Transcript of PM Direct in Leicester

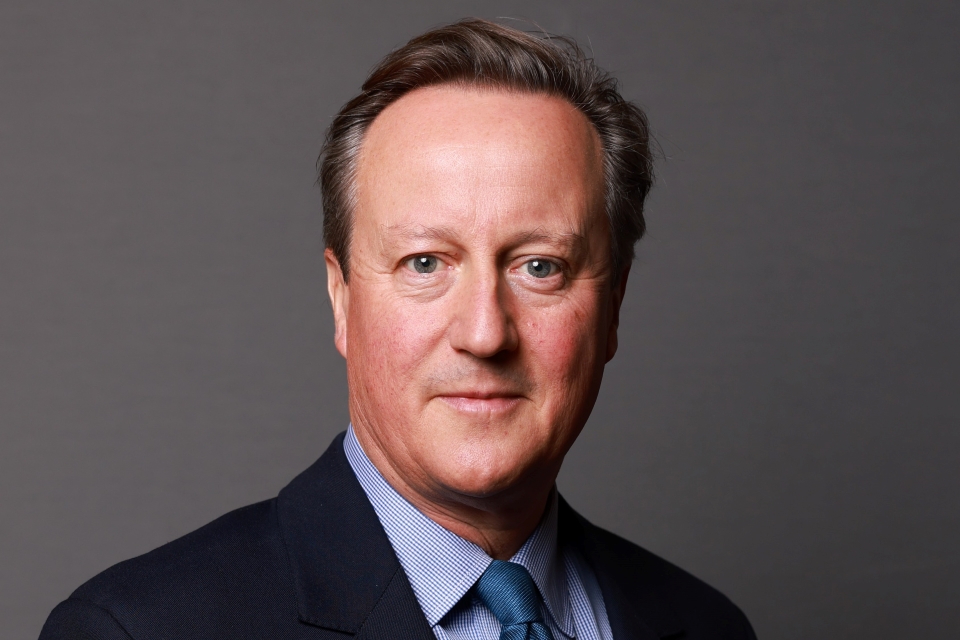

A transcript of Prime Minister David Cameron's PM Direct in Leicester on 5 January 2011.

Prime Minister

Thank you very much. Thank you very much for that warm welcome.

Look, no long introduction from me because the point about this afternoon is your questions and my answers to those questions. But I just want to say a couple of words.

First of all, it is really good to be here. It’s good to get out of Westminster and to go and engage directly with people and try and answer their questions.

The second reason is this is really a massively important year for our country, because we’ve got to do two things at the same time. We’ve got to try and get the country to live within its means. We’ve got to get the budget deficit down, we’ve got to keep ourselves out of the danger zone that countries like Ireland and Portugal have got themselves into with big budget deficits - and our budget deficit was actually bigger than theirs when we came to office last year.

But, as important, we’ve got to get the economy growing. We need more jobs. We need more investment; we need businesses like this to keep on growing. So we’ve got to make the right decisions this year to try and help business expand and grow and take on new people.

So I think this is a great opportunity, so without any further ado, who’s going to ask the first question?

Question

I wonder if you could justify for me your Chancellor’s statement that the VAT increase was progressive, when in May last year on the run up to the election you said it was ‘very regressive, it hits the poorest the hardest, it does, I absolutely promise you’?

Prime Minister

The truth about VAT is if you look at spending - if you look at the money that people spend and you measure the nature of this tax by how people spend - it does affect relatively better-off people a bit more than relatively less well-off people for the very simple reason that VAT isn’t applied to food or children’s clothes and some of the essentials of life. But if you look at income, if you look at the effect compared with people’s income, then yes it does - it is regressive. So it depends whether you’re looking at expenditure or whether you’re looking at income.

But I think frankly we’ve got to stand back and ask ourselves the bigger question, ‘Why are we having to put up taxes at all?’ And if we are putting up taxes, are we putting up the right taxes? Now, as I say, when we came to office, we were borrowing 11% of our national income. That was more than was forecast for Spain or Portugal or Greece or Ireland. We were in the danger zone. We were in the zone where people were saying they’re going to get rid of our credit rating, you’re going to see interest rates go up, you’re going to see a lack of confidence in your economy. As a government and as a country, you can’t let those debts go on and on and on. You have to sort it out.

