Background Information Document

Published 5 August 2021

1. About this release

This release contains statistics relating to challenges and changes in England and Wales across the Council Tax Valuation Lists in England and Wales. It is the latest in the series of annual publications from the Valuation Office Agency (VOA) and includes statistics by administrative area and financial year from 1 April 1993 to 31 March 2021. This update includes the following tables:

1.1 Challenges in the financial year 2020 to 2021

- Table CTCAC1.1: Summary of challenges by administrative area in 2020 to 2021

- Table CTCAC1.2: Summary of band reviews by administrative area in 2020 to 2021

- Table CTCAC1.3: Summary of proposals by administrative area in 2020 to 2021

- Table CTCAC1.4: Summary of appeals by administrative area in 2020 to 2021

- Table CTCAC1.5: Summary of appeals resolved without a tribunal by administrative area in 2020 to 2021

- Table CTCAC1.6: Summary of appeals resolved at tribunal by administrative area in 2020 to 2021 Amendments to the Council Tax Valuation List in 2020 to 2021

- Table CTCAC2.1: Amendments to the England (1993) and Wales (2005) Council Tax Valuation Lists by administrative area in 2020 to 2021

1.2 Time series: Challenges in the financial years 1993-94 to 2020-21

Total challenges: 1993-94 to 2020-21

- Table CTCAC3.1: Challenges received by administrative area and financial year, 1993-94 to 2020-21

- Table CTCAC3.2: Challenges resolved by administrative area and financial year, 1993-94 to 2020-21

- Table CTCAC3.3: Challenges outstanding by administrative area at the end of each financial year, 1993-94 to 2020-21

Band reviews: 2004-05 to 2020-21

- Table CTCAC4.1: Band reviews received by administrative area and financial year, 2004-05 to 2020-21

- Table CTCAC4.2: Band reviews resolved by administrative area and financial year, 2004-05 to 2020-21

- Table CTCAC4.3: Band reviews outstanding by administrative area at the end of each financial year, 2004-05 to 2020-21

Proposals and appeals: England, 2008-09 to 2020-21

- Table CTCAC5.1: Proposals received by administrative area and financial year in England, 2008-09 to 2020-21

- Table CTCAC5.2: Proposals resolved and appealed by administrative area and financial year in England, 2008-09 to 2020-21

- Table CTCAC5.3: Proposals outstanding by administrative area at the end of each financial year in England, 2008-09 to 2020-21

Appeals: England, 1993-94 to 2007-08, and Wales, 1993-94 to 2020-21

- Table CTCAC6.1: Appeals received, resolved and outstanding by administrative area and financial year in England, 1993-94 to 2007-08

- Table CTCAC6.2: Appeals received, resolved and outstanding by administrative area and financial year in Wales, 1993-94 to 2020-21

The counts shown in all tables are calculated from domestic property data for England and Wales as at 31 March 2021. All data was extracted from the VOA’s administrative database on 30 June 2021. Counts in the tables are rounded to the nearest 10; counts of zero are reported as “0” and counts fewer than five are reported as negligible, denoted by “-”. If you have any queries regarding this release, please contact us at statistics@voa.gov.uk.

2. Background notes

The VOA is an Executive Agency of HM Revenue and Customs. One of the responsibilities of the VOA is to provide Council Tax bands for properties in England and Wales. It does not set the level of Council Tax nor collect the tax; these are tasks for local government. Council Tax is a local tax set by local authority districts to help pay for local services. It uses the relative value of properties to determine each household’s contribution to these local services. The VOA has had responsibility for banding properties for Council Tax since the tax was first introduced in 1993. Before 1993, the VOA was responsible for the earlier system of domestic rates. It is the duty of the VOA to make sure that each home is correctly assessed and placed in the right band. This ensures that there is a consistent and objective basis on which local authority districts can determine the amount they charge each household in Council Tax. The VOA maintains a high level of professionalism when carrying out this duty. The VOA places each property into a valuation band; there are eight bands for properties in England and nine bands for properties in Wales. The valuation band is assigned to a property on the basis of its value at 1 April 1991 for England (for the 1993 Council Tax Valuation List) and 1 April 2003 for Wales (for the 2005 Council Tax Valuation List); this band then determines the amount of Council Tax to be paid. New properties are assigned a band based on what their value would have been on either 1 April 1991 (properties in England) or 1 April 2003 (properties in Wales). The basis of valuation is set down in regulations made under the Local Government Finance Act 1992. Minor updates were made to the initial regulations in 1994 but they have not been changed since. The following tables show the breakdown of bands for England and Wales:

