JETS (Job Entry Targeted Support) Impact Evaluation

Updated 8 September 2025

Applies to England and Wales

Executive summary

This report estimates the impact and cost-effectiveness of the Job Entry Targeted Support scheme (JETS).

JETS was part of a larger set of employment support measures aimed at mitigating the disruptive effect on the labour market brought about by the Covid-19 pandemic. The scheme offered 6 months of employment support services to help individuals early on their benefit claim return to work and prevent short spells of unemployment leading into increased risk of labour market detachment.

This report provides a quantitative impact assessment of JETS in England and Wales, where the programme ran between October 2020 and September 2022. The scheme was delivered through contracted providers operating under a Cost-plus model – paying 5% on top of the average cost of administering the programme per participant. A total of 460K individuals were referrals to the scheme in England and Wales, resulting in 320K programme starts.

This report provides programme effects in the form of Propensity Score Matching (PSM) estimates – where the labour market outcomes of circa 203K JETS participants who went on the programme before December 2021 are compared against a carefully constructed comparison group of non-participants. The results presented might be subject to some degree of over or underestimation of the programme’s impact, which depends on the extent to which the analysis is able to capture selection into programme effects.

Over the two years following referral to JETS, individuals that received support from the scheme spent on average 53 more days in payrolled employment (7.2 pp) and 11 fewer days on an out-of-work or low-income benefits (1.6 pp) than the comparison group. The reason additional payrolled employment does not automatically result in an equal benefit reduction is due to the design of the benefit system, as lower income levels from employment are compatible with the receipt of Universal Credit. In addition, JETS participation reduced the time spent on other out-of-work/low-income benefits (with no searching for work requirements) and leaving the labour market (not in employment nor on benefits) by 2.9 pp. By the end of the observation period JETS participants had accumulated, on average, £2,549 in additional earnings and were 10.2 pp less likely to remain jobless (unable to find a job for two years).

Assessing the employment outcomes of an early group of participants (referred to the programme between October and November 2020), estimates show, on average, 95 additional days spent in payrolled employment (8.7 pp), 26 fewer days spent on out-of-work or low-income benefits (2.4 pp), and £5,335 additional earnings over a period of 3 years.

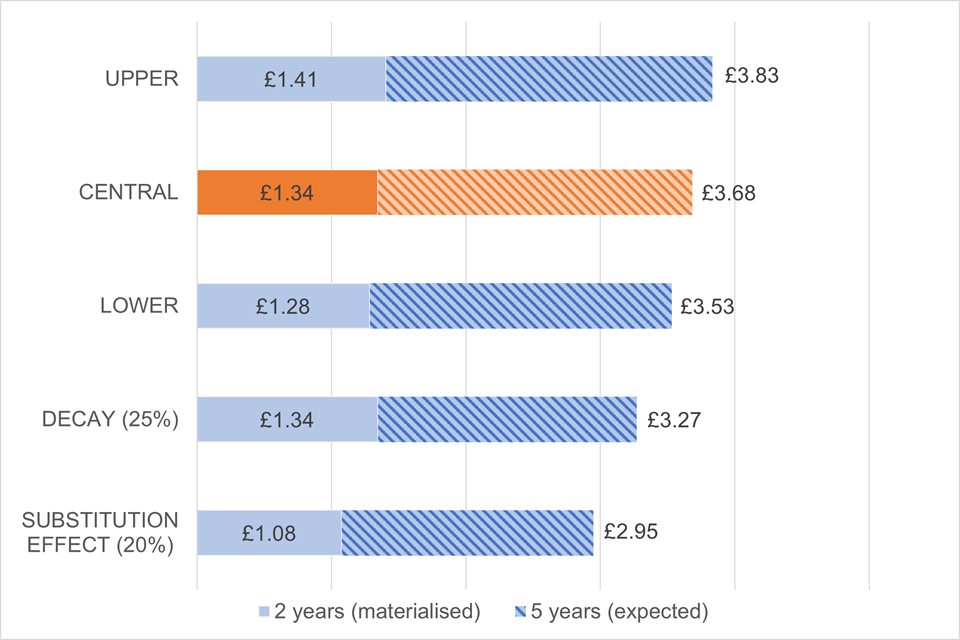

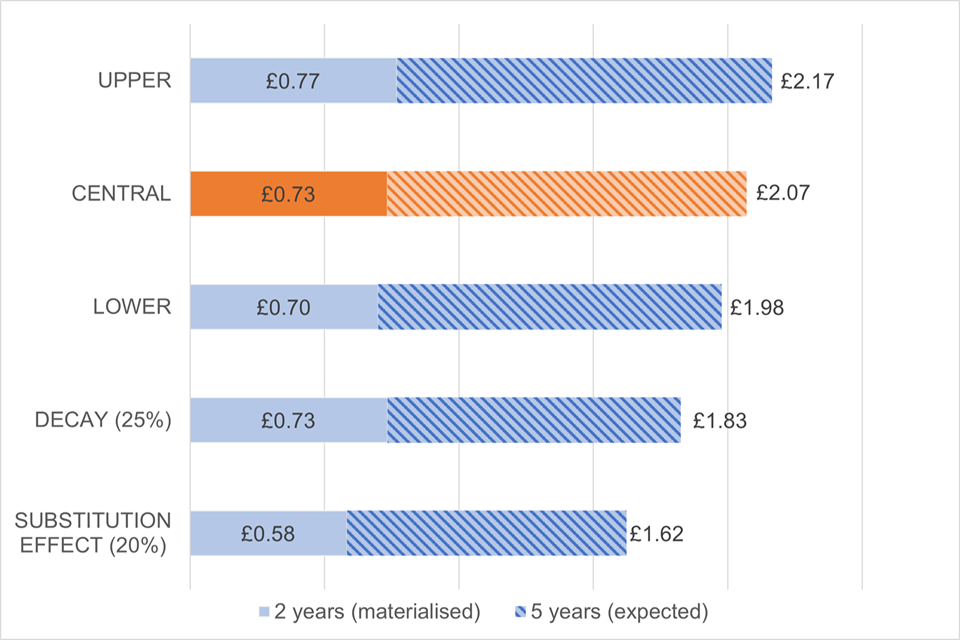

At an estimated cost of £823 per participant, the Cost Benefit Analysis (CBA) assessing the value for money of the scheme shows that JETS generated a fiscal benefit of £1.28 – £1.41 after two years for each £1 spent on the scheme (mainly through benefit-related savings and taxes returned to the Exchequer). Extrapolating the impact estimates an additional three years we expect JETS to generate a fiscal benefit of £3.53 – £3.83. Overall and considering the wider effects to society, we estimate a return on investment of £5.93 – £6.35 over 5 years for each £1 spent on the programme.

Acknowledgements

We would like to thank Professor Richard Dorsett of the University of Westminster for his considered and thoughtful advice on the analysis. We also thank Abeer Shafqat for her analytical support and Simon Marlow and Diane Hume for their insight and guidance.

Author details

Paulino Font-Gilabert, Economist at the Department for Work and Pensions

Connor Lowe, Economist at the Department for Work and Pensions

Laura Durant, Statistician at the Department for Work and Pensions

Oluwakemi Adewumi, Statistician at the Department for Work and Pensions

Glossary

| Term | Definition |

|---|---|

| BCR | Benefit cost ratio |

| Caliper | The maximum distance between propensity scores acceptable for a match |

| CBA | Cost benefit analysis |

| CIA | Conditional Independence Assumption |

| CJRS | Coronavirus Job Retention Scheme |

| Common support | The overlap in matched treatment and comparison group observations based on their propensity scores. |

| Comparison Group | Carefully selected subset of the comparison pool, selected to have characteristics as similar as possible, to act as a counterfactual |

| Confidence interval | A 95% confidence interval is a range within which the true population would fall for 95% of the times the sample was repeated. For example, for a 95% confidence interval, the true (unknown) value of the estimate would be expected to lie within it 19 times out of 20 |

| CPA | Contract Package Area |

| CPI | Consumer Prices Index |

| DLA | Disability Living Allowance |

| DWP | Department for Work and Pensions |

| ESA | Employment and Support Allowance |

| HMRC | HM Revenue and Customs |

| IB | Incapacity Benefit |

| IHS | The inverse hyperbolic sine (IHS) transformation is frequently applied to transform right-skewed variables that include zero or negative values |

| IS | Income Support |

| JCP | Jobcentre Plus |

| JSA | Jobseeker’s Allowance |

| LGP | Local Government Partnership |

| LMS | Labour Market System |

| NBD | National Benefits Database |

| OBR | Office for Budget Responsibility |

| OLS | Ordinary Least Squares |

| ONS | Office for National Statistics |

| Payrolled employment | Employment paid via the HM Revenue and Customs (HMRC) Pay As You Earn (PAYE) system. This excludes self-employment and a small number of employees. |

| Participant Group | The group of individuals who participated in the programme being evaluated |

| PIP | Personal Independence Payment |

| PAYE | Pay As You Earn |

| PRaP | Provider Referrals and Payments system |

| Propensity Score | The probability that an individual with a given set of characteristics has some chosen attribute, for example, participates in an intervention |

| PSM | Propensity Score Matching. A statistical technique in which individuals are identified as statistically similar to each other based on a set of characteristics |

| QALY | Quality-adjusted life years |

| RTI | Real Time Information |

| SCBA | The DWP Social Cost Benefit Analysis model |

| SDA | Severe Disablement Allowance |

| SMD | Standardised Mean Difference. A statistic which indicates how different the treatment and comparison groups are across characteristics at various stages of the propensity score matching procedure. |

| TA | Training Allowance |

| UC | Universal Credit |

| UC-IWS | Universal Credit – Intensive Work Search |

1. The JETS scheme

1.1. Policy background

The outbreak of the Covid-19 pandemic and the measures put in place to slow its spread brought about significant disruptions in economies across the globe. The introduction of national and regional lockdowns to safeguard public health during this unprecedented global emergency induced a freeze in many industries and sectors across the UK, triggering a shock wave in the labour market.

Despite the quick announcement and introduction of the Coronavirus Job Retention Scheme (CJRS) in March 2020 to help businesses with the cost of retaining employees (8.9 million jobs on furlough on 8th May 2020), the number of people on unemployment related benefits more than doubled between March and May of that same year (from 1.2 million to 2.6 million) [Powel et al. (2020)].

In April 2020, estimates from the Office for Budget Responsibility (OBR) expected the unemployment rate to go as high as 10% in the second quarter of 2020 (up from the 3.8% forecast in the 2020 budget), and persistently stay above pre-pandemic levels throughout 2021 (OBR, 2020). A response was needed to:

- Help people find jobs and get back to work

- Prevent short spells of unemployment turn into long-term unemployment and increased detachment from the labour market

1.2. Aims and design

The Jobs Entry Targeted Support scheme (JETS) was part of the ‘supporting jobs measures’ included in the Plan for Jobs – a comprehensive set of interventions aimed at supporting Jobcentre Plus capacity to tackle increased unemployment and the record claimant numbers generated in March 2020.[footnote 1]

JETS aimed at helping back to work those individuals who had been unemployed for 3 months or more, and in receipt of Universal Credit and in the Intensive Work‑Search regime (UC-IWS), or New Style Jobseeker’s Allowance (JSA).[footnote 2] The scheme was labelled as “light-touch” and it offered 6 months of employment support services to claimants who were judged to be capable of moving relatively quickly into work.

The programme began in October 2020 in England and Wales and was set to initially run for one year. However, it was later extended until September 2022 in anticipation of a spike in unemployment resulting from the end of the Coronavirus Job Retention Scheme (CJRS) on 30 September 2021. The scheme operated in Scotland from January 2021 to September 2022, where it was devolved under the Scotland Act 2016. JETS was devolved to Local Government Partnerships (LGPs) in London and Greater Manchester.

In England and Wales, JETS was delivered through the Work and Health Programme (WHP) contracted providers under a Cost-Plus payment model – with payments set at 5% above the cost per participant.[footnote 3],[footnote 4] Referrals to the programme were made by Work Coaches (WC) in Jobcentre Plus offices (JCP) based on suitability and interest – participation was entirely voluntary. After the referral, providers set up a first meeting with participants to discuss a tailored support plan to help them move back to employment. Elements included but were not limited to:

- personalised approach - including regular adviser contact to agree a tailored action plan that helps build the relationship and facilitate collaborative approach to getting the participant back into employment

- diagnostic screening - including IT skills and Basic Skills capability assessments

- job search support - including CV writing, application process, interview skills

- transferable skills - support to consider different employment sectors/routes and ways of working

- re-building confidence and self-efficacy in Post Covid-19 environment – including support for anxieties about working in a Post Covid-19 environment with peer support network and potential access to mental health and wellbeing support

- advice and guidance for those wishing to change sector – e.g., building on the sector based “Step Into” guides

- signposting clients and supporting access to reskilling offers – (National Careers Service, Further Education colleges, Sector Based Work Academies and Fair Start Scotland), via their Jobcentre Plus work coach where required

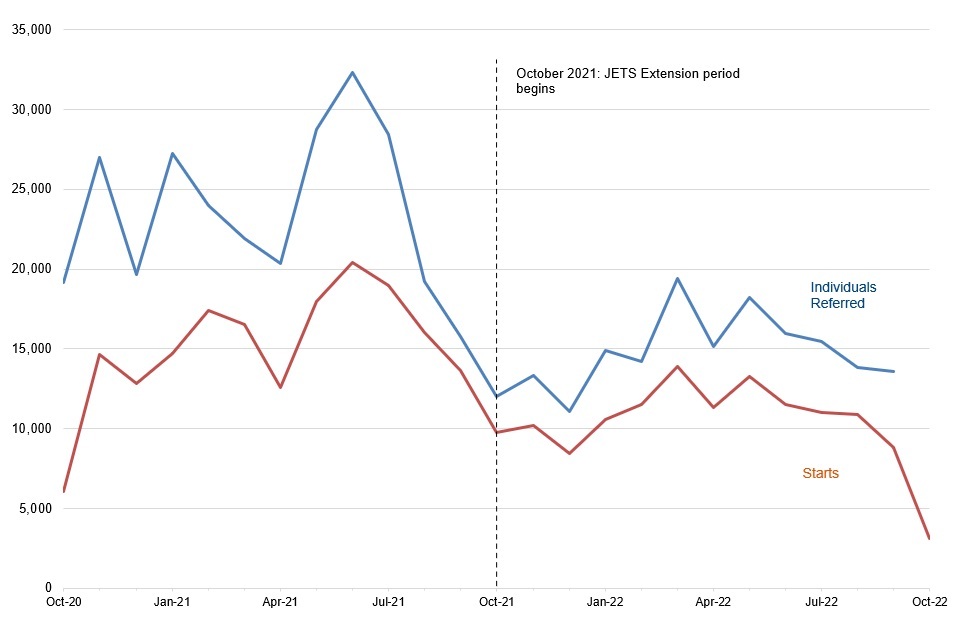

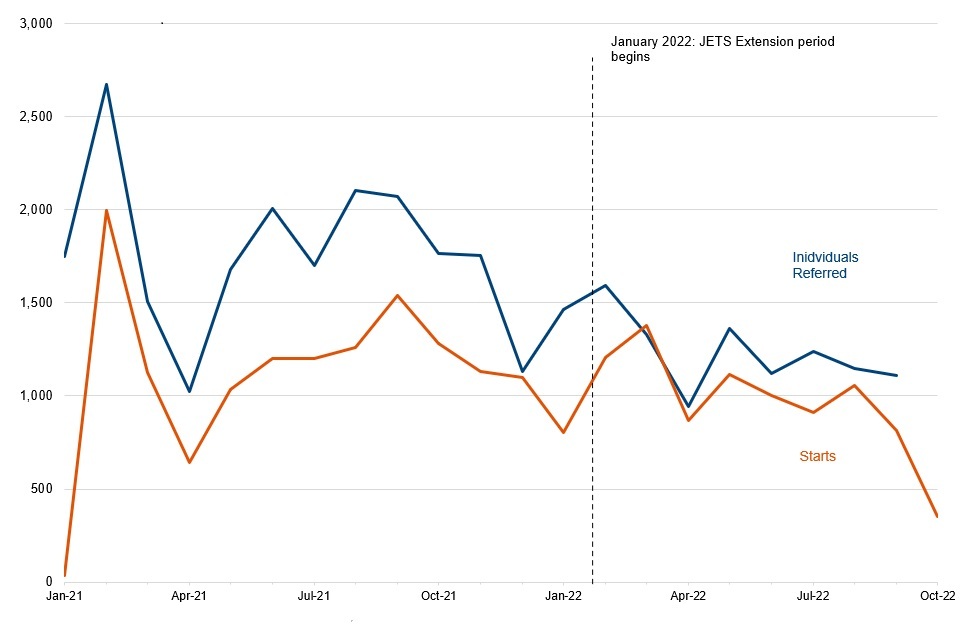

1.3. Programme’s volumes and contractual performance

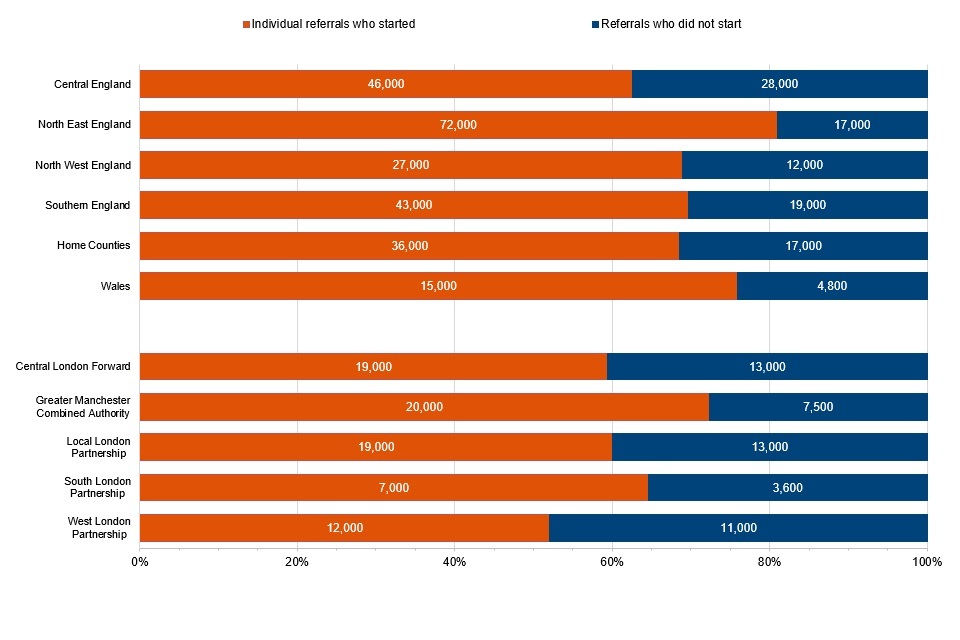

England and Wales saw a total of 460,000 individuals referred to JETS and 320,000 starts on the programme.

In England and Wales, the programme’s contractual performance – the level at which providers are expected to find employment for participants – was set at 22% of those starting JETS achieving a minimum of £1,000 on earnings from employment within 10 months of starting. This expectation was set by observing the employment entry rate of a similar population to the one JETS was targeting. By the end of the programme, a total of 120,000 participants achieved the minimum earnings threshold (38% of those starting). However, it is worth noting that expectations were set during the summer of 2020, when pessimism on the economy and the labour market were widespread and the pace of recovery expected to be slower than what happened in practice. Moreover, many JETS participants would have not been unemployed in normal labour market conditions (with no Covid‑19 related disruption) and therefore might have been easier to help. In retrospect, the performance target was likely to be too low.

More detailed information about the number of referrals to JETS, starts, and job outcomes achieved in the different areas in which the programme operated can be found in Appendix H.

1.4. Purpose of the analysis

This study provides a quantitative assessment of JETS’ effectiveness at helping participants back to work.

We evaluate the scheme by following the labour market experience (employment, earnings, and benefit receipt) of a large group of participants and compare it against a similar group that did not receive support from JETS. The analysis therefore provides insight on the effectiveness of schemes aimed at quickly bringing back to work large numbers of people who lost their jobs unexpectedly. The report further evaluates the value for money of the scheme in a Cost Benefit Analysis (CBA) exercise.

More broadly, this study contributes to better understand the value of additional support and its capacity to increase employment prospects among the unemployed. The caveats in the analysis include those that arise from the use of PSM methods to estimate causal effects (mainly the uncertainty on whether all relevant characteristics that determine success in the labour market and programme participation are controlled for in the analysis), and the extent to which estimates can inform future provisions (external validity) in view of the significant disruption brought about by the Covid-19 pandemic.

For instance, during JETS rollout in Autumn 2020 regular interactions with Work Coaches were very much reduced, and those that did take place were mainly digital. A series of lockdowns and mobility restrictions were introduced and labour market uncertainty was high. As the Covid-19 vaccine rolled out in 2021 the economic uncertainty reduced, vacancies increased and more employment support in Jobcentre Plus was made available. It is likely that the comparison group in our analysis might have experienced lower-than-usual support than in more normal conditions, while the strong economic rebound observed at the end of the Covid-19 related restrictions might have impacted differently those with and without specialised employment support.

It is worth noting that during our period of analysis there were other employment support schemes managed by the Department for Work and Pensions (DWP) in operation. Mainly:

- The Work & Health Programme (WHP), helping those individuals with a disability or health condition and the long term‑unemployed[footnote 5]

- Job Finding Support (JFS), aimed at people who had been unemployed for fewer than 13 weeks; Restart, supporting Universal Credit claimants who had been out-of-work for at least nine months

- Intensive Personalised Employment Support (IPES), helping people with a disability into work

- the European Social Fund (ESF), an economic and social cohesion fund targeting the unemployed and socially excluded people find work or become more employable, and prevent people in work from becoming unemployed[footnote 6]

- NEA Phase 2 (New Enterprise Allowance phase 2), designed to support the move into self-employment for those people who wanted to start their own business.

