Green Freeports in Scotland: bidding prospectus (delivered in partnership by the Scottish Government and the UK government)

Updated 28 July 2023

Applies to Scotland

Ministerial forewords

For over three hundred years, Scotland’s powerhouse ports drove Britain’s ascendancy from island nation to global power.

Today, they are once again leading the way on one of the defining challenges of our age; the pursuit of fairer, greener growth.

In February, we announced a landmark partnership between the Scottish and UK governments for two new, Green Freeports for Scotland – special zones with job-creating, growth-powering, potential-unleashing tax breaks and rebates for green investment.

This partnership is backed by up to £52 million of seed funding from the UK and has been long in the making. I’m delighted to see it taking off.

It is a great illustration of levelling up in action, a vote of confidence in the strength of the United Kingdom and a reaffirmation of our commitment to maintaining the momentum of COP26.

And, with the publication of the prospectus, we are now at this exciting bidding phase of the project.

This document sets out the essential selection criteria that bidders need to meet, which include a focus on investing in skills and training, creating well-paid local jobs and harnessing new, green infrastructure to regenerate communities.

Crucially, we expect to see bidders clearly demonstrating how they will use their Green Freeport status to generate trade and investment opportunities, support the UK’s advanced manufacturing base and speed progress towards Net Zero.

Both governments will have an equal say on the successful bids.

Scotland has long been at the forefront of our world-leading ambitions to tackle climate change via incredible projects, supported by the UK and Scottish Governments, such as floating offshore wind manufacturing, carbon capture and storage, and next generation hydrogen production plants.

These new Green Freeports will help ensure that this burgeoning green economy continues to blaze a trail for others to follow.

And I look forward to seeing ambitious bids come forward that grasp this opportunity and deliver for Scotland as part of a joint commitment between our two Governments to level up opportunity and prosperity across the whole country.

Rt Hon Michael Gove MP Secretary of State for Levelling Up, Housing and Communities

The Scottish Government published its new National Strategy for Economic Transformation earlier this month. Scotland has extraordinary economic potential. Securing commitments to fair work and accelerating the journey to a net zero economy as part of the agreement to introduce two new Green Freeports in Scotland will contribute to our aims for a wellbeing economy.

The twin objectives of creating high-quality jobs and contributing to decarbonisation of our national economy sit right at the heart of our ambitions for, and expectations of, Green Freeports.

We want the new designations to exemplify progressive best practice, including that set out in Scotland’s Fair Work First criteria, and we will expect applicants to set out clear plans to deliver equally on both of our two core priorities. While two locations will be designated as Green Freeports, it will be vital to ensure that regional economies and wider national supply chains will also benefit from the new economic activity taking place within the Green Freeport areas. The Scottish Government wants applicants to set out how they will foster the growth of new clusters of modern industrial sectors, how they will create hubs for global trade and investment and how they will support innovation. The transformative potential of Green Freeports as places of innovation and incubators of high-quality employment is what we want to realise.

Scotland’s economic growth and prosperity over many decades has been the result of the efforts of entrepreneurial, talented and motivated workers and businesses. We are clear that Green Freeports must be inclusive places synonymous with high standards of work, governance and financial probity.

We want Scotland’s economy to be more prosperous, more productive and more internationally competitive. We will do this by building on our strengths in sectors like energy, financial services, creative industries and life-sciences and carving out new strengths in technology, space and decarbonisation. We want Green Freeports to form part of creation of a wellbeing economy which drives a green economic recovery to meet our climate and nature targets while ensuring a just transition.

I look forward to considering the applications for Green Freeport status. As a country, working alone or in partnership with our neighbours, we will be judged on the outcomes we deliver for our people, and our readiness to trade ethically with the world. In forming an agreement to introduce Green Freeports, the Scottish and UK governments have demonstrated a clear will to collaborate. With the launch of this prospectus, the baton is now handed to applicants and the inclusive partnerships they form.

Kate Forbes MSP Scottish government Cabinet Secretary for Finance and Economy

Section 1. Introduction and context

1.0.1 The long-term strength and sustainability of Scotland’s economy is crucial to ensure economic recovery from the COVID-19 pandemic and tackling climate change.

1.0.2 Green Freeports will help Scotland overcome these challenges and respond to the economic shocks of COVID-19 by helping Scotland secure a globally competitive, entrepreneurial, inclusive and sustainable economy which makes a positive contribution internationally, and delivers high quality, fair work for everyone. This will particularly benefit the disadvantaged communities that are often located close to ports.

1.0.3 Green Freeports will also incentivise private businesses to support Scotland’s just transition to a net zero economy; reduce emissions and respond to climate change. This will be done in a way that is fair for Scotland’s workers and communities whilst supporting the creation of high-quality employment opportunities offering good salaries, a shared commitment of the Scottish and UK governments.

1.1 Policy context

1.1.1 In August 2019, following the UK Freeports consultation, the UK government announced its intention to establish Freeports to help regenerate communities by unlocking the economic potential of UK ports. When the UK government launched the Freeports Bidding Prospectus for England, a commitment was made to work with the devolved administrations to ensure all four nations of the UK could benefit from Freeports.

1.1.2 In February 2022, the UK government published the Levelling Up White Paper. The paper recognised the significant spatial disparities, on a range of indicators, between different places across the UK, and set 12 ambitious missions to drive levelling up. A key theme of the White Paper is boosting productivity, pay, jobs and living standards by growing the private sector, including through support for inward investment and trade. The White Paper reiterated the UK government’s commitment to establish new Freeports in Wales, Scotland and Northern Ireland, working with the devolved administrations.

1.1.3 The Scottish Government’s policy statements relevant to Green Freeports are consolidated in the new National Strategy for Economic Transformation (NSET). This details the steps the Scottish Government will take to deliver a green economic recovery and support new green jobs, businesses, and industries for the future. NSET builds on existing strategies, taking into account the context of COVID-19, commitment to fair work, a just transition to ‘Net Zero’, and long term demographic trends.

1.1.4 The Scottish and UK governments have worked together constructively to develop a Green Freeport model that reflects our joint values, the unique conditions in Scotland, and ensures businesses, ports and communities across Scotland can benefit from the Green Freeport opportunity.

1.2 Green Freeports

1.2.1 Many Green Freeport features will operate in the same way to Freeports in England, creating a consistent offer across the entire UK. Green Freeports will also contribute to realising the outcomes set out in Scotland’s National Performance Framework. This means supporting Scotland’s just transition to a net zero economy; reducing emissions and responding to climate change in a way that is fair for Scotland’s workers and communities. At the same time Green Freeports should help Scotland secure a globally competitive, entrepreneurial, innovative, inclusive and sustainable economy, which makes a positive contribution internationally, and delivers high quality, fair work for everyone.

1.2.2 The Scottish and UK governments want to partner with leaders in the private and public sectors to support businesses with a global reach, and businesses who aspire to a global reach, to achieve their ambitions. This will unlock the potential of Scotland’s regions for the benefit of the national economy, businesses, workers, and local communities, and builds on successful partnership working that is already established between UK and Scottish Government through the implementation of City and Growth deals across Scotland.

1.2.3 Both governments want Green Freeport partners to form strong coalitions to develop ambitious, deliverable proposals. Partners should set out why a Green Freeport is right for their area; how they will use the measures; and how they will deliver a successful Green Freeport which will contribute to both the net zero and the levelling up agendas. These coalitions will include ports, local businesses, international businesses, academic institutions, and local authorities (and the Regional Economic Partnerships where they are formed). We recognise that different regions will have different existing strengths, institutions, and economic strategies. We want to select successful Green Freeport locations that account for and take full advantage of the diverse potential of the different regions of Scotland. Green Freeports will be expected to work hard to ensure that the creation of high quality well paid jobs, and encouragement of an accelerated journey to a net zero economy, form the guiding mission of any Green Freeport designation in Scotland.

