Construction Sector Deal

Updated 22 July 2019

Modern cityscape and communication network concept (credit: metamorworks/iStockphoto)

Foreword

Construction underpins our economy and society. Few sectors have such an impact on communities across the UK or have the same potential to provide large numbers of high-skilled, well-paid jobs.

The construction sector reaches every corner of the United Kingdom and touches each of our lives. It is fundamental to our economy as we invest in our future: building the homes we live in, the schools and hospitals we rely on, and the offices, factories, and transport and energy infrastructure that keep the wheels of industry turning.

We are in the early days of one of the greatest construction programmes in our history, from delivering more homes that people can afford, in the places they want to live, to major infrastructure projects such as Crossrail and the third runway at Heathrow. This infrastructure pipeline represents more than £600 billion of spend over the next decade, including at least £44 billion for housing. The pace of this change, and the size of this opportunity, demands a construction sector that is the best in the world.

At the same time, the UK is at the forefront of one of the greatest industrial opportunities of our time: the move to cleaner economic growth.

Through the Clean Growth Grand Challenge, the government has set out its determination to maximise the advantages for UK industry from this global shift, including the mission to halve the energy use of new buildings by 2030.

Today, we are setting out our vision for a construction sector that more than meets these challenges: a sector that can build new homes in weeks – and even days – rather than months; that can deliver new buildings at a third of the cost; that can provide affordable, energy efficient homes.

A transformed sector does not only mean an industry that is more productive, more highly skilled and ready to grasp the opportunities of the global infrastructure market. It means benefits across every sector and every community:

- better homes that are cheaper to run

- smarter and safer buildings

- lower emissions and cleaner air

The Construction Leadership Council has drawn together the wider sector – the construction professions, contractors and product suppliers – to set out a vision for the future and a plan to address its challenges.

A continued commitment to partnership across the construction sector, local and national government, universities and research institutes, and with businesses and organisations throughout society, will be pivotal to our success.

This Sector Deal will drive economic growth, create well-paid, highly-skilled jobs in every part of the UK and improve lives across the country. It represents a shared commitment to achieve these goals by establishing a strategic partnership between the government and the sector that we will seek to strengthen in the years ahead.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Andrew Wolstenholme OBE

Co-Chair, Construction Leadership Council

Industrial Strategy at a glance

We will create an economy that boosts productivity and earning power throughout the UK.

5 foundations of productivity

The Industrial Strategy is built on 5 foundations:

- Ideas - the world’s most innovative economy

- People - good jobs and greater earning power for all

- Infrastructure - a major upgrade to the UK’s infrastructure

- Business environment - the best place to start and grow a business

- Places - prosperous communities across the UK

Grand Challenges

We will set Grand Challenges to put the United Kingdom at the forefront of the industries of the future:

- AI and Data Economy - We will put the UK at the forefront of the artificial intelligence and data revolution

- Future of Mobility - We will become a world leader in the way people, goods and services move

- Clean Growth - We will maximise the advantages for UK industry from the global shift to clean growth

- Ageing Society - We will harness the power of innovation to help meet the needs of an ageing society

Key policies

Key policies include:

Ideas

- Raise total research and development (R&D) investment to 2.4% of GDP by 2027

- Increase the rate of R&D tax credit to 12%

- Invest £725 million in new Industrial Strategy Challenge Fund programmes to capture the value of innovation

People

- Establish a technical education system that rivals the best in the world to stand alongside our world-class higher education system

- Invest an additional £406 million in maths, digital and technical education, helping to address the shortage of science, technology, engineering and maths (STEM) skills

- Create a new National Retraining Scheme that supports people to re-skill, beginning with a £64 million investment for digital and construction training

Infrastructure

- Increase the National Productivity Investment Fund to £31 billion, supporting investments in transport, housing and digital infrastructure

- Support electric vehicles through £400 million charging infrastructure investment and an extra £100 million to extend the plug-in car grant

- Boost our digital infrastructure with over £1 billion of public investment, including £176 million for 5G and £200 million for local areas to encourage roll out of full-fibre networks

Business environment

- Launch and roll out Sector Deals – partnerships between government and industry aiming to increase sector productivity. The first Sector Deals are in life sciences, construction, artificial intelligence and the automotive sector

- Drive over £20 billion of investment in innovative and high potential businesses, including through establishing a new £2.5 billion investment programme, incubated in the British Business Bank

- Launch a review of the actions that could be most effective in improving the productivity and growth of small and medium-sized businesses, including how to address what has been called the ‘long tail’ of lower productivity firms

Places

- Agree Local Industrial Strategies that build on local strengths and deliver on economic opportunities

- Create a new Transforming Cities fund that will provide £1.7 billion for intra-city transport. This will fund projects that drive productivity by improving connections within city regions

- Provide £42 million to pilot a Teacher Development Premium. This will test the impact of a £1,000 budget for high-quality professional development for teachers working in areas that have fallen behind

An independent Industrial Strategy Council will assess our progress and make recommendations to government.

""

Executive summary

The Construction Sector Deal sets out an ambitious partnership between the industry and the government that aims to transform the sector’s productivity through innovative technologies and a more highly skilled workforce.

The life of every person in Britain is affected by the construction sector. It is one of our truly nationwide industries – encompassing individual homes in remote areas and some of the greatest infrastructure projects of our generation, in every corner of the United Kingdom. It is one of our major employers, with around 3.1 million people[footnote 1] working in the sector, most of whom are outside London and the South East.

The construction sector has an important role to play in achieving the vision set out in our Industrial Strategy: strengthening the foundations of our economy and achieving the Grand Challenges[footnote 2] of:

- putting the UK at the forefront of the AI and data revolution

- maximising the advantages from the global shift to clean growth

- becoming a world leader in the future of mobility; and

- meeting the needs of an ageing society

The construction sector, encompassing contracting, product manufacturing and professional services, had a turnover of around £370 billion in 2016, adding £138 billion in value to the UK economy[footnote 3] – 9% of the total – and exported over £8 billion of products and services[footnote 4].

However, the potential of the sector has been held back by productivity that is historically below than the wider economy – an average of 21% lower since 1997[footnote 5].

The Farmer Review[footnote 6], published in 2016, highlighted a combination of factors behind this problem, including the cyclical nature of the sector, the unpredictability of future work and a lack of collaboration across the sector. It concluded that transforming the industry would require shared leadership by the industry, its clients and the government.

This Sector Deal meets that goal, bringing together a coalition of businesses from across the sector, its clients, the government and research institutions to set out a strategy to improve the industry’s performance and help it fulfil its potential to deliver wide-reaching social benefits.

We are setting out an ambition for the construction sector to deliver:

- better-performing buildings that are built more quickly and at lower cost;

- lower energy use and cheaper bills from homes and workplaces;

- better jobs, including an increase to 25,000 apprenticeships a year by 2020;

- better value for taxpayers and investors from the £600 billion infrastructure and construction pipeline

- a globally-competitive sector that exports more, targeting the $2.5 trillion global infrastructure market

The Sector Deal builds on Construction 2025[footnote 7], published by the government and the Construction Leadership Council (CLC) in 2013, and provides the framework for a sector that delivers:

- a 33% reduction in the cost of construction and the whole life cost[footnote 8] of assets

- a 50% reduction in the time taken from inception to completion of new build

- a 50% reduction in greenhouse gas emissions in the built environment –supporting the Industrial Strategy’s Clean Growth Grand Challenge

- a 50% reduction in thetrade gap between total exports and total imports of construction products and materials

These goals will be met by focusing on 3 strategic areas:

- Digital techniques deployed at all phases of design will deliver better, more certain results during the construction and operation of buildings. Clients, design teams, construction teams and the supply chain working more closely together will improve safety, quality and productivity during construction, optimise performance during the life of the building and better our ability to upgrade and ultimately dismantle and recycle buildings.

