Community pharmacy drug reimbursement reform: consultation response

Updated 11 November 2021

Executive summary

In 2020 to 2021 1.1 billion prescription items (medicines, drugs, appliances and other items) were dispensed in the community with a total value of £9.6 billion. The department wants to ensure that the money spent on those items represents value for money to the NHS and taxpayer, and that pharmacy contractors are paid appropriately and fairly for the items they dispense. While in general the arrangements for reimbursing pharmacy contractors for the prescription items they dispense works well, the department has identified a number of technical adjustments to improve the system.

Between 23 July and 17 September 2019 the government consulted on proposals for a number of changes to the way it reimburses community pharmacy contractors in England for the drugs they dispense against NHS prescriptions.

These reforms strive to ensure that the following principles are adhered to, in so far as is possible and practicable:

-

the entirety of the arrangements provides value for money to the NHS and taxpayer

-

reimbursement prices better reflect market prices to improve pharmacy contractors’ cash flow

-

all pharmacy contractors have fair access to medicine margin

-

the addition of medicine margin to reimbursement prices does not make medicines look more expensive than they really are and influences prescribing patterns

We consulted on 8 proposals and asked 20 questions across the 8 reforms and one question on the impact assessment that was published alongside the consultation document. An overview of the reforms was also published at the same time.

Section 2 of the consultation document provides the context and background for community pharmacy reimbursement and sets out how reimbursement of pharmacy contractors works in England.

328 responses to the consultation were received. For the purposes of the analysis detailed in this response each of the 328 responses was counted equally. Respondents in this cohort included individuals and representatives from organisations on behalf of their members including community pharmacy contractors, dispensing doctors, industry bodies, pharmaceutical representative groups, NHS bodies and other healthcare professionals. Therefore, a single response from a representative body may represent a significant number of individuals.

Figure 1: responses from individuals versus organisations

Figure 2: responses from pharmacists and pharmacy managers

This response outlines each proposal, what respondents said and what the government’s next steps are. As set out in the consultation document this consultation has 2 phases, a public consultation on the high-level principles of the proposed changes followed by a consultation with the Pharmaceutical Services Negotiating Committee (PSNC), the representative body for pharmacy contractors, on the detail and the mechanics of how we implement these reforms. This consultation response concludes the first phase of the consultation.

The government thanks those who responded to the consultation. The form of the consultation meant that the government was not able to present and discuss all possible proposals and mitigations in depth. Several respondents noted that it was not possible to comment on the specifics of the proposals as this was reserved for the second phase of negotiations. The government acknowledges the limitations of providing a consultation based on high-level principles. The aim of the first phase being a public consultation was to allow all participants or respondents to contribute their views without pre-empting negotiations in the second phase.

Respondents were provided with an opportunity to present their views on each proposal, having the option to select either ‘yes’, ‘no’ or ‘do not know’. The government notes that for all but 2 of the proposals (Category C and specials procurement) there was a majority agreement to support the proposals, with over 50% supporting. However, the level of disagreement for Category C and specials procurement, was not significant taking into account that a substantial number of respondents selected the ‘do not know’ option. Therefore, the government believes that there is still merit in considering new arrangements in these areas. Therefore, the government will progress all proposals for detailed discussion with the PSNC.

The government will now move to the second phase of the consultation with the PSNC with a view to implement the reforms. As noted in the consultation document, this does not mean that all proposals will be implemented or taken forward in the same timeframes.

Reimbursement prices of generic medicines in Category A

Current reimbursement arrangements

If a medicine is prescribed generically and the medicine is listed in Part VIIIA of the Drug Tariff, a pharmacy contractor in England will be reimbursed by the NHS for it according to the price listed in Part VIIIA. There are essentially 3 categories of drugs listed in Part VIIIA of the Drug Tariff, referred to by the letters A, C and M. Category C products are the products not generally available as a generic.

To be in Category A or M, the medicine must be available as a generic. The decision as to whether or not to move a product from Category C to Category A or M is taken by the Secretary of State, after consultation with the PSNC.

Part VIIIA explains how Category A prices are calculated. The reimbursement price of products in Category A represent the average of the price calculated for the pack size listed in the Drug Tariff, weighted by the following 4 manufacturers and suppliers: AAH, Alliance Healthcare (Distribution) Ltd, Teva UK Ltd and Accord Healthcare Ltd, on or before day 8 of the month being reimbursed. In the weighted formula, AAH and Alliance Healthcare (Distribution) Ltd prices have a weighting of 2, the prices from the other suppliers have a weighting of one.

A product has to score 4 in the weighted formula to be considered for Category A. That is, the product has to be available from both AAH and Alliance Healthcare (Distribution) Ltd, or from one of those companies plus both of the other suppliers, in order to prompt a discussion with PSNC over the possibility of the product moving into Category A.

The problem with the current arrangements

Manufacturers’ and wholesalers’ price lists do not reflect actual selling prices to pharmacy contractors by the manufacturers and wholesalers. Furthermore, we are aware of instances where the supplier has multiple price lists, does not produce price lists, or uses the Category A reimbursement price in the Drug Tariff as their list price. Typically, these issues result in reimbursement prices being significantly higher than actual selling prices. This creates the following problems:

- medicine margin – the difference between the contractor’s purchase price and the reimbursement price is found retrospectively in the margin survey, where this margin contributes to margin exceeding the amount agreed as part of the Community Pharmacy Contractual Framework (CPCF) (currently £800 million), a downwards adjustment is made to reimbursement prices. However, this may be some time after the purchase and reimbursement of the medicines in question and hence may significantly affect contractor’s cash flow, for example if reimbursement prices go down at a time when actual selling prices may have risen

- pharmacy contractors who dispense more Category A medicines that have a higher margin than others because of the way the list price has been derived by the supplier will retain an increased amount of margin compared to other contractors

- high reimbursement prices that do not reflect actual purchase prices may affect the perceived cost effectiveness of a medicine compared to other medicines and so may affect prescribers’ choice of medicine, potentially to the detriment of a particular patient

Our proposal for reform

To address the problem outlined above, we proposed that we use actual purchase, sales and volume information already obtained in the quarterly collection under the Health Service Products (Provision and Disclosure of Information) Regulations 2018 to set Category A reimbursement prices. The reimbursement prices that would be set would include an element of medicine margin, to allow pharmacy contractors to earn medicine margin on the Category A generic medicines they dispense. We anticipate that unlike the medicine margin arrangements for Category M medicines, the medicine margin on Category A medicines would not be adjusted to achieve the annual amount of medicine margin under the CPCF.

This approach would mean that Drug Tariff reimbursement prices would reflect actual selling prices (with an element of medicine margin) nearer to the time of the contractor paying their supplier (there would be some delay from the selling price data to the reimbursement price it informs). The system would not be so dependent on the retrospective medicine margin survey to find the retained medicine margin or adjust reimbursement prices as needed to deliver the agreed amount of margin, and hence be better for contractors’ cash flow. By using the data from suppliers and applying medicine margin, there will be a more even distribution of medicine margin across all Category A products, so overall there is more equitable distribution of margin to contractors who dispense Category A products and it will not distort the cost-effectiveness of a product to prescribers.

Consultation responses

We asked whether respondents agreed with the proposal. Out of 289 respondents, 149 agreed with the proposal, 96 disagreed and 47 said they did not know.

Figure 3: responses Category A proposal

Figure 4: responses Category A proposal (excluding ‘don’t know’)

Most respondents supported the proposal. Nevertheless, several issues or concerns were raised by respondents, in particular:

Category A medicines should not be treated as Category M medicines

Respondents said that Category A medicines are dispensed in lower volumes and are often subject to limited competition compared to Category M medicines and should therefore not be treated as Category M products. We agree that Category A and M medicines have different characteristics and plan to continue to treat them separately in the Drug Tariff.

Due to the smaller volumes and often limited competition of Category A medicines, compared to Category M, the distribution of medicine margin through Category A will be limited in relation to the amount distributed through Category M. Therefore, we do not propose to use Category A to make adjustments for medicine margin under the CPCF.

The Drug Tariff is less responsive where prices are set quarterly rather than monthly

Some respondents were concerned that quarterly updates rather than monthly updates mean that the Drug Tariff cannot respond quick enough to changes in the market. However, the government believes that using market information instead of list prices to inform Category A reimbursement prices will mean that reimbursement prices respond quicker to pharmacy purchase prices.

Furthermore, the government has found that stability in the reimbursement price gives contractors confidence in purchasing. Changing the reimbursement prices on a monthly rather than quarterly basis could create considerable instability in market confidence as contractors will not know from one month to the next what they are going to be reimbursed. Quarterly adjustments (as with current Category M) seem to strike the balance between stability and responsiveness.

