Automatic disqualification rules for charity trustees and charity senior positions

Guidance for individuals about automatic disqualification rules, what to do if you become disqualified and how to apply for a waiver.

The automatic disqualification rules

There are rules which disqualify certain people from being a trustee or senior manager of a charity. Being disqualified means that a person can’t take on, or stay in, a charity trustee position or senior manager position – even on an interim basis, unless the Charity Commission has removed (or ‘waived’) the disqualification.

You are disqualified from acting as a charity trustee or senior manager if any of the reasons shown in this apply to you.

The senior manager positions that are affected by disqualification are at chief executive and chief finance officer level. This guidance explains in more detail how to identify these roles.

It’s important that you check carefully whether you are disqualified and get advice if you are in any doubt. It is normally an offence to act whilst disqualified. Conviction may lead to a fine, imprisonment or both. If you act whilst disqualified, you may also have to repay any money received from the charity during this period.

If you are disqualified, you can, in most circumstances, apply to the Charity Commission to waive your disqualification, as described in this guidance. You can do this at any time after you become disqualified. If given, a waiver will bring your disqualification to an end in respect of the charities named in the waiver.

The waiver application form is available to use if you need to apply.

When automatic disqualification doesn’t apply

The rules will only apply to trustee and senior manager positions at all charities (registered or not) based in England and Wales and who can run them (trustees and certain senior managers). They do not apply to charities registered in Scotland, Northern Ireland or other countries.

You are not disqualified if your conviction is spent, unless you are subject to the notification requirements under Part 2 of the Sexual Offences Act 2003 (which is a separate basis for automatic disqualification). You can use this guidance from Unlock to work out when your conviction otherwise becomes spent, and no longer disqualifies you.

You can also look at the Nacro website or at the employment section of GOV.UK for information about what counts as a spent conviction and when convictions become spent.

Automatic disqualification rules do not disqualify people from all involvement with charities.

There are other ways that a disqualified person can be involved with charities, such as volunteering, advisory positions or appropriate employment in positions that don’t count as senior manager roles.

Other disqualifying rules

There are other rules that might stop someone from being a charity trustee or holding some positions at a charity:

- Disclosure and Barring Service (DBS) rules which include who is eligible to work or volunteer with children and other vulnerable groups

- Charity Commission Orders can also disqualify someone from being a trustee

The Charity Commission does not set or enforce the rules around DBS check eligibility.

Restricted charity positions that disqualification applies to

The rules mean that trustees and certain senior manager roles within charities are restricted to individuals who are not disqualified.

Trustees

A trustee is either:

- a charity trustee - a person responsible for governing a charity and directing how it is managed and run. The charity’s governing document may call them trustees, the board, the management committee, governors, directors, or something else. The Charities Act 2011 defines charity trustees as the people who have ultimate control of a charity, whatever they are called in the charity’s governing document

- a trustee for a charity - a person or organisation who holds property for a charity such as a holding or custodian trustee

- an officer of a company (or other corporate body) when it acts as a trustee of a charity (a corporate trustee). An “officer” includes any of the persons having general control and management of the administration of the body which is usually the directors of the corporation

Relevant senior manager positions

The relevant senior manager positions are the Chief Executive (or equivalent) positions and Chief Finance Officer (or equivalent) positions.

It’s important to understand how the rules define the senior manager positions that are affected because it is the function, and not the title, of the position that matters. You can use this guidance to help you understand whether a charity position that you hold, or are interested in applying for, meets the definition of a senior manager position.

What you must not do if you are disqualified and actions you may need to take

If you are disqualified you must not act in a trustee or a relevant senior manager position at a charity, unless and until your disqualification is waived by the Charity Commission.

If you do not have a waiver and act whilst disqualified, and we become aware of it, we:

- will advise you that you must stop acting in your position immediately

- are likely to bring the matter to the attention of the trustees of any charities where you hold a relevant position

- can order you to repay any expenses, benefits, remuneration or the value of benefits in kind received from the charity during the time when you were acting while disqualified

- will consider whether the matter should be referred to the police

Actions you may need to take if you are disqualified

Senior manager positions

If you are, or become disqualified whilst in a relevant senior manager position at a charity, you must cease to act in that position, unless and until the Commission waives your disqualification.

You and the charity may need to take legal advice about how this will affect your employment and other rights.

