NHS Pension Scheme: proposed changes to Scheme Regulations

Updated 27 May 2021

Applies to England and Wales

1. Introduction

The Department of Health and Social Care (DHSC) is consulting on a draft statutory instrument (SI) entitled: The National Health Service Pension Schemes and Injury Benefits (Amendment) Regulations 2021 (the ‘Draft Regulations’).

The Draft Regulations propose amendments to the regulations that provide the rules for the NHS Pension Schemes and the NHS Injury Benefits Scheme in England and Wales.

1.1 The legal framework for the NHS Pension Schemes

There are two NHS Pension Schemes: the reformed 2015 NHS Pension Scheme (the ‘Scheme’) and the closed legacy 1995/2008 NHS Pension Scheme (the ‘1995/2008 Scheme’), which is divided into the 1995 and 2008 Sections. Accordingly, there are 3 sets of regulations under which entitlement to pension and other benefits are calculated:

-

The National Health Service Pension Scheme Regulations 1995 (as amended) (S.I. 1995/300) (the ‘1995 Regulations’)

-

The National Health Service Pension Scheme Regulations 2008 (as amended) (S.I. 2008/653) (the ‘2008 Regulations’)

-

The National Health Service Pension Scheme Regulations 2015 (as amended) (S.I. 2015/94) (the ‘2015 Regulations’).

1.2 The legal framework for the NHS Injury Benefits Scheme

The National Health Service (Injury Benefits) Regulations 1995 (as amended) (S.I. 1995/866) (the ‘Injury Benefits Regulations’) set out the rules governing the operation of the NHS Injury Benefits Scheme. The NHS Injury Benefits Scheme provides a replacement income to certain NHS employees and general practitioners who sustained an injury, disease or other health condition in the course of their employment on or before 30 March 2013.

Reforms to the NHS Injury Benefits Scheme saw those arrangements replaced from 31 March 2013 by contractual payments from NHS employers. However, NHS employees who sustained an injury or contracted a disease on or before 30 March 2013 can still access the NHS Injury Benefits Scheme until 30 March 2038 in circumstances where there was a delayed onset of symptoms and there is evidence that the disease or injury occurred on or before 30 March 2013.

1.3 Proposed changes to the NHS Pension Scheme and NHS Injury Benefits Scheme Regulations

In summary, the Draft Regulations amend the above-mentioned Scheme Regulations for the following purposes:

-

equalise the entitlement to survivor pensions for male survivors of female scheme members who would otherwise receive a lower pension under existing rules, following the Employment Tribunal decision in Goodwin v Secretary of State for Education [1308506/2019]

-

further to the changes required following Goodwin v Secretary of State for Education, remove certain amendments to the 1995 Regulations made by the Civil Partnership (Opposite Sex Couples) Regulations 2019 (S.I. 2019/1458)

-

ensure that payments and allowances under the New to Partnership Payments (N2PP) Scheme, introduced by NHS England and NHS Improvement (NHS E&I) in 2020, are treated as non-pensionable earnings for both GPs and non-GP providers

-

reform the final pay control provisions of the 1995 Regulations, following a review and recommendations by the NHS Pension Scheme's Scheme Advisory Board

-

make miscellaneous amendments to correct minor errors or omissions in the NHS Pension Scheme Regulations and the NHS Injury Benefits Scheme Regulations

This document explains the purpose and effect of the provisions set out in the Draft Regulations. Throughout this document ‘amending regulation x’ refers to a regulation in the Draft Regulations. It should be read in conjunction with the Draft Regulations.

1.4 Consultation questions

The department welcomes any comments or views on the proposals set out in this document and the Draft Regulations, including evidence to support the response.

Respondents are invited to consider the following questions:

Do you agree or disagree that the proposed amendments to the NHS Pension Scheme Regulations and the Injury Benefit Scheme Regulations should be made?

Please provide details as to your answer

Do you think any changes are needed to ensure the proposed amendments deliver the policy objectives set out in the consultation document?

Please provide details as to your answer

In relation to chapter 6, are there any further considerations and evidence that you think the department should take into account when assessing any equality issues arising as a result of the proposed changes, and in particular whether there may be any potential impact on people who share a protected characteristic (age, disability, gender re-assignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex (gender) or sexual orientation).

2. How to respond

Comments on the proposals and draft legislation can be submitted online or by email to: nhspsconsultations@dhsc.gov.uk.

The consultation will close at midnight on 8 April 2021.

3. Confidentiality of information

We manage the information you provide in response to this consultation in accordance with the Department of Health and Social Care’s personal information charter.

Any information received, including personal information, may be published or disclosed in accordance with the access to information regimes (primarily the Freedom of Information Act 2000 (the ‘FOIA’), the Data Protection Act 2018 (the ‘DPA 2018’) and the Environmental Information Regulations 2004.

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals, amongst other things, with obligations of confidence. In view of this it would be helpful if you would explain to us why you regard the information that you have provided as confidential. If we receive a request for disclosure of the information you have provided, we will take full account of your explanation, but we cannot give an assurance that confidentiality will be maintained in all circumstances.

An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the department.

The department will process your personal data in accordance with the DPA 2018 and, in most circumstances, this will mean that your personal data will not be disclosed to third parties.

