Public spending statistics: July 2021

Updated 27 October 2021

1. Introduction

This National Statistics release is intended to provide comprehensive information on public spending. Data are arranged thematically by section. Each section contains overview commentary on the statistics being released, statistical tables, and further background information. The key data being updated in this release are for the years 2016-17 to 2020-21. This release contains the first estimate of 2020-21 outturn. All data in this release are National Statistics and are on an outturn basis. Where major revisions to the data for past years have been made we refer to them in the text accompanying the tables. Further background detail is found in the accompanying background material published alongside this release. HM Treasury Public Spending Statistics provide a range of information about public spending. Further detailed explanations are provided in the PSS guidance document. This information can be found on the main release page. The release is classified as National Statistics and conforms to the rules and principles set out in the Code of Practice for Official Statistics overseen by the United Kingdom Statistics Authority.

1.1 Related releases from HM Treasury

- The PESA command paper is an annual release, containing plans data for the Spending Review period, alongside the data contained in this release.

- The quarterly public spending statistics releases update the key series found in this release.

- Changes to this release have been made in response to requests from the United Kingdom Statistics Authority and feedback received from users. We welcome further user feedback at pesa@hmtreasury.gsi.gov.uk

1.2 What’s new

- The ongoing pressures faced by some departments, due to the impact of the pandemic, may again lead to delays in the laying of some annual reports and accounts (ARAs) this year[footnote 1]. As a result, the 2020-21 outturn published in PESA may be subject to data quality issues, as not all departments will have been able to align data to their ARAs. The public spending statistics (PSS) release, published on a quarterly basis, will reflect any later revisions made by departments to their 2020-21 outturn.

- The Foreign and Commonwealth Office and Department for International Development were merged on 2 September 2020. All outturn data for both departments are now shown within the totals for the Foreign, Commonwealth and Development Office.

- At Spending Review 2020, the Resource DEL excluding depreciation budgetary control was redefined to exclude the Scottish Block Grant Adjustments. These now form part of the depreciation ringfence within Resource DEL. Total Resource DEL is left unchanged. The reclassification is fiscally neutral and does not affect the spending power of the Scottish Government.

- The GDP deflator used for real terms calculations has been produced by the ONS, as per previous years. However, it should be noted that in 2020-21 it reflects the impact of Covid-19 on calculations of GDP. The effects on GDP and difficulties involved in calculating GDP at this time have been highlighted by the ONS and it should be noted that the deflator is still subject to revision[footnote 2].

2. Departmental budgets

The tables for departmental budgets in chapter 1 bring together information on public expenditure within the current budgeting and control framework. This comprises departmental budgets, including all control totals, as well as reconciling from the budgetary framework to the fiscal aggregates in the National Accounts.

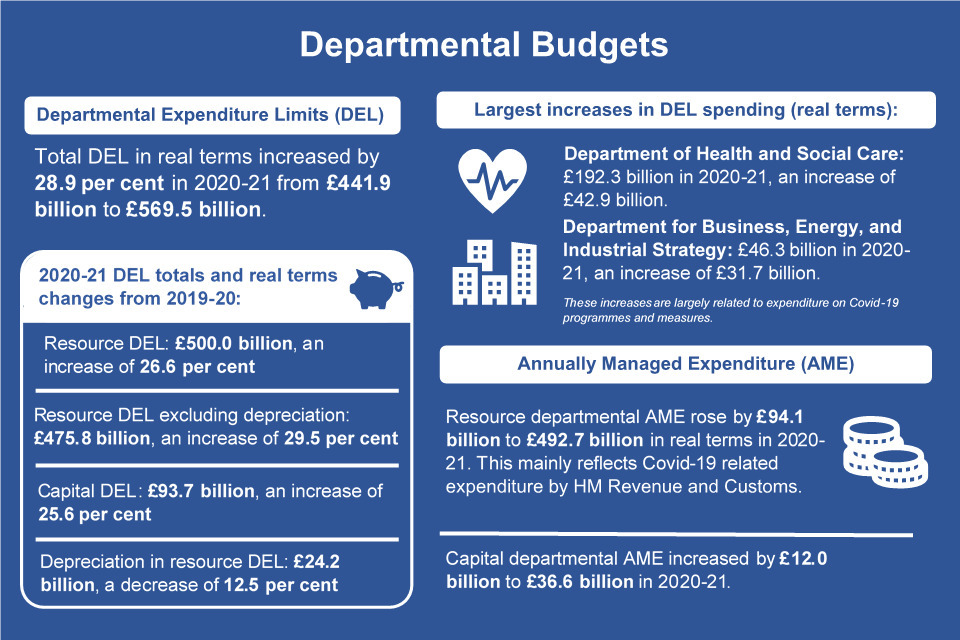

An infographic summarising the main departmental budget figures.

