Government grants statistics 2020 to 2021

Published 31 March 2022

1. Purpose of this report

This report accompanies the release of the Government grants register 2020 to 2021. This report provides context to this grants data, an overview of grant spending and guidance notes on how the data has been compiled.

This release is classified as Official Statistics.

The Government grants register 2020 to 2021 constitutes the largest data publication to date. The details of the ongoing improvements to these statistics are outlined in the statistics development plan accompanying this publication.

Government grants register 2020 to 2021 data release covers:

- General grants and formula grants (at both scheme and award level) across all government departments. Note HM Treasury is not included in this publication because they do not manage any formula or general grants.

- Grants funded during the period 1 April 2020 to 31 March 2021.

- Grants that are new for 2020 to 2021 and grants that were set up in previous years which have continued to be active in 2020 to 2021.

- Exchequer-funded grants (this excludes grants funded by devolved governments of Scotland, Wales and Northern Ireland); this includes overseas aid provided by the UK government as grants, but excludes grants made by the EU or the UK government contribution to the EU.

- Any central government departments or arm’s length bodies (ALBs) that manage exchequer funded grants.

This data does not include:

- Grants-in-aid – these are funds allocated from one part of government to another part of government, for example, central government funding for the running costs of non-departmental public bodies (NDPBs).

- Details of awards relating to the Coronavirus Job Recovery Scheme (CJRS) - information regarding these awards is published by HM Revenue and Customs (HMRC).

- Details of awards made by Local Authorities.

- Details of fraud and error. Data relating to fraud and error is reported centrally and published annually in the Cross-Government Fraud Landscape Annual Report.

There are a number of notes and caveats that will help inform the interpretation of this data. A summary of these, as well as departmental statements, can be found at the end of this report. Full details can be found in the Quality and Methodology Information document, published alongside this report. Note that values presented in this report are rounded. Therefore totals may not equal the sum of their parts, and percentages may not add up to exactly 100%. The statistics in this report are based on unredacted data, so will not exactly match any statistics calculated directly from the accompanying government grants register.

We would appreciate your feedback to help us improve future publications. This can be provided via this feedback form.

2. Introduction to government grants

Government grants are funds intended to be permanently transferred[footnote 1] from a government organisation, to a grant recipient[footnote 2], in order to fulfil a policy or public interest need. Unlike contracts/procurements (e.g. for the purchase of goods or services), grants are provided with the focus on the outcomes and impacts of the activities being funded. Usually grants are awarded to finance (or reimburse expenditure on) the recipients’ activities in order to further the implementation of government policy or public interest, where it is neither appropriate nor possible for the government organisation to carry out those activities itself.

