Understanding the experience of customers who need extra help when accessing tax support from voluntary and community sector (VCS) organisations

Published 30 March 2023

Quantitative research with customers who need extra help.

HM Revenue and Customs (HMRC) Research Report 690.

Research conducted by IFF Research between March and May 2022, the findings in this report reflect the attitudes of participants at the time it was conducted. Prepared by IFF Research (Alistair Kuechel, Alex Pearson, Dani Cervantes, and Jamie Pitchford) for HMRC.

Disclaimer: The views in this report are the authors’ own and do not necessarily reflect those of HMRC.

1. Glossary

| Term | Definition |

|---|---|

| Child Benefit | A payment made to parents and carers of children under 16 or people under 20 if they are in an approved form of education or training. |

| Customers who need extra help (CWNEH) | HMRC customers who require extra support with their tax affairs. This can be for a variety of reasons such as medical conditions, confidence, access, or changes in circumstances (this is not an exhaustive list), these can have a profound effect on customers and their ability to manage their tax affairs. |

| Extra support team | A specialist HMRC service available to customers who may need extra support. |

| Funded voluntary and community sector organisations | Voluntary and community sector organisations which are supported by HMRC. |

| Pay As You Earn (PAYE) | The system employer and pension providers use to take Income Tax and National Insurance contributions. |

| Self Assessment | Self Assessment is a process HMRC uses to collects Income Tax. Tax is usually deducted automatically from wages, pensions, and savings. People and businesses with other income must report it in a Self Assessment tax return. |

| Tax Credits | Payments made to families with children (Child Tax Credits) and people in employment on lower incomes (Working Tax Credit). |

| Unfunded voluntary and community sector organisations | Voluntary and community sector organisations which are not supported financially by HMRC |

| Voluntary and community sector | Charities and not-for-profit organisations which operate with the aim of helping people |

2. Executive summary

2.1 Introduction

Some HM Revenue and Customs (HMRC) customers require extra support with their tax affairs. This can be for a variety of reasons, such as medical conditions, confidence, access, or changes in circumstances (this is not an exhaustive list). This group of customers is referred to by HMRC as Customers Who Need Extra Help (CWNEH).[1]

As part of its commitment to serve these customers, HMRC provides tailored support through a variety of different services. This includes, but is not limited to, a team of in-house specialist advisors (the extra support team), funding and signposting to voluntary and community sector organisations, offering alternatives to telephone helplines (for example, Webchat and British Sign Language) and delivering the Trusted Helper Service.[2]

Previously HMRC has undertaken research to better understand the needs of these customers and their use of voluntary and community sector organisations for support with their tax affairs[3]. This research was commissioned with two overarching objectives. Firstly, to update HMRC’s understanding following significant contextual changes in recent years (for example, the COVID-19 pandemic) and changes made to HMRC’s support offer, following the findings from the previous research.[4] Secondly, to provide insight into how HMRC’s services and relationships with voluntary and community sector organisations can continue to be improved so that customers are successfully supported.

The specific objectives were to:

- gain a deeper understanding of the journey and emotional barriers facing CWNEH when accessing support with their tax affairs.

- assess the effect of HMRC’s recent changes to the ways CWNEH are supported.

- identify and assess any persistent effects of recent contextual change on CWNEH.

- understand how effective CWNEH perceive HMRC’s services to be in meeting their specific needs, and how these could be improved.

- understand how comfortable CWNEH feel about the future digitisation of tax and how confident they feel about their ability to adapt.

- explore if, how and why relationships between CWNEH, the voluntary and community sector and HMRC have changed since the implementation of actions following the completion of the previous research in 2019.

To achieve these objectives, IFF Research conducted qualitative interviews with 35 HMRC customers, all of whom had used voluntary and community sector organisations for additional support with tax matters over the previous 6 months.[5] When interpreting the data in this report it should be noted qualitative samples are small and purposively designed, so the findings cannot be considered as representative of the views of all customers that receive tax support from voluntary and community sector organisations.

2.2 Key findings

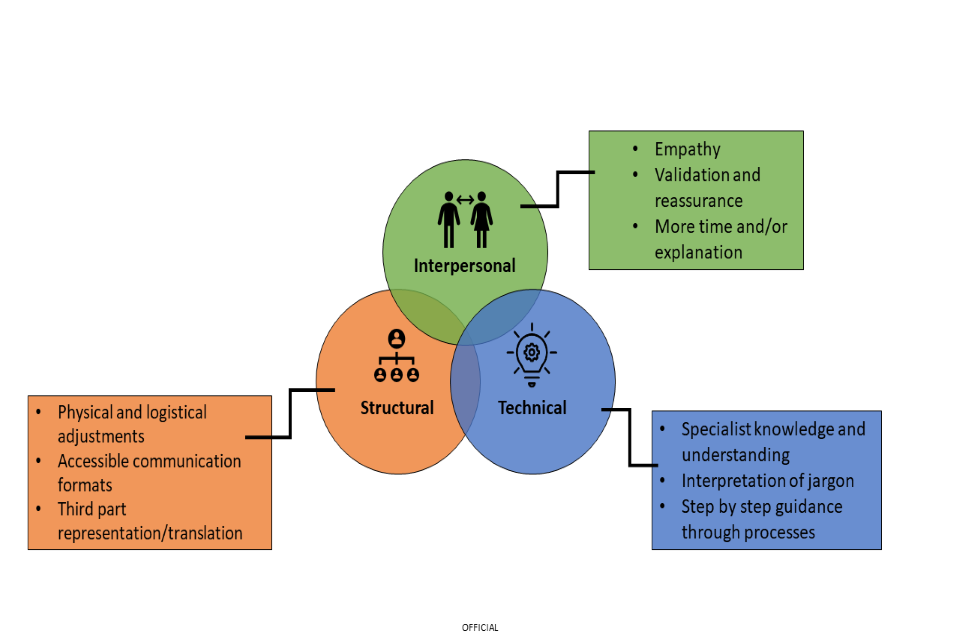

The type of support participants required can be segmented into three main types: interpersonal (that is the need for understanding, empathy, and reassurance), technical (that is the need for specialist knowledge and expertise) and structural (that is the need for physical and logistical adjustments). Some participants exhibited two or more of these needs.

