Local government transparency code 2015

Updated 29 January 2025

Applies to England

Part 1: Introduction

Policy context

1. This Code is issued to meet the government’s desire to place more power into citizens’ hands to increase democratic accountability and make it easier for local people to contribute to the local decision making process and help shape public services. Transparency is the foundation of local accountability and the key that gives people the tools and information they need to enable them to play a bigger role in society. The availability of data can also open new markets for local business, the voluntary and community sectors and social enterprises to run services or manage public assets.

2. ‘Data’ means the objective, factual data, on which policy decisions are based and on which public services are assessed, or which is collected or generated in the course of public service delivery. This should be the basis for publication of information on the discharge of local authority functions.

3. Analysis by Deloitte[footnote 1] for the Shakespeare Review of Public Sector Information estimates the economic benefits of public sector information in the United Kingdom as £1.8 billion, with social benefits amounting to £5 billion. The study highlights the significant potential benefits from the publication of public data. And, local authorities and local people want to see published open data:

- 80% of those responding to a transparency survey[footnote 2] by the Local Government Association in September 2012 cited external accountability as a benefit, with 56% citing better local decision making and democracy as a benefit

- a survey of 800 members of Bedford’s Citizens Panel[footnote 3] showed that 64% of respondents thought it was very important that the council makes data available to the public and the public were most interested in seeing data made available about council spending and budgets (66%)

- research by Ipsos MORI[footnote 4] found that the more citizens feel informed, the more they tend to be satisfied with public services and their local authorities

4. Therefore, the government believes that in principle all data held and managed by local authorities should be made available to local people unless there are specific sensitivities (eg. protecting vulnerable people or commercial and operational considerations) to doing so. It encourages local authorities to see data as a valuable resource not only to themselves, but also their partners and local people.

5. Three principles have guided the development of this Code:

- demand led – there are growing expectations that new technologies and publication of data should support transparency and accountability. It is vital that public bodies recognise the value to the public of the data they hold, understand what they hold, what their communities want and then release it in a way that allows the public, developers and the media to use it

- open – provision of public data should become integral to local authority engagement with local people so that it drives accountability to them. Its availability should be promoted and publicised so that residents know how to access it and how it can be used. Presentation should be helpful and accessible to local people and other interested persons, and

- timely – the timeliness of making public data available is often of vital importance. It should be made public as soon as possible following production even if it is not accompanied with detailed analysis.

6. This Code ensures local people can now see and access data covering (Annex A summarises the publication requirements specified in this Code):

- how money is spent – for example, all spending transactions over £500, all Government Procurement Card spending and contracts valued over £5,000

- use of assets – ensuring that local people are able to scrutinise how well their local authority manages its assets[footnote 5]. For example, self-financing for council housing – introduced in April 2012 – gave each local authority a level of debt it could support based on the valuation of its housing stock. This Code gives local people the information they need to ask questions about how their authority is managing its housing stock to ensure it is put to best use, including considering whether higher value, vacant properties could be used to fund the building of new affordable homes and so reduce waiting lists. The requirement in paragraphs 38 to 41 builds on existing Housing Revenue Account practices[footnote 6]

- decision making – how decisions are taken and who is taking them, including how much senior staff are paid, and

- issues important to local people – for example, parking and the amount spent by an authority subsidising trade union activity.

7. Local authorities are encouraged to consider the responses the government received[footnote 7] to its consultation and look to go further than this Code by publishing some of the data proposed by respondents, in line with the principle that all data held and managed by local authorities should be made open and available to local people unless there are specific sensitivities to doing so.

8. Fraud can thrive where decisions are not open to scrutiny and details of spending, contracts and service provision are hidden from view. Greater transparency, and the provisions in this Code, can help combat fraud. Local authorities should also use a risk management approach with strong internal control arrangements to reduce the risk of any payment fraud as a result of publishing public data. Local authorities should refer to the Chartered Institute of Public Finance and Accountancy Code of Practice on Managing the Risk of Fraud and Corruption[footnote 8]. Annex B provides further information on combating fraud.

Application

9. This Code is issued by the Secretary of State for Communities and Local Government in exercise of his powers under section 2 of the Local Government, Planning and Land Act 1980 (“the Act”) to issue a Code of Recommended Practice (the Code) as to the publication of information by local authorities about the discharge of their functions and other matters which he considers to be related. It is issued following consultation in accordance with section 3(11) of the Act.

10. The Code does not replace or supersede the existing legal framework for access to and re-use of public sector information provided by the:

- Freedom of Information Act 2000 (as amended by the Protection of Freedoms Act 2012)

- Environmental Information Regulations 2004

- Re-use of Public Sector Information Regulations 2005

- Infrastructure for Spatial Information in the European Community (INSPIRE) Regulations 2009, and

- sections 25 and 26 of the Local Audit and Accountability Act 2014[footnote 9] which provide rights for persons to inspect a local authority’s accounting records and supporting documentation, and to make copies of them

11. This Code does not apply to Police and Crime Commissioners, for whom a separate transparency framework applies.

12. This Code only applies to local authorities in relation to descriptions of information or data where that type of local authority undertakes the particular function to which the information or data relates.

13. The Code applies in England only.

Definitions

14. In this Code:

“local authority” means:

- a county council in England

- a district council

- a parish council which has gross annual income or expenditure (whichever is the higher) exceeding £200,000

- a London borough council

- the Common Council of the City of London in its capacity as a local authority

- the Council of the Isles of Scilly

- a National Park authority for a National Park in England

- the Broads Authority

- the Greater London Authority so far as it exercises its functions through the Mayor

- the London Fire and Emergency Planning Authority

- Transport for London

- a fire and rescue authority (constituted by a scheme under section 2 of the Fire and Rescue Services Act 2004 or a scheme to which section 4 of that Act applies, and a metropolitan county fire and rescue authority)

- a joint authority established by Part IV of the Local Government Act 1985 (fire and rescue services and transport)

- a joint waste authority, i.e. an authority established for an area in England by an order under section 207 of the Local Government and Public Involvement in Health Act 2007

- an economic prosperity board established under section 88 of the Local Democracy, Economic Development and Construction Act 2009

- a combined authority established under section 103 of that Act

- a waste disposal authority, i.e. an authority established under section 10 of the Local Government Act 1985, and

- an integrated transport authority for an integrated transport area in England

“a social enterprise”[footnote 10] means a business that trades for a social and/or environmental purpose and is a business which:

- aims to generate its income by selling goods and services, rather than through grants and donations

- is set up to specifically make a difference, and

- reinvests the profits it makes for the purpose of its social mission

“a small or medium sized enterprise” means an undertaking which has fewer than 250 employees

“voluntary and community sector organisations” means a non-governmental organisation that is value-driven and which principally reinvests its surpluses to further social, environmental or cultural objectives

Data protection

15. The government believes that local transparency can be implemented in a way that complies with the Data Protection Act 1998. Where local authorities are disclosing information which potentially engages the Data Protection Act 1998, they must ensure that the publication of that information is compliant with the provisions of that Act. The Data Protection Act 1998 does not restrict or inhibit information being published about councillors or senior local authority officers because of the legitimate public interest in the scrutiny of such senior individuals and decision makers. The Data Protection Act 1998 also does not automatically prohibit information being published naming the suppliers with whom the authority has contracts, including sole traders, because of the public interest in accountability and transparency in the spending of public money.

