UK-Japan free trade agreement: the UK's strategic approach

Updated 4 January 2021

Chapter 1: strategic case

This chapter sets out the strategic approach for securing a bilateral trade agreement with Japan, as well as the evidence that supports this approach.

More trade is essential if the UK is to overcome the unprecedented economic challenge posed by coronavirus. It can give us security at home and opportunities abroad – opening new markets for business, bringing investment, better jobs, higher wages and lower prices just as we need them most. At a time when protectionist barriers are on the rise, all countries need to work together to ensure long-term prosperity and international trade is central to this cooperation.

That is why we will use our voice as a new independent trading nation to champion free trade, fight protectionism and remove barriers at every opportunity. The government’s ambition is to secure free trade agreements (FTAs) with countries covering 80% of UK trade within the next three years, to become a truly Global Britain.

An FTA with Japan, the third largest economy in the world in 2018, represents significant opportunities throughout the economy, from agriculture to digital and to increase the resilience of our supply chains and the security of our whole economy as we diversify our trade. Japan is a developed economy with high standards. The UK and Japan are major investors in each other’s economies, ranking fifth[footnote 1] and sixth[footnote 2] respectively for inward foreign direct investment.

Potential benefits from a deal include better jobs, higher wages, more choice and lower prices for all parts of the UK. The total value of trade between the UK and Japan in 2018 was just over £29 billion.[footnote 3] A UK-Japan FTA could increase trade between both countries by £15.2 billion in the long run (compared to 2018) and increase UK workers’ wages by £800 million.[footnote 4] This analysis relates to the long term, and implicitly assumes that by that period the economy would have recovered from any impacts of the coronavirus. At this point in time it is too early to identify whether or how the estimated impacts in this document might be affected by the current situation.

Removing trade barriers with Japan could deliver huge gains, both for the 8,000 UK small and medium-sized (SMEs) across the UK already exporting goods with Japan as well as those making plans to enter the Japanese market.[footnote 5] For example, total annual tariff reductions on goods exports to Japan could be worth around £33 million per year in the long run.[footnote 6]

Sectors set to benefit from a deal include textiles, agriculture, and the services industry. Now that we have left the EU, we can also make more progress in areas such as the free flow of data, which will support emerging fields such as artificial intelligence (AI) and the UK’s position as a technology superpower.

The government has been clear that when we are negotiating trade agreements, we will protect the National Health Service (NHS). Our objectives reinforce this. Any agreement will ensure high standards and protections for consumers and workers, and will not compromise on our high environmental protection, animal welfare and food standards.

The UK intends to use its voice as an independent trading nation to champion free trade. Japan is the third largest economy in the world. The UK and Japan are among the most vocal advocates for free trade and most determined defenders of a rules-based international trading system. Together, we can create new opportunities to trade, boost our nations’ economies, bring prosperity to our people and ensure the UK remains a gateway to Europe and beyond.

The outline approach published in Chapter 2 sets out the UK’s overall objectives for these negotiations, enabling us to begin full talks with Japan. These objectives are also underpinned by a call for input which gave the UK public, businesses and civil society a chance to highlight their priorities in a future trade agreement with Japan. Our response to this detailed input can be found in Chapter 3.

An FTA to underpin the UK’s strategy for Asia Pacific

These bilateral negotiations will also be a logical stepping stone to joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). CPTPP is one of the world’s largest free trade areas, representing 13% of global gross domestic product (GDP) in 2018; increasing to more than 16% if the UK were to join[footnote 7], and Japan is the largest trading partner out of all the CPTPP member nations, representing over 28% of total CPTPP trade.[footnote 8]

Whilst the impact of coronavirus will inevitably affect near-term growth, joining CPTPP will mean we benefit from the significant long-term trade and investment opportunities for UK businesses in the Asia-Pacific region. CPTPP will open markets for UK businesses so that they can capitalise on these opportunities and diversify their exports.

The Asia Pacific region also affords major opportunity for some of UK industry’s priority sectors, with Japan at the forefront of some of these. For example, Japan leads the way in the areas of AI, data and ageing society. An FTA with Japan will be a driving force to put the UK at the forefront of these areas and maximise our advantage in the opportunities Asia Pacific affords.

An FTA that benefits the whole UK

This deal is expected to deliver a significant and sustained long-term boost to every region in the UK. The benefits include a substantial increase in trade in the long run, estimated to be around £15.2 billion. This would result in a projected £800 million boost to workers’ wages, as well as lowering prices on a range of key consumer goods imported from Japan.[footnote 9]

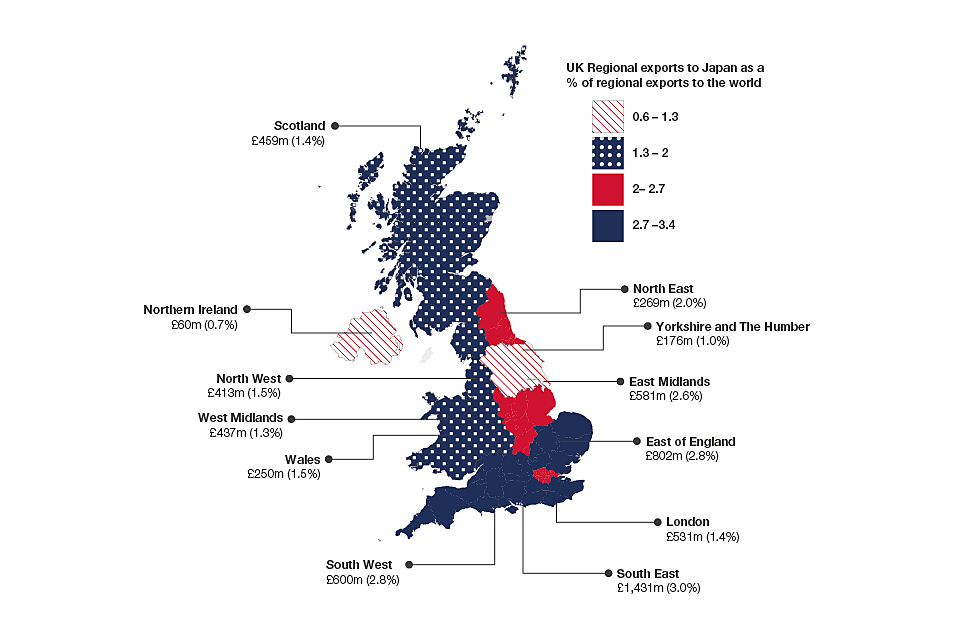

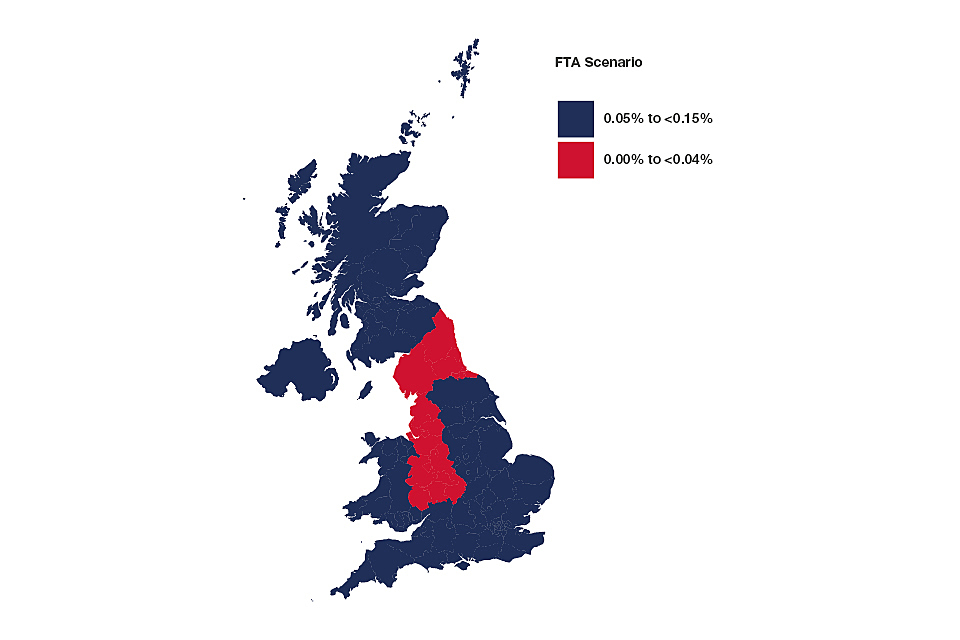

The parts of the United Kingdom that could benefit the most from the FTA are Scotland, the East Midlands, and London, but our scoping assessment shows that all regions will see a positive impact.

Higher wages and lower prices

The UK-Japan FTA could result in a £800 million boost to workers’ wages, as well as lowering prices on a range of key consumer goods imported from Japan.[footnote 10] The projected increase in wages, combined with lower priced consumer goods, would provide a boost for the living standards of households across the UK.

The deal could also contribute to improvements in productivity in the domestic economy. Studies show that this can result from increased international trade flows, which leads to greater specialisation and competition.

Total annual tariff reductions on goods imports from Japan could be worth up to around £275 million per year in the long run.[footnote 11] Some 59% of all Japanese goods imported into the UK and 44% of all UK goods exported into Japan are used in supply chains.[footnote 12] So as well as reducing the price of consumer goods, lower tariffs could also cut the costs of domestic production in both countries.

An FTA for SMEs, exporters and entrepreneurs

In our Japan FTA we will seek a dedicated SME chapter, and SME-friendly provisions throughout – on everything from customs and trade facilitation, services sectors and business mobility to telecommunications, digital trade and intellectual property – knocking down trade barriers that will benefit the 8,000 SMEs in every part of UK already exporting goods to Japan.[footnote 13]

We will agree cutting edge provisions on digital that maximise opportunities for digital trade across all sectors of the economy, providing trust and stability for UK businesses, entrepreneurs and exporters.

Business across the economy and the country will benefit from an FTA including:

- Digital trade: Ambitious digital provisions, including supporting the free flow of data between Japan and the UK, can help us take the lead on innovation, supporting the development of important emerging technologies such as blockchain, driverless cars and quantum computing.