The research observed many different journeys to obtain the support required. Some participants began their support journey with HMRC before seeking support from a voluntary and community sector organisation, while others started with a voluntary and community sector organisation without consideration for HMRC as a source of support. Within each of these groups there was also a mix of first time and repeat users of voluntary and community sector organisations and, with regards to first time users, a mix of those that had identified the organisation themselves and those that had been referred. Some participants received support from HMRC’s extra support team in addition to a voluntary and community sector organisation.

The variety and complexity of relationships between customers, voluntary and community sector organisations and HMRC is consistent with the findings of previous research. However, there is evidence of greater collaboration between voluntary and community sector organisations and HMRC’s extra support team. Specifically, there is evidence of voluntary and community sector organisations referring customers to the extra support team service.

Participants who started their support journey with HMRC felt that HMRC’s support offer fell short of their requirements because of two factors: barriers to accessing HMRC advisors and difficulty in understanding the information and guidance provided by HMRC. They consequently sought support from voluntary and community sector organisations.

For some participants, barriers to accessing HMRC’s support offer had been introduced or exacerbated by recent changes to the economy and/or their personal circumstances. However, the influence of these factors is likely to be short-lived. They tended to be entwined with recent events and participants did not expect them to persist once these events had passed.

The research uncovered a low level of awareness of HMRC’s extra support team. Some participants had engaged with this service having been referred by a voluntary and community sector organisation and were pleased with the support they received. However, there were comments from these participants that the extra support team should be easier to access.

Some participants who started their support journey with a voluntary and community sector organisation were motivated to do so by perceived shortcomings in HMRC’s support offer. They did not think HMRC could deliver the support they required. Other participants accessed support from a voluntary and community sector organisation because they did not trust HMRC or did not feel confident dealing with HMRC directly.

Participants felt that the support delivered by voluntary and community sector organisations was critical to them achieving positive outcomes. Compared to HMRC’s standard (non-extra support team) support offer, the support available from voluntary and community sector organisations was felt to be easier to access and better suited to meet their needs.

If faced with a similar tax issue in the future, some participants said that they would go to a voluntary and community sector organisation for support. This was typically because they were satisfied with their recent experience and so would look to replicate it. Other participants said they would contact HMRC. This was because, off the back of the recent support delivered by voluntary and community sector organisations, they now felt equipped with the confidence and technical knowledge to deal with HMRC directly.

Some participants were comfortable with the prospect of increased digitisation of the tax system. These participants were confident using digital services, with some already using those offered by HMRC to manage their tax affairs. They thought that digitisation would benefit them by making the tax system more convenient and reducing barriers to access.

However, some participants had concerns about increased digitisation of the tax system owing to limited digital skills, barriers to accessing internet enabled devices and a lack of interest in using digital services. These participants felt that increased digitisation of the tax system would force them to seek additional support from HMRC, voluntary and community sector organisations and friends or family members.

2.3 Reflections

The research found that voluntary and community sector organisations play a pivotal role in HMRC’s support model. Customers revealed that they were able to obtain support with their tax affairs through a voluntary and community sector organisation in instances when they are unable to do so directly from HMRC (due to barriers to access or difficulties understanding information) and in instances when they were unwilling to seek support from HMRC (due to emotional barriers).

In addition to providing standalone support, the research found that voluntary and community sector organisations also complement HMRC’s support offer by signposting customers to HMRC services and resources. For example, referring customers to the extra support team and providing details of how to find forms online. They also facilitate customer interactions with HMRC by providing interpretation and representing customers in discussions with HMRC advisors.

A key finding of the research was a low level of awareness of existing support available from HMRC. Specifically, alternatives to telephone helplines, and the existence of the extra support team.

3. Introduction

3.1 Background and objectives

Some HMRC customers require extra support with their tax affairs. This can be for a variety of reasons, such medical conditions, confidence, access, or changes in circumstances (this is not an exhaustive list). This group of customers is referred to by HMRC as Customers Who Need Extra Help (CWNEH).[6]

As part of its commitment to serve these customers HMRC provides tailored support through a variety of different services. This includes, but is not limited to, a team of in-house specialist advisors (the extra support team), funding and signposting to voluntary and community sector organisations, offering alternatives to telephone helplines (for example, Webchat and British Sign Language) and delivering the Trusted Helper Service.

Voluntary and community sector organisations play an important role in HMRC’s support model. They provide frontline support with tax matters (for example, tax credits, child benefit and Self Assessment) and non-tax issues (for example, mental health, low income, and age-related difficulties). In 2020/21 alone, the voluntary and community sector organisations funded by HMRC provided support to 38,000 HMRC customers.[7] Voluntary and community sector organisations and HMRC work collaboratively, with customers being signposted from one to the other. HMRC’s extra support team receive over 6,000 referrals from voluntary and community sector organisations each year.

This research was commissioned with two overarching objectives. Firstly, to update HMRC’s understanding following significant contextual changes in recent years (for example, the COVID-19 pandemic) and changes made to HMRC’s support offer, following the findings from the previous research. [8] Secondly, to provide insight into how HMRC’s services and relationships with voluntary and community sector organisations can continue to be improved so that customers are successfully supported. The specific objectives were to:

- gain a deeper understanding of the journey and emotional barriers facing customers when accessing support with their tax affairs

- assess the effect of HMRC’s recent changes to the ways customers are supported

- identify and assess any persistent effects of recent contextual change on customers

- understand how effective customers perceive HMRC’s services to be in meeting their specific needs, and how these could be improved

- understand how comfortable customers feel about the future digitisation of tax and how confident they feel about their ability to adapt

- explore if, how and why relationships between customers, the voluntary and community sector and HMRC have changed since the implementation of actions following the completion of the previous research in 2019.

