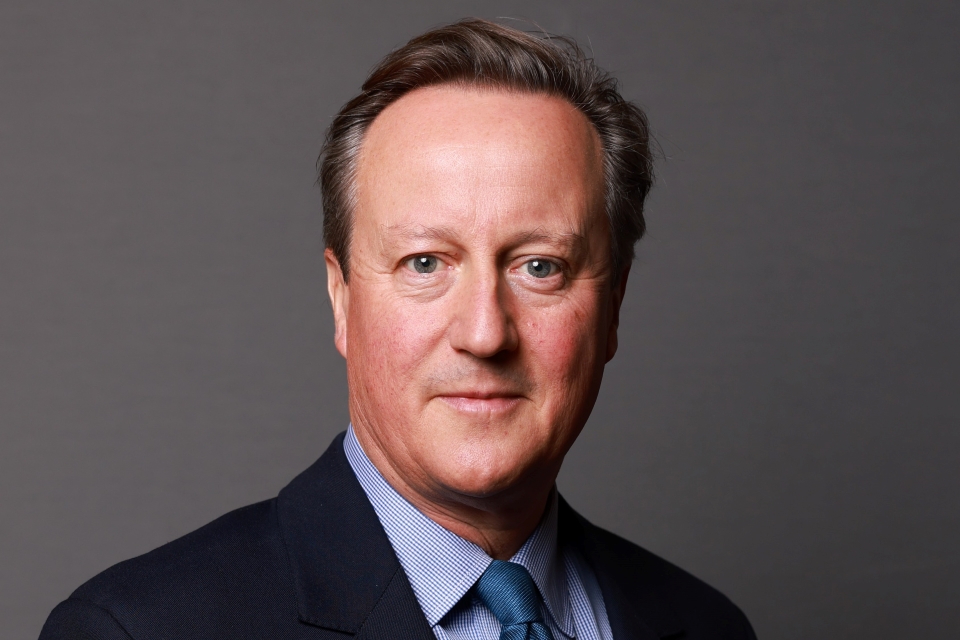

Transcript: PM at European Council

"My message to other leaders was clear: we've got to be bold and decisive."

The Prime Minister has given a press conference following the summit held at the European Council in Brussels on Monday 30th January 2012.

Prime Minister:

Welcome everybody. Today the Council has tackled three issues: how we boost growth across Europe; how the Eurozone countries are going to strengthen their fiscal rules; and how the European Union must increase the pressure on Assad’s murderous regime. Let me take each in turn.

Let me start with growth. This was rightly the focus of today’s meeting. It has to be our number one priority, not just today, but every time we meet. My message to other leaders was clear: we’ve got to be bold and decisive. EU action should match the ambition that we are showing back at home. So it’s a step forward, I believe, that we’ve agreed today to accelerate the legislation that will do the most to generate growth, to consider a clear plan at our March summit to cut red tape, to remove barriers to trade in services right across the EU and to make it easier to do business online - the so-called digital single market - across a market with half a billion customers. And we agreed this must be a decisive year to get trade moving with those big deals we want to make: with India, Japan, the US and others. These are all good steps forward. They are things that the UK has been asking for for years in many cases and are now firmly on the agenda.

Second, on the Eurozone. Eurozone members and others have today agreed a new treaty focussed on tighter fiscal discipline which we understand is important. Now, this is a totally separate treaty. That is because we vetoed an EU treaty in December. We are not signing this treaty, we will not be ratifying this treaty and it places no obligations on the United Kingdom. But as I said in December, this is new territory. It’s only been agreed today, it has yet to be ratified or implemented. There are a number of legal concerns on the use of EU institutions. Now, we do not want to hold up the Eurozone doing what is necessary to solve the crisis as long as it doesn’t damage our national interest. So, it’s good that the new treaty is absolutely explicit and clear that it cannot encroach on the competencies of the European Union and they must not take measures that in any way undermine the EU single market. But I made clear today we will watch this closely and if necessary we are able to take action if our national interests are threatened. And let me say this: while tough fiscal discipline is obviously important to the Eurozone, it is still vital that the Eurozone countries recapitalise their banks, end their uncertainty around Greece and establish a firewall big enough to deal with the crisis. These measures cannot wait: the risks are still too great. They are the immediate steps necessary if the single currency is to succeed.

