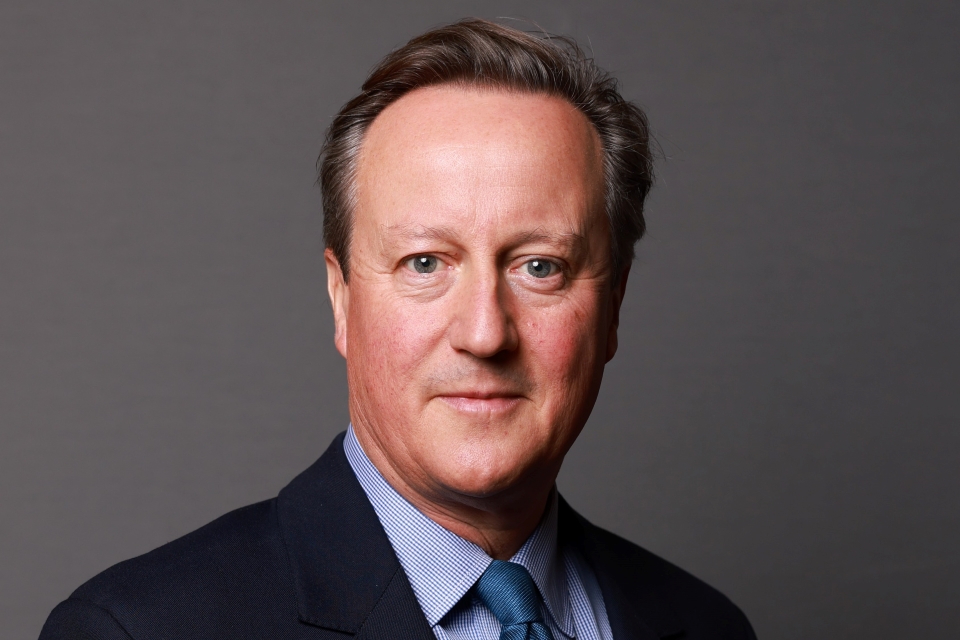

PM press conference at G20

A transcript of Prime Minister David Cameron's press conference at the close of the G20 Summit in Seoul on 12 November 2010.

Read the transcript

Thank you and good afternoon. I said yesterday when speaking to business leaders that this G20 summit needed to take action in three areas: first, endorsing our decision to tackle our deficit to support economic growth and stability; second, taking all the steps necessary to boost global trade; and third, putting in place the arrangements to address the global imbalances which were at the root of the financial crisis and that still hold back growth in the world economy today. Let me take you through what we have agreed.

First, dealing with our deficits. In Britain, we are taking the tough steps to deal with the massive deficit that we inherited. Here in Seoul, we agreed to formulate and implement clear, credible, ambitious and growth friendly fiscal consolidation plans. We also agreed - and I quote - ‘that the failure to implement consolidation would undermine confidence and growth’. There can be no clearer statement of our collective intent than this. Deficits are dangerous; we simply have to deal with them.

Second, boosting trade. Increasing trade is the biggest boost and the biggest stimulus that we could give to the world economy, and it doesn’t cost any money. Britain is an open trading economy. We welcome overseas investment, so this agenda can really help us to create wealth and jobs. That is why I’m linking Britain to the fastest growing countries in the fastest growing parts of the world and why I’m backing so vigorously trade liberalisation. Trade barriers, protectionism, beggar my neighbour policies, these are the things that wrecked the world economy in the 1930s, and the G20 and I are absolutely determined to stop this from happening again. Today, we committed to keeping markets open and liberalising trade and investment as a means to promote economic progress for all and we said that we would - and I quote - ‘roll back any new protectionist measures that may have arisen’.

