Lower benefit cap: quantitative analysis of outcomes of capped households

Updated 11 May 2023

DWP research report no: 1027

Crown copyright 2020.

You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit http://www.nationalarchives.gov.uk/doc/open-government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email psi@nationalarchives.gov.uk.

This document/publication is also available on our website at:

If you would like to know more about DWP research, email socialresearch@dwp.gov.uk

First published Month 2020.

ISBN: 9781786595195

Views expressed in this report are not necessarily those of the Department for Work

and Pensions or any other government department.

Voluntary statement of compliance with the Code of Practice for Statistics

The Code of Practice for Statistics (‘the Code’) is built around three main concepts, or pillars, of trustworthiness, quality and value[footnote 1]:

- trustworthiness – is about having confidence in the people and organisations that publish statistics

- quality – is about using data and methods that produce assured statistics

- value – is about publishing statistics that support society’s needs for information

The following explains how we have applied the pillars of the Code in a proportionate way.

Trustworthiness

- the analysis presented in this report has been scrutinised internally by DWP analysts, and externally peer-reviewed by the Institute for Fiscal Studies (IFS)

- The Department commissioned the IFS to provide an independent peer review of methodology, approach and interpretation of the results. This is similar to the contracted arrangement with the IFS during the previous evaluation of the original benefit cap[footnote 2], published in 2014

- the detailed methodology, data sources and econometric approach taken in this research are set out in this report alongside the findings. The cohort-based, econometric methodology used builds on the methodology used in the previous quantitative evaluation of the benefit cap

- the figures presented in this report are based on analysis of DWP and HMRC administrative datasets, and the figures used to produce the charts in this report are published in an Excel file alongside this report

Quality

- the process to produce the analysis in this report was conducted by professional analysts taking account of the latest administrative data and applying methods using their professional judgement. The analysis has been through a rigorous quality-assurance process by other DWP analysts and external peer review by the IFS. The statistical methodology used in this report builds on the methodology used in the previous evaluation of the benefit cap

- this research is part of the mixed method evaluation of the lower benefit cap by the Department, which includes a longitudinal quantitative survey of capped claimants and qualitative case studies of local authority, Jobcentre Plus and local support representatives[footnote 3] within six sampled local authorities, conducted by the National Centre for Social Research (NatCen), an independent research institute. The findings in this report are consistent with the findings from the NatCen strands of the evaluation

Value

- this research provides important new evidence for Ministers, policy makers and external stakeholders on the operation and impacts of the lower cap policy (see Section 1.5 on key research questions in the main report)

- this evaluation sits alongside the benefit cap official statistics published by the Department on a quarterly basis which show the benefit cap caseload and off-flows under Housing Benefit and Universal Credit and allows the Department to monitor the impacts of the lower benefit cap policy

Executive summary

The benefit cap was introduced in April 2013 across Great Britain, as part of the Coalition Government’s strategy to reform the welfare system and incentivise work. It limits the total amount of benefit income that working-age households can receive. Between November 2016 to January 2017 the benefit cap was reduced from previous levels, and tiered according to where households were located. The benefit cap levels were reduced from £26,000 a year in Great Britain, for couples and lone parents (or £18,200 for single adults with no dependent children), to:

- £23,000 a year (or £15,410 for single adults with no dependent children) in Greater London

- £20,000 a year (or £13,400 for single adults with no dependent children) in the rest of Great Britain

This report assesses the quantitative impact of the lower benefit cap on household’s employment, exempting benefit and housing outcomes after twelve months. An exempting benefit includes receipt of certain disability and carer’s benefits and provides a household with exemption from the benefit cap (See Annex A).

The lower benefit cap has a positive impact on employment; households in scope for the cap are 5.1 percentage points more likely to move into paid work compared to similar households not affected by the cap. The employment impact is larger for households in scope for both the original and lower benefit caps, compared to households only in scope for the lower cap (8.4 vs. 4.1 percentage points more likely to be in work, respectively). Employment impacts of the cap also vary by household characteristics, for example, family type and location, and by cap amount.

The lower benefit cap leads to an estimated increase of 2.6 percentage points in the likelihood of being in receipt of an exempting benefit compared to similar households not affected by the cap. The impact is larger for households affected by both cap levels than those in scope for the lower cap levels only (3.8 vs. 2.2 percentage points, respectively). The impact of the lower benefit cap on receipt of an exempting benefit also varies by household characteristics and cap amount.

Results also show that the lower benefit cap increases the probability of moving property at Census Output Area (COA) level by 1.8 percentage points but there is no evidence to suggest that the lower cap leads to a statistically significant increase in moves between Local Authorities (LAs).

Acknowledgements, Authors and Contacts

Acknowledgements

The Department for Work and Pensions (DWP) commissioned the Institute for Fiscal Studies (IFS) to provide an independent peer review of this analysis, and we thank Carl Emmerson and Robert Joyce of the IFS for the helpful methodological advice that they provided over the duration of this project.

We also thank Rhys Cockerell, Oliver Barrett, Katie Riley, Andrew Parfitt, James Oswald, David Ryan-Mills and Ashley Kershaw (all DWP) for their contributions to this research.

Authors

Richard Ward

Stephanie Astley

Laura Gonzalez Alonso

Mark Griffiths

Hjalte Sorensen

Benefit Cap Analysis Team, Department for Work and Pensions (DWP)

Contacts

Press enquiries should be directed to the Department for Work and Pensions Press Office: Media enquiries: 0203 267 5144; Out of hours: 0203 267 5144; Website: www.dwp.gov.uk

Follow us on Twitter: www.twitter.com/dwppressoffice

For any general queries about this document please contact the benefit cap evaluation project team at ask.benefitcapevaluation@dwp.gov.uk

Summary

Background

Following the Welfare Reform Act 2012, the benefit cap was introduced in April 2013 across Great Britain, as part of the Coalition Government’s strategy to reform the welfare system and incentivise work. It limited the total amount of benefit income that most working-age households could receive. In the Welfare Reform and Work Act 2016, the benefit cap was reduced from its previous levels, and tiered according to where households are located. It reduced benefit cap levels from £26,000 a year, for couples and lone parents (or £18,200 for single adults with no dependent children), to:

- £23,000 a year (or £15,410 for single adults with no dependent children) in Greater London

- £20,000 a year (or £13,400 for single adults with no dependent children) in the Rest of Great Britain[footnote 4]

The rollout period across local authorities took place from November 2016 to January 2017 and was completed by February 2017.

Purpose of this report

This report explores the quantitative impact of the lower benefit cap. Specifically, it assesses whether one of the main aims of the policy is achieved: to increase the number of households moving into work[footnote 5]. In addition, it investigates whether households in scope for the cap are more likely to receive an exempting benefit (which excludes them from the cap) or to move home.

The report provides a quantitative analysis on a range of outcomes for households twelve months after they become in scope for the cap and to what extent these are as a direct result of the lower benefit cap.

This report is published alongside qualitative research on the impacts of the benefit cap, commissioned by the Department for Work and Pensions (DWP) from the National Centre for Social Research (NatCen).

Data and Methodology

The dataset used in this analysis is extracted from DWP and Her Majesty’s Revenue and Customs (HMRC) administrative data for the period November 2016 to January 2018. The analysis tracks and compares outcomes of a) a group of households who were in scope for the cap (‘capped households’) when the lower cap began to roll out to b) a similar group of households but with total weekly benefit income just below the lower cap levels (‘comparison group’); the two groups are referred to as the ‘rollout cohort’.

The outcomes are tracked over twelve months, from the month when the lower benefit cap starts to roll out in a specific Local Authority. Therefore, results from this analysis reflect only the outcomes during this period; outcomes may subsequently change.

The analysis considers only households capped at rollout under Housing Benefit (HB), as very few households were capped under Universal Credit (UC) at this time and were disproportionately located in Greater London due to the UC full service rollout schedule.

As mentioned above, the ‘rollout’ cohort is divided into two main groups:

- capped households, also referred to as the ‘All capped group’: households with a total benefit income above the lower cap levels. This group can be sub-divided into two different groups

- both caps: households with a total weekly benefit income above both the original cap levels and the new lower levels

- lower cap only: households with a total weekly benefit income below the original cap levels but above the new lower levels

- comparison group: households whose total weekly benefit income is below the lower cap levels by £25 or less per week

This report first presents a descriptive analysis on a range of outcomes for households in scope for the lower benefit cap. The main outcomes assessed are those which:

- exempt households from being capped (i.e. moving into work, or moving into receipt of an exempting benefit)

- involve a change in housing circumstances but do not necessarily prevent application of the cap

The econometric analysis, which follows the descriptive analysis, assesses the extent to which outcomes can (under certain assumptions) be directly attributed to the lower benefit cap. It consists of a regression analysis based on a linear ‘difference-in-difference’ methodology, which controls for differences in observed characteristics between the all capped and comparison groups and allows for any additional time-invariant difference between these groups. This analysis estimates the impact of the lower benefit cap compared with what may have happened in the absence of the cap.

