Universal Credit statistics, 29 April 2013 to 8 April 2021

Published 18 May 2021

Applies to England, Scotland and Wales

The latest release of these statistics can be found in the collection of Universal Credit statistics.

This bulletin contains statistics on claims made, starts, and people on Universal Credit and households including payments for Universal Credit for England, Scotland and Wales (Great Britain).

Proposed changes to Universal Credit statistics in forthcoming releases

New geographical data on wards available in Stat-Xplore from 15 June 2021

Wards will be available as a geographical breakdown on Stat-Xplore for people on Universal Credit and households on Universal Credit from 15 June 2021. This breakdown was requested in the user engagement survey conducted last year.

New statistics intended for release in August 2021

In line with the DWP Statistics User Engagement Strategy we are also seeking views from users on our intention to include new measures on children in Universal Credit households from the August 2021 release. These measures are:

- the number of children in Universal Credit households

- the age of the youngest child in Universal Credit households

It is also intended to amend family type, as the children variables will be based on a broader definition of children than the policy definition for eligibility for the child entitlement.

More information on these new statistics are provided in about these statistics. Users are invited to comment on these proposed changes.

1. Main Stories

- 39,000 claims made to Universal Credit per week in the 4 weeks to 8 April 2021

- 130,000 claims started on Universal Credit in the 4 weeks to 8 April 2021

- 6.0 million people on Universal Credit at 8 April 2021, broadly unchanged from 11 March 2021

- 5.0 million households on Universal Credit in February 2021, of which 87% (4.4 million) received a payment

- 90% of new claims and 98% of all claims received their payment in full and on time for the assessment period covering 14 January 2021, compared with 86% and 95% respectively in March 2020

2. What you need to know

Universal Credit statistics cover 4 series:

- Claims: the number of people who have made a new claim for Universal Credit. Not all new claims go on to “start” on Universal Credit

- Starts: the number of people who verify their ID and accept their claimant commitment in the period of the statistics

- People: the number of people claiming Universal Credit who have verified their ID and have accepted their claimant commitment on the 2nd Thursday of the month

- Households: the number of households who have a calculated entitlement for Universal Credit for the monthly assessment period active on the count date (2nd Thursday of the month). The commentary for households in this bulletin focuses mostly on households who are “in payment” which is defined as households with a monthly award or advance payment of more than £0

Further guidance on these statistics is provided in the About these statistics section of this bulletin and the background information and methodology document. Information on the timeliness of the statistics is provided in the background quality report.

Interactive tools

Alternative ways to view these statistics are available:

- Stat-Xplore allows users to explore Universal Credit data and build their own tables – it also contains some ready-made tables

- Universal Credit claimants at Jobcentre Plus office level in an interactive map

- Households on Universal Credit at local authority level in an interactive map

- An interactive dashboard of the latest Universal Credit household statistics by region

Impact of Coronavirus (COVID-19)

The coronavirus (COVID-19) pandemic has had an impact on these statistics. Operational and policy changes in response to the coronavirus pandemic have affected the time series for Universal Credit statistics. Therefore, we do not recommend making comparisons with trends before the coronavirus pandemic to during it.

The background information and methodology document explains the changes made and how they affect these statistics.

Experimental statistics

Universal Credit statistics are official statistics that are experimental. This is due to the ongoing development of the data systems that are used to support Universal Credit.

3. Claims made for Universal Credit

Making a claim is the first step an individual will need to do to receive Universal Credit.

There was an average of 39,000 claims per week made to Universal Credit in the 4 weeks to 8 April 2021.

Fewer new claims made than before the coronavirus (COVID-19) pandemic

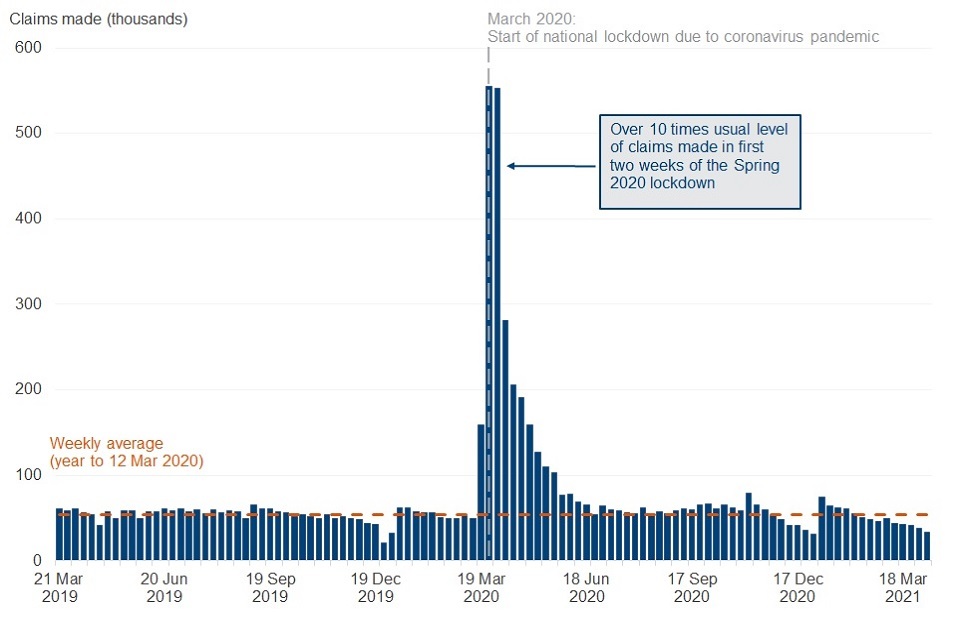

Claims made (weekly), Universal Credit, Great Britain, 21 March 2019 to 8 April 2021

Note: (p) provisional. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Claims on Universal Credit, weekly

In the week leading up to 8 April 2021 there were 34,000 claims made to Universal Credit. This is a 55% decrease on the 75,000 claims made in the first week of 2021. The week up to 8 April 2021 included Easter during which fewer claims are normally made. There has been a gradual decline in the number of claims made to Universal Credit over the first 4 months of the year.

There were, on average, 39,000 and 47,000 claims per week made to Universal Credit in the 4 weeks to 8 April 2021 and 4 weeks to 11 March 2021 respectively. For both April and March 2021, the average claims per week are lower than the average for the 52 weeks to 12 March 2020 before coronavirus pandemic restrictions started to be imposed.

In the two weeks between 20 March 2020 and 2 April 2020 there were 1.1 million claims made to Universal Credit. Each of these weeks is more than 10 times the weekly average for the year to 12 March 2020 of 54,000 claims. This was because of restrictions introduced throughout the country in March 2020 due to the coronavirus pandemic.

In total, since the 13 March 2020 when claims to Universal Credit started to increase in response to restrictions caused by the coronavirus pandemic, there have been 5.0 million claims made to Universal Credit. This is over two-fifths (42%) of the 12.0 million claims made to Universal Credit since its introduction in April 2013.

Not all claims that are made will go on to start on Universal Credit. This can be because, for example, the circumstances of some people who have made a claim may change before they start on Universal Credit, and they may close their claim before starting.

4. Starts to Universal Credit

Following making a claim, a claimant is counted as starting on Universal Credit statistics when they have agreed their commitment requirements and had their identity verified among other criteria. For the full definition of what is regarded as a start on Universal Credit refer to the background and methodology document.

There have been 130,000 claims starting on Universal Credit in the 4 weeks to 8 April 2021. This is a 23% decrease from the 4 weeks to 11 March 2021.