1.3 This prospectus

1.3.1 This prospectus document is intended as a guide for applicants and provides detail on:

a. Green Freeport (objectives Section 2)

b. Green Freeport geography, including guidelines on site size and design (Section 3.1)

c. how the different policy levers will work (e.g. how reserved and devolved taxes will work) (Section 3.2 to 3.8)

d. how Green Freeports should be governed and delivered (Section 4)

e. the fair, open, and transparent selection process that will determine successful designations (Section 5)

f. the application questions (Sections 5.6 to 5.7)

1.4 Application process

1.4.1 Applicants and multi-applicant partnerships must submit their proposals to the Department for Levelling Up, Housing and Communities (DLUHC) by 10am on 20 June 2022. Proposals should be submitted via the Green Freeports application portal which will be sent to parties who register an interest in bidding for Green Freeport status. See the registration form. All questions asked for as part of the application be found in sections 5.6, 5.7 and 5.8 of this prospectus.

1.4.2 Potential applicants will be able to contact greenfreeports@gov.scot to request clarification on the content of this applicant prospectus until 5pm on 29 April 2022. A summary of answers provided will then be published online no later than 5pm on 20 May.

1.4.3 Proposals will be assessed via an open competitive process, with chosen designations announced in summer 2022.

1.4.4 Successful applicants will be granted some revenue funding subject to an initial governance review to support governance set-up costs. They will also work with us to develop detailed business cases for their spending plans associated with the award of any additional funding offered to Green Freeports.

1.5 Summary of key dates

25 March 2022 - Prospectus published, applicants can submit clarification questions, and application portal opens

29 April 2022 - Deadline for all prospectus clarification questions to be submitted

20 May 2022 - Deadline for publication of summary of prospectus clarification question responses

20 June 2022 - Application deadline, 10am

Summer 2022 - Announcement of winning bids

Spring 2023 - First Green Freeport becomes operational

Section 2. Objectives

2.0.1 This document is the applicant prospectus for Green Freeports in Scotland only.

2.0.2 The Scottish and UK governments have worked together to design a Green Freeport model which will deliver on 4 main objectives. All of these objectives need to be met by applicants:

a. promote regeneration and high-quality job creation – our lead policy objective

b. promote decarbonisation and a just transition to a net zero economy

c. establish hubs for global trade and investment

d. foster an innovative environment

2.0.3 No two local economies or ports are the same. To meet the ambition of Green Freeports applicants should: reflect on the characteristics of their local economy or port; consider how to optimally use their assets and tackle their relative weaknesses; and set out a strategy for inclusive growth founded on the Green Freeports objectives. Applicants will submit a strategy in their bid to evidence this (Question 2) and how they will achieve each of the objectives set out in this section. This written submission will form a key part of the overall application for Green Freeport status.

2.0.4 In practice, many of the activities described will achieve more than one objective, and create virtuous cycles, with one activity reinforcing another. For example:

a. a strategic site adjacent to an established port is developed that builds on existing assets in a capital intensive sector that capitalises on the firm’s location, for example, building components for wind turbines. This Green Freeport could effectively market itself to international investors in the wind energy and related sectors by pointing to its existing industrial strengths, allowing a large firm to establish itself quickly by accessing an existing supply of skilled workers and suitable infrastructure at the port. As the site is adjacent to the port, it would lower transport costs, so firms with goods that carry high transport costs may benefit in particular. For the local community, this new and significant demand for their skills should boost wages and create job opportunities in more disadvantaged areas

b. once a large firm had been attracted, it could increasingly interlink with local supply chains, with by-products of one process acting as inputs to others. This could grow a new cluster of firms, allowing them to benefit from shared infrastructure, storage facilities and transport, with energy intensive industries benefitting from reduced costs and so greater environmental compliance. These increases in efficiency should further boost job creation and increase wages

c. firms could pool their training budgets to establish a further education provider focused on technical skills, in partnership with existing skills providers. This could provide training opportunities on site, so that learners can benefit from work experience and ensure the labour market best meets the needs of this emerging industrial cluster. There may be opportunities to pilot innovative schemes around clean energy, helping to develop the industrial strengths of the future

2.1 Promote regeneration and high quality job creation

2.1.1 Promoting regeneration and job creation through inclusive sustainable growth is our lead objective. We want Green Freeports to stimulate net growth in jobs across innovative industries and sectors of the economy, creating high quality job opportunities, sustainable and inclusive economic growth, and regenerating the areas which need it most. Applicants should include, in their application, a demonstration of the benefit to wider supply chains across Scotland and beyond.

Promoting regeneration – local authorities, ports, and business working together

2.1.2 We want Green Freeports to help promote regeneration in their local economies and communities by driving inclusive and sustainable growth locally, regionally and nationally. Inclusive growth combines increasing prosperity with greater equality. It is growth that creates opportunities for all and distributes the benefits of increased prosperity fairly.

2.1.3 To attract the private investment needed to drive this regeneration Green Freeports will have: access to a mixture of financial incentives; good governance that supports a strong partnership between local, private and public sector stakeholders; support of both the Scottish and UK governments in attracting investment; and support to create a strong local skills base.

2.1.4 We expect local authorities to help shape regeneration plans, by sharing relevant local and regional plans for inclusive and sustainable growth. In turn, private operators and beneficiary businesses must:

a. put in place provisions to ensure investment, that is additional and aligned with the policy objectives, is brought forward on tax sites, including through landowners working with the Green Freeport to shape the end use of their land

b. comply with all good practice in procuring goods and services in Scotland. This would be inclusive of the sustainable procurement duty and community benefit requirements as defined in the Procurement Reform (Scotland) Act 2014

c. focus investment on activity which is genuinely additional to their existing investment plans. Either by significantly accelerating investment or by tackling promising development sites which would otherwise be unviable. Bids that demonstrate genuine and tangible commitments from all partners to the delivery of the regeneration objective will be looked on more favourably

d. consider how they can benefit other local businesses, wider supply chains and local communities via engagement with the local authority and prioritising local recruitment where possible

Support emerging industrial clusters

2.1.5 Green Freeport applicants should set out a clear sectoral focus, and the proposal should outline how emerging clusters in those sectors help deliver the policy objectives. By targeting particular sectors that are present and growing in the local or regional economy, Green Freeports should further catalyse innovation to support emerging clusters. This should involve collaboration with Scotland’s enterprise agencies, universities, and colleges. (Industrial strengths and clusters can be identified using several methods, from statistics on industries ranked by local job share to “Economic Complexity Analysis”.)

2.1.6 Applicants should provide evidence of their knowledge of these emerging clusters in their local economy, outline why the proposed locations can provide a solid value proposition for the target sectors, as well as the investment viability gaps faced and how Green Freeport status could help address this gap. Clear evidence of new private sector investment – either from commercial property developers serving those sectors, or from occupiers themselves – will be rewarded with a higher assessment against relevant criteria.

2.1.7 Some clustering benefits have been observed at locality and even office premises level. Therefore, applicants must also show how they intend to align the skills available in the local labour market to the needs of the businesses and sectors being targeted, including support for upskilling in line with local and national skills strategies. Bids that propose commercial property development should show how they will enhance these effects, demonstrating how they will attract larger “anchor firms” around which other firms can cluster or ensuring that estates are well-designed to promote collaboration.

Creating high quality jobs and enhancing the local skills base

2.1.8 By supporting emerging clusters and taking advantage of incentives, Green Freeports can produce high quality jobs, with higher wages in innovative industries. We want to see firms in target sectors commit to high standards around employment practices at the bidding stage. For example, businesses could provide evidence of existing good working practices and commitments. Businesses that support the initial bid can and should act as examples to others and show how their business practices promote fair and well paid work.

2.1.9 This could include investing in the skills of their workforce, tackling the gender pay gap, creating more inclusive workplaces, and avoiding inappropriate use of zero-hours contracts. Applicants should submit a strategy to show how they will achieve the desired outcome of better jobs and improved wages. It should include:

a. how the Green Freeport itself will enable the creation of new higher paid jobs

b. how it will attract companies to locate in the area

c. how fair work practices will be embedded across the area

2.1.10 Applicants must also show how they intend to align the skills available in the local labour market to the needs of the businesses and sectors being targeted, including support for upskilling in line with local and national skills strategies. The Scottish Government and Scottish local authorities are committed to pursuing a Fair Work First approach and bidding parties may therefore wish to consider the relevant criteria when completing their application.

