commitment to implementing an improved method of capturing and sharing HSE events.

Dounreay

We are pleased to report that Dounreay Site Restoration Ltd (DSRL) responded positively to the challenges of last year, and that substantial improvements in safety and environmental performance have been achieved at the site.

As part of our oversight of Dounreay under the contracts in place between us and the operator, DSRL and its parent Cavendish Dounreay Partnership (CDP), we worked with DSRL to improve health, safety and environmental performance at the site. Following Scottish Environment Protection Agency (SEPA’s) feedback to us in March 2017, we asked DSRL and CDP to attend an NDA Board meeting in Scotland, to brief us on their plans to improve performance and meet an acceptable level of compliance. We followed this up later in 2017 with DSRL and CDP attending the Board Safety Committee, where they were again challenged to demonstrate improved performance. In the Autumn, members of the Committee, together with senior NDA executives, visited Dounreay to observe progress on the ground.

The NDA has an effective and transparent working relationship with SEPA and ONR, with the joint purpose of facilitating the safe delivery of decommissioning and clean-up of our sites in Scotland. We are not the operator and we do not engage formally with either body on regulatory matters – the site licence company DSRL has that relationship with them. However, we expect and require all our operators to be in full compliance and perform in a manner that meets or exceeds good practice, and we will continue scrutiny until we are convinced that further improvements have been made and can be sustained.

Magnox

Magnox sustained improvements in safety performance and at the end of the year, the Recordable Incident Rate was 0.31, a 60% improvement on the recorded rate at the end of 2016 to 2017.

In common with many large industrial structures of a similar age, all Magnox sites have historical issues with the management of asbestos, which will become clearer as decommissioning progresses. Magnox has responded to ONR’s Improvement Notice on the Wylfa site (January 2017), requiring improvements in the management of asbestos and has engaged well with NDA’s detailed audit of asbestos management. The scale and nature of this issue means that further work is required to reduce the risk and control the hazard.

Low Level Waste Repository (LLWR)

LLWR maintained its safety performance through initiatives such as the ‘Perfect Day’ principle, which combines safety with work delivery and management effectiveness. However, towards the end of the year, performance against LLWR’s own metrics deteriorated. There were no serious injuries, but action has been taken to improve performance, and we will continue to hold LLWR to account.

Subsidiaries

Other businesses demonstrated good safety performance throughout the year.

We repeated the Group HSL Safety Climate Survey during 2017 to 2018 and we will use the results to inform our approach to the assurance of safety, and the development of our environment, health and safety strategy.

Security Performance in the NDA Group

Security remains a key focus in the UK civil nuclear sector and the NDA Group has continued to play a major part in the protection of nuclear and other radiological material. The Group has capitalised on work commenced in previous years to further improve both security and resilience capabilities.

Improvements have been made through a collaborative approach involving key stakeholders such as BEIS, Home Office, ONR, Civil Nuclear Security (CNS) and Civil Nuclear Constabulary (CNC). Interactions have also taken place with local resilience forums, blue light responders, British Transport Police (BTP), Ministry of Defence (MOD) and the wider civil nuclear sector organisations. Such collaboration has allowed a greater emphasis on shared learning and operations to support security and resilience.

Specific deliverables include:

- The NDA’s Cyber Security and Resilience Programme (CSRP): NDA Cyber Security Programme is fully aligned with the National Cyber Security Strategy and BEIS. This includes supporting development of UK Cyber Security talent by creating Cumbria’s first cyber lab, and establishing the first cohort of apprentices for NDA’s businesses.

- Supply Chain Security: The NDA continues to lead the industry in the development of an aligned approach to ensuring information shared in the supply chain is sufficiently protected in line with its classification. We are also simplifying the process for companies gaining contracts in the nuclear industry.

- Alignment of Security and Resilience (S and R) Group Strategy: The initiation of collaborative Security and Resilience forums has created economies of learning and brought the NDA S and R family together. The creation of an agreed strategy seeks to capitalise on economies of scale and scope, delivering value for money.

- Improved performance and accountability: S and R assurance and accountability continues to develop through continuous learning. Improvements in this area are now under way following a variety of initiatives such as the creation of meaningful metrics to measure performance.

