Use of marketed tax avoidance schemes in the UK (2020 to 2021)

Updated 30 November 2022

Marketed tax avoidance schemes are contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. Where this report refers to avoidance schemes, we mean marketed tax avoidance schemes.

1. Introduction from Mary Aiston, Director Counter-Avoidance

This report follows on from the previous Use of marketed tax avoidance schemes in the UK report published in November 2021 and provides an update on what we know about the avoidance market, focusing on the tax year 2020 to 2021.

In 2020 to 2021, the estimated amount of tax the UK lost to marketed tax avoidance was around £0.4 billion. The tax avoidance market continues to be dominated by disguised remuneration (DR) schemes, targeting contractors and agency workers. Our most recent findings are that these schemes are largely operated or facilitated by non-compliant umbrella companies (meaning they do not fully comply with their obligation to deduct taxes under PAYE on payments made to their workers).

HMRC publishes information on tax avoidance schemes, suspected promoters and those connected to avoidance schemes in order to warn taxpayers about who to steer clear of, so as not to get involved in tax avoidance.

Between April and September 2022, HMRC published the names of 18 promoters and 20 schemes. In August 2022, we published the names of the directors behind two of the companies promoting avoidance using powers contained within Finance Act 2022.

If a tax avoidance scheme is not shown in the GOV.UK list of named tax avoidance schemes, this does not mean that the scheme works or is in any way approved by HMRC. HMRC does not approve tax avoidance schemes.

At the same time, we are increasing taxpayer awareness of the risks of getting into tax avoidance through a public information campaign, so they can steer clear of getting caught up in avoidance schemes.

In addition, through our early intervention work we continue to use our data to identify people who might have entered tax avoidance schemes, alert them to the risks and help them leave as quickly as possible.

HMRC encourages people to be vigilant about arrangements they are entering into for their pay and employment, particularly contractors and agency workers who are often targeted by promoters of tax avoidance. If you see adverts promising take home pay that looks too good to be true, or become aware of a scheme that does not look right or is overly complex, steer clear. If you have concerns about a scheme, consider getting independent professional tax advice, or speak to one of the tax advice charities. Please also report the scheme to HMRC.

It is important that taxpayers look carefully at any arrangements they are being offered before signing up.

2. The size of the UK tax avoidance market

2.1. The size of the problem

Measuring tax gaps 2022 edition estimates that 95 per cent of total tax due in 2020 to 2021 was paid. HMRC collected £608.8 billion of tax revenue in that year. This figure includes £30.4 billion of additional tax revenue that our work in tackling all forms of non-compliance collected and protected.

HMRC’s illustrative estimates of the tax gap by taxpayer behaviour show that around £1.2 billion was lost to tax avoidance in 2020 to 2021.

About £0.4 billion of this gap relates to marketed avoidance schemes sold primarily to individuals and made up of unpaid Income Tax, National Insurance contributions (NICs) and Capital Gains Tax. These estimates are likely to be revised as more information becomes available.

Avoidance is estimated to be the smallest element of the tax gap by taxpayer behaviour. The vast majority of people do not try to avoid paying their tax.

Figure 1: Why tax goes unpaid, 2020 to 2021

| Behaviour | Value | Share of tax gap |

|---|---|---|

| Failure to take reasonable care | £6.1bn | 19% |

| Criminal attacks | £5.2bn | 16% |

| Non-payment | £4.9bn | 15% |

| Evasion | £4.8bn | 15% |

| Legal interpretation | £3.7bn | 12% |

| Hidden economy | £3.2bn | 10% |

| Error | £3.0bn | 9% |

| Avoidance | £1.2bn | 4% |

Note: Around half of the avoidance tax gap (£0.6 billion) is attributed to Corporation Tax, with £0.4 billion attributed to Income Tax, National Insurance contributions and Capital Gains Tax which relates to marketed avoidance schemes, £0.1 billion to VAT and £0.1 billion to other taxes.