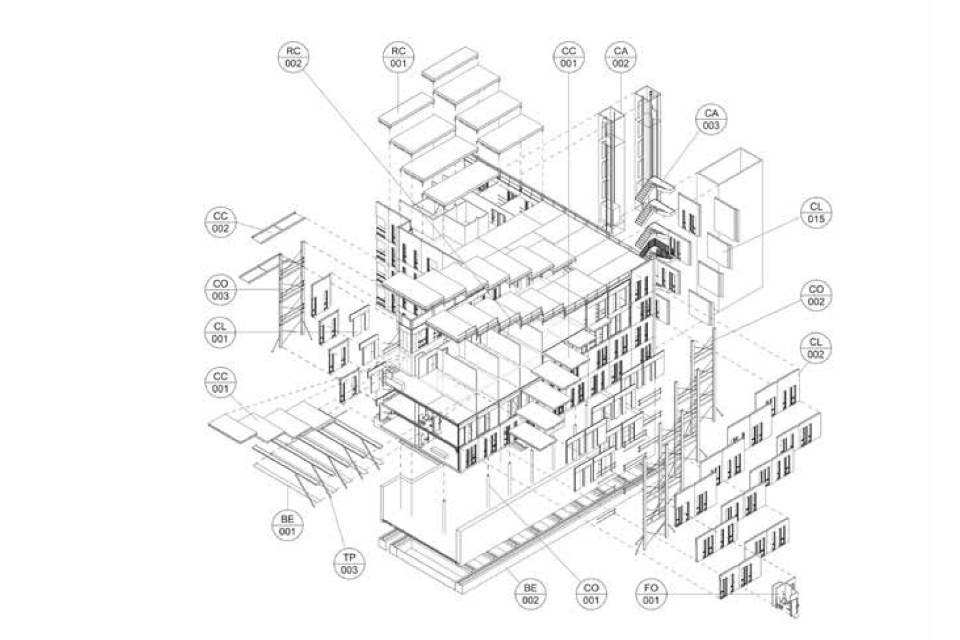

- Offsite manufacturing technologies will help to minimise the wastage, inefficiencies and delays that affect onsite construction, and enable production to happen in parallel with site preparation – speeding up construction and reducing disruption.

- Whole life asset performance will shift focus from the costs of construction to the costs of a building across its life cycle, particularly its use of energy. The government will ensure that our modern Industrial Strategy and our significant investments in housing and infrastructure support this change and innovation.

As part of the Clean Growth Grand Challenge, the Prime Minister[footnote 9] has announced a mission to at least halve the energy use of new buildings by 2030 through developing innovative energy and low carbon technologies driving lower cost, and high-quality construction techniques. This will also reduce the cost of retrofitting existing buildings to make them more efficient and more sustainable.

And this commitment to innovation and improvement will help the industry respond to the recommendations of the Independent Review of Building Regulations and Fire Safety[footnote 10], published in May 2018, which challenged the sector to apply the lessons learned from its successful work in order to improve the sector’s health and safety culture to deliver high-quality, safe buildings.

Industrial Strategy foundations

A key ambition for the Industrial Strategy is to establish long-term partnerships between industry and the government that aim to transform productivity and boost earning power in sectors across the UK.

This Sector Deal reinforces the 5 foundations of the Industrial Strategy:

- ideas

- people

- infrastructure

- business environment

- places

Ideas

The government committed in the Industrial Strategy white paper to increase investment in research and development (R&D) to 2.4 per cent of GDP by 2027[footnote 11]. The Construction Sector Deal sets out how the construction industry will contribute to this, with a £420 million joint investment from the sector and the government in new technology and techniques. This will build on existing initiatives such as the Centre for Digital Built Britain; the technology roadmap developed by the Infrastructure Industry Innovation Platform (i3P) consortium; and work with construction clients to drive demand for innovative construction materials, technologies and techniques.

People

The government set out its vision to create good jobs and greater earning power for all in the Industrial Strategy. The construction sector employs nearly one in 10 working people in the UK, giving it unparalleled potential to improve skill levels right across the country. This deal sets out how the industry will attract, train and retain a more skilled workforce, and how it will meet the demographic challenge of a workforce where nearly a third of workers are aged over 50[footnote 12].

This includes working with the Construction Industry Training Board (CITB) to ensure a strategic focus on future skills needs, and toincrease significantly the number of approved apprenticeship standards. The sector will also aspire to increase the number of apprenticeship starts to 25,000 a year by 2020, and work with professional institutions and the higher and further education sectors to ensure that all those training for or working within the industry are able to develop and increase their skills.

Infrastructure

The government is delivering a major upgrade to the UK’s infrastructure. To provide greater certainty of demand for the sector, the Infrastructure and Projects Authority publishes the National Infrastructure and Construction Pipeline, with current projections of around £600 billion of public and private investment in infrastructure over the next 10 years[footnote 13] – including a doubling of economic infrastructure in the decade to 2022 to 2023[footnote 14]. This is backed by a commitment to modernise the way major projects are delivered[footnote 15], which will ensure this Sector Deal will help to deliver both high-performing infrastructure and growth in the construction sector.

Housing is the cornerstone of our infrastructure, which is why the government is supporting communities with ambitious, innovative plans to deliver 1.5 million more homes by 2022[footnote 16], backed by least £44 billion of financial support – providing the homes that people so urgently need and giving certainty to the construction sector about future demand.

Business environment

To ensure the construction sector is home to more sustainable, profitable businesses, the standard business model needs to change to one that is based on strong, integrated supply chains and higher levels of collaboration. This will be based on four principles:

- a standard approach to how built assets are procured, based on whole life asset value and digital designs, with benchmarks that will allow performance to be measured clearly;

- a new, fairer approach to contract and payment practices to ensure SMEs are not unfairly disadvantaged, reducing risk to SMEs and supporting collaborative supply chains;

- a boost in the sector’s exporting capability, driven by our new investments in digital and manufacturing technologies to get the most of a market that is estimated to be worth £49 trillion between now and 2030[footnote 17]; and

- better access to the capital the industry needs to invest and grow, including taking account of existing funding streams and the conclusions of the Patient Capital Review[footnote 18], which aims to increase availability of longterm finance for innovative firms.

Places

The construction sector operates across the country and employs significant numbers of highly skilled workers in all nations and regions of the UK, in jobs as diverse as minerals extraction, construction contracting, products manufacturing and professional services. Around 80% of construction products used by the sector are produced or manufactured in the UK[footnote 19].

The Sector Deal will embed these supply chains in the UK, ensuring they can support a construction sector that is increasingly based on digital and manufacturing technologies. And with a technology-driven business model, fewer jobs will need to be concentrated on construction sites and can instead by created across the UK, meaning that investments in infrastructure or housing will create greater economic benefits across the UK, as well as the places in which they are located.

