Policy equality statement (social security co-ordination)

Updated 21 December 2018

1. Policy background

An Immigration Bill was announced in the Queen’s Speech on 21 June 2017 as one of the bills needed to ensure that the UK can make a success of withdrawing from the European Union (EU).

We need the Immigration and Social Security Co-ordination (EU Withdrawal) Bill (“the Bill”) to end the EU’s rules on free movement of persons into the UK and other retained EU law on immigration which will have been saved in UK law by the European Union (Withdrawal) Act 2018 (“EU (Withdrawal) Act”). Without the Bill, EU, European Economic Area (EEA) and Swiss nationals (hereafter referred to collectively as EEA nationals) would be able to continue to live and work in the UK in accordance with the retained EU law on free movement as it is saved on exit day.

As well as ending EU free movement, the Bill makes EEA nationals and their family members subject to UK immigration controls. This means they will require permission to enter and remain in the UK under the Immigration Act 1971. The Bill will deliver the legal framework for the future immigration system. It does not set out the details of the future immigration system because we will set out the details (i.e. the requirements to be met to come to the UK as a worker, student, family member, etc.) in the Immigration Rules and secondary legislation as we do now for non-EEA nationals who are subject to immigration control. These Rules will be designed to meet UK objectives, command the confidence of the public and reflect the wider economic, social and political context and any agreement we reach with the EU or other countries.

The Bill also includes a provision allowing the Government to modify retained EU law relating to social security co-ordination. This retained law governs the co-ordination of social security between Member States and contains rules relating to individuals whose social security situation is not confined to a single Member State. This includes rules relating to the payment of social security contributions and access to benefits (including export and aggregation) across the EEA by EEA nationals, Swiss nationals and in some cases third country nationals. The power in this Bill will allow post-Exit policy changes to be made to the social security co-ordination regime which has been retained, and fixed, under the EU (Withdrawal) Act. Detailed policy arrangements are yet to be determined, therefore it is difficult to assess the impacts of provisions in the Bill in a meaningful way. Equality considerations, including the public sector equality duty, are being considered more widely throughout the policy development and any policy changes which may be considered under secondary legislation will result in an updated Equalities Analysis.

The Bill will provide the legislative framework for the future, post EU Exit immigration system by enabling UK immigration laws to be applied to EEA nationals and their family members. The detailed policies under the new system will be contained in Immigration Rules and secondary legislation after the UK exits the EU. Equalities considerations, including the public sector equality duty, are being considered more widely throughout the development of the future immigration system and further Policy Equality Statements, or equivalent, will be prepared as proposals are finalised.

During the period between EU Exit and the implementation of the future immigration system, measures will be in place to ensure a smooth transition to the new system. This includes ensuring that EEA nationals and their family members who were in the UK before EU Exit can remain in the UK.

The EU Settlement Scheme enables EU citizens and their family member’s resident in the UK before a specified date to apply for leave under the Immigration Act 1971. This is part of our ongoing preparations for leaving the EU and bringing EEA nationals into the UK immigration system. The impact of the EU Settlement Scheme on people with protected characteristics has been evaluated in line with the public sector equality duty and remains under consideration throughout the scheme’s implementation.

1.1 Policy proposals contained in the Bill

Upon EU Exit, the Immigration and Social Security Co-ordination (EU Withdrawal) Bill will enable us to:

- repeal principal retained EU law relating to free movement and immigration;

- apply UK immigration laws to nationals of the EU, European Economic Area (EEA) and Switzerland following the end of free movement in the UK; and

- protect the position of Irish citizens in UK immigration law once their EU free movement rights end; and

- modify the rules governing social security co-ordination (as retained in UK law by the EU (Withdrawal) Act)

1.2 Repeal of principal retained EU law relating to free movement

The EU (Withdrawal) Act provides for the retention of EU law relating to free movement as UK law following EU Exit. The Bill will repeal the key free movement provisions and end the operation in the UK of EU rules on free movement. This means that when the UK exits the EU, the UK Government will be able to set UK Immigration Rules for EEA nationals and their family members. The Bill removes the exemption from UK immigration control which currently applies to EEA nationals and their family members and requires them to apply for permission to enter and remain under the Immigration Act 1971.

