Use of marketed tax avoidance schemes in the UK (2019 to 2020)

Updated 30 November 2022

Marketed tax avoidance schemes are contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. Where this report refers to avoidance schemes, we mean marketed tax avoidance schemes.

1. Introduction from Mary Aiston, Director Counter-Avoidance

This report follows on from the Use of marketed tax avoidance schemes in the UK report published in November 2020 and provides an update on what we know about the avoidance market, focusing on the 2019 to 2020 tax year.

In 2019 to 2020, the estimated amount of tax the UK lost to marketed tax avoidance was around £0.5 billion, the same figure as for 2018 to 2019. The tax avoidance market continues to be dominated by disguised remuneration avoidance schemes, often targeted at contractors and agency workers. These schemes are frequently operated or facilitated by non-compliant umbrella companies (meaning they do not fully comply with their obligation to deduct taxes under PAYE on payments made to their workers). A small group of persistent promoters are behind most of the tax avoidance schemes marketed to the UK public.

We are continuing our efforts to squeeze the hard core of promoters out of the market, adopting a two-pronged approach involving choking the demand for these schemes and disrupting their supply. We are doing this through a mixture of a targeted educational campaign to would-be users of avoidance schemes and tough enforcement action against promoters.

We also continue to use our data to identify people who might have entered tax avoidance schemes so we can alert them to the risks and help them exit these schemes as quickly as possible.

To further squeeze the hard core of promoters, Finance Act 2021 enhanced our existing anti-avoidance regimes to enable HMRC to take quicker action against promoters. The government has also consulted on and will be legislating in Finance Bill 2021-22, a further package of measures to build on these changes, to ensure promoters face stronger sanctions more quickly.

Whilst we are working hard to tackle the promoters who sell these schemes, it remains the case that taxpayers are personally responsible for paying the right amount of tax. The vast majority of taxpayers don’t get involved in tax avoidance, but where they do, we take a risk-based approach to opening enquiries, to secure the tax that should have been paid.

People should be vigilant about arrangements they are entering into for their pay and employment, particularly contractors and agency workers who are often targeted by promoters of tax avoidance. If people see adverts promising take home pay that looks too good to be true, or become aware of a scheme that doesn’t look right or is overly complex, they should steer clear. Anyone with concerns about a scheme should consider getting independent professional tax advice, or speak to one of the tax advice charities. They should also report the scheme to HMRC.

Tax avoidance is not acceptable. It deprives our public services of the funding they need and it can leave those who get involved with big tax bills. HMRC has a vital role to play in stamping out tax avoidance. It is also important that taxpayers be wary about the arrangements they are being offered and steer clear of avoidance.

2. The size of the UK tax avoidance market

2.1 The size of the problem

In 2019 to 2020, we estimate that nearly 95 per cent of all the tax that was legally due in the UK was paid. That is £634 billion in revenues in 2019 to 2020. Of the revenues HMRC brought in, an estimated £36.9 billion was additional tax from tackling avoidance, evasion and other non-compliance. Whilst this is a considerable figure, some of the tax that was legally due went unpaid as a result of avoidance.

In 2019 to 2020 HMRC estimates that around £1.5 billion was lost to tax avoidance. About £0.5 billion of this gap relates to marketed avoidance schemes sold primarily to individuals and made up of unpaid Income Tax, National Insurance contributions (NICs) and Capital Gains Tax. These estimates are likely to be revised as more information becomes available.

Although it is a large amount of money lost to public services, and the public can rightly expect HMRC to take action, avoidance is the smallest element of the tax gap.

Figure 1: Why tax goes unpaid, 2019 to 2020

| The reason tax goes unpaid | Amount of tax revenue lost |

|---|---|

| Failure to take reasonable care | £6.7 bn |

| Legal interpretation | £5.8 bn |

| Evasion | £5.5 bn |

| Criminal attacks | £5.2 bn |

| Non-payment | £4.0 bn |

| Error | £3.7 bn |

| Hidden economy | £3.0 bn |

| Avoidance | £1.5 bn |

Note: For avoidance, about £0.5 billion relates to marketed avoidance schemes.

Our analysis shows the overall amount lost to avoidance schemes sold primarily to individuals has trended downwards since HMRC’s Counter-Avoidance function was formed in 2013, although it has remained level over 2018 to 2019 and 2019 to 2020.