Lowest level of starts since the beginning of the coronavirus (COVID-19) pandemic

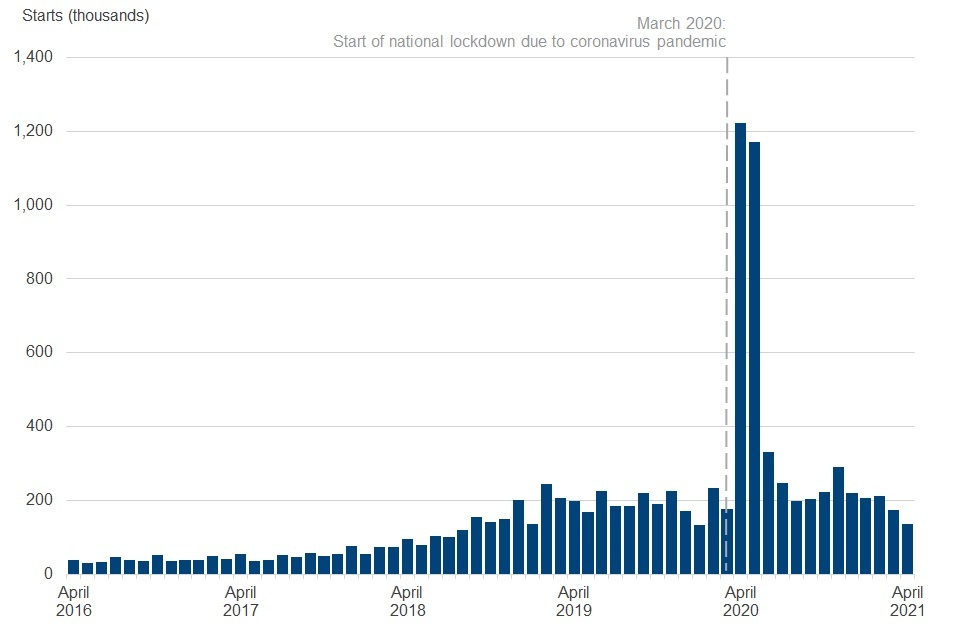

Starts on Universal Credit (monthly), Great Britain, April 2016 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Starts on Universal Credit, month

There were 130,000 starts to Universal Credit in the 4 weeks to 8 April 2021. This is a 23% decrease on the 170,000 starts in the 4 weeks to 11 March 2021. In comparison, there were 1.2 million starts to Universal Credit in the 4 weeks to 9 April 2020 at the beginning of the coronavirus (COVID-19) pandemic.

The UK government made some changes to Universal Credit to support people through the coronavirus pandemic in March 2020. These changes, together with the changes in people’s circumstances caused by the coronavirus pandemic, resulted in a large increase to the number of starts to Universal Credit between 13 March 2020 and 14 May 2020. In total between these dates there were 2.4 million starts to Universal Credit. This contributes to a total of 4.8 million claims for Universal Credit having started between 13 March 2020 and 8 April 2021.

More men started on Universal Credit in the early stages of the coronavirus pandemic than women

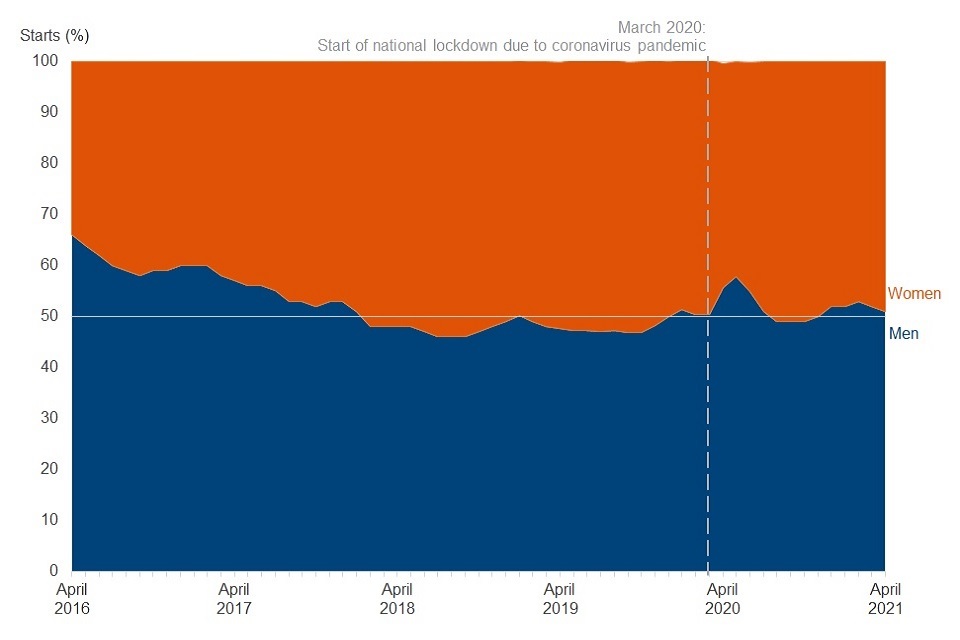

Starts on Universal Credit by gender, Great Britain, April 2016 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series Source: DWP Stat-Xplore, Starts on Universal Credit, gender by month

Since February 2018, in general more women than men have started on Universal Credit each month. However, in the 4 weeks up to 8 April 2021, men (51%) are a higher proportion of the starts on Universal Credit than women (49%). A similar trend was observed during the first lockdown at the beginning of the coronavirus pandemic when 56% of starts were men in the 4 weeks to 9 April 2020.

Percentage of starts that are 16 to 24 year olds returning to levels from before the coronavirus pandemic

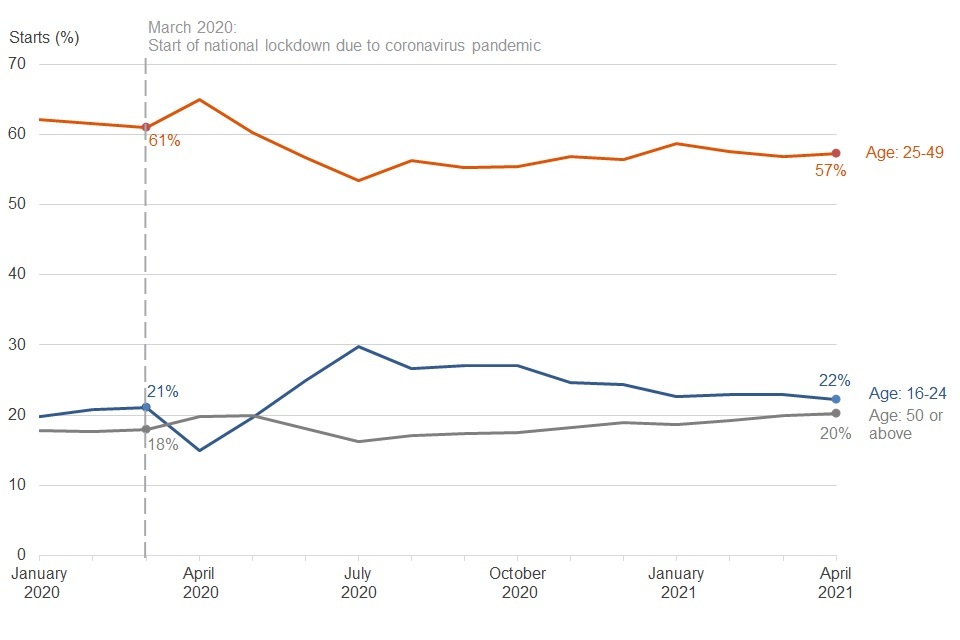

Starts on Universal Credit by age group, Great Britain, January 2020 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Starts on Universal Credit, gender by month

The proportion of Universal Credit starts who are under 25 has increased when compared to levels before the coronavirus pandemic. In the 4 weeks to 8 April 2021, the proportion of Universal Credit claimants who were aged between 16 and 24 was 22%, compared with 21% in the 4 weeks to 12 March 2020. This age range peaked in July 2020 with a proportion size of 30%.

This contrasts with the early stages of the coronavirus pandemic following the lockdown when people aged under 25 fell as a proportion of those starting on Universal Credit. In April 2020, claimants who were aged between 16 and 24 fell to 15% of people starting on Universal Credit.

Claimants starting on Universal Credit who are 50 or above make up a higher proportion than before the pandemic. In the 4 weeks to 8 April 2021, the proportion of Universal Credit claimants who were aged 50 or above was 20%, compared with 18% in the 4 weeks to 12 March 2020. It had fallen to 16% of people starting on Universal Credit in July 2020, coinciding with the peak for under 25s.

