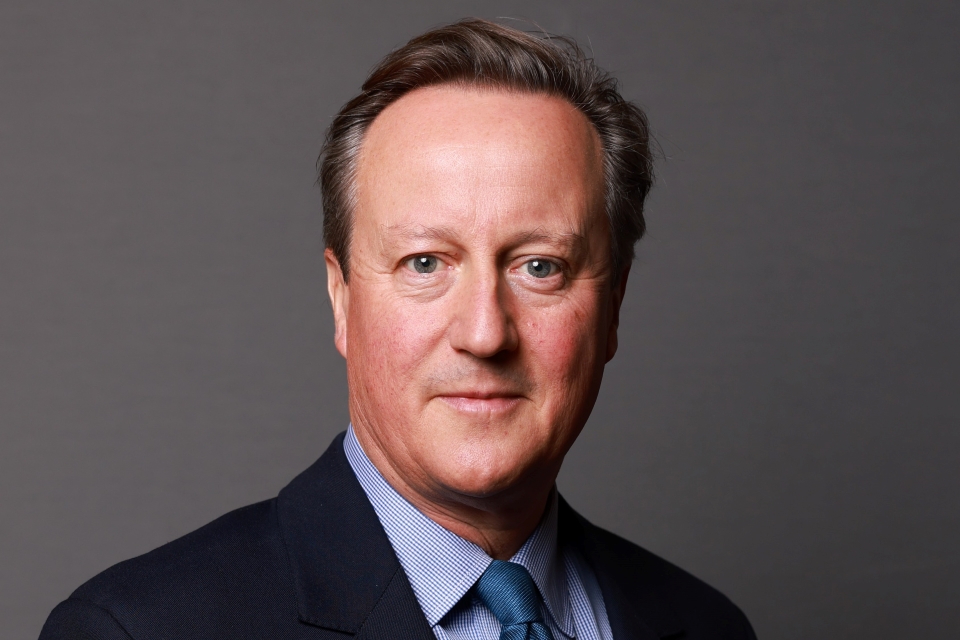

PM press conference in Cannes

The Prime Minister gave a press conference at the end of the G20 summit in Cannes on 4 November 2011.

Find the full transcript below.

Prime Minister

Good afternoon. This is obviously a very difficult time for the world economy. We face profound and unprecedented challenges and I know that people at home are very worried about their jobs and about their livelihoods. My objective at this summit has been to help Britain to weather the storm and to safeguard our economy. The problems in the global economy show why Britain has been right to take the tough action we have to get to grips with our debt and our deficit. We have avoided the worst of this stage of the global debt crisis. The interest rates that we are paying on our national debt are the lowest since World War II, around 2.5%, even though our deficit is high; higher than many of the countries around that table today. Why? Because we have a credible plan to deal with our debts and to deal with our deficit and the summit recognised yet again the importance of implementing - and I quote - ‘clear, credible and specific measures to achieve fiscal consolidation’. But when the single biggest boost to the British economy this autumn would be a resolution to the eurozone crisis [indistinct] the eurozone to sort out its [indistinct] this has rightly been the first and most pressing concern at this G20.

Britain’s view about how to solve the eurozone’s immediate problems has been clear, it’s been consistent, it has [indistinct] expressed. First, reinforcement [indistinct] eurozone countries of the bailout fund to create a proper firewall against contagion. Second, recapitalisation of weak European banks and, third, a decisive resolution to the unsustainable position of Greece’s debts. The deal in Brussels a week ago was welcome progress, as I said at the time, and we encourage and support the euro area countries to do everything possible to implement their agreement urgently. The current political situation in Greece and its impact on markets are a cause for great concern and we’ve urged the Greek Prime Minister to clarify that situation as soon as possible.