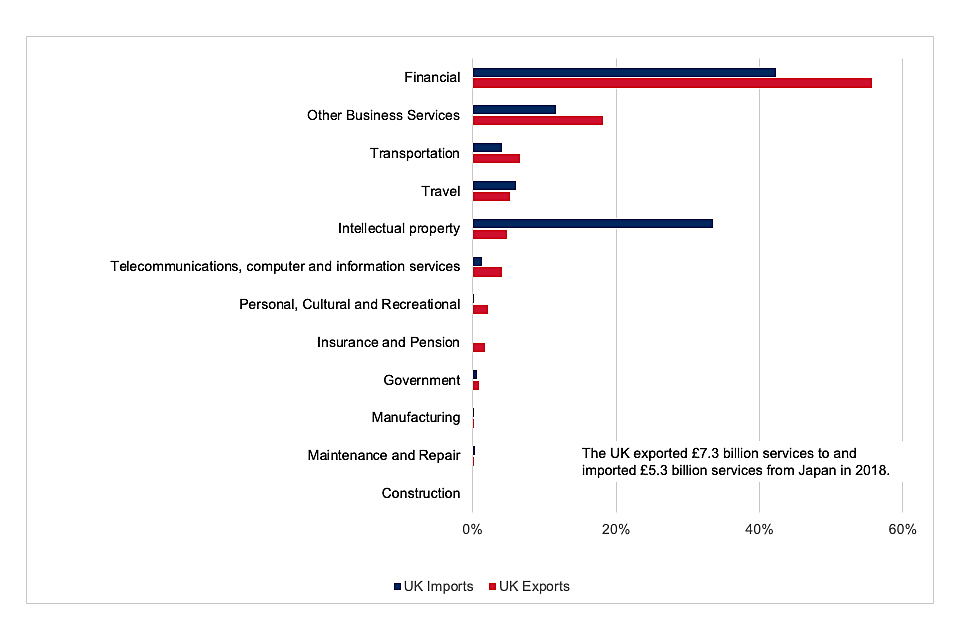

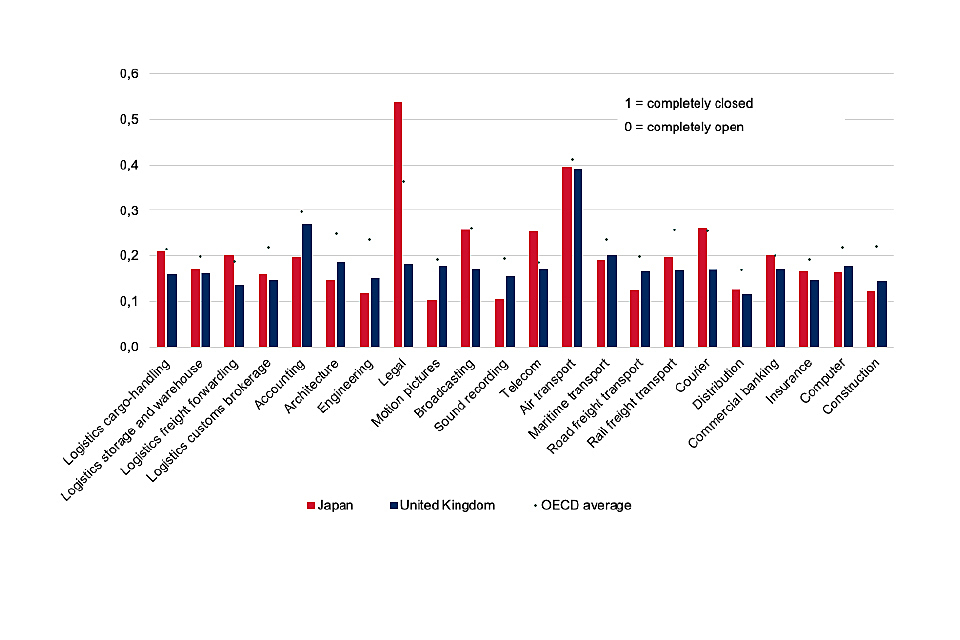

- Professional and business services: The UK exported £1.5 billion of business services to the Japan, including in key areas of UK strength such as accountancy, engineering and legal services.[footnote 14] An FTA with Japan could allow professionals to move more easily and support recognition of professional qualifications, for example in accountancy and the legal profession.

- Financial services: The UK exported £4.1 billion of financial services to Japan,[footnote 15] and we expect that the sector could benefit from reduced barriers to cross-border trade and investment, as well as co-operation between the two countries on financial regulation.

- Agriculture: Our scoping assessment suggests that UK agriculture could benefit from an FTA with Japan through a combination of reduced tariffs and red tape for food and drink exports.

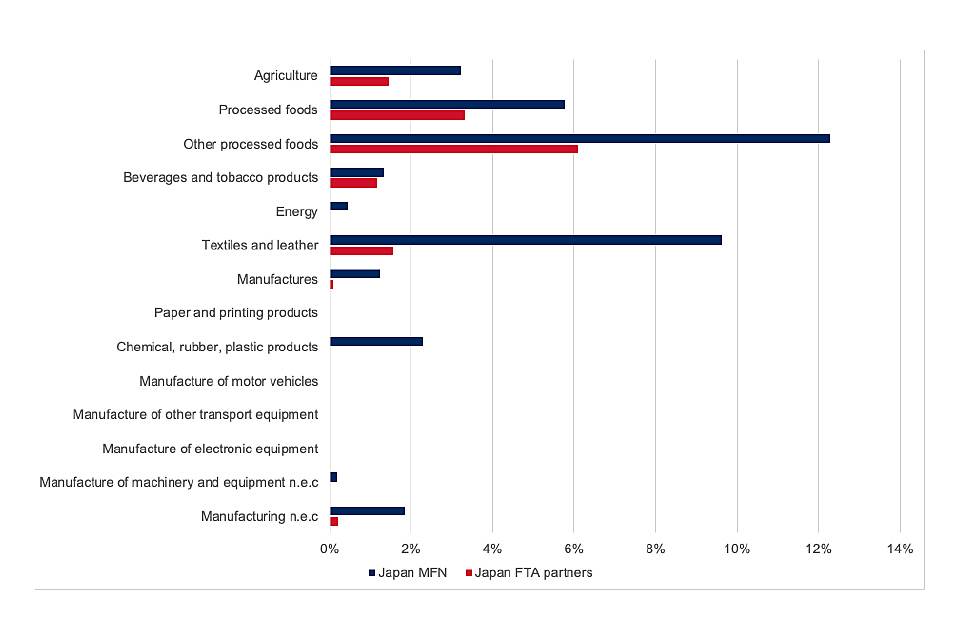

- Textiles and leather: Our scoping assessment suggests that this sector could benefit the most from an FTA with Japan due to a reduction in tariff and non-tariff barriers to trade. If no trade deal is negotiated with Japan, the vast majority of UK textiles and articles of leather exports to Japan could face tariffs of up to 10%.

- Automotive: Cars are one of our top goods exports to Japan, worth around £1.1 billion.[footnote 16] Our automotive exporters could benefit from reduced non-tariff barriers in an FTA.

- Creative industries: The UK’s world-leading creative industries sector will benefit and be supported by copyright provisions that link to an effective and balanced global system. We will establish frameworks for the industries of the future, with a focus on agreeing advanced digital trade provisions that promote an eco-system for businesses of all sizes across the UK to thrive.

Chapter 2: outline approach

Public negotiating objectives for a free trade agreement with Japan: overall objectives

- Agree an ambitious and comprehensive free trade agreement (FTA) with Japan that builds on the EU-Japan Economic Partnership Agreement (EPA), and secures additional benefits for UK businesses.

- Increase UK GDP and provide new opportunities for UK businesses, including small and medium-sized enterprises (SMEs) and investors, and facilitating greater choice and lower prices for UK producers and consumers.

- The government has been clear that when we are negotiating trade agreements, the National Health Service (NHS) will not be on the table. The price the NHS pays for drugs will not be on the table. The services the NHS provides will not be on the table. The NHS is not, and never will be, for sale to the private sector, whether overseas or domestic.

- Throughout the agreement, ensure high standards and protections for UK consumers and workers and build on our existing international obligations. This will include not compromising on our high environmental protection, animal welfare and food standards, and ensure both parties meet their commitments on climate change.

- Secure an agreement which works for the whole of the UK and takes appropriate consideration of the UK’s constitutional arrangements and obligations.

Trade in goods

Goods market access

- Secure broad liberalisation of tariffs on a balanced and mutually beneficial basis, taking into account UK product sensitivities.

- Secure comprehensive access for UK industrial and agricultural goods into the Japanese market through the reduction or elimination of tariffs.

- Develop simple and modern rules of origin that reflect UK industry requirements and consider existing as well as future supply chains, supported by predictable and low-cost administrative arrangements.

Customs and trade facilitation

- Secure commitments to efficient and transparent customs procedures which minimise costs and administrative burdens for businesses, while ensuring that customs authorities remain able to protect their regulatory, security and financial interests.

- Ensure that processes are predictable at, and away from, the border.

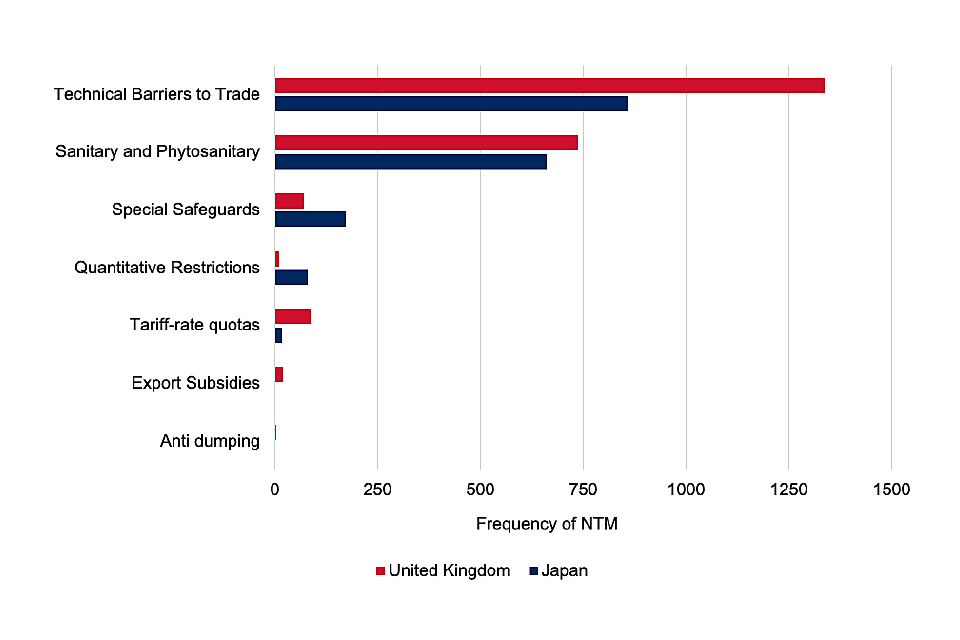

Technical barriers to trade

- Reduce technical barriers to trade by removing and preventing trade-restrictive measures in goods markets, while upholding the safety and quality of products in the UK.

- Seek arrangements to make it easier for UK manufacturers to have their products tested against Japanese rules in the UK before export.

- Promote the use of international standards to further facilitate trade between the parties.

Sanitary and phytosanitary measures (SPS)

- Uphold the UK’s high levels of public, animal, and plant health including food safety.

- Ensure access for UK agri-food goods to the Japanese market by securing commitments to improve the timeliness and transparency of Japanese approval processes for UK goods.

Good regulatory practice (GRP) and regulatory cooperation

- Reduce regulatory obstacles, facilitate market access for UK businesses and investors, and improve trade flows by ensuring a transparent, predictable, and stable regulatory framework to give confidence and stability to UK exporting businesses and investors.

- Secure commitments to key GRP provisions such as public consultation, use of regulatory impact assessment, retrospective review, and transparency, as well as regulatory cooperation.

Transparency

- Ensure world class levels of transparency between the UK and Japan, particularly with regards to the publication of measures (such as laws and regulations) affecting trade and investment, public consultation, and the right of appropriate review of these measures.

