UK House Price Index (HPI) for July 2016

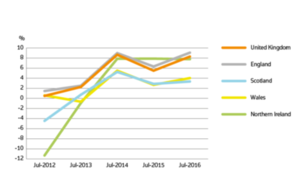

The UK House Price Index shows house price changes for England, Scotland, Wales and Northern Ireland.

The July data shows an annual price increase of 8.3% which takes the average property value in the UK to £216,750. Monthly house prices rose by 0.4% since June 2016. The monthly index figure for the UK was 113.7.

In England, the July data shows an annual price increase of 9.1% which takes the average property value to £232,885. Monthly house prices rose by 0.5% since June 2016.

Wales shows an annual price increase of 4.0% which takes the average property value to £144,828. Monthly house prices fell by 1.8% since June 2016.

London shows an annual price increase of 12.3% which takes the average property value to £484,716. Monthly house prices rose by 1.0% since June 2016.

The regional data indicates that:

- East of England experienced the greatest increase in its average property value over the last 12 months with a movement of 13.2%

- the North East experienced the greatest monthly growth with an increase of 2.3%

- Yorkshire and The Humber saw the lowest annual price growth with an increase of 4.7%

- West Midlands saw the most significant monthly price fall with a movement of -0.8%

UK home sales fell by 0.9% in July 2016 compared to the previous month, which means that home sales on a monthly basis remain below levels seen in 2014 and 2015 and before the stamp duty changes in early 2016. See the economic statement.

Sales during May 2016, the most up-to-date Land Registry figures available, show that:

-

the number of completed house sales in England fell by 33.5% to 49,795 compared with 74,897 in May 2015

-

the number of completed house sales in Wales fell by 29.6% to 2,596 compared with 3,685 in May 2015

-

the number of completed house sales in London fell by 46% to 5,111 compared with 9,466 in May 2015

- there were 494 repossession sales in England in May 2016

-

there were 57 repossession sales in Wales in May 2016

- the lowest number of repossession sales in England and Wales in May 2016 was in the East of England

Price change by region for England

| England by region | Monthly change % since June 2016 | Annual change % since July 2015 | Average price July 2016 |

|---|---|---|---|

| East Midlands | 0.5 | 7.8 | £173,783 |

| East of England | 0.6 | 13.2 | £273,806 |

| London | 1.0 | 12.3 | £484,716 |

| North East | 2.3 | 5.8 | £129,750 |

| North West | 0.8 | 6.1 | £150,082 |

| South East | 0.6 | 11.9 | £313,315 |

| South West | -0.3 | 7.8 | £237,291 |

| West Midlands | -0.8 | 6.4 | £176,598 |

| Yorkshire and The Humber | 0.2 | 4.7 | £151,581 |

Average price by property type for England

| Average price by property type (England) | July 2016 | July 2015 | Difference % |

|---|---|---|---|

| Detached | £349,905 | £320,036 | 9.3 |

| Semi-detached | £215,929 | £197,839 | 9.1 |

| Terraced | £188,602 | £173,425 | 8.8 |

| Flat/maisonette | £218,303 | £200,004 | 9.1 |

| All | £232,885 | £213,518 | 9.1 |

Price change for Wales

| Wales | Monthly change % since June 2016 | Annual change % since July 2015 | Average price July 2016 |

|---|---|---|---|

| Wales | -1.8 | 4.0 | £144,828 |

Average price by property type for Wales

| Average price by property type (Wales) | July 2016 | July 2015 | Difference % |

|---|---|---|---|

| Detached | £218,003 | £209,105 | 4.3 |

| Semi-detached | £140,079 | £133,827 | 4.7 |

| Terraced | £112,232 | £108,148 | 3.8 |

| Flat/maisonette | £102,474 | £100,556 | 1.9 |

| All | £144,828 | £139,213 | 4.0 |

Average price by property type for London

| Average price by property type (London) | July 2016 | July 2015 | Difference % |