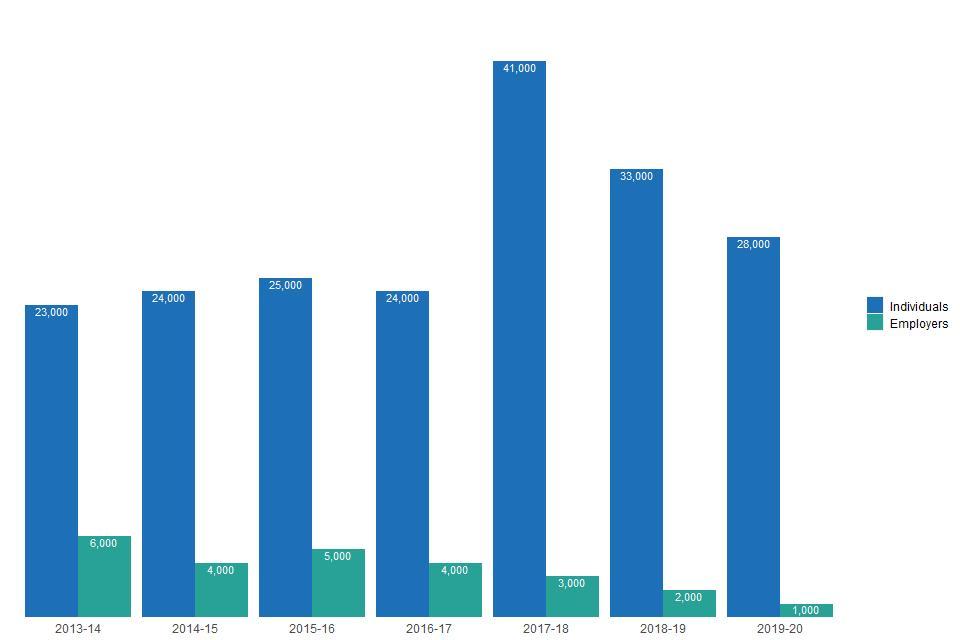

The number of individuals using avoidance schemes has changed over time, as has our ability to identify those involved in avoidance. Between 2013 to 2014 and 2016 to 2017 the number of individuals identified as involved in avoidance schemes per year was between 23,000 and 25,000. In 2017 to 2018 the number of individuals we identified as being involved in avoidance schemes peaked at around 41,000.

Since then, we have seen a reduction in the number of individuals involved in avoidance, down to 28,000 in 2019 to 2020. A large proportion of these individuals are workers employed by non-compliant umbrella companies who facilitate tax avoidance schemes. Umbrella companies employ individuals on behalf of clients and employment businesses and are responsible for, among other things, paying salary and deducting taxes under PAYE. Many umbrella companies are compliant, however, as set out in this report, some non-compliant umbrella companies exploit their position in the supply chain to operate tax avoidance schemes.

Figure 2: Number of individuals and employers using avoidance schemes each year

The chart shows an estimate of the number of individuals and employers using avoidance schemes in each year between 2013 to 2014 and 2019 to 2020, as recorded on our avoidance database, which holds records of open and closed enquiries into tax avoidance schemes and other instances of probable avoidance use.

| Year | Individuals | Employers |

|---|---|---|

| 2013-14 | 23000 | 6000 |

| 2014-15 | 24000 | 4000 |

| 2015-16 | 25000 | 5000 |

| 2016-17 | 24000 | 4000 |

| 2017-18 | 41000 | 3000 |

| 2018-19 | 33000 | 2000 |

| 2019-20 | 28000 | 1000 |

Note: The employers population includes companies, partnerships, trusts and other corporate entities using an avoidance scheme but does not include non-compliant umbrella companies who act as the employer for the majority of individuals involved in avoidance schemes. The individuals who work through non-compliant umbrella companies are counted in the individuals population. Figures are rounded to the nearest thousand. Figures may change as our data is consolidated and updated in line with our compliance activity.

Our analysis of the increase in the number of individuals identified as being involved in avoidance schemes in the year 2017 to 2018 suggests this is primarily a result of improvements to the way we identify those involved in avoidance. From the tax year 2017 to 2018, we enhanced how we used data and intelligence and therefore identified more individuals using avoidance. We now systematically use real time information from our PAYE systems to uncover more avoidance schemes that were not formally disclosed to us because promoters were trying to keep them hidden.

