Self-Employment Income Support Scheme statistics: October 2021

Published 7 October 2021

1. Overview

This publication covers the fifth grant for the Self-Employment Income Support Scheme (SEISS) administered by HM Revenue and Customs (HMRC) up to 15 September 2021.

The release is classified as Experimental Statistics as the methodologies used to produce the statistics are still in their development phase. As a result, the data are subject to revision. These statistics have been produced quickly in response to developing world events.

The Office for Statistics Regulation, on behalf of the UK Statistics Authority, has reviewed them against several key aspects of the Code of Practice for Statistics and regards them as consistent with the Code’s pillars of Trustworthiness, Quality and Value.

1.1 Contact details

For queries or feedback on this publication, please email:

For press queries, please contact HMRC Press Office:

1.2 Next release

The next publication will be released on 4 November 2021.

2. Main findings

- To date £27.7bn has been paid in SEISS grants in total (up to 15 September 2021). Across the five grants 2.9 million individuals have received a grant and 10.2 million total grants have been claimed

- Around 5.0 million individuals reported self-employment income for the tax year 2019 to 2020, and had their data assessed for potential SEISS eligibility. In order to be assessed, a self-employed individual needed to have traded in the tax year 2019 to 2020 and submitted a Self-Assessment tax return on or before 2 March 2021 for that year

- Via this process, 3.3 million self-employed individuals were identified as potentially eligible for the fifth grant. This is a similar size population as those potentially eligible for the earlier SEISS grants. (Potentially eligible means that they met the criteria for the scheme based on Self-Assessment tax returns from 2019 to 2020 and earlier years. However, some of the businesses will not have been affected by Coronavirus or have ceased trading since 2019 to 2020 so will not have been eligible)

- Not all potentially eligible individuals will claim the grant. As of 15 September 2021, 1.1 million of this population have claimed the fifth grant, representing a take-up rate of 33%. The value of these claims totals £2.5 billion

- The 1.1 million successful claims can be divided into categories: a higher grant (worth 80% of 3 months’ average trading profits capped at £7,500) and a lower grant (receiving 30% of 3 months’ average trading profits capped at £2,850). There have been 778,000 higher grant claims (71%) and 315,000 lower grant claims (29%)

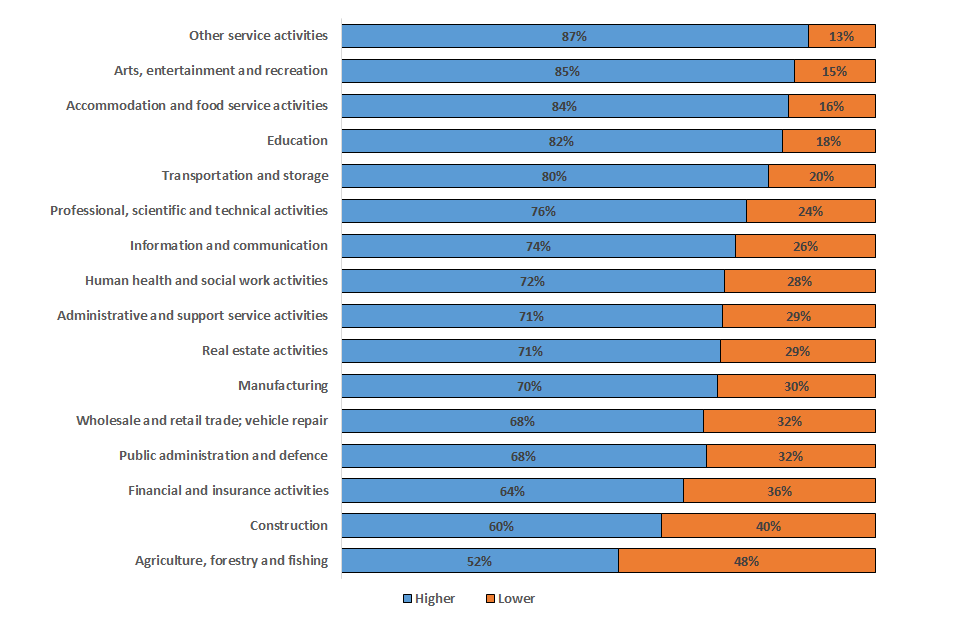

- Among female claimants, 79% claimed the higher grant. Among male claimants, 68% claimed the higher grant. The proportion of higher grant claims rises with age. Individuals in other service activities (87%) and arts, entertainment and recreation (85%) have the highest proportion of claims for the higher grant. The lowest proportions are in agriculture, forestry and fishing (52%) and construction (60%)

- Around 500,000 people are brought into scope who either became self-employed in 2019-20 or were ineligible for the first three grants, but now may be eligible for the fifth grant based on their 2019-20 tax return

- There are 57,000 (28% take-up) claims by individuals that were newly self-employed in 2019-20, meaning they did not trade in any of 2016-17, 2017-18 or 2018-19. 60,000 (21% take-up) claims are by individuals that were assessed for the third grant and found ineligible but are now eligible to claim based on their 2019 to 2020 tax returns. Some of the 60,000 individuals had not been assessed for the third grant as they did not trade in 2018 to 2019, but they had traded before 2018 to 2019 and began trading again in 2019 to 2020

- For the fifth grant the average value per claim was £2,300. Around two-thirds of the potentially eligible population are male (2.3m). The average claim for female claimants is lower at £1,900 compared to the average claim for male claimants of £2,400

- No single age group dominates take-up of the fifth grant, although take-up is notably lower among the over 65s at 20%

- The sector with the highest number of potentially eligible individuals and the highest proportion of claims is the construction industry. By 15 September, construction workers had made 378,000 claims for the fifth grant, totalling £966 million. Construction is the largest sector among the self-employed population with 1.2 million individuals assessed for eligibility

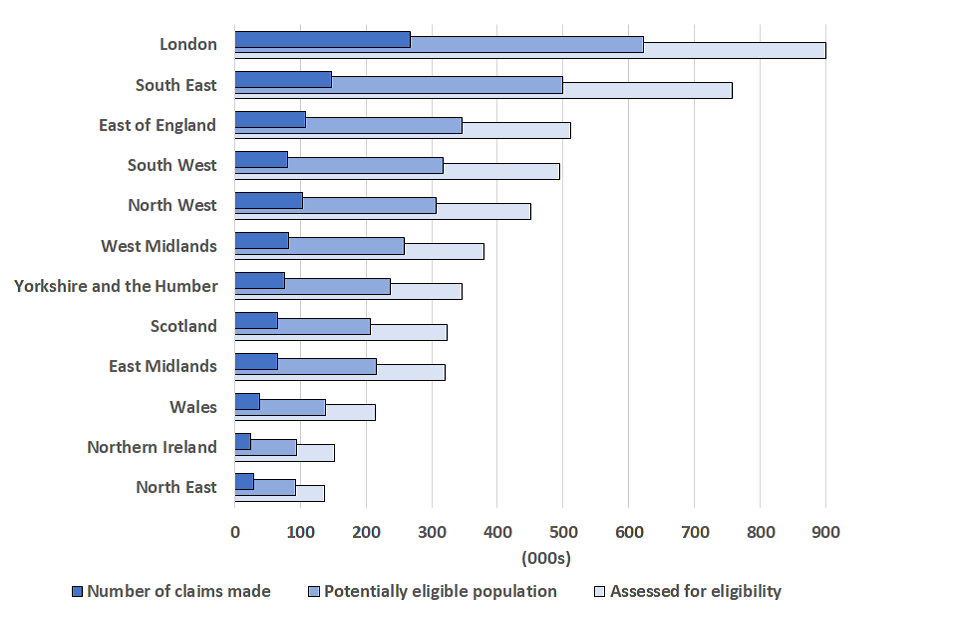

- The two regions with the highest number of fifth grant claims are London (268,000) and the South East (148,000), reflecting their relative population sizes

- Of the 1.7 million that did not meet one or more of the SEISS eligibility criteria, 1.4 million (84%) had trading profits less than non-trading profits (e.g. income from employment, investment or other income sources), 0.5 million (32%) had trading profits of £0 or made a loss, and 0.2 million (11%) had trading profits over £50,000. (N.B. Individuals may be counted more than once). This represents a slight increase on the 1.6 million individuals who were assessed as ineligible for the fourth grant in the July statistics

3. About this release

The Self-Employment Income Support Scheme (SEISS) provides support for self-employed individuals whose business has been affected by Coronavirus (COVID-19). Applications for the fifth grant opened 29 July and closed 30 September 2021. To make a claim for the fifth grant businesses must have had a new or continuing impact from coronavirus between 1 May 2021 and 30 September 2021.

This grant is worth either 80% or 30% of three months’ average trading profits, paid out in a single instalment, and capped at £7,500 for the higher percentage or £2,850 for the lower percentage. These categories will be referred to as the higher grant and lower grant respectively.

To claim the fifth grant, individuals have to compare their pandemic year turnover with that from 2019 to 2020 or 2018 to 2019, their reference year. If turnover in the pandemic period is down by 30% or more compared to turnover in the reference period, the higher 80% grant can be claimed. Otherwise, individuals are eligible for the lower grant only. Newly self-employed individuals are exempt from the turnover test and are able to claim the higher grant. To be eligible for the fifth grant an individual must have traded in both tax years:

- 2019 to 2020 and submitted their tax return on or before 2 March 2021

- 2020 to 2021

They must either:

- be currently actively trading but impacted by reduced activity, demand or capacity due to COVID-19

- have been previously trading but are temporarily unable to do so due to COVID-19

They must also declare that they:

- intend to continue to trade

- reasonably believe that there will be a significant reduction in trading profits compared to what they might expect absent the pandemic

The data used in this release covers claims for the fifth grant up to 15 September 2021. The claims window closed on 30 September 2021. This data has been matched with other HMRC data to present breakdowns of claims by:

- gender

- age

- sector of the economy

- geography

Information on the first four grants can be found on HMRC coronavirus (COVID-19) statistics page on gov.uk.