Moreover, should these quarterly adjustments not be responsive enough there are still the 2 mitigations of retrospective medicine margin inquiry and concessionary prices. Namely, when a pharmacy contractor cannot purchase a particular product at or below the listed price in the Drug Tariff, an application can be made for a ‘concessionary price’. This is essentially an upward revision of the listed price for that month, where the PSNC submit a list to the Department of Health and Social Care (DHSC) each month that is carefully considered, negotiated and finally published. Overall, this should ensure contractors are paid fairly and do not overall dispense at a loss.

Pharmacy contractors should not dispense at a loss

A number of respondents thought the proposal would increase the risk that pharmacy contractors dispense at a loss. Reimbursement arrangements are not designed to pay every individual pharmacy exactly what they purchased the medicine for. Fundamentally, it is recognised that there will be some ‘winning’ (that is where a pharmacy pays less than they are remunerated) and ‘losing’ (that is where a pharmacy pays more than they are remunerated) at an individual level.

Taking into account the 2 mitigations in place (namely concessionary prices and adjustments to medicine margin) on average, the reimbursement arrangements cover the cost of the product plus the amount of medicine margin that is set to contribute to the funding of the CPCF.

Reimbursement prices should be based on wholesalers’ rather than manufacturer’s selling prices

Several respondents argued that wholesalers’ prices are the prices that pharmacy contractors pay, and therefore it would make sense to use their prices. The data that will be used to inform Category A reimbursement prices will be part of the discussion with the PSNC in phase 2 (see the ‘Next steps’ section below).

Next steps

In light of the responses and that concerns raised can be mitigated, the government intends to progress this proposal. A more detailed discussion such as which supplier data to use, what level of medicine margin would be appropriate for Category A reimbursement prices and how to manage the transition to any new system, will be subject to discussion with the PSNC in phase 2 of the consultation.

Distribution of medicine margin added to generic medicines in Category M

Current reimbursement arrangements

Category M

As set out above, if a medicine is prescribed generically and the medicine is listed in Part VIIIA of the Drug Tariff, pharmacy contractors in England will be reimbursed for it according to the price listed which will be from one of the 3 categories: A, C or M.

To be in Category M, a drug must be available as a generic. The guideline criteria for Category M are that the drug is available from more than one manufacturer and the drug fulfils minimum spend and/or volume requirements.

Category M prices are calculated based on quarterly information provided by all manufacturers and suppliers. This information is obtained under the Health Service Products (Provision and Disclosure of Information) Regulations 2018.

The reimbursement prices include medicine margin allowing pharmacy contractors to retain medicine margin on the medicines they dispense. Category M is also the main (but not the only) tool used to support the delivery of the £800 million medicine margin.

Branded generics

In some instances, branded versions of generic medicines are available that are priced below the Category M reimbursement price. If they are prescribed by their brand name, those branded medicines are reimbursed under non-Part VIII arrangements that is the list price of the manufacturer, wholesaler or supplier from which the dispensing contractor sourced the medicine.

Reimbursement prices of branded medicines, such as the list price from the manufacturers, may not enable pharmacy contractors to secure as much medicine margin as a generic product reimbursed at a Category M reimbursement price, or indeed secure any margin, and hence they do not in the main contribute as much (or any) to the delivery of the £800 million medicine margin.

The problem with the current arrangements

Some suppliers of branded products price them below the Category M reimbursement price. As the branded version then appears cheaper, this encourages clinical commissioning groups (CCGs) and prescribers to prescribe the product by brand rather than generically. To take the simplest example, of how this might work in practice, as mentioned above, when a GP prescribes a medicine, the software that they use will generally inform them of the Drug Tariff reimbursement price of the medicine. It will also generally inform them of branded versions of the medicine that are available and their prices. It may therefore look to the GP that a branded version represents good value to the NHS because its list price is significantly below the Drug Tariff reimbursement price.

In reality, however, the branded medicine may be more expensive to the NHS because it does not contribute as much (if anything) to the £800 million medicine margin under the CPCF. In this case, pharmacies do not secure any, or very little medicine margin, when they dispense the branded product which means they individually do not get their fair share of the available margin and leads to a shortfall in medicine margin that will need to be recovered elsewhere from medicine reimbursement and ultimately CCGs.

In addition, where a CCG recommends prescribing the branded product because they see it as a cheaper approach, pharmacy contractors in the CCG’s catchment area do not have fair access to medicine margin as they do not retain medicine margin on brands. This also means that not all CCGs contribute equally to the £800 million medicine margin under the CPCF: so that a particular CCG may benefit as a consequence of paying a lower list price with little or no contribution to the £800 million margin, but CCGs as a cohort and the NHS overall will lose out as medicine margin has to be secured from other medicines.

Our proposal for reform

To address the problem outlined above we proposed that we change the distribution of medicine margin added to generic medicines in Category M. We proposed to add less medicine margin to those generic medicines for which branded equivalents are available and that are priced below the generic medicine, and as a consequence add more medicine margin on all other Category M medicines. This would help address the current distortion where certain generic medicines appear more expensive than the branded version.

It will also go some way to giving fairer access to medicine margin for pharmacy contractors, as generic prescriptions where there are also prescriptions for branded generic medicines will get less medicine margin for those generic prescriptions than traditionally; and the medicine margin to all contractors of those products whether written as brand or generic medicine will be less than typical generic reimbursement prices. The reimbursement price for other generic medicines, where branded generic medicines are not used, will increase for all pharmacies to ensure enough medicine margin is available. It also begins to ensure that all CCGs pay a fairer share of the medicine margin.

Consultation responses

We asked whether respondents agreed with the proposal. Out of 283 respondents, 170 agreed, 78 disagreed and 35 said they did not know.

Figure 5: responses Category M proposal

Figure 6: responses Category M proposal (excluding ‘don’t know’)

Most respondents supported the proposal. Nevertheless, several issues or concerns were raised by respondents, in particular:

Different solutions to address the problem with the current arrangements may be available

Several respondents thought that other solutions would be available, in particular generic substitution. Generic substitution allows pharmacists and other dispensers to fulfil a prescription for branded medicines by dispensing an equivalent generic medicine. This is currently not allowed in primary care legislation in England. The department consulted on introduction of generic substitution in England in 2010. The consultation response concluded:

In the light of the strong perception that generic substitution poses a threat to patient safety, the inconclusive position on cost effectiveness and the ability to utilise or explore other mechanisms to support the use of generic medicines, DH [DHSC] will not be progressing any further the implementation of generic substitution.[footnote 1]

Therefore, we will not be progressing generic substitution to address the reimbursement issue as set out above.

Another solution raised by respondents was to reimburse branded generic medicines at the reimbursement price of the generic medicine. However, we believe that this would risk incentivising more off patent medicines to be marketed and prescribed by brand – if the pharmacy is paid the same whether it dispenses a brand or a generic medicine, then there is potential for brand companies to develop brand loyalty schemes, again undermining the policy intention of supporting a vibrant generic market.

Pharmacy contractors may dispense at a loss

Respondents said that where pharmacy contractors dispense generic medicines in Category M with less medicine margin (that is those for which branded equivalents are available) they may dispense at a loss. While the proposal is that less medicine margin is added to generic medicines in Category M for which branded equivalents are available, medicine margin will still be added, therefore we would not expect to knowingly set a reimbursement price at a price lower than current selling prices. Reimbursement arrangements are not designed to pay every individual pharmacy exactly what they purchased the medicine for.

Fundamentally, it is recognised that there will be some ‘winning’ (that is where a pharmacy pays less than they are remunerated) and ‘losing’ (that is where a pharmacy pays more than they are remunerated) at an individual level. Taking into account the 2 mitigations in place (namely concessionary prices and adjustments to medicine margin) on average the reimbursement arrangements cover the cost of the product plus the amount of medicine margin that is set to contribute to the funding of the CPCF.

The proposal could lead to shortages and price increases

Some respondents said that the proposal could lead to shortages and price increases if branded generic manufacturers decide to leave the market, while others said there are already availability problems with branded generic medicines. The objective of the proposal is not to push manufacturers of branded generic medicines out of the market. Instead the proposal aims to ensure that all pharmacy contractors have fair access to medicine margin and all CCGs contribute equally to medicine margin.

Manufacturers of branded generic medicines can continue to supply as they do now.

The concern about withdrawal from the market is in contrast with other concerns raised that there are already availability problems with some branded generic medicines. Where a CCG decides to change to branded prescribing for a medicine, the number of prescriptions for that branded generic medicine increase and there is not always sufficient supply available to meet the increased demand. This leads to supply problems and patients having to go back to their GP to have their prescription changed.

