Update on the work of the CMA’s Taskforce

Published 3 July 2020

1. Background

The Competition and Markets Authority (CMA) works to ensure that consumers get a good deal when buying goods and services, and that businesses operate within the law.

The CMA established its COVID-19 Taskforce to identify, monitor and respond to competition and consumer problems arising from coronavirus (COVID-19) and the measures taken to contain it.

This report sets out some of the work of the Taskforce, focusing on the complaints we have received and the actions we have taken in response. It follows earlier reports published on 24 April and 21 May. We intend to publish further reports if problems persist, updating the complaints data, and providing additional information about the work of the Taskforce.

People and businesses who have seen or experienced businesses behaving unfairly during the coronavirus outbreak can report it to the CMA by using our dedicated online form. Where there is evidence that businesses have breached competition or consumer protection law, the CMA will take enforcement action if warranted.

2. Overview

The vast majority of businesses are behaving responsibly and fairly in the unprecedented circumstances created by the coronavirus outbreak [footnote 1]. But we are concerned that a small minority may be exploiting the situation, for example by ignoring customers’ cancellation rights, charging excessive prices, or making misleading claims about goods or services.

The CMA’s assessment of the current situation is based on:

-

monitoring and analysis of complaints received, both through email and its online form. From 10 March to 28 June 2020, the CMA has been contacted more than 80,000 times about coronavirus-related issues. The rate at which consumers contacted the CMA in June (around 3,500 per week) has fallen back from levels seen in May (almost 7,000 per week).

-

information received from consumer bodies, such as Which? and Citizens Advice; through enforcement partners such as Trading Standards and sector regulators; and through electronic point of sale data.

Based on this information and data, the CMA’s principal concerns relate to:

Unfair practices in relation to cancellations and refunds

The restrictions on travel and business activity resulting from the coronavirus outbreak have resulted in the cancellation of holidays, travel, event bookings and other services. In most cases, the CMA would expect consumers to be offered a full refund where no service is provided, including where a consumer cancels, or is prevented from receiving any services, because of the restrictions that apply during the current lockdown.

Since mid-April, the large majority of complaints received by the CMA have been about unfair practices in relation to cancellations and refunds. Consumers continue to raise concerns about firms refusing to provide refunds; introducing unnecessary complexity into the process of obtaining refunds; charging high administration or cancellation fees; and pressuring consumers into accepting vouchers instead of cash refunds. Around three-quarters of cancellation complaints received to date relate to holidays and air travel. The Taskforce is investigating whether companies are failing to comply with the law. Based on the number and nature of complaints received, four sectors have been prioritised: holiday accommodation; weddings and private events; nursery and childcare providers; and package holidays. In respect of holiday lets, the CMA has now secured formal commitments from two major firms – Vacation Rentals and Sykes Cottages – to offer full refunds to customers. These two companies collectively account for a majority of all complaints received about holiday lets. In respect of wedding venues and nursery providers, the CMA is considering a range of interventions, likely to include some further advice for these sectors on how to comply with consumer law.

Complaints about airlines – representing around a fifth of all cancellation complaints – have been passed to the Civil Aviation Authority, which has lead responsibility for the enforcement of consumer law as it applies to air travel. [footnote 2]

Unjustifiable price increases, particularly for essential goods

The volume of price-related contacts received by the CMA declined from early April and remains at low levels: an average of 11 per day in June, down from 76 in April. With complaints running at low levels, point-of-sale data indicating a reduction in prices across a number of essential goods, and restrictions on movement and economic activity now being eased, the CMA judges that this problem is now less widespread. Nonetheless, it remains vigilant to the risks of unjustifiable price rises, particularly if new restrictions are introduced – locally or nationally – to contain further outbreaks.

The CMA has investigated complaints of unjustifiable price rises, and taken a number of steps to prevent and address such practices. This has included:

- writing to 277 traders that have collectively been the subject of over 4,600 complaints – over 40% of the total number of actionable complaints received about price rises; [footnote 3]

- opening investigations into suspected breaches of competition law by four pharmacies and convenience stores. The investigations relate to suspected charging of excessive and unfair prices for hand sanitiser;

- working with trade associations, regulators and other bodies to clarify expectations and warn about the potential consequences of charging unjustifiably high prices. Most recently, the CMA has published a joint letter with the General Pharmaceutical Council; and it has issued a joint statement with trade associations in the retail, wholesale and pharmacy sectors.

Section 3, below, gives an analysis of the complaints received through the CMA’s online form. Section 4 describes the actions taken in response to the two principal areas of concern set out above. Section 5 summarises other work being undertaken by the Taskforce to help businesses and government protect consumers.

3. Complaints analysis

The CMA has been contacted over 80,000 times about coronavirus-related issues via emails and the CMA’s online form from 10 March to 28 June 2020. The best way to report unfair business conduct is by filling out the dedicated online form. This section provides an analysis of the more than 74,000 submissions received via the form up to and including 28 June 2020.[footnote 4]