- Culture and the Human Factor: Human factor experts have conducted a series of interviews across the Group to explore the underlying factors that influence security delivery. This work will guide improvement plans to further enhance the Group’s nuclear security.

- Group Security Improvement projects: Security enhancements continue through the Group with National Nuclear Archive providing greater information security. Off-Site Command Facility (OSCF) and the Multi-Services Command Facility (MSCF) provide greater capability and resilience.

The individual businesses have had a demanding year but overall maintained professional S and R functions. The work initiated in 2017 will continue to improve the Group’s S&R capabilities.

Environmental Performance in the NDA Group

The NDA measures environmental performance as the number of non-compliances with environmental permits. In 2017 to 2018, the Group reported 59 non-compliances, which is broadly consistent with previous years. Most were technical breaches, and none resulted in any environmental impact.

In a year of good performance, Sellafield reacted well to the discovery of flammable chemicals in a building on the site. Disposal required the attendance of Army EOD, who transported the chemicals to a remote area of the site and destroyed them with explosives. The destruction left no harmful residues, and did not damage the local environment.

| Although Sellafield reacted well to the discovery of flammable chemicals in a building on the site (noted above) there were issues with the control of chemicals and the consignment of wastes, for which they received a Warning Letter from the Environment Agency. |

| At the end of 2016, the SEPA rated Dounreay ‘at risk’ for the management of radioactive waste, and ‘poor’ for the low level waste vaults. In 2017, SEPA gave an overall rating of ‘poor’. DSRL is making considerable efforts to rectify historical environmental issues and is making environmental compliance a priority. There are early signs of improvement, but the coming year will still be challenging as DSRL deals with its environmental legacies. We will monitor progress. |

| During the year, Magnox received Warning Letters (a form of regulatory sanction) from environmental regulators for the misconsignment of waste to LLWR, and a number of radiological clearance events. Improvements were made, and Magnox ended the year with sustained good performance. |

| Elsewhere, we were pleased to note good environmental performance at LLWR, which had no non compliances this year, and in our businesses, NDAPL, INS/PNTL, RWM and DRS. |

Safety and Environmental Performance in NDA Corporate Centre

NDA’s in-house safety performance continued to be good, with no serious accidents or injuries during the year.

See Something, Say Something, the NDA’s event reporting process, introduced in 2015, has continued to provide us with useful information and we use the analysis to report to our safety representatives every quarter.

This year, we ran successful campaigns in personal well-being, workplace stress and office safety. Included in these campaigns have been talks to promote mental health and welfare in the workplace.

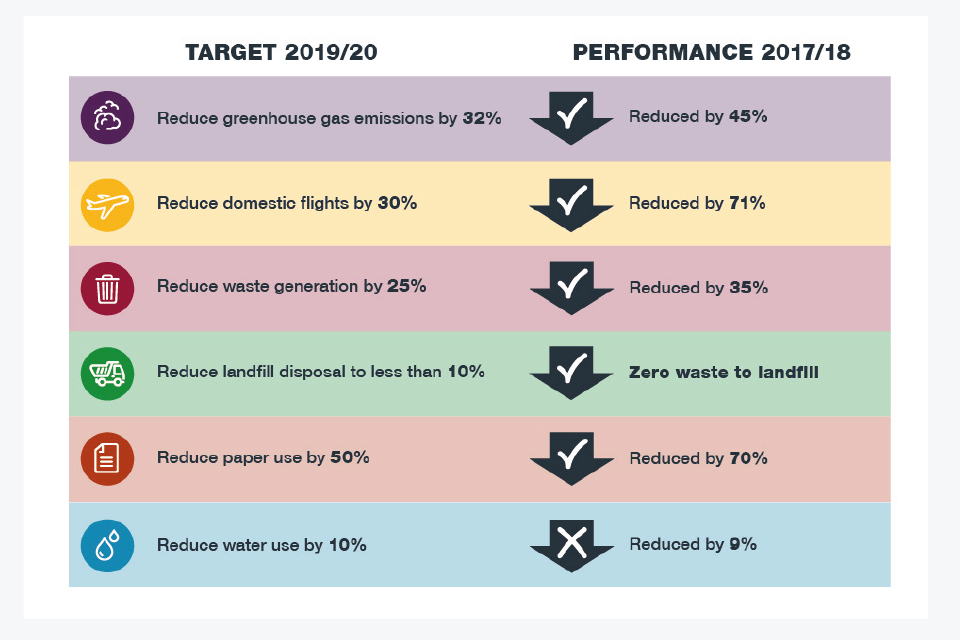

The Government has set environmental and sustainability targets that must be met by 2019/20.