DEL expenditure in real terms (billions)

| Expenditure | 2019-20 | 2020-21 |

|---|---|---|

| Resource DEL | 395.0 | 500.0 |

| Depreciation | 27.7 | 24.2 |

| Capital DEL | 74.6 | 93.7 |

| Total DEL | 441.9 | 569.5 |

2.1 Departmental expenditure limits (DEL)

- Total resource DEL was £500.0 billion in 2020-21, an increase of 26.6 per cent in real terms on the previous year.

- Total resource DEL (RDEL) excluding depreciation was £475.8 billion in 2020-21, an increase of 29.5 per cent in real terms on the previous year.

- Depreciation in resource DEL was £24.2 billion in 2020-21, a decrease of 12.5 per cent in real terms on 2019-20.

- Total capital DEL was £93.7 billion in 2020-21, an increase of 25.6 per cent in real terms on the previous year.

- Total DEL in real terms increased by 28.9 per cent in 2020-21 from £441.9 billion in 2019-20 to £569.5 billion. The largest increases in DEL spending in real terms in 2020-21 were for Health and Social Care, which increased by £42.9 billion to £192.3 billion, and Business, Energy and Industrial Strategy which was up by £31.7 billion to £46.3 billion. These increases are both largely a result of expenditure related to Covid-19 measures.

2.2 Total Departmental Expenditure Limits, 2020-21 (£millions)

For the full table, including years from 2016-17 onward, please refer to Table 1.10 in the accompanying Chapter 1 tables ODS file.

| Departmental Group | Total DEL |

|---|---|

| Health and Social Care | 192,287 |

| Education | 72,981 |

| Home Office | 15,347 |

| Justice | 9,685 |

| Law Officers’ Departments | 619 |

| Defence | 42,355 |

| Single Intelligence Account | 2,848 |

| Foreign, Commonwealth and Development Office | 12,585 |

| MHCLG - Housing and Communities | 11,812 |

| MHCLG - Local Government | 21,271 |

| Transport | 33,439 |

| Business, Energy and Industrial Strategy | 46,292 |

| Digital, Culture, Media and Sport | 3,887 |

| Environment, Food and Rural Affairs | 5,348 |

| International Trade | 527 |

| Work and Pensions | 6,944 |

| HM Revenue and Customs | 5,043 |

| HM Treasury | 323 |

| Cabinet Office | 1,763 |

| Scotland | 44,075 |

| Wales | 20,975 |

| Northern Ireland | 16,602 |

| Small and Independent Bodies | 2,460 |

2.3 Annually Managed Expenditure (AME)

- Resource departmental AME increased by £94.1 billion to £492.7 billion in real terms in 2020-21. This is mainly reflects Covid-19 related expenditure within HM Revenue and Customs.

- Capital departmental AME increased by £12.0 billion to £36.6 billion in 2020-21.

Departmental AME expenditure in real terms (billions)

| Expenditure | 2018-19 | 2019-20 |

|---|---|---|

| Resource departmental AME | 398.6 | 492.7 |

| Capital departmental AME | 24.5 | 36.6 |

| Total departmental AME | 423.1 | 529.2 |

3. Economic analysis of budgets

The tables in chapter 2 of Public Spending Statistics present an analysis by economic category of the budgeting aggregates shown in chapter 1. A description of the economic categories referred to below can be found in the main chapter text of PESA.

3.1 Treatment of Coronavirus funding in departments’ budgets

Following the Coronavirus outbreak in 2020, the government announced it was making additional funding available to provide support for households and businesses. In total, £140.6 billion of RDEL and £8.6 billion of CDEL was provided to departments as COVID-19 funding in 2020-21. In the OSCAR data supplied by departments and used to produce PESA, it is not always possible to separate Coronavirus related expenditure from departments’ day-to-day spend on existing programmes and economic categories (For more information on OSCAR see PESA Annex G). Additional expenditure by the NHS on PPE, for example, will be reflected as a higher total for gross current procurement in resource DEL in 2020-21, but it is not possible to see from the OSCAR data how much of that increase is due to the Coronavirus. Where it has been possible to identify new programmes in the PESA data, they are treated as follows in Table 2.1:

DEL resource budget

-

Current grants to local government: £23.2 billion in 2020-21. This includes Covid Business Support Grants, the Expanded Retail Discount and direct support for local authorities.

