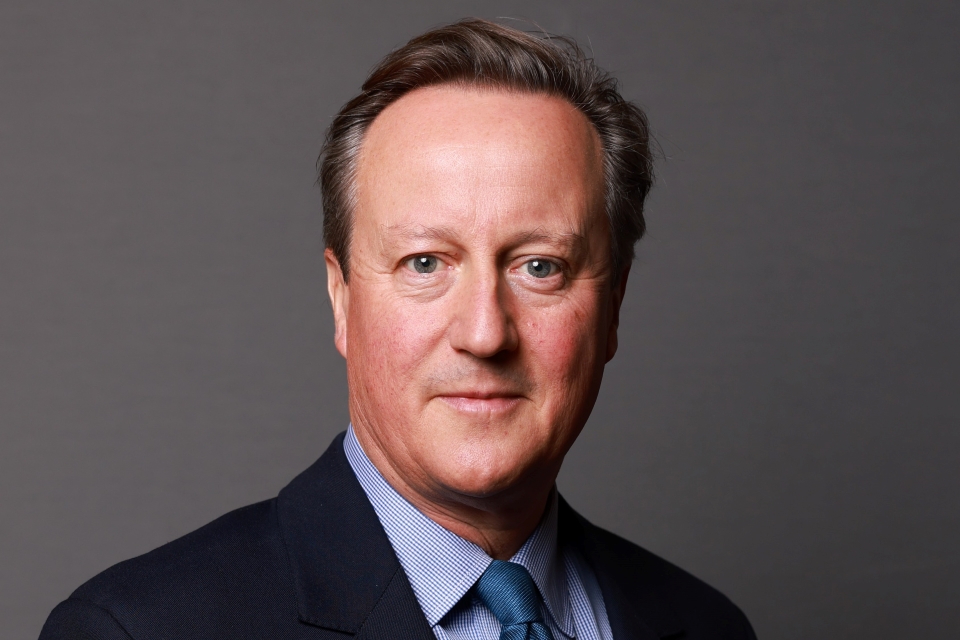

Prime Minister's speech in Brussels

Speech by Prime Minister David Cameron in Brussels, at the end of the European Council, on 29 June 2012.

Prime Minister

This has been a long and painstaking summit, but it is important because we will not get the strong and lasting economic recovery we need back at home without strong action here in Europe.

Britain had three objectives: action by the eurozone to deal with the immediate crisis; a growth package firmly focused on Britain’s priorities; and putting down a clear marker about what Britain pays into Brussels and the budget negotiations to come, and I want to say a word about each of them.

We have said for a long time that the eurozone needs urgent short-term action to deal with the instability: recapitalising banks; dealing with the high interest rates in Italy and Spain; putting beyond doubt the commitment of the eurozone - its countries, its authorities - to defend their currency. There is more to do but they have made some important steps forward.

Now in the longer term the eurozone, like any single currency, needs closer economic and fiscal integration to secure its future: the remorseless logic we have spoken about. These are difficult decisions but I believe all the countries now recognise how much more needs to be done.

Now, while Britain wants this done, it needs to be achieved in a way that does not distort the single market. For us, that is the cornerstone of the European Union and the biggest benefit that we get out of membership. Three million British jobs depend on that market being open and working for us.

Now, in the conclusion today I secured explicit commitments that as this work, deepening EMU, goes ahead, the integrity of the single market will be fully respected. It was tough securing this, but absolutely vital. So as this work proceeds, it goes ahead in a way that protects our interests.

Now the original draft of the Growth Compact had an entire section on Economic and Monetary Union. I was not happy with this, not least because it implied that - part of what needs to happen - a banking union might apply to all 27 countries and not just the 17 in the eurozone. Let me explain why this matters so much.

Outside of the single currency, I want the Bank of England properly regulating Britain’s banks. Outside the single currency; yes, we have to stand behind our own banks but I do not want British taxpayers guaranteeing eurozone banks: Spanish banks or Greek banks. Now I am confident we are going to secure these outcomes and the whole section of the Growth Compact has gone.

I also believe that the eurozone countries are well on the way to making the eurozone bank, the ECB, the regulator of their banks and that would be a good outcome.

