2021-22 Government Financial Reporting Manual

Updated 16 December 2021

1. Introduction

1.1 The purpose of the Government Financial Reporting Manual (FReM)

1.1.1 Controlling public spending is central to running the country. In a healthy democracy, the power to spend money comes with a responsibility to be open to scrutiny about how that power is used.

1.1.2 The Government Financial Reporting Manual (FReM) sets out core guidance for preparing government annual reports and accounts in the United Kingdom. It complements guidance on the handling of public funds published separately by the relevant authorities in England and Wales, Scotland and Northern Ireland, where these are issued.

1.1.3 The relevant authorities are:

- HM Treasury

- the Welsh Government

- the Scottish Government

- the Executive Committee of the Northern Ireland Assembly

- the Department of Health and Social Care

- CIPFA/LASAAC

1.1.4 Under the Government Resources and Accounts Act 2000 (GRAA 2000) HM Treasury is required to provide directions to certain entities to prepare accounts that:

- Present a true and fair view; and

- Conform to generally accepted accounting practice subject to adaptations necessary in the context of public sector accounts.

The publication of this manual is one of the ways HM Treasury discharges its responsibilities under the GRAA 2000.

1.1.5 Entities to whom this Manual applies is explained in section 1.2 below.

1.1.6 The FReM is prepared following consultation with the Financial Reporting Advisory Board (FRAB) and is issued by the relevant authorities.

1.1.7 The government has the responsibility to control and account for public expenditure. This Manual provides guidance on the external financial reporting requirements for reporting entities and falls under the government functional standard GovS 006: Finance. GovS 006 is part of a set of operational standards which set the expectations regarding how government is managed. The purpose of GovS 006 is to set out expectations for effective management and use of public funds. GovS 006 is found on the Gov.UK website: https://www.gov.uk/government/publications/government-finance-standards-page

1.1.8 This Manual references Public Expenditure System (PES) papers and Employer Pension Notices (EPNs). These papers and notices can be accessed as follows:

- Public Expenditure System (PES) papers can be accessed through One Finance. Registered users can access OneFinance here: https://gff.civilservice.gov.uk/

- EPNs are linked in Annex 4 to this Manual.

1.2 The scope of the FReM

1.2.1 The FReM applies directly to all entities (‘reporting entities’) other than those listed in 1.2.2, and to funds, flows of income and expenditure and any other accounts (referred to collectively as ‘reportable activities’) that are prepared on an accruals basis and consolidated within Whole of Government Accounts (with the exception of the accounts of any reportable activities that are not covered by an Accounts Direction). Relevant authorities and sponsor departments may also require other entities not consolidated in the WGA, through an accounts direction or a framework agreement, to apply the FReM,

1.2.2 The FReM does not apply to:

- Local government,

- those public corporations that are not trading funds, and

- NHS Trusts, NHS Foundation Trusts and Clinical Commissioning Groups.

1.2.3 The Department for Health and Social Care Group Accounting Manual, the NHS Foundation Trust Annual Reporting Manual and the CIPFA/LASAAC Code of Practice on Local Authority Accounting in the United Kingdom are compliant with this Manual other than for specific divergences.

1.2.4 In addition, the Welsh Government and the Department of Health in Northern Ireland will apply the principles outlined in the FReM in the accounting guidance that they issue in respect of NHS Bodies in Wales , and Health and Social Care Trusts in Northern Ireland.

1.2.5 More detailed guidance on the applicability of the FReM to different bodies is provided in section 4.3 and section 4.4 of this manual.

1.3 The structure and contents of the FReM

1.3.1 The FReM consists of this introduction followed by four sections of guidance, each with its own purpose:

Part A: Purposes, principles and best practice, including:

- Chapter 2 explains what government financial reporting and government annual reports and accounts are, before outlining the purposes and principles of government financial reporting and the importance of user engagement.

- Chapter 3 sets out the role of narrative reporting, including the need for balance, the importance of providing context and trends and the importance of making narrative clear and usable.

Part B: The form and content of government annual reports and accounts:

- Chapter 4 gives an overview of the required format and content of the annual reports and accounts for entities covered by the requirements of this Manual, including a discussion of some of the underpinning concepts.

- Chapter 5 outlines the requirements of the performance report.

- Chapter 6 outlines the requirements of the accountability report.

- Chapter 7 provides guidance to reporting entities on the format and content of the financial statements.

Part C: Application of accounting standards for government annual reports and accounts.

- Chapter 8 outlines UK adopted IFRS Standards, together with a record of whether they have been adapted or interpreted for the public sector context in this Manual.

Part D: Further guidance for government annual reports and accounts

- Chapter 9 provides further guidance on accounting boundaries, including accounting for transfers of function between public sector bodies.

- Chapter 10 gives further guidance on accounting for assets and liabilities, including PPE, the Carbon Reduction Commitment (CRC) Energy Efficiency Scheme, intangible assets, impairments and inventories.

- Chapter 11 provides further guidance on accounting for certain specific income and expenditure, including Supply, Consolidated Fund income and the Apprenticeship Levy.

Part E: Additional guidance

- Chapter 12 outlines further guidance on accounting for pensions, covering pensions accounting by employers and pensions accounting by certain public sector pension schemes.

- Chapter 13 considers the specific accounting and disclosure requirements adopted in the Whole of Government Accounts.

1.3.2 Four annexes give illustrative wording on specific points and links to further resources. Full illustrative financial statements are also available on gov.uk.

1.4 How to apply the FReM

1.4.1 Government annual reports and accounts are prepared within a principles-based framework. The Treasury and other relevant authorities make many of the decisions about how best to apply the principles to reports across government. This ensures consistency, making it easier for users to understand and compare financial reports.

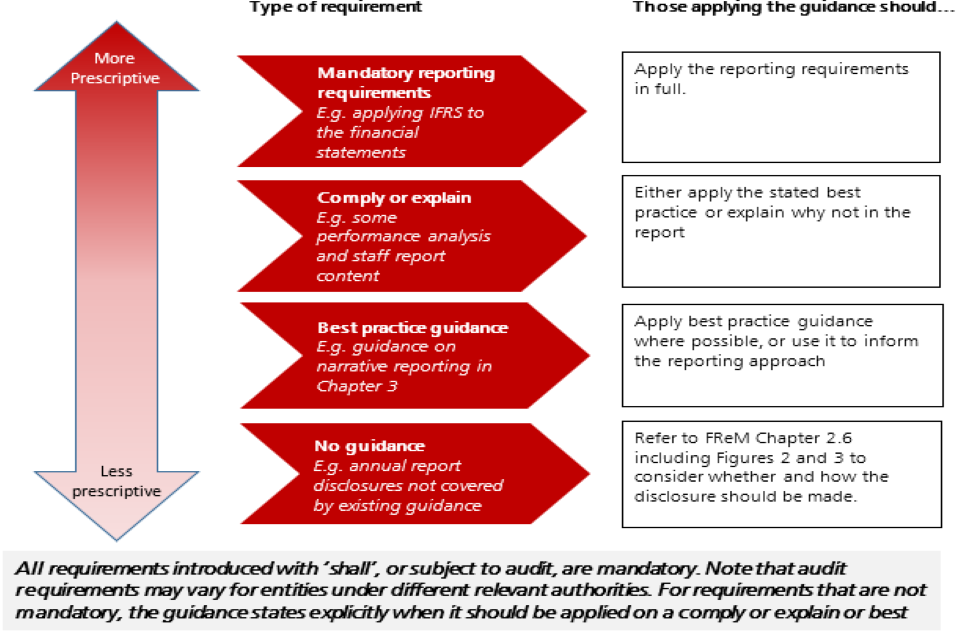

1.4.2 Annual reports and accounts are composite documents, bringing together different kinds of information. This Manual sets out mandatory reporting requirements for the financial statements, and for some parts of the annual report. It also includes less prescriptive guidance to support a more flexible approach in other parts of the annual report.

