Creative industries: Sector Deal (HTML)

Published 28 March 2018

A man in a virtual reality headset holding 2 wireless controllers. (Courtesy of the UK Games Fund).

Foreword

In the Industrial Strategy white paper, the government committed to making the most of the UK’s strengths so that we can be at the forefront of emerging technologies and industries in the years ahead.

The creative industries - including film, TV, music, fashion and design, arts, architecture, publishing, advertising, video games and crafts - are an undoubted strength of our economy; indeed, they are at the heart of the nation’s competitive advantage.

From Harry Potter to Grand Theft Auto, Saatchi & Saatchi to Savile Row, the creative industries account for £92 billion of Gross Value Added (GVA), 2 million jobs and are growing twice as fast as the economy as a whole. Film and high end TV alone attracted over £2 billion of inward investment to the UK in 2017, creating employment, boosting tourism and bringing global talent to the UK. And with creative industries’ export value nearly double their share of the economy,[footnote 1] they are a key component of what makes us a great, global trading nation, respected around the world and confident at home.

But there is enormous potential to go further. The immediate opportunity is in growing global demand for British creative content - not just culture and entertainment, but services like design and advertising that power wider industry. The sector has a critical role to play as the UK exits the European Union and we build a global Britain.

It was to realise this potential that the creative industries were identified as a priority for an early sector deal. The independent Bazalgette review found that while creative businesses were already thriving, joint action by industry and government could unlock further growth, particularly outside their biggest existing concentration of strength in London and the South East. As recent research from NESTA has found,[footnote 2] the priority for the sector is scale: helping the SMEs and entrepreneurs that overwhelmingly make up the sector to grow, in order to raise productivity. We want to build on Britain’s creative strengths right across the UK by helping businesses innovate, access investment and skills, protect their ideas, and export.

Led by the Creative Industries Council and with critical input from the Creative Industries Federation and other leading voices across the sector, this deal will invest more than £150 million across the lifecycle of creative businesses including:

- the places of the future by funding leading creative clusters to compete globally;

- the technologies and content of the future via research into augmented reality and virtual reality; and

- the creative skills of the future via a careers programme that will open up creative jobs to people of every background.

A new industry led Trade and Investment Board will ensure the sector can better take advantage of international opportunities, and a commercial investment programme to support business angels will help to ensure that creative businesses, among other industries, find it easier to access the finance they need to scale. New measures to strengthen copyright protection will tackle infringement and underline the government’s commitment to ensure that creators realise increased value from the distribution of creative content online.

This Sector Deal is just the beginning: the first iteration of an agreement that will develop over time. If we can get the conditions right and the creative industries continue to outperform the rest of the UK economy, their exports will increase by 50% by 2023, they will be worth £150 billion and create 600,000 new jobs.

Together we can build on the UK’s position as a global leader and strengthen its advantage as a creative nation by increasing the number of opportunities and jobs in the creative industries across the country, improving their productivity, and enabling us to greatly expand our trading ambitions abroad.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Rt Hon Matt Hancock MP

Secretary of State for Digital, Culture, Media and Sport

Nicola Mendelsohn CBE

VP EMEA Facebook, Co Chair Creative Industries Council

At a glance

'Victoria' filming at Church Fenton Yorkshire Studios (Mammoth Screen for ITV).

Industrial Strategy at a glance

We will create an economy that boosts productivity and earning power throughout the UK.

5 foundations of productivity

The Industrial Strategy is built on 5 foundations:

- Ideas - the world’s most innovative economy

- People - good jobs and greater earning power for all

- Infrastructure - a major upgrade to the UK’s infrastructure

- Business environment - the best place to start and grow a business

- Places - prosperous communities across the UK

Grand Challenges

We will set Grand Challenges to put the United Kingdom at the forefront of the industries of the future:

- AI and Data Economy - We will put the UK at the forefront of the artificial intelligence and data revolution

- Future of Mobility - We will become a world leader in the way people, goods and services move

- Clean Growth - We will maximise the advantages for UK industry from the global shift to clean growth

- Ageing Society - We will harness the power of innovation to help meet the needs of an ageing society

Key policies

Key policies include:

Ideas

- Raise total research and development (R&D) investment to 2.4% of GDP by 2027

- Increase the rate of R&D tax credit to 12%

- Invest £725 million in new Industrial Strategy Challenge Fund programmes to capture the value of innovation

People

- Establish a technical education system that rivals the best in the world to stand alongside our world-class higher education system

- Invest an additional £406 million in maths, digital and technical education, helping to address the shortage of science, technology, engineering and maths (STEM) skills

- Create a new National Retraining Scheme that supports people to re-skill, beginning with a £64 million investment for digital and construction training

Infrastructure

- Increase the National Productivity Investment Fund to £31 billion, supporting investments in transport, housing and digital infrastructure

- Support electric vehicles through £400 million charging infrastructure investment and an extra £100 million to extend the plug-in car grant

- Boost our digital infrastructure with over £1 billion of public investment, including £176 million for 5G and £200 million for local areas to encourage roll out of full-fibre networks

Business environment

- Launch and roll out Sector Deals – partnerships between government and industry aiming to increase sector productivity. The first Sector Deals are in life sciences, construction, artificial intelligence and the automotive sector

- Drive over £20 billion of investment in innovative and high potential businesses, including through establishing a new £2.5 billion Investment Fund, incubated in the British Business Bank

- Launch a review of the actions that could be most effective in improving the productivity and growth of small and medium-sized businesses, including how to address what has been called the ‘long tail’ of lower productivity firms

Places

- Agree Local Industrial Strategies that build on local strengths and deliver on economic opportunities

- Create a new Transforming Cities fund that will provide £1.7 billion for intra-city transport. This will fund projects that drive productivity by improving connections within city regions

- Provide £42 million to pilot a Teacher Development Premium. This will test the impact of a £1,000 budget for high-quality professional development for teachers working in areas that have fallen behind

An independent Industrial Strategy Council will assess our progress and make recommendations to government.

Creative industries at a glance since 2010

UK Creative Industries Split 2016 (£m)

Bubble chart showing split of UK creative industries in 2016 (£m): IT, software & games = 34,704; film & TV = 15,361; advertising = 12,312; publishing = 11,622; music, arts & culture = 8,237; architecture = 4,203; design & fashion = 3,537; crafts = 421.

Change in GVA* 2010 to 2016

Bar chart showing the change in Gross Value Added between 2010 and 2016. UK average = 22.7%; Creative industries = 44.8%.

Value (GVA)

The UK Creative Industries 2016:

£91.8bn a year

£10.5m an hour

7.6% increase in value since 2015

Jobs

The Creative Economy 2016:

3.04m jobs

1 in 11 UK jobs

5% year on year growth

Exports (Services)

UK Creative Industries Exports 2015:

£21.2bn annual service exports value

9.4% of total UK services exports

+44.3% growth in creative services exports since 2010

Employment

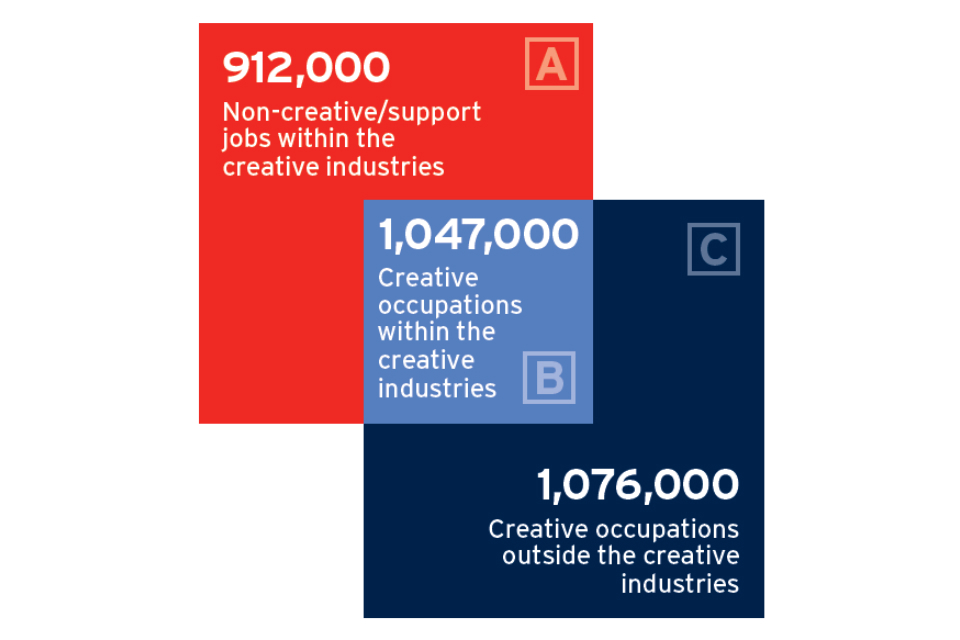

Employment in the UK creative economy 2016.