The number of employers who use avoidance schemes has broadly reduced since its peak at 6,000 in 2013 to 2014. This figure has reduced to about 1,000 employers involved in avoidance in 2019 to 2020. These figures do not include non-compliant umbrella companies who act as the employer for the majority of individuals involved in avoidance schemes. The individuals who work through non-compliant umbrella companies are counted in the individuals population.

We believe this trend in the reduction of employers who use avoidance schemes is due to changes in the avoidance market and HMRC action. Over the years there has been a shift away from disguised remuneration avoidance schemes targeted at small and medium sized employers, including those using Employee Benefit Trusts and Employer Funded Retirement Benefit Schemes. Instead, we now see a much greater proportion of schemes targeted at individuals such as contractors or agency workers.

2.2 The market for tax avoidance schemes

The market in 2019 to 2020 continued to be dominated by disguised remuneration schemes. This type of avoidance scheme uses contrived arrangements to try to make the taxable money someone receives for doing a job look like non-taxable money, all with the aim of avoiding the tax that is legally due. HMRC does not accept that these schemes achieve their objective of avoiding tax, and so we challenge their use to recover the correct amount of tax.

Figure 3: How the avoidance market has changed between 2018 to 2019 and 2019 to 2020

This table shows the use of avoidance by individuals by scheme type in 2018 to 2019 and 2019 to 2020.

| Scheme type | 2018 to 2019 | 2019 to 2020 |

|---|---|---|

| Disguised remuneration | 98% | 100% |

| Other | 2% | <0.1% |

Note: Figures are rounded to the nearest percentage point so can add up to more than 100%. ‘Other’ includes, but is not limited to, Stamp Duty Land Tax and Sideways Loss Relief. Figures may change as our data is updated in line with our compliance activity.

The data shows that in both years, the vast majority of marketed avoidance scheme use involving individuals related to disguised remuneration schemes.

A large proportion of disguised remuneration schemes involve an individual receiving their income or earnings as, what are claimed to be a series of:

- loans

- grants

- salary advances

- capital payments

- credit facilities

- annuities

- shares and bonuses

- fiduciary receipts

- other untaxed payments

These types of disguised remuneration schemes are generally targeted at temporary workers (such as agency workers or contractors) who are employed through non-compliant umbrella companies that operate avoidance schemes.

A smaller proportion of disguised remuneration schemes are typically used by small and medium sized employers. Unlike large employers, these smaller employers are often controlled by their owner. These employers can enter into contrived arrangements which primarily seek to make payments of earnings to their employees or directors in a way that, the promoter of the scheme argues, involves no liability to Income Tax and NICs.

As with the schemes used by temporary workers, schemes used by small and medium sized employers can involve an employer making payments directly, or via a third party, to its employees. These payments are described as loans or something else which is claimed not to be subject to Income Tax and NICs.

2.3 Who uses avoidance schemes?

HMRC data shows that, for individuals involved in tax avoidance during 2019 to 2020, use of tax avoidance schemes is most prevalent in the 41 to 50 years age group.

Figure 4: Age distribution of people who used tax avoidance schemes in 2019 to 2020

The age range of people who used tax avoidance in 2019 to 2020 and are either in PAYE or filed a Self Assessment return.

| Age range | Percentage |

|---|---|

| Under 21 | 0% |

| 21-30 | 9% |

| 31-40 | 23% |

| 41-50 | 32% |

| 51-60 | 26% |

| 61-70 | 9% |

| Over 70 | 1% |

More than half of individuals involved in tax avoidance during 2019 to 2020 have used at least one other avoidance scheme in previous years; in some cases, it appears that the original scheme has simply been re-branded.

Nine out of ten people who used avoidance schemes during 2019 to 2020 reported an income of less than £50,000 per year for tax purposes. This is similar to our findings for 2018 to 2019. As the avoidance schemes used sought to artificially lower their taxable income, their true income is likely to be much greater than reported.

Figure 5: Artificially reduced income levels among people who used tax avoidance schemes in 2019 to 2020

Artificially reduced income for people who used avoidance schemes in 2019 to 2020 and are either in PAYE or filed a Self Assessment return.

| Reported income | Percentage of people using avoidance schemes |

|---|---|

| £0-25,000 | 59% |

| £25-50,000 | 31% |

| £50-75,000 | 6% |

| £75-100,000 | 2% |

| £100,000 or more | 2% |

Note: The reported income has been extracted from HMRC’s Real Time Information PAYE data and Self Assessment data. Where a person had more than one employment in the tax year, the income was summed across the employments. Amounts declared will not reflect the full income for tax purposes.