Key commitments

Ideas

To be the world’s most innovative economy.

To increase the capacity of the sector to innovate – accelerating the development and commercialisation of digital and manufacturing technologies to create infrastructure that is higher performing and built more safely.

Sector action to support construction

Invest £250 million directly aligned with the Industrial Strategy Challenge Fund Transforming Construction: Manufacturing Better Buildings programme:

- The Infrastructure Industry Innovation Platform (i3P) will align strategic R&D investment by the consortium with the Industrial Strategy Challenge Fund Transforming Construction programme, to accelerate change in the infrastructure and construction sector. Currently Infrastructure Industry Innovation Platform (i3P) members invest more than £150 million per annum in R&D.

Develop digital building designs for use in procurement for all projects:

- Continue the development within the product and manufacturing sector of tools to allow accurate, repeatable, machine-readable product information to be used across the sector. Industry funded and led initiatives such as digital object indicators as well as LEXiCON from the Construction Products Association can significantly increase construction speed and confidence in product performance and overall building safety[footnote 20], supporting productivity improvements.

Support the commercialisation of new construction technologies and techniques:

- Support the adoption of new construction technologies and techniques developed through the Transforming Construction programme.

- Consider with the government how to increase the capability of the Infrastructure Industry Innovation Platform (i3P) consortium so that it can fully support innovation and best practice in the construction sector.

- Develop a common metrics methodology for the capture and analysis of data on the use of smart construction in the housing sector – starting with data dashboards and a series of case studies in spring 2018.

Government action to support construction

Invest £170 million from the Industrial Strategy Challenge Fund (ISCF) in the Transforming Construction: Manufacturing Better Buildings programme, providing funding for:

- Digital technologies, including Building Information Modelling (BIM), sensors, data analytics and smart systems technologies and the Information Management Landscape (IML); which will increase the efficiency of construction techniques.

- Manufacturing technologies and production systems, which will develop new digital building designs for built assets and new manufacturing technologies that will enable the delivery of these.

- Energy generation and storage technologies for buildings, reducing running costs for building users.

- Research and development (R&D) and demonstration programmes, which will support innovations using digital and manufacturing technologies across the infrastructure, social infrastructure, commercial construction and homebuilding sectors.

Develop digital building designs for use in procurement for infrastructure projects:

- The Education & Skills Funding Agency (ESFA) to work to develop a product platform for new school buildings, and to use this platform to procure suitable projects.

- The government will work with housing clients, developers and their supply chains, to ensure that the Industrial Strategy Challenge Fund supports the development and commercialisation of technologies and digital building designs that can help deliver the government’s 2015 commitment to deliver 1.5 million homes by 2022.

- Consider with the sector how to increase the capability of the Infrastructure Industry Innovation Platform (i3P) consortium so that it can fully support innovation in the construction sector.

People

To generate good jobs and greater earning power for all.

To make sure that high quality construction training is available and is taken up, so that the sector can attract, retain and develop workers with the skills it needs now and in the future.

Sector action to support construction

Reform the Construction Industry Training Board (CITB) so that it is more strategic and focussed on future skills needs:

- Support the implementation of the CITB reform plan, by strengthening links with the CITB, providing greater strategic direction, leadership and accountability to enable it to identify current and future skills needs, training and progression routes, set standards, fund construction training and promote the industry.

Attract, retain and develop the people and skills that the industry needs:

- Set the industry aspiration to increase the number of construction sector apprenticeships to 25,000 a year by 2020.

- Co-ordinate the development of new apprenticeship standards across the sector, and to work with the IfA to ensure these are developed to the required standard, approved and implemented as quickly as possible, with 50 new apprenticeship standards agreed by December 2018.

- Work with the CITB, IfA and key trade associations to ensure the sector has access to accurate information about new apprenticeship standards and the Apprenticeship Levy, and models for supporting apprentices in small employers, enabling it to use levy funding to support the development of construction skills across the supply chain.

- Develop a single industry platform and portal to support construction careers based on GoConstruct and building on the ‘Inspiring Construction’ joint campaign between Build UK and the CITB that promotes careers in construction to the next generation.

- Work to increase diversity of the sector, with regard to gender, ethnicity and disability, and to actively promote construction careers across society.

Sector action to support construction

- Work with the government and providers to develop structured career pathways into and within the sector, including high quality industry placements for students in schools, further and higher education. This includes testing and trialling industry placements in the academic years leading up to 2020, and ensuring placements are available for approximately 1,000 students taking Construction T levels from September 2020, with the aim of increasing placements to meet demand in future years, and working with the CITB to develop solutions to the challenges to implementing industry placements in the construction sector.

- Develop common training standards and programmes in key areas such as Health & Safety and management, to continue to improve standards in the UK construction sector.

- Improve competences for those working on the design, construction and operation of higher risk residential buildings, taking forward key recommendations from the final report of the Independent Review of Building Regulations and Fire Safety. The Industry Response Group Steering Group on Competences for Building a Safer Future will set out a plan for an overarching body to provide oversight of competence requirements and support the delivery of competent people.

- Develop programmes to retrain the workforce with the skills to support the future industry needs to embed and maximise the use of digital technologies and modern methods of construction.

- Develop programmes to engage and retain the current workforce.

Government action to support construction

Reform the Construction Industry Training Board (CITB) so that it is more strategic and focussed on future skills needs:

- Implement fully the commitments made in the CITB Review[footnote 21], including working with the industry to deliver planned reforms.

Attract, retain and develop the people and skills that the industry needs:

- Invest £34 million to scale up innovative training models across the country – to support the delivery of 1.5 million new homes by 2022[footnote 22].

- Work with the Confederation of British Industry (CBI) and Trades Union Congress (TUC) to establish a National Retraining Partnership, which will target skills shortages in the construction sector as a priority.

- Work with the sector and the Institute for Apprenticeships (IfA) to develop new apprenticeship standards, to enable the industry to make effective use of its Apprenticeship Levy contributions.

- Work with industry to build capacity and prepare for the implementation of new Construction T levels by supporting the construction sector to test and trial industry placements within existing vocational qualifications before 2020 and to offer high quality construction industry placements within the first T levels from September 2020.

Make effective use of public procurement to encourage skills development in construction supply chains:

- Continue to use public sector procurement to drive investment in the skills needed to support modernisation and industry-led innovation.

Infrastructure

A major upgrade to the UK’s Infrastructure.

To ensure the construction sector can support the government’s ambition to deliver a major upgrade to the UK’s infrastructure.

Sector action to support construction

- Take forward the private sector investment set out in the National Infrastructure and Construction Pipeline, contributing to the delivery of more than £460 billion of planned infrastructure investment. This will include contributing to over £50 billion of investment in the energy sector, £47 billion of investment in utilities, and over £10 billion of investment in digital infrastructure to 2020 to 2021[footnote 23].

- Use the Infrastructure Client Group (ICG) to share and embed best practice across the sector.

- Collaborate with Kings College London to create model forms of procurement to enable sustainable business models to be developed, to encourage increased adoption and standardisation of innovations across the housing sector.