2.1.11 In developing their strategies, bidders may include elements that align with the Scottish Government’s Fair Work First criteria, for example business commitments on the real living wage or trade union engagement. These will be taken into account where they support the overall objective.

Transport

2.1.12 Applicants should make sure activity and decision making embeds the second National Transport Strategy (NTS2) vision, priorities and outcomes for the transport system, including the sustainable travel and investment hierarchies as well as aligning with regional and local transport strategies. In line with planning policy, the applicant should identify the potential transport impacts resulting from development and, where mitigation is required, this should be identified and delivered by the applicant.

2.2 Promote decarbonisation and a just transition to a net zero economy

2.2.1 Operators and beneficiary businesses must support the Scottish and UK government’s climate change ambitions and Scotland’s National Just Transition Outcomes. Applicants should confirm a commitment to submitting a robust and ambitious plan for decarbonisation within a Green Freeport and should provide an outline of that plan as part of their application. Applicants can note how the UK government intends to combat climate change in the UK government’s Net Zero strategy.

2.2.2 Proposals could include:

a. making sure that greenhouse gas emissions of on-land freight distribution are minimised

b. making sure that vessels using the port operate in a low-carbon manner (e.g. reducing use of fossil fuels)

c. ensuring any construction work is sustainable and low-carbon

d. reduction in use of carbon-intensive energy within the Green Freeport and/or transition towards renewable or low-carbon energy use

e. if applicable, increasing the use of technologies such as carbon capture and storage and renewable or low-carbon hydrogen. e.g. a Green Freeport could use the tax measures to support a renewable cluster, indirectly supporting net zero

2.2.3 Applicants can also take note of the Transport decarbonisation plan. It includes the UK government’s pathway to net zero transport in the UK, the wider benefit net zero transport can deliver, and the principles that underpin our approach to delivering net zero transport.

2.2.4 A just transition is about delivering on social, economic and climate goals. The application should outline how the Green Freeport’s plans will support Scotland’s eight Just Transition National Outcomes. This may be cross referenced to material provided in support of the other 3 objectives, particularly the lead policy objective of supporting regeneration and high quality job creation.

2.3 Establish hubs for global trade and investment

2.3.1 Establishing Green Freeports as hubs for global trade and investment will generate increased economic activity across Scotland, and the wider UK. The economic impact that international investment has on host economies is well established; with the benefits secured from good inward investment including employment, higher wages, productivity gains, increased exports spread across many of our regions in a number of key sectors and regeneration of communities.

2.3.2 Proposals should clearly demonstrate the additionality provided by the Green Freeport to increase trade. The Green Freeport should make clear whether it seeks to become an import and/or export facility or whether they are seeking to prioritise the import market. If applicants are seeking to enhance export activities, proposals should identify target markets and outline the approach to use existing market relationships as well as generate new markets to benefit the local community.

2.3.3 Proposals should include how applicants intend to use digitally based infrastructure development products. They should also include the applicant’s position on adopting best practice to support the achievement of greener and sustainable infrastructure.

2.3.4 Further detail on UK and Scottish Government’s ambition can be found in: the Scottish Governments inward investment plans, Shaping Scotland’s Economy, Scottish Government’s export growth plan, Scotland: A Trading Nation, Scotland’s Vision for Trade, as well as Made in the UK, Sold to the World and the Levelling Up White Paper.

2.3.5 Proposals should focus on:

a. demonstrating how the Green Freeport will bring new investment into the surrounding areas and increase trade through the port(s) involved. Applicants should demonstrate their understanding of Foreign Direct Investment and inward investment propositions and how these align with Scottish and UK government Trade and Investment support activities

b. demonstrating how the Green Freeport will bring new investment into the surrounding areas and increase trade through the port(s) involved

c. showing how they will work with local and international businesses to enhance the impact of increased investment in a way that supports sustainable, inclusive growth which creates opportunities for all, distributing the dividends of increased prosperity fairly

d. outlining how they envisage their Green Freeport will further internationalise our economy, generate sustainable trade growth and enable trade processes to become easier and more efficient. In addition to the increased investment, Green Freeports provide businesses and ports with the opportunity to improve current practices and benefit from customs facilitation easements that are not available elsewhere to maximise development opportunities

e. indicating which sectors would benefit from having a Green Freeport (e.g. to assist with any necessary import/export checks or supporting their supply chain needs)

2.3.6 Applicants may also choose to include in their proposal:

a. a description of their investor and company onboarding and management process, providing detailed process maps that identify each of the engagement steps throughout the company or investor journey

b. examples of specific investment opportunities which demonstrate how these are supportive of the wider Scottish and UK government objectives

2.4 Foster an innovative environment

2.4.1 Green Freeports will focus private and public-sector investment in research and development (R&D); they will be dynamic environments that bring together innovators to collaborate in new ways, while offering controlled spaces to develop and trial new ideas and technologies. We expect landowners to prioritise more innovative investments and the Green Freeport executive to bring businesses into contact with the Freeports Regulation Engagement Network (FREN). All Green Freeport partners should seek opportunities to access wider innovation funding.

2.4.2 Applicants can take note of the UK government’s R&D Roadmap and Innovation Strategy. The Integrated Review also outlined a new approach to growing the UK’s science and technology power in pursuit of strategic advantage.

Innovation in Green Freeports

2.4.3 Innovative activity in Green Freeport locations can be characterised into 3 distinct areas of focus. Applicants could focus on any, or all of these in outlining their innovation ambitions.

a. port-specific innovation – innovation that directly benefits air, rail or maritime ports i.e. autonomous cranes and cargo-handling equipment, digital security, customs software that can track goods across a broader area, creative use of people and skills to develop innovative solutions driving efficiency and effectiveness

b. port-related innovation – innovation that indirectly benefits air, rail or maritime ports or their supply chain i.e. autonomous transport, modal shift, decarbonisation of transport, industrial decarbonisation etc

c. non-port-related innovation – innovation unrelated to air, rail or maritime ports that can take advantage of port-proximate locations or the Green Freeport wider offer i.e. pharmaceuticals, quantum technologies, advanced materials, robotics, AI

Innovation activity

2.4.4 In creating a successful innovative environment, proposals should highlight how Green Freeport status can bring additionality to those already collaborating in the region and consider the following:

a. capability and Investment: Build and reinforce the capability for R&D in the Green Freeport region, by funding and supporting private and public investment in research, innovation and skills

b. collaboration and Commercialisation: Facilitate translational research, skills development and data-sharing in the Green Freeport region, by linking start-ups, businesses and ports with academic institutions, innovation structures and regulators and by making best use of the Freeports Regulation Engagement Network (FREN)

c. novel solutions: Drive the development, testing and application of new ideas and technologies, including developing innovative solutions to problems faced by Green Freeports

2.4.5 We are also particularly interested in how innovation ambitions can support the decarbonisation and net zero agenda, as outlined in Section 2.2.

2.5 Logic model

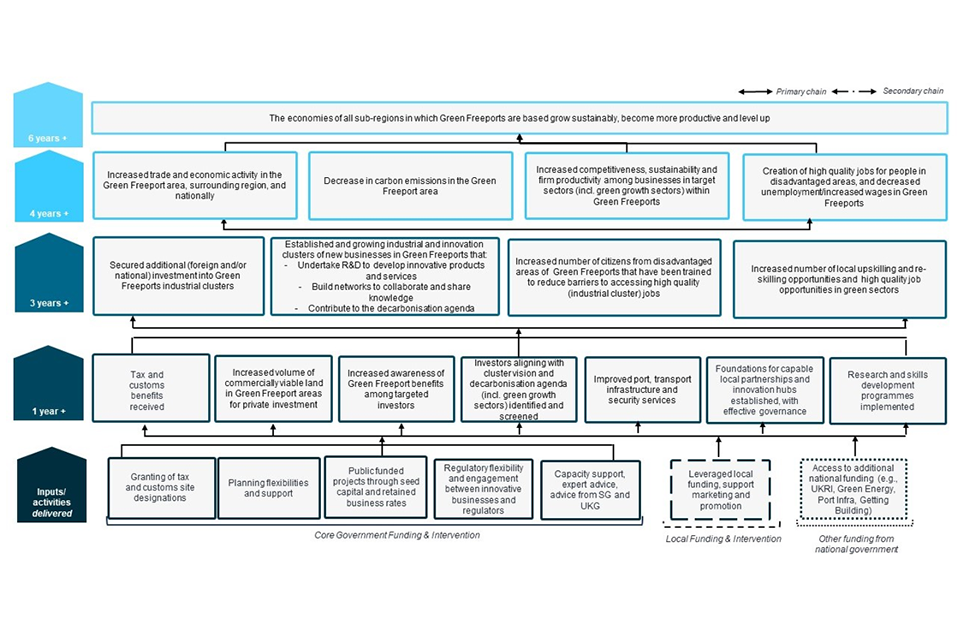

Figure 1: The Logic model – a map of the inputs and activities delivered with their respective outputs followed by the expected long term impacts of the policy.