5. People on Universal Credit

People on Universal Credit counts the number of people with an open claim on the count date who had accepted a claimant commitment and verified their identity. Not every person on Universal Credit on the count date will go on to receive a calculated entitlement or payment for the assessment period.

There were 6.0 million people on Universal Credit on 8 April 2021.

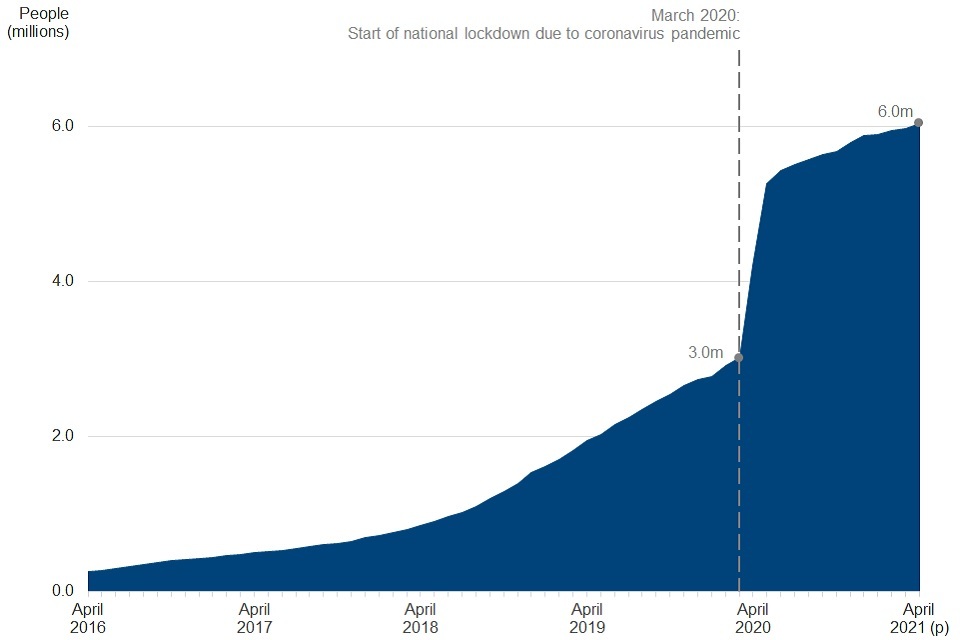

Number of people on Universal Credit doubles since beginning of coronavirus (COVID-19) pandemic

People on Universal Credit, Great Britain, April 2016 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series.

Source: DWP Stat-Xplore, People on Universal Credit, month

The number of people on Universal Credit was 6.0 million on 8 April 2021, broadly unchanged from 11 March 2021. There has been a 100% (3.0 million) increase in the number of people on Universal Credit from 3.0 million on 12 March 2020, the last count date before the coronavirus pandemic.

The increase in the number of people on Universal Credit since 12 March 2020 is due to the economic impact of the coronavirus pandemic. Policy responses to support households through the coronavirus pandemic have also contributed to the increase. Details on the policy and operational changes that would affect these statistics are in the background information and methodology document.

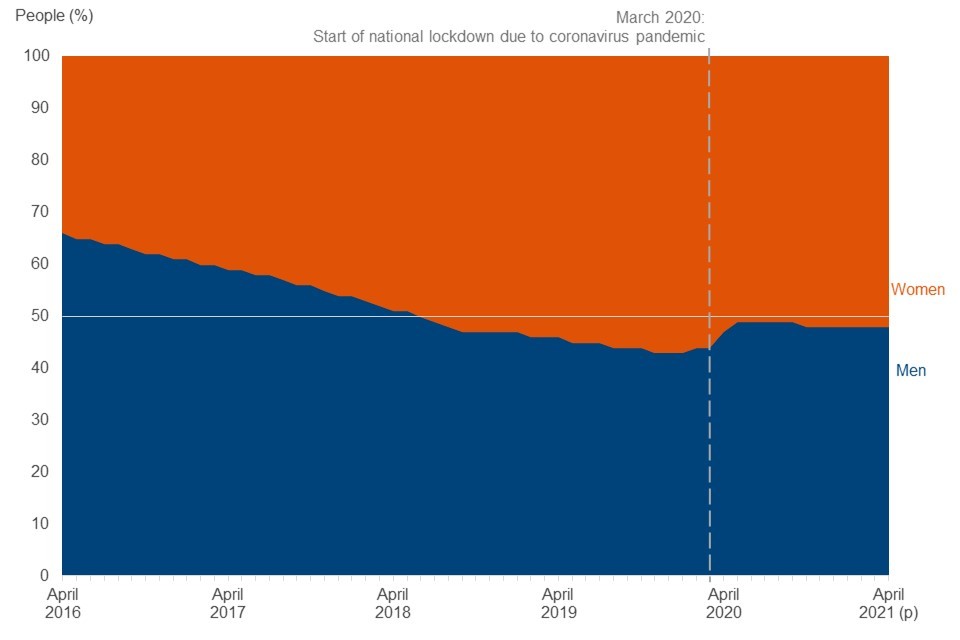

52% of people on Universal Credit are women

People on Universal Credit by gender, Great Britain, April 2016 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series.

Source: DWP Stat-Xplore, People on Universal Credit, gender by month

Women account for 52% of people on Universal Credit on 8 April 2021. During the early months of the coronavirus pandemic more men than women were coming on to Universal Credit. The proportion of people on Universal Credit that were men increased to 49% in May 2020 from 44% in March 2020.

From the introduction of Universal Credit up until June 2018, men on Universal Credit outnumbered women on the benefit. Since June 2018, this has changed to women outnumbering men. This change is explained by Universal Credit being only available to working age individuals with no children and who were seeking employment in the initial introduction of Universal Credit. This group of people are those that would have claimed income related Jobseeker’s Allowance, which is a benefit that has been typically claimed by men more than women (source: Stat-Xplore).

The broadening of Universal Credit to the people who would have claimed the other legacy benefits has led to more women than men claiming Universal Credit. These benefits, which include Income Support and Child Tax Credit, tended to have been claimed by women.

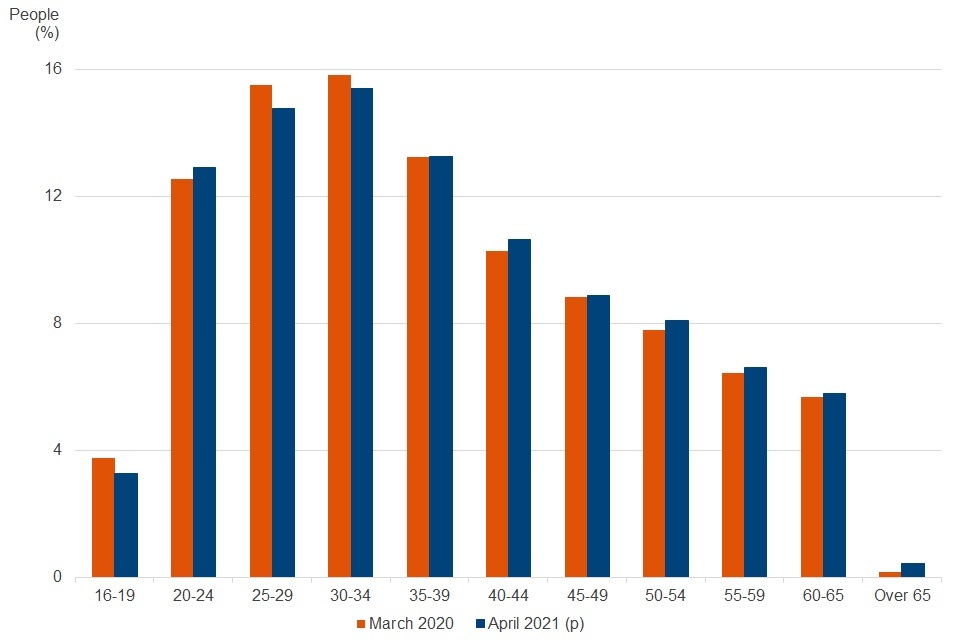

16 to 19 and 25 to 34 year olds on Universal Credit have decreased in proportion since the beginning of the coronavirus pandemic

People on Universal Credit by age group, Great Britain, March 2020 compared to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, People on Universal Credit, age by month

There has been a general upward shift in the age distribution of Universal Credit claimants with the exception of 16 to 19 year olds and 25 to 34 year olds. The proportion of claimants aged 16 to 19 has fallen slightly since the beginning of the coronavirus pandemic, from 3.7% on 12 March 2020 to 3.3% on 8 April 2021. Similarly, the proportion of claimants aged 25 to 29 has decreased from 15.5% to 14.8% and the proportion of claimants aged 30 to 34 has decreased from 15.8% to 15.4% between 12 March 2020 and 8 April 2021.