The tables that accompany this publication can also be accessed on HMRC coronavirus (COVID-19) statistics page on gov.uk.

4. Total Self-Employment Income Support Scheme grant claims

To date, 2.9m individuals have claimed at least one of the five grants. In total, £27.7bn has been claimed across 10.2m total claims. The claims window for the fifth grant opened on 29 July.

Table 1 - Number and value of claims, and number of individuals claiming each grant to 15 September 2021

| Grant | Total no. of claims (000s) | Total value of claims (£m) | Average value of claims (£) | Take-up rate |

|---|---|---|---|---|

| First grant | 2,610 | 7,591 | 2,900 | 77% |

| Second grant | 2,351 | 5,931 | 2,500 | 69% |

| Third grant | 2,194 | 6,219 | 2,800 | 65% |

| Fourth grant | 1,957 | 5,517 | 2,800 | 58% |

| Fifth grant | 1,092 | 2,477 | 2,300 | 33% |

| All SEISS grants | 10,204 | 27,735 | 2,700 | - |

| Total number of individuals | 2,893 | 27,735 | 9,600 | - |

Notes

- The lower average claim for the second grant is a result of grants being paid out at 70% of an individual’s three months’ average trading profits, rather than 80% as for the first, third and fourth grants

- The fifth grant has a lower average claim due to some claimants receiving a 30% lower grant instead of the 80% higher grant

5. Self-Employment Income Support Scheme fifth grant claims and eligibility

Around 5 million individuals who reported income from self-employment were assessed for SEISS: 3.3 million of these were found to be potentially eligible and 1.7 million were found to be ineligible.

HMRC has received 1.1 million claims for the fifth grant of the Self-Employment Income Support Scheme (SEISS) from a total potentially eligible population of 3.3 million. This represents a take-up rate of 33%. These claims totalled £2.5 billion with an average award of £2,300 per claimant.

Eligibility for SEISS required an individual to have levels of income which met specific tests on:

- their 2019 to 2020 tax year income, or

- the combination of income for consecutive tax years 2016 to 2017, 2017 to 2018, 2018 to 2019, and 2019 to 2020 where available

With 2019 to 2020 tax year income assessed for the first time, some individuals could claim a grant that were previously unable to do so. These individuals are now described as either:

- newly self-employed previously ineligible, meaning they were assessed for the third grant, but did not meet the criteria for eligibility, for example because their trading profit was less than their non-trading income

- newly self-employed, meaning they traded for the first in 2019-20 and did not trade in any of 2016-17, 2017-18 or 2018-19

Around 500,000 people are brought into scope who either became self-employed in 2019-20; or were ineligible for previous grants, but now may be eligible for the fifth grant on the basis of submitting their 2019-20 tax return.

Table 2 - The Self-Employment Income Support Scheme potentially eligible population, number and value of fifth grant claims to 15 September 2021, by status

| Status | Total potentially eligible population (000s) | Total no. of claims made (000s) | Total value of claims made (£m) | Average value of claims (£) |

|---|---|---|---|---|

| Previously eligible | 2,852 | 975 | 2,243 | 2,300 |

| Newly self-employed | 207 | 57 | 131 | 2,300 |

| Previously ineligible | 285 | 60 | 103 | 1,700 |

| All | 3,345 | 1,092 | 2,477 | 2,300 |

Of the 1.1 million individuals who made a successful claim:

- 29% received the lower grant, with an average claim of £1,100

- 71% received the higher grant, with an average claim of £2,700

Table 2a - The Self-Employment Income Support Scheme, number and value of fifth grant claims to 15 September 2021, by grant category

| Grant Category | Total no. of claims made (000s) | Total value of claims made (£m) | Average value of claims (£) |

|---|---|---|---|

| Higher Grant | 778 | 2,127 | 2,700 |

| Lower Grant | 315 | 349 | 1,100 |

| All | 1,092 | 2,477 | 2,300 |

Of the 1.7 million individuals who were assessed to be ineligible:

- 84% (1,398,000) had a trading profit that was less than their non-trading income

- 32% (532,000) had a trading profit £0 or less

- 11% (181,000) had trading profit exceeding £50,000 per year

- 8% (133,000) were ineligible for other reasons

Figures above represent all criteria that apply to each individual from both sets of tests. Additionally, within each element individuals can be ineligible for multiple reasons and, as a result, there is a high level of overlap between the categories. The take-up rate of the fifth grant among individuals who were newly self-employed or previously ineligible for the third grant is noticeably lower than the full population.

6. Self-Employment Income Support Scheme fifth grant by gender

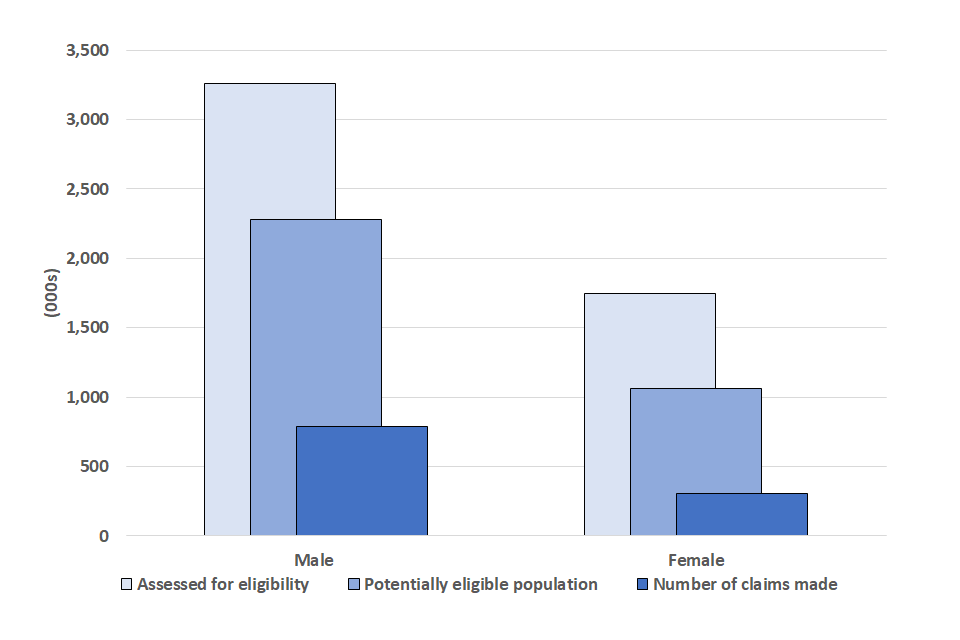

Figure 1 shows the number of claims for the fifth grant and the potentially eligible population by gender. Table 2 also shows claim values by gender.

Of 5.0 million individuals who were assessed, male claimants make up around two-thirds (65%) and make up a slightly higher proportion (68%) of the potentially eligible population.

HMRC has received 788,000 claims from male claimants totalling £1.89 billion compared to 304,000 claims from women for £590 million. Male claimants have a higher take-up rate than female claimants (35% compared to 29%) and their average grant value (£2,400) is higher than the average for female claimants (£1,900). Female claimants had a higher percentage of claims receiving the higher grant than male claimants (79% compared to 68%).

Figure 1: The Self-Employment Income Support Scheme potentially eligible population and fifth grant claims to 15 September 2021 by gender

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Table 3 - Self-Employment Income Support Scheme potentially eligible population, number and value of fifth grant claims to 15 September 2021, by gender

| Gender | Assessed for potential eligibility (000s) | Total potentially eligible population (000s) | Total no. of claims made (000s) | Total value of claims made (£m) | Average value of claims (£) |

|---|---|---|---|---|---|

| Male | 3,259 | 2,278 | 788 | 1,890 | 2,400 |

| Female | 1,746 | 1,065 | 304 | 586 | 1,900 |

| All | 5,010 | 3,345 | 1,092 | 2,477 | 2,300 |

Table 4 - Number and value of fifth grant claims to 15 September 2021, by not previously assessed and previously ineligible, and by gender

| Gender | Number of claims made by not previously assessed (000s) | Value of claims made by not previously assessed (£m) | Average value of claims made by not previously assessed (£) | Number of claims made by previously ineligible (000s) | Value of claims made by previously ineligible (£m) | Average value of claims made by previously ineligible (£) |

|---|---|---|---|---|---|---|

| Male | 41 | 101 | 2,500 | 43 | 79 | 1,800 |

| Female | 16 | 29 | 1,800 | 17 | 23 | 1,400 |

| All | 57 | 131 | 2,300 | 60 | 103 | 1,700 |

7. Self-Employment Income Support Scheme fifth grant by age group

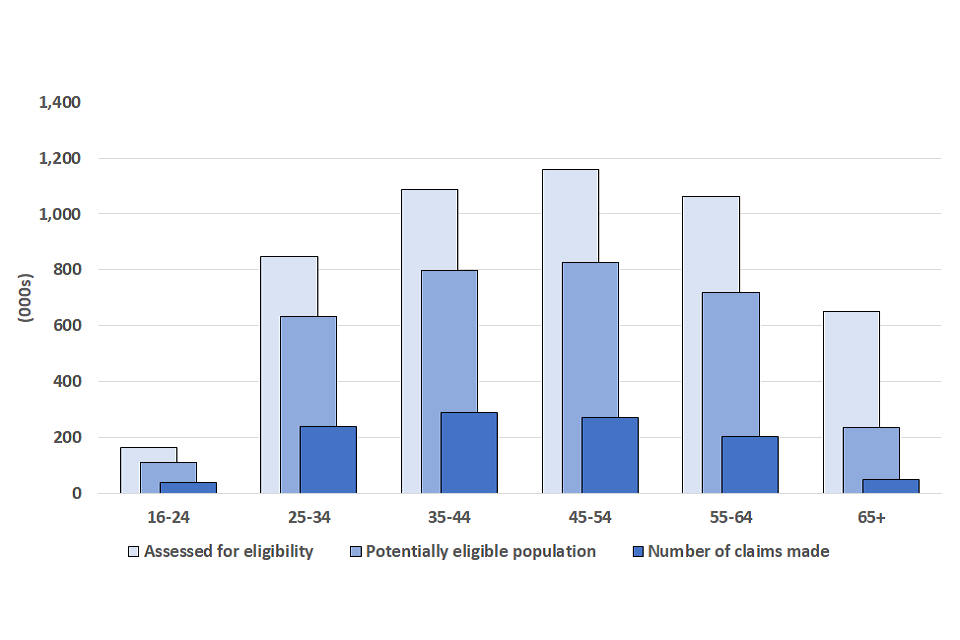

Figure 2 and Table 5 show the assessed for potential eligibility population, the potentially eligible population and volumes of claims made for the fifth grant by age group. Table 5 also shows claim values by age.