Now just as we had to tackle the euro crisis, so we have to tackle the growth crisis. Britain has been driving this debate. In March we formed an unprecedented alliance of 12 countries behind clear priorities to strengthen growth, deepening the single market, driving innovation, cutting red tape, boosting trade, doing trade deals with the rest of the world, all measures which Prime Minister Monti of Italy and I have pushed. All of these are included in the compact for growth and jobs which has been agreed today.

We have also agreed to go ahead with the European patent. This has been more than 23 years in the making. A vital part of the court, covering pharmaceutical and life science industries, in which Britain excels, will be based in London. This will bring millions of pounds and hundreds of jobs. I secured the changes to the nature of the patent that businesses have been demanding. Let me put it this way: reports in some early editions of today’s newspapers, that this was a diplomatic gamble that had failed, were somewhat premature.

We also had our first discussion of the EU’s next multi-annual budget. I made a simple point: of course there is some EU spending that goes to things that our worthwhile that we support, like vital research in some of Britain’s strongest universities, but it is not right for the EU budget to go up sharply when so many countries are confronting deficits and debts at home. We want a budget that is focused on growth not a focus on growth in the budget.

The EU as a whole is €3.5 trillion more in debt now than when the last EU budget was negotiated and we have to face up to that tough reality. What we need to do is not spend more, but spend better. The real negotiations are for later in the year but I wanted to put down a very clear marker about our priorities for the budget and I made it absolutely clear that the British rebate is not up for renegotiation; it is fully justified. Without it, we would have the largest net contribution in the EU. It would be double that of France or Italy and almost one and a half times bigger than Germany; so I will always defend that rebate.

Let me say a word about the banks at home. People are rightly angry about the behaviour of the banks and so am I. People want to see real accountability for what has happened. When people have broken the rules, they should face the consequences.

This needs a change of culture, absolutely, as the Governor of the Bank of England has rightly said today. I note that Bob Diamond has quite rightly agreed to appear in front of the Treasury Select Committee. As I said yesterday, he and his management team have serious questions to answer.

We need to see banks properly regulated and serving their customers and the wider economy. We need to see trust restored. I understand that completely; the whole government is working for this and we are going to take action right across the board. We are scrapping the failed tripartite system of bank regulation, which we inherited and which failed so badly. We are giving the Bank of England more powers on regulation and supervision. We are calling time on the excessive levels of debt in our banks. We are increasing the taxes that banks must pay, including the permanent bank levy. We are introducing the toughest and most transparent rules on remuneration of any major financial centre in the world, including the power to claw back bonuses from people.

Plainly we need to go further and we will, as the Chancellor made clear in the House yesterday. We will bring forward new regulations to prevent people manipulating interest rates in the way that took place. We will examine whether any changes in the criminal regime are needed, so that just as crimes on our streets are punished, crimes in the banking sector are punished too. We will consult on the possibility of criminal sanctions, so that directors of failed banks are properly held to account.

Frankly I am not satisfied by this idea that fines are used to reduce the bank’s annual levy, and in effect are going back to the banks. These fines should not be reducing the bills of banks; they should be reducing the bills of hard-pressed taxpayers, and that is how it is going to be.

It is vital that all the investigations underway get to the bottom of what has happened. It is vital they go wherever the evidence leads and hold those responsible to account, without fear or favour. Dealing with this whole issue is vital for the government. Frankly, it is as vital as dealing with the unsustainable debts that we were also left by the last government.

At the heart of our approach has been the Vickers Inquiry, which is leading to very radical action to separate the risky investment banking from the proper high-street banking that serves the small businesses and our citizens that frankly we all want to see properly restored in our country.

I never forget in all of the debates about this, and all of the action that we are taking and all of the debates taking place today, each and every family put about £4,000 into our banking system to prop it up at the height of the crisis. One of the biggest responsibilities of government is not to rest until we get that money back for everyone who had to put their money in.

Thank you very much for that. I am happy to take some questions.

Question

Prime Minister, is there any suggestion that the changes needed to introduce banking union at 17 might need a treaty change as they are developed over the next year?

Secondly, isn’t the reality of the banking union that you are going to have the 17 eurozone countries acting as a block on important matters of financial services, acting as a block and potentially more likely to out vote Britain in any matter on financial regulation? Are there any practical safeguards that you have been able to secure on that specific point?

Prime Minister

Talking on safeguards, in the Council conclusions very importantly it says that these things must go ahead in a way that protects the security and the integrity of the single market. That was something I insisted on; I think it is very important.