16. For other situations where information held by local authorities contains public data which cannot be disclosed in a Data Protection Act compliant manner, the Information Commissioner’s Office has published guidance on anonymisation of datasets, enabling publication of data which can yield insights to support public service improvement, whilst safeguarding individuals’ privacy[footnote 11].

17. To ensure that published valuation information for social housing assets (see paragraphs 38 to 41) is not disclosive of individual properties, authorities are required to publish their valuation data at postal sector level, i.e. full ‘outbound’ code (first part of the postcode) and first digit of the ‘inbound’ code (second part of the postcode). This provides an average cell size of 2,500 households, which should be large enough to prevent identification of individual dwellings. However, in particular areas where the postcode sector gives a number of households below 2,500 the postcode level should be set higher, that is at postcode district level (e.g. PO1 ***).

18. Local authorities should also make the following adjustment prior to publishing social housing valuation data in order to mitigate the possibility of identifying individual properties:

- Step 1 – for any given postcode sector where the number of occupied social housing properties in any valuation bands is less than a threshold of ’10’, authorities should merge that particular cell with the next lowest valuation band, and so on until the resultant merged cells contain at least ‘10’ occupied social housing properties. However, if continued repetition of step 1 leads to the number of valuation bands applied to that postcode sector falling below the proposed minimum threshold of valuation bands as set out in paragraph 17, authorities should then apply step 2.

- Step 2 – authorities should merge the original (non-merged) valuation data for the relevant postcode sector with the valuation data with any adjoining postcode sectors which show the lowest number of socially rented properties. Then apply Step 1.

Licences

19. When using postcode data (for example, in connection with paragraphs 35 to 41), local authorities will need to assess their current licence arrangement with the Royal Mail with regards to the terms of use of the Postcode Address File (PAF).

Commercial confidentiality

20. The government has not seen any evidence that publishing details about contracts entered into by local authorities would prejudice procurement exercises or the interests of commercial organisations, or breach commercial confidentiality unless specific confidentiality clauses are included in contracts. Local authorities should expect to publish details of contracts newly entered into – commercial confidentiality should not, in itself, be a reason for local authorities to not follow the provisions of this Code. Therefore, local authorities should consider inserting clauses in new contracts allowing for the disclosure of data in compliance with this Code.

Exclusions and exemptions

21. Authorities should ensure that they do not contravene the provisions of sections 100A, 100B or 100F of the Local Government Act 1972.

22. Where information would otherwise fall within one of the exemptions from disclosure, for instance, under the Freedom of Information Act 2000, the Environmental Information Regulations 2004, the Infrastructure for Spatial Information in the European Community (INSPIRE) Regulations 2009 or fall within Schedule 12A to the Local Government Act 1972 then it is at the discretion of the local authority whether or not to rely on that exemption or publish the data. Local authorities should start from the presumption of openness and disclosure of information, and not rely on exemptions to withhold information unless absolutely necessary.

Timeliness and errors

23. Data should be as accurate as possible at first publication. While errors may occur, the publication of information should not be unduly delayed to rectify mistakes. This concerns errors in data accuracy. The best way to achieve this is by having robust information management processes in place.

24. Where errors in data are discovered, or files are changed for other reasons (such as omissions), local authorities should publish revised information making it clear where and how there has been an amendment. Metadata on data.gov.uk should be amended accordingly.

Further guidance and support

25. The Local Government Association has published guidance[footnote 12] on transparency (eg. technical guidance notes, best practice examples and case studies) to help local authorities comply with this Code.

Part 2: Information which must be published

2.1: Information to be published quarterly

26. Data covered by this section includes:

- expenditure exceeding £500 (see paragraphs 28 and 29)

- Government Procurement Card transactions (paragraph 30), and

- procurement information (see paragraphs 31 and 32)

27. The data and information referred to in this Part (2.1) must be:

- first published within a period of 3 months from the date on which the local authority last published that data under the Local Government Transparency Code 2014[footnote 13] and not later than 1 month after the quarter to which the data and information is applicable

- published quarterly thereafter and on each occasion not later than 1 month after the quarter to which the data and information is applicable

Expenditure exceeding £500

28. Local authorities must publish details of each individual item of expenditure that exceeds £500[footnote 14]. This includes items of expenditure[footnote 15], consistent with Local Government Association guidance[footnote 16], such as:

- individual invoices

- grant payments

- expense payments

- payments for goods and services

- grants

- grant in aid

- rent

- credit notes over £500, and

- transactions with other public bodies

29. For each individual item of expenditure the following information must be published:

- date the expenditure was incurred

- local authority department which incurred the expenditure

- beneficiary

- summary of the purpose of the expenditure[footnote 17]

- amount[footnote 18]

- Value Added Tax that cannot be recovered, and

- merchant category (eg. computers, software etc)

Government Procurement Card transactions

30. Local authorities must publish details of every transaction on a Government Procurement Card. For each transaction, the following details must be published:

- date of the transaction

- local authority department which incurred the expenditure

- beneficiary

- amount[footnote 19]

- Value Added Tax that cannot be recovered

- summary of the purpose of the expenditure, and

- merchant category (eg. computers, software etc)

Procurement information

31. Local authorities must publish details of every invitation to tender for contracts to provide goods and/or services[footnote 20] with a value that exceeds £5,000[footnote 21], [footnote 22]. For each invitation, the following details must be published:

- reference number

- title

- description of the goods and/or services sought

- start, end and review dates, and

- local authority department responsible

32. Local authorities must also publish details of any contract[footnote 23], commissioned activity, purchase order, framework agreement and any other legally enforceable agreement with a value that exceeds £5,000[footnote 24]. For each contract, the following details must be published:

- reference number

- title of agreement

- local authority department responsible

- description of the goods and/or services being provided

- supplier name and details

- sum to be paid over the length of the contract or the estimated annual spending or budget for the contract[footnote 25]

- Value Added Tax that cannot be recovered

- start, end and review dates

- whether or not the contract was the result of an invitation to quote or a published invitation to tender, and

- whether or not the supplier is a small or medium sized enterprise and/or a voluntary or community sector organisation and where it is, provide the relevant registration number[footnote 26]

2.2: Information to be published annually

33. Data covered by this section includes:

- local authority land (see paragraphs 35 to 37)

- social housing assets (see paragraphs 38 to 41)

- grants to voluntary, community and social enterprise organisations (see paragraphs 42 and 43)

- organisation chart (see paragraph 44)

- trade union facility time (see paragraph 45)

- parking account (see paragraph 46)

- parking spaces (see paragraph 47)

- senior salaries (see paragraphs 48 and 49)

- constitution (see paragraph 50)

- pay multiple (see paragraphs 51 and 52), and

- fraud (see paragraph 53)

34. With the exception of data relating to social housing assets (paragraphs 38 to 41), the data and information in this Part (2.2) must be:

- first published within a period of 1 year from the date on which the local authority last published that data under the Local Government Transparency Code 2014[footnote 27] and not later than 1 month after the year to which the data and information is applicable