1.4.3 Some areas of best practice apply in most situations, but either cannot be applied or would be misleading if applied in others. In these cases, the guidance may specify a ‘comply or explain’ approach. This means that entities applying this Manual must either follow the stated best practice or else provide a full explanation in their report for their preferred alternative. It is expected that a reporting entity would not provide a ‘comply or explain’ disclosure only in exceptional circumstances. The comply or explain approach should only be taken where specified in the guidance, and never applied in place of a mandatory requirement.

1.4.4 The figure below shows the different levels of guidance, from more to less prescriptive, and how they should be applied to develop high quality financial report.

1.5 The FReM review and update cycle

1.5.1 The FReM is kept under constant review. It is updated to reflect developments in relevant financial reporting standards and best practice and, where appropriate, to reflect comments received from users and preparers.

1.5.2 The authoritative version of the FReM for any given financial year will be available by the start of the financial year to which it relates. In the event of the need for mid-year updates to the FReM, they will be issued after following due process.

1.5.3 Due process includes consideration of proposed policies by the relevant authorities and consideration by FRAB.

1.5.4 FRAB meeting minutes and papers are published on gov.uk.

2. The purposes and principles of government financial reporting

2.1 Introduction

2.1.1 This chapter sets out:

- what government financial reporting is

- what government annual reports and accounts are

- the purposes of government financial reporting

- the importance of user engagement

- the principles of government financial reporting

2.1.2 The principles in this chapter apply to all government financial reporting. The rest of the Government Financial Reporting Manual (FReM) gives full guidance on how to apply these principles to prepare government annual reports and accounts.

2.2 What is government financial reporting?

2.2.1 Every government body generates a data trail giving details of its financial activity. Filtering and combining this raw data creates useful financial information. For example, a list of every purchase made by an organisation is raw data. One way of turning it into financial information would be to combine data to make it more meaningful, such as breaking expenditure down by categories such as IT equipment, or staff training.

2.2.2 When government financial information is collected and shared, it becomes a financial report. Government financial reports can be internal or external, looking forward (as in budgets) or historical (as in accounts). Each has its own purpose and forms part of the wider landscape of government financial reporting.

2.2.3 At the heart of financial reporting in government are annual reports and accounts, which this Manual supports. However, many of the principles in this chapter could and should apply to all government financial reports.

2.3 Annual reports and accounts

2.3.1 The system of annual reports and accounts is central to financial accountability in the public sector. These reports bring together information on the financial position and activity of a government body, or (in the case of consolidated departmental accounts) of a whole area of government across several bodies. Most financial reporting requirements in annual reports and accounts are mandatory.

2.3.2 A set of government annual reports and accounts includes a performance report, an accountability report and the financial statements with their associated notes.

2.3.3 Financial statements are prepared according to International Financial Reporting Standards (IFRSs) issued by the International Accounting Standard Board as adapted and interpreted in this Manual.

2.3.4 The IFRS Conceptual Framework includes two fundamental qualitative characteristics of useful financial information: relevance, and faithful representation.

- Relevant financial information is capable of making a difference in the decisions made by users, and may have predictive value, confirmatory value, or both.

- A faithful representation is, to the maximum extent possible, complete, neutral and free from error.

Useful financial information, with both characteristics, is essential for the financial statements (and therefore the annual report and accounts) to be fair, balanced and understandable. Preparers should also consider the enhancing qualitative characteristics of comparability, verifiability, timeliness and understandability.

2.3.5 See Chapter 5 for more on the performance report, Chapter 6 for more on the accountability report, and Chapter 7 for more on the financial statements.

2.4 Purposes of government financial reporting

2.4.1 The four main purposes of government financial reporting, as outlined by the Public Accounts and Constitutional Affairs Committee and considered as part of the Government Financial Reporting Review, are:

- to maintain and ensure Parliamentary control of government spending, enabling, in particular, Parliament to hold the Government accountable for its spending.

- to enable the public and researchers (both in civil society and Parliament) to understand and consider the value for money offered by public spending, so that they can make decisions about the effectiveness, efficiency and economy of particular policies or programmes.

- to provide a credible and accurate record which can be relied upon.

- to provide managers inside departments (including both ministers and civil servants) with the information they require to run the departments and their agencies efficiently and effectively.

2.4.2 All government financial reports should meet one or more of these purposes. Public sector annual reports and accounts should meet all of them. Enabling Parliament to hold the government to account (Parliamentary accountability) is, however, the key purpose of government annual reports and accounts. If there is any conflict between meeting different purposes, then the needs of Parliament take precedence.

2.4.3 Parliament in the context of the FReM is defined as:

- The UK Parliament;

- the Scottish Parliament;

- the Senedd ; and

- the Northern Ireland Assembly.

2.4.5 The application of UK adopted IAS, as adapted and interpreted for the public sector context (see Chapter 8) with additional disclosure when necessary, is presumed to result in financial statements that that meet the needs of Parliament and other users, and to give a true and fair view (see Chapter 4).

2.5 User engagement

2.5.1 Each of the four purposes of government financial reporting reflects the needs of a different group of users. The best way of assessing whether a financial report is fulfilling its purpose, therefore, is to ask those users for feedback.

2.5.2 Another benefit of engaging directly with users is to raise the profile of reports and help them reach a wider audience.

2.5.3 Those preparing government financial reports can increase user engagement both passively, by making their reports more accessible, and actively, by reaching out directly to known users.

2.5.4 The primary user of government annual reports and accounts is Parliament. Select committees review consolidated departmental annual reports and accounts, and the Public Accounts Committee (PAC) holds hearings on the Whole of Government Accounts.

2.5.5 Those preparing annual reports and accounts should actively engage with their users. For example, preparers at the departmental level should seek feedback from the relevant select committee. Having conversations about the nature and use of the annual report and accounts will help preparers meet the needs of Parliament.

2.6 Principles for government financial reporting

2.6.1 Every government body is unique, and no two government reports have exactly the same story to tell, as outlined in the Simplifying and Streamlining report and the Government Financial Reporting Review. There are, however, some fundamental principles that help entities tell their unique story.

2.6.2 Many aspects of government annual reports and accounts are long established in law, precedent, and best practice. The flexible nature of the annual report, however, means that new disclosures may be suggested at any time.

2.6.3 Accounting Officers across the public sector take ultimate responsibility for what is included in the annual report and accounts. Where there is no existing guidance, it is the Accounting Officer who should be comfortable with any choices made in selecting new information to be published, and in deciding how to publish it.