More information on these schemes and on the period over which they were operational can be found in the Plan for Jobs and employment support (Eighth Report of Session 2022–23).[footnote 7]

The rest of this report is structured as follows: Section 2 offers insight into the findings from qualitative research; Section 3 details the evaluation design and methodology implemented to estimate the programme’s quantitative effect; Section 4 discusses the statistical validity of the estimation approach; Section 5 documents the estimated labour market effects from participating in JETS; and Section 6 carries out the Cost Benefit Analysis (CBA) of the value for money of the scheme.

2. Qualitative evidence from JETS

Qualitative research carried out in Spring 2022 by DWP documented the experiences of those participating in JETS and the views from those responsible for its delivery. The findings were generated from a total of 67 interviews: 40 with JETS participants, 12 with staff at DWP, 13 with JETS programme providers and 2 from staff at LGPs (Local Government Partnerships) across 4 different areas of the country.

2.1. Support offered

The research identified three key areas of support:

- Employability support

- CV writing

- Job search and application support

- Interview preparation

- Careers advice

2. Material support

- Digital devices for work searching

- Transport costs

- Clothing and uniform for job interviews and work

- Training and qualifications

- Vouchers

3. Referral to other support services

- Mental health and wellbeing services

- Confidence building courses

- Money management courses

2.2. Findings

In general, participants had a positive experience from JETS; with provider staff promptly addressing negative feedback. Outcomes for individuals in the scheme included securing employment, improving confidence, and a better understanding of their transferable skills.

Jobcentre Plus staff thought the programme was overall able to bring participants closer to the labour market (even when participation did not always result in a job offer). On the other hand, provider staff thought job seekers should have been given more information about the programme at the point of referral, and considered some individuals would have benefited more from other provisions (especially those with more complex needs).

Personal circumstances – mainly health conditions (mental/physical) – limited some participants’ ability to find work, with local factors influencing the types of work available (i.e., industries hiring or seasonal work). The study also offered some insight relevant to the impact analysis around how people were referred and why people didn’t start after being referred. Among the reasons listed as to why some individuals did not start the provision include the scheme being voluntary, finding a job before the support started, and perceived added pressure to find employment.

In addition, the study found that personal circumstances such as childcare, age, IT literacy, and learning difficulties, combined with local factors such as limited public transport, might have deterred some individuals from participating in JETS.

Our analysis attempts to control for as many of these factors as possible when estimating programme effects.

3. Evaluation design

3.1. Methodology

To estimate the extent to which JETS improved employment prospects among participants we compare the labour market outcomes of participants – those who received support from the scheme – against a carefully constructed comparison group using propensity score matching (PSM).

PSM is a quasi-experimental method which involves creating an artificial control group by matching each participant with one or more non-participants of similar characteristics. If the model is successful at replicating experimental conditions – so that individuals in the treated and comparison group are similar– the difference in outcomes between groups can be attributed to the intervention (programme).

The internal validity of PSM is dependent on the ‘Conditional Independence Assumption’ (CIA). That is the assumption that, after matching, the only difference between the treated and comparison groups is programme participation (i.e., individuals are similar in both observed and unobserved characteristics other than participation status). While it is possible to assess the success of PSM in balancing observed characteristics across groups, it is not possible to test the CIA assumption on unobserved characteristics (e.g. individuals’ motivation to find a job). Nevertheless, in this study we minimise concerns on groups’ dissimilarity in at least two important ways

- Taking advantage of the programme’s referral process

- Exploiting rich administrative data

3.2. The programme’s referral process

To enrol in JETS, jobseekers had to be referred to the programme by Work Coaches (WC) in Jobcentre Plus (JCP) offices. Work coaches screened candidates on their suitability and interest before making the referral. It is worth noting that while JETS was aimed at those who had been recently unemployed (13 weeks or more), we observe substantial variation in the length of the most recent out-of-work or low‑income benefit spell among individuals being referred to the scheme.[footnote 8]

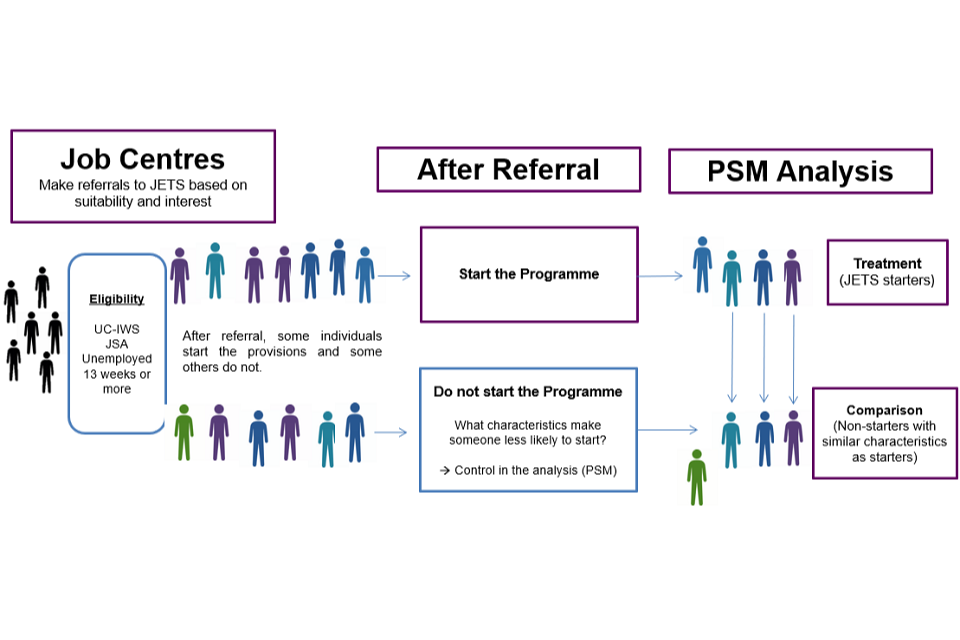

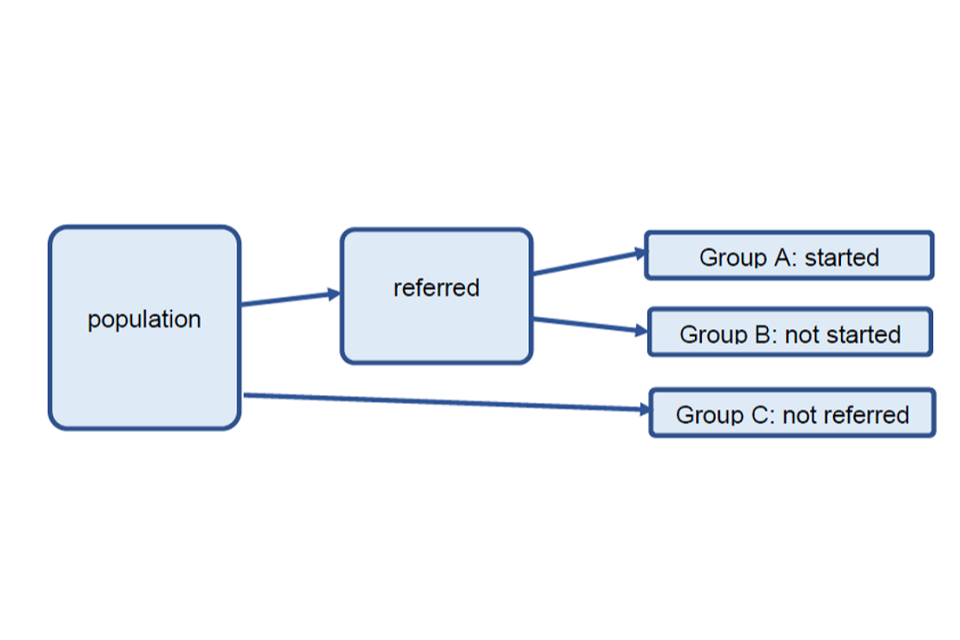

The main analysis compares the outcomes of those who were referred to JETS and started the provision against those who were referred but did not to start (see Figure 3.1). The advantage of this approach is that it ensures every individual in both the treatment and the comparison group was assessed as being suitable for the programme by trained JCP work coaches and had shown interest in participating (irrespective of their later decision as to whether they actually participated).

Nevertheless, some bias might still be present in the impact estimates if, for instance, referred individuals did not start the provision because they found a job, or were no longer interested once they learned more details about the programme, or decided another form of support was more appropriate to them, or simply failed to be contacted by the provider. It is difficult to assess the direction of the potential bias, as different reasons for not starting would impact programme estimates differently.

The qualitative research findings showed that health conditions (mental/physical), and other personal circumstances such as childcare responsibilities, IT literacy, learning difficulties and limited public transport negatively influenced the probability of individuals participating in JETS. Our analysis attempts to control for as many of these factors as possible when estimating programme effects.

Figure 3.1: JETS referral and evaluation flow chart

Figure 3.1 illustrates the process of referring claimants to JETS and the impact evaluation approach we followed in this report. Those individuals assessed as suitable and who started the provision after being referred form the treatment group. A comparison group with similar characteristics to those starting JETS is then created with Propensity Score Matching (PSM) using the sample of individuals assessed suitable, interested in participating, but that decided not to start after being referred to the programme.

3.3. PSM with administrative data

Our PSM analysis benefits from our capacity to construct a suitable comparison group to JETS participants exploiting rich administrative data. That is, we can match participants and non-participants on:

- a large array of relevant individual characteristics and

- repeated measures of key variables

For instance, we can construct a comprehensive historical profile of attachment to the labour market and barriers to employment. Key measures include employment and benefit histories, labour market transitions, occupation, earnings, care responsibilities, and disabilities, among others. More information on the data and the sources can be found in Appendix A. Moreover, to the extent that individuals’ labour market histories correlate well with unobserved factors like motivation to find employment, achieving a successful balance on previous employment and benefit spells will also make the participant and comparison groups more similar on unobserved characteristics. More importantly, it will make the two groups more similar on both observed and unobserved factors linked to both the decision to participate in the programme and subsequent labour market outcomes. For instance, while Caliendo et al. (2014) show that unobserved characteristics like personality traits, attitudes, expectations, and job search behaviour play a significant role for selection into treatment and labour market outcomes, their effect on impact estimates are minimised in specifications that include rich and detailed labour market histories.

As set out above, we restricted the comparison pool to those individuals who had been referred but did not start – based on a belief that this group would be more similar to participants than those who did not get as far as being referred. As a check we also carried out a comparison based on a wider pool of non-referred eligible individuals, which supported our choice – this is set out in Appendix E.

3.4. Sample selection

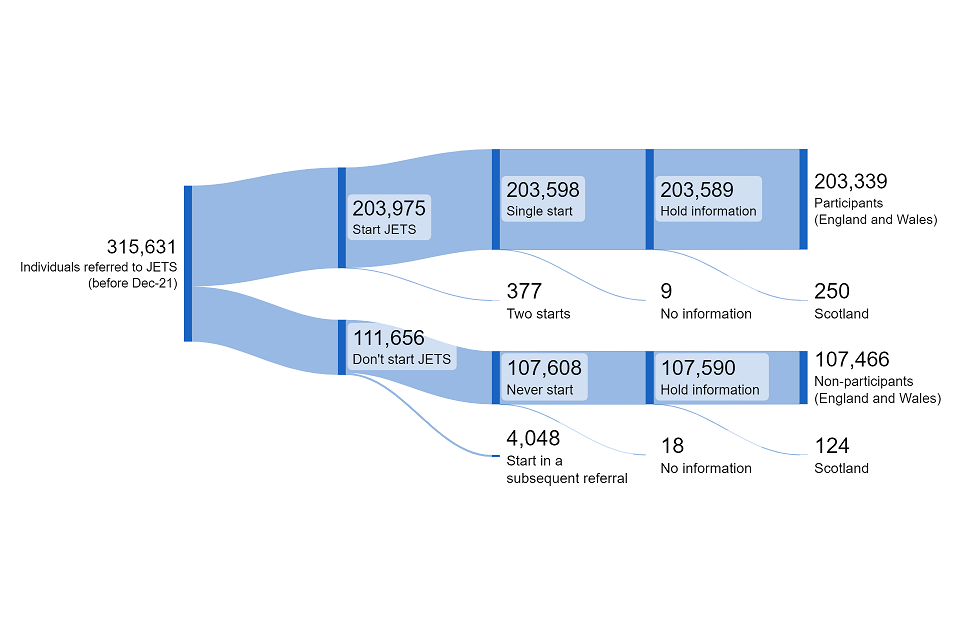

A total of 315,631 unique individuals were referred to JETS between Oct-20 and Nov-21. Our treatment group (n=203,339) is composed of those who were referred to the scheme before Dec-21 and started it. It excludes those who had more than one start (377 individuals removed, 0.2%)[footnote 9], those for whom we hold no information on individual characteristics in our systems (9 individuals) and those that show as registered with a Jobcentre Plus located in Scotland (250 individuals, 0.1%). See Figure 3.2 below.

Figure 3.2: Analysis sample selection

Figure 3.2 illustrates how individuals referred to JETS before December 2021 are defined as participants and non-participants in the analysis sample. Those individuals referred and that start the scheme are defined as participants. Those individuals who are referred but do not start the scheme are defined as non-participants.

Our main comparison pool (n=107,466) is derived from those referred to the scheme between Oct-20 and Nov-21 who did not start it, excluding those who start in a subsequent referral (4,048, 3.6%), those for whom we hold no information on individual characteristics (18 individuals) and that show as registered with a Jobcentre Plus located in Scotland (124 individuals, 0.1%).[footnote 10],[footnote 11]

Our alternative comparison sample (n= 278,978) is randomly selected among those who were claiming UC-IWS at the time JETS was taking referrals and were never referred to the scheme.[footnote 12] More information on the selection of this group can be found in Appendix E.

Sample selection

Treatment group: Referred to JETS and started the provision

Comparison group:

- Referred to JETS and not started the provision

- UC-IWS wider comparison group (not referred to the provision)

3.5 Assessing labour market outcomes

This report inspects the impact JETS had on employment, earnings, and unemployment related benefits (out-of-work or low-income benefits) for up to three years after programme start. We present impact estimates for:

- The All cohort (main sample): Those referred to the programme from October 2020 to November 2021 (allows tracking outcomes for two years after programme start).

- The Early cohort: Referred to the programme in October and November 2020 (allows tracking outcomes for three years).

We perform the main analysis on the larger group of JETS referrals (All cohort) as it provides impact estimates that are more representative of the population that received support from JETS. We estimate programme effects for an early group of referrals (Early Cohort) to infer future impact estimates (three years after starting the provision). The All cohort sample accounts for two thirds (67%) of all programme referrals (9% in the case of the Early Cohort).

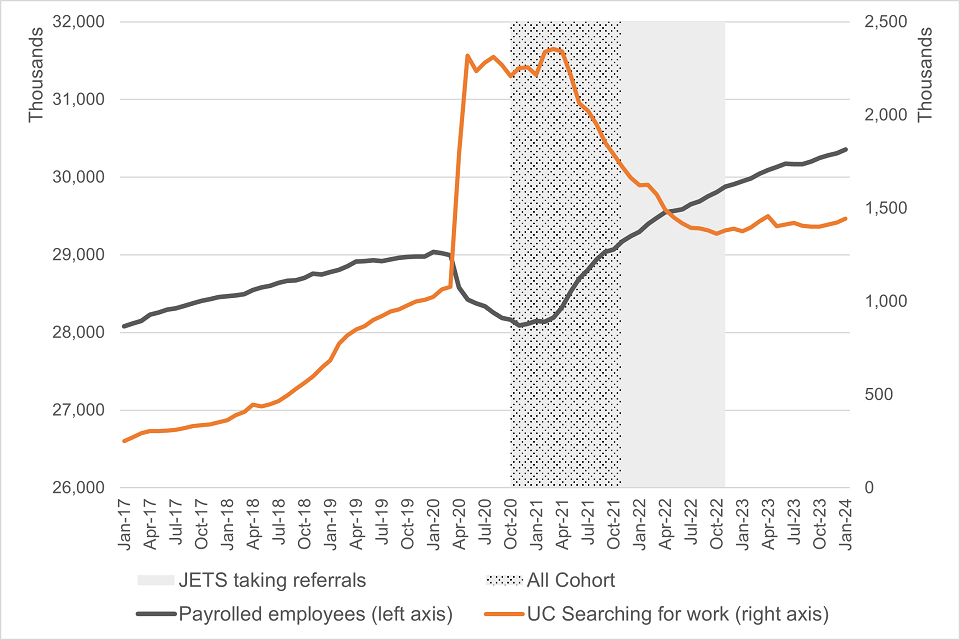

See Figure 3.3 for more information on the timing of the JETS scheme and the evolution of the labour market. Referrals to JETS started after a large drop in payrolled employment and a steep increase of UC claimants with a searching for work conditionality. When referrals ended, the level of employment was back to what it would have been had the pre-Covid trend continued. Similarly, the number of individuals on UC with searching for work requirements had reduced considerably after the initial spike.

Figure 3.3: Timing of JETS and the labour market environment

Figure 3.3 shows the evolution in payrolled employment and the number of individuals receiving Universal Credit with searching for work conditionality between January 2017 and January 2024 in the UK. The figure shows referrals to JETS started after a large drop in payrolled employment and a steep increase in the number of UC claimants with searching for work requirements. When referrals ended (September 2022), the level of employment had returned to what it would have been had the pre-Covid trend continued. Similarly, the number of individuals on UC with searching for work requirements had reduced considerably after the initial spike.

Source: Pay As You Earn Real Time Information from HM Revenue and Customs and Department for Work and Pensions (DWP Stat-Xplore).

To assess the impact of JETS at helping claimants back into employment we construct employment measures using payment data collected by HM Revenue and Customs (HMRC) through the Real Time Information (RTI) system. RTI is the reporting system for income taxed via Pay-As-You-Earn (PAYE). Through RTI we capture both earnings and time spent in payrolled employment.

We also measure out-of-work or low-income benefit receipt status and spells using different benefit datasets managed by the Department for Work and Pensions (DWP). Out-of-work or low-income benefits include Universal Credit with searching for work requirements (UC-IWS), Jobseeker’s Allowance (JSA), Income Support (IS), Employment and Support Allowance (ESA), Incapacity Benefit (IB), Severe Disablement Allowance (SDA), and Training Allowance (TA).

Moreover, we further disaggregate benefit receipt status by splitting out-of-work benefits between those who have requirements to search for work (looking for work benefits) and those who do not (other out-of-work/low-income benefits). Appendix A provides more details on the data and its sources.

We also assess the role of JETS at preventing individuals from moving into a status of neither in employment nor on benefits – ‘Other’ category. While the ‘Other’ category might include individuals moving into self-employment and not claiming benefits, or still looking for work but with no access to benefits, among others, it most likely captures – in large part – individuals whom by choice or otherwise, temporarily or permanently, left the labour market.