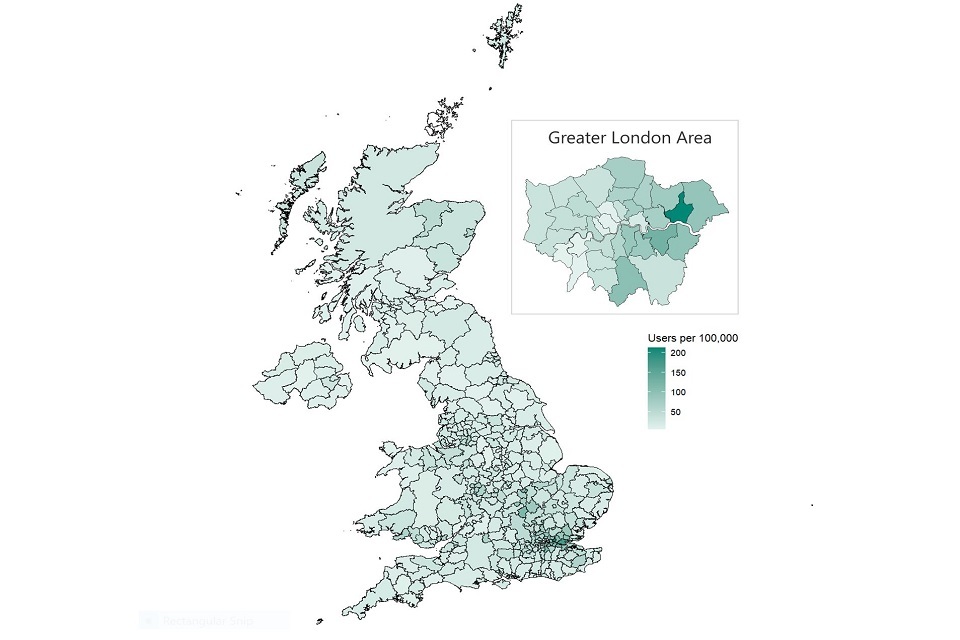

People involved in tax avoidance schemes in the UK continue to be concentrated in London, including the outer boroughs and commuter belt, and the south-east of England. There continue to be notable concentrations in Barking and Dagenham, Thurrock, Dartford and Greenwich.

As expected, given the overall decline in individuals using avoidance schemes in 2019 to 2020 compared with 2018 to 2019, there has been a decline in the prevalence of people using an avoidance scheme in most local authority areas.

Figure 6: Geographical distribution of people in the UK who used avoidance schemes during 2019 to 2020

The number of people who used tax avoidance in 2019 to 2020 by local authority, scaled by the local authority population.

Note: For each local authority area, the number of people who used an avoidance scheme in 2019 to 2020 is scaled by the total population (mid-2019 Office for National Statistics (ONS) population estimates). The frequency is presented per 100,000 inhabitants. The darker colour represents areas where there is a higher prevalence of avoidance.

Figure 7: The table shows the distribution of people who used avoidance schemes during 2019 to 2020 across the UK local authority areas

Number of people who used tax avoidance in 2019 to 2020 by local authority area, scaled by the local authority population - the frequency is shown per 100,000 inhabitants.

| Local authority | Cases per 100,000 |

|---|---|

| Barking and Dagenham | 201-225 |

| Thurrock | 151-175 |

| Dartford, Greenwich | 126-150 |

| Bexley, Corby, Croydon, Harlow, Havering, Lewisham, Milton Keynes, Redbridge, Southwark, Stevenage | 101-125 |

| Basildon, Bedford, Brentwood, Chelmsford, Enfield, Gravesham, Hackney, Hammersmith and Fulham, Haringey, Hertsmere, Lambeth, Luton, Newham, Northampton, Slough, Waltham Forest, Watford, Welwyn Hatfield | 76-100 |

| Aberdeen City, Ashford, Barnet, Birmingham, Brent, Bromley, Broxbourne, Castle Point, City of Bristol, Ealing, Great Yarmouth, Harrow, Hillingdon, Hounslow, Islington, Kettering, Leicester, Manchester, Medway, Merton, Newport, Peterborough, Reading, Runnymede, Sandwell, Southampton, Southend-on-Sea, Spelthorne, Surrey Heath, Sutton, Swansea, Swindon, Tower Hamlets, Walsall, Wandsworth, Wellingborough, Woking, Wolverhampton, Worcester | 50-75 |

Note: For each local authority area, the number of people who used avoidance in 2019 to 2020 is scaled by the total population (mid-2019 ONS population estimates). The frequency is presented per 100,000 inhabitants and local authorities with fewer than 50 people who used an avoidance scheme per 100,000 inhabitants are not shown. Values for local authorities with fewer than 10 people who used an avoidance scheme are not shown.