Finally, on Syria. It is frankly an appalling situation: more than 5,000 people killed; 400 children murdered; tens of thousands detained. Tomorrow the Foreign Secretary will go to New York to support the Arab League’s call for Security Council action condemning the repression and supporting a transition of power. Today, all 27 EU members backed that call for UN action in a move that was led by the UK. And if the violence doesn’t end there, we will tighten the EU sanctions. Our message is clear: we will stand with the Syrian people. And it’s time for all the members of the EU Security Council to live up to their responsibilities instead of shielding those who have blood on their hands. So, we’ll be making a very strong stand at the UN Security Council tomorrow, led by William Hague.

Question:

Prime Minister, should decisions on Mr Hester’s pay and conditions be taken or overseen by the RBS Board or by you? And if the answer is the Board, why haven’t you encouraged him to take the bonus he was awarded?

Prime Minister:

Well look, the arrangements were put in place by the last government. That’s the arrangements to hire Stephen Hester, the arrangement for payment of bonuses, for the role of the Board, the role of the Remuneration Committee and all of that. They decided to put this on a commercial basis: to have an arm’s length agreement with UKFI who were going to represent the government’s interest. Of course there’s a role for shareholders and we made very clear our view about the level of bonus which is why it radically came down. I think the main thing that needs to happen is for this bank to be turned round, for its balance sheet to be made safe and for the taxpayers’ money vitally to be recovered. I want to make sure that every penny piece that went into that bank we get back out when we eventually sell down our stake. That is absolutely vital. Now of course we’ll look closely at the arrangements that were put in place. We don’t plan to change them. We’ll look closely at them, but I think it’s very important that this bank operates under those arrangements.

Question:

My point was, why in that case did you not encourage Mr Hester to take the bonus he’d been awarded?

Prime Minister:

Well, the point I made, as it were, on behalf of the shareholder - and the point the Chancellor made very vigorously - was that they needed to show restraint in bonuses. And that is exactly what I said. I said if he was going to get a bonus is should be nothing like last year. That is the role of the shareholder. Then the role of the Board as the arm’s length principle is to look at the performance and reach a judgement. And then it is up to the individual whether they take the bonus. So everyone if you like has played their part. Some of them have done it in slightly interesting ways if I can put it that way. Those are the arrangements that were put in place by the last government, those are the ones that we’re currently operating but of course we can look closely at all of that and more.

Question:

Prime Minister, you’ve just told us that the United Kingdom is unlikely to stand in the way of the European Court of Justice being used to police the new fiscal compact. If it deals with the fiscal compact, if it tries to rewrite the single market, then obviously you’ll have something to say about that. Do you regret having put the EU institutions in the frame? Because some of your colleagues are saying that your decision now is annulling that veto in December.

And secondly, on another matter I think a few weeks ago you briefed Aung San Suu Kyi on how you’ll be raising the recent developments in Burma at this summit. Are you happy with the response that you’ve got from your fellow EU leaders on those recent developments in Burma?

Prime Minister:

Well, first on the second question. I spoke to Aung San Suu Kyi at the weekend and asked her about how quickly she thought the reengagement process should take place between countries in the West, countries in the EU, with the Burmese regime. And I think it’s very important that we listen carefully to her, an absolute figure of brilliance in terms of what she has been through and what she is now going to achieve in that country. And I think the message is yes, we should be engaging but we should do it in stages. And we should look very carefully to make sure that the by-elections they are going to hold are fair, that prisoners go on being released, that they go on opening up and moving towards democracy. And as they do that, I think there are opportunities for European Union countries to engage and I’m delighted that the Council has made such a clear statement tonight.

On the issue of the veto, look, nothing changes the fact that we were confronted by an EU treaty and we vetoed that treaty. So, there was the Nice Treaty, there was the Maastricht Treaty, there was the Amsterdam Treaty: all EU treaties. Well, there isn’t a Brussels EU treaty because I vetoed it. It doesn’t exist. They’ve had to make a treaty outside the EU. Now obviously, they’d prefer to have it inside the EU which is why they’re already talking about trying to bring it back inside the EU. So, to argue that the veto doesn’t matter seems to me to be bizarre. We’re not in this treaty, we’re not part of it, we’re not bound by it, we don’t have to ratify it, we don’t take it to the British parliament. That is what the veto secures you.