List of employment outcomes:

Payrolled employment:

- Whether in employment [footnote 13]

- Days spent in employment

- Earnings from employment

Out-of-work benefits:

- Whether on benefits

- Days spent on benefits

Further divided by:

- Looking for work benefits (unemployment-related benefits with searching for work requirements)

- Other out-of-work/low-income benefits (unemployment-related benefits with no searching for work requirements)

Other (not in employment nor benefits):

- Whether not in employment nor benefits

- Days spent not in employment nor benefits

4. Matching quality

4.1. Common support

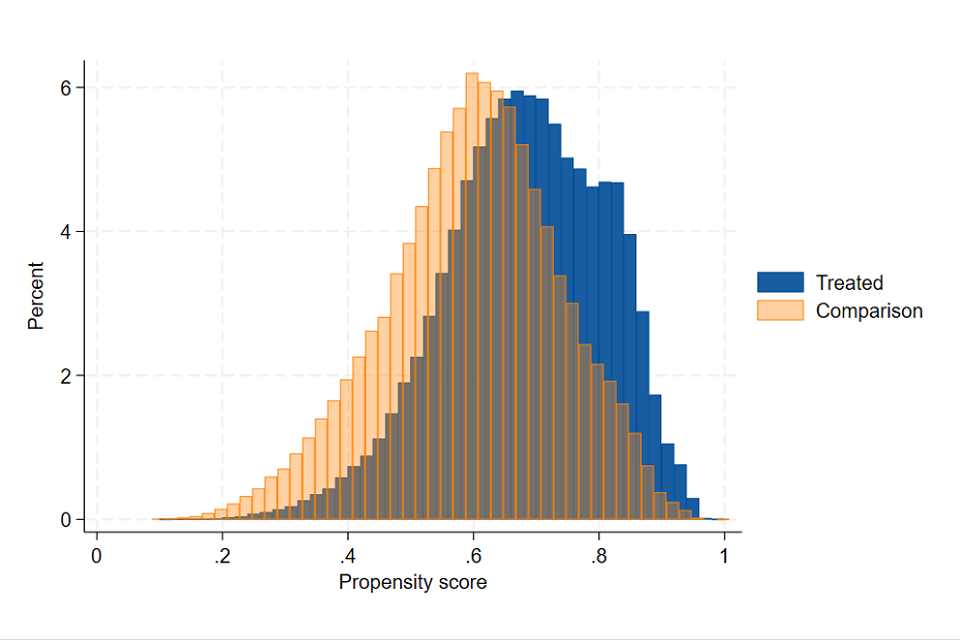

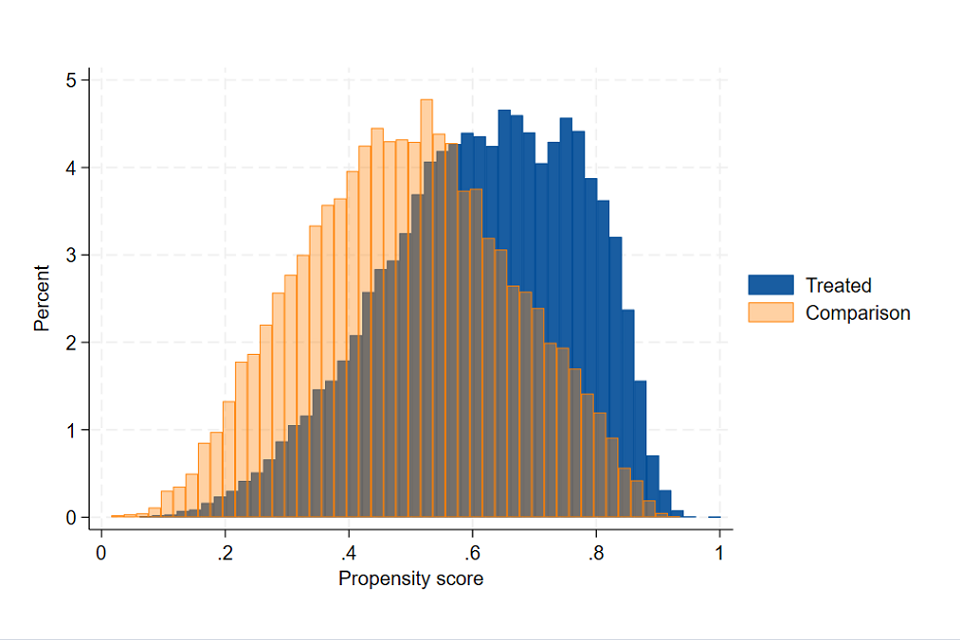

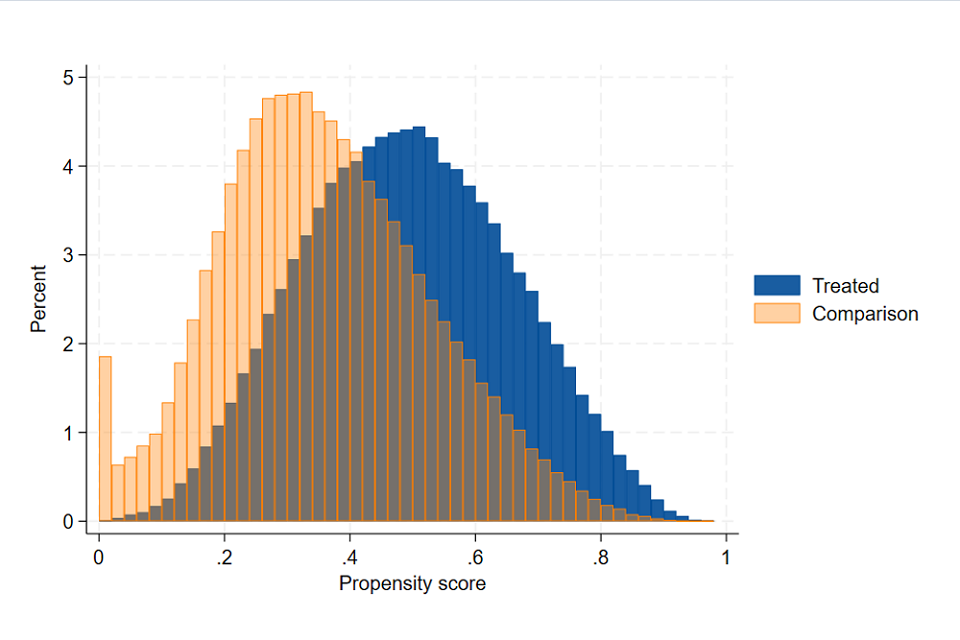

The success of a PSM analysis is in large part assessed by how well participants can be matched to non-participants based on individual and other relevant characteristics. The first consideration is the degree of similarity in propensity scores (the probability to participate in JETS) between those who start the provision and those who do not. Ideally, we would like to observe a similar distribution of the propensity scores between participants and non-participants and a high level of overlap.[footnote 14]

We estimate the propensity score to participate in JETS using a logit model that includes the following covariates:

- Labour market history: employment and benefit receipt in the 2 years prior to referral to JETS.[footnote 15] Labour market transitions between employment-unemployment-inactivity in the 3 months prior to referral. Income trajectories (from payrolled employment) in the 2 years leading to the referral using the inverse hyperbolic sine (IHS) transformation of earnings[footnote 16]

- History of previous referrals to other specialised employment support programmes

- Personal characteristics including age, sex, family circumstances (living with a partner and/or with dependent children), ethnicity, socio-economic occupation, and the experience of disabilities

- Local labour market environment (unemployment rate, vacancy rate, and intensive work search rate at the time of referral)

- Jobcentre Plus Geography identifiers and date of referral

A more detailed list of the matching variables used can be found in Appendix F.

The variables described above are thought to potentially influence both employment and benefit outcomes as well as the decision to participate in JETS. Figure 4.1 displays the estimated propensity scores. While on average JETS participants have higher propensity scores than non‑participants – with a median propensity score of 0.69 and 0.61, respectively – the two distributions are fairly similar and there exists good common support when applying commonly used bandwidths (only 1 participant cannot be matched to non-participants).[footnote 17]

Figure 4.1: Common support – Main sample

Figure 4.1 displays the estimated propensity scores for the treatment and the comparison group in the main sample. The two distributions are fairly similar and there exists good common support ranging approximately between 0.1 and 1.

4.2. Balance after matching

The main estimates are derived when matching each participant to 4 non-participants on their propensity score using nearest neighbour matching with replacement and a calliper width of 0.01.[footnote 18], [footnote 19]

Table 4.1 shows a summary of relevant statistics that are helpful at assessing the overall quality of the matching algorithm at creating a comparison group. After the matching, Rubin’s B and Rubin’s R are 5.8 and 1.0 respectively, well within the accepted thresholds for a balanced sample. The maximum % bias on the group of all covariates is 1.6, with the mean and median % bias of covariates set at 0.3%.[footnote 20]

Table 4.1: Summary statistics of the matching exercise – Main sample

| Unmatched | Matched | |

|---|---|---|

| Mean bias (%) | 5.8 | 0.3 |

| Median bias (%) | 4.4 | 0.3 |

| Max bias (%) | 23.8 | 1.6 |

| Rubin B | 62.1 | 5.9 |

| Rubin R | 1.0 | 1.0 |

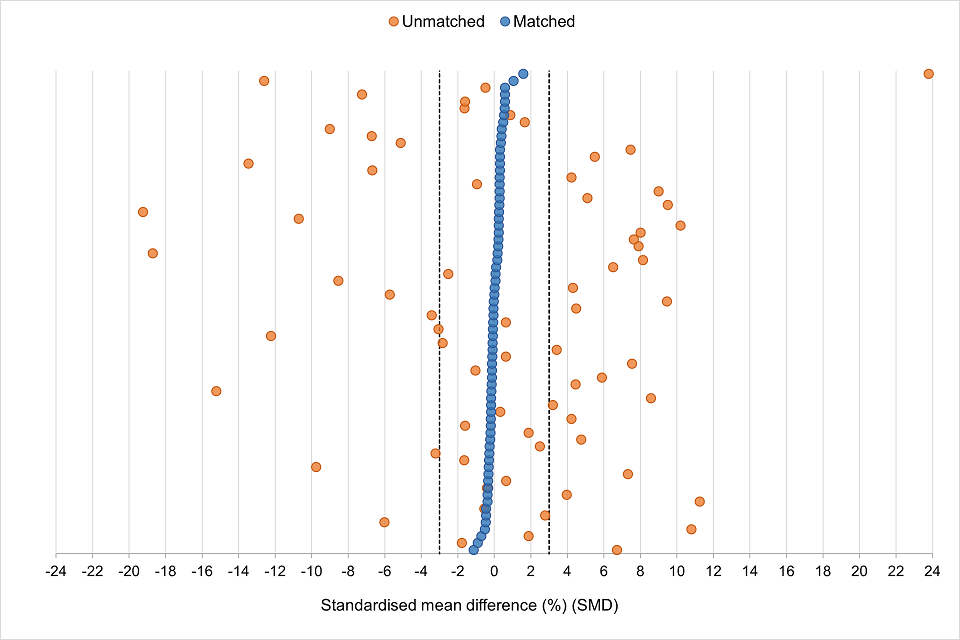

Figure 4.2 displays the standardised mean differences (SMDs) of a key set of covariates between the treatment and the comparison group before and after the matching (expressed as a percentage). Orange circles display SMDs before the matching exercise. Blue circles depict SMDs in the matched sample. The black dashed vertical lines represent a common acceptable range in covariate differences (between -3% and 3%). After the matching, differences in covariates are close to 0 (ranging from -1.12% to 1.59%).[footnote 21]

Figure 4.2: Standardised mean difference (%) – Main sample

Table 4.2 displays a descriptive summary of a selection of key covariates for both the unmatched and matched samples and shows the high degree of success of the PSM at reducing initial differences in characteristics that are likely linked to performance in the labour market. For instance, males represent 58% of participants and 60% of non-participants in the unmatched sample. After matching, males account for 58% of individuals in both the participant and comparison groups – a reduction of the initial difference of 98.9% (from a standardised mean difference or bias of -3.4% to 0.0%). Similarly, a t-test of mean differences shows there are no statistically significant differences in the proportion of males in the treatment and comparison group after the matching (p-value of 0.90).

The good balance observed using rich administrative data, together with the referral process to the scheme– which filters individuals based on programme’s suitability and initial interest in employment support – improves the confidence in the validity of the impact estimates presented in the next section.

A more detailed summary of matching variables balance can be found in Appendix G.

Table 4.2: Balancing statistics – Main sample

| Variable | Sample | Treatment | Comparison | % Bias | Reduction | t-stat | p-value |

|---|---|---|---|---|---|---|---|

| Male | Unmatched | 0.58 | 0.60 | -3.4 | – | -9.05 | 0.00 |

| Male | Matched | 0.58 | 0.58 | 0.0 | 98.9% | -0.12 | 0.90 |

| Age | Unmatched | 38.2 | 37.3 | 7.3 | – | 19.39 | 0.00 |

| Age | Matched | 38.2 | 38.2 | -0.3 | 95.6% | -1.02 | 0.31 |

| Age group: 18-24 | Unmatched | 0.11 | 0.13 | -6.7 | – | -17.98 | 0.00 |

| Age group: 18-24 | Matched | 0.11 | 0.11 | 0.4 | 93.9% | 1.35 | 0.18 |

| Age group: 25-49 | Unmatched | 0.67 | 0.66 | 0.6 | – | 1.70 | 0.09 |

| Age group: 25-49 | Matched | 0.67 | 0.67 | -0.1 | 85.0% | -0.31 | 0.76 |

| Age group: 50+ | Unmatched | 0.22 | 0.20 | 4.8 | – | 12.59 | 0.00 |

| Age group: 50+ | Matched | 0.22 | 0.22 | -0.2 | 95.4% | -0.69 | 0.49 |

| Disabled | Unmatched | 0.15 | 0.14 | 2.8 | – | 7.38 | 0.00 |

| Disabled | Matched | 0.15 | 0.15 | -0.4 | 83.9% | -1.41 | 0.16 |

| Single parent | Unmatched | 0.11 | 0.09 | 4.2 | – | 11.11 | 0.00 |

| Single parent | Matched | 0.11 | 0.11 | 0.3 | 92.7% | 0.96 | 0.34 |

| SOC: Elementary Occupations | Unmatched | 0.16 | 0.16 | 0.6 | – | 1.69 | 0.09 |

| SOC: Elementary Occupations | Matched | 0.16 | 0.16 | -0.06 | 90.5% | -0.19 | 0.85 |

| SOC: Sales and Customer Service | Unmatched | 0.13 | 0.11 | 3.42 | – | 9.02 | 0.00 |

| SOC: Sales and Customer Service | Matched | 0.13 | 0.13 | -0.09 | 97.4% | -0.27 | 0.78 |

| SOC: Administrative and Secretarial | Unmatched | 0.06 | 0.05 | 4.46 | – | 11.68 | 0.00 |

| SOC: Administrative and Secretarial | Matched | 0.06 | 0.06 | -0.14 | 96.8% | -0.44 | 0.66 |

| SOC: Missing | Unmatched | 0.45 | 0.48 | -6.68 | – | -17.73 | 0.00 |

| SOC: Missing | Matched | 0.45 | 0.45 | 0.31 | 95.3% | 0.99 | 0.32 |

| Referred to Work Programme | Unmatched | 0.23 | 0.19 | 9.5 | – | 24.95 | 0.00 |

| Referred to Work Programme | Matched | 0.23 | 0.23 | 0.3 | 96.9% | 0.90 | 0.37 |

| Referred to other CEP | Unmatched | 0.16 | 0.09 | 23.8 | – | 60.63 | 0.00 |

| Referred to other CEP | Matched | 0.16 | 0.16 | 1.6 | 93.3% | 4.53 | 0.00 |

| In employment 3 months pre-referral | Unmatched | 0.09 | 0.13 | -9.8 | – | -26.36 | 0.00 |

| In employment 3 months pre-referral | Matched | 0.09 | 0.10 | -0.3 | 96.9% | -1.02 | |

| In employment 12 months pre-referral | Unmatched | 0.31 | 0.31 | 0.7 | – | 1.73 | 0.08 |

| In employment 12 months pre-referral | Matched | 0.31 | 0.31 | -0.3 | 49.4% | -1.05 | 0.29 |

| On OoW benefits 3 months pre-referral | Unmatched | 0.93 | 0.91 | 7.5 | – | 20.37 | 0.00 |

| On OoW benefits 3 months pre-referral | Matched | 0.93 | 0.93 | -0.1 | 98.5% | -0.39 | 0.70 |

| On OoW benefits 12 months pre-referral | Unmatched | 0.31 | 0.31 | 0.7 | – | 1.73 | 0.08 |

| On OoW benefits 12 months pre-referral | Matched | 0.31 | 0.31 | -0.3 | 49.4% | -1.05 | 0.29 |

| On OoW benefits 24 months pre-referral | Unmatched | 0.33 | 0.29 | 9.0 | – | 23.77 | 0.00 |

| On OoW benefits 24 months pre-referral | Matched | 0.33 | 0.33 | 0.3 | 96.7% | 0.93 | 0.35 |

| Days in employment over 24 months pre-referral | Unmatched | 199.0 | 200.3 | -0.5 | – | -1.44 | 0.15 |

| Days in employment over 24 months pre-referral | Matched | 199.0 | 200.0 | -0.4 | 17.9% | -1.44 | 0.15 |

| Days on OoW benefits over 24 months pre-referral | Unmatched | 419.4 | 395.4 | 10.2 | – | 26.99 | 0.00 |

| Days on OoW benefits over 24 months pre-referral | Matched | 419.4 | 418.8 | 0.3 | 97.5% | 0.80 | 0.43 |

| Days on an active benefit over 24 months pre-referral | Unmatched | 380.3 | 361.9 | 8.0 | – | 21.15 | 0.00 |

| Days on an active benefit over 24 months pre-referral | Matched | 380.3 | 379.7 | 0.2 | 96.9% | 0.77 | 0.44 |

| Days on an inactive benefit over 24 months pre-referral | Unmatched | 39.12 | 33.58 | 4.3 | – | 11.28 | 0.00 |

| Days on an inactive benefit over 24 months pre-referral | Matched | 39.12 | 39.09 | 0.0 | 99.5% | 0.07 | 0.95 |

| Cumulative transformed earnings over 24 months pre-referral | Unmatched | 5.61 | 5.52 | 1.9 | – | 5.00 | 0.00 |

| Cumulative transformed earnings over 24 months pre-referral | Matched | 5.61 | 5.65 | -0.7 | 63.1% | -2.21 | 0.03 |

5. Programme Impacts

5.1. Main effects

Results show that JETS had a positive impact on a wide range of labour market outcomes. Those receiving support from the scheme spent more time in payrolled employment – therefore securing higher earnings –, were less dependent on out-of-work or low‑income benefits, and less likely to leave the labour market.