Through the Bill’s provisions, certain directly effective EU rights, for example, those relating to the Swiss free movement agreement, cease to be recognised in domestic law. To the extent that directly effective EU rights are not expressly ended for domestic purposes, such as the right to provide services, which derives from Article 56 of the Treaty of the Functioning of the EU, are misapplied insofar as they are inconsistent with the UK’s immigration law.

1.3 Irish citizens: entitlement to enter or remain without leave

The Bill protects the status of Irish citizens in the UK which existed prior to the UK’s membership of the EU once free movement rights end. Since the 1920s British and Irish citizens have enjoyed a ‘special status’ in each other’s State, distinct from that later enjoyed as a consequence of EU citizenship. Section 2(1) of the Ireland Act 1949 declares that “…notwithstanding that the Republic of Ireland is not part of [Her] Majesty’s dominions, the Republic of Ireland is not a foreign country for the purposes of any law in force in any part of the UK…”. The fundamental provisions for the immigration status of Irish citizens in the UK are provided for in the Immigration Act 1971, but these provisions only cover Irish citizens who enter the UK from within the Common Travel Area (CTA); Irish citizens arriving from outside the CTA currently enter the UK under EU free movement law. The Bill will rectify this disparity and protect the special status of Irish citizens when free movement rights end, irrespective of from where they have entered the UK. This means that Irish citizens will continue to be free to enter and remain in the UK without restriction unless they are subject to a deportation order, exclusion order or international travel ban. This status is consistent with the commitments in the Belfast (‘Good Friday’) Agreement in relation to citizenship and identity.

1.4 Consequential, transitional and savings provisions

The Bill includes powers to enable the Secretary of State to make to make consequential, transitional and savings provisions in respect of ending free movement.

1.5 Social security co-ordination

The Bill creates powers to modify retained EU law in relation to social security co-ordination. It allows the Government (and/or, where appropriate, a devolved authority) to modify the retained rules, as appropriate, and gives the government flexibility to respond to various post-Exit scenarios that might arise. This clause also provides for the disapplication of directly effective rights, which have been saved by section 4 of the EU (Withdrawal) Act, to the extent that they conflict with the exercise of this power.

Consequential, transitional and savings provisions (in relation to social security co-ordination)

The Bill includes powers to enable the Government (and/or a devolved authority where appropriate) to make to make consequential, transitional and savings provisions to primary legislation and other retained direct EU legislation which is not listed in the clause. This will allow the Government (and/or, where appropriate, a devolved authority) to ensure that changes made to the retained social security co-ordination regime can be reflected across the complex range of domestic primary and secondary legislation which governs this area.

2. Summary of the evidence considered in demonstrating due regard to the Public Sector Equality Duty

This Policy Equality Statement (PES) focuses on the Social Security Co-ordination part of the Bill. For equalities analysis on the other provisions within the Bill, please see the separate Home Office PES.

The Migration Advisory Committee report on the economic and social impacts of the UK’s exit from the EU has been considered throughout our assessment on any impacts. In addition, the Department for Work and Pensions (DWP) and HM Revenue and Customs (HMRC) administrative data sources have been used to examine and assess the demographics, where available, of those who currently export a benefit to the EEA. Given the demographic differences between claimants of different benefit types, the analysis is presented in three groups:

- those in receipt of UK State Pension (SP)

- those in receipt of other DWP benefits, for example Employment and Support Allowance (ESA)

- those in receipt of HMRC benefits (Child Tax Credits and Child Benefit)

Further analysis and breakdowns are presented in Annex 1 and for more information on the data sources and the methodologies used, please see Annex 2. As further data and policy details becomes available, we will look to update the PES.

3. The public sector equality duty under s149 of the Equality Act 2010 requires that in exercising their functions public authorities must have due regard to the need to:

- eliminate discrimination, harassment, victimisation and any other conduct prohibited by the Act;

- advance equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it; and

- foster good relations between persons who share a relevant protected characteristic and persons who do not share it

3.1 Consideration of limb 1 of the duty: Eliminate unlawful discrimination, harassment, victimisation and any other conduct prohibited by the Equality Act

Under s149, the eight specified protected characteristics are age; disability; gender reassignment; pregnancy and maternity; race (including ethnic or national origins, colour or nationality); religion or belief; sex; and sexual orientation.