As of September 2022, our database shows that in 2020 to 2021 there were approximately 31,000 individuals who used an avoidance scheme at least once. Approximately two-thirds of these individuals were existing users, meaning they had also used an avoidance scheme in an earlier year.

Approximately 1,000 employers also used avoidance schemes in 2020 to 2021. The number of employers generally does not include the employers of the 31,000 individuals.

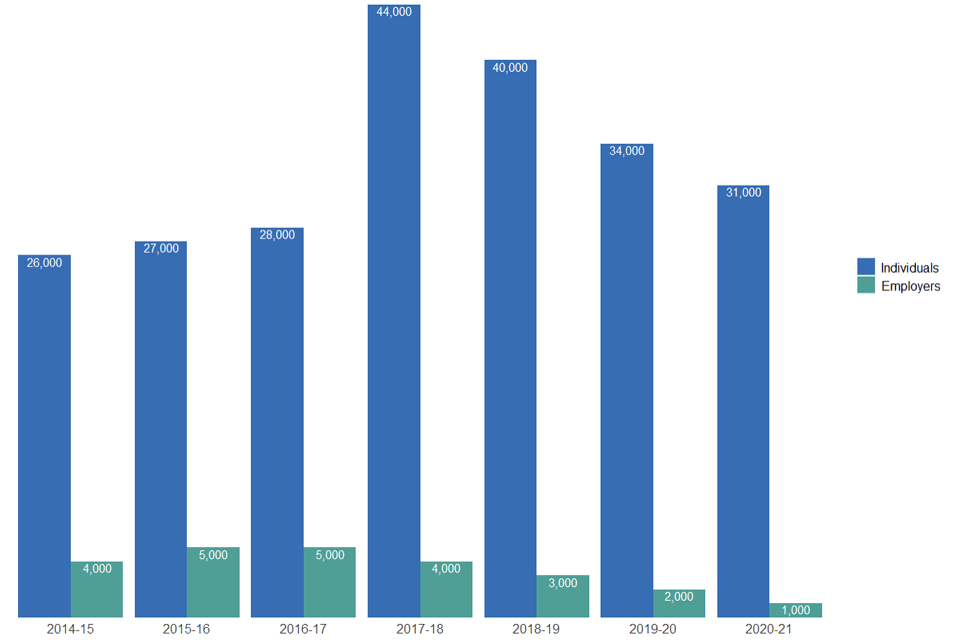

Figure 2: Number of individuals and employers using tax avoidance schemes each year

The chart below shows an estimate of the number of individuals and employers using tax avoidance schemes in each year between 2014 to 2015 and 2020 to 2021, as recorded on our avoidance database, which holds records of open and closed enquiries into tax avoidance schemes and other instances of probable avoidance use. This chart does not distinguish between people who use an avoidance scheme for the whole year and those who are active in a scheme for only a few weeks. If someone uses more than one avoidance scheme in the same year, they are only counted once.

We update and improve the previous years’ figures as data is consolidated and refreshed in line with our compliance activity.

| Year | Individuals | Employers |

|---|---|---|

| 2014-15 | 26,000 | 4,000 |

| 2015-16 | 27,000 | 5,000 |

| 2016-17 | 28,000 | 5,000 |

| 2017-18 | 44,000 | 4,000 |

| 2018-19 | 40,000 | 3,000 |

| 2019-20 | 34,000 | 2,000 |

| 2020-21 | 31,000 | 1,000 |

Note: The employers population includes companies, partnerships, trusts, and other corporate entities using an avoidance scheme but generally does not include non-compliant umbrella companies who act as the employer for the majority of individuals involved in avoidance schemes. Umbrella companies employ individuals on behalf of clients and employment businesses and are responsible for, among other things, paying salaries and deducting taxes under PAYE. Many umbrella companies are compliant, that is to say they fulfil these responsibilities. However, as set out in this report, some umbrella companies are non-compliant in that they exploit their position in the supply chain to operate tax avoidance schemes. The individuals who work through non-compliant umbrella companies are counted in the individuals’ population. Figures are rounded to the nearest thousand.