4. Survivor benefits - male survivors of female members

4.1 History of survivor benefits in the NHS Pension Scheme

Changes to survivor benefits introduced by the Social Security Act 1986 resulted in the NHS Pension Scheme providing survivor benefits to widowers (male survivors of opposite-sex marriages) based on the female spouse’s service from 6 April 1988 onwards. Female members were given a time-limited opportunity to purchase survivor benefit entitlement for service before 6 April 1988 (referred to as ‘service pre-1988’).

With the introduction of both same-sex civil partnerships and same-sex marriages, the NHS Pension Scheme provided survivor benefits in respect of both which were in line with those paid to widowers. As with widowers, members were given a time-limited opportunity to purchase survivor benefit entitlement for service pre-1988.

Following the Supreme Court judgment in the case of Walker v Innospec Ltd [2017 UKSC 47], the government decided that surviving same-sex spouses and civil partners of public service pension scheme members would, in certain cases, receive benefits equivalent to those received by widows (female survivors of opposite-sex marriages). The entitlement of widows is based on service that includes service pre-1988.

Changes to the 1995 Regulations as a consequence of the Walker judgment were implemented from 1 April 2019 and were made with retrospective effect. The changes applied to civil partners from 5 December 2005 (the date civil partnerships were introduced) and same-sex spouses from 13 March 2014 (the date marriage for same-sex couples was introduced).

The changes made in 2019 extended automatic cover for pre-1988 service to same-sex civil partners and same-sex spouses, and the associated provisions relating to the facilities allowing relevant members to purchase additional survivor benefit entitlements or nominate their partner to receive cover for pre-1988 service were removed.

4.2 Goodwin v the Secretary of State for Education

In June 2020, the Employment Tribunal handed down its judgment in Goodwin v the Secretary of State for Education [1308506/2019]. The tribunal considered the rules on survivor benefits in the Teacher's Pension Scheme and concluded that a female member in an opposite-sex marriage was treated less favourably than a female member in a same-sex marriage or civil partnership, and that treatment amounted to direct discrimination on the grounds of sexual orientation. As a direct result of this discrimination, male survivors of female members were entitled to a lower rate of survivor benefit than a comparable same-sex survivor. Consequently, the relevant provisions of the Teachers' Pension Scheme Regulations 2010 were found to be in breach of the non-discrimination rule set out in Section 61 of the Equality Act 2010.

Following the judgment in Goodwin, the Chief Secretary to the Treasury made a written ministerial statement on behalf of the government on 20 July 2020. The Chief Secretary to the Treasury announced:

The government has concluded that changes are required to the Teachers' Pension Scheme to address the discrimination. The government believes that this difference in treatment will also need to be remedied in those other public service pension schemes, where the husband or male civil partner of a female scheme member is in similar circumstances.

Accordingly, the department is consulting on amendments to equalise the position of female members in opposite-sex marriages or civil partnerships with that of female members in same-sex marriages or civil partnerships under the 1995 Regulations.

There are no proposed amendments to the 2008 Regulations or the 2015 Regulations as the rate of survivor benefits have already been fully equalised in both the 2008 Section and 2015 Scheme.

4.3 Proposed changes to the 1995 Regulations

The department proposes to amend the 1995 Regulations to equalise the survivor benefits payable to a male survivor of a female member in circumstances where the entitlement to benefits arose on or after 5 December 2005 (the date on which legislation recognising same-sex civil partnerships came into force). The entitlement of a male survivor of a female member who died before this date is unaffected.

Changes to the 1995 Regulations to equalise the benefits payable to surviving spouses of same-sex couples following the Walker decision came into force on 1 April 2019[footnote 1]. The proposed amendments to equalise the survivor benefits payable to male civil partners and spouses of female members will also have effect from 1 April 2019. Arrears of survivor benefits may be payable to a surviving spouse or civil partner from the date on which the benefits became payable, provided that the member died after 5 December 2005.

Where a surviving spouse or civil partner would have been entitled to a back payment, but they died on or after 1 April 2019, this will be payable to their estate. In circumstances where the surviving male spouse died on or before 31 March 2019, there will be no adjustment of benefits payable to the estate because the entitlement arose prior to 1 April 2019.

4.4 Proposed draft amending regulations

The above changes are provided for by draft amending regulations 6 to 10, which amend the following regulations of the 1995 Regulations respectively:

- Regulation G7 (widower’s pension); Regulation G8 (dependent widower’s pension)

- Regulation G9 (increased widower’s pension)

- Regulation G16 (purchase of surviving partner’s pension in respect of service before 6 April 1988)

- Regulation G17 (increased surviving partner's pension)

4.5 Implementation

As a result of the amendments described above, some surviving male spouses and civil partners may become entitled to an increased survivor pension. This will in turn have an impact on the position of female members who purchased increased survivor benefits for their male spouse or civil partner, either by additional voluntary contributions or electing for a reduced lump sum at retirement. Where increased benefits are payable to male surviving spouses and civil partners of female members following the proposed amendments, female members who have purchased additional benefits for their male spouse may be entitled to a refund of any additional contributions paid or a further lump sum payment.

The NHS Business Services Authority (BSA), the Scheme administrator, will review member records to identify and contact the members and recipients of survivor pensions who could benefit from the change. Members and recipients of survivor benefits will not need to take any action to instigate this process. The BSA has the authority to make any payments in arrears as necessary prior to the proposed amendments being enacted.