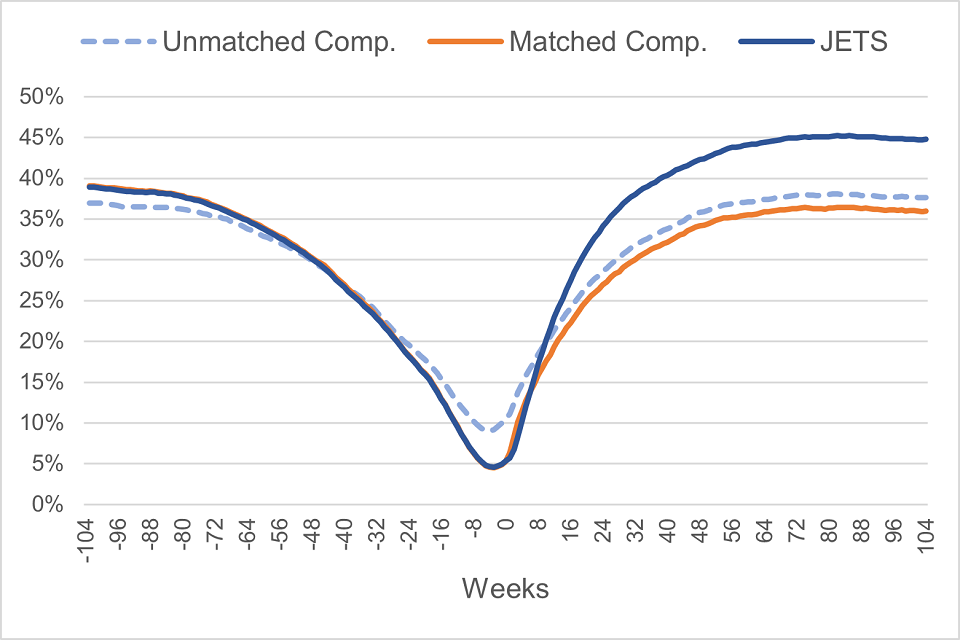

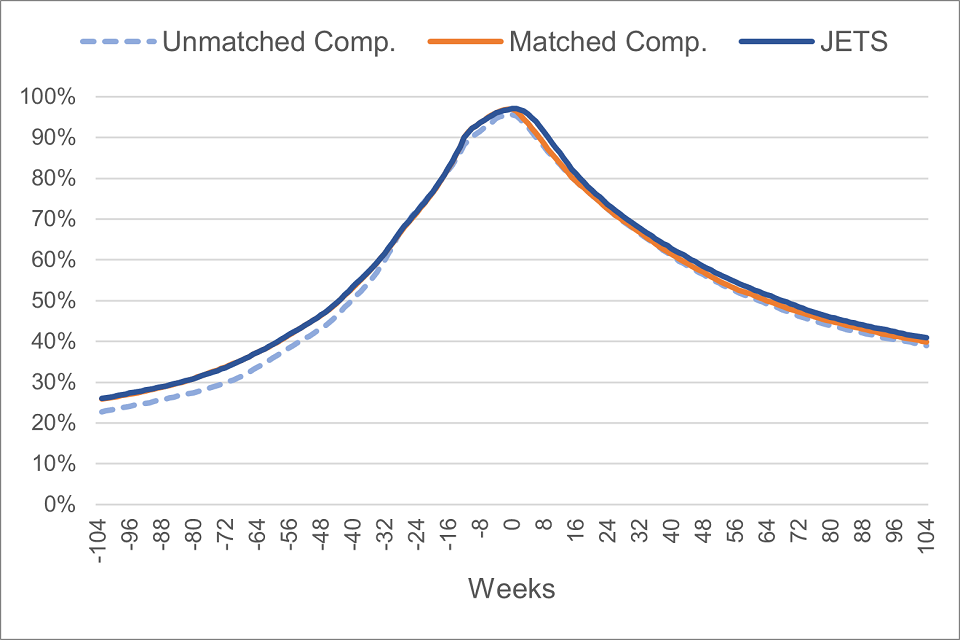

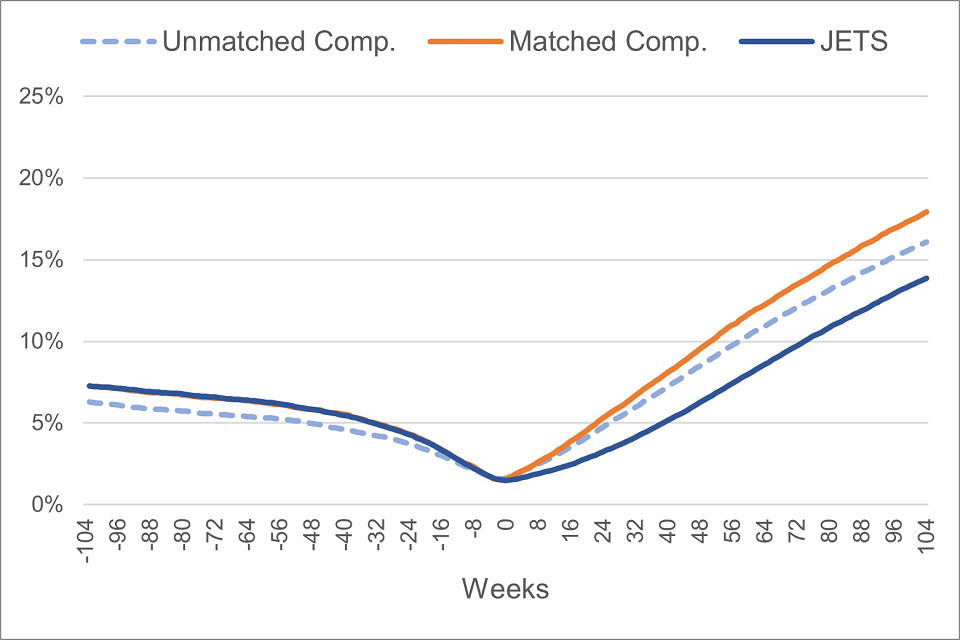

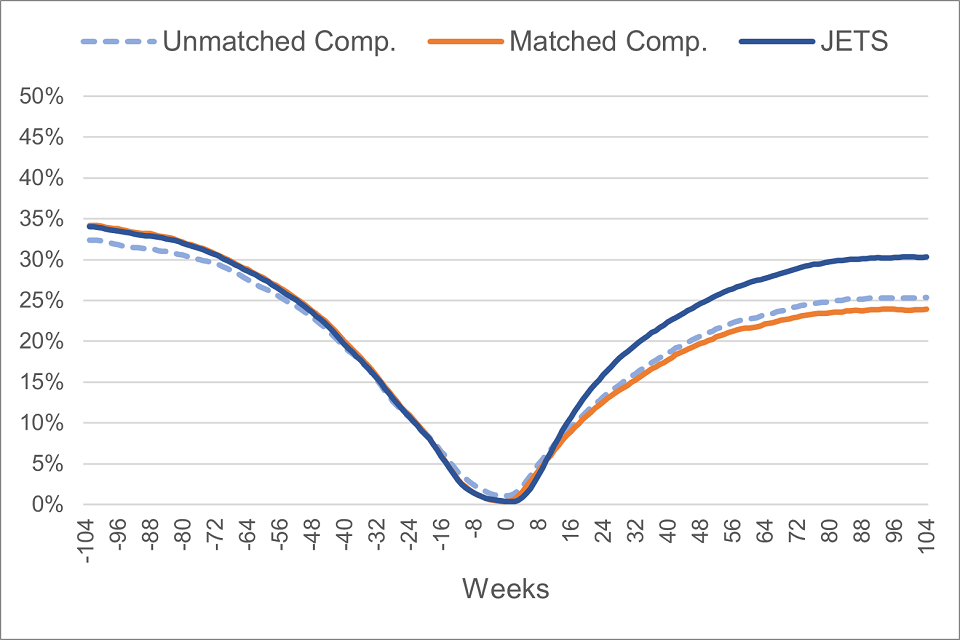

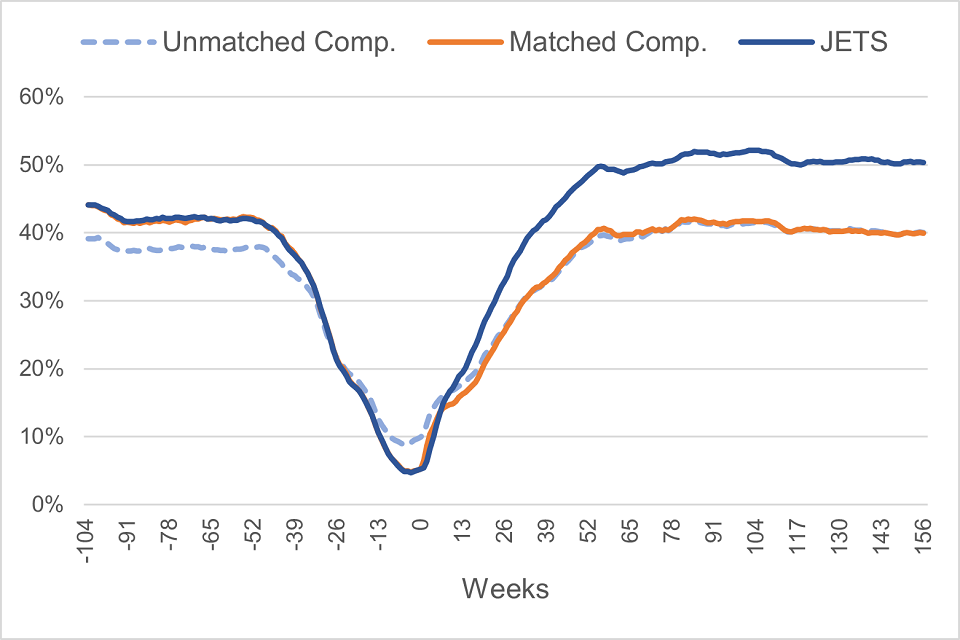

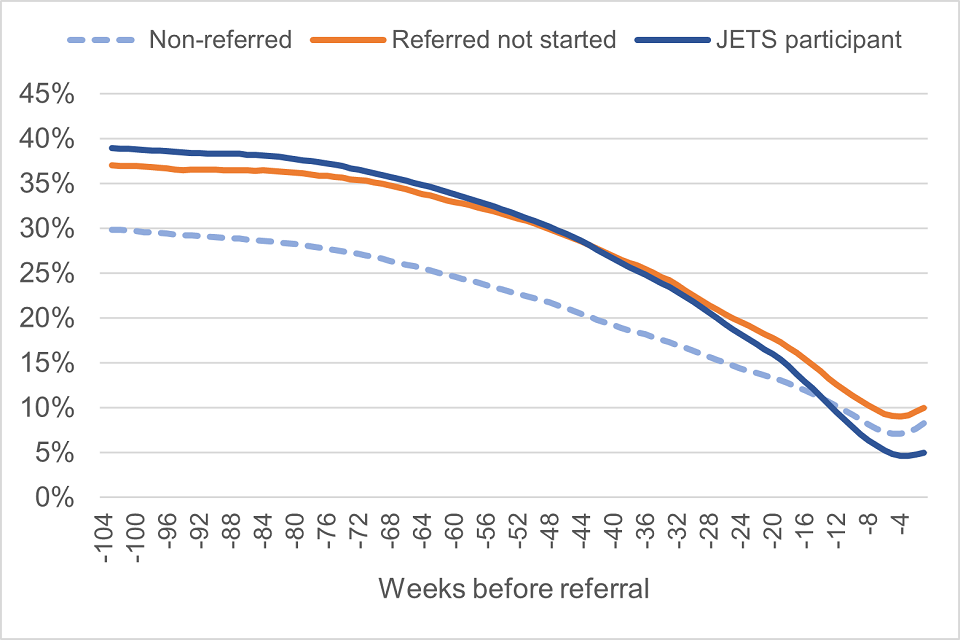

The solid blue line in Figure 5.1 shows the evolution in the proportion of JETS participants in payrolled employment before and after starting the scheme. The grey dashed line shows the proportion in employment among those referred to the scheme that did not start the programme, and the orange line displays the proportion in employment among our constructed comparison group using PSM (the counterfactual).

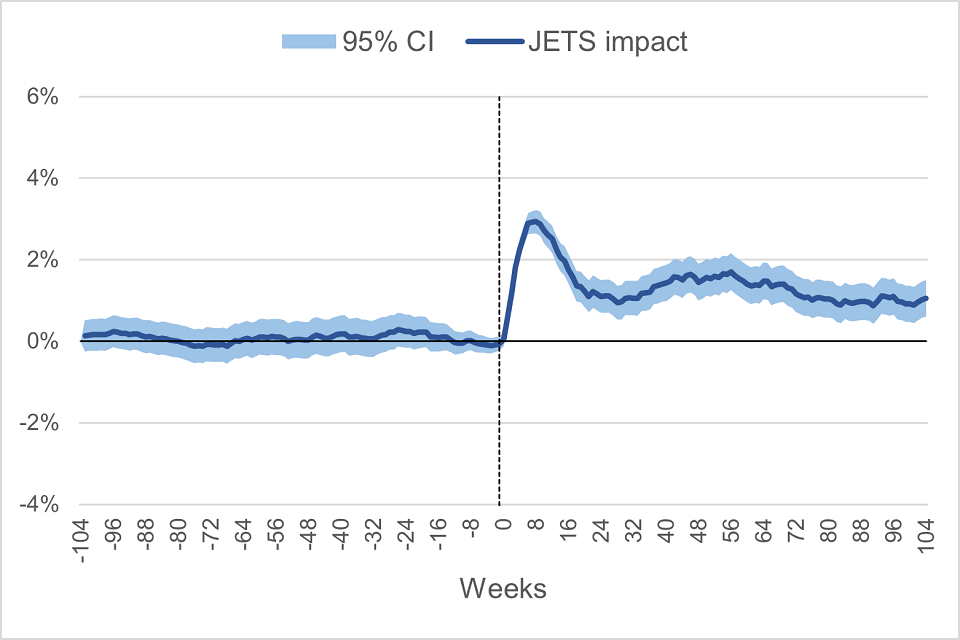

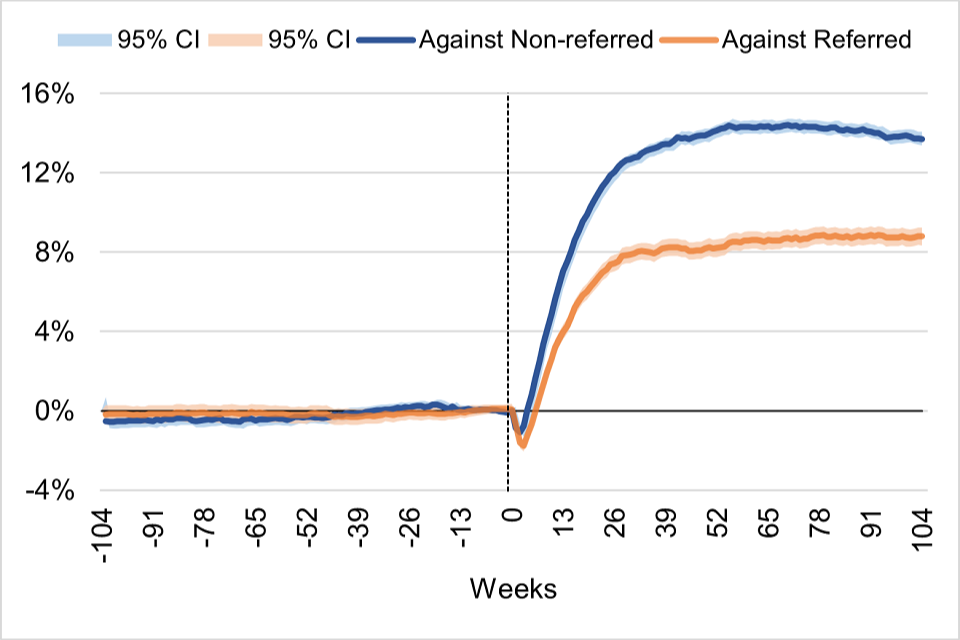

After 2 years of being referred to JETS, 44.8% of participants were in payrolled employment, compared to about 36% in the matched comparison sample. This difference in employment levels across groups can be attributed – subject to satisfying the CIA – to the programme and it is displayed in Figure 5.2.