3.2 Methodology

Between 29 March and 30 May 2022, IFF Research conducted qualitative interviews with 35 HMRC customers who had used voluntary and community sector organisations for support with their tax affairs. All participants had sought support from voluntary and community sector organisations with at least one of the five tax issues of interest to the research over the last 6 months. These were: tax credits, child benefit, debt owed to HMRC, Self Assessment and Pay As You Earn (PAYE).

A qualitative approach was adopted for two reasons. Firstly, qualitative interviews are an effective method of understanding experiences and journeys as they allow for in-depth discussions with participants, while nuances, complexities and subtle signals can be captured and unpicked by the interviewer. Secondly, a qualitative approach is well suited to the potentially sensitive topics relevant to this research (for example, financial circumstances and mental and physical health). Qualitative interviews allow participants to express their views and experiences in their own words and in their own time, and interviewers can adapt their approach to accommodate the different circumstances.

Sample and recruitment

The contact details for participants were obtained from one of three sources:

- voluntary and community sector organisations

- HMRC’s extra support team

- free-find recruitment

HMRC provided contact details of voluntary and community sector organisations they work with, including both funded and unfunded organisations. IFF Research emailed these organisations requesting their help with recruitment by publicising the research amongst their network and/or sharing the contact details of people who had recently used the organisation for support in their dealings with HMRC. HMRC also provided contact details of individuals who had received support from the extra support team and gave consent to be contacted by IFF Research about this research.

Additionally, IFF Research enlisted the services of Mojo Fieldwork to free-find customers who had received support from voluntary and community sector organisations with at least one of the five tax issues of interest in the previous 6 months.

Once contact details of customers had been acquired, specialist recruiters within IFF Research contacted each individual to recap the purpose of the research, answer any questions, and to check their eligibility for the research.

Fieldwork

Between 29 March and 30 May 2022, IFF Research conducted qualitative interviews with 35 participants.

A topic guide was used to ensure discussions stayed on track and all the key points relevant to the research objectives were covered. The topic guide is available in Annex A.

All interviews were conducted remotely, either by telephone or video call. Participants were given the option to have a face-to-face interview to meet any accessibility needs, but none chose to do so.

Interviews took 60 minutes to complete on average. As a ‘thank you’ for their time, IFF Research paid all participants £50. This was paid via bank transfer, PayPal, or vouchers for major retailers, depending on the preference of the participant.

Profile of participants

Recruitment quotas were used to ensure that the 35 participants interviewed sought support for a range of different tax matters and from a variety of different sources (including both funded and unfunded voluntary and community sector organisations and HMRC’s extra support team). Table 2.1, Table 2.2 and Table 2.3 present a breakdown of completed interviews by the area of tax that participants needed support with, and the sources of support used.

Table 2.1: Tax matters

| Tax matter | No. of participants |

|---|---|

| Pay As You Earn (PAYE) | 15 |

| Self Assessment (personal, for example, on income from abroad) | 9 |

| Self Assessment (business, for example, self-employed) | 5 |

| Tax credits / benefits | 6 |

| Owing money to HMRC | 7 |

| Other dealings | 6 |

Table 2.2: Voluntary support type

| Voluntary and community sector organisation type | No. of participants |

|---|---|

| Funded | 15 |

| Unfunded | 20 |

Table 2.3: Use of HMRC’s extra support team

| Use of HMRC’s extra support team | No. of participants |

|---|---|

| Yes | 6 |

| No | 29 |

Quotas were also used to ensure participants covered a wide range of different demographic and personal characteristics. Table 2.4 presents a breakdown of completed interviews by gender, 2.5 age, 2.6 ethnicity, 2.7 caring responsibilities, and 2.8 health condition/disability status.[9]

Table 2.4: Gender

| Gender | No. of participants |

|---|---|

| Male | 14 |

| Female | 21 |

Table 2.5: Age

| Age | No. of participants |

|---|---|

| 25-34 | 4 |

| 35-44 | 9 |

| 45-54 | 7 |

| 55-64 | 8 |

| 65-74 | 4 |

| 75+ | 3 |

Table 2.6: Ethnicity

| Ethnicity | No. of participants |

|---|---|

| White / White British | 23 |

| Asian / Asian British | 5 |

| Black / African / Caribbean / Black British | 5 |

| Mixed / Multiple ethnic groups | 2 |

Table 2.7: Type of caring responsibility

| Type of caring responsibility | No. of participants |

|---|---|

| Shared caring responsibilities | 11 |

| Single parent | 7 |

| No caring responsibilities | 17 |

Table 2.8: Health condition / disability status

| Health condition / disability status | No. of participants |

|---|---|

| Physical health condition or disability | 12 |

| Mental health condition | 5 |

3.3 About this report

When interpreting the data in this report it should be noted that qualitative research provides insight into perceptions, feelings, and behaviours rather than quantifiable findings from a statistically representative sample. Qualitative samples are small and purposively designed, so the findings cannot be considered as representative of the views of all customers.

Pseudonymised case studies are used throughout this report to illustrate the experiences, support journeys and opinions of participants. These case studies include:

- case study A (Emily): Participant with technical and interpersonal support needs

- case study B (Abi): Participant who contacted HMRC initially before seeking voluntary and community sector support

- case study C (George): Participant with a positive experience of voluntary and community sector support

- case study D (Alan): Participant with concerns about increased digitisation

4. Accessing support

4.1 Types of support needed

The type of support participants required can be segmented into three main types: interpersonal, technical, and structural. As presented in Figure 3.1 these support needs overlapped, with some participants requiring a combination of two or more.

Figure 3.1: Support needs

Participants with technical needs required support to help them better understand their tax matters and obligations. This included interpretation and clarification of communications from HMRC, assistance with forms and applications and guidance on the actions required to resolve issues or disputes. These participants did not feel able to deal with their tax matters independently. From their perspective, specialist knowledge and expertise were required to ensure matters were dealt with correctly. In some cases, participants wanted to check that HMRC’s stance was accurate.

“The Child Tax Credit letters never make any sense. It is not straightforward to read, and you have to clarify your income and I just never have that information to hand and trying to work out whether it’s correct [is difficult].”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

“Initially I thought I would give [my Self Assessment tax return] a go and try and, you know, see how it pans out. But then I started finding areas that were quite grey and ambiguous.”