Government action to support construction

- Take forward the public sector investment set out in the National Infrastructure and Construction Pipeline, contributing to the delivery of more than £460 billion of planned infrastructure investment. This will include contributing to over £70 billion in transport infrastructure, and over £43 billion in social infrastructure such as schools, housing and healthcare to 2020 to 2021[footnote 24].

- Establish a new team within the Infrastructure and Projects Authority (IPA) to define cost and performance benchmarks.

- Use digital technology and innovation to improve the way we deliver and extract maximum whole life value from infrastructure by supporting effective delivery of the Digital Build Britain programme.

- Use the presumption in favour of offsite construction by 2019 across suitable capital programmes, where it represents best value for money.

- Promote long-term, collaborative relationships with industry to reduce transaction costs in procurement and maximise innovation.

Places

To have prosperous communities throughout the United Kingdom.

To use the adoption of digital technologies and the move to offsite manufacturing to strengthen local supply chains across the UK.

Sector action to support construction

- Work with the government to strengthen the supply chain for mineral and construction products across the whole of the UK.

Government action to support construction

- Work with the wider construction sector, to strengthen the supply chain for mineral and construction products across the whole of the UK.

- Ensure high quality training is available in all nations and regions of the UK.

Business environment

To be the best place to start and grow a business.

To improve the lifetime performance of buildings, through better procurement and a more sustainable business model in construction – and to establish the UK as a global leader by increasing exports of UK construction products and services.

Sector action to support construction

Improve the lifetime performance of buildings, through better procurement:

- Develop an industry wide definition of value which takes into account more than capital cost.

- Produce a universally applicable methodology for procurement and promote common and consistent standards across industry.

A sustainable business model – and fairer payment practices:

- The Construction Leadership Council, supported by BEIS, will bring together the industry to seek to develop an agreed set of proposals to improve contractual and payment practices and performance within the sector. These will take account of the lessons learned from the insolvency of Carillion, and also the outcomes of the 2 construction specific consultations on retention payments and the 2011 amendments made to the Housing Grants, Construction and Regeneration Act 1996.

- Remove bureaucracy from the procurement process by developing a standardised cross-industry pre-qualification process and Pre-Qualification Questionnaire (PQQ) that can be adopted across the public and private sectors.

- Publish Project 13 Blueprint for a more sustainable construction sector in the UK.

Performance benchmarking of assets:

- Work with clients and government to develop and implement consistent design and performance benchmarks for the design, construction and operation of built assets.

Establish the UK as a global leader in the global infrastructure market:

- Work with the government to select and target key markets and projects.

- Work with the government to scope markets to determine prioritisation and to position UK expertise.

- Form consortia capable of delivering complete infrastructure project solutions.

- Create an innovative capability demonstrator to highlight UK expertise in infrastructure development.

- Identify gaps in the UK supply chain to enable the development of a comprehensive UK offer and attract inward investment.

- Support the export of new construction products and services developed through the Transforming Construction programme funded through the Industrial Strategy Challenge Fund.

- Develop an international and export strategy linked to the strategic objectives of the Sector Deal during 2018.

Government action to support construction

Improve the lifetime performance of buildings through better procurement:

- Embed ‘procure for value’ approach in public procurement and build capability to do this through the Infrastructure Projects Authority (IPA) and government departments across Whitehall.

A sustainable business model – and fairer payment practices:

- Publish a response to the consultations on the practice of retention payments in the construction sector and the 2011 amendments to the Housing Grants, Construction and Regeneration Act 1996. Work with the industry and financial services sector to identify ways of ensuring the industry has access to the capital investment required to adopt new construction technologies and techniques.

- Promote the use of un-amended forms of contract on publicly funded projects where this is possible.

Performance benchmarking of assets:

- Work with the sector to develop consistent design and performance benchmarks for the design, construction and operation of built assets.

- Adopt performance benchmarking in line with strategy outlined in Transforming Infrastructure Performance (TIP)[footnote 25] and Transport Infrastructure Efficiency Strategy (TIES)[footnote 26]

Establish the UK as a global leader in the global infrastructure market:

- Use the UK network of overseas posts to gather information, identify and help validate market and project opportunities.

- Provide government-to-government support for UK project consortia supported by IE:UK.

- Utilise government resources overseas and in the UK to support work plans developed by consortia.

- Work with UK Export Finance to ensure the availability of finance for UK consortia.

- Support the ongoing international work of the Centre for Digital Built Britain to promote the adoption of UK Building Information Modelling (BIM) standards overseas, and develop collaborations with international partners.

Ideas

To increase the capacity of the sector to innovate – accelerating the development and commercialisation of digital and manufacturing technologies to create infrastructure that is higher performing and built more safely.

""

Improving the productivity of the construction sector, and the performance of the infrastructure and buildings it produces, is a global challenge. The Reinventing Construction report of February 2017 highlighted that construction is one of the least digitised industries in the world, with lower levels of digitisation than, for example, the retail or basic goods manufacturing sectors[footnote 27].

The poor productivity performance of the construction sector is in part explained by its relatively low level of investment in research and development (R&D). Business expenditure on R&D in the construction sector was £211 million in 2016, 0.9% of total UK business R&D. In contrast, the automotive sector invested over £3.3 billion and the aerospace sector over £1.9 billion[footnote 28].

An analysis of the factors contributing to productivity growth[footnote 29] suggests that investing in new construction technologies and techniques that combine labour and capital could be the most effective means of addressing this issue. Modern methods of construction and digitisation help combine labour and capital more efficiently, but have not been widely adopted by the sector. This is partly as a result of inconsistent demand from clients, but also because construction supply chains, from designers, through to constructors and to specialist manufacturers have not collaboratively invested in the processes and products needed to maximise the potential of innovation.

In Reinventing Construction[footnote 30], the McKinsey Global Institute estimated that productivity gains of 50% to 60% could be achieved through the adoption of digital and manufacturing technologies, the transition to new business models based on collaboration and more efficient and better integrated supply chain management practices.

Innovation

The Transforming Construction programme will drive innovation and collaboration in the sector through investing in research and technology centres that can support this, and funding R&D and demonstration projects that will enable the development and testing of digitally designed and manufactured buildings and infrastructure. This is already an area of strength for the UK, with organisations like SPECIFIC[footnote 31] in Swansea using the latest in digital and offsite technology to build an office capable of generating more energy than it uses.

The application of innovative technologies and digital data will help drive transformation in the business models and productivity of the sector, and will also link the Transforming Construction programme with other Industrial Strategy Challenge Fund supported programmes, including the Buildings Mission and Clean Growth Grand Challenge, the Artificial Intelligence and Data Driven Economy Grand Challenges[footnote 32], as well other programmes funded by UK Research and Innovation on data science, manufacturing technologies, the built environment and energy and the Information Management Landscape (IML)[footnote 33].

The government and firms in the digital, construction, manufacturing, energy and infrastructure sectors will invest a combined £420 million – which includes £170 million allocated to Transforming Construction as part of the Industrial Strategy Challenge Fund. This will develop digital, manufacturing and renewable energy technologies for the construction sector, improving construction productivity and enabling built assets to be produced more quickly, sustainably and at reduced cost. By involving major construction clients in the public and private sector and creating a sustained pipeline of demand, the commercialisation of these technologies will be accelerated.

The programme will deliver:

- an information management initiative to create and introduce the use of information (as data) at the right quality and at the right time to improve the way people and organisations workand deliver their services.