Trustee positions

If you are, or become disqualified as a trustee you must cease to act in any trustee positions, unless and until the Commission waives your application. You should also resign formally from your trustee position so that it is clear that you are no longer part of the trustee body.

If you are, or become, disqualified, you aren’t prevented from all involvement with charities. There are other ways in which a disqualified person can be involved with charities, through employment or volunteering.

Senior manager positions affected by the rules - an overview

Disqualification applies to both Chief Executive (or equivalent) positions and Chief Finance Officer (or equivalent) positions.

It is important to understand how the rules define the senior manager positions that are affected because it is the function (and not the title) of the position that matters.

You can use these more detailed questions to help you make this check.

Quick check - what a senior manager position is

Chief Executive (or equivalent) positions

A Chief Executive (or equivalent) position:

- carries overall responsibility for the day day-to-day management and control of the charity

- is accountable only to the charity trustees

Where there is no separate Chief Finance Officer (or equivalent) responsible for the financial operation of the charity, the only restricted senior manager position is the Chief Executive (or equivalent) position.

Chief Finance Officer (or equivalent) positions

A Chief Finance Officer (or equivalent) position is restricted if it:

- is accountable only to the chief executive or the trustees

- is responsible for overall management and control of the charity’s finances

These are the key factors in deciding if the position is restricted.

Other factors, such as the title of the position, the size of the charity, the number of its staff or volunteers, having budgetary authority, having authority for handling, transacting or accounting for the charity’s money are not relevant unless the position carries responsibility for overall management and control of the charity’s finances.

Where a position is restricted it cannot be occupied by a disqualified person unless they have a waiver. This applies whether the role is permanent, temporary, part time or interim.

It will usually be paid positions that are restricted, but it is also possible for volunteer positions to be restricted. The examples in this guidance illustrate these points.

Detailed check - what a senior manager position is

Questions to ask to identify restricted positions

To work out which, if any, positions are restricted, you need to ask whether there are any management of the charity positions.

If there are no management of the charity positions, the charity does not have any restricted positions. If there are management of the charity positions, you need to think about both of the following:

- if there is more than one management of the charity position, you need to identify which position, reporting to the trustees, is restricted. It will be the most senior management of the charity position

- whether there is also a separate position, involving control over money which is restricted

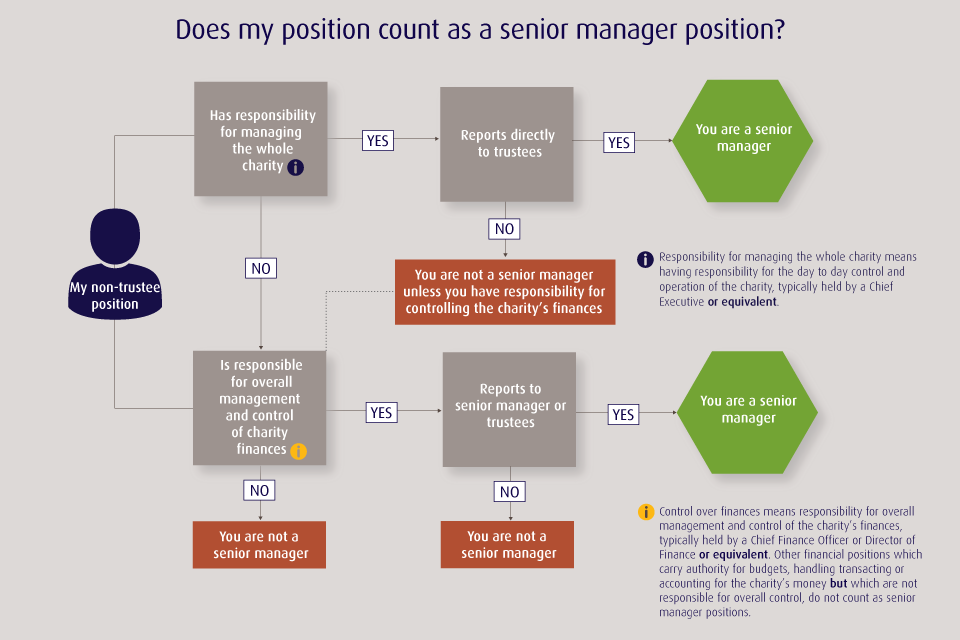

You can use this senior manager position visual to help you with this, and the examples below to identify restricted positions.