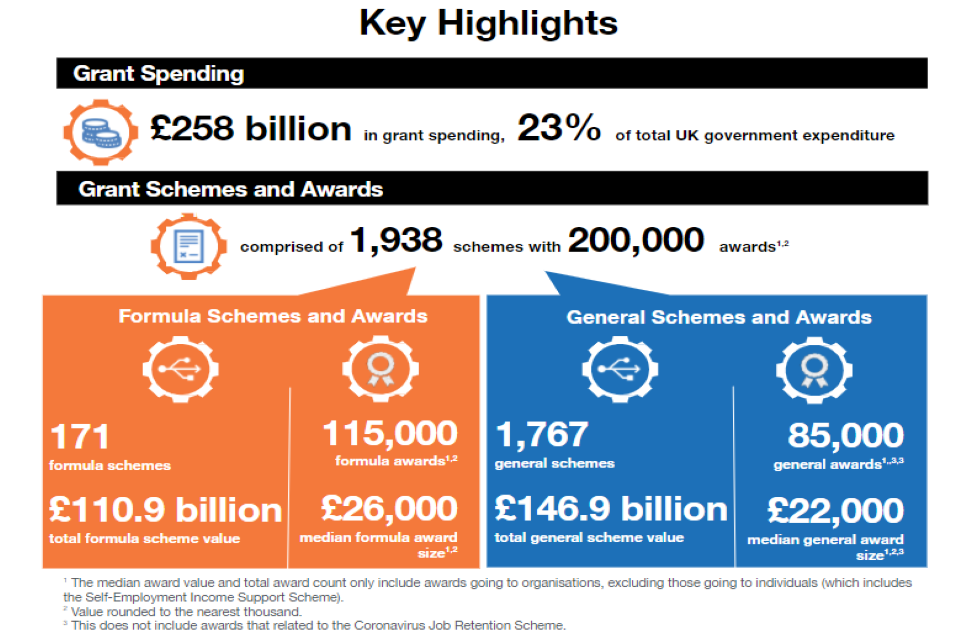

Grant spending accounts for around 23% of total UK government expenditure.[footnote 3] Government grant funding plays an important role domestically, in areas such as education, research, civil society and innovation, and abroad through international aid projects.

Grants can be used for a number of purposes, including providing financial subsidies to deliver activities and outcomes, supporting government policy initiatives, and funding research, development and innovation.

During the financial year covered by this report, grant funding played a significant role in the government’s ongoing response to the COVID-19 pandemic.

Examples of this funding from financial year 2020 to 2021 include the £170m COVID-19 Winter Support Grant from the Department for Work and Pensions (DWP), and the Department for Health and Social Care’s (DHSC) £260m Hospice COVID-19 Emergency Grant.

2.1 Allocation of government grants

There are two allocation methods by which grants are issued:

-

Formula grants: are those calculated by way of a formula. This funding is provided, in recognition of specific criteria, by central government to organisations such as local authorities, schools and the police. Funding is determined by factors relevant to the purpose, such as population or number of pupils who receive free school meals. These grants account for 43% (£110.9 billion across 171 schemes) of government grant spending.

-

General grants: allow the government to secure policy objectives which the market cannot, such as innovation and research, and they allow an effective funding route for the voluntary and charitable sectors, for example to address homelessness and regional inequalities. General grants account for 57% (£146.9 billion across 1,767 schemes) of government grant spending.

Source: Accompanying statistical tables – Table 1

2.2 Total grant spend by department and allocation method

The government spent £258 billion on grants in the financial year 2020 to 2021. This is a 119% increase from £118 billion in the financial year 2019 to 2020. The HMRC gave out the greatest amount of money as grants, accounting for £80.4 billion (31%) of the total value of government grants. This includes the CJRS and the Self-Employment Income Support Scheme (SEISS); these two schemes account for a combined total of £80.4 billion. Large grant giving departments also include the Department for Education (DfE), the Department for Business, Energy & Industrial Strategy (BEIS), Department for Levelling Up Housing & Communities (DLUHC), and the Home Office (HO) which together with HMRC gave out £227.4 billion (88%) of the total value of government grants.

Source: Accompanying statistical tables – Table 1

3. How grant spending has changed over time - from financial years 2018 to 2019 up to 2020 to 2021

In the financial years prior to financial year 2020 to 2021, grants spending was broadly static at £113bn in 2018 to 2019, and £118bn in 2019 to 2020. This spend was dominated by formula grant schemes, making up around 70% of spend in both years. The majority of formula grant spending continues to be associated with the DfE on schemes such as the Dedicated Schools Grant and the General Annual Grants schemes.

In the financial year 2020 to 2021, grant spending played a key role in the UK government’s response to the COVID-19 pandemic.

Total grant spending in the financial year 2020 to 2021 more than doubled compared to previous years. Most of this increase was associated with general grants to support the COVID-19 response with a value of £123 billion[footnote 4], meaning that general grant spending was higher than formula grant spending for the first time.

This shift also saw a change in the breakdown of spending by department, with HMRC becoming the highest grant spending department while other departments such as BEIS, the Department for Transport (DfT) and the Department for Digital, Culture, Media and Sport (DCMS) saw large increases in spending compared to previous years. Prominent examples of COVID-19 grants include the large HMRC CJRS and SEISS schemes mentioned above, alongside many smaller grant schemes such as the DCMS’s £690m Culture Recovery Fund: Arts Recovery (ACE) and the DfE’s £376m Coronavirus Catch-Up Premium.