Choosing what to publish and how to publish it

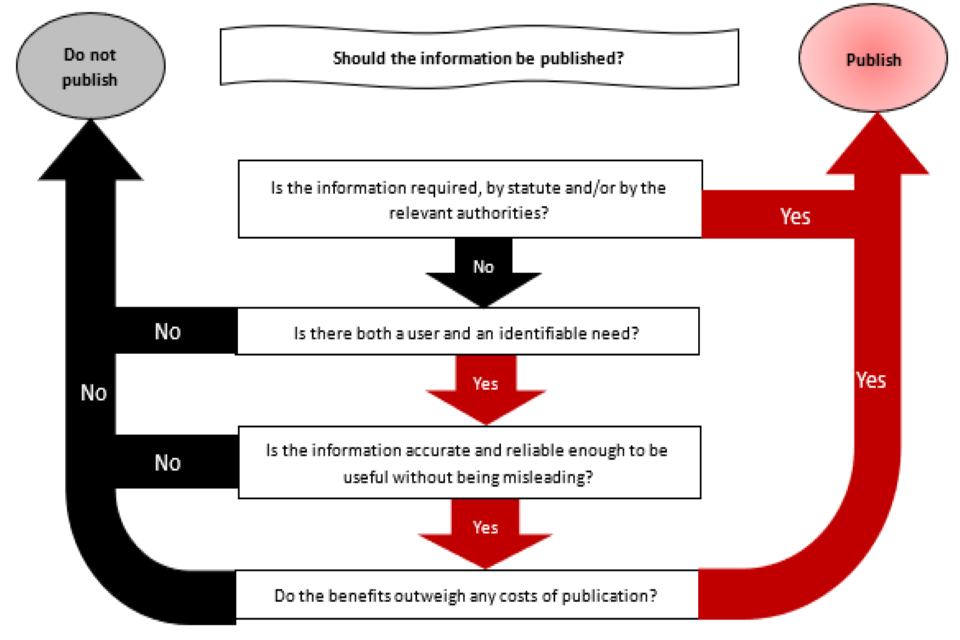

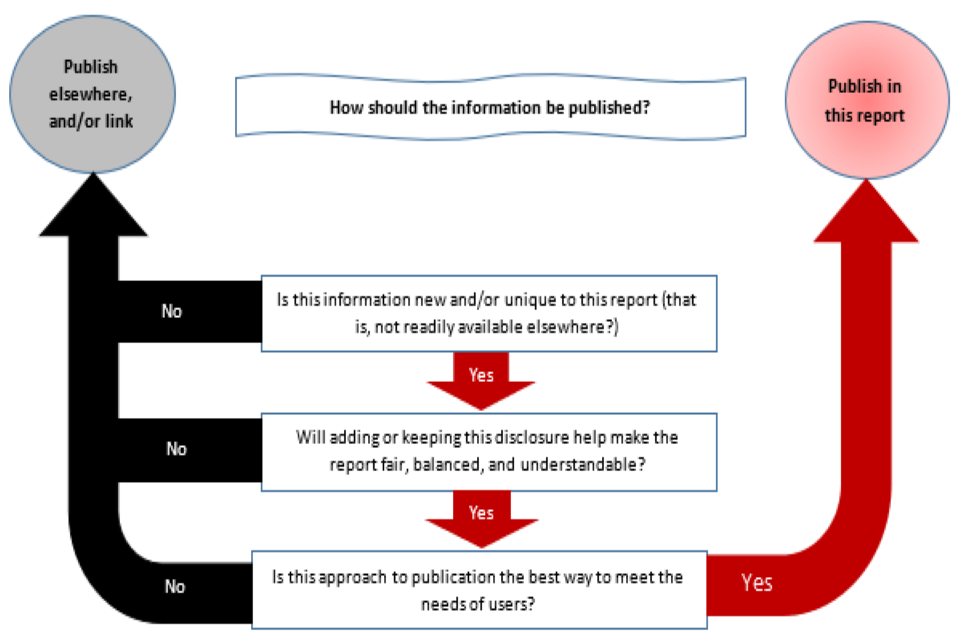

2.6.4 Figures 2 and 3 give a two-part decision tree to support those considering whether to publish additional information in a report. The set of questions in Figure 2 help determine whether information should be published, and those in Figure 3 help determine whether a given report is the right place for that publication.

2.6.5 When deciding whether to include information in the Performance Report and Accountability Report, entities must consider whether the information is material to the primary users of the annual report and accounts and determine the appropriate level of information to disclose in relation to the given matter. As noted in section 2.5 above, the primary users of government annual reports and accounts is Parliament.

2.6.6 Information is material if its omission or misrepresentation could reasonably be expected to influence the decisions primary users take on the basis of the annual report as a whole. As a general principle entities should disclose material financial and non-financial information in the annual report and accounts that is necessary for the understanding of the performance and accountability of the entity irrespective of whether there is an explicit disclosure requirement in statute or in this Manual.

2.6.7 Due to the nature of the information contained in the Performance Report and Accountability Report, qualitative factors will often have a greater influence on what is material in the context of these reports, particularly in relation to non-financial information.

2.6.8 Entities may consider the following questions when deciding whether information is material:

- What types of information are likely to influence the decisions of the primary users of the annual report and accounts?

- For any given matter, what is the appropriate context for assessing materiality?

- When do non-financial issues become qualitatively material?

2.6.9 Unless explicitly allowed, the concept of materiality cannot be applied to disclosures in the Performance Report and Accountability Report that are required:

- in this Manual;

- by law or regulation; or

- promulgated by HM Treasury through PES papers.

The use of terms such as ‘to the extent necessary for an understanding of’ or ‘principal’ mean materiality judgements can be made to disclosure requirements.

2.6.10 For example, section 6.5 of this Manual sets out the minimum disclosure requirements for the Staff Report to be included by all entities applying this Manual. Materiality cannot be applied to these requirements and must be included by all entities. On the other hand, para 5.3.2 requires a summary of the principal risks faced by the entity- the use of the term ‘principal’ means the entity can apply materiality judgements to determine what risks are material to understanding the performance of the entity.

2.6.11 As per Figure 2 above, there are exceptional cases where information is not accurate or reliable and should not be reported. Where relevant, the governance statement should acknowledge this and identify the steps that are being taken to improve data collection and disclosure, as well when reliable data will be made available.

How you present what you publish

2.6.12 Transparency, and therefore accountability, depends not just on how much data is published but on how it is turned into information that readers can understand. Making reports longer can make them unreadable and obscure information which is material to the primary users of the accounts. Too much information can be difficult to absorb, and as unhelpful or misleading as too little information would be.

2.6.13 Though an annual report contains information which has differing objectives, entities should aim to present the annual report as a cohesive document and link related information together. Where information relevant in one part of the annual report and accounts is included elsewhere in the annual report and accounts, entities should use cross-refencing and avoid duplicating information. Where cross referencing is used, the entity may wish to explain the nature of the relationship or interdependency, rather than just highlighting the existence of the relationship or interdependency.

2.6.14 The annual report should highlight and explain linkages between pieces of information presented within the annual report and accounts . While each component of the annual report is independently useful, more valuable insight can be provided where linkages between information in the annual report and accounts is explained.

Balanced reporting

2.6.15 Government annual reports should be trustworthy and transparent. The Accounting Officer is responsible for ensuring that, taken as a whole, they are fair, balanced, and understandable. A financial report that only tells only the good news may undermine readers’ trust, even if what is reported is accurate.

2.6.16 Two useful questions to help those preparing annual reports to assess them for balance are:

- Is this report complete? That is, does it refer to everything that is relevant?

- Does this report put the information it contains into full context?

2.6.17 Chapter 3 of this Manual provides more guidance on best practice in narrative reporting. Chapter 6 provides more guidance on the responsibilities of the Accounting Officer in respect of the annual report and accounts.

Balancing cost and usefulness in reporting

2.6.18 Every disclosure in a set of annual reports and accounts comes with a cost. Relevant authorities consider the cost of reporting when interpreting or adapting reporting standards and developing guidance. All government bodies have a duty to use public resources well, and Accounting Officers should therefore also consider value for money when making the judgements about financial reporting that fall into their remit.

2.6.19 However, reporting entities are not permitted to disregard mandatory reporting requirements due to value for money concerns. Instead, any such concerns should be raised with the appropriate relevant authority.

2.6.20 In rare circumstances, if cost is the reason given for not following best practice in a comply or explain scenario, the explanation should include enough details to allow a user to understand why best practice, in that instance, would not give value for money.

3. Best practice in narrative reporting

3.1 Introduction

3.1.1 This chapter gives best practice guidance for developing narrative in government financial reporting.

3.1.2 Most financial reports include narrative. In the annual report and accounts, for example, the performance report and accountability report are mostly narrative, and there are extensive notes giving context to the financial statements.

3.1.3 This chapter discusses:

- The role of narrative reporting

- Balance in narrative reporting

- Context and trends

- Design choices and graphics

- Usability

- Using clear English

- Handling standardised content with care

3.1.4 Annex 4 provides a range of links to resources for better narrative reporting.

3.2 The role of narrative reporting

3.2.1 Chapter 2 discusses the difference between data, information, and reports. Financial information is used to tell a story, and in a report the role of the narrative is to make that story clear to readers.

3.2.2 The narrative elements of government financial reports are crucial for meeting the needs of users, as they provide context and describe the financial information presented. Narrative that is confusing, repetitive, or misleading can undermine the whole purpose of a report.