-

Subsidies to private sector companies: £12.4 billion in 2020-21 on Covid Business Support Grants, Bounce Back Loan Schemes and Covid Business Interruption Loan Schemes.

AME resource budget

-

Subsidies to private sector companies: £78.8 billion in 2020-21. This is expenditure on the Coronavirus Job Retention and Self-Employment Income Support Schemes and the Eat Out to Help Out scheme.

-

Release of provisions: -£10.8 billion for Covid Business Support Grants

AME capital budget

- Capital grants to private sector companies: £18.9 billion in 2020-21 for the Bounce Back Loan Scheme (BBLS) and the Business Interruption Loan Schemes (CLBILS and CBILS). As of July 2021, these guarantee schemes had not been included in the ONS’s figures for Total Managed Expenditure.

Departments’ individual Annual Reports and Accounts should include an analysis of COVID-19 related expenditure, alongside a summary of the impact of the pandemic on departmental activities and outcomes. Further information on measures announced by the government in response to the Coronavirus pandemic, how much has been spent, and how it is treated in the National Accounts may also be found in publications by the National Audit Office and the Office for National Statistics.

3.2 Resource DEL

- Total resource DEL was £500.0 billion in 2020-21, compared to £371.6 billion in 2019-20, in nominal terms.

- Staff costs increased by 10.3 per cent in 2020-21 (to £143.0 billion) and gross current procurement rose by 31.4 per cent (to £158.7 billion). A breakdown of gross current procurement by individual departments is shown in table 2.2.

- Expenditure on grants to local government totalled £95.1 billion and subsidies to private sector companies totalled £26.3 billion in 2020-21, an increase of 61.3 percent and 398.7 per cent, respectively. The financing of local government expenditure is examined in more detail in chapter 7.

- Spending on administration, composed mainly of pay and procurement, stood at £11.2 billion in 2020-21. This is a rise of 7.6 per cent from the previous year.

3.3 Resource AME

- Resource departmental AME increased by £117.7 billion to £492.7 billion in 2020-21. The majority of the spending within resource AME is made up of grants to persons and non-profit bodies, which is mainly social security benefits. Expenditure on this heading rose by 10.4 per cent to £236.0 billion in 2020-21 from £213.8 billion in the previous year.

- In table 2.1 for resource departmental AME, subsidies to private sector companies showed the largest increase in 2020-21 of 652.9 per cent, with a total of £91.7 billion up from £12.2 billion the previous year. This reflects expenditure on the various Covid-19 measures outlined above.

- Depreciation increased to £55.0 billion from -£21.3 billion in 2019-20. This was mainly due to changes in the fair value of financial assets held by HM Treasury in 2019-20.

3.4 Capital budgets

- Capital spending within budgets was £130.3 billion in 2020-21, an increase of 39.7 per cent on the previous year. The majority of capital spending occurred within DEL.

- Within capital budgets, gross capital procurement increased by £10.0 billion and capital support for local government increased by £1.3 billion in 2020-21. These are broken down by department in Tables 2.3 and 7.3 respectively.

- Capital grants to private sector companies increased by £19.0 billion in 2020-21, reflecting expenditure on the Covid-19 measures outlined above. Net lending and investment to the private sector and abroad fell by £2.8 billion to £24.2 billion in 2020-21.

3.5 Treatment of financial sector interventions in budgets

In the pre-Budget report of December 2009 the use in fiscal policy of new aggregates excluding the temporary effects of financial interventions was introduced. In these aggregates, banks classified to the public sector in the National Accounts (Northern Rock, Bradford & Bingley, Dunfermline, Lloyds Banking Group and Royal Bank of Scotland) were treated as if they were outside the public sector, reflecting the government’s intention to return these banks or their assets to the private sector. Only Royal Bank of Scotland is still classified to the public sector. The financial sector interventions are treated as follows in Table 2.1:

Resource budget

- Income from sales of goods and services: -£0.1 billion in 2016-17 and £0.0 billion for 2017-18 to 2020-21. This is mainly underwriting commission and guarantee fee income.