2.6 Expected outcomes

2.6.1 Each objective is underpinned by a set of key outcomes. These outcomes describe what we want to achieve, however it is not an exhaustive list. Applicants’ plans to deliver on the governments’ objectives must show how they will deliver outputs in support of these key outcomes. Progress on these outcomes will be measured and form the basis for subsequent evaluation of the success of the programme overall.

2.6.2 The performance of Green Freeports will be assessed against all of these outcomes as part of the monitoring and evaluation process. At this proposal stage, submitted applicant implementation plans will help in our assessment of the highest quality bids.

Promote regeneration and high-quality job creation

a. Increased number of jobs and average private sector wages within the Green Freeport, host local authority area(s), wider regional economy, and specifically disadvantaged areas in the host local authority area(s).

b. Increased economic activity through new company formation and expansion of existing companies in the Green Freeport tax sites, wider designated area and the regional economy

Promote decarbonisation and a just transition to a net zero economy

a. Decrease in carbon emissions in the Green Freeport area, relative to the sector averages of those firms occupying the site.

b. Increased number of local upskilling and re-skilling opportunities and job opportunities in green sectors.

Establishing hubs for global trade and investment

a. Net increases in inward investment within the Green Freeport boundary area, surrounding region and nationally, in line with the Scottish Government’s Vision for Trade.

b. Increased transactions in trade throughput through the designated port(s), in line with the Scottish Government’s Vision for Trade and the ambitions in Scotland: A Trading Nation.

Foster an innovative environment

a. Increased public and private sector funding in R&D and innovation in the Green Freeport area, enabling increased productivity in the wider region.

b. Scale of sectoral clusters is increased by innovation and collaboration with Scotland’s enterprise agencies, universities, and colleges.

Section 3. Economic levers and design of interventions

3.0.1 This section details the specific design of a Green Freeport, including geography and economic levers offered to applicants as they would apply in Scotland. The Green Freeport model is based on the model the UK government have used for Freeports in England.

3.1 Green Freeport geography

3.1.1 The Green Freeport model is geographically flexible, and applicants should use this flexibility to best apply the model to their specific space and geography.

3.1.2 The model allows for multiple sites to be designated within the overall Green Freeport. This allows applicants to best reflect existing economic geographies; to maximise collaboration between ports, businesses, wider stakeholders and relevant economic assets by allowing them to benefit and contribute to the Green Freeport. However, limits must ultimately apply to generate agglomeration benefits and control costs. These limits, and flexibilities around them in exceptional cases, are set out below.

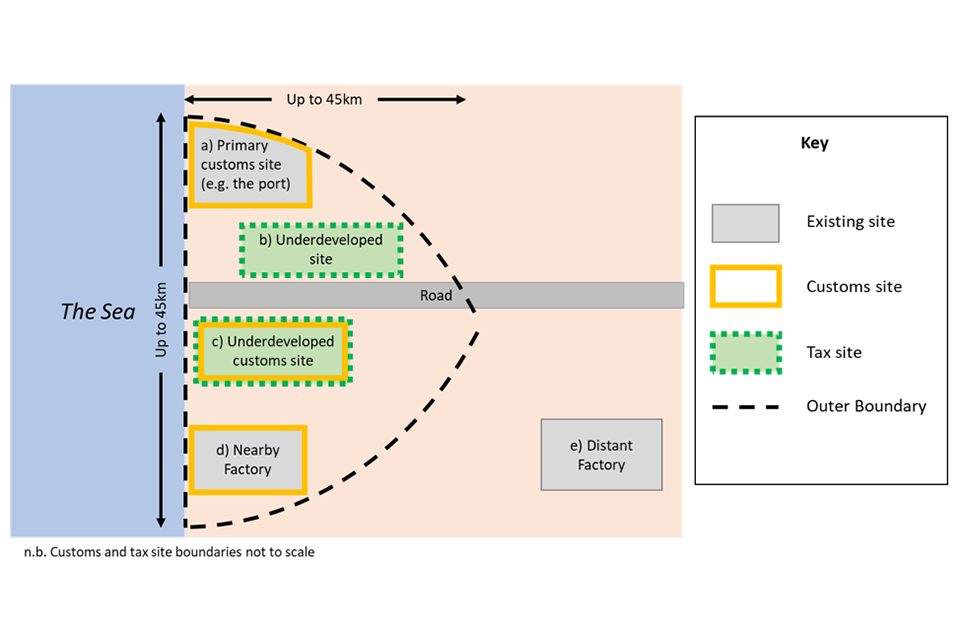

Figure 2: The Green Freeport model – a Green Freeport with the outer boundary, customs sites, tax sites and existing sites labelled. Customs and tax site boundaries not to scale.

Overview of the Green Freeport model

3.1.3 The above shows a hypothetical Green Freeport focused around a seaport. It is demarcated with an Outer Boundary containing:

a. a primary customs site around the seaport – site a) which, in this case, is not within the tax site, so businesses inside benefit from the customs measures, but not tax measures

b. additional “underdeveloped” land separate from the primary customs site – sites b) and c) where businesses in both sites will benefit from the tax measures

c. an additional customs site – site c) which is also part of a tax site so businesses inside benefit from both the customs measures and the tax measures

d. a nearby factory site – site d) which is an additional customs site but is not covered by the tax site, so businesses inside site d) benefit from customs measures but do not benefit from tax measures – as per site a)

e. a distant factory – site e) which is outside the Outer Boundary, so cannot be a customs site or part of a tax site without a special economic case for inclusion

Outer boundary

3.1.4 Applicants must define an Outer Boundary in their application. Applicants will need to provide clear economic rationale for why the Outer Boundary is defined as it is. Applications judged to be designed simply to maximise the area contained within the Outer Boundary without a clear economic rationale will fail the application process at the pass/fail stage.

3.1.5 All Green Freeport measures must be applied within an Outer Boundary. The largest area a Green Freeport Outer Boundary can cover is a circle of diameter 45km, as demonstrated by the hypothetical multi-port Green Freeport in Figure 2. We intend that the Green Freeport model should help a place which has a clear economic geography, and the Outer Boundary ensures those sites that exist within the Green Freeport all help that clearly defined place within the Outer Boundary.

3.1.6 Applicants will need to submit a map with the Outer Boundary marked on it to delineate the geography of the Green Freeport.

3.1.7 The Scottish and UK governments will consider applications for exceptional additional customs sites and tax sites outside the Outer Boundary, where this can be supported by a clear economic rationale (see below). Applicants must provide a written submission with clear and specific reasoning justifying such additional proposals.