Senior manager position visual

Download the

Image description: does my position count as a senior manager position?

Responsibility for managing the whole charity

Responsibility for managing the whole charity means having responsibility for the day to date control and operation of the charity, typically held by a Chief Executive or equivalent.

If your position has responsibility for managing the whole charity and reports directly to trustees, you are a senior manager.

If your position has responsibility for managing the whole charity but does not report directly to trustees, you are not a senior manager unless you have responsibility for controlling the charity’s finances.

Responsibility for overall management and control of charity finances

Control over finances means responsibility for overall management and control of the charity’s finances, typically held by a Chief Finance Officer, Director of Finance, or equivalent.

Other financial positions which carry authority for budgets, handling, transacting or accounting for the charity’s money but which are not responsible for overall control, do not count as senior manager positions.

If your position is responsible for overall management and control of charity finances and reports to a senior manager or trustees, you are a senior manager.

If your position is responsible for overall management and control of charity finances but does not report to a senior manager or trustees, you are not a senior manager.

Management of the charity positions

Management of the charity positions involve authority and responsibility for the day to day control and operation of the charity, or a significant part of it. Typically people occupying such positions have authority to make decisions on key strategic, financial or operational matters.

In some charities there will be a number of positions, below the trustees, which relate to management of the charity, and in others there may be none.

Where there are a number of positions which relate to the management of the charity, thinking about the charity’s structure as outlined below will help you decide which of these positions is restricted.

The charity’s structure for management of the charity positions

If the description of management of the charity applies to the position, you need to decide whether the position is:

- the most senior managerial position below the trustees or

- whether, although it meets the description, it reports to another position, on the staff or below the trustees

The position is not restricted if it includes:

- management of the charity but

- reports to another person, below the trustees, with responsibility for management of the charity

It follows that for all charities with management of the charity positions, even the largest, it is likely that there will only be one relevant management position that is restricted.

Mostly this will be the Chief Executive, Chief Operating Officer or most senior Charity Manager position, or those with equivalent functions but different titles.

No single most senior management of the charity position

In some, less common, charity structures there is no single most senior managerial position below the trustees.

Instead of having a Chief Executive (or equivalent) position, responsibility for management of the charity, below the trustees, is shared equally between a number of positions.

In this kind of charity structure, all of these equal positions are restricted.

Control over money positions

These are positions below the trustees, which are accountable to the chief executive or trustees for overall management and control of the charity’s finances.

The responsibilities of this position are likely to include overall responsibility for the charity’s financial:

- performance and strategy

- policies

- controls

- compliance with accounting and reporting requirements

Most positions at a charity that have a financial element will not be restricted because they do not carry this level of control over money.

Examples include positions that may have budgetary authority, or authority for handling, transacting, recording and reporting on a charity’s money. Whilst positions including these tasks and functions involve responsibility and require skill, they are only restricted if they carry authority for overall management and control of the charity’s finances.

The charity’s structure for control over money positions

For the purposes of the rules, a charity only has a control over money position where the trustees have, in addition to the most senior management of the charity position, made another position responsible for overall management and control of the charity’s finances.

Typically this will be to the Finance Director, Head of Finance or Chief Finance Officer positions, or those with equivalent functions but different titles.

It follows that for all charities with restricted positions, even the largest, it is likely that there will only be one control over money position that is restricted.

If there is no such control over money position at a charity, then it only has to consider if it has a restricted management of the charity position.

Examples of restricted and non-restricted positions

No restricted positions

A small women’s health charity has no paid staff. It has volunteers, in addition to its trustees, who help with fundraising. Their work includes some cash handling. The charity has no restricted positions.

This is not because its workers are unpaid volunteers. It is because none of the volunteers’ tasks or functions involve management of the charity. They do not have authority for the day to day control and operation of the charity or a significant part of it.

The management of the charity is carried out by the trustees.

No restricted positions, even where there are some employees

A small women’s health charity has employed a temporary paid worker to develop a supporter database and charity newsletter. There are no other paid staff.

The temporary position is not restricted even though it is accountable to the trustees and there are no other staff. This is because the employee is fulfilling a particular remit and the type of authority her position has does not amount to authority for the day day-to to-day control and operation of the charity or a significant part of it.