Number of submissions

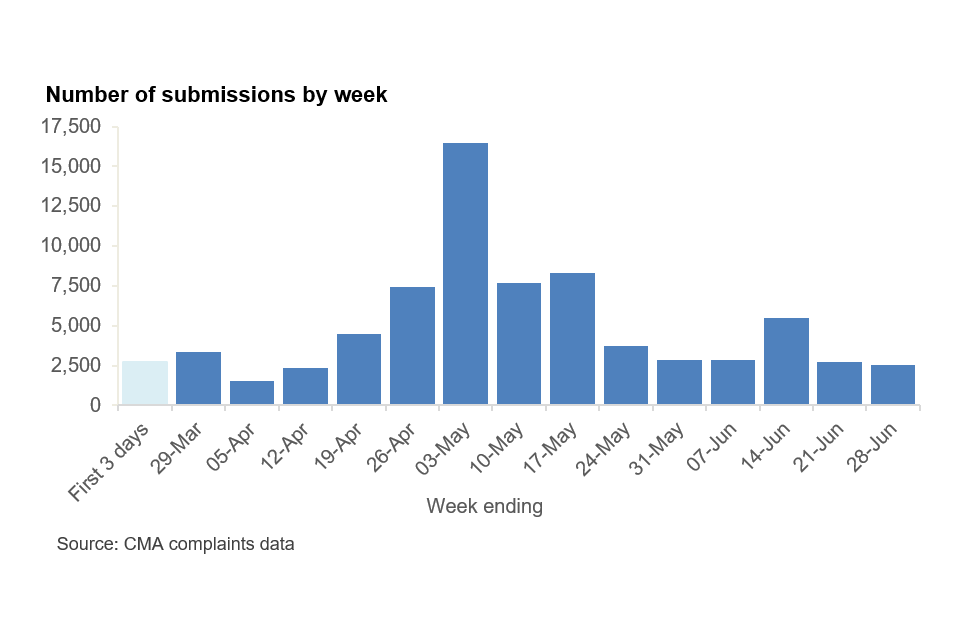

The chart below shows the number of submissions made to the CMA’s online form since its launch on 20 March. Fluctuations should be interpreted cautiously because they can be driven by the CMA’s public statements, news coverage and organised campaigns.

The average from 23 March to 28 June is around 5,000 submissions a week, with higher levels between mid-April and mid-May and lower levels before and after that period. In June, the average was around 3,500 a week. The peak of submissions in the week ending 3 May corresponds to the announcement of our programme of work to investigate businesses failing to respect cancellation rights.[footnote 5]

Number of submissions by week.

For a description of what this chart shows, see the chart descriptions section, below.

Number of businesses reported

The chart below shows the number of new businesses reported to us by week.[footnote 6] The numbers peak in the same week as the submission numbers, but at a much lower level. Overall, the bars show a downward trend, as fewer newer businesses are complained about over time.

The average from 23 March to 28 June is around 900 new businesses a week. The average for June is around 500.

Number of new businesses reported by week.

For a description of what this chart shows, see the chart descriptions section, below.

In total, there are a little over 14,000 businesses in this chart. This is a very small minority of the more than 5.9 million private sector businesses in the UK – fewer than three in a thousand.[footnote 7]

The difference between the number of submissions and the number of businesses is due to a small group of large companies attracting hundreds or thousands of complaints. Taken together, the ten most complained about companies account for a third of submissions. By contrast, the vast majority of businesses have only been reported to us once.

The vast majority of complaints about the ‘top-ten’ companies relate to issues around cancellations and refunds. Nine out of the ten companies supply services, all of which are to do with travel, holidays and accommodation. Only one of the top ten sells goods.

Types of complaint

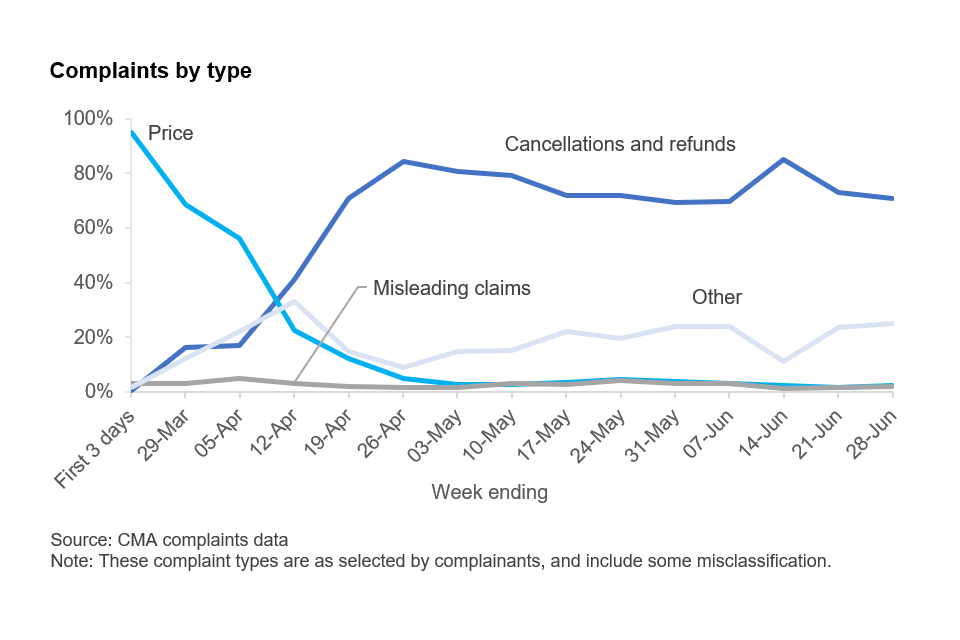

A large proportion of complaints initially received by the Taskforce related to price rises, particularly for personal hygiene goods such as hand sanitiser and basic food products. Over time, however, there has been substantial growth in the number of complaints about cancellations and refunds, and a decline in complaints about prices. Cancellation complaints decisively overtook price complaints on 9 April, and have accounted for 70% to 80% of complaints since.

Complaints by type.

For a description of what this chart shows, see the chart descriptions section, below.

Complaints about misleading claims – for instance about the efficacy of personal protective equipment – have remained low, hovering between 1% and 5% of the total. The “other” category includes complaints not within the remit of the CMA.[footnote 8] Where appropriate, these complaints are being referred to other authorities for consideration.