Around 89% of individuals who were assessed as potentially eligible were between the ages of 25 and 64, with 92% of claimants coming from this age group. Take-up of the grant in these age-groups is at or above 28%.

The take-up rate is noticeably lower for those who are aged 65 and over (20% have claimed), although they have the highest average claim value at £2,700 and the highest percentage receiving the higher grant (77%). The youngest age group have the lowest average claim value at £1,700 and the lowest percentage receiving the higher grant (64%).

Figure 2: The total potentially eligible population and number of claims to 15 September 2021 by age group

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes

- Age is calculated at the date the fifth grant opened on 22 April 2021

- There is missing age information for 25,000 in the potentially eligible population

Table 5 - Potentially eligible population, number and value of claims to 15 September 2021, by age band

| Age band (as at 22 April 2021) | Assessed for potential eligibility (000s) | Total potentially eligible population (000s) | Total no. of claims made (000s) | Total value of claims made (£m) | Average value of claims (£) |

|---|---|---|---|---|---|

| 16-24 | 162 | 111 | 37 | 62 | 1,700 |

| 25-34 | 848 | 633 | 238 | 525 | 2,200 |

| 35-44 | 1,088 | 796 | 289 | 658 | 2,300 |

| 45-54 | 1,160 | 827 | 272 | 616 | 2,300 |

| 55-64 | 1,063 | 717 | 202 | 471 | 2,300 |

| 65+ | 649 | 236 | 48 | 128 | 2,700 |

| Missing | 39 | 25 | 7 | 16 | 2,300 |

| All | 5,010 | 3,345 | 1,092 | 2,477 | 2,300 |

Table 6 - Number and value of fifth grant claims to 15 September 2021, by not previously assessed and previously ineligible, and by age band

| Age band (as at 22 April 2021) | Number of claims made by not previously assessed (000s) | Value of claims made by not previously assessed (£m) | Average value of claims made by not previously assessed (£) | Number of claims made by previously ineligible (000s) | Value of claims made by previously ineligible (£m) | Average value of claims made by previously ineligible (£) |

|---|---|---|---|---|---|---|

| 16-24 | 8 | 15 | 1,900 | 3 | 4 | 1,200 |

| 25-34 | 20 | 47 | 2,300 | 18 | 29 | 1,500 |

| 35-44 | 15 | 34 | 2,300 | 16 | 28 | 1,700 |

| 45-54 | 9 | 21 | 2,400 | 12 | 21 | 1,800 |

| 55-64 | 4 | 10 | 2,500 | 8 | 16 | 2,000 |

| 65+ | <1 | 1 | 3,000 | 2 | 5 | 2,500 |

| Missing | <1 | 2 | 2,400 | <1 | <1 | 1,800 |

| All | 57 | 131 | 2,300 | 60 | 103 | 1,700 |

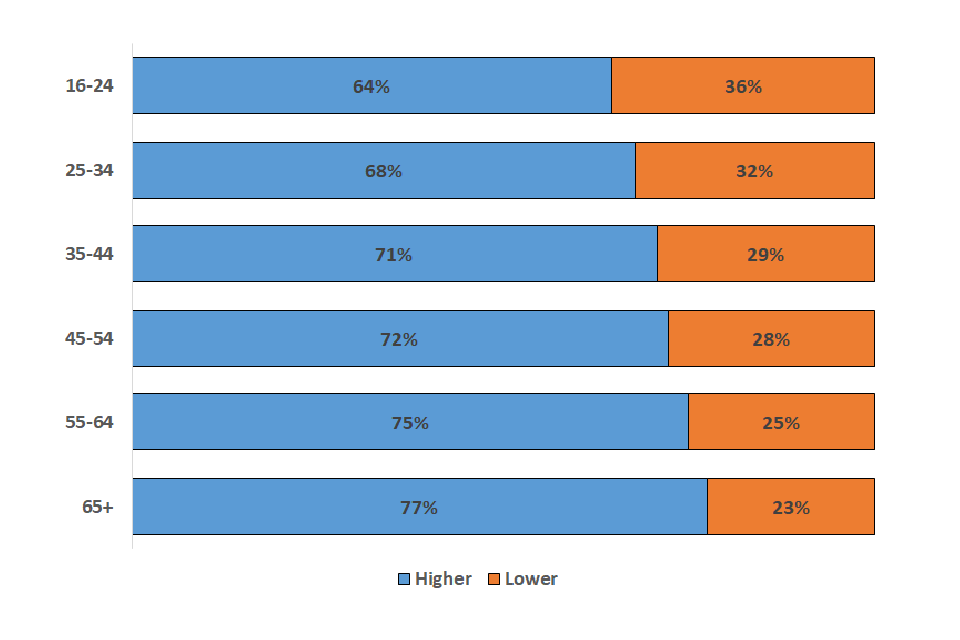

The proportion of claims for the higher grant rises with age as shown in Figure 2a. For those aged 65 and over, 77% of claims have been for the higher grant, compared to 64% for ages between 16 and 24.

Figure 2a: Higher and lower grants to 15 September 2021 by age group

Table 7 – Proportion of fifth grant claims to 15 September 2021, by age and grant type

| Age band (as of 22 April 2021) | Proportions of claims for higher grant | Proportion of claims for lower grant |

|---|---|---|

| 16-24 | 64% | 36% |

| 25-34 | 68% | 32% |

| 35-44 | 71% | 29% |

| 45-54 | 72% | 28% |

| 55-64 | 75% | 25% |

| 65+ | 77% | 23% |

8. Self-Employment Income Support Scheme fifth grant by industry sector

(see Table 3 in the accompanying tables for further details)

Self-employed individuals are asked to provide a description of their business activity on their self-assessment returns. These activities have been mapped across to the Standard Industrial Classification (SIC) 2007 to enable analysis to be carried out by industry sector. Where an individual has multiple sources of self-employed income the activity with the highest income has been used for the analysis.

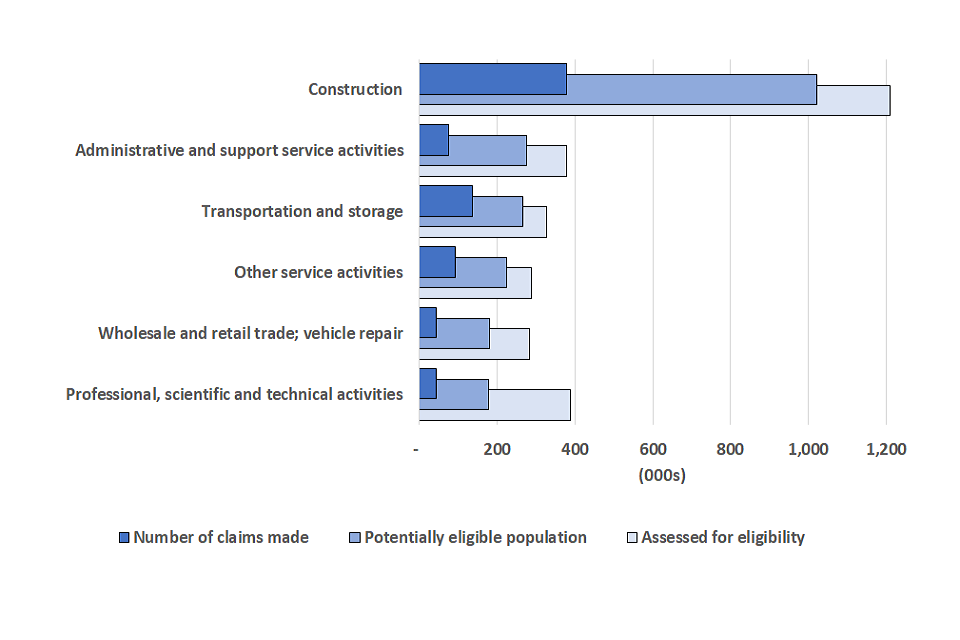

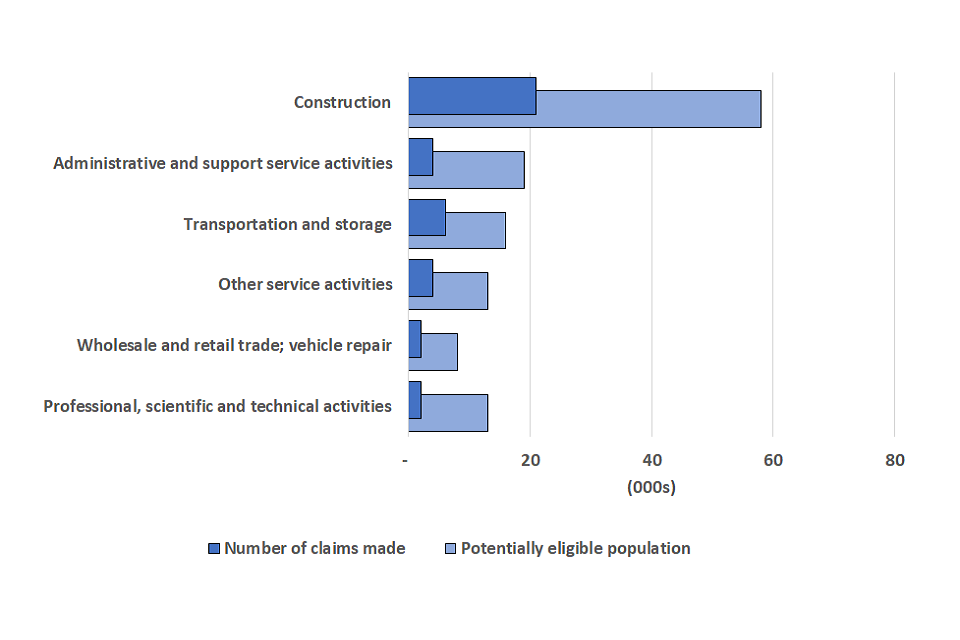

Figures 3 and 4 show the SEISS populations and number of claims for the fifth grant made by industry sector.