Trade in services

- Secure ambitious commitments on market access and national treatment to ensure certainty for UK services suppliers in their access to the Japanese market.

- Secure best-in-class rules for all services sectors, as well as sector specific rules to ensure transparency and support our world-leading services industries, including key UK export sectors such as financial services, professional and business services, telecommunications and transports services.

- Ensure certainty for UK services exporters in their continuing access to the Japanese market and transparency on Japanese services regulation.

Public services

- Protect the right to regulate public services, including the NHS and public service broadcasters.

- Continue to ensure that decisions on how to run public services are made by UK governments, including the devolved administrations (DAs), and not our trade partners.

Business mobility

- Secure opportunities for UK services suppliers and investors to operate in Japan through provisions for temporary business travel and supporting the recognition of professional qualifications.

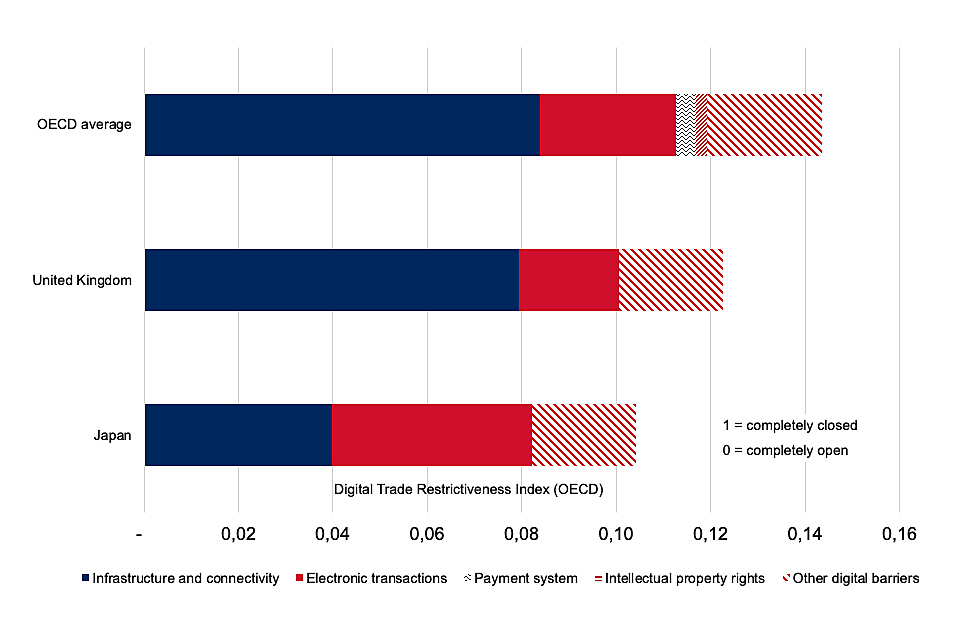

Digital and e-commerce

- Secure cutting-edge provisions which maximise opportunities for digital trade across all sectors of the economy.

- Promote a world leading eco-system for digital trade that supports businesses of all sizes across the UK.

Telecommunications

- Promote fair and transparent access to the Japanese telecommunications market.

- Promote accessibility and connectivity for UK consumers and businesses in the Japanese market.

Financial services

- Expand opportunities for UK financial services to ease frictions to cross-border trade and investment, complementing co-operation on financial regulatory issues.

Investment

- Agree rules that ensure fair and open competition, and address barriers to UK investment across the Japanese economy.

- Ensure UK investors in Japan continue to enjoy high standards of treatment.

- Maintain the UK’s right to regulate in the national interest and as the government has made clear, continue to protect the NHS.

Intellectual property (IP)

- Secure protections for UK geographical indications (GIs). This should be in a way that reflects their geographical origins, getting the balance right for consumers so they are not confused or misled about the origins and the quality of goods.

- Secure copyright, patents, trade marks and designs provisions that:

- adequately secure protection for rights holders, whilst keeping the market open to fair competition

- protect the UK’s existing IP standards while encouraging and supporting innovation

- support the UK creative industries through a balanced and effective global framework

- do not lead to increased medicines prices for the NHS

- ensure consumer access to modern technology

- are consistent with the UK’s existing international obligations, including the European Patent Convention (EPC), to which the UK is a party

- Secure provisions that promote the transparent and efficient administration and enforcement of IP rights, and facilitates cross-border collaboration on IP matters.

- Secure the parties’ continued commitment to the Doha Declaration on Public Health, the TRIPS Agreement, other multilateral IP treaties and conventions, and agreed flexibilities that support access to medicines, particularly during public health emergencies in developing countries.

Competition law, subsidies, procurement and state-owned enterprises

Competition

- Provide for effective competition law and enforcement that promotes open and fair competition for UK firms at home and in Japan.

- Provide for transparent and non-discriminatory competition laws, which respect procedural rights for businesses and people under investigation.

- Promote effective cooperation between enforcement agencies.

Subsidies

- Secure industrial subsidies provisions that promote open and fair competition for UK firms at home and in Japan.

Government procurement

- Secure access that goes beyond the level set in the World Trade Organisation (WTO) Government Procurement Agreement (GPA) based on clear and enforceable rules and standards.

- Secure rules to ensure that procurement processes are simple, fair, open, transparent and accessible to all potential suppliers in a way that supports and builds on commitments in the WTO GPA.

- Ensure appropriate regard to public interests and services, including the need to maintain existing protections for key public services, such as NHS health services.

State-owned enterprises (SOEs)

- Provide for open and fair competition between commercially oriented SOEs and private businesses by preventing discrimination and unfair practices.

- Secure transparency commitments on SOEs.

- Ensure that UK SOEs, particularly those providing public services, can continue to operate as they do now.

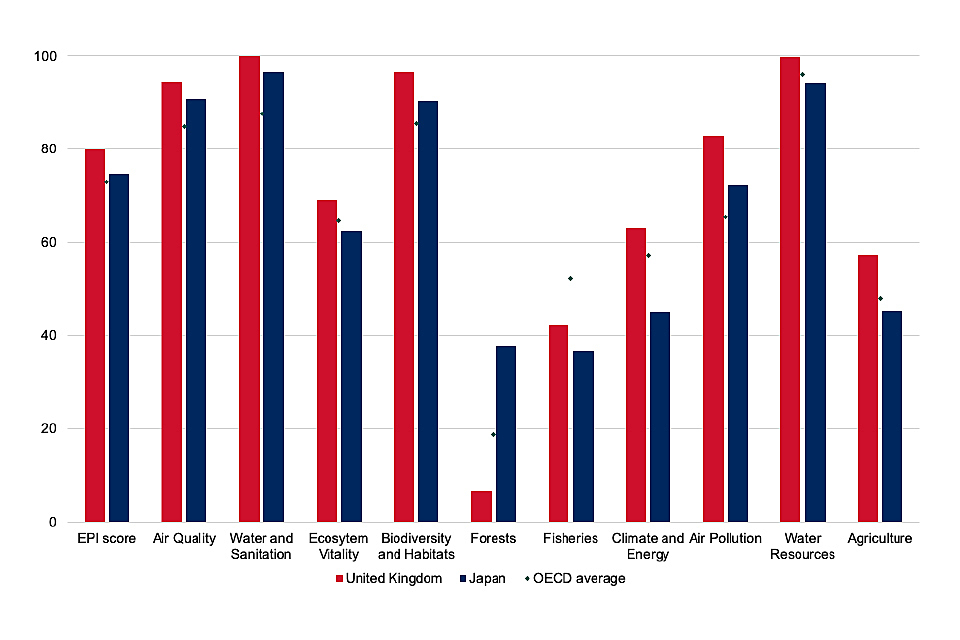

Sustainability, labour and environment

- Ensure parties reaffirm their commitment to international environment and labour standards.

- Ensure parties do not fail to enforce their domestic environmental or labour protections in ways that create an artificial competitive advantage.

- Include measures which allow the UK to maintain the integrity, and provide meaningful protection, of the UK’s world-leading environmental and labour standards.

- Secure provisions that support and help further the government’s commitments on climate change and achieving net zero carbon emissions by 2050, including promoting trade in low carbon goods and services, supporting research and development collaboration and maintaining both parties’ right to regulate in pursuit of decarbonisation, and reaffirming our respective commitments to the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement.

- Apply appropriate mechanisms for the implementation, monitoring and dispute resolution of environmental and labour provisions.

Trade remedies

- Ensure provisions that uphold WTO commitments and are underpinned by transparency, efficiency, impartiality and proportionality.

- Support trade liberalisation in the agreement by protecting against unfair trading practices and import surges.

Dispute settlement

- Establish appropriate mechanisms that promote compliance with the agreement and seek to ensure that state to state disputes are dealt with consistently and fairly in a cost-effective, transparent and timely manner whilst seeking predictability and certainty for businesses and stakeholders.

Small and medium-sized enterprises (SMEs)

Support UK SMEs to seize the opportunities of UK-Japan trade, by:

- ensuring a dedicated SME chapter to facilitate cooperation between the UK and Japan on SME issues of mutual interest

- ensuring that SMEs have easy access to the information necessary to take advantage of the trade opportunities generated by the agreement

- ensuring SME-friendly provisions are included that support businesses exporting both services and goods

General provisions

- Ensure flexibility for the UK government to protect legitimate domestic priorities by securing adequate general exceptions to the agreement.

- Provide for prompt and open information sharing between the UK and Japan.

- Seek opportunities for co-operation on issues related to economic growth.

Territorial application

- Provide for application of the treaty to all four constituent nations of the UK, taking into account the effects of the Northern Ireland Protocol.

- Provide for further application of the agreement to the Crown Dependencies and Overseas Territories as appropriate.

Chapter 3: response to the call for input on trade negotiations with Japan

In January 2019, the UK and Japan agreed to negotiate a new bilateral agreement using the existing EU-Japan Economic Partnership Agreement (EPA) as a basis, ensuring the new agreement is as ambitious, high standard and mutually beneficial as the EPA and enhanced in areas of mutual interest. In order to understand the priorities of businesses, interest groups and members of the public for a future trade agreement with Japan, the Department for International Trade launched a call for input which asked questions about where stakeholders see challenges and opportunities for trading with Japan.

The call for input ran for 6 weeks, between 20 September 2019 and 4 November 2019. In support of its launch, we held a series of stakeholder events in London, Belfast and Edinburgh, in addition to a webinar, to meet directly with stakeholders to discuss their views and encourage responses to the call for input.

We would like to thank all those who took the time to respond to this call for input.

Why this free trade agreement?

Japan and the UK have a longstanding international relationship in trade and beyond. We are two like-minded, free trading nations, who share common values and are committed to upholding the rules-based international system.

Japan is the world’s third largest economy and is currently the UK’s fourth largest non-EU export market (and 11th globally), accounting for just over 2% of the UK’s total exports in 2018.[footnote 17] Total trade between the two countries was worth around £29.5 billion in 2018, with over half of this being goods trade.[footnote 18]

The EU-Japan EPA entered into force on 1 February 2019. The UK has the opportunity to sign a bilateral agreement with Japan that is more tailored to the UK economy and could generate greater benefits for the UK. The new agreement would build on existing cooperation between the UK and Japan in international fora, such as the G20 and World Trade Organisation, which include supporting trade liberalisation and the rules-based system.