3.2.3 There is no single right way to prepare the narrative elements of a financial report. Some specific pieces of narrative may be required in a certain format. In most cases, though, mandatory guidance only states what should be included in the narrative, not how to say it. This is because every organisation, situation, and audience is different.

3.3 Balance in narrative reporting

3.3.1 The narrative is the part of a government financial report that shapes its message. Preparers must choose how best to tell the story to achieve a fair, balanced, and understandable report. That can be in words, through images, or through design choices in style and structure.

3.3.2 As Parliament is the primary user of a department’s annual report and accounts, preparers should consider whether the narrative meets the needs of Parliamentarians who might read it. Meeting the requirement for an annual report and accounts is fair, balanced, and understandable is essential to meeting the needs of Parliament.

3.3.3 Preparers should also consider each part of the narrative in the context of the report as a whole. When a report is wide-ranging, different authors may draft different sections. The final product should stand as a whole, with the narrative in every section working together to create a single joined-up story.

3.4 Context and trends

3.4.1 Context is key to understanding what any information in a financial report means. Sharing trend data can help build trust in the information presented. It provides context and can give users confidence that the numbers have not been cherry picked to the benefit of the entity preparing the report.

3.4.2 Showing one prior year comparison helps, but it is best practice to present several years of data. Five years of comparison is a good target for narrative reporting that will make the trend clear. Information may be added year-on-year as it becomes available.

3.4.3 Preparers of annual reports and accounts have a comply or explain requirement to report on trend data in the performance analysis section as set out in section 5.4 of this Manual. Data trends can also be shared in graphs or tables, or in a footnote, or with a link to another part of a report.

3.4.4 Clear and full explanations can help the user to make connections and understand conclusions. Adding context with both narrative and numbers gives a user the best possible support to understand the story set out in a report.

3.4.5 Information should be specific to the entity- the inclusion of boilerplate information on its own is of limited use to users of the annual report and accounts.

3.5 Design choices and graphics

3.5.1 The layout and design choices influence how a reader understands a financial report. For example, it is likely that the reader will assume the first item in a list is the most important.

3.5.2 Preparers can use design choices to direct a reader’s attention, to put information in context, or to make things easier to grasp. For example, headings and subsections can break up a report and show how one point relates to another.

3.5.3 Graphics are powerful tools for sharing concepts at a glance. They work best when they:

- serve a clear purpose

- show relationships that are more difficult to describe in words

- are properly labelled

- are supported by sufficient narrative

3.5.4 Graphics are also more accessible when they rely on shape and layout to tell a story.

3.5.5 Account preparers may find the following guide to data visualisations- issued by the ONS- useful: https://gss.civilservice.gov.uk/policy-store/introduction-to-data-visualisation/#section-1

3.5.6 Graphics, and other design choices, can sometimes be misleading. Preparers should consider possible alternative presentation and be careful that the narrative in their annual reports and accounts conveys the intended message.

3.5.7 Contrasting colours may appear differently to different readers, or on different screens.

3.5.8 When deciding on graphics and other design choices, entities may also wish to consider whether they make the annual report and accounts accessible. For example, would a certain design choice make the annual report and accounts less accessible to individuals with visual impairments?

3.5.9 Guidance on accessible communication can be found here: https://www.gov.uk/government/publications/inclusive-communication/accessible-communication-formats#accessible-print-publications

3.6 Usability

3.6.1 Many users of government financial reports will first access them online. This means that the landing page can be integral in influencing the user’s experience of the report.

3.6.2 The format of the report also has implications for users. Search engines will pick up key words from web pages but will only read the title of a pdf report. Spreadsheet formats are easier for users who want to use tables of data, but do not include much narrative.

3.6.3 Many users may be looking for specific information. The easier it is to navigate across a report, the less time they will have to spend searching. Ways to improve reader navigation include:

- informative chapter or section headings

- a clear integrated structure and contents list

- concise summaries of key points

- the use of internal links throughout a report

3.6.4 Preparers can take practical steps to help users find the information they are looking for by:

- adding text to the landing page to help search engines find the report

- sharing transparency data in spreadsheet format such as Excel or the more flexible .CSV format

- when one report relates to another, giving a link between landing pages

- designing the structure and internal links in a report

3.7 Using clear English

3.7.1 Clear and simple language makes reports easier for a wide range of people to read. Even when the subject of a report is complicated, using clear English makes the narrative easier to read. Some useful goals are:

- keep sentences short, with an average length of 15 to 20 words.

- avoid acronyms.

- where possible, use active verbs.

- excessive use of jargon should be avoided.

- where industry-specific terms are necessary for clear communication, they should be clearly defined and used consistently.

3.7.2 These are guidelines rather than rules. Preparers should use their judgement, informed on an ongoing basis by feedback from those who use their reports.

3.8 Handling standardised content with care

3.8.1 Many people drafting narrative for financial reports start with relevant examples, such as last year’s report. This can be helpful but can also lead to problems.

3.8.2 Text copied from one place to another can grow less readable with each transfer to a new context. Over time, large sections of repeated text can be off-putting to users, making reports unwieldy so caution must be taken. At the same time, it should be recognised that there are benefits in maintaining a degree of consistency year-to-year for comparability and familiarity for the users of the accounts. There is therefore a need to strike a balance in the way that information is reported in annual reports and accounts.

3.8.3 To avoid repeating unnecessary text, preparers of narrative reporting should reconsider every piece of text before reusing it:

- Does it meet the needs of the report’s primary users?

- Does it fit with the rest of the report?

- Does it still reflect best practice, or could it be revised for clarity in its new context?

3.8.4 Some standardised definitions and descriptions are mandated by guidance to ensure that reports are consistent across government. Relevant authorities should keep standardised wording to a minimum and review it on an ongoing basis.

4. The annual reports and accounts

4.1 Introduction

4.1.1 This chapter gives an overview of the required format and content of the annual reports and accounts for entities covered by the requirements of this Manual.

4.1.2 The exceptions to the entities required to apply this format are pension schemes (see Chapter 12), and reportable activities.

4.1.3 Reportable activities is a collective term for funds, flows of income and expenditure, and any other accounts that are not entities, but have their own accounts directions, are prepared on an accruals basis, and are consolidated into the Whole of Government Accounts. The FReM applies directly to reportable activities in most respects, but their format, as set out in their accounts direction, may differ from the guidance in this chapter.

Structure of public sector annual reports and accounts

4.1.4 The annual report and accounts comprise:

- The performance report, discussed in Chapter 5.

- The accountability report, including (where relevant) the Statement of Outturn against Parliamentary Supply (SOPS), discussed in Chapter 6.

- The financial statements, discussed in Chapter 7.

4.1.5 Reporting entities must prepare and publish an annual report and accounts as a single document unless the relevant authorities have specifically agreed otherwise.

4.1.6 Illustrative financial statements are provided on the FReM section of the gov.uk website.

4.2 Accounting principles for government annual reports and accounts

4.2.1 The Treasury, according to Managing Public Money 1.4.3: “sets the standards to which central government organisations publish annual reports and accounts in the Financial Reporting Manual (FReM). This adapts International Financial Reporting Standards (IFRS) to take account of the public sector context”

4.2.2 The IFRS Conceptual Framework 2018 sets out the principles that underlie general purpose financial reporting under IFRS Standards.

4.2.3 Applying IFRS Standards to government annual reports and accounts ensures that they are prepared according to internationally recognised standards of accounting excellence. This chapter gives a high-level overview of the principles of applying IFRS Standards and general best practice in accounting to achieve the four purposes of government financial reporting set out in FReM paragraph 2.4.1.

4.2.4 This edition of the FReM applies UK adopted IFRS Standards, in effect for accounting periods commencing on or after 1 January 2021 , except for IFRS 16 Leases.

