Practice guide 57: exempting documents from the general right to inspect and copy

Updated 21 July 2025

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

To view the update history for this practice guide, please see practice guide 57: update history.

1. Introduction

All documents are open to inspection and copying by anyone as of right under section 66 of the Land Registration Act 2002. This right is referred to in this guide as the ‘general right of inspection under the Land Registration Act 2002’.

The general right of inspection under section 66(1) of the Land Registration Act 2002 is subject to certain exceptions under section 66(2) of the Land Registration Act 2002.

The Land Registration Rules 2003 include important provisions to allow documents that contain prejudicial information to be exempt from the general right of inspection under the Land Registration Act 2002. This guide explains how to make applications to designate documents as exempt information documents and so gain this exemption.

It also covers how to make applications for official copies of exempt information documents, including points that applicants should be aware of.

It covers how to withdraw the exempt status when it is no longer required.

This guide takes into consideration the Freedom of Information Act 2000, that came into effect on 1 January 2005.

View all HM Land Registry practice guides.

Once you have completed your application form, look at Things to remember.

See HM Land Registry address for applications for details of how and where to send your completed application.

2. Applying to make a document an exempt information document

Some documents may contain prejudicial information that you do not want made public. You can apply at any time for such a document to be designated an exempt information document under rule 136 of the Land Registration Rules 2003, as long as the document falls within the definition of ‘relevant document’ in rule 136(7) of the Land Registration Rules 2003.

A ‘relevant document’ is a document:

- referred to in the register of title, or one that relates to an application to the registrar, the original or a copy of which is kept by the registrar

- that will be referred to in the register of title as a result of an application (the ‘accompanying application’) made at the same time as an application under this rule, or that relates to the accompanying application, the original or a copy of which will be or is for the time being kept by the registrar

You must use form EX1 and form EX1A – see Completing form EX1 and Completing form EX1A for guidance on how to complete these. Because of the nature of the information you will need to supply, form EX1A is exempt from the general right of inspection under the Land Registration Act 2002. The EX1 and any correspondence will be open. You must, therefore, take care that any letters you write do not themselves reveal the claimed prejudicial information.

You should take care to ensure that the information you are applying to exempt is not disclosed elsewhere in the document and is not viewable in the edited copy.

A fee is payable under the current Land Registration Fee Order (HM Land Registry: Registration Services fees).

We will need only certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies. However for the avoidance of any doubt applications to exempt information from the general right to inspect still require a full certified copy of the deed in question as well as the edited copy.

When your application is received, it will be entered on the day list (our database of pending applications). At that time we will place restrictions on the rights to inspect and make copies. These will remain until your application has been considered (and, if successful, completed).

If successful, only a copy of the edited information document omitting the prejudicial information will be subject to the general right of inspection under the Land Registration Act 2002. Access to the exempt information document itself will, however, be available to the police and certain others applying under rule 140 of the Land Registration Rules 2003 or following a successful application in form EX2 or under the Freedom of Information Act 2000 (see Applying for an official copy of an exempt information document).

2.1 How to edit the document

The application must be accompanied by a full unedited copy of the document and an edited copy. The edited copy must comply with rule 136(2) of the Land Registration Rules 2003, which means that it needs to have excluded what is claimed to be the prejudicial information and the words ‘excluded information’ should appear where the prejudicial information has been removed. Also, it must be certified on the face of the document itself as being a true copy of the relevant document from which copy this information has been excluded. So it might be certified along the following lines.

“I, [name], certify that this is a copy of the [description of document] dated [date of document] after removal of all the ‘prejudicial information’ within the meaning of r.131 of the Land Registration Rules 2003 and (wherever appropriate) includes the words ‘excluded information’ as required by rule 136(2)(b), and that it is otherwise a true copy. [Signature and date.]”

If the application leads to designation, this copy becomes the ‘edited information document’ and will be subject to the general right of inspection under the Land Registration Act 2002.

The edited copy need not be a photocopy, but it must contain all the information in the original that is not to be exempted.

You should edit the document to exclude only the prejudicial information. We will not accept applications that omit large sections of a document without apparent good reason.

You should not exclude information that needs to be included in the register, such as the price paid in a transfer or lease, or clauses containing an easement or a restrictive covenant. Applications that exclude such information may be cancelled on the basis that designation could prejudice the keeping of the register. It is also not possible, for this reason, to exempt the execution of a deed. Please note in particular that although Companies House allows for the redaction of the execution of a charge this is not permissible for the purposes of land registration.