The primary responsibility for sorting out the problems in the eurozone lies with eurozone countries themselves, as they have recognised. This means, as I’ve said all along, that Britain will not contribute to the eurozone bailout fund and we are clear that the IMF will not contribute to the eurozone bailout fund either. The IMF does, however, have a vital role to play in supporting countries right across the world that are in serious economic distress. There are 53 countries currently being supported by the IMF, only three of which are in the eurozone. It is essential for confidence and economic stability that the IMF has the resources it needs. So the G20 has made clear that it is willing to increase IMF resources as necessary to provide a boost to global confidence. Alongside other countries, Britain stands ready to contribute to this effort within the limits that have already been agreed by Parliament. But let’s be clear: global action cannot be a substitute for concrete action by the eurozone to stand behind their currency and by implementing what they’ve agreed and resolving the uncertainty that remains in Greece and elsewhere.

I’m determined that Britain will weather the storm, but we’ve also sought to remove the obstacles that there are to global growth both now and in the future: the persistence of global imbalances, the slide towards protectionism and the failure of global governance. Let me briefly say a word about each.

First, imbalances. Three years on from 2008 dangerous imbalances persist and stand in the way of sustainable global growth. In simple terms, countries with a trade surplus need to increase domestic demand and ensure they keep their markets open, while those with a trade deficit have to undertake structural reforms to restore competitiveness. Importantly, at this summit we welcome the recent changes to Russia’s foreign exchange regime and China’s determination to increase its exchange rate flexibility. That is real progress. The pledges made at this summit demonstrate the collective commitment of the whole G20 to support balanced and sustainable economic growth.

Second, we agreed we must halt the slide to protectionism. The danger of a worsening global economic situation is that it increases the pressures for people to put up trade barriers. You can see that happening in different countries around the world. The G20 responded to this in the first wave of the crisis in 2008 and it needed to do so again. Here in Cannes it has done just that. We reaffirmed our pledge not to take protectionist actions, committed to roll back any new protectionist measures that may have arisen and reaffirmed our determination to refrain from competitive devaluation of currencies. And we welcome the breakthrough which will allow Russia, the last G20 outside the World Trade Organisation, to become a member by the end of the year.

In terms of moving forward on Doha, we had a much more candid and realistic discussion than previously. If we go on with business as usual we are simply not going to get the trade liberalisation that we need. Six weeks ago, I wrote to President Sarkozy together with five other G20 leaders to make the case for innovative approaches to trade liberalisation. Today the G20 agreed that approach. The communique reflects the need for fresh, credible approaches to furthering negotiations. I’ve been clear that all potential approaches should be on the table, including working with smaller subsets of countries in so called ‘coalitions of the willing’; finding ways to deal quickly with the concerns of the poorest countries and potentially going deeper on specific individual issues like services that are of key interest to the United Kingdom.

Third, at the invitation of President Sarkozy I presented a report last night to the G20 on improving global governance. Interconnected nation states in a global economy need governance that works. I secured agreement for our key proposals. In particular, we agreed we must maintain the informality which has made the G20 the only group that can come together and create political consensus on the key economic challenges that we face. We agreed we should give the Financial Stability Board the authority and the capability that it needs and we agreed to strengthen the WTO’s role as the guardian of the world trade system, fighting against protectionism, settling trade disputes and helping us to find innovative approaches to trade liberalisation.

More than anything else right now, the world needs growth. This summit has agreed an action plan for growth and jobs, including many of the things that Britain is already doing: fiscal consolidation, monetary activism, getting rid of the barriers to business and job creation. We took some positive steps forward today to dealing with the instability in the world economy, including in the eurozone. The world has shown it is ready to act, but I’m not going to pretend that all of the problems in the eurozone have been fixed; they haven’t.

The task for the eurozone is the same as the one going into this summit: to implement the 27th October agreement, to end the uncertainty, to restore confidence that your arrangements will work. Britain will continue to keep up the pressure for that to happen.

Thank you very much. Very happy to answer some questions.