Unfunded voluntary and community sector, Self Assessment (personal)

Participants with structural needs required physical and/or logistical adjustments to be made to allow them to access information and communicate with advisors. For example, face-to-face meetings, guidance in alternative formats and interpreters joining discussions with HMRC advisors. Some of these participants had a disability which meant that without such structural adjustments they would be unable to interact with HMRC and fulfil their tax obligations.

“I can’t use the phone… it would be really helpful to be able to just pick up the phone, but I have none of that.”

Unfunded voluntary and community sector, Self Assessment (personal)

“That’s why I needed some support; because I have limited minutes on my phone contract, limited Wi-Fi, stuff like that. That’s why I had to use a secondary organisation to contact HMRC.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

Interpersonal support needs cut across both technical and structural needs. Participants wanted support - whether technical, structural or both - to be delivered by someone with an in-depth understanding of their circumstances, who would treat them with integrity and empathy and could dedicate sufficient time to their issue. Some participants had recently experienced stressful and emotionally distressing situations, including unemployment and bereavement, which had enhanced their need for interpersonal support.

“[HMRC] advisors didn’t show any empathy or anything. They didn’t sympathise with me. They were quite blunt, just like I was another customer, not a person. I’m just a number to them.”

Unfunded voluntary and community sector, PAYE

“[I wanted] sensitivity to the fact that although someone sounds articulate and educated, things might be going on in their life.”

Funded voluntary and community sector, Self Assessment (personal)

Case Study A: Participant with technical and interpersonal support needs

Emily is in her mid-thirties and runs her own education consultancy business.

In 2019, both Emily’s brother and mother died.

Bereavement caused Emily to enter “a very distressed and grieving state” causing her to withdraw from some aspects of her business. She then experienced a significant reduction in earnings during the COVID-19 pandemic. She did not file a Self Assessment return for two years and was sent a letter from HMRC to inform her she owed £10,000.

Emily tried to resolve the issue with HMRC directly but felt unable to access an advisor that was understanding of her circumstances and felt overwhelmed by the forms she was sent.

“This woman [at HMRC] was very impatient and was saying ‘Come on – It’s easy,’ … She was very brusque about the debt and almost judgemental. All the things you wanted to avoid.”

Emily sought support from a voluntary and community sector organisation because she required interpersonal and technical support. They referred to the extra support team and helped re-structure her debts. Her experience of the extra support team was very positive.

4.2 Accessing HMRC and voluntary and community sector support

Two distinct starting points for accessing support were uncovered. Some participants contacted HMRC initially, but due to difficulties resolving their issue directly, sought support from a voluntary and community sector organisation. Other participants went directly to voluntary and community sector organisations without considering HMRC as a source of additional support.

Accessing support from HMRC

Some participants started their support journey with HMRC but were unable to resolve their issue or dispute directly. This was because of two primary reasons: difficulties with access and difficulties with understanding. Some participants faced both barriers.

Barriers to accessing support and guidance directly from HMRC were sometimes related to HMRC services. For example, some participants found finding the most appropriate advisor for their needs difficult, which could add to call waiting times, and some had difficulties navigating digital services. For some participants barriers to access were linked to disabilities. For example, those with a hearing or speech impairment were typically unable to use telephone helplines.

“If there’s no deaf awareness and no sign language, there’s no point. I’d have the same issues as I have had before, I’m not interested.”

Unfunded voluntary and community sector, Self Assessment (personal)

“Every time I called it was always the wrong person or the wrong department and they kept saying ‘Oh, you have to do this online’ and we kept going backwards and forwards and nothing seemed to be straight forward, and what they were telling us didn’t really materialise.”

Funded voluntary and community sector, Self Assessment (personal)

Some participants were dissatisfied with the support offered because they felt the information provided was unclear or inconsistent. These participants did not fully understand the tax issue at hand or their options going forward from engagement with HMRC, and so were required to seek expert advice and guidance from voluntary and community sector organisations.

“I think it was the way they explained it to me. It really confused me, and I didn’t know what to do… they just used a lot of jargon which is easy for some people, but not me.”

Funded voluntary and community sector, PAYE

“I thought it would be a very complicated process and I didn’t think I’d be equipped to deal with it.”

Unfunded voluntary and community sector, PAYE

For some participants, barriers to accessing HMRC’s support offer had been introduced or exacerbated by recent changes in the economy and/or their personal circumstances. For example, the option of face-to-face contact with an HMRC advisor was withdrawn during the COVID-19 pandemic for a deaf participant.

“Through [HMRC] I was able to contact someone who I could see in person. I used to go to a library in [London] … I used to see him in person, which was very helpful, and then we would communicate through text. But then I lost contact with him through Covid and that was difficult.”

Unfunded voluntary and community sector, PAYE

For other participants, recent events had impacted their mental and emotional state to such an extent that their ability and confidence in dealing with their tax affairs had been compromised. Changes in forms of employment over the past two years, particularly shifts between PAYE and self-employment, also introduced new and previously unknown tax obligations which some participants had difficulty understanding.

“My mental health hasn’t been good since the start of the first lockdown … I had so much time on my mind and my thoughts were going round and round without my husband by my side.”

Funded voluntary and community sector, PAYE

The influence recent external factors had on accessing support from HMRC is likely to be short-lived. Participants that had faced barriers related to economic changes, the COVID-19 pandemic or changes to their personal circumstances generally described these barriers as being entwined with recent events and did not expect them to persist once these events had passed. However, these participants are still likely to require support in the future due to other long-term factors. For example, barriers to accessing support from HMRC and low trust and confidence in dealing with the tax systems and/or HMRC.

Accessing support from voluntary and community sector organisations

Some participants accessed support from a voluntary and community sector organisation because of perceived shortcomings in HMRC’s support offer. These participants felt that HMRC were unlikely to provide clear and impartial guidance (technical support), and often thought that voluntary and community sector organisations would provide support in a friendlier and more empathetic way (interpersonal support).