The management of the charity is carried out by the trustees.

Restricted management of the charity position (Chief Executive equivalent), but no restricted control over money position

A community centre charity has a part time paid centre manager position. The centre has a small paid staff - an administrative worker and a caretaker. It also has some volunteers who help with fundraising.

The centre manager is responsible to the trustees for the day to day running of the charity, including management of all staff and volunteers. The position also includes responsibility for working with the trustees to plan and develop the charity and for maintaining financial operations.

The centre manager position is restricted because:

- the tasks and functions of the position include management of the charity. The employee has authority and responsibility for the day to day control and operation of the charity or a significant part of it; and

- the position is the most senior managerial position below the trustees

Because there is a restricted management of the charity position, consideration has to be given to whether there is also a separate position at the charity with control over money.

In this example there is no such position, so the centre manager position is the only one which meets the definition.

Title of position is not relevant to whether it is restricted

In the example above, the position is not titled centre manager. It is titled development officer. In all other respects it is the same.

The development officer position is restricted for the same reasons outlined above, even though its title does not indicate that it is a managerial position.

Financial positions only restricted where they are accountable for overall management and control of the charity’s finances

In the example above, in addition to the centre manager and other staff, there is a part-time paid finance administrator position. The position includes cash handling, recording and reconciling transactions, banking grants and donations, providing reports and information to the trustees and the charity’s accountant, and invoicing and processing expenditure to an agreed budget.

Even though the position involves responsibility and requires skill, and carries a number of important finance functions, it is not a control over money position because it does not carry responsibility for overall management and control of the charity’s finances.

This is carried out by the trustees, working with the Centre Manager.

Restricted positions cannot be occupied by a disqualified person on an interim or temporary basis, unless the disqualified person has a waiver

In the example at above, the serving centre manager is unwell and will not be back at work at the charity for a few months. The trustees would like to arrange interim cover for the position by another person on the charity staff.

The person proposed to carry out the interim cover is disqualified. The interim arrangement cannot happen without a waiver.

If the trustees decide to support a waiver application, they should let the Charity Commission know that they would like a quick decision.

Any waiver application will be decided on the same tests and factors that apply to all waiver applications.

Where there are a number of “management of the charity” positions at a charity, only the most senior managerial position below the trustees is restricted. Where there is also a separate control over money position, which is accountable for overall management and control of the charity’s finances, this will also be restricted

An international children’s charity employs over 8,000 staff and has 1,500 volunteers. There are numerous positions at the charity which involve management of the charity.

The most senior management team at the charity report to the Chief Executive. The senior management team include director positions for Services, Strategy, Fundraising and Finance.

Although there are many positions at the charity which involve management of the charity, this does not mean that there are many restricted positions. It is the positions accountable to the trustees which need to be considered.

The Chief Executive position is restricted because:

- the tasks and functions of the position include management of the charity. The employee has authority and responsibility for the day to day control and operation of the charity or a significant part of it; and

- the position is the most senior managerial position below the trustees

Because there is a management of the charity position which meets the definition, consideration has to be given to whether there is also a separate position at the charity with control over money.

In this example the Director of Finance position is also restricted because:

- the tasks and functions of the position involve control over money. The tasks and functions of the position carry responsibility for overall management and control of the charity’s finances

- the only other position to which the Director of Finance position reports, below the trustees, is the Chief Executive position which is the most senior managerial position

No single most senior management of the charity position

A medical charity has no single most senior manager position. Instead of having a Chief Executive (or equivalent) position, three paid regional directors are equally responsible to the trustees for the day to day running of the charity, including management of other staff and volunteers.

The positions also include equal responsibility for working with the trustees to plan and develop the charity. All of the regional director positions are restricted because:

- the tasks and functions of the positions include management of the charity. The employees have equal authority and responsibility for the day to day control and operation of the charity or a significant part of it; and

- their positions are the most senior managerial position below the trustees

Because there are restricted management of the charity position, consideration has to be given to whether there is also a separate position at the charity with control over money.

What a waiver is and who can apply

A waiver brings a person’s disqualification to an end, either for:

- a named charity or named charities

- a class of charities - this is a group of charities which share a characteristic. For example, a class of charities can be charities with the same charitable purpose, or charities operating in the same area

- all charities

If you are disqualified you can apply to the Charity Commission for more than one of these types of waiver at the same time.