What we asked

The call for input questions focused on ways in which the EU-Japan EPA could be made more ambitious. The questions were therefore focused on that particular theme.

They were:

-

[Are you / is your business / is your organisation] aware of the Economic Partnership Agreement that came into force between the EU and Japan in February this year?

-

Which of the following trade related areas best describe the areas of the Economic Partnership Agreement that are important to [you / your business / your organisation]? [Please select all that apply]

- Goods trade

- Services trade

- Regulation and standards

- Cross border investment

- Small and medium sized enterprises (SMEs)

- Competition law, subsidies, procurement and state-owned enterprises (SOEs)

- Intellectual property

- State to state dispute settlement

- Structure of the agreement

- Other

- None

- Don’t know

-

Based on your selection above, which areas of the Economic Partnership Agreement between the EU and Japan are important to [you or the UK / your business / your organisation] and in what ways are they important?

-

Which of the following trade related areas best describe the areas of the Economic Partnership Agreement that the UK government should consider changing during future negotiations? [Please select all that apply]

- Goods trade

- Services trade

- Regulation and standards

- Cross border investment

- small and medium sized enterprises (SMEs)

- Competition law, subsidies, procurement and state-owned enterprises (SOEs)

- Intellectual property

- State to state dispute settlement

- Structure of the agreement

- Other

- None

- Don’t know

-

Based on your selection above, which areas of the Economic Partnership Agreement between the EU and Japan do you think the UK government should consider improving during future trade negotiations with Japan and why?

-

Is there anything else that you would like to say about the UK’s future trade and investment relationship with Japan?

Overview of the responses

In total, we received 124 responses to the call for input. Respondents were given the option of replying either through our online tool, hosted on the Qualtrics platform, or to a Department for International Trade-monitored inbox. On request, the questions that were included via the online platform were provided to respondents in a PDF copy to facilitate review and distribution.

The online survey had a total of 46 questions. All respondents were asked the same core 6 questions as listed above, alongside 6 questions for identification and data protection purposes. In addition, demographic and logistical questions were asked, targeted at each group. Individuals were asked 8 questions, NGOs 6 questions, PSBs 4 questions, businesses 10 questions, and business associations 6 questions.

The division between the number of responses can be seen below:

- Online survey responses: 72

- Emails: 52

- Campaign: 0

Respondents were categorised into one of the following five groups:

- An individual – Responding with personal views, rather than as an official representative of a business, business association or another organisation.

- Business – Responding in an official capacity representing the views of an individual business.

- Business association – Responding in an official capacity representing the views of a business representative organisation or trade association.

- Non-governmental organisation (NGO) – Responding in an official capacity as the representative of a non-Governmental organisation, trade union, academic institution or another organisation.

- Public sector body (PSB) – Responding in an official capacity as a representative of a local Government organisation, public service provider, or another public sector body in the UK or elsewhere.

A breakdown of responses by respondent group can be seen below:

| Respondent group | Responses (portal) | Responses (email) |

|---|---|---|

| Individual | 21 | 5 |

| NGO | 4 | 5 |

| Business | 25 | 14 |

| Business association | 18 | 28 |

| PSB | 4 | 0 |

| TOTAL | 72 | 52 |

Summary of responses

This document summarises the individual policy areas that were raised through the Japan call for input, and groups together the key asks from each of these. A short response has been provided here, whilst more detail about how we will approach each of these areas in the negotiations can be found in the accompanying uutline approach document.

Section 1: general themes

Respondents identified a wide range of priorities for a potential future UK-Japan free trade agreement, particularly with regard to where they would like to see us go further than the EU-Japan EPA. The summary below sets out the key themes across the call for input, while Section 2 categorises some of the more specific asks.

Theme 1: maintain the ambition found in the EU-Japan Economic Partnership Agreement.

In general, many respondents were clear that they would like to see the ambition and achievements of the EU-Japan EPA protected in any future trade agreement with Japan, with 40 separate responses noting this preservation as particularly important.

As such, organisations or individuals from almost every sector noted the importance of protecting the terms of the existing EU-Japan EPA, including provisions for services, goods, GI and IP, sustainability, regulations and standards, e-commerce, and SMEs.

Policy explanation

The EU-Japan EPA entered into force in February 2019. The UK has been a long-standing supporter of the EU-Japan EPA, which was approved overwhelmingly by the UK Parliament after it was debated on the floor of the House of Commons on 26 June 2018 with 317 votes in favour and only 1 against. The EU-Japan EPA is positive for the UK, the wider EU and global free-trade. In the long term, the agreement liberalises tariffs on the vast majority of products.

In January 2021 the EU-Japan EPA will no longer apply to the UK. The UK clearly recognises the importance of a timely future trade deal with Japan. The UK and Japan have agreed to negotiate a new bilateral agreement using the existing EPA as a basis, ensuring the new agreement is as ambitious, high standard and mutually beneficial as the EPA and enhanced in areas of mutual interest.

We have noted in each of the policy areas below where there were requests for continuity and have responded in kind.

Theme 2: that a deal with Japan is concluded quickly in order to protect UK businesses.

Four respondents made explicit reference to the fact that there should be as little disruption as possible to their current trading arrangements under the EU-Japan EPA, so have asked for a deal to be agreed quickly. Additional respondents implied that a deal needed to be done quickly by stressing the importance of the existing EPA.

Policy explanation

The government recognises that if there is not an agreement in place by January 2021, the UK and Japan would return to WTO terms. This would have an effect on both UK and Japanese businesses. The government therefore recognises the desirability of trying to get a new agreement in place by the end of the transition period to maintain current preferential treatment.

Section 2: summary of responses by policy area

Trade in goods

Trade in goods refers to the import and export of materials between the UK and Japan, including those goods listed in the tariff schedule of both countries.

Rules of origin (RoO)

RoO are a key component of any trade agreement, as they define the processes that must take place in order for goods to be eligible for the market access liberalisation achieved in the agreement. They also prevent circumvention of tariffs and tariff quotas by goods from countries which are not parties to the agreement.

RoO was raised by 17 respondents. The main views and recommendations relating to rules of origin for trade between the UK and Japan were:

- To recognise existing supply chains and ensure continuity for UK industries that currently qualify for preferential treatment through the EU-Japan EPA.

- To ensure that the rules of origin in a UK-Japan agreement are clear, simple, and easily applicable. This includes greater flexibility for exporters to confer origin, using any one of change in tariff classification, value added or specific processing rules.

- To ensure simple and predictable administration requirements for complying with rules of origin, and remove unjustifiable administrative barriers that companies currently face when exporting to Japan.

- To provide for alignment on administration between a UK-Japan agreement and the EU-Japan EPA, including using the same format of the statement of origin.

Policy explanation

The government recognises that a key issue for UK businesses is the complex, and sometimes inconsistent, procedures with exporting to Japan under the EPA. The UK’s objective will be to agree rules of origin with Japan that are clear and flexible for UK producers, and to have procedures for exporting to Japan that are as simple, predictable and provide as much continuity as possible.

Tariffs

Tariffs are customs duties on imported goods. Tariffs are normally applied on a Most Favoured Nation (MFN) basis. This means that there can be no discrimination in duties applied to goods from any World Trade Organisation member, unless there is a preferential trade agreement.

Under the EU-Japan EPA bilateral tariffs are reduced or removed on the vast majority of products. This facilitates the export of UK goods to Japan and the availability of Japanese goods in the UK.

The main views and recommendations relating to tariffs for trade between the UK and Japan raised by forty respondents were that:

- exporters in both countries should continue to benefit from the tariff reduction/elimination secured by the EU-Japan EPA including ‘inheriting the clock’ for the staged tariff reduction in the EPA, i.e. that the liberalisation in the UK-Japan EPA should at a minimum not fall behind that in the EU-Japan EPA.

- tariffs in both countries should be eliminated further and/or faster than foreseen by the provisions of the EPA for a range of industrial and agricultural goods.

Policy explanation

The EU-Japan EPA already liberalises tariffs significantly. The government recognises that a key concern of UK and Japanese businesses alike is to also secure the current staging schedule for tariff liberalisation. The government will consider whether for some tariff lines it would be beneficial to seek or provide accelerated liberalisation.

Customs

The customs and trade facilitation chapter of a trade agreement ensures that procedures at the border are as facilitative and predictable as possible to make importing and exporting easier. Reducing customs delays and costs could increase the ability of businesses, especially small and medium sized enterprises (SMEs), to trade with Japan. Chapter 4 of the EPA sets out the commitments made by both sides on the treatment of goods at the border.

The main views and recommendations relating to customs procedures for trade between the UK and Japan raised by thirteen respondents were:

- to maintain the existing facilitations available to businesses exporting to Japan, including both the Authorised Economic Operator scheme and the temporary admission of specified goods without duty

- to ensure the efficient implementation and enforcement of the customs and trade facilitation provisions in the agreement

- minimising delays and ensuring procedures are as simple, efficient and transparent as possible, making use of improved electronic systems

- consideration of the fees, charges and VAT which are levied on traders

- consideration of the de minimis level for traders

Policy explanation

The government recognises the importance of customs procedures which are efficient and predictable for both UK importers and exporters. The government also recognises that, to ensure compliance burdens are minimised, the UK should seek to be at the forefront of global customs policy and committed to reducing frictions.

Regulation and standards

One of the main barriers to international trade, especially for small and medium-sized enterprises (SMEs), is the difference between countries in what producers need to do to show that their products are safe and effective for that market.

The EU-Japan EPA seeks to establish clear and mutually advantageous rules governing trade and investment between the parties and to reduce or eliminate barriers. To achieve this, the EU and Japan have made commitments on regulations and standards in several areas:

- sanitary and phytosanitary measures (Chapter 6)

- technical barriers to trade (Chapter 7)

- corporate governance (Chapter 15)

- transparency (Chapter 17)

- good regulatory practices and regulatory cooperation (Chapter 18)

The main views and recommendations relating to regulations and standards for trade between the UK and Japan raised by thirty-one respondents were:

- the agreement should seek to further facilitate regulatory cooperation between the UK and Japan

- the agreement should maintain current UK standards and avoid downward pressure on the UK compliance system

- the UK should secure mutual recognition of conformity assessment and reduce duplicative regulatory requirements that impede access

- a UK-Japan FTA should retain the EPA automotive annex and explore additional annexes that cover regulation in the cosmetic and wine and spirits sectors

- the agreement should maintain and improve the regulatory and supervision standards from the EU-Japan EPA

- to maintain a regulatory cooperation committee (the EU-Japan EPA forms a committee on regulatory cooperation), however some respondents raised concerns that the EU-Japan EPA’s provisions for regulatory dialogue risks putting downwards pressure on standards

- to ensure that the UK maintains existing standards on animal welfare and food safety, including with regard to the UK’s position on whaling and dolphin hunting

- to include the precautionary principle in any future trade deal with Japan

- to ensure efficient veterinary approval across multiple sectors

- that Japan should adopt UK SPS standards and maintain strict rules against GMOs and hormones in beef

- to maintain the UK’s right to regulate for new SPS measures and that the UK should be able to put in place effective import controls

- to maintain an SPS committee similar to that in the EU-Japan FTA

- that Japan should make changes to their additive regime

- that Japan should accept UK risk assessments for BSE risk and lift its ban on UK bovine material in vaccines.