The construction industry has the largest population of individuals who were assessed for potential eligibility with over 1.2 million and over 1 million of these were potentially eligible to apply. By 15 September construction workers had made 378,000 claims totalling £966 million; an average of £2,600 per claimant.

Self-employed individuals in the transportation and storage sector make up 8% of the potentially eligible population and made 136,000 claims totalling £259 million. Administrative and support services also make up 8% of the potentially eligible population and have made 74,000 claims totalling £118m.

The highest rates of being assessed as potentially eligible were from individuals working in the construction industry (84%) and transportation and storage (81%).

Lower rates of being assessed as potentially eligible were found for individuals working in real estate activities (29%), financial and insurance activities (41%), agriculture, forestry and fishing (45%) and professional, scientific and technical activities (46%).

Agriculture, forestry and fishing had the lowest percentage of claimants receiving a higher grant (52%), with the construction industry having the second lowest percentage (60%). The highest percentages of claimants receiving the higher grant were found in other service activities (87%) and arts, entertainment and recreation (85%)

Figure 3: The Self-Employment Income Support Scheme population and number of fifth grant claims made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Table 8 - The Self-Employment Income Support Scheme population and number of fifth grant claims made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

| Sector | Assessed for potential eligibility (000s) | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|---|

| Construction | 1,210 | 1,022 | 378 |

| Administrative and support service activities | 378 | 276 | 74 |

| Transportation and storage | 326 | 265 | 136 |

| Other service activities | 288 | 224 | 92 |

| Wholesale and retail trade; vehicle repair | 282 | 181 | 42 |

| Professional, scientific and technical activities | 388 | 177 | 44 |

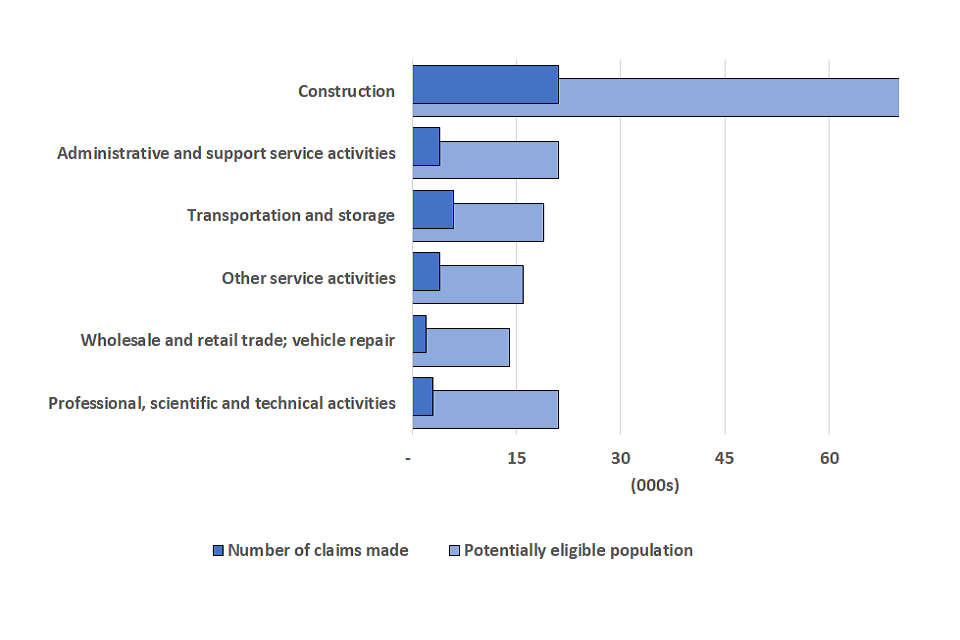

Figure 3a: The Self-Employment Income Support Scheme population and number of fifth grant claims by not previously assessed individuals made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Table 8a - The Self-Employment Income Support Scheme population and number of fifth grant claims by not previously assessed individuals made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

| Sector | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|

| Construction | 58 | 21 |

| Administrative and support service activities | 19 | 4 |

| Transportation and storage | 16 | 6 |

| Other service activities | 13 | 4 |

| Wholesale and retail trade; vehicle repair | 8 | 2 |

| Professional, scientific and technical activities | 13 | 2 |

Figure 3b: The Self-Employment Income Support Scheme population and number of fifth grant claims by previously ineligible individuals made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Table 8b - The Self-Employment Income Support Scheme population and number of fifth grant claims by previously ineligible individuals made to 15 September 2021, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

| Sector | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|

| Construction | 71 | 21 |

| Administrative and support service activities | 21 | 4 |

| Transportation and storage | 19 | 6 |

| Other service activities | 16 | 4 |

| Wholesale and retail trade; vehicle repair | 14 | 2 |

| Professional, scientific and technical activities | 21 | 3 |

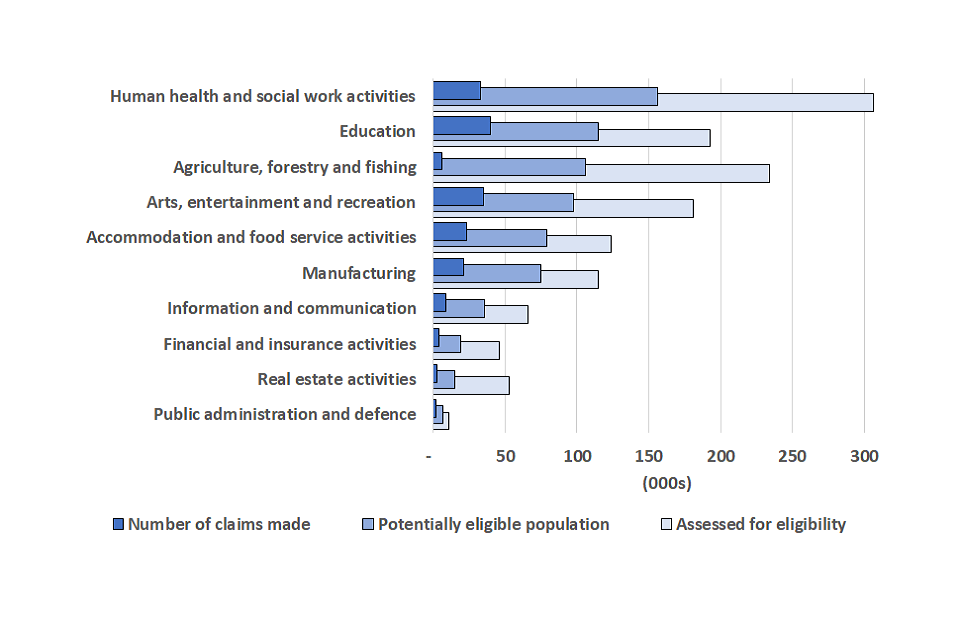

Figure 4: The Self-Employment Income Support Scheme population and number of claims for the fifth grant made to 15 September 2021, by sector; (smaller sectors not shown in figure 3)

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- 494,000 cases in the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code

Table 9 - The Self-Employment Income Support Scheme population and number of claims for the fifth grant made to 15 September 2021, by sector; (smaller sectors not shown in figure 3)

| Sector | Assessed for potential eligibility (000s) | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|---|

| Human health and social work activities | 306 | 156 | 33 |

| Education | 234 | 106 | 6 |

| Agriculture, forestry and fishing | 193 | 115 | 40 |

| Arts, entertainment and recreation | 181 | 98 | 35 |

| Accommodation and food service activities | 124 | 79 | 23 |

| Manufacturing | 115 | 75 | 21 |

| Information and communication | 66 | 36 | 9 |

| Real estate activities | 53 | 15 | 3 |

| Financial and insurance activities | 46 | 19 | 4 |

| Public administration and defence | 11 | 7 | 2 |

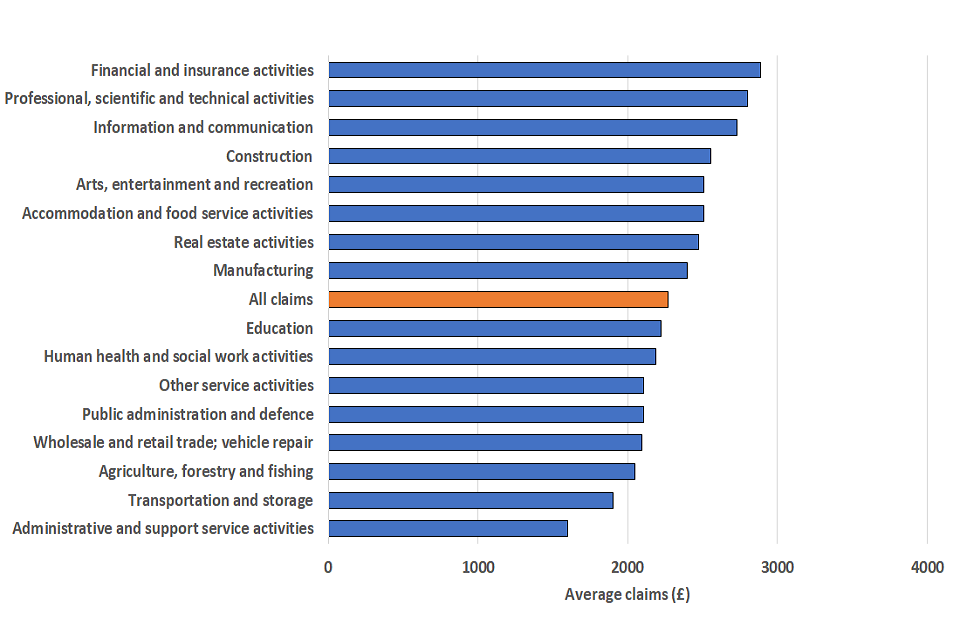

Figure 5 shows the average value of claims by sector which range from £2,900 per claimant in the finance and insurance sector to £1,600 per claimant in administrative and support services.