Descriptive analysis results

Results from the descriptive analysis represent the change in circumstances for households from the month that they become in scope for the lower benefit cap and twelve months later. These results are presented by cap group (lower cap only and both caps group) and household characteristics.

Outcomes that exempt households from being capped

Of all capped households, more than half (53 per cent) are no longer capped twelve months later. The main outcomes are:

- 23 per cent are exempt from the cap because they move into work, either claiming Working Tax Credit (WTC) or earning enough to meet the work exemption under UC

- 10 per cent are in receipt of an exempting benefit (but are not in work)[footnote 6]

- 9 per cent have a different change of circumstances that leads them to reduce their benefit income below the cap levels

- 11 per cent are no longer claiming HB and not in scope for the cap under UC

The proportion of households within each outcome varies depending on their characteristics and whether they are in scope for both caps or the lower cap only:

Households in the both caps group are more likely to move into work or to receive an exempting benefit than those in the lower cap only group.

Of all capped households, the most likely to move into work are[footnote 7]:

- living in Greater London

- couples with children

- households with the youngest child aged 3 or 4

- Jobseeker’s Allowance (JSA) claimants

The most likely to begin receiving an exempting benefit are:

- living in the rest of Great Britain

- couples without children and single claimants

- households with the youngest child aged 5 or older

- Employment and Support Allowance (ESA) claimants in the work-related activity group (WRAG)

Outcomes that do not prevent the application of the cap but involve a change in housing circumstances

In principle, capped households could experience one or more of the following:

- move property

- a change to their rent level

- a change to their housing tenure; for example, moving to the Social Rented Sector (SRS), where rents are usually lower than in the Private Rented Sector (PRS)

The housing-related changes assessed within this report are:

- moves between geographical areas, either at Census Output Area (COA)[footnote 8] or Local Authority (LA) level

- rent level

- housing tenure

Descriptive analysis on housing status for capped households shows that, after twelve months, the majority (80 per cent) stay in the same COA, 14 per cent stay within the same LA but change COA and 6 per cent move LA (and therefore also COA).

Analysis on moving property is limited by the administrative data used for this analysis, which allows for identification of moves between COAs but not within the same COA. If a household were to move to another property on the same street, for example, then this might not be captured in the administrative data.

Whilst 80 per cent of capped households remain in the same COA, 38 per cent of capped households experience a reduction in their rent. For those capped households who move property, 40 per cent are associated with a reduction in their rent. Of the capped households who do not move, 37 per cent are associated with a reduction in their rent.

Generally, capped households tend to stay in the same tenure type twelve months after rollout. Eighty-seven per cent of households in the Social Rented Sector (SRS) and 77 per cent in the Private Rented Sector (PRS) stay in the same tenure, although there is some movement from the PRS into the SRS (6 per cent). Households in Temporary Accommodation (TA) in Greater London tend to remain within this tenure type (78 per cent) but the figure is somewhat lower in the Rest of Great Britain (49 per cent).

Econometric analysis results

The econometric analysis estimates the impact of the lower benefit cap on a) movement into employment, b) receipt of an exempting benefit and c) changing housing circumstances. Results from this analysis are significant at the 1 per cent level, unless otherwise stated.

Impact on employment

For the purposes of this analysis, a household is defined as moving into work if a member of the household has an open Working Tax Credit (WTC) claim twelve months after becoming capped.

Results from the econometric analysis suggest that twelve months after the rollout of the cap:

Capped households are 5.1 percentage points more likely to move into work compared to otherwise similar uncapped households. This is a relative increase of 28 per cent compared to the comparison group, which is an increased employment rate to 23 per cent from 18 per cent (the ‘counterfactual’ estimate of the proportion of households who move into work in the absence of the cap).

This means that out of 100 capped households:

- 23 households move into work, of which 18 would have moved into work in the absence of the cap

- an additional 5 households move into work, which is attributable to the lower benefit cap policy

The positive impact on employment is similar in magnitude to that found by the original benefit cap policy evaluation[footnote 9], which showed an increase of 4.7 percentage points in the capped household’s employment rate[footnote 10], and a relative increase of 41 per cent compared to the comparison group. Although it should be noted that results are not directly comparable due to differences in methodology, time period, comparison group[footnote 11] and benefit incomes.

The employment impact of the lower benefit cap varies depending on whether a household is in scope for both caps or the lower cap only at rollout:

- households in the lower cap only group are 4.1 percentage points more likely to be in work after twelve months, with a relative increase in the employment rate of 23 per cent compared to the comparison group

- households in the both caps group are 8.4 percentage points more likely to be in work after twelve months, which represents a relative increase in the employment rate of 43 per cent compared to the comparison group. This shows that the lower cap levels have an additional work impact above the original levels for this group

The impact of the lower benefit cap on employment differs depending on the main benefit claimed in addition to HB, at rollout i.e. benefit type. Although the lower benefit cap has a positive impact on employment across all benefit types, households in receipt of Income Support (IS) or Jobseeker’s Allowance (JSA) are more likely to be in employment after twelve months than households claiming Employment and Support Allowance (ESA) within the work-related activity group (WRAG).

The lower benefit cap increases the employment rate for households with a youngest child aged under 2 by more than for households whose youngest child is older. However, households with a youngest child aged under 2 are less likely to be in employment in the absence of the cap (the counterfactual employment rate) than households whose youngest child is aged over 2.

At relatively small cap amounts (up to £25 per week), the lower benefit cap has a negligible effect on employment rates. However, as cap amounts increase, the estimated impact of the lower cap on employment also increases up to cap amounts of £150 per week. At amounts greater than £150 per week it starts to diminish, especially outside of Greater London.

There is no statistically significant impact of the lower benefit cap on employment for single person households compared to otherwise similar uncapped households.

Impact on exempting benefits

Exempting benefits provide additional support for caring or for severe disability or health conditions, and include Disability Living Allowance (DLA), Personal Independence Payment (PIP) and Carer’s Allowance (CA). Being in receipt of any exempting benefit excludes households from the application of the benefit cap which ensures protection for claimants of exempting benefits for whom work may not be a viable option. Moving on to an exempting benefit represents around 18 per cent of all HB off-flows from the benefit cap[footnote 12] (between April 2013 and February 2020); the second most common reason after moving into work.

Results from the econometric analysis suggest that twelve months after the rollout of the cap:

- 10 per cent of capped households are in receipt of an exempting benefit, compared to a counterfactual estimate of 7 per cent. This means that capped households are 2.6 percentage points more likely to be in receipt of an exempting benefit than the comparison group, implying that the lower benefit cap policy may lead to an additional 3 out of 100 households moving into receipt of an exempting benefit. As a result, capped households experience a relative increase of 34 per cent in their likelihood of being in receipt of an exempting benefit compared to the comparison group

- households in the both caps group are 3.8 percentage points more likely to be in receipt of an exempting benefit than the comparison group, a relative increase of 46 per cent

- households in the lower cap only group are 2.2 percentage points more likely to be in receipt of an exempting benefit than the comparison group, a relative increase of 30 per cent

- the impact of the cap on receipt of exempting benefits is greater for households living outside of Greater London, particularly for lone parent households in the both caps group and with a child aged under two

- the impact of the cap on being in receipt of an exempting benefit is greatest for households initially claiming Employment and Support Allowance (ESA) within the work-related activity group (WRAG), who are 4.6 percentage points more likely to be in receipt of an exempting benefit than the comparison group, followed by households initially claiming Income Support (IS) and Jobseeker’s Allowance (JSA), with increases of 2.6 and 0.8 percentage points[footnote 13] compared to the comparison group, respectively

- in Greater London, at cap amounts below £100 per week, the lower benefit cap has a negligible effect on being in receipt of an exempting benefit. But at cap amounts above £100 per week, it is increasingly likely to result in households receiving an exempting benefit

- in the Rest of Great Britain, households are more likely to receive an exempting benefit as cap amount increases, up to £150 per week; above this, further increases in cap amount do not increase the likelihood of receiving an exempting benefit

- single person households are 5.6 percentage points more likely to receive an exempting benefit than similar uncapped households, a relative increase of 47 per cent. This impact is larger than for households with children, with increases of 2.9 and 2.4 percentage points for couples with children and lone parents compared to the comparison group, respectively

Impact on housing outcomes

The lower benefit cap increases the probability of moving property to a different COA[footnote 14]. Overall, there is no statistically significant evidence to suggest that the lower cap leads to an increase in moves between LAs at a National level, however there is some evidence of a slight impact of the cap for some of the subgroups.