- Depreciation: There was a gain of £23.1 billion in 2016-17. In 2017-18 there was an impairment of £0.4 billion and gains of £14.0 billion in 2018-19 and £35.2 billion in 2019-20. There were impairments of £44.8 billion in 2020-21.

- Other: income of -£1.7 billion in 2016-17, -£0.5 billion in 2017-18, -£1.1 billion in both 2018-19 and 2019-20 and -£0.2 billion in 2020-21. This is mainly interest paid to government and from the sale of shares.

Capital budget

- Net lending to the private sector-£3.5 billion in 2016-17 -£0.9 billion in 2017-18, -£2.5 billion in 2018-19, -£1.6 billion in 2019-20 and -£2.7 billion in 2020-21. This is mainly lending to banks, the Financial Services Compensation Scheme and the Republic of Ireland and subsequent repayments, and income from the sale of shares in Lloyds Banking Group and the Royal Bank of Scotland.

These transactions score within the HM Treasury AME budget in tables in Chapter 1.

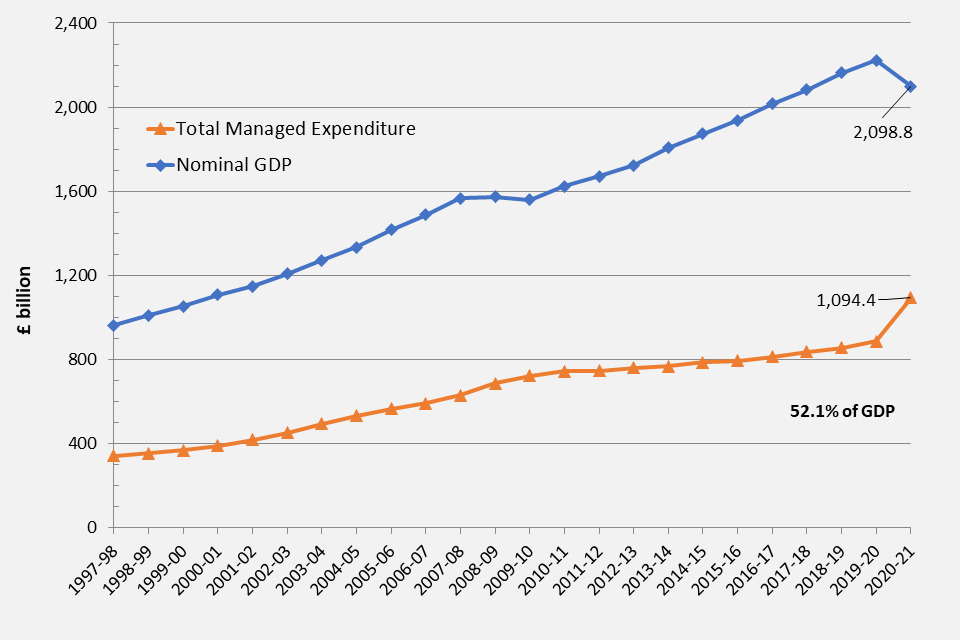

4. Trends in public spending

The tables in chapter 4 show trends in public spending on a longer run basis than other chapters in this release, in nominal, real (inflation-adjusted) and percentage of GDP terms.

Table 4.1 shows long run trends in Total Managed Expenditure (TME) and its Public Sector Current Expenditure (PSCE) and Public Sector Net Investment (PSNI) components back to 1978-79.