- published annually thereafter and on each occasion not later than 1 month[footnote 28] after the year to which the data and information is applicable

The data on social housing assets (see paragraphs 38 to 41) must be published:

- on the first occasion, not later than 1 September 2015 (based on the most up to date valuation data available at the time of publishing the information), then

- in April 2016, and

- every April thereafter

Local authority land

35. Local authorities must publish details of all land and building assets including:

- all service and office properties occupied or controlled by user bodies, both freehold and leasehold

- any properties occupied or run under Private Finance Initiative contracts

- all other properties they own or use, for example, hostels, laboratories, investment properties and depots

- garages unless rented as part of a housing tenancy agreement

- surplus, sublet or vacant properties

- undeveloped land

- serviced or temporary offices where contractual or actual occupation exceeds 3 months, and

- all future commitments, for example under an agreement for lease, from when the contractual commitment is made

Information about the following land and building assets are to be excluded from publication:

- rent free properties provided by traders (such as information booths in public places or ports)

- operational railways and canals

- operational public highways (but any adjoining land not subject to public rights should be included)

- assets of national security, and

- information deemed inappropriate for public access as a result of data protection and/or disclosure controls (eg. such as refuge houses)

36. For the purposes of this dataset about local authority land (paragraphs 35 to 37), details about social housing should not be published. However, information about the value of social housing stock contained in a local authority’s Housing Revenue Account does need to be published for the social housing asset value dataset (paragraphs 38 to 41).

37. For each land or building asset, the following information must be published together in one place:

- Unique Property Reference Number[footnote 29]

- Unique asset identity - the local reference identifier used by the local body, sometimes known as local name or building block. There should be one entry per asset or user/owner (eg. on one site there could be several buildings or in one building there could be several users floors/rooms etc – where this is the case, each of these will have a separate asset identity). This must include the original reference number from the data source plus authority code

- name of the building/land or both

- street number or numbers - any sets of 2 or more numbers should be separated with the ‘-‘ symbol (eg. 10-15 London Road)

- street name – this is the postal road address[footnote 30]

- post town

- United Kingdom postcode

- map reference – local authorities may use either Ordnance Survey or ISO 6709 systems to identify the location of an asset, but must make clear which is being used. Where an Ordnance Survey mapping system is used (the grid system) then assets will be identified using Eastings before Northings. Where geocoding in accordance with ISO 6709 is being used to identify the centre point of the asset location then that reference must indicate its ISO coordinates

- whether the local authority owns the freehold or a lease for the asset and for whichever category applies, the local authority must list all the characteristics that apply from the options given below:

for freehold assets:

- occupied by the local authority

- ground leasehold

- leasehold

- licence

- vacant (for vacant properties, local authorities should not publish the map reference or full address details, they should only publish the first part of the postcode[footnote 31])

for leasehold assets:

- occupied by the local authority

- ground leasehold

- sub leasehold

- licence

for other assets:

-

free text description eg. rights of way, access etc[footnote 32]

-

whether or not the asset is land only (i.e. without permanent buildings) or it is land with a permanent building

Social housing asset value

38. Local authorities must publish details of the value of social housing stock that is held in their Housing Revenue Account[footnote 33].

39. The following social housing stock data must be published:

- valuation data to be listed at postal sector level[footnote 34] (e.g. PO1 1**), without indicating individual dwelling values, and ensuring that data is not capable of being made disclosive of individual properties, in line with disclosure protocols set out in paragraphs 15 to 18

- valuation data for the dwellings using both Existing Use Value for Social Housing and market value (valued in accordance with guidance[footnote 35]) as at 1 April. This should be based on the authority’s most up to date valuation data at the time of the publication of the information

- an explanation of the difference between the tenanted sale value of dwellings within the Housing Revenue Account and their market sale value, and assurance that the publication of this information is not intended to suggest that tenancies should end to realise the market value of properties

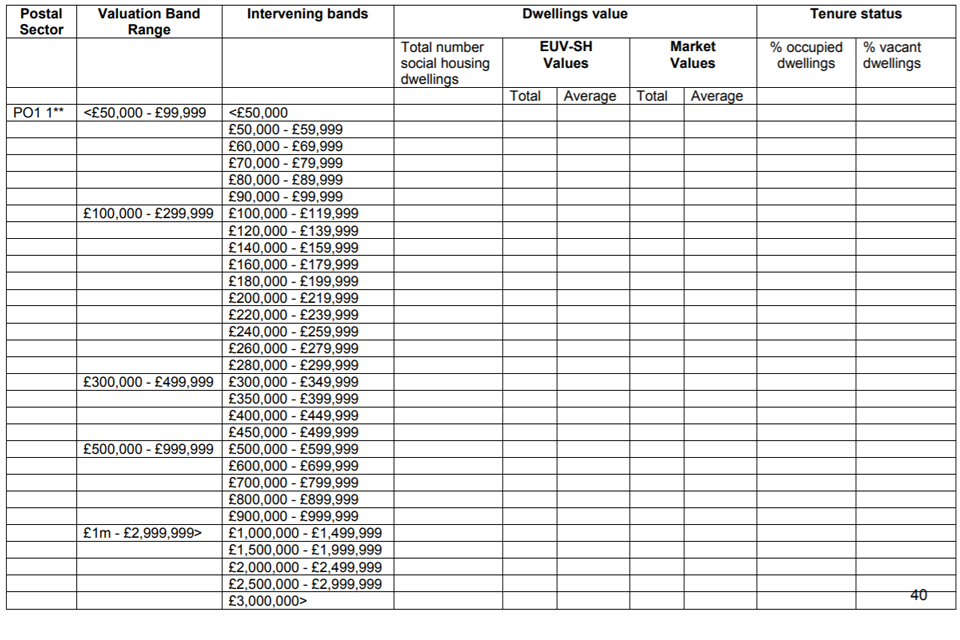

40. The valuation data and information referred to in paragraph 39 must be published in the following format:

- for each postal sector level, the valuation data should be classified within set bands of value. Authorities must set their valuation bands within the general parameters set out in the table below, in light of the local characteristics of the housing market in their area, in order to ensure that valuation data published by all authorities is consistent and clear to understand:

| Valuation Band Range | Intervening bands value |

|---|---|

| < £50,000 - £99,999 | 6 Bands of £10,000 |

| £100,000 - £299,999 | 10 Bands of £20,000 |

| £300,000 - £499,999 | 4 Bands of £50,000 |

| £500,000 - £999,999 | 5 Bands of £100,000 |

| £1,000,000 - £2,999,999> | 5 Bands of £500,000 |

- authorities should ensure that any band should only include values that fall within the band parameters (i.e. not give a top value band). If that is the case, the lowest and highest band should be further disaggregated

- authorities should bear in mind that it is likely that the numbers of properties in the lowest and highest bands will be low, leading to potential disclosure problems. The protocol to address this issue is set out in paragraphs 15 to 18

- for each postal sector level, within the set band of value, the data should indicate:

- the total number of dwellings

- the aggregate value of the dwellings and their mean value, using both Existing Use Value for Social Housing and market value, and