Results from the econometric analysis on moving house suggest that twelve months after the rollout of the cap:

- capped households are 1.8 percentage points more likely to move COA than the comparison group. This is a 10 per cent relative increase in the moves rate, from a counterfactual of 18 per cent to 19 per cent[footnote 15], and suggests that the lower benefit cap leads to almost 2 out of 100 households moving house at COA level

- households in the both caps group are more likely to move COA, than the lower cap only group. This is consistent for Greater London, the Rest of Great Britain and all family types and tenure types

- capped households in Greater London are 3.2 percentage points more likely to move COA than the comparison group, whereas in the Rest of Great Britain, they are 1.4 percentage points more likely to move COA

- lone parent households are more likely to move COA than couples with dependent children[footnote 16]

- the larger the cap amount the larger the impact on COA moves, particularly in Greater London

- households in the both caps group are 0.5 percentage points more likely to move LA than the comparison group

- only households in Greater London are more likely to move LA; those in the both caps group are 1.7 percentage points more likely to move LA than the comparison group, and those in the lower cap only group are 1.2 percentage points[footnote 17] more likely to move LA

In summary, of all capped households 53 per cent were no longer capped twelve months later, including 23 per cent with an open WTC claim and 10 per cent in receipt of an exempting benefit. Some of these changes were a direct result of the cap, whereas others would have happened anyway. Results from the econometric analysis suggest that twelve months after the rollout of the cap, capped households were 5.1 percentage points more likely to move into work compared to otherwise similar uncapped households. Households were also 2.6 percentage points more likely to receive an exempting benefit compared to the comparison group. For the remaining 47 per cent of households who are still capped after twelve months, any adjustments this group may have made in response to the cap are not analysed, however some may be included in those that have moved COA or LA but remain capped. Chapter 7 of the NatCen integrated evaluation report includes examining how these 47 per cent of households have responded to the Cap.

1. Introduction

The benefit cap is a policy introduced by the Coalition Government as part of its strategy to reform the system of benefits for working-age households. The benefit cap limits the total amount of benefit income that households can receive, which can be achieved by reducing either the award of Housing Benefit or Universal Credit.

1.1 Policy overview

The Welfare Reform Act 2012 set out the key principle of the benefit cap, to limit the total benefit income that working-age households[footnote 18] could receive to £500 per week (or £26,000 per year), for families and couples, or £350 per week for single people without dependent children (or £18,200 per year). The policy was introduced from April 2013. The aims of this policy, as set out in the ‘Benefit cap: a review of the first year’,[footnote 19] were to:

- increase incentives to work by limiting the amount of benefit that households on out-of-work benefits can receive so that they will be financially better off on entering work

- introduce greater fairness in the welfare system between those receiving out-of-work benefits and taxpayers in employment by preventing households on out-of-work benefits from receiving a greater income from benefits than the average weekly wage

- make financial savings where the benefit cap applies and, more broadly, help make the system more affordable by incentivising behaviours that reduce long-term dependency on benefits

The 2014 impact evaluation of the original benefit cap[footnote 20] found that:

- capped households were 41 per cent more likely to move into work than comparable households not affected by the benefit cap after a year; an increase in the employment rate of 4.7 percentage points from 11 per cent to 16 per cent

- the greater the amount benefits were reduced by the cap, the greater the rate at which households moved into employment

- almost half of the households impacted by the original benefit cap were based in Greater London

1.2 Aims of the lower benefit cap

In the 2016 Welfare Reform and Work Act, the benefit cap levels were lowered and tiered according to where a household is located. The two original benefit cap levels were replaced by four new levels. The ‘Welfare Reform and Work Act: Impact Assessment for the benefit cap’ document[footnote 21], published in August 2016, stated that the lower benefit cap policy aims to:

- Further improve work incentives for those on benefits

- Promote even greater fairness between those on out-of-work benefits and tax payers in employment (who largely support the current benefit cap), whilst providing support to the most vulnerable

- Further reduce benefit expenditure and continue to help tackle the financial deficit

The lower cap levels, introduced from November 2016, are:

- in Greater London (the 32 London boroughs and the City of London)

- £23,000 per year for families and couples

- £15,410 per year for single people without dependent children

- in the Rest of Great Britain

- £20,000 per year, for families and couples

- £13,400 per year, for single people without dependent children

A summary of the cap levels is given in Table 1.1.

Table 1.1 Original and lower benefit cap levels by region and family type.

| Pre 7 November 2016 weekly cap (£) | Current weekly cap (£) | Difference (£) | |

|---|---|---|---|

| London couples / lone parents | 500 | 442 | 58 |

| London single without children | 350 | 296 | 54 |

| Rest of Great Britain couples / lone parents | 500 | 385 | 115 |

| Rest of Great Britain single without children | 350 | 258 | 92 |

The new lower, tiered, cap was rolled out across local authorities from November 2016 to January 2017, being fully rolled out in February 2017.

The 2016 Impact Assessment outlined that the lower, tiered, benefit cap aims to ensure that the benefit cap affects households more evenly across geographies; rather than disproportionately affecting households in Greater London, as the original benefit cap did.

According to the official statistics[footnote 22], published in May 2020, 79,000 households had their benefits capped in February 2020, of which 33,000 had their Housing Benefit capped and 46,000 had their Universal Credit award capped. Since April 2013, a total of 310,000 households have been capped at some point: 220,000 under Housing Benefit and (since October 2016) 92,000 under Universal Credit. See Figure 1.1, below.

Figure 1.1 Official statistics of capped households at each month, from April 2013 to February 2020.

| Month | Housing Benefit | Universal Credit | Total |

|---|---|---|---|

| Apr-13 | .. | .. | .. |

| May-13 | 396 | .. | 396 |

| Jun-13 | 2,432 | .. | 2,432 |

| Jul-13 | 2,755 | .. | 2,755 |

| Aug-13 | 7,843 | .. | 7,843 |

| Sep-13 | 18,024 | .. | 18,024 |

| Oct-13 | 25,508 | .. | 25,508 |

| Nov-13 | 27,352 | .. | 27,352 |

| Dec-13 | 28,434 | .. | 28,434 |

| Jan-14 | 27,743 | .. | 27,743 |

| Feb-14 | 27,735 | .. | 27,735 |

| Mar-14 | 27,720 | .. | 27,720 |

| Apr-14 | 26,792 | .. | 26,792 |

| May-14 | 27,019 | .. | 27,019 |

| Jun-14 | 26,458 | .. | 26,458 |

| Jul-14 | 26,472 | .. | 26,472 |

| Aug-14 | 27,241 | .. | 27,241 |

| Sep-14 | 26,473 | .. | 26,473 |

| Oct-14 | 24,978 | .. | 24,978 |

| Nov-14 | 24,264 | .. | 24,264 |

| Dec-14 | 23,756 | .. | 23,756 |

| Jan-15 | 23,728 | .. | 23,728 |

| Feb-15 | 23,093 | .. | 23,093 |

| Mar-15 | 22,537 | .. | 22,537 |

| Apr-15 | 22,281 | .. | 22,281 |

| May-15 | 22,456 | .. | 22,456 |

| Jun-15 | 22,270 | .. | 22,270 |

| Jul-15 | 22,866 | .. | 22,866 |

| Aug-15 | 23,379 | .. | 23,379 |

| Sep-15 | 23,173 | .. | 23,173 |

| Oct-15 | 22,005 | .. | 22,005 |

| Nov-15 | 20,999 | .. | 20,999 |

| Dec-15 | 20,417 | .. | 20,417 |

| Jan-16 | 19,881 | .. | 19,881 |

| Feb-16 | 20,189 | .. | 20,189 |

| Mar-16 | 20,346 | .. | 20,346 |

| Apr-16 | 19,521 | .. | 19,521 |

| May-16 | 20,124 | .. | 20,124 |

| Jun-16 | 19,995 | .. | 19,995 |

| Jul-16 | 19,931 | .. | 19,931 |

| Aug-16 | 20,041 | .. | 20,041 |

| Sep-16 | 20,187 | .. | 20,187 |

| Oct-16 | 19,095 | 350 | 19,445 |

| Nov-16 | 20,096 | 490 | 20,586 |

| Dec-16 | 32,962 | 1,320 | 34,282 |

| Jan-17 | 51,007 | 1,890 | 52,897 |

| Feb-17 | 66,135 | 2,300 | 68,435 |

| Mar-17 | 68,587 | 2,670 | 71,257 |

| Apr-17 | 66,928 | 3,110 | 70,038 |

| May-17 | 68,079 | 3,250 | 71,329 |

| Jun-17 | 68,891 | 3,360 | 72,251 |

| Jul-17 | 69,303 | 3,470 | 72,773 |

| Aug-17 | 68,265 | 3,620 | 71,885 |

| Sep-17 | 66,756 | 3,740 | 70,496 |

| Oct-17 | 64,503 | 3,850 | 68,353 |

| Nov-17 | 62,644 | 3,890 | 66,534 |

| Dec-17 | 60,870 | 4,060 | 64,930 |

| Jan-18 | 59,338 | 4,380 | 63,718 |

| Feb-18 | 60,075 | 4,720 | 64,795 |

| Mar-18 | 58,366 | 4,990 | 63,356 |

| Apr-18 | 58,384 | 5,260 | 63,644 |

| May-18 | 60,378 | 5,830 | 66,208 |

| Jun-18 | 60,537 | 6,350 | 66,887 |

| Jul-18 | 58,367 | 7,080 | 65,447 |

| Aug-18 | 57,755 | 7,950 | 65,705 |

| Sep-18 | 56,814 | 8,590 | 65,404 |

| Oct-18 | 54,867 | 9,170 | 64,037 |

| Nov-18 | 52,645 | 9,930 | 62,575 |

| Dec-18 | 49,855 | 10,970 | 60,825 |

| Jan-19 | 50,073 | 12,330 | 62,403 |

| Feb-19 | 52,289 | 14,950 | 67,239 |

| Mar-19 | 50,930 | 18,530 | 69,460 |

| Apr-19 | 50,533 | 22,050 | 72,583 |

| May-19 | 49,700 | 26,630 | 76,330 |

| Jun-19 | 47,754 | 29,880 | 77,634 |

| Jul-19 | 45,300 | 33,480 | 78,780 |

| Aug-19 | 43,131 | 35,840 | 78,971 |

| Sep-19 | 41,140 | 37,530 | 78,670 |

| Oct-19 | 38,718 | 38,940 | 77,658 |

| Nov-19 | 36,508 | 41,160 | 77,668 |

| Dec-19 | 35,462 | 43,040 | 78,502 |

| Jan-20 | 32,887 | 45,550 | 78,437 |

| Feb-20 | 32,589 | 46,230 | 78,819 |

Further information on the benefit cap policy, including the benefits taken into account in the cap calculation is set out in Annex A.