“I always imagine with HMRC that they’re only going to answer your questions. But you don’t know what you don’t know, and I never imagine they’re going to be that helpful with that aspect.”

Funded voluntary and community sector, Self Assessment (personal)

Other participants felt that HMRC would be unable to provide the structural support they required, such as British Sign Language interpretation and in-person meetings.[10] For some participants, these feelings were influenced by past experiences where they had received poor customer service or where adjustments were unavailable at the time. For others, this opinion was based on perceptions.

“HMRC need to offer video calls … meaning I have equal access, like a hearing person would call … no-one at HMRC can sign, so can’t communicate directly using sign language.”

Unfunded voluntary and community sector, Self Assessment (personal)

Some participants accessed support from a voluntary and community sector organisation because they did not trust HMRC or did not feel confident dealing with them. These participants had negative perceptions of HMRC and the tax system in general which meant the prospect of dealing with tax matters without support from a voluntary and community sector organisation introduced anxiety and fear. For some participants, these feelings were influenced by recent life events and the potential implications of the issue clouding their mental and emotional state.

“I get very scared when it comes to tax. I imagine that if I do anything wrong, I’m going to go to prison, or something like that. It’s just very scary. So, anyone that can provide me with some support, I’m going to go to.”

Funded voluntary and community sector, Self Assessment (personal)

“I find HMRC quite scary, I don’t feel too comfortable contacting them … I feel they might pick up on something I’ve done [wrong] and I might get penalised.”

Unfunded voluntary and community sector, Owing money to HMRC

Some participants had a pre-existing relationship with the voluntary and community sector organisation and had positive experiences of receiving support from them in the past. These past experiences were often tax related, but sometimes included other forms of support (for example, employment advice and support specific to a disability). These participants returned to the same voluntary and community sector organisation because of a proven track record and the opinion that they had a better understanding of their circumstances than HMRC. Repeat use of voluntary and community sector organisations was a theme amongst customers with disabilities.

For some participants engagements with the voluntary and community sector organisation used were their first interactions with the organisation. They had typically identified the voluntary and community sector organisation independently through online research. Some were recommended the organisation by friends or family members, others were referred or signposted to them by HMRC or another voluntary and community sector organisation.

“They had a good website. I could see they were helping people with all sorts of tax matters, benefits, and changes in circumstances… [I] liked the vibe of the website and felt comfortable using them.”

Unfunded voluntary and community sector, Owing money to HMRC

“I rang HMRC to resolve my online login problems. HMRC said they couldn’t help so they passed me onto [voluntary and community sector organisation].”

Funded voluntary and community sector, PAYE

Case Study B: Participant who contacted HMRC initially before seeking voluntary and community sector support

Abi is in her early thirties, lives with her husband and two children and works as a manager in the leisure industry. She experienced an issue with PAYE owing to an overlap in employment after starting a new job. In April 2021 she realised she was paying a higher rate of tax than she should be.

Abi contacted HMRC initially but was unable to resolve the issue; she was provided an online form which didn’t seem appropriate to her circumstances. This caused emotional stress. She identified a voluntary and community sector organisation that could help.

“I called a few times and was told several different things by different people, and obviously it was quite a lot of money and so I was getting quite irritated.”

Once an appropriate source of support was identified. Abi said she felt a weight had lifted from her shoulders. She was given one point of contact who provided consistency.

“I felt almost like the battlefield had now calmed down and it felt like stepping down. It relieved a lot of anxiety.”

5. Extent to which support meets the needs of customers

5.1 Experience of HMRC support

As covered in Chapter 3, participants sought support from voluntary and community sector organisations because they did not think HMRC’s support offer would meet their needs. Some started their support journey with HMRC but were unable to resolve their issue or dispute directly because of difficulties with access and / or difficulties with understanding the information and guidance provided. Others accessed support from a voluntary and community sector organisation without considering HMRC as a source of support because of perceived shortcomings in HMRC’s support offer or because they did not trust HMRC or did not feel confident dealing with HMRC.

However, those that had engaged with HMRC’s extra support team were pleased with the support delivered. These participants felt that extra support team advisors were more understanding and empathetic than advisors working on HMRC’s general support channels and were able to provide more appropriate technical guidance and/or structural adjustments.

“[The extra support team] are cognisant that you need help … they reassure you.”

Funded voluntary and community sector, Self Assessment (personal)

“I felt that I got the support that I needed [from extra support team]. Otherwise, I would have been sat in the corner crying.”

Unfunded voluntary and community sector, Self Assessment (business)

Participants who received support from the extra support team said this service should be easier to find and access. Participants tended to have been made aware of the extra support team through signposting and referrals from voluntary and community sector organisations. On reflection they felt their support journey would have been quicker and easier if the extra support team was advertised more and if advisors working within HMRC’s other support channels had directed them to this service.

“I wouldn’t have survived without that help. If I were to go on the HMRC website, it would be nice to come across the page quite early on… if you need specialised help, or extra help - go this way.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

Some participants were unaware of the extra support team at the point of interview but were interested in the concept when they were introduced to it. These participants wanted to learn more about the extra support team, and there was a desire from some to use the extra support team in the future should they need support with their tax matters.

“I think that sounds absolutely brilliant. In a sense, I get that anyway because the [voluntary and community sector organisation] only phone people at HMRC who know about the blindness allowance. If you could get through to a small team at HMRC that knows you, you know them, you’d get off the ground a lot quicker.”

Funded voluntary and community sector, PAYE

“[The extra support team is] a good idea … when you’re on the phone waiting and waiting, if you could get through to a specialised team that would be good. It would feel more personalised.”

Unfunded voluntary and community sector, Owing money to HMRC

5.2 Experience of voluntary and community sector support

Participants felt that the support delivered by voluntary and community sector organisations was critical to them achieving positive outcomes. Compared with perceptions and experiences of HMRC’s non-extra support team support offer, the support available from voluntary and community sector organisations was felt to be easier to access and better suited to meet their needs (for example, technical, structural and/or interpersonal).