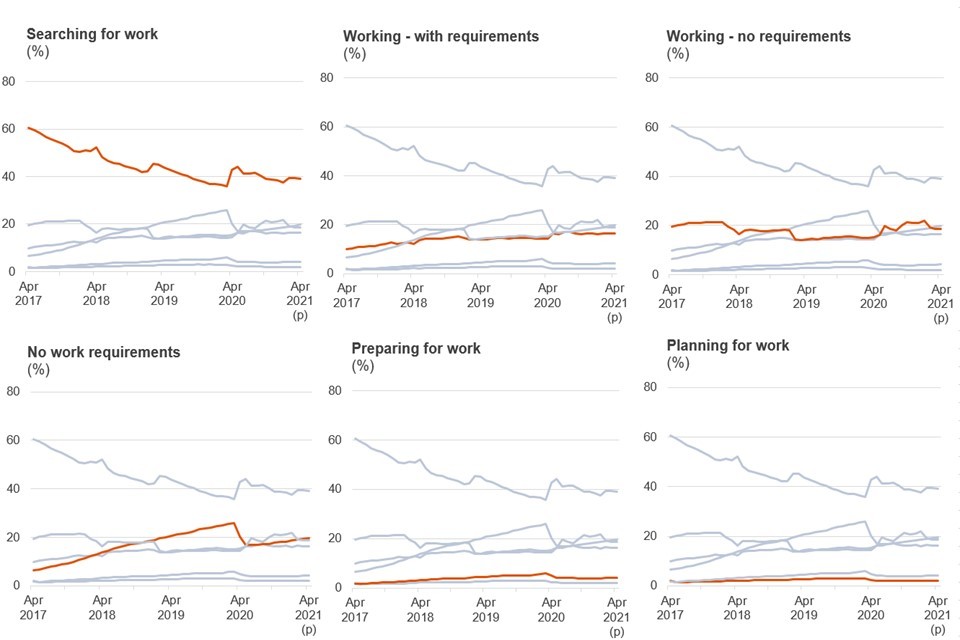

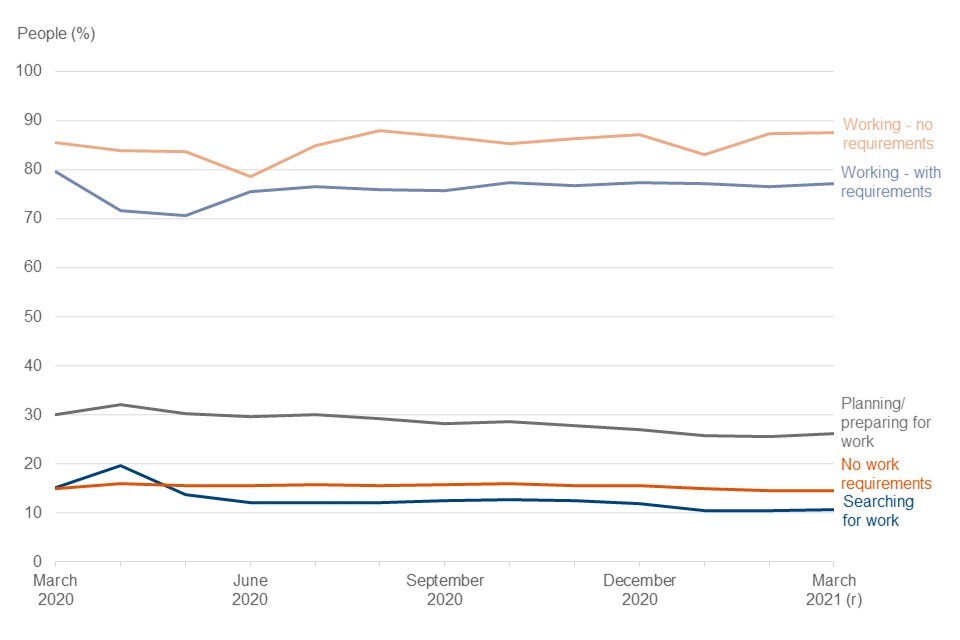

Number of people on the ‘searching for work’ regime has remained broadly unchanged since May 2020

Claimants are required to do certain work-related activities to receive Universal Credit. These activities are determined by which of the 6 conditionality regimes the claimant is placed in. The conditionality regime also determines the level of contact with the claimant, and the support that they will receive.

Conditionality regime is used in Universal Credit statistics instead of the terms ‘conditionality group’ and ‘labour market regime’. To help users understand the different regimes more easily, this bulletin uses different terms to the official terms for the labour market regimes. The definitions section of this bulletin provides more information on the different conditionality regimes, and their associated conditionality groups and labour market regimes.

Different members of the same household may be subject to the same or different requirements. As circumstances change claimants will also transition between different levels of conditionality. This means that there is a ‘flow’ of claimants between these groups. The number of claimants in each group is constantly changing in our published statistics, month to month.

Conditionality regime, Universal Credit, Great Britain, April 2017 to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series.

Source: DWP Stat-Xplore, People on Universal Credit, conditionality regime by month

The proportions of people on Universal Credit on each of the conditionality regimes has changed because of the new claimants to Universal Credit during the initial period of the coronavirus pandemic.

The proportion of all people on Universal Credit who were not working or on low earnings and required to search for work as a condition of their claim (‘searching for work’) increased to 39% on 8 April 2021 from 36% on 12 March 2020.

Since the initial increase in people on Universal Credit at the beginning of the coronavirus pandemic, the number of people in the searching for work conditionality regime has remained between 2.2 million and 2.4 million.

Until the beginning of the coronavirus pandemic, the ‘searching for work’ conditionality regime was on a long-term downward trend. It fell from 62% in October 2016 to 36% in March 2020. This was because Universal Credit was initially only offered to jobseekers. As the benefit broadened to other eligible groups, and more people transferred from legacy benefits, the share of people in ‘searching for work’ has fallen.

During the coronavirus pandemic, a claimant’s requirement to search for work is tailored towards their individual circumstances. This considers their personal circumstances, government health advice and their ability to work. Through an easement, work-related requirements can be ‘turned off’ either by a legal requirement or on a discretionary basis in response to the claimant’s particular circumstances.

The proportion of people on Universal Credit whose circumstances mean they have no requirements to work (‘no work requirements’) has fallen to 20% in April 2021 from 26% in March 2020. This is following an increase of new claimants being in employment since the beginning of the coronavirus pandemic and therefore increasing the relative proportion of those whose circumstances mean they have requirements to work. Examples of the circumstances which place people in this conditionality regime are provided in the definitions section.

Over the same period, the proportion of people on Universal Credit who were working and earning enough not to have any work-related requirements as a condition of their claim (‘working – no requirements’) has increased to 19% in April 2021 from 15% in March 2020. This is primarily because a greater proportion of employees are entitled to claim Universal Credit with higher earnings due to the increase in standard allowance.

The conditionality regime measures which regime an individual is in on the count date. This may not be representative of their entire assessment period. Conditionality regime figures are not the same as the employment measures, which show whether an individual has had earnings during their assessment period. The two measures should only be used together with caution. The background information and methodology document provides more information on this.

