Council Tax: stock of properties statistical commentary

Published 25 September 2025

Applies to England and Wales

This release includes statistics on the stock of domestic properties by Council Tax band and property attributes in England and Wales as at 31 March 2025.

Responsible Statistician

Anna McReady

Statistical enquiries

Date of next publication

Summer 2026

1. Headline facts and figures – 1 April 2024 to 31 March 2025

There were 27.2 million properties on the Council Tax list as at 31 March 2025, up from 27.0 million as at 31 March 2024.

In England, the most frequent council tax band was Band A: 6.1 million properties, or 23.7% of all properties, are Band A.

In Wales, the most frequent council tax band was Band C: 0.3 million properties, or 21.8% of all properties, are Band C.

2. About these statistics

The statistics in this publication relate to England and Wales only. Property valuations are not carried out by the Valuation Office Agency (VOA) in Scotland and Northern Ireland, where the valuation law and practice differ from England and Wales.

The statistics are available at national, regional and billing authority level.

This publication is released in support of bringing greater transparency to VOA functions. The data are also used to inform government policy and conduct analyses to support the operations of the VOA.

3. Distribution of Council Tax bands

3.1 Properties by Council Tax band and country, 31 March 2025

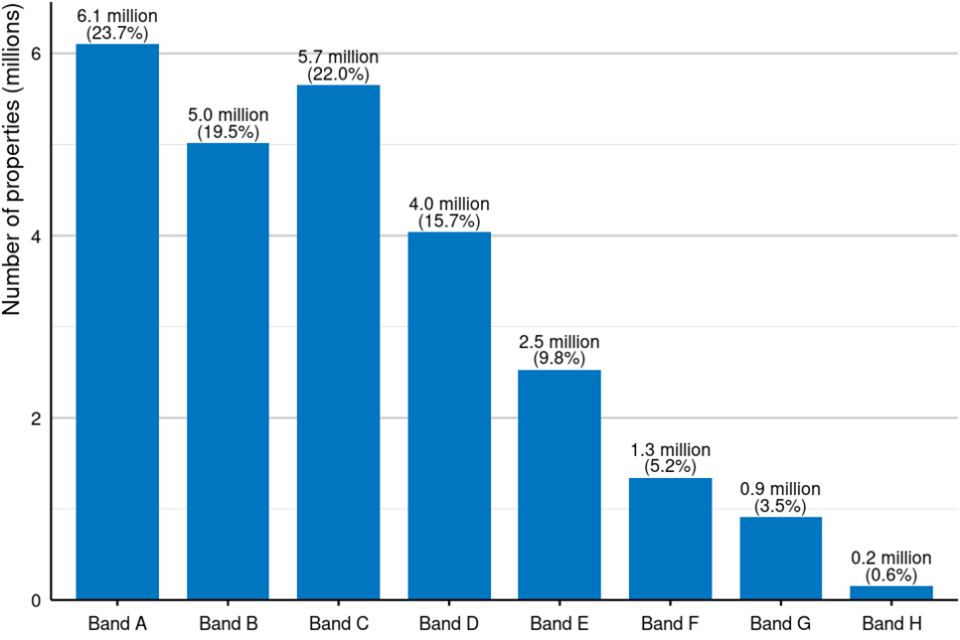

Figure 1.1: The number of properties by Council Tax band in England, 31 March 2025

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest hundred thousand. Percentages are rounded to one decimal place.

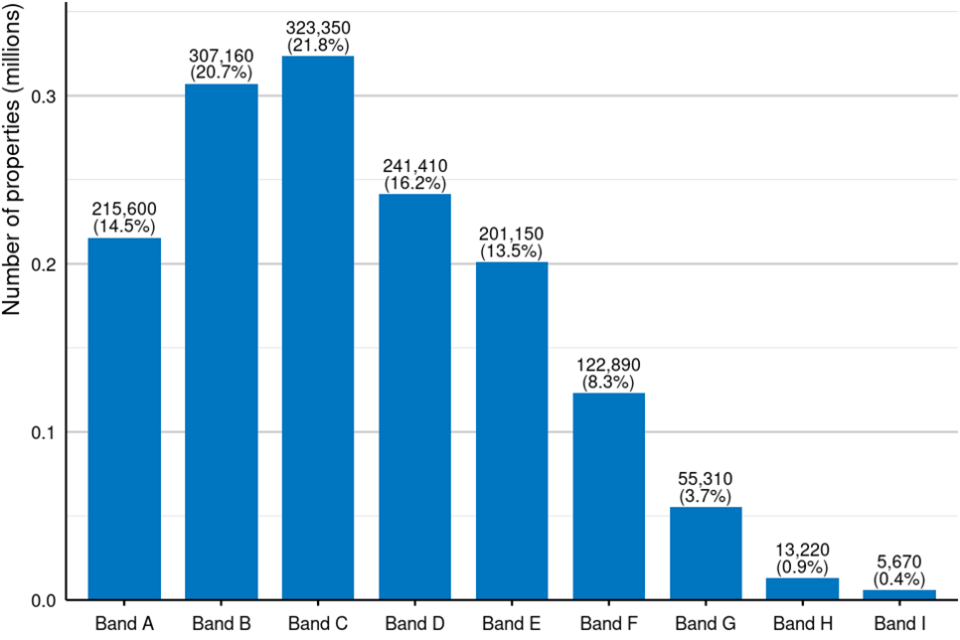

Figure 1.2: The number of properties by Council Tax band in Wales, 31 March 2025

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place.