- the percentage of the dwellings that are occupied and the percentage that are vacant

- authorities must publish the valuation data for both tenanted and vacant dwellings

41. An example of how the data specified in paragraphs 39 and 40 could be presented is included at Annex C.

Grants to voluntary, community and social enterprise organisations

42. Local authorities must publish details of all grants to voluntary, community and social enterprise organisations. This can be achieved by either:

- tagging and hence specifically identifying transactions which relate to voluntary, community and social enterprise organisations within published data on expenditure over £500 or published procurement information, or

- by publishing a separate list or register

43. For each identified grant, the following information must be published as a minimum:

- date the grant was awarded

- time period for which the grant has been given

- local authority department which awarded the grant

- beneficiary

- beneficiary’s registration number[footnote 36]

- summary of the purpose of the grant, and

- amount

Organisation chart

44. Local authorities must publish an organisation chart covering staff in the top 3 levels of the organisation[footnote 37]. The following information must be included for each member of staff included in the chart:

- grade

- job title

- local authority department and team

- whether permanent or temporary staff

- contact details

- salary in £5,000 brackets, consistent with the details published under paragraph 48, and

- salary ceiling (the maximum salary for the grade)

Trade union facility time

45. Local authorities must publish the following information on trade union facility time:

- total number (absolute number and full time equivalent) of staff who are union representatives (e.g. general, learning and health and safety representatives)

- total number (absolute number and full time equivalent) of union representatives who devote at least 50% of their time to union duties

- names of all trade unions represented in the local authority

- a basic estimate of spending on unions (calculated as the number of full time equivalent days spent on union duties by authority staff that spent the majority of their time on union duties multiplied by the average salary), and

- a basic estimate of spending on unions as a percentage of the total pay bill (calculated as the number of full time equivalent days spent on union duties by authority staff that spent the majority of their time on union duties multiplied by the average salary divided by the total pay bill)

Parking account

46. Local authorities must publish on their website, or place a link on their website to this data if published elsewhere:

- a breakdown of income and expenditure on the authority’s parking account[footnote 38],[footnote 39]. The breakdown of income must include details of revenue collected from on-street parking, off-street parking and Penalty Charge Notices, and

- a breakdown of how the authority has spent a surplus on its parking account[footnote 38],[footnote 40]

Parking spaces

47. Local authorities must publish the number of marked out controlled on and off-street parking spaces within their area, or an estimate of the number of spaces where controlled parking space is not marked out in individual parking bays or spaces.

Senior salaries

48. Local authorities are already required to publish, under the Accounts and Audit Regulations 2015[footnote 41]:

- the number of employees whose remuneration in that year was at least £50,000 in brackets of £5,000

- details of remuneration and job title of certain senior employees whose salary is at least £50,000, and

- employees whose salaries are £150,000 or more must also be identified by name

49. In addition to this requirement, local authorities must place a link on their website to these published data or place the data itself on their website, together with a list of responsibilities (for example, the services and functions they are responsible for, budget held and number of staff) and details of bonuses and ‘benefits-in-kind’, for all employees whose salary exceeds £50,000. The key differences between the requirements under this Code and the Regulations referred to above is the addition of a list of responsibilities, the inclusion of bonus details for all senior employees whose salary exceeds £50,000 and publication of the data on the authority’s website.

Constitution

50. Local authorities are already required to make their Constitution available for inspection at their offices under section 9P of the Local Government Act 2000. Local authorities must also, under this Code, publish their Constitution on their website.

Pay multiple

51. Section 38 of the Localism Act 2011 requires local authorities to produce Pay Policy Statements, which should include the authority’s policy on pay dispersion – the relationship between remuneration of chief officers and the remuneration of other staff. Guidance produced under section 40 of that Act[footnote 42], recommends that the pay multiple is included in these statements as a way of illustrating the authority’s approach to pay dispersion.

52. Local authorities must, under this Code, publish the pay multiple on their website, defined as the ratio between the highest paid taxable earnings for the given year (including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind) and the median earnings figure of the whole of the authority’s workforce. The measure must:

- cover all elements of remuneration that can be valued (eg. all taxable earnings for the given year, including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind)

- use the median earnings figure as the denominator, which should be that of all employees of the local authority on a fixed date each year, coinciding with reporting at the end of the financial year, and

- exclude changes in pension benefits, which due to their variety and complexity cannot be accurately included in a pay multiple disclosure

Fraud

53. Local authorities must publish the following information about their counter fraud work[footnote 43]:

- number of occasions they use powers under the Prevention of Social Housing Fraud (Power to Require Information) (England) Regulations 2014[footnote 44], or similar powers[footnote 45]

- total number (absolute and full time equivalent) of employees undertaking investigations and prosecutions of fraud

- total number (absolute and full time equivalent) of professionally accredited counter fraud specialists

- total amount spent by the authority on the investigation and prosecution of fraud, and

- total number of fraud cases investigated

2.3: Information to be published once only

Waste contracts

54. Local authorities must publish details of their existing waste collection contracts, in line with the details contained in paragraph 32. Local authorities must publish this information at the same time as they first publish quarterly procurement information under paragraphs 27, 31 and 32 of this Code.

2.4: Method of publication

55. Public data should be published in a format and under a licence that allows open reuse, including for commercial and research activities, in order to maximise value to the public. The most recent Open Government Licence published by the National Archives should be used as the recommended standard. Where any copyright or data ownership concerns exist with public data these should be made clear. Data covered by Part 2 of this Code must be published in open and machine-readable formats (further information about machine-readable formats can be found in Part 3.2).

Part 3: Information recommended for publication

56. Part 2 of this Code set out details of the minimum data that local authorities must publish. The government believes that in principle all data held and managed by local authorities should be made available to local people unless there are specific sensitivities to doing so. Therefore, it encourages local authorities to go much further in publishing the data they hold, recognising the benefits of sharing that data for local people, more effective service delivery and better policy making. Part 3 of this Code sets out details of data that the government recommends local authorities publish.

3.1: Information recommended for publication

57. Data covered by this section includes:

- expenditure data (see paragraph 58)

- procurement information (see paragraphs 59 and 60)

- local authority land (see paragraph 61 and 62)

- parking spaces (see paragraphs 63 and 64)

- organisation chart (see paragraph 65)

- grants to voluntary, community and social enterprise organisations (see paragraphs 66 and 67), and

- fraud (see paragraph 68)

Expenditure data

58. It is recommended that local authorities go further than the minimum publication requirements set out in Part 2 and:

- publish information on a monthly instead of quarterly basis, or ideally, as soon as it becomes available and therefore known to the authority (commonly known as ‘real-time’ publication)

- publish details of all transactions that exceed £250 instead of £500. For each transaction the details that should be published remain as in paragraph 29

- publish all transactions on all corporate credit cards, charge cards and procurements, including those that are not a Government Procurement Card. For each transaction the details that should be published remain as set out in paragraph 30

- publish the total amount spent on remuneration over the period being reported on, and

- classify expenditure using the Chartered Institute of Public Finance and Accountancy Service Reporting Code of Practice to enable comparability between local authorities

Procurement information

59. It is recommended that local authorities place on Contracts Finder[footnote 46], as well as any other local portal, every invitation to tender or invitation to quote for contracts to provide goods and/or services with a value that exceeds £10,000. For each invitation, the details that should be published are the same as those set out in paragraph 31.