“I find the [voluntary and community sector organisation’s] tax service totally invaluable … I don’t know how I would cope without them.”

Funded voluntary and community sector, PAYE

Once a relevant voluntary and community sector organisation had been identified, contact information was easy to find and the waiting times on telephone helplines and for email responses were short. Those that had experience of seeking non-extra support team support from HMRC described the process of receiving support from voluntary and community sector organisations as more efficient and less stressful.

“[voluntary and community sector organisation] have got a specific department that deals with that area [of tax]. The gentleman there phoned me and said they could help. He said, ‘would you like to get all of this sorted now?’ … It was extraordinarily efficient, I was gobsmacked.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

“If I go to [voluntary and community sector organisation] I know it’s going to be stress-free, and my issues will get sorted. With HMRC I always expect there will be some difficulty.”

Unfunded voluntary and community sector, Self Assessment (personal)

Participants with technical support needs said that staff at voluntary and community sector organisations possessed the specialist knowledge and expertise they needed to help them understand their tax issues and resolve them. For example, advisors from voluntary and community sector organisations explained what communications from HMRC meant in plain English, provided guidance on how to complete forms, and investigated issues on behalf of the participants.

“They explained the jargon a bit more and why the overpayment might have happened. They advised me that I could contact HMRC and also my payroll department … actually speaking to someone and feeling like [my situation] wasn’t set in stone really helped.”

Unfunded voluntary and community sector, Owing money to HMRC

“She told me what I needed to know over the phone. She told me how I go about registering for self-employment, how to pay your taxes, what the tax years went from and to, and everything I needed to know.”

Unfunded voluntary and community sector, Self Assessment (business)

Participants who had structural needs said that voluntary and community sector organisations had an in-depth understanding of their circumstances and provided access to appropriate adjustments. For example, participants with hearing impairments said that voluntary and community sector organisations arranged conference calls with HMRC advisors with an interpreter in attendance. Others had been able to appoint voluntary and community sector advisors to deal with HMRC on their behalf. Without these adjustments, these participants felt they would have been unable to resolve their tax issue.

“Because my deafness is profound it means that right from the beginning, I’m in my own bubble… [voluntary and community sector organisation] have been the most helpful because they understand fundamentally what I’m struggling with, understanding what I’m meant to be doing and why I don’t perhaps know what the average person knows.”

Unfunded voluntary and community sector, Owing money to HMRC

“We would not have been able to get this situation resolved if it wasn’t for my intervention and going through [voluntary and community sector organisation] where we had a designated representative that could go direct to HMRC”

Funded voluntary and community sector, Self Assessment (personal)

Participants with interpersonal needs said that the voluntary and community sector organisation staff they dealt with showed empathy and understanding during interactions and gave them the opportunity to talk about their issues, including non-tax matters, in their own time. Some commented that staff had an in-depth understanding of their circumstances and how these circumstances interacted with their tax affairs and their ability to deal with HMRC directly, which meant support was tailored to their needs.

“He listened, I didn’t feel rushed, felt he was incredibly sympathetic … it felt like an organic conversation.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

“The woman I spoke to at [voluntary and community sector organisation] came across with empathy. Her voice sounded very caring and compassionate. When I spoke to people at HMRC, it was ‘What’s your name? What’s your number?’ No caring or empathy.”

Unfunded voluntary and community sector, Self Assessment (personal)

Participants tended to have felt stressed and anxious about their tax issue or dispute with HMRC, but the support delivered by voluntary and community sector organisations helped to resolve this. Participants explained that they went from feeling “on your own,” “nervous” and “worried” about the situation to feeling “relieved,” “supported” and “on the right track”.

“I was greatly relieved because there’s a constant worry that I’m going to get huge tax bill because I don’t understand.”

Funded voluntary and community sector, PAYE

Case Study C: Participant with a positive experience of voluntary and community sector support

George is in his early fifties. He works as a salesman and lives on his own, with his only son having recently left home for university.

In January 2022, George received a letter from HMRC informing him that he owed £900 in National Insurance contributions. He tried to contact HMRC in the first instance but could not get through. George was becoming worried about owing HMRC money, and so decided to approach a voluntary and community sector organisation for advice and guidance.

George had a phone call with an advisor. Afterwards, he was sent a document via email with instructions on how to compile financial information for the last few tax years.

Following the submission of this document, George was contacted by the advisor to inform him that HMRC had made an error. With this information he could resolve the matter.

“He called me back and told me ‘You don’t owe anything. This is the number you need to call; this is what you need to tell them, he had it all sorted … he was very thorough, had checked my figures were correct … I then called HMRC.”

5.3 Suggestions for refining HMRC’s support offer

Reflecting on their experiences of HMRC and voluntary and community sector support, some participants identified areas where they felt HMRC’s support offer could be refined to better meet their needs.

Where participants had issues that meant they had to deal with HMRC on multiple occasions over a longer period they felt that the ability to access support from HMRC quickly would help them. Linked to this, some suggested having a direct line of communication to a specific HMRC advisor throughout an issue or dispute as a consistent point of contact.

Some participants said that HMRC should introduce alternative communication channels, such as video calls and a live chat function. HMRC already offers alternatives to telephone helplines and so this indicates a lack of awareness of existing features of HMRC’s support model.[11]

To help customers better understand the information provided by HMRC some participants said they would benefit from the use of more straightforward language in place of perceived tax jargon in written communications, during conversations with advisors and in guidance documents.

The support delivered by HMRC’s extra support team was highly valued by those that had engaged with it. However, awareness of this service was low amongst participants. It was suggested that HMRC should raise awareness by promoting the service and that advisors working within HMRC’s other support channels should refer customers to the extra support team more readily.

6. How the support needs may evolve with the increasing digitisation of tax

6.1 Current use of digital services

Participants were generally confident using internet enabled devices and digital services. It was common for participants to manage their personal finances online and to use digital services for communication and entertainment.

“My house insurance, mortgage, car insurance, banking; I do it all online.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

Some participants used digital services to manage their tax affairs. For example, using GOV.UK to access guidance, completing forms online and using the Government Gateway service. These participants preferred using digital services to manage their tax affairs because they were felt to be more convenient than non-digital services.