Generic prescribing has guarded against shortages and price increases by encouraging competition. This competition ensures that pharmacies can access good levels of stock within the market. An additional advantage to generic prescribing is that it provides pharmacists with greater flexibility in relation to the products they are able to dispense to patients. It facilitates patients obtaining their medicines more quickly and allows pharmacies to hold less stock (that is they do not have to keep supplies of every supplier’s version of the product). This in turn leads to savings for the NHS.

The government acknowledges that branded generic medicines play a part in the mix of dispensed medicines. As argued in the consultation, this proposal ensures that branded generic medicines do not have an unfair advantage over generic medicines due to the medicine margin added to generics. Though this does not widely create problems in the system, respondents to the consultation raised the issue that there were more issues with filling branded generic prescriptions (such as continuity of supply, having to hold lots of different suppliers product) than with generic prescriptions.

A different discount deduction should apply to generic medicines in Category M with less medicine margin (that is those for which branded equivalents are available)

Several respondents said that if less medicine margin is added to generic medicines in Category M for which branded equivalents are available, then a different level of discount deduction should be applied. We will consider this as part of the discussion with the PSNC in phase 2.

Next steps

Considering the support for the proposal expressed in the public consultation, the government intends to progress this proposal. A more detailed discussion as to what level of medicine margin would be appropriate for branded generic and generic products listed in Category M and applying a different level of discount deduction to branded and generic products will be subject to discussion with the PSNC in phase 2 of the consultation.

Reimbursement prices of medicines in Category C which are prescribed generically but have multiple suppliers

Current reimbursement arrangements

Part VIIIA of the Drug Tariff is about generically prescribed medicines. As has been noted, there are essentially 3 categories of drugs listed in Part VIIIA of the Drug Tariff, referred to by the letters A, C and M. Category C products, in the main, are not generally available as a generic medicine. However, generic medicines without any competition or with very limited competition may also be in Category C.

Category C reimbursement prices are based on the price of a particular product or supplier. The Drug Tariff determination generally sets the reimbursement price as the price listed by the manufacturer or supplier on or before the 8th of the month being reimbursed.

This means that although reimbursement arrangements for Category C medicines assume that there is no competition for what, mostly, will be branded medicines, in reality there are Category C products where there is competition between products and suppliers – this is not currently reflected in the pricing mechanism.

The problem with the current arrangements

Where a Category C product is prescribed generically but more than one version of that product is available, then pharmacy contractors have a choice as to what they can dispense. This incentivises pharmacy contractors to source the cheapest product available, thus allowing them to retain as much medicine margin as possible.

However, the current reimbursement arrangements for medicines in Category C generally assume that they are branded medicines with no competition. In reality, there are multiple suppliers of some Category C products. Therefore, reimbursement prices for medicines with competition in Category C do not reflect actual selling/purchase prices and, as a consequence, more medicine margin than intended may be retained. Pharmacy contractors will source the medicine with the biggest margin against the list reimbursement price and not the medicine that has the lowest suppliers’ list price. As a consequence, the NHS and CCGs pay more for Category C medicines where there is competition, resulting in poor value for money.

As mentioned above the medicine margin survey measures what has been paid by pharmacy contractors compared to what they were reimbursed by the NHS. Where a Category C product is prescribed generically and pharmacy contractors have more than one choice as to what they can dispense, the distortive effect that it has on prescribing decisions means that pharmacies have to keep lots of different brands in stock. When adjustments to the medicine margin are made, this has a direct effect on all pharmacy contractors and CCGs leading to the same issues with inequity and issues with cashflow (as these adjustments are made retrospectively) as outlined in the reforms above for Category A and C.

Our proposal for reform

To address the problem outlined above we proposed 2 options for generically prescribed products in Category C:

Option 1

Under option one, for branded medicines in Category C with multiple suppliers, we would determine the reimbursement price by using the weighted average of the relevant suppliers’ list prices as published in the Dictionary of medicines and devices (dm+d), adjusted for prescribing volume, instead of the supplier’s list price. The basket of prices would reflect the products in dm+d that could have been supplied to meet a generic prescription for the product in question.

We would work with the PSNC to introduce a process for pharmacy contractors to appeal a list price published on the Dictionary of medicines and devices (dm+d) which then fed into the weighted average calculation.

Option 2

Under option 2, for branded medicines in Category C with multiple suppliers, we would determine the reimbursement price using actual sales and volume data from suppliers. This would mean that those medicines would need to be included in the quarterly collection of sales and purchase information from manufacturers and wholesalers. Initially, this information will be gathered as a quarterly ad hoc request under Part 4 of the Health Service Products (Provision and Disclosure of Information) Regulations 2018. However, the department would then consult on amending the Regulations to include these medicines in quarterly collection arrangements, that parallel those under Part 3 of the Regulations.

Consultation responses

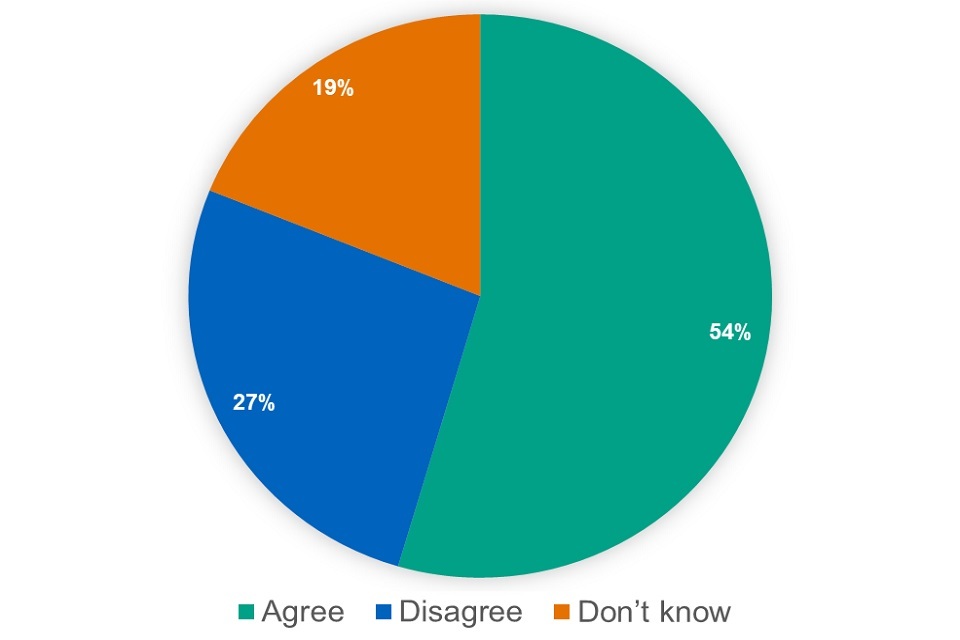

We asked whether respondents agreed with the proposal. Out of 283 respondents 114 agreed with the proposal, 117 disagreed and 52 said they did not know.

Figure 7: responses Category C proposal

Figure 8: responses Category C proposal (excluding ‘don’t know’)

40% of respondents agreed with the proposal and when removing those who said they did not know this increased to almost half of respondents. The issues or concerns raised most often by respondents were:

Concerns about risk to patient safety and access

Respondents felt that the proposal could encourage switching patients to different, cheaper brands where MHRA guidance dictates that the medicines must be prescribed by brand, for example in the case of category 1 antiepileptic drugs (if prescribed for any type of epilepsy). However, this proposal does not contradict MHRA guidance in this area. Prescribers should follow MHRA guidance and, where they prescribe a branded medicine, a pharmacy contractor must dispense that branded medicine and will be reimbursed the list price of the supplier.

Not all branded medicines in Category C are required to be prescribed by brand. For example, MHRA no longer requires all modified release products to be licensed as branded medicines but most of them are still marketed as brands and are therefore in Category C.

This proposal is about how pharmacy contractors would be reimbursed for a generically written prescription for a Category C medicine listed with a price in Part VIIIA of the Drug Tariff. Part VIIIA lists reimbursement prices for generic prescriptions only. Therefore, we believe it is right that the NHS gets value for money and the pharmacy contractor is incentivised to source the cheapest product available.

Branded medicines are dispensed at a loss after discount deduction which is not reflected in the current deduction scale

Several respondents raised that the current deduction scale which applies an assumed discount that does not reflect the difference in discounts between generic and branded medicines means that pharmacy contractors dispense Category C medicines at a loss. This is addressed by our proposal to change the deduction scale to reflect different levels of discount for generic and branded medicines, as set out in the ‘Changes to the deduction scale to reflect different levels of discount for branded and generic medicines’ section.