Diagram showing jobs in the UK creative economy, 2016. 3 squares: A. 912000 non-creative jobs within creative industries; B. 1047000 creative occupations within creative industries; C. 1076000 creative occupations outside the creative industries.

Total 3.04 million jobs in the UK creative economy:

Creative economy = A + B + C

Creative industries = A + B

Regions

Percentage of UK creative industries jobs by region 2016.

Map showing the % of UK creative industries jobs by region in 2016: London 32%; SE = 16%; EofE & SW = 8%; Scotland & NW = 7%; West Mids = 6%; Yorkshire & Humber & East Mids = 5%; Wales = 3%; NE = 2%; N. Ireland = 1%.

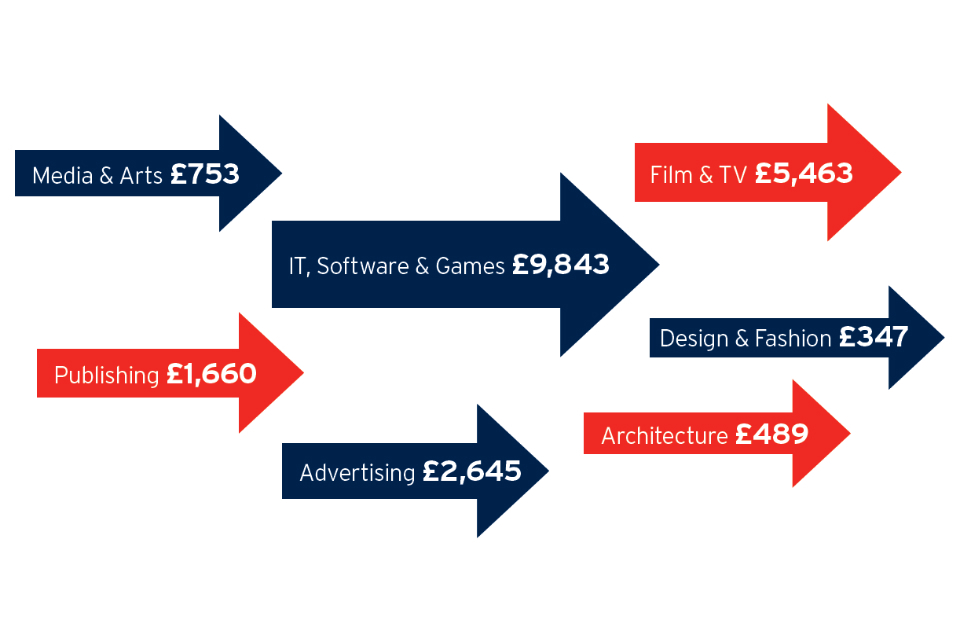

Service Exports

Services exports from UK creative industries 2015 (£m).

Diagram showing service exports from UK creative industries in 2015 (£m): IT, software & games = £9,843; film & TV = £5,463; advertising = £2,645; publishing = £1,660; media & arts = £753; architecture = £489; design & fashion = £347. [Source: Creative Industries Council and DCMS Sector Estimates (2017).]

Key Sector Deal policies at a glance

Places

- Support creative centre across the country, to enable clusters of worldclass businesses to increase GVA and employment. We will commit £20 million over the next 2 years to roll out a Cultural Development Fund so that local partnerships can bid for investments in culture and creative industries, with industry contributing funding, networks and leadership.

Ideas

- Open up Research and Development (R&D) funding to catalyse innovation. The Industrial Strategy Challenge Fund and industry will invest an estimated £58 million to harness the power of immersive technologies and double the UK’s share of the global creative immersive content market by 2025. We will also jointly invest £64 million in an Arts and Humanities Research Council programme to deliver eight partnerships between universities and creative businesses across the UK, creating 900 business-led collaborations, 360 jobs and 65 new businesses, backed by a national Policy and Evidence Centre.

Business Environment

- Tackle copyright infringement, continue to address the transfer of value from creative industries and progress work on closing the value gap at the European and domestic levels. We will convene online intermediaries and rights holders to consider the need for and agree new Codes of Practice in: social media, digital advertising and online marketplaces. We will also extend investment for the successful ‘Get it Right’ copyright education campaign.

- Reduce barriers to accessing finance for growth. The British Business Bank will seek to improve access to finance for high-growth firms outside London - including creative businesses - via a commercial investment programme to support clusters of business angels. We will help creative firms access finance by investing up to £4 million (subject to business case) in a programme of intensive business investment readiness support.

- Build on strong export performance to drive a Global Britain. We will create an industry and government Trade and Investment Board targeting a 50% increase in creative industries exports by 2023.

People

- To increase the supply and diversity of skills and talent in the creative industries, government will make up to £2 million available (subject to business case) to support an industry-led creative careers programme aiming to reach at least 2,000 schools and 600,000 pupils in 2 years and industry development of apprenticeship standards. Industry will provide further leadership on diversity and scope expanding the voluntary Skills Investment Fund supporting on-the-job training.

Executive summary

HRH the Queen at Fashion week AW18 (Credit: Darren Gerrish, British Fashion Council).

The Creative Industries Sector Deal, an agreement between the government and industry concluded with the Creative Industries Council seeks to unlock growth for creative businesses. It contributes to the Industrial Strategy’s vision of good jobs, greater earning power for all, and prosperous communities across the UK.

The creative industries are at the heart of the UK’s competitive advantage, and - in the face of technological transformation at home and new possibilities globally - represent a major strategic opportunity. Already booming, the creative industries are fast growing, and high exporting - both to the EU but also internationally. The ‘soft power’ influence of the sector means it has a critical role to play as the UK exits the European Union and we create a global Britain.

The deal builds on many of the recommendations of Sir Peter Bazalgette’s independent review of creative industries, which explored the challenges facing a sector comprised of firms rich in intellectual property where more than 9-in-10 enterprises employ fewer than 10 people. The Bazalgette Review forecast that a successful agreement could enable UK creative businesses to:

- Increase exports: delivering a 50% increase in reported creative industries exports by 2023

- Sustain growth: forecast GVA of £150 billion by 2023

- Boost jobs: continued strong growth implies 600,000 new creative jobs by 2023

- Narrow the gap in creative business activity between the South East of England and the rest of the UK

- Be more representative of UK society: opening careers to a wider range of people

Focusing on 4 of the 5 foundations of the Industrial Strategy aimed at growing productivity in the UK economy - Places, Ideas, Business environment and People - the measures outlined in this document total more than £150 million in investment from government and businesses, and a range of new policies. The government and industry have worked closely on a first phase deal, and expect further agreements to be reached as the deal is implemented.

The deal recognises and respects the devolution settlements of Scotland, Wales and Northern Ireland. With many of the policies that can drive productivity being devolved, it is a deal that necessarily brings our work together with that of the devolved administrations as we work in partnership to get the best possible outcome for every part of the UK.

Places

The Industrial Strategy commits to helping prosperous communities thrive across the UK. Creative industries help to deliver this objective because they give places strong identities, as well as driving employment and growth. While research has identified some 47 clusters of creative businesses around the country from Dundee’s games hub to Salford’s MediaCityUK, almost half of creative businesses are concentrated in the capital and the South East. The deal tackles this via new public investment and industry backing for leading creative industries clusters with the potential to compete globally helping more of the country project global Britain to the world.

Ideas

The Industrial Strategy white paper commits to establish the UK as the world’s most innovative economy. The creative industries businesses already invest substantially in R&D; from epic, outdoor illuminations in 59 Production’s Bloom to the world leading fashion customization of Unmade. But there are also obstacles including the fragmentation of a heavily SME-based sector and the fact that creative research and its application can be seen as separate to ‘hard’ industrial research, even though it often involves many of the same technologies.

The deal helps drive innovation by joint public and industry investment in 8 partnerships of business and universities, backed by a national research centre, and a commitment to investigate barriers to creative businesses taking up R&D funding. It also pledges joint investment in a strategic innovation challenge set to transform creative content immersive technologies like Virtual, Augmented and Mixed Reality.