Source: Accompanying statistical tables – Table 1

4. Formula grants in financial year 2020 to 2021

Formula grants are those calculated by way of a formula. This funding is provided, in recognition of specific criteria, by central government to organisations such as local authorities, schools and the police. Funding is determined by factors relevant to the purpose, such as population or number of pupils who receive free school meals. These grants account for 43% (£110.9 billion across 171 schemes) of government grant spending. This is a 35% increase on the value in 2019 to 2020, when £82.3 billion was funded via formula schemes. £9.6 billion of this increase is due to DLUHC’s Expanded Retail Discount scheme, which compensated local authorities for Business Rates relief provided during the pandemic.

Source: Accompanying statistical tables – Table 1

The largest grant funder is the DfE who provided £63.8 billion in formula grant funding during 2020 to 2021. Outside of the DfE, the next largest formula grant schemes are the HO’s £4.5 billion Police Main Grant and the DHSC’s £3.3 billion Public Health Ring-fenced Grant. See the government grants register, accompanying this bulletin, for details of all grant schemes.

4.1 Table 1: The 10 largest formula grants schemes

| Department | Scheme Name | Purpose and objectives | Value |

|---|---|---|---|

| DfE | Dedicated Schools Grant (DSG) | The main funding for schools, high needs and early years education. | £26.8 billion |

| DfE | General Annual Grant (GAG) | Main monthly revenue funding for academies. Allocations are net of Pupil Number Adjustment (PNA), Risk Protection Agreement (RPA) etc. | £22.4 billion |

| DLUHC | Expanded retail discount | Compensates local authorities for Business Rates reliefs provided during the pandemic. | £9.6 billion |

| HO | Police Main Grant | Statutory funding to all Police and Crime Commissioners (PCCs) as the Police Main Grant, awarded under statute each year. | £4.5 billion |

| DfE | 16-19 Education | To fund 16-19 further education and support. | £4.0 billion |

| DHSC | Public Health Ring-fenced Grant 20/21 | The purpose of the grant is to provide local authorities in England with the funding required to discharge the public health functions. Subject to specified exceptions, the grant must be used only for meeting eligible expenditure incurred or to be incurred by local authorities for the purposes of their public health functions as specified in Section 73B(2) of the National Health Service Act 2006 (The 2006 Act). | £3.3 billion |

| HO | DCLG Funding 2020-21 | Part of the Police Grant Report set by the Home Secretary. | £3.0 billion |

| DLUHC | Local Government Del Contingency | Helping Local authorities with contingency funding for the financial year 2020 and 2021. | £3.0 billion |

| DfE | Pupil Premium | Funding to improve the attainment of disadvantaged pupils and pastoral support for children of service families. | £2.4 billion |

| DLUHC | Improved better care fund | The Better Care Fund (BCF) is a programme spanning both the NHS and local government which seeks to join-up health and care services. | £2.0 billion |

5. General grants in financial year 2020 to 2021

General grants allow the government to secure policy objectives which the market cannot, such as innovation and research, and they allow an effective funding route for the voluntary and charitable sectors, for example to address homelessness and regional inequalities.

General grants account for 57% (£146.9 billion) of the value of government grants spending and 91% (1,767) of the volume of grant schemes in 2020 to 2021. This is a 316% increase on the value in 2019 to 2020, when £35.3 billion was funded via general schemes.

Source: Accompanying statistical tables – Table 1

The largest general grant funder in 2020 to 2021 was HMRC which spent £80.4 billion on general grants. This includes the CJRS and the SEISS; these two schemes account for a combined total of £80.4 billion. Outside of HMRC, the next largest general grant schemes are the BEIS’s £12.3 billion Small and Retail Hospitality Business Support Grants Fund Cohort 1 and the BEIS’s £7.8 billion Small business retail and leisure local restrictions Grant 20-21 Cohort 2.