Generally Accepted Accounting Practice (GAAP)

4.2.5 The accounting policies contained in the FReM follow generally accepted accounting practice (GAAP) as adapted and interpreted for the public sector context. Although the term ‘GAAP’ has no statutory or regulatory authority, for the purposes of the FReM, GAAP is taken to be:

1.the accounting and disclosure requirements of the Companies Act 2006 (the Companies Act) 2.IFRS Standards and Interpretations, and other related material, including:

- UK-endorsed IFRS (IAS and IFRS Standards and IFRIC Interpretations) as adapted or interpreted for the public sector context by this Manual

- the Conceptual Framework for Financial Reporting

- the Basis for Conclusions relating to IFRS Standards and IFRIC Interpretations

- Other pronouncements (for example, educational material) issued or published by the International Accounting Standards Board

2.reporting in accordance with the appropriate sectoral manual or direction from its relevant authority e.g. Statement of Recommended Practice (SORP) for Charities (see section 1.2 for more detail on applicability)

4.2.6 These requirements and standards should be interpreted as necessary in the light of the body of accumulated knowledge built up over time and shared in textbooks, technical journals and research papers as examples.

Parliamentary accountability and regularity

4.2.7 In addition to the general principles underlying GAAP, reporting entities and reportable activities covered by the requirements of this Manual need to apply two additional principles – Parliamentary accountability and regularity. These principles are explained in the context of the relevant authorities in Managing Public Money.

Historical cost convention

4.2.8 Financial statements should be prepared under the historical cost convention, modified by the revaluation of certain assets and liabilities as determined by the relevant accounting standards, and subject to the interpretations and adaptations of those standards in this Manual.

A true and fair view

4.2.9 All financial statements prepared in accordance with the FReM (except accounts prepared on a cash basis such as the National Insurance Fund cash accounts and parts of the Consolidated Fund accounts) should give a true and fair view of the state of affairs of the reporting entity or reportable activity at the end of the financial year and of the results for the year.

4.2.10 The application of UK adopted IAS, as adapted and interpreted for the public sector context (see Chapter 8) with additional disclosure when necessary, is presumed to result in financial statements that give a true and fair view.

4.2.11 In extremely rare circumstances, an entity may conclude that reporting in compliance with the FReM (or with financial reporting standards as interpreted by the FReM) would be so misleading that it would prevent the financial statements (and therefore the annual report and accounts) from giving a true and fair view. In that situation:

- The entity should follow the principles set out at paragraphs 20-24 of IAS 1, and depart from the FReM requirements

- Any material departure from the FReM should be discussed in the first instance with the relevant authority (through sponsoring bodies where appropriate)

- The details of any departure, the reasons for it and its effects should be disclosed in the financial statements

- The Accounting Officer, or other person who is required to approve the accounts, should not provide approval unless they are satisfied that the accounts give a true and fair view of the assets, liabilities, financial position and net income or expenditure of the entity, and where relevant, of the group.

Conceptual Framework for Financial Reporting

4.2.12 The primary users of financial reporting identified in the IFRS Conceptual Framework are existing and potential investors, lenders and other creditors. By contrast, Parliament is the primary user of government annual reports and accounts, which enable Parliament to hold the government to account .

4.2.13 Parliament is defined in 2.4.3. Other users, as discussed in Chapter 2, include the public, researchers, relevant authorities, creditors, suppliers, and managers inside departments.

4.2.14 Preparers of financial statements should have regard to:

- the underlying assumption that financial statements shall be prepared on a going concern basis

- the qualitative characteristics of financial statements

- the elements of financial statements

- the recognition of the elements of financial statements

- the measurement of the elements of financial statements

4.2.15 Most of the entities covered by the requirements of this Manual will prepare general purpose financial statements that are sufficient for the needs of their primary users. However, where departments are required by the relevant legislation to demonstrate accountability to Parliament, they should prepare a statement on Parliamentary accountability, which can be regarded as a special purpose financial report.

4.2.16 The Conceptual Framework provides the concepts and guidance that underpin the decisions the IASB makes when developing IFRS standards. The Conceptual Framework is not a standard and does not override any standard or any requirement in a standard.

4.2.17 IAS 8 paragraphs 10-12 set out requirements and guidance that applies for the purposes of developing an accounting policy in the absence of IFRS Standards that specifically applies to a transaction, other event or condition. Entities in this situation should discuss this with their relevant authority at the earliest opportunity.

Applying IFRS Standards

4.2.18 Preparers of financial statements should consider materiality when applying IFRS Standards as interpreted and adapted in the FReM for the public sector:

- in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, accounting policies set out in IFRSs need not be applied when the effect of applying them is immaterial

- in accordance with IAS 1 Presentation of Financial Statements, a specific disclosure requirement in a Standard or in an Interpretation need not be satisfied if the information is not material (disclosures should be limited to those necessary to give a true and fair view)

- preparers do not need to develop accounting policies, or provide disclosure notes, relating to accounting standards that do not apply to their circumstances or are not material

- Additional commentary on matters that are not material may be provided if it is helpful to the user, whether in the accounting policy note or next to an individual disclosure note

- Entities may apply new IFRSs before the effective date, with the consent of the relevant authority

4.2.19 The way entities are required to implement in full, adapt or interpret the various IASs and IFRSs are detailed in chapter 8.

Accounting policies and budgetary controls

4.2.20 Reporting entities that comply with the FReM also prepare budgets on a resource (accruals) basis and are subject to control by the relevant authorities. Entities should refer to the Consolidated Budgeting Guidance published by HM Treasury.

4.2.21 Accounting policies are generally common to both accounting and budgeting. An overview of the main differences between budgets and accounts is included in Annex 3.

4.2.22 Entities should select the accounting policies that best reflect a true and fair view, but should ensure that the budgeting implications and impact on Estimates are well understood.

4.2.23 Preparers of financial statements need to consult with the relevant authority (through sponsoring bodies where appropriate) before changing significant accounting policies and estimation techniques where it appears that there could be a potential impact on budgets and on the National Accounts.

4.2.24 Where preparers consider it necessary to adjust retrospectively for changes in accounting policies or material errors, they should first contact the relevant authority (through sponsoring bodies where appropriate) to ensure that the budgeting and Estimates implications have been properly considered.

4.2.25 Departments are required to report outturn against Estimate in the Statement of Outturn against Parliamentary Supply, which forms part of their accountability report. See Chapter 6.

4.3 Consolidation and accounting boundaries

4.3.1 Entities preparing financial statements within the scope of this Manual shall prepare annual reports and consolidated financial statements as follows:

- Departments shall prepare annual reports and consolidated financial statements (as defined in Chapter 5 of this Manual) covering all entities designated for consolidation. Accounting policies should be aligned on consolidation where alternative GAAP is applied, such as where there are subsidiaries that are charities.

- Executive agencies shall prepare annual reports and consolidated financial statements in accordance with the requirements of IFRS 10, IFRS 11, IFRS 12, IAS 27 and IAS 28, ‘the Group Accounting Standards’ in so far as those subsidiaries and investments are within the controlling department’s consolidation boundary

- Arm’s length bodies shall prepare consolidated financial statements in accordance with the requirements of Group Accounting Standards, without adaptation and interpretation

Designation

4.3.2 The departmental boundary is similar to the concept of a group under generally accepted accounting practice but is based on control criteria used by the Office for National Statistics to determine the sector classification of the relevant sponsored bodies.

4.3.3 Except where legislation requires otherwise, departments will account for subsidiary undertakings in accordance with the Group Accounting Standards only if they are designated for consolidation by order of the relevant authority under statutory instrument, which will reflect the ONS’s classification of an entity to the central government sector.

4.3.4 In accordance with the principles set out in Managing Public Money, executive non-departmental and similar public bodies classified to central government by the ONS will normally be controlled for accountability purposes by only one department and the designation order will require that they are consolidated by the department.

4.3.5 Where a department has an investment in another public sector entity that has not been designated for consolidation, it should be reported following the requirements of IFRS 9. This includes all interests in bodies classified as public corporations by the ONS and investments in public sector bodies which would otherwise meet the definition of an associate or joint venture. Entities should refer to the adaptations and interpretations to the group accounting standards set out in section 8.2 of this manual for further guidance.