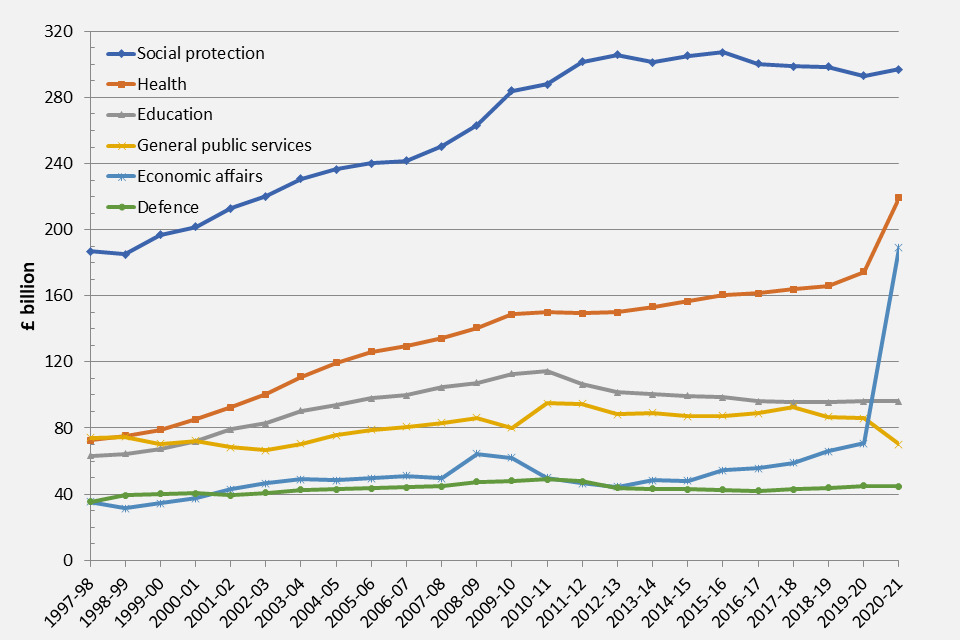

Tables 4.2 to 4.4 show total expenditure on services split by high level spending function (health, education, social protection, etc.) back to 1997-98.

4.1 Trends in TME, PSCE and PSNI (Table 4.1)

- During 2020-21, Total Managed Expenditure has increased in nominal terms by £208.4 billion (23.5 per cent), and also in real (inflation-adjusted) terms by £152.5 billion (16.2 per cent).

- TME as a percentage of GDP, which shows the size of the public sector relative to the size of the whole economy, was 52.1 per cent in 2020-21. This is the highest in the period covered by these tables (1955-56), reflecting not only increased spending, but also lower GDP as the economy entered recession during the Covid-19 pandemic.

4.2 Trends in functional expenditure (Table 4.2 to 4.4)

- In real terms, spending in five of the ten functions (excluding EU transactions) increased whilst spending in five functions fell during 2020-21.

- The largest real terms percentage increases were in economic affairs (166.6 per cent), mainly as a result of Covid related spend (see sub-functional analysis below for more detail) and in health (25.8 per cent).

- The largest real terms decreases in spending were in general public services (-18.2 per cent), mainly due to lower expenditure on public sector debt interest, and in housing and community amenities (-7.9 per cent).

- Spending on health shows a nominal and real terms increase in 2020-21 (33.7 per cent in nominal terms, 25.8 per cent in real terms).

- For greater detail see Table 5.2, which shows a breakdown of public spending at the sub-functional level.

A line graph showing trends in overall spending compared with overall nominal GDP.

Line graph showing trends in public spending in real terms according to the UN-defined Classification of the Functions of Government (COFOG) framework.

From 2011-12 onwards the ‘grant-equivalent element of student loans’ is no longer part of the TES framework and has therefore been removed from the Education function. Therefore figures are not directly comparable between 2010-11 and 2011-12. A full explanation of this decision can be found in PESA 2016 Annex E.

5. Public sector spending by function, sub-function and economic category

- The tables in chapter 5 of this release present analysis of total public sector expenditure on services split by function, sub-function and economic category.

- Year on year changes on a functional basis as described below are derived from tables 4.2 or 5.4, whilst sub-functional changes year on year are derived from table 5.2.

- These presentations are more stable between years than presentations of data by government department on a budgeting basis (Chapters 1 and 2) because they are not affected by changes in the structure of Government over time.