2.1 England

|

Band |

Value of property (at 1 April 1991) |

|

A |

Up to £40,000 |

|

B |

£40,001 up to £52,000 |

|

C |

£52,001 up to £68,000 |

|

D |

£68,001 up to £88,000 |

|

E |

£88,001 up to £120,000 |

|

F |

£120,001 up to £160,000 |

|

G |

£160,001 up to £320,000 |

|

H |

£320,001 and above |

2.2 Wales

|

Band |

Value of property (at 1 April 2003) |

|

A |

Up to £44,000 |

|

B |

£44,001 up to £65,000 |

|

C |

£65,001 up to £91,000 |

|

D |

£91,001 up to £123,000 |

|

E |

£123,001 up to £162,000 |

|

F |

£162,001 up to £223,000 |

|

G |

£223,001 up to £324,000 |

|

H |

£324,001 up to £424,000 |

|

I |

£424,001 and above |

2.3 Challenges

The VOA has responsibility for maintaining accurate Council Tax Lists. When evidence suggests that a band may be inaccurate, a taxpayer may request a band review. The VOA will investigate and, if necessary, change the band. The taxpayer does not have the right to appeal the outcome of a band review.

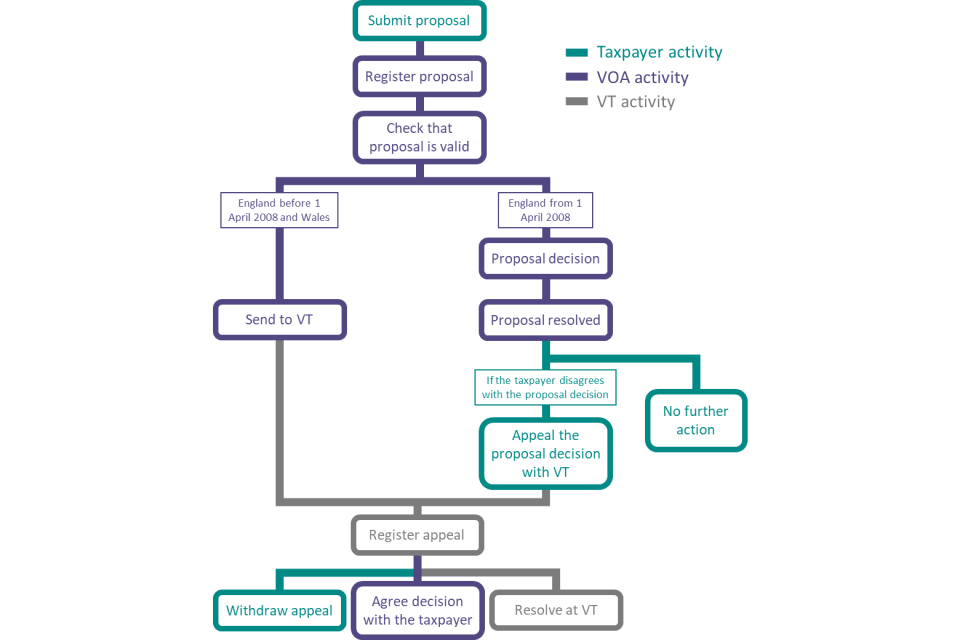

In certain circumstances, set out in legislation, a taxpayer can submit a ‘proposal’ (for example, a new occupier can submit a proposal within the first six months of becoming the taxpayer for their home). If the VOA finds that the taxpayer did not meet the criteria required for submitting a proposal, that proposal will be deemed ‘invalid’. If the taxpayer meets the criteria, that proposal will be deemed ‘valid’. The VOA will review the band and issue a decision. In both circumstances, if the taxpayer is not satisfied with the decision they have the right to appeal to an independent Valuation Tribunal (VT). Only ‘valid’ proposals are included and counted in this publication.