4.3.6 For the purposes of applying the principles of consolidation, the department will be the parent entity in departmental consolidations. The financial statements of all entities whose results are to be consolidated will generally have the same accounting reference date. Where a subsidiary has:

- An accounting reference date more than 3 months different to the accounting reference date of the department; and

- The subsidiary is material to the group;

the relevant authority will consider the treatment of the non-coterminous reference dates. In other cases the entity shall approach the consolidation of subsidiaries with non-coterminous year ends in line with IFRS 10 paras B92-B93.

4.4 Reporting requirements beyond central government departments

Scottish, Welsh, and Northern Irish spending bodies

4.4.1 The accounts to be published by spending bodies accountable to the Scottish Parliament will follow the format agreed between Scottish Ministers and the Public Audit Committee of the Scottish Parliament. The format of those accounts will be based on the principles, but not the detail, set out in this Manual. This means the accounts of these bodies will meet disclosure requirements which originate in accounting standards or Companies Act application as set out in the FReM. These accounts will also meet relevant requirements in Scottish legislation and in the Scottish Public Finance Manual and in other relevant guidance issued by the Scottish Ministers.

4.4.2 The Welsh Government will determine the format and content of the performance report for its annual report and accounts. The performance report will reflect the wider reporting landscape in Wales. The Welsh Government will also issue guidance to its sponsored bodies and subsidiary organisations on the extent to which these organisations should comply with the FReM.

4.4.3 The Northern Ireland Executive determines the appropriate level of reporting for the performance report for each organisation in Northern Ireland.

Executive agencies and trading funds

4.4.4 Trading funds are established under government trading legislation to engender a market- based approach to managing activities. They might also be executive agencies or departments in their own right.

4.4.5 In preparing their financial statements, trading funds should follow the requirements of applicable accounting standards but should also follow the principles set out in this Manual and provide the additional disclosures required by the Manual where these go beyond the requirements of the applicable accounting standards.

4.4.6 For trading funds, the annual statement of accounts is laid in Parliament by the Comptroller and Auditor General under section 4(6)(b) of the 1973 Act and article 8(6) (b) of the Financial Provisions (Northern Ireland) Order 1993. A report is sent to the responsible Minister under section 4(6A)(b) of that Act, but that report is not laid in Parliament. Instead it is published by that minister along with the annual statement of accounts in such manner as the Treasury may require. For executive agencies which aren’t trading funds, accounts will be prepared under section 7 of the Government Resources and Accounts Act 2000 (‘the GRAA’) if the Treasury issues a direction under that section requiring their preparation by the relevant government department.

Other arm’s length bodies

4.4.7 Within the context of this manual, arm’s length bodies refers to non-departmental public bodies, trading funds, and other entities designated to the departmental group, excluding the core department and its agencies.

4.4.8 Arm’s length bodies that are not incorporated as companies can use an annual report to meet a statutory obligation to prepare a separate report.

4.4.9 Where there is no statutory requirement for the preparation of a separate report, arm’s length bodies will prepare an annual report and accounts.

Arm’s length bodies which are companies

4.4.10 Arm’s length bodies incorporated as companies should comply with the requirements of the Companies Act 2006 in full, going further if necessary, to follow the guidance or principles set out in this Manual.

4.4.11 Sections 381 to 384 of the Companies Act 2006 define the qualifying criteria for the small companies’ regime. Entities meeting these criteria can apply the small companies’ regime only if approved by their relevant authority.

4.4.12 A reporting entity that wishes to publish a document additional to its annual report and accounts that contains supplementary material including summary financial statements should comply with the requirements of sections 426 and 426A of the Companies Act 2006. The summary data must not be published in advance of the full annual report and accounts being laid before Parliament as to do so would be a breach of Parliamentary privilege.

4.4.13 If, due to exceptional circumstances, there is a conflict between the requirements of the Companies Act and the FReM, the Companies Act takes precedence for those arm’s length bodies that are companies. Companies should discuss the situation in the first instance with their sponsoring department and relevant authority.

Arm’s length bodies which are charities

4.4.14 Arm’s length bodies which are charities should follow the requirements of the Charities’ SORP and regulations made under charities legislation. If they are both registered companies and charities, they must comply with the Companies Act 2006 and the Charities SORP. They should also go further if necessary, to follow the guidance or principles set out in this Manual.

4.4.15 There is a strong presumption that compliance with the SORP is necessary for charities’ accounts to give a true and fair view. Charities that are exempt from the requirements of the Charities Act should comply with the recommendations of the SORP wherever possible, unless they or their sponsor department feel that the resulting financial statements will not provide the information needed for monitoring purposes. Any departure from the SORP should be disclosed on a comply or explain basis.

4.4.16 Where a sponsoring department considers that the Statement of Financial Activities (SOFA) prepared by its charitable arm’s length body does not provide sufficient information to monitor and control the arm’s length body or to allow appropriate comparison with its non-charitable arm’s length bodies, it may direct the charitable arm’s length body to supplement the SOFA with a summarised income and expenditure account.

Reportable activities

4.4.17 Preparers of the financial statements of reportable activities should apply the guidance in this Manual only to the extent that it is relevant to those activities and in the light of any statutory requirements or other pronouncements made by the relevant authorities

4.5 Presentation to Parliament and publication

4.5.1 After the annual report and accounts have been certified by the Comptroller and Auditor General (or other appointed auditor) there is an expectation that they will not be changed prior to laying in Parliament. Where an entity wishes to make any change to a certified annual report and account prior to laying in Parliament, that entity must first discuss with their external audit team.

4.5.2 HM Treasury will lay before the House of Commons the resource accounts of departments (including agencies that are whole departments) under section 6(4) of the Government Resources and Accounts Act 2000. They will then be published by the entity.

4.5.3 For executive agencies that are not departments, the Treasury will lay their annual reports and accounts before the House of Commons under section 7(3)(c) of the Government Resources and Accounts Act 2000. They will then be published by the entity.

4.5.4 The Auditor General for Wales will lay before the Senedd the resource accounts of the Welsh Ministers (Welsh Government) under section 131(6) of the Government of Wales Act 2006. The Auditor General for Wales will lay the resource accounts of Estyn (Her Majesty’s Chief Inspector of Schools in Wales) under Schedule 6 section 6(2)(b) of the Government of Wales Act 1998. They will then be published by the entity.

4.5.5 The Department of Finance will lay before the Northern Ireland Assembly the resource accounts of Northern Ireland departments (including agencies which are whole departments) under section 10(4) of the Government Resources and Accounts Act (Northern Ireland) 2001. They will then be published.

4.5.6 In the case of Northern Ireland agencies which are not whole departments, the parent department will lay before the Northern Ireland Assembly the annual report and accounts of those agencies under section 11(3)(c) of the Government Resources and Accounts Act (Northern Ireland) 2001. They will then be published.

4.5.7 Scottish Ministers will lay before Parliament accounts prepared under the Public Finance and Accountability (Scotland) Act 2000 under section 22(5) of that Act. They will then be published.

4.5.8 The procedure for publishing and laying the accounts of ALBs varies according to the provisions of the governing statute. Where the legislation requires the accounts to be laid before Parliament or where accounts are placed in the library of the House of Commons (and perhaps also the House of Lords), the accounts should be published thereafter.

4.5.9 The procedure for publishing and laying the accounts of ALBs in Northern Ireland varies according to the provisions of the incorporating statute. If responsibility does not lie with the Comptroller and Auditor General, the ALB is normally required to submit the audited accounts to its sponsor department, who will arrange to lay them before the Northern Ireland Assembly. A copy should be placed in the library of the Northern Ireland Assembly.

4.5.10 The Comptroller and Auditor General will lay before Parliament the annual reports and accounts of trading funds under section 4(6) (b) of the Government Trading Funds Act 1973. They will then be published.

4.5.11 The Comptroller and Auditor General will lay before the Northern Ireland Assembly the annual reports and accounts of trading funds in Northern Ireland under article 8(6)(b) of the Financial Provisions (Northern Ireland) Order 1993. The annual reports and accounts will then be published.