As with 2018 to 2019, about a fifth of the people who used avoidance schemes during 2019 to 2020 had an employment categorised as ‘Bookkeeping activities’. Most of the employers classified as ‘Bookkeeping activities’ along with those categorised as ‘Temporary Employment Agencies activities’ and ‘Other business support service activities’, have been identified as umbrella companies. Where someone works through an umbrella company HMRC data does not show what type of business they are ultimately working for. Our data does not give us a further breakdown of professions.

About a fifth of the people who used avoidance schemes during 2019 to 2020 had an employment categorised as hospital activities.

This is consistent with our findings for the 2018 to 2019 avoidance population suggesting individuals using avoidance schemes in 2019 to 2020 are broadly employed in similar sectors to those in the previous year, and that a significant proportion of individuals involved in avoidance schemes were employed by umbrella companies.

Figure 8: Most common employment types for people who used avoidance schemes during 2019 to 2020

Top 10 most frequent employment types for people who used avoidance schemes in 2019 to 2020 and are on PAYE.

| Employment type | Percentage |

|---|---|

| Bookkeeping activities | 21% |

| Hospital activities | 20% |

| Temporary employment agency activities | 8% |

| Management consultancy activities other than financial management | 8% |

| Combined office administrative service activities | 5% |

| Other activities of employment placement agencies | 3% |

| Other human health activities | 3% |

| Business support activities not classified elsewhere | 3% |

| Professional, scientific and technical activities not classified elsewhere | 3% |

| Primary education | 2% |

Note: Sectors are extracted from HMRC’s Real Time Information PAYE data. A relevant code from the International Standard Industrial Classification is associated to each employment. Where someone had more than one employment on record, the sector associated with the highest paid employment was selected.

3. Tax avoidance promoters

3.1 Who is selling these schemes

There are about 20 to 30 promoter organisations who are behind most of the tax avoidance schemes that are marketed to the UK public.

Since the last report was published some promoter organisations have left or significantly reduced their activity in the avoidance market. However, new promoters have entered the market.

These organisations typically comprise multiple entities involved in promoting their avoidance schemes. Some of the entities involved in promoting avoidance are umbrella companies that facilitate the operation of disguised remuneration avoidance schemes.

Many umbrella companies are compliant. However, their position in the labour supply chain enables some to operate tax avoidance schemes which involve making payments to the individuals they employ, either directly or via a third party, in a contrived way to seek to avoid the payment of Income Tax and NICs on the individual’s earnings.

We continue to see non-compliant umbrella companies operating avoidance schemes. We estimate there are currently around 60 to 80 non-compliant umbrella companies involved in the operation of disguised remuneration avoidance schemes. Many of these umbrella companies are short lived, typically operating for less than 2 to 3 years before winding-up their activities and being replaced with newly formed umbrella companies operating new avoidance schemes.

The government has already announced its commitment to expand state enforcement to umbrella companies by bringing these companies within scope of the new Single Enforcement Body and has recently published a call for evidence on the umbrella company sector. The call for evidence invites views on a broad range of questions regarding the role that umbrella companies play in the labour market and on the government’s understanding of the behaviours in the market that are causing concern.

3.2 How HMRC is tackling promoters

We continue to implement the actions set out in our published strategy on Tackling promoters of mass-marketed avoidance schemes and sustain our pressure on promoters by disrupting their activities and supply chains.

Using our existing anti-avoidance regimes

We act quickly once we become aware of a scheme, to disrupt the promoter’s business and stop them selling the scheme. We challenge schemes and promoters, using our powers under the Disclosure of Tax Avoidance Scheme (DOTAS), Promoter of Tax Avoidance Scheme (POTAS) rules and the Enablers penalty.