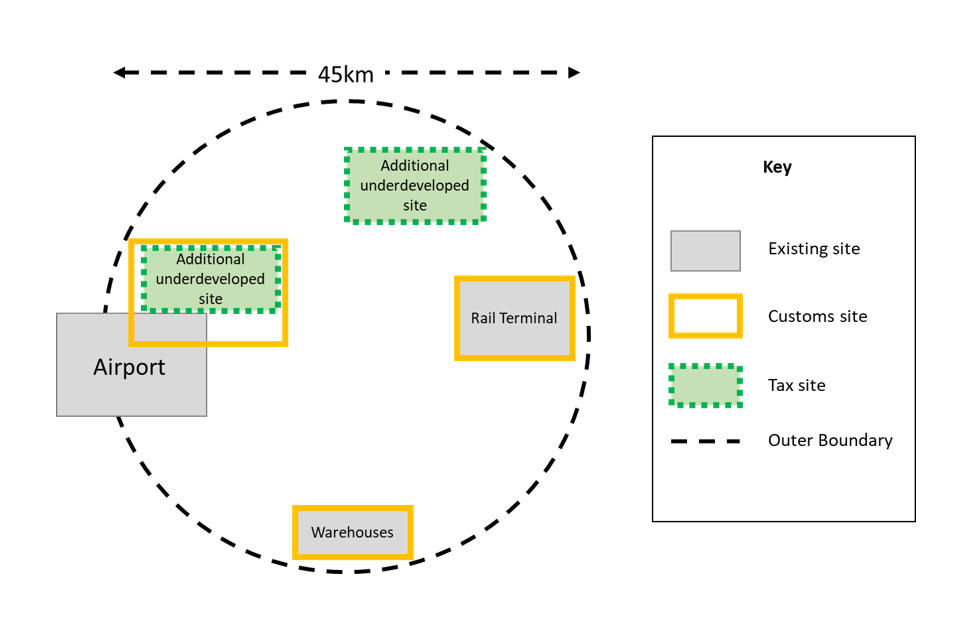

Figure 3: The Green Freeport model – a Green Freeport with multiple ports within the 45km outer boundary. Customs and tax site boundaries not to scale.

The Port

3.1.8 Applicants must include at least one port of any mode (sea, air, rail) within their Green Freeport Outer Boundary. The port does not have to be a tax site or a customs site. Applications without a port within their Outer Boundary will fail the applicant process at the pass/fail stage.

The Customs Site(s)

3.1.9 Applicants must include at least one customs site within their Green Freeport Outer Boundary, within which the customs benefits outlined in Section 3.3 will apply. Applications without at least one viable customs site will fail the application process at the pass/fail stage. Applicants must provide clear rationale for the customs site(s) including expected uses; outputs/benefits expected to be generated; and how they relate to each other and the wider Green Freeport.

3.1.10 Applicants may apply for as many customs sites within the Outer Boundary as they can deliver, so long as they are relevant to the Green Freeport area. To apply for multiple customs sites, applicants must submit a written justification for why additional sites are required and clear justification of every site’s relationship to the wider Green Freeport.

3.1.11 If a multi-site application is submitted it will be approved conditional on at least one customs site being viable, with any additional customs sites considered unviable, being removed or amended.

3.1.12 The UK government is prepared to authorise customs sites in inland locations so long as an economic relationship can be clearly demonstrated between the site and the port. Government will consider customs sites of any size, so long as a clear economic case for the site can be made, and strict security requirements enabling HMRC and Border Force to monitor the sites effectively can be met.

3.1.13 We will expect applicants to meet the cost of establishing and securing all customs sites (primary and additional) according to these requirements. Overly expansive or inadequately secured customs sites will not be authorised.

3.1.14 The operator of the site (who monitors goods moving in and out of it) must be authorised by HMRC. Businesses that operate in the operator’s site must also be authorised by HMRC. The process for becoming an approved site operator and Green Freeport business operator can be found on gov.uk. Applicants should ensure that the operator of each customs site is willing and able to undergo the relevant customs authorisation.

3.1.15 The operator could host multiple authorised businesses, creating a hub for trade – or the operator could host a single company, acting as both the operator and the business.

3.1.16 For more detail about the obligations and benefits of the customs offer, see Section 3.3 Customs.

The Tax Site

3.1.17 Bidders should aim for a single tax site to benefit from the tax offer. When there is an economic case to do so, applicants may define up to three individual areas as the location of the tax sites. New and existing businesses who expand or invest further within these tax sites may benefit from the tax reliefs outlined in Section 3.2.

3.1.18 A tax site can encompass all, or part, of the primary customs site and/or any additional customs site but does not have to encompass either. Tax reliefs will only apply in customs sites located within a Green Freeport tax site.

3.1.19 As with customs sites, tax sites should be located within the 45km Outer Boundary. However, if applicants are considering multiple tax sites and have a strong economic and geographic rationale for including a tax site outside the Outer Boundary because it has a significant relationship to the area within the Boundary, they may apply to do so. Applications which fail to provide justifiable reasoning for any proposed tax sites outside the Outer Boundary will be disadvantaged in the application process.

3.1.20 The tax sites:

a. should be underdeveloped, with reference to section 3.1.26

b. should be clearly delineated on a map – they should not be engineered to create a single site with the use of long and narrow lines (if there is an economic case for it there can be multiple sites, please see point c)

c. should encompass a single site within the Green Freeport of no greater than 600 hectares, or up to 3 individual sites aiming to be between 20-200 hectares – we will consider submissions that make an economic case for an individual site that falls outside the 20-200 hectares guideline, but the total area of the individual sites within the Green Freeport must not exceed 600 hectares. Those that do exceed 600 hectares will automatically fail the Green Freeport application process at the pass/fail stage

d. can have uneven boundaries, if that helps capture promising areas while cutting out areas that are more developed, so long as those sites are justifiably single and individual

e. do not have to be a single piece of land – for example, a single site could be two pieces of land split by a road. If there is no portion of land connecting the sites – for example, if they are split by a river, or residential property – we would consider these two separate sites unless very clear geographic and economic interconnection can be demonstrated. We are open to one single site containing multiple parcels of land split by a road, protected area or geographic feature (such as a river) so long as the parcels within the land can reasonably be considered one single site because geographic and economic interconnection between the sites can be demonstrated (e.g. travel between them is plausible).

f. do not all have to be owned by one owner – it can include multiple, separately owned parcels of land that all fall under the single delineated site. Applicants must provide evidence that landowners have signed up to the vision for the proposed tax site and will take appropriate steps to ensure development on the site aligns with the Green Freeport’s objectives and those of the wider Green Freeports policy

g. do not need to be fenced – but it should have clearly identifiable boundaries (for enforcement purposes) and be clearly delineated on a map provided as part of the application

h. should ideally be located in areas with:

i. below national average GDP per head currently or over the last 5 years

ii. above average national unemployment rates currently or over the last 5 years

3.1.21 Applicants will need to provide evidence and justification as to why an area which does not meet the criteria in 3.1.20.h requires regeneration and would benefit from being a tax site.

3.1.22 Applicants that are successful will receive formal confirmation of the boundary for their proposed tax site(s), where tax reliefs will be available at the end of a separate tax site approval process. The final scope of the site will take into consideration the ability of HMRC, and where appropriate Revenue Scotland, to monitor the activity that takes place within this site effectively. Being awarded Green Freeport status in the initial bidding round does not constitute formal approval of the proposed tax sites. In most cases we anticipate that these confirmed sites will be of the same size as the original applications, however some adjustments may be needed in order to comply with the criteria in this document.

3.1.23 In order to minimise the risk of tax evasion or other criminal activity in the tax site, the Green Freeport governance body will be required to maintain a record of all of the businesses operating or applying to operate within the tax site. This record will need to be readily accessible by HMRC, Revenue Scotland, the NCA, and Border Force operatives.

Justifying tax site locations

3.1.24 Applicants should submit an analysis explaining:

a. how their proposed sites are “underdeveloped” (see criteria below in 3.1.26)

b. if any proposed sites are not a qualifying area as set out above, why the proposed site(s) needs regenerating

c. how the tax measures will generate additional economic activity in the site(s) and create genuinely new economic activity

d. why the proposed site(s) are the optimal choice for the local area, representing good value for money

3.1.25 The assessment process will ensure that the criteria outlined in 3.1.20.b and c are met. Applicants should note the remaining criteria of 3.1.20 as these will provide supporting evidence for assessment of their chosen tax site(s). Applicants should also note the level of wastage of expenditure that will occur in these sites will be considered, to support our objective of generating additional economic activity.