5. The performance report

5.1 Purpose of the performance report

5.1.1 The purpose of the performance report is to provide the user with an understanding of the entity and how it has performed. It is a vital resource for Parliament and the public, enabling them to hold the government to account, and it should draw together information from across the annual report and accounts to provide a holistic view of performance. Given its importance, preparers must dedicate sufficient time to its preparation and be mindful of applying the principles, best practice and guidance laid out below and in Chapters 2 and 3.

5.1.2 The performance report should cover, but is not limited to:

- a description of the entity (and its group);

- how it is organised;

- what its aims are;

- how it has performed and met those aims; and

- any future plans or key risks the entity faces.

It should be straightforward and accessible, so that it can be easily understood by a lay user and contain cross-references to other parts of the annual report and accounts where relevant and appropriate.

5.1.3 The performance report is required to have two sections: a ‘performance overview’ and a ‘performance analysis’. The performance overview is a short summary of the full story of an organisation and its performance over the period covered by the report. The performance analysis provides a detailed view.

5.2 Principles for the performance report

5.2.1 When compiling the performance report, preparers should meet the objectives and principles of government reporting detailed in Chapter 2. Specifically, performance reporting must be fair, balanced, and understandable. It must tell the full story of an organisation, including both positive and negative aspects of performance, so users can have confidence in any judgements and so it is clear that reporting is trustworthy and transparent.

5.2.2 In addition, preparers should follow best practice in narrative reporting, as detailed in Chapter 3. Graphical representation and visual aids should be used where possible to aid usability. For example, a Red/Amber/Green (RAG) rating may add clarity when reporting against indicators.

5.2.3 Further principles to follow when compiling the performance report are as follows:

- performance reporting should reflect the structure and activity of the organisation, and the information used by internal decision makers, broken down as appropriate by priority outcome (as agreed during SR 20), project, policy, and/or programme.

- preparers should include trend data to give context to statistics and other metrics, including explanations of the information provided.

- where practical, preparers should detail when information they present has been audited or not, cross referencing users to where audited information originates in the financial statements or Statement of Outturn against Parliamentary Supply (SOPS).

5.2.4 Performance reporting requirements are based on best practice, specific public sector needs, and Strategic Report requirements as set out in the Companies Act 2006 (Chapter 4A of Part 15).

5.2.5 As noted in Chapter 4, arm’s length bodies which are companies or charities should follow the requirements of the Companies Act 2006, charity legislation or SORPs respectively, providing additional disclosures as required by this Manual where these go beyond legislation or guidance.

Performance report accountability

5.2.6 Auditors will review the performance report for consistency with other information in the financial statements and give an opinion on this. This underlines the importance of the performance report reflecting the position outlined by the financial statements, which, as detailed in 5.1.1 above, is key for users.

5.2.7 The performance report shall be signed and dated by the Accounting Officer or Chief Executive.

5.3 Performance overview

5.3.1 The purpose of the performance overview is to give the user a short (no more than 10 to 15 pages) summary that provides them with sufficient information to understand the organisation, its purpose, the outcomes it is aiming to achieve, its objectives, its performance against delivering those outcomes and/ or objectives and both the impact of and management of key risks. The performance overview should be enough for the lay user to have no need to look further into the rest of the annual report and accounts, unless they were interested in further detail or had specific accountability or decision-making needs.

5.3.2 The performance overview should not simply be a duplication of the performance analysis section. The performance overview should be a summary to the more detailed appraisal provided in the performance analysis section (which includes more detail on performance against a department’s priority outcomes (as agreed at SR20), goals and strategic objectives, the risks an entity faces and a financial review)

5.3.3 Entities have a degree of flexibility to tell the story of their performance in the manner that best suits the needs of the user. As a minimum, the performance overview shall include:

- A short summary explaining the purpose of the overview section.

- A statement from the entity’s lead minister or chief executive providing their perspective on the performance of the organisation over the period.

- A statement of the purpose and activities of the organisation, including a brief description of the business model and environment.

- A brief description or diagram detailing organisational structure, if not already included as a result of the above requirements.

- A summary of priority outcomes agreed at the latest Spending Review (SR) and strategic enablers contained within the Outcome Delivery Plan or any other organisational strategic objectives and goals where the entity does not have priority outcomes agreed at the latest SR.

- A summary performance appraisal, providing a synopsis of the performance analysis section and outlining whether a department is progressing towards achieving its priority outcomes, strategic objectives, strategic enablers and any other organisational goals. This section should provide key indicators for the priority outcomes (which should include the metrics agreed to be published as part of SR20) and other objectives, sub-objectives or work areas. These indicators should be drawn from official statistics or publicly available information and detail whether performance has met expectation or explain why performance is below expectation.

- A summary of the principal risks faced and how these have affected the delivery of priority outcomes and/ or strategic objectives, how they have changed, how they have been mitigated and any emerging risks that may affect future performance. The descriptions of the principal risks should be sufficiently specific that the reader can understand why they are important. Please note, this should only serve as a summary of the further detail on risks provided in the analysis section, see 5.4.4 (2) below. Cross-referencing between the discussion of risk in the performance analysis section (and risk management and internal control in the accountability report, see 6.4.8) is encouraged where relevant and appropriate.

- For arm’s length bodies, an explanation of the adoption of the going concern basis where this might be called into doubt, for example where there are significant net liabilities, what will be financed from resources expected to be voted by Parliament in the future.

5.4 Performance analysis

5.4.1 The purpose of the performance analysis is for entities to provide a detailed view of their performance.

5.4.2 Entities should seek to tie in the performance analysis to other parts of the annual reports and accounts as relevant, for example to the Statement of Outturn against Parliamentary Supply (SOPS) and the financial statements, to provide a cohesive and consistent understanding of performance across the annual report and accounts.

5.4.3 The guidance on the performance analysis section is broken down as follows:

- mandatory requirements in 5.4.4

- comply or explain requirements in 5.4.5 (see Figure 1 and paragraph 1.4.3 in Chapter 1 on the distinction between mandatory and comply or explain requirements)

- best practice recommendations in 5.4.6

5.4.4 It is mandatory to include in the performance analysis:

Reporting on priority outcomes agreed at the SR (for those entities that have them):

1.The performance report section of a department’s annual report and accounts shows how they have performed against their priority outcomes agreed at the latest SR, allowing Parliament and the public to track and monitor progress and performance against key indicators. In this section:

- Entities should report against their priority outcomes using indicators using metrics agreed at SR20 and in a manner that they consider would best contribute to the understanding of performance and value for money. This may include both quantitative and qualitative information.

- Departments should provide outturn performance data against each of the indicators used to monitor performance against priority outcomes with prior year comparative data (where data has been previously reported against a given outcome). Data for years earlier than the prior year should also be included where available and where this provides relevant context. Any financial information provided should link to the financial review (see below) and common core tables, as relevant.

- Entities should also note the requirement to report on sustainable development goals in 5.4.7 below.

- Entities may wish to report on each priority outcome in turn and structure their performance analysis around their Outcome Delivery Plans.

2.Further detail on the risk profile of the organisation, i.e. the risks it faces, how risks have affected the organisation in achieving its objectives, how they have been mitigated and how this may affect future plans and performance. This should also cover how risks have changed over time and through the period – including significant changes in risks, such as a change in the likelihood or possible impact, and new and emerging risks. How existing and new risks could affect the entity in delivering its plans and performance in future years should also be discussed. This requirement is different to the requirement to report on risk in the overview section (5.3). The description in the overview should only serve as a summary of the detail provided in the analysis section. This requirement is also different to that included in the accountability report (6.4.8). The discussion of risk in the analysis section covers risk in relation to performance, what risks are faced and how these are mitigated against. The discussion of risk in the accountability report instead focuses on the risk management and internal control system. However, clear and effective cross-referencing between the three sections is encouraged where relevant and appropriate.

3.Departments and entities should also report on their delivery against the strategic enablers and agreed metrics set out in the Outcome Delivery Plans:

- Workforce, skills and location.

- Innovation, technology and data.

- Delivery, evaluation and collaboration.