So the big question is, ‘How?’ Well, there are only two ways, really. You have to reduce your spending and you have to put up some taxes. The judgement we took was that it was right to try to do more by reducing spending rather than by putting up taxes. And in terms of the taxes that we put up, we inherited a situation where the previous government had already put in place the 50p top rate of tax, had already put in place higher National Insurance contributions, particularly for higher earners. And so we made the judgement that while spending needs to take the biggest share, in terms of the one tax we would put up, it would probably be right to do VAT rather than a National Insurance rise. A National Insurance rise is quite an easy tax to put up, it’s all collected by your employer and comes out of your income, but it’s effectively a tax on jobs and the big challenge, as I said at the start, this year is how do we deal with this deficit but get jobs created at the same time?

I know no one wants to put up taxes, but I think better to put up a tax on spending - VAT - rather than to put up a tax on employment and on jobs, which is what National Insurance contributions would have been. Look at the budget overall, the decisions we took on spending, the decisions we took on taxes, the taxes that were already coming in, the richest pay the most both in total and as a percentage of their income, and the poorest pay the least. I think that’s fair, but everyone makes a contribution, and I think that is fair because frankly we are all in this together. This is a problem for the whole country; we all have to deal with it together, but it’s right the poorest should pay the least, the richest pay the most, and under our plans they do.

Question

How important do you think the British manufacturing industry is to the British economy? You know - actually making things. And what plans do you have to help support the growth of that industry within the British economy?

Prime Minister

I think manufacturing is important. I’m not just saying this because I’m standing in front of a backhoe loader and I’m here at Caterpillar. Manufacturing is important because you’ve got to have a balanced economy and I think one of the things that was going wrong, not just over the last decade, but, frankly, over the last 20 years, was that our economy was becoming unbalanced - too much on services and banking and finance, and not enough on manufacturing and export and technology.

And our economy was also becoming too imbalanced between the South East and London and the rest of the country. And I think it’s important to try and rebalance it. If you look at the last 10 years, most of the growth really came from financial services, housing, government spending and immigration. Well, that’s actually no way to run an economy because financial services have gone into reverse, the housing boom has come to an end, the government has run out of money and actually immigration, while it can benefit a country, you can’t grow your economy just by importing more and more people.

So manufacturing is important. What are we going to do about it? Well, I think the first thing is tax. I think, you know, one of the signals you can send as a country is what rate of corporation tax you’re going to set as a country. And, although we’ve had to make difficult decisions on VAT and spending and elsewhere, we’ve said that over this Parliament we’re going to get our corporation tax rate down to 24%.

Companies like Caterpillar or companies from around the world, when they think, ‘Where am I going to invest? Where am I going to put my money? Where am I going to build my factories?’ If they know they can come to the UK and pay one of the lowest rates of corporation tax in the world, that makes us competitive. I think that is sensible.

The second thing I’d say is apprenticeships. I was just talking to some of you before coming in here. You’re growing, you’re expanding, you’re employing more people and when it comes to finding good people and well-trained people, it isn’t always that easy. So I think, while we’re having to make difficult decisions, we’re actually expanding by 50,000 this year the number of apprenticeships we take on. I think that helps.

Last thing for manufacturing I’d mention is you have to move goods around the country, so you need good roads, good rail, good port infrastructure, and I think we are challenged in that way in this country. So, again, while we’re making big cuts to welfare, while we’re making cuts to some services, when it comes to capital spending, we’ve actually relatively protected it and we’re putting money into roads and particularly into port infrastructure to help businesses like yours move their stuff round the country and round the world.

For those reasons, I think we can see a rebalancing in our economy. The recession hit us particularly badly because we were over-reliant on banking and financial services. We shouldn’t hit those industries; we should recognise that finance is a good thing for this country, but we’ve under-gunned and underplayed manufacturing and we need to boost it and build it up.

Question

Good afternoon, Prime Minister. You spoke about taxation with different levels of welfare, but there is one thing that affects everybody. It affects every business in the UK and every person who needs to travel to work, and it’s fuel. Fuel keeps going up. It affects absolutely everything that happens within the UK travel-wise, whether it’s trains, planes or travelling by car. Yet I hear on the news this morning that they can produce millions more barrels of oil, but they choose not to because it keeps the supply there and the prices high. What is the British government doing to combat that and to reduce the fuel duty that we pay?

Prime Minister

Well, the question’s really got two halves. It’s ‘What’s happening in terms of world oil production, because there’s been too much of a cartel through OPEC, and what are we doing about that?’ And there’s also what we’re doing as a country in terms of taxing fuel.