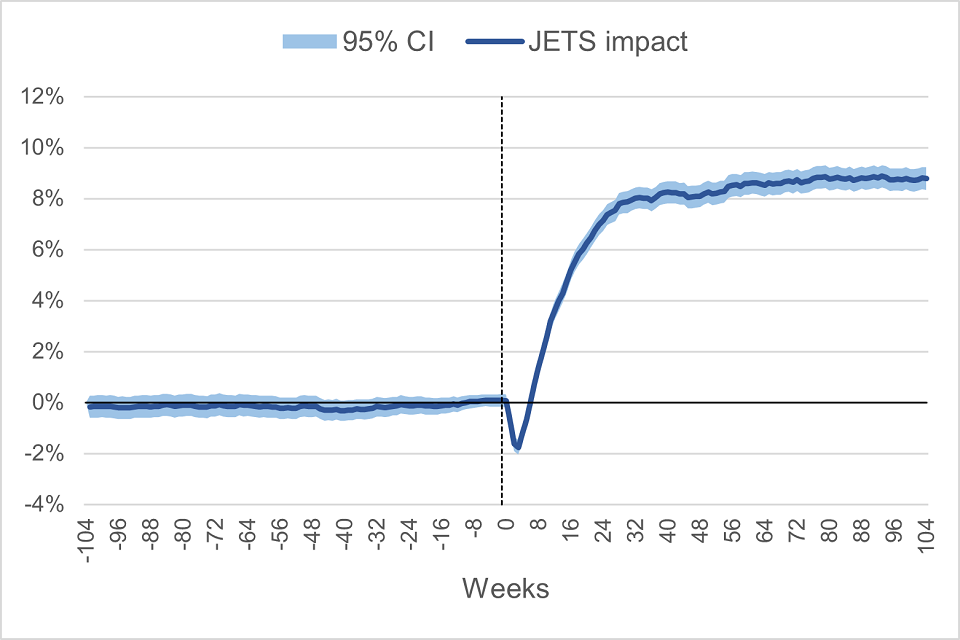

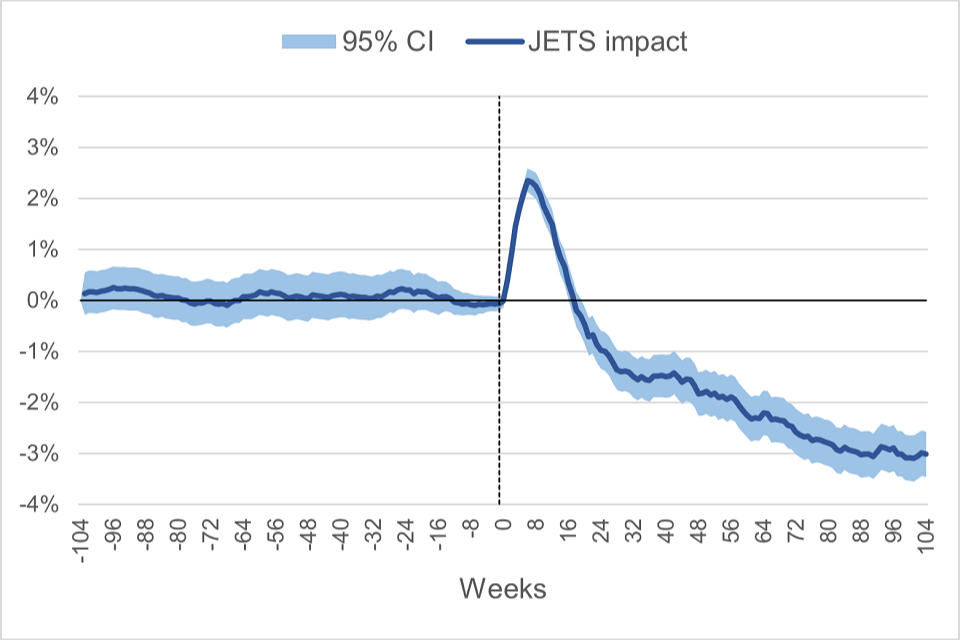

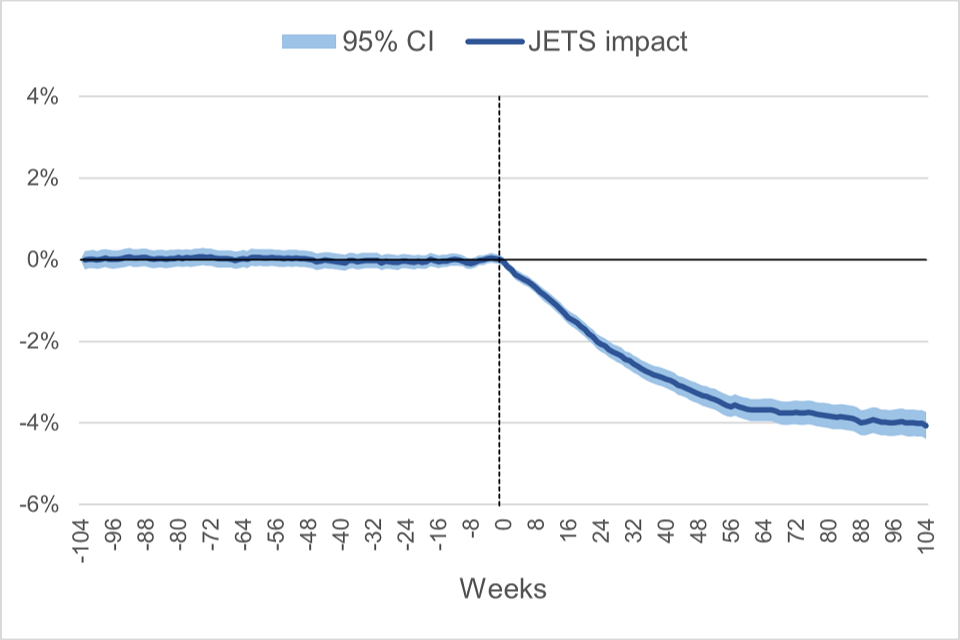

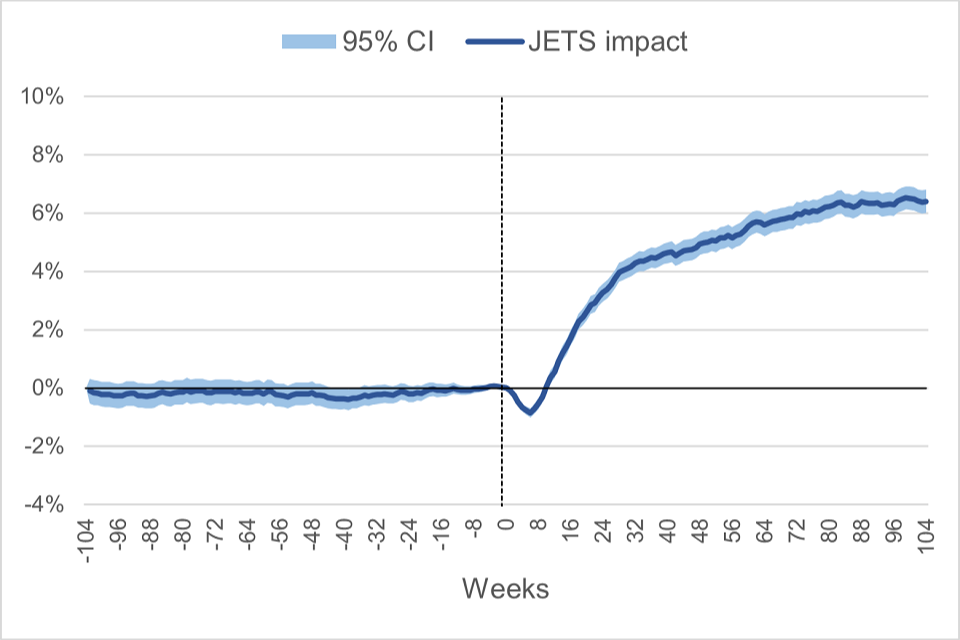

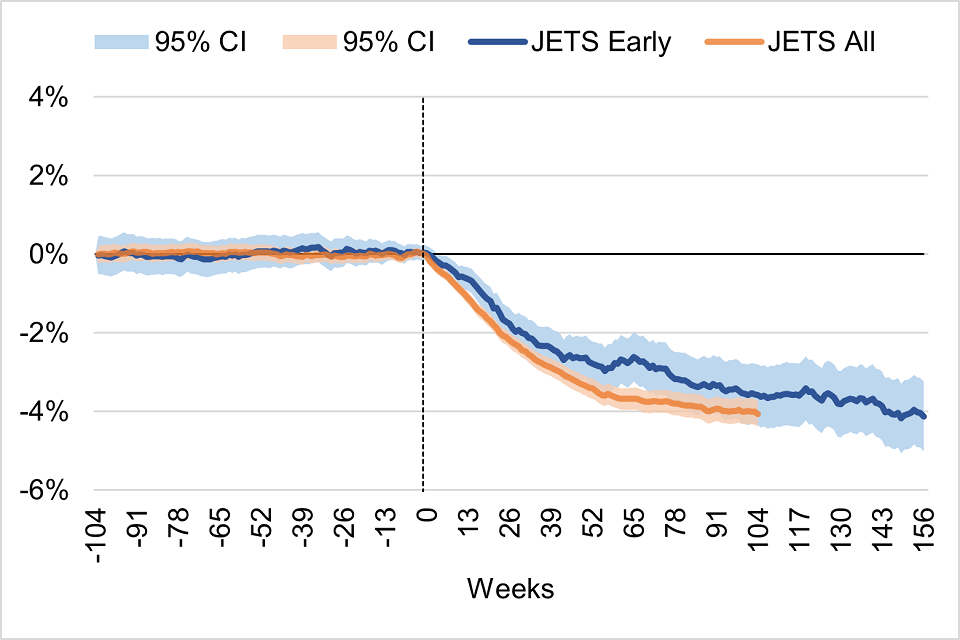

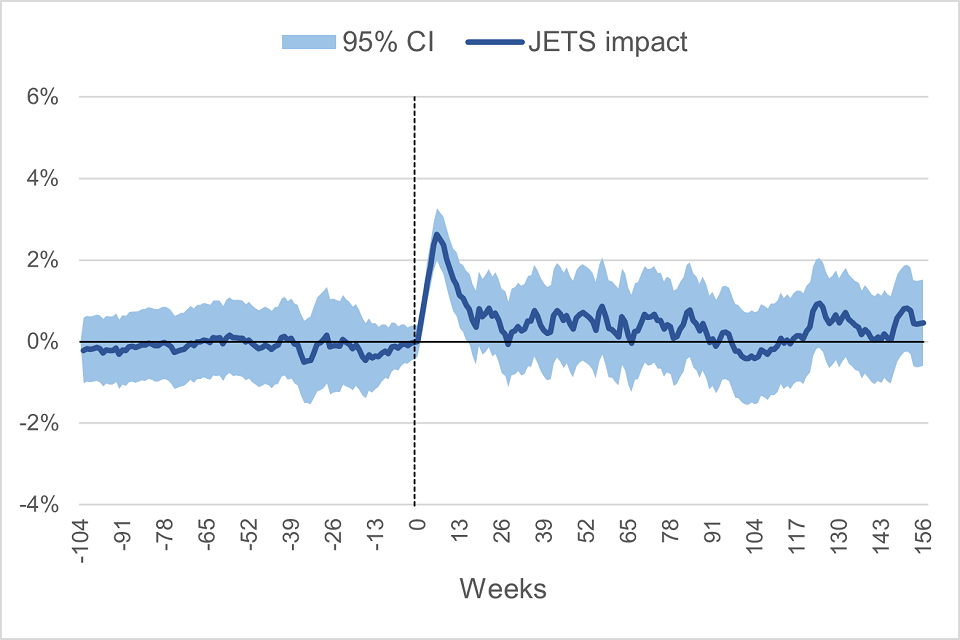

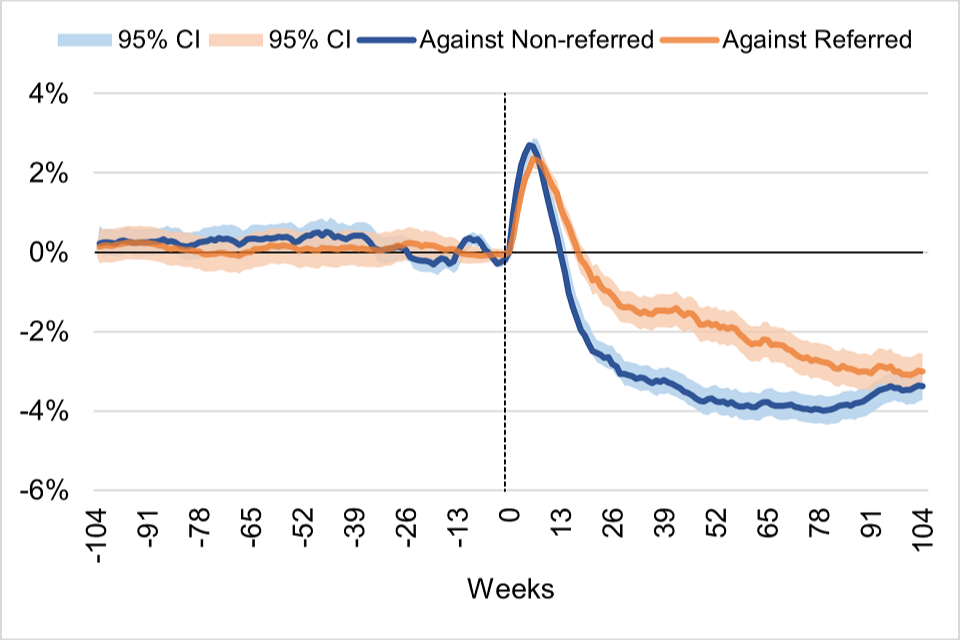

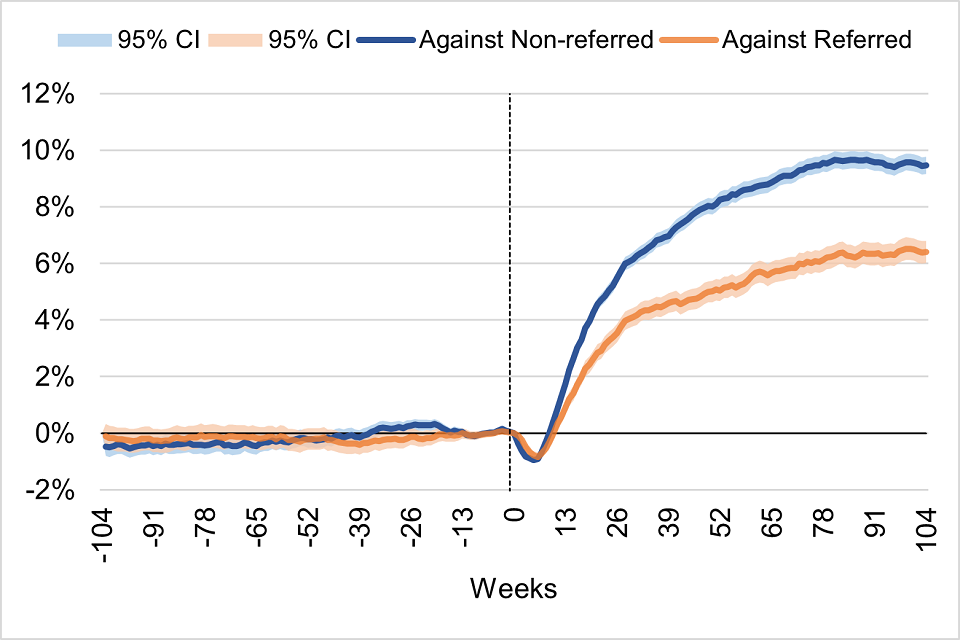

Figure 5.2 shows there were no differences in payrolled employment levels between participants and matched non-participants over the 2 years prior to being referred to the programme (vertical dashed line at the 0-axis). Since then and after a short ‘lock‑in’ effect period of lower employment, those who received support from the scheme were more likely to be in payrolled employment than those who did not (8.2 pp higher employment at year 1 and 8.8 pp higher employment at year 2).[footnote 22] The light blue area represents the 95% confidence interval of the point estimates.

Figure 5.1: Proportion in payrolled employment by group – Main sample

Figure 5.1 shows there was a similar employment level between participants and matched non-participants over the 2 years prior to being referred to the programme. After referral, those who received support from the scheme were more likely to be in payrolled employment than those who did not (44.8% versus 36.0%, respectively, at year 2).

Figure 5.2: Percentage point difference in payrolled employment – Main sample

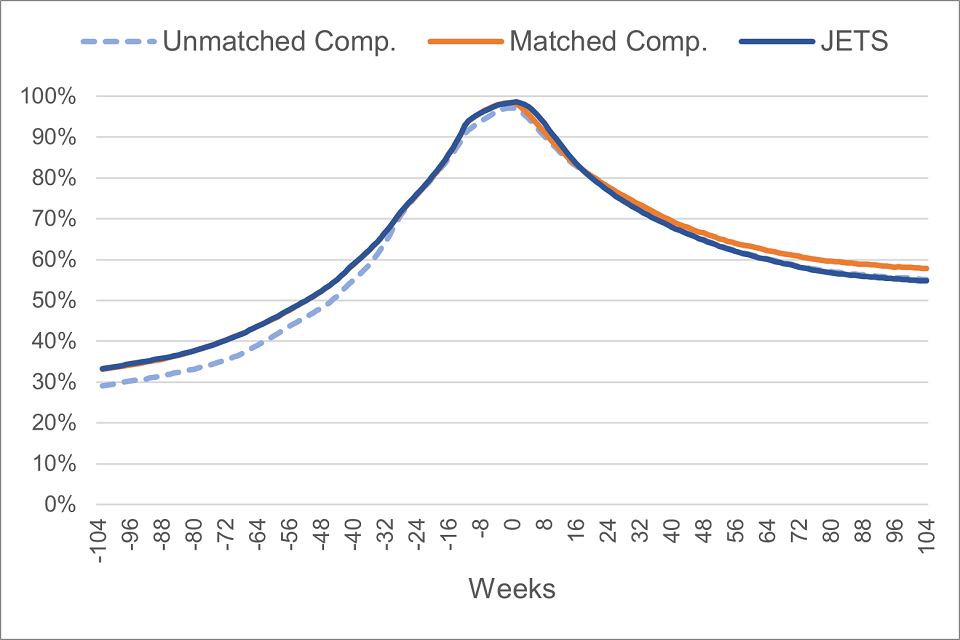

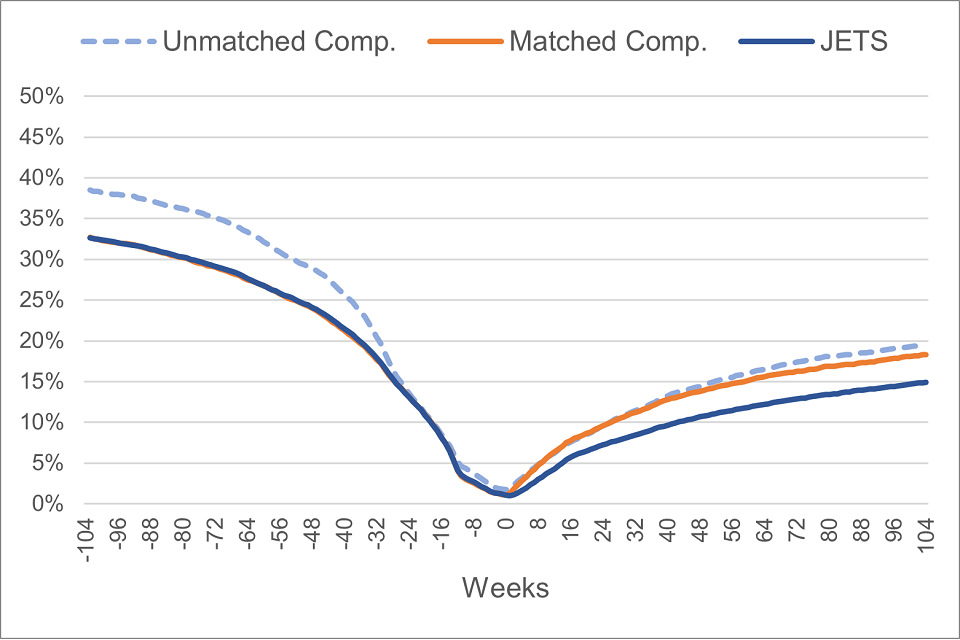

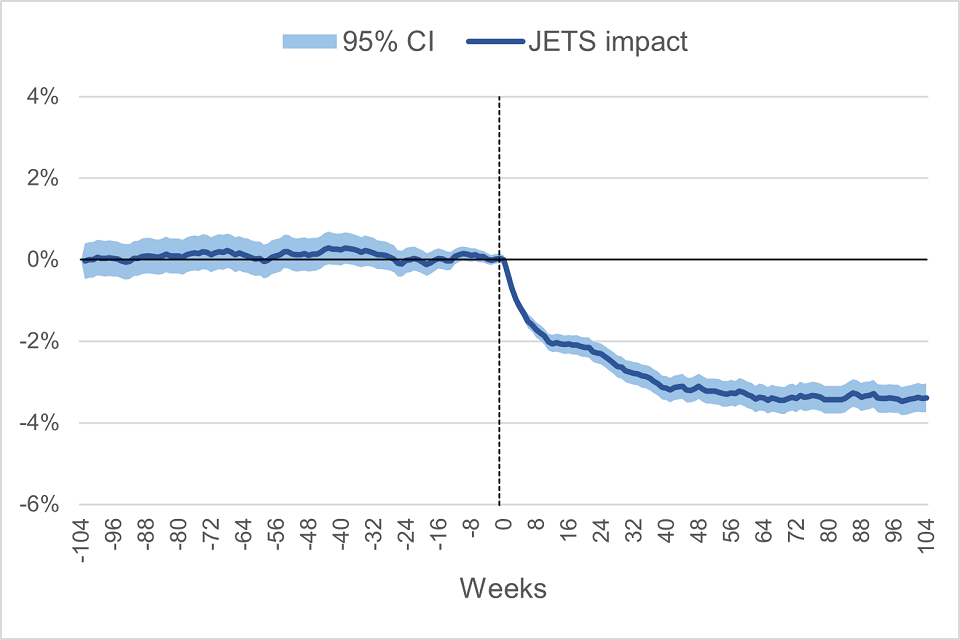

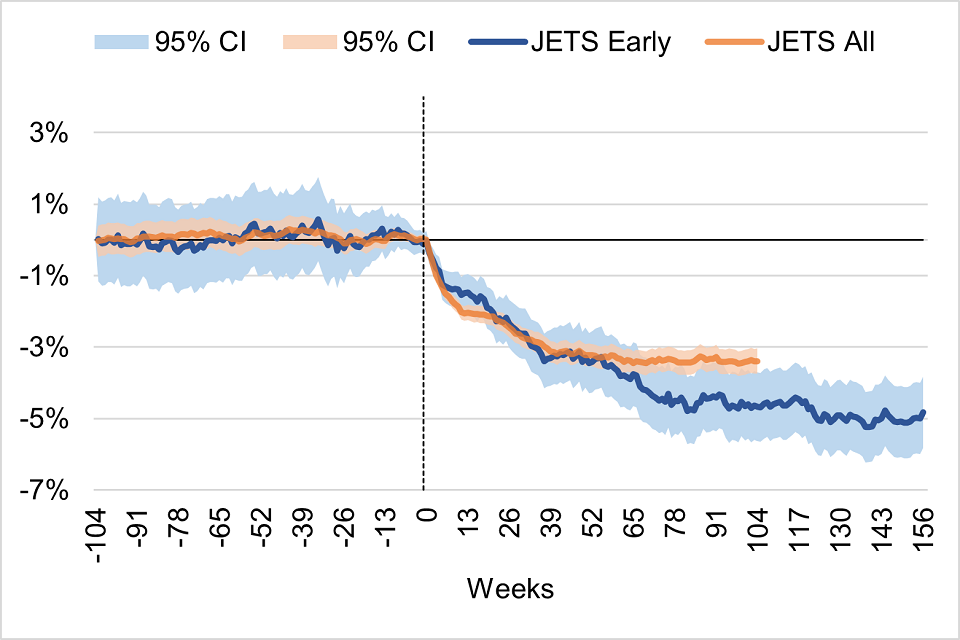

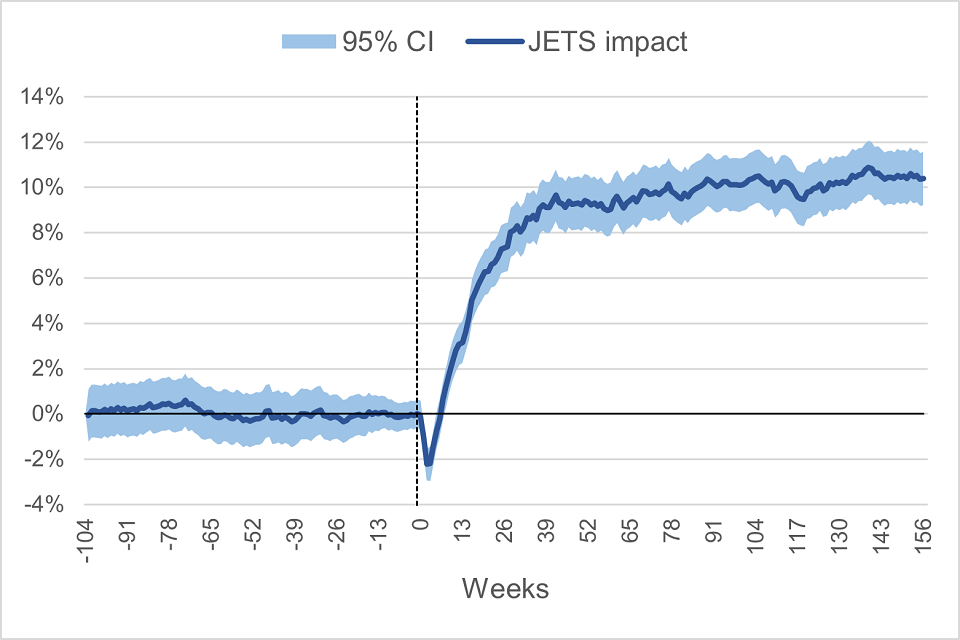

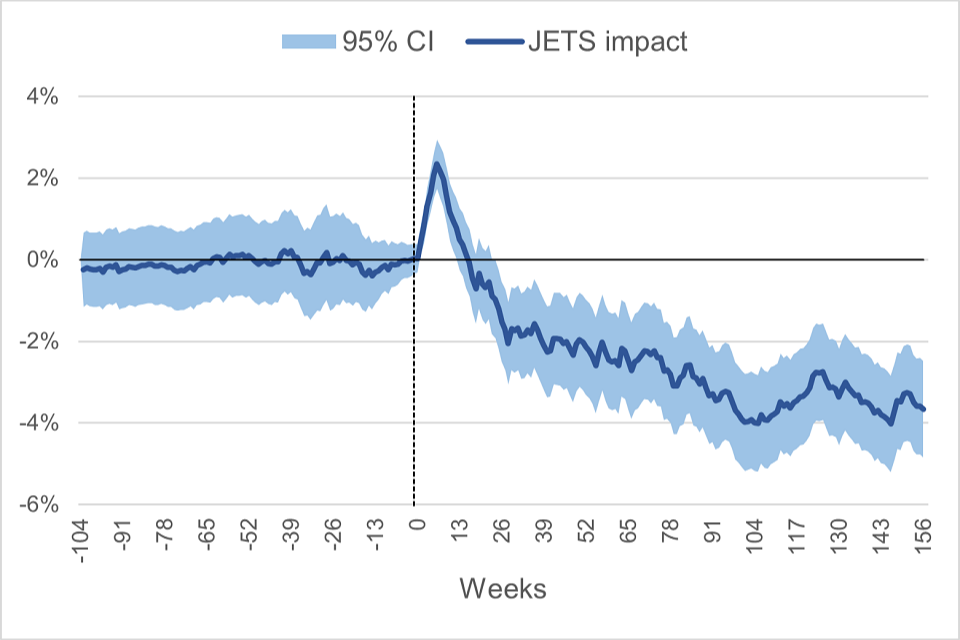

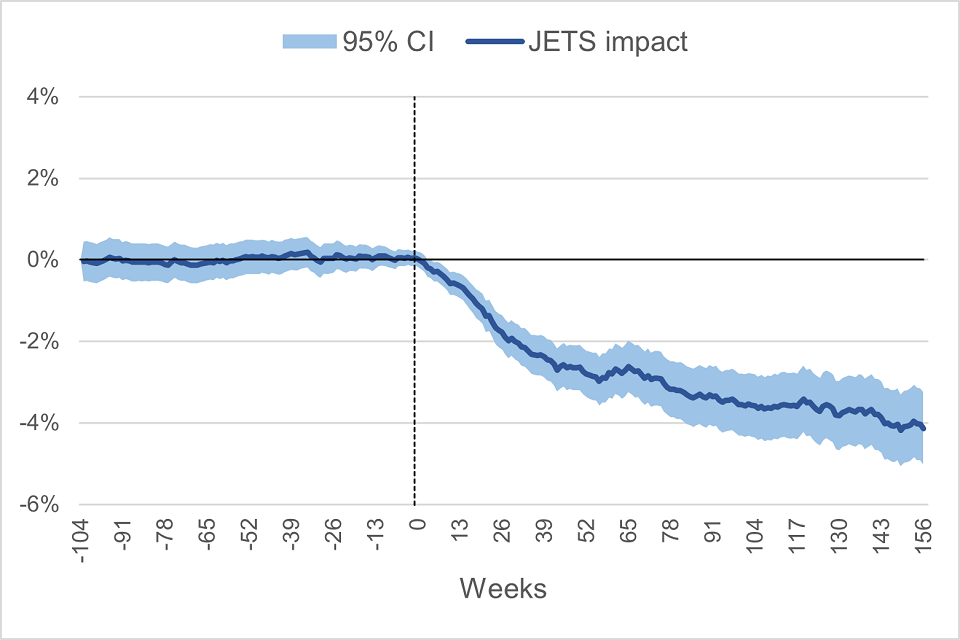

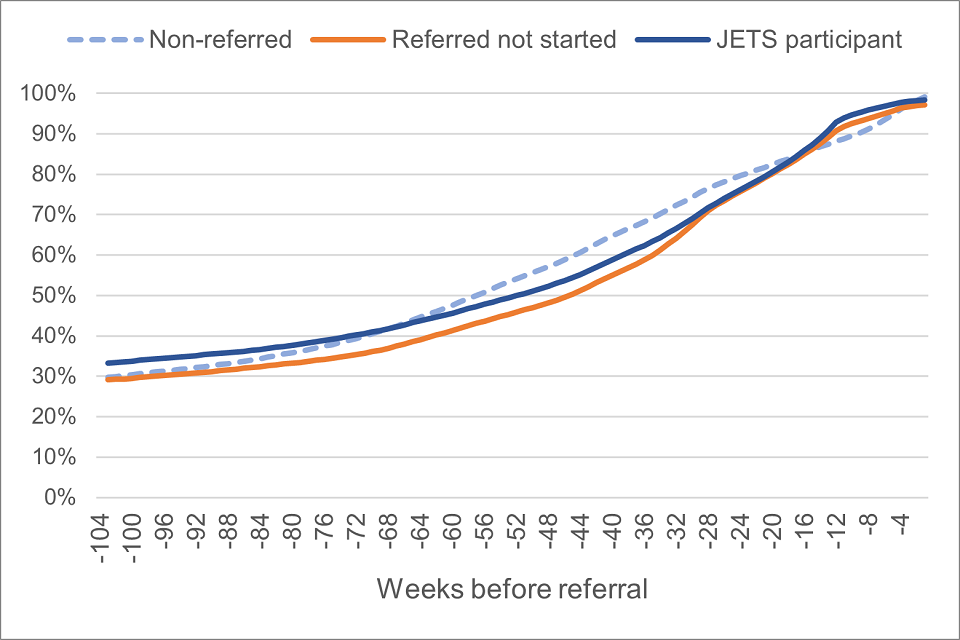

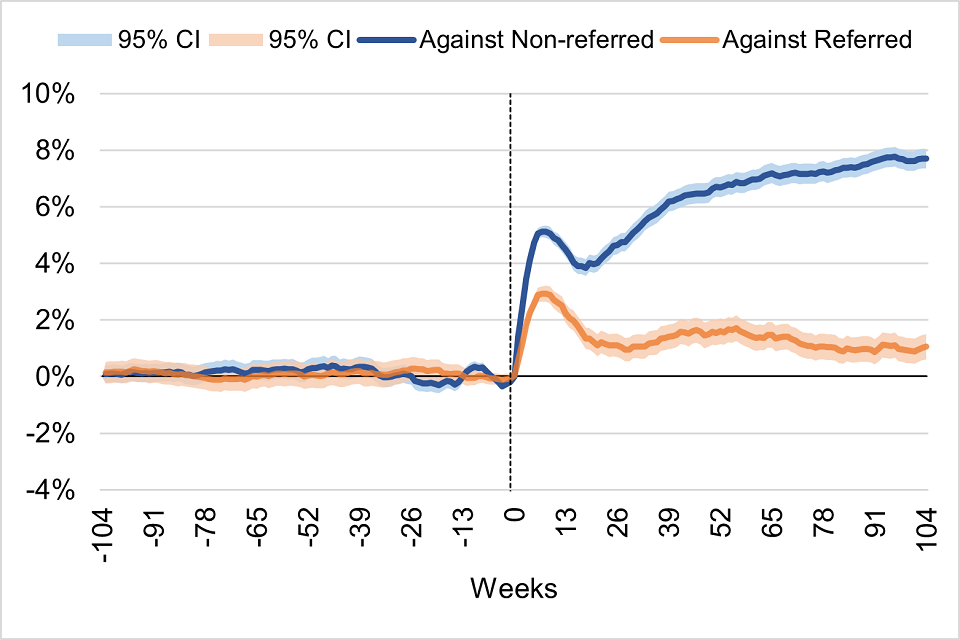

Figure 5.3 and Figure 5.4 show the evolution on out-of-work or low-income benefit receipt between participants and the comparison group. Similarly, while there are no differences on benefit receipt between groups before programme referral, those who started JETS were 3 pp less likely to be claiming an unemployment related benefit two years later.