1.3 Pre-implementation support

Six months before the introduction of the lower benefit cap, pre-implementation support was offered to households (identified using a scan of DWP and HMRC administrative records) that might potentially be capped. Around 120,000 households received a letter, where they were informed about their potentially capped status and the range of support available for them, including JCP work coach support. Claimants were also strongly encouraged to contact the benefit cap helpline to get assistance with the practical implications of the lower benefit cap policy. A second ‘reminder’ letter was issued closer to the implementation date.

Alongside these two letters, wider communications across DWP and LAs were put in place to enable work coaches to target employment support effectively and to provide information on the type of housing support whenever needed[footnote 23].

The pre-implementation support offered was on a voluntary basis with no additional conditionality requirements (apart from the existing benefit conditionality) to engage with this support.

1.4 Housing policy changes in 2016 Welfare Reform and Work Act

Most working-age benefits and tax credit elements were subject to a four-year freeze, covering the period 2016/17 to 2019/20. This followed a three-year period (2013/14-2015/16) when increases were limited to 1 per cent. The four-year freeze was announced in the 2015 Summer Budget and legislated for by the Welfare Reform and Work Act[footnote 24] 2016. This freeze covered the various allowances, premiums and Local Housing Allowance (LHA) rates (for claimants renting in the PRS) for HB claimants and the UC equivalents.

The Welfare Reform and Work Act (2016) also introduced rules around the levels of rent charged by registered providers of social housing (Local Authorities and Housing Associations) in England from 1 April 2016. This required registered providers to reduce the majority of social rents by 1 per cent per annum during four years. A maximum rent was set for new tenancies, up to the social rent rate defined in the Act. Exemptions from the social rent reduction rules were also provided for certain types of providers such as those designated as specialised supported housing or temporary social housing. In addition, different rent setting policies were applied in Scotland and Wales[footnote 25].

1.5 Key research questions

This evaluation seeks to answer the following questions:

What are the most common outcomes observed for capped households?

We analyse household outcomes twelve months after rollout of the lower benefit cap. Specifically, we focus on households’ employment status, exempting benefit status and any housing-related changes that have taken place (i.e. geographical moves, changes in rent level and tenure type).

What is the impact of the lower benefit cap on encouraging movement into work thereby providing an exemption from the cap?

We assess the impact of the lower benefit cap on households’ employment by comparing the rate at which capped households move into work with a similar comparison group (with a total benefit income just below the cap levels therefore are uncapped).

What is the impact of the lower benefit cap on receipt of benefits that provide an exemption from the cap?

We assess the impact of the lower benefit cap on the receipt of exempting benefits by comparing the move-into-exempt-benefit rate of those capped and a similar comparison group with total benefit income just below the cap levels.

What is the impact of the lower benefit cap on housing moves?

We assess whether capped households are more likely to move to another Local Authority (LA) or Census Output Area (COA), in response to the lower benefit cap, and if by moving their rent reduces, compared to a similar comparison group with total benefit income just below the cap levels. We also analyse moves by tenure type e.g. Private Rented Sector (PRS), Social Rented Sector (SRS) and Temporary Accommodation (TA).

Results are presented by geography (Greater London vs Rest of Great Britain), family type (i.e. lone parents, couples with children, single), age of youngest child, cap amount and benefit type (i.e. Income Support (IS), Jobseeker’s Allowance (JSA), Employment and Support Allowance (ESA)).

This report is part of a broader evaluation of the lower benefit cap, published alongside independent research commissioned by the Department for Work and Pensions, undertaken by the National Centre for Social Research (NatCen). Details of this research can be found in Annex B.

1.6 Structure of this report

The report is structured in the following chapters:

Chapter 2: sets out the data and cohort methodology used in this report.

Chapter 3: provides descriptive analysis on the different outcomes observed for capped households twelve months after rollout, including outcomes which exempt them from the application of the cap, such as moving into work or being in receipt of an exempting benefit. See Annex A for information on exemptions from the benefit cap.

Chapter 4: sets out the methodology and results from the econometric analysis on the impact of the lower cap on employment, including sub-group analysis by demographic characteristics.

Chapter 5: examines the impact of the lower cap on receipt of exempting benefits, based on the same econometric analysis methodology set out in the previous chapter. It also includes sub-group analysis by household characteristics.

Chapter 6: examines housing-related changes twelve months after households become capped and the impact of the lower cap on these outcomes, based on the same econometric analysis methodology followed in previous chapters, and including sub-group analysis by household characteristics.

Chapter 7: summarises the key findings of this report.

In addition, a number of annexes are included to support the information provided in the report:

- Annex A: Benefit cap policy overview

- Annex B: Wider lower cap evaluation strategy

- Annex C: Data sources

- Annex D: Measuring employment outcomes under Universal Credit for households in receipt of Housing Benefit at rollout

- Annex E: Econometric analysis technical annex

- Annex F: Analysis of single person households

All tables and chart data can be found in a separate spreadsheet published alongside the report (Tables : Lower benefit cap: quantitative analysis of outcomes of capped households).

2. Data and Methodology

This section sets out the data sources and cohort methodology used in this evaluation, including the selection criteria for the cohorts of households analysed. It also presents descriptive statistics for the cohort groups and a description of the main outcomes observed for potentially capped households.

2.1 Data sources

The analysis presented in this report has been performed using bespoke datasets created for the purpose of the benefit cap evaluation, from a range of administrative benefit datasets held by the Department for Work and Pensions, Her Majesty’s Revenue and Customs (HMRC) and Local Authorities (LAs). A full list of the data sources used can be found in Annex C.

2.2 Cohort groups

We use a cohort analysis approach to assess the changes in households’ circumstances that can be attributed to the introduction of the lower benefit cap policy. This methodology allows monitoring households’ behavioural changes by tracking a group of households and comparing their outcomes over a fixed period of time.

The tracking period covers twelve months from the introduction of the lower benefit cap policy. This varies by LA and so a household’s start month is dependent on the LA they reside in. This is referred to as the ‘rollout month’. There were three reasons for the selection of twelve months for the tracking period:

- consistency with the longitudinal claimant survey: In the NatCen survey capped households were interviewed at two stages: seven months and thirteen months after first being capped[footnote 26]; more details are found in Annex B

- consistency with the tracking period used in the previous evaluation of the benefit cap

- it is considered as the minimum time required to observe any behavioural change in households’ circumstances as a result of the lower benefit cap policy

We refer to our main cohort throughout the report as the ‘rollout cohort’ and within this we identify capped households as being in scope for the lower benefit cap levels, including those also in scope for the original benefit cap levels (referred to throughout the report as ‘capped’ households), and a comparison group, with a total weekly benefit income up to £25 per week below the lower cap level, and thus, out of scope of the policy. Therefore, the cohort of households can be divided into two main groups:

All capped group:

Households that meet the lower benefit cap eligibility criteria (i.e. are working-age[footnote 27] and not receiving an exempting benefit or claiming WTC) and have a total benefit award above the lower cap levels (£23,000 in Greater London or £20,000 for the Rest of Great Britain, or single person equivalents) at the rollout month. This group can be sub-divided into two different groups:

Lower cap only group:

Households with a total weekly benefit income below £26,000 (or £18,200 for single adults with no dependent children) and above £23,000 a year (or £15,410 for single adults with no dependent children), in Greater London, or £20,000 a year (or £13,400 for single adults with no dependent children), for the Rest of Great Britain.

Both caps group:

Households which have a total weekly benefit income above the previous levels of the original cap, £26,000 levels for families (or £18,200 for single adults with no dependent children), and above the lower benefit cap levels, introduced in November 2016.

Comparison group:

Households that meet the lower benefit cap eligibility criteria (i.e. working-age and not receiving an exempting benefit), whose total weekly benefit income is similar to the all capped group, but just below the cap levels by £25 or less per week.