5.1 Table 2: The 10 largest general grants schemes

| Department | Scheme Name | Purpose and objectives | Value |

|---|---|---|---|

| HMRC | Coronavirus Job Retention Scheme (CJRS) | Support employers who cannot maintain their workforce because their operations have been affected by coronavirus (COVID-19). Employers can put employees on furlough and apply for a grant to cover a portion of the usual monthly wage costs. | £60.7 billion |

| HMRC | Self-Employment Income Support Scheme (SEISS) | Grants paid to a self-employed individual or a member of a partnership where they are affected by the coronavirus pandemic and unable to work due to lockdown/restrictions. | £19.7 billion |

| BEIS | Small and Retail Hospitality Business Support Grants Fund Cohort 1 | To support eligible businesses in England affected by COVID-19. | £12.3 billion |

| BEIS | Small business retail and leisure local restrictions Grant 20-21 Cohort 2 | To support eligible businesses during lockdown in England. | £7.8 billion |

| BEIS | Nuclear Liabilities Fund grant contribution 20-21 | BEIS contribution to the nuclear liabilities fund agreed with HM Treasury. | £5.1 billion |

| DfT | Greater London Authority Transport Grant DEL LA 20/21 | This grant is provided by the government to Transport for London to deliver transport services and investment in the capital, including London Underground. | £2.6 billion |

| DfE | Free Schools Capital | Capital funding for the building of new Free Schools by DfE on behalf of Academy Trusts. | £1.3 billion |

| DfE | Apprenticeships Participation 18+ | To fund the provision of apprenticeship training. | £1.3 billion |

| BEIS | ALB - UKRI - Innovate UK grant awards in 20-21 | To support innovation and the commercialisation of research in the UK in 20-21. | £1.3 billion |

| BEIS | ALB - UKRI - EPSRC grant awards in 20-21 | To support high quality research in the sciences covered by EPSRC’s remit. | £1.1 billion |

5.2 General grant awards by allocation method in financial year 2020 to 2021

There are three means by which general grants are allocated to recipients:

-

Competed - applications are invited and evaluated, with awards made based on the outcome of the application. In 2020 to 2021 these grants had a total value of £15.6 billion. Competed grant awards in 2020 to 2021 had an average (median) value of £25,000. As per the Grants Functional Standard, competition should be the default allocation method, wherever appropriate.

-

Un-competed - grants are awarded to a single organisation or individual without a competition, for example where there is only a single organisation that has the capability of delivering the objectives. In 2020 to 2021 these grants had a total value of £22.1 billion. Un-competed grant awards in 2020 to 2021 had an average (median) value of £126,000.

-

Criteria - disseminated based on specific qualifying criteria, for example grants to assist those affected by floods. In 2020 to 2021 these grants had a total value of £48.2 billion. Criteria grant awards in 2020 to 2021 had an average (median) value of £11,000. Criteria spending is higher in the financial year 2020 to 2021 than in previous years. Grants provided as part of BEIS’s Small and Retail Hospitality Business scheme and Small business retail and leisure local restrictions scheme were the main contributors to this increase.

Source: Accompanying statistical tables – Table 2

Note that these totals are calculated based on award level data, and only on awards to organisations. Therefore these totals do not add up to the other general grants totals in this report. This is mostly due to the exclusion of award level data for the CJRS.

6. Grant schemes by COFOG in financial year 2020 to 2021

We can classify grants by their area of economic activity using the Classification of the functions of government (COFOG). COFOG defines the broad objectives of government activity. The UK government classifies £108.3 billion of its grants spending as Economics affairs (see COFOG definitions for details on what areas of spending this category includes). This is higher in the financial year 2020 to 2021, compared to previous years, due to spending on schemes such as CJRS and SEISS. Education (£71.6 billion) is the second largest classification.

Source: Accompanying statistical tables – Table 3

Please note that in previous releases, COFOG statistics were calculated using award data. These statistics are now calculated using scheme level data.

7. Data Notes

Full notes for each data field are included in the scheme and award level data accompanying this report. Below are the key notes that users should be aware of when interpreting this data:

- The location recorded on the register is not necessarily reflective of the ultimate beneficiary of grant funding. The address may represent the head office of the initial recipient, rather than where the money is actually spent.

- Some data has been redacted at both scheme and award level in the published data, where there is a requirement by law and data protection regulations; where data has been redacted at award level but not scheme level, this will result in a difference between scheme-level and award-level data values.

- The details of awards relating to the CJRS are excluded - information regarding these awards is published by HMRC.