We have had success over the past few years having taken legal action against several promoter organisations for failure to disclose schemes under DOTAS. The 9 decisions received to date have confirmed our view that the schemes are notifiable under the DOTAS regime. One such win in March 2019 protected tax of over £40 million and required the promoter to disclose the names and addresses of the over 1,000 high earners who used the scheme.

Many other promoters have disclosed schemes when we challenged them, to avoid litigation. We continue to litigate cases, where necessary, to ensure schemes are correctly disclosed to HMRC.

Our activity is not restricted to the powers we have under our anti-avoidance regimes. It extends to investigations into any potential non-compliance across all of the promoter’s tax affairs, this can include their own Income Tax, Corporation Tax and VAT returns.

During 2019 to 2020 we made over 500 interventions into promoters and enablers of tax avoidance across a range of different taxes and reporting obligations. This includes interventions into non-compliant umbrella companies operating avoidance schemes.

As well as our full range of civil sanctions, where an avoidance scheme involves fraud or other criminal offences, HMRC uses the full range of criminal powers to tackle those who promote or enable avoidance schemes. Since April 2016, more than 20 individuals have been convicted for offences relating to fraudulent arrangements promoted and marketed as tax avoidance schemes. The courts ordered over 100 years of custodial sentences. Most of these individuals were promoters.

Strengthening our existing anti-avoidance regimes

Our existing powers have been strengthened by new legislation enacted in Finance Act 2021. The measures include:

- changes to the DOTAS regime which enable HMRC to act decisively when promoters fail to provide information. This will help reduce the time it takes for HMRC to obtain details of an avoidance scheme by over a year

- changes to the POTAS regime to allow more effective issue of ‘stop notices’ and to prevent promoters abusing corporate structures to avoid their obligations under the POTAS rules

- changes to the Enabler penalty to enable us to issue information notices earlier and speed up the point at which penalties can be issued to enablers

- changes to the general anti-abuse rule (GAAR) so it can be used to counteract tax avoidance schemes marketed at partnerships.

We have used the new powers enacted in Finance Act 2021 to issue over 130 information notices to gather evidence of organisations who are enabling the creation and marketing of tax avoidance. We expect this to provide us with the information we need to take action under the Enablers penalty legislation.

We have also used the new powers to issue 5 DOTAS notices to promoters. These notices require the promoters to provide information to satisfy HMRC that the scheme is not notifiable. If they fail to provide that information, HMRC will issue a Scheme Reference Number (SRN). We will then take the legal steps to publish the names of promoters and details of the schemes they are promoting. We anticipate publishing the first such details in early 2022.

Further steps to tackle promoters

The government has announced and is legislating for further measures which will build on the changes to existing avoidance regimes and ensure promoters face stronger sanctions more quickly.

These measures will:

- clamp down on promoters who dissipate or hide their assets to avoid paying penalties, by ensuring HMRC can secure a promoter’s assets to pay any relevant penalties

- penalise UK entities which facilitate the promotion of tax avoidance schemes in the UK on behalf of offshore promoters

- enable HMRC to name promoters and the schemes they promote at the earliest possible stage, to support taxpayers to stay clear of avoidance

- allow HMRC to present winding-up petitions to court for companies or partnerships involved in promoting tax avoidance, where it can be shown they are not operating in the public interest

Working with partner bodies

We are also working with partner bodies to leverage our joint interest in tackling promoters of tax avoidance and debunking misleading communications around tax avoidance. In November 2020, HMRC and the Advertising Standards Authority (ASA) issued a joint Enforcement Notice which set out what promoters should and should not include in their internet advertising. As at October 2021, 11 websites have shut down, 2 following referrals to the ASA, and 5 have been amended to comply with the notice. A further eight websites have been removed following other HMRC challenge.

HMRC makes pro-active referrals to the Insolvency Service (INSS) for it to consider whether disqualification proceedings should be brought against a director under the Company Directors Disqualification Act 1986.

We are currently aware of 14 director disqualifications as a result of INSS investigations involving those who promoted or used tax avoidance, where HMRC has made referrals or supported enquiries. We are also aware of a number of directors, many of whom are involved in the promotion of avoidance schemes, who are currently being investigated by the Insolvency Service or undergoing disqualification proceedings.