Schedule 18 to the 2010 Act sets out exceptions to the public sector equality duty. In relation to the exercise of immigration and nationality functions, s149(1)(b) – advance equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it – does not apply to the protected characteristics of age, race (insofar as it relates to nationality or ethnic or national origins) or religion or belief. It is worth noting that much of the legislative framework provided by the Bill already applies to non-EEA nationals. To that extent, the Bill will align the treatment of EEA nationals and non-EEA nationals insofar as they will need permission to enter and remain in the UK, and therefore any discrimination arising from this is likely to be indirect discrimination.

The following sub-section looks at the impact of the provision which takes a power allowing modifications to be made to the social security co-ordination regulations (as retained by the EU (Withdrawal) Act) to deliver post-Exit policy changes. At this point in time we are unable to make any detailed analysis on the impact of these policies on particular groups because we do not know what the final policy will be.

Gender

Analysis shows that a greater proportion of women (54%) are in receipt of a State Pension in the EU compared to men (46%) whereas there are significantly more men (72%) exporting HMRC benefits such as Child Benefit. This suggests that women may be more likely to be affected by any future policy change to pension-age benefits. Men however, may be more affected by any future policy change to HMRC working-age benefits, although this benefit may be exported for the child/mother in another Member State; therefore could affect both genders equally. The social security co-ordination clause is an enabling power, allowing changes to be made to the retained regime via secondary legislation. Policy changes will be set out in the regulations that will follow, and will be affected by the context in which the power is exercised. Until that time, the impact of this provision cannot be known, therefore further equality analysis will be considered in due course.

Age

Analysis shows that the largest proportion of overseas recipients of other DWP benefits fall in the age bracket of ’45-54’ and ’60 and over’. For HMRC benefits, most recipients were of working age, with over 50% being in the ‘35-44’ age-band. This suggests that those in the age band ‘35-44’ may be more affected by any future policy change to HMRC benefits with relatively older claimants being impacted by any changes to DWP benefits. The social security co-ordination clause is an enabling power, allowing changes to be made to the retained regime via secondary legislation. Policy changes will be set out in the regulations that will follow, and will be affected by the context in which the power is exercised. Until that time, the impact of this provision cannot be known, therefore further equality analysis will be considered in due course.

Sexual orientation

The DWP/HMRC does not hold information on its administrative systems on the sexual orientation of claimants. We do not envisage an adverse impact on these grounds.

Pregnancy and maternity

The DWP/HMRC only holds information on pregnancy and maternity on its administrative systems where it is the primary reason for incapacity. It cannot therefore be used to accurately assess the equality impacts. We do not envisage an adverse impact on these grounds.

Religion or belief

The DWP/HMRC does not hold breakdowns on religion or belief for claimants. We do not envisage an adverse impact on these grounds.

Ethnicity

The DWP/HMRC does not hold available information on its administrative systems on the ethnicity of all benefit claimants. We do not envisage an adverse impact on these grounds.

Gender reassignment

The DWP/HMRC does not hold information on its administrative systems on transgender persons. The Department has endeavored to ensure that customers will be treated in the same way, regardless of whether they have undergone gender re-assignment. Therefore we do not envisage an adverse impact on these grounds

Marriage and Civil Partnership

The DWP/HMRC does not hold available information on its administrative systems on the marital or civil partnership status of claimants. We do not envisage an adverse impact on these grounds.

Disability

The DWP/HMRC cannot identify across all benefits those with a disability according to the Equality Act 2010 definition using administrative data. The DWP can estimate how many are in receipt of a disability-related benefit. Very few claimants are in receipt of disability-related benefits in the EU, for example 8,000 in receipt of DLA/PIP/AA and 6,000 in receipt of ESA. The social security co-ordination clause is an enabling power, allowing changes to be made to the retained regime via secondary legislation. Policy changes will be set out in the regulations that will follow, and will be affected by the context in which the power is exercised. Until that time, the impact of this provision cannot be known, therefore further equality analysis will be considered in due course.

3.2 Consideration of limb 2: Advance equality of opportunity between people who share a protected characteristic and people who do not share it

At this point in time we are unable to make any detailed analysis on the impact of future amendments to the retained social security co-ordination legislation on particular groups because we do not know what the final policy will be. However, information on protected characteristics is provided in 3a.3.