We have updated all of the figures in this time series with our latest information for each of the years from 2014 to 2021. The increases in previously reported numbers are due to a mix of factors, the main one being that, as we complete casework and resolve an individual’s tax affairs, we often identify that their use of an avoidance scheme affects more years than had previously been recorded. This can increase the number of both individuals and employers who are recorded as having used an avoidance scheme in previous years. As stated in last year’s report, our analysis of the increase in the number of individuals identified as being involved in avoidance schemes in the year 2017 to 2018 suggests this is primarily a result of improvements to the way we identify those involved in avoidance.

2.2. The market for tax avoidance schemes

In 2020 to 2021, circa 99% of the avoidance market was disguised remuneration schemes. Disguised remuneration tax avoidance schemes claim to avoid Income Tax and NICs on a worker’s earnings. They normally involve paying earnings in the form of a loan or other payment from a third-party which is unlikely to ever be repaid. These schemes are used by employers and individuals. If they are used by contractors, they are often known as contractor loan schemes.

HMRC does not accept that these schemes achieve their objective of removing the liability to tax and NICs and so we challenge their use, to make sure that people pay the Income Tax and NICs that is due on their income.

A large proportion of disguised remuneration schemes involve an individual receiving their income or earnings as, what are claimed to be, a series of:

- loans

- grants

- salary advances

- capital payments

- credit facilities

- annuities

- shares and bonuses

- fiduciary receipts

- other untaxed payments

These types of disguised remuneration schemes are generally targeted at temporary workers (such as agency workers or contractors) who are employed through non-compliant umbrella companies that operate avoidance schemes. A smaller proportion of disguised remuneration schemes are used by small and medium sized employers. These are typically used by owner-managed businesses to pay the owners in a way that, the promoter of the scheme claims, involves no liability to Income Tax and NICs.

As with the schemes used by contractors, schemes used by small and medium sized employers can involve an employer making payments directly, or via a third party, to its employees. These payments are described as loans or something else which are claimed not to be subject to Income Tax and NICs.

2.3. Who uses avoidance schemes?

Our data shows that, for individuals involved in tax avoidance during 2020 to 2021, use of tax avoidance schemes is most prevalent in the 41 to 50 years age group. There is broadly an equal split between men and women using avoidance schemes, reflecting the gender split in the wider population.

Figure 3: Age distribution of people who used tax avoidance schemes in 2020 to 2021

The age range of people who used tax avoidance in 2020 to 2021 and are either in PAYE or filed a Self Assessment return.

| Age range | Percentage |

|---|---|

| Under 21 | 1% |

| 21-30 | 11% |

| 31-40 | 23% |

| 41-50 | 30% |

| 51-60 | 26% |

| 61-70 | 9% |

| Over 70 | 1% |

Almost nine out of ten people who used an avoidance scheme during 2020 to 2021 reported an income of less than £50,000 per year for tax purposes. This is similar to our findings in previous years. This is not unexpected, because most recent avoidance schemes involve disguised remuneration, so those using them will, by definition, have suppressed their declared income by excluding income received as ‘loans’. Their true income is likely to be much greater than reported.

Figure 4: Artificially reduced income levels among people who used tax avoidance schemes in 2020 to 2021

Artificially reduced income for people who used tax avoidance schemes in 2020 to 2021 and are in PAYE or filed a Self Assessment return.

This figure shows the income distribution for individuals who used avoidance schemes in the 2020 to 2021 tax year:

| Reported income | Percentage |

|---|---|

| £0-25,000 | 57% |

| £25-50,000 | 30% |

| £50-75,000 | 8% |

| £75-100,000 | 2% |

| £100,000 or more | 3% |

Note: The reported income has been extracted from HMRC’s Real Time Information PAYE data and Self Assessment data. Where a person had more than one employment in the tax year, the income has been summed across all the employments. Amounts declared will not reflect the full income for tax purposes. A small fraction of people appeared as having zero income in the relevant tax year, suggesting they might be left on the books of their employers but are no longer providing services.