- investment in technology development centres, R&D projects and demonstrators to build industry capability to innovate and accelerate the commercialisation of new technologies;

- an increase in R&D funding aligned with strategic industry priorities such as those identified in the Infrastructure Industry Innovation Platform (i3P) Technology Roadmap;

- new digital building designs for digitally designed and industrially manufactured kits of component parts for homes, schools and other built assets, which can be procured by construction clients; and

- measurable improvements in productivity, and the level of pre-manufactured value in buildings and infrastructure.

Sustainability

Buildings account for around 40% of UK energy consumption and 19% of UK greenhouse gas emissions[footnote 34]. The adoption of new information management measures, digital and manufacturing technologies will enable the precision design and modelling of buildings, improve project management of construction projects and facilitate the incorporation of new technologies, such as sensors, smart systems and materials into built assets. Using innovative and more efficient technologies in infrastructure will help deliver the Buildings Mission objective of at least halving the energy use of new buildings by 2030. The Mission will make more sustainable and lower carbon buildings cheaper to build, and give those who occupy buildings greater control over the energy they use. It will help to improve the environment through significantly reducing the costs of retrofitting these technologies within existing buildings, reducing their energy consumption and increasing their sustainability. More efficient processes will also help to minimise waste, reducing the current volume of approximately 120 million tonnes a year produced by construction, demolition and excavation, which accounts for nearly 60% of all UK waste[footnote 35]. Using innovative and more efficient technologies in infrastructure will complement the Clean Growth Grand Challenge identified in the Industrial Strategy.

New approaches to information management and related technologies will also drive the improved environmental performance of built assets. The transition to smart, low carbon and distributed energy generation systems will create opportunities for new renewable energy generation and energy storage technologies in buildings. It is estimated that the benefits of a smart energy system would be £17 billion to £40 billion by 2050, through avoided or deferred network reinforcements, improving the utilisation of existing and future generating capacity and more efficient system operation[footnote 36].

Improving quality of life

Improving the quality and performance of buildings can also support the wider economy and delivery of public services. An estimated £47 billion per annum is spent on the repair and maintenance of buildings[footnote 37], and the facilities management sector has recently been valued at £120 billion[footnote 38]. Reducing the costs of occupying buildings enables firms and public services to invest more in improving their own products and services.

These information-enabled services and technologies will also improve our living environment by delivering better homes and workplaces. It is estimated that we spend up to 90% of our time indoors[footnote 39]. Poor quality buildings have an impact on the physical and mental well-being of those who live and work in them, and it has been estimated that ‘sick building syndrome’ creates significant costs to employers through increased sickness absences and lower productivity. Better buildings have a positive impact on user performance and well-being, and help boost the output of firms and public services. A study by the University of Salford showed that school classroom design quality has a direct impact on the performance of students.

The adoption of new technologies that enable us to create better homes, workplaces and public buildings will drive economic growth and promote better physical and mental health, and through improving energy and heat efficiency, will help reduce carbon emissions and tackle fuel poverty.

Building safety

Digital techniques and offsite manufacture offers the potential to significantly improve the safety of buildings, and to support the implementation of the recommendations of the final report of the Independent Review of Building Regulations and Fire Safety[footnote 40]. These information-enabled technologies will enable better designed buildings which meet both Building Regulations and best practice in relation to safety, and to adapt and upgrade these in future as better designs and systems are developed. This will facilitate the incorporation of better and safer materials and building safety systems into the built environment, and provide building owners and those who live in them with greater assurance about the safety of the buildings on which they rely.

People

To ensure that high quality construction training is available and is taken up, so that the sector can attract, retain and develop workers with the skills it needs now and in the future.

""

The construction sector is one of the largest in the UK economy – employing 3.1 million people or over 9% of the workforce. It relies on a labour intensive business model, which is becoming unsustainable due to the impact of demographic change. Of the current UK construction workforce, 32% are aged over 50, with a further 58% aged between 25 and 49. Only 10% are under 25. The sector faces the twin challenge of equipping workers with the skills needed to adopt digital and manufacturing technologies effectively, while recruiting and retaining enough people with traditional skills to replace those leaving.

Increasing workforce skills

The construction industry needs to recruit and retain people with a wide range of skills, so it needs high-quality, relevant apprenticeships and training to be available. The adoption of digital and manufacturing technologies in the coming years will change the balance of skills the industry requires and introduce new skills and roles. The industry will have to show strategic leadership to develop the standards and training that the workforce of the future will need, without neglecting the traditional skills for which there will be an ongoing need. Given the skills challenges the industry now faces, employers across the industry will need to provide more apprenticeships and more work placements and continue to develop the skills of the existing workforce.

The industry will work with and support both government and the Construction Industry Training Board (CITB) to implement fully the recommendations of the CITB Review[footnote 41] to ensure these strategic objectives can be achieved. The reforms will create a CITB that is more strategic and industry-led, more responsive to the needs of employers of all sizes and has grant funding mechanisms that are better able to support skills development particularly amongst small and medium-sized enterprises (SMEs).

The reforms will create a CITB that is more strategic and industry-led, with improved communication with firms in the sector, and grant funding mechanisms that are better able to support skills development amongst small and medium-sized enterprises (SMEs).

Secondly, the sector will create Trailblazer groups to co-ordinate work on the development of new-standards for apprenticeships; prioritising these and working with the Institute for Apprenticeships (IfA) to secure approval for 50 new apprenticeship standards by December 2018. This will enable the industry to increase the number of apprentices recruited and in training in the UK, with the aspiration of increasing these from around 22,000 to 25,000 apprenticeships a year by 2020. The sector will also work with the government to take forward the skills and competence related recommendations of the final report of the Independent Review of Building Regulations and Fire Safety.

Recruitment

The CITB estimates that the sector will need to recruit and train train 158,000 workers between 2018 and 2022[footnote 42] – 31,600 annually – simply to keep up with the current levels of demand. However, demand is projected to increase, and the construction sector needs to be able to recruit sufficient workers and to ensure it can train them in the specialist and broader skills that the sector will need in the future. Achieving this will require a coordinated approach to promoting construction careers, recruiting a more diverse workforce and reducing the numbers who complete construction training but do not take up employment in the sector.

The industry does not have a coordinated approach to promoting construction careers as initiatives developed by businesses, trade associations and professional institutions have largely been run in isolation. As a result, potentially skilled and talented employees are lost to other sectors. The industry is committed to changing this through a unified approach. It will create a single industry platform and portal based on the CITB’s Go Construct site and will build on Inspiring Construction, the industry campaign to promote construction careers, to enable those seeking construction careers to better understand the opportunities the sector can offer and the routes into different careers.

The sector also faces significant difficulties in managing the transition from training to employment. At present, between 30% and 40% of those who complete construction courses have not entered the industry within 6 months of course completion. One reason is the lack of access to high quality work experience. Apprenticeships, where trainees are employed whilst they train, help to overcome this problem and are one of the best routes into the sector. However, similar high quality work experience is needed for those in higher and further education, and from 2020 those undertaking the T Level in construction, one of the first to be introduced, will undertake an industry placement of a minimum of 45 working days[footnote 43]. The sector will work with government to develop a structured work experience programme, building on existing initiatives such as Experience Construction, and supporting employers to commit to industry placements for T levels and other work experience initiatives to attract under-represented groups, through establishing clear processes, guidance and incentives for students across further and higher education.