“I thought it was all digital anyway. I only ever deal digitally with HMRC apart from if I did have to phone them about something… the Self Assessment is all digital now.”

Funded voluntary and community sector, Self Assessment (personal)

“Prefer to do everything on a screen so I can see what I’m doing.”

Unfunded voluntary and community sector, Self Assessment (business)

However, although participants were generally confident using digital services, this did not necessarily translate to confidence with managing tax affairs. Some participants were reluctant to use HMRC’s digital services because of the view that there was an increased risk of human error online, which could result in penalties. Some had concerns about online data security when it came to managing tax affairs online.

Some participants did not use any digital services. This was because of a variety of reasons including limited digital skills, barriers to accessing internet enabled devices and a lack of interest in using digital services. This group included older participants and those with a physical health condition which affected their ability to access and use the internet.

“I’m not interested in the internet or learning how to use it… there’s no consideration for age. No consideration whatsoever. Whether it be HMRC, the Councils, the Doctors… you know, its ‘go online’. I don’t go online!”

Funded voluntary and community sector, PAYE

6.2 Views on increased digitisation of tax system

Some participants were comfortable with the prospect of increased digitisation of the tax system. As covered in the previous sub-section, participants were generally confident using digital services and some were already using those offered by HMRC to manage their tax affairs. Therefore, they did not envisage increased digitisation to have negative implications for them or bring about the need for additional support. In fact, some thought that digitisation would benefit them by making the tax system more convenient and reducing barriers to access.

“I would be happy to do it all online. I have the least faith in the postal service, and I would prefer email alerts to be honest … with HMRC you want speed, you want references and ease of contact.”

Unfunded voluntary and community sector, PAYE

“It would speed things up … I’d sooner do it online. That’s the way the world is going anyway.”

Funded voluntary and community sector, Self Assessment (personal)

However, some participants had concerns about increased digitisation of the tax system. Owing to low digital confidence and capabilities, these participants felt that increased digitisation of the tax system would force them to seek additional support from HMRC, voluntary and community sector organisations and friends or family members.

“I would need more support [to use online services] because it is not an area of strength and because of consequences [for example, fines]. It makes me get very anxious about these things.”

Unfunded voluntary and community sector, Self Assessment (personal)

“I could ask a friend to help [use online services], but if he couldn’t help, he’d probably suggest I contact the [voluntary and community sector organisation] to see if they could help me.”

Funded voluntary and community sector, PAYE

With regards to the nature of support participants would need from HMRC, some participants said they would need documents and videos to be published to accompany new digital services to provide step-by-step guidance. Others said they would need dedicated helplines for assistance if they had an issue navigating or using a digital service. There were also comments that digital services should be designed to be as simple and straightforward as possible, and that efforts should be made so that new digital services are easy to locate.

“If they made all their forms simpler then I could definitely do [tax returns] online myself … but it’s the jargon they use, if I don’t understand it, I’ll have to go somewhere else to get help.”

Unfunded voluntary and community sector, Self Assessment (personal)

“I think it is fine if it is a straightforward service, but they really need to have a backup so that you can say ‘I am on such, and such a page and they could talk you through it.”

Unfunded voluntary and community sector, Tax Credits and Child Benefits

Some participants said that they would be unable to use digital services, even if support mechanisms were introduced by HMRC. Due to limited digital skills and barriers to access (such as limited access to the internet and internet enabled devices and disabilities), these participants said they would need non-digital aspects of the tax system to be preserved. Some examples were physical forms and telephone helplines.

Case Study D: Participant with concerns about increased digitisation

Alan is in his early seventies and was born blind. He is now retired having spent most of his working life as a telephone operator in the financial services sector.

Alan had recently experienced an issue claiming Blind Persons Allowance and owing money to HMRC. He went direct to a specialist voluntary and community sector organisation for help.

If faced with a similar issue in the future, Alan said he would probably return to the same voluntary and community sector organisation for support. He described the service as “invaluable” and held the view that HMRC would be unable to offer the same level of support.

Alan said he was confident using the internet to browse websites and send emails but did not engage with online services. He wasn’t keen on HMRC’s service becoming more digital. He expected to need more assistance from the same specialist voluntary and community sector organisation.

“It is apparent that a lot of things are being digitised … we’ve not done anything like that before and it worries us. I would hope the [voluntary and community sector organisation] could continue to assist me with my tax and benefits, this is what blind people will need help with [if digitised].”

7. The relationships between customers, the voluntary and community sector and HMRC

7.1 Recent changes

This sub-section details changes made by HMRC to the relationships between the department, customers and the Voluntary and Community Sector (voluntary and community sector) since 2019. This information has been included to contextualise findings on existing relationships and how they may evolve in the future.

In 2019, after the completion of previous research in this area with customers that used voluntary and community sector organisations for support with their tax affairs[12], HMRC introduced a series of changes to establish the role of the voluntary and community sector within the tax ecosystem and to improve the relationships between customers, voluntary and community sector organisations and HMRC.[13] These included:

- creation of the HMRC’s principles of support for customers who need extra help which commit the department to provide timely and appropriate support for all customers who may need extra help.[14]

- a grant funding programme worth £4.98 million (£1.66 million per year) from 2021 to 2024 to voluntary and community sector organisations who can provide tailored help and support to HMRC customers.

- a training programme and improved guidance for HMRC customer service colleagues and compliance officers to enable them to better identify when to provide extra help.

- continued development and internal awareness of HMRC’s extra support team so that customers identified as needing extra help are quickly transferred to Extra Support advisers.

7.2 Current relationships

The research observed a myriad of relationship types between customers, voluntary and community sector organisations and HMRC. The variety and complexity of these relationships are consistent with the findings of research conducted in 2019. In particular, the two distinct starting points for accessing support uncovered by this research remained consistent. Some participants contacted HMRC initially, but due to difficulties resolving their issue directly, sought support from a voluntary and community sector organisation. Other participants went directly to voluntary and community sector organisations without considering HMRC as a source of additional support.