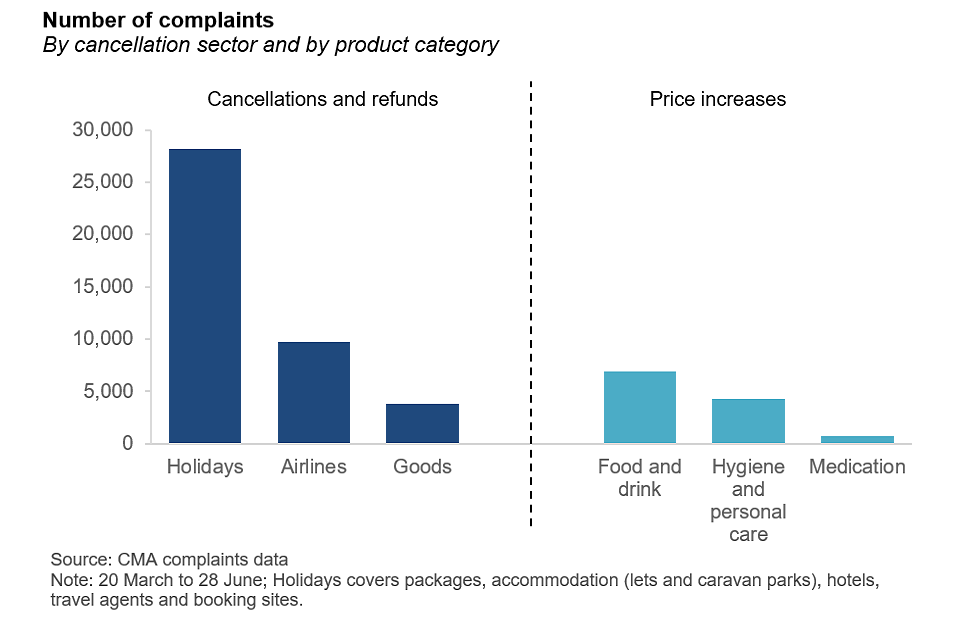

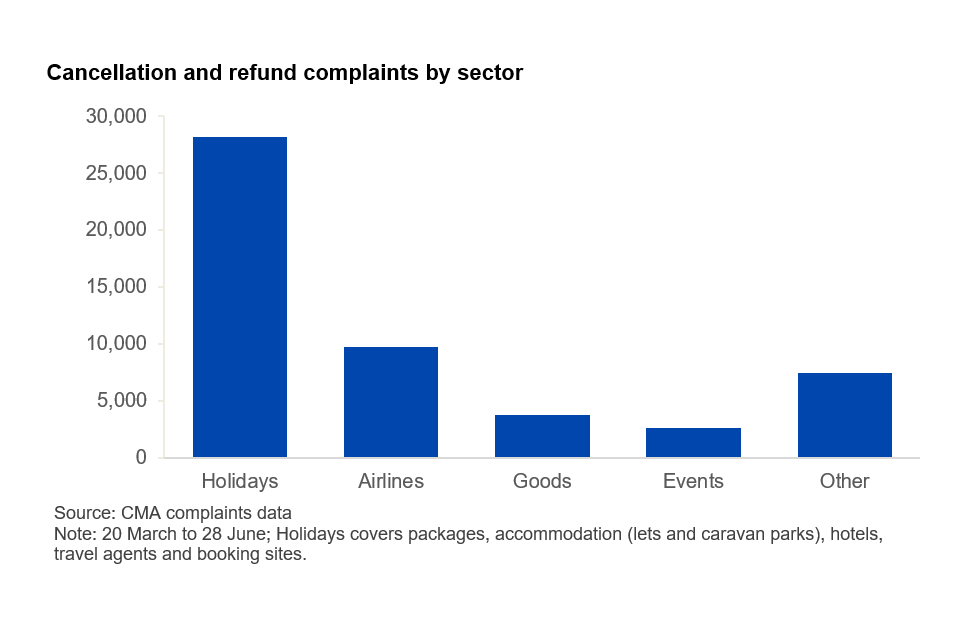

The chart below shows the most complained-about product categories and sectors within price and cancellation complaints. The food and drink category has received the most price complaints – 7,000 since 20 March – but holiday-related complaints about cancellations and refunds have attracted four times as many complaints – over 28,000.

Number of complaints.

For a description of what this chart shows, see the chart descriptions section, below.

Online vs offline

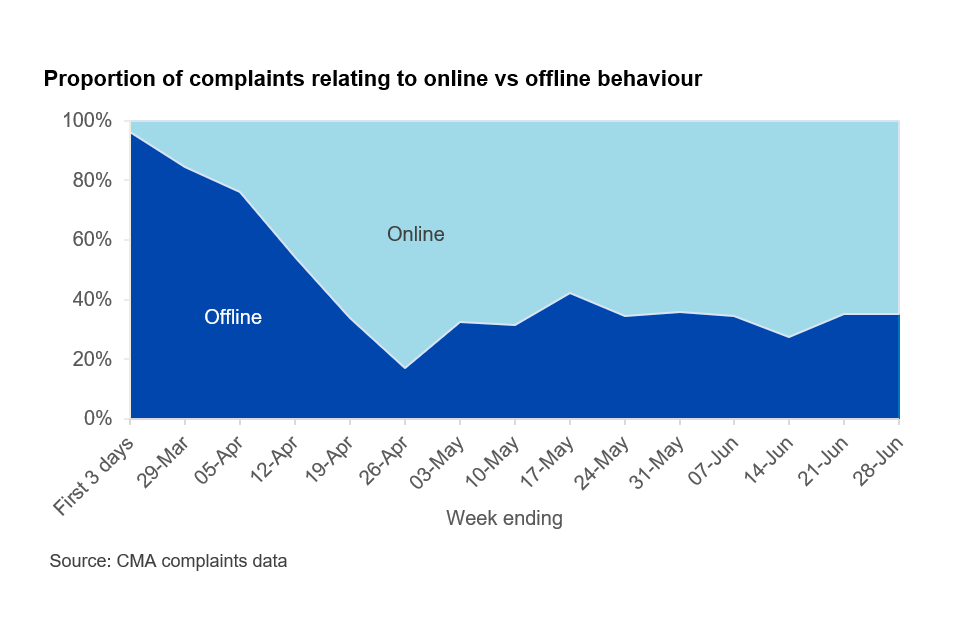

The proportion of complaints relating to online goods and services has risen steadily from March to a peak of over 80% in the week ending 26 April. Since then, it has stabilised at around 60%-70% of the total. This trajectory largely mirrors the trend in cancellation complaints: nearly 80% of cancellation complaints relate to goods and services bought online, while the opposite is true of price and “other” complaints.