For households in the lower cap only group and those in the comparison group, the rollout month is set to the month when the lower cap began to roll out in the household’s LA (November 2016, December 2016 or January 2017). For the both caps group, it is set to November 2016, when the lower benefit cap was introduced. Table 2.1 shows the number of households in each group by rollout month.

Table 2.1 Number of households in the rollout cohort during the rollout phase (November 2016 to January 2017).

| Rollout Month | Total | Proportion of rollout cohort (%) | Lower cap only | Both caps | All capped | Comparison |

|---|---|---|---|---|---|---|

| Nov-16 | 55,040 | 39 | 20,360 | 23,740 | 44,100 | 10,940 |

| Dec-16 | 42,760 | 30 | 28,040 | .. | 28,040 | 14,720 |

| Jan-17 | 44,070 | 31 | 28,990 | .. | 28,990 | 15,080 |

| Total | 141,860 | 100 | 77,380 | 23,740 | 101,120 | 40,740 |

The cohort groups include only households claiming Housing Benefit (HB) and exclude those claiming Universal Credit (UC), at rollout. This is because the proportion of households affected by the lower benefit cap under UC full service at rollout is very small and disproportionately located in Greater London. For instance, in November 2016, only 490 households had their Universal Credit capped (Table 2.2 and Figure 2.1), which is around 2 per cent of the total number of capped households in November 2016 (20,590); 380 or 78 per cent of these households were located in Greater London. In February 2017, when the lower cap was fully rolled out, only 2,300 households were capped under UC full service (3.2 per cent of the total benefit cap caseload)[footnote 28]. This implies that evaluating the benefit cap under UC at this stage would not provide a good indication of the likely effects of the cap under UC across Great Britain and therefore, we exclude these households from the analysis.

Households in Supported Exempt/Specified Accommodation (SEA) [footnote 29] are also excluded from our cohort groups, as their housing costs are disregarded from the cap calculation (see Annex A for reference) which means that very few of these households would be capped in practice.

Table 2.2 Number of households that had their Universal Credit capped, by month.

| Nov-16 | Dec-16 | Jan-17 | Feb-17 | Mar-17 | … | Nov-17 | Dec-17 | Jan-18 | |

|---|---|---|---|---|---|---|---|---|---|

| Great Britain | 490 | 1,320 | 1,890 | 2,300 | 2,670 | … | 3,890 | 4,060 | 4,380 |

| Greater London | 380 | 820 | 1,110 | 1,280 | 1,420 | … | 2,100 | 2,160 | 2,250 |

| Rest of Great Britain | 110 | 500 | 780 | 1,020 | 1,250 | … | 1,790 | 1,900 | 2,130 |

Figure 2.1 Number of households capped under Housing Benefit and Universal Credit since October 2016.

| Month | Housing Benefit | Universal Credit |

|---|---|---|

| Oct-16 | 19,095 | 350 |

| Nov-16 | 20,096 | 490 |

| Dec-16 | 32,962 | 1,320 |

| Jan-17 | 51,007 | 1,890 |

| Feb-17 | 66,135 | 2,300 |

| Mar-17 | 68,587 | 2,670 |

| Apr-17 | 66,928 | 3,110 |

| May-17 | 68,079 | 3,250 |

| Jun-17 | 68,891 | 3,360 |

| Jul-17 | 69,303 | 3,470 |

| Aug-17 | 68,265 | 3,620 |

| Sep-17 | 66,756 | 3,740 |

| Oct-17 | 64,503 | 3,850 |

| Nov-17 | 62,644 | 3,890 |

| Dec-17 | 60,870 | 4,060 |

| Jan-18 | 59,338 | 4,380 |

| Feb-18 | 60,075 | 4,720 |

| Mar-18 | 58,366 | 4,990 |

| Apr-18 | 58,384 | 5,260 |

| May-18 | 60,378 | 5,830 |

| Jun-18 | 60,537 | 6,350 |

| Jul-18 | 58,367 | 7,080 |

| Aug-18 | 57,755 | 7,950 |

| Sep-18 | 56,814 | 8,590 |

| Oct-18 | 54,867 | 9,170 |

| Nov-18 | 52,645 | 9,930 |

| Dec-18 | 49,855 | 10,970 |

| Jan-19 | 50,073 | 12,330 |

| Feb-19 | 52,289 | 14,950 |

| Mar-19 | 50,930 | 18,530 |

| Apr-19 | 50,533 | 22,050 |

| May-19 | 49,700 | 26,630 |

| Jun-19 | 47,754 | 29,880 |

| Jul-19 | 45,300 | 33,480 |

| Aug-19 | 43,131 | 35,840 |

| Sep-19 | 41,140 | 37,530 |

| Oct-19 | 38,718 | 38,940 |

| Nov-19 | 36,508 | 41,160 |

| Dec-19 | 35,462 | 43,040 |

| Jan-20 | 32,887 | 45,550 |

| Feb-20 | 32,589 | 46,230 |

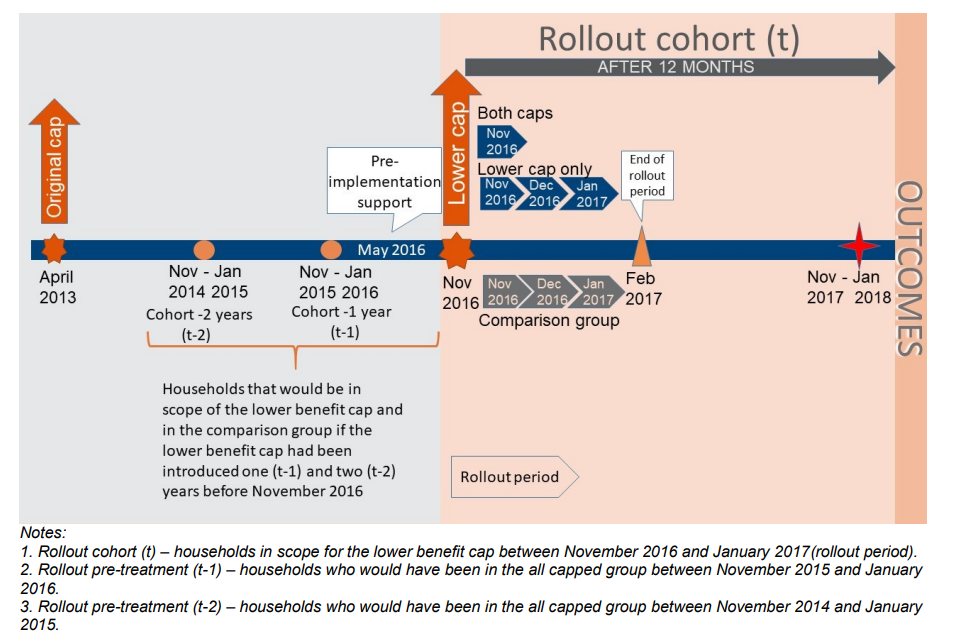

Alongside the rollout cohort, we also define two comparison or ‘pre-treatment’ cohort groups (cohort t-1 and cohort t-2), which include households that would be in either the all capped group or the comparison group if the lower benefit cap had been introduced one (t-1) and two (t-2) years before November 2016. These additional cohort groups allow us to track – and compare – outcomes of potentially capped households for the two years prior to the introduction of the lower benefit cap levels. Households in the pre-treatment groups may also be included in the rollout cohort, although would not necessarily be capped at rollout. Table 2.3 shows the number of households for each cohort group, in Great Britain and subdivided by ‘geography’, i.e. between Greater London and the Rest of Great Britain and Figure 2.2 shows the timeline of the key milestones in the lower benefit cap policy with cohort groups.

Table 2.3 Composition of the cohort groups: rollout, t-1 and t-2.

| Cohort | Geography | Lower cap only | Both caps | All capped | Comparison | Total |

|---|---|---|---|---|---|---|

| Rollout | Great Britain | 77,380 | 23,740 | 101,120 | 40,740 | 141,860 |

| Greater London | 12,950 | 9,620 | 22,560 | 8,470 | 31,040 | |

| Rest of Great Britain | 64,430 | 14,120 | 78,550 | 32,270 | 110,820 | |

| Cohort t-1 | Great Britain | 82,550 | 26,300 | 108,850 | 40,500 | 149,350 |

| Greater London | 14,320 | 10,930 | 25,250 | 8,650 | 33,910 | |

| Rest of Great Britain | 68,230 | 15,370 | 83,600 | 31,840 | 115,440 | |

| Cohort t-2 | Great Britain | 96,410 | 31,380 | 127,790 | 50,280 | 178,070 |

| Greater London | 17,800 | 13,500 | 31,290 | 9,770 | 41,070 | |

| Rest of Great Britain | 78,620 | 17,880 | 96,490 | 40,500 | 137,000 |

Figure 2.2 Lower benefit cap timeline and cohort groups.