60. It is recommended that local authorities should go further than the minimum publication requirements set out in Part 2 and publish:

- information on a monthly instead of quarterly basis, or ideally, as soon as it is generated and therefore becomes available (commonly known as ‘real-time’ publication)

- every invitation to tender for contracts to provide goods and/or services with a value that exceeds £500 instead of £5,000. The details that should be published are the same as those set out in paragraph 31

- details of invitations to quote where there has not been a formal invitation to tender. The details that should be published are the same as those set out in paragraph 31

- all contracts in their entirety where the value of the contract exceeds £5,000[footnote 47]

- company registration number at Companies House

- details of invitations to tender or invitations to quote that are likely to be issued in the next 12 months. The details that should be published are the same as those set out in paragraph 31

- details of the geographical (eg. by ward) coverage of contracts entered into by the local authority

- details of performance against contractual key performance indicators, and

- information disaggregated by voluntary and community sector category (eg. whether it is registered with Companies House, Charity or Charitable Incorporated Organisation, Community Interest Company, Industrial and Provident Society, Housing Association, etc)

Local authority land

61. It is recommended that local authorities should go further than the minimum publication requirements set out in Part 2 and publish information on a monthly instead of annual basis, or ideally, as soon as it becomes available and therefore known to the authority (commonly known as ‘real-time’ publication). It is also recommended that local authorities should publish all the information possible on Electronic Property Information Mapping Service.

62. It is further recommended that local authorities also go further than the minimum publication requirements set out in paragraph 37 by publishing, alongside them in one place, the following information:

- size of the asset measured in Gross Internal Area (m2) for buildings or hectares for land, in accordance with the Royal Institute of Chartered Surveyors Code of Measuring Practice. The Gross Internal Area is the area of a building measured to the internal face of the perimeter walls at each floor level. Local authorities using Net Internal Area (m2) should convert measurements to Gross Internal Area using appropriate conversion factors[footnote 48] and state the conversion factor used

- services offered from the asset using the services listed in the Effective Services Delivery government service function list (listing up to 5 main services)

- reason for holding asset such as, it is occupied by the local authority or it is providing a service on the authority’s behalf, it is an investment property, it supports economic development (eg. provision of small businesses or incubator space), it is surplus to the authority’s requirements, it is awaiting development, it is under construction, it provides infrastructure or it is a community asset

- whether or not the asset is either one which is an asset in the authority’s ownership that is listed under Part 5 Chapter 3 of the Localism Act 2011 (assets of community value) and/or an asset which the authority is actively seeking to transfer to the community

- total building operation (revenue) costs as defined in the corporate value for money indicators for public services[footnote 49]

- required maintenance - the cost to bring the property from its present state up to the state reasonably required by the authority to deliver the service and/or to meet statutory or contract obligations and maintain it at that standard. This should exclude improvement projects but include works necessary to comply with new legislation (eg. asbestos and legionella)

- functional suitability rating using the scale:

- good – performing well and operating efficiently (supports the needs of staff and the delivery of services)

- satisfactory – performing well but with minor problems (generally supports the needs of staff and the delivery of services)

- poor – showing major problems and/or not operating optimally (impedes the performance off staff and/or the delivery of services)

- unsuitable – does not support or actually impedes the delivery of services

- energy performance rating as stated on the Display Energy Certificate under the Energy Performance of Buildings (England and Wales) Regulations 2012 (as amended)

Parking spaces

63. It is recommended that local authorities should publish the number of:

- free parking spaces available in the local authority’s area and which are provided directly by the local authority, and

- parking spaces where charges apply that are available in the local authority’s area and which are provided directly by the local authority

64. Where parking space is not marked out in individual parking bays or spaces, local authorities should estimate the number of spaces available for the 2 categories in paragraph 63.

Organisation chart

65. It is recommended that local authorities should go further than the minimum publication requirements set out in Part 2 and publish:

- charts including all employees of the local authority whose salary exceeds £50,000

- the salary band for each employee included in the chart(s), and

- information about current vacant posts, or signpost vacancies that are going to be advertised in the future

Grants to voluntary, community and social enterprise organisations

66. It is recommended that local authorities should go further than the minimum publication requirements set out in Part 2 and publish information on a monthly instead of annual basis where payments are made more frequently than a single annual payment, or ideally, as soon as the data becomes available and therefore known to the authority (commonly known as ‘real-time’ publication).

67. It is further recommended that local authorities publish information disaggregated by voluntary and community sector category (eg. whether it is registered with Companies House, charity or charitable incorporated organisation, community interest company, industrial and provident society, housing association, etc).

Fraud

68. It is recommended that local authorities should go further than the minimum publication requirements set out in Part 2 and publish:

- total number of cases of irregularity investigated

- total number of occasions on which a) fraud and b) irregularity was identified

- total monetary value of a) the fraud and b) the irregularity that was detected, and

- total monetary value of a) the fraud and b) the irregularity that was recovered

3.2: Method of publication

69. The government endorses the 5 step journey to a fully open format:

- One star – Available on the web (whatever format) but with an open license

- Two star – As for one star plus available as machine-readable structured data (eg. Excel instead of an image scan of a table)

- Three star – As for two star plus use a non-proprietary format (eg. CSV and XML)

- Four star – All of the above plus use open standards from the World Wide Web Consortium (such as RDF and SPARLQL21)

- Five star – All the above plus links an organisation’s data to others’ data to provide context

70. The government recommends that local authorities publish data in three star formats where this is suitable and appropriate[footnote 50], alongside open and machine-readable format, within 6 months of this Code being issued.

Annex A: Summary of all information to be published

Expenditure exceeding £500

Information which must be published

Quarterly publication - Publish details of each individual item of expenditure that exceeds £500, including items of expenditure, consistent with Local Government Association guidance, such as:

- individual invoices

- grant payments

- expense payments

- payments for goods and services

- grants

- grant in aid

- rent

- credit notes over £500

- transactions with other public bodies

For each individual item of expenditure the following information must be published:

- date the expenditure was incurred

- local authority department which incurred the expenditure

- beneficiary

- summary of the purpose of the expenditure

- amount

- Value Added Tax that cannot be recovered

- merchant category (eg. computers, software etc)

Information recommended for publication

- Publish information on a monthly instead of quarterly basis, or ideally, as soon as it becomes available and therefore known to the authority (commonly known as ‘real time’ publication).

- Publish details of all transactions that exceed £250 instead of £500. For each transaction the details that should be published remain as set out in paragraph 29.

- Publish the total amount spent on remuneration over the period being reported on.

- Classify purpose of expenditure using the Chartered Institute of Public Finance and Accountancy Service Reporting Code of Practice to enable comparability between local authorities.