The specific targets set by BEIS in 2009/10 are:

- 32% reduction in greenhouse gas emissions from energy and business travel

- 10% reduction in waste to landfill

- 25% reduction in waste generation

- continue to reduce water usage with 10% reduction

- reduce domestic air travel by 30%

- reduce paper use by 50%.

The targets apply to the NDA Corporate Centre combined with Radioactive Waste Management (RWM).

At the time the targets were first set, RWM was part of NDA and managed by NDA Facilities Management. In 2014 RWM became a subsidiary of NDA and in 2016 took full ownership of its facilities management. However, it is still mandated for inclusion in the overall NDA report.

With the exception of water use, we expect to meet all the targets set. Further measures are being implemented for 2018/19 to try to reduce the water usage. An overview of progress against each of the targets is shown below.

Environmental performance at NDA

ACCOUNTABILITY REPORT

Directors’ Report

The NDA is an Executive Non-Departmental Public Body (NDPB), established by the Energy Act (2004) to oversee and monitor the decommissioning and clean-up of the UK’s civil nuclear legacy.

Since then, the NDA’s remit has been extended to include the long-term management of all the UK’s radioactive waste by finding appropriate storage and disposal solutions.

Accounts direction

These accounts have been prepared in a form directed by the Secretary of State with the approval of HM Treasury and in accordance with section 26 of the Energy Act (2004).

Directors’ interests

Directors of the NDA must declare any personal, private or commercial interests. A register of such interests is maintained by the NDA.

Rob Holden declared a commercial interest. He will be excluded from any involvement with Moorside deliberations because of his role at EdF.

All other directors have no personal, private or commercial interests which would conflict with his or her role as a director of the NDA.

Directors comprise senior management and non-executives whose details are set out in the Governance Statement.

Auditor of the NDA

The NDA is audited by the Comptroller and Auditor General (C&AG) in accordance with the Energy Act (2004). The services provided by the C&AG relate to statutory audit work for the NDA. No fees were paid to the C&AG for services other than statutory audit work.

Pensions

All NDA employees are eligible to participate in the Civil Service Pension Arrangements. Employees within the Group participate in various defined benefit pension schemes detailed in note 26 to the accounts.

Group employees also participate in various schemes which are accounted for on a defined contribution basis, with details given in note 26 to the accounts.

Better Payment Practice

The NDA supports the Better Payment Practice Code in its treatment of suppliers. The key principles are to settle the terms of payment with suppliers when agreeing the transaction, to settle disputes on invoices without delay and to ensure that suppliers are made aware of the terms of payment and to abide by those terms.

During the year, the NDA has achieved a 91.60% success rate for payment of suppliers in accordance with terms (2016 to 2017 – 92.84%). The average number of payment days from invoice date was 30 days and for a valid invoice, (i.e. one with all details correct and entered on the accounting system), 12 days (2016 to 2017 - 29 days and 12 days). The proportion that is the aggregate amount owed to trade creditors at the year-end compared to the aggregate amount invoiced by suppliers expressed as a number of days is 8.42 days (2016 to 2017 – 18.40 days).

Personal data

There were no data breaches or loss of personal data for 2017 to 2018.

Other disclosures

Some disclosures required in the Director’s Report have been included elsewhere in the Annual Report.

Disclosures on Equal Opportunities, Learning and Development and how the NDA engages with all staff are in the Our People Report. Details of investment in socio-economic developments, research and development and funding, counterparty and foreign exchange risk are all included in the financial statements. The NDA’s environmental performance is detailed in the HSSSE report.