Figure 5: Geographical distribution of people in the UK who used avoidance schemes during 2020 to 2021

The number of people who used tax avoidance in 2020 to 2021 by local authority, scaled by the local authority population.

Note: For each local authority area, the number of people who used an avoidance scheme in 2020 to 2021 is scaled by the total population (mid-2019 Office for National Statistics (ONS) population estimates).

There has been a shift in the geographical distribution of people involved in avoidance schemes in the UK. There are increases in the number of users in the Midlands. Tamworth is now the local authority with the highest use of marketed avoidance per-capita. For the year 2019 to 2020 this was Barking and Dagenham.

Figure 6: The table shows the distribution of people who used tax avoidance schemes during 2020 to 2021 across the UK local authority areas

Number of people who used tax avoidance in 2020 to 2021 by local authority, scaled by the local authority population – where this number was more than 50 per 100,000 individuals.

| Local authority | Cases per 100,000 |

|---|---|

| Tamworth | 201-225 |

| Barking and Dagenham, Nuneaton and Bedworth, Thurrock | 176-200 |

| Corby, Dartford, Greenwich | 126-150 |

| Bexley, Croydon, Lewisham, Milton Keynes, North West Leicestershire, Northampton, Redbridge, Southwark, Wolverhampton | 101-125 |

| Basildon, Bedford, Birmingham, Chelmsford, Coventry, Enfield, Gravesham, Hackney, Hammersmith and Fulham, Haringey, Harlow, Havering, Hertsmere, Lambeth, Leicester, Luton, Merton, Newham, North Warwickshire, Rugby, Sandwell, Slough Stevenage, Walsall, Waltham Forest, Watford, Wellingborough | 76-100 |

| Ashford, Barnet, Brent, Bromley, Broxbourne, City of Bristol, Daventry, Derby, Ealing, East Staffordshire, Epping Forest, Harrow, Hillingdon, Hounslow, Islington, Kettering, Manchester, Medway, Newcastle under-Lyme, Newport, Nottingham, Oadby and Wigston, Peterborough, Portsmouth, Reading, Rochdale, Runnymede, Solihull, South Derbyshire, South Northamptonshire, Southend-on-Sea, Spelthorne, Surrey Heath, Sutton, Swansea, Swindon, Telford and Wrekin, Three Rivers, Tower Hamlets, Wandsworth, Welwyn Hatfield | 50-75 |

Note: There were no local authorities falling within the 151 to 175 band.

When we break down our data by business sectors, HMRC is reliant on the sectors reported to us by employers in PAYE data. The true picture is obscured by the fact that the majority of individuals in avoidance schemes work through umbrella companies. These umbrella companies report themselves in their PAYE returns as operating in a range of sectors relating to financial services and intermediaries. When someone works through an umbrella company, our data does not show what type of business they are ultimately working for and does not give us a further breakdown of professions.

Hospital activities appears as the sector with the highest number of people who used avoidance schemes in 2020 to 2021. It should be noted that where individuals have more than one employment, the figure below shows the sector of each individual’s highest reported income. This may not be the employment in which an avoidance scheme was used. For example, an individual whose highest paid employment is in hospital activities and who has tax deducted correctly under PAYE, but who has a second employment in a different sector where an avoidance scheme is being used, will appear in this data in hospital activities.

Figure 7: Most common employment types for people who used avoidance schemes during 2020 to 2021

Top 10 most frequent employment types for people who used avoidance schemes in 2020 to 2021 and are on PAYE.

| Employment type | Percentage |

|---|---|

| Hospital activities | 17% |

| Bookkeeping activities | 16% |

| Management consultancy activities other than financial management | 11% |

| Temporary employment agency activities | 8% |

| Other business support service activities not classified elsewhere | 6% |

| Accounting and auditing activities | 5% |

| Other activities of employment placement agencies | 4% |

| Other human health activities | 3% |

| Primary education | 2% |

| Combined office administrative service activities | 2% |

Note: Sectors are extracted from HMRC’s Real Time Information PAYE data. A relevant code from the International Standard Industrial Classification is associated to each employment. Where someone had more than one employment on record, the sector associated with the highest paid employment was selected. As noted above, this may not be the employment in which an avoidance scheme was used.