Figure 5.3: Proportion on out-of-work or low-income benefits – Main sample

Figure 5.3 shows there was a similar proportion of individuals in out-of-work or low income benefits between participants and matched non-participants over the 2 years prior to being referred to the programme. After referral, those who received support from the scheme were less likely to be in out-of-work or low income benefits than those who did not (54.8% versus 57.8%, respectively, at year 2).

Figure 5.4: Percentage point difference on out-of-work or low-income benefits – Main sample

Figure 5.4 shows there were no differences in out-of-work or low income benefit receipt between participants and matched non-participants over the 2 years prior to being referred to the programme. Since then and after a short ‘lock in’ effect period of higher benefit receipt, those who received support from the scheme were less likely to be in out-of-work or low income benefits than those who did not (1.8 pp less likely at year 1 and 3.0 pp less likely at year 2). The light blue area represents the 95% confidence interval of the point estimates.

The cumulative effects from participating in JETS are shown in Table 5.1. On average and after two years from having started the scheme, those on JETS spent 53 additional days (7.2 pp) in payrolled employment and 11 fewer days (1.6 pp) on out-of-work or low‑income benefits. It is worth mentioning that because of the design of Universal Credit – where benefits are compatible with lower levels of income from employment – additional days in payrolled employment do not automatically translate to fewer days on benefits. On average, the increased attachment to the labour market resulted in about £2,550 additional earnings, with participants 5.8 percentage points (pp) more likely to have earned at least £20,000 since joining the scheme (see Appendix Figure B.5 on the evolution of additional cumulative earnings).

Similarly, while over 42% of the comparison group was unable to find employment during the period of analysis (remained jobless), this percentage was 32% among the sample of participants (10 pp lower).

Table 5.1: JETS impact over 2 years – Main sample

| Payrolled employment | Treatment | Comparison | Impact | [95% CI] |

|---|---|---|---|---|

| Days | 277 | 225 | 53 | [50 , 55 ] |

| Level (pp) | 38.1 | 30.9 | 7.2 | [6.9 , 7.6] |

| Earnings | Treatment | Comparison | Impact | [95% CI] |

|---|---|---|---|---|

| Cumulative earnings (£) | 12,785 | 10,236 | 2,549 | [2,399 , 2,699] |

| Achieved £1K (pp) | 62.5 | 52.2 | 10.3 | [9.8 , 10.7] |

| Achieved £20K (pp) | 25.8 | 20.1 | 5.8 | [5.4 , 6.1] |

| Jobless | 31.9 | 42.1 | -10.2 | [-10.7 , -9.8] |

| Out-of-work (OoW) benefits | Treatment | Comparison | Impact | [95% CI] |

|---|---|---|---|---|

| Days | 492 | 503 | -11 | [-14 , -9] |

| Level (pp) | 67.5 | 69.1 | -1.6 | [-1.9 , -1.2] |

| Looking for work benefit: Days | 439 | 429 | 10 | [8 , 12] |

| Looking for work benefit: Level (pp) | 60.3 | 58.9 | 1.4 | [1.1 , 1.7] |

| Other OoW benefit: Days | 53 | 74 | -21 | [-23 , -20] |

| Other OoW benefit: Level (pp) | 7.2 | 10.2 | -2.9 | [-3.1 , -2.7] |

| Other category | Treatment | Comparison | Impact | [95% CI] |

|---|---|---|---|---|

| Days | 74 | 95 | -21 | [-23 , -19] |

| Level (pp) | 10.1 | 13.0 | -2.9 | [-3.1 , -2.7] |

Table 5.2 shows the proportion of individuals in each of the labour market categories assessed by treatment status at the end of each year since being referred to the programme. After 1 year, 43.0% of JETS participants were employed (compared to 34.8% in the comparison group). The difference in payrolled employment between the two groups grows to 8.8 pp at year 2 (44.8% versus 36.0%).

Breaking down the type of benefit received by conditionality, Table 5.2 shows JETS reduced the likelihood of jobseekers moving to other out-of-work/low-income benefits (with no searching for work requirements) and was able to retain more claimants in the looking for work benefit – closer to the labour market. After 2 years, those supported by the JETS scheme spent 10 more days on a looking for work benefit and 21 fewer days on other out-of-work/low-income benefits (see Table 5.1).

Similarly, JETS reduced the proportion of individuals in the ‘Other’ category (not in employment nor on an out-of-work or low-income benefit), preventing an increased detachment from the labour market. As a result, participants spent, on average, 21 days fewer in this category.

Table 5.2: Impact at of each follow-up year - Main sample

| Payrolled Employment (pp) | Baseline | Year 1 | Year 2 |

|---|---|---|---|

| Treatment | 5.3 | 43.0 | 44.8 |

| Comparison | 5.2 | 34.8 | 36.0 |

| Impact [95% CI] | – | 8.2 [7.8 , 8.6] | 8.8 [8.4 , 9.2] |

| Out-of-Work (OoW) benefits (pp) | Baseline | Year 1 | Year 2 |

|---|---|---|---|

| Treatment | 98.6 | 63.3 | 54.8 |

| Comparison | 98.6 | 65.1 | 57.8 |

| Impact [95% CI] | – | -1.8 [-2.3 , -1.4] | -3.0 [-3.5 , -2.6] |

| Looking for work benefit (pp): Treatment | 97.1 | 56.5 | 40.9 |

| Looking for work benefit (pp): Comparison | 97.0 | 54.9 | 39.9 |

| Looking for work benefit (pp): Impact [95% CI] | – | 1.6 [1.2 , 2.1] | 1.1 [0.6 , 1.5] |

| Other OoW benefit (pp): Treatment | 1.5 | 6.8 | 13.9 |

| Other OoW benefit (pp): Comparison | 1.5 | 10.3 | 17.9 |

| Other OoW benefit (pp): Impact [95% CI] | – | -3.4 [-3.7 , -3.2] | -4.1 [-4.4 , -3.7] |

| Other category (pp) | Baseline | Year 1 | Year 2 |

|---|---|---|---|

| Treatment | 1.1 | 11.1 | 14.9 |

| Comparison | 1.1 | 14.3 | 18.3 |

| Impact [95% CI] | – | -3.2 [-3.5 , -2.9] | -3.4 [-3.7 , -3.0] |

Additional figures on the evolution of labour market outcomes and programme effects can be found in Appendix B.

5.2. Long-term effects: The Early Cohort

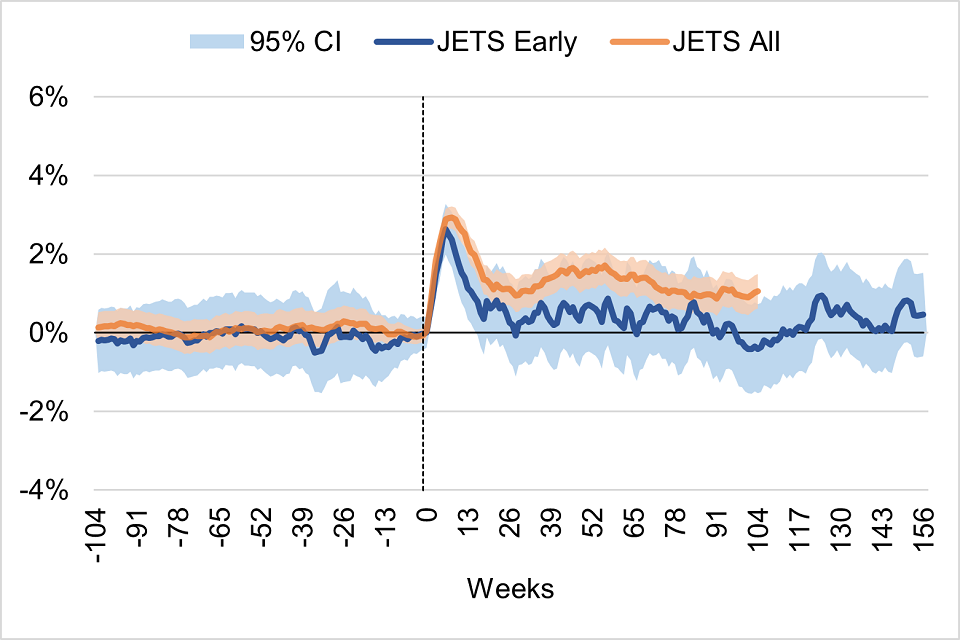

Evaluating the impact JETS had on an early group of participants (those referred in Oct/Nov 2020) allows to make inferences on the continuation of overall programme effects beyond the 2 years observed for the main sample (referred up until Nov 2021). To make inferences about continuing programme effects using the Early cohort we need to assess:

- How similar/dissimilar are programme effects between the Early and the All Cohort (main sample) in the first 2 years after starting JETS.

- Whether programme effects for the Early Cohort increase, decrease, or stabilise over time (between year 2 and 3).

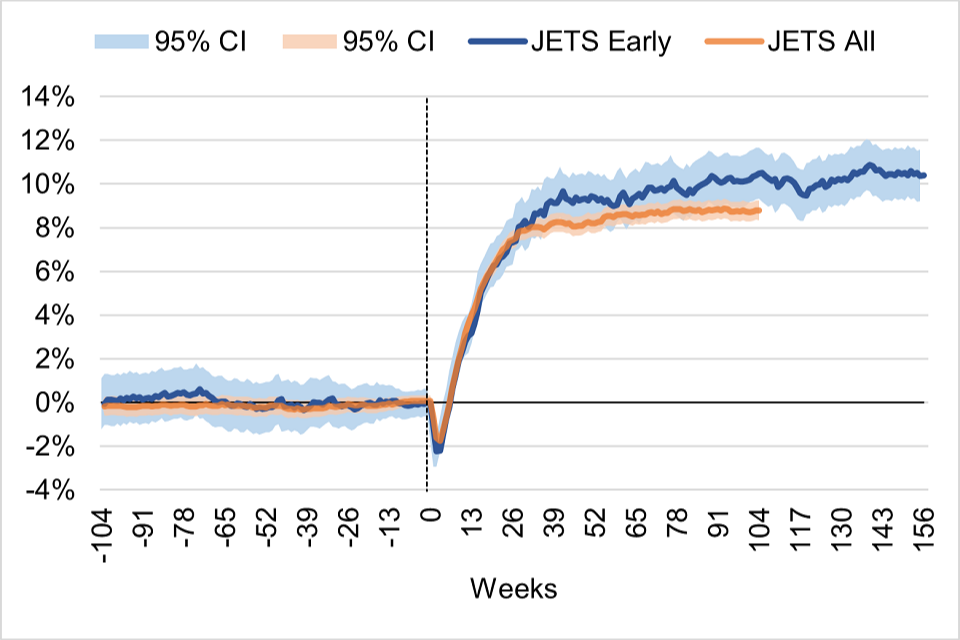

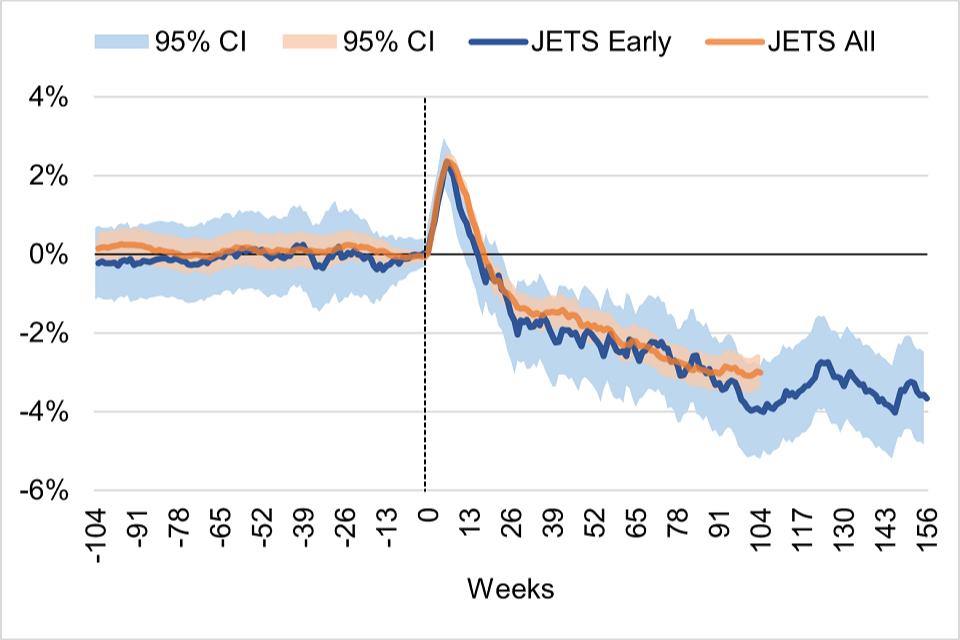

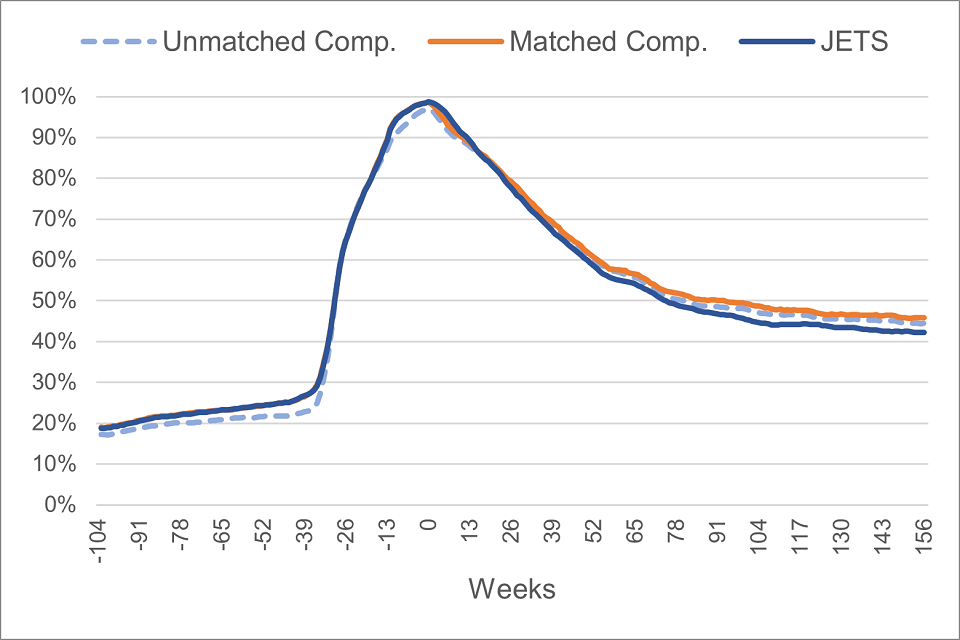

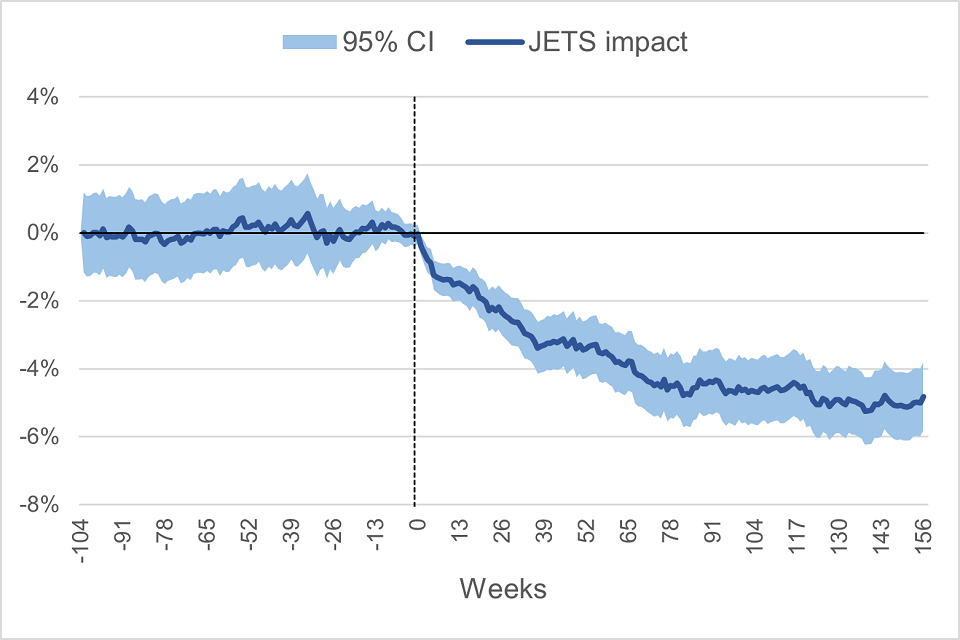

Figures 5.5 and 5.6 show a similar pattern of increased payrolled employment and reduced benefit receipt between the Early and the All Cohort. More importantly, estimates show sustained impact effects between year 2 and 3 after programme start (with no sign of impact decay).

Figure 5.5: Percentage point difference in payrolled employment – All (main sample) vs Early Cohort

Figure 5.6: Percentage point difference on out-of-work or low-income benefits – All (main sample) vs Early Cohort

If anything, employment effects seem slightly larger among early participants compared to the wider group of referrals – 0.7 pp higher impact on additional days in payrolled employment and 0.2 pp higher impact on reducing the number of days in receipt of out-of-work or low-income benefits over the first 2 years since programme start (see Table 5.3).

Table 5.3: JETS impact over 2 years – All Cohort (main sample) vs Early Cohort

| Payrolled employment | Early Cohort, Impact [95% CI] | All Cohort, Impact [95% CI] |

|---|---|---|

| Days | 58 [52 , 64] | 53 [50 , 55] |

| Level (pp) | 7.9 [7.1 , 8.8] | 7.2 [6.9 , 7.6] |

| Earnings | Early Cohort, Impact [95% CI] | All Cohort, Impact [95% CI] |

|---|---|---|

| Cumulative earnings (£) | 3,014 [2,613 , 3,415] | 2,549 [2,399 , 2,699] |

| Achieved £1K (pp) | 11.2 [10.0 , 12.3] | 10.3 [9.8 , 10.7] |

| Achieved £20K (pp) | 7.1 [6.1 , 8.1] | 5.8 [5.4 , 6.1] |

| Jobless | -11.0 [-12.1 , -9.9] | -10.2 [-10.7 , -9.8] |

| Out-of-work (OoW) benefits | Early Cohort, Impact [95% CI] | All Cohort, Impact [95% CI] |

|---|---|---|

| Days | -13 [-19 , -8] | -11 [-14 , -9] |

| Level (pp) | -1.8 [-2.6 , -1.0] | -1.6 [-1.9 , -1.2] |

| Looking for work benefit: Days | 4 [-2 , 10] | 10 [8 , 12] |

| Looking for work benefit: Level (pp) | 0.5 [-0.2 , 1.3] | 1.4 [1.1 , 1.7] |

| Other OoW benefit: Days | -17 [-21 , -14] | -21 [-23 , -20] |

| Other OoW benefit: Level (pp) | -2.4 [-2.8 , -1.9] | -2.9 [-3.1 , -2.7] |

| Other category | Early Cohort, Impact [95% CI] | All Cohort, Impact [95% CI] |

|---|---|---|

| Days | -24 [-28 , -20] | -21 [-23 , -19] |

| Level (pp) | -3.3 [-3.9 , -2.7] | -2.9 [-3.1 , -2.7] |

The reason impact estimates might have been slightly higher among those starting JETS during its initial stages is likely related to the circumstances of the period. During the initial JETS rollout in Autumn 2020 there was little employment support from Jobcentre Plus, many of the interactions were digital, and not many people were going on other programmes. As a result, the comparison group at the time may have experienced lower support than usually available during normal conditions.[footnote 23]

Additional figures comparing other labour market outcomes between the Early and the All cohort can be found in Appendix B.

Moreover, estimates show that at the 3-year mark since programme start JETS participants from the Early Cohort had a 10.4 pp higher payrolled employment rate, 3.7 pp lower rate of out-of-work/low-income benefit receipt, and had accumulated over £5,300 more from earnings than those who did not start JETS. See Appendix C for more detailed results on the analysis of programme effects for the Early Cohort.

As a result, we anticipate JETS to continue generating positive effects among participants beyond the initial 2 years observed. We use the findings from this exercise to extrapolate programme effects beyond the 2-year tracking period when evaluating the cost-effectiveness of the scheme in the Cost Benefit Analysis section of the report.

5.3. Sensitivity of impact estimates

To alternative model specifications

We assess the sensitivity of the main impact estimates to different model specifications. Details of the analysis can be found in Appendix D. All in all, results show impact estimates are robust to alternative model specifications and the use of alternative PSM parameters.