No events affecting these accounts have occurred since the reporting date. A full explanation of the adoption of a going concern basis appears in note 2.1 of the financial statements.

Statement of Accounting Officer’s Responsibilities

Under Section 26 of the Energy Act 2004, the Secretary of State (with approval of HM Treasury) has directed the NDA to prepare a statement of accounts in the form and on the basis set out in the Accounts Direction.

The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the NDA and its income and expenditure, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by the Secretary of State (with approval of HM Treasury), including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

- make judgements and estimates on a reasonable basis;

- state whether applicable accounting standards have been followed, as set out in the Government Financial Reporting Manual, and disclose and explain any material departures in the accounts, and

- prepare the accounts on a going concern basis.

The Accounting Officer for the Department for Business, Energy and Industrial Strategy (BEIS) has designated the Chief Executive as Accounting Officer for the NDA.

The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, keeping proper records for safeguarding the NDA’s assets, are set out in Managing Public Money published by HM Treasury.

In addition, the Accounting Officer confirms that, as far as he is aware, there is no relevant audit information of which the NDA’s auditors are unaware, and that he has taken all steps necessary to ensure that he is aware of any relevant audit information, and that the NDA’s auditors are aware of that information.

He takes responsibility for ensuring that the NDA Annual Report and Accounts as a whole is fair, balanced and understandable in both the preparation of the document and in making the judgements necessary in preparation of the document.

Governance Statement

The NDA is sponsored by the Department for Business, Energy and Industrial Strategy (BEIS). UK Government Investments (UKGI) advises BEIS on corporate governance issues relating to the NDA, and act as BEIS’s agent in managing the NDA Shareholder Function. The formal agreement between the NDA and BEIS is set out in a Framework Document, supported by a Memorandum of Understanding between BEIS and UKGI.

This governance statement provides a summary of the structure of the NDA Board and the Executive and the effective governance over the key activities undertaken during 2017 to 2018. It explains the frameworks used to measure the effectiveness of delivery, the findings of key audit and assurance reviews and associated improvement actions.

The Authority’s Governance Framework

We are governed by the Energy Act (2004), the government’s Framework Document and Cabinet Office guidelines for Non-Departmental Public Bodies (NDPBs). Our structure is summarised below and further explained in this statement.

| NDA Board and Sub-Committees |

Chairman: Accountable for the delivery of obligations under Energy Act 2004 and provides effective leadership and direction of the Board

| Meeting | Frequency | Purpose of meeting | Meeting Chair |

|---|---|---|---|

| NDA Board | Monthly 10 per year | To set strategic framework and direction. Ensure corporate governance is observed. Responsible for key decisions. Monitor and challenge Group performance. | Board Chair |

| Safety and Security Committee | Quarterly | To provide support to Board on discharging responsibility across NDA estate relating to Health, Safety and Security matters. | Non-Executive Director |

| Audit and Risk Assurance Committee | 5 per year | To provide advice to Board on risk, control and governance. Assessment on assurance reliability and integrity. | Non-Executive Director |

| Remuneration Committee | Quarterly | To provide advice to Board on remuneration, monitors performance, assesses succession planning and talent management. | Non-Executive Director |

| Programmes and Projects Committee | 5 per year | To provide advice to Board on sanction, performance and assurance of programmes and projects. | Non-Executive Director |

| Executive Committee and Sub-Committee |

Accounting Officer (AO) and CEO: Responsible for leadership and operational management of the NDA. Accountable to Parliament for NDA activities, public funds employed and ensuring targets are met.

| Meeting | Frequency | Purpose of meeting | Meeting Chair |

|---|---|---|---|

| Executive Committee | Monthly | Accountable for implementing strategy and plans approved by Board. Includes sanction review and decision making. | Chief Executive Officer |

| Risk and Assurance Committee | Monthly | To monitor and manage risk and assurance mechanisms. To provide advice to Board Audit and Risk Assurance Committee. | Chief Financial Officer |

| People Committee | Monthly | To manage the performance management and development of NDA employees. | Human Resources Director |

| Sanction Committee | Monthly | To review and approve work activities across the NDA estate, including: programmes, projects, procurements, IT expenditure, contracts, asset disposal and investment opportunities. Subject to delegated authority, further approval by the NDA Board and Government may be required. | Assurance Director |

| Projects and Programmes Committee | Monthly | To provide oversight of the Corporate Centre led projects, programmes and change initiatives – managing, monitoring and reviewing performance at a portfolio level. | Assurance Director |