Employment rate higher than before the coronavirus pandemic

Universal Credit is available to people who are in work and on a low income, as well as to those who are out of work. Most claimants on low incomes will still be paid Universal Credit when they start a new job or increase their hours.

Universal Credit statistics measure employment as receiving PAYE earnings during the assessment period which is active on the count date.

As earnings for this period can be received up to one month after the count date, this data is not available for processing at the time that other data for people on Universal Credit is available. The later availability of this data means that statistics on employment for people on Universal Credit are published a month later than other statistics for people on Universal Credit.

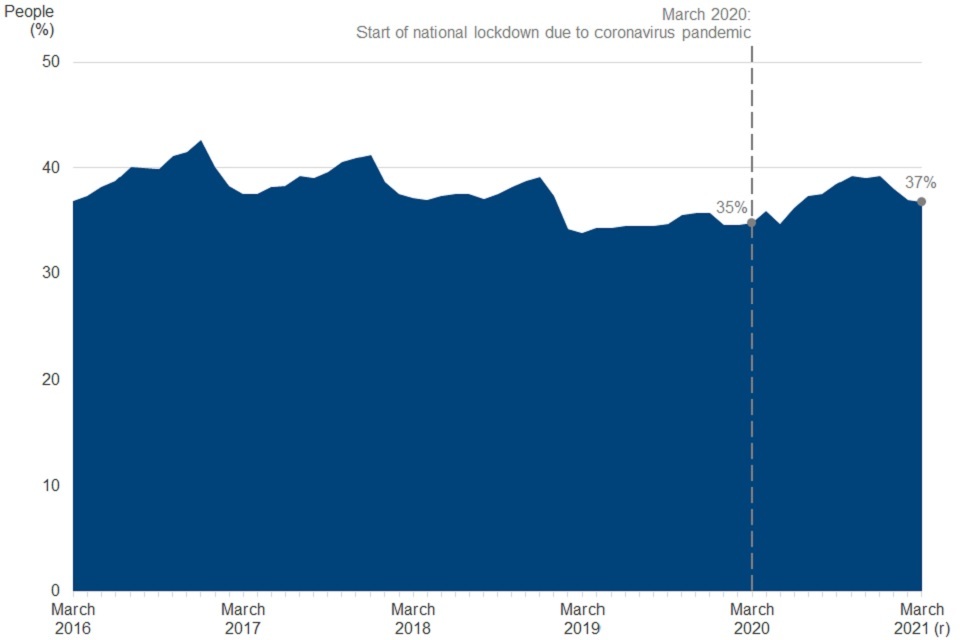

People on Universal Credit in employment, Great Britain, March 2016 to March 2021

Note: (r) revised. See Stat-Xplore for the complete data series

Source: DWP Stat-Xplore, People on Universal Credit, employment indicator by month

The composition of Universal Credit claimants has changed since before the coronavirus pandemic. There is now a higher proportion of people on Universal Credit being recorded as in employment. This is because of policy and operational changes that has allowed people with higher earnings to be eligible for Universal Credit, relative to before the coronavirus pandemic.

The employment rate has increased for all people on Universal Credit to 37% (2.2 million) on 11 March 2021 from 35% (1.0 million) on 12 March 2020, the last count date before the coronavirus pandemic.

The increase in the employment rate, and that it is higher than the pre-pandemic rate, should not be interpreted as increasing employment. This increase may seem contradictory to other statistics on the labour market, but it should be considered in the context of the policy changes to Universal Credit to support people through the coronavirus pandemic.

Not all people in ‘searching for work’ conditionality are unemployed

People on Universal Credit, employment rate by conditionality regime, Great Britain, March 2020 to March 2021

Note: See Stat-Xplore for the complete data series.

Source: DWP Stat-Xplore, People on Universal Credit, employment indicator by conditionality regime and month

A claimant’s conditionality regime may not be apparent from their employment status as there are differences between how conditionality regime and employment status are measured.

The conditionality regime is a measure of the regime the claimant is on the count date whereas employment status measures whether a claimant has received any (PAYE) earnings during the assessment period that covers the count date. For this reason, a claimant may not necessarily be in employment on the count date.

In the ‘searching for work’ conditionality regime, 89% of claimants received no earnings and are recorded as not in employment for the assessment period covering 11 March 2021. Typically, around 85% of claimants received no earnings and were recorded as not in employment in the months before the coronavirus pandemic.

This means that 11% are recorded as having received earnings and being in employment. These claimants will include those who are in work with earnings below £338 per month, or with earnings below this level and household earnings below £541 per month. These amounts are known as the Administrative Earnings Level (AET).

In the ‘working – no requirements’ regime there are 87% of claimants in employment. There are 13% of claimants who are recorded as not having received earnings and not in employment. These include claimants who are not in work, but who are in a household with earnings above the household Conditionality Earnings Threshold (CET). The CET is the amount of the National Minimum Wage for the claimant’s expected hours of work.

In a couple household, if one of the adults is earning above the household CET, then the claimant is placed in the ‘working – no requirements’ regime regardless of the individual employment status. The household CET is a combination of both adults individual CETs.

The number of people on Universal Credit in London and surrounding regions has more than doubled since the beginning of the coronavirus pandemic

Percentage increase of people on Universal Credit by region, Great Britain, March 2020 to April 2021

| Region | % |

|---|---|

| London | 138 |

| South East | 120 |

| East of England | 112 |

| East Midlands | 102 |

| South West | 97 |

| West Midlands | 91 |

| Yorkshire and The Humber | 89 |

| Scotland | 86 |

| North West | 83 |

| Wales | 82 |

| North East | 68 |

Note: See Stat-Xplore for the complete data series.

Source: DWP Universal Credit statistics.

There have been regional disparities in the growth of the number of people on Universal Credit during the coronavirus pandemic. London (138%), the South East (120%) and the East of England (112%) have seen the largest growth between 12 March 2020 and 8 April 2021. This has more than doubled the number of people on Universal Credit in those regions.

The North East has seen the smallest growth with a 68% increase in the number of people on Universal Credit.

Claimants from London and the North West make up a greater proportion of people on Universal Credit

People on Universal Credit by region, Great Britain, March 2020 compared to April 2021

Note: (p) provisional. See Stat-Xplore for the full data series.

Source: DWP Stat-Xplore, People on Universal Credit, region by month

The disparities in growth in people on Universal Credit between regions are reflected in how the proportions of people on Universal Credit in each region has changed since the beginning of the coronavirus pandemic.

There is an increase in the percentage of people on Universal Credit that live in London, South-East and East of England compared with before the pandemic.

There were 17.1% of people on Universal Credit that live in London in April 2021, an increase from 14.4% in March 2020. The South-East and East of England have increased to 11.5% and 8.3% of people on Universal Credit in April 2021 from 10.4% and 7.9% in March 2020 respectively.

Other regions have either fallen or had very little change as a percentage of people on Universal Credit since the beginning of the coronavirus pandemic.

For more regional and local level information see the map for claimants on Universal Credit at Jobcentre Plus office level

6. Households on Universal Credit

In Universal Credit statistics a household is a single person or couple living together with or without dependent children. This is sometimes referred to as a benefit unit in other statistics. To be counted in the ‘households on Universal Credit’ series, a household needs to have had their entitlement calculated for the assessment period covering the count date.

Statistics for ‘households on Universal Credit’ are produced 3 months in arrears. For more information and the timeliness of these statistics, refer to the background information and methodology document.

There were 5.0 million households on Universal Credit in February 2021. This is an increase of 0.1 million since November 2020.

Of these households, 87% (4.4 million) received a payment.