Business environment

Creative businesses are nimble, fast growing and globally exporting - but they also face barriers to achieving scale. There are recognised market failures in access to finance, especially outside London. Online piracy continues to be a serious inhibitor to growth in the creative industries. Technologies like stream ripping and illicit streaming devices enable illegitimate access to content without rewarding its creators. Many rights holders are also concerned about how their works are exploited online, especially where they are used without generating substantial returns for content creators. This sector deal sets out measures to make it easier for creative businesses to get the finance they need to grow. It describes how industry and government will create a new partnership to realise greater value and impact from public support for exports particularly important as we respond to the challenges and opportunities associated with leaving the EU, and project our values and influence on the global stage. It also seeks to safeguard copyright and address the transfer of value from the creative industries.

People

The government set out its vision to create good jobs and greater earning power for all in the Industrial Strategy. The UK boasts world class skills and talent across the creative industries. This deal sets out how government and industry are taking steps to overcome existing barriers to entry, as well as addressing future skills needs: from improving understanding of the sector among students, parents and teachers via a substantial careers programme, to monitoring uptake of apprenticeships and ensuring that apprenticeship standards for roles identified as important to the Industrial Strategy are prioritised.

Key commitments

Crane Dance Bristol, by Laura Kriefman as part of the inaugural Space/WIRED Creative Fellowship, supported by the Watershed. Lighting designed by Howard Eaton and Emma Chapman of Studio Three Sixty. (credit: Jon Rowley).

Places

Developing more world-class creative industries clusters to narrow the gap between London, the South East and other regions.

Government action to support construction

Investing to develop world-class creative clusters: we will provide £20 million over the next 2 years to roll out a Cultural Development Fund. Local partnerships will be able to bid for strategic investments in culture and creative industries - helping leading areas become world-class, unlocking growth, investment and jobs. creative industries

Sector action to support creative industries

Investing to develop world-class creative clusters: to benefit from the Cultural Development Fund, local partnerships of businesses, museums and galleries, universities and local government will matchfund investment and bring to bear leadership and expertise. Industry will develop a supporting Creative Kickstart Programme to provide firms in clusters with mentoring and advice on finance, exports and IP including a creative industries roadshow to introduce businesses and investors.

Ideas

Sustain growth: achieve forecast GVA of £150 billion by 2023.

Government action to support creative industries

Capturing new audiences by strategic investment in immersive content: we will enable creative businesses to harness the power of immersive technologies to create content, products and services with a £33 million investment from the Industrial Strategy Challenge Fund into the Audiences of the Future Challenge.

Building new research and development partnerships between universities and businesses: we will invest £39 million from the Industrial Strategy Challenge Fund to the Arts and Humanities Research Council (AHRC) to bring together top universities and businesses in a series of research and development partnerships. These will cultivate existing clusters within the creative industries. Alongside the R&D partnerships, investment will be made in a Policy and Evidence Centre for the Creative Industries.

Breaking down barriers to accessing R&D: to explore longstanding barriers and understand the track record of creative industries in securing R&D investment, and improve take-up of investment and public support for creative industries R&D, we will establish a creative industries working group between government and industry.

Sector action to support creative industries

Capturing new audiences with funding for cutting-edge, immersive content: Industry will provide match funding of at least £25 million, and provide expertise to support and shape the challenge.

Building new research partnerships between businesses and universities: Working together with universities, industry will contribute upwards of £25 million to the AHRC Creative Industries Clusters Programme ensuring that business needs are fully integrated into the research and development partnerships.

Business environment

Sustain growth: forecast GVA of £150 billion by 2023. Boost job creation: higher than average growth rate implies 600,000 new creative jobs by 2023.

Government action to support creative industries

Protecting the IP of creative businesses: We will further safeguard copyright content by convening online intermediaries and rights holders to consider the need for and agree new Codes of Practice on social media and user upload platforms, digital advertising and online marketplaces (considering legislative backstops if sufficient voluntary progress is not made by the end of 2018). We will continue to address the transfer of value from the creative industries and progress work on closing the value gap at the European and domestic levels. We will continue to support the successful ‘Get it Right’ campaign investing £2 million in order to educate consumers on the dangers of copyright infringement and direct them towards legitimate sources of creative content online.

Putting in place key rungs in the ladder of finance: The British Business Bank will seek to unlock access to finance for high-growth firms outside London - including creative businesses - via a commercial investment programme to support clusters of business angels. To ensure there is pipeline of investable businesses ready to access growth funding, government will invest up to £4 million, subject to business case, in a programme of intensive business investment readiness support to develop both pools of investable businesses and viable networks of investors.

Increasing business influence on trade priorities to drive up exports: To boost the sector’s export performance we will establish a new Creative Industries Trade and Investment Board, with at least £4 million from existing Department for International Trade budgets to support exports in 2018 to 2019, subject to final business planning. It will develop a business-led 3-year export strategy aiming to increase exports by 50% by 2023.

Supporting entrepreneurialism, access to finance and IP creation in a trailblazing creative sector: we will provide an additional £1.5 million for the highly successful UK Games Fund so that it can support more young businesses in 2018 to 2019 and, as announced in the Budget, extend the programme to run in 2019 to 2020.

Sector action to support creative industries

Protecting the IP of creative businesses: Industry will help to train and educate SMEs and microbusinesses on how to police their content and products online and investigate partnerships between small and large players to assist in enforcement. It will play a critical role in identifying key leaders to take part in the joint work programme to better value IP

Putting in place key rungs of a ladder of finance: Industry will establish a Creative Champions initiative to offer tailored advice, mentoring and networking opportunities for creative entrepreneurs and businesses in order to help them become investment-ready, and to improve understanding between investors, financiers and creative businesses. UK Finance, the representative body for the banking and finance sector, will work with its member organisations to launch and coordinate a PR and outreach campaign. This will increase visibility and market intelligence on the growth opportunity of creative businesses to intermediaries and stakeholders; provide expertise to creative companies and connect them to business mentors around the country.

Increasing business influence on trade priorities to drive up exports: Businesses will match government investment in creative industries export programmes under the new Board’s strategy. Industry will nominate a lead from each sub-sector to the new Board, and also provide secretariat support.

Supporting inward investment and trade: Industry will bring together innovators from industry with creative visionaries to consider the challenges and opportunities posed by economic and societal trends and scientific discoveries at Createch. The 2018 event is fully funded by industry with the support of Facebook, Imagination, Dentsu Aegis, King, Lewis Silkin and Kingston Smith.

People

Strengthen the talent pipeline to address current and future skills needs, as well as ensure that it is more representative of UK society.

Government action to support creative industries

Supporting a strong and sustainable talent pipeline: we will make up to £2 million available (subject to business case) for a package of support to ensure there is a larger and more diverse intake of talent and a broader range of routes into the creative industries. This includes support for an industry-led creative careers programme and industry development of apprenticeship standards.

Helping deliver more apprenticeships: The Institute for Apprenticeships (IFA) will prioritise apprenticeships standards development in the creative industries in areas where they are experiencing skills gaps and identified as Industrial Strategy priorities.

Sector action to support creative industries

Ensuring there is a larger and more diverse intake of talent and a broader range of routes into the creative industries: The sector will work with government to develop a major sustainable industry-led creative industries careers programme, including delivering a major advertising campaign led by the Creative Industries Federation. In 2 years, the programme aims to reach a minimum of 2,000 schools and 600,000 pupils, recruit at least 50 new ambassadors from the creative industries with at least 100 employers from the sector participating in encounter events reaching 15,000 young people.

The sector will continue to show leadership in implementing programmes seeking to provide a step change in the diversity of its workforce like Project Diamond in TV, BFI’s Diversity Standards, Penguin Random House’s WriteNow programme, Women in Games, BAME in Games and PRS Foundation’s Keychange initiative.

Helping deliver more apprenticeships: The sector will seek to increase its number of apprenticeship starts. It will also explore the scope for expanding the voluntary Skills Investment Fund (SIF) supporting on-the-job training in film and television.

Existing support for the creative industries

This Sector Deal comes against the backdrop of strong support for the creative industries from government and its delivery partners.

Still from the Laser League video game.

Business environment

The UK’s suite of creative tax reliefs are among the most competitive in the world, with government investing £415 million in film last year alone through the film tax relief - a 23% increase year on year. The tax reliefs have since 2007 attracted over £11 billion of investment in British screen industries and, in total, our film, TV and video games sectors contributed £13.2 billion in GVA and 158,000 jobs in 2016.

Almost £70 million in grant in aid and National Lottery funding are invested annually through the British Film Institute (BFI) to support a range of activities across the UK.

To ensure that consumers have breadth of choice, we are - subject to business case - establishing a pilot Contestable Fund, that will commit up to £60 million of licence fee money to help stimulate the provision and plurality of public service content in targeted areas.