Figure 5: Average value of claims to 15 September 2021 by primary industry of self-employment, ranked by average claim

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- The allocation to industry represents an individual’s highest earning self-employment

- 494,000 cases of the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code

Table 10 - Average value of claims to 15 September 2021, by primary industry of self-employment, ranked by average claim

| Sector | Average value of claims (£) |

|---|---|

| Financial and insurance activities | 2,900 |

| Professional, scientific and technical activities | 2,800 |

| Information and communication | 2,700 |

| Construction | 2,600 |

| Arts, entertainment and recreation | 2,500 |

| Accommodation and food service activities | 2,500 |

| Real estate activities | 2,500 |

| Manufacturing | 2,400 |

| All claims | 2,300 |

| Education | 2,200 |

| Human health and social work activities | 2,200 |

| Other service activities | 2,100 |

| Public administration and defence | 2,100 |

| Wholesale and retail trade; vehicle repair | 2,100 |

| Agriculture, forestry and fishing | 2,000 |

| Transportation and storage | 1,900 |

| Administrative and support service activities | 1,600 |

Figure 5a shows the proportion of claims of the higher and lower grants by sector. This ranges from 52% of claims in Agriculture, forestry and fishing for the higher grant to 87% in Other service activities.

Figure 5a: Higher and lower grants to 15 September 2021 by sector

Table 11 – Proportion of fifth grant claims to 15 September 2021, by sector and grant type

| Sector | Proportion of higher grant claims | Proportion of lower grant claims |

|---|---|---|

| Other service activities | 87% | 13% |

| Arts, entertainment and recreation | 85% | 15% |

| Accommodation and food service activities | 84% | 16% |

| Education | 82% | 18% |

| Transportation and storage | 80% | 20% |

| Professional, scientific and technical activities | 76% | 24% |

| Information and communication | 74% | 26% |

| Human health and social work activities | 72% | 28% |

| Administrative and support service activities | 71% | 29% |

| Real estate activities | 71% | 29% |

| Manufacturing | 70% | 30% |

| Wholesale and retail trade; vehicle repair | 68% | 32% |

| Public administration and defence | 68% | 32% |

| Financial and insurance activities | 64% | 36% |

| Construction | 60% | 40% |

| Agriculture, forestry and fishing | 52% | 48% |

9. Self-Employment Income Support Scheme fifth grant by geography

(see Table 2 in the accompanying tables for further details) Using the claimant’s Self-Assessment address, claims can be mapped to countries of the UK, English regions and lower geographies.

Figure 6 shows the SEISS population and number of claims made by country and region.

London has the largest number of individuals that were assessed for eligibility (900,000), the largest potentially eligible population (622,000) and the largest number of claims (268,000) totalling £617 million.

England had the highest proportion of assessed individuals that were found to be eligible (67%), followed by Wales (65%), Scotland (64%) and Northern Ireland (63%).

The take-up rate varies across the UK with most nations and regions having a take-up rate between 28% and 34%. London has the highest take-up rate (43%) while the take-up rates in Northern Ireland (26%) and in the South West are the lowest (25%).

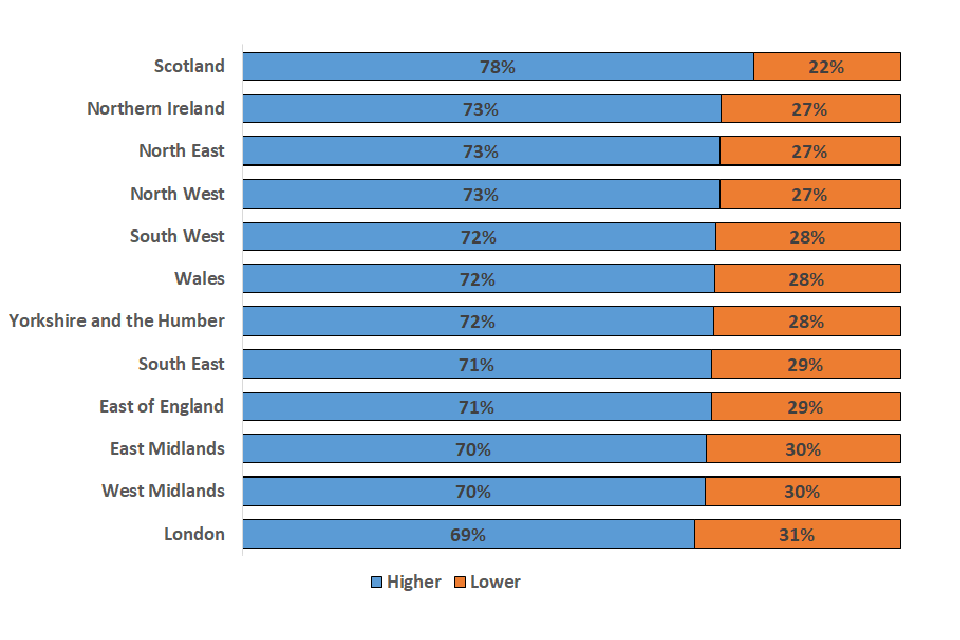

The percentage of claimants receiving the higher grant is very consistent across the UK, with each country and region (other than two exceptions) having between 70% and 73%. The exceptions are Scotland which has the highest percentage (78%) and London which has the lowest percentage (69%).

Self-employed individuals in Scotland have made 65,000 claims totalling £154m; in Wales 39,000 claims for £82m have been made and in Northern Ireland 24,000 claims for £53m have been submitted.

Figure 6: The Self-Employment Income Support Scheme population and number of claims for the fifth grant made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self-Assessment return

- 9,000 of the potentially eligible population could not be allocated to a NUTS1 region

Table 12 - The Self-Employment Income Support Scheme population and number of claims for the fifth grant made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

| Sector | Assessed for potential eligibility (000s) | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|---|

| London | 900 | 622 | 268 |

| South East | 757 | 499 | 148 |

| East of England | 512 | 346 | 108 |

| South West | 495 | 318 | 81 |

| North West | 451 | 307 | 103 |

| West Midlands | 379 | 258 | 83 |

| Yorkshire and the Humber | 347 | 237 | 76 |

| Scotland | 324 | 207 | 65 |

| East Midlands | 320 | 216 | 65 |

| Wales | 215 | 139 | 39 |

| Northern Ireland | 152 | 95 | 24 |

| North East | 137 | 93 | 30 |

| All | 5,010 | 3,345 | 1,092 |

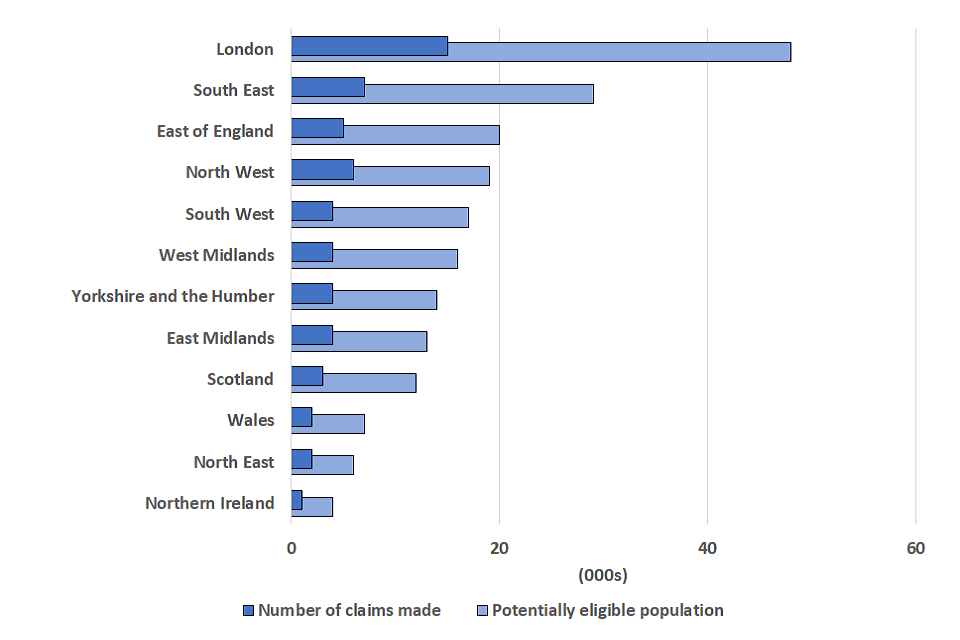

Figure 6a: The Self-Employment Income Support Scheme population and number of claims for the fifth grant by not previously assessed individuals made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self-Assessment return.

- 9,000 of the potentially eligible population could not be allocated to a NUTS1 region.