Options

We set out 2 options for this proposal, in summary:

Under option one for branded medicines in Category C with multiple suppliers, we would determine the reimbursement price by using the weighted average of the relevant suppliers’ list prices as published on dm+d. Under option 2 for branded medicines in Category C with multiple suppliers, we would determine the reimbursement price using actual sales and volume data from suppliers.

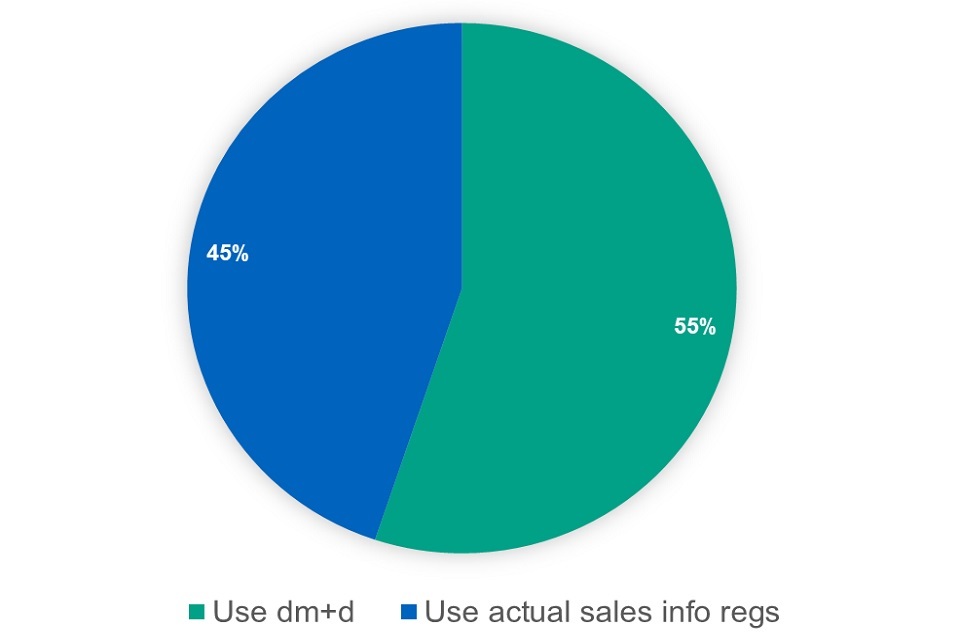

Figure 9: responses options Category C proposal

Figure 10: responses options Category C proposal (excluding ‘don’t know’)

Figure 11: responses options Category C proposal (excluding ‘don’t know’ and ‘neither’)

When asked which option respondents preferred, 49 respondents preferred option one, 80 preferred option 2, 105 said they preferred neither and 43 said they did not know. More respondents preferred the use of market data from suppliers obtained under the Regulations than those who preferred the use of weighted averages of the relevant suppliers’ list prices as published on the dm+d. The issues/concerns raised most often by respondents were:

Actual sales and volume data would create an additional burden on industry

Respondents representing industry said that providing information on more products than they do now would put an additional burden on them. While there would be an additional burden on industry, the information used to set reimbursement prices would reflect actual market prices rather than list prices. This is generally a preferable approach for setting reimbursement prices as it ensures that reimbursement prices reflect the actual prices that pharmacy contractors pay. The benefit of this would need to be balanced with the additional burden on industry.

Quarterly information is not sufficiently reactive to changes in the market

Some respondents were concerned that quarterly updates rather than monthly updates would mean that the Drug Tariff cannot respond quick enough to changes in the market. However, the government believes that using market information instead of list prices to inform Category C reimbursement prices will mean that reimbursement prices respond quicker to pharmacy purchase prices. Furthermore, the government has found that stability in the reimbursement price gives contractors confidence in purchasing. Changing the reimbursement prices on a monthly rather than quarterly basis could create considerable instability in market confidence, as contractors will not know from one month to the next what they are going to be reimbursed. Quarterly adjustments (as with current Category M) seem to strike the balance between stability and responsiveness. Furthermore, should these quarterly adjustments not be responsive enough, there are still the 2 mitigations of concessionary prices and retrospective medicine margin inquiry to ensure contractors are paid fairly and do not dispense at a loss.

dm+d list prices are not always accurate

Some respondents raised concerns about dm+d list prices not reflecting actual list prices. We continue to encourage companies to update dm+d, and the 2019 Voluntary Scheme for Branded Medicines Pricing and Access requires scheme members to update dm+d pricing information within 24 hours of a change to their NHS list price becoming effective. We will investigate reimbursement scenarios that can potentially be appealed if pharmacy contractors are concerned about a particular price; we will work with the PSNC regarding the detail of how this can be achieved.

Next steps

While recognising there was not a clear majority in favour or against the proposal, we will take this proposal, including the 2 options for implementation, forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above including the lack of a clear majority in favour of the proposal.

Inclusion of drugs (other than licensed and unlicensed medicines) with a reimbursement price in Part VIII

Current reimbursement arrangements

There are products treated as ‘drugs’ that are not medicines but that have been prescribed for medical purposes such as medical foods, commercially available food supplements and some dermatological products.

Some of these products have been included with a reimbursement price in Category A or C in Part VIIIA of the Drug Tariff. Drugs not listed with a reimbursement price are reimbursed under the non-Part VIII arrangements that is the list price of the manufacturer, wholesaler or supplier from which the dispensing contractor sourced the medicine.

The problem with the current arrangements

Under the non-Part VIII arrangements, namely the list price of the supplier (manufacturer or wholesaler), pharmacy contractors will source products with the biggest discount and not the drug that has the lowest list price. As a consequence, the NHS or CCGs may pay more for these products than is necessary.

As a result of the disparity in reimbursement, the amount paid for products that are in essence the same, varies across CCGs and within CCGs. Aligning prices so that they are more consistent across England would ensure contractors avoid excessive prices and on average achieve better value for money for these products.

Our proposal for reform

To address the problem outlined above we propose to include more ‘drugs’ that are not medicines with a reimbursement price in Part VIII.

We proposed 2 different options for the reimbursement of these particular drugs:

Option 1

Under option 1, for drugs that are not medicines but which are to be listed with a reimbursement price in the Drug Tariff, we would determine the reimbursement price by using the weighted average of the relevant suppliers’ list prices as published on the dm+d. The basket of prices would reflect the products in dm+d that could have been supplied to meet a generic prescription for the product in question.

We would work with the PSNC to introduce a process for pharmacy contractors to appeal a list price published on the dm+d which then fed into the weighted average calculation.

Option 2

Under option 2 for drugs that are not medicines, but which are to be listed with a reimbursement price in the Drug Tariff, we would determine the reimbursement price using actual sales data from suppliers. This would mean that the drugs in question would need to be included in the quarterly collection of sales and purchase information from manufacturers and wholesalers. Initially, this information would be gathered as a quarterly ad hoc request under Part 4 of the Health Service Products (Provision and Disclosure of Information) Regulations 2018. However, the department would then consult on amending the Regulations to include non-medicines in quarterly collection arrangements that parallel those under Part 3 of the Regulations.

Consultation responses

We asked whether respondents agreed with the proposal. Out of the 289 respondents to this question, 149 agreed with the proposal, 62 disagreed and 76 said they did not know.

Figure 12: responses ‘Inclusion of drugs’ proposal

Figure 13: responses ‘Inclusion of drugs’ proposal (excluding ‘don’t know’)

49% of respondents supported the proposal. When removing the respondents who said they did not know, this increased to 68%. Nevertheless, several issues or concerns were raised by respondents, in particular:

The proposal should not apply to drugs for which a licensed medicine is available

Respondents said that where a licensed medicine is available, the drug (for example a food supplement) should not be listed with a reimbursement price. We agree with this and this was our proposal but looking at the responses this may not have been clear in the consultation document. Where a licensed medicine is available it will not also be listed in Part VIII as a ‘drug’.

The proposal should not apply to drugs for which a special (unlicensed medicine) is available

Some respondents said that even if a product not classified as a medicine (such as a food supplement) has been prescribed, but an unlicensed medicine could be sourced, the pharmacy contractors should supply the unlicensed medicine. These respondents argued that this is what the hierarchy in Appendix 2 of MHRA guidance note 14: The supply of unlicensed medicinal products (‘specials’) requires them to do. However, Guidance note 14 provides advice on manufacture, importation, distribution and supply of unlicensed medicinal products and the hierarchy provides guidance on the use of licensed medicines and unlicensed medicines. The guidance and the hierarchy are not relevant for a prescription that is not clearly prescribed for a licensed or an unlicensed medicine. Where the prescriber is of the opinion that an unlicensed medicine needs to be supplied in order to meet the special needs of an individual patient, they need to add a clear indication on the prescription that an unlicensed medicine should be dispensed. In the absence of that indication, if there is a commercial product, such as a food supplement available, this should be supplied.