Government Procurement Card transactions

Information which must be published

Quarterly publication - Publish details of every transaction on a Government Procurement Card. For each transaction, the following details must be published:

- date of the transaction

- local authority department which incurred the expenditure

- beneficiary

- amount

- Value Added Tax that cannot be recovered

- summary of the purpose of the expenditure

- merchant category (eg. computers, software etc)

Information recommended for publication

Publish all transactions on all corporate credit cards, charge cards and procurements, including those that are not a Government Procurement Card. For each transaction the details that should be published remain as set out in paragraph 30.

Procurement information

Information which must be published

Quarterly publication - Publish details of every invitation to tender for contracts to provide goods and/or services with a value that exceeds £5,000. For each invitation, the following details must be published:

- reference number

- title

- description of the goods and/or services sought

- start, end and review dates

- local authority department responsible

Quarterly publication - Publish details of any contract, commissioned activity, purchase order, framework agreement and any other legally enforceable agreement with a value that exceeds £5,000. For each contract, the following details must be published:

- reference number

- title of agreement

- local authority department responsible

- description of the goods and/or services being provided

- supplier name and details

- sum to be paid over the length of the contract or the estimated annual spending or budget for the contract

- Value Added Tax that cannot be recovered

- start, end and review dates

- whether or not the contract was the result of an invitation to quote or a published invitation to tender

- whether or not the supplier is a small or medium sized enterprise and/or a voluntary or community sector organisation and where it is, provide the relevant registration number

Information recommended for publication

Place on Contracts Finder, as well as any other local portal, every invitation to tender or invitation to quote for contracts to provide goods and/or services with a value that exceeds £10,000. Publish:

- information on a monthly instead of quarterly basis, or ideally, as soon as it is generated and therefore becomes available (commonly known as ‘real-time’ publication)

- every invitation to tender for contracts to provide goods and/or services with a value that exceeds £500 instead of £5,000

- details of invitations to quote where there has not been a formal invitation to tender

- all contracts in their entirety where the value of the contract exceeds £5,000

- company registration number at Companies House

- details of invitations to tender or invitations to quote that are likely to be issued in the next 12 months

- details of the geographical (eg. by ward) coverage of contracts entered into by the local authority

- details of performance against contractual key performance indicators

- information disaggregated by voluntary and community sector category (eg. whether it is registered with Companies House, charity or charitable incorporated organisation, community interest company, industrial and provident society, housing association, etc)

Local authority land

Information which must be published

Annual publication - Publish details of all land and building assets including:

- all service and office properties occupied or controlled by user bodies, both freehold and leasehold

- any properties occupied or run under Private Finance Initiative contracts

- all other properties they own or use, for example, hostels, laboratories, investment properties and depots

- garages unless rented as part of a housing tenancy agreement

- surplus, sublet or vacant properties

- undeveloped land

- serviced or temporary offices where contractual or actual occupation exceeds 3 months

- all future commitments, for example under an agreement for lease, from when the contractual commitment is made

However, information about the following land and building assets are to be excluded from publication:

- rent free properties provided by traders (such as information booths in public places or ports)

- operational railways and canals

- operational public highways (but any adjoining land not subject to public rights should be included)

- assets of national security

- information deemed inappropriate for public access as a result of data protection and/or disclosure controls (eg. such as refuge houses)

Information on social housing is also excluded from this specific dataset.

For each land or building asset, the following information must be published together in one place:

- Unique Property Reference Number

- Unique asset identity – the local reference identifier used by the local body, sometimes known as local name or building block. There should be one entry per asset or user/owner (eg. on one site there could be several buildings or in one building there could be several users, floors/rooms etc – where this is the case, each of these will have a separate asset identity). This must include the original reference number from the data source plus authority code

- name of the building/land or both

- street number or numbers – any sets of 2 or more numbers should be separated with the ‘-‘ symbol (eg. 10-15 London Road)

- street name – this is the postal road address

- post town

- United Kingdom postcode

- map reference – local authorities may use either Ordnance Survey or ISO6709 systems to identify the location of an asset, but must make clear which is being used. Where an Ordnance Survey mapping system is used (the grid system) then assets will be identified using Eastings before Northings. Where geocoding in accordance with ISO 6709 is being used to identify the centre point of the asset location then that reference must indicate its ISO coordinates

- whether the local authority owns the freehold or a lease for the asset and for whichever category applies, the local authority must list all the characteristics that apply from the options given below:

for freehold assets:

- occupied by the local authority

- ground leasehold

- leasehold

- licence

- vacant (for vacant properties, local authorities should not publish the full address details and should only publish the first part of the postcode)

for leasehold assets:

- occupied by the local authority

- ground leasehold

- sub leasehold

- licence

for other assets:

-

free text description eg. rights of way, access etc

-

whether or not the asset is land only (without permanent buildings) or it is land with a permanent building

Information recommended for publication

Publish information on a monthly instead of annual basis, or ideally, as soon as it becomes available and therefore known to the authority (commonly known as ‘real-time’ publication). It is also recommended that local authorities should publish all the information possible on Electronic Property Information Mapping Service. Publish the following additional information:

- the size of the asset measured in Gross Internal Area (m2) for buildings or hectares for land, in accordance with the Royal Institute of Chartered Surveyors Code of Measuring Practice. The Gross Internal Area is the area of a building measured to the internal face of the perimeter walls at each floor level. Local authorities using Net Internal Area (m2) should convert measurements to Gross Internal Area using appropriate conversion factors and state the conversion factor used

- the services offered from the asset, using the services listed in the Effective Services Delivery government service function list (listing up to 5 main services)

- the reason for holding asset such as, it is occupied by the local authority or it is providing a service in its behalf, it is an investment property, it supports economic development (eg. provision of small businesses or incubator space), it is surplus to the authority’s requirements, it is awaiting development, it is under construction, it provides infrastructure or it is a community asset

- whether or not the asset is either one which is an asset in the authority’s ownership that is listed under Part 5 Chapter 3 of the Localism Act 2011 (assets of community value) and/or an asset where the authority is actively seeking transfer to the community

- total building operation (revenue) costs as defined in the corporate value for money indicators for public services

- required maintenance – the cost to bring the property from its present state up to the state reasonably required by the authority to deliver the service and/or to meet statutory or contract obligations and maintain it at that standard. This should exclude improvement projects but include works necessary to comply with new legislation (eg. asbestos and legionella)

- functional suitability rating using the scale:

- good – performing well and operating efficiently (supports the needs of staff and the delivery of services)

- satisfactory – performing well but with minor problems (generally supports the needs of staff and the delivery of services)

- poor – showing major problems and/or not operating optimally (impedes the performance off staff and/or the delivery of services)

- unsuitable – does not support or actually impedes the delivery of services

- energy performance rating as stated on the Display Energy Certificate under the Energy Performance of Buildings (England and Wales) Regulations 2012 (as amended)

Social housing asset value

Information which must be published

Annual publication - Publish details on the value of social housing assets within local authorities’ Housing Revenue Account. Information to be published using the specified value bands and postal sector:

- total number of homes

- the aggregate value and mean value of the dwellings for both existing use value (social housing) and market value, and

- percentage of homes that are vacant and that are tenanted

Information to be published at a general level:

- an explanation of the difference between the tenanted sale value of homes within the Housing Revenue Account and their market sale value, and

- an assurance that the publication of this information is not intended to suggest that tenancies should end to realise the market value of properties.