5. Entitlement for survivors of opposite-sex civil partners

5.1 The Civil Partnership (Opposite-sex Couples) Regulations 2019

The Civil Partnership Act 2004 (the ‘2004 Act’) came into force on 5 December 2005, establishing the right for same-sex couples to form a civil partnership. The act granted civil partnerships legal rights and responsibilities very similar to civil marriages. Survivor pensions for same-sex civil partners were first introduced as a scheme benefit in the 1995 Regulations from 5 December 2005.

In February 2018, the government commenced a review of civil partnerships with a view to expanding them to include opposite-sex couples. In June 2018, the Supreme Court handed down its judgment in R (on behalf of Steinfeld and Keidan) v the Secretary of State for the International [UKSC 2017/0060], which held that restricting civil partnerships to same-sex couples was incompatible with the European Convention on Human Rights.

Consequently, the Civil Partnership (Opposite-sex Couples) Regulations 2019 (S.I. 2019/1458) (the ‘Civil Partnership Regulations’), which extended civil partnerships to opposite sex couples, came into force on 2 December 2019.

An important change made by the Civil Partnership Regulations was to alter the basic definition of ‘civil partnership’ in the 2004 Act so that it includes both same-sex and opposite-sex couples. The 1995 Regulations adopt the definition of ‘civil partner’ and ‘civil partnership’ set out in the 2004 Act, which means that any references to civil partners or civil partnerships in those regulations now includes both same-sex and opposite-sex couples.

5.2 The effect of the Civil Partnership Regulations on the 1995 Regulations

The Civil Partnership Regulations amended the 1995 Regulations so as to give effect to the government policy at the time, which was to treat opposite-sex civil partners in the same way as opposite-sex married couples. This meant that female surviving civil partners of male members were entitled to the same benefits as female surviving spouses of male members (widows). Male surviving civil partners of female members, on the other hand, were entitled to the same benefits as male surviving spouses of female members (widowers). These changes had effect from 2 December 2019.

5.3 Proposed changes to the 1995 Regulations

Following the government’s decision to equalise the benefits payable to male civil partners and spouses of female members (see 4.2 above), it is necessary to remove the amendments to the 1995 Regulations made by the Civil Partnership Regulations. The proposed changes will have effect from 2 December 2019. Once those amendments are removed, opposite-sex civil partner pensions will be equalised with those provided for widows due to the definition of ‘civil partnership’ in the 1995 Regulations, which refers back to the 2004 Act and includes both same-sex and opposite-sex couples.

5.4 Proposed draft amending regulations

Draft amending regulations 3 and 4 remove the changes made by the Civil Partnership Regulations to Regulation A2 (interpretation) and Regulation A4 (treatment of same-sex marriages and opposite-sex civil partnerships) of the 1995 Regulations.

5.5 Implementation

The BSA will review member records to identify and contact the recipients of survivor pensions who may benefit from the change. Members and recipients of survivor benefits will not need to take any action to instigate this process. The BSA has the authority to make any payments in arrears as necessary prior to the proposed amendments being enacted.

6. Non-pensionable one-off payments from the New to Partnership Payment (N2PP) Scheme

6.1 The N2PP Scheme

The N2PP was first announced in February 2020 as part of the series of interlocking recruitment and retention initiatives outlined in the update to the GP contract agreement 2020/21-2023/24. NHS England and NHS Improvement introduced the N2PP Scheme from 1 April 2020.

The N2PP Scheme seeks to support general practice health care professionals in England to become partners within a practice by providing a training allowance to grow necessary partnership skills, coupled with a financial payment. In return, participants commit to holding an equity-shares partnership for 5 years, and to delivering a minimum of two clinical sessions per week in their general practice setting, therefore increasing clinical participation levels.

Under the N2PP Scheme, new partners receive a one-off payment of up to £20,000, plus a £3,000 business training allowance to support their establishment as a partner. A contribution to on-costs (tax and national insurance) of up to £4,000 may also be made. Payments are pro-rata if the recipient works on a part-time basis.

The N2PP Scheme is open to individuals who are eligible to become partners in general practice, as set out in Section 86(2) of the NHS Act 2006, and who are registered with their respective professional body and deliver clinical care to patients through a General Medical Services (GMS), Personal Medical Services (PMS) or Alternative Provider Medical Services (APMS) contract.

It is also open to nurses (including advanced nurse practitioners), pharmacists, physiotherapists, midwives, and other professional groups who will be eligible for NHS Pension Scheme membership as a non-GP provider. A non-GP provider [footnote 2] is defined in NHS Pension Scheme Regulations.

6.2 Proposed changes to the NHS Pension Scheme Regulations

Non-regular payments, including bonuses or other non-regular payments, are already non-pensionable in respect of officer members. Pensionable earnings for GPs, on the other hand, are defined differently.

The proposed amendments ensure that payments and allowances under the N2PP Scheme are non-pensionable in respect of GPs and non-GP Provider members. These amendments would have effect from 1 April 2020.

6.3 Proposed draft amending regulations

Draft amending regulation 12 amends Schedule 2 paragraph 1 (additional definitions used in this schedule) and paragraph 3 (meaning of pensionable earnings) of the 1995 Regulations.

Draft amending regulations 14, 15, 19 and 20 amend Regulation 2.A.1 (interpretation: general), Regulation 2.A.8 (meaning of pensionable pay), Regulation 3.A.1 (interpretation of Part 3: general) and Regulation 3.A.7 (meaning of pensionable earnings) of the 2008 Regulations.

Draft amending regulation 28 amends Schedule 10 (practitioner income) of the 2015 Regulations.