To an alternative comparison sample

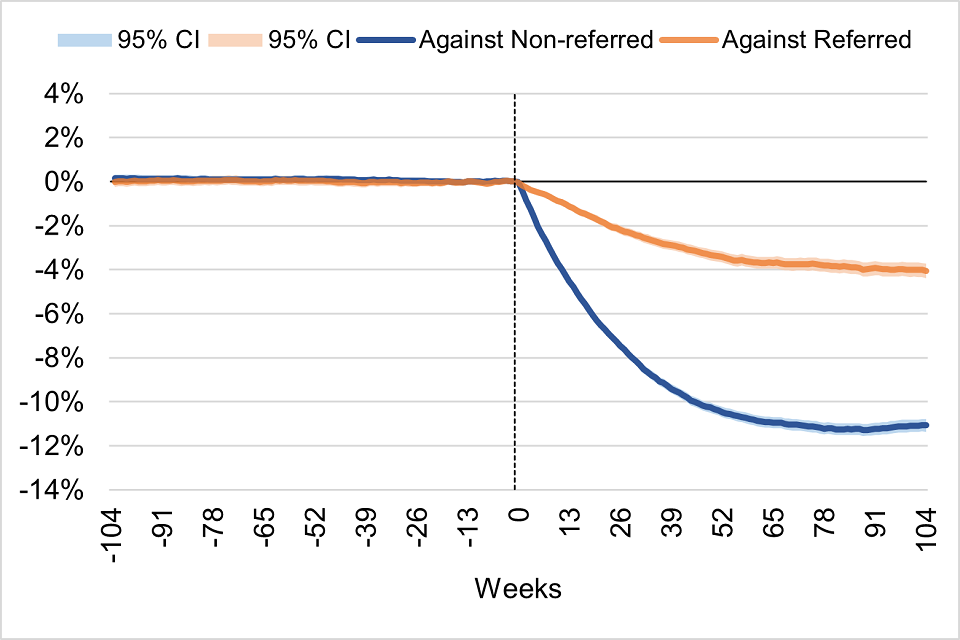

As explained previously, our main estimates of programme effects compare the labour market outcomes of those who started JETS with a comparison group created from those who did not start the programme after being referred to it. As a sensitivity check, we estimate programme effects by comparing the outcome of participants with a comparison group created from a sample of individuals that were claiming UC-IWS but were never referred to the scheme. Details of the analysis can be found in Appendix E.

The analysis shows that those who were never referred to the scheme are less similar to participants than those who were referred but did not start. Results show larger impact effects when using the non-referred sample (4.9 pp higher payrolled employment rate at year 2). This difference we believe is attributable to there being unobserved variables which affect the referral process – supported by a further PSM analysis which showed a difference of 5 pp in the payrolled employment rate at year 2 between those who were referred but did not start and the non-referred group, even after controlling for all the observed factors.

5.4. Contemporaneous employment support

As mentioned earlier, JETS co-existed with other contracted employment schemes. This means that both participants and non-participants could have started alternative and/or additional employment support during the period of observation.

While impact estimates capture the effect of participating in JETS, this effect is influenced by the decision among individuals in our sample to start other provisions. For instance, those who were referred to JETS but did not start the provision could have done so to start another programme. This would result in an underestimation of JETS ability at creating additional employment. Similarly, those who started JETS and were unsuccessful at finding employment could have benefited from additional employment support following JETS. This would overestimate JETS ability (in isolation) of increasing employment prospects among participants.

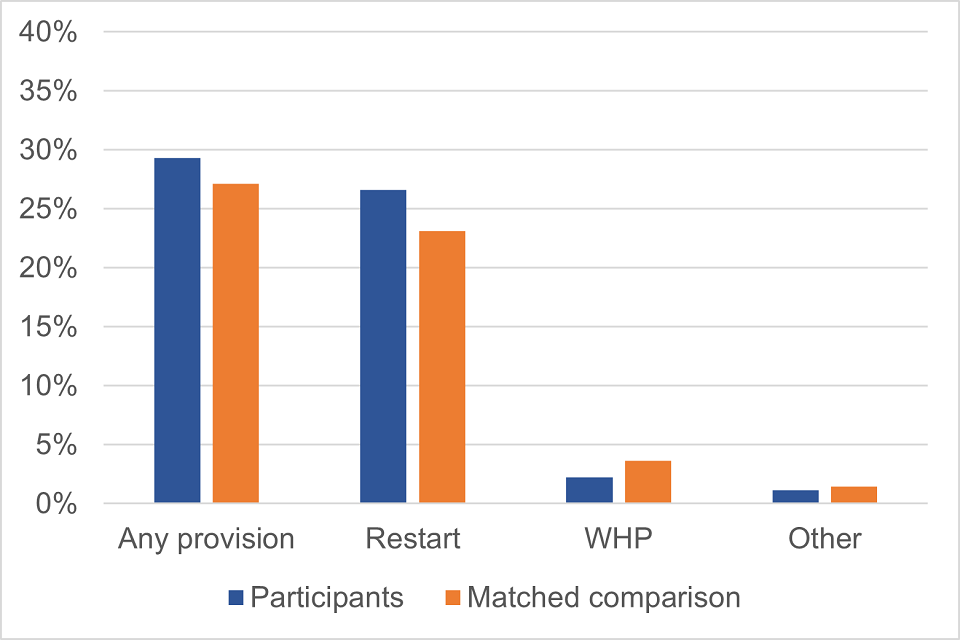

Figure 5.7 shows that 29.3% of JETS participants and 27.1% of matched non‑participants (the comparison group) started other employment support in the 2 years following referral to JETS. These figures are primarily driven by the share of individuals starting Restart across groups (26.6% vs 23.1% in the participant and comparison group, respectively). On the other hand, a higher proportion of individuals in the comparison group started the WHP (1.4 pp higher participation relative to the participant group). The Other smaller combined category comprises participation in the IPES, ESF, JFS, and NEA Phase 2 programmes (described in Section 1.5 of the report).[footnote 24]

Figure 5.7: Starts in other contracted provisions within 2 years following referral to JETS

Ultimately, the effect of participation in other provisions on the JETS impact estimates will depend on how successful these other programmes are at increasing employment among participants. Given the relatively small difference in participation rates in other programmes across JETS participants and the comparison group (2.2 pp difference), we expect a marginal effect of contemporaneous programmes on the JETS impact estimates.

5.5. Programme effects by population groups

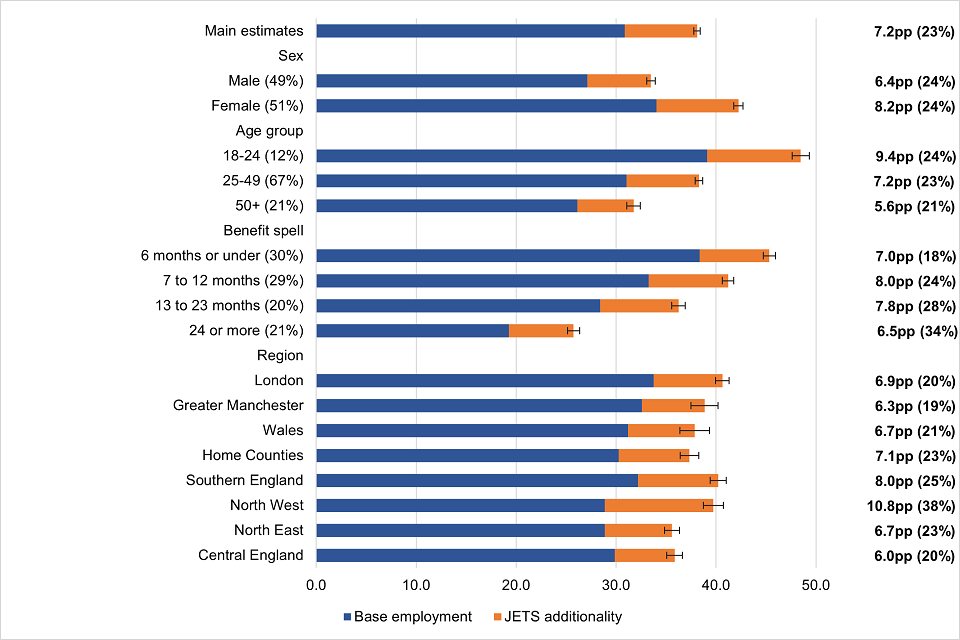

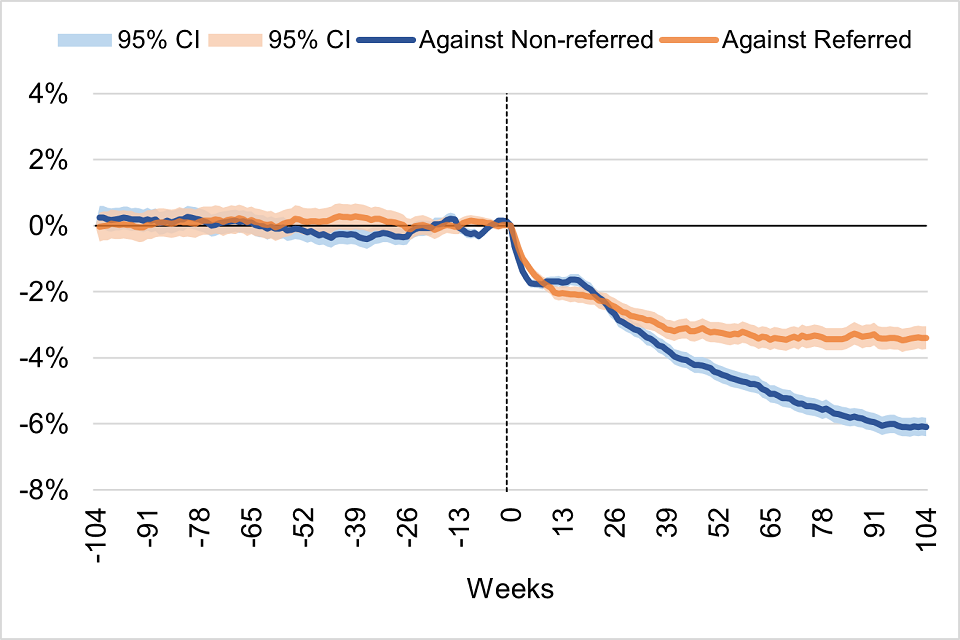

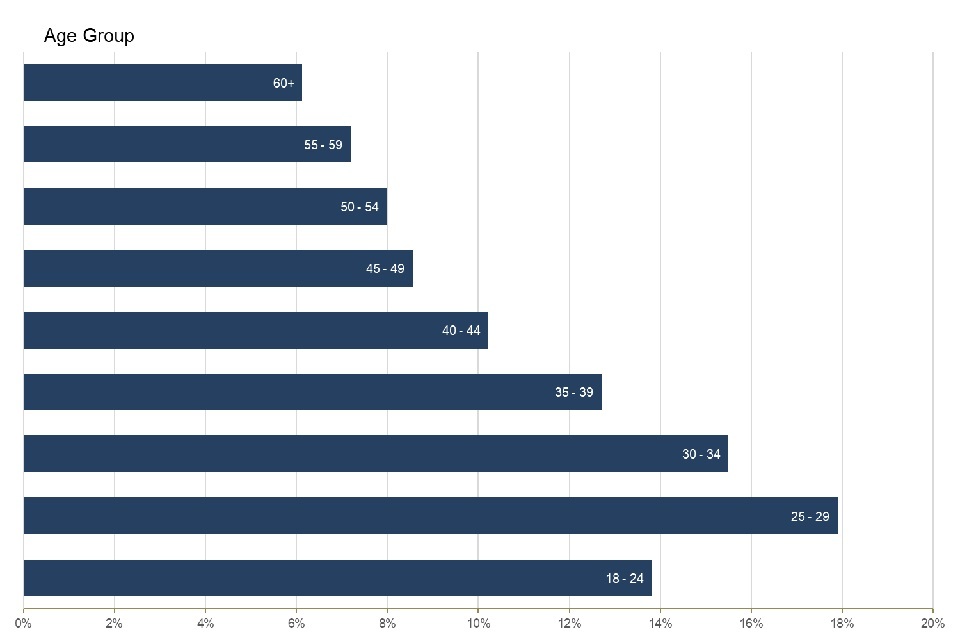

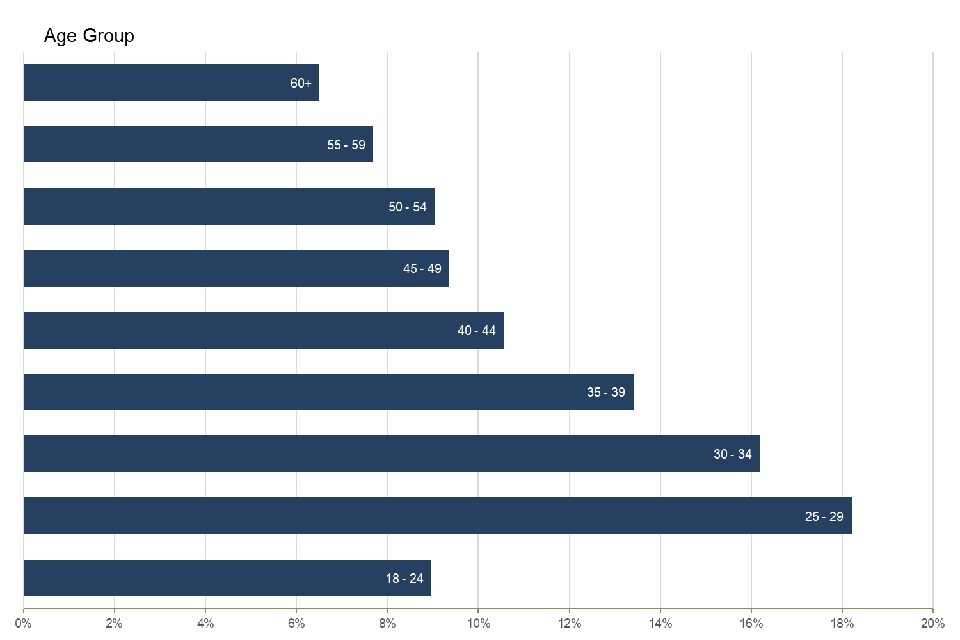

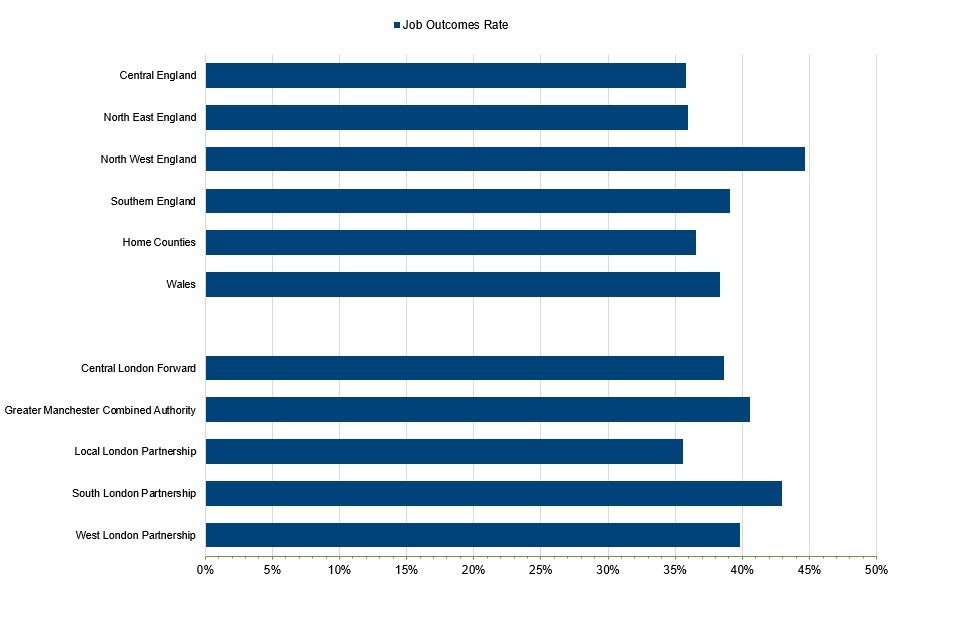

This section provides a closer assessment to the effect that participation in JETS had on different population groups. More specifically, Figure 5.8 displays the additionality in payrolled employment over the 2 years following referral split by sex, age, time on out-of-work benefits and regions.[footnote 25]

Results show a higher effect from programme participation among females than males (8.2 pp versus 6.4 pp in additional payrolled employment, statistically and significantly different at the 1% level). The analysis of programme effects by age group shows a clear gradient, with JETS increasing the payrolled employment rate by 9.4 pp among those aged 18 to 24, by 7.2 pp among the 25 to 49 age group, and by 5.6 pp among those aged 50 or more (all differences between groups statistically significant at the 1% level).

Assessing employment effects by the duration of the most recent out-of-work benefit spell, Figure 5.8 shows the highest impact among those who were between 7 to 12 consecutive months on out-of-work benefits at the point of referral (8.0 pp). On the other hand, the lowest impact is estimated for those with a benefit spell of 24 months or higher.[footnote 26]

The analysis shows that JETS had a positive impact in all regions. The highest impact was in the North West (10.8 pp) and the lowest impact was in Central England (6.0 pp). The difference in impact between these regions and the aggregate effect for England and Wales is statistically significant at the 1% level. Except for Southern England (with an estimated employment additionality of 8.0 pp – statistically and significantly different to the overall effect at the 10% level) participants across all the other regions experienced similar positive employment effects. There are many factors that might affect these regional findings, including differences in the characteristics of participants and non-participants across regions, varying levels of alternative employment support, and/or differences in the evolution of local labour markets, among others.

Figure 5.8: Impact effects by sub-population groups: Proportion in payrolled employment over 2 years after programme start

Figure 5.8 shows the percentage point additionality in payrolled employment over 2 years from participating in JETS and for different sub-population groups. By sex: males (6.4 pp), females (8.2 pp); by age groups: 18 to 24 (9.4 pp), 25 to 49 (7.2 pp), 50+ (5.6 pp); by the duration of the most recent benefit spell: 6 months or under (7.0 pp), 7 to 12 months (8.0 pp), 13 to 23 months (7.8 pp), 24 or more (6.5 pp); by region: London (6.9 pp), Greater Manchester (6.3 pp), Wales (6.7 pp), Home Counties (7.1 pp), Southern England (8.0 pp), North West (10.8 pp), North East (6.7 pp), Central England (6.0 pp).

Note: Estimates are derived by conducting a separate PSM analysis for each subgroup. Base employment shows the level of employment of the matched comparison group. JETS additionality shows the percentage point difference between the level of employment among JETS participants and the matched comparison group. The percentage increase (%) in the employment level is displayed in brackets.

The findings from this exercise would suggest that the type of employment support offered by JETS is particularly beneficial among young claimants, who might be relatively new to the labour market and/or might have had less time to develop relevant skills. If we consider that spells of unemployment early in life can have long-lasting consequences, intervening in this group would seem particularly advantageous.

Similarly, females seem to have disproportionately benefited more from the support offered by JETS than males. This could signal increased barriers to employment experienced among this group (for instance, due to a reduced network, information, or relevant contacts in the job search; or due to a higher level of caring responsibilities, among others).

An assessment of programme effects by the duration of the most recent out-of-work benefit spell shows that, while the payrolled employment rate increased by 6.5 pp among the group with the longest out-of-work benefit spell (the lowest of all groups) this represents a 34% increase (from 19.3 pp to 25.8 pp), the highest of all benefit duration groups.

6. Cost Benefit Analysis

This section presents the Cost Benefit Analysis (CBA) of JETS (Job Entry Targeted Support), where the benefits derived from increased employment among participants are compared against the cost of the scheme.

6.1. CBA Methodology

We perform the analysis following the guidance set out in the Green Book – issued by HM Treasury on how to appraise policies, programmes, and projects – and using the DWP Social Cost Benefit Analysis (SCBA) framework as set out by Fujiwara (2010). This is a recognised piece of supplementary guidance to the Green Book which has been scrutinised and approved for use within DWP – other departments each have their own standard methodology. This framework is consistent with previous DWP impact evaluations and with the development of departmental business cases.[footnote 27] The following sections outline how this approach was applied to JETS, whose perspectives are being considered, which costs and benefits are included and the scale of these.

This framework, however, excludes a number of costs and benefits where it was not possible to obtain robust evidence, for example, the additional childcare costs incurred both by participants after entering employment and by the exchequer/DWP in the form of increased UC childcare allowance. Further details on the limitations of the adopted methodology are also discussed.

6.1.1. Perspectives under consideration

The costs and benefits are considered from the perspectives of:

- The JETS participant

- The Employer

- The Exchequer

- Society

- The Department for Work and Pensions (DWP)

The JETS participant perspective primarily considers the individual changes in wages and benefits received by those on the programme. The employer perspective considers the increase in economic output produced by employees and the increase in wages and national insurance contributions paid by the employer. In this CBA, the costs and benefits for the employer are always equal, as there are no employer subsidies or additional costs to the employer, meaning the benefit-cost ratio is always £1. The Exchequer – or government budget perspective – includes the benefits and costs accruing to the DWP in addition to other fiscal benefits like income tax receipts.

The society perspective represents the net impact from the other perspectives, with society representing an aggregate of all British citizens. When all perspectives are considered, some elements cancel out as they represent an equal benefit and cost from two different perspectives, such as wages (benefit for participants, cost for employers) and income tax (cost for participants, benefit for the exchequer).[footnote 28]

The DWP perspective considers reductions in benefits payments departmental operational costs, and the cost of running the programme. These form part of the costs and benefits for the exchequer, and so these perspectives are not mutually exclusive.

Different costs and benefits are considered for each of these perspectives, and cost benefit ratios can be calculated based on estimates of these. The cost benefit ratio represents the value returned for each £1 of cost incurred.

The main driver of the estimated costs and benefits are the impact results, i.e. the number of additional days spent in employment as a result of participation in the programme. As impact estimates carry some degree of uncertainty and programme benefits are subject to model assumptions, we further perform a sensitivity analysis on the value for money of the scheme.

6.1.2. Costs and benefits under consideration

The different monetised costs and benefits from the JETS scheme included in the CBA are detailed below and summarised in Table 6.1. The sign in Table 6.1 shows whether a specific element is considered a cost or a benefit (or has a null effect) depending on the perspective under consideration.

Table 6.1: Monetised costs and benefits of JETS

| Impact | Participants | Employer | Exchequer | Society | DWP | |

|---|---|---|---|---|---|---|

| Increase in economic output | 0 | + | 0 | + | 0 | |

| Increase in wages | + | - | 0 | 0 | 0 | |

| Programme costs | 0 | 0 | - | - | - | |

| Reduction in operational costs | 0 | 0 | + | + | + | |

| Reduction in benefits payments | - | 0 | + | 0 | + | |

| Increase in taxes | - | - | + | 0 | 0 | |

| Increase in travel costs | - | 0 | 0 | - | 0 | |

| Redistributive costs and benefits | + | 0 | 0 | + | 0 | |

| Monetised change in quality of life | + | 0 | 0 | + | 0 |

Increase in output

This refers to the economic output produced by participants because of additional time spent in employment. This output represents a benefit to employers (who sell it) and society (who consume it). As we do not have information on the value of this output we make the simplifying assumptions below.