We fund the specialist Police IP Crime Unit (PIPCU) which has investigated more than £100 million worth of IP crime, diverted more than 11 million visits from copyright infringing sites, and delivered a 64% decrease in advertising on copyright infringing websites.

As well as promoting exports through the GREAT campaign, the government supports British companies to attend overseas events through the Trade Access Programme and Music Export Growth Scheme, benefit from missions at key events including China Joy and South by Southwest®, and access high-level government to government networks. Government has negotiated co-production treaties in key international markets such as China and Brazil, which will help British business thrive.

Places

More than £200 million of inward tourism spend is associated with High-End TV (and £23 million in tax revenues).[footnote 3] Including spillover effects, tourism as a result of British film is estimated to have brought 8,400 FTEs, £400 million GVA and more than £90 million tax revenue. The placement of the UK on screens around the globe led to an estimated additional £700 million in turnover for UK companies in 2013.

In 2016 to 2017, government invested more than £180 million in grant in aid in the arts through Arts Council England (ACE) in London and more than £290 million outside London - in addition to more than £50 million of National Lottery funding in London and more than £140 million outside London. Around 65% of British Film Institute (BFI) spending supports activities outside London.

Channel 4 has agreed to move staff and spending outside of the capital, stimulating new investment and TV production as the supply chain responds. According to government commissioned economic analysis,[footnote 4] the agreed redistribution of spending from London could support over 2,600 jobs out of London, while 300 staff could support an overall redistributive impact of close to a further 1,400 jobs.

Ideas

In 2015 to 2016, R&D tax credits provided almost £2.9 billion of support.[footnote 5] At Autumn Budget 2017 we increased the rate of the R&D Expenditure Credit from 11% to 12%.

The BBC spent £161 million supporting the screen sector and beyond over the last decade on R&D. Public R&D funders such as Innovate UK, ACE and AHRC have provided grant funding and support to leading firms like Industrial Light and Magic, Improbable, and Aardman Animations amongst others.

People

Between 2012 and 2017 the government invested over £580 million in a diverse portfolio of music and arts education programmes.

To improve diversity and tackle skills shortages, the BFI has launched its £20 million Lottery-funded Future Film Skills Programme and we provide over £2 million a year to the National Film and Television School to increase the supply of film, TV and video games production graduates with cutting-edge skills.

The BBC’s investment in developing the creative industries workforce includes 65,000 unique training sessions for staff in 2017, increasing its number of apprenticeships more than 5-fold over the past 5 years and offering 400 by the end of 2018. BBC initiatives to support workforce diversity include their recent £1 million scheme recruiting and training journalists with disabilities and the Make it Digital Traineeships.

Places

Provide a more consistent national spread of creative industries: narrowing the gap between the South East of England and the rest of the UK.

'Peaky Blinders' filming near Bolton Abbey, North Yorkshire. Caryn Mandabach Productions/Tiger Aspect for Screen Yorkshire/BBC 2.

Our goal

The government is committed to helping prosperous communities thrive across the UK. While world-leading businesses are located across the country, some places are not realising their full potential, with greater regional disparities in productivity in the UK than other European countries.

The Industrial Strategy white paper found that, alongside transport links, housing, skilled labour and rich innovation ecosystems, an attractive cultural environment was a key attribute for a local economy to succeed.

Cultural and creative investment can drive economic growth by making them attractive locations to live and work. Margate’s Turner Contemporary gallery and Belfast’s Titanic Studios - home to ‘Game of Thrones’ - highlight the impact that creative anchor institutes can have on pride and economic performance in an area. During Liverpool’s Capital of Culture year, the local economy generated almost £754 million of additional income.[footnote 6]

The challenge

However, as the Bazalgette Review argues, the UK creative industries’ success to date has been achieved despite unequal distribution of opportunities, skills, finance and knowledge; almost half of creative industries jobs (47%) remain concentrated in the capital and the South East.[footnote 7] The problem is not that London is too big, but that other centres are too small. There is enormous potential to grow other leading hubs across the UK.

Research has identified some 47 clusters of creative businesses around the country, accounting for 82% of the UK’s creative industries employment and 75% of creative businesses.[footnote 8] Regions from the South West, to Yorkshire and the Humber, to the West Midlands have experienced the benefits of creative industries’ growth, with the sector growing twice as fast as in the rest of the economy on average.[footnote 9]

Place matters particularly to creative businesses because the industry is characterised by a large proportion of SMEs and micro-businesses. By bringing creative firms together, business support, R&D, talent and infrastructure can be shared across the supply chain, with spill-over benefits for the wider area.

Industry, central and local government working together

Industry and government have worked together to deliver several prominent creative industries cluster projects.

Salford’s MediaCityUK grew up around the BBC’s relocation of 2,500 jobs to the area in 2006 and has since become an international tech and creativity hub, with over 7,000 people employed on-site. As well as significant creative industries employers such as the BBC, ITV and Shine North, the development is now also home to more than 150 SMEs. KPMG has estimated that the BBC’s activities contributed £277 million to the economy of the North West in 2014 to 2015.[footnote 10]

In Bristol, a globally-significant, high-growth creative cluster has grown out of anchor institutions, including co-working spaces, serviced creative hubs and cultural organisations at the Harbourside Mile, The Arnolfini Contemporary Art Gallery, Watershed and Spike Island. Recently government and industry have jointly invested £61 million investment in the Temple Quarter Enterprise Zone. The project, focussed on the growth of businesses in the creative, media and microelectronics sectors, is scheduled to deliver 17,000 new jobs and attract £1 billion of private sector investment.[footnote 11]

Screen Yorkshire has championed the film, TV, games and digital industries in Yorkshire and Humber since it was established in 2002. In 2012, building on its work as a screen agency, it set up the Yorkshire Content Fund, with backing from the European Regional Development Fund (ERDF), which has subsequently provided financial support to over 40 film and TV projects including National Treasure, ‘Dad’s Army’, ’71’, and ‘Peaky Blinders’. The region has seen strong growth with employment in the film and television industries increasing 88% between 2009 and 2015, and turnover increasing by 247% over the same period.[footnote 12]

In Dundee, an early nucleus of creative businesses that generate games IP, targeted funding and responsive higher education institutions have supported the area to develop as one of the UK’s most significant video games development clusters, with more than 40 established games firms and 350 employees. Run from the same city, the UK Games Fund helps SMEs across the UK creating new games IP. It now supports a community of around 100 UK video games developers.[footnote 13]

HBO’s decision to film ‘Game of Thrones’ in Belfast in 2010 has delivered spill-over effects for the local creative economy, supporting a cluster of businesses including post-production house Yellowmoon and Belfast facilities company, Acorn Film and Video, who produce the Behind the Scenes packages for the show’s website.[footnote 14]

Creative clusters in the UK

Map of the UK showing the creative clusters by type (high concentration, high growth, high concentration & growth). Detail in table below.

| Cluster | Type |

|---|---|

| 1 Edinburgh | High concentration and growth |

| 2 Glasgow | High concentration and growth |

| 3 Newcastle | High growth |

| 4 Belfast | High concentration and growth |

| 5 Middlesbrough and Stockton | High growth |

| 6 Harrogate | High concentration and growth |

| 7 Leeds | High growth |

| 8 Liverpool | High growth |

| 9 Manchester | High concentration and growth |

| 10 Warrington and Wigan | High growth |

| 11 Sheffield | High growth |

| 12 Chester | High concentration and growth |

| 13 Crewe | High growth |

| 14 Norwich | High concentration |

| 15 Peterborough | High concentration and growth |

| 16 Northampton | High growth |

| 17 Leamington Spa | High concentration and growth |

| 18 Cambridge | High concentration |

| 19 Milton Keynes | High concentration and growth |

| 20 Colchester | High concentration and growth |

| 21 Cheltenham | High concentration and growth |

| 22 Luton | High concentration and growth |

| 23 Chelmsford | High growth |

| 24 Oxford | High concentration and growth |

| 25 High Wycombe | High concentration and growth |

| 26 London | High concentration and growth |

| 27 Southend | High growth |

| 28 Cardiff | High growth |

| 29 Bristol | High concentration and growth |

| 30 Slough and Heathrow | High concentration and growth |

| 31 Reading | High concentration |

| 32 Newbury | High concentration |

| 33 Bath | High concentration |

| 34 Medway | High growth |

| 35 Canterbury | High concentration |

| 36 Trowbridge | High concentration and growth |

| 37 Basingstoke | High concentration and growth |

| 38 Guildford and Aldershot | High concentration and growth |

| 39 Tunbridge Wells | High concentration and growth |

| 40 Southampton | High concentration and growth |

| 41 Hastings | High concentration and growth |

| 42 Eastbourne | High concentration and growth |

| 43 Chichester and Bognor Regis | High concentration and growth |

| 44 Brighton | High concentration and growth |

| 45 Bournemouth | High growth |

| 46 Exeter | High growth |

| 47 Penzance | High concentration |

| Source: Nesta and ONS Business Structure Database (2016) |

The contribution of the Industrial Strategy

By introducing Local Industrial Strategies and further strengthening local leadership through Local Enterprise Partnerships and Mayoral Combined Authorities we will provide incentives to make a wider range of places attractive environments for creative businesses.