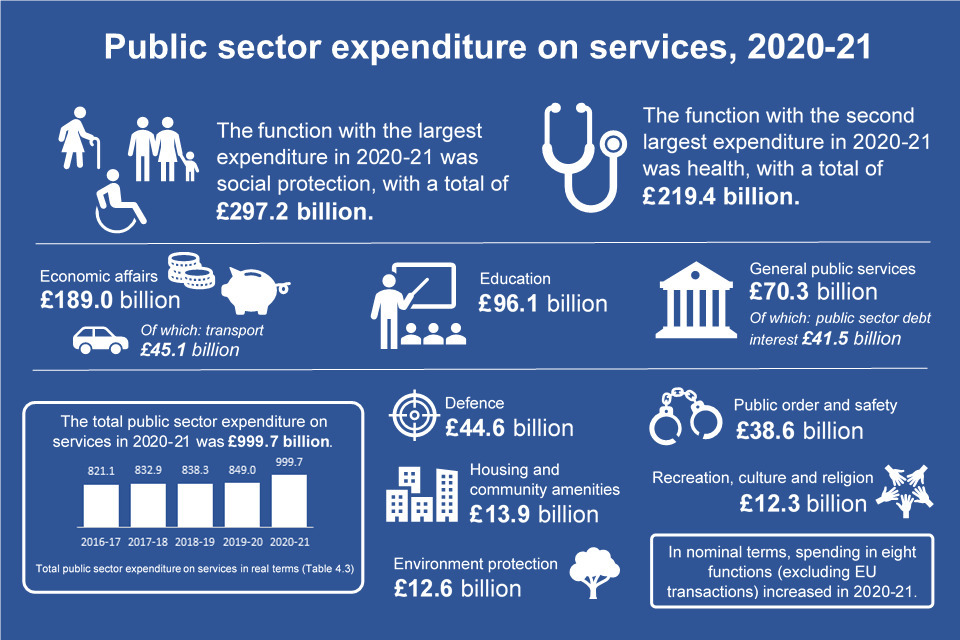

An infographic summarising expenditure on services by function.

5.1 Functional tables

- In nominal terms, spending in eight of the ten functions (excluding EU transactions) increased in 2020-21.

- The largest increases in percentage terms were in economic affairs (183.5 per cent), health (33.7 per cent), and public order and safety (11.9 per cent).

- The two functional decreases in percentages terms were in general public services (-13.1 per cent) and housing and community amenities (-2.1 per cent).

5.2 Sub-functional tables

- The largest nominal spending increase by function in 2020-21 was in economic affairs, which rose by £122.3 billion to a total of £189.0 billion (an increase of 183.5 per cent). This was largely driven by an increase of £111.7 billion in 4.1 General economic, commercial and labour affairs, which included HM Revenue and Customs expenditure on the Coronavirus Job Retention and Self-Employment Income Support Schemes and spend by BEIS on business support grants and business interruption loan schemes.

- Health saw the second largest nominal increase in 2020-21 of £55.3 billion, of which Medical services rose by £29.0 billion and Central and other health services by £25.6 billion. This was largely driven by large increases in the purchase of goods and services, as well as an increase in staff costs.

- Social protection saw the third largest nominal increase in 2020-21 of £21.4 billion (an increase of 7.8 per cent). The main contributor to this increase was 10.7 Social exclusion n.e.c. which rose by £17.3 billion during this period and was largely driven by Department for Work and Pensions expenditure on Universal Credit.

6. Central government own expenditure

The tables in chapter 6 of Public Spending Statistics (PSS) present analyses of central government own expenditure. This is spending by government departments and other central government bodies on their own activities. Central government support for local government and capital support for public corporations is not included.

- Tables 6.1 to 6.3 show central government expenditure on a budgeting basis, consistent with the data shown in chapters 1 and 2.

- Tables 6.4 to 6.6 show expenditure on services, consistent with chapters 4 and 5.

6.1 Expenditure in budgets

- Central government own expenditure within DEL reached £313.7 billion in 2019-20, from £287.9 billion in 2018-19, a rise of 9.0 per cent.

- Expenditure within AME increased to £371.5 billion in 2019-20 from £223.0 billion in 2018-19. The increase in AME is largely due to large negative provisions in 2018-19 relating to the Nuclear Decommissioning Authority.

6.2 Expenditure on services

- Central government’s own current expenditure on services increased to £749.4 billion in 2020-21, from £576.8 billion the previous year. Capital expenditure on services increased from £54.8 billion in 2019-20 to £86.6 billion in 2020-21.

- As shown in Table 6.4, social protection and health together account for more than half of all of central government own expenditure. In 2020-21 spending on social protection increased to £242.7 billion compared to £221.2 billion in the previous year.

- Expenditure on central government debt interest fell from £48.1 billion in 2019-20 to £39.3 billion in 2020-21, a decrease of 18.4 per cent.

- Expenditure on current grants to persons and non-profit bodies, which is mainly composed of social benefits, rose to £254.1 billion in 2020-21 from £230.2 billion in 2019-20.