Proportion of complaints relating to online vs offline behaviour.

For a description of what this chart shows, see the chart descriptions section, below.

Cancellations and refunds

The chart below shows the number of cancellation and refund complaints received since 20 March, broken down by broad sector. Complaints related to holidays (accommodation, travel agents, booking sites and package holidays) account for over half of all cancellation complaints. Within the holidays category, around half of complaints are about package holiday providers, and a quarter are about holiday accommodation.

Cancellation and refund complaints by sector.

For a description of what this chart shows, see the chart descriptions section, below.

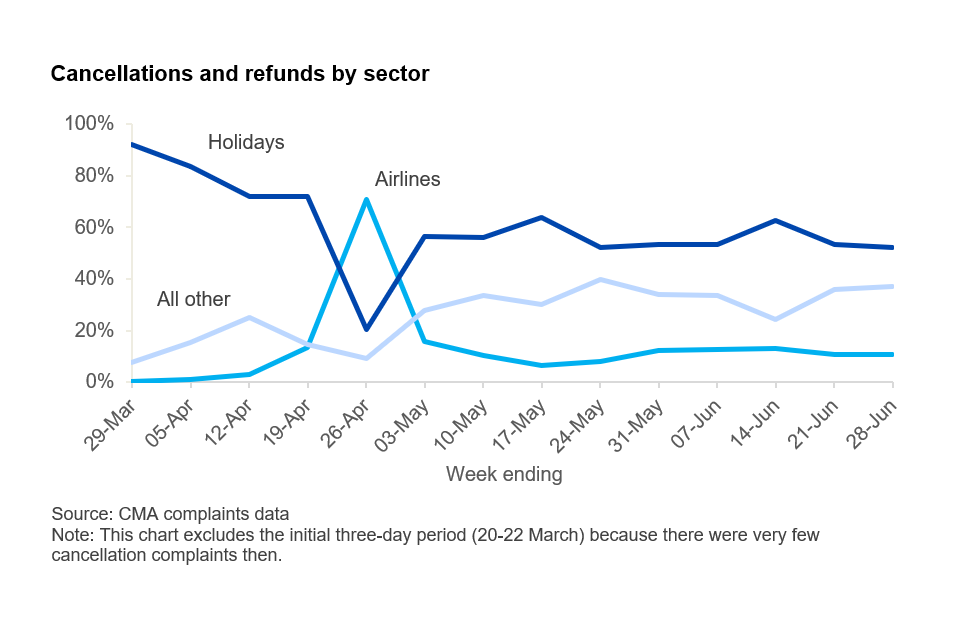

The chart below shows trends in cancellation complaints by sector. The sharp increase in the proportion of complaints about airlines in the second half of April might reflect campaigns at the time by consumer organisations and other groups about the approach to refunds by a number of major airlines.

Cancellations and refunds by sector.

For a description of what this chart shows, see the chart descriptions section, below.

Sectors differ not only in the number of complaints they attract, but also with respect to the amounts at stake for consumers. Across all cancellation complaints, the average (median) amount at stake is £800. At the lower end, the median amount at stake for goods is £200. At the top end is weddings which account for a relatively small number of complaints (around 650), but involve much larger sums (an average of £3,200 at stake). The holiday sector has both high volume (over half of all cancellation complaints) and high amounts at stake (average of £1,000).

Cancellations amounts at stake.

For a description of what this chart shows, see the chart descriptions section, below.

Price increases

The chart below shows a breakdown of price increase complaints by product category. Between 20 March and 28 June, the proportion of complaints relating to food and drink vs hygiene and personal care has flipped, with the former going from around 70% to 25% and the latter doing the opposite. The medication category has grown somewhat over time, from around 4% in March to a little over 10% in June. Overall, the most complained about product is hand sanitiser, followed by toilet paper, chicken, rice and other meats.

Price increase complaints by product category.

For a description of what this chart shows, see the chart descriptions section, below.

Size of price increases

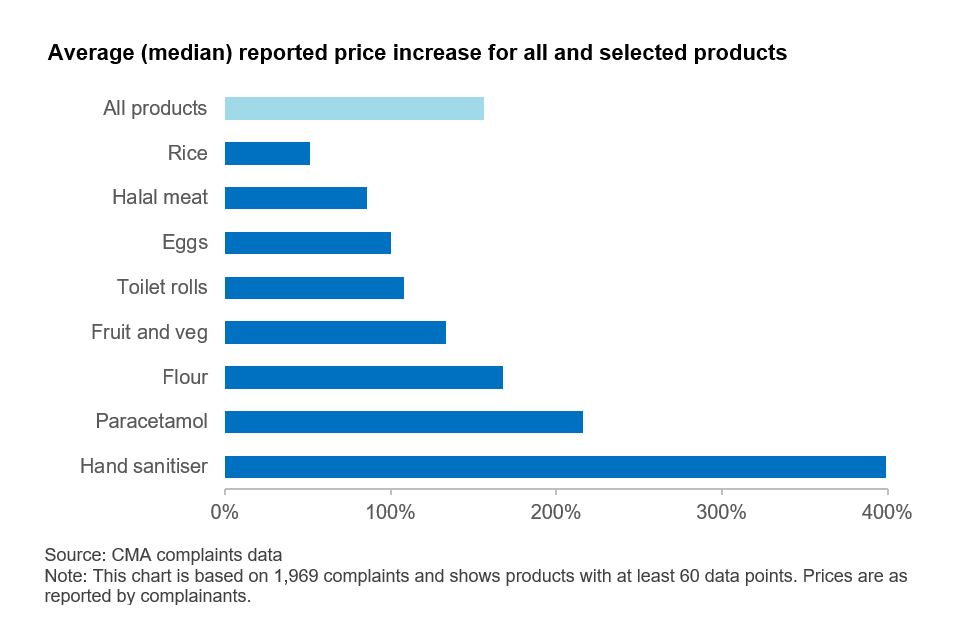

Since 3 April, the CMA has asked those reporting unfair price increases to specify, where possible, the original price and the raised price. The chart below shows the average (median) price increase across just under 2,000 complaints that reported ‘before’ and ‘after’ prices, and the average increase for some individual products.