As in the 2014 impact evaluation of the benefit cap, we include households in the cohorts when they have a total weekly benefit award above the lower benefit cap levels and are in scope for the lower benefit cap and we refer to these as capped households. This is different to the Official statistics measure for the number of households recorded as having the benefit cap reduction applied to the HB or UC award. The differences are due to a time interval between a household first being identified as being in scope for the cap at rollout by DWP and the benefit cap actually being applied to the HB award by local authorities, who administer HB. The period taken to administer the benefit cap between DWP and LA can take between a few weeks and up to 1-2 months, and this can vary for a number of operational reasons. Although there may be slight differences between the number of households actually capped and in scope for the lower cap, the two groups are similar, as demonstrated in Chapter 3 of the 2014 impact evaluation and therefore we use the term capped households irrespectively. In addition, in-scope households, even if they do not have their benefit income actually capped will likely have a strengthened incentive to change their circumstances; this methodology allows us to record behaviour responses for this group.

2.3 Methodology overview

As mentioned in the previous section, we use a cohort analysis approach that follows the analysis undertaken in the 2014 impact evaluation[footnote 30], which tracks outcomes for the cohort groups. However, there are some important differences compared to the previous evaluation:

- unlike the evaluation of the original benefit cap, the lower benefit cap evaluation does not have an easily identifiable group of households who are not affected by any benefit cap policy, as the original benefit cap was already implemented, from April 2013. This means that the cohort groups, particularly the both caps group (see below), are already affected by the original cap

- the number of households, either capped or in the comparison group is significantly increased compared to the previous evaluation. This is largely due to the lower levels, which affect more households. Eligibility criteria remain largely unchanged with the exception of the new exemption for households in receipt of Carer’s Allowance and Guardian’s Allowance, coinciding with the introduction of the lower benefit cap (see Annex A)

- within the group of capped households at rollout, there is a subgroup who are capped under the original cap levels and who would lose more benefit income than before (both caps group). In this evaluation, we analyse separately the impacts of the lower cap on the both caps group and those in scope for the lower levels only; the lower cap only group

- as the new lower cap introduces new tiered levels across different geographies, this motivates new subgroup analysis by geography (Greater London/Rest of Great Britain) in addition to the different cap groups (i.e. lower cap only and both caps group)

In this evaluation, first, we compare household outcomes or circumstances at the introduction of the lower benefit cap with those twelve months later and assess the outcomes by different characteristics i.e. family type, benefit type. Then, we determine the magnitude of the change for capped households that might be attributed directly to the lower benefit cap policy. We use the comparison group to identify what would happen to those affected by the lower benefit cap if the cap had not been introduced (known as their ‘counterfactual’ outcomes). A full technical description of the econometric methodology can be found in Annex E.

2.4 Composition of the rollout cohort

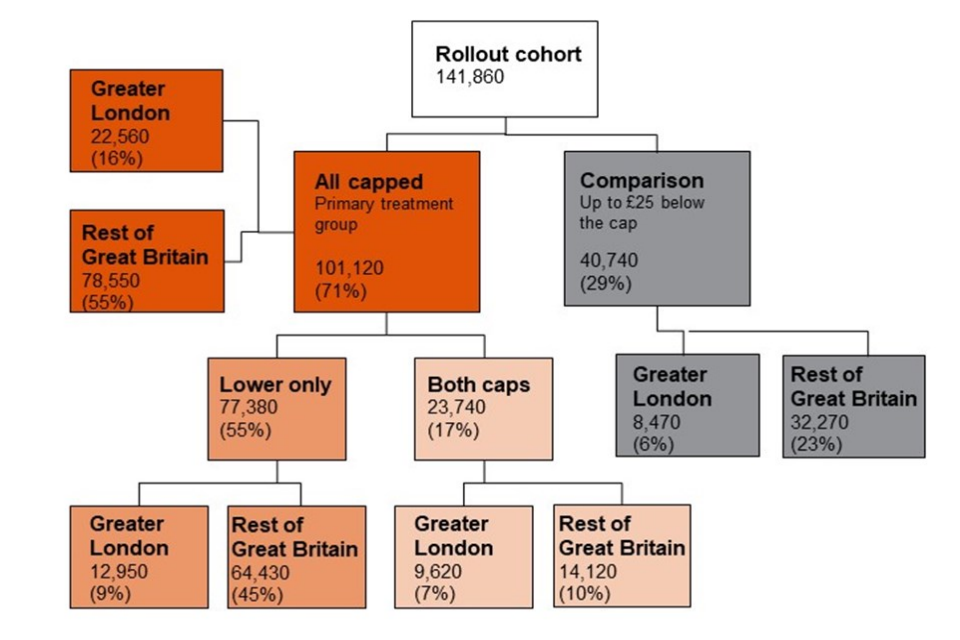

Figure 2.3 illustrates the distribution of households in each group across the rollout cohort groups and geography (Greater London and Rest of Great Britain) and Table 2.4 presents the detailed composition of the rollout cohort groups by different characteristics, i.e. geography, family type, benefit type, age of youngest children and tenure type. Throughout this report where we refer to households with children, these are dependent children aged up to 19 years old.

Figure 2.3 Diagram of the distribution of households in each group across the rollout cohort groups and geography

The rollout cohort includes 141,860 households of which:

- 29 per cent are in the comparison group

- 71 per cent are in the all capped group, of which:

- 55 per cent are in the lower cap only group

- 17 per cent are in the both caps group

We present below the composition of the rollout cohort, as well as the criteria to identify and analyse the comparison group and its robustness.

Table 2.4: Composition of the rollout cohort by household characteristics and cap group at rollout

| Lower cap only | Both caps | All capped | Comparison | |

|---|---|---|---|---|

| Totals | 77,380 | 23,740 | 101,120 | 40,740 |

| Family type | ||||

| Lone parents | 68 | 63 | 67 | 66 |

| Couples with children | 20 | 29 | 22 | 15 |

| Couples w/o children | <0.5 | <0.5 | <0.5 | <0.5 |

| Singles | 12 | 8 | 11 | 19 |

| Benefit type | ||||

| IS | 52 | 49 | 51 | 49 |

| JSA | 20 | 20 | 20 | 19 |

| ESA WRAG | 19 | 19 | 19 | 21 |

| Other | 9 | 12 | 10 | 11 |

| Age of youngest child | ||||

|---|---|---|---|---|

| Under 2 | 32 | 38 | 33 | 28 |

| Aged 2 | 13 | 13 | 13 | 12 |

| Aged 3-4 | 21 | 20 | 21 | 19 |

| Aged 5-19 | 22 | 20 | 21 | 21 |

| Tenure type | ||||

| SRS | 50 | 40 | 48 | 59 |

| PRS | 44 | 42 | 43 | 34 |

| TA | 1 | 9 | 3 | 1 |

| Other | 5 | 8 | 6 | 6 |

| Geography | ||||

|---|---|---|---|---|

| Greater London | 17 | 41 | 22 | 21 |

| Rest of Great Britain | 83 | 59 | 78 | 79 |

| Region | ||||

| Inner London | 7 | 16 | 9 | 9 |

| Outer London | 9 | 25 | 13 | 12 |

| North East | 4 | 3 | 4 | 4 |

| North West | 10 | 7 | 9 | 9 |

| Yorkshire and the Humber | 8 | 6 | 8 | 9 |

| East Midlands | 7 | 4 | 6 | 6 |

| West Midlands | 12 | 9 | 11 | 9 |

| East of England | 10 | 7 | 9 | 8 |

| South East | 14 | 11 | 13 | 15 |

| South West | 6 | 5 | 6 | 7 |

| Scotland | 6 | 5 | 6 | 7 |

| Wales | 5 | 3 | 5 | 6 |

2.4.1 All capped group

At rollout, the all capped group is mainly formed[footnote 31] by (Table 2.4):

- lone parent households (67 per cent)

- income Support claimants (51 per cent)

- households with a youngest child aged under 2 years (33 per cent)

- households in either the Social Rented Sector (48 per cent) or Private Rented Sector (43 per cent)

- living outside Greater London (Rest of Great Britain) (78 per cent)

2.4.2 Comparison group

The comparison group characteristics are similar to the all capped group. As such, this group is mostly composed of (Table 2.4):

- lone parent households (66 per cent)

- income Support claimants (49 per cent)

- households with a youngest child aged under 2 years (28 per cent)

- households in either the Social Rented Sector (59 per cent) or Private Rented Sector (34 per cent)

- living outside of Greater London (Rest of Great Britain) (79 per cent)

2.4.3 Choice of the comparison group

To assess the impact of the lower benefit cap, we compare outcomes of capped households with the outcomes of a similar group of households not affected by the benefit cap policy called the ‘comparison group’. The comparison group provides information on what would have happened to households affected by the lower cap, in the absence of the cap, or the ‘counterfactual’ estimate.

In the 2014 impact evaluation, the comparison group was formed by households with a total weekly benefit income of £0-£50 below the cap. For the purposes of this evaluation, households who have a total weekly benefit income £0-£25 below the cap provide a good representation, in terms of sample size (larger than the comparison group in the previous evaluation) for robust statistical evaluation, and a closer comparator to the lower cap group, in terms of observed characteristics, as well as total weekly benefit income.