We strongly recommend that the way you choose to edit the document does not alter the layout or the page numbering of the original. You must include the words ‘excluded information’ wherever prejudicial information has been excluded. Take care to ensure that the prejudicial information is permanently excluded from the edited copy and is not just obscured, electronically or physically, in a way that might allow it to be revealed by someone obtaining an official copy or otherwise inspecting the document.

If we designate a document as an exempt information document this may not prevent the information being disclosed in the register as a result of a subsequent application. For example, if the amount secured by a charge were omitted from the edited information document, we would still register a subsequent application to note the maximum amount secured by the charge.

Where information from a document already appears in the register this will not be removed. We take the view that this would prejudice the keeping of the register. In any event, the information would still be available on a historical copy of the register.

2.2 Which documents are covered by exemption

2.2.1 Copy documents held by HM Land Registry

HM Land Registry will treat as exempt information documents:

- all copies HM Land Registry makes of documents designated as exempt information documents

- all copies of documents so designated made by another party and lodged at HM Land Registry at or before the application for exemption

In other words, copies of exempt documents made outside HM Land Registry and received by us after the date of the EX1 application will not be treated as exempt information documents.

2.2.2 Counterpart and duplicate documents

Counterpart leases and any other counterpart or duplicate documents are to be treated as separate documents for the purposes of exemption.

If you wish to exclude information therein from the general right of inspection under the Land Registration Act 2002 you must make a separate application in forms EX1 and EX1A for each counterpart or duplicate document.

2.3 Which provisions may justify exemption

We consider each request on its merits based on the explanation you give in form EX1A. The question of whether or not information is actually prejudicial can be properly answered only after taking into account all the circumstances. Information may be prejudicial information in one case but not in another, even though the same wording is used.

The following are examples of when a request might be granted. Please note that this list is not intended to be comprehensive. Inclusion on this list is not a guarantee the information will be exempted.

2.3.1 Commercial

- Profit-sharing agreements. Turnover and profitability information, both projected and historic.

- Barrelage clauses in leases of licensed premises.

- Terms in development leases by, for example, local authorities and other large institutions. Local authorities may wish to prevent future parties considering taking a new development lease from being able see the terms in an earlier such lease by the authority, particularly if the model is to be changed.

- Provisions in consortia leases relating to complex funding arrangements.

- Major financial restructuring arrangements where a business is in trouble. These may involve many banks as parties and if the precise terms of a particular bank’s exposure become public knowledge, then this may affect the viability of its own business, share price and so on.

- In some cases, the actual rent at the commencement of the lease, so far as it is not already in the register. However, as time passes, that rent will generally have been reviewed and the original rent will lose its commercial sensitivity.

- An inter-company transfer or lease and mortgage as a back-to-back transaction. The charge back will not be a commercial mortgage and the terms might be considered commercially sensitive.

- In leases, particular terms of rent-free periods, alteration to rent, break options, repairing covenants (for example, exclusion of inherent defects), bank details, indemnity costs and other special deals. For example, the amount to be paid or some of the other details on an option to determine the lease might be exempted, but not necessarily the option clause itself.

2.3.2 Personal

- An address revealed in correspondence where the individual concerned fears for their safety if that address were to be revealed, such as a spouse or partner who has been the victim of domestic violence.

- Details of the beneficial interest under a trust.

- Financial details in a mortgage (perhaps a private mortgage).

- Provisions relating to illegitimacy, gender recognition or mental health

- A matrimonial ancillary relief order containing detailed financial information.

2.4 When an application for exemption is likely to be refused

We consider each request on its merits based on the explanation you give in form EX1A. However we will not approve an application for exemption if we consider that doing so would prejudice the keeping of the register (see rule 136(4) of the Land Registration Rules 2003).

We would not normally accept, for example, the following requests for exemption, but each application will be given full consideration on a case-by-case basis.

- Names of parties to deeds.

- Execution of parties to deeds (except those not required for land registration purposes, such as guarantors to charges).

- Price paid.

- Information required for register entries, such as easements and covenants.

- In contracts or options, the date, parties, land affected and any option period.

- In leases, the date, parties, term and premium, the fact that rent is payable, that there are restrictive covenants, that there is a right of re-entry, restrictions on alienation, and that there are frustration or determination clauses (but not the details).

- In charges, the date and parties, and the existence of a power of sale (but not the details).

- Any of the above information held in a subsidiary document referred to in the document lodged for registration.

- Headers or numbering or lettering of clauses.