On the issue of the institutions, you have to understand that the EU institutions are already used in other settings that we’re not involved in. They’re used in the Euro Group countries, they’re used in Schengen. The key point here for me is what is in our national interest. Now, our national interest is that these countries get on and sort out the mess that is the Euro. That’s in our national interest. It’s also in our national interest that the new treaty outside the EU doesn’t encroach on the single market or the things that we care about. That’s the outcome we want to achieve. So, we’ll be watching like a hawk. And if there’s any sign that they’re going to encroach on the single market then clearly we would, you know, we would take the appropriate action if I can put it that way. But if they’re going to stick to fiscal union issues and all the things they’re planning to do, then that’s an outcome Britain is comfortable with.

But the principle that the EU institutions can only be used when there’s permission of all 27: that is absolutely safeguarded and hasn’t changed and that’s why we reserved our position. And we’re using that reserve to watch over this treaty and say in as much as this is about fiscal union, fine; start to encroach on the single market, not fine. So very clear national interests: don’t signature the treaty without the safeguards, so there isn’t an EU treaty, point one. Make sure the new treaty’s restricted to the fiscal union, point two. Hold back the position on the institution so you’ve got some real leverage over what these countries will do in that treaty. But say to your colleagues and friends and partners in the European Union, in the Eurozone, please get on and sort out what’s going wrong in the Eurozone because this is doing damage to Britain.

Question:

Prime Minister, just next door president Sarkozy said that you didn’t share the aims, the belief in the fiscal pact. Do you regret that so much time has been spent on this fiscal compact and do you really think that it’s been worth the effort and will dramatically help the European Union? And secondly, Angela Merkel has made it clear that she is happy to campaign for President Sarkozy: will you be and how will you do so?

Prime Minister:

First of all, I’m a big supporter and friend of Nicolas Sarkozy and I wish him well. I think he’s a remarkable man. I worked with him very closely over the Libya conflict. I think that was probably the closest that the British and French have worked together in the last 40 years so, I’m full of admiration for Nicolas. Every now and again, he says something I don’t agree with. Today, when he said that Britain is short of industry: we actually have a larger industrial sector than France but we’ll gloss over that.

On the issue of the fiscal compact. Look, I understand particularly why the Germans want to make sure that others in Europe keep a tight fiscal rule, that they do not get into excessive debt and deficit. Do I think that this treaty on its own is going to solve the problems of the Eurozone? No, I do not. As I said in Davos, there is a fiscal issue that needs to be sorted out, but there’s also a competitiveness issue that needs to be sorted out. Just piling up fiscal rules will not actually help Italy, Spain, Portugal, Greece and others to compete in the Eurozone.

To do that, they have to reform their labour markets. They need the opening up of the services in Europe. They need more competitive markets etc. Let us not believe it is all about fiscal changes. There are lots of other things that need to be done too.

As I said, I do not want to stand in the way of what they think they need to do to sort out the Eurozone. Fiscal is part of it and so that is going ahead not without us involved. The other part of it, which is the growth package, where Britain is not just sort of letting people go ahead, we are driving the agenda. The Services Directive, completing the energy market, completing the single market, this is a very British agenda that we are driving very hard and having a big influence on.

Question:

Back on bonuses, what is your view and your advice going forward for RBS, both for bonuses for other executives this year and in future for Mr Hester so long as the taxpayer is the majority shareholder? Do you agree with Ed Miliband that there needs to be a cultural change and a shift downwards on the whole question of top executive reward?

Prime Minister:

I think what needs to happen is a sense of restraint, which is exactly what the Government urged on RBS in the first place, and I think they have to do a better job, as everybody has, to demonstrate how pay is linked to performance. If that performance isn’t the share price, then people need to see very clearly what it is you are doing to sort out that bank, to turn it around, to make it safe, to make sure that it’s long term value. That is what I care about. Is the taxpayer going to get the money back that we had to put into this bank that was so badly managed in the past? Those are the things that they have got to focus on.

I think they have to have a proper regard in terms of restraint, when they have had so much money from the taxpayer and when they have made so many mistakes in the past.

[political content]

Question:

Still on RBS, a week ago, you and Vince Cable were saying that what needs to happen is shareholders need to put their feet down and get involved. I think a lot of shareholders in other banks might say it is all very well for you to say it, but when it came right down to it you did not do it. It was only after the Labour Party threatened to call a vote on the matter that Hester’s bonus was set aside. What would you say to those shareholders?

Prime Minister:

First of all, what we did, as shareholders, was we made very clear our views about what ought to happen. That is why the level of bonus that was contemplated was immediately halved. They did not listen as carefully as perhaps they should have done to shareholders, but the view given was a very clear one. In terms of the changes we are going to make. It still applies that we want to see binding shareholder votes on packages, pay packages, including rewards for success or failure before they are put in place. That would make a real difference. If someone’s contract and whether they succeed or fail and what they are going to be paid would be voted on by shareholders before they are actually in place, that, I think, would make a much bigger difference.