We have committed to investing £21 million in Tech City UK over 4 years to expand into Tech Nation supporting digital companies and start-ups all across the UK, which will include many creative businesses. Regional hubs will be located in Cambridge, Bristol and Bath, Manchester, Newcastle, Leeds, Sheffield, Reading, Birmingham, Edinburgh, Glasgow, Belfast and Cardiff.

We have set out plans to strengthen infrastructure including funding from the National Productivity Investment Fund to grow Local Full Fibre Networks and further investment into the 5G Testbeds and Trials programme. This will allow creative businesses with a digital footprint to thrive anywhere in the UK by closing down digital coldspots.

On top of these cross-cutting measures, a range of existing sector-specific commitments benefit the creative industries.

Channel 4 has agreed to relocate staff and spending outside London, supporting jobs and GVA growth in new locations, stimulating new investment and TV production as the supply chain responds.

Last year almost £70 million of public money was invested via government grant in aid and National Lottery funding through the BFI to support a range of activities across the UK, including film production, skills development and cultural promotion. Of this, approximately 65% was spent on supporting activities outside of London.

Scope to go further

But we wish to further harness the creative talents of communities and make sure that the prosperity of the creative industries is felt across the UK.

We will commit £20 million to establish a Cultural Development Fund (CDF) that will deploy investment to promote growth and prosperity for all. The fund will run over 2 years and will invest in areas of the country that can demonstrate high impact, robust plans for using investment in cultural and creative industries assets to further economic growth and support local communities. Bids will be expected to demonstrate how they are match funding the investment, including with significant private sector investment. The creative industries will need to ensure that they play a prominent role in making these bids as strong as possible. Bids will need to outline specific commitments - including match-funding - in areas such as capital investment, physical space, new cultural and creative programmes, events and activities to enable the development and scale up of local areas and businesses. This programme cannot work top-down.

Industry will play a vital role in supporting the CDF by developing a programme of activity to promote businesses in specific areas outside London. This includes industry delivery of a Creative Kickstart programme to provide mentoring and advice on sector-specific issues around finance, branding, advertising, marketing, communications, exports and IP. This will be allied to an annual Creative Industries Roadshow, which will bring creative businesses together across clusters to network and exchange best practice.

As well as investment, there is a need for advocacy and support to help local areas with strengths in creative business learn from each other on how to drive growth using leadership, planning, procurement and other tools.

Building on the consultative approach to the Sector Deal, government will convene a Creative Local Industry Partnership to enhance collaboration between creative industries consortia, including the Creative Industries Federation, Creative Industries Council, Local Enterprise Partnerships, Combined Authorities and partners in Devolved Nations. Together, these parties will inform the creative aspects of Local Industrial Strategies - such as interventions to grow local creative sector strengths or harnessing creative industries to address the Grand Challenges that places are developing with government. This includes the forerunner strategies in development with partners in Greater Manchester, West Midlands and the Oxford-Milton Keynes-Cambridge growth corridor.

We will help areas reflect the aspirations and great economic potential of their creative businesses. The network will be to share good practice and support local leadership across the UK.

Alongside all these measures, other steps in this Sector Deal will support leading clusters including:

- The Arts and Humanities Research Council’s Creative Industries Clusters Programme - enabling UK universities and creative businesses to address regional sector challenges through tailored research.

- Business support - given their links with the creative business community, creative clusters can house business support programmes, facilitate conversations between investors and businesses, inform investment decisions, or sign-post tenants to other advice that is available.

- Creative careers - creative clusters bring together regional businesses, education providers and - critically - creative people. Within clusters lies a wealth of knowledge on career pathways, skills supply and employment demand; all are essential components to a successful careers programme.

Ideas

Sustain growth: achieve forecast GVA of £130 billion by 2025 (3.9% annual growth).

Men’s Fashion Catwalk. (Credit: Kensington Leverne/British Fashion Council).

Our goal

The Industrial Strategy white paper set out how the government is investing to establish the UK as the world’s most innovative economy. The UK is a global leader in science and research - home to 4 of the top 10 universities in the world, and rated an innovation leader in the 2017 European Innovation Scoreboard.

But we invest less in R&D than most of our competitors: 1.7% of GDP compared to 2.8% in the United States and 2.9% in Germany, and we need to do more to ensure our excellence in generating ideas translates into excellence in applying them.[footnote 15]

UK’s spending on research and development compared to other coutries

Gross domestic expenditure on R&D by source of financing as a proportion of GDP, 2015

Stacked bar chart showing the Uk's spending on R&D compared to other countries. The UK falls in the middle of the range with Israel offering the most government funding and Chile the least. [Source: OECD (2017) OECD Economic Surveys: United Kingdom 2017

*2014 data for France, Ireland, Italy, Portugal and OECD aggregate. 2013 data for Belgium, Israel, Luxembourg and Sweden. Non-government financed includes finance from higher education, which may be partly government-financed; and from the rest of the world, which may include foreign and supranational government finance.]

The challenge

The creative industries are an important part of the UK’s research agenda. Analysis from the Enterprise Research Centre for Nesta suggests that the creative industries are as likely as manufacturing firms to conduct in-house and external R&D and be more likely than services firms to do so.[footnote 16] Much innovation is taking place at the intersection of creativity and technology:

- Landmrk is a location-based experiences platform – ‘the Pokémon GO of branded content’ – that has created global campaigns for companies including Sony Music, Showtime Networks and CeX. The company recently partnered with Shakira to promote her album El Dorado, placing exclusive, digital content in 1,000 hotspots across 99 countries.

- Covatic was born when Oxford data science and machine learning academics joined forces with broadcast industry experts to better connect broadcasters with their audiences. Covatic’s flagship product is Serendipity, a mobile app framework that determines individual content preferences to improve broadcasters’ audience understanding.

- Unmade is a fashion technology business that gives brands, from e-commerce to manufacturing, the ability to mass customise products, enabling individual orders to be manufactured at the same cost and speed as mass-produced items.

However, while the creative industries are highly innovative, they are characterised by an abundance of SMEs spread across sectors. As a consequence, they can lack the capacity for strategic, cross-sectoral R&D, including linkages with our universities. Sir Charlie Mayfield’s productivity review highlighted how creative businesses face challenges because their outputs are primarily intangible, and in many cases unique.[footnote 17] Funding from UK research councils and Innovate UK has been trending upwards, though remains dominated by IT, software and computer services research.

Barriers include: fragmentation - microbusinesses are sometimes less well placed to bid for, and manage, largescale funding awards that could build networks of expertise; the ideas-rich, IP-heavy nature of creative business assets which are not always recognised as collateral; and the fact that creative research and its application has tended to be seen as separate to hard industrial research, even though it often involves many of the same technologies.

R&D matters particularly at a time of changing technology. Virtual and augmented reality will transform not only how we experience entertainment but also our experience of the physical world - from shops to museums, cars to classrooms. Whilst hardware offers new ways to deliver experiences, demand is likely to depend on the production of popular high quality content. This is a major opportunity for the UK to establish itself as a global leader. We have world-class creative companies, researchers and technologists, and a strong base of production businesses, entertainment events and expertise in arts, design, and computer science. We must bring these together if we are to fulfil our potential as an immersive hub.

The contribution of the Industrial Strategy

The Budget and Industrial Strategy set out a range of measures to raise investment in R&D and to improve the UK’s ability to turn exciting ideas into commercial products and services.

We pledged a further increase in R&D investment of £2.3 billion from the National Productivity Investment Fund in 2021 to 2022, and committed to work with industry to boost spending on R&D to 2.4% of GDP by 2027. We are also investing £725 million in new Industrial Strategy Challenge Fund Programmes to drive innovation, and increasing the rate of the R&D expenditure credit to 12%.

Total project funding to projects with creative organisations

Line graph showing total project funding to projects with creative organisations, 2006 to 2017. [Source: Nesta and GlassAI (2017)

*Total project funding from Research Council (RCUK) and Innovate UK.]

Fraction of total creative project funding

Stacked bar chart showing fraction of total creative project funding 2006 to 2017.