2.5 General or bulk exemption

There is no provision in the Land Registration Act 2002 or the Land Registration Rules 2003 for an applicant to obtain a general exemption for all examples of a specific document (eg a charge or lease in standard form). If you believe that a deed contains prejudicial information, you must submit forms EX1 and EX1A with each individual application.

2.6 Registration conditional on exemption

Where an application for exemption accompanies another application for registration, you may specify (if you wish) that your application for registration is not to proceed in the event that the application for exemption is unsuccessful.

If so, you must make the conditionality of the substantive application absolutely clear.

2.7 Completing form EX1

Panel 1: local authority serving the property

This is stated in the register. It is usually the district council, London borough or other authority to which you pay your council tax and business rates.

Panel 2: title number(s) of the registered estates to which the document relates

Give the title number or numbers against which the application to the registrar in respect of that document relates. If you do not know the title number (for example, if the form accompanies a first registration application) then leave this blank.

Panel 3: property

Insert the full postal address. If there is no postal address, insert a full description of the land, for example ‘land adjoining 2 Acacia Avenue’. If you have not quoted the title number and there is no postal address, then please supply a plan showing the extent and exact location of the property.

Panel 4: title number under which this document is held (if different from that in panel 2)

Some register entries have a note saying the document is filed under another title number or reference. If you know what this is, insert the reference here. We also hold some documents that affect large commercial organisations and transactions under file references at HM Land Registry Head Office - for example HO ref: 261/331/123. If this is the case, insert the reference here.

Panel 5: application and fee

A fee is payable under the current Land Registration Fee Order (see HM Land Registry: Registration Services fees). Information about fees can be found on our website at the address given in the panel. Please enclose the fee with your application and make cheques or postal orders payable to ‘HM Land Registry’.

Panel 6: the applicant

Insert the details of the person or company who is sending the application to us. If you are applying on behalf of someone else, insert their name and address here.

Panel 7: this application is sent to HM Land Registry by

If we have any questions about the application, we will send them to the name and address in this panel. If we receive an application for a copy of the exempt information document and need to serve a notice, we will send it to the name and address in this panel.

Panel 8: applicant’s address

It is important that this address is correct and up to date. If the address changes, you or the person named in panel 7 should write to the HM Land Registry office to which this application was sent informing them of the new details. We will accept up to 3 addresses for service, including an email address.

Panel 9: provide details of the document that the applicant claims contains prejudicial information

Insert details of the document you are applying to have designated as an exempt information document. You must send us a copy of the document that excludes the prejudicial information (the edited information document). We must also have a full copy of the exempt information document. We may already have a copy of this in our files unless you are lodging it for the first time with an accompanying application.

Panel 10 contains the words of application and your certificate that the edited copy is a true copy of the original (except for the omitted information).

Panel 11: signature of applicant

Sign and date this panel.

2.8 Completing form EX1A

Panels 1 and 2

Complete panels 1 and 2 in the same way as you completed panels 2 and 3 on the EX1.

Panels 3 and 4

These panels contain information already included on form EX1, but is essential in case the forms become detached.

Panel 5: reasons for application

Complete this panel with the reasons why you believe the document contains prejudicial information. It would be helpful if you refer to the page, clause, schedule or paragraph of the deed/document that contains the exempt information where possible. As form EX1A is exempt from the general right of inspection under the Land Registration Act 2002, you must include specific details. However, this will not prevent anyone making a request for information under the Freedom of Information Act 2000, in which case, depending on the nature of the information, HM Land Registry might have to disclose the information if the public interest in disclosure outweighs that in favour of not doing so. Please note it is not acceptable to simply state in panel 5 that the information in question is commercially sensitive or will cause unwarranted distress or damage. Panel 5 must include why the information is commercially sensitive, or why it is likely to cause distress or damage. Remember that if you do not give us sufficient evidence to satisfy us that the information is prejudicial we may ask for more evidence. Any correspondence will not be exempt from the general right of inspection, so it is important that full reasons are given in form EX1A.

Avoid adding extra information in an accompanying letter because this will be subject to the general right of inspection under the Land Registration Act 2002. If there is not enough room in panel 3 of the form EX1A, continue on form CS and staple to form EX1A.

3. Further applications to exempt the same document

An application may already have been made to designate a document an exempt information document.

Where this happens, you should send us an edited information document omitting only the prejudicial information you wish omitted.

You should do this even if the information you wish to be made exempt is exactly the same as that omitted from any existing edited information document. The reason for this is that it is possible that the other party may apply to withdraw the designation when you still require the information to be restricted.