- that Japan should make changes to its medicines evaluation and reimbursement regimes to allow fair and equitable access for British companies

Policy explanation

The government will continue to ensure the safety and quality of products on sale in the UK, recognising the important role that international standards play.

The UK is also committed to the transparent and predictable development of regulations. We recognise the benefits of the current EU-Japan EPA to UK businesses and that preserving the terms included in that agreement will be important to the UK.

The UK will maintain its own autonomous sanitary and phytosanitary (SPS) regime to protect human, animal and plant life and health and the environment, reflecting its existing high standards. We will retain the provisions relating to cooperation on matters relating to animal welfare in the current EU-Japan EPA. We will not compromise on our high environmental protection, animal welfare and food standards. The import of whale and dolphin meat is prohibited in the UK and this will not be changed in a future UK-Japan agreement.

Trade in services

In trade agreements, parties agree a desired level of liberalisation through trade in services obligations and commitments. This is so that service suppliers abroad can be confident that they will not face discrimination or protectionism when exporting to, or investing in, a partner’s market. The interconnectedness of goods and services, for example through services incidental to manufacturing, also means that the benefits from the liberalisation of services trade under a UK-Japan agreement are likely to have positive spillover effect on goods trade and vice-versa.

Respondents identified opportunities for greater trade liberalisation in services trade with Japan in the following areas.

- Many respondents noted that provisions for the Mutual Recognition of Professional Qualifications (MRPQ) are an important aspect of services trade liberalisation.

- Respondents raised that firms face establishment requirements, burdensome administrative procedures, and legal uncertainty when providing services in Japan.

- Some respondents proposed to enhance the commitments made on financial services in the Japan-EU EPA to ensure that issues such as regulatory coordination and cross-border financial data flows are adequately covered in a future UK-Japan agreement. Other specific asks, including in relation to banking, insurance, and asset management were also raised.

- Several respondents suggested that the UK seek ongoing rights for the temporary entry of workers to supply services in Japan, whilst some consider further visa liberalisation in a future UK-Japan agreement as a potential benefit. Other respondents raised the importance of temporary entry of workers and transparency on visa processing as particularly relevant to small and medium sized enterprises.

- Some respondents had concerns that the existing Japan-EU EPA limits the government’s right to regulate in the public interest, and that mutual recognition frameworks should not undermine professional standards or patient safety in the health sector.

Policy explanation

The government recognises the benefits of the EU-Japan EPA for UK service suppliers. The government’s position is that we should secure ambitious levels of market access. This will ensure certainty for UK services suppliers in their continuing access to the Japanese market, maintain existing transparency of Japanese services regulation, and prevent discrimination. Where appropriate and possible, the government will seek to improve upon the terms of the EU-Japan EPA for UK service suppliers. The government will seek to secure opportunities for UK services suppliers and investors to operate in Japan through provisions for temporary business travel and supporting the recognition of professional qualifications.

The delivery of public services is safeguarded in the trade in services aspects of all trade agreements the UK is party to. In the EU’s trade agreements, the UK’s public services are protected by specific exceptions and reservations. Having left the EU, the UK will continue to ensure that public services – including the National Health Service (NHS) – are protected in all trade agreements it is party to, whether transitioned from an EU context or as a result of new negotiations. Protecting the UK’s right to regulate in the public interest and protect public services, including the NHS, is of the utmost importance. The government has been clear that when we are negotiating trade agreements, the NHS will not be on the table. The price the NHS pays for drugs will not be on the table. The services the NHS provides will not be on the table. The NHS is not, and never will be, for sale to the private sector, whether overseas or domestic.

Digital and telecommunications

Digital trade supports the UK economy and is vital to both goods and services exports.

The main views and recommendations relating to digital trade between the UK and Japan raised by respondents were:

- some respondents stated the importance of facilitating the free flow of data and protecting personal data

- the responses included the need to consider the unique circumstances of financial services data

- the responses included a request for closer regulatory cooperation for data and information-sharing between the UK and Japan

- the inclusion of a comprehensive digital trade chapter that reflects the interests of all digital stakeholders was suggested

- the responses included the suggestion for government data to be available in machine-readable/searchable formats

- some respondents suggested measures be pursued to better protect digital intellectual property

- a number of responses supported the prohibition of customs duties on electronic transmissions

- several respondents made comments which suggested several approaches on how the UK should approach creative industries

- the establishment of an internet communications technology dialogue between the UK and Japan was requested alongside the continuation of current levels of cooperation

Policy explanation

The government recognises that the EU-Japan EPA achieved results in a number of the areas highlighted via the call for input, including customs duties and intellectual property. The government will seek to replicate these provisions.

The government also recognises the calls for high ambition in the responses, including through the request for a dedicated digital trade chapter. The UK will seek to retain and build upon the commitments in the Economic Partnership Agreement in order to agree an improved digital package that maximises opportunities for digital trade across all sectors of the economy. The government will ensure positive co-operation between the UK and Japan in this area and on future innovation within the digital sector.

The government notes stakeholders’ concerns on the importance of data protection and privacy standards. The UK will seek to facilitate the continued flow of data with the EU and international partners, whilst ensuring the UK’s high standards of personal data protection. It notes the interests in facilitating the free flow of data and eliminating unjustified data localisation requirements.

Investment

The main views and recommendations relating to the investment relationship between the UK and Japan raised by respondents were:

- some were in favour and some were against the inclusion of investment protection and Investor-State Dispute Settlement (ISDS) provisions in a new UK-Japan trade agreement

- the importance of replicating the investment liberalisation provisions in the EU-Japan EPA and parts of the treaty that address non-formal barriers to investment in Japan, such as the corporate governance chapter

- to go beyond the EPA in addressing formal and non-formal barriers to investment in Japan, including raising equity caps, establishing a less restrictive investment screening regime and ensuring governmental, regulatory and legislative consultations are published in English

Policy explanation

The government recognises the importance of maintaining and increasing UK-Japan foreign direct investment. UK investors who invest overseas are able to access new markets, increase their financial returns and contribute to both the UK and foreign economies. Foreign investment into the UK provides capital for major projects, helps to fund start-ups and generates economic growth. The government recognises the desirability in providing a supportive environment for investment.

The government will seek to ensure that UK investors in Japan continue to enjoy high standards of legal treatment. We will also safeguard the UK’s right to regulate in the public interest.

Intellectual property (IP)

A balanced and effective IP regime is an essential element of a vibrant and creative economy, providing confidence and protection for innovators and creators, while also reflecting wider public interests. As part of the EU-Japan EPA, the EU and Japan agreed to a comprehensive IP chapter that promotes cross-border cooperation and enforcement, while reducing friction for business wanting to trade and invest abroad.

In addition, Japan agreed to protect six UK geographical indications (GI):

- Scottish farmed salmon

- Irish cream

- Irish whiskey

- Scotch whisky

- blue/ white Stilton cheese

- West Country farmhouse Cheddar cheese

The main views and recommendations relating to intellectual property for trade between the UK and Japan raised by thirty-one respondents are below:

- the agreement should require Japan to introduce an Artists’ Resale Right

- provisions should be included to provide better protections for the publishing industry and freedom of speech

- a provision should be included on Collective Rights Management (CRM) that places greater responsibility on Japan to ensure transparency, non-discrimination and accountability

- Japan should adopt a public performance right

- Japan should introduce civil liability for the secondary infringement of IP rights

- the duration and scope of Supplementary Protection Certificate (SPC) protection should be in line with UK standards

- the term of data and market exclusivity for pharmaceuticals should be extended in Japan, in line with UK standards

- provisions to make processes easier for SMEs to be granted patents

- strong measures should be included to prevent the theft of trade secrets, including cyber theft

- Japan should have effective enforcement mechanisms in place with regards to remedies and sanctions and should undertake improved efforts to tackle online IP infringement, including by introducing website blocking

- there should be protections for more UK geographical indications (GIs), with improved enforcement in Japan

- the UK should ensure continued membership to the European Patent Convention (EPC), a non-EU agency, and the Unified Patent Court Agreement (UPCA)

Policy explanation

The UK is widely recognised as being a world leader in IP protection, providing an effective balance between rights holders, users and consumers. IP-rich and creative industries make a significant contribution to the UK economy. Chapter 14 of the EU Japan EPA contains measures aimed at protecting and enforcing IP rights. The Government takes note of the above provisions. While we will seek to include provisions in some areas that go beyond our multilateral obligations, any provisions in a UK-Japan FTA will need to be compliant with the WTO TRIPS Agreement, to which both the UK and Japan are Members.

Competition law, subsidies, procurement and state-owned enterprises

The UK and Japan are both countries with robust competition rules, which allow businesses to compete freely and fairly to the benefit of consumers. Chapters 11, 12 and 13 of the EU-Japan EPA cover competition, subsidies and state-owned enterprises.

The main views and recommendations relating to competition law, subsidies, procurement and state-owned enterprise for trade between the UK and Japan raised by 30 respondents are split into two sections below.

Competition

With regard to competition, respondents wanted consumer protection provisions included in a future FTA, such as a specific consumer chapter to support consumer rights in trade, a standstill provision to be included so that there is a ‘floor’ on consumer rights with provisions dedicated to enhancing them.

On other competition matters respondents called for an FTA to have provisions for:

- both the UK and Japan to maintain an independent competition authority

- provisions preventing anti-competitive conduct which grant business legal certainty and transparent reciprocal market surveillance and enforcement co-operation to be more explicitly mentioned

Policy explanation

The government recognises that NGOs and other interested parties in the UK want to see consumer protections covered in a future UK-Japan FTA. The government notes the views that there should be no regression in the current commitments to consumer rights and competition policy.

Procurement

Procurement provisions in FTAs promote transparency, non-discrimination and competition within the trading partners’ public procurement markets, ensuring that in those procurements covered by the agreement, suppliers from the other party are treated the same as national suppliers. Chapter 10 of the EPA includes specific provisions on government procurement which extend beyond both EU and Japanese commitments in the WTO agreement on government procurement (GPA). The EPA therefore gives businesses increased and improved access to contracts with both the EU and Japan committing to treat suppliers to government from the other party in a fair and non-discriminatory manner.

The main views and recommendations related to UK and Japanese businesses’ access to one another’s procurement markets raised by respondents are below:

- To maintain guaranteed access to Japanese ‘core cities’ and further open the public procurement market, including energy and infrastructure markets.

- To ensure access to government procurement for financial and related professional services in respective markets.

- To ensure the EPA includes regulatory frameworks providing for fair and transparent public procurement regimes.

- To retain access to the EU-Japan government procurement portal or equivalent.

- To retain the SME facilitation provisions in the EPA and for Japan to provide procurement thresholds which are adjusted to SMEs.

- To ensure that local authorities should still be able to take into consideration environmental and social considerations in awarding contracts.