As at 31 March 2018, we had 9 members of the NDA Board - 3 Executive plus 6 Non-Executive Directors (NEDs) including the Non-Executive Chair. Board membership and current terms, committees and attendance for those who have served during 2017 to 2018 are summarised below:

NDA Board - Number of meetings held and attended

| Name | Role | Term of office ends | Board (10) | A&RAC (5) | REMCO (4) | S&SC (4) | P&PC (5) | |

|---|---|---|---|---|---|---|---|---|

| Tom Smith | Chairman | N/A | 28 Feb 2020 | 10* | 0 | 0 | 0 | 5* |

| Janet Ashdown | Senior Non Executive Director | Chair of S&SC | 30 Nov 2018 | 9* | 5* | 0 | 4 | 0 |

| Volker Beckers | Non Executive Director | Chair of A&RAC | 30 Sept 2018 | 8.5* | 5* | 0 | 0 | 0 |

| Evelyn Dickey | Non Executive Director | Chair of REMCO | 30 Sept 2018 | 10* | 0 | 4* | 0* | 0 |

| Rob Holden | Non Executive Director | Chair of P&PC | 30 Nov 2018 | 9* | 0 | 4* | 4 | 5* |

| Candida Morley | Non Executive Director | N/A | 6 Nov 2020 | 7* | 0 | 0 | 0 | 0 |

| David Peattie | CEO and AO | N/A | N/A | 10* | 5** | 4** | 4** | 5** |

| David Batters | CFO | N/A | N/A | 10* | 5** | 0 | 3** | 0 |

| Adrian Simper | Director of Strategy and Technology | N/A | N/A | 10* | 0 | 0 | 0 | 0 |

*member

**in attendance

Current Non-Executive Directors (NEDs) including Non-Executive Chair

Tom Smith - Chairman

Tom began his career in the Diplomatic Service, working in London, Hong Kong and Beijing between 1979 and 1990, when he was part of the team that negotiated the 1984 treaty with China on Hong Kong.

In 1990 he joined Trafalgar House plc and held several senior positions before becoming Managing Director of Midland Expressway Ltd (MEL) in 1997, where he led the development and construction of the M6 Toll, the UK’s first privately financed toll motorway. He subsequently joined the Go-Ahead Group plc as Managing Director Rail Development and over 10 years was instrumental in turning Go-Ahead into one of the country’s largest passenger rail operators. He was Chairman of the Association of Train Operating Companies from 2009 to 2013. He was a non-executive director of Highways England from 2014 to 2016.

Current external appointments include:

- Chair - Angel Trains Group

Rob Holden CBE – Non-Executive Director

Between 1999 and 2009, Rob led the London and Continental Railways (LCR) team in a series of transactions that secured the future of the Channel Tunnel Rail Link (later renamed High Speed 1). In 2009 he was awarded a CBE for services to the rail industry.

Current external appointments include:

- Non-Executive Director - Electricity North West

- Chair - High Speed 1

- Chair - Submarine Delivery Agency

- Other positions - Non-Executive Director of Nuclear New Build (NNB) Generation Sizewell C (SZC).

Volker Beckers – Non-Executive Director

Volker was Group Chief Executive Officer of RWE Npower plc until the end of 2012 and prior to this, its Group Chief Financial Officer from 2003 to 2009. He has worked in a variety of trade and industry bodies, including the CBI President’s Committee, on the Board of the German-British Chamber of Industry and Commerce, and, since 1999, as Deputy Chair of the Executive Commercial Management Committee at the German Association of Energy and Water Industries (BDEW). He was also member of the Executive Committee of UKBCSE (now Energy UK).