On the Doha Round specifically, we agreed that 2011 is a critical window of opportunity, and I secured agreement that our engagement to secure a deal must intensify and expand to complete the endgame of negotiations. Now, I know this has been going on for nearly a decade. I know that you are probably as fed up as I am of having to hear language about Doha and not seeing the progress. I think we did make progress today. These words ‘critical window’, ‘endgame’ and the lunch that was had to discuss Doha represented real progress, because the leaders agreed to go back to their negotiators to say to put more on the table, and instructed the WTO and Pascal Lamy to get out there and try and put a deal together; and, crucially, the American President Barack Obama has said that he is prepared to take a deal forward if a good and balanced deal can be achieved. This is progress and it was secured, in part, because of very strong pushing by the UK and by Germany too. There is real movement on this issue and we have played a key role in this regard.

Development and its links to trade are now firmly on the G20 agenda. On the specific issue of trade in Africa, I initiated, together with President Zuma of South Africa, a G20 agreement that we would help to realise the vision of a free trade area in Africa. Just 10% of Africa’s trade is with itself. That is crazy and needs to change, and a free trade area in Africa could make a real difference. Knocking down the trade walls will help unleash economic growth, and it’s not just that I want Africa to be less dependent on aid, I also want Africa to be a source of economic growth for the world, including for Britain. But on the issue of aid I was clear: we made our promises about aid and Britain will stick to its promise of delivering 0.7% of our gross national income. And we shouldn’t underestimate the power and the influence that that gives us in meetings like these where not everyone else has been so clear about keeping their promises.

Third, imbalances - let me address the currency issue first. I believe that the value of currencies should ultimately be determined by market fundamentals, and we agreed today that we will move towards more market determined exchange rate systems and refrain from competitive devaluation of currencies. This is progress, but the issue of trade imbalances obviously goes beyond just currencies. Let me explain why I think this matters. Just as countries with big budget deficits must cut public spending, which is right for them and right for the world economy, so countries with big trade deficits need to save more, consume less and export more, and if that is not accompanied by higher consumption by the surplus countries, world growth will be cut. It is, in the end, as simple as that. By acting together we can maximise world growth and we can cut world unemployment. So this is not some obscure economic issue; in the end, it is about jobs.

Also, trade imbalances have led to an imbalance of funds - a wall of money in the East, a wall of debt in the West - and this is what helped to create the tidal wave that helped cause the booms that helped pump up the bubbles that led to the crash that affected us all. Again, I believe we’ve made some progress. We agreed today that we would pursue the full range of policies to reduce excessive external imbalances and maintain current account imbalances at sustainable levels. We also agreed that this should include assessing imbalances against indicative guidelines to be agreed by our finance ministers and central bank governors. This was never going to be solved overnight, but the key thing is this: it is being discussed in a proper multilateral way without resort to tit-for-tat measures and selfish policies. It’s not just there is an absence of war, as in absence of a trade war; there is, I believe, real presence of real progress.

I said yesterday that this was not going to be an heroic meeting of the G20, but that the G20 was still an essential forum in which to manage the tensions that are present in the global economy, and I stand by that view now. If the G20 didn’t exist, we would have to invent it, but this is still clearly a forum in transition. Last year, the G20 proved itself in handling a crisis. Now it’s got to prove itself in delivering the recovery, and there is still work to be done, but we’ve made some important steps forward today on which I congratulate President Lee for his chairmanship. Reforming the IMF, completing the Basel programme to make sure banks have enough capital: both these things needed to happen, both are agreed here in Seoul.

My challenge this week in Asia was to help business and help create jobs, both through stronger links with China and greater consensus globally on the next steps for the world economy, and on both these we have made good progress. In China, we strengthened our connection to one of the fastest growing economies in the world. Deals were signed between British and Chinese businesses in a huge range of areas. We strengthened our ties on education, culture, security, all the while raising our concerns with China where we have a difference of view.

And here at the G20 we’ve won support for the action we’re taking on our deficit, action that is a prerequisite for growth. We’ve agreed to step up our efforts to unlock the billions of pounds of benefits that including the Doha Round would bring with it. That would mean more trade for British companies, more exports and therefore more jobs. And finally, we’ve agreed to work to rectify the imbalances that threaten global economic stability. This too is good for business and, ultimately, good for jobs.