Pharmacists need to be free to use their professional judgement

Some respondents also said that General Pharmaceutical Council (GPhC) standard 5 on professional judgment requires the pharmacy contractor to use their professional judgment when faced with a generic prescription for a drug or appliance to decide whether it is clinically appropriate to supply a special (unlicensed medicine) instead. We agree: if it’s in the pharmacist’s professional judgment that they think the prescriber’s intentions is for the patient to be supplied an unlicensed medicine as set out above, it is for the prescriber to clearly indicate that an unlicensed medicine is required. In this instance, the prescriber needs to either issue a new prescription or amend the current one to make it clear that an unlicensed medicine is required.

Having a list set out in the Drug Tariff will make it clearer to prescribers that unless they indicate otherwise, the pharmacy will be reimbursed and therefore likely to dispense a commercially available product (for example a food supplement) rather than a bespoke special.

Pharmacy contractors should not dispense at a loss

A number of respondents thought the proposal would increase the risk that pharmacy contractors dispense at a loss. Reimbursement arrangements are not designed to pay every individual pharmacy exactly what they purchased the medicine for. Fundamentally, it is recognised that there will be some ‘winning’ (that is where a pharmacy pays less than they are remunerated) and ‘losing’ (that is where a pharmacy pays more than they are remunerated) at an individual level. Taking into account the 2 mitigations in place (namely concessionary prices and adjustments to medicine margin) on average the reimbursement arrangements cover the cost of the product plus the amount of medicine margin that is set to contribute to the funding of the CPCF.

Options

We set out 2 options for this proposal, in summary:

Under option 1, for ‘drugs’ that are not medicines, but which are to be listed with a reimbursement price in the Drug Tariff, we would determine the reimbursement price by using the weighted average of the relevant suppliers’ list prices as published on the dm+d.

Under option 2, for ‘drugs’ that are not medicines, but which are to be listed with a reimbursement price in the Drug Tariff, we would determine the reimbursement price using actual sales data from suppliers.

When asked which option respondents preferred, 86 preferred option one, 70 preferred option 2, 72 said they preferred neither and 53 said they did not know.

Figure 14: responses – options – ‘Inclusion of drugs’ proposal

Figure 15: responses – options – ‘Inclusion of drugs’ proposal (excluding ‘don’t know’)

Figure 16: responses – options – ‘Inclusion of drugs’ proposal (excluding ‘don’t know’ and ‘neither’)

More respondents preferred the use of weighted averages of the relevant suppliers’ list prices as published on the dm+d, than those who preferred the use of market data from suppliers obtained under the Regulations. The issues and concerns raised most often by respondents were:

Actual sales and volume data would create an additional burden on industry

Respondents representing industry said that providing information on more products than they do know would put an additional burden on them. While there would be an additional burden on industry, the information used to set reimbursement prices would reflect actual market prices rather than list prices. This is generally a preferable approach to setting reimbursement prices as it ensures that reimbursement prices reflect the actual prices that pharmacy contractors pay. The benefit of this would need to be balanced with the additional burden on industry.

Quarterly information is not sufficiently reactive to changes in the market

Some respondents were concerned that quarterly updates rather than monthly updates mean that the Drug Tariff cannot respond quick enough to changes in the market. However, the government believes that using market information instead of list prices to inform reimbursement prices will mean that reimbursement prices respond quicker to pharmacy purchase prices. Furthermore, the government has found that stability in the reimbursement price gives contractors confidence in purchasing. Changing the reimbursement prices on a monthly rather than quarterly basis could create considerable instability in market confidence as contractors will not know from one month to the next what they are going to be reimbursed.

Quarterly adjustments (as with current Category M) seem to strike the balance between stability and responsiveness. Furthermore, should these quarterly adjustments not be responsive enough there are still the 2 mitigations of concessionary prices and retrospective medicine margin inquiry to ensure contractors are paid fairly and do not dispense at a loss.

dm+d list prices are not always accurate

Some respondents raised concerns about the dm+d list prices not reflecting actual list prices. We continue to encourage companies to update dm+d, and the 2019 Voluntary Scheme for Branded Medicines Pricing and Access requires scheme members to update the dm+d pricing information within 24 hours of a change to their NHS list price becoming effective. We will investigate what reimbursement scenarios can be appealed if pharmacy contractors are concerned about a particular price, we will work with the PSNC regarding the detail of how this can be achieved.

Next steps

Considering the support for the proposal expressed in the public consultation, we will take the proposal, including the 2 options for implementation, forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above.

Reimbursement prices for non-part VIIIA products

Current reimbursement arrangements

Non-Part VIIIA products are those that are prescribed as a generic medicine, but their non-proprietary name is not listed with a reimbursement price in Part VIIIA of the Drug Tariff. These products include licensed medicines and drugs (as explained earlier in the ‘Inclusion of drugs (other than licensed and unlicensed medicines) with a reimbursement price in Part VIII’ section, these are products prescribed for a medical purpose such as medical foods, food supplements and some dermatological products). The department aims to include as many products as possible with a reimbursement price listed in Part VIIIA. However, it is not possible or practical to list every product available. Currently, non-Part VIIIA products are reimbursed at the list price of the supplier that the pharmacy contractor has sourced the product from, which can be the manufacturer or wholesaler.

The problem with the current arrangements

If the prescription is written generically for a non-Part VIIIA product, pharmacy contractors will source drugs with the biggest discount and not the drug that has the lowest list price. Because pharmacy contractors are reimbursed the list price of their supplier, the NHS or CCGs pay more for those products than is necessary.

As a result of the disparity in reimbursement, the amount paid for essentially the same products varies across CCGs and within CCGs. Aligning prices so that they are more consistent across England would ensure contractors avoid excessive prices and on average achieve better value for money for these products.

Our proposal for reform

To address the problems outlined above we proposed that:

For single-source products we base the non-Part VIIIA reimbursement price for prescriptions written generically on the manufacturer’s list price as published on the dm+d.

For multi-source products for prescriptions written generically, we base the non-Part VIIIA reimbursement price on average weighted list prices of suppliers as published on the dm+d. The weighted average of the supplier’s list prices from the previous month as published on the dm+d, will be published to provide an indicative reimbursement price to pharmacy contractors.

We would work with the PSNC to introduce a process for pharmacy contractors to appeal a list price published on the dm+d.

Consultation responses

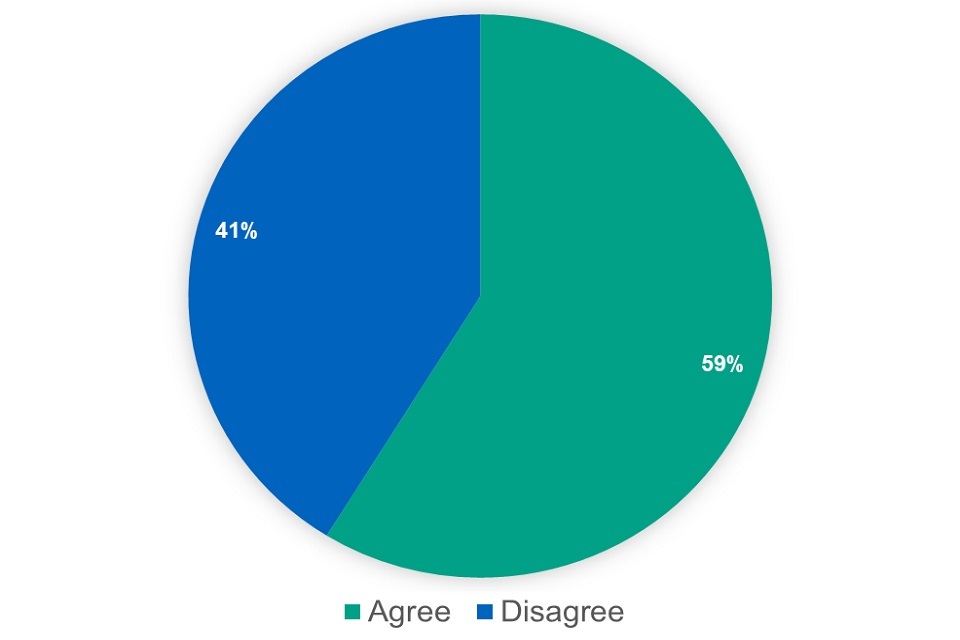

We asked whether respondents agreed with the proposal. Out of 269 respondents, 120 agreed with the proposal, 84 disagreed and 65 said they did not know.