These come on top of existing commitments to the creative industries, including support from public R&D funders such as Innovate UK, the Arts Council England and the AHRC.

Analysis from Innovate UK suggests that 2.4% of 2016 to 2017 funding from its Foundation competitions went to creative businesses. In that same year the creative industries were only eligible for 3 of the 10 competitions, but under an envisaged new approach from 2018 to 2019, all such competitions will be open. These opportunities will be equally scheduled across the year – giving creative businesses a near continuous opportunity to apply for funding.

In addition, £161 million has been invested in R&D at the BBC over the past decade, every £1 of which is estimated to have returned £5-9 to the UK economy.[footnote 18]

Scope to go further

To help pioneer the next generation of products, services and experiences, the government will invest £33 million over 3 years via the Industrial Strategy Challenge Fund in an Audience of the Future Challenge. The Challenge - beginning in April 2018 - will comprise:

- A £16 million programme of investment in projects applying immersive technologies that can then be used as demonstrators to encourage wider uptake. This will create novel large scale experiences and test them at a mass audience scale.

- A £12 million R&D programme combined of 3 competitions (a collaborative competition aimed at making the production of high quality content cheaper, faster and more accessible by driving immersive innovation; a competition aimed at attracting additional private capital into this emerging sector; and an early stage design competition focused on understanding the future consumer, delivering vital insight into audience perceptions and behaviours).

- A £10 million Industry Centre of Excellence (supported by £5 million from the AHRC’s clusters programme) to overcome silos in the key industries, ensuring the UK creative workforce is the most skilled in the world in the use of immersive technologies.

Matching this government investment, the creative industries will provide expertise and at least £25 million in co-investment and in-kind support to the programme - with grant funding only available to bidders that also contribute.

We anticipate this investment could lead to a significant boost in generation of immersive content in the UK, cementing our place as a dominant market leader in the creative immersive sector. The challenge aims to ensure that 10% of global creative immersive content is made in the UK by 2025 and that the UK will double its share of global investment in immersive technologies from a baseline of 5% in 2016 to 10% in 2025.[footnote 19]

Taking advantage of new technologies requires leadership. The Creative Industries Council has recognised the importance of convening industry to consider how to harness technology to grow the sector with its establishment of Createch. The annual event, which takes place during London Technology Week each June, seeks to identify opportunities for collaborative innovation within the creative economy. Its aim is to accelerate growth and exports by creating new revenue streams and business models. Createch 2018 will be fully managed, delivered and funded by industry, with support from Facebook, Imagination, Dentsu Aegis, King, Lewis Silkin and Kingston Smith.

New partnerships between universities and businesses to strengthen R&D in leading creative clusters, and transform understanding of the sector

To encourage creative industries innovation, the AHRC will deliver a Creative Industries Cluster Programme (CICP), funded by £39 million of government investment, complemented by a minimum contribution of £25 million from industry. The programme includes funding for up to 8 Creative Research and Development Partnerships to boost long-term strategic R&D activity between businesses and higher education institutions across the UK.

The programme received 45 proposals for R&D partnerships naming 700 partner organisations, including every UK region and every creative industries sub-sector.

Alongside the Creative R&D Partnerships, the Creative Industries Cluster Programme will also provide investment into a pioneering UK Policy and Evidence Centre for the creative industries. The Centre will provide the evidence crucial to devising policy solutions to the sector’s biggest challenges.

Amongst other objectives the CICP programme will encourage the development, commercialisation and protection of the UK’s creative assets, create new products, services and experiences as well as driving up employment and creating new categories of jobs. It is also envisaged that the programme will help to expand international trade for the creative industries across the whole of the UK.

Breaking down the barriers to accessing R&D investment

The success of the creative industries is critically dependent on their ongoing investment in R&D. To increase investment, government will convene a Creative Industries R&D Working Group from across the sector.

The group, made up of chief technology officers and sector leaders proposed by the Creative Industries Council, as well as officials from HMT, HMRC, BEIS, DCMS and Innovate UK, will focus on reviewing R&D funding for the creative industries, exploring barriers to access and opportunities to improve successful uptake of existing support such as the newly increased R&D tax relief, as well as delivering better data on the type and amount of R&D activity and its return on investment.

The findings of the working group will inform HMRC’s ongoing activities to increase awareness of eligibility for R&D tax credits which will include, in 2018, a new campaign focussed on emerging technologies. The working group will be set up in 2018 and will conclude its findings by the winter.

In order to leverage the expertise in the sector, Sir Peter Bazalgette has joined the Board of [UKRI] to provide expert advice on how to increase investment in the creative industries.

Business environment

Increase exports: delivering a 50% increase in reported creative industries exports by 2023. Sustain growth: forecast GVA of £130 billion by 2025 (3.9% annual growth). Boost job creation: higher than average growth rate implies 1 million new creative jobs by 2030.

Coldplay, Production Park. (Credit: Sarah Womack).

Our goal

A new business starts up in the UK every 75 seconds.[footnote 20] While the Organisation for Economic Cooperation and Development (OECD) already ranks us among the best places in the world to start and grow a business, the government’s intention is to make Britain the best place to start and grow a business.

The Industrial Strategy white paper identified a number of priorities if this ambition is to be realised, including better connecting our exceptional financial services industry with businesses seeking access to finance (particularly outside of London, where most investors are concentrated); maintaining a world-beating regulatory environment; placing a renewed focus on driving up exports as we leave the European Union; and diffusing business productivity more evenly across the UK businesses of all sizes.

The challenge

The creative industries face many of the same challenges as businesses in other parts of the economy. However these challenges are magnified by 2 main factors.

The first is size - over a third (34%) of those working in the creative industries are self-employed, versus 13% of the UK workforce.[footnote 21] 95% of creative businesses employ fewer than 10 people.[footnote 22] This means creative businesses often lack ‘absorptive capacity’, defined by Frontier Economics as ‘the ability of a firm to identify and acquire relevant external knowledge, assimilate it, transform existing knowledge and practices, and exploit these new capabilities for commercial ends’.[footnote 23]

The second factor is a reliance on intangible assets. Creative industries firms need to be able to protect and value their intellectual property correctly in order to effectively trade and access finance.

The UK is recognised internationally for its world leading IP enforcement framework. The Copyright, Designs and Patents Act 1988 provides significant criminal penalties for the worst online offenders, as well as giving rights holders the ability to pursue website blocking injunctions from the High Court.

Case Study: Creative England

Over the last 5 years, Creative England has invested more than £23 million in loan and equity investments to SMEs. This step-up finance - from £10,000 to £250,000 - is offered alongside business support. It has given creative, digital businesses based outside London the financial runway to develop new products or services, increase employment, turnover and scale up. To date, Creative England - supported companies have created or safeguarded 1,725 jobs and leveraged £49 million private investment. As an example, Creative England invested £50,000 in 2013 in Avocarrot, a digital advertising platform. By June 2015 the company had raised a total of $2 million from venture capital and angel investors and doubled in size. In 2016 they were acquired by Glispa Global for $20 million.

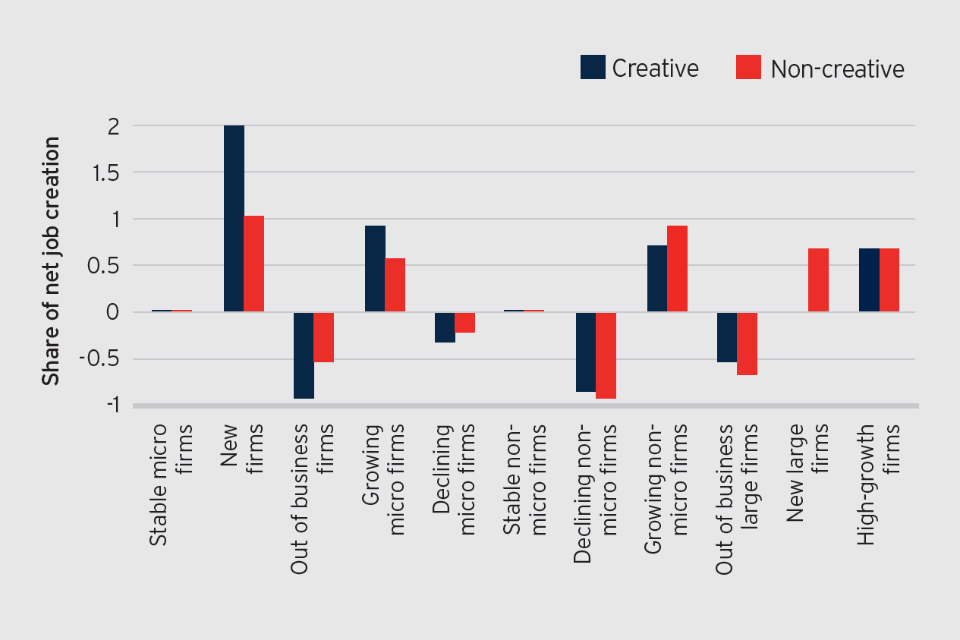

Firm category as share of all

Bar chart showing firm category as share of all. [Source: ONS, Interdepartmental Business Register, Nesta analysis*

Figure depicts growth dynamics of different business types (between 2013-2016) across the creative industries, compared to wider economy. Figure illustrates high reliance on start-ups and micro-businesses to job creation in the creative industries.]