3.1.26 Tax sites should be “underdeveloped” so that the tax measures support areas with economic potential, rather than already economically successful sites. Under this broad, economic definition, empty land, brownfield land, under-utilised land with some construction and vacant premises are some examples of what might be considered “underdeveloped” so long as a good case is made. When justifying how their sites are “underdeveloped”, applicants should consider three main criteria underpinning our definition:

a. underutilised: tax sites should have sufficient viable but unoccupied physical space that is yet to be developed or used; to allow new or expanding businesses to construct, renovate, purchase or lease new premises in the Green Freeport

b. potential investment growth: applicants should explain how Green Freeport status will lead to additional investment by new and/or existing businesses in the tax site(s) significantly above current levels

c. job creation: applicants should evidence that their proposed tax site does not contain significant incumbent employment in relation to the local region. Applicants should then explain how Green Freeport status will lead to additional employment in the Green Freeport tax site(s) by new and/or existing businesses above current levels

3.1.27 Existing buildings with planned obsolescence within the timeline for Green Freeport tax sites can be part of the Green Freeport tax site. However, only new investments or employments, such as new investment funding the renovation of an existing building eligible for the Structures and Buildings Allowance (SBA), will be eligible to benefit from the tax offer.

3.1.28 In addition, applicants will also be required to explain how their choice of tax site location(s) minimises displacement of economic activity from wider local areas, especially other economically disadvantaged areas.

Green Freeport Distribution

3.1.29 Ports of all modes: The model has been designed to apply effectively to areas with seaports, airports and rail ports. Every mode of port is welcome to make an application or form part of an applicant coalition.

3.1.30 Multiple ports: We welcome applications that include multiple ports, including multiple ports of different modes.

3.1.31 If there are two or more ports located within the Outer Boundary distance that are interested in being part of a Green Freeport, and their economic activity affects one another and the region, they may be able to make a strong case for collaboration in support of the wider economic geography. However, proximate ports of different scale or with different economic focus are also free to be part of separate applications, if they have a strong individual case for a distinct economic Green Freeport cluster.

3.1.32 Should applicants wish to include a port outside the Outer Boundary (because there is a strong economic rationale), they may present such a case for consideration.

3.2 Tax

3.2.1 Successful bidders will be able to access a range of tax reliefs comparable with the English Freeports offer once an Outline Business Case (OBC) has been agreed with both governments. The exact time in which businesses can apply and then benefit from tax reliefs will be confirmed in the OBC guidance, which will be published once successful bidders have been announced. We intend for this to be closely aligned to English Freeports. The English tax relief deadlines have been included as a reference in the descriptions below.

Land and Building Transaction Tax (LBTT) Relief

3.2.2 The Scottish Government proposes to offer a specific LBTT relief on relevant land transactions within qualifying tax sites in Scotland where that property is to be used for qualifying commercial activity.

3.2.3 Legislation to provide for this is required to be laid before the Scottish Parliament and subsequently approved before any relief can be made available. As such, the timing for this is subject to confirmation.

3.2.4 Further details on the Scottish Government’s proposals will be provided in due course, but for planning purposes the expectation is that any relief would be available for a period of five years. Where relief is available, clawback provisions will apply in the event that land, or property, is not used for a qualifying purpose within a control period which will be set out in the legislation. This is expected to be three years, or earlier if the land or property is sold.

3.2.5 Applicants should note that as LBTT policy is devolved, the details of relief may differ from the Stamp Duty Land Tax relief, based on the specifics of the Scottish approach.

Enhanced Structures and Buildings Allowance (SBA)

3.2.6 The UK government intends to offer an enhanced SBA rate for firms constructing or renovating structures and buildings for non-residential use within Green Freeport tax sites. This accelerated relief will allow firms to reduce their taxable profits by 10% of the cost of investment every year for ten years, compared with the standard 3% p.a. over 33 1/3 years available nationwide. This relief would be claimable where qualifying expenditure is incurred, all associated construction contracts are entered into and the asset in question is brought into qualifying use between the date the tax site is designated and 30 September 2026.

3.2.7 Qualifying firms will claim capital allowances as part of their income or corporation tax return. As is standard under the existing SBA, claimants will be required to retain an allowance statement to demonstrate eligibility for claims throughout the 10-year period over which relief can be claimed.

3.2.8 The standard SBA capital gains clawback and anti-avoidance provisions will be maintained under the enhanced SBA in Green Freeports.

Enhanced Capital Allowances (ECA)

3.2.9 The new ECA the UK government intends to offer in Green Freeport tax sites will provide enhanced tax relief for companies investing in qualifying new plant and machinery assets. This accelerated relief is intended to allow firms to reduce their taxable profits by the full cost of the qualifying investment in the same tax period the cost was incurred. Firms investing in the Green Freeport tax site would be eligible to benefit from the relief where the qualifying expenditure is incurred after the tax site is designated until 30 September 2026. Assets eligible for relief must be for use primarily within defined Green Freeport tax sites.

3.2.10 Firms will access the measure by claiming capital allowances as part of their corporation tax return.

3.2.11 As is standard for capital allowances, the Green Freeports ECA will feature a balancing charge in some situations where a purchased asset for which the ECA has been claimed is then later sold (disposed of). The standard disposal rules for capital allowances for plant and machinery will apply including, where appropriate, balancing charges.

Employer National Insurance Contributions (NICS)

3.2.12 The UK government intends to enable employers operating in a Green Freeport tax site to pay 0% employer NICs on the salaries of any new employee working in the Green Freeport tax site. This 0% rate would be applicable for up to three years per employee on earnings up to a £25,000 per annum threshold.

3.2.13 An employee will be deemed to be working in the Green Freeport tax site if they spend 60% or more of their working hours in that tax site.

3.2.14 The relief is intended to be available for up to 9 years from April 2022. Partway through, the UK government intends to review this relief and decide whether it should be continued up to its end date in 2031. The relief would end no earlier than April 2026 and would therefore be available for a minimum of four years. The UK government will provide further detail on timings in due course. The UK government will ensure it has the power to prevent access to the relief for those employers found to be abusing this relief by manipulating their employment practices, for example dismissing staff specifically to benefit from it.

3.2.15 Employers will be able to claim the relief through the existing Real Time Information returns, and the UK government will work with payroll software providers to facilitate this. Employers will be required to notify HMRC when an employee is no longer eligible due either to the three year per-employee eligibility period coming to an end, or to the employee or employer ceasing to meet the eligibility criteria.

Non-Domestic Rates Relief (NDRR)

3.2.16 Businesses may be eligible for up to 100% relief from non-domestic rates on certain properties and property improvements within designated tax sites. This relief is intended to support new businesses, and existing businesses when they expand into new or unused space. It would apply for up to five years from the point at which the beneficiary first receives relief. Relief must be applied for by 31 March 2028.

3.2.17 Eligible firms will be able to apply to the relevant local authority to access this relief.

3.3 Customs

3.3.1 Authorised businesses operating within Green Freeport customs sites can import goods for storage and / or processing with import duties suspended. They will only have to pay these duties where goods are then declared for home use in the UK. In doing so, they will usually be able to elect to pay duties on the imported goods either as they stood before (inputs) or after processing (finished good) in the customs site. Subject to the UK’s trade agreements, businesses may also be able to take advantage of customs duty exemption on goods that are exported from a customs site. (Some Free Trade Agreements (FTAs) contain a Duty Drawback Prohibition. Duty drawback is refund of import duty when the goods are re-exported. This clause prohibits granting tariff preferences to goods that benefitted from duty drawback on third-country inputs. This means businesses have to choose between whether they want to benefit from the duty drawback or the preferential rates under the FTA (provided they meet the rules of origin test under that FTA). The UK has rolled over 15 FTAs that contain this prohibition.) They will also be able to suspend import VAT on goods entering the Green Freeport customs site and benefit from a VAT zero-rate in respect of certain transactions that take place within the Green Freeport customs site.

3.3.2 Authorised Green Freeport businesses importing goods subject to excise duty will be able to suspend payment whilst the goods are stored or processed within the customs site. Businesses will also be able to produce excise goods from raw materials under customs duty suspension (subject to being authorised under the existing excise production legislation).