3. Tax avoidance promoters

3.1. Who is selling these schemes?

Twenty to thirty promoter organisations are behind most of the tax avoidance schemes that are marketed to the UK public. These organisations are typically made up of multiple entities, who control umbrella companies that facilitate the operation of disguised remuneration avoidance schemes.

Since the last report was published some promoter organisations have left or significantly reduced their activity in the avoidance market. However, new promoters have entered the market.

While many umbrella companies are compliant, some non-compliant umbrella companies abuse their position in the labour supply chain to enable disguised remuneration avoidance schemes. This involves making payments to the individuals they employ, either directly or via a third party, in a contrived way to seek to avoid the payment of Income Tax and NICs on earnings. The vast majority of disguised remuneration schemes currently being sold are through this small number of non-compliant umbrella companies.

We estimate there are currently around 70 to 80 non-compliant umbrella companies involved in the operation of disguised remuneration avoidance schemes. Many of these umbrella companies are short lived, typically operating for less than two to three years before closing down, before a new umbrella company is set up and starts operating new avoidance schemes.

3.2. How HMRC is tackling promoters

We continue to implement the actions set out in our published strategy to disrupt the activities and supply chains of promoters. The figures quoted in this section are correct as at 30 September 2022.

We continue to take legal action against promoter organisations for failure to disclose schemes under the Disclosure of Tax Avoidance Schemes (DOTAS). All of the 14 tribunal decisions received to date have confirmed our view that the schemes are notifiable under the DOTAS regime.

We have also recently had a success in long running litigation, with a DOTAS penalty of over £1 million confirmed in July 2022.

The Government brought in legislation in Finance Act 2021 and in Finance Act 2022 to enhance HMRC’s ability to tackle promoters and suppliers of tax avoidance schemes and reduce the scope for them to market such schemes.

Finance Act 2021 changed the DOTAS regime to allow HMRC to issue Scheme Reference Numbers (SRN) in respect of arrangements that we reasonably suspect should have been disclosed to us. We can issue an SRN to suppliers, as well as promoters, of arrangements.

We have used the powers enacted in Finance Act 2021 to issue 26 DOTAS warning notices to promoters so far. These notices require the promoters or their suppliers to provide information to satisfy us that the scheme is not notifiable. If they fail to satisfy us of this, we issue an SRN. We have issued SRNs in this way for 19 schemes.

Under powers legislated in Finance Acts 2021 and 2022, we have so far published the names of 18 promoters and details of 20 schemes they are promoting.

In August 2022 we used, for the first time, powers under Section 86 of Finance Act 2022. These new powers enable us to publish more information, more quickly, about tax avoidance schemes and those who promote them, including publishing details of the directors of promoting organisations. This helps to warn taxpayers and encourage them to leave or steer clear of these schemes. The details of two directors have been published under this legislation. We have a number of other cases in the pipeline that will lead to further promoters and schemes being named.

Note: If a tax avoidance scheme is not shown in the GOV.UK list, this does not mean that the scheme works or is in any way approved by HMRC. HMRC does not approve tax avoidance schemes.

We have now issued over 230 information notices to promoters and others we think are enabling tax avoidance, requiring them to provide information about their activities. We expect this to provide us with the information we need to issue our first penalties under the Penalties for Enablers of Defeated Tax Avoidance legislation.

We have begun to issue stop notices to promoters following changes to the Promoters of Tax Avoidance Schemes (POTAS) legislation. A stop notice legally requires the promoter to stop promoting the tax avoidance scheme specified in the notice. Penalties of up to £1 million can be issued for failure to comply.