Table 12a - The Self-Employment Income Support Scheme population and number of claims for the fifth grant by not previously assessed individuals made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

| Sector | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|

| London | 48 | 15 |

| South East | 29 | 7 |

| East of England | 20 | 5 |

| North West | 19 | 6 |

| South West | 17 | 4 |

| West Midlands | 16 | 4 |

| Yorkshire and the Humber | 14 | 4 |

| East Midlands | 13 | 4 |

| Scotland | 12 | 3 |

| Wales | 7 | 2 |

| North East | 6 | 2 |

| Northern Ireland | 4 | 1 |

| All | 207 | 57 |

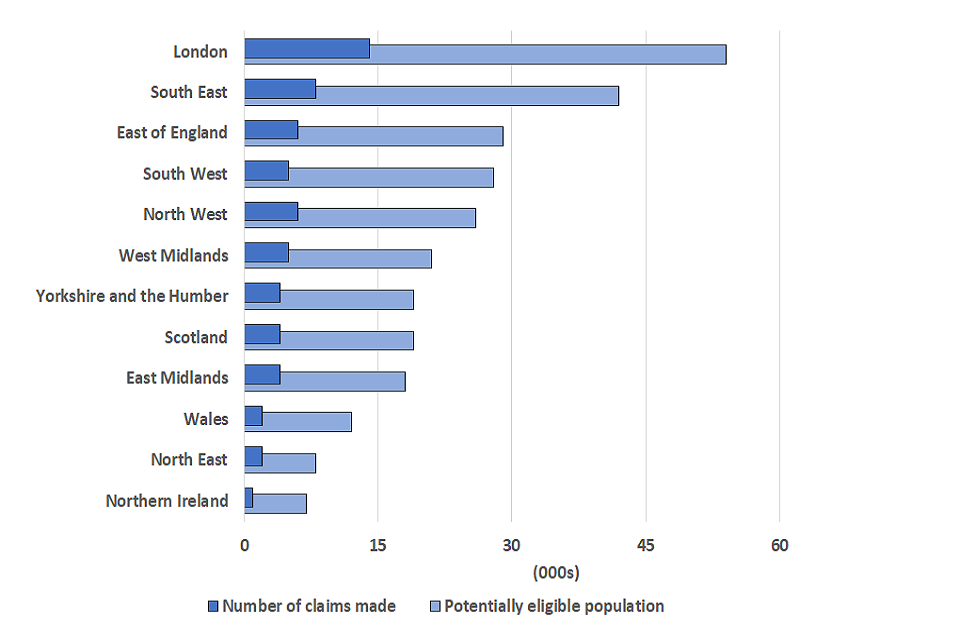

Figure 6b: The Self-Employment Income Support Scheme population and number of claims for the fifth grant by previously ineligible individuals made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self-Assessment return.

- 9,000 of the potentially eligible population could not be allocated to a NUTS1 region.

Table 12b - The Self-Employment Income Support Scheme population and number of claims for the fifth grant by previously ineligible individuals made to 15 September 2021 by country and region, ranked by size of assessed for eligibility population

| Sector | Total potentially eligible population (000s) | Total no. of claims made (000s) |

|---|---|---|

| London | 54 | 14 |

| South East | 42 | 8 |

| East of England | 29 | 6 |

| South West | 28 | 5 |

| North West | 26 | 6 |

| West Midlands | 21 | 5 |

| Yorkshire and the Humber | 19 | 4 |

| Scotland | 19 | 4 |

| East Midlands | 18 | 4 |

| Wales | 12 | 2 |

| North East | 8 | 2 |

| Northern Ireland | 7 | 1 |

| All | 285 | 60 |

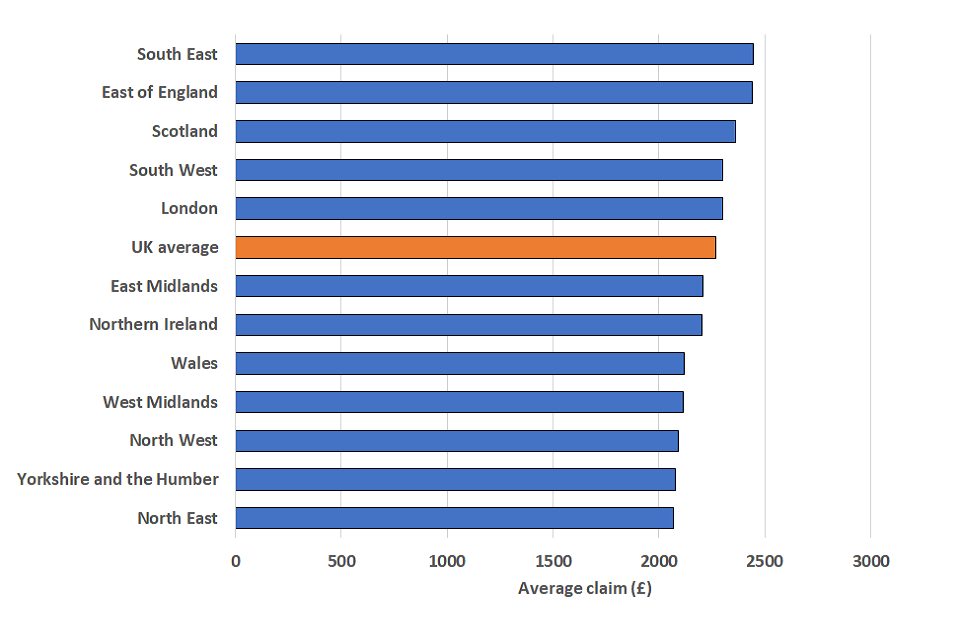

Figure 7 shows the average value of fifth grant claims by country and region.

The regions and countries with the lowest average claim values are the North East, North West, Yorkshire and the Humber, West Midlands and Wales (£2,100).

The South East, the East of England and Scotland (£2,400) have average claim values above the UK average of £2,300.

Figure 7: The average value of claims by region, ranked by value

Source: HMRC Self-Employment Income Support Scheme linked to Self-Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self-Assessment return

- 9,000 of the potentially eligible population could not be allocated to a NUTS1 region

Table 13 - The average value of claims by region, ranked by value

| Sector | Average value of claims (£) |

|---|---|

| South East | 2,400 |

| East of England | 2,400 |

| Scotland | 2,400 |

| London | 2,300 |

| South West | 2,300 |

| UK average | 2,300 |

| East Midlands | 2,200 |

| Northern Ireland | 2,200 |

| West Midlands | 2,100 |

| Wales | 2,100 |

| Yorkshire and the Humber | 2,100 |

| North West | 2,100 |

| North East | 2,100 |

Figure 7a: Higher and lower grants to 15 September 2021 by region

Table 14 – Proportion of claims to 15 September 2021, by region and grant type

| Region | Proportion of higher grant claims | Proportion of lower grant claims |

|---|---|---|

| Scotland | 78% | 22% |

| Northern Ireland | 73% | 27% |

| North East | 73% | 27% |

| North West | 73% | 27% |

| South West | 72% | 28% |

| Wales | 72% | 28% |

| Yorkshire and Humber | 72% | 28% |

| South East | 71% | 29% |

| East of England | 71% | 29% |

| East Midlands | 70% | 30% |

| West Midlands | 70% | 30% |

| London | 69% | 31% |

9.1 Sub-regional breakdowns

Tables 4 and 5 in the accompanying data table pack provide a breakdown of fifth grant claimants by Parliamentary Constituency and Local Authority.

These tables also include a gender breakdown which show the number of male and female claimants and the amount they claim by each area.

The maps below illustrate how the take-up rate for the fifth grant to 15 September 2021 varies by Parliamentary Constituency and Local Authority. Darker shades indicate a higher take-up rate.

The key points to note for UK Parliamentary constituencies at 15 September 2021 are:

- the London constituency of East Ham had the highest take-up rate at 61%

- West Ham constituency had the highest number of claims for SEISS 5 with 11,100

- in Northern Ireland, Belfast West had the highest take-up rate of 48%

- in Scotland, Glasgow South West had the highest take-up rate at 45%

- in Wales, the Rhondda constituency had the highest take-up rate at 41%

The key points to note for UK Local Authority at 15 September 2021 are:

- the London local authority of Newham had the highest take-up rate at 59%

- Newham local authority had the highest number of claims for the fifth grant with 21,600

- in Northern Ireland, Belfast had the highest take-up rate of 39%

- in Scotland, Glasgow City had the highest take-up rate at 41%

- in Wales, the Merthyr Tydfil local authority had the highest take-up rate at 40%

Self-Employment Income Support Scheme claims as a proportion of the potentially eligible population, by Local Authority

This contains the boundaries for Local Authority districts in the United Kingdom as at December 2020.

Source: Office for National Statistics (ONS) licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright and database right 2020

Self-Employment Income Support Scheme claims as a proportion of the potentially eligible population, by Parliamentary Constituency

Source: ONS licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright and database right 2020

10. Self-Employment Income Support Scheme fifth grant claims by industry sector and geography

(see Table 6 in the accompanying tables for further details)

Sections 10-12 of this bulletin consider the breakdown of the number of claims received in each country and region by different demographics (industry, gender and age). Comparable information relating to the value of claims, the potentially eligible population and take-up rates can be found in tables 6 and 7 in the accompanying tables.