3.3.3 Payment of any duty will follow general customs requirements (release to free-circulation) and UK duty is not due if the goods are exported. In addition, authorised businesses operating in a Green Freeport customs site will be able to use simplified import and export procedures. This model expands on existing customs facilitations and procedures available to business.

3.3.4 Authorised businesses operating in the Green Freeport customs site will be responsible for following the rules of their HMRC approval. Operators of customs sites will need to obtain authorisation from HMRC. When authorised, the site for which they are responsible will need to be designated by HMG by statutory order. Applicants should ensure that the operators of all proposed customs sites are willing and able to undergo appropriate authorisation.

3.3.5 Find full details on how to apply for authorisation to be a Customs Site Operator.

3.3.6 Find full details relating to Freeport customs sites.

Responsibilities of operators of customs sites

3.3.7 Principally, the operator of a Green Freeport customs site is responsible for the control of movement of goods and people in and out of the customs site. This will include ensuring that goods are only able to leave the Green Freeport customs site when the appropriate conditions have been met.

3.3.8 Operators of Green Freeport customs sites must adhere to the OECD Code of Conduct for Clean Free Trade Zones – and the specific anti-illicit trade and security measures therein. They will also need to maintain the current obligations set out in the UK’s Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017

3.3.9 An operator of a Green Freeport customs site will be jointly and severally liable with a declarant for any import duty liability arising where there is a breach of any requirement of the Green Freeport customs site operator’s authorisation in relation to the keeping of goods in the Green Freeport customs site. This is consistent with other authorisations.

Authorisation requirements

3.3.10 As set out in 3.1.9, applicants will need to set out any sites within the Green Freeport area they intend to use as a customs site. Each site will need to be designated before it can operate as a customs site and have an authorised site operator to run it. To get authorised as a customs site operator, the relevant business will need to meet the requirements set out by HMRC. Authorisation of the Green Freeport customs site operator is dependent on meeting the existing Authorised Economic Operator security and safety (AEO(S)) standards or the Freeport alternative. Customs site operators may also wish to apply for a temporary storage approval at their customs site. In doing so, they’ll need to amend their customs site designation to reflect the arrangement.

3.3.11 Find further details on authorisations on gov.uk.

Other customs authorisations

3.3.12 Infrastructure will be required by HMRC, Border Force and other Government agencies to carry out checks in line with existing arrangements at ports. Green Freeport operators will be required to provide this infrastructure. Infrastructure may include, but not be limited to, examination facilities, potential sites to scan goods and vehicles, and a dedicated area to securely store goods.

3.3.13 Operators of Green Freeport customs sites may wish to facilitate Transit movements to and from their customs sites. To do this, operators may offer Transit facilities and Authorised Consignee and Consignor functions to businesses on site. This will offer a streamlined approach for businesses to start and end their transit movements within the Green Freeport.

3.3.14 To offer Transit facilities and Authorised Consignee and Consignor functions, operators will need to have the appropriate authorisations in place.

Future border requirements

3.3.15 The requirements will be regularly reviewed, and applicants will be expected to keep up to date with the requirements and co-operate with government agencies.

3.3.16 The UK government recently published the 2025 UK Border Strategy. One of the aims is to support “ports of the future” to make the experience smoother and more secure for businesses and traders. Applicants are encouraged to set out how they would be able to contribute to making a highly digitised process available for businesses and providing infrastructure that is resilient, multifunctional and facilitative.

Removal of authorisation

3.3.17 Operators of Green Freeport customs sites are always required to meet the conditions as set out in their designation. Failure to meet any of these conditions may result in revocation of their designation.

3.4 Seed capital, retained non-domestic rates, and local authority capital

Seed capital

3.4.1 Successful applicants will have the opportunity to access seed capital funding of up to £25 million. The amount accessed will depend on the submission of an outline business case (OBC) and full business case (FBC), the quality of those business cases and the proposals strategic fit with the policy. Business cases will be approved by the Green Freeport Programme board with joint representation from Scottish Government and UK government. We expect that any funding provided will be matched or part-matched by private sector investment, local authority borrowing and co-funding from other public bodies where relevant. When released the funding will be issued to the local authority within the Green Freeport governance body. They will be accountable to the Scottish Government for the expenditure and management of Green Freeports seed capital funding. Where there is more than one local authority on the governing body a lead local authority will be identified.

3.4.2 Applicants should provide outline proposals for how they will spend seed capital funding within their Outer Boundary in order to contribute to the Scottish and UK government objectives for Green Freeports and address the three pillars of the Scottish Government’s Infrastructure Investment Plan which outlines the Scottish Government’s strategic approach to delivering the National Infrastructure Mission. The three pillars are: enabling the transition to net zero and environmental sustainability; driving inclusive economic growth; and building resilient sustainable places.

3.4.3 We expect proposals to be focused primarily on land assembly, site remediation, and internal small-scale transport infrastructure to connect sites within the Green Freeport to each other, the immediate surroundings or other economic assets within the Outer Boundary. These should embed transport strategies, sustainable transport and investment hierarchies. Proposals for spending seed capital on skills, digital and/or other infrastructure will only be considered in exceptional circumstances. Seed capital may not be spent on security infrastructure for customs sites.

Retained non-domestic rates and local authority capital

3.4.4 Local authorities should also consider how they can use an uplift in non-domestic rates to cover borrowing costs for infrastructure (where relevant); re-invest in the Green Freeport tax site to generate further growth; or offset expected effects of displacement of local economic activity from disadvantaged areas.

3.4.5 It is intended that the local authority or local authorities in which the Green Freeport tax sites are located will retain the non-domestic rates growth for that area above an agreed baseline. This will be guaranteed for 25 years, giving local authorities the certainty they need to borrow to invest in regeneration and infrastructure that will support further growth. Retained receipts should be used to cover borrowing costs (where relevant); re-invest in the Green Freeport tax site to generate further growth; or offset expected effects of any displacement of local economic activity from deprived areas. Bidders should set out a decision-making process for agreeing how retained rates should be reinvested.

3.4.6 Applicants should detail the costs of delivering their proposal, as well as the source(s) of funding (e.g. Green Freeport seed capital, private sector investment, local authority borrowing, co-funding), and application partner responsible for that cost in their response. As far as possible this should be broken down by financial year. Key delivery milestones should also be reflected in applicant responses as part of their implementation plan. Proposals should also detail community support, and any critical interdependencies.

3.4.7 To ensure resources in the local economy are used effectively, Green Freeport proposals should build on and add to existing partnerships and plans for the port, and complement pre-existing strategies such as Regional Economic Strategies, Local Development Plans, Skills Development Scotland strategic plans, spatial strategies and national, regional and local transport plans.

3.5 Wider government funding

3.5.1 Applicants should outline how their Green Freeport proposals could be complemented by funding from existing or additional upcoming funding rounds from across government. The Green Freeport proposal should be viable without these additional sources of unsecured funding, though government may choose to align allocations across funds where objectives and timing allows.

3.6 Innovation

3.6.1 Green Freeport applicants are key to creating an innovative environment for businesses. Proposals should highlight how their Green Freeport status can bring additionality to those already collaborating in the region. Government is particularly interested in private sector-led innovation within Green Freeports, and innovation ambitions that contribute to the decarbonisation agenda or net zero.

3.6.2 Additional detail on UK government innovation support will be announced in due course.

Green Freeport innovation funding

3.6.3 It is expected that all partners seek opportunities to access wider innovation funding. Applicants should set out their initial ideas for how this funding could be delivered as well as any industry commitment they have secured to invest in innovative activity or the testing of new technologies.

3.6.4 The official Scottish Government “FindBusinessSupport” portal provides the ability to search for support across Scotland. Additionally, the UK government portal “Apply for innovation funding” provides a similar opportunity to search for UK-wide support, including Innovate UK funding to help commercialise ideas and grow through innovation and UKRI’s website which outlines current UKRI funding opportunities.