The promoter is also required to:

- pass the stop notice to associated persons, who also must stop selling the scheme

- inform their clients who are using the avoidance scheme and any intermediaries that they are subject to the stop notice

- inform HMRC of all the current and previous users of the scheme

We will issue more stop notices to stop promotion of schemes at an earlier stage. We have issued 10 information notices to date to obtain information that may lead to further stop notices.

We are currently considering a number of cases under the Finance Act 2022 power which allows HMRC to present a winding-up petition to the court on public interest grounds for companies involved in or associated with the promotion of tax avoidance.

As well as our full range of civil sanctions, where an avoidance scheme involves fraud or other criminal offences, we use the full range of criminal powers to tackle those who promote or enable avoidance schemes. Since the formation of HMRC’s Fraud Investigation Service on 1 April 2016, more than 20 individuals have been convicted for offences relating to arrangements which have been promoted and marketed as tax avoidance. These have resulted in over 100 years of custodial, and nine years of suspended, sentences being ordered. We also have individuals under live criminal investigation for offences relating to arrangements promoted and marketed as tax avoidance. These include arrangements we have categorised as relating to disguised remuneration and the Loan Charge.

Working with partner bodies

The majority of promoters are not members of professional bodies, but since March 2021 we have made 14 public interest misconduct disclosures, referring promoters to their professional bodies to consider whether they should be removed or disqualified, undermining their claims of legitimacy.

We continue to work with partner bodies to tackle misleading tax avoidance advertisements. In November 2020, HMRC and the Advertising Standards Authority (ASA) issued a joint Enforcement Notice which set out what promoters should and should not include in their internet advertising. As at September 2022, 14 websites have been removed, and eight have been amended to comply with the notice.

We have actively engaged with the insolvency profession to disrupt those who promote avoidance schemes and are pro-actively targeting promoters of avoidance using both existing insolvency legislation and powers in Finance Act 2022 to disrupt their activities and ensure we maximise our chance of recoveries.

We continue to make referrals to the Insolvency Service (INSS) who consider whether disqualification proceedings are appropriate under the Company Directors Disqualification Act 1986. We work collaboratively with the INSS to assist and support their investigations. These referrals have resulted in the disqualification of 16 directors who have promoted or used tax avoidance. There are several ongoing investigations, the majority of which are looking at the controlling minds of promoter entities.

4. HMRC is here to help people get out of avoidance

4.1. HMRC is here to help

If anyone is worried about becoming involved in a tax avoidance scheme or thinks that they are already involved and wants to get out of one, HMRC is here to help. We offer a wide range of support to get people back on track or prevent them being caught out in the first place.

Anyone concerned about the schemes they are currently using should consider getting independent professional tax advice or speak to one of the tax advice charities. Anyone with concerns can also email HMRC.

4.2. Helping people settle their tax liabilities

HMRC is committed to helping people get out of avoidance and making it as easy as possible for them to settle their outstanding avoidance use and pay the tax due. In August 2020 we published the disguised remuneration 2020 settlement terms. These can be used to settle liabilities in relation to all disguised remuneration liabilities, including the Loan Charge. For open enquiries and assessments relating to loans subject to the Loan Charge, HMRC will take into account how much Loan Charge has been paid. Where there is an amount remaining due after taking account of the Loan Charge, we refer to this amount as ‘residual tax’. HMRC will not collect an individual’s residual tax in certain circumstances as set out in the 2020 settlement terms and the issue briefing: settling disguised remuneration schemes use and/or paying the loan charge.

There is a different process for people to settle their tax affairs if they have used other types of tax avoidance schemes. To find out more about these processes, anyone already speaking to someone at HMRC about settling should contact them. Anyone who does not have an existing contact should contact HMRC’s dedicated team for help.

In all cases, we encourage people who are using an avoidance scheme to contact HMRC as soon as possible. Settling will give people certainty about their tax affairs and helps them get out of tax avoidance for good. It may also mean they do not face a bigger tax liability at a later date if the scheme they used is referred to the tribunal.