- Grants-in-aid are excluded from this publication; grants-in-aid are funds allocated from one part of government to another part of government, for example, central government funding for the running costs of non-departmental public bodies (NDPBs).

- Financial figures can be reported on either a cash or accruals basis. We are working with departments to make this consistent for future publications.

- Some data is completely redacted for reasons of national security or commercial security. The statistics in this document and the accompanying statistical tables are calculated based on un-redacted data. This means that the statistics in this report won’t completely match the full published dataset.

- Some recipient information is redacted due to it containing personal information or for national security or commercial security reasons. These details are replaced with [Redacted] in the dataset.

- Average (median) award values only include awards going to organisations, excluding those going to individuals, and are rounded to the nearest thousand.

- Where central government provides grant funds to an organisation that then provides onwards grants to end recipients, only the grant to the initial organisation (e.g. the local authority) is included in this data.

8. Departmental statements about the data in this report

Cabinet Office

During the 2020-21 period, in addition to grants that would have been ordinarily issued by the Cabinet Office, of significant relevance, the Cabinet Office has also issued a number of grants in relation to COP26 activities and the G7 summit. COP26, was the 26th United Nations Climate Change conference, held at the SEC Centre in Glasgow, Scotland, United Kingdom, from 31 October to 13 November 2021.The UK hosted the G7 Summit as part of its 2021 G7 Presidency. The G7 Summit was held in Carbis Bay, Cornwall on 11-13 June 21 2021.

Department for Business, Energy and Industrial Strategy

The BEIS data contained within the Government Grants Information System (GGIS), and therefore within this publication, is an approximation of the grant schemes run by BEIS. The awards data covers grants to individual identifiable entities (companies, charities, universities) but excludes awards to persons and consortia. The data excludes non-grant award funding such as funding issued as contracts, loans and operating cost subsidies. Further details of these categories of spending are set out in the Department’s accounts and those of its partner organisations. The core BEIS grants data team is working with the Government Grants Management Function to improve data quality and completeness for the FY 21/22 publication. This is to strive for a better centralised representation of the grants delivered by BEIS, its partner organisations and ALBs. BEIS Covid support schemes allocated by local authorities are for eligible businesses in England. The Devolved Governments received funding for their own Covid support schemes which is not included in this report.

Department for Digital, Culture, Media and Sport

Because of data capture issues, a proportion of the data is budget/forecast data rather than actuals. Some data and data fields have been redacted for commercial confidentiality. Some financial fields read as zero where a grant agreement is signed but actual payments are not made until subsequent financial years. The total value of DCMS exchequer funded grants herewith is £2.5bn, whereas consolidated DCMS accounts show total grants as £3.9bn; however this figure reflects all grants including those from other funding sources other than exchequer funds.

Department for Education

Excepting the Office for Students’ (OfS) grant schemes, the DfE return is on an expenditure basis for schemes and awards, which is consistent with prior years’ treatment. The OfS grant schemes are on an allocations basis and their awards are actual awards. Each grant scheme’s award data consists of one line for each recipient of the grant. For previous years, many schemes’ data was at a transaction level so recipients could feature more than once for a scheme. Consequently, there are fewer award lines this year. Being on an expenditure basis, the data includes transactions that relate to prior years, repayments, and accounting adjustments such as accruals. There is an overall difference of 0.5% between the scheme value and the supporting awards’ value. This is a result of accounting adjustments that we have been unable to attribute to specific recipients, other adjustments that the GGIS process omits, and awards where further investigation was not proportionate on a value for money basis. Where a grant has been awarded to an Academy, the Academy’s or its Trust’s details may be present in the recipient organisation fields. Some grants are paid to a third party, such as a solicitor or a construction company, rather than the beneficiary, and these third parties’ details will be in the award data.

Department for Health and Social Care

DHSC Grant expenditure on GGIS has increased in 2020-21. Key increases relate to the Public Health Grant and a range of grants made to Local Authorities specifically in response to the COVID-19 pandemic. The Public Health Grant 2020-21, issued by Public Health England, provided £3.279 billion funding to Local Authorities in England to discharge their public health functions. Following data quality improvements, the routine funding provided by the Public Health Grant is being shown on GGIS for the first time in 2020-21: the comparative funding for 2019-20 was £3.134 billion. The Department has issued £3.517bn of funding to Local Authorities making over 3800 Awards. The majority of this funding, £3.422bn, was issued in response to the pandemic.