The proposal system in Wales differs from the system that was introduced in England on 1 April 2008. All proposals received in Wales (or in England prior to 1 April 2008), if unresolved, are automatically transmitted as appeals to Valuation Tribunal Service (VTS) within thirty days of receiving them. Since 1 April 2008 in England, the taxpayer has three months after receiving the proposal decision from VOA to appeal it with VTS. The following infographic illustrates the proposals and appeals process:

CT cases

2.4 Changes

Changes to the Council Tax Valuation Lists cover all amendments to the Council Tax Valuation Lists as a result of physical changes to a property, changes to the surrounding area or new information being provided.

Challenge outcomes

Each table showing the number of resolved challenges also includes the outcomes of those challenges. Outcomes of a challenge can include:

- a Council Tax band increase (property attribute details, e.g. number of bedrooms, have been updated on the VOA’s administrative system)

- a Council Tax band decrease (property attribute details have been updated on the VOA’s administrative system)

- no change to the Council tax band (property attribute details may have been updated on the VOA’s administrative system)

- an entry for a property being deleted from a list, e.g. where a property has been demolished

- a list entry may be split into two or more entries, e.g. when a house has been converted into flats

- one or more entries on the list being merged to form a single entry, e.g. when flats are converted to a single property

- a new entry being added to the list, e.g. where a new property has been built

|

Challenge type |

Band increase |

Band decrease |

No change to band |

Deletion |

Split/merger |

New entry |

|

Band review |

yes |

yes |

yes |

no |

no |

no |

|

Proposal |

yes [note 1] |

yes |

yes |

yes |

yes |

yes |

|

Appeal |

yes |

yes |

yes |

yes |

yes |

yes [note 2] |

[Note 1] Whilst band increases as a result of proposals are possible, they rarely take place.

[Note 2] Whilst new entries as a result of appeals are possible, they rarely take place.

Amendments

Amendments may occur either as a result of a challenge, or when a report of a change has been registered with the VOA. For example, the VOA will register such a report when a property has been altered and then sold. For further information, please visit the VOA guidance at: https://www.gov.uk/guidance/council-tax-band-changes.

The bands of properties recorded on the Council Tax Valuation Lists can be changed as a result of: physical alterations made to a property (e.g. extensions or refurbishments); a change to the surrounding area (e.g. a new road built nearby); or from new information that has been brought to light which makes it clear that the original banding was incorrect (e.g. the dimensions of the property are incorrect). As a result, the Council Tax band may increase, decrease or remain unchanged. Property details (e.g. number of bedrooms) may be updated even when the Council Tax band remains unchanged. Amendments may not necessarily occur as a result of a challenge, for example, they may occur when a property has been altered and then sold.

As part of our drive to improve the quality of our Official Statistics publications, we have moved the tables showing the number of properties inserted to and deleted from the Council Tax Valuation Lists to the Council Tax Stock of Properties release that will be published 23 September 2021.

3. Methodology

3.1 Received challenges

Band reviews

A band review is reported if it was registered on the VOA’s administrative system on a date within the given publication period.

Proposals

A proposal is reported using the date it was registered on the VOA’s administrative system. Only ‘valid’ (i.e. passed the legal criteria for submitting a proposal) proposals submitted in England from 1 April 2008 are reported, with all other ‘valid’ proposals (those submitted in Wales or in England prior to 1 April 2008) being recorded in the count of appeals.

Appeals

Appeals are only included in the statistics if the associated proposal was deemed to be ‘valid’ by the VOA (i.e. passed the legal criteria for submitting a proposal). Additionally, all appeals shown in the statistics may have been submitted at any time up to 30 June 2021, when the data extract was taken. As taxpayers have up to three months to submit an appeal after receiving the proposal decision, taking the data extract at 30 June allows the inclusion of appeals from proposal decisions issued up to 31 March 2021.

Table CTCAC5.2 shows information about appeals in England from 1 April 2008 only. In this table, the count of appeals for a particular year shows the number of proposals which were resolved (i.e. cleared from the VOA’s administrative system) in that year which were subsequently appealed, showing the relationship between a resolved proposal and if applicable, its subsequent appeal.

In all other tables showing information about appeals (tables CTCAC3.1-3.3, CTCAC6.1-6.2), the count of appeals for a particular year shows the number of proposals which were received (i.e. registered on the VOA’s administrative system) in that year which were subsequently appealed.

3.2 Resolved challenges

Challenges are reported as resolved using the date they are recorded as ‘cleared’ in the VOA’s administrative system.