- Sustainability (more details can be found at 5.4.7-5.4.11).

4.Details of any non-financial information on environmental protection, social responsibility, respect for human rights, anti-corruption and anti-bribery matters and diversity, specified by law and adapted by the FReM to apply to the UK public sector.

Reporting on objectives by entities that did not previously have a single departmental plan and do not have priority outcomes agreed at the latest SR:

5.These entities should agree an approach to reporting on performance with their sponsoring body and, if needed, their HM Treasury Spending Team and relevant Parliamentary select committee. Otherwise, they should report on their objectives and progress made against them, using unbiased indicators of progress where these have been established. The discussion of progress against plan should incorporate qualitative and quantitative information and prior year and trend information where possible. It may be the case that preparers find it easiest to structure their performance analysis around reporting against objectives.

6.In Northern Ireland, government departments and arm’s length bodies should report on performance in the context of how they are contributing towards the achievement of outcomes, as set out in the Programme for Government (or, in the absence of devolved government, within the Northern Ireland Civil Service Outcomes Delivery Plan). Supplementary guidance will be issued for Northern Ireland. Additional items to report on for all entities (where they are relevant to the entity):

7.A short explanation detailing the purpose of the performance analysis section and its structure.

8.Further detail on the structure of the organisation, unless sufficient detail has already been provided in the performance overview section (5.3) or elsewhere in the annual report. Providing additional detail at this point may be beneficial for larger or more complex departments and could potentially refer users to the structural information provided in the accounting officer system statement.

9.If unit costs are central to decision-making or accountability for the organisation, then they should be disclosed. This disclosure should include the basis for calculation, revealing any areas of subjective judgement. Where possible, the same basis for calculation should be used across different entities and reporting periods to support meaningful comparisons.

10.Where statistics, metrics, or other indicators are disclosed without relevant trend data or comparators, the reason for the lack of trend data should be disclosed. For example, if it is the first year that an indicator has been collected, no prior period data is available.

11.If not already covered through the above, entities should detail performance against any further key financial indicators or measures, tying this into the broader discussion.

12.If not otherwise covered in a trend analysis included elsewhere, entities should provide further detail on future plans, and expected future performance. In particular, anticipated changes in the structure or strategic objectives of the organisation should be noted.

13.A summary or reference to any accountability issues or breaches outlined in the accountability report, that may be worth drawing the attention of users to (this is not intended to duplicate disclosures).

14.A financial review, detailing financial performance. Entities should attempt to tie in a discussion of financial performance into their overall performance where possible, as financial performance is more effectively appraised against the context of an organisation’s overall performance, detailing where the effective use or ineffective use of resources has contributed to meeting or failing to meet objectives. The following should be included:

5.4.5 For entities that produce a Statement of Outturn against Parliamentary Supply (SOPS), this financial review should include (each on a comply or explain basis):

- Context and an explanation of the public sector budgeting framework and the split of funds between resource, capital, AME and DEL. Diagrams may aid in providing this explanation, showing the flow of funds between different budget categories (i.e. how much is RDEL, CAME, admin, program, etc). This context is required to enable users to understand the analysis of outturn vs Estimate, that should follow, and the SOPS. Key terms should also be defined. Refer to Chapter 1 of the Consolidated Budgeting Guidance for an explanation of budgeting terms and 6.6 below.

- A summary table showing outturn compared to Estimate. This table should summarise outturn against Estimate and is not intended to be a detailed duplication of the SOPS. A note should explain that the table ties directly to the SOPS as a key accountability statement which is audited, providing the context that entities must operate within their control limits.

- Commentary on outturn against Estimate variances should be provided to help the user understand where there has been agreed or unexpected changes in spending, when compared to the Estimate, and how that has affected performance and why. Commentary should tie to figures disclosed in the SOPS. To provide a summary understanding of variances, preparers may need to tie back to variances presented in note 1 of the SOPS.

- A summary budget to accounts reconciliation, to help users understand simply how the financial statements link to budget outturn. In some instances, it will be difficult to provide this, where the reconciliation is complex and difficult to summarise. Where this is the case, preparers can of course utilise the comply or explain nature of this requirement and explain why it has not been met with a link to SOPS 2. Please note, this disclosure is intended to summarise and make the information in SOPS 2 more relevant to lay users (for example by presenting it graphically), it is not intended to duplicate SOPS 2.

- A trend analysis, showing RDEL, CDEL, RAME, CAME spend over the previous 5 years, with future projections based on Spending Review settlements (if future information is available). Supporting analysis should draw attention to patterns of spend over time, how this has impacted performance and how future projections of spend are likely to impact on future performance. A note should detail that the information in the trend analysis ties to common core tables, where further breakdowns are provided. Please note, this disclosure is intended to summarise and make the information in core tables more relevant to lay users (for example by presenting it graphically), it is not intended to duplicate the core tables.

5.4.6 The following are best practice recommendations:

1.Entities that do not prepare a SOPS may still wish to follow the guidance in 5.4.4 (14) above and consider how they can apply it to their annual report for the benefit of the user.

- Following this guidance will ensure all performance analyses will have a clear and consistent structure, detailing non-financial and financial information that summarises key sections of the annual reports and accounts and details progress against organisational goals.

- While detail on the budgeting framework and outturn against Estimate will not be as relevant for entities that do not prepare SOPS, they should still consider what information on net funding provided through the Estimate and how they have met this, or equivalent, would be useful.

2.Entities may wish to include, in their performance report, disclosures on how they have promoted equality of delivery of services to different groups. These disclosures may include:

- How the entity has had due regard to the three aims of the public sector equality duty under the Equality Act 2010 , being: (1) Eliminate unlawful discrimination, harassment, victimisation and any other conduct prohibited by the Act; (2) Advancement of equality of opportunity between people who share a protected characteristic and those who do not share it; (3) Foster good relations between people who share a protected characteristic and people who do not share it.

- Customer satisfaction scores broken down by protected groups.

- If the entity has key performance indicators (KPIs) to cover the fair treatment of different groups and have open access to services, report on performance against these KPIs.

- Explanations of what the entity is doing to promote equalities in how services are delivered and what diversity issues mean in the context of the entity. For example, an entity delivering a frontline service could provide data and information on the groups accessing their service. This may highlight groups who are not accessing the service as much as they could. The entity can then explain what they are doing to address inequalities in access to that service.

- The entity may wish to cross-reference to separately published reports covering how they promote equality of service delivery to protected groups and/ or demonstrate how they have due regard to the public sector equality duty.

3.Further best practice forms of reporting to include in a financial review are:

- an analysis of the balance sheet position year on year, detailing movements in asset or liability balances.

- detail on the type of spend incurred over the year, for example, on employees, administration, equipment or buildings.

- detail on outturn against Estimate by priority outcome agreed at the SR, other strategic objective or other goal, although it is recognised this reporting may be difficult to produce if objectives do not align to Estimate lines and if apportioning spend to objectives is highly judgemental.

Sustainability reporting

5.4.7 The requirements in this section are mandatory.

5.4.8 Reporting entities are expected to provide information on environmental matters, including the impact of the entity’s business on the environment. Entities must also comply with mandatory sustainability reporting requirements. This information is published in the HM Treasury sustainability reporting guidance on gov.uk.

5.4.9 Departments are required to report against climate change adaption and rural proofing , and to report on the impact operations have on the environment as part of wider sustainability reporting. This includes how climate change adaptation and rural proofing:

- are embedded within overall governance, decision making and assurance processes

- feature in performance and project management, including the monitoring of impact assessments, and the effective use of sound evidence in policy making

- whether these commitments feature in programme and project gateway reviews

5.4.10 In relation to climate change adaptation and rural proofing, departments should also report on:

- where policy development has been challenged and informed where appropriate, through consultation and stakeholder engagement

- how the department supports staff learning and participation through performance management, learning modules, tools and guidance for policy makers, awareness campaigns, local champions, volunteering and membership of departmental, government, or external groups

- how the department has supported delivery

- the forward-looking commitments for improving performance