Firm category as share of employment growth or decline

Bar chart showing firm category as share of employment growth or decline.

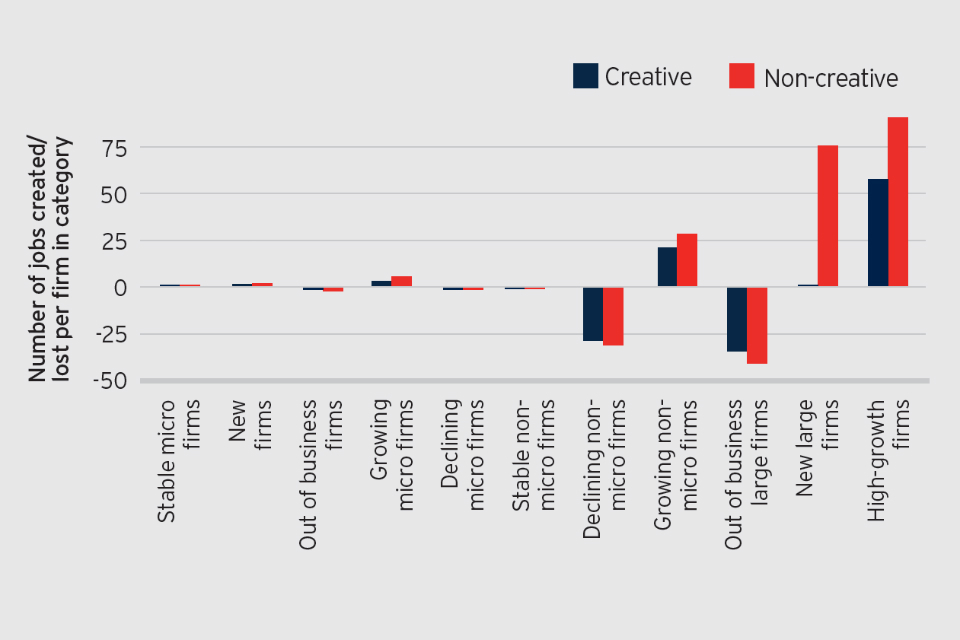

Jobs created/lost per firm category

Bar chart showing jobs created/lost per firm category.

Non-IP specific legislation is also often used, as in the case of illicit TV streaming devices, where successful action has most notably been taken under the Fraud Act 2006.

This framework reflects the scale of the underlying copyright enforcement challenge for content creators. Research from the IPO shows that while an increasing majority of consumers choose to access content through legitimate sources, as many as 25% still access infringing content illegally.[footnote 24] Professional infringers continue to find new ways and technologies to illegally exploit creative content, threatening livelihoods and businesses. PRS for Music report that stream ripping is one of the most prevalent and fastest growing forms of music piracy, accounting for just under 70% of music copyright infringement.[footnote 25]

Their small size and reliance on vulnerable, intangible assets makes it particularly difficult for creative businesses to attract investment. The Bazalgette Review identified 3 investment pinch points in the ladder of growing creative businesses: the need for loans and equity for early stage businesses; angel equity finance for high growth potential firms looking to scale up; as well as debt and equity growth finance for bigger, more established businesses.

These barriers were most apparent outside London: analysis of data from Beauhurst indicates that 60% of equity investments in creative industry firms in 2016 went to London-based businesses, despite the capital only accounting for 37% of the sector.[footnote 26]

The Review also concluded that these barriers are exacerbated by weaknesses in uptake of business support for the sector. New research commissioned by the Creative Industries Council found that only 54% of surveyed businesses had used business planning tools – an indicator of ‘investment readiness’ — compared to 72% of SMEs in general.[footnote 27]

Size in particular is also a challenge to creative industries businesses seeking to export. The creative industries currently account for 9.4% of UK service exports, almost twice their share of the economy. However, there remains a great deal of untapped potential in the sector, with many businesses not yet exporting at all.

Case study: British Fashion Council Business Development and Support Programme

Through advocacy, domestic and international promotion, showcasing and a tiered training approach, the British Fashion Council incubates and accelerates potential talent to drive business growth.

The BFC’s talent support pathway takes designers through an 11 Stage Programme across all areas of the fashion value chain from concept to business modelling and from market offering to being investment ready.

Over the last 3 years, the BFC’s programme has supported the development of designers such as Marques’Almeida and Sophia Webster; businesses supported have created over 200 jobs and exported over £10 million worth of product.

Case study: Pact university module

A number of industry initiatives have been established in an attempt to equip creative graduates with the business as well as creative skills required to run a creative industries business. Screen trade body Pact, for example, has led an industry working group that has designed a module for media degree courses to help ensure that graduates entering the TV production industry are equipped with the right business skills and knowledge. The module covers 3 business areas:

- IP and rights – understanding them and their value

- Content and funding – understanding co-production structures and new commercial models around TV productions

- IP exploitation – understanding distribution, global trading and secondary exploitation

The contribution of the Industrial Strategy

Intellectual Property

Government and industry have been proactive in working together to build on the successes of our IP framework, with the Intellectual Property Office (IPO)’s call for views laying the foundation for action.

In the most recent Autumn Budget, the Chancellor announced plans to consult on the tax treatment of intangible property (including IP) through the Intangible Fixed Asset Regime (IFA). This consultation considered the economic case for targeted changes to this regime.

These measures come on top of existing commitments on copyright protection, including extensive activity to tackle infringement. For example, we fund the specialist Police IP Crime Unit (PIPCU) which, since its inception, has investigated more than £100 million worth of IP crime and diverted more than 11 million visits from copyright infringing sites. PIPCU’s Operation Creative has also resulted in a 64% decrease in advertising from the UK’s top ad spending companies on copyright infringing websites.

Government understands that rights holders are concerned about the value they realise from the use of their works online, especially where works are used without generating substantial returns for creators. We are committed to addressing the transfer of value from the creative industries through use of their works online and closing the value gap. At the EU level, government is participating fully in the DSM copyright negotiations and championing targeted measures that address fairness in the online value chain, seeking to increase revenue flows to creators. We are seeking to clarify when online service providers might be liable for content uploaded by their users without the permission of rights holders and ensuring that proposals support creators without creating unnecessary burdens for businesses. And as we leave the EU we will seek to ensure stability and certainty in the UK IP framework. Domestically, the government’s Digital Charter will consider legal liability that online platforms have for the content shared on their sites, including how we could get more effective action through better use of the existing legal frameworks and definitions.

Activity: activities conducted

Bar chart showing activities conducted in March 2017 and March 2016: consumed = 59% / 59%; Streamed/accessed = 54% / 52%; Downloaded = 38% / 39%; Shared = 9% / 9%.

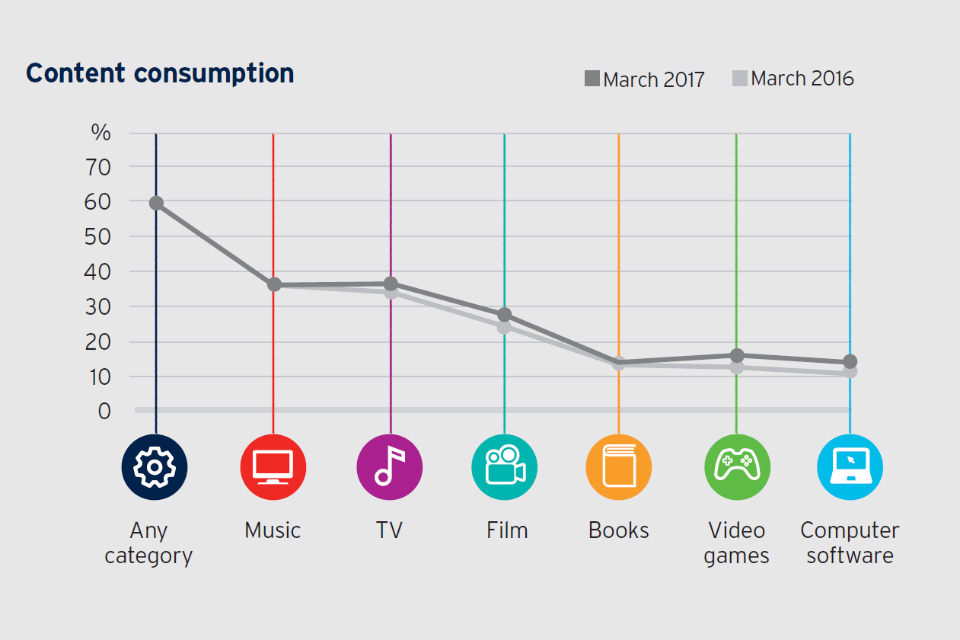

Activity: content consumption

Line graph showing % of content consumption by type: any category = 60%; music 37%; TV = 34%; film = 28%; books = 14%; video games = 12%; computer software = 11%.