Current external appointments include:

- Board Member of Directors and Vice-Chairman - Danske Commodities A/S

- Chair - UK PwC Advisory Board

- Honorary VP and Advisory Board - Energy and Utility Forum

- Advisory Board - Kings College

- Director and Honorary VP - British Institute of Energy Economics

- Non-Executive Director - Elexon Ltd.

- Other positions - Advisor to Executive - Mercatus Inc CA, USA

- Non-Executive Chairman - Foresight Metering Ltd, Cornwall Insight Ltd.

- Trustee - Forum for the Future; German Heart Foundation, DHB Trust.

Janet Ashdown – Non-Executive Director

Janet worked for BP plc for over 30 years, holding a number of local and global positions in fuel supply, manufacturing, oil trading and retail marketing. She was a senior leader in BP, running BP’s UK retail and commercial fuel business in her last role. Janet was, until the end of 2012, Chief Executive Officer of Harvest Energy Ltd.

Current external appointments include:

- Non-Executive Director - SIG plc; Marshall’s plc; Victrex plc.

- Other positions: Chair RemCom SIG plc; Marshall’s plc; Victrex plc.

Evelyn Dickey – Non-Executive Director

Evelyn has extensive human resources experience, leading design and delivery of major change programmes, business restructuring, employee relations, resourcing, executive remuneration, organisational capability and performance management initiatives.

Evelyn has worked in HR consultancy and as HR Director (HR Operations) for Boots the Chemist, before joining Severn Trent’s HR function in November 2006, retiring as Director of HR in 2017.

Current external appointments include:

- Director - HR Function, Severn Trent (to 31 August 2017).

Candida Morley – Non-Executive Director

Candida joined UKGI as a Director in October 2017 from HgCapital where she was an Operating Partner. Between 2001 and 2015 she worked at private equity fund LDC where her roles included Chief Portfolio Officer and Chief Operating Officer, prior to which she worked at Elementis plc, 3i plc and as Director of Development at the Victoria and Albert Museum.

Candida joined the NDA Board as Non-Executive in November 2017.

Current external appointments include:

- Director - UK Government Investments.

Board Performance

Compliance with the Government Code of Corporate Governance

We comply with the Government Code of Corporate Governance and government guidance for an arm’s length body of our size and complexity:

- the Board monitors the NDA’s performance and directs its business effectively, including playing an active role in stakeholder relations

- the Chair is responsible for leading the Board and non-executive directors to challenge and help develop strategy

- the Board receives frequent updates on the NDA’s financial position, forecasts and sensitivities

- the Board has an appropriate balance of skills and experience to discharge its responsibilities

- the Board ensures that a balanced assessment of performance is reported to BEIS and regularly debates the main (corporate strategic) risks facing the NDA

- the Audit and Risk Assurance committee has oversight of, and provides challenge to, the management and internal control systems

- the Board places particular emphasis on the quality and integrity of the data submitted for its use. Critical processes and outputs fall within the control of the NDA Assurance Framework and are subject to peer review and/ or independent review by Internal Audit

- the Board reviews the terms of reference for its sub-committees annually

- executive director remuneration is determined by the remuneration committee, having regard to the need for defensibility in public sector pay under advice and guidance from HM Treasury and BEIS. Non-Executive remuneration is set by BEIS and reviewed annually.

Board performance and effectiveness review

The Board undertakes an annual evaluation of its effectiveness, led by the senior non-executive director.

Throughout 2017, progress was maintained on the findings from the 2016 review in the following areas:

- a Strategy Review day was held in October 2017. This followed a similar exercise in October 2016 and is in response to the Board review 2016 recommendation that there should be increased Board engagement in setting and reviewing strategy on a regular basis

- performance reporting has undergone a full review throughout 2017 and the Board now receives, on a quarterly basis, a comprehensive and detailed performance report and shorter performance report inbetween. This aligns with the Executive Quarterly Performance Review undertaken with each of the businesses. Work will continue into 2018/19 to align the Board meetings with the quarterly calendar to provide a more focused discussion on contemporary issues and the actions that management are taking to address these.