If I take the first bit, we are an oil producer and there’s still a good amount of oil in the North Sea. We need a regime that encourages firms to continue to extract oil from the North Sea, because actually in a small way, by not being members of OPEC, we’re outside that cartel and so we can push our own production levels and we should be arguing for opening up OPEC and opening up oil production in the world. That helps.

On the issue of taxation, I accept this is very difficult. As I was saying to your colleague, we inherited a whole lot of tax plans that the last government had already put into place. One of those was an increase in fuel duty, and we’ve had to just put that in place. And obviously with the increase in VAT as well, you can tell when you fill up the car now. 1.30, 1.32 a litre - it is very painful and difficult.

I think we’ve got to recognise part of it is to do with the oil price, which is getting close to $100 a barrel again. I think we also need to ask ourselves this question, and I’m working with the Treasury on this: is there a way in which, when the oil price goes up, if the Treasury is getting more revenue out of that oil, can we find a way of sharing that risk with the consumer - i.e. if the price goes up, the tax comes down; and if the price goes down, the tax goes up? It’s called the Fuel Duty Escalator, and we are looking at it. It’s not simple, it’s not an easy thing to put in place, but I would love to try to find some way of, as I say, sharing the risk of higher fuel prices with the consumer. At the moment I think they feel they are bearing all of the burden. So we are looking at this, because I do want to try to help people.

Question

Most people think that the banks are responsible for our current problems in the world and in this country due to the whole issue of finance and debt. What is your opinion of the Robin Hood Tax campaign?

Prime Minister

Well, first of all, I think it’s wrong to try and pin all of the blame either onto governments or the banks. I mean the fact is lots of people were to blame for the mess that we’re in and we do want the banks to get out there and lend money to small businesses and large business, and we need a healthy banking sector. They should take their share of responsibility and we should tax them properly, but I think there comes a time where you’ve got to say, ‘Right, actually, you’re now paying the right amount of taxes.’

Now, what we’ve done as a government is we’ve actually introduced a banking levy. We didn’t wait for the rest of the world. We said, ‘As well as the corporation tax you pay, we’re going to levy a bank levy on you of £2.5 billion a year and you’re going to pay that each and every year,’ so that is actually a significant contribution to paying down the deficit and funding public services.

The Robin Hood Bank Tax idea is a more simple one. The idea is that everyone across the world introduces a tax on transactions and uses that money perhaps to alleviate poverty in the rest of the world. That’s the idea you’re referring to. There are some good thoughts in it, but there is a problem with it, which is, if you tax bank transactions, you probably would drive a lot of them offshore and you’d find those countries that introduce the Robin Hood Tax would end up actually without much revenue and without much banking.

So I’m all for international collaboration, but I think in this case we acted swiftly and we said, ‘Right, we’re going to tax you in a way where you won’t leave the country, but you will make a fairer contribution,’ that’s the £2.5 billion we’re taking out every year.

I think the biggest challenge now is to get the banks lending because I’ve just been to a meeting with a lot of small businesses in Leicester and I asked them, ‘Put up your hands if you’ve had a problem getting a loan out of the bank to expand your business,’ and almost every hand in the room went up. So we’ve got to get a situation where we encourage the banks to start lending again to British businesses, so we can expand and grow our economy. If the only conversation we have with the banks is about tax, we’re not going to get very far.

Question

My question relates to housing. When I was a child, my dad was a sole earner. And he, with those earnings, money was tight, but he could afford to feed a family and three children. At the moment, correct me if I’m wrong, but there’s families out there that get help with their rent or, you know, working tax credits and that sort of thing. What are you going to do to rebalance the pricing of mortgages and rents, so that a working man can afford to feed a family and that people like myself, who are single don’t resent the fact that I pay taxes that pays other people’s rent and it means that I can’t save up for a mortgage.

Prime Minister

Very good question. I mean I could spend hours on this. I’ll try and give you a short answer. First of all, at the moment you’re paying your taxes and some of that money is going to fund housing benefit for people who live in houses that you couldn’t dream of living in. We’ve said there should be a limit - no one should get any more than £20,000 a year. That’s still quite a lot of money - I mean £20,000 of rent a year is a lot of money. But when we came to power there were some families getting 30, 40, 50, even £60,000 a year in housing benefit, all paid for by people, many of whom were actually earning less than £20,000. That is completely unfair. So the first thing we’ve got to do is we’ve got to get on top of the welfare system, we’ve got to get on top of the housing-benefit system.