Question

Thank you very much. Could I ask, you say the eurozone problems aren’t fixed, the crisis continues, so does that mean our chances of going into a second recession are still strong? And I wondered as well what view you took as you watched from the sidelines, perhaps, to some extent at this summit, as it appeared eurozone countries and institutions tried to alter the composition of the government in a member state.

Prime Minister

Well, first of all, let me be frank, every day that the eurozone crisis continues, every day it isn’t resolved is a day that has a chilling effect on the rest of the world economy including the British economy. That is the case. I would say there is some progress that’s been made here. We started with the danger of going backwards because of the situation in Greece. I think that is less likely now to happen and also there’s been some progress made with respect to Italy and the undertakings that they have made. But as I said in my statement, we need more to happen in terms of detail on the European firewall, action putting it into place to show that sort of decisive, confidence-building action that will make a difference. Clearly this is having an effect on the British economy. I don’t make economic forecasts. Those are made by the independent Office of Budget Responsibility. They will present their report at the time of the autumn statement this November.

In terms of the conversations that have been taking place, look, Britain isn’t in the eurozone. We don’t want to join the eurozone, so we don’t have as many discussions with eurozone countries as eurozone countries have with themselves. But Britain has played a role, not just at this conference but over the preceding weeks, to actually build some pressure for action and that has, I think, shown some benefits in terms of getting the proper recapitalisation of Europe’s banks, making sure decisions have been made to start the process of building the firewall and also decisive action with respect to Greece. And I think actually in many ways that’s what this G20 has been about, which is the rest of the world outside the eurozone saying ‘we are ready to do our part to help stabilise the global economy, to build up IMF resources to help countries that are in distress and in difficulty all over the world, but you can’t ask the IMF or other countries to substitute for the action that needs to be taken within the eurozone itself’. That has been the very clear message. Britain has played a very important part in helping to deliver that message.

Question

Prime Minister, both you and your Chancellor said that you were absolutely determined to have agreement by the end of this summit. You haven’t got the agreement you wanted, so why is everyone going home?

And secondly, can I just ask you to be more specific? You clearly seem to have got roughly the kind of direction you want from the Greeks. You clearly seem to have got roughly the kind of direction you wanted from the Italians. It seems clear that in terms of what you, the Americans, the Chinese and others want you just haven’t got the Germans to do what you wanted them to do. Can you be specific about that, please?

Prime Minister

Well, the point I’d make is that we have got some important agreements today. We got agreement that the world stands ready to boost the IMF resources as required. That’s important. We got agreement to stop the slide to protectionism. We got agreement to deal with imbalances and actually some new approaches from countries like Russia and China that we haven’t seen in the past. We got agreement that actually the eurozone crisis needs to be resolved and that the actions that were agreed on the 27th October need to be put in place. But as I said very frankly, we need more than that, because we need those actions to be taken. We need that firewall to be established. We need the banks to be recapitalised. We need the decisive action with respect to Greece, frankly, one way or the other, to be decisive and to take place. Those are the things that need to happen, but this G20 has been progress in sharpening the resolve on those key issues and I think that is to be welcomed.

Question

Why won’t the Germans do what you want them to do?

Prime Minister

Well, you have to ask the Germans. The point is that I understand that there are very strong views within the eurozone different countries about how the institutions of the eurozone should work and the Germans have already, to be fair to them, gone to their parliament on several occasions to ask for resources to go into the EFSF, but in the end - and it says this very clearly in the communique from today - the institutions of the eurozone have to take all the action necessary to safeguard their currency. That is what needs to happen and that’s the progress we need to see in the coming weeks.

Question

Thank you very much, Prime Minister. Isn’t it starker than you’re saying? There is no deal on the eurozone and no deal on IMF financing. All the details have yet to be done. And can you explain to the British taxpayer why should the British taxpayer fund loans to the IMF when eurozone taxpayers are not willing to cough up for their own problems?