The largest price increases concern hand sanitiser, with a reported median rise of just under 400%. The median increase across all reports is around 160%.

Average reported price increase for all and selected products.

For a description of what this chart shows, see the chart descriptions section, below.

Location of price increases

The table below shows the number of shops complained about for every thousand retail premises, by nation.[footnote 9] The proportion of shops reported is a small minority in all nations: seven in every thousand in England, and two in every thousand in the other nations of the UK.

Number of shops complained about for every thousand retail premises

| Nation | Number of shops complained about | Total retail premises | Complaints per thousand premises |

|---|---|---|---|

| England | 3,200 | 487,810 | 7 |

| Northern Ireland | 31 | 15,780 | 2 |

| Scotland | 113 | 53,962 | 2 |

| Wales | 57 | 29,470 | 2 |

Source: CMA complaint data, 20 March to 28 June; Valuation Office Agency, Stock of properties 2019; Scottish Assessors Association, General Statistics, Report 2; NI Valuation List, Administrative data at 1 April 2020. Notes: 1. Retail premises include bank branches in England and Wales, and exclude them in Scotland. 2. Identifying the number of shops and their location relies on complainants providing the postcode of the shop they are complaining about. Because 32% of consumer price complaints do not report a postcode, the true number of shops complained about could be higher.

Densely populated urban areas have on average higher rates of complaint than more rural areas.

Intelligence from other sources

Electronic point of sale data

The volume and nature of price gouging complaints over time is broadly consistent with data collected by Nielsen on purchases in ‘offline’ retailers. Taking hand sanitiser as an example, the chart below shows that the average price of 50ml hand sanitisers sold in pharmacies peaked at £5 in the week from 15 to 21 March – five times the normal price at grocery multiples throughout the period (see note 1, below); and five times what pharmacies themselves were charging at the beginning of January.

Price of 50ml hand sanitiser by channel.

For a description of what this chart shows, see the chart descriptions section, below.

Source: Nielsen, electronic point of sale data and extrapolations Notes: 1. ‘Grocery multiples’ are large supermarket chains along with Boots and Superdrug; ‘independents’ are independent retailers; ‘symbols’ are independent shops using a franchise (e.g.: Londis, Spar, Nisa); ‘chemists’ are independent pharmacies and pharmacy chains. 2. Nielsen relies on a mixture of sampling and extrapolation to estimate the universe of transactions in smaller retailers.

Nielsen estimates that 12.5 million bottles of 50ml hand sanitisers were sold from January to mid-May in the above offline channels.[footnote 10] The large majority (over 90%) were sold at grocery multiples; but substantial numbers (around 725,000 bottles) were sold at chemists in that period.

A significant number of purchases of hand sanitiser were made at very high prices. According to the data, shoppers have bought nearly 200,000 bottles at prices higher than £5 in these offline channels between January and mid-May – over five times the normal price.

Stakeholders

The Taskforce works closely with other enforcers (in particular Trading Standards Services (TSS)), consumer organisations and overseas authorities. Many of these are also collecting data about COVID-19-related consumer concerns.

Information shared by other enforcers (notably TSS) and consumer organisations (including Which? and Citizens Advice) broadly reflects the analysis set out above: in particular, cancellations and refunds overtaking price rises as the most common cause of complaint, with holidays, travel, weddings and events among the most complained-about sectors.

Information shared by overseas consumer protection and enforcement authorities is also broadly consistent with this picture. Many have reported problems with price rises and businesses refusing to pay refunds to consumers, particularly in the travel sector, and they are using their own laws to try to tackle these issues.

4. Tackling harmful practices

The CMA has a range of options at its disposal to tackle harmful practices. It can seek further information from businesses; it can issue them with advisory or warning letters; it can work with enforcement partners, consumer bodies and trade associations; where appropriate, it can take enforcement action under its competition and consumer protection law powers; and it can advise government, including on any emergency legislative changes that might be required.

The remainder of this section sets out the CMA’s response to the two principal concerns that have come to light from complaints and other intelligence-gathering so far: problems with refunds and cancellations, and unjustifiable price rises.

Cancellations and refunds

As set out above, the large majority of the complaints received by the CMA relates to difficulties securing refunds following cancellation. The Taskforce has responded to these complaints in the following ways.

Issuing guidance to businesses and consumers

To help consumers understand their rights and to help businesses treat their customers fairly, the CMA – working closely with other consumer law enforcement partners – set out its general views on how the law operates in respect of cancellations and refunds in a statement published on 30 April. The statement covers a range of consumer contracts and different situations and sets out that in most cases the CMA would expect a full refund to be offered if:

- a business has cancelled a contract without providing any of the promised goods or services;

- no service is provided by a business, because this is prevented by restrictions that apply during the current lockdown; or

- a consumer cancels, or is prevented from receiving any services, because of the restrictions that apply during the current lockdown.

With many people spending more time at home and online, the Taskforce has also worked with the Advertising Standards Authority to provide guidance to consumers on avoiding unwanted and unexpected charges when signing up to ‘free’ trials.