7. Reform of the 1995 Regulations final pay controls

7.1 Current final pay control policy

In the 1995 Regulations pension benefits are calculated by taking the pensionable pay figure in each of the 3 complete scheme years preceding retirement and selecting the higher amount. This is the member's final pensionable pay.

In 2012, the department commissioned the Government Actuary's Department (GAD) to analyse the final pensionable pay increases of 1995 Section members. The analysis suggested that a reasonable number of members were receiving larger than expected pay increases immediately prior to retirement, which had the effect of increasing the pension benefits they received. The additional scheme costs created by these increases, not recoverable through normal scheme contributions, would therefore fall on all employers.

Introduced as part of a suite of new control provisions in the NHS Pension Scheme (Amendment) Regulations 2014 (S.I. 2014/570), to facilitate the admission of Independent Provider employers into the NHS Pension Scheme, the final pay control policy applies to all employers from 1 April 2014.

Under Regulation D3, pensionable pay increases in the last 3 years before retirement cannot exceed an ‘allowable amount’. A pay increase is considered 'excessive' if the annual percentage increase in pay for one or more of a member’s final 3 years’ service prior to retirement exceeds the rate of the Consumer Price Index (CPI) plus 4.5%.

The employer is charged an ‘excess employer contribution’, known as a final pay control charge, for the cost of pension benefits calculated on pay increases above the allowable amount. The final pay control charge is calculated as: (excess pension x pension factor) + (excess lump sum x lump sum factor).

Excess pension and lump sum are calculated based on the excess pensionable pay; this is the increased pensionable pay less the calculated allowable amount. The applicable factors, referred to in Regulation D3(6), are provided by GAD.

A final pay control charge is issued by the BSA to the employer who awarded the excess pay increase to the retiring member, ensuring the employer meets the cost of paying the excess pension benefits and not the NHS Pension Scheme, its members or other employers. The member's increased pension benefits are unaffected by the final pay control charge issued to their employer.

Subsequent to implementation of the final pay control policy a limited number of exemptions have been introduced to Regulation D3 [footnote 3] in order to prevent employers receiving a final pay control charge where there has been a significant pay increase for reasons outside of their control. These recent exemptions are:

- pay increases due to an increase in the national minimum wage; and

- pay increases pursuant to the ‘Framework agreement on the reform of Agenda for Change’ adopted on 27 June 2018.

7.2 Review of current final pay control policy

Having operated final pay controls since their introduction, the BSA raised concerns in 2018 that the volume of charges had significantly increased and therefore was creating an administrative burden. Separately, several employers expressed concerns that they had been charged for large pay increases which were the result of promotions and which those employers did not think properly fell within the policy intention.

In light of these factors, and in consideration of the time that had passed since the introduction of the policy, the department decided to review the policy. Therefore, the department asked the NHS Pension Scheme's Scheme Advisory Board (SAB) to review the final pay control regulations and consider options for reform. SAB is a statutory board that advises the Secretary of State on the merits of making changes to the NHS Pension Scheme. It comprises representatives from NHS trade unions and employers.

SAB carried out a review of the final pay control regulations, including a detailed analysis of various options for reform. SAB considered the impact of each option on scheme members, employers and the NHS Pension Scheme – both in terms of scheme funding and scheme administration.

Analysis completed by GAD for SAB in 2019 showed that, although some members were receiving large pay increases prior to retirement, most members receive more standard increases within the allowable amount, with around 90% receiving 5% or less and around 70% receiving 2% or less.

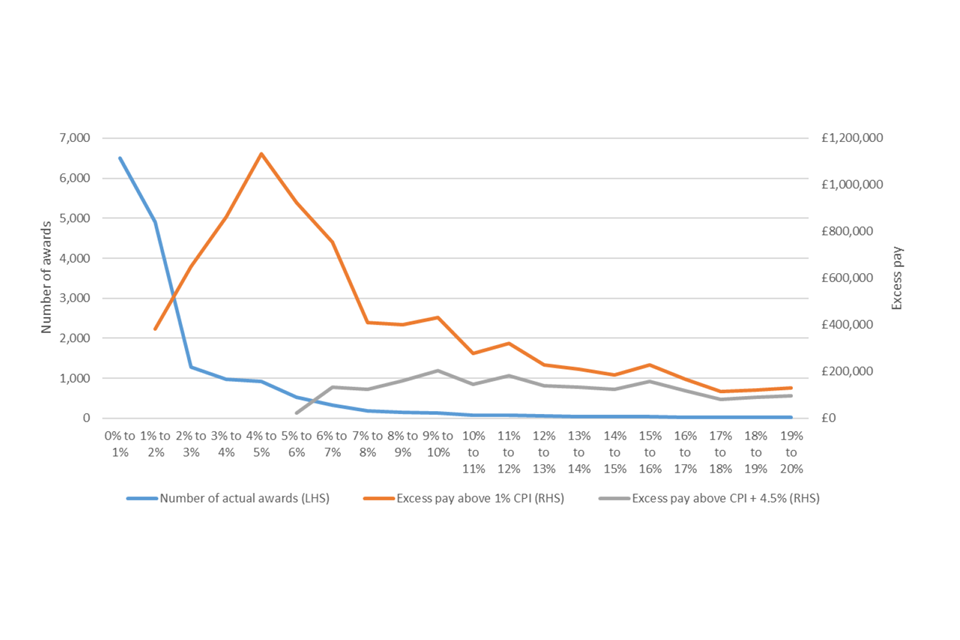

Figure 7.1 below illustrates the pensionable pay increases from 2016 to 2017, assuming that each member would have been subject to only one pay increase during this period.