- Expenditure on subsidies to private sector companies rose by £100.5 billion to £118.0 billion in 2020-21, up from £17.4 billion in 2019-20. This was driven by Covid-19 related measures in HM Revenue and Customs AME.

7. Local government financing and expenditure

Chapter 7 analyses central government support for local government within budgets (tables 7.1 to 7.3) and local government expenditure on services (tables 7.4 to 7.8). It deals primarily with Great Britain, as most equivalent spending in Northern Ireland is central government spending carried out by Northern Ireland departments.

7.1 Central government support for Local government

- Total central government support in DEL was £107.0 billion in 2020-21, up from £69.3 billion the year before. Support in AME rose from £47.6 billion to £49.2 billion over the same period.

- Capital support for local government rose from £11.7 billion in 2019-20 to £13.0 billion in 2020-21.

7.2 Local government expenditure on services

- Total local government current expenditure on services rose to £137.1 billion in 2020-21 compared to £133.5 billion in 2019-20. Over the same period total local government capital expenditure on services fell to £19.2 billion from £20.9 billion.

- As shown in table 7.4, local government current expenditure on education showed an increase from £41.2 billion in 2019-20 to £42.9 billion in 2020-21.

- Local government capital expenditure rose in 2020-21 for three of the ten functions. The increases were seen in general public services (up £0.6 billion), public order and safety (up £7 million) and health (up £4 million) over the same period.

- A breakdown of local government expenditure by economic category is shown in table 7.8. Spending on pay, which amounted to £67.5 billion in 2020-21, accounts for just over 43 per cent of all spending on services by local government. The majority of this was within the education and public order and safety functions.

8. Public corporations

Chapter 8 analyses the impact of public corporations on departmental budgets and expenditure on services.

Tables 8.1 and 8.2 examine the impact on departmental budgets (DEL and departmental AME), breaking this down by economic category and departmental group.

Tables 8.3 to 8.5 analyse capital spending by public corporations. They break the expenditure down by individual public corporations as well as by function and economic category. Debt interest payments to the private sector, which is the only public corporation current spending that forms part of Total Managed Expenditure (TME), is also included.

- Public corporations’ capital expenditure was £11.7 billion in 2020-21, up from £11.3 billion the year before.

- Out of this total, expenditure by the Housing Revenue Account (for England, Scotland and Wales) was £4.4 billion, down from £4.6 billion the previous year.

- The other main contributors to public corporations’ capital expenditure were London Underground (as Transport Trading Limited) and Scottish Water.

9. Public expenditure by country and additional information

9.1 Country and regional analysis in this release

The Country and Regional Analysis (CRA) is published each autumn. As a result there are no new substantive data on regional spending for this PSS release. However, the four headline tables of the CRA release published in November 2020 have been included in chapter 9.

Additionally we have included several other tables which complement the tables shown in this release. In particular we have included the GDP deflators used to calculate the real terms tables through the rest of this document. The CRA-based tables in this chapter are based on GDP deflators that were current at their time of original publication.

9.2 What’s new

No new tables or presentations of country and regional data are included in this chapter. However, the CRA documentation and text published in November 2020 included a new presentation in HTML format.

10. Revisions in this release

All of the data contained in the Public Spending National Statistics are open for revision in every publication. The table below summarises the key revisions in this release.

| Revisions to Budgets since July 2020 (£million) | 2016-17 | 2017-18 | 2018-19 | 2019-20 |

|---|---|---|---|---|

| Total Managed Expenditure | 1,227 | 1,849 | 2,868 | 4,536 |

| Total Departmental Expenditure Limits (DEL) | 5,501 | 12,451 | 12,275 | 11,955 |

| Departmental Annually Managed Expenditure (AME) | 0 | 0 | 0 | -440 |

| Other AME | -4,274 | -10,692 | -9,407 | -6,979 |

| Total resource DEL | 1 | 9 | 24 | 2,642 |

| Total capital DEL | 0 | -8 | -21 | -215 |

Figures for Total Managed Expenditure (TME) are taken from the ONS/HM Treasury Public Sector Finances release. The main revisions since last July’s publication are:

- Changes to TME and other AME in all years are due to updated ONS data. More information about these changes is available in the monthly ONS public sector finances (PSF) release.

- Changes to DEL and departmental AME expenditure reflecting departments revising data in line with their 2020-21 resource accounts. The large changes to total DEL reflect the new treatment of the Scottish Government Block Grant Adjustments, which increased the size of RDEL excluding depreciation.