Question

Does that mean you’ll be sorting out the bank lending? Because part of the recession was the situation with three or four times worth incomes for mortgages.

Prime Minister

Absolutely. The first thing is sort out the housing benefit. The second point is helping people onto the housing ladder. There is a problem here because we all know one of the ways we got into trouble as a country was we were allowing banks to lend to people sometimes 120% of the value of the property they were buying and sometimes six or seven times what they were earning.

That was unsustainable so we were encouraging people to buy flats and houses they could not afford and then they were going into negative equity and left with a real problem. In a way the pendulum now has almost swung too far the other way. If you are a single person, you are earning a decent salary here at Caterpillar, you go to the bank or building society, you are actually quite a good risk. They won’t give you 80% of the value of the property, or four times your salary, so we are working with them to try and say, ‘look of course we do not want to see the unsustainable boom of the past, we do not want people to be able to borrow 120% of the value of the house, but we have got to get proper, respectable lending going again’.

We do not want another housing boom where the prices rise again out of people’s reach, but the housing market is a key part of the economy. You need a housing market where people are able to sell, buy, move to different parts of the country, or go in search of that job they want or reunite their family or whatever it is. The housing market has become very stuck and we have got to get it moving again and so a proper conversation with the banks and the building societies that stops the pendulum going too far the other way is important. What we want is a market that is moving, but not the unsustainable rise in prices. That is what we are trying to deliver.

Question

Will you increase incentives for capital investment for businesses so that they can hire more people and safeguard the jobs that they have already got.

Prime Minister

I think the priority we have got is to try to get the corporation tax rate down. There is a choice - you can either go for more allowances, or try to get the headline rate of tax down. I think we should focus on the headline rate of tax. I am standing in a business that probably benefits from capital allowances and I can see a person in the front row looking a bit disappointed. We are in an international market place. Caterpillar can decide to buy their plants in Britain or Brazil or Belgium or France and I think it is really important to have as the label over the top of your economy that this is the place with one of the lowest rates of corporation tax: come here, make money, invest, employ people and you will be able to make money and plough that back into your business. I would rather that we shoot for that 24% rate of corporation tax that we have set out for this Parliament rather than try to find lots of other different things to do.

Having said that, we should be looking at which sectors we are trying to encourage and get behind. We have for instance said to the pharmaceutical sector that we are going to have a patent box so if you develop patents in Britain and then go on and manufacture it in the UK as a result of those patents, your rate of corporation tax will only be 10%. I personally have rung the chief executives of some of the biggest pharmaceutical companies in the world telling them about this and saying ‘come and do more in Britain’. That is what we need - to get behind the sectors and the businesses of the future and encourage the growth and the jobs and the investment we want to see.

Question

My concern is about the student tuition fees at the moment. I’ve got a daughter at university in Manchester studying chemistry; she has just gone there this year. I have got a boy of 16 who will potentially go on to do an engineering degree in two years’ time when the large tuition fees come in. I just do not see how this can be sustainable, that they potentially will not be able to go to university because of the cost of the tuition fees. We are a middle-class earning family and we just will not be able to put them in university. My children are on courses that I feel will benefit the country and I feel that this potential policy will deprive the country of a lot of potential students in the future that can develop the country.

Prime Minister

I see it as a very important part of my job that I have got to convince you, sir, and your children, that it is going to be a good idea to go to a good university and get a good degree. There has been so much misinformation put around about this policy. Let me just give you two facts that a lot of people do not know: today, if you leave university, you have to start paying back your student loans when you are earning just £15,000. Under our plans, you will not start paying anything back until you are earning £21,000. You do not start paying back the full amount each month until you are earning something like £35,000 and because of that, under the new system, everyone will actually be paying less per month than under the current system. Yes, they will be paying back for quite a long period of time but in terms of what they actually have to pay, because of the £21,000 starting band, and because of the period of time over which you pay back the loan, everyone will pay less back per month in the future than they do under the current system.

Now, the current system has not put off people from going to university. Universities are seeing more and more people wanting to go, so I believe the system we are putting in place will not put people off because they will not pay until they are earning £21,000; they will be paying less per month than they do now. I think that it will have a big knock-on benefit which is this: that your children, and my children, will be asking themselves before they go to university - because the universities are only going to get the money if they choose to go - our children are going to be asking ‘is this course good, are the tutors working hard, are they teaching me a subject that is really worthwhile, am I going to benefit from having this degree?’