Figure 17: responses ‘Non-Part VIIIA’ proposal

Figure 18: responses ‘Non-Part VIIIA’ proposal (excluding ‘don’t know’)

45% of respondents supported the proposal. When removing the respondents who said they did not know, this increased to 59%. Nevertheless, several issues or concerns were raised by respondents, in particular:

Providing an indicative reimbursement price for generic prescriptions for multi-source non-Part VIIIA drugs based on the previous month’s average weighted list prices is not fair on pharmacy contractors

Several respondents felt that pharmacy contractors should know the price they are reimbursed in the month that the product is supplied. However, there is a precedent for indicative prices, as current Category A reimbursement prices are also indicative. We believe it is unlikely that the prices will change significantly from one month to the next one.

Pharmacy contractors should not dispense at a loss

In light of the above, several respondents thought the proposal would increase the risk that pharmacy contractors dispense at a loss. However, as stated above, we believe it is unlikely that the prices will change significantly. Reimbursement arrangements are not designed to pay every individual pharmacy exactly what they purchased the medicine for. Fundamentally, it is recognised that there will be some ‘winning’ (that is where a pharmacy pays less than they are remunerated) and ‘losing’ (that is where a pharmacy pays more than they are remunerated) at an individual level. Taking into account the 2 mitigations in place (namely concessionary prices and adjustments to medicine margin) on average the reimbursement arrangements cover the cost of the product plus the amount of medicine margin that is set to contribute to the funding of the CPCF.

It is unclear how drugs not on dm+d would be reimbursed

A number of respondents pointed out that the proposal did not set out how non-Part VIIIA drugs not on the dm+d would be reimbursed. Management of the arrangement with those drugs will be subject to discussion with the PSNC in phase 2 of the consultation.

dm+d list prices are not always accurate

Some respondents raised concerns about the dm+d list prices not reflecting actual list prices. We continue to encourage companies to update the dm+d and the 2019 Voluntary Scheme for Branded Medicines Pricing and Access requires scheme members to update the dm+d pricing information within 24 hours of a change to their NHS list price becoming effective. We will look into what reimbursement scenarios can be appealed if pharmacy contractors are concerned about a particular price, we will work with the PSNC regarding the detail of how this can be achieved.

Next steps

Considering the support for the proposal expressed in the public consultation, we will take the proposal forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above.

Reimbursing and procuring unlicensed medicines (‘specials’)

Current reimbursement arrangements

Specials are products which have been specially manufactured or imported for the treatment of an individual patient after being ordered by a doctor, dentist, nurse independent prescriber, pharmacist independent prescriber, supplementary prescriber. An unlicensed medicinal product of this sort may only be supplied in order to meet the special needs of an individual patient. An unlicensed medicinal product of this sort should not be supplied where an equivalent licensed medicinal product can meet the special needs of the patient.

The most commonly prescribed specials are listed with a reimbursement price in Part VIIIB of the Drug Tariff. Reimbursement prices are based on quarterly information from suppliers obtained under the Health Service Products (Provision and Disclosure of Information) Regulations 2018. Specials are included in Part VIIIB of the Drug Tariff when they fulfil the minimum spend and/or volume requirements.

Any special not listed in Part VIIIB of the Drug Tariff is reimbursed at the invoice price (less any discount or rebate).

Part VIIIB was introduced in 2011 and as a consequence the average reimbursement price of a special has gone down from £191 in 2010 to £121 in 2020. The average cost of a special listed with a reimbursement price in Part VIIIB was £49 and the average cost of a non-part VIIIB special was £230 in 2020. The introduction of Part VIIIB, together with a reduction in prescribing of specials, reduced NHS expenditure on specials in the community from £136 million in 2010 to £47 million in 2020.

The problem with the current arrangements

The reimbursement arrangements for specials listed with a reimbursement price in Part VIIIB work well, but the scope of Part VIIIB is currently restricted to manufactured non-solid dosage forms (for example liquids, creams and lotions) while 40% (about £26 million) of our expenditure on specials is on tablets and capsules, the majority of which are imported.

For non-Part VIIIB specials there is no incentive for pharmacy contractors to source at the cheapest price possible because they are reimbursed the invoice price (less any discount or rebate). As a consequence, the prices paid for those specials vary enormously and, in some instances, pharmacy contractors appear to have been charged excessive prices that do not reflect the cost of manufacturing the special.

Our proposals for reform

To address the problem outlined above we proposed that, where possible, we include tablets and capsules (any other formulations not covered by current arrangements) with a reimbursement price in Part VIII of the Drug Tariff. Manufacturers and wholesalers are already providing information about approximately 100 tablets and capsules (covering 95% of our expenditure on special capsules and tablets).

For those specials for which we cannot introduce a reimbursement price in Part VIII we sought views on 4 possible solutions.

Once we include capsules and tablets with a reimbursement price in Part VIII of the Drug Tariff, these proposed solutions would have covered circa 49,000 items representing about £16 million in expenditure in 2020.

Option 1: quotes

We would require pharmacy contractors to seek 2 quotes and to submit those quotes to the NHS BSA. Pharmacy contractors would be reimbursed the price of the cheapest quote but would also continue to be remunerated the £20 SP fee.

While this would be a relatively straightforward option, we believe that this option is unlikely to address the problem as the 3 quotes may not be the cheapest options available.

Option 2: central approvals service

DHSC or NHS England and NHS Improvement (NHSE&I) would set up or procure a central approvals service for quotes for non-Part VIIIB specials.

We would require pharmacy contractors to seek approval from the central approvals service for every quote for a non-Part VIIIB special. The central approval service then either approves or declines the quote. If the quote is declined, then the service would provide the pharmacy contractor with an indication of what would be an acceptable price. We believe that the majority of quotes can be dealt with relatively easily based on historic purchase prices.

A more sophisticated central approvals service could also liaise with pharmacies and GPs where specials have been prescribed for which either a licensed alternative is available or a special listed with a reimbursement price in Part VIIIB.

The pharmacy contractor would be reimbursed the invoice price of the special that is dispensed and would also continue to be remunerated the £20 SP fee.

Alternatively, each CCG could set up their own approvals service, but we believe it would be preferable to centralise this task to ensure an efficient service and central knowledge about pricing of specials.

Option 3: procurement

DHSC and NHSE&I would procure non-Part VIIIB specials for pharmacy contractors. There are 2 options for this:

a) central supply of non-Part VIIIB specials

b) a central procurement service for non-Part VIIIB specials

Option 3a: central supply

DHSC and NHSE&I would procure the central supply of non-Part VIIIB specials to pharmacies. This could be one or multiple (regional) contracts, with the expectation that the contractor who won the contract might sub-contract some supply that it could not fulfil itself.

Pharmacy contractors would be required to contact the central service for each prescription for a special. The central supply service then provides the pharmacy with the special, either directly or indirectly via a sub-contractor.

Pharmacy contractors would not be reimbursed but they would continue to be remunerated the £20 SP fee.

Option 3b: central procurement service

DHSC and NHSE&I would procure a central procurement service for non-Part VIIIB specials. The contract would be for a service that sources specials at the cheapest possible price by sourcing from across the industry (but the service does not directly supply or pay for the special). NHSE&I would then pay the company supplying the special directly.

Pharmacy contractors would be required to contact the central service for each prescription for a special. The central supply service would then seek the cheapest supplier who will provide the special to the pharmacy.

Pharmacy contractors would not be reimbursed but they would continue to be remunerated the £20 SP fee.

Consultation responses

Tablets and capsules

We asked whether respondents agreed with the proposal to include tablets and capsules with a reimbursement price in Part VIII of the Drug Tariff. Out of 286 respondents, 156 agreed with the proposal, 76 disagreed and 54 said they did not know.

Figure 19: responses ‘Specials capsules and tablets’ proposal

Figure 20: responses ‘Specials capsules and tablets’ proposal (excluding ‘don’t know’)

Most respondents supported the proposal. Nevertheless, several issues or concerns were raised by respondents, in particular:

The Drug Tariff is not sufficiently responsive where prices are set quarterly

Some respondents were concerned that quarterly updates rather than monthly updates, meant that the Drug Tariff cannot respond quick enough to changes in the market. However, the government believes that using market information instead of list prices to inform reimbursement prices will mean that reimbursement prices respond quicker to pharmacy purchase prices. Furthermore, the government has found that stability in the reimbursement price gives contractors confidence in purchasing. Changing the reimbursement prices on a monthly rather than quarterly basis could create considerable instability in market confidence as contractors will not know from one month to the next what they are going to be reimbursed.