We’ve protected and promoted our national interests this week in Asia, so it has been a good week for Britain in the world.

Question

You predicted this would not be a heroic summit. Would it not be fair to say it is un-heroic? It has not taken any immediate steps to get the world economy growing again at speed, and over time people may look back at this as a huge missed opportunity.

Prime Minister

No, I don’t think they will. I mean ‘not heroic’ because we’re not meeting at a time of crisis. I think the difference between this G20 and the G20s of London and Pittsburgh is that then there was a time of crisis and there was a need for countries to do the same thing in terms of actually stimulating their economies. This time we’re not meeting with the same sense of crisis. That makes things more difficult. And we also need to agree that different countries do different things towards a common goal. Those deficit countries need to address their deficits. The surplus countries need to address their surpluses.

That’s a more complicated and difficult and subtle thing to achieve, but I think real progress has been made, not just on the sort of meat and drink issues of IMF reform, Basel reform - things that in the past used to take years and years now done much more quickly through this G20 - but actually there is progress on this issue of imbalances. Slowly, slowly, China is moving into a position of actually increasing domestic consumption, of rebalancing its economy, and the G20 is a helpful marker in that progress.

So I always said it wasn’t going to be heroic, but I think it’s good and steady progress, and as I say, I think we should celebrate the fact that here we are in a multilateral format with Britain and France and Germany and others helping to broker the deals between America and China and other members of the G20, rather than having these things decided on a bilateral basis. That is a good thing and that’s why we should treasure what the G20 represents.

Question

You said that this is not just about abstract economics - you know, we were talking here about the global economy and walls of cash and walls of debt and currency imbalances and so on, but you did say it’s about real jobs. Just explain how what’s been decided at the G20 affects people in Britain worried about their jobs and other issues we’ve had problems with, such as banks lending to small businesses.

Prime Minister

The first thing I’d say is, look, Britain is an open, trading economy. We rely on having our export markets open. We will be hit very hard by trade wars, by currency wars, by tit-for-tat measures - the things that happened in the 1930s, the things that there are pressures today in the world to bring about. We would suffer from those, and so working through the G20 to say, ‘No, we’re not going to have protectionism, yes, we’re going to try and get the Doha round going again, yes, we’re going to support free trade’ - that is good for British jobs, good for British business, good for British exporters.

But this issue of imbalances, let me have another go. It is complex and economic-jargon-sounding, but in a way it’s quite simple. If countries that have a big trade deficit need actually to consume a bit less and save a bit more, then you need other countries in the world to take up the baton of faster growth of consumption. And it’s those countries that have trade surpluses that have been heavily reliant on exports that could consume a bit more at home and build up their domestic economies: that would help to boost growth in the world economy. That’s what the discussion is about. That’s why it’s so important we get it right.

And as I say, having heard in China before coming here about how they are rebalancing their economy, they do plan greater domestic consumption, they are going to develop their own home-grown economy - that is good news for Britain, for British exporters, for British jobs, and one of the reasons for going to China is to make sure we’re there getting a piece of the action.

Question

You said yesterday that China’s huge trade surpluses and low currency were stifling global trade. In truth, they haven’t really given any ground here. You’ve just admitted they’re going ‘slowly, slowly’. How does that slow progress affect businesses back home? How do they increase exports and create jobs, as you want?

Prime Minister

Well, if you listen to the Chinese themselves, before we even get onto the G20, they are saying in their next five-year plan that the chief driver of growth is going to be more domestic consumption, development of their domestic economies. Obviously, from the point of view of the rest of the world, we’d like that to happen faster, because as countries with deficits in the West need to address those deficits, the faster the transition can take place, the better for the world economy. What I’m saying is, I think the Chinese themselves recognise this imbalance point and are taking action. And the G20 is helping to make that happen. I accept the language in the communique is never going to provide you with a glistening headline, but actually it does talk about a timeline, it talks about reporting back in the first half of next year.

This issue’s on the agenda. The pressure is there, the recognition that the world needs to act together and it’s better if deficit countries address their deficits at the same time as surplus countries address their surpluses. The recognition is there and it’s happening in a forum that covers all of the biggest and most important economies in the world.