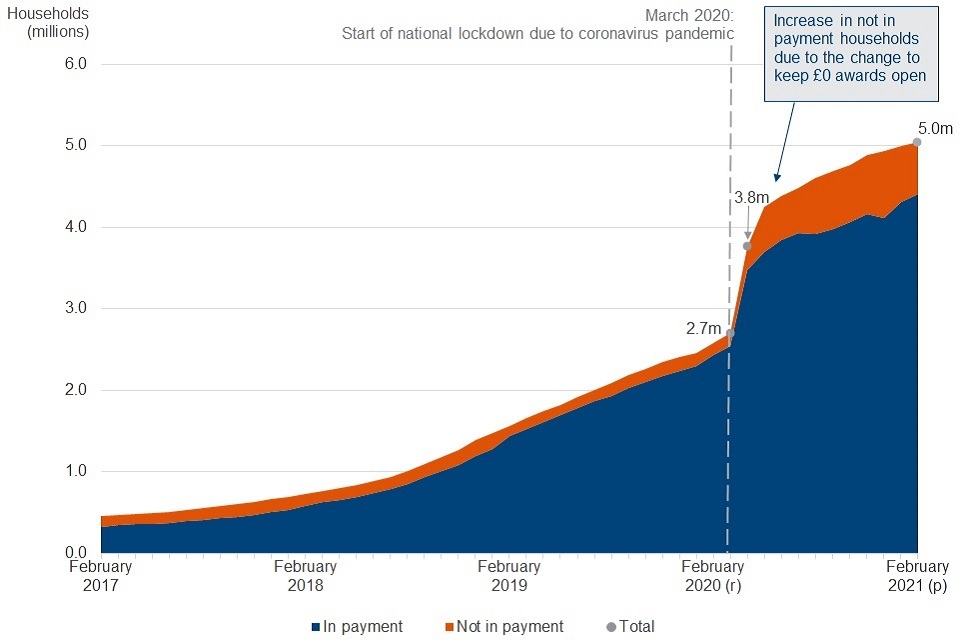

Total households on Universal Credit by in payment and not in payment, Great Britain, February 2017 to February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Households on Universal Credit, payment indicator (yes)

The number of households on Universal Credit has increased to 5.0 million for assessment periods covering 11 February 2021. Before the coronavirus (COVID-19) pandemic, in March 2020, there were 2.7 million households on Universal Credit.

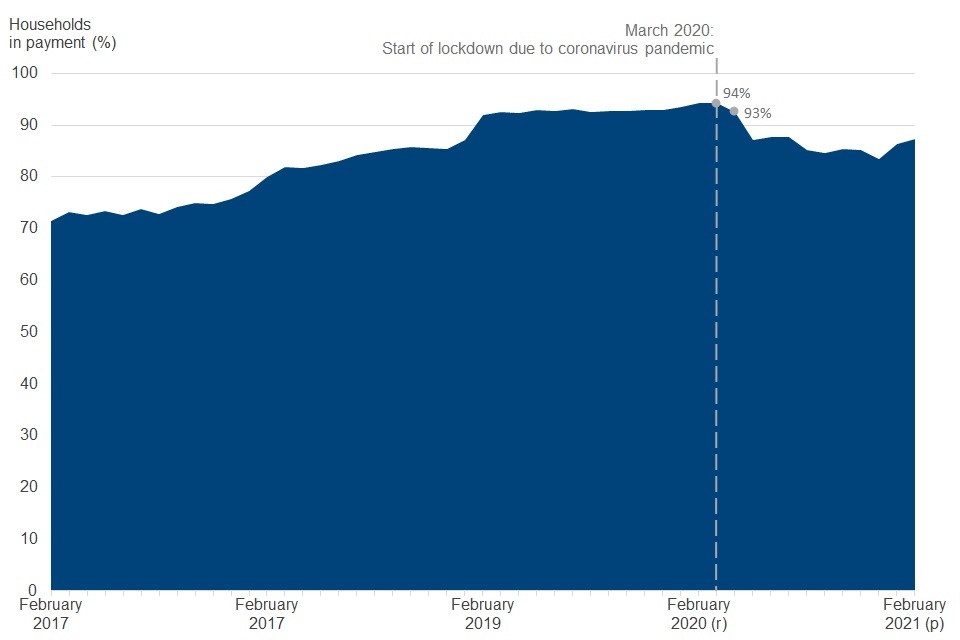

Fewer households in payment, proportionally, than before the coronavirus pandemic.

Households on Universal Credit are categorised as either in payment or not in payment. Of the 5.0 million households on Universal Credit in February 2021, 87% were in payment. The proportion of households in payment is lower than before the coronavirus pandemic. This is because of operational changes that kept claims not in payment open longer. Before the coronavirus pandemic, the proportion of households in payment was 94% in February 2020.

Households on Universal Credit in payment, Great Britain, February 2017 to February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Households on Universal Credit, payment indicator (yes)

There are several reasons why a household may not be in receipt of a payment. For example, when someone moves into work and their level of earnings means that they no longer receive a payment.

Claims are normally considered to be closed if the household earnings reduce their award to £0. However, there is a temporary process change during the coronavirus pandemic where claims are kept open for up to 6 assessment periods of a £0 award. This means there have been more open claims with a £0 award.

In addition, households would have claimed Universal Credit at the beginning of the coronavirus pandemic before other support measures were announced. As the Coronavirus Job Retention Scheme and other support measures were announced and came into effect, their earnings may not have fallen as much as the claimant expected when they had made their claim. Consequently, their award was tapered down to £0 because of their earnings.

The average (mean) Universal Credit payment is higher than before the coronavirus pandemic

The amount of Universal Credit a household receives is based on the standard Universal Credit allowance plus additional entitlements that they are eligible for.

Above these entitlements households may also receive additional payments, for example a loan advance or mortgage interest payment.

A payment to a household may be lower than their entitlement. For example, where they are being sanctioned, limited by the benefit cap or earning above the threshold and the payment is reduced by the taper.

Average (mean) Universal Credit payment for in payment households, Great Britain, February 2017 to February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

The average (mean) amount of Universal Credit paid to households on Universal Credit was £770 per month in February 2021. This is an increase of £40 from £730 in February 2020, before the coronavirus pandemic.

The higher average payment of Universal Credit since March 2020 is due to annual uprating of Universal Credit entitlements. It is also due to a temporary £1,040 a year increase (£20 a week) to the standard allowance from April 2020 in response to the coronavirus pandemic. This temporary increase to the standard allowance has been extended and continues to be included in Universal Credit awards.

There was a spike in the average payment for assessment periods covering 9 April 2020, with the average payment of £840. Management information shows that there was an increase in the number of advances being paid in the early weeks of the coronavirus pandemic.

Additionally, some payments would have increased from a suspension of the recovery of debts for benefit overpayments, Social Fund loans and third-party debts. The recovery of these debts was suspended until early May 2020, when recoveries were gradually reintroduced.

Moreover, requirements for work search and work availability were suspended from 30 March 2020 at the beginning of the coronavirus pandemic. These requirements have been gradually reintroduced from 1 July 2020. This suspension led to fewer reductions from sanctions than normal, increasing the average payment amount.

Although claimants will fully benefit from the annual benefit uprating and the £20 a week temporary increase to the standard allowance, this does not show in the increase to the average (mean) payment since February 2020. This is due to:

-

a higher proportion of single people without children

-

a higher proportion of claims made without the housing element in new claims

-

people returning to work since 1 June 2020 on a flexible-working basis as allowed by the coronavirus Job Retention Scheme

The average payment is influenced by large payments. In February 2021, nearly 8% of households where Universal Credit is in payment were paid more than £1,500. The average (mean) payment is increased by these large payments, which are mostly caused by households receiving payments in addition to their standard entitlements.

In February 2021, the median payment (£690) was lower than the average (mean) payment of £770.

Average (mean) payment is influenced by the number of high payments

In payment households by payment band, Great Britain, February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

More households received a payment in the £300.01 to £400 payment band than any other payment band. Nearly 90% of claimants in this payment band were single claimants without children. In contrast, in the over £1,500 payment band, 93% were households with children (Source: Stat-Xplore).