Quarterly adjustments (as with current Category M) seem to strike the balance between stability and responsiveness. Further, should these quarterly adjustments not be responsive enough, there are still the 2 mitigations of concessionary prices and retrospective medicine margin inquiry to ensure contractors are paid fairly and do not dispense at a loss.

Moving from endorsement to reimbursement prices increases the risk that pharmacy contractors dispense at a loss

Some respondents thought the proposal would increase the risk that pharmacy contractors dispense at a loss. However, for special capsules and tablets there is currently no incentive for pharmacy contractors to source at the cheapest price possible because they are reimbursed the invoice price (less any discount or rebate). Consequently, the prices paid for those specials vary enormously and in some instances, pharmacy contractors appear to have been charged excessive prices. As set out above, the addition of an appropriate medicine margin to tablets and capsules will ensure that pharmacy contractors are still able to purchase at or below the reimbursement price, and where selling prices increase a concessionary price could be set.

Reimbursement arrangements are not designed to pay every individual pharmacy exactly what they purchased the medicine for. Fundamentally, it is recognised that there will be some ‘winning’ (that is where a pharmacy pays less than they are remunerated) and ‘losing’ (that is where a pharmacy pays more than they are remunerated) at an individual level. Taking into account the 2 mitigations in place (namely concessionary prices and adjustments to medicine margin) on average the reimbursement arrangements cover the cost of the product plus the amount of medicine margin that is set to contribute to the funding of the CPCF.

Several issues of technical detail were raised such as inclusion criteria for special capsules and tablets to be listed with a reimbursement price in the Drug Tariff and allowing broken bulk and special containers. We will discuss these issues with the PSNC in phase 2 of the consultation.

Non-Part VIIIB specials

For those specials for which we cannot introduce a reimbursement price in Part VIII we sought views on 4 possible solutions:

-

require pharmacies to obtain 3 quotes for non-Part VIII specials (‘quotes’)

-

set up or procure a central approvals service for non-Part VIII (‘central approvals service’)

-

procure the central supply of non-Part VIII specials and then supply on to pharmacies (‘central supply’)

-

procure a service that sources specials on behalf of the NHS (‘central procurement service’)

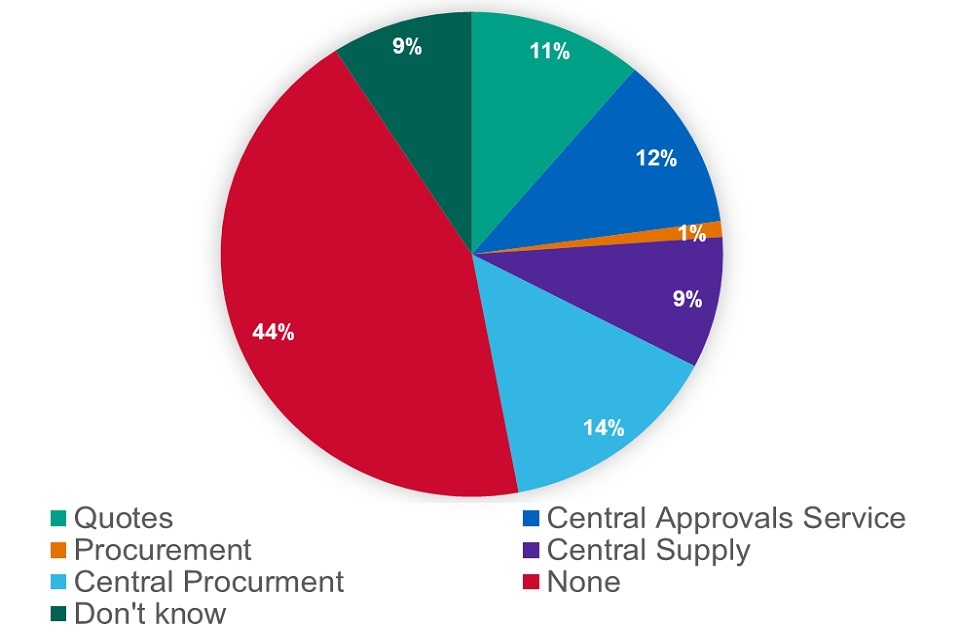

Figure 21: responses – ‘Solutions – non-Part VIIIB specials’ proposal

We asked which solution respondents preferred. Out of 285 respondents, 32 expressed a preference for quotes, 33 for a central approvals system, 25 for central supply, 41 for central procurement and 3 for any procurement solution. 144 respondents did not like any of the options and 26 said they did not know.

Figure 22: responses – ‘Solutions – non-Part VIIIB specials’ proposal (excluding ‘don’t know’)

44% of respondents said they did not like any of the solutions. When we excluded those responses and those who said they did not know, this showed that preferences were divided almost equally across the 4 options with 51% preferring one of the procurement solutions.

While respondents generally shared the analysis of the problem with non-Part VIIIB specials as set out above, they also raised a range of issues/concerns in relation to the proposed solutions. The issues/concerns raised most often by respondents were:

-

Delays to patients getting their specials for all the proposed solutions.

-

The loss of flexibility in sourcing specials to meet the needs of patients in all the proposed solutions.

-

The additional burden on pharmacy contractors, in particular if they would need to obtain 3 quotes for every non-part VIIIB special.

-

The lack of savings the solutions would generate.

Figure 23: responses – ‘Solutions – non-Part VIIIB specials’ proposal (excluding ‘don’t know’ and ‘none’)

The impact on the market of the procurement solutions that is these could remove competition, which in the long term will lead to higher prices.

Alternative solutions were raised including: pre-approved manufacturers and importers, including more specials with a reimbursement price in Part VIII, include preferred specials as indicated by doctors’ bodies with a reimbursement price in the Part VIII, make use of NHS manufacturers, make GP software identify licensed alternatives, a wholesale role for NHSE&I and provide information to pharmacy contractors about prices and sources.

Next steps

Considering the support for the proposal expressed in the public consultation, we will take the proposal to include special capsules and tablets with a reimbursement price in the Drug Tariff forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above.

We will also take the proposal for non-Part VIIIB specials forward to phase 2 of the consultation with the PSNC. Together with the PSNC, NHSE&I and the Association of Pharmaceutical Specials Manufacturers (APSM) we will work on implementing an appropriate solution to address the problems with non-Part VIIIB specials, taking account of the issues and concerns raised in the public consultation as set out above.

Reimbursement of generically prescribed appliances and drugs dispensed as ‘specials’

Current reimbursement arrangements

There are instances where a pharmacy contractor dispenses a special (that is an unlicensed medicine – see the previous chapter) against a generically written prescription when they could have dispensed an appliance or, in other cases, a drug that is not a special.

If an appliance is dispensed, the pharmacy contractor will be reimbursed the reimbursement price listed in Part IX of the Drug Tariff. If a drug other than a special is dispensed, unless there is a reimbursement price listed in the Drug Tariff, the pharmacy contractor is reimbursed the list price of the supplier that the pharmacy contractor has sourced the drug from, which may be a manufacturer or wholesaler.

If a special is dispensed, the pharmacy contractor will be reimbursed either the Part VIIIB reimbursement price or the invoice price (less any discount and rebate) and will be remunerated the £20 SP fee.

The problem with the current arrangements

If a product is listed as an appliance in Part IX of the Drug Tariff, it cannot also be considered a medicine.

Appliances have to comply with requirements that show that the device is fit for the intended purpose stated and meets legislation relating to safety. To meet this requirement, they must undergo conformity assessments which is followed by the CE/UKCA mark that is then placed on the appliance.

Specials are generally more expensive than appliances and drugs and in addition, pharmacy contractors are paid a £20 fee every time they dispense a special. In the main, when a pharmacy contractor chooses to dispense a special where other options were available, this costs the NHS more. This is because it is likely that this approach would pay more than it would have done if the pharmacy contractor had dispensed an appliance or drug. Thereby not resulting in good value for money for the NHS from the spend on these products. Furthermore, prescribers have no clarity as to what their patients may be dispensed if they issue a generically written prescription. This leads to the possibility that patients might be fluctuating between an appliance and a special or between a drug and a special.

Our proposal for reform

To address the problem outlined above we proposed that where there is an appliance available listed in Part IX, pharmacy contractors will be reimbursed the price of the appliance in Part IX for a generically written prescription (unless the prescription specifically indicates unlicensed / special order product), regardless of whether they dispensed an appliance or a special.

We also proposed that where pharmacy contractors receive a generically written prescription that can be fulfilled either by a drug (non-medicines that have been prescribed for medical purposes) or a special; they are reimbursed either the reimbursement price for the drug in Part VIIIA or, where there is no reimbursement price listed in the Drug Tariff, are reimbursed under the new non-Part VIIIA reimbursement arrangements for drugs (that is weighted average list prices of suppliers as published on dm+d or the manufacturer’s list price as on dm+d).