The government will support the ambitious commitment to implement T levels, through ensuring construction employers have access to appropriate support to be able to implement industry placements. The government will provide a designated account manager from the National Apprenticeship Service (NAS), who will work with construction employers to implement industry placements across the industry. This account manager will provide support and guidance to businesses delivering industry placements, be the main point of contact for queries, and provide targeted communications to businesses within the construction industry. This will help build capacity within the sector to support the implementation of industry placements, and help ensure those training for careers in the industry are ready for work.

Diversity

If it is to meet its future recruitment needs, the sector will need a more diverse workforce. Despite its size, the construction workforce is one of the least diverse: 86% of construction workers are male[footnote 44], and 94% are white[footnote 45]. The adoption of new digital and manufacturing technologies will create new roles that will position the sector to attract a more diverse workforce. The sector will work to increase diversity of the sector, with regard to gender, ethnicity and disability, and to actively promote construction careers across society.

A safer sector

Higher standards of health and safety will make the industry more attractive, help retain staff, and create a productive and sustainable sector. The UK construction sector has improved its performance significantly in relation to health and safety in the past decade, but there is scope to go further.

The final report of the Independent Review of Building Regulations and Fire Safety also calls on the sector to take greater ownership of work to invest in the competence of key professionals who are involved in delivering safe buildings and to create a culture geared towards continuous improvement, better performing products and greater innovation.

Key areas for improvement are standardising work-related health and safety training for employees, supporting longer term physical and mental health, and improving working environments. The Health and Safety Executive’s Construction Industry Advisory Committee (CONIAC), which includes industry and trade union representatives, will work with the CITB, firms in the sector and the Construction Leadership Council (CLC) to improve and embed high standards of health and safety practice across the industry, supporting the objectives of the Sector Deal.

Infrastructure

To ensure the construction sector can support the government’s ambition to deliver a major upgrade to the UK’s infrastructure.

""

Our investments in infrastructure, and our decisions on procurement, are among the government’s most significant interventions in the economy. Our investment decisions need to be more geographically balanced and include more local input. The Industrial Strategy highlights the need to ensure our approach to infrastructure not only provides the basics for the economy, but also actively supports our long-term national interests. Cost-benefit analysis will remain central to decision making, complemented by our approach to strategic programme design, referenced previously, which will make use of broad-based and dynamic assessment techniques that reflect the full potential for infrastructure to support local economies.

National Infrastructure Investment

Modern and efficient infrastructure drives economic growth. The country has delivered over 4,500 public and private infrastructure projects since 2010, and it is committed to sustained investment to improve the UK’s national infrastructure[footnote 46]. The government has established the National Infrastructure Commission (NIC), with a fiscal remit of 1% to 1.2% of GDP, and published the National Infrastructure Delivery Plan 2016 to 2021[footnote 47]. It is also committed to a long term programme of infrastructure investment, as set out in the National Infrastructure and Construction Pipeline[footnote 48].

The pipeline sets out over £460 billion of planned public and private sector investment in nearly 700 projects, programmes and other investments across the transport, social infrastructure, energy, utilities and digital technology sectors. More than £240 billion will be invested by 2021. This will include a 50% increase in transport investment between 2015 and 2020. The pipeline includes a projection for infrastructure investment over the next 10 years of around £600 billion[footnote 49]. The government will also provide more than £15 billion of new financial support for housing over the next 5 years, taking total financial support to at least £44 billion to 2022 to 2023[footnote 50].

The scale and sustained nature of this investment can drive the transformation of the business model of the construction sector, building on previous initiatives such as the 2010 Infrastructure Cost Review, which delivered efficiency savings in infrastructure delivery[footnote 51], and the government Construction Strategy – with its commitment to using Level 2 Building Information Modelling (BIM) to deliver publicly funded projects, which has been mandated since 2011[footnote 52].

These initiatives have supported the wider construction sector to build its capability in Design for Manufacture and Assembly (DfMA), driving the adoption of digital and manufacturing technologies. In the Autumn Budget 2017, the government announced that it would take the next step, with 5 government departments[footnote 53] introducing a presumption in favour of offsite construction from 2019.

Transforming Infrastructure Programme

The government is also committed to working with the sector to change the way in which infrastructure is planned, procured and delivered. The Transforming Infrastructure Performance (TIP) strategy[footnote 54] sets an ambitious plan for achieving significant improvements in the delivery and performance of infrastructure through four areas of focus:

- Benchmarking for better performance – adopting cost, schedule and performance benchmarks to support the selection, budgeting and design of projects. This means developing disciplined definitions of required outcomes and ensuring that they can be delivered in line with whole-life performance, cost and schedule targets.

- Alignment and integration – ensuring that projects and programmes are planned in an integrated way, looking across sectors and tiers of government so that they are designed from the outset to support priority economic, social and environmental objectives.

- Procurement for growth – building smarter commercial relationships between clients and the supply chain to drive long term value for taxpayers and the users of infrastructure, and ensure a sustainable supply chain.

- Smarter infrastructure – increasing the use of information-enabled operations, related technology and innovation to drive more productive delivery and smarter operation of our infrastructure assets.

Progress in these areas will require a strong, collaborative relationship between the sector and the government. The Sector Deal has an important role to play in building capability within the sector to deliver this vision. The priorities set out in the TIP align closely with those of the Sector Deal, and the Construction Leadership Council (CLC) is committed to working closely with the Infrastructure and Projects Authority (IPA) to make them a reality.

Transport Infrastructure Efficiency Strategy

The government has also recently published the Transport Infrastructure Efficiency Strategy (TIES)[footnote 55]. The strategy is the result of collaboration between the Department for Transport, Crossrail, Highways England, High Speed Two Ltd, Network Rail and Transport for London – which collectively represent one of the biggest client groups of the construction sector. This group’s pipeline of planned transport projects presents a significant opportunity to drive transformation in the sector, aligned with the Industrial Strategy’s Future of Mobility Grand Challenge.

The TIES sets out seven challenges which Department for Transport partner bodies will tackle to deliver efficiency improvements across transport and better value for taxpayers. These challenges align with the key priorities set out in the Sector Deal – in particular:

- creating a transport infrastructure performance benchmarking forum to share best practice and innovation;

- promoting long term collaborative relationships with industry to reduce transaction costs in procurement and maximise innovation and;

- exploiting digital technologies and the standardisation of assets to enable the adoption of best practice from the manufacturing sector.

The Construction Leadership Council (CLC) will therefore also work closely with the organisations involved in the TIES to deliver better performing and better value transport infrastructure in the years to come.

Business environment

To improve the lifetime performance of buildings through better procurement and a more sustainable construction business model, and to establish the UK as a global leader by increasing exports of UK products and services.

""

The current business model of the construction sector is not sustainable. Construction customers and businesses across the supply chain are focused on the costs and risks of individual projects, and do not collaborate effectively. This results in built assets that deliver poor value, supply chain inefficiencies and unfair payment practices that have a disproportionate impact on small firms in the sector. Transforming the business model will be difficult. It requires construction clients, their advisers and businesses at all levels in the supply chain to adapt. The Sector Deal will take action in 3 areas to support this.