Figure 7.1: percentage of pensionable pay increases from 2016 to 2017

Source: GAD

The graph shows the number of retirement awards from 2016 to 2017 where excess pay was above (i) 1% CPI and (ii) CPI plus 4.5%. There was a spike of 6,000+ awards where pay was above 4.5% CPI.

To carry out this analysis GAD considered around 16,000 1995 Section members retiring at their normal pension age during scheme year 2017/18 taken from membership data provided by the BSA. This data included retirement type, age at retirement and final pensionable pay. GAD used annual full-time equivalent pensionable pay for 2015, 2016 and 2017 based on the membership data extracts. 1995 Section medical and dental practitioners were excluded as their pension benefits are career average, not final salary.

At the time the review was being undertaken, the BSA reported 954 breaches of the final pay control policy to SAB, with the average charge being around £35,000. These charges can be broken down as follows:

| Scheme Year | FPC Breaches |

|---|---|

| 2014/15 | 6 |

| 2015/16 | 3 |

| 2016/17 | 14 |

| 2017/18 | 60 |

| 2018/19 | 607 |

| 2019/20* | 264 |

Source: BSA

(* asterisk indicates partial year)

Subsequent data obtained from the BSA at the end of scheme year 2019/20 showed 931 final pay control breaches. As a consequence, this increased the overall number of final pay control breaches from 954 to 1,621.

From their review SAB concluded that the final pay controls policy still served an important purpose and should therefore be retained, but that it needed reform. As such 4 recommended changes were proposed.

Increase the allowable amount

SAB considered a number of alternative figures to increase the allowable amount and agreed CPI plus 7% would be appropriate. GAD’s analysis illustrated that increasing the allowable amount to CPI plus 7% would reduce the number of pay increases exceeding the allowable amount by around 50%.

Add further exemptions to the final pay control regulations

SAB suggested that pay increases above the allowable amount could be exempt from the final pay control regulations if the reason for the pay increase is in line with the policy intention.

Potential specific exemptions identified by SAB included promotional pay increases, pay increases following the regrading of a post after a job evaluation process and all nationally agreed pay awards.

Improve the drafting of the regulations to allow more discretion

SAB recommended that existing regulations be amended to state that a final pay control charge ‘may apply’ rather than ‘applies’. However, it was acknowledged that this would increase the BSA's workload as there would be a requirement for the BSA to make an additional discretionary assessment as to whether a final pay control charge should apply in any given case.

Only pursue charges above a certain minimum level

The analysis showed that some final pay control charges are very small and therefore the administrative cost of the BSA issuing a charge may exceed the value of the income to the Scheme. However, it was acknowledged that prioritising the collection of larger charges, likely to be incurred by higher earners, may not be in keeping with the mutual nature of the NHS Pension Scheme.

7.3 Proposed changes to the 1995 Regulations

The department is grateful for SAB's work in reviewing the policy and developing recommendations. After careful consideration the department proposes to take forward the two of these, namely to:

- increase the allowable amount to CPI + 7%

- include further exemptions to the final pay control regulations

The GAD analysis, at paragraph 7.2, shows that 7% is the point beyond which the volume of cases falls significantly such that pay increases in excess of this can be considered exceptionally large. Therefore, increasing the allowable pay increase to CPI + 7% would not only remove a significant number of cases from the scope of the regulations but also better serves the original policy intention, which was to capture excessive pay increases.

We propose to introduce further exemptions to the policy, by which employers will be able to demonstrate that a pay increase above the allowable amount was justified. The proposed exemptions are set out below.

Pay increases in line with certain nationally agreed contracts

Pay increases that are mandated under the ‘Framework agreement on the reform of Agenda for Change’, which covers the period from 1 April 2018 to 31 March 2021, are already exempt under Regulation D3. We propose to introduce a further exemption relating to pay increases that are in line with NHS terms and conditions that have been formally approved by the Secretary of State. This would include pay increases due to re-banding where this is authorised under particular NHS terms and conditions, as well as pay rises under nationally agreed contracts and framework agreements.

National Clinical Excellence Awards

It is proposed that an increase to pensionable pay as the result of a National Clinical Excellence Award (CEA) will be excluded from final pay control calculations. National CEAs are outside an employer's control.

Promotions following open and fair competition

It is proposed that pay increases due to promotion on the basis of fair and open competition will be excluded from final pay control calculations.

Profit share percentage for non-GP providers

Charges for non-GP providers make up a significant portion of all charges the BSA issue. The department recognises that this can be the result of profit share arrangements which form the basis for GP and non-GP partner pensionable income. We propose that, where practice profits increase in the final 3 years before a member retires and their pensionable pay increases beyond the allowable amount, this increase will not be included in final pay control calculations if their percentage share of the profits did not increase during this period or, if their share did increase, it was the consequence of another partner leaving the practice.

Increasing the number of exemptions permitted under the policy will ensure that charges are raised only in cases where increases are unjustifiably large, by allowing the BSA to test justification from employers with greater precision.

Employers who seek to increase staff pay, close to retirement, beyond the allowable amount in circumstances not covered by an exemption will still remain in the scope of a charge, in line with the original policy aim to recoup the cost of unjustifiably large pensionable pay increases.