3.3 Consideration of limb 3: Foster good relations between people who share a protected characteristic

At this point in time we are unable to make any detailed analysis on the impact of future amendments to the retained social security co-ordination legislation on particular groups because we do not know what the final policy will be. However, information on protected characteristics is provided in 3a.3.

4. Foreseeable impacts of policy proposal on people who share protected characteristics

The final policy on social security co-ordination is still being developed and at this point in time we are unable to make any detailed analysis on the impact of future amendments to the retained social security co-ordination. As policy details become clearer, the Government will look into how to best support claimants who may be affected.

5. Review date

18 December 2018

SCS sign off: Neil Hodgson

Name/title: Neil Hodgson (DWP)

I have read the available evidence and I am satisfied that this demonstrates compliance, where relevant, with Section 149 of the Equality Act and that due regard has been made to the need to: eliminate unlawful discrimination; advance equality of opportunity; and foster good relations.

Directorate/Unit: Department for Work and Pensions

Lead contact: Lorna Simmonds (DWP)

Date: 18 December 2018

6. Annex 1: Descriptive Analysis on Social Security Co-ordination

6.1 Overview

Some UK benefits can be received when a claimant is living in the EEA, for example Contributory ESA (see table A6 for an overview). Adding up caseload estimates across benefits may lead to an overestimate of benefit claimants due to some individuals claiming more than one benefit. Therefore using DWP data, the following estimates the number of claimants living in the EEA; however this does not include HMRC-administered benefits (Child Benefit and Tax Credits) which are presented separately.

6.2 Expenditure and Caseload

In 2017/18, around £2bn was spent on exporting UK benefits abroad to around 500,000 claimants living in the EEA. The vast majority (over 90%)[footnote 1] of this expenditure was on State Pension and the vast majority (over 90%) of recipients of a DWP benefit/pension were UK/Irish nationals.

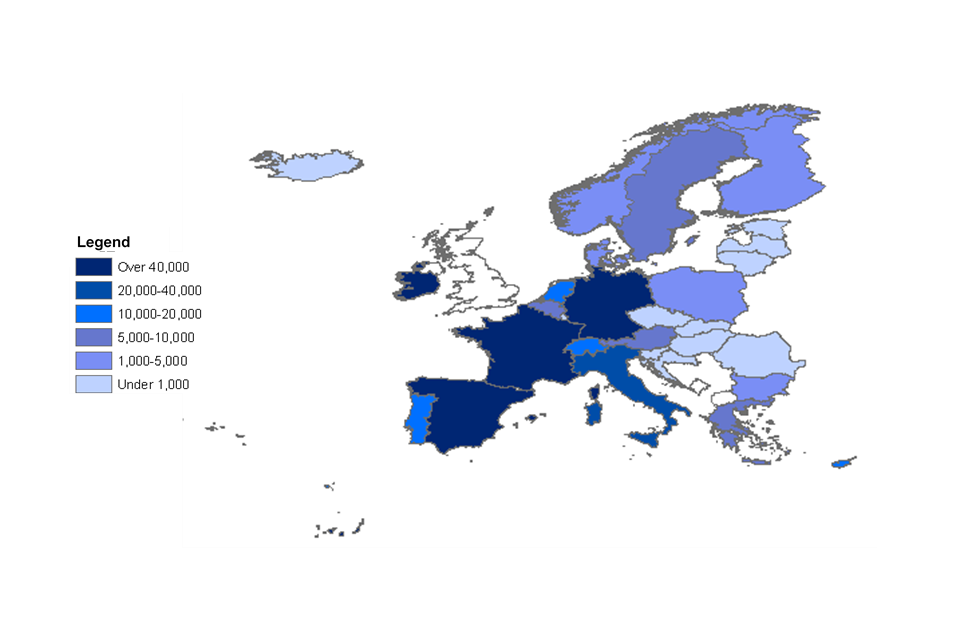

Around 90% of UK State Pension recipients in the EU are residing in EU15 countries, with over 60% residing in just three countries (Ireland, Spain and France). The UK pays the pensions of UK (and other Member State) nationals in the EU who have contributed to the UK system. This is part of reciprocal arrangements where Member States are also obliged to pay pensions in the UK. The weekly average (mean) amount of UK State Pension for those in the EU is currently £78 compared to £147 in Great Britain (see table A1).