For regional data, refer to the household dashboard and household maps at region and local authority level

Increased proportion of households in payment are without children since beginning of coronavirus pandemic

In payment households by family type, Great Britain, February 2017 to February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Households on Universal Credit, payment indicator (yes), family type

Households without children have increased to 59% of households on Universal Credit in payment in February 2021. Before the coronavirus pandemic, in March 2020, 54% of households on Universal Credit in payment had no children.

Prior to the coronavirus pandemic there was a long-term upward trend for the proportion of households with children on Universal Credit claims in payment. This was due to Universal Credit replacing legacy benefits and tax credits for new claims. Migration from legacy benefits and tax credits due to a change in circumstances also contributed to this trend.

A smaller proportion of households in payment receive additional entitlements since the beginning of the coronavirus pandemic

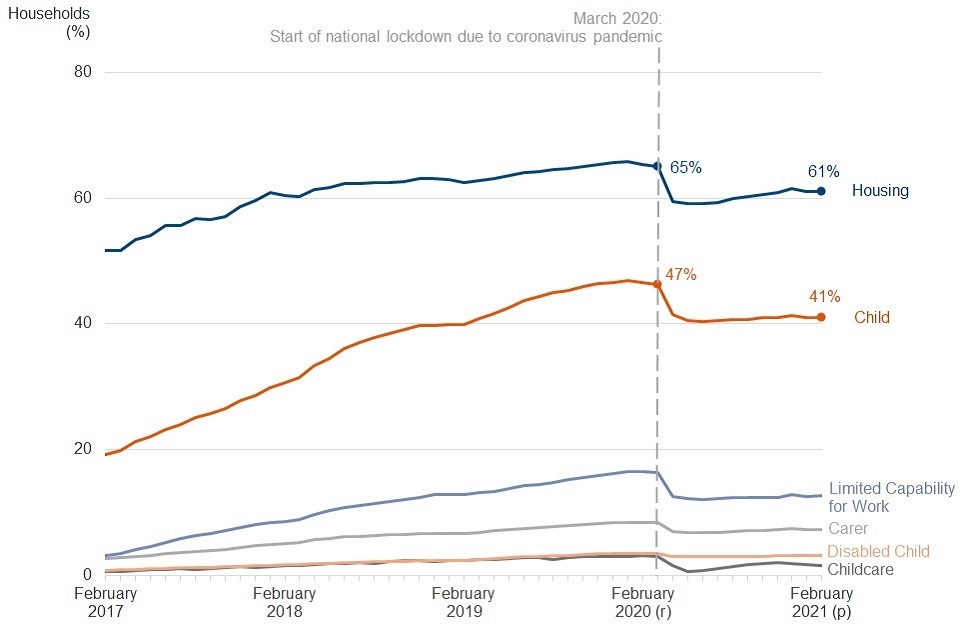

Entitlements for in payment Households, Great Britain, February 2017 to February 2021

Note: (p) provisional. (r) revised. See Stat-Xplore for the full data series

Source: DWP Stat-Xplore, Households on Universal Credit, Entitlements

There are a range of additional entitlements in Universal Credit payments for children, health and disabilities, housing, and carers.

The proportion of Universal Credit payments with each of these entitlements began to decrease because of an increase in claimants from the coronavirus pandemic. This suggests a greater proportion of new claimants were not claiming additional entitlements. Previously, the proportion of claimants with additional entitlements was on an increasing trend as Universal Credit gradually replaced legacy benefits for new claims.

Support for rental housing costs (housing entitlement) was included in 61% of households receiving a payment in February 2021. This is down from a peak of 66% in January 2020.

Households are paid child entitlement to help with the cost of looking after children. Over two in five households in payment (41%) received child entitlement in February 2021. This is compared to a high of 47% in February 2020. As Universal Credit has replaced legacy benefits such as child tax credits, the proportion of households receiving this entitlement has changed. For example, in February 2018 it was included in 31% of payments.

One in five households with a housing entitlement affected by Removal of Spare Room Subsidy

Households on Universal Credit in payment with housing entitlement in their payment may receive a reduction to their payment due to the Removal of Spare Room Subsidy (RSRS) scheme. This is where tenants in social housing whose accommodation is deemed to be larger than they need may lose part of their Universal Credit payment. In February 2021, the proportion of households on Universal Credit in payment with housing entitlement in their payment to receive a reduction due to the RSRS scheme was 20% (250,000). The average (mean) monthly reduction amount was £70 and the median reduction amount was £60.

In January 2021, 98% of households in payment received their full payment on time

Statistics on payment timeliness are produced 4 months in arrears to avoid large revisions to provisional figures caused by retrospection. This is to allow for more accurate and higher quality statistics.

Payment timeliness (all claims), Universal Credit, Great Britain, January 2017 to January 2021

Note: Payment timeliness statistics are available in Stat-Xplore from April 2019 onwards. To allow sufficient time for information to be gathered on all payments, figures are not included for the latest month in the series. Payment timeliness statistics for January 2017 to March 2019 for Universal Credit full service can be found in table 1.1 in the ODS table accompanying this bulletin. Figures prior to April 2019 are Universal Credit full service only. Figures marked (p) are provisional; figures marked (r) have been revised since the previous release.

Source: Stat-Xplore, Households on Universal Credit, Payment Timeliness

Payment timeliness for all claims in payment has continued an upward trend throughout the coronavirus pandemic. Of households in payment, 98% received all their payment on time in January 2021. This is an increase from 94% in March 2020, the start of the coronavirus pandemic.

Around 99% of all households in payment were paid all or some payment on time, compared to 98% in March 2020.

More new claims received their full payment on time than before the coronavirus pandemic

Payment timeliness (new claims), Universal Credit, Great Britain, January 2017 to January 2021

Note: Payment timeliness statistics are available in Stat-Xplore from April 2019 onwards. To allow sufficient time for information to be gathered on all payments, figures are not included for the latest month in the series. Payment timeliness statistics for January 2017 to March 2019 for Universal Credit full service can be found in table 1.1 in the ODS table accompanying this bulletin. Figures prior to April 2019 are Universal Credit full service only. Figures marked (p) are provisional; figures marked (r) have been revised since the previous release.

Source: Stat-Xplore, Households on Universal Credit, Payment Timeliness

Payment timeliness is lower for new claims in comparison to all claims. There are several one-off verification processes that must be completed by the claimant and by DWP at the start of the claim. These are to confirm the current circumstances of the claimant (or both claimants in a joint claim) and their entitlement to Universal Credit. Delays to completion of these processes can cause payments not to be made on time.

The proportion of new claims (claims in their first assessment period on the count date) receiving all the first payment on time in January 2021 was 90%. This is higher than the 86% of new claims receiving all their first payment on time in March 2020 before the coronavirus pandemic.

Just over 93% of households received some or all their first payment on time in January 2021.

Before the coronavirus pandemic, payment timeliness for new claims had been on a general upward trend for households receiving some or all their award on time. In March 2020, the month containing the last count date before the coronavirus pandemic, 92% of new claims received all or some of their first payment on time.

Payment timeliness is higher during the coronavirus pandemic because of temporary operational and policy changes. This includes redeploying staff within DWP to handle Universal Credit claims, and changes to some verification processes due to the closure of Jobcentres.

7. Definitions

Claim made

A claim made is when an individual submits an application for Universal Credit.

Start

A person has started on Universal Credit when their identity has been verified and they have agreed their claimant commitment.

People

A person is counted on Universal Credit when they have met the definition to start, they have a National Insurance number recorded and there is no record of a closure of the claim.

Household and in payment

A household is a single person or co-habiting couple with or without dependant children. A household is counted when their assessment period overlaps the count date. An in payment household is one that has received a Universal Credit payment of £0.01 or more after deductions, sanctions and the benefit cap during that assessment period.