Table 2.4 shows that the comparison group is very similar in characteristics to the lower cap only group, although less similar to the both caps group. The characteristics of the both caps group are somewhat different to the other groups, reflecting their higher level of benefit entitlement in the absence of the cap. This is a difference that must be considered throughout the impact assessment and is the reason behind the choice of our empirical methodology design (see Annex E). For this reason, the analysis presented throughout this report includes regression models for both groups (lower cap only and both caps), to account not only for the overall impact of the lower benefit cap but also for the additional impact of the previous higher cap levels.

In addition to sharing similar characteristics in terms of composition, the comparison group should ideally have similar outcomes pre-implementation of the cap, i.e. similar employment rates. We observe that twelve months before the implementation of the benefit cap the proportion of households in the comparison group who are in work is 12 per cent, similar to households in the lower cap only (13 per cent) and in the both caps group (14 per cent).

Taking into account the above considerations, we consider it reasonable to conclude that the comparison and capped groups are affected similarly by factors other than the benefit cap policy. Therefore, we are confident that the comparison group provides an appropriate basis for assessing the impact of the lower benefit cap.

2.5 Household outcomes

We assess in detail, in Chapter 3, a range of different outcomes observed for households claiming HB twelve months after rollout of the lower benefit cap. The main outcomes considered, consistent with the benefit cap official statistics[footnote 32] are (see Annex A for reference):

- claiming Working Tax Credits, which exempts households from the application of the cap to their HB award

- being in receipt of an exempting benefit

- having a total weekly benefit income below the benefit cap threshold, which means the household is uncapped or ‘out of scope’ of the cap levels

- no longer claiming HB and without a Universal Credit (UC) claim

- migrating from HB to UC with earnings above the cap threshold, which results in the household becoming out of scope for the cap. This is explained in Annex D

- migrating from HB to UC with earnings below the threshold, still capped

- still claiming HB and with a total weekly household benefit income above the cap threshold, still capped

In addition, we also assess a range of outcomes related to housing status, in Chapter 6. These outcomes include:

- moves between geographical areas, either at Census Output Area (COA) or Local Authority (LA) level

- rent level

- housing tenure e.g. moving from the Private to the Social Rented Sector or vice versa

2.6 Measures for working and exempting benefit outcomes

In this section, we explain in detail some of the measures used to determine movement into work and into an exempting benefit, as outlined in Section 2.5.

2.6.1 Movement into work

For the purposes of this report, movement into employment is defined as households who have an open Working Tax Credit (WTC) claim. The methodology is consistent with the official statistics and based on that followed in the 2014 impact evaluation, which assessed the likelihood of households to be in receipt of WTC, twelve months after they become capped, compared to the comparison group. The WTC measure is especially appropriate for this evaluation, where changes in employment status before and after the application of the cap are more important than defining the exact level of employment.

Households’ WTC entitlement is extracted from two DWP administrative scans, the Work and Pensions Longitudinal Study dataset (WPLS) and the General Matching Service (GMS) data. The two data sources are merged to create 25 single binary indicator variable (i.e. a variable that can take one of only two values) which measure whether a household is in receipt of WTC over a 25-month period, tracked twelve months before and twelve months after the rollout of the lower benefit cap.

According to the latest official statistics, of the 220,000 households that have had their Housing Benefit capped since the introduction of the cap, in April 2013, 186,000 households are no longer capped, in February 2020. Moving into paid work (proxied by an open WTC claim) is the primary reason to no longer be in scope for the benefit cap, representing 61,000 households and 33 per cent of the total off-flows under HB since the introduction of the benefit cap.

Although this methodology captures a large proportion of those who move into work, it does not count the following outcomes as ‘in-work’:

- households not working enough to be entitled to WTC (at least 16 hours per week but depends on individual circumstances)[footnote 33]

- households who become eligible for WTC during the tracking period but do not claim it. We are not able to quantify exactly the size of this group, but we observe that the number of households affected is small

- movements into work where earnings exceed WTC limits (and so a WTC payment cannot be processed). This could include households whose earnings are high enough that they have been awarded a “nil award” as a result of the WTC means test The proportion of nil awards in the treatment and comparison groups is similar across the tracking period for the rollout cohort and pre-treatment cohorts at around 2-3 per cent; this shows there has not been an increase in those registering for a nil award. These findings are consistent with the those in the 2014 impact evaluation

- households who migrate from HB to UC and start to work (see Annex D for analysis on this group and the extent to which the WTC measure is under-estimating employment flows)

Using WTC awards to measure work outcomes also includes households who were already in employment, but were not previously taking up their WTC entitlement but subsequently claim WTC (perhaps due to the benefit cap policy).

These limitations mean that the WTC measure may either over or under-estimate the impact of the cap on employment. However, we believe that this is the best measure available to measure movement into work for capped households using the available data sources. In addition, analysis in Annex D demonstrates that the number of flows into work for households in the rollout cohort who claimed UC rather than WTC during the twelve-month tracking period is very small and has a negligible effect on the overall estimate of the employment impact of the policy. Annex C includes a discussion of alternative measures based on the HMRC Real Time Information (RTI) on earnings.

2.6.2 Receipt of exempting benefit

Exempting benefits are generally health, disability or carer-related that exempt households from the application of the cap, which ensures protection for those claimants for whom work may not be a viable option. A full list of the exempting benefits is provided in Annex A.

We assess the percentage of households in receipt of any exempting benefit after twelve months of being capped and the degree at which the lower benefit cap increases the likelihood to be in receipt of an exempting benefit, twelve months after rollout compared to the comparison group.

3. Descriptive analysis of outcomes of capped households twelve months after rollout

This chapter consists of a descriptive analysis of a range of different outcomes, defined to be mutually exclusive, and observed for households twelve months after becoming capped. This chapter does not attempt to relate these outcomes to how the same households would have responded in the absence of the cap and, therefore, does not estimate the causal impact of the cap. That is presented in later chapters in the econometric analysis.

3.1 Outcomes overview

As explained in Section 2.5, there are multiple ways in which households’ circumstances can change in the twelve months after they become capped. For the purposes of this chapter, we assign each household a single mutually exclusive outcome, following the hierarchy below. This means that once a household is assigned an outcome, it will not be counted in any lower ranked outcome. The outcomes considered are, in ranking order:

- If a household has an open WTC claim, it is assigned to be ‘In Work’

- If a household is no longer capped under HB and has a UC earnings exemption, it is assigned to be ‘In Work’[footnote 34]

- If a household is in receipt of an exempting benefit, it is assigned to be ‘Exempt’

- If a household is still capped under HB, it is assigned to be ‘Capped’

- If a household is no longer capped under HB but is capped under UC it is assigned to be ‘Capped’

- If a household still has a benefit income above the cap levels and is in scope but is yet to have their benefits capped, it is assigned to be ‘Capped’

- If a household has benefit income below the cap, but is still claiming HB, it is assigned ‘Out of Scope’

- If a household is no longer claiming HB and is not in scope for the cap under UC, it is assigned ‘Off HB

For example, a household that starts work and claims WTC but also has a reduction in benefit income to below the cap, is assigned as ‘In work’.

Outcomes are assessed for every cohort group and for each of the following subgroups: geography, family type, benefit type, age of youngest child and cap amount.

It should be noted that the analysis presented in this chapter represents a point in time or ‘snapshot’ of households’ circumstances twelve months after becoming capped. It does not reflect changes in circumstances that may occur for households before or after this point.

3.2 Status of capped households after twelve months

Table 3.1 shows the proportion of households for each outcome assessed, twelve months after they become capped sub-divided into the three cap groups: the lower cap only, both caps and all capped group. Single person households are included for context; however, they are excluded from the econometric analysis and presented separately in Annex F due to this group exhibiting different characteristics to lone parents and couples with children. As mentioned previously, outcomes are mutually exclusive and the figures in each row of the table sum up to 100 per cent.