Question

You were talking about Britain’s role in the world, and I appreciate that at the last G20 Britain held the chairmanship, so they made a difference, but your role here seems to have been more peripheral than Gordon Brown’s role. Britain doesn’t seem to be at the centre of things in quite the same way. You’ve been to China, picked up some trade, but nothing like as much as France just did. You go back to a country where there are cuts in everything, including defence. Are we watching Britain’s international role shrink before our eyes?

Prime Minister

No, not at all. I think Britain has a very strong and large role in the world, and actually what we’re doing is we are re-linking Britain with the fastest-growing parts of the world to make sure that we secure our prosperity and our security. And if you look at Britain’s role at this G20 I would argue that actually we played a very central role.

The whole idea of a pan-African free-trade area - that was a British initiative into the communique, there for all to see. The brokering of the agreement between China and others over the language about the timetable - the British played a role in making sure that that happened. The whole push on global imbalances - the British team have been playing a very strong role on that.

So I don’t accept that we don’t play a big role. We do. But I think the G20 is a good forum in which to play it, because you’ve got all the major economies there and an ability to build up alliances and get things done.

On the sort of broader role of Britain in the world, about which I’ll be speaking on Monday night at the Lord Mayor’s Banquet, I think actually if you look at the last six months you’ve seen the biggest trade mission ever taken to India by a British Prime Minister, the biggest trade mission ever taken to China, you’ve seen success in the European Council stopping unnecessary increases in the European budget, very strong relations between Britain and France on defence, very strong tripartite relations, if you like, between Britain, France and Germany. I think actually you can see Britain is reaching out in the world - very good meetings at the G20 here with the Canadians and the Australians. We want to re-energise our links with the Commonwealth. Very strong links with the Gulf countries, where a number of ministers have been and where I hope to make a trip next year.

So, I would say actually quite wrong to say this is about shrinkage. It is actually about reenergising a lot of Britain’s relations in the world to make sure we continue to punch above our weight and we continue to maintain and enhance both our security and our prosperity.

Question

Prime Minister, it still feels a little bit as if this is the bare minimum summit; it feels as if there’s very little enthusiasm for the goals which everyone says they are signed up to, like greater openness in international trade. In the end, aren’t people still looking to their own interests first and not saying, ‘The first thing we have to do is find a deal that will fix the world economy’?

Prime Minister

I don’t think that is right. If you didn’t have the G20, I think there would be a real danger of what you say - that countries might go off and pursue their own interests and not think, ‘How does this impact other countries?’ But the fact is, at a time when we’ve had difficult recessions in the West - and of course there are pressures for protectionism you can see in Western countries - the fact is those pressures aren’t being acted on, because through the G20 we come together and recognise that actually, if we did that, it might give us five minutes relief with our own public, but it won’t actually give us five years of strong economic growth.

So, I don’t accept that the G20 process isn’t working; it is making sure that countries think of the impact of their policies on other countries. The whole way the IMF helps to run this summit is to get everyone to set out what their policies are and then to look at what their impacts will be on others. And the reason why we have these debates and arguments about currency wars and imbalances is because we are looking at the overall cake of the world economy rather than what each of us can take out of it. Now, that is extremely valuable. Of course, it is a process rather than some superb end point, but it is a process that actually means something and I think is having good effect.

Question

I wondered if you could tell us about your meeting today with European leaders on the EU budget? What do you think about this idea that MEPs are attempting to link the issue of tax-raising powers to the budget now? And isn’t there a real prospect that there may not be an agreement and what we’ll end up with is a freeze - there won’t be any rise, which would be welcomed by British payers.

Prime Minister

Well, I’ve always said that a freeze is a perfectly good outcome. In fact, in many ways it would be the best outcome because you just take last year’s budget, divide it up into 12 parts and section it out over the year. What I can tell you - because obviously I’ve been in Seoul rather than in Brussels - is that here, talking to Nicolas Sarkozy and Angela Merkel and indeed, Silvio Berlusconi, is that we signed that approach of limiting the budget to a 2.9% increase and we are sticking to that approach; and that is very, very firm indeed, and they were extremely staunch when I asked them to be extremely staunch.