Any illegal infringers by demographic

Bar chart showing illegal Intellectual Property infringers by demographic. The average is 25%. 16 to 24 year olds infringe the most at around 33%. [Source: Kantar Media 2017.]

Infringement

Bar chart showing overall levels of Intellectual Property infringement in March 2017 and March 2016: Any illegal activity = 25% / 25%; 100% illegal activity = 54% / 52%.

Access to finance

As part of the Patient Capital Review, government announced a major programme of action to unlock over £20 billion of patient capital investment across all sectors over 10 years by:

- establishing a £2.5 billion Investment Fund incubated in the British Business Bank with the intention to float or sell once it has established a track record. By co-investing with the private sector, a total of £7.5 billion of investment will be unlocked.

- doubling the annual allowance for people investing in knowledge intensive companies through the Enterprise Investment Scheme (EIS) and the annual investment those companies can receive through EIS and the Venture Capital Trust scheme, and introducing a new test to reduce the scope for and redirect low-risk investment, together unlocking over £7 billion of growth investment.

- backing new and emerging fund managers through the British Business Bank’s established Enterprise Capital Fund programme, unlocking at least £1.5 billion of new investment.

- backing overseas investment in UK venture capital through the Department for International Trade, expected to unlock £1 billion of investment.

The Industrial Strategy builds further on this work by setting out the government’s intention to scale up business support including £21 million investment over the next 4 years to expand Tech City UK’s reach so it will become Tech Nation – and support digital companies and start-ups to fulfil their potential and leverage their world leading IP.

Trade

As part of the Industrial Strategy, we have also committed to review our export strategy and establish a network of 9 UK Trade Commissioners, each developing a regional trade plan covering export promotion, investment and trade policy. Alongside other initiatives to help businesses fulfil overseas contracts, UK Export Finance will introduce a new bank guarantee designed to increase liquidity in the supply chain.

This builds on government and industry support for British companies to attend overseas events through the Trade Access Programme and Export Growth Scheme, with particular benefits for the creative industries, for example:

- British Underground provides support costs for artists selected to perform at international showcases such as South By Southwest and WOMEX.

- British Fashion Council’s London Show Rooms takes leading design talents to Paris Fashion Week each year to help develop their businesses internationally and raise their media presence.

- Funded by DIT and managed by the BPI, the Music Export Growth Scheme (MEGS) provides funding support for independent music companies, labels, distributors and management companies, to build on their UK success and break into overseas markets.

Not all IP regimes work in the same way, and concerns about international regimes can deter British businesses from exporting. To address this, the government will continue to make doing business abroad easier and safer for IP-rich creative businesses. Positive steps have already been taken and we welcome progress on IP in key markets such as China.

The IPO will also use the UK’s status as one of the best IP systems in the world to make a positive difference to the global IP system. To make this happen, the UK IPO will play a leading role to inform and influence the multilateral agenda and build strong bilateral relationships in priority countries and will continue to evaluate our international reach to ensure the UK is maximising trade and investment opportunities for our creative businesses. For example, the UK’s network of IP attachés will work with other government representatives in country, and with industry and UK based experts to improve international IP frameworks, build UK IP capability and deliver IP specific projects.

Scope to go further

Building on our world leading IP strength

Consumers are increasingly turning online to consume creative content and both government and businesses have a responsibility to make sure that they are presented with legitimate and licensed content when they go online. In 2017 the government helped broker a landmark code of practice which sees search engines and the creative industries work together to stop consumers being led to copyright infringing websites. This code has already shown considerable success in significantly reducing the prominence of illegal sites returned in search results.

Building on the progress made with search engines, government will work with industry to organise new roundtables between rights holders and (1) the online advertising industry; (2) social media and user upload platforms; and (3) online marketplaces to assess the evidence base and, where appropriate, agree further action to reduce online infringement and incentives towards infringement, with a senior government representative in the chair.

Each roundtable will:

- i . Scope and gather evidence to clarify the extent to which there are significant problems of online infringement which have not been adequately addressed to date by measures between rights holders and intermediaries taking account of any work going on in other forms (maximum duration 4 months). If no significant problems are identified then part (II) below will not proceed.

- ii. Develop codes of practice embodying further cooperative measures aimed at significantly reducing online infringement in the UK. Depending on the findings of part (I), these measures could include proactive steps to detect and remove illegal content, improving the effectiveness of notice and takedown arrangements, reducing incentives for illegal sites to engage in infringement online and reducing the burdens on rights holders in relation to protecting their content.

If part (II) fails to result in the agreement of an effective code by 31 December 2018, government will consider further legislative action to strengthen the UK copyright framework to ensure that the identified problems are addressed. The creative industries will in turn commit to train and educate SMEs on how to police their content and products online and investigate partnerships to assist in enforcement between small and large players. Industry will partner with government to develop a package of resources and training for SMEs accessible via Companies House, HMRC, IPO and other agencies, building on the work already undertaken by the IPO and organisations such as the Alliance for Intellectual Property.

In addition to these steps, the IPO will work with industry to ensure that, where appropriate, the benefits of the existing search code of conduct are available across the creative industries, with the overall goal of presenting consumers with links to legitimate sites.

As part of the ongoing review of the legislative framework for enforcement due to complete in 2019, government will consider the evidence for and potential impact of administrative site blocking, as well as the mechanisms through which administrative site blocking could be introduced, and take appropriate action. Government will also broaden the scope of its review, as part of the Enforcement Strategy, to assess the ‘notice and staydown’ mechanism as it relates to IP infringing material. This is in addition to the UK’s close involvement in shaping the work being done in Europe as part of the Digital Single Market copyright package to see online platforms step up the fight against infringing content online and that reforms that benefit creators.

Finally, the IPO and DCMS will continue to support the successful ‘Get it Right’ campaign with £2 million over 3 years in order to educate consumers on the dangers of copyright infringement and direct them towards legitimate sources of creative content online. This will be supported by in-kind support from the creative industries including content development and the provision of distribution channels.

Government is also committed, by Autumn 2018, to publish a programme of work to support the IP valuation market and will work with industry to support the identification and addressing of skills gaps around IP valuation among business advisers and intermediaries involved with the creative industries.

Access to finance and tailored advice for creative businesses

The creative industries are affected by a range of market failures as a result of both their size and reliance on intangible IP. As announced in the Autumn Budget, the British Business Bank will seek to unlock access to finance for high growth IP rich firms outside London via a new commercial investment programme. This regional angel co-investment fund, currently in development and set to be launched in the coming months, will complement the British Business Bank’s existing equity schemes. As with previous co-investment funds, the new regional angel programme will provide match funding to syndicates of angel investors. This creates an opportunity for the industry to provide support to investors on a deal-by-deal basis in order to help secure match funding.

The challenge for such cross-cutting support is to ensure it can be readily accessed by creative businesses. Government will bring together businesses, lenders, insurers, the British Business Bank and the IPO to overcome the barriers high growth, IP rich firms face in using their IP to access growth funding. In addition, the Minister for Digital and the Creative Industries, the Minister for Small Business and the Chief Executive of the British Business Bank will regularly meet to discuss progress on tackling these barriers and wider access to finance issues facing smaller businesses.

Case study: PRS Foundation

The PRS Foundation is an independent charity which receives a £3 million annual donation from PRS for Music and, via its wide range of seed investment programmes, levers £11 million from other public/private sources. Support from the Foundation includes the Momentum Music Fund which provides career-boosting grants to pre-commercial, independent artists at a crucial tipping point in their career. The Fund’s partners include PPL and Spotify. For every £1 granted by Momentum, artists have returned £7.46 to the UK music industry. The Foundation’s International Showcase Fund, which supports UK artists’ first steps into new priority markets overseas, generates a 10:1 ROI.