4. HMRC is here to help people get out of avoidance

4.1 HMRC is here to help

If anyone is worried about becoming involved in a tax avoidance scheme, or thinks that they are already involved and wants to get out of one, HMRC is here to help. We offer a wide range of support to get people back on track or avoid being caught out in the first place.

Anyone concerned about the schemes they are currently using should consider getting independent professional tax advice or speak to one of the tax advice charities. Anyone with concerns can also email HMRC.

4.2 Helping people settle their tax liabilities

HMRC is committed to helping people get out of avoidance and making it as easy as possible for them to settle their outstanding avoidance use and pay the tax due. In August 2020 we published the disguised remuneration 2020 settlement terms. These can be used for settlements in relation to all disguised remuneration liabilities.

There is a different process for people to settle their tax affairs if they have used other types of tax avoidance scheme. To find out more about these processes, anyone already speaking to someone at HMRC about settling should contact them to discuss. Anyone who doesn’t have an existing contact should contact HMRC’s dedicated team for help.

In all cases, people who are using an avoidance scheme are encouraged to contact HMRC as soon as possible. Settling will give people certainty about their tax affairs and helps them get out of tax avoidance for good. It may also mean they do not face a bigger tax liability at a later date if the scheme they used is referred to the tribunal.

4.2 Helping people with debt

Where someone is unable to pay the tax they owe in full and on time, we want to work with them. We are always ready to help those who want to settle their affairs. We do not want anyone to worry and we are here to make things as straightforward as possible.

As we become aware that someone has an avoidance related tax debt, we always try to contact them by phone, post or SMS so that we can talk about their situation and agree a way forward. We urge people to respond to these communications as soon as possible because, unless we can discuss their situation, we cannot tell if they need support or are refusing to pay.

In all cases, we want to work with people to find a way for them to pay off their tax debt as quickly as possible, and in an affordable way for them.

Everyone is different, so the support we offer differs from person to person – we tailor our support to individual needs. Where people are facing difficulty in making a tax payment, they should ask us about affordable payment options. We will work with them to try and agree a payment plan called Time to Pay, based on their financial position. We typically have more than half a million arrangements in place at any one time, and nine out of ten of them complete successfully.

4.3 Stopping tax avoidance early or before it starts

HMRC is taking action to help taxpayers understand the risks and consequences of their involvement as soon as possible after they enter a tax avoidance scheme.

We are contacting taxpayers when our systems show they might have joined an avoidance scheme. We make them aware of HMRC’s concerns about the scheme they have joined and help them to understand what they need to do to pay the right amount of tax. The aim of this is to help them move out of their avoidance schemes before they build up large tax bills.

We also ran a pilot for an advisory service where we have written to taxpayers suspected of being involved in an avoidance scheme and invited them to contact us to get advice on their arrangements.

We are exploring ways to enhance our contact to increase the number of people who choose to leave avoidance. We are expanding the advisory service pilot so that we are offering the service to greater numbers of people we suspect are using an avoidance scheme.

We also launched a marketing campaign in November 2020 to help educate taxpayers so that they can stay clear of tax avoidance. We recently launched the next phase of this Tax avoidance - don’t get caught out campaign. The campaign aims to help people spot tax avoidance and make sure they understand the risks.

We want to get people out of avoidance faster and we’re here to help anyone who is worried they might be caught up in it.

This is, and always has been, about ensuring everyone pays the correct amount of tax.

5. Glossary

| Term | Definition |

|---|---|

| Advertising Standards Authority (ASA) | The UK’s independent regulator of advertising across all media. They apply the Advertising Codes, which are written by the Committees of Advertising Practice (CAP). |

| Agency, often referred to as intermediaries | Agencies are generally recruiters who look to supply engagers with flexible labour. There are often several agencies in the supply chain between the engager and the individual providing their labour. |

| Contractor or Agency worker | Individual providing flexible professional services to an engager, either directly or through an agency. |

| Contrived Arrangement or Transaction | An arrangement or transaction that has an artificial structure that does not accurately reflect the true nature and intention of the arrangement or transaction. |

| Disclosure of Tax Avoidance Schemes (DOTAS) | Introduced in Finance Act 2004 for HMRC to obtain early information about how tax arrangements work and information about who has used them. Disclosure has no effect on the underlying tax position of a taxpayer or tax avoidance scheme, but there may be penalties for failure to disclose on both the promoters and scheme users. |