On the issue of banking union at 17, what I believe is going to have to happen is probably some form of enhanced cooperation under the existing treaties, which means there is lots of protection in terms of the single market. I think the key thing for people to understand is that at the heart of a really deep banking union are two things that we would not want to be part of. First of all, deposit guarantees, because I want, as I said, British taxpayers to stand behind British banks, not Spanish banks or Portuguese banks.

The second thing at the heart of a deep banking union is a sort of one, single supervisor for all those eurozone banks. In my view that must be the Bank of England for our banks, outside the Euro, rather than a single European regulator. The fact that they are going down the path of using an existing treaty base to give those powers to the European Central Bank, the ECB, the bank of the eurozone, I think is all quite encouraging.

It is never entirely clear how far these changes will go, exactly which treaty clauses will be used, whether further treaty changes will be suggested. That is one of the reasons, when you come to these summits, you have to be absolutely focused on the text and what you are signing up to and what you are not signing up to.

But I am confident that what we have from the last two days is an acceptance that the eurozone countries need to go ahead and do these things, and that is in our interest too. We want a functional eurozone, not a dysfunctional eurozone. But we need the safeguards for Britain and those outside the Euro that the single market is safe. I think that we are well on the way to getting those, but permanent vigilance is required, if I can put it that way.

Question

Prime Minister, in the past you have called for the big bazooka to be used to sort out the eurozone crisis. To what extent last night do you think you got that, and that what was agreed here really is going to fix this problem?

Prime Minister

I think obviously we have to look and see absolutely on the detail, and then see how it is implemented. There were one or two important things that took place last night in terms of eurozone action, the sorts of things that we have been calling for when we talk about bazookas.

That is the eurozone mechanisms, the EFSF and the ESM, intervening to buy bonds of countries where interest rates are too high. I think that is important. Addressing this problem about the seniority of the debt, because that was clearly hampering the Spanish situation, and the idea of directly recapitalising banks. These are all the sorts of steps that we have been talking about and urging on the eurozone countries.

The principle here is pretty simple, which is if you want a single currency to succeed you need institutions that absolutely stand behind it. So in Britain you have the Bank of England standing behind the currency, doing what is necessary to safeguard the financial system. You need that in Europe too, and so I think last night was significant but I have been to enough of these summits to know that Rome, Europe, none of these things was built in a day.

There will be other steps that are required, but for the first time in some time we’ve actually seen steps taken that I think the markets will see are trying to get ahead of the game. They need to be followed through and I hope there will not be a lot of quibbling and worrying about ‘is it too far?’ and the rest of it. If they want to save their currency, they have to get on and do it, and I think last night’s action will help to make that happen.

Question

Prime Minister, on Barclays do you agree with Mervyn King’s damning verdict that some bankers have been deceitful, effectively accusing them of lying?

Prime Minister

I think what the Governor of the Bank of England said is absolutely right in every way. He not only has made some pretty stinging criticisms, and I have it here in front of me: excessive levels of compensation, shoddy treatment of customers, deceitful manipulation. But what he says is, I think, vitally important. Two things: one, we need a real change of culture. And the second thing is we know what has gone wrong and largely we know what needs to be done to put it right.

What you are going to see from the government is an incredibly methodical series of actions to deal with all of these problems. They were not regulated properly, so we are changing the regulatory system and putting the Bank of England properly in charge. They were not regulated properly in terms of conduct, so we are creating the new Financial Conduct Authority that will deal with that. They were not paying enough taxes, so we have put in place the bank levy. There was not proper accountability, so we are changing the laws. There was not enough transparency, so we are creating transparency over bonuses.

Above all, at the heart of this, the Vickers Inquiry, which was a big and bold inquiry involving highly expert people that’s made a really radical change to how we run banks in Britain, which is to say it is time to separate the investment-banking arms from the retail-banking arms, because frankly you need in the retail-banking arms a real culture of banking that is about being on the side of small businesses, the entrepreneur, the citizen who wants to have a safe and secure bank.

I think that is a very important part of changing the culture, so I think you have a whole set of actions there and more that George Osborne set out in the House of Commons yesterday that is going to deal with this. But I recognise it is a very, very big task for the government.

Question

Prime Minister, can I just ask you? Ed Balls has said in the last hour that there should be a full banking inquiry after what has happened at Barclays. You have not mentioned that. Are you rejecting it or is it something that could happen down the line?