Prime Minister

Okay, well, let’s deal with both of those. First of all, there are agreements on both the eurozone and on the IMF. There is the eurozone agreement of the 27th October which is an agreement that represents good progress in terms of recapitalising banks, dealing with Greek debts and setting up a European firewall. The problem is not that there isn’t a deal. The problem is that not all of the detail, all of the specifics, all of the action has been put in place and, as I said, there has been some additional progress here in Cannes in terms of Greece, in terms of Italy.

In terms of the IMF, there is also an agreement. There is an agreement that the world stands ready to increase the resources of the IMF as necessary. Let me be clear: this is not about the IMF putting money into a eurozone bailout fund. That is not right. We wouldn’t support that. That is not going to happen. It’s about the IMF doing the job it was established to do, which is to help countries in distress all over the world. There are 53 IMF programmes as we speak today around the world; only three of them are in the eurozone.

In terms of the interests of British taxpayers, I have protected the interests of British taxpayers by keeping us out of some eurozone bailout into Greece by getting us out of European bailout funds arranged through the European Union completely from 2013 and I had to negotiate very hard to get that. But it is in Britain’s interest to be a member of the IMF, a shareholder of the IMF, a contributor to the IMF. Why? Because Britain is a trading nation. We rely on our trading partners to be standing up and working rather than falling down and on the floor. So it’s in our interest to support the IMF and no government has ever lost money on lending to the IMF. It doesn’t add to your debt. It doesn’t add to your deficit. It is the right thing for an advanced economy like ours to do and we should continue to do so. But it does not put Britain’s taxpayers’ money at risk. It is just really the most sensible thing for us to do to support the economy and you could ask the same question to the Japanese, the Chinese or, indeed, the Prime Minister of Vanuatu, all of whom are members of the IMF and all of whom - I might not be speaking for Vanuatu - make a contribution.

Question

Just briefly, aren’t you saying though that eurozone taxpayers aren’t taking all the necessary action to support the eurozone? So why should you at this stage - perhaps in future, yes - but why at this stage should you ask British taxpayers to contribute more via the IMF?

Prime Minister

I’m not asking British taxpayers to contribute to the IMF because European taxpayers aren’t doing enough. That is absolutely what I’m not doing. Let me be clear once again: Britain will not invest in a eurozone bailout fund. Britain will not invest in the IMF so the IMF can invest in a eurozone bailout fund. That is not going to happen. The message, in many ways, of this G20 is the rest of the world, Britain included, from outside the eurozone is saying to the eurozone, ‘We are responsible countries. We want the global economy to work. We want it to grow. We want to be trading with successful countries. We’re ready to expand the resources of the IMF as that becomes necessary.’

Resourcing the IMF is not a substitute for the eurozone dealing with its own issues and problems. That has been our view throughout. That continues to be our view and there’s clearly more action that is required by eurozone countries in terms of putting flesh on the bones of that deal that they did: decisive action on Greece one way or the other; recapitalisation of Europe’s banks in a credible and timely fashion; and building up a strong firewall to prevent contagion. Those are the things that need to happen, and I think the message out of this G20, in that respect, is actually very clear.

Let me take a couple more questions.

Question

Could you explain - I don’t think you’ve actually spelt out why there was no agreement today on a specific number for increasing the level of resources. Secondly, last time the UK increased its contribution to the IMF, there was a vote in the House of Commons. Can you guarantee that that will happen if this happens a second time?

Prime Minister

On the issue of the number, the very worst thing would be to try to cook up a number without actually being very specific about who was contributing what. I think it’s better to have an agreement, if you can’t do that, to have an agreement that says, as it says here very clearly, I think in paragraph 11, that the world stands ready to increase the resources of the IMF as necessary, using a number of different methods. The world said very clearly, ‘We stand ready to do this.’ I think that is important.

If you go back to our last increase in IMF resources, there was a parliamentary vote. That vote allowed for some extra headroom, and what we’d anticipate doing would be within that headroom.