Further sector-specific guidance may also follow in due course for the weddings and nurseries sectors (see below).

Launching investigations

The CMA has so far prioritised four sectors for investigation, set out below,[footnote 11] which together account for 40% of the cancellation and refund complaints received. Complainants also report some of the largest amounts of money at stake in these sectors (see ‘amounts at stake’ chart above). These investigations are examining whether companies in these sectors are failing to comply with the law. Where there is evidence that this is the case, the CMA will take appropriate enforcement action, which could include taking a company to court if it does not address the CMA’s concerns.

Weddings and private events

Practices of concern include venues refusing to refund any money and telling people to claim on their insurance. Following engagement with trade associations and businesses, the CMA is considering a range of interventions which is likely to include some further advice for the sector on how to comply with consumer law.

Holiday accommodation

Practices of concern include pressuring consumers into accepting vouchers instead of refunds. On 9 June, the CMA secured a formal commitment from Vacation Rentals – which operates accommodation sites including Hoseasons and Cottages.com – to offer full refunds to customers who booked holiday homes but could not stay in them owing to lockdown restrictions. Similar commitments were secured in respect of Sykes Cottages on 3 July. These two companies collectively account for a majority of all complaints received about holiday lets. The CMA continues its inquiries into other companies in the holiday accommodation sector.

Nurseries and childcare provision

Practices of concern include asking people to pay very high sums to keep a place open for their child while the nursery is closed (“retainer fees”). While the majority of nursery and daycare businesses were striving to reach reasonable agreements with parents, some practices were unfair. We are continuing to engage with trade associations with a view to providing further advice to the sector on how to comply with consumer law and reach fairer outcomes for parents in these unprecedented circumstances.

Package holidays

Practices of concern include refusing refunds; making it very difficult for consumers to obtain refunds; and insisting that consumers rebook or accept vouchers.

The Taskforce may move on to examine other sectors, based on the information it receives from complaints and other sources.

Working with other enforcers of consumer law

Around 10,000 complaints – a fifth of all cancellation complaints – relate to air travel booked directly with airlines, and particularly difficulties securing refunds following cancelled flights. These complaints have been passed to the Civil Aviation Authority, which has lead responsibility for the enforcement of consumer law as it applies to air travel. Smaller numbers of complaints have been passed to other regulators, including the FCA (132 complaints in respect of 10 financial services firms) and Ofcom (106 complaints in respect of two telecoms companies).

Unjustifiable price rises

The Taskforce has responded to complaints about unjustifiable price rises in the following ways.

Investigations under the Competition Act

On 18 June, the CMA launched investigations into suspected breaches of competition law by four pharmacies and convenience stores. The investigations relate to suspected charging of excessive and unfair prices for hand sanitiser. The focus on hand sanitiser in these investigations reflects the prevalence of complaints and the magnitude of reported price increases for this product. Since 20 March, hand sanitiser has been the most complained-about product, reported in 20% of all price complaints received by the Taskforce; and the average price increase reported by complainants has been 400%, larger than for any other product.

Working with trade associations, regulators and other bodies

The Taskforce has worked with others to clarify expectations of businesses and warn about the potential consequences of charging unjustifiably high prices.

On 3 July, it issued a joint statement with trade associations in the retail, wholesale and pharmacy sectors, highlighting the impact of such practices on consumers and the potential consequences for traders. This followed a joint letter with the General Pharmaceutical Council (GPhC), published on 29 June, which explained to pharmacists and pharmacy owners the respective roles and expectations of the CMA and GPhC in relation to pricing practices. The GPhC has issued the letter directly to over 4,000 pharmacy owners and superintendent pharmacists across Great Britain.

Previously, the Taskforce wrote to 26 trade associations and published an open letter to the pharmaceutical and food and drink industries. These letters summarised our concerns about the practices of a minority of traders, set out the CMA’s expectations of how traders should behave, and sought further information.

Requesting information from individual businesses where we have concerns

As of 28 June, we have written to 277 individual businesses asking for more information, or expressing concern about unjustifiable price rises. [footnote 12] Together, these businesses account for over 4,600 complaints: over 40% of the total number of actionable complaints received about price rises. Businesses would be well advised to heed these warnings, given the possibility of enforcement action, and the reputational consequences of being seen by their customers to exploit the outbreak.

To date, we have received 184 responses from the businesses to which we have written. The majority of these attribute high prices to higher costs charged by suppliers, although this does not adequately explain prices that are far in excess of the average. The Taskforce is seeking further evidence of claims about supplier pricing practices. Businesses experiencing large price rises or other unfair practices from their suppliers are encouraged to report this through the CMA’s online form.

In addition to opening the Competition Act investigations mentioned above, the CMA has engaged with a number of other retailers that were the subject of complaints about high prices for hand sanitiser. Several of these have since reduced the prices they were charging.

Engagement with online retail platforms

Many complaints about unjustifiable price rises relate to listings placed on online platforms. We wrote to Amazon and eBay in March and have continued to draw to their attention complaints about listings charging unjustifiable prices for essential goods. The CMA expects retail platforms to take steps to prevent such listings appearing in the first place; for them to be identified and removed quickly when they do appear; and for the accounts of unscrupulous sellers to be blocked or terminated.

Our approach to complaints of price hikes during the pandemic

In normal times, price increases by small traders operating in competitive markets are unlikely to be of concern to the CMA. Consumers are able to shop around, rendering it unprofitable for traders to maintain higher prices than their competitors. And in normal circumstances generalised price rises can provide an important signal to increase supply.