| Disguised remuneration | Arrangements through which individuals are rewarded through a third party in the form of loans, or other payment arrangement, often involving an offshore trust. Outstanding balances on these loans at 5 April 2019 are subject to the Loan Charge in the 2018 to 2019 tax year. Disguised remuneration tax avoidance schemes claim to avoid the need to pay Income Tax and NICs. |

| Employee Benefit Trust (EBT) | A trust set up by a company to hold cash and/or other assets (eg shares) to provide benefit for employees and/or their families. These can be established either in the UK or offshore. There are legitimate uses for these, but they are also often used as part of disguised remuneration schemes. |

| Enabler | Any person who is responsible, to any extent, for the design, marketing or otherwise facilitating another person to enter into abusive tax arrangements. |

| Enablers Penalty | A penalty for any person who enables the use of abusive tax arrangements, which are later defeated. The legislation for this was introduced in schedule 16 to the Finance (No.2) Act 2017. |

| General Anti-Abuse Rule (GAAR) | Introduced in Finance Act 2013 to deter taxpayers from entering into abusive arrangements, and to deter would-be promoters from promoting such arrangements. Additional GAAR provisions were enacted in Finance Act 2016. The GAAR operates to counteract the abusive tax advantage which is trying to be achieved. The counteraction that the GAAR permits will be a tax adjustment which is just and reasonable in all the circumstances. The appropriate tax adjustment is not necessarily the one that raises the most tax. |

| HM Revenue and Customs (HMRC) | HMRC is the UK’s tax, payments and customs authority. |

| Loan charge | Introduced in Finance Act 2017 to address tax loss to the Exchequer due to the use of disguised remuneration schemes. The legislation required scheme users to either repay their outstanding disguised remuneration loans, or declare them as income on their 2018 to 2019 tax returns. The Income Tax and NICs charges on this income is known as the ‘loan charge’. |

| Marketed tax avoidance | Contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. |

| PAYE, also referred to as Pay As You Earn | A system of paying Income Tax in which an employer pays an employee’s tax directly to HMRC. The taxes paid are then deducted by the employer from the employee’s salary/wages. |

| Promoters of Tax Avoidance Schemes (POTAS) | Introduced in Finance Act 2014, the legislation allows HMRC to issue conduct notices to promoters and subsequently monitor those who breach a conduct notice. Monitored promoters are subject to information powers and penalties, which will also apply to intermediaries that continue to represent them after the monitoring commences. |

| Promoter | Those who devise and market the use of tax avoidance schemes, including securing QC opinions, producing promotional material and marketing the schemes, either to agencies as an option for their staff or directly to contractors. Can be summarised as anyone who, in the course of providing tax services: is to any extent responsible for the design of a tax scheme (defined by reference to DOTAS); approaches others with a view to making a scheme available to them; makes a scheme available for implementation to others; organises or manages the implementation of a scheme |

| Self Assessment | Self Assessment is a system HMRC uses to collect Income Tax. Tax is usually deducted automatically from wages, pensions and savings. Individuals and businesses with other income must report it in a tax return. Completed for each tax year ending 5 April tax returns are due on 31 October (paper) or 31 January (online) following the end of the tax year. |

| Stop notice | Forming part of the POTAS regime, stop notices may be issued be to a person who HMRC suspect is promoting an avoidance scheme. If a promoter does not comply with a stop notice they would meet a POTAS threshold condition which may lead to HMRC giving them a conduct notice. |

| Tax advantage | A reduction in the amount of tax due or increase in the amount tax reclaimable by a person or organisation in particular circumstances. |

| Tax avoidance | Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce this advantage. It involves operating within the letter, but not the spirit, of the law. |

| Tax evasion | Tax evasion is where there is a deliberate attempt not to pay the tax which is due. It is illegal. |

| Tax gap | The difference between the amount of tax that should, in theory, be paid to HMRC, and what is actually paid. |

| Tax liabilities | The total amount of tax owed by an individual or business to HMRC. |

| Tax year | For individuals, the Self Assessment tax year starts on the 6 April and ends 5 April the following year. For example, the 2019 to 2020 tax year began on 6 April 2019 and ended on the 5 April 2020. For corporate bodies, the tax year depends on the end of the accounting period. |

| Umbrella company | A UK limited company which acts as an employer to a number of individuals, meeting PAYE and other requirements where operating legitimately. It signs contracts to provide the individual’s labour to engagers, either directly or through another intermediary such as a recruitment agency. |