- Concern about allowing Japanese firms to bid for publicly funded healthcare contracts and a request that a future UK-Japan FTA should exclude the NHS.

- To favour domestic suppliers and limit the scope of the procurement chapter in future FTAs.

- Concern that the government procurement dialogue (between regulators of the EU and Japan) created by the EPA lacks appropriate scrutiny from national legislatures.

Policy explanation

The government recognises the importance of the non-discrimination provisions in the EPA and its position is that these should be maintained. The government’s position is to also secure the level of market access opportunities for UK businesses and explore opportunities to build on the EPA, whilst retaining existing protections for key UK public services. The EPA does not apply to the procurement of UK healthcare services. Furthermore, it does not apply to the procurement of goods and services indispensable for national security or defence purposes. This will not change in a UK-Japan agreement.

There were some comments calling for the UK’s international procurement obligations to favour UK domestic suppliers, but the UK’s domestic regulations, which apply to government procurement, generally require contracting authorities and contracting entities to treat suppliers equally and without discrimination. These principles will continue now the UK has left the EU.

Sustainability, labour, gender equality and environment

In the context of a trade agreement, labour, environment and sustainability provisions typically refer to commitments made through international obligations like the International Labour Organisation (ILO) conventions and multilateral environmental agreements (MEAs). Trade agreements also often stipulate commitments to cooperation in these areas.

The EU-Japan EPA contains a full trade and sustainable development (TSD) chapter. This chapter sets out commitments to effectively implement obligations on labour and environment and highlights the EU and Japan’s recognition of the linked nature of economic, social and environmental development.

The main views and recommendations relating to sustainability, labour, gender equality and the environment for trade between the UK and Japan raised by nine respondents are below:

- That the TSD chapter in the EU-Japan EPA should be used as a baseline, building on the provisions included. This could include anti-corruption measures, or further cooperation on environmental goods and services in the future.

- That labour and human rights provisions, sustainable development and environmental standards should be protected and enforceable, as well as closely aligned with the UK-EU FTA and consistent with multilateral commitments and international agreements such as the Paris Agreement and the United Nations Framework Convention on Climate Change (UNFCC).

- That gender equality and women’s economic empowerment should be protected and promoted in the UK-Japan FTA. The UK should recognise and address the impacts of trade policy on different genders and ensure all agreements align with other international commitments on human rights.

- For a full impact assessment covering environmental and social issues to be carried out prior to and during the lifespan of a future agreement.

- That the future agreement should uphold the right to regulate and ensure that the UK and Japan have the freedom to develop and implement domestic law and policy.

- That robust, transparent and reliable procedures for monitoring the implementation of the commitments should be contained in the agreement, that trade unions be given a role in this process, and that these commitments are paired with adequate enforcement mechanisms.

Policy explanation

We recognise that for the environment, climate, labour, and human rights, the key message communicated from the responses received is that the government should maintain the provisions already set by the EU-Japan EPA and not roll back on these, including on how these provisions are enforced. The government shares these views. Furthermore, we recognise that gender equality is an important issue and that women continue to face barriers in accessing the opportunities of free trade. More broadly the government is exploring domestic and international best-practice in order to develop our own approaches on how best to support women in trade. Furthermore, the government is committed to encouraging all states to uphold international human rights obligations.

Dispute settlement and trade remedies

Dispute settlement refers to the formal state-to-state mechanism for resolving disputes where one or more parties consider that there has been a breach of obligations under the relevant international trade agreement and it has not been possible to resolve the dispute informally. Chapter 21 of the EU-Japan EPA sets out the system to resolve disputes between the EU and Japan. It is only available to governments and does not relate to investor-state dispute settlement, which is not part of the EPA.

The main views and recommendations relating to dispute settlement and trade remedies for trade between the UK and Japan raised by nine respondents were:

- they wanted an independent, transparent dispute settlement mechanism

- that a dispute settlement mechanism be able to levy fines or other penalties

- the agreement includes provisions to permit the application of anti-dumping, countervailing measures and safeguards as per the WTO rules book

Policy explanation

The government considers an effective dispute settlement mechanism to be an appropriate part of an FTA. Effective dispute settlement mechanisms give the parties and stakeholders the confidence that commitments made under the agreement can be upheld, and that any disputes will be addressed fairly and consistently. Chapter 21 of the EU-Japan EPA contains state-to-state dispute settlement mechanisms to resolve disputes between the EU and Japan under the EPA, unless it states an area is specifically out of scope of the chapter. The UK considers this an effective and appropriate mechanism.

The government views trade remedies as an important part of a rounded trade policy. They provide a safety net to protect domestic industries if injured by unforeseen import surges or certain aspects of unfair trading (dumping and subsidy) or injury caused by unforeseen surges in imports. They can therefore help to build a broad base of support for trade liberalisation including from sensitive sectors. Trade remedies are about restoring a fair competitive environment, applying measures that are at a high enough level to provide protection, but without harming our downstream users or consumers.

SMEs

SMEs are an integral part of the UK economy. Over 99 percent of the business population in the UK are SMEs.[footnote 19] Barriers to trade disproportionately affect smaller firms and can even prevent them from exporting altogether. Chapter 20 of the EU-Japan EPA currently contains measures specifically aimed at helping SMEs, although the benefits are available to all businesses.

The main views and recommendations relating to SMEs for trade between the UK and Japan raised by sixteen respondents were:

- for Chapter 20 measures to help SMEs be preserved, including the creation of free online information that explains parts of the EPA relevant to SMEs and enable them to have easier access to procurement contracts

- reduction of non-tariff barriers for SMEs

- that an SME committee is established and can collaborate with other committees on SME issues, including on rules of origin and custom issues

- for low cost IP protection for SMEs

- that we consider improvements in the areas of e-commerce, intellectual property, trade facilitation and the use of obligatory language

- ensuring that simplified customs procedures and trusted trader schemes are suitable for SMEs

Policy explanation

The government is committed to seeking an FTA that reduces potential barriers to trade. The government recognises the varied views around the opportunities and the risks for SMEs. We will seek to ensure that even SMEs with limited organisational capacity can take advantage of the benefits achieved through the agreement, supporting businesses exporting both services and goods. We will also seek commitments from Japan to make information about rules relating to trade and investment transparent and easily accessible.

We will seek to agree an appropriate framework for collaborating with Japan on issues affecting SMEs.

The government recognises that the EU-Japan EPA provided SMEs with better market access. Preserving these benefits and enhancing them where possible will be important to the UK.

Next steps

As we have been developing our independent UK trade policy, the government has been consulting with stakeholders through both informal and formal mechanisms. These have included dialogues with the Secretary of State for International Trade, Ministers and Officials.

We will ensure that our new agreements and our future trade policy work for the whole of the UK and its wider UK family, Parliament, local government, business, trade unions, civil society and the public from every part of the UK will have the opportunity to engage and contribute. We will ensure that we continue to work closely with the devolved administrations in developing trade policy.

This will be delivered by:

- open public consultations, to inform our overall approach and the development of our policy objectives

- use of the Strategic Trade Advisory Group (STAG), to seek informed stakeholder insight and views on relevant trade policy matters

- use of Expert Trade Advisory Groups (ETAGs), to contribute to our policy development at a detailed technical level

- engagement outreach events across the English regions and in the Devolved Nations.

The STAG’s principal purpose is for the government to engage with stakeholders on trade policy matters as we shape our future trade policy and realise opportunities across all nations and regions of the UK through high level strategic discussion. The STAG’s remit extends across the breadth of trade policy.

Find out who is currently a member of the STAG.

The objective of the ETAGs is to enable the government to draw on external knowledge and experience to ensure that the UK’s trade policy is backed up by evidence at a detailed level and is able to deliver positive outcomes for the UK. We will draw on the expertise of these groups to gather intelligence for informing the government’s policy positions.

The government is committed to ensuring we will have appropriate mechanisms in place during negotiations to inform the government’s position. As we move forward, we will review our approach to engagement, and consider whether existing mechanisms are fit for purpose.

The government will ensure that our trade policy is transparent and subject to appropriate Parliamentary scrutiny. We will publish our approach to negotiations, call for input response and scoping assessment, and work with the appropriate Parliamentary scrutiny committees. During negotiations with Japan, the government will provide updates to Parliament.

After launching negotiations with Japan, we will seek to agree a high-quality and mutually beneficial trade agreement which furthers the UK’s key interests. Throughout this process we will be reflecting on the responses to the public call for input conducted in 2019 as well as those submitted via the CPTPP consultation in 2018, and will continue to work closely with stakeholders to deliver high quality agreements for the UK.

Chapter 4: scoping assessment

Summary

The Department for International Trade (DIT) is preparing for negotiations with Japan. This scoping assessment provides a preliminary assessment of the potential long run impacts of a free trade agreement (FTA) between the UK and Japan prior to the launch of negotiations.

The importance of trade and investment links between the UK and Japan

Japan is the world’s third largest economy[footnote 20] and the UK’s fourth largest non-EU trading partner (and 11th globally).[footnote 21] Total trade between the two countries was worth around £29.5 billion in 2018, with over half of this being goods trade. The UK is the second largest recipient of Japanese direct investment.[footnote 22]

UK businesses and UK jobs

In 2018, 9,500 VAT-registered businesses exported goods to Japan, employing 2.4 million people. Around 6,700 VAT-registered businesses, supporting 2.5 million jobs, imported goods from Japan.

- 9,500 UK businesses export

- 2.4 million employees work in these businesses

Source: HMRC UK Trade in goods by business characteristics 2018

Goods trade

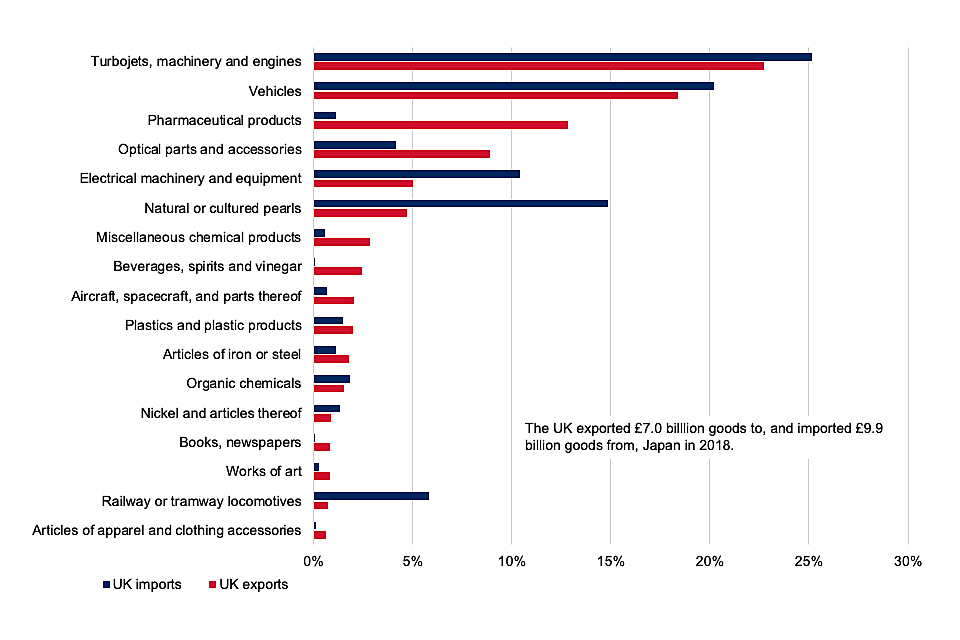

Cars and trucks are the UK’s largest export to Japan and the largest imported good from Japan.