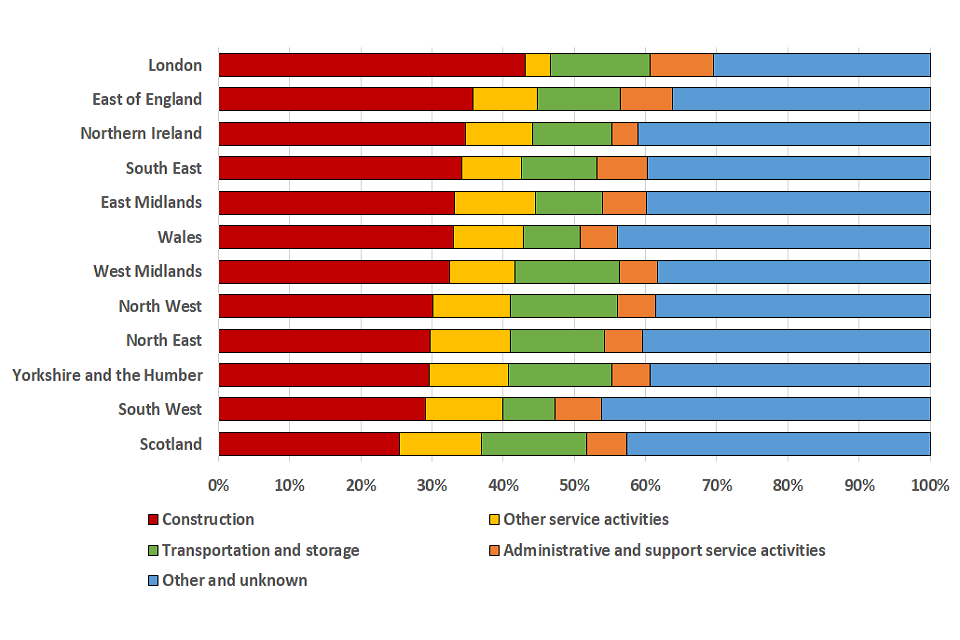

Figure 8 shows the breakdown of claims in each region and country by industry sector. Construction, transport and administrative services have the largest number of claims overall and are shown as separate categories on the chart. Other smaller industries have been combined.

The industry profile of claimants does not vary greatly between countries and regions. The main exceptions are seen in the construction industry and agriculture, forestry and fishing.

Individuals working in the construction industry account for the highest proportion of claims in every country and region of the UK. London has the highest proportion, with 43% of claims being from those working in construction and Scotland has the lowest with 25%.

The second largest sector by number of claims is Transportation and storage. This industry accounts for 15% of claims in North West, West Midlands and Scotland. The lowest proportion of claims for this sector are in the South West (7%) and Wales (8%). #### Figure 8: The proportion of claims received by 15 September 2021 in each country and region by primary industry of self-employment

Notes:

- The allocation to industry represents an individual’s highest earning self-employment.

- 494,000 cases of the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code.

Table 15 - The proportion of claims received by 15 September 2021 in each country and region by primary industry of self-employment

| Proportion of claims by region and sector | Construction | Transportation and storage | Other Service Activity | Administrative and support service activities | Other and unknown |

|---|---|---|---|---|---|

| London | 43% | 14% | 3% | 9% | 31% |

| East of England | 36% | 12% | 9% | 7% | 36% |

| Northern Ireland | 35% | 11% | 9% | 4% | 41% |

| South East | 34% | 11% | 8% | 7% | 40% |

| East Midlands | 33% | 9% | 11% | 6% | 41% |

| West Midlands | 33% | 15% | 9% | 5% | 38% |

| Wales | 33% | 8% | 10% | 5% | 44% |

| South West | 29% | 7% | 11% | 7% | 46% |

| Yorkshire and the Humber | 30% | 14% | 11% | 5% | 40% |

| North West | 30% | 15% | 11% | 5% | 39% |

| North East | 30% | 13% | 11% | 5% | 41% |

| Scotland | 25% | 15% | 12% | 6% | 42% |

11. Self-Employment Income Support Scheme fifth grant claims by gender and geography

(see Table 7 in the accompanying tables for further details)

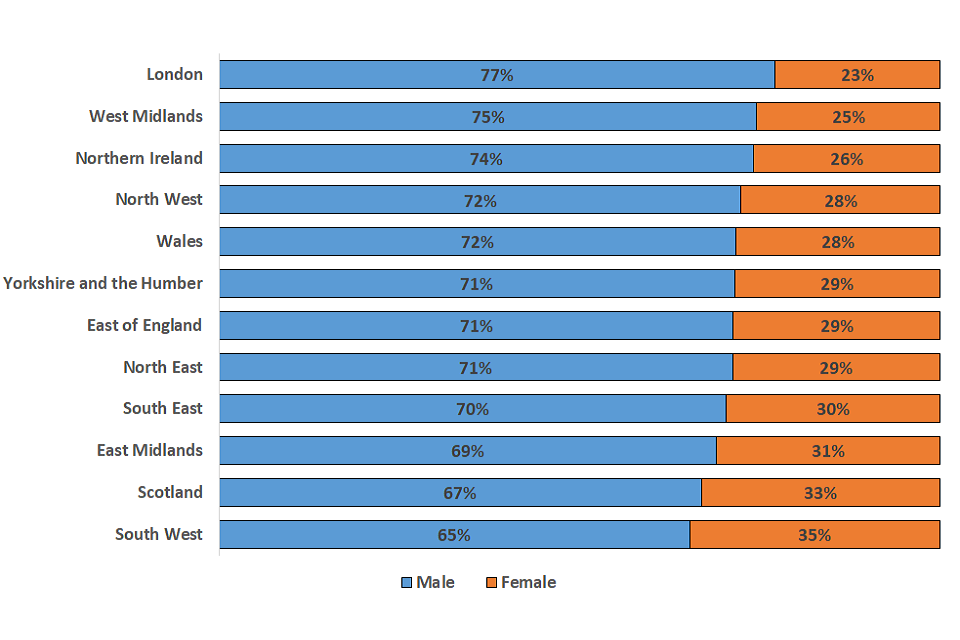

The area with the highest proportion of male claimants in the potentially eligible population is Northern Ireland (73%) and the lowest areas are Scotland and the South West (64% each). A similar pattern is seen in the number of claims received by 15 September with male claimants accounting for 77% of claims in London, 75% of claims in West Midlands and 65% of claims in South West.

Since the average claim amount is higher for male claimants than female claimants as well, men account for an even higher proportion of total claim values. In the West Midlands (78%) and London (81%) of total claim values are from men. The lowest male share is in the South West where 70% of the total amount claimed is claimed by men.

Figure 9 shows the proportion of claims within each region by gender. The majority of claims for the fifth grant are made by men, ranging from 65% of claims in the South West to 77% in London.

Figure 9: The proportion of fifth grant claims received by 15 September 2021 in each country and region by gender

Table 16 - The proportion of claims received by 15 September 2021 in each country and region by gender

| Proportion of claims by region and gender | Male | Female |

|---|---|---|

| London | 77% | 23% |

| West Midlands | 75% | 25% |

| Northern Ireland | 74% | 26% |

| North West | 72% | 28% |

| Wales | 72% | 28% |

| East of England | 71% | 29% |

| North East | 71% | 29% |

| Yorkshire and the Humber | 71% | 29% |

| South East | 70% | 30% |

| East Midlands | 69% | 31% |

| Scotland | 67% | 33% |

| South West | 65% | 35% |

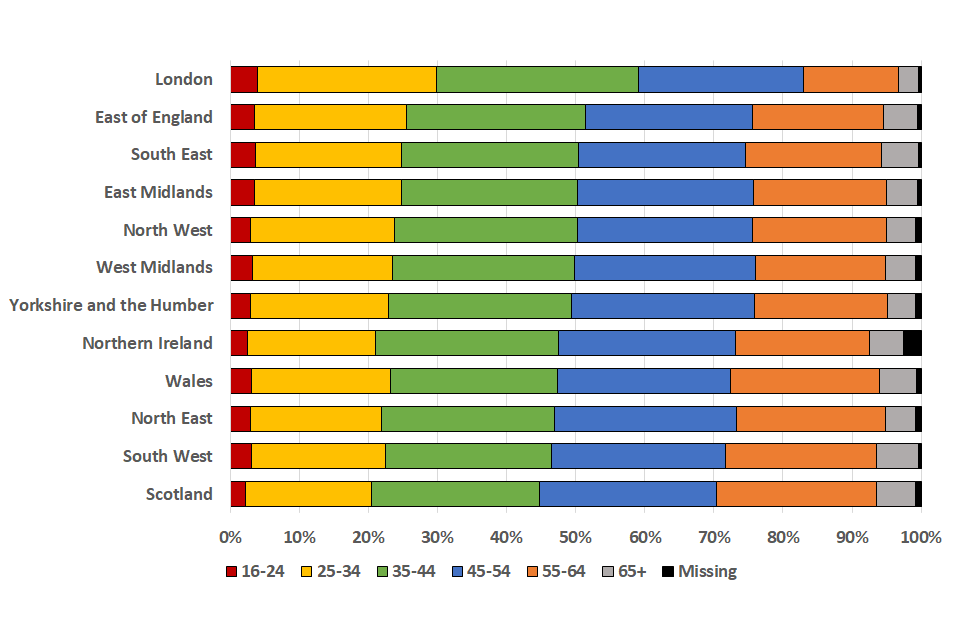

12. Self-Employment Income Support Scheme fifth grant claims by age and geography

(see Table 7 in the accompanying tables for further details)

The age distribution of the potentially eligible population and claims received by 15 September 2021 is reasonably consistent across all countries and regions except for London.

Between 40% (Scotland) and 46% (the East of England) of the potentially eligible population in each country and region is aged under 45 except in London where 56% are under 45.

A similar distribution is observed for claims and claim value with the lowest proportion aged under 45 being in Scotland (44% of claims and 43% of claim value) and the highest being in London (59% of claims and 59% of claim value).

Figure 10: Age distribution of claims received by 15 September 2021 in each country and region

Notes:

- Age is calculated at the date the first grant opened on 22 April 2021.

- The age for around 40,000 individuals in the potentially eligible population is not known which is around 1% of each country/region although slightly higher at 3% for individuals living in Northern Ireland.