Question:

Can I take you back to Nicolas Sarkozy? Did you talk to Nicolas Sarkozy about this calumny against the British economy today, because he has been repeating it in his press conference and saying we chose not only to develop financial services but to boost industry? Is that a fair assessment of your policy, do you think? Have you brought it up with him?

Secondarily, is there some prospect of you heading to Burma this year, given how things are going?

Prime Minister:

Taking the second point first, I am delighted that William Hague and Andrew Mitchell have both been and had such good meetings. As I said, I spoke to Aung Sang Suu Kyi on the telephone. We keep in quite regular touch and my office keeps in touch with hers. She has an extremely busy schedule with these elections and everything else coming up, so keep all options open. However, we are going to watch very closely and do anything we can to help, frankly, because there are many depressing things going on in the world, but the flowering of democracy in Burma and the emergence from sort of captivity, as it were, of this great democrat is a wonderful development and one that we want to do everything we can to encourage.

On the issue of industry and finance, we are rebalancing the economy. We want to see a growth of manufacturing, technology, aerospace and pharmaceuticals. We have great British companies in those sectors. If you look for instance at our automotive sector, where we have Honda, Nissan, Toyota, Jaguar Land Rover, each one of those is investing, expanding and growing in Britain. We are going to rebalance, but we are not going to rebalance by somehow punishing a successful industry, financial services, which is not just the City of London. It is 100,000 people employed in Birmingham. It is 100,000 people employed in Scotland. It is a widespread industry and one of Britain’s strengths.

That is why I have been so clear about the financial transactions tax. If other countries want to put in place a financial transactions tax as originally envisaged by the European Commission, I know I used the word ‘mad’, but I do think it is an extraordinary thing to do. The European Commission has told us this would cost Europe half a million jobs. Now, when we are all fighting for jobs and for growth, to do something that would cost so many jobs does seem to me to be extraordinary. In the spirit of this healthy competition with France, if France goes for a financial transactions tax, then the door will be open. We will be able to welcome many more French banks, businesses and others to the UK and we will expand our economy in that way as well as by rebalancing it, because I think this is the wrong move.

I have said very clearly to other European leaders that there are ways of taxing financial services to make sure they make a fair contribution. We have stamp duty on share dealings. Other countries could do that. We have the bank levy, which is taking £2.5 billion more out of the banks every year. You can do that. The financial transactions tax, unless it is put everywhere in the world at the same time, simply drives those transactions to the jurisdiction that does not have it. That has been proven to be the case and that is why we think it is such a mistake.

Question:

I have two questions. First of all, what is your message directly to senior Conservatives, such as Bernard Jenkin, senior conservative MEPs such as Daniel Hannan, who believe that effectively you have discarded the veto that you exercised in December by accepting any role at all for EU institutions in the new fiscal pact?

Secondly, you mentioned Ed Miliband. Why was it the case that an Opposition debate seemed to convince Stephen Hester to give up his bonus, rather than exhortations from the Prime Minister and Deputy Prime Minister? Can you do something now to tackle the bonus culture among the rest of the RBS executives?

Prime Minister:

On the issue of the veto, let me repeat, the fact is there is no EU treaty because I vetoed it. That is the effect of the veto. There is no treaty that Britain is going to have to sign, comply with, ratify, pass through our Parliament, amend any of our laws. It does not exist for us. There is a treaty outside the European Union that is going to be principally focused on fiscal union and, because we have reserved our position over the use of the institutions, because there are legal questions outstanding, we have leverage over that treaty and can do what is possible to make sure it is restricted to fiscal union. We are maintaining the very important principle that the institutions are only used with the consent of the 27. By reserving our position, we maintain the maximum leverage, but at the same time we allow Eurozone countries to go ahead with sorting out the Eurozone, which we need them to do.

I think I have answered the question on pay. As I say, there are arrangements in place and everyone has to play their role - the Government as shareholder, making its views known as shareholder, which is what we did. The board of the company then is contractually obliged, under a contract drawn up by [political content - the previous administration] , to go through with Mr Hester and the other executives at RBS what their remuneration is. That is their job. They have to do their job. Then they have to justify what they have done. Then it is up to Mr Hester, as indeed it is up to other people in business, whether to take that award or not take that award.

Anyway, thank you for spending so long here in Brussels today. Thank you.