Question

Moreover, on the IMF lack of agreement on a number, your Chancellor yesterday suggested that we might even be lucky enough to have a number on the increased contributions by Newsnight last night. We haven’t even got one by today, almost 24 hours on. This is, although obviously perhaps some relief to your backbenchers, a personal failure for you, is it not, in terms of what you were trying to establish here?

Prime Minister

No, what I was trying to establish here very clearly were two things: first of all, to keep the pressure up on eurozone countries to do the things that they and only they can do to sort out the difficulties in the eurozone; but secondly, with other countries around the world, to say that we stood ready to increase IMF resources, which may well be necessary in an unstable world economy. I had very good conversations, including with the Canadian Prime Minister and Australian Prime Minister, that this is absolutely the right thing to do. They’re in exactly the same situation as Britain - ready to step up to the plate and help with IMF resources, but recognising all the time that you can’t ask the IMF, nor should you, nor ever would I ask the IMF to put its money into a eurozone bailout fund. That wouldn’t be right.

I think I would say about this summit that it’s an important staging post in dealing with some of these problems. Some good progress on things like bank regulation, protection, imbalances. Clearly we need more to be done on the eurozone. I wouldn’t hide that from you for a second, but on the IMF I think it’s important to have that agreement. As I say, better to have that agreement rather than a big number that actually countries wouldn’t be able to explain. I think this is important workmanlike progress, and done in the right way, rather than trying to grandstand.

Question

Can you explain why it wouldn’t be right to ask the IMF to put money into a eurozone bailout fund? Indeed, given that the UK is happy to give money to Greece through the IMF, so we don’t have a philosophical problem with giving money to Greece, why, to use your analogy from last week, when your neighbour’s house on fire isn’t it a good idea to help pay for some hoses?

Prime Minister

I think it’s quite a simple point, which is the job of the IMF is to help countries in distress, not to support currency systems. This is very important, because it is the job of eurozone countries and eurozone institutions to do the work of protecting, defending, promoting, building confidence in their currency. That is not the job of the IMF, nor is it the job of Britain. But it is the job of the IMF to deal with countries that go into programmes and that need that remedial help. That’s why there are IMF programmes, for instance, in Ireland and, for instance, in Greece. It’s an important distinction and a distinction that I think is quite well and widely understood, and I hope will become more widely understood.

Question

Now I suppose one of the remarkable things that happened this weekend is we had the German and the French leaders explicitly countenancing an end to the - well, there could be a break-up of the euro project. Greece could leave. Now that that is out there and being discussed openly, can you comment on that and also explain precisely what this would mean to Britain if it were to happen?

Prime Minister

The point is this, take a step back for a second, it’s in Britain’s interests that the eurozone crisis is sorted out as rapidly as possible. This is having a chilling effect on our economy. As I said, for every day that it goes on not resolved, there’s a day that is not good for our economic prospects. That is fact. Clearly one aspect of getting it solved is to resolve the Greek situation one way or the other. The Greeks have to decide: do they want to stay in the eurozone, accept the debt reduction package that was negotiated and make that work for them within the eurozone, or do they want to take a different path? What they can’t do is just string this out endlessly with another round of conversations, discussions and negotiations. The world can’t wait for the eurozone to go through endless questions and changes about this.

Now, if Greece was to leave the eurozone, we’ve always been very clear that we have to be frank about what this would mean economically. There would be bad economic effects that would be felt across Europe, including in the United Kingdom, for obvious reasons. Because of that, it’s right that we should have proper plans in place, contingency plans, to deal with any and all eventualities. That’s exactly what the Treasury does. As I say, we want this resolved; we want it resolved quickly. The elements of any resolution have got to include decisive action on Greece, recapitalising the banks and establishing the firewall. Those are fundamentals but, as Mervyn King and others have said, those are fundamentals to the immediate situation. There’s still a longer-term piece of work that has to be done to make sure countries within the eurozone are properly competitive within the eurozone, and imbalances building up within the eurozone are properly dealt with.

Can I thank you all very much indeed for coming and wish you a safe journey home. Thank you.