The Charity Commission makes a formal decision about each waiver application, considering each case on its own merits. We make our decision based only on what is in the best interests of the charity or charities covered by the waiver application.

We will also check that the waiver is not likely to damage public trust and confidence in a charity or charities.

A waiver decision can be appealed.

If you are applying for a waiver you should read this guidance to find out how we make decisions on waiver cases and what you can do if you disagree with our decision.

You should also read our privacy notice for waivers which explains how we process your information.

If you already have a waiver, its terms will continue to apply. You are only disqualified again if another disqualifying reason applies to you.

Who can apply for a waiver

Most people who are disqualified can apply for a waiver. But, there are also limited circumstances where the Charity Commission is:

- unable to consider a waiver application from you; or

- required to give you a waiver unless there are special reasons not to do so

If you are, or will become, disqualified, and either of the circumstances below do not apply, you can make a waiver application.

Circumstances where you can’t get a waiver

The Charity Commission cannot give you a waiver where the rules of the charity you want to work with disqualify you from being a trustee or from holding a senior manager position. For example, where the charity’s rules say that a person who is an undischarged bankrupt cannot be a trustee, a waiver cannot override that.

If you are applying for a waiver, you need to check that the charity’s rules (in its governing document) don’t prevent a person with your disqualification reason from acting in the position you wish to take up.

The following reasons will also prevent you being given a waiver:

- you are, or will become, disqualified, not because of automatic disqualification rules but because of other legal rules

- the charity is a company or Charitable Incorporated Organisation (CIO), and either you are disqualified as a company director, are an undischarged bankrupt under the Insolvency Act 1986 or failed to pay a county court administration order and you have not been granted leave to act as a director, or trustee of a CIO, by the court

A CIO is a type of incorporated charity.

Circumstances where we must give you a waiver

The Charity Commission must give you a waiver (if applied for) if you are, or will become, disqualified because:

- you have been removed by the Charity Commission from office as a trustee, officer, agent or employee of a charity and

- 5 years or more have passed since the removal, and none of the following exceptions apply:

The waiver application relates to a charitable company or Charitable Incorporated Organisation (CIO) and either:

- you are disqualified as a company director or trustee of a CIO

- you are an undischarged bankrupt

- you have defaulted under a county court administration order and

- you have not been granted leave to act as a director of another company or trustee of another CIO

The Charity Commission is satisfied that there are special circumstances which mean that the waiver should be refused, such as where:

- there is evidence to suggest that there is a real risk that you will repeat the behaviour which led to the original disqualification

- there is evidence of your unsuitability to act as a trustee or hold a senior manager position at a charity

- the trustees of a charity or charities that you want to work with in a trustee or senior manager position don’t support your application for a waiver

The types of waiver

You can apply for a waiver that allows you to:

- be a trustee, or hold a senior manager position at a named charity or charities

- be a trustee, or hold a senior manager position, at any charity (general waiver)

- be a trustee, or hold a senior manager position, at a class of charities

- hold a senior manager position only at a named charity or charities. If this type of waiver is given, your disqualification from acting as a trustee remains

- hold senior manager positions only at a class of charities. If this type of waiver is given, your disqualification from acting as a trustee remains

- hold senior manager positions only at any charity. This is a general waiver. If this type of waiver is given, your disqualification from acting as a trustee remains

General and class waivers

It is likely to be harder for you convince the Charity Commission to give you a general waiver or a waiver for a class of charities. This is because we will need to be confident that the risk in giving the waiver is outweighed by the benefit to the charity sector generally.

This is different from a decision about a waiver for a named charity or charities, where the Charity Commission is able to make a decision about risk to those particular charities, informed by the views of their trustees.

This does not mean that we will never give a general waiver, but that the evidence that a disqualified person no longer represents a risk to a group of charities or the sector as a whole must be convincing.

How to apply for a waiver

You can apply online using the waiver web form.

We have produced a explaining what needs to be included as part of your waiver application.

You should:

- read the application form questions carefully and answer them fully

- submit the supporting documentation requested in the application form

The Charity Commission will reject your waiver application if:

- it is unclear or incomplete

- you have not signed it

- it is not from you, or an adviser on your behalf

We cannot accept applications from charities on your behalf.