Firstly, it will improve and standardise approaches to the design and procurement of construction projects to deliver better whole life value and project performance. Secondly, the deal will develop a new, fairer and more sustainable approach to contractual and payment practices. Thirdly, it will benchmark the performance of assets so that clients and the supply chain have access to more data in order to deliver better performing assets.

These actions will start the process of changing the business model of the construction sector to one that is focused on delivering better outcomes, based on stronger and more sustainable supply chain relationships and fair contractual and payment practices. A stronger and more sustainable business model will enable the UK to exploit its strengths in the expanding global construction market, and increase exports of construction products and services.

The construction industry is committed to achieving this modernisation. The Infrastructure Clients Group and Institution of Civil Engineers have launched the Project 13 programme[footnote 56], which seeks to shift the business model of the sector from project based transactional relationships, to one based on creating sustainable enterprises, with greater investment in innovation and skills that are more productive and deliver better value to construction clients and users.

This will lead to a more collaborative approach to the commissioning, design and delivery of construction projects and shared responsibility for management of the risks associated with these. This transition will lead to longer term relationships between investors, construction clients, contractors, firms in the construction and products supply chain and professional advisors with commercial reward based on the value they contribute to the outcomes of construction projects. The blueprint for this approach has been launched recently[footnote 57].

Improving procurement

The adoption of digital and offsite manufacturing techniques must be driven by construction clients who seek to procure for the ‘whole life’ performance of built assets, and to optimise this performance. However, there is no single accepted standard procurement methodology for delivering whole life performance; as advisers use a range of different methodologies. Similarly, construction clients and professional advisers rarely consider whole life performance. A standard methodology, used across the sector, would drive the construction supply chain to focus on the performance of assets across their whole life, and invest in the capability and skills needed to deliver this. If this standard methodology is to be adopted by clients and the construction sector, then it will need to be supported by a single body of knowledge, a shared digital asset that is accessible to all and enables the rapid sharing of expertise and best practice.

Benchmarking performance

The vast majority of the life cycle cost of built assets is incurred in the operational phase (including the energy that the asset consumes), with only a minority attributable to the design and construction phase. Despite this, there is no standard approach to benchmarking the performance of assets during design, construction and operation. A comprehensive, standardised approach would enable the comparison of assets to identify inefficiencies. It would also provide information that would feed into the ongoing development of better building designs, components and materials that will reduce the running costs of built assets across their lifecycle.

Contractual and payment practices

Contractual and payment practices in the construction sector often disadvantage small firms in the supply chain. These practices can unfairly transfer legal risk, or economic risk in relation to cash flow. They act as a barrier to the development of more strategic and collaborative relationships across the supply chain, and inhibit investment in productivity enhancing technologies and skills. Changing this business model is essential to maximising the potential of digital and manufacturing technologies to deliver improved productivity.

The government is committed to improving payment practices within the UK, including within the construction sector. The Duty to Report on Payment Practices and Performance[footnote 58] will increase transparency in relation to payment performance within the construction sector, through imposing a duty to report on large firms. This will include reporting on their standard and maximum payment terms, and the average time taken to pay invoices received, including the percentage of payments made in under 30 days, 30 to 60 days and over 60 days, and the percentage of payments not paid within the agreed payment period. The duty will apply to all companies and Limited Liability Partnerships if they meet 2 or more of the following criteria: an annual turnover of over £36 million, £18 million balance sheet total or more than 250 employees. It will require these firms to publicly report on their performance every 6 months, and will give small firms far more information about larger firms they are considering doing business with. This data will be used by Build UK to benchmark the payment performance of its members, and to drive cultural change within the industry on this issue.

The government will also support the Construction Leadership Council (CLC) to bring together the industry to seek to develop an agreed set of proposals to improve contractual and payment practices and performance within the sector. These will take account of the lessons learned from the insolvency of Carillion, and also the outcomes of the 2 construction specific consultations on retention payments and the 2011 amendments made to the Housing Grants, Construction and Regeneration Act 1996.

Business finance

Traditionally, the construction sector has operated a cash flow business model, with external finance used to supplement this by providing short term bridging finance to overcome cash flow problems. This has primarily been obtained as short-term loans overdraft facilities, or through using mechanisms such as invoice financing, rather than through longer term, investment-focused sources of funding.

To tackle this problem, BEIS, the Federation of Master Builders and UK Finance are currently developing the SME Housebuilders Finance Guide to enable SMEs to understand how they can best secure long term finance for investment. Through facilitating greater collaboration between developers, lenders and construction teams, it aims to make the process more efficient, reducing risk and improving profitability. The British Business Bank (BBB) has also been building on their existing portfolio of programmes with expansions such as a new asset finance variant of the Enterprise Finance Guarantee[footnote 59] programme, and the provision of ENABLE guarantees designed specifically to increase the amount of lending that banks are able to provide to SME Housebuilders, both of which will increase the nature of support available to small and medium sized businesses in the construction sector.

Modernising the sector will require significant additional investment, and the construction sector will need to attract this from a wider range of external investors and use new forms of funding. To do this, the sector will work with the government and the financial services sector to identify what sources of funding are available, and how these can be used. It will take account of the outcomes of the Patient Capital Review; existing programmes managed by the BBB, and in particular, seek opportunities to link investors to the Transforming Construction programme and the technologies that emerge from this.

Exports and International

The UK is a successful exporter of construction products, construction contracting and associated professional services. The construction products sector exported goods worth over £6 billion in 2016[footnote 60]. Construction contracting businesses accounted for £822 million of exports to the European Union and £965 million of exports to the rest of the world in 2016; the Office for National Statistics also estimates that in 2016 the UK had a positive trade balance of £469 million for architectural services alone[footnote 61].

The rapidly-growing international infrastructure market presents an opportunity for growth. Currently worth $2.5 trillion annually its value is estimated at $49 trillion[footnote 62] in the period to 2030[footnote 63].

This growth will create new opportunities in countries around the world, but particularly in fast-growing markets in Latin America, Asia and the Middle East. Much of this growth will be concentrated in urban areas. It will increase demand for new methods of construction that are able to create quickly new built assets with minimal disruption; and better performing smart assets that can be integrated into urban networks.

The UK is already a leader in developing and exporting new construction standards. It developed the Building Research Establishment Environmental Assessment Method (BREEAM), the world-leading sustainability assessment method for projects, infrastructure and buildings. Globally, over 2.25 million buildings have been BREEAM assessed[footnote 64]. A Centre for Economics and Business Research study, The Economic Contribution of Standards to the UK Economy, found that the application of standards made a positive and significant contribution to the UK economy. This is comprised of around 28% of annual growth in GDP, 37% in productivity gains and £6 billion of exports[footnote 65]. The UK is leading the development and application of Building Information Modelling (BIM). UK BIM methods have been adopted in the USA, Australia, Japan and Brazil, and these offer the potential to create opportunities in global markets for UK firms.

Investing in digital and manufacturing technologies will allow suppliers and professional services firms to build on their competitive advantage in BIM and compete successfully in the global market. The Sector Deal will also encourage greater investment in R&D, skills and capacity by UK construction product manufacturers. As the UK prepares to leave the EU, such investment will be crucial to ensuring not only a more competitive industry on the international stage but also in support of the UK market as well. To maximise the potential for success, the Sector Deal will identify priority markets and projects, coordinate the development and marketing of the services the UK can provide, and build consortia that can tender successfully and deliver the complete project solutions customers demand.