|---|---|---|---|

| Detached | £914,387 | £787,783 | 16.1 |

| Semi-detached | £585,741 | £506,181 | 15.7 |

| Terraced | £503,185 | £443,661 | 13.4 |

| Flat/maisonette | £425,732 | £385,416 | 10.5 |

| All | £484,716 | £431,644 | 12.3 |

Sales volumes for England

| Month | Sales 2016 England | Sales 2015 England | Difference % |

|---|---|---|---|

| April | 44,941 | 64,540 | -30.4 |

| May | 49,795 | 74,897 | -33.5 |

Sales volumes for Wales

| Month | Sales 2016 Wales | Sales 2015 Wales | Difference % |

|---|---|---|---|

| April | 2,464 | 3,244 | -24.0 |

| May | 2,596 | 3,685 | -29.6 |

Sales volumes for London

| Month | Sales 2016 London | Sales 2015 London | Difference % |

|---|---|---|---|

| April | 4,616 | 8,688 | -46.9 |

| May | 5,111 | 9,466 | -46.0 |

Funding, buyer and building status for England

| England | Monthly change % | Annual change % | Average price |

|---|---|---|---|

| Cash | 0.3 | 8.3 | £218,331 |

| Mortgage | 0.5 | 9.4 | £240,233 |

| First time buyer | 0.3 | 8.9 | £195,484 |

| Former owner occupier | 0.6 | 9.2 | £264,184 |

| New build | -2.2 | 16.4 | £295,039 |

| Existing resold property | 0.7 | 8.5 | £228,779 |

Funding, buyer and building status for Wales

| Wales | Monthly change % | Annual change % | Average price |

|---|---|---|---|

| Cash | -2.2 | 3.3 | £140,604 |

| Mortgage | -1.5 | 4.5 | £147,342 |

| First time buyer | -1.8 | 4.1 | £125,245 |

| Former owner occupier | -1.8 | 4.0 | £167,627 |

| New build | -2.8 | 13.1 | £196,533 |

| Existing resold property | -1.7 | 3.4 | £141,815 |

Funding, buyer and building status for London

| London | Monthly change % | Annual change % | Average price |

|---|---|---|---|

| Cash | 0.6 | 11.3 | £510,028 |

| Mortgage | 1.1 | 12.6 | £476,922 |

| First time buyer | 0.8 | 12.0 | £423,422 |

| Former owner occupier | 1.1 | 12.5 | £547,424 |

| New build | -2.4 | 18.2 | £506,525 |

| Existing resold property | 1.3 | 11.8 | £482,896 |

Repossession

| Repossession sales | May 2016 |

|---|---|

| East Midlands | 45 |

| East of England | 14 |

| London | 27 |

| North East | 79 |

| North West | 134 |

| South East | 61 |

| South West | 19 |

| West Midlands | 42 |

| Yorkshire and The Humber | 73 |

| England | 494 |

| Wales | 57 |

Notes to editors

-

The UK House Price Index (HPI) is published on the second or third Tuesday of each month with Northern Ireland figures updated quarterly. The August 2016 UK HPI will be published at 9.30am on 18 October 2016. A calendar of release dates is available.

-

Data for the UK HPI is provided by Land Registry, Registers of Scotland, Land & Property Services Northern Ireland and the Valuation Office Agency.

-

The UK HPI is calculated by the Office for National Statistics andLand & Property Services Northern Ireland. It applies a hedonic regression model that uses the various sources of data on property price, in particular Land Registry’s Price Paid Dataset, and attributes to produce estimates of the change in house prices each month. Find out more about the methodology used from ONS and Northern Ireland Statistics & Research Agency.

-

The first estimate for new build average price (April 2016 report) was based on a small sample which can cause volatility. A three month moving average has been applied to the latest estimate to remove some of this volatility.

-

Work has been taking place over the past two years to develop a single, official HPI that reflects the final transaction price for sales of residential property in the UK. Using the geometric mean, it covers purchases at market value for owner-occupation and buy-to-let, excluding those purchases not at market value (such as re-mortgages), where the ‘price’ represents a valuation.

-

Information on residential property transactions for England and Wales, collected as part of the official registration process, is provided by Land Registry for properties that are sold for full market value.

-

The Land Registry dataset contains the sale price of the property, the date when the sale was completed, full address details, the type of property (i.e. detached, semi-detached, terraced or flat), if it is a newly built property or an established residential building and a variable to indicate if the property has been purchased as a financed transaction (i.e. using a mortgage) or as a non-financed transaction (cash purchase).

-

Repossession data is based on the number of transactions lodged with Land Registry by lenders exercising their power of sale.

-

For England this is shown as volumes of repossessions recorded by Government Office Region. For Wales there is a headline figure for the number of repossessions recorded in Wales.

-

The data can be downloaded as a .csv file. Repossession data prior to April 2016 is not available. Find out more information about Repossessions.

-

The repossession data for April 2016 reported in our last publication, has been revised. The updated figures are available.

-

Background tables of the raw and cleansed aggregated data, in Excel and CSV formats, are also published monthly although Northern Ireland is on a quarterly basis. They are available for free use and re-use under the Open Government Licence.

-

As a government department established in 1862, executive agency and trading fund responsible to the Secretary of State for Business, Energy and Industrial Strategy, Land Registry keeps and maintains the Land Register for England and Wales. The Land Register has been open to public inspection since 1990.

-

With the largest transactional database of its kind detailing more than 24 million titles, Land Registry underpins the economy by safeguarding ownership of many billions of pounds worth of property.

-

For further information about Land Registry visit www.gov.uk/land-registry.

-

Follow us on Twitter @LandRegGov our blog and LinkedIn and Facebook.

Press Office

Trafalgar House

1 Bedford Park

Croydon

CR0 2AQ

Email HMLRPressOffice@landregistry.gov.uk

Phone (Monday to Friday 8:30am to 5:30pm) 0300 006 3365

Mobile (5:30pm to 8:30am weekdays, all weekend and public holidays) 07864 689 344