4.3. Helping people with debt

Where someone is unable to pay the tax they owe in full and on time, we want to help them to get out of debt. We are always ready to help those who want to settle their affairs. We do not want anyone to worry, and we are here to make things as straightforward as possible.

As we become aware that someone has an avoidance-related tax debt, we always try to contact them by phone, post, or SMS so that we can talk about their situation and agree a way forward. We urge people to respond to these communications as soon as possible because, unless we can discuss their situation, we cannot tell if they need support or are refusing to pay.

In all cases, we want to work with people to find a way for them to pay off their tax debt as quickly as possible, in an affordable way for them.

Everyone is different, so the support we offer differs from person to person – we tailor our support to individual needs. Where people are facing difficulty in making a tax payment, they should ask us about affordable payment options. We will work with them to try and agree a payment plan called Time to Pay, based on their financial position. We typically have more than half a million Time to Pay arrangements in place at any one time, and nine out of ten of them complete successfully.

4.4. Stopping tax avoidance early or before it starts

We launched a public information campaign in November 2020 to help educate taxpayers so that they can stay clear of tax avoidance. This campaign, Tax avoidance - don’t get caught out, aims to help people spot tax avoidance and make sure they understand the risks. We have an interactive risk checker and payslip guidance to help contractors check how they’re being paid and whether they are at risk of being involved in tax avoidance.

We are taking action to help taxpayers understand the risks and consequences of their involvement as soon as possible after they enter a tax avoidance scheme.

As mentioned above, we have published the names of promoters and the schemes they are promoting. This is to let taxpayers know as early as possible that these are avoidance schemes, so they can steer clear of them or exit them.

We are also writing to taxpayers when our systems show they might have joined an avoidance scheme. We make them aware of our concerns about the scheme they have joined and help them to understand what they need to do to pay the right amount of tax. The aim of this is to help them move out of their avoidance schemes before they build up large tax bills.

We have used our Spotlight series of HMRC publications to warn contractors about umbrella companies operating disguised remuneration schemes.

We are engaging with employment intermediaries (also known as agencies) and industry representative bodies, including trade unions, to pass on key messages about steering clear of avoidance. We continue to work with professional bodies across the accountancy, financial and legal professions, and employers in key industries, to issue educational material and guidance. We aim to ensure their members do not facilitate avoidance and help educate clients, so they do not enter tax avoidance schemes.

We want to get people out of tax avoidance fast and prevent people from entering into it, and we are here to help anyone who is worried they might be caught up in it.

This is, and always has been, about ensuring everyone pays the correct amount of tax.

5. Glossary

| Term | Definition |

|---|---|

| Advertising Standards Authority (ASA) | The UK’s independent regulator of advertising across all media. They apply the Advertising Codes, which are written by the Committees of Advertising Practice (CAP). |

| Agency, often referred to as intermediaries | Agencies are generally recruiters who look to supply engagers with flexible labour. There are often several agencies in the supply chain between the engager and the individual providing their labour. |

| Contractor or Agency worker | Individual providing flexible professional services to an engager, either directly or through an agency. |

| Contrived Arrangement or Transaction | An arrangement or transaction that has an artificial structure that does not accurately reflect the true nature and intention of the arrangement or transaction. |

| Disclosure of Tax Avoidance Schemes (DOTAS) | Introduced in Finance Act 2004 for HMRC to obtain early information about how tax arrangements work and information about who has used them. Disclosure has no effect on the underlying tax position of a taxpayer or tax avoidance scheme, but promoters, suppliers and scheme users may face penalties for failure to adhere to DOTAS obligations. |

| Disguised remuneration (DR) | Tax avoidance schemes that claim to avoid the need to pay Income Tax and National Insurance contributions on remuneration by paying an amount alleged to be non-taxable (often involving a loan or other payment, sometimes from a third party, which is unlikely to ever be repaid). |