Department for International Trade

Grants provided by the Tradeshow Access Programme were designed to support businesses exhibiting at trade shows overseas. During 20/21 the programme did not have the expected level of applications due to the ongoing uncertainty of the COVID-19 pandemic. This uncertainty was multi-faceted and included variable travel policies and restrictions implemented by countries around the world and variable restrictions on indoor gatherings in countries around the world. In addition, whilst in some jurisdictions exceptions were made for exhibitors to travel the same flexibility was not always available for show visitors, resulting in very low audience numbers which made it unviable for UK SMEs to invest valuable time and resources.

Department for Levelling Up, Housing and Communities

Grants made or received by the Department for Levelling up, Housing and Communities are recorded as expenditure or income respectively in the period that the underlying event or activity giving entitlement to the grant occurs. Grants to local authorities include the Revenue Support Grant which finances revenue expenditure and capital grants which finance non-current assets. The Department for Levelling up, Housing and Communities makes Grant-in-Aid payments from the core department to ALBs. ALBs treat receipts of Grant-in-Aid as financing in accordance with the Government Financial Reporting Manual. These transactions are eliminated on consolidation. Grant payments may need to be recovered from recipients for a variety of reasons depending on the grant conditions. Where recoveries are made income is recognised at the point that the invoice, or other notice requiring repayment, has been issued. Grant expenditure and income in respect of the European Regional Development Fund (ERDF) is also recognised at the point at which eligibility is determined. The negative values relate to year end accounting adjustments. Grant recoveries and ERDF income also contribute to negative grant scheme and award values.

Department for Transport

The award amounts for ‘Covid 19 Bus Service Support Grant commercial’ have been redacted and appear as £0 in this publication. Specific amounts of grants paid to each company could risk distorting competition in the sector.

Foreign, Commonwealth & Development Office

The data contained within this Government Grants Register shows a single year snapshot of FCDO grant spend as it is held on the GGIS at the point of publication.The most accurate and up to date information on FCDO programmes can be found under FCDO transparency releases on gov.uk. All Overseas Development Assistance (ODA), including FCDO grant funding, is published to the International Aid Transparency Initiative (IATI) standard on Development Tracker.

HM Revenue & Customs

Names and Addresses of the Customs Grant recipients have been redacted as they contain personal information.

Home Office

The HO data contained within the GGIS, and therefore within this publication, is reflective of the grant schemes run by HO. The awards data covers grants to individual identifiable entities (companies, charities, universities) and other bodies. The data excludes non-grant award funding such as funding issued as contracts. The figures represent actual expenditure up to the time of completion and additional expenditure may have occurred since these details were presented and accounts for variances between the scheme value and the supporting awards. The core HO grants team is working with the Government Grants Management Function to improve data quality and completeness. Some scheme details are not included in the publication report due to their sensitive nature or for reasons of national security.

Ministry of Defence

Scheme vs award value differences: Variations are due to several factors; COVID-19 restrictions prevented commemorative events taking place, in the usual way, for the Armed Forces Day scheme and other variances are due to some awards being considered and approved by award panels in the final quarter of the Financial Year.

Ministry of Justice

Addresses of Rape Support Funding Grant recipients have been redacted as they contain sensitive information.

-

unless unused or misspent ↩

-

a third party that is seperate from the government organisation ↩

-

Calculated based on the Office for Budget Responsibility’s Public finances databank figure for total managed expenditure at the time of publication. ↩

-

Total COVID-19 spending is estimated by summing the total value of schemes that have been identified by departments as being predominantly part of the response to the COVID-19 pandemic. Note there may be further schemes (not predominantly part of the COVID-19 response) that contained subsets of awards relating to COVID-19. Equally there may be schemes included in this estimate that would have still paid out in the absence of the pandemic, or contain some spending that is not related to COVID-19. ↩