Other residential tenanted properties that the authority may hold within their General Fund are excluded from this specific dataset, as is information on other building assets or land that local authorities hold within their Housing Revenue Account.

Grants to voluntary, community and social enterprise organisations

Information which must be published

Annual publication - Publish details of all grants to voluntary, community and social enterprise organisations. This can be achieved by either:

- tagging and hence specifically identifying transactions which relate to voluntary, community and social enterprise organisations within published data on expenditure over £500 or published procurement information, or

- by publishing a separate list or register

For each identified grant, the following information must be published as a minimum:

- date the grant was awarded

- time period for which the grant has been given

- local authority department which awarded the grant

- beneficiary

- beneficiary’s registration number

- summary of the purpose of the grant

- amount

Information recommended for publication

Information disaggregated by voluntary and community sector category (eg. whether it is registered with Companies House, charity or charitable incorporated organisation, community interest company, industrial and provident society, housing association etc).

Organisation chart

Information which must be published

Annual publication - Publish an organisation chart covering staff in the top three levels of the organisation. The following information must be included for each member of staff included in the chart:

- grade

- job title

- local authority department and team

- whether permanent or temporary staff

- contact details

- salary in £5,000 brackets, consistent with the details published for Senior Salaries

- salary ceiling (the maximum salary for the grade)

Information recommended for publication

Local authorities should publish:

- charts including all employees in the local authority whose salary exceeds £50,000

- the salary band for each employee included in the chart(s)

- information about current vacant posts, or signpost vacancies that are going to be advertised in the future

Trade union facility time

Information which must be published

Annual publication - Publish the following information:

- total number (absolute number and full time equivalent) of staff who are union representatives (including general, learning and health and safety representatives)

- total number (absolute number and full time equivalent) of union representatives who devote at least 50% of their time to union duties

- names of all trade unions represented in the local authority

- a basic estimate of spending on unions (calculated as the number of full time equivalent days spent on union duties multiplied by the average salary), and

- a basic estimate of spending on unions as a percentage of the total pay bill (calculated as the number of full time equivalent days spent on union duties multiplied by the average salary divided by the total pay bill)

Parking account

Information which must be published

Annual publication - Publish on their website, or place a link on their website to this data published elsewhere:

- a breakdown of income and expenditure on the authority’s parking account. The breakdown of income must include details of revenue collected from on-street parking, off-street parking and Penalty Charge Notices

- a breakdown of how the authority has spent a surplus on its parking account

Parking spaces

Information which must be published

Annual publication - Publish the number of marked out controlled on and off-street parking spaces within their area, or an estimate of the number of spaces where controlled parking space is not marked out in individual parking bays or spaces.

Information recommended for publication

Local authorities should publish the number of:

- free parking spaces available in the local authority’s area and which are provided directly by the local authority, and

- parking spaces where charges apply that are available in the local authority’s area and which are provided directly by the local authority

Where parking space is not marked out in individual parking bays or spaces, local authorities should estimate the number of spaces available for the two categories.

Senior salaries

Information which must be published

Annual publication - Local authorities must place a link on their website to the following data or must place the data itself on their website:

- the number of employees whose remuneration in that year was at least £50,000 in brackets of £5,000

- details of remuneration and job title of certain senior employees whose salary is at least £50,000

- employees whose salaries are £150,000 or more must also be identified by name

- a list of responsibilities (for example, the services and functions they are responsible for, budget held and number of staff) and details of bonuses and ‘benefits in kind’, for all employees whose salary exceeds £50,000

Constitution

Information which must be published

Annual publication - Local authorities must publish their Constitution on their website.

Pay multiple

Information which must be published

Annual publication - Publish the pay multiple on their website defined as the ratio between the highest taxable earnings for the given year (including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind) and the median earnings figure of the whole of the authority’s workforce. The measure must:

- cover all elements of remuneration that can be valued (eg. all taxable earnings for the given year, including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind)

- use the median earnings figure as the denominator, which should be that of all employees of the local authority on a fixed date each year, coinciding with reporting at the end of the financial year

- exclude changes in pension benefits, which due to their variety and complexity cannot be accurately included in a pay multiple disclosure

Fraud

Information which must be published

Annual publication - Publish the following information:

- number of occasions they use powers under the Prevention of Social Housing Fraud (Power to Require Information) (England) Regulations 2014, or similar powers

- total number (absolute and full time equivalent) of employees undertaking investigations and prosecutions of fraud

- total number (absolute and full time equivalent) of professionally accredited counter fraud specialists

- total amount spent by the authority on the investigation and prosecution of fraud

- total number of fraud cases investigated

Information recommended for publication

Local authorities should publish:

- total number of cases of irregularity investigated

- total number of occasions on which a) fraud and b) irregularity was identified

- total monetary value of a) the fraud and b) the irregularity that was detected, and

- total monetary value of a) the fraud and b) the irregularity that was recovered

Waste contracts

Information which must be published

One-off publication - Local authorities must publish details of their existing waste collection contracts, in line with the details contained in paragraph 32 of the Code, at the point they first publish quarterly contract information under Part 2 of this Code.

Annex B: Detecting and preventing fraud

Tackling fraud is an integral part of ensuring that tax-payers money is used to protect resources for frontline services. The cost of fraud to local government is estimated at £2.1 billion a year. This is money that can be better used to support the delivery of front line services and make savings for local tax payers.

A culture of transparency should strengthen counter-fraud controls. The Code makes it clear that fraud can thrive where decisions are not open to scrutiny and details of spending, contracts and service provision are hidden from view. Greater transparency, and the provisions in this Code, can help combat fraud.

Sources of support to tackle fraud include:

Fighting Fraud Locally, The Local Government Fraud Strategy, was drafted by the National Fraud Authority and CIPFA (the Chartered Institute of Public Finance and Accountancy). The document calls for the adoption of a tougher approach to tackle fraud against local authorities. The strategy is part of a wider collaboration on counter fraud and is the local authority contribution to the national fraud strategy – Fighting Fraud Together – which encompasses both the public and private sectors response to fraud in the UK.

Local authorities should use a risk management approach with strong internal control arrangements to reduce the risk of any payment fraud as a result of publishing public data. Local authorities should refer to the Chartered Institute of Public Finance and Accountancy Code of Practice on Managing the Risk of Fraud and Corruption.

The document sets out a step by step toolkit to tackling fraud: identifying and understanding your fraud risks and potential exposure to fraud loss; assessing current resilience to fraud; evaluating the organisation’s ability to respond to potential or identified fraud; and developing a strategy. Developing an anti-fraud culture is an important part of improving resilience; the benefits of improving resilience to fraud include reduced exposure to fraud and an organisation that is better able to identify attempted frauds or vulnerabilities.

The National Fraud Authority have produced a guide on procurement fraud – Procurement Fraud in the Public Sector – which deals with the whole process, from bidding during the pre-contract award phase through to false invoicing in the post-contract award phase.