We will create a further edited information document excluding the information from all edited information documents that have been lodged. This is the edited information document that will then be generally available. The edited information documents lodged with each separate application will be retained by us but will not be subject to the general right of inspection under the Land Registration Act 2002.

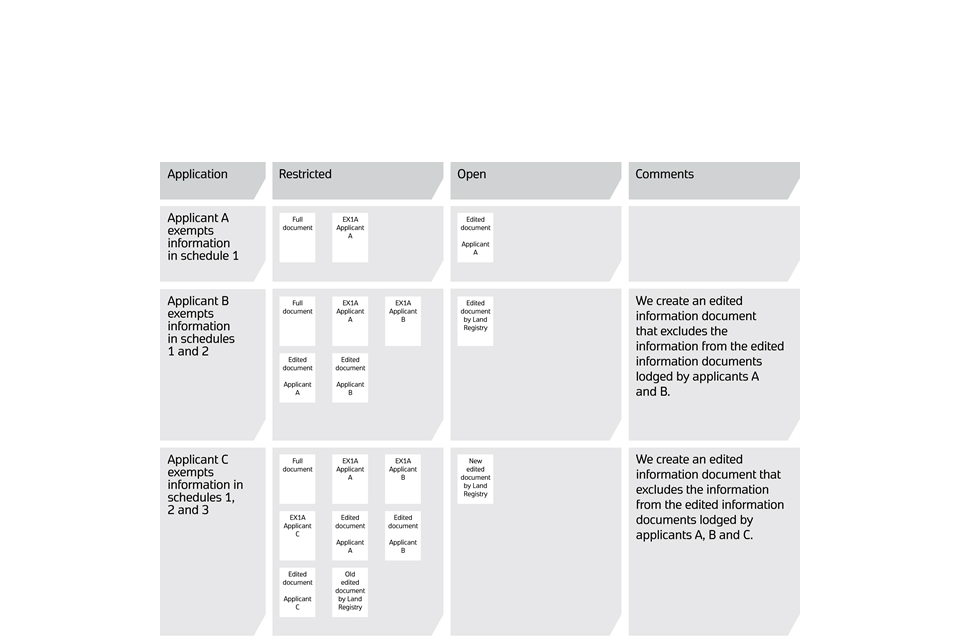

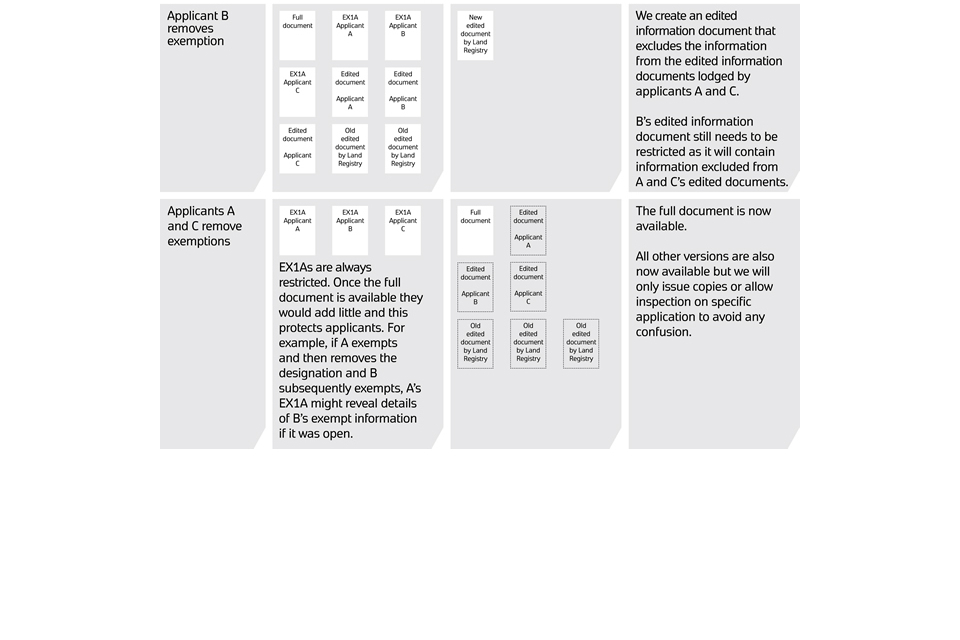

The following table shows examples of what we will keep and whether access will be open or restricted. Please note that by ‘open’ and ‘restricted’ we mean subject to and outside the general right of inspection under the Land Registration Act 2002.