Prime Minister

I never reject anything Ed Balls says. The point I would make is this. I think it is worth listening to the Governor of the Bank of England, who says it is a cultural problem. There is action that needs to be taken. We know what needs to be done. Let us get on and take those actions. I have enumerated, I think, a number of them in terms of accountability, regulation, taxation, transparency, behaviour, punishment for things that are done wrong. On every one of those, action is required.

I think we know what needs to be done, and I think the most important thing people want to see is a really concrete set of actions that will help change the culture. You do not change culture by changing laws and changing regulators alone. But I think if we can do this in a very clear and consistent way, then we have a chance of getting this right.

Question

Can I just ask about Britain’s relationship with the European Union? Self-evidently, Europe is changing; that is concerning a lot of people in your party who are talking about a referendum. We know that you have legislated for your referendum lock; we know what you think the significance of that is.

But there are people in your party who are now calling on you to go beyond that, to start looking at a vote on the wider relationship. You said last October, I think, that you were opposed to an in/out referendum and you thought that Britain should always remain a member of the European Union. Is that still your position?

Prime Minister

The point I would make is I completely understand people’s concerns. I think part of addressing the concerns - and I share a lot of the concerns people have - part of addressing the concerns is this safety lock that we have: that however unsatisfied with Britain’s relationship with Europe, you know that this any government cannot pass powers without there being a referendum. I think that is vitally important.

But I would make two points to you. One is, yes, you are absolutely right: Europe is changing. There’s a change taking place as the countries of the eurozone follow the remorseless logic of having a single currency, having 17 finance ministries and all the rest of it. They need to change; they recognise that. Now, that change has consequences for Britain. My job is to make sure that we secure all the safeguards that we need so that our role in the European Union, our access to the single market, our say in the single market is properly safeguarded.

This is going to be something that is going to evolve over a whole series of years as these countries realise what needs to be done, and as we fight for the safeguards and the position that we need. So I think that is the first point. Europe is changing; Britain is not going to cede more powers to Brussels.

As I have often argued, I think there are powers that should be going in the other direction. This is going to be an unfolding story, but one where I think Britain has every chance of securing the sort of relationship that we want in Europe. That is the first point that I would make.

The second point is I completely understand why some people want an in/out referendum, why they wanted it yesterday, why they want it today. Some people just want to get out; they literally, you know, ‘Stop the bus, I want to get off.’ I completely understand that, but I do not share that view. I do not think that is the right thing to do.

I think the problem with an in/out referendum is it actually only gives people those two choices: you can either stay in with all the status quo, or you can get out. Most people in Britain, I think, want a government that stands up and fights for them in Europe, and gets the things we want in Europe, that changes some of the relationship we have in Europe.

I have made some small steps forward on that. We used to be part of these bailout schemes, right? I got us out of those bailout schemes. That has saved us real money. Now, there are other things I would like us to get out of. So, I think that is the trouble with the argument about the in/out; it is only those two options, whereas I think what we want is a government that stands up and fights for Britain in Europe, gets what we want.

This is a developing situation, but it is a situation where I think for those of us who are, I would say, sort of practical Eurosceptics, who know it is in Britain’s interests to be in here trading, fighting, cooperating. Today, we secured language on how Europe approaches Iran, how Europe approaches Syria; we lead the debates on some of those subjects.

So for those of us who are practical Eurosceptics, who know there is a real benefit from being engaged but are frustrated by some of the ways the relationship works, I see lots of reasons to say the argument’s going in our direction. So I am not only a practical Eurosceptic; I am an optimist about getting this relationship right.

We can also, by the way, secure things for Britain while having some of these debates and discussions. Just recently we got the President of the European Bank of Reconstruction and Development; that required agreement by countries all over the world. As I have just argued, we got a third of the patent court, including the most important bits for Britain coming to Britain, with all the changes to the patent that we asked for, so that it should be welcomed by business.

Question

Prime Minister, Bob Diamond took millions of pounds of bonuses over a period of years while people working for him were lying, in effect, to up their profits. Is he a man that British taxpayers can trust with their savings?

Prime Minister

Well, I think he and the whole management team have some very serious questions to answer. How many people were engaged in this activity? Who were they? Who was managing them? To whom were they accountable? How much did the management of this company know about what was happening? Now we do know what has happened, what has happened to these people and so on.