There are some specific steps local authorities can take to prevent procurement fraud. These might include:

- only accepting requests for changes to supplier standing data in writing

- seeking confirmation from the supplier that the requested changes are genuine, using contact details held on the vendor data file or from previous and legitimate correspondence; and not contacting the supplier via contact details provided on the letter requesting the changes

- ensuring that there is segregation of duties between those who authorise changes and those who make them

- only authorising changes when all appropriate checks have been carried out with legitimate suppliers and only making the changes when the proper authorisations to do so have been given

- maintaining a suitable audit trail to ensure that a history of all transactions and changes is kept

- producing reports of all changes made to supplier standing data and checking that the changes were valid and properly authorised before any payments are made

- carrying out standard checks on invoices before making any payments, and

- regularly verifying the correctness of standing data with suppliers

Annex C: Social housing asset data to be published

-

Market Assessment of Public Sector Information, Deloitte, May 2013. ↩

-

‘Local Government Transparency Survey 2012’, LGA, December 2012. ↩

-

‘Citizens Panel Summer 2011 Survey Results Data Transparency’, Bedford Borough Council, August 2011 (unpublished). ↩

-

What do people want, need and expect from public services?, Ipsos MORI, 2010. ↩

-

Nationally, local authorities’ estate (all forms of land and buildings) is estimated to be worth about £220 billion. ↩

-

The Housing Revenue Account (Accounting Practices) Directions 2011 require that local authorities’ annual statement of accounts include disclosure of the total balance sheet value of the land, houses and other property and the vacant possession value of dwellings within the authority’s Housing Revenue Account. ↩

-

See paragraph 37 of the Code of recommended practice for local authorities on data transparency: government response to consultation. ↩

-

Code of Practice on Managing the Risk of Fraud and Corruption. ↩

-

See the Accounts and Audit Regulations 2015 for details of when and how those rights may be exercised. ↩

-

Anonymisation: Managing data protection code of practice (PDF, 1.84MB). ↩

-

Under the Local Government Transparency Code 2014, local authorities were required to publish this data on the first occasion, not later than 31 December 2014 and quarterly thereafter. ↩

-

The threshold should be, where possible, the net amount excluding recoverable Value Added Tax. ↩

-

Salary payments to staff normally employed by the local authority should not be included. However, local authorities should publish details of payments to individual contractors (e.g. individuals from consultancy firms, employment agencies, direct personal contracts, personal service companies etc) either here or under contract information. ↩

-

This could be the descriptor that local authorities use in their accounting system providing it gives a clear sense of why the expenditure was incurred or what it purchased or secured for the local authority. ↩

-

Where possible, this should be the net amount excluding recoverable Value Added Tax. Where Value Added Tax cannot be recovered – or the source of the data being used cannot separate out recoverable Value Added Tax – then the gross amount should be used instead with a note stating that the gross amount has been used. ↩

-

Where possible, this should be the net amount excluding recoverable Value Added Tax. Where Value Added Tax cannot be recovered – or the source of the data being used cannot separate out recoverable Value Added Tax – then the gross amount should be used instead with a note stating that the gross amount has been used. ↩

-

This includes contracts for staff who are employed via consultancy firms or similar agencies. ↩

-

The threshold should be, where possible, the net amount excluding recoverable Value Added Tax. ↩

-

Tenders for framework agreements should be included, even though there may be no initial value. ↩

-

This includes contracts for staff who are employed via consultancy firms or similar agencies. ↩

-

The threshold should be, where possible, the net amount excluding recoverable Value Added Tax. ↩

-

Where possible, this should be the net amount excluding recoverable Value Added Tax. Where Value Added Tax cannot be recovered – or the source of the data being used cannot separate out recoverable Value Added Tax – then the gross amount should be used instead with a note stating that the gross amount has been used. ↩

-

For example, this might be the company or charity registration number. ↩

-

Under the Local Government Transparency Code 2014, local authorities were required to publish this data on the first occasion, not later than 2 February 2015 and annual thereafter. ↩

-

In relation to parking account data, where the local authority’s annual accounts have not been finalised, the authority should publish estimates within 1 month after the year to which the data is applicable and subsequently publish final figures as soon as the authority’s accounts are finalised. ↩

-

The Unique Property Reference Number (UPRN) is a unique 12 digit number assigned to every unit of land and property recorded by local government, this is a statutory obligation. The UPRN uniquely and definitively identifies every addressable location in the country. The numbers originate from Geo-Place (an OS and LGA joint venture). ↩

-

Local authorities should use the official postal address. Exceptionally, where this is not available, local authorities should use the address they hold for the asset. ↩

-

The first part of the postcode, or Outward Code, refers to the area and the district only. See UK Postcodes explained. ↩

-

Where a local authority feels unable to verify rights of way information, for example, it should add a short narrative explaining why it is unable to identify and verify the information. ↩

-

All local housing authorities who hold housing stock are required to account for all income and expenditure in relation to that stock in a separate account which is called the Housing Revenue Account. ↩

-

The first part of the postcode, or Outward Code (which refers only to the area and the district only), and first digit of the second part of the postcode, or Inward Code (the number identifies the sector in the postal district). See UK Postcodes explained. ↩

-

Stock valuation for resource accounting 2010: guidance for valuers published by the Secretary of State for Communities and Local Government in January 2011. ↩

-

For example, this might be the company or charity registration number ↩

-

This should exclude staff whose salary does not exceed £50,000. ↩

-

A parking account kept under section 55 of the Road Traffic Regulation Act 1984 as modified by Regulation 25 of the Civil Enforcement of Parking Contraventions (England) General Regulations 2007. ↩ ↩2

-

Local authorities should also have regard to both statutory guidance, Statutory Guidance to Local Authorities on the Civil Enforcement of Parking Contraventions and non-statutory operational guidance, Operational Guidance to Local Authorities: Parking Policy and Enforcement. ↩

-

Section 55 (as amended) of the Road Traffic Regulation Act 1984 sets out how local authorities should use a surplus on their parking account. Local authorities should breakdown how they have spent a surplus on their parking account within the categories set out in section 55. ↩

-

For the accounting year 2014-15, the Accounts and Audit (England) Regulations 2011 remain applicable. ↩

-

Openness and accountability in local pay: Guidance under Section 40 of the Localism Act. ↩

-

The definition of fraud is as set out by the Audit Commission in Protecting the Public Purse. ↩

-

The Prevention of Social Housing Fraud (Power to Require Information) (England) Regulations 2014. ↩

-

For example, the Council Tax Reduction Schemes (Detection of Fraud and Enforcement) (England) Regulations 2013 gives local authorities the power to require information from listed bodies, during the investigation of fraud connected with an application for or award of a reduction under a council tax reduction scheme. ↩

-

Documentation for all procurements valued at over £10,000 is stored on Contracts Finder for public viewing as part of government’s transparency commitment. ↩

-

Where a contract runs into several hundreds of pages or more, a local authority should publish a summary of the contract or sections of the contract, if this would be more helpful to local people and businesses. ↩

-

Local authorities are not expected to re-measure buildings. Research undertaken for the Scottish Government offers one method of converting Net Internal Area to Gross Internal Area. ↩

-

Estates Management Indicators - page 17. ↩

-

Statistical data, lists etc should be capable of being published in this format but others (eg. organisation charts) may be more difficult. ↩