Places

To use the adoption of digital and the move to offsite manufacturing to strengthen local supply chains across the UK.

""

The wider construction sector, including construction contracting, construction product manufacturing and associated professional services employs around 3.1 million people, or 9% of the UK workforce[footnote 66]. It is one of the few sectors that operates throughout the UK, with contractors, product manufacturers and professional services firms found in all regions of England, Scotland, Wales and Northern Ireland. More than 70% of those employed in the construction contracting sector work outside London and the South East, with 11% of the workforce in the East of England[footnote 67], 10% in Scotland and 9% based in the North West of England. The UK’s construction product manufacturing sector as well is largely based not in the South East of England but rather across all regions and particularly in the Midlands and North.

The construction supply chain is domestic and often localised, across contracting, products and professional services. One of the consequences of this is that a high proportion of spend is retained within the region where construction work is undertaken. This means that improvements to the performance and profitability of the construction supply chain can be expected to directly benefit the local economies in which these businesses operate.

There is a high concentration of employment in both micro (1 to 9 employees) and small (10 to 49 employees) businesses. Within the contracting sector, over 99% of firms are small or micro businesses[footnote 68]; 64.7% of construction product businesses have between 1 to 9 employees and only 1.2% has 250 or more[footnote 69]. There are around 33,000 architectural services businesses employing 1 to 9 employees, with only 125 firms employing more than 250 staff[footnote 70].

There is significant mineral extraction, product production and recycling in all parts of England, Wales, Scotland and Northern Ireland, in over 2,000 active quarries or mineral product production sites[footnote 71]. These produced 360 million tonnes of aggregates or manufactured mineral products in 2015, with a value of £20 billion[footnote 72]. Over 22,000 firms in the construction products sector produced over £50 billion of construction products[footnote 73]. Around 80% of construction products used in the UK are manufactured in England, Wales, Scotland and Northern Ireland[footnote 74]. As a consequence, investment in construction has the potential to benefit the whole of the UK. It is estimated that for every £1 of output by the construction contracting sector, an additional 86p of demand is created in its supply chain; every £1 spent on wages in the sector generates an additional £1 of wages in its supplier industries[footnote 75].

The sector can deliver increased benefits to the UK through strengthening the construction supply chain. The Construction Sector Deal will support the development of digital technologies that can underpin better integrated supply chains, through improved project management processes and logistics. It will also support the development of new construction products and construction applications for materials that are suitable for use in building components that are manufactured offsite.

The investment in infrastructure as outlined for this Sector Deal simultaneously offers several major benefits in support of local supply chains and communities across the UK; first, as a major pipeline of market opportunities for local firms; second, as a catalyst for much-needed changes in processes and technologies to drive greater productivity and performance in this sector; and third, as an enabler of local economic activity across all regions not only for the construction industry but for society as a whole.

Housing is vital to the economic success of our cities and regions and the earning power of individuals. The government will therefore provide more than £15 billion of new financial support for housing over the next 5 years, taking total financial support to at least £44 billion to 2022 to 2023[footnote 76].

The government wants to support places with ambitious and innovative plans to build additional homes where they are needed. The government will work with housing clients, developers and their supply chains, to ensure that the Industrial Strategy Challenge Fund funding for the Transforming Construction programme supports the development and commercialisation of technologies and digital building designs that can help deliver the government’s housing objectives.

This will help support the sector to develop the products and technologies that will enable it to fulfil the market demand that will be created by the recent commitment by the Department for Transport, the Department for Health and Social Care, the Department for Education, the Ministry of Justice and the Ministry of Defence to move to a presumption of offsite by 2019. This represents a potential pipeline for modern methods of construction which will provide a significant market incentive for investment in the adoption of these techniques. This will also drive investment and the creation of new jobs across England, Wales, Scotland and Northern Ireland. Factories that produce buildings offsite operate throughout the UK with examples in England – in Yorkshire and the Humber, the East Midlands the East of England, the South West of England – and in Scotland.

Further information

Implementation plan

| Date | Milestone |

|---|---|

| November 2017 | A presumption in favour of offsite construction for suitable capital programmes from 2019 for 5 departments announced in the Autumn 2017 Budget. Industrial Strategy Challenge Fund (ISCF) Wave 2 announced with £170 million allocated to Transforming Construction. Industrial Strategy white paper published – including a high level overview of the Construction Sector Deal. |

| December 2017 | National Infrastructure and Construction Pipeline and Transforming Infrastructure Plan published by the Infrastructure and Projects Authority (IPA). |

| May 2018 | Final report of the Independent Review of Building Regulations and Fire Safety published. |

| July 2018 | Construction Sector Deal published. |

| Summer 2018 | Establish a network of centres of excellence and demonstrator projects to support the development of smart construction for housing. |

| December 2018 | 50 new apprenticeship standards developed by the construction sector working with the Institute for Apprenticeships (IfA). Improve availability and affordability of insurance products for homes built via smart construction techniques including offsite and MMC. Construction Leadership Council (CLC) strategy for international and exports published. |

| July 2019 | Construction Leadership Council (CLC) conducts annual review of Sector Deal implementation. |

| December 2019 | Implement in full the recommendations of the Construction Industry Training Board Review (published in November 2017). |

| 2020 | Industry to increase the total number of apprenticeship starts in the sector to 25,000 a year by 2020. Develop and publish a common approach to procuring for whole life asset value, and cost and performance benchmarks for built assets. Develop standardised industry training modules in key areas such as health and safety and management and leadership. |

| 2021 | Develop and demonstrate new building designs based of digital building designs, and associated manufacturing technologies, techniques, and performance and quality standards. Deliver measurable improvements in productivity, and the level of pre-manufactured value in built assets. |

Governance

The Construction Leadership Council (CLC) will lead on the implementation of the Sector Deal, and review progress at its quarterly meetings.

Additionally, a number of sub-groups will be convened that, working closely with industry stakeholders, will oversee the delivery of the key commitments of the deal. Membership of these sub-groups will be extended to trade associations and professional bodies, as well as other partner organisations, to ensure they are representative of the sector as a whole and able to co-ordinate activities across it.

The Construction Leadership Council (CLC) will also work with the government and other key partners involved in delivering the Sector Deal to develop and publish a delivery plan for implementing the Sector Deal. The delivery plan will cover the key objectives, milestones towards achieving these and the timetable for implementation. The delivery plan will be updated regularly, and will inform the development of an annual report on the progress in implementing the Sector Deal.

To ensure that the industry, construction clients and other stakeholders are informed of the progress made in implementing the Sector Deal, and the outcomes that have been achieved, the Construction Leadership Council will publish an annual report on the progress made. This will report on progress in relation to the specific commitments made in the Sector Deal, and also the progress made towards the delivery of the wider Construction 2025 objectives of saving time and cost, reducing carbon emissions and increasing exports. It will also report on the impact that the Sector Deal is having across the UK.

References

-

Office for National Statistics (ONS), ‘Annual Business Survey’, (October 2017) and Labour Market Statistics, (October 2017) (self-employed construction contractors) ↩

-