Salary sacrifice arrangements

It is proposed that an increase in pensionable pay that is solely due to the ending of a salary sacrifice arrangement will be excluded from final pay control calculations.

Proposed draft amending regulations

Amending regulation 5 amends Regulation D3 of the 1995 Regulations to substitute 7.0% instead of 4.5% into the formula for calculating the allowable amount and to introduce the additional exemptions outlined above. It is proposed that these changes take effect from 1 April 2021, as the start of the 2021/22 scheme year.

In seeking to improve the operation and efficacy of final pay controls, the department recognises that some employers who have paid a final pay control charge, or who have been issued with a charge but have not yet paid it, may wish to have the opportunity to have the charge reassessed against the new allowable amount and exemptions.

The department therefore proposes that employers who have had a charge notified on or after 1 April 2018 can apply, within 6 months of amendments to Regulation D3 coming into force, to have the charge redetermined under the amended regulations. 1 April 2018 is the start of the 2018/19 scheme year during which the department became aware of potential difficulties in administering the final pay control provisions and commissioned SAB to undertake a review as noted in paragraph 7.2.

Upon receiving an employer application for a redetermination, the BSA will assess whether an exemption applies and calculate the allowable amount in accordance with the revised rates. If it is determined that a final pay control charge would not have been payable, or a lesser amount would have been payable, then the employer will be reimbursed for the relevant amount. If any amount of final pay control charge remains outstanding a notice will be issued to the employer to pay this charge to be paid to the BSA within one month.

The department will review the proposed reforms to the final pay control policy two years from the date the reforms come into effect.

8. Miscellaneous amendments

The department proposes a series of minor and miscellaneous amendments to introduce new definitions and make technical corrections to the NHS Pension Scheme Regulations and NHS Injury Scheme Regulations.

8.1 Proposed changes to definitions in the NHS Pension Scheme Regulations

8.2 NHS standard sub-contract

Amending regulations 3,14 and 30 amend Regulation A2 (interpretation) in the 1995 Regulations, Regulation 2.A.1 (interpretation: general) in the 2008 Regulations and Schedule 15 (definitions) in the 2015 Regulations, respectively, to update the definition of an ‘NHS standard sub-contract’. This is to ensure the definition aligns with NHS England and Improvement's forthcoming ‘NHS Standard Sub-Contract for the Provision of Clinical Services 2021/22 Guidance’.

8.3 Locum practitioner

Amending regulations 12 and 19 amend the definition of ‘locum practitioner’ Schedule 2 (medical and dental practitioners)) of the 1995 Regulations and Regulations 3.A.1 (interpretation of Part 3: general)) of the 2008 Regulations so that it includes those engaged under a contract of services by the National Health Service Commissioning Board.

This ensures consistency with the definition of ‘locum practitioner’ in the 2015 Regulations.

8.4 Dental performer

The term ‘dental performer’ is not currently defined in the 2015 Regulations. Amending regulations 27 and 30 align the 2015 Regulations with the 1995 Regulations and the 2008 Regulations by amending Schedule 5 and Schedule 15 of the 2015 Regulations to insert a definition of ‘dental performer’, which was omitted from the 2015 Regulations in error.

8.5 Guarantee date

Regulations 133 to 140 of the 2015 Regulations deal with the transfer out of pension benefits from the 2015 Scheme. Regulation 135 requires a member who wishes to transfer out to make a written application for a statement of entitlement. The statement of entitlement contains a ‘guarantee date’. Regulation 136 requires a member who has received a statement of entitlement and who wants to proceed with the transfer to apply for a transfer payment to be made. That application must be made within the period of 3 months beginning with the guarantee date (Regulation 136(2)).

Regulation 135 currently defines the guarantee date as being not more than 10 days after the date on which the member is provided with the statement of entitlement. This is incorrect.

Amending regulation 25 amends Regulation 135 (application for statement of entitlement) of the 2015 Regulations so that the guarantee date is correctly set as being within the period of 10 days ending with the date on which the member is provided with the statement of entitlement.

8.6 Other proposed technical amendments and corrections

8.7 Forfeiture

Where a member of the NHS Pension Scheme or other beneficiary is convicted of certain offences, the NHS Pension Scheme Regulations give the Secretary of State power to direct that part or all of the person's pension benefits be forfeited.

The NHS Pension Schemes, Additional Voluntary Contributions and Injury Benefits (Amendment) Regulations 2019 (S.I. 2019/418) sought to introduce a power to suspend the right to or the payment of benefits, pending a forfeiture decision, where a member has been charged with or convicted of relevant offences.

However, in a judgment handed down on 17 January 2020 the High Court quashed the relevant amending regulations on the basis that the proposed suspension power was unlawful (see R. (on the application of the British Medical Association) v the Secretary of State for Health and Social Care).The department is considering all policy options available to it following the judgment.

In addition to enacting the suspension powers, Regulations 37, 55, 72 and 91 of S.I. 2019/418 also sought to introduce certain minor amendments required as a consequence of the Supreme Court's decision in Brewster, Re Application for Judicial Review (Northern Ireland) [2017] UKSC8. The amendments sought to substitute ‘surviving scheme partner’ for ‘nominated partner’ at relevant junctures in each of the NHS Pension Scheme Regulations. These particular amendments are still required and need to be re-enacted.