- £0.9 billion car and truck exports

- £1.4 billion worth of car and truck imports

Source: HMRC using a 2016-18 average at the HS4 level

Services trade

The UK’s largest service export to Japan is financial services and this is also the largest services sector imported from Japan.

- £3.9 billion finance exports

- £1.9 billion finance imports

Source: ONS using a 2016-18 average. Where data is disclosed, averages only account for years in which data is available.

Source: HMRC and ONS data, 2016-18 annual averages.

Scope to further enhance trade and investment

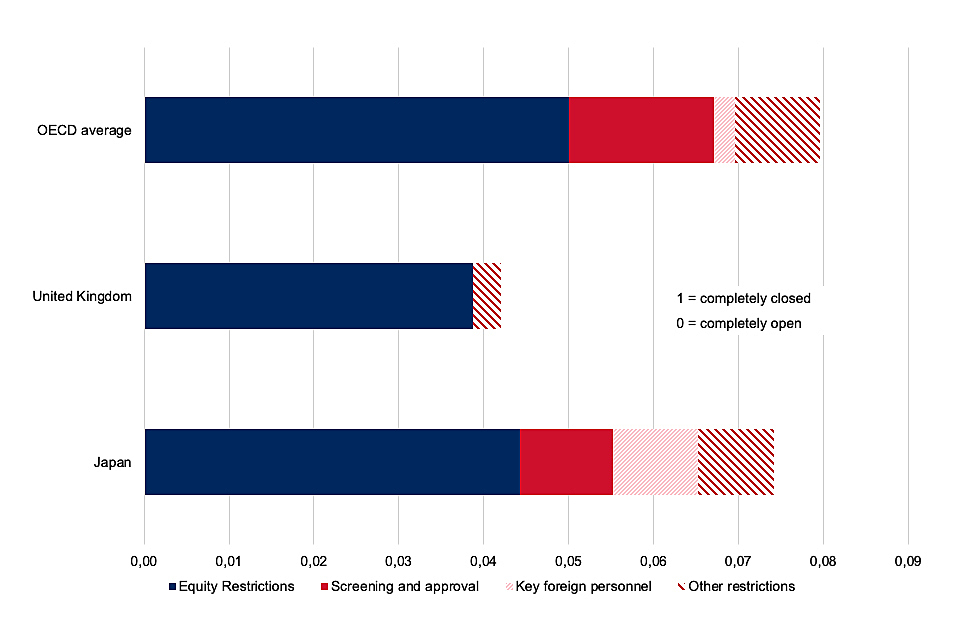

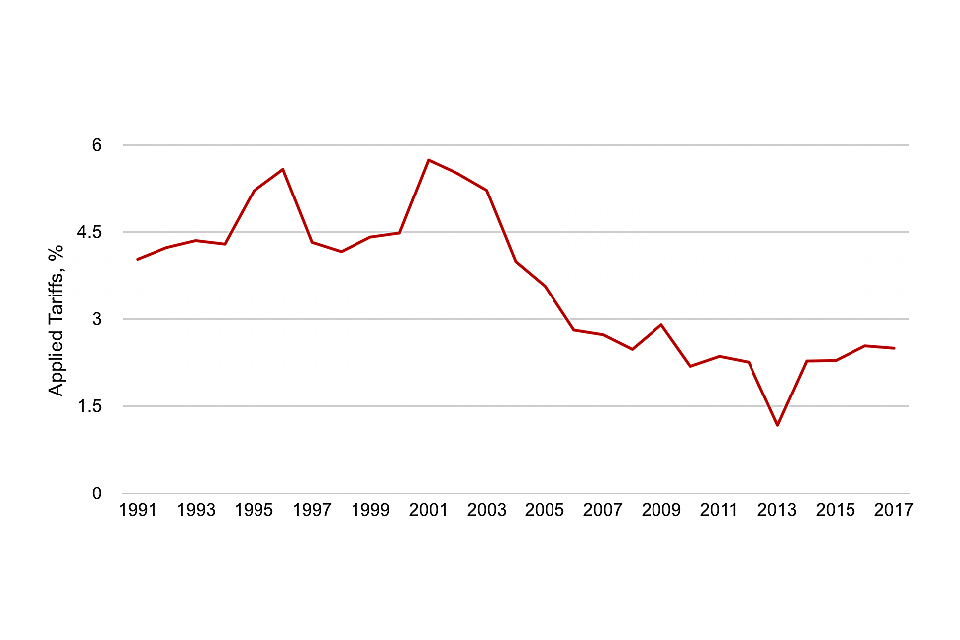

The EU-Japan Economic Partnership Agreement (EPA) entered into force on 1 February 2019. In January 2019, the UK and Japan agreed to negotiate a new bilateral agreement. While there are strong trade and investment links between the UK and Japan already, evidence on trade and investment barriers between the two countries suggests that there is scope to further enhance this relationship. Several sources of evidence on trade barriers, including responses from the Japan FTA call for input, indicate there are barriers which could be liberalised through an FTA.

In February 2019 the EU-Japan Economic Partnership Agreement (EPA) entered into force. The UK was party to this agreement as a member of the EU, and it remains in place during the transition period. The new agreement will build on the EU-Japan EPA and secure additional benefits for UK business.

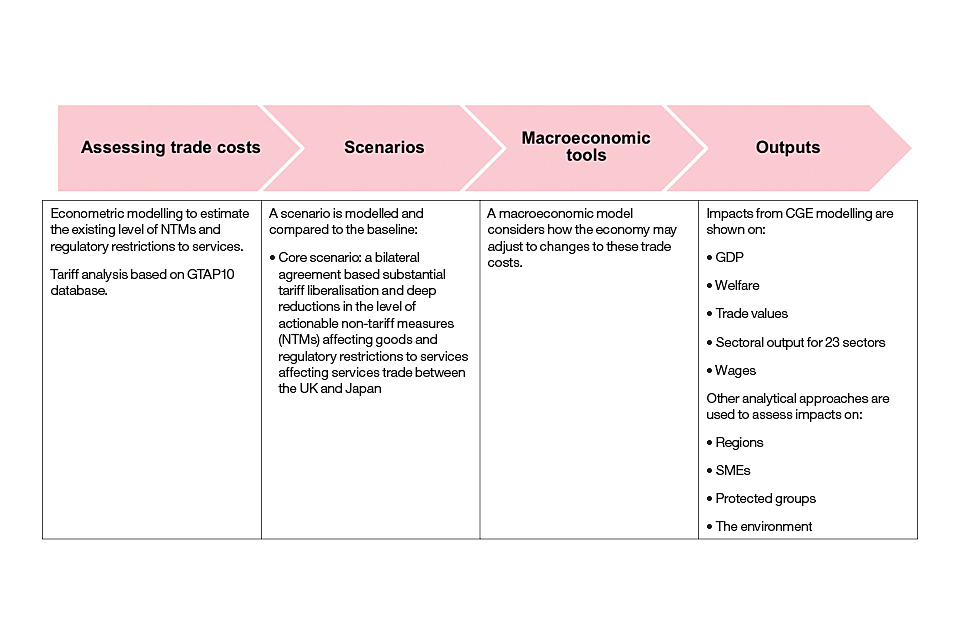

The potential impact of a UK-Japan free trade agreement

International evidence suggests that FTAs can reduce the costs of trade and investment, by eliminating tariffs and reducing non-tariff barriers, and regulatory restrictions to services trade. The analysis in this scoping assessment draws on robust evidence and the best tools available for this type of analysis. The results should be interpreted with caution, due to inherent uncertainty, and should not be considered as an economic forecast for the UK economy.

The scenario used for modelling is based upon the UK’s current tariff schedule (the EU’s ‘Common External Tariff’). The government is currently developing its new UK MFN tariff schedule.

Coronavirus has had a major impact on most major economies. Its’ economic impact is expected to be highly significant for the next few years. However, the analysis of the impact of a trade agreement with Japan relates to the long term. It is too soon to say what the lasting impacts of the pandemic will be on international trade and domestic sectors. Our analysis therefore implicitly assumes that in the long term, the UK, Japan and global economies will have recovered from the impacts of the coronavirus. At this point in time it is too early to identify whether or how the estimated impacts in this document might be affected by the current situation.