Green Freeport collaboration hub

3.6.5 Green Freeports should enhance local and national innovation ecosystems ensuring collaboration is supported in line with the Green Freeports objectives. Applicants should set out their proposals to establish Green Freeports as collaboration hubs, including as far as possible, a coherent plan for engaging with local leadership to help them accelerate economic growth through R&D, any plans to establish new facilities or link with existing facilities, facilitate skills development, and promote Freeport-specific research programmes.

Green Freeport regulatory innovation

3.6.6 We are committed to working together to ensure the Green Freeport model maintains Scotland and the UK’s high standards with respect to security, safety, workers’ rights, data protection, biosecurity and the environment, while ensuring fair and open competition between businesses.

3.6.7 However, the government recognises that regulation in some cases can be challenging to navigate for innovative firms as they develop, test and apply new ideas and technologies in some sectors.

3.6.8 Therefore, we will facilitate engagement between Green Freeports and relevant regulators through a “Freeport Regulation Engagement Network” (FREN). The FREN’s exact operation in Scotland will be confirmed after the competition concludes, but FREN will:

a. enable an early engagement process between innovative businesses and regulators

b. support businesses on regulatory issues, minimising bureaucracy and uncertainty

c. generate ideas to engage businesses and regulators on areas of potential opportunity

d. identify opportunities for regulatory flexibility and new regulatory sandboxes

3.6.9 In outlining their innovation ambitions, applicants should outline how they would look to take advantage of the Freeports Regulation Engagement Network to support these proposals; for example, how they would benefit from an early engagement process with specific regulators.

3.7 Trade and investment support

3.7.1 Applicants should outline what specific trade and investment support measures they believe would benefit a Green Freeport in their area. Applicants should reference Scotland: A Trading Nation and Shaping Scotland’s Economy as well as Made in the UK, Sold to the World. Proposals should emphasize the type of support required and the frequency and timing of said support. The longevity of the support over the first 5 years of the Green Freeports’ operational life should also be included.

3.7.2 The Scottish Government and agencies will work with successful applicants and the Department for Business and Trade to ensure a workable business support programme is clearly articulated to businesses considering locating within a Green Freeport.

3.7.3 Applicants should demonstrate an independent Trade and Investment function within the Green Freeport proposal. This should be adequately staffed, properly financed and contain requisite expertise. The proposal should demonstrate the functions a Green Freeport will provide and how these will intersect with existing Trade and Investment services across the Scottish Government and from within DIT.

3.7.4 Trade and Investment activities should be matched with the sectoral proposition. Applicants should show knowledge and understanding of the competitor environment and should include the applicant’s strategy for competing successfully within their chosen market(s).

3.8 Planning

3.8.1 The Scottish Government is undertaking a review of National Planning Policy in Scotland with a view to publishing National Planning Framework 4 (NPF4) in 2022. This will be Scotland’s long-term spatial strategy. Draft NPF4 was published in November 2021 for a period of public consultation and parliamentary scrutiny. The formal consultation period will close at the end of March 2022. Once approved by the Scottish Parliament and adopted by the Scottish Ministers, NPF4 will become part of the statutory development plan and will directly influence planning decisions. The Scottish Government are working towards laying a final NPF4 in Parliament this summer.

Place-based planning approaches

3.8.2 A number of place-based tools could be used to inform the delivery of appropriate development in Green Freeport areas by providing greater planning certainty and enabling streamlined decision-making. These include Enterprise Areas, Simplified Planning Zones and processing agreements, and new mechanisms like Masterplan Consent Areas. (The Planning (Scotland) Act 2019 introduces new powers for planning authorities to designate Masterplan Consent Areas (MCAs). Building on existing provisions for Simplified Planning Zones, MCAs are intended to be a proactive tool for planning authorities to use to promote investment. The Scottish Government will be engaging stakeholders later this year on the implementation of these powers and associated secondary legislation.) Such tools may enable planning authorities to take a more strategic approach to Green Freeport development. We therefore encourage authorities and prospective applicants to consider their use.

3.8.3 Applicants will need to demonstrate relevant stakeholder support for their proposals to ensure successful delivery. Applicants should consider the planning needs across the entirety of the outer boundary and in particular those associated with the tax sites, seed capital projects, customs sites and any other supporting investment.

3.8.4 We would expect the relevant local authorities to:

a. be part of the application coalition

b. have discussed the fit with relevant development plans and policies (and the potential use of place-based planning approaches referred to above) as part of compiling the application

3.8.5 Such cooperation will help to ensure development proposals are able to progress smoothly through the planning system. Applications should demonstrate local authority support for commercial property development within tax and customs sites, to support their growth. Proposed development will be subject to local planning approvals where necessary.

3.8.6 We welcome applications which present innovative development proposals, including those that are forward leaning on using available land to bring forward infrastructure and support businesses that further the Scottish and UK government’s net zero ambitions.

3.8.7 For each relevant site successful applications should:

a. explain the current planning status including status in relation to the local plan

b. explain the planning needs for the anticipated development

c. detail how these development needs will be met, including what options have been considered

d. explain the steps taken (or planned) to engage with local communities to consider how proposals will maintain and enhance where possible the quality of the locality within which the proposal is located

e. explain how any relevant requirements for environmental assessment will help to mitigate any adverse impacts. Applications can also usefully indicate whether any early engagement with key agencies has been undertaken as part of this

f. provide evidence of early discussions they have had with planning authorities on the potential use of place-based planning tools

Section 4. Delivery requirements

4.1 Contribution to decarbonisation and environmental impact

Driving the decarbonisation agenda

4.1.1 Green Freeports have great potential to contribute towards the Scottish and UK government’s decarbonisation agenda and net zero ambition. Applicants must present an outline decarbonisation plan for the Green Freeport. This should be followed by robust plan of action setting out how they intend to contribute to a just transition to net zero emissions by 2045, including how they can facilitate decarbonisation of the Green Freeport following designation. In support of a just transition, this planning approach will demonstrate support for decent, fair and high-value work; low-carbon investment and infrastructure; meaningful engagement with relevant stakeholders and partners (such as workers, local communities and local authorities); and consideration of inclusive growth.

4.1.2 An applicant’s approach to planning will:

a. work from established, clearly defined baselines for emissions, environmental impact and climate risk management, ensuring that the ambition they have set, and the progress being made against those ambitions, will be publicly available

b. set targets and milestones (in line with Scotland’s net-zero ambition) for emissions reductions and economic growth and wellbeing in a net-zero economy

c. identify and sequence key actions (enablers, barriers, dependencies), opportunities and partners across different actors to enable collaboration. This must include consideration of emerging technologies and supply of alternative fuels

4.1.3 Full details of monitoring of plans for Green Freeports will be set out for successful applicants as part of the final designation process for Scotland. Applicants must detail how they will approach meeting all relevant environmental regulations and Scottish Government commitments. Following designation, we will look for detailed, achievable action-focused plans for decarbonisation in support of a net zero economy. Within that, applicants will be required to provide both a timeline and realistic programme of work for achieving these decarbonisation goals.

4.1.4 Applicants should evidence, in their outline initial plan, how they would support job creation through low carbon investment and infrastructure.

4.1.5 This approach supports the 2020 Programme for Government commitment to create green jobs in line with the ambitions of the Scottish Government Climate Emergency Skills Action Plan.

4.1.6 Green Freeports have great potential to contribute towards the Scottish and UK government’s decarbonisation agenda and net zero ambition. As part of the assessment process, applicants should outline how their sustainable Green Freeport proposal aligns with Scotland’s 2045 net zero policy both operationally and links to wider benefits such as stimulating innovation.

4.1.7 Green Freeport applications must outline how their proposals will ensure compliance with all applicable environmental regulations and standards with pertinence to air and water quality, waste management, chemical treatment and handling; and any additional assessment of impacts on protected sites and species including mitigation.

4.1.8 It is essential that Green Freeports are bio-secure and ensure robust adherence to sanitary and phytosanitary (SPS) standards. The Scottish Government will provide future operators with guidance on adherence to SPS standards and the role of a Border Control Post for the performance of controls to ensure the protection of public, animal and plant health. Green Freeport applications will be assessed by the Scottish Government to assure proposals are sufficient for the port to act as a Border Control Post in cases where such facilities are required.