Amending regulations 11, 18, 23 and 26 amend Regulation T6 (loss of rights to benefits) of the 1995 Regulations; Regulations 2.J.7 (forfeiture of rights to benefits) and 3.J.7 (forfeiture of rights to benefits) of the 2008 Regulations and Schedule 3 (administrative matters) of the 2015 Regulations, respectively, to replace references to ‘nominated partner’ with ‘surviving scheme partner’. The proposed amendments to the 1995 Regulations and the 2008 Regulations will have retrospective effect from 1 April 2008. The proposed amendments to the 2015 Regulations will have retrospective effect from 1 April 2015.

8.8 Lump sum on the death of a pension credit member after the pension credit becomes payable

Amending regulations 17, 22 and 29 amend Regulations 2.E.20 (amount of lump sum: pension credit members) and 3.E.20 (amount of lump sum: pension credit members) of the 2008 Regulations and paragraph 8 of Schedule 14 of the 2015 Regulations, respectively. All 3 amending regulations provide for a lump sum to be paid in circumstances where a pension credit member dies within the first 5 years after their pension credit pension has come into payment.

The amount payable is 5 times the annual amount of the pension credit less payments already made to the pension credit member. The annual amount of the pension credit and the payments already made for the purposes of this calculation are the basic amounts without any pensions increases that may apply. Any pensions increase then due to be paid on the lump sum is provided for by the Pensions (Increase) Act 1971.

The amending regulations remove incorrect references to increases under the Pensions Increase Act 1971 from the 3 regulations in order to ensure that such increases are not applied twice, once by virtue of NHS Scheme Regulations and again by virtue of the Pensions Increase Act 1971.

8.9 Early retirement on ill-health

Regulations 2.D.8 (early retirement on ill-health (active members and non-contributing members) and 3.D.7 (early retirement on ill-health (active members and non-contributing members) of the 2008 Regulations provide ill-health retirement benefits for officer and practitioner members respectively.

Paragraph (5) of Regulations 2.D.8 and 3.D.7 provides for service to be increased by a tier 2 enhancement period where the member has had a break in pensionable service of 12 months or more and it is more beneficial to the member for service to be treated as continuous. However, both regulations should also provide for service to be increased by the enhancement period where the member has not had any breaks of over 12 months. Amending regulations 16 and 21(2) correct paragraph (5) of Regulations 2.D.8 and 3.D.7 accordingly.

Paragraph (7) of Regulation 3.D.7 currently provides for uprated earnings to be increased in respect of a tier 2 pension if a member has both officer and practitioner service. Amending regulation 21(3) amends paragraph (7) to ensure that the increase to pensionable earnings correctly applies in circumstances where a member has only practitioner service.

While the amendments to Regulations 2.D.8 and 3.D.7 will have retrospective effect to 1 April 2008, there is no need for members to contact NHS Pensions as the BSA has confirmed that ill health benefits have been continually calculated according to the proposed change to paragraph (7) since this date.

8.10 Proposed amendments to the Injury Benefits Regulations

When determining the amount of injury benefit allowance payable to a successful applicant, certain Department for Works and Pensions (DWP) benefits are deductible from the injury benefit awarded, in accordance with Regulation 4(6)(b) of the Injury Benefits Regulations.

Such benefits include entitlement to DWP's Employment and Support Allowance (ESA) established under section 1(2)(a) of the Welfare Reform Act 2007 (WRA2007). The WRA2007 was amended by the Welfare Reform Act 2012 (WRA2012) to include sections 1A and 1B in relation to the duration of a contributory award of ESA. If an ESA award has been time-limited under section 1A, entitlement to an award continues under section 1B if the conditions in that section are met.

Amending regulation 32 amends Regulation 4(6)(b)(vi) of the Injury Benefits Regulations to clarify that an ESA award payable under section 1B of the WRA2007 (provided for by section 52 of WRA2012) is also an accountable benefit when determining the amount of Injury Benefit allowance payable.

The amendments have retrospective effect from 1 May 2012, the date that section 52 of the WRA2012 came into force.

As part of the amendments introduced by the NHS Pension Schemes, Additional Voluntary Contributions and Injury Benefits (Amendment) Regulations 2019 (S.I. 2019/418) to remove the requirement that a nomination must be made in order for an otherwise qualifying partner to receive a survivor benefit on the death of a member, amending regulation 102 substituted a new paragraph (3) for the existing paragraph (3) of Regulation 7 (surviving partner allowance) of the Injury Benefits Regulations. Sub-paragraphs providing for the re-instatement of a discontinued partner pension on hardship grounds were incorrectly omitted from new paragraph (3).

Amending regulation 33(2) corrects that omission by substituting a new paragraph (3) which re-introduces the incorrectly omitted sub-paragraphs with retrospective effect from 1 April 2019.

Regulation 7 of the Injury Benefits Regulations provides for the payment of allowances to surviving partners. Paragraph (3A) of Regulation 7 was inserted into Regulation 7 by S.I. 2005/3074 and aimed to ensure that a surviving widow or widower whose partner died before 5 December 2005 would not lose their allowance if they later formed a same-sex civil partnership or lived with a person of the same-sex as if they were civil partners. At the time when paragraph (3A) was enacted, only same-sex couples could form a legally-recognised civil partnership and therefore the reference to forming a ‘civil partnership’ in that paragraph was limited to same-sex civil partners. However, following the extension of civil partnerships to opposite-sex couples, the reference to ‘civil partnership’ in paragraph (3A) includes opposite-sex civil partnerships. This was not the intended effect of paragraph (3A) of Regulation 7 when the relevant amendments were made.