All the people here who did not go to university who are working hard, sometimes earning relatively low salaries, are paying taxes so that our children can go to university. Is that really fair? Their hard-earned money is going to your children and my children to go to university who then on average in their lifetime will earn £100,000 more than people who do not go to university. I think that it is fair to ask those people who benefit from university education to make the payment. That is the absolute key. In the end we all want the same thing - we want well-funded universities, we want graduates from all backgrounds being able to go to those universities.

The only question is ‘how do we pay for this?’ We can either pay for it out of general taxation, which is everybody - including those who do not go and do not benefit - paying for it. Or you ask those who benefit from university education to pay for it. And because we say you pay nothing until you are earning £21,000, if you go to university and you never benefit from it because you never get a well-paid job then you will never make a contribution to it. I do think that our system - difficult though it is going to be to explain to your children and others - I do think that it will work and I do not think it will discourage people from going to university because they will benefit and therefore they will pay. But they will not pay as much per month as they do now.

Question

How concerned are you that if private spending does not decrease, the interest rates will increase, and what the social consequences of even a comparatively small rise in interest rates might be?

Prime Minister

It is right that interest rates are set independently by the Bank of England. I think we have had a much better system ever since that was introduced rather than politicians moving interest rates around, often for very political reasons. I think what we need in this country frankly at the moment is because the government is going to be spending less, because the government has got a massive overdraft, we are having to cut our spending and put up some taxes. What we need to happen is for the private sector to spend more, so we need to see more exports, more manufacturing, more private-sector investment.

We also need to see a recovery in private spending as well. So far what we are seeing, although it is early days, we are actually seeing good growth in manufacturing, good growth in exports and actually I think we will see a private-sector led recovery. That is what the forecasters predict.

The question of interest rates is much more related to what happens to inflation. The Bank of England’s responsibility is to keep inflation under control and if they see inflation rise then they have to make the decision about interest rates. I think that what we are going to see this year is a private-sector growth that will make up for the fact that the government is having to cut back. I must leave the Bank of England to set interest rates. All I would say is that they are at a historically very low level and I think the key problem in the banking and mortgage system is not actually so much the interest rate, it is actually that people cannot get hold of the money. If you ask the small businessman ‘are you worried about the rate of interest they are paying?’, they will say that it is not the interest rate they are paying but that they cannot get the loan. If you ask the single person who wants to get on the housing ladder, ‘what do you think about what you are being offered at the moment in terms of the interest rate?’ they will say never mind that, I cannot get hold of the loan. So I think the problem at the moment is not the price of money, but the quantity. It is being able to get hold of the loans and get the money out of the banks and that is what we need to focus on.

Question

Is it not time for the British people to have a vote on the EU?

Prime Minister

I think that whenever there is a new European treaty that passes power from Westminster to Brussels that’s when we should ask the British people, ‘You elect us to go and run the government and run Parliament’ - if we start giving away your powers we should ask you first. And so we’re introducing a Bill in Parliament that makes sure that if ever that happens in the future, unlike with the Lisbon Treaty or the Maastricht Treaty or the Nice Treaty, if there’s a treaty that passes powers from Westminster to Brussels we ask you the British people first. I think that’s a very good idea.

Do I think there should be an In/Out referendum for us to leave altogether? No I don’t frankly. Because I don’t think leaving the European Union altogether is a sensible thing to do so I don’t want to promote a referendum on it. I think that there are many things that frustrate me about the European Union and believe me, I have to go to these European Councils often month after month and we have many arguments and disagreements. But I’m quite convinced from the point of view of our national interest it is right we are in this organisation fighting to try and keep it as an organisation that is in favour of trade and openness and cooperation and not a sort of federal superstate.

I mean, think of this business we’re standing in here, think of Caterpillar; you want to be able to sell into all of the European markets, you want to have a say on what the rules of those markets are. If we left the European Union they would sit there in Brussels and they would write rules about the shape and the colour and the size and how many lights and how many seatbelts and we’d have not a word, not a say. No, that seems to be not in our interest. It’s in our interest to be in this club fighting to make it an open trading club. But we shouldn’t give it more power without asking you the British people first. That seems to be the right approach.