Conditionality Regimes

All people on Universal Credit are placed into one of four conditionality groups, depending on their personal circumstances. Which of these groups they are placed into will determine what activities they are required to do (if any) as part of their claim. Universal Credit statistics uses the term conditionality regime in place of ‘conditionality group’ and ‘labour market regime’. The table below shows the circumstances of individuals for each conditionality regime and the associated group and labour market regime.

| Conditionality regime | Description | Conditionality Group | Labour Market Regime |

|---|---|---|---|

| Searching for work | Not working, or with very low earnings. Claimant is required to take action to secure work - or more or better paid work. The Work Coach supports them to plan their work search and preparation activity. Typical examples of people in this regime include jobseekers and self-employed in start-up period. Claimants are only in this regime if they do not fit into one of the other regimes. | All work related requirements | Intensive Work Search |

| Working – with requirements | In work, but could earn more, or not working but has a partner with low earnings. | All work related requirements | Light touch |

| No work requirements | Not expected to work at present. Health or caring responsibility prevents claimant from working or preparing for work. Examples of people on this regime include those in full time education, over state pension age, has a child under 1 and those with no prospect for work. | No work related requirements | No work related requirements |

| Working – no requirements | Individual or household earnings over the level at which conditionality applies. Required to inform DWP of changes or circumstances, particularly at risk of earnings decreasing or job loss. | No work related requirements | Working enough |

| Planning for work | Expected to work in the future/ Lead parent or lead carer of child aged 1 (aged 1 to 2, prior to April 2017). Claimant required to attend periodic interviews to plan for their return to work. | Work focused interview | Work focused interview |

| Preparing for work | Expected to start work in the future even with limited capability to work at the present time or a child aged 2 (aged 3 to 4, prior to April 2017). Claimant expected to take reasonable steps to prepare for working including Work Focused Interview. | Work preparation | Work preparation |

Universal Credit live service

The original service offering Universal Credit. Initially restricted to mostly single working age people with no children, seeking work. It was available throughout Great Britain by May 2016. It closed to new claims from 1 January 2018 and all remaining claimants were moved to full service by March 2019.

Universal Credit full service

Full service is the digital system that offers Universal Credit to the full range of claimant groups. New claims are made on gov.uk and most accounts are managed only through an online account. It was gradually introduced to Jobcentres from 2016 and was available in every Jobcentre across Great Britain and Northern Ireland by December 2018. When full service became available in a Jobcentre, existing Universal Credit claimants on live service were transferred to full service within 3 months.

A glossary for further terms used in Universal Credit statistics is included in the background and methodology document.

8. Related statistics

This publication complements other statistics bulletins that, together, provide a more coherent view of Universal Credit claimants and awards, and other benefits.

Universal Credit statistics for Northern Ireland are published by the Department for Communities (Northern Ireland).

Benefit sanctions includes statistics on people having their award stopped or reduced for not meeting their agreed conditions.

Benefit Cap includes statistics on people who have had their Universal Credit award capped because their total amount received in benefits is higher than the maximum amount of benefits a person can receive.

DWP benefits provides statistics for benefits that Universal Credit is replacing.

Fraud and error in the benefit system provides estimates of the number of households that may have been paid too much Universal Credit or not enough. These overpayments and underpayments happen as a consequence of fraud; claimant error; and official error (processing errors or delays by DWP, a Local Authority, or Her Majesty’s Revenue and Customs). ‘Fraud and error in the benefit system’ estimates how much money the department incorrectly pays.

Claimant Count is a measure of the number of people claiming benefits principally for the reason of being unemployed, based on administrative data from the benefits system. It includes people on Universal Credit in the searching for work conditionality regime for the UK. Universal Credit statistics uses the same data excluding Northern Ireland.

Alternative Claimant Count statistics measure the number of people claiming unemployment related benefits by modelling what the count would have been if Universal Credit had been fully available from when Universal Credit was introduced in 2013 with the broader span of people this covers. Under Universal Credit, a broader span of claimants are required to look for work than under Jobseeker’s Allowance. This is a feature of the design of Universal Credit and has the effect of increasing the Claimant Count irrespective of how the economy performs. For this reason, the Office for National Statistics have stated that the Claimant Count figures are no longer a reliable indicator of the labour market. The Alternative Claimant Count attempts to address this.

European Social Fund (ESF) 2014 to 2020 (ESF 14 to 20) programme is an EU-funded employment, skills and social inclusion programme across England aimed at providing the help people need to achieve their potential. This publication uses Universal Credit data to show how many people who started on the programme were on Universal Credit.

9. About these statistics

What is Universal Credit?

Universal Credit is a single payment for each household to help with living costs for those on a low income or out of work. It is replacing 6 benefits, commonly referred to as the legacy benefits.

Support for housing costs, children and childcare costs are integrated into Universal Credit. It also provides additional support for people with a disability, health condition, or caring responsibilities which may prevent them from working.

Payments are contingent on certain work related activities being carried out depending on the outcome of the claimant assessment. Payment amounts can be reduced for a variety of reasons, such as sanctions, debt repayment, removal of spare room subsidy, or the taper for earnings above the work allowance.

Where to find out more

Information on these statistics are available in the following documents:

- background information and methodology

- background quality report

- Quality Assurance of Administrative Data report

- release strategy

Detailed guidance on the policy and operational aspects of Universal Credit:

Data sources and limitations

These official statistics have been compiled using data in systems used by the department in the administration of Universal Credit and records of Universal Credit benefit payments made by the department.

While every effort is made to collect data to the highest quality, as with all administrative data it is dependent on the accuracy of information entered into the system. Checks are made throughout the process from collection of the data to producing the statistics, but some data entry or processing errors may filter through to the data used to produce the statistics. The quality assurance of administrative data report provides quality assessments on the data sources used in these statistics.

As Universal Credit continues to develop, caution should be used when interpreting statistics over long time periods. Administrative system changes could cause discontinuities in the time series that were not the result of a policy decision or the economic environment.

There are inherent differences in the data for People on Universal Credit and Households on Universal Credit, thus it is not possible to cross-tabulate between the two measures. More information is provided in the relationship between people and households on Universal Credit section of these differences between the 2 datasets.

A full discussion of strengths and limitations is in the background information and methodology

Release schedule

The bulletin is published quarterly in February, May, August and November, supplemented by monthly data updates for people on Universal Credit statistics in Stat-Xplore.

Next release of people on Universal Credit: 15 June 2021

Next release for claims, starts and households on Universal Credit: 17 August 2021

All releases for Universal Credit statistics can be found in the Universal Credit statistics collection.

Compliance check against the Code of Practice for Statistics

These statistics are produced in accordance with the Code of Practice for statistics.

A compliance check was conducted on Universal Credit statistics by the Office for Statistics Regulation (OSR) in May 2019. We have acted on the recommendations made by the OSR to improve the presentation and user understanding of these statistics.

Rounding

Volumes and amounts have been rounded as detailed in the background information and methodology document. Percentages are calculated using numbers prior to rounding and rounded to the nearest whole percentage point.

Revisions

Universal Credit statistics are subject to scheduled revisions as detailed in the background information and methodology document.

New measures

Children in Universal Credit households

It is intended to release new measures on Universal Credit households from August 2021. The definition of children for these new variables will be all children declared in the Universal Credit claim whose age has been verified as under 20.

This definition for children is broader than the definition used in the eligibility for the child entitlement. This is because a child or young person can be declared on a claim initially and living in the household, but may not meet other eligibility requirements once the claim is processed.

Reasons for ineligibility include but are not limited to: older children or young people who are not in full-time non-advanced courses, children who are looked after or fostered, and the policy to provide support for a maximum of two children, affecting children born after 6 April 2017 unless they are covered by an exception.

Issues

Postcode district for claims and starts to Universal Credit remains withdrawn

This is due to an issue with the underlying data. Postcode districts (for example, E5) will be restored when a new methodology is developed. This does not affect postcode area (for example, ‘E’ in the postcode E5) for claims and starts which remains available.

10. Contacts

Feedback on the content, relevance, accessibility and timeliness of these statistics and any non-media enquiries should be directed to:

Statistician: Stephen Slater

Email: team.ucos@dwp.gov.uk

For media enquiries on these statistics, please contact the DWP press office

For statistics enquiries only. These contact details are unable to provide any information or assistance with claiming Universal Credit.

ISBN: 978-1-78659-309-2