Of all capped households at rollout, just over half are no longer capped after twelve months (53 per cent), and just under half are still capped (47 per cent; Figure 3.1). In addition, we observe that:

- 23 per cent are exempt from the cap because they move into work (either claiming WTC or earning enough to meet the work exemption under UC)

- 10 per cent are not in work, but in receipt of an exempting benefit, such as Carer’s Allowance, Employment and Support Allowance (Support Group), Personal Independence Payment (PIP) or Disability Living Allowance (DLA)

- 9 per cent have total benefit income below the cap levels

- 11 per cent are no longer claiming HB

- 47 per cent are still capped, either under HB or UC

Table 3.1 Status of capped households after twelve months, by household characteristics and cap group at rollout. For each cap group, rows add to 100%

| Twelve month outcome | Number of Households | Proportion in Both caps (%) | Lower cap only | Both caps | All capped | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | |||

| Great Britain | 90,030 | 24 | 22 | 9 | 10 | 11 | 48 | 28 | 11 | 5 | 12 | 44 | 23 | 10 | 9 | 11 | 47 |

| Including Singles | 101,120 | 23 | 20 | 10 | 12 | 13 | 45 | 26 | 12 | 6 | 14 | 42 | 21 | 11 | 11 | 13 | 45 |

| Geography | |||||||||||||||||

| Greater London | 17,030 | 50 | 22 | 7 | 13 | 9 | 50 | 31 | 9 | 5 | 10 | 45 | 27 | 8 | 9 | 9 | 48 |

| Rest of Great Britain | 72,990 | 18 | 22 | 9 | 9 | 11 | 48 | 26 | 13 | 4 | 14 | 43 | 23 | 10 | 8 | 12 | 47 |

| Family type | |||||||||||||||||

| Lone parents | 67,610 | 22 | 21 | 8 | 10 | 9 | 52 | 26 | 10 | 5 | 11 | 48 | 22 | 9 | 9 | 10 | 51 |

| Couples with children | 22,360 | 31 | 26 | 12 | 10 | 17 | 36 | 33 | 13 | 3 | 16 | 34 | 28 | 12 | 8 | 16 | 36 |

| Couples w/o children | 60 | 28 | 9 | 21 | 19 | 35 | 16 | 6 | 0 | 47 | 29 | 18 | 8 | 15 | 27 | 33 | 17 |

| Singles | 11,090 | 17 | 1 | 17 | 29 | 27 | 26 | 2 | 21 | 25 | 28 | 25 | 1 | 17 | 28 | 27 | 26 |

| Benefit type | |||||||||||||||||

| IS | 50,960 | 23 | 20 | 7 | 8 | 9 | 55 | 25 | 10 | 4 | 11 | 50 | 21 | 8 | 8 | 10 | 54 |

| JSA | 16,200 | 26 | 31 | 7 | 12 | 13 | 37 | 36 | 7 | 5 | 15 | 37 | 32 | 7 | 10 | 14 | 37 |

| ESA WRAG | 13,560 | 25 | 14 | 24 | 12 | 13 | 37 | 19 | 28 | 5 | 13 | 35 | 15 | 25 | 10 | 13 | 37 |

| Other | 9,310 | 29 | 29 | 4 | 12 | 13 | 42 | 42 | 5 | 4 | 14 | 36 | 33 | 4 | 10 | 13 | 40 |

| Age of youngest child | |||||||||||||||||

| Under 2 years | 33,430 | 27 | 19 | 7 | 8 | 11 | 54 | 26 | 10 | 4 | 13 | 47 | 21 | 8 | 7 | 12 | 52 |

| Aged 2 | 13,620 | 23 | 20 | 8 | 8 | 10 | 54 | 27 | 10 | 4 | 12 | 46 | 22 | 8 | 7 | 11 | 52 |

| Aged 3-4 | 20,750 | 23 | 27 | 9 | 9 | 11 | 45 | 31 | 11 | 4 | 12 | 42 | 28 | 9 | 8 | 11 | 44 |

| Aged 5-19 | 21,320 | 22 | 24 | 13 | 14 | 11 | 39 | 30 | 14 | 7 | 12 | 37 | 25 | 13 | 12 | 11 | 39 |

Figure 3.1 Status of capped households twelve months after rollout of the lower benefit cap.

| Status | Number of households |

|---|---|

| Still Capped | 47 |

| Off HB | 11 |

| Benefit award below the cap | 9 |

| Movement onto an exempting benefit | 10 |

| Movement into Work | 23 |

The rate at which households move into work varies by whether the household is affected by the original benefit cap or the lower benefit cap only:

- households in the both caps group have a higher propensity to move into work (28 per cent) than those in the lower cap only group (22 per cent)

- households in the both caps group are slightly more likely to be in receipt of an exempting benefit (11 per cent) than those in the lower cap only group (9 per cent)

Work outcomes also differ depending on other characteristics, i.e. geography, family type, benefit type and age of youngest child.

- households in Greater London, couples with children, families with youngest children aged three or four and households that initially claim JSA are more likely to be in work after twelve months

- households in the Rest of Great Britain, couples without children and single households, families with children aged five to nineteen and households that were initially ESA (WRAG) claimants are more likely to be in receipt of an exempting benefit after twelve months

The percentage of households who are still capped twelve months after rollout in the both caps group, is slightly lower than for the lower cap only group (44 per cent vs 48 per cent). Lone parents, households receiving Income Support, and those with a youngest child aged two or under are more likely to still be capped after twelve months.

Table 3.2 shows the outcomes for households twelve months after rollout, by cap amount and geographical area. We observe that:

- increasing cap amounts below £150 per week are associated with increasing proportions of households moving into work. The maximum proportion in work in Great Britain is for households capped by £100-£150 per week (29 per cent). As cap amounts increase above £150 per week the percentage in work starts to decrease. The exception is in Greater London where the proportion of household in work continues to increase at increasing cap amounts

- the proportion of households in receipt of an exempting benefit increases gradually with cap amount, independently of the geography

- the proportion of households still capped is higher at lower cap amount

Our findings on work outcomes by cap amount differs from the descriptive analysis of the 2014 impact evaluation[footnote 35] of the original benefit cap, which found that the greater the cap amount, the greater the proportion of households in work.

The administrative data does not provide the scope for further analysis on how households change their circumstances in response to the cap. The quantitative and qualitative analysis on the impact of the cap, by NatCen, provides some detailed information on how this group did actually respond to the cap; specifically, Section 3.4 “Whether still affected by the cap”.

Table 3.2 Status of capped households after twelve months by cap amount and geography at rollout. Rows add to 100% for each geography

| Cap amount | Number of Households | Proportion in Greater London (%) | Greater London | Rest of Great Britain | Great Britain | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | In work (%) | Exempt (%) | Out of scope (%) | Off HB (%) | Capped (%) | |||

| Up to £25 | 25,700 | 16 | 20 | 6 | 15 | 9 | 50 | 19 | 8 | 13 | 10 | 51 | 19 | 7 | 13 | 10 | 51 |

| £25-£50 | 17,440 | 21 | 23 | 7 | 10 | 9 | 52 | 22 | 9 | 10 | 12 | 47 | 22 | 9 | 10 | 11 | 48 |

| £50-£100 | 25,710 | 19 | 29 | 7 | 8 | 8 | 48 | 24 | 11 | 7 | 12 | 46 | 25 | 10 | 7 | 11 | 47 |

| £100-£150 | 11,780 | 19 | 32 | 10 | 4 | 10 | 44 | 28 | 13 | 4 | 13 | 42 | 29 | 12 | 4 | 12 | 42 |

| £150-£200 | 5,200 | 21 | 32 | 10 | 4 | 11 | 43 | 27 | 13 | 4 | 14 | 43 | 28 | 12 | 4 | 13 | 43 |

| £200 or more | 4,200 | 27 | 37 | 12 | 2 | 12 | 37 | 23 | 13 | 5 | 16 | 43 | 27 | 13 | 4 | 15 | 41 |

3.2.1 Status by type of exempting benefit.

Moving into receipt of an exempting benefit is the second most frequent reason for becoming exempt from the application of the cap. Annex A gives a full list of the exempting benefits.

Table 3.3 shows the most common combinations of exempting benefits and the percentage of capped households in receipt of these twelve months after the lower benefit cap rollout, sub-divided by geography, family type, benefit type and cap group. We observe for households moving on to an exempting benefit:

- the most common benefits received are ESA Support Group (SG), DLA/PIP, and a combination of Carer’s Allowance and Child DLA, with 2 per cent of the rollout cohort in receipt of each of these benefit combinations twelve months later

- the proportion of households moving into receipt of an exempting benefit, related to health conditions or disability, is higher for couples with children (3, 2 and 1 per cent respectively for ESA SG, DLA/PIP and DLA/PIP & ESA SG), than for lone parents (1, 2 and <0.5 per cent, respectively), whilst the opposite is true for exempting benefits for carers; lone parents are more likely to move into receipt of Carer’s Allowance with/without Child DLA, compared to couples with children (4 per cent vs. 3 per cent, respectively)

- households receiving ESA Work Related Activity Group (WRAG) at rollout are the most likely to move on to an exempting benefit, most commonly to ESA SG (9 per cent) and DLA/PIP (7 per cent)

Table 3.3 Exempting benefit status of all capped households twelve months after rollout, by household characteristics at rollout.

| Exempting benefit | ESA SG only (%) | DLA/PIP only (%) | DLA/PIP & ESA SG (%) | Child DLA only (%) | Carer’s Allowance only (%) | Carer’s Allowance and Child DLA (%) | Other (%) |

|---|---|---|---|---|---|---|---|

| Great Britain | 2 | 2 | 1 | 1 | 1 | 2 | 1 |

| Geography | |||||||

| Greater London | 3 | 3 | 1 | 1 | 1 | 1 | <0.5 |

| Rest of Great Britain | 2 | 2 | 1 | 1 | 1 | 2 | 1 |

| Family type | |||||||

| Lone parents | 1 | 2 | <0.5 | 2 | 1 | 3 | <0.5 |