It is very easy in politics and in life to reach for the simple answer of pinpointing one person, but I think what we need to do is hear some of the answers to these questions to work out exactly what needs to happen at this bank to fully account to people for what has gone wrong. The Treasury Select Committee is an important moment in making that happen.

Question

Prime Minister, you have said you do not change a culture by bringing in laws and regulations -

Prime Minister

Alone, I think that is quite important.

Question

Alone, but you know because you tried to change the culture of government by bringing some people in that are very, very important. Can you say to millions of Barclays customers tonight, hand on heart, that Bob Diamond is the man to lead that bank?

Prime Minister

I cannot say that, as I say he has questions to answer. But let me go directly to your point about culture and laws; you do not change a culture simply by changing laws, but you can help. This is where I think Vickers is so important. Effectively what Vickers is saying is that the skills required to run an investment bank are quite different to the skills required to run a retail bank.

I think what the British public and I am crying out for is a return to some good old-fashioned banking, in terms of High Street banks that want to serve the economy; lend to entrepreneurs; help the small investor; provide banking services to ordinary people up and down our country; and not put that at risk by big bets in investment banking.

So, the change that Vickers is suggesting - that the Governor of the Bank of England is fully behind - I think will really help to change the culture in banking, and that is why I think that the Governor of the Bank of England is so in favour of this approach, as am I.

Question

Just to follow up on the question on the referendum; why is it proving so difficult to convince your own MPs that this referendum lock is going to work, and that we do not need a little bit more?

Prime Minister

With regard to my MPs, I think that I completely share their view about this. I think that Conservative MPs, broadly speaking, are very happy that we have the lock; because you know with the referendum lock, to put it brutally, that things cannot get worse.

You cannot have a government that suddenly pitches up and says, ‘Oh sorry, I’ve signed another treaty and a whole lot of powers are going from Britain to Brussels.’ That happened with Nice, it happened with Amsterdam, it happened with Lisbon; it was immensely frustrating for people, saying ‘Hold on, we’re elected to parliament to help govern the country and yet the rules of the games keep changing and the British public aren’t asked.’

I think that Conservative MPs - and I would argue people across this country - are pleased that we have this lock. The question for the future is how is Europe going to change? How is Britain’s relationship with Europe going to change, as Europe changes?

The answer I tried to give is that I am confident that Britain fighting and standing up for itself in Europe can secure good deals in Europe, as I think this European summit has shown. So a practical Eurosceptic, but one who is optimistic that we can get what we want in Europe.

The changes that are taking place, in terms of the deepening of the eurozone - which we are not involved in, and we are not going to join; we will not be part of the fiscal union, the banking union or the political union that comes about as part of the eurozone: we are not going to be in that.

But we need to safeguard what we do want in Europe, and I am confident we can do that. I think we should go into this argument confident that we can shape a relationship with Europe that benefits the United Kingdom, because that is the kind of country we are: we are a massive trading nation.

Sitting round that table, with 27 others, we are one of the most international economies; we have a financial centre that not only serves Britain but the whole of Europe. We should be standing proud and tall about that in Europe and that is the way I go about I things. I think we can achieve in that way.

Question

To what extent can the results of this summit be deemed a defeat for Angela Merkel?

Prime Minister

I do not think we should see in that way; at the end of the day, Italy, Spain, France, Germany: they may be playing each other at football but when it comes to the eurozone they should all be on the same side. The side they need to be on is doing what is necessary to make their single currency succeed.

There were some important steps forward last night for the short term, because that extra financial effort - getting behind banks, getting behind the periphery countries whose interest rates have got to high - frankly if that happens, that will be good for Germany, France, Italy, Spain and good for Britain.

We are suffering when Italian and Spanish interest rates are 6 or 7%; that is bad for Italy and Spain, but frankly it is bad for us too. So I do not see this as some sort of face-off between Italy, Germany, whoever. Taking the right steps is right for all of them.

What we have to understand is that it is incredibly difficult. We have been talking about our domestic politics; it is very difficult in their domestic politics. Angela Merkel is being asked to do some things that are difficult for her to deliver. The German people have worked incredibly hard to make their economy competitive, to pay down their debts, to do all the right things; and it is very difficult when they are asked to do even more to support countries that may not have done all those things.

From outside the eurozone, I think we have to be a source of pressure for action - and we have been - but we also should show some understanding about the difficult political decisions that we are expecting others to make.

Thank you very much indeed.