- Local government expenditure has also been revised.

11. GDP deflators and population numbers

11.1 GDP deflators

A number of the tables in this publication give figures in real terms. Real terms figures are the current price outturns or plans adjusted to a constant price level by excluding the effect of general inflation as measured by the GDP deflator at market prices. The real terms figures in this publication are given in 2020-21 prices. The GDP deflators used in this publication are those given below. The most up to date deflators can be found on the GOV.UK website.

| Financial year | GDP deflator at market prices | Per cent change on previous year | Money GDP (£million) |

|---|---|---|---|

| 1978-79 | 19.379 | 11.26 | 192,151 |

| 1979-80 | 22.645 | 16.85 | 232,309 |

| 1980-81 | 26.974 | 19.12 | 267,219 |

| 1981-82 | 29.815 | 10.53 | 297,912 |

| 1982-83 | 32.01 | 7.36 | 327,113 |

| 1983-84 | 33.539 | 4.78 | 357,776 |

| 1984-85 | 35.446 | 5.69 | 385,702 |

| 1985-86 | 37.419 | 5.57 | 423,588 |

| 1986-87 | 38.971 | 4.15 | 455,402 |

| 1987-88 | 41.151 | 5.6 | 510,969 |

| 1988-89 | 43.839 | 6.53 | 570,134 |

| 1989-90 | 47.238 | 7.75 | 628,400 |

| 1990-91 | 51.121 | 8.22 | 678,521 |

| 1991-92 | 54.091 | 5.81 | 714,840 |

| 1992-93 | 55.499 | 2.6 | 737,126 |

| 1993-94 | 56.865 | 2.46 | 780,790 |

| 1994-95 | 57.601 | 1.29 | 819,023 |

| 1995-96 | 59.314 | 2.97 | 863,523 |

| 1996-97 | 61.422 | 3.55 | 920,418 |

| 1997-98 | 61.219 | -0.33 | 962,452 |

| 1998-99 | 62.227 | 1.65 | 1,009,908 |

| 1999-00 | 62.504 | 0.45 | 1,053,356 |

| 2000-01 | 63.644 | 1.82 | 1,107,366 |

| 2001-02 | 64.574 | 1.46 | 1,147,125 |

| 2002-03 | 66.015 | 2.23 | 1,206,906 |

| 2003-04 | 67.433 | 2.15 | 1,270,825 |

| 2004-05 | 69.359 | 2.86 | 1,334,628 |

| 2005-06 | 71.189 | 2.64 | 1,417,614 |

| 2006-07 | 73.21 | 2.84 | 1,487,940 |

| 2007-08 | 75.274 | 2.82 | 1,566,500 |

| 2008-09 | 77.313 | 2.71 | 1,572,822 |

| 2009-10 | 78.549 | 1.6 | 1,559,454 |

| 2010-11 | 79.987 | 1.83 | 1,624,581 |

| 2011-12 | 81.2 | 1.52 | 1,670,141 |

| 2012-13 | 82.86 | 2.04 | 1,724,150 |

| 2013-14 | 84.355 | 1.8 | 1,805,768 |

| 2014-15 | 85.518 | 1.38 | 1,873,833 |

| 2015-16 | 86.216 | 0.82 | 1,936,795 |

| 2016-17 | 88.35 | 2.47 | 2,016,681 |

| 2017-18 | 89.905 | 1.76 | 2,082,483 |

| 2018-19 | 91.995 | 2.32 | 2,163,750 |

| 2019-20 | 94.068 | 2.25 | 2,223,595 |

| 2020-21 | 100 | 6.31 | 2,098,761 |

Data are based on the June 2021 National Accounts figures from ONS.

Please note that these deflators do not apply to the real terms Country and Regional Analysis (CRA) tables 9.3 and 9.4 that were originally published in November 2020.

11.2 Population numbers by country and region

The population numbers used in Chapter 9 are derived from ONS’s mid-year estimates as used in the November 2020 Country and Regional Analysis release.

ONS’s most recent mid-year population estimates for the UK are directly available online.

12. Future development of Public Spending Statistics

We would be interested in readers’ views on how PSS might be developed to further increase its value to users. Please write to:

The Editor, PESA

Government Financial Reporting

Floor 2 Red Zone

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