Table showing examples of what Land Registry will keep and whether access will be open or restricted.

Table showing examples of what Land Registry will keep and whether access will be open or restricted.

4. Transferring the benefit of an exempt information document

You cannot pass the benefit of the EX1 exemption to someone else, for example if you sell the land or the charge. The exemption will continue until withdrawn (unless the registrar removes it under rule 137(5) of the Land Registration Rules 2003 – see Applying for an official copy of an exempt information document). However, only the person who applied for the exemption can apply to have the designation removed. In most cases it will, therefore, be advisable for the original designation to be removed and for a new EX1 application to be lodged.

5. Applying for an official copy of an exempt information document

If you apply for an official copy of an exempt information document using form OC2, you will receive a copy of the edited information document. This should be sufficient for most purposes. However, if it is not suitable for your needs, you can apply for an official copy of the full copy of the exempt information document. (For information – the exempt information document contains all the prejudicial information. We will refer to it in this section as the ‘full copy’ to make it easier to distinguish from the ‘edited information document’.)

To apply for the full copy of the exempt information document, you may use form EX2 or apply in writing (which can be by email) under the Freedom of Information Act 2000.

Fee for full copies of an exempt information document are charged at the same rate, whether made in form EX2 or under the Freedom of Information Act 2000, as for other official copies. For details see the current Land Registration Fee Order.

No further fee is payable for a request under the Freedom of Information Act 2000 for specific information that has been exempted from a document (for example, the rent in a lease) if the applicant has already applied and paid a fee for an official copy of a document that is an exempt information document, and has received a copy of the edited information document.

The issue of a full copy is not automatic. Although there is no requirement under the Freedom of Information Act 2000 for you to give reasons, they may assist your application and we will consider these. Under the Land Registration Rules 2003 there are 2 grounds on which a full copy can be issued.

- none of the information omitted is prejudicial information.

- although the information is prejudicial information, the public interest in allowing a full copy to be issued outweighs the public interest in not doing so.

Under the Freedom of Information Act 2000, HM Land Registry may need to determine whether the information omitted from the edited information document is ‘personal data’ under the Data Protection Act 2018, the disclosure of which would contravene any of the data protection principles in that Act. If it is, the information is exempt from the general right of access under Freedom of Information Act 2000. If it is not, HM Land Registry has to apply essentially the same public interest test as under the Land Registration Rules 2003. We will normally serve notice on any third party who may be affected by the decision to disclose information and they will have the opportunity to make representations to inform the decision-making process by the registrar.

Form EX2 and any letters are subject to the general right of inspection under the Land Registration Act 2002. You must, therefore, take care that anything you write does not contain any information you would not want made public. Similarly, any notice that we issue and any correspondence in response is also subject to the general right of inspection under the Land Registration Act 2002, unless accompanied by a fresh EX1 application.

Following an application made in form EX2 if we decide that we will issue a full copy on the basis that the omitted information is not prejudicial information, we must remove the designation and the document will become subject to the general right of inspection under the Land Registration Act 2002. (Rule 137(5) Where the registrar has decided an application [in form EX2 for a full copy of the exempt information document] on the basis that none of the information is prejudicial information, the designation of the document as an exempt information document and any entry made in respect of the document under rule 136(5) must be removed.)

If we decide not to issue a full copy, you will be informed and given the reasons for the decision.

5.1 Completing form EX2

Panel 1: local authority serving the property

This is stated in the register and will be the local authority area to which council tax and business rates are normally paid.

Panel 2: title number(s) of the registered estate(s) to which the document relates

Give the title number or numbers of the register or registers in which reference is made to the document. You may have quoted this title number if you applied for a copy of the edited information document in form OC2.

Panel 3: property

Insert the full postal address of the property registered under the title number shown in panel 2. If there is no postal address, insert a full description of the land.

If you have not quoted the title number, insert the full postal address or a full description of the land. If there is no postal address, then please supply a plan showing the extent and exact location of the property.

Panel 4: title number under which this document is filed

Some register entries have a note saying the document is filed under another title number or reference. If you know what this is, insert the reference here. We also hold some documents that affect large commercial organisations and transactions under file references at HM Land Registry Head Office - for example HO ref: 261/331/123. If this is the case, insert the reference here.

Panel 5: application and fee

See the current Land Registration Fee Order for details of the fee payable. Insert the amount in this panel. If paying by cheque, postal order or cash complete the top box and statement. If paying by variable direct debit account complete the bottom box. Please do not complete both boxes. Please enclose the fee with your application and make cheques and postal orders payable to ‘HM Land Registry’.