This will increase transparency for both prescribers and patients regarding what will be dispensed against a prescription, and for pharmacies it will be clear what they will be reimbursed for. In addition, this will secure greater value for money for the NHS by restricting reimbursement prices for generic prescriptions that could be fulfilled by a special (which is often more expensive) or a drug that is not a licensed medicine to the cost of the available drug. This proposal does not impinge on the clinical freedom of healthcare professionals, as they will still be able to indicate on the prescription where a special is required for their patient, but it does provides transparency around reimbursement in situations where both types of product are available on the market.

Consultation responses

We asked whether respondents agreed with the proposal. Out of 288 respondents, 110 agreed with the proposal, 101 disagreed and 77 said they did not know.

Figure 24: responses ‘Appliances or drugs vs. specials’ proposal

Figure 25: responses ‘Appliances or drugs vs. specials’ proposal (excluding ‘don’t know’)

38% of respondents agreed with the proposal. When removing the respondents who said they did not know, this increased to 52%. The main issue or concern raised by respondents was that the proposal would conflict with existing MHRA guidance and GPhC standards.

When a drug or appliance has been prescribed generically and a special (unlicensed medicine) can be sourced then pharmacy contractors should supply the special rather than the food supplement and should be reimbursed for the special

Respondents argued that this is what the hierarchy in Appendix 2 of MHRA guidance note 14: The supply of unlicensed medicinal products (‘specials’) requires them to do.

Guidance note 14 however provides advice on manufacture, importation, distribution and supply of unlicensed medicinal products and the hierarchy provides guidance on the use of licensed and unlicensed medicines. The guidance and the hierarchy are not relevant for a prescription that is not clearly prescribed for a licensed or an unlicensed medicine. Where the prescriber is of the opinion that an unlicensed medicine needs to be supplied in order to meet the special needs of an individual patient, they need to add a clear indication on the prescription that an unlicensed medicine should be dispensed. In the absence of that indication, if there is an appliance available, this should be supplied.

Pharmacists should remain free to use their professional judgement

Some respondents also said that General Pharmaceutical Council (GPhC) standard 5 on professional judgment requires the pharmacy contractor to use their professional judgment when faced with a generic prescription for a drug or appliance to decide whether it is clinically appropriate to supply a special (unlicensed medicine) instead. We agree, if it’s in the pharmacist’s professional judgment that they think the prescriber’s intention is for the patient to be supplied with an unlicensed medicine as set out above, it is for the prescriber to clearly indicate that an unlicensed medicine is required. In this instance, the prescriber needs to either issue a new prescription or amend the current one to make it clear that an unlicensed medicine is required.

It is, however, important that prescribers know that when they prescribe a drug that is not a licensed medicine, a commercially available product would be supplied unless they indicate that a special (unlicensed medicine manufactured or imported) must be supplied. We will therefore work with NHSE&I to provide guidance to prescribers.

Next steps

Considering the support for the proposal expressed in the public consultation, we will take the proposal forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above.

Deduction scale reflecting different levels of discount for branded and generic medicines

Current reimbursement arrangements

Pharmacy contractors are paid monthly for the items they dispensed in a given month. Every month a deduction is made to their payments, based on a scale known as the ‘deduction scale’. This is an assumed amount of discount received to avoid pharmacy contractors having to calculate and declare discount received on each item dispensed.

Currently, the deduction scale is based on the monthly total of prices paid to the pharmacy contractor with a minimum of 5.63% and a maximum of 11.5% deducted from the monthly total. The amounts within this maximum and minimum are set out in a table in the Drug Tariff.[footnote 2]

The problem with the current arrangements

We know from information obtained from pharmacy contractors, as part of the medicine margin survey, that branded medicines do not attract as much discount as generic medicines. When taking into account the deduction scale, pharmacy contractors, on average, dispense branded medicines at a loss. Currently as indicated above, the deduction scale does not take into account whether a pharmacy contractor dispenses more brands or generic medicines. Consequently, pharmacy contractors that dispense more branded medicines than average do not have fair access to medicine margin. Additionally, CCGs in areas where more branded medicines are prescribed are not paying their fair share of medicine margin.

Our proposal for reform

To address the problem outlined above we proposed that the deduction scale is split into 2 separate scales, one for generic medicines and one for branded medicines. This will, on average, improve fair access to the medicine margin for community pharmacies and it will improve the deduction scale apportionment to CCGs.

Separately, NHSE&I would need to consider amendments to the CCG apportionment arrangements with a view to making them more equitable.

Additionally, to complement this measure we proposed to decrease the medicine margin included in the Drug Tariff reimbursement price of Category M products where a branded alternative appears less expensive than the Category M product (M2 products). The changes to the deduction scale outlined in this reform could mitigate any impacts on pharmacy cashflow driven by a reduction in the medicine margin added to these products, if the proposed brands deduction scale were also applied to M2 products. In phase 2 we will discuss the detail of how we implement the proposal with the PSNC, taking account of the issues as above.

Consultation responses

We asked whether respondents agreed with the proposal. Out of 289 respondents, 206 agreed with the proposal, 36 disagreed and 45 said they did not know.

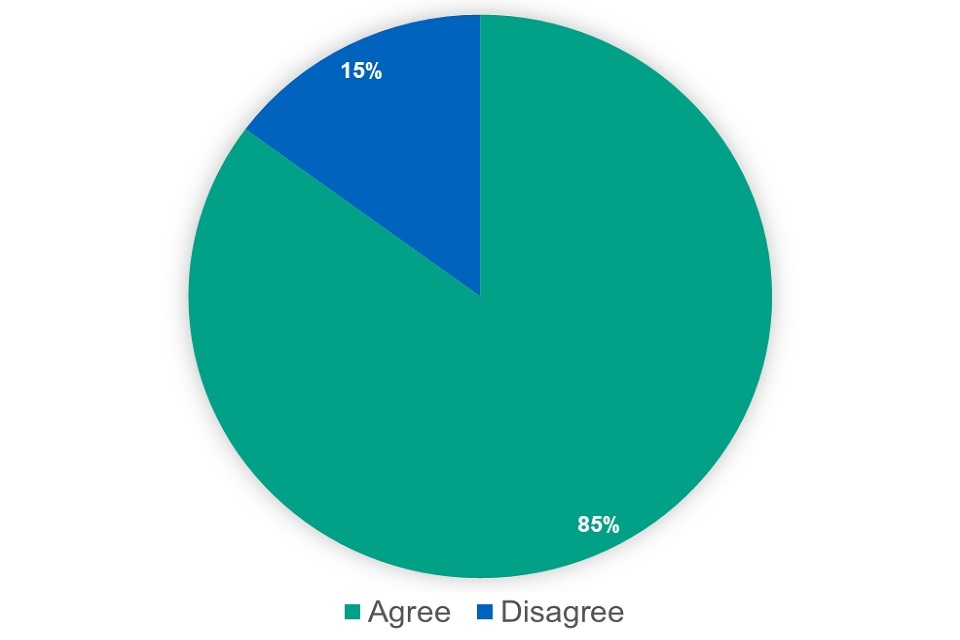

Figure 26: responses ‘Deduction scale’ proposal

Figure 27: responses ‘Deduction scale’ proposal (excluding ‘don’t know’)

A very large majority of respondents supported the proposal. The main issue or concern raised was that any change to the deduction scale should not leave the average pharmacy contractor worse off. Some respondents made suggestions for extending the existing scales, introducing different scales for different types of pharmacies and a zero-scale for branded medicines. We will discuss these implementation issues with the PSNC in phase 2 of the consultation.

Next steps

Considering the support for the proposal expressed in the public consultation, we will take the proposal forward to phase 2 of the consultation with the PSNC. In phase 2 we will discuss the detail of how we implement the proposal taking account of the issues and concerns raised in the public consultation as set out above.

With NHSE&I we will continue to discuss amendments to the CCG apportionment arrangements, with a view to making them more equitable.

Impact assessment

Alongside this consultation response we have published the final impact assessment. We have made several improvements to the original impact assessment including in response to the consultation. Most notably, we have assessed the impact on dispensing doctors for each proposal and have taken into account where relevant, the loss of income from the voluntary and statutory schemes for branded medicine spend. In addition, we have also made several methodological changes

Dispensing doctors

In the consultation document we recognised that some of the proposals impact either directly or indirectly on others, aside from pharmacy contractors, in the supply chain. This includes manufacturers and wholesalers, and more widely on the NHS, in particular Dispensing Doctors, and also Clinical Commissioning Groups who pay for the cost of prescribed products in their areas.