| Enabler | Any person who is responsible, to any extent, for the design, marketing or otherwise facilitating another person to enter into abusive tax arrangements. |

| Enablers Penalty | A penalty for any person who enables the use of abusive tax arrangements, which are later defeated. The legislation for this was introduced in Schedule 16 to the Finance (No.2) Act 2017. |

| HM Revenue and Customs (HMRC) | HMRC is the UK’s tax, payments, and customs authority. |

| Loan Charge | Introduced in Finance Act 2017 to address tax loss to the Exchequer due to the use of disguised remuneration schemes. The legislation required scheme users to either repay their outstanding disguised remuneration loans or declare them as income on their 2018 to 2019 tax returns. The Income Tax and NICs charges on this income is known as the Loan Charge. |

| Marketed tax avoidance | Contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. |

| PAYE, also referred to as Pay As You Earn | A system of paying Income Tax in which an employer pays an employee’s tax directly to HMRC. The taxes paid are deducted by the employer from the employee’s salary/wages. |

| Promoters of Tax Avoidance Schemes (POTAS) | Introduced in Finance Act 2014, the legislation allows us to issue stop notices to stop promotion of avoidance schemes, conduct notices to change the behaviour of promoters, and subsequently monitor those who breach a conduct notice. Monitored promoters are subject to strong information powers and penalties, which will also apply to intermediaries that continue to represent them after the monitoring commences. |

| Promoter | Those who devise and market the use of tax avoidance schemes, including securing King’s Council (KC) opinions, producing promotional material and marketing the schemes, including to agencies as an option for their staff or directly to contractors. Can be summarised as anyone who: is to any extent responsible for the design of a tax scheme (defined by reference to DOTAS); approaches others with a view to making a scheme available to them; makes a scheme available for implementation to others; organises or manages the implementation of a scheme |

| Residual tax | An amount remaining to settle open enquiries and assessments relating to loans subject to the Loan Charge, taking into account how much Loan Charge has been paid. HMRC refers to this amount as ‘residual tax’. Residual tax is made up of Income Tax, NICs and late payment interest. |

| Scheme Reference Number (SRN) | An SRN is a number allocated to a tax avoidance scheme by HMRC at the time the scheme is disclosed to them, or, where a scheme has not been disclosed and HMRC reasonably suspect that the scheme should have been disclosed. It allows HMRC to identify and track users of disclosed tax avoidance schemes. The allocation of an SRN does not mean that HMRC has in any way approved or cleared a scheme for use. |

| Stop notice | Forming part of the POTAS regime, stop notices may be issued to a person we suspect is promoting an avoidance scheme. If a promoter does not comply with a stop notice they would meet a POTAS threshold condition which may lead to us giving them a conduct notice and they face tough penalties. |

| Supplier | Supplier refers to persons involved in the supply of tax avoidance schemes. ‘Supplier’ includes promoters and also other suppliers who do not meet the definition of promoter. There are many different ways a person may be involved in the supply of the scheme. |

| Tax advantage | A reduction in the amount of tax due or increase in the amount of tax reclaimable by a person or organisation in particular circumstances. |

| Tax avoidance | Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce this advantage. It involves operating within the letter, but not the spirit, of the law. |

| Tax evasion | Tax evasion is where there is a deliberate attempt not to pay the tax which is due. It is illegal. |

| Tax gap | The difference between the amount of tax that should, in theory, be paid to HMRC, and what is actually paid. |

| Tax liabilities | The total amount of tax owed by an individual or business to HMRC. |

| Tax year | For individuals, the Self Assessment tax year starts on the 6 April and ends 5 April the following year. For example, the 2020 to 2021 tax year began on 6 April 2020 and ended on the 5 April 2021. For corporate bodies, the tax year depends on the end of the accounting period. |

| Umbrella company | A UK limited company which acts as an employer to a number of individuals, meeting PAYE and other requirements where operating legitimately. It signs contracts to provide the individual’s labour to clients, either directly or through another intermediary such as a recruitment agency. |