Note that Council Tax policy is devolved in Wales and the banding systems are different in England and Wales. For example, band I is only used in Wales and the valuation bands and valuation dates are different. For details please see the background information.

Figures 1.1 and 1.2 show the number of properties by Council Tax band in England and Wales as at 31 March 2025:

-

In England, the highest number of properties were in Council Tax band A (6.1 million properties, or 23.7% of the total stock in England), followed by band C (5.7 million, 22.0%).

-

In Wales, the highest number of properties were in Council Tax band C (323,350 properties, or 21.8% of the total stock in Wales), followed by band B (307,160, 20.7%).

-

In both countries, the highest band had the fewest properties, with 154,470 (0.6%) properties in band H in England and 5,670 (0.4%) properties in band I in Wales.

3.2 Properties by country and region, 31 March 2025

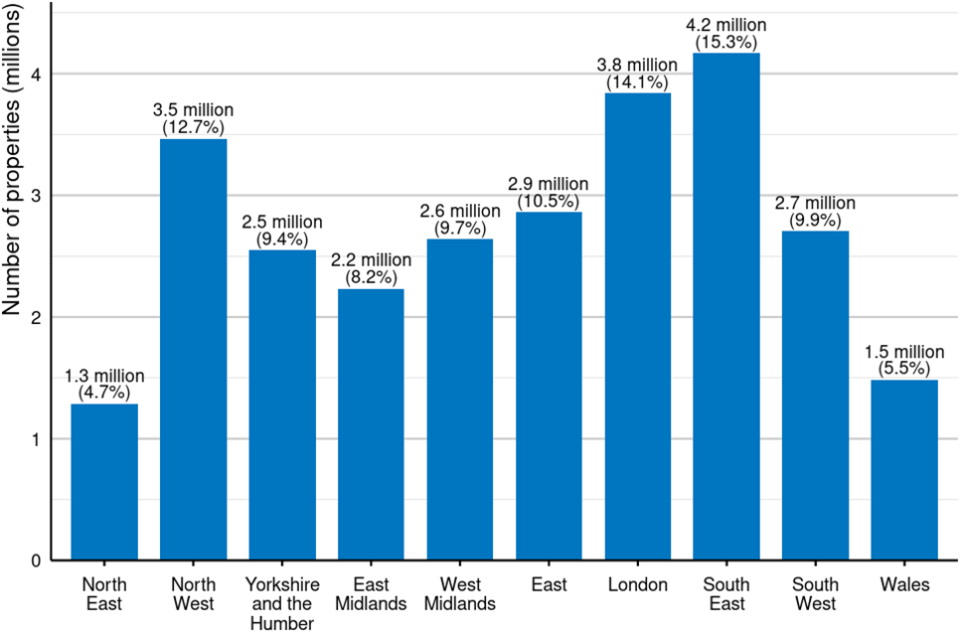

Figure 2: The number of properties by region in England and Wales, 31 March 2025

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest hundred thousand. Percentages are rounded to one decimal place.

Figure 2 shows the number of properties in each region of England and in Wales as at 31 March 2025:

-

The South East had the highest number of properties (4.2 million properties, or 15.3% of the total stock), followed by London (3.8 million, 14.1%) and the North West (3.5 million, 12.7%).

-

Wales (1.5 million, 5.5%) and the North East (1.3 million, 4.7%) had the fewest properties.

3.3 Properties by Council Tax band, country and region, 31 March 2025

Figure 3: Properties by Council Tax band and region in England and Wales, 31 March 2025

Source: Table CTSOP1.0

Figure note: Note that Council Tax policy is devolved in Wales and the banding systems are different in England and Wales. For example, band I is only used in Wales and the valuation bands and valuation dates are different. For details please see the background information.

Figure 3 shows the percentage of properties by Council Tax band in each region of England and in Wales as at 31 March 2025:

-

In the North East, the North West, Yorkshire and the Humber, the East Midlands and the West Midlands, band A was the most frequent Council Tax band, containing between 30% and 52% of all properties.

-

In the South West, band B was the most frequent band, containing 24% of all properties.

-

In the East, London and the South East, band C was the most frequent band, containing between 26% and 27% of all properties.

-

In Wales, band C was the most frequent band, containing 22% of all properties.

-

In every region, the percentages of properties in each band gets smaller, the further that band is from the most frequent band.

Further information

Further information about the data and methodology presented in this commentary can be found in the background information.

As part of our improvement programme, if you’re interested in participating in user research about this statistical release, please contact us at statistics@voa.gov.uk.

GOV.UK has more information on:

Timings of future releases are regularly placed on the VOA research and statistics calendar.

For further information on the geographical information used in this release please refer to the ONS Administrative Geography Guidance.

Housing statistics from other government departments

Office for National Statistics

Department for Levelling Up, Housing and Communities and Homes England (England)

Welsh Government (Wales)

Department for Communities (Northern Ireland)

Housing and Social Justice Directorate (Scotland)