In January 2018, the Board procured an external organisation to undertake a comprehensive Board annual effectiveness review. This has been successfully completed. An action plan has been produced, covering areas such as Board administration and support, the skills and composition of the Board, frequency of Board and Committee meetings, greater oversight of strategy and interactions and relationships with government. Progress of individual actions will be reviewed at Board meetings over the course of the current year and will be reported in next year’s Annual Report.

Board Committees

The Board is supported by its committees as outlined below:

Audit & Risk Assurance Committee (A&RAC)

The NDA Board established an Audit and Risk Assurance Committee for the continuous monitoring of the effectiveness of the financial and risk assurance control frameworks established by the Executives of the NDA.

The Audit and Risk Assurance Committee consists of 2 full members:

- Volker Beckers (Chair)

- Janet Ashdown

The following persons may attend meetings of the Audit and Risk Assurance Committee:

- Julian Kelly – Standing Advisor (from March 2018)

- Chief Executive / Accounting Officer

- Chief Financial Officer

- Assurance Director

- Head of Group Internal Audit

- Chief Compliance Officer

- Head of Financial Operations

- External Audit Representation (NAO)

- Representative from Government Internal Audit Agency (GIAA)

- NDA Chairman

The Audit and Risk Assurance Committee advises the Board on:

- the strategic processes for risk management, information risk management, control and governance within the core NDA, and across the wider NDA Group

- assurances relating to the management of risk and corporate governance requirements for the NDA as an organisation

- anti-fraud policies, whistle-blowing processes, and arrangements for special investigations

- proposals for tendering for either Internal or and External Audit services or for purchase of non-audit services from contractors who provide audit services

- the accounting policies, the Annual Report and Accounts, matters arising from the external audit, and management’s Letter of Representation to the external auditors

- the plans, activities and performance of Internal and External Audit

- the adequacy of management response to issues identified by audit activity, including the External Auditor’s Management Letter.

During the year, the Audit and Risk Assurance Committee has:

- ensured the NDA met all financial reporting obligations;

- ensured that NDA accounting practices are in line with BEIS and HM Treasury guidance

- supported the NDA’s changed approach to risk management, which places increased emphasis on the strategic risks facing the organisation

- provided oversight of the control framework for information risk management and associated improvement plans

- provided oversight on the further development of the NDA’s Risk and Assurance Framework.

| Number of meetings in the year: 5 |

Remuneration Committee (REMCO)

The Remuneration Committee’s membership consists of 2 full members:

- Evelyn Dickey (Chair)

- Rob Holden

The following persons may attend meetings of the Remuneration Committee:

- Chief Executive / Accounting Officer

- HR Director (except for discussion in relation to their own remuneration)

- NDA Chairman

| Number of meetings in the year: 4 |

More details on Remuneration Committee are contained in the Remuneration and Our People report.

Safety and Security Committee (S&SC)

The NDA Board has established the Safety and Security Committee to support it in discharging its responsibilities in respect of issues of Health, Safety (including both nuclear and occupational safety), Environment, Nuclear Safeguards and Security in the NDA Group.

The primary responsibility for the majority of these issues within the NDA Group lies with the businesses and duty holders. In particular the SLC’s have unambiguous responsibility for safety on their sites. However, the NDA has a duty of care over the operation of its whole group and in particular must ensure that the businesses discharge their responsibilities properly.

The Safety and Security Committee advises the Board on:

- issues of HSSSE in the NDA Group (current and projected)

- detailed summaries of safety, security and other information which are supplied to the Board

- appropriate Board response to issues of HSSSE within the NDA Group

- what further external or internal advice the Board should seek in relation to specific issues of HSSSE that may arise

The Committee’s routine business this year has been to scrutinise the management of HSSSE risks and performance across the NDA Group. Performance is benchmarked against relevant industry sectors, including high hazard, manufacturing, and energy, oil and gas. From time to time, and as considered necessary, the Committee will receive reports from Group businesses on events and accidents. For example, Sellafield Ltd and Dounreay Site Restoration Ltd were invited into Committee during the year to report on the actions taken to improve performance.