The labour market is assumed to be perfectly competitive. This implies that employers will hire workers up to the point where the value of an additional unit of output is equal to the associated marginal cost of production. The cost of production, and therefore the value of the output produced during additional spells in employment, is assumed to equal the commensurate gross wage payments and employers’ National Insurance contributions (NICs).

Increase in wages

This refers to the gross wages received by participants from additional time spent in employment. This is a benefit to the participants and an equal cost to their employers. From the society’s perspective there is no net benefit or cost, only a redistribution of resources. The increase in wages is calculated by taking the median weekly gross earnings among those participants in employment over the two-year tracking period (reported in the PAYE-RTI dataset).

Programme costs

As set out in section 1, JETS operated under a Cost-plus model – paying 5% on top of the average cost of administering the programme per participant. The programme’s cost to the Exchequer is calculated at £823 per participant and is obtained through a weighted average of the service fee paid in the different areas (different providers) and the volumes each area supported.

Reduction in operational costs

Higher employment level and lower benefit receipt among JETS participants translates to a lower need of support from Jobcentre Plus advisers and other DWP employment programmes. This translates into operational savings which represent a benefit to the Exchequer and society – as economic resources can be reallocated to alternative uses.

Reduction in benefits

This refers to the net reduction in benefit entitlement and take-up that occurs when participants spend additional time in employment following participation on the JETS programme. This is treated as a transfer payment, representing a cost to participants but a benefit to the Exchequer – which means there is a null net cost or benefit to the Society (except via redistributive effects). Changes in benefit entitlement and take-up are estimated using the DWP Policy Simulation Model.[footnote 29]

Increase in taxes

This refers to the increase in income tax, National Insurance and indirect tax revenue that occurs when participants spend additional time in employment as a result of participation in JETS. This represents a benefit to the Exchequer but a cost to participants and employers, which means there is no net cost or benefit to society (except via redistributive effects). Increases in tax revenue are estimated based on the increase in wages.

Increase in travel costs

This refers to the additional travel costs that are incurred by:

- Participants: as a result of increased employment following participation in JETS.

- The society: as the provision of additional travel services diverts economic resources from alternative uses. Moreover, there is an additional social cost from increased travelling due to, for instance, congestion or pollution.

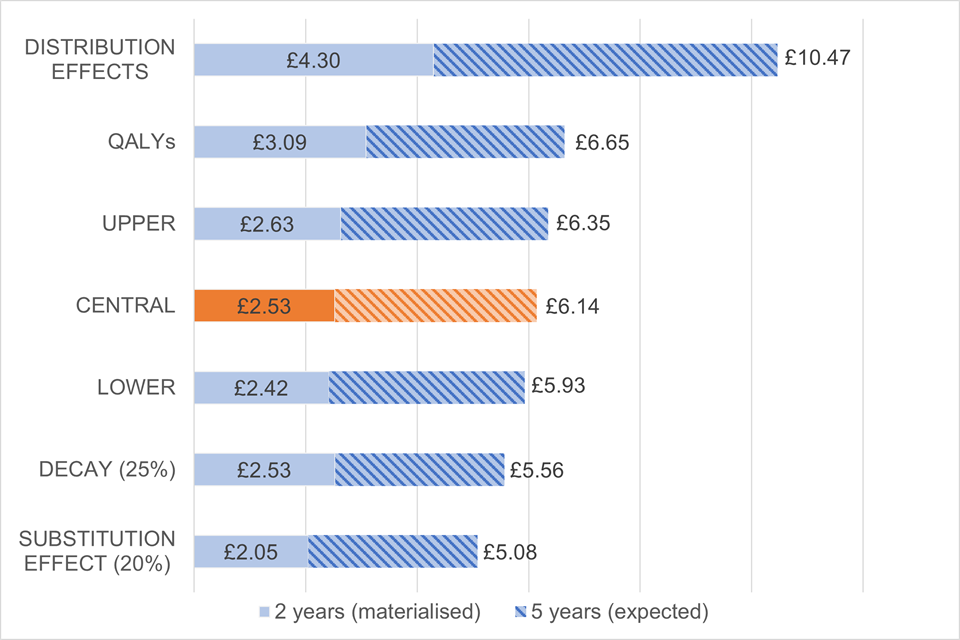

Redistributive costs and benefits

This refers to the redistributive costs and benefits associated with monetary transfers between participants, employers, and the Exchequer. In line with the methodology prescribed in the HM Treasury Green Book (HM Treasury, 2022), participants, who have relatively low incomes, are assumed to attach a higher value to each additional pound than the average taxpayer (with a relatively higher income). This assumption is based on the economic principle of the diminishing marginal utility of income. In other words, individuals on lower incomes value an additional pound more than wealthier individuals. This implies that monetary transfers from the Exchequer to JETS participants represent a benefit to society as a whole.

Redistributive effects in this report are considered as part of the sensitivity analysis, not the main results. In line with the recommendations of Fujiwara (2010) – and as previously applied in the Universal Credit Business Case [footnote 30] – redistributive costs and benefits are estimated by applying a ‘welfare weight’ to monetary transfers made to and from programme participants. The welfare weight applied depends on the equivalised household income quintile of the participant before they start the programme, though most JETS participants will begin in the lowest income quintile. We know that participants are unemployed at the point of referral and that their median earnings from employment are 0. We also assume that participants don’t receive any non-employment income other than Universal Credit, and that partner earnings (where applicable) are 0.[footnote 31]

Monetised change in quality of life

This captures the change in physical and mental wellbeing as a result of being in employment. These health outcomes are estimated using quality-adjusted life years (QALYs) – which combine longevity and level of health into a single measure – with 1 QALY representing a year in perfect health. The Department of Health estimates that a QALY has a monetised value of £70,000 in 2020/21 prices.[footnote 32] Schuring et al. (2010) estimates the QALY gains associated with returning to employment at 0.068, which gives a monetised value of £4,760 (£70,000×0.068). The monetised QALY gain is attributed to the year in which an individual returns to employment. As JETS increased by 10.3 pp the proportion of individuals returning to employment (see Table 5.1 in section 5), we use that estimate to determine the QALY gain that can be attributed to the programme.[footnote 33] For our example, this results in a monetised QALY gain of £490 per participant.

This represents a benefit to the participant and society and is included in the CBA only as part of the sensitivity analysis, not the main results.

6.1.3. Estimating the scale of the benefits under consideration

The scale of the costs and benefits of JETS depends on the magnitude and the duration of its impacts. In this case, the impacts are measured as the average number of additional days participants spent in employment relative to a similar group of non-participants. These additional days are derived in Section 5 of the report.

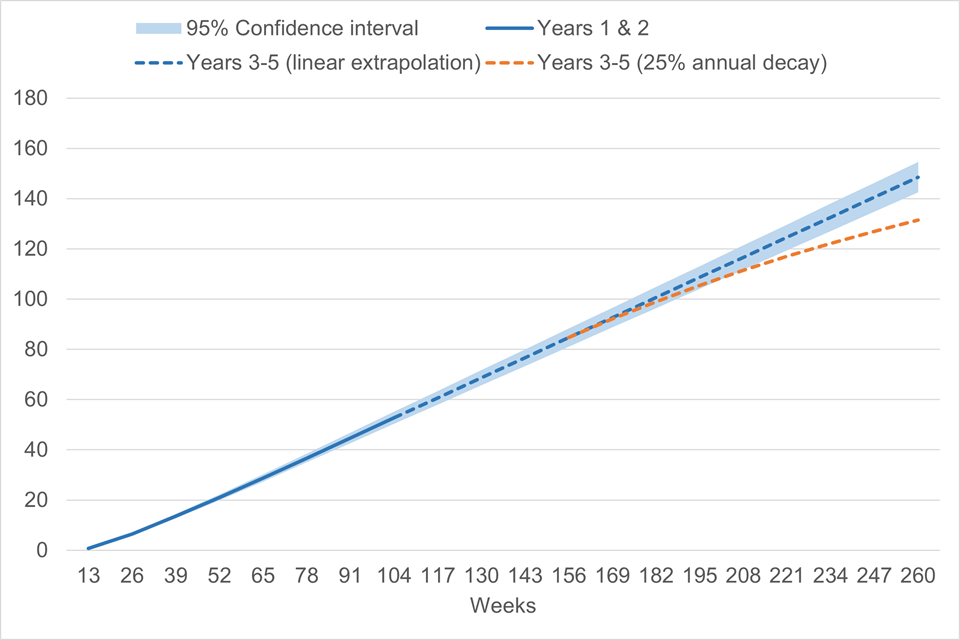

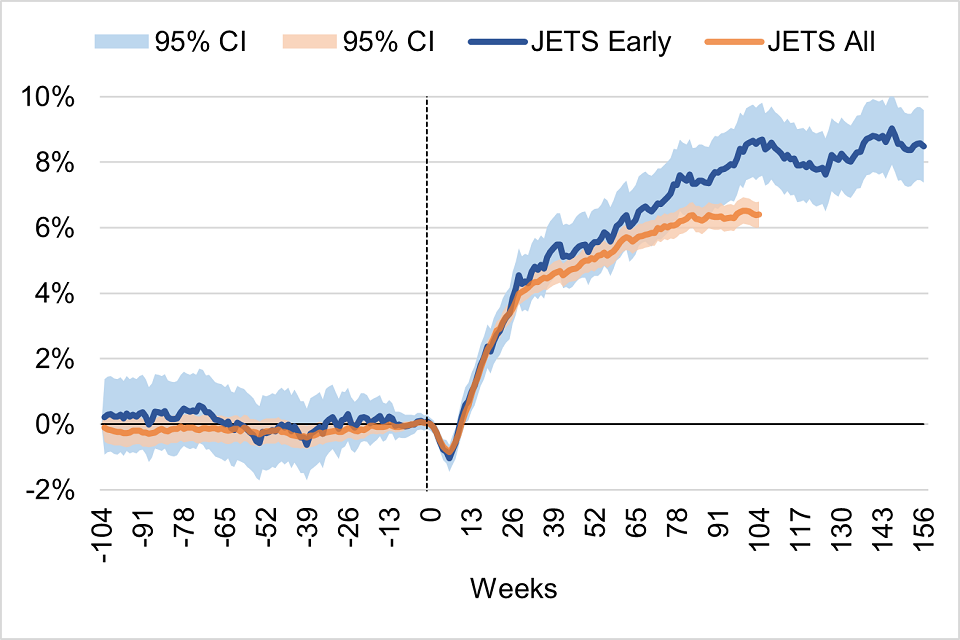

The main tracking period in this study covers two years from the point of referral, though we also estimate programme effects over three years for an early group of participants (Early cohort). Figure 5.5 shows sustained employment effects beyond year 2 for the Early cohort with no signs of impact decay. As a result, our baseline assumption when extrapolating programme effects is that employment additionality will follow the trend observed during the first 2 years of follow-up. As future effects from programme participation are uncertain, we also perform, as a sensitivity, a conservative extrapolation that assumes impact decays at an annualised rate of 25% between years 3 and 5 – after which employment additionality is assumed to be zero.[footnote 34]

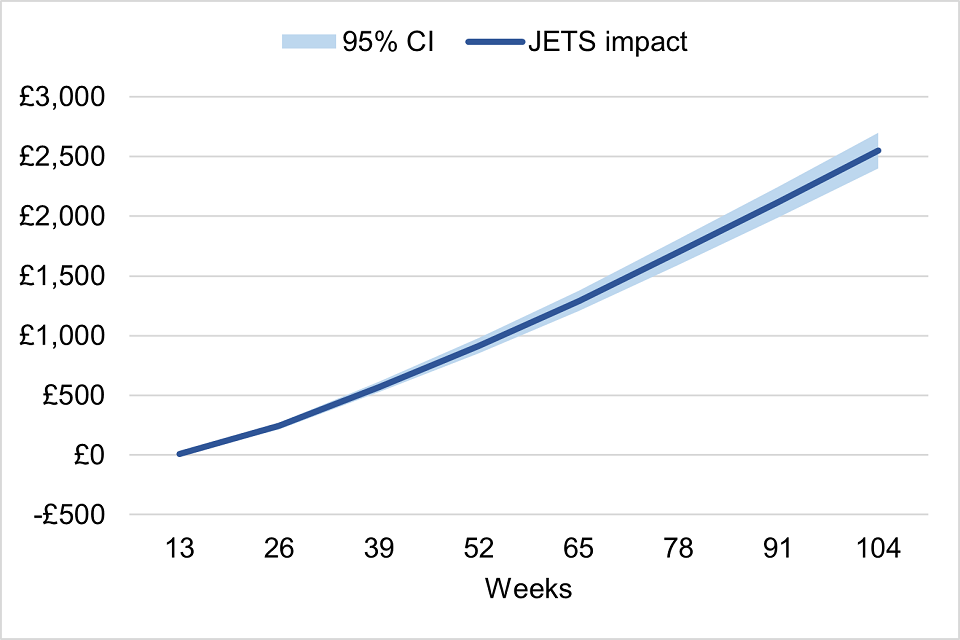

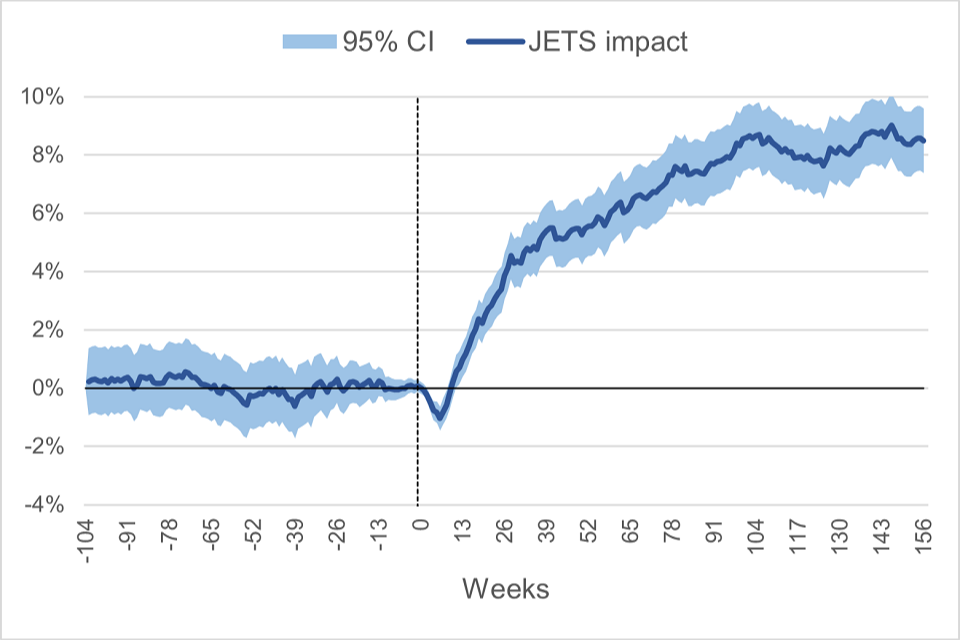

Figure 6.1: Actual and extrapolated cumulative additional days in employment

Figure 6.1 shows the evolution in the estimated and extrapolated cumulative additional days in employment from participating in JETS. At week 104 after referral, the cumulative additional days in employment are estimated at 52.7. A linear extrapolation of the observed effects shows 148.5 days of cumulative additional employment after 5 years. An extrapolation that assumes a 25% annualized decay of the impact shows 131.5 days of cumulative additional employment after 5 years. Confidence intervals at the 95% level are displayed for the estimated effects and for the linear extrapolation.

Table 6.2: Cumulative average additional days in employment in each year following referral to JETS

| Central | Lower bound (95% confidence interval) | Upper bound (95% confidence interval) | 25% annualised decay | |

|---|---|---|---|---|

| Year 1 | 21.1 | 19.9 | 22.2 | 21.1 |

| Year 2 | 52.7 | 50.3 | 55.1 | 52.7 |

| Year 3 | 84.7 | 81.0 | 88.3 | 84.7 |

| Year 4 | 116.6 | 111.8 | 121.4 | 111.4 |

| Year 5 | 148.5 | 142.5 | 154.6 | 131.5 |

Note: Additional days in employment at Year 1 and Year 2 are derived from Propensity Score Matching (PSM) impact estimates. Additional days in Years 3 to Year 5 are extrapolated using the impact estimates.

Table 6.3: In-year average additional days in employment in each year following referral to JETS

| Central | Lower bound (95% confidence interval) | Upper bound (95% confidence interval) | 25% annualised decay | |

|---|---|---|---|---|

| Year 1 | 21.1 | 19.9 | 22.2 | 21.1 |

| Year 2 | 31.6 | 30.4 | 32.9 | 31.6 |

| Year 3 | 31.9 | 30.7 | 33.2 | 31.9 |

| Year 4 | 31.9 | 30.7 | 33.2 | 26.8 |

| Year 5 | 31.9 | 30.7 | 33.2 | 20.1 |

Note: Additional days in employment at Year 1 and Year 2 are derived from Propensity Score Matching (PSM) impact estimates. Additional days in Years 3 to Year 5 are extrapolated using the impact estimates.

6.1.4. Limitations of this approach

The CBA estimates are subject to the same level of uncertainty as the impact estimates and the underlying model assumptions used to generate these. In addition, the assumptions underpinning the methodology of the CBA described earlier in this section directly affect the magnitude of the estimated results.

The CBA under this framework excludes some potentially significant costs and benefits where robust evidence is lacking. Any interpretation of the CBA estimates should consider these missing costs and benefits. These include:

- Additional leisure time foregone by participants.

- Non-pecuniary benefits associated with additional time in unsubsidised employment.

- The economic multiplier effect of the programme.

- Potential reduction in crime because of movement into employment.

See Fujiwara (2010) for a more detailed discussion of the non-monetised costs and benefits of employment programmes.

6.2. Findings of cost benefit analysis

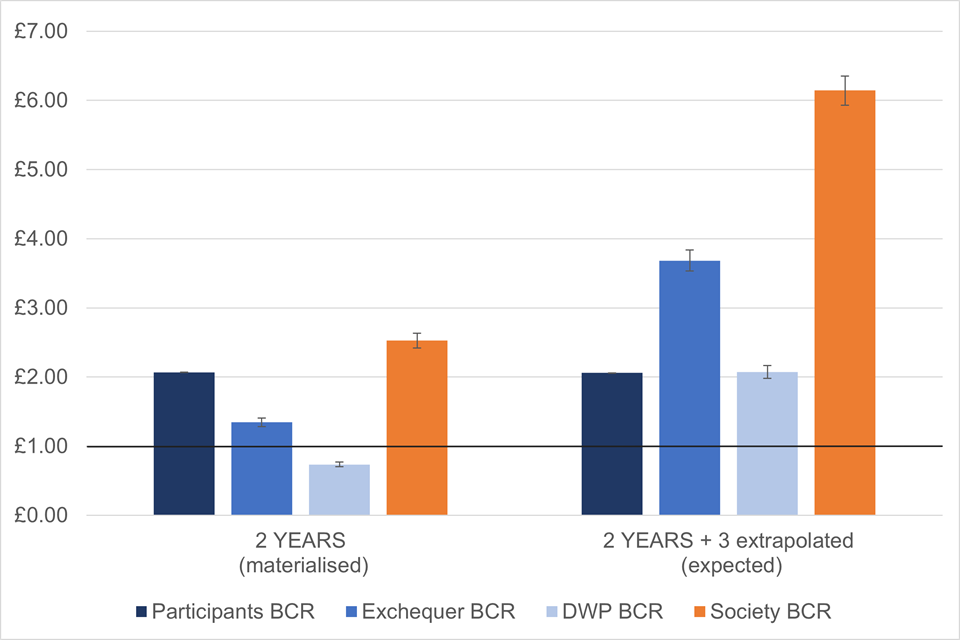

This section presents the estimated benefit-cost ratios (BCRs) of the JETS programme.

Baseline scenario estimates of the central impact with upper and lower bounds are presented first; at both the 2-year (materialised) and 5-year (expected) points. This is followed by a sensitivity analysis where varying options and assumptions are considered. BCRs are based on costs and benefits expressed in 2021/22 prices.

6.2.1. Baseline estimates

Table 6.4 below lists the BCRs from each perspective using the central, lower, and upper bound estimates of additional days in employment.

Table 6.4: Baseline benefit-cost ratios

| Participant | DWP | Exchequer | Society | |

|---|---|---|---|---|

| 2 years (materialised): Central | £2.07 | £0.73 | £1.34 | £2.53 |

| 2 years (materialised): Lower | £2.07 | £0.70 | £1.28 | £2.42 |

| 2 years (materialised): Upper | £2.07 | £0.77 | £1.41 | £2.63 |

| 2 years + 3 extrapolated (expected): Central | £2.06 | £2.07 | £3.68 | £6.14 |

| 2 years + 3 extrapolated (expected): Lower | £2.06 | £1.98 | £3.53 | £5.93 |

| 2 years + 3 extrapolated (expected): Upper | £2.06 | £2.17 | £3.83 | £6.35 |

These results are presented graphically in Figure 6.2, with the error bars representing the BCRs under the lower and upper bound impact estimates. These are based on the uncertainty underpinning the estimation of the impact results, as well as the following:

- The value of output produced through participation in JETS is equal to the commensurate gross wage payments and employers’ national insurance contributions.

- JETS does not result in redistributive costs or benefits, substitution effects, or a social cost to the Exchequer (distribution and substitution effects are considered in the sensitivity analysis).

Figure 6.2: Baseline benefit-cost ratios

As noted previously, the reliability of the CBA is dependent on the robustness of the impact estimates as well as the assumptions used in the CBA modelling. Furthermore, the ‘expected’ view includes 3 years of extrapolated data – impact estimates are more uncertain the further into the future projections are made.