The number of people getting UK State Pensions in each country varies greatly. For example, in February 2018, Ireland, Spain, France and Germany each had over 40,000 UK State Pension recipients. At the same time, Lithuania, Slovakia and Romania are among the countries which each had fewer than 1,000 recipients.

Map 1: UK state pension recipients in the EEA (February 2018)

6.3 Table A1: Country of residence of recipients of State Pension in the EU and average weekly amounts (February, 2018)

| Country | Number of recipients | Mean Weekly Amount |

|---|---|---|

| Austria | 5,200 | £43 |

| Belgium | 5,300 | £57 |

| Bulgaria | 1,200 | £119 |

| Croatia | 600 | £54 |

| Cyprus | 18,400 | £111 |

| Denmark | 3,600 | £53 |

| Estonia | 100 | £71 |

| Finland | 1,600 | £51 |

| France | 66,700 | £104 |

| Germany | 41,400 | £41 |

| Greece | 5,900 | £100 |

| Hungary | 900 | £101 |

| Iceland | 100 | £71 |

| Ireland | 133,200 | £60 |

| Italy | 35,300 | £51 |

| Latvia | 300 | £67 |

| Liechtenstein | - | £28 |

| Lithuania | 600 | £37 |

| Luxembourg | 600 | £74 |

| Malta | 6,400 | £96 |

| Netherlands | 12,700 | £49 |

| Norway | 4,500 | £51 |

| Poland | 3,400 | £63 |

| Portugal | 10,900 | £107 |

| Romania | 200 | £102 |

| Slovakia | 500 | £46 |

| Slovenia | 300 | £54 |

| Spain | 106,800 | £108 |

| Sweden | 5,900 | £51 |

| Switzerland | 11,500 | £46 |

| Czechia | 700 | £88 |

| Total | 484,900 | £78 |

Tables A2, A3, A4, A5 and A6 present further details around nationality, benefit combinations, gender and age of recipients of a UK benefit in the EEA. Given the demographic differences between claimants of different benefit types, the analysis is presented in three groups:

- those in receipt of UK State Pension (SP);

- those in receipt of other DWP benefits, for example Employment and Support Allowance (ESA)

- those in receipt of HMRC benefits (Child Tax Credits and Child Benefit)

6.4 Table A2: proportion of people in receipt of UK benefits in the EU split by nationality (2018)[footnote 2]

| Nationality | In receipt of SP | Other DWP Benefits | HMRC Benefits |

|---|---|---|---|

| EU15 | 3% | 12% | 4% |

| EU8 | 1% | 14% | 70% |

| EU2 | <1% | 1% | 6% |

| Other EEA | <1% | 1% | <1% |

| Republic of Ireland (ROI) | 1% | 6% | 3% |

| Rest of World (RoW) | 1% | 2% | 1% |

| UK | 94% | 65% | 16% |

Note: Figures may not sum due to rounding. DWP figures given for February 2018, HMRC figures given for September 2018. Nationality groupings can be found in annex 2.

6.5 Table A3: the three most common benefit combinations of UK nationals in receipt of DWP benefits in the EU (February 2018)

| Total | In receipt of SP | Other DWP Benefits | |||

|---|---|---|---|---|---|

| Benefit Combination | Proportion all combinations | Benefit Combinations | Proportion all combinations | Benefit Combinations | Proportion all combinations |

| SP only | 97% | SP only | 99% | ESA only | 53% |

| SP,PIP/DLA/AA | 1% | SP,PIP/DLA/AA | 1% | WB/BB | 22% |

| ESA only | 1% | SP/CA | <1% | PIP/DLA/AA,ESA | 10% |

Note: Figures may not sum due to rounding. A very small number of ESA cases may be in receipt of SDA or IB.

6.6 Table A4: proportion of people in receipt of UK benefits in the EU split by gender (2018)

| In receipt of SP | Other DWP Benefits | HMRC benefits | |

|---|---|---|---|

| Female | 54% | 57% | 28% |

| Male | 46% | 43% | 72% |

Note: Figures may not sum due to rounding, DWP figures given for February 2018, HMRC figures given for September 2018.