3.3 Outstanding challenges

Challenges are reported as outstanding if they have been registered on the VOA’s administrative system and have not been resolved.

3.4 Outcomes

Council Tax band increase/decrease/no change

A classification of either ‘increase’, ‘decrease’ or ‘no change’ is determined by comparing the Council Tax band of the property before and after a challenge.

Deleted

A challenge may result in an entry for a property being deleted from the Council Tax Valuation List, e.g. where a property has been demolished. The property will be recorded as inactive and removed from the list.

Split/merger

A property is reported as a split/merger when the number of properties associated with the challenge is different before and after the challenge.

New entry

A property is reported as a new entry if it was not on the Council Tax Valuation List before the challenge. New entries to the list are usually handled by Billing Authority Reports (the taxpayer informs their local Billing Authority of a new entry and the Billing Authority sends a report of that new entry to the VOA). Therefore, the number of new entries to the list as a result of challenges tends to be extremely low.

3.5 Assigning geographies

The statistical geographies used in this release have been assigned using the following methodology: Each property with a Council Tax band held on the VOA’s database is assigned to a Billing Authority, each of which have a unique Billing Authority code (BA code). These BA codes have been linked to the codes and names used in the UK statistical geographies maintained by the Office for National Statistics (ONS). For further information on the area codes used in this release, please refer to the please refer to the ONS Administrative Geography Guidance.

4. Data quality

4.1 Suitable data sources

The information supplied in the tables are based on administrative data held within the VOA operational database. Because it is a statutory requirement of the VOA to maintain accurate valuation lists, the data are considered accurate. However, while the VOA actively seeks to maintain accurate Valuation Lists for Council Tax bandings, some reliance is placed upon the taxpayer to notify the VOA of any inaccuracies to their entry in the Valuation List and billing authorities to notify the VOA of any changes (including new builds, demolitions or alterations).

There is some uncertainty and variability in this process and all administrative data may be subject to processing and system errors. Consequently, although the VOA has made every effort to ensure accuracy of the data underpinning this publication, it is possible that some errors remain. We reflect this by rounding counts to the nearest 10 and suppressing counts lower than 5.

The Valuation Tribunal Service provides regular updates to the VOA about appeals raised and resolved. There can be short delays inputting this information onto the VOA administrative system. As a result, it is possible that appeals raised or resolved shortly before the data extract date may not be recorded.

4.2 Assured quality

Our quality assurance follows the approach set out in the VOA Quality Policy. As part of the production of this publication, quality assurance takes place:

- during the valuation of properties

- as part of the creation of the data which underpins the publication

- as part of the coding which produces the publication outputs

- as part of automated and manual checks of outputs

- using a comprehensive QA Check List and a QA Issues Log

5. Uses of the data

This publication is being released as part of a drive towards making the VOA’s data more accessible as well as continuing to improve, and make more consistent, presentation of information in order to assist users conducting their own analysis of VOA data. The data are used to inform government policy and conduct analyses to support the operations of the VOA.

The data in this publication relate to England and Wales only. The rating law and practice in Scotland and Northern Ireland are different and the valuations for rating in those countries are not carried out by the VOA. The VOA welcomes feedback from users on the information provided in the release. Please forward any comments to statistics@voa.gov.uk.

6. CSV metadata

A file which provides the variable names and descriptions appearing in the CSV files is included in this release; it can be found within the CSV zip file on the release page.

7. Timeliness and punctuality

Timeliness refers to the lapse of time between publication and the period to which the data refer. Punctuality refers to the gap between planned and actual publication dates.

This publication is published on an annual basis. The data extract was taken on the 30 June 2021 in order to capture activity as at 31 March 2021. This publication is published within 2 months of the data extract date.

Releases are always published on pre-announced dates at 9:30am. Pre-announcement of the precise date occurs up to four weeks before publication. The VOA always pre-announce the month of publication in our 12-month planning schedule.

8. Relevance

Relevance is the degree to which statistical outputs meet users’ needs.

It is important that the statistics produced meet the needs of users, both in coverage and in content. These statistics evolved largely in response to Freedom of Information requests and Parliamentary Questions and were further developed with input from a CT Statistics Advisory Panel, which involved key users of the data.