Question

Just to make the imbalances question a little bit more tangible, could you give a commitment here that if the indicative guidelines in the communique asked Britain to change its economic policy, you would change economic policy? And if not, why should we think any other sovereign nation will?

Prime Minister

I think if we had a 4% current account deficit or a 4% current account surplus, we should be thinking about the balance of our economy, and what that means for us and what it means for others. We’re doing that with our budget deficit, so we’re doing it with that imbalance if you like, and I think we would take a similar approach on the current account. But the fact is that you perhaps wouldn’t do it unless you were sitting round a table regularly with other countries to whom it makes a big difference. And I think this is where I find these meetings quite effective - because the lessons are spelt out very clearly by the IMF, the WTO, the World Bank and others, it puts pressure on the political leaders to think, ‘Is what I’m about to do purely in my own short-term interest or in the long-term interest of trying to maximise global growth?’ And as I say, if we didn’t have this forum, I suspect there would be bilateral exchanges between perhaps America and China over these issues, but in fact it’s doing it in a multilateral way where you can really see the benefits of acting together. And it actually, in this case, meant that the Germans and the British and others were able to work with the Chinese to get a reasonable agreement.

Question

The situation in Ireland: how concerned are you that that could spill over onto the UK economy and European markets in general, and is there anything that we can do about that? And secondly, given that Ireland themselves moved quite swiftly a couple of years ago to cut their deficit, isn’t what’s happening in Ireland - doesn’t it show the danger of moving too quickly?

Prime Minister

Well, first of all, on what the Irish have done and will do, I would applaud what the Irish government is trying to do to sort out their very difficult position with regard to their public finances, and I know that they’ll be making further announcements setting out four-year budget perspectives next week. What I’d say about the Irish situation as opposed to the United Kingdom’s position is obviously there is one key difference, which is that we are not members of the Eurozone. And, you know, one of the reasons I never wanted to join the Euro is I believe that one currency for Europe is very inflexible; it means one interest rate for Europe, and actually I think there are times when different countries need different monetary policies, different interest rate policies. And I think that the flexibility we’ve had outside the Euro is important for Britain and will stay as long as I’m Prime Minister.

Question

How would you characterise the behaviour of the G2 here, the Americans and the Chinese? Were they more confrontational, side-by-side, head-to-head? What was the negotiating here?

Prime Minister

Look, what I observed - and I was involved in a number of conversations with both of them - is, of course they have interests they want to promote and protect. If you are America you are very keen to get your economy growing again, to get jobs, to get your exports moving, to recognise that you have a deficit - both trade and budget - that you’ve got to deal with, and you need a growing world economy to help you do that, and you want to get those markets open. If you’re China, you have an incredibly successful export-driven model that’s taken millions of people out of poverty, and there’s obviously caution about the rebalancing and moving to a new model. And so, obviously there are robust conversations that take place both between the two and within the G20.

But what I witnessed was relatively good-natured conversations and a relatively good-natured agreement that does put imbalances up front and centre. I wouldn’t necessarily read every word of this massive communique, but if you read the declaration, if you read the first four pages, you get a very clear view that this is an organisation that did well in a crisis, that earned its reputation; it wants to do well in a recovery, it has a shared view about what needs to happen with the world economy, it wants to set out a shared pathway, and I think it’s quite a compelling story that it tells. So, yes, of course there are pressures and tensions, but it’s right that they should be addressed in a meeting like the G20 rather than spill over into bilateral action that could be very harmful for the rest of the world. So, what I witnessed was relatively good-natured; some tough negotiations - I’m sure the sherpas will tell you stories of late nights and tough talks and all the rest of it - but in the end the sherpas managed to, I think, come together in a text that does set out why imbalances matter, why we need to deal with them, and a process for doing so.

Thank you very much indeed.