The waiver application form asks for detailed information in the following categories:

- information to help us decide whether the we can consider a waiver application from you

- your disqualification reason, when it happened, the events surrounding it, and your conduct since it happened

- any particular charity or charities where you want to hold a trustee or senior manager position, and the type of position you would have

- the views of the trustees about your application

- the type of waiver you are applying for

The application form includes space for you to supply any other information which you consider is relevant to your application. We will carefully consider all of the information that you submit.

If you are unable to use the online form, you can apply by email. You will need to include all of the information outlined in the checklist and send this to CCWaivers@charitycommission.gov.uk

In some cases, when we receive your application, the Charity Commission may contact the trustees of a charity you have named to ask for more information about the information they have supplied. We will also verify the information you have provided against our own records and open source checks.

We respect confidences as far as we are able to and will give proper consideration to your rights under data protection, freedom of information and human rights legislation.

Our privacy notice explains how we will handle personal data we may collect or receive about you.

You can read more about how the Charity Commission will assess waiver applications, and what to do if you disagree with our decision.

Summary of the legal disqualification reasons

Disqualifying reasons relating to unspent convictions

You are disqualified if you have an unspent conviction for:

- a dishonesty or deception offence disqualified from trusteeship. There is more information about what is meant by this in Annex A

- particular terrorism related offences

- particular money laundering offences

- particular bribery offences

- offences for misconduct in public office, perjury, and perverting the course of justice

- attempting, aiding or abetting these offences

You are not disqualified if your conviction is spent. You can use this guidance from the charity Unlock to work out when your conviction becomes spent, and so no longer disqualifies you from being a charity trustee and from holding certain senior manager positions at a charity.

You can also look at the Nacro website or at the employment section of GOV.UK for information about what counts as a spent conviction and when convictions become spent.

Other disqualifying reasons

You are disqualified if you:

- are found guilty of disobeying a Charity Commission order or direction under the Charities Act

- are subject to notification requirements under Part 2 of the Sexual Offences Act 2003. This includes if you are subject to a Sexual Harm Prevention Order or you have breached a Sexual Risk Order. If the notification requirements apply to you, you are disqualified by the automatic disqualification rules

- are currently declared bankrupt or are subject to bankruptcy restrictions or an interim order, including an individual voluntary arrangement (IVA) - limited exceptions apply

- are subject to a debt relief order under the Insolvency Act 1986, or a debt relief restrictions order, or interim order, under that Act

- are disqualified from being a company director - limited exceptions apply

- have previously been removed as a trustee, or as an officer, agent or employee of a charity by either the Charity Commission or the High Court due to misconduct or mismanagement

- have previously been removed from a position of management or control of a charity in Scotland for mismanagement or misconduct

- have been found to be in contempt of court for making, or causing to be made, a false statement - limited exceptions apply

- are a designated person under particular anti-terrorist legislation

The disqualifying reasons and the exceptions are set out in full in the .

It is important that you look at these full descriptions to decide if you are disqualified, and to see the limited exceptions that apply. You may need help from a legal advisor to decide whether your circumstances fall within the disqualifying reasons.

Annex A: What a dishonesty/deception offence is

These are offences that by definition must include an element of dishonesty or deception.

If you look at the legal definition for these offences, you will see that a person who commits them can only be found guilty if they are found to have acted dishonestly or by deception, such as in proven cases of theft.

Many offences can be committed by using dishonesty or deception, but that is not the same as an offence which must include an element of dishonesty or deception for it to be committed.

For example, a person committing murder may employ deception to lure a victim to a particular place, but deception is not required to prove the offence of murder.

Some examples of offences involving dishonesty or deception are:

- theft

- fraud by false representation

- fraud by failing to disclose information

- obtaining services dishonestly

- obtaining property or services by deception

- evading liability by deception

Some examples of offences which do not involve dishonesty or deception include:

- television licence evasion

- most motoring offences

- assault

- possession of classified drugs

- murder

Updates to this page

-

Updated to reflect changes as part of the Charities Act 2022.

-

Updated in line with automatic disqualification rules that come into force on the 1 August 2018.

-

Added a link to sample declarations, which are available in the guidance for charities.

-

Added a link to the online waiver application form.

-

First published.