6.7 Table A5: Proportion of people living abroad in receipt of UK benefits by age-band (2018)

| In receipt of SP | Other DWP Benefits | HMRC benefits | |

|---|---|---|---|

| Under 18 | 0% | 3% | 0% |

| 18-24 | 0% | 1% | <1% |

| 25-34 | 0% | 5% | 12% |

| 35-44 | 0% | 16% | 51% |

| 45-54 | 0% | 27% | 30% |

| 55-59 | 0% | 20% | 4% |

| 60 and over | 100% | 28% | 2% |

Note: Figures may not sum due to rounding, DWP figures given for February 2018, HMRC figures given for September 2018.

6.8 Table A6: overview of DWP benefits paid to the EEA (2017/18)

| Benefit | Export Rules | Expenditure (2017/18) | Caseload (2017/18) |

|---|---|---|---|

| State Pension (SP) | Export worldwide under domestic legislation but only uprate each year as if living in UK when a Reciprocal Agreement (RA) or EU law permits us. | £1,963m | 489,000 |

| Employment Support Allowance (ESA) | ESA (income-related) is not exportable. ESA (contributory) is exportable because of EU law or RAs with third countries (e.g. USA). | £25m | 6,100 |

| Disability Living Allowance (DLA) / Personal Independence Payment (PIP) | DLA and PIP mobility components are not exportable DLA and PIP care components are because of EU law. | £15m | 4,600 |

| Industrial Injuries Disablement Benefit (IIDB) | Export worldwide under domestic legislation and uprate. | # £16m (Worldwide) | 6,000 (Worldwide) |

| Bereavement Benefits (BB+WB) | Export worldwide under domestic legislation and uprate. | £20m (Worldwide) | 4,400 (Worldwide) |

| Attendance Allowance (AA) | AA is exportable because of EU law. | £11m | 3,100 |

| Winter Fuel Payment (WFP) | WFP is exportable because of EU law. | £8m | 40,000 |

| Carer’s Allowance (CA) | CA is exportable because of EU law. | £1m | 1,100 |

| Maternity Allowance | MA is exportable because of EU law | £1m | Around 100[footnote 3] |

| Jobseeker’s Allowance (JSA) | JSA (Income-based) is not exportable. EU law provides the right to export JSA (c) for three months (after already claimed for 4 weeks). | Less than £1m | Less than 100 |

Notes: Estimates presented below are consistent with Autumn Budget 2018 expenditure estimates and Stat-xplore (unless otherwise stated).

7. Annex 2: technical annex

7.1 Data sources

The Benefit Combinations Data – This combines the WPLS and SHBE datasets (as described below) alongside recent Universal Credit information and Personal Independence Payment (PIP), to produce one dataset containing one record per individual on benefit combinations. This is significant as, for household level benefits (UC and HB), both the main claimant and partner (if applicable) are included in the statistics as separate individuals. This differs from publication elsewhere of HB statistics where figures show number of claims regardless of whether for a single person or a couple; a full background and methodology note on this data is available on GOV.UK. This is the dataset used in most of the analysis on benefits in this annex.

Migrant Worker Scan – This dataset contains nationality at point of National Insurance number registration for non-UK adults. This data has been matched to datasets outlined below following a similar approach to the established approach to identify the nationality of benefit claimants in existing Official Statistics series. As this only provides nationality at the point of registration, the nationality may have subsequently changed, for example, because the individual has been granted UK citizenship. Claimants not present in the data are assumed to be UK nationals. As the nationality information started from the late 1970’s, this may mean foreign nationals arriving before this time period, who may now be pension-age, would not be captured in our data. Therefore this is likely to be an under-estimate of non-UK nationals for pensioner benefits.

The Work and Pensions Longitudinal Study (WPLS) – A 100% quarterly extract of Departmental administrative data. Datasets are available quarterly on a range of benefits including: Attendance Allowance, Income Support, Jobseeker’s Allowance, Incapacity Benefit / Severe Disablement Allowance, Employment and Support Allowance, Disability Living Allowance, Bereavement Benefits, Carer’s Allowance, Pension Credit and State Pension. This data is the underlying data for publishing a range of DWP statistics.

HMRC Export Data – A dataset was produced by HM Revenue and Customs (HMRC) on Child Benefit and Child Tax Credit claims. This data takes a snapshot approach for Child Benefit claims in August 2018 and Child Tax Credit claims in September 2018. The Migrant Worker Scan was matched to find nationality.

The estimates in this document are not official statistics. The official statistics series on working-age benefits by nationality at point of NINo registration should be used for nationality-related information and the Benefit Combinations official statistics series should be used for benefit combinations related information.