Amending regulation 33(3) therefore amends paragraph (3A) of Regulation 7 to clarify that the civil partnership referred to in this paragraph is a civil partnership formed with a person of the same-sex.

9. Equality Impact Assessment

9.1 Public Sector Equality Duty

The Public Sector Equality Duty is set out in section 149 of the Equality Act 2010 (‘the 2010 Act’) and requires public authorities, in the exercise of their functions, to have due regard to the need to:

- eliminate unlawful discrimination, harassment and victimisation and other conduct prohibited by the 2010 Act

- advance equality of opportunity between people who share a protected characteristic and those who do not

- foster good relations between people who share a protected characteristic and those who do not

This involves having due regard, in particular, to the need to:

a) remove or minimise disadvantages suffered by people due to their protected characteristics

b) take steps to meet the needs of people from protected groups where these are different from the needs of other people

The equality duty covers the nine protected characteristics: age, disability, gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex (gender) and sexual orientation.

This chapter sets out the department's initial assessment of the proposals in accordance with the Public Sector Equality Duty. The department has considered each proposal in turn and we invite respondents to help refine this initial analysis by contributing comments and evidence in relation to the potential impact of the proposals on people who share a protected characteristic.

9.2 Survivor benefits – male survivors of female members

The proposed amendments seek to equalise survivor benefits for male spouses and civil partners of female members and will therefore have the effect of removing any potential discrimination on the grounds of sexual orientation that currently exists in the 1995 Regulations.

The proposed changes enhance the NHS pension benefit position for some members but not at any detriment to other members. Equalisation is not expected to have a negative impact on members or their surviving partners.

The proposed changes are therefore considered to be consistent with the need to eliminate unlawful discrimination, advance equality of opportunity between those who share a protected characteristic and those who do not and foster good relations between those who share a protected characteristic and those who do not.

9.3 Entitlement for survivors of opposite sex civil partners

These proposed changes form part of the overall package of amendments that seek to give effect to the government’s decision to equalise the benefits payable to male partners of female members (see 9.2 above). The effect will be that surviving male civil partners and spouses of female members will be in the same position as surviving female civil partners and spouses of male partners, as well as being in the same position as same-sex spouses and civil partners of either gender.

The proposed amendments enhance the NHS pension benefit position for some members, but not at any detriment to other members. The changes are therefore considered to be consistent with the need to eliminate unlawful discrimination, advance equality of opportunity between those who share a protected characteristic and those who do not and foster good relations between those who share a protected characteristic and those who do not.

9.4 Non-pensionable one-off payments from the New to Partnership Payment (N2PP) Scheme

The New to Partnership Payment (N2PP) Scheme is a NHSE&I initiative and equality duties were taken into account when designing the rules of the N2PP Scheme, including the recommendation that the payments should be non-pensionable.

In proposing amendments to make payments and allowances under the N2PP Scheme non-pensionable in respect of both GPs and non-GP provider members, the department has sought to ensure that all N2PP Scheme recipients, regardless of job role, are treated equally. Without the proposed amendments, current rules would result in inequality between recipients depending on whether they held practitioner or officer membership in the NHS Pension Scheme.

The department is not aware of any potential negative impact of the proposed amendments on people who share a protected characteristic.

9.5 Reform of the 1995 Regulations final pay controls

The department considers that changes proposed to Regulation D3 of the 1995 Regulations are unlikely to have a negative impact on people who share a protected characteristic as final pay controls are payable by the employer. It is hoped that the reforms will help to address any potential age discrimination that may be an indirect result of the current policy, as concerns that a charge might be payable are less likely to be an obstacle to members being awarded a promotion in the later stages of their career.

9.6 Miscellaneous amendments

Paragraph (3A) of Regulation 7 of the Injury Benefits Regulations has been in force since December 2005, when same-sex civil partnership provisions were introduced to the Scheme. The amendment to paragraph (3A) clarifies that the reference to a civil partnership in this context, where the member died before 5 December 2005 (see paragraph 5.27 above), refers to same-sex civil partners, recognising the position applying to same-sex couples at the time.

The department acknowledges that maintaining the limited operation of paragraph (3A) of Regulation 7 means that the relevant easement is only available to same-sex civil partners (and not opposite-sex civil partners, same-sex spouses or opposite-sex spouses). However, since the amendment is simply to confirm the original 2005 policy intention, it considers the decision to be justified. Other proposed amendments seek to equalise the position of male survivors of female members in circumstances where the scheme member dies on or after 5 December 2005.

In proposing the other miscellaneous changes, the department has not identified any negative impact on people who share a protected characteristic.

The proposed amendments are either new definitions or revisions to existing definitions and technical updates to preserve accuracy or improve the operation of the existing underlying policy, which is unchanged.

10. Endnotes

-

Inserted by The NHS Pension Schemes, Additional Voluntary Contributions and Injury Benefits (Amendment) Regulations 2019 (S.I. 2019/418). ↩

-

Non-GP providers are ‘single-handers’, partners or shareholders (including those on a fixed salary) in a GP practice (or APMS organisation) who are not GPs. ↩

-

Inserted by The NHS Pension Schemes, Additional Voluntary Contributions and Injury Benefits (Amendment) Regulations 2019 (S.I.2019/148). ↩