The COVID-19 pandemic led to the markets for certain essential goods functioning in unusual ways, including spikes in demand – driven in some cases by stockpiling – and disruptions to supply. These features, combined with the restrictions on movement that were in place particularly during the “Stay at home” phase of lockdown, gave some traders a high degree of market power in local markets. The complaints the CMA received indicated that a small minority of traders were exploiting this by raising prices to levels that were very unlikely to have been justified by cost increases. The price consumers are prepared to pay for essential goods is less likely to be a reflection of their preferences, and more likely to be a reflection of their income. There is a risk that anxious wealthier consumers buy-up all the stock at the hiked prices while others, who may need products such as hand sanitiser even more, are faced with empty shelves. The result is not a socially optimal allocation of the product, but simply an inability of the less well-off to acquire it. In such circumstances, quantity rationing (i.e. restrictions on the number of the same item a consumer can purchase), rather than rationing on the basis of ability to pay, is likely to lead to better outcomes.

In competitive markets, price changes help to bring demand into line with supply. This a desirable process that leads to efficient outcomes. However, if price rises reflect market power, then there is a strong economic case to take steps to prevent and address it. Moreover, the harmful effects that come from the exploitation of market power in this context are likely to be felt particularly acutely by vulnerable consumers, who are less able to afford the higher prices and are less likely to be able to go to a different shop, or to go online, to get a better deal.

In deciding whether and how to respond to complaints of price rises, the CMA therefore took a number of factors into account, including:

- The number of complaints. The CMA has prioritised action in respect of traders that have been the subject of multiple complaints.

- The size of the reported price increases. Many complainants reported prices rises that far exceeded the average price increase for the product concerned and are likely to have been much greater than what would be needed to bring about increased supply.

The extent to which the products were essential. Consumers have less choice about the purchase of essential products.

As set out above, the CMA considers that price gouging has now become less widespread, although this trend may reverse, particularly if new restrictions on people and businesses are introduced, whether locally, nationally or overseas. The CMA will take forward its Competition Act investigations; and it will monitor closely the complaints it receives, and other sources of data, to inform any further work in this area.

5. Helping government and businesses protect consumers

Guidance for businesses

The CMA recognises that in some cases it will be appropriate for businesses to work together during the coronavirus outbreak, to ensure that essential products and services get to the people who need them.

Competition law prohibits certain types of cooperation and information-sharing between businesses. The CMA does not want its approach to enforcing these prohibitions to stand in the way of necessary cooperation to deal with the current crisis; but nor will it tolerate crisis conditions being used opportunistically as a cover for non-essential collusion. With that in mind, we announced on 19 March 2020 that ‘the CMA has no intention of taking competition law enforcement action against cooperation between businesses or rationing of products to the extent that this is necessary to protect consumers’. Following the announcement, we published guidance on 25 March 2020 on the CMA’s approach to acceptable business cooperation in response to coronavirus.[footnote 13]

On 22 April, the CMA published guidance on its assessment of mergers during the outbreak. The guidance provides further information on key aspects of its practice, including information-gathering, the timing of investigations, the conduct of meetings and hearings, and its approach to interim measures and substantive assessment. The guidance also contained a summary of the existing principles that govern how the CMA assesses mergers when ‘failing firm’ claims are raised.

On 30 April, the CMA published a statement setting out the CMA’s view on how the law operates in respect of cancellations and refunds. (see Section 4, above).

Advice to government

A function of the Taskforce is to provide advice and assistance to Government, where appropriate, on the measures and policies it is developing in response to the coronavirus outbreak. In particular, the Taskforce has advised the Government on ‘exclusion orders’ (which exempt certain types of agreement in specific sectors from competition law) to help ensure risks to competition and consumers are minimised. At the time of writing, five exclusion orders have been enacted in the groceries, ferry transport, dairy and healthcare sectors (in England and Wales). Advice is being provided on other proposals and measures to support the economy.

All our coronavirus-related announcements and publications can be found on the CMA coronavirus (COVID-19) response page.

Chart descriptions

Number of submissions by week

This chart shows the number of submissions made to the CMA’s online form since its launch on 20 March. Over 2,500 submissions were made in the first three days. After that, the average from 23 March to 28 June was around 5,000 submissions a week, with higher levels between mid-April and mid-May and lower levels before and after that period. The week ending 5 April shows the lowest count of any week, at around 1,500 submissions. The highest count was recorded in the week ending 3 May, with over 16,000 submissions. In June, the average was around 3,500 a week.

Number of new businesses reported by week

This chart shows the number of new businesses reported to the CMA by week. The average from 23 March to 28 June is around 900 new businesses a week. The chart shows an overall declining trend interrupted by a sudden peak in the middle. In the first three days from 20 March to 22 March, the number of new businesses reported was around 1,300. The numbers decline to around 700-800 in April, before peaking to nearly 2,500 in the week ending 3 May. Numbers halve in the following week, and thereafter continue to decline gently all the way to the last week ending 28 June, which shows the lowest count of any week, at below 500.

Note: This chart relies on matching business names reported by different complainants; it should be regarded as a good approximation, rather than an exact reflection, of the number of individual businesses complained about.

Complaints by type

This chart shows the proportion of complaints by type over time. In the first three days from 20 March to 22 March, nearly 95% of complaints are about price increases. Thereafter, the proportion of complaints about price increases declines quite rapidly, with complaints about cancellations and refunds and the ‘other’ category rising correspondingly. Cancellation complaints decisively overtake price complaints in the week ending 12 April, and account for 70% to 80% of complaints thereafter. The ‘other’ category fluctuates between 10% and 30%. Complaints about misleading claims remain low throughout the chart, hovering between 1% and 5% of the total.

Note: These complaint types are as selected by complainants, and include some misclassification.

Number of complaints

This chart shows the most complained-about product categories and sectors within price and cancellation complaints. On the cancellation and refunds side of the chart, the holiday sector shows over 28,000 complaints, followed by airlines at around 10,000 and goods at around 4,000. On the price side of the chart, the food and drink category shows 7,000 complaints, followed by hygiene and personal care at around 4,500 and medication at around 700.