7.2 Geographic coverage

Figures relate to people resident overseas who are receiving United Kingdom benefits. Information on country of residence for all benefits is not known. Where country is not known, those with a government office region recording of “foreign” has been included in the estimates above. Some benefit data (for example, State Pension) includes specific country of residence and can therefore be restricted to the EEA. For some other benefits, it has been assumed, any foreign/missing case is claimed in the EEA (which is largely in line with the export rules).

7.3 Nationality groupings

In the analysis, nationality groups are shown with:

- EU15: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden. Note that the UK and Republic of Ireland would usually be included in this group, but for the purposes of this publication are treated separately

- EU8: Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, Slovenia

- EU2: Bulgaria and Romania

- other EEA: Iceland, Lichtenstein, Norway, Switzerland, Cyprus, Malta, Croatia.

- rest of world: Non-EEA, UK or Irish nationals

7.4 Benefit coverage

Most DWP and HMRC benefits are covered in the analysis. For DWP benefits, this includes Carer’s Allowance, Employment and Support Allowance (and previous incapacity benefits), Bereavement Benefits, Personal Independence Payment, Disability Living Allowance, Attendance Allowance, Jobseeker’s Allowance, and State Pension. Due to data, Maternity Allowance and Industrial Injuries Disablement Benefit have not been included in the analysis but separate estimates of total caseload are presented in Table A6. DWP benefits have been split between those in receipt of a State Pension and those under State Pension age. HMRC benefits include Child Benefit and Child Tax Credit.

7.5 Statement of compliance with the Code of Practice for Statistics

The Code of Practice for Statistics (the Code) is built around 3 main concepts, or pillars:

- trustworthiness – this is about having confidence in the people and organisations that publish statistics

- quality – this is about using data and methods that produce assured statistics

- value – this is about publishing statistics that support society’s needs for information

The following explains how we have applied the pillars of the Code in a proportionate way.

Trustworthiness

The figures are based on DWP analytical datasets which have been outlined above. Many of the data sources, for example WPLS, are regularly used for DWP official statistics. In addition, the figures have been scrutinised through validation checks by a number of DWP analysts including those responsible for producing official statistics. We have also been transparent in outlining the limitations of the data and compared to other sources.

Quality

The data presented in the paper comes from a range of analytical datasets held within the DWP. Many of the datasets used, such as the Benefit Combinations are used to produce quarterly official statistics. Where analysis has used other data sources, the limitations of the data has been outlined in the previous section.

Value

This paper provides an overview of a range of evidence and statistics on UK benefits being claimed in the EU. Making this information accessible provides Ministers and stakeholders with an overview of the evidence available to help inform the public debate while helping to reduce the administrative burden of answering Parliamentary Questions, Freedom of Information requests and ad hoc queries.

8. Annex 3: Contact Details

Bill enquiries should be addressed to the Home Office Immigration Bill team and any analytical enquiries from this document should be directed to Lorna.Simmonds@dwp.gsi.gov.uk.

As the Migrant Worker Scan starts from the late 1970’s, this may mean foreign nationals arriving before this time period, who may now be pension-age, would not be captured in our data. Therefore this is likely to be an under-estimate non-UK nationals and over-estimate UK nationals. Nationality is not collected for the purposes of payment of State Pension. This is only nationality at the point of NINo registration; nationality may change over time.

-

As the Migrant Worker Scan starts from the late 1970’s, this may mean foreign nationals arriving before this time period, who may now be pension-age, would not be captured in our data. Therefore this is likely to be an over-estimate of UK nationals and under-estimate of foreign nationals. Nationality is not collected for the purposes of payment of State Pension. This is only nationality at the point of NINo registration and nationality may change over time. ↩

-

Estimate for those in receipt of SP and non-SP DWP benefits estimate was derived using Benefit Combinations, Migrant Workers Scan, Work and Pensions Longitudinal Study, for February 2018. For those in receipt of HMRC benefits, export data (September 2018). Migrant Workers Scan data (May 2018) was used to estimate nationality. For many benefits, country of residence is not available, therefore for benefits which are exportable worldwide, the estimate for non-SP benefit recipients may be a slight overestimate. ↩

-

Estimate uncertain, but applying a similar proportion of expenditure abroad estimates around 100 cases. ↩