Panel 6: the applicant

Insert the details of the person or company who is sending the application to us.

Panel 7: the application is sent to HM Land Registry by

If we have any questions about the application, we will send them to the name and address in this panel.

Panel 8: application

Insert details of the exempt information document you are applying for a copy of.

Panel 9: reasons why edited version is not sufficient

Please give reasons why the edited information document is not sufficient for your purposes.

Form EX2 is not exempt from the general right of inspection under the Land Registration Act 2002. You must, therefore, take care that anything you write in this panel and panel 10 does not contain any information you would not want made public.

Panel 10: reasons why you believe omitted information is not prejudicial or that there is a public interest in publication

Please complete one or both of the alternatives in this panel.

If we serve notice on any third party who may be affected by a decision to disclose the information, we will also consider any comments they give us. We will, however, always bear in mind our obligation to provide information under the Freedom of Information Act 2000 within 20 working days (where the information is not exempt from the general right of access under that Act). If it seems likely that we are unable to meet this, we will inform you in advance and give you an estimate of the likely time it will take to deal with your request.

Panel 11: signature

Sign and date this panel.

6. Withdrawing the exempt status

Once the information is no longer considered to be prejudicial information, the person who originally applied for the exemption can apply to withdraw the document’s exempt status using form EX3. Only the original applicant can apply to withdraw the status.

There is no fee for this application.

Where another party has also applied for exempt status but has not yet lodged an EX3, we will create a further edited information document. This will omit only that information that is omitted from any edited information documents that have not yet been withdrawn. Where there has only been one application for designation as an exempt information document, we will simply remove the designation.

In some circumstances, the registrar must also remove the exempt status following an application for an official copy (see Applying for an official copy of an exempt information document).

6.1 Completing form EX3

Panel 1: local authority serving the property

This is stated in the register and will be the local authority area to which council tax and business rates are normally paid.

Panel 2: title number(s)

Give the title number or numbers of the register or registers in which reference is made to the document. If you do not know the title number then leave this blank.

Panel 3: property

Insert the full postal address. If there is no postal address, insert a full description of the land. If you have not quoted the title number and there is no postal address, then please supply a plan showing the extent and exact location of the property.

Panel 4: title number under which document is filed

Some register entries have a note saying the document is filed under another title number or reference. If you know what this is, insert the reference here. We also hold some documents that affect large commercial organisations and transactions under file references at HM Land Registry Head Office - for example HO ref: 261/331/123. If this is the case insert the reference here.

Panel 5: application and fee

See the current Land Registration Fee Order for details of the fee payable. Insert the amount in this panel. If a fee is payable and you are paying by cheque, postal order or cash complete the top box and statement. If paying by variable direct debit account complete the bottom box. Please do not complete both boxes. Please enclose the fee with your application and make cheques and postal orders payable to ‘HM Land Registry’.

Panel 6: the applicant

Insert the applicant’s name. This is the name of the person applying to remove the designation, not their conveyancer.

Panel 7: the application is sent to HM Land Registry by

Insert the details of the person or company who is sending the application to us. If we have any questions about the application, we will send them to the name and address in this panel.

Panel 8: details of the document

Insert the details of the exempt information document.

Panel 9: application

Insert the date of the original EX1 application where indicated.

Panel 10: signature

Sign and date this panel.

7. Things to remember

For an EX1 application, you must:

- fully complete forms EX1 and EX1A (See Applying to make a document an exempt information document)

- enclose a copy of the document omitting the information you claim is exempt

- please ensure all parts of the document containing prejudicial information are appropriately redacted, to ensure they cannot be revealed by someone obtaining an official copy

- ensure HM Land Registry has a full copy of the document either because

- it is already kept by us

- it is lodged as part of the application

- enclose the correct fee (any cheque or postal order should be made payable to ‘HM Land Registry’)

Note that form EX1 and any letters written are subject to the general right of inspection under Land Registration Act 2002.

For an EX2 application, you must:

- fully complete form EX2 (See Applying for an official copy of an exempt information document)

- complete panels 9 and 10

- enclose the correct fee

Note that form EX2 and any letters written are subject to the general right of inspection under the Land Registration Act 2002.

With an EX3 application, if you are you the person who applied for the document to be exempted, then you must:

- fully complete form EX3 (seeWithdrawing the exempt status)

No fee is payable.

We only provide factual information and impartial advice about our procedures. Read more about the advice we give.