Note: 20 March to 28 June; Holidays covers packages, accommodation (lets and hotels), travel agents and booking sites

Proportion of complaints relating to online vs offline behaviour

This chart shows the proportion of complaints relating to online and offline goods and services over time. In the first three days to 22 March, the offline proportion accounts for over 95% complaints. Thereafter, the online proportion rises steadily from March to a peak of over 80% in the week ending 26 April. After that, it stabilises at around 60%-70% of the total all the way to the end of June.

Cancellations and refund complaints by sector

This chart shows the number of cancellation and refund complaints broken down by broad sector. Complaints related to holidays (accommodation, hotels, travel agents, booking sites and package holidays) shows the highest total, at over 28,000, followed by airlines at around 10,000, goods around 4,000, events around 2,500 and ‘other’ around 7,500.

Note: 20 March to 28 June; Holidays covers packages, accommodation (lets and hotels), travel agents and booking sites.

Cancellations and refunds by sector

This chart shows trends in cancellation complaints by sector. In the first week ending 29 March, holidays account for over 90% of complaints. Holiday-related complaints remains the highest sector throughout the chart except for the week ending 26 April, which shows a surge in airline complaints. The proportion of holiday-related complaints stabilises at around 50%-60% in May and June. Airlines stabilise at around 10%, while all other complaints put together account for around 30% to 40% of complaints in May and June.

Note: This chart excludes the initial three-day period (20-22 March) because there were very few cancellation complaints then.

Cancellations: amounts at stake

This chart shows the median amounts at stake in cancellation complaints as reported by complainants. Across all cancellation complaints, the median amount at stake is £800. At the lower end, the median amount at stake for goods is £200. At the top end is weddings with a median of £3,200 at stake. The holiday sector is the second highest, showing a median of £1,000 at stake.

Note: This chart relies on extracting the amounts at stake as described by complainants in free text. It should be regarded as a good approximation, rather than an exact reflection, of the true value; future methodological improvements may lead to revisions.

Price increase complaints by product category

This chart shows a breakdown of price increase complaints by product category. Between 20 March and 28 June, the proportion of complaints relating to food and drink vs hygiene and personal care flips, with the former going from around 70% to 25% and the latter doing the opposite, after a period between April and May where the two categories hover close to each other at just under 50% of complaints each. The medication category grows somewhat over time, from around 4% in March to a little over 10% in June.

Note: This chart excludes unusual products that have not been the subject of many complaints.

Average (median) reported price increase for all and selected products

This chart shows the median price increase across just under 2,000 complaints that reported ‘before’ and ‘after’ prices, and the average increase for some individual products. The median increase across all reports is around 160%. The largest price increases concern hand sanitiser, with a reported median rise of just under 400%, followed by paracetamol at around 220%. The lowest rise in the chart is recorded by rice, at around 50%, followed by halal meat, at around 90%.

Note: This chart is based on 1,969 complaints and shows products with at least 60 data points. Prices are as reported by complainants.

Price of 50ml hand sanitiser, by channel

This chart shows the weighted average price of 50ml hand sanitiser between January and mid-May in four different offline channels. The chart shows that the average price of 50ml hand sanitisers sold in pharmacies starts at around £1 at the beginning of January, peaks at £5 in the week from 15 to 21 March, and then falls to under £3 in May. The second-highest rise is shown by the ‘symbols’ channel, which starts at around £1.5 between January and mid-March, but jumps to nearly £4 in the week ending 21 March. The symbols price then falls to around £2.5 in May. The ‘independents’ channel shows a smaller rise to under £3 in March, and falls to around £2 in May. Average prices in the ‘grocery multiples’ channel remain low and stable at around £1 before increasing gently from late March to May, recording their highest value in the last week ending 16 May at £1.4.

-

The CMA has received complaints via its online form relating to a little over 14,000 individual businesses, fewer than three in a thousand of the total number of private sector businesses operating in the UK. ↩

-

The CAA has announced that it is reviewing how airlines are handling refunds during the coronavirus pandemic. An update to this work was published on 1 July. The CAA has also published guidance and advice on refunds for industry and consumers. ↩

-

Actionable complaints are those where the complainant has specified at least one of either the postal address, postcode or web address of the business being complained about. ↩

-

We define a ‘contact’ as a person getting in touch with us, whether via email or the online form. Each form submitted online is a ‘submission’. A contact, whether by email or form, can contain zero, one or more than one product complaint (for example, a person may be complaining about several products, or none). ↩

-

COVID-19: CMA to investigate cancellation policy concerns (press release), 30 April 2020. ↩

-

Owing to improvements in the matching of different names that refer to the same business, these figures are not directly comparable with those presented in earlier reports. ↩

-

BEIS, Business Population Estimates, 2019, Table 1. ↩

-

The key themes include: facing dismissal; unsafe work conditions (particularly adherence to social distancing rules); non-key workers still at work; non-essential businesses still open; companies not allowing staff to work from home; staff not having PPE (especially in shops/delivery drivers); pubs still having to pay licences despite being closed; and general concerns for public health. However, the “other” category also includes a number of cancellation and refund complaints that complainants have misclassified. ↩

-

Owing to methodological improvements, some of the figures are lower than those presented in the previous report. ↩

-

The figure does not cover all offline channels; forecourts and convenience multiples are missing. ↩

-

Details of the CMA’s work in relation to weddings and private events; nurseries and childcare providers; and holiday accommodation can be found in the 24 April update. Further information about the CMA’s work in respect of package holidays will be made available in due course. ↩

-

Actionable complaints are those where the complainant has specified at least one of either the postal address, postcode or web address of the business being complained about. ↩

-

This guidance made clear that “The CMA understands that this may involve coordination between competing businesses. It wants to provide reassurance that, provided that any such coordination is undertaken solely to address concerns arising from the current crisis and does not go further or last longer than what is necessary, the CMA will not take action against it”. ↩