Question

Prime Minister, we as a business have to make decisions about what projects we’re going to endorse and take ahead in the New Year. What are you able to do, what is your government currently doing to improve - not just when you’re looking at the projects that you’re saying you’re levying - each department that you manage has to limit its budget, cut back on its budget, retrench; what are you doing to improve the decision-making process particularly within those bureaucracies because it’s bad project decisions that also cost this country an awful lot of money. Like the movement to digital records within the NHS or things like the decision making for the requisition departments within the MoD.

Prime Minister

Yes. I think there are two ways of answering that. There are some things that government just has to do better. It’s got to control its budgets better, it’s got to stop wasting money, it’s got to be less bureaucratic, it’s got to adopt some of the methods that business has in terms of zero-based budgeting, in terms of making sure you’re always competitive. There are some things government has got to do, but I think there’s a much bigger answer to your question which is I think the whole way government works is wrong and we need to change it. And I think this is particularly the case with public services. I think we have in this country a very outdated approach to schools and welfare and hospitals which is very top down, very bureaucratic, very ‘There’s your local school, take it, put up with whatever you’re offered’ rather than what you do in business or anything else in life which is give people more choice, have more competition; say that you don’t have to be a state school to offer a state education. I think that we should be opening up our public services, we should be opening up our welfare system and we should be much more modernising about what we offer to people.

So, we’re doing that in education. We’re saying all excellent schools have the opportunity immediately to become academies, to control their own budgets, to employ their own staff, to set their own curriculum, to make their own decisions. We’re saying if you want to set up a new school in the state sector because you want to offer a quality education, you shouldn’t be restricted from doing that.

We’re saying in the health service, let’s get rid of all the bureaucracy and let’s let the doctors and their patients choose where they’re related and the money follows the patient through the system. If people want to come into the NHS and set up as providers, providing free service of a quality at the same or better than the NHS they should be able to.

So, I think we need a revolution in the way we think of public services in our country so we give people the choice, the competition, the contestability, all the things you get in business life. So, yes, government’s got to be better at controlling its costs, more efficient, less bureaucratic, but there’s a much bigger agenda that should give us modern public services. We should stop putting up with second best in Britain. In some cases, like in education, frankly we’ve got to catch-up with the rest of the world, whose results are ahead of ours, and in other cases like welfare it’s just ridiculous that we’ve got such an expensive system that keeps people trapped in unemployment for so long and we need a modern system that helps people get out of it.

So, while I believe this year for my government is very much about getting the economy moving and getting the budget deficit dealt with and keeping us out of the danger zone I referred to, I also think we should have a real mission of trying to modernise our public services, of giving people the choice and the competition and the diversity that they completely expect in every other aspect of their life.

Question

Young people, when they get to retirement age, are going to retire a lot older than at present at 65. Now some people that are 65 who wish to carry on working were not allowed to work because of an ageism thing; they used to fire them. Now, somebody tells me that’s altering in April, is that correct?

Prime Minister

Yes. It’s a difficult issue. You’re absolutely right, we’re all, hopefully, living a bit longer and that’s why we’re saying that people should get the state retirement pension a bit later, so we’re putting back the age you get the state retirement pension both for men and for women, I think that’s important. But it goes to a bigger question that you’re asking which is, at the moment there’s the default age of retirement so when you get to 65, you know, a company can in effect let you go. And so, if we want to change that, which we should, there’s a problem which we have to be frank about; which is that obviously it’s a potential benefit to businesses and individuals if they can go on working if they want to, but it’s a potential cost to business if you get rid of the default age of retirement and those people that they need to let go at 65, it’s going to cost them more money.

So, I think what we need to do is a sort of deal where we recognise the default age of retirement should go but in return we need to find a reasonable way of not putting too much excessive cost onto business. But basically we should be moving towards a system where we think of retirement as a process rather than a cliff edge. Because it’s a bit ridiculous if suddenly at 65, bang, that’s it, no more work. Whereas actually what many people would choose to do as they get older is a sort of flexible decade of retirement; perhaps work part-time, perhaps spend a bit more time with your grandchildren, perhaps downscale a bit at work because of health reasons. At the moment there’s a cliff edge and we need to change that, but as we change it we’ve got to try and take business with us because otherwise we’re suddenly going to be saying to business, ‘I’m afraid the default age of retirement’s gone, isn’t it great? You can keep everyone on for longer…’ But they’re going to find a big cost building up. So, we need to come to a fair arrangement with them and that’s exactly what we’re going to try and do.