However, this research did find some evidence of greater collaboration between voluntary and community sector organisations and HMRC’s extra support team, with some participants giving accounts of being signposted or transferred to this specialist team.

“It was all done on the phone, and they were absolutely brilliant… [the voluntary and community sector advisor] was so supportive and he said I can put you through to HMRC’s extra support team and I was like ‘What is that?’.”

Unfunded voluntary and community sector, Owing money to HMRC

“People like me, with a disability, can get a direct line into the extra support team… the lady [in the extra support team] is almost like my one-on-one person. She’s keeping in touch with me regularly now.”

Funded voluntary and community sector, Tax Credits and Child Benefits

This finding suggests that the work HMRC have undertaken since 2019 to develop awareness of the extra support team so that customers requiring extra help are referred to Extra Support advisers has had an impact. However, among the people participating in this research there was no evidence of wider HMRC advisors transferring participants to the extra support team (rather it was voluntary and community sector organisations signposting towards the extra support team).

7.3 Future relationships

HMRC recognises that the voluntary and community sector plays a pivotal role in their support model by providing support that they are unable to offer customers (for example, advice unrelated to tax, like budgeting) and by helping customers who are unwilling to interact with HMRC (for example, due to issues with trust and confidence).

This is reinforced by the fact that some participants said that they would go to a voluntary and community sector organisation for support again if faced with a similar tax issue in the future. This was because they were satisfied with their recent experience and so would look to replicate it. Some of these participants had disabilities and/or were repeat users of the same voluntary and community sector organisation. From their perspective there was no alternative; they did not think HMRC would be able to cater to their needs.

“If I go to [voluntary and community sector organisation] I know it’s going to be stress free and my issues will get sorted. With HMRC I always expect there will be some difficulty.”

Unfunded voluntary and community sector, Self Assessment (personal)

Other participants said they would contact HMRC directly if faced with a similar tax issue. This was because, off the back of the recent support delivered by voluntary and community sector organisations, they now had greater trust in HMRC and felt equipped with the confidence and technical knowledge to deal with the department. Others held the view that it was necessary to contact HMRC in the first instance as it was HMRC that the issue or dispute was with, and so would seek to resolve the matter directly first.

“I now have more confidence that it is possible to reach out to HMRC and make them understand that you do want to do the right things.”

Unfunded voluntary and community sector, Self Assessment (personal)

For some participants, the willingness to contact HMRC for support in the future marked a shift in their attitude towards HMRC. Previously they had been unable or unwilling to obtain support from HMRC due to experienced or perceived barriers to access, difficulties with understanding, a lack of trust and low confidence. These issues had now been overcome for some participants. This demonstrates that support from voluntary and community sector organisations can help to restore some customers’ confidence and ability to engage with HMRC directly.

Some participants said they would contact HMRC’s extra support team if faced with a similar tax issue again. However, some commented that this service should be easier to access. These participants were only made aware of the extra support team through a voluntary and community sector organisation and were unclear whether it was possible to go direct to the extra support team without referral.

“I would go for the Extra Support thing because hopefully they would be a bit more understanding that I don’t understand the jargon really.”

Unfunded voluntary and community sector, PAYE

“I would very much use [the extra support team]. I think that needs to be advertised more. I’d far rather deal with HMRC than go through [voluntary and community sector organisation], as helpful as they were.”

Funded voluntary and community sector, Self Assessment (personal & business)

Low awareness of HMRC’s extra support team coincided with low awareness of other existing features of HMRC’s support offer. For example, alternatives to telephone helplines such as video calls and a live chat function.

8. Appendix A: voluntary and community sector organisations funded by HMRC

- Advice NI

- CAB Burnley & Pendle

- CAB Isle of Wight

- CAB South Tyneside

- CAB West Lothian

- Gingerbread

- Good Things Foundation

- Money Advice Trust

- Refugee and Migrant Centre

- RNIB

- Tax Help for Older People

- Taxaid

[1] HMRC’s principles of support for customers who need extra help can be found here: HMRC’s principles of support for customers who need extra help - GOV.UK (www.gov.uk).

[2] The Trusted Helper Service enables customers to ask family or friends to represent them and talk to HMRC on their behalf.

[3] Previous research conducted in 2019 can be found here: understanding customers who receive support through voluntary and community sector organisations.

[4] An update on how HMRC has used the findings from the research can be found here: Supplementary update on how HMRC has used the findings from the research - GOV.UK (www.gov.uk).

[5] These tax matters included: Pay As You Earn (PAYE); Personal Self Assessment; Business Self Assessment; Tax Credits and Child Benefits; and money owed to HMRC.

[6] HMRC’s principles of support for customers who need extra help can be found here: HMRC’s principles of support for customers who need extra help - GOV.UK (www.gov.uk).

[7] A list of voluntary and community sector organisations funded by HMRC is available in Appendix A.

[8] Previous research conducted in 2019 can be found here: understanding customers who receive support through voluntary and community sector organisations and an update on how HMRC has used the findings from the research can be found here: Supplementary update on how HMRC has used the findings from the research - GOV.UK (www.gov.uk).

[9] The number of participants under the ‘health condition / disability status’ heading does not sum to 35 because these categories are not mutually exclusive. Five participants had both physical health conditions or disabilities and mental health conditions.

[10] It should be noted that HMRC offer alternative forms of contact: Get help from HMRC if you need extra support: If you cannot use a telephone and need a different way to contact HMRC - GOV.UK (www.gov.uk)

[11] Get help from HMRC if you need extra support: If you cannot use a telephone and need a different way to contact HMRC - GOV.UK (www.gov.uk)

[12] Previous research conducted in 2019 can be found here: understanding customers who receive support through voluntary and community sector organisations.

[13] An update on how HMRC has used the findings from the research can be found here: Supplementary update on how HMRC has used the findings from the research - GOV.UK (www.gov.uk).

[14] HMRC’s principles of support for customers who need extra help: HMRC Charter - GOV.UK (www.gov.uk).