Table 14 - Age distribution of claims received by 15 September 2021 in each country and region

| Proportion of claims by region and gender | 16-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Missing |

|---|---|---|---|---|---|---|---|

| London | 4% | 26% | 29% | 24% | 14% | 3% | 0% |

| East of England | 4% | 22% | 26% | 24% | 19% | 5% | 1% |

| South East | 4% | 21% | 26% | 24% | 20% | 5% | 0% |

| East Midlands | 3% | 21% | 26% | 25% | 19% | 5% | 0% |

| North West | 3% | 21% | 27% | 25% | 19% | 4% | 1% |

| West Midlands | 3% | 20% | 26% | 26% | 19% | 4% | 1% |

| Yorkshire & the Humber | 3% | 20% | 26% | 26% | 19% | 4% | 1% |

| Northern Ireland | 2% | 19% | 27% | 26% | 19% | 5% | 3% |

| Wales | 3% | 20% | 24% | 25% | 22% | 5% | 1% |

| North East | 3% | 19% | 25% | 26% | 22% | 4% | 1% |

| South West | 3% | 20% | 24% | 25% | 22% | 6% | 0% |

| Scotland | 2% | 18% | 24% | 26% | 23% | 6% | 1% |

13. Background to the Self-Employment Income Support Scheme

The Self-Employment Income Support Scheme (SEISS) was announced on 26 March 2020 as part of the UK government’s support package for businesses and self-employed people during the coronavirus outbreak in early 2020.

The scheme was open to self-employed individuals and members of a partnership who met the following criteria:

- traded in the tax year 2018 to 2019 and submitted their Self-Assessment tax return on or before 23 April 2020 for that year, and

- traded in the tax year 2019 to 2020, and

- intend to continue to trade in the tax year 2019 to 2020, and

- carried on a trade which had been adversely affected by coronavirus

A business could be adversely affected by coronavirus if, for example:

- They were unable to work because they:

- were shielding

- were self-isolating

- were on sick leave because of coronavirus

- had caring responsibilities because of coronavirus

- They have had to scale down or temporarily stop trading because:

- their supply chain has been interrupted

- they have fewer or no customers or clients

- their staff are unable to come in to work

The grant is not open to limited companies or those operating a trade through a trust.

To work out eligibility, HMRC first look at the 2018 to 2019 Self-Assessment tax return. Trading profits must be between £0 and £50,000 and at least equal to non-trading income. If an individual was not eligible based on the 2018 to 2019 Self-Assessment tax return, HMRC then looked at an average of the tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019.

The scheme allows an eligible individual to claim a taxable grant worth 80% of three months’ average trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £7,500 in total. The first grant closed for claims on 13 July 2020.

On the 17 August 2020 applications for the second grant opened. This was a taxable grant worth 70% of three months’ average trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £6,570 in total. The second grant closed for claims on 19 October 2020.

On 30 November 2020 applications for the third grant opened. This was a taxable grant worth 80% of three months’ average trading profits, paid out in a single instalment and capped at £7,500 in total. The third grant closed for claims on 29 January 2021.

The eligibility rules changed slightly for the third grant. To be eligible for the third grant an individual must have been eligible for the first and second grant and also declare that they intend to continue to trade and either:

- are currently actively trading but are impacted by reduced activity, capacity or demand due to COVID-19

- were previously trading but are temporarily unable to do so due to COVID-19

The Government announced at Budget 2021 that the Self-Employment Income Support Scheme (SEISS) will continue until September, with a fourth and a fifth grant.

On 22 April 2021 applications for the fourth grant opened. The claims window closed on 1 June 2021. Eligibility for the fourth grant is based on a person’s tax returns for either:

- the 2019 to 2020 tax year, or

- an average of the consecutive tax years 2016 to 2017, 2017 to 2018, 2018 to 2019, and 2019 to 2020, if a person is not eligible based on 2019 to 2020 alone

With 2019 to 2020 tax year income assessed for the first time, some individuals could claim a grant that were previously unable to do so. These individuals are now described as either:

- newly self-employed, meaning the individual started trading in 2019-20 having not traded in any of 2016-17, 2017-18 or 2018-19.

- previously ineligible, meaning they were assessed for the third grant, but did not meet the criteria for eligibility, for example because their trading profit was less than their non-trading income

On 29 July 2021 applications for the fifth grant opened. The claims window closed on 30 September 2021. This grant introduced two levels of grant based on the reduction in turnover experienced. These two levels are either:

- a grant of 80% of 3 months’ average trading profits capped at £7,500 for those with a turnover down by 30% or more, or

- a grant of 30% of 3 months’ average trading profits capped at £2,850 for those with a turnover down by less than 30%

To be eligible for the higher grant, the individual’s turnover must have fallen by 30% or more between their reference year and the pandemic year. Newly self-employed individuals are not subject to the turnover test and can claim the higher grant.

The statistics presented in this release cover claims for the fifth grant in the scheme up to 15 September 2021.

More information about the fifth SEISS grant can be found on HMRC coronavirus (COVID-19) guidance and support page on gov.uk.

14. Glossary

The assessed for potential eligibility population are those self-employed individuals who HMRC identified as having traded in the tax year 2019 to 2020 and submitted their Self-Assessment tax return on or before 2 March 2021 for that year.

The potentially eligible population are those who HMRC identified as being potentially eligible for a SEISS grant based on the information held from their Self-Assessment tax returns relating to the tax years; 2016 to 2017, 2017 to 2018, 2018 to 2019, and 2019 to 2020. This is the group who have been invited to claim for a grant. This does not attempt to assess if a business was affected by coronavirus or whether they continued trading after 2019 to 2020. So, it is the potentially eligible population based only on the information in the self-assessment returns and not all will apply for the grant.

The assessed to be ineligible population are those self-employed individuals who HMRC identified as having traded in the tax year 2019 to 2020 and submitted their Self-Assessment tax return on or before 2 March 2021 for that year but were found not to be eligible after being assessed against the criteria. Trading profits must be between £0 and £50,000 and at least equal to non-trading income. For an individual to be found ineligible based on the income criteria they need to be found ineligible based on the 2019 to 2020 Self-Assessment tax return and the combination of the relevant fields for consecutive tax years 2016 to 2017, 2017 to 2018, 2018 to 2019, and 2019 to 2020. Individuals are also included in the ineligible figures in this publication if an individual’s grant calculation resulted in an amount of £0 or less and if they are recorded as having ceased trading on the self-assessment systems.

The number of claims is defined as the total number of individuals who had submitted a claim for a grant by the 15 September 2021 that had been either paid, sent for payment or had been received and were awaiting various checks. Only non-rejected claims are included, with the majority of these having been paid or sent for payment. However, a small number of claims were still being processed and could be rejected.

15. Methodology and data sources

15.1 Coverage

This publication covers all self-employed individuals assessed for potential eligibility for the fifth grant as of 15 September 2021. Generally, this includes individuals that HMRC identified as having traded in the tax year 2019 to 2020 and submitted their Self-Assessment tax return on or before 2 March 2021 for that year.

Small changes in the numbers of eligible and ineligible individuals between publications may be observed as HMRC continue to review and monitor HMRC data systems to identify all potentially eligible individuals and to ensure that only genuine HMRC customers are invited to claim.

The claim information covers individuals who had submitted a claim for the grant by 15 September 2021 which had not been rejected or failed certain compliance checks.

15.2 Data sources used in this release

The data for this release come from HM Revenue and Customs’ (HMRC’s) system for administering SEISS. It covers the whole population rather than a sample of people or companies.

Additional data from HM Revenue and Customs’ (HMRC’s) Self-Assessment system and other HMRC administrative systems has been matched with SEISS data to produce the data released here.

The age, gender and postcode of residential address has been collected from the self-assessment account for each individual. The industry information has been collected from the Self-Assessment tax return for the tax year ending 5 April 2020 and relates to the self-employment business description provided on that return.

To produce the geographic breakdowns, the claimants’ residential postcode has been matched to Office for National Statistics (ONS) data that links UK Post Codes to geographic areas. The geographic areas that have been presented in this release are Country and English Region, Local Authority and Parliamentary Constituency.

The self-assessment system is a live operational dataset and, as such, details such as residential address may be updated at any point. The allocation of geography and industry in these statistics is based on the latest reported information. As a result, it is possible for an individual claimant’s characteristics to change between the first publication of SEISS statistics on 11 June 2020 and subsequent publications.

15.3 Ineligible population compared against Self-Employment Income Support Scheme eligibility criteria

Analysis of the assessed ineligible population against the eligibility criteria is as a result of additional analysis of the SEISS data in order to provide a description of this group of individuals. An individual can be outside of the criteria for multiple reasons for both the 2019 to 2020 Self-Assessment tax return and the tax years 2016 to 2017, 2017 to 2018, 2018 to 2019, and 2019 to 2020. Additionally, it is possible for the same individual to be ineligible due to different criteria across these two stages. For the purposes of the figures presented here, ineligible individuals are recorded against all the categories that apply to that individual. As a result, individuals can be ineligible in multiple ways and there is a high level of overlap between the categories presented.

16. Strengths and limitations

16.1 Experimental Statistics status

This release is classed as Experimental Statistics as the methodologies used to produce the statistics are still in their development phase. This does not mean that the statistics are of low quality, but it does signify that the statistics are new and still being developed. As the methodologies are refined and improved, there may be revisions to these statistics.

16.2 HMRC Self-Employment Income Support Scheme Management Information

Management information (MI) on the number and value of SEISS claims received was previously published by HMRC at various dates since the scheme was launched on 13 May 2020. This MI report will no longer be published and instead the HMRC Coronavirus statistics page will point towards these statistics.

16.3 Differences compared to Survey of Personal Incomes

In HMRC’s Survey of Personal Incomes individuals are considered as self-employed if HMRC received or expects to receive SA forms covering income from self-employment in their 2018 to 2019 Self-Assessment tax return. The population assessed for SEISS eligibility here includes only those individuals who submitted 2019 to 2020 Self-Assessment tax returns by 2 March 2021 and included data on self-employment in that return.

16.4 Differences compared to other sources

Other organisations such as the Office for National Statistics and Institute for Fiscal Studies have published information about SEISS either from surveys or estimates derived from previously published data. We believe these HMRC statistics provide a more reliable picture as they are based on administrative data from the SEISS claim and Self-Assessment systems.