9. Coherence and comparability

Coherence is the degree to which data that are derived from different sources or methods, but refer to the same topic, are similar. Comparability is the degree to which data can be compared over time and domain, for example, geographic level.

Statistics related to challenges are drawn from the same source and use a coherent and consistent methodology. Therefore, these statistics can be compared over time. Statistics related to changes, shown in table 2.1 (Amendments to the England (1993) and Wales (2005) Council Tax Valuation Lists by administrative area in 2020-21) can only be compared with the 30 March 2020 release. This is because an improved methodology was introduced to count amendments in this release, therefore, the statistics in this publication cannot be compared with those published in previous releases.

The Valuation Tribunal Service (VTS) also publish appeals data. However, the VTS count all appeals that they receive in a specified time period. The VOA counts the appeal in the financial year that the corresponding proposal was received. As the statistics included in this release and the statistics published by VTS use different methods to count appeals, the figures should not be compared.

10. Accessibility and clarity

Accessibility is the ease with which users are able to access the data, also reflecting the format in which the data are available and the availability of supporting information. Clarity refers to the quality and sufficiency of the release details, and accompanying advice.

The release is available free of charge. All official statistics are made available primarily as Excel spreadsheets with data available in CSV format (see section CSV metadata), a background information document, and a statistical summary document.

11. Confidentiality, transparency and security

Access to the data and release during its publication is limited to the statistics production team only. Occasionally, valuation experts may be consulted as part of the quality assurance process. The list of pre-release recipients is published alongside the release.

Further information can found within the VOA Confidentiality and Access policy.

12. Further information

More detailed information on Council Tax bands can be found at https://www.gov.uk/council-tax-bands.

Timings of future releases are regularly placed on the Agency’s website in the upcoming releases section.

For further information on the area codes used in this release, please refer to the ONS website.

13. Glossary

Amendments – amendments are made as a result of: physical alterations made to a property (e.g. extensions or refurbishments), a change to the surrounding area (e.g. a new road is built nearby) or from new information that has been brought to light that makes it clear the original banding was incorrect (e.g. the dimensions of the property are incorrect).

Appeal – where a valid proposal has been made, a taxpayer has the right to appeal against the VOA’s decision on the proposal to an independent VT. Appeals are often withdrawn or settled before being heard by the VT.

Band review – a band review is carried out when a potential inaccuracy is brought to the attention of the VOA. The VOA will investigate the matter and inform the taxpayer of the outcome. The taxpayer does not have the right to appeal the outcome of a band review.

Challenges – these are challenges against the entries in the Council Tax Valuation Lists for England (1993) and Wales (2005), consisting of band reviews, proposals and appeals.

Changes – these include any amendments (including those that result from challenges) to the Council Tax Valuation Lists as a result of maintenance changes such as physical changes to the property, changes to the surrounding area or new information being provided. Further details about the circumstances under which a change occurs are included in the changes section.

Deleted – in some cases a challenge may result in an entry for a property being deleted from a list, e.g. where a property has been demolished.

New entry – the outcome of a challenge may result in a new entry being added to the list e.g. where a new property has been built.

Property – a separate unit of living accommodation, together with any garden, yard, garage or other outbuildings attached to it, all occupied by the same person(s) and within the same area of land.

Proposals – a formal challenge to a Council Tax list entry. There are limited circumstances under which a proposal can be accepted; for example, a new occupier can make a proposal within the first six months of becoming the taxpayer for their home. In England, the VOA will review the band and provide the taxpayer with a written decision, usually within two months; the taxpayer then has up to three months to appeal to a Valuation Tribunal (VT). In Wales, the VOA transmits all proposals to the Valuation Tribunal Service (VTS) for appeal within 30 days of receipt.

Split/merger – where a change has been made to a property, a list entry may be split into two or more entries, e.g. where a house has been converted into flats. Conversely, two or more entries on the list can be merged to form a single entry, e.g. where flats have been converted into a single property. Valuation Tribunal for England (VTE) – this is an independent body responsible for making decisions on Council Tax appeals in England.

Valuation Tribunal Service (VTS) – this is an administrative statutory body which supports the Valuation Tribunal for England and Valuation Tribunal Wales in their work dealing with appeals.

Valuation Tribunal Wales (VTW) – this is an independent body responsible for making decisions on Council Tax appeals in Wales.