The Committee also receives and commissions independent reports from NDA’s in house HSE and Security and Resilience teams, including trend analysis and reports of work undertaken by NDA to promote high standards and encourage collaboration. The output of the recently completed NDA Safety Climate Survey, is one such example.

The Safety and Security Committee membership consists of 2 full members:

- Janet Ashdown (Chair)

- Evelyn Dickey

The following persons may attend meetings of the Safety and Security Committee:

- Perr Lindell – Standing Advisor (from March 2018)

- Chief Executive / Accounting Officer

- Assurance Director

- Director of SSSE (until September 2017)

- Head of Health, Safety and Environment (from September 2017)

- Security, Information and Services Director

- Regulators (attend once per year)

- NDA Chairman

| Number of meetings in the year: 4 |

Programmes and Projects Committee

The Board established a Programmes and Projects Committee to provide additional oversight and scrutiny of Major Programmes and Projects within the NDA Group. Including but not limited to programmes and projects relating to engineering, procurement and construction, information, technology, telecommunications, security and real estate development. The Committee supplements Board oversight; it is not intended to supplant it.

The Programmes and Projects Committee will report and advise the Board on:

- progress of Major Programme and Projects against approved business cases and funding

- assurance that emerging issues concerning Major Programmes and Projects are understood and that mitigations are being appropriately pursued outcomes of assurance reviews (internal or external) and progress against actions plans to address any issues raised in these reviews

- the forward plan of programmes and projects/business cases coming to the Board for approval

During the year, the Programmes and Projects Committee has provided oversight to and advised the Board on a number of major Programme and Projects business cases, oversight of the enhanced assurance arrangements, oversight of completed assurance in support of impending board decisions and forward assurance in support of later board decisions.

The Programmes and Projects Committee membership consists of 2 full members:

- Rob Holden (Chair)

- Tom Smith

The following persons may attend meetings of the Programmes and Projects Committee:

- To be appointed – Standing Advisor

- Chief Executive / Accounting Officer

- Assurance Director

- Sellafield Programme Director

- Director of Nuclear Operations

- Head of Portfolio Management

| Number of meetings in the year: 5 |

Executive leadership team

David Peattie: Chief Executive - Executive Board Director

David began his career at BP in 1979 as a petroleum engineer and, during 33 years at the company, held a number of technical, commercial and senior management positions.

His roles included Head of BP Group Investor Relations, Commercial Director of BP Chemicals, Deputy Head of Global Exploration and Production, Head of BP Group Planning, and finally as Head of BP Russia where he was responsible for BP’s interests in the TNK-BP joint venture as well as its businesses in the Russian Arctic and Sakhalin. In addition, he was BP’s lead Director on the board of TNK-BP and Chairman of its Health, Safety and Environment Committee.

Current additional appointments include:

- Director - London Power Corporation plc. and Pacific Nuclear Transport Ltd (PNTL)

Adrian Simper OBE: Strategy and Technology Director - Executive Board Director

Adrian joined the nuclear industry in R&D at Sellafield. His subsequent career has included strategic roles in R&D and technology, project delivery, commercial and finance both in the UK and the US.

He played a key role in setting up the NDA through the transfer of assets and liabilities from BNFL and the associated re-structuring of BNFL.

He was appointed to the Order of the British Empire (OBE) in the 2017 New Year Honours’ list, recognising his services to the UK nuclear industry in Japan.

Current additional appointments include:

- Chair - International Nuclear Services Ltd

- Other positions - Trustee of St Bees School and Hon. Vice President of Wasdale Mountain Rescue Team

David Batters: Chief Financial Officer and Programme Director - Executive Board Director (Programme Director until 4 April 2018)

Prior to joining the NDA, David spent more than 20 years with BAE Systems and predecessor companies in which he held a variety of roles, primarily in finance including Mergers and Acquisitions, Planning and Analysis, Reporting, Project Accounting and as Finance Director of a number of businesses.

As CFO, David is responsible for NDA’s finance function (Finance, Modelling and Analysis, Insurance, Pensions) Business Planning, Revenue and Internal Audit. For the year to March 2018 he was the Executive responsible for Dounreay Site Restoration Ltd, LLW Repository Ltd and Magnox with respect to performance and contract management.