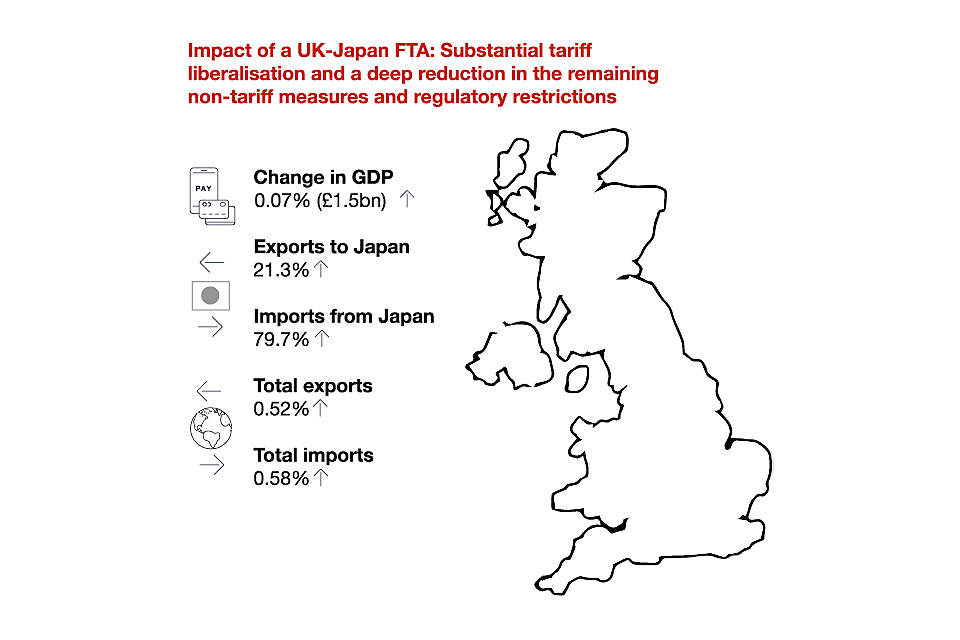

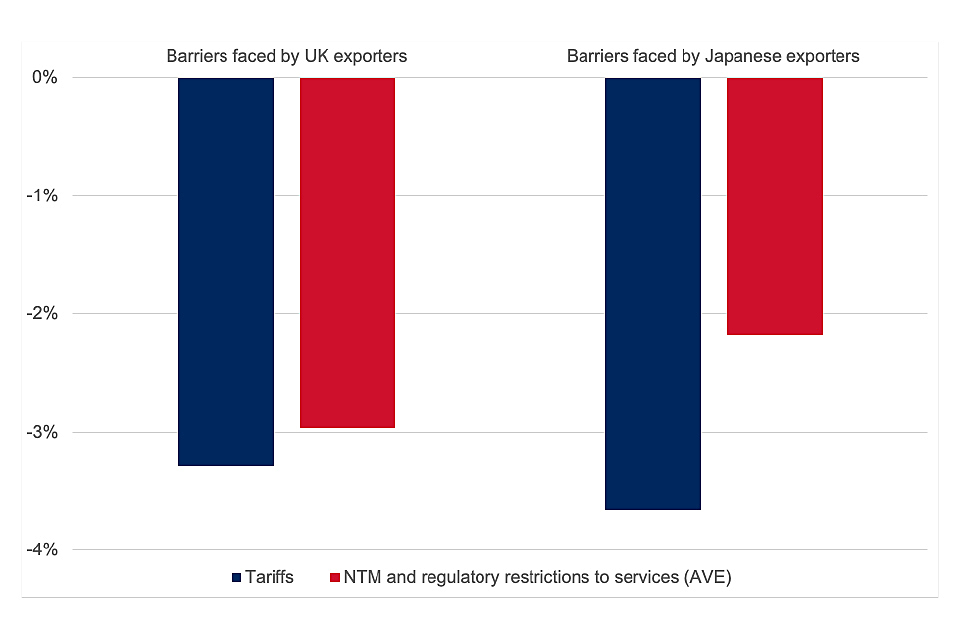

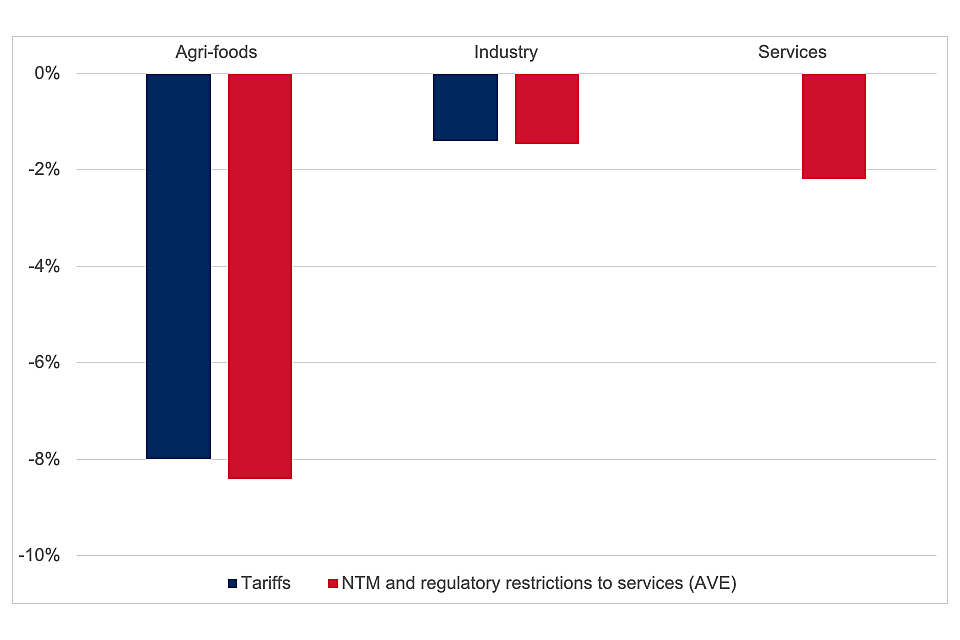

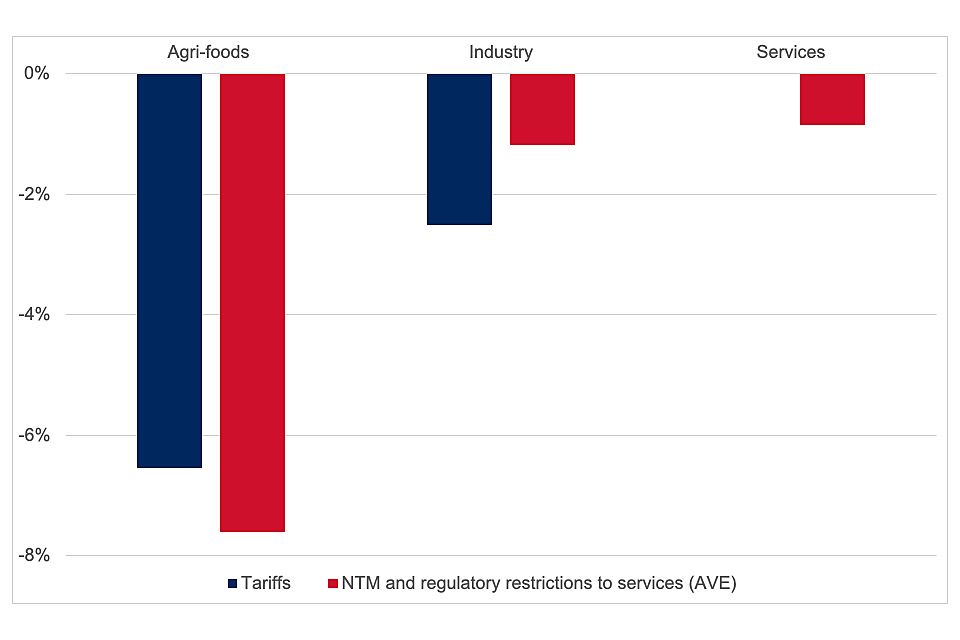

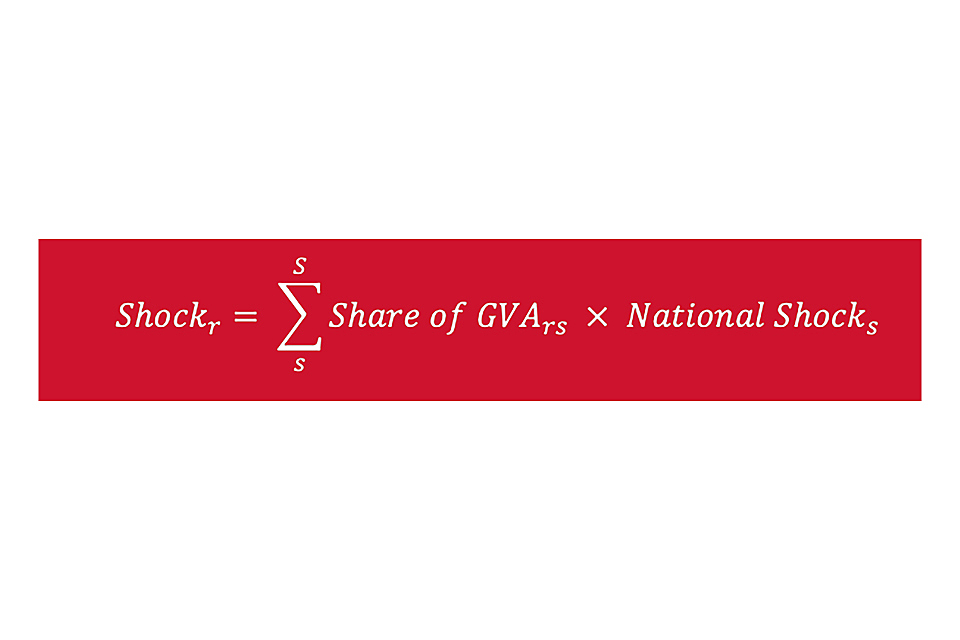

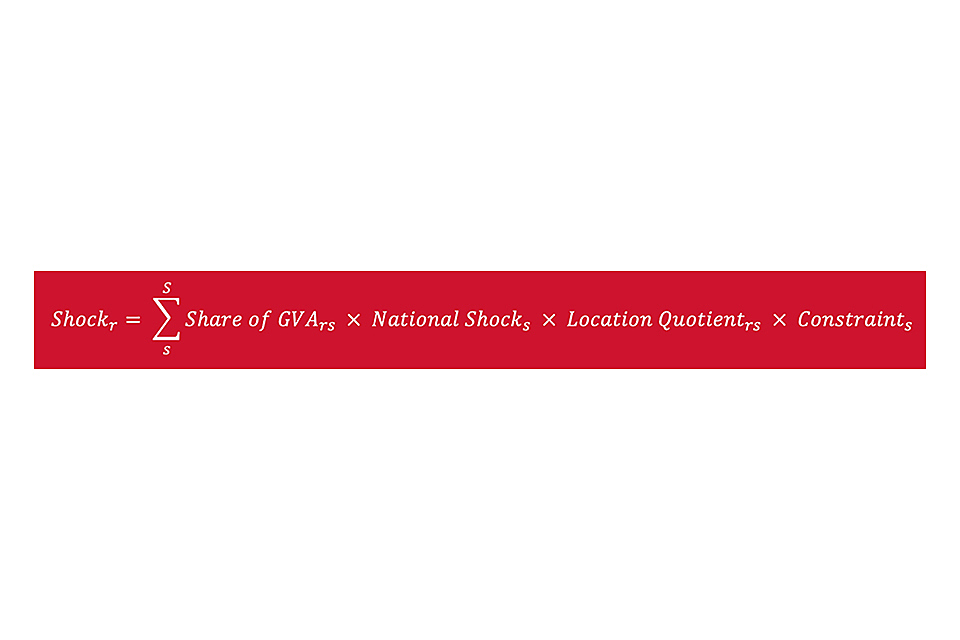

The image shows that there would be substantial tariff liberalisation and a reduction in remaining non-tariff measures and regulatory restrictions if a free trade agreement between the UK and Japan came into effect.

Source: external CGE modelling. £ values in 2018 terms

As the final details of a bilateral agreement between Japan and the UK have not yet been negotiated, the modelling is based on a plausible scenario that represents the depth of a potential agreement. This scenario assumes substantial tariff liberalisation and deep reductions in the level of actionable non-tariff measures (NTMs) affecting goods trade and regulatory restrictions affecting services trade between the UK and Japan, compared to not having a trade agreement with Japan. This scenario is used to generate the potential magnitude of impacts of trade liberalisation but should not be interpreted as the specified option for a future agreement.

A bilateral trade agreement with Japan could increase UK GDP in the long run by around 0.07% under the modelled scenario. This is equivalent to an increase of £1.5 billion in total GDP compared to its 2018 level. This increase reflects changes to the underlying economy brought about by a reduction in barriers with Japan through an FTA compared to the UK not having a trade deal with Japan. These reduced costs for firms and consumers result in changes to domestic specialisation and the composition of imports. Productivity gains are driven by resources moving to where they are more productive, including between sectors and industries, as well as between firms within sectors.

In the long run, almost all UK sectors are estimated to increase output, suggesting productivity gains from further specialisation are likely within sectors, through the reallocation of resources to more productive firms. Resource reallocation also occurs between sectors, with some sectors reducing employment as workers are drawn to other growing sectors. In the modelled scenario, workers are expected to experience increases in real wages.

UK goods and services are expected to become relatively more competitive in Japan, and exports to Japan are expected to increase by 21.3% in the modelled scenario. Firms would be able to expand trade as a result of the reduction in trade costs on both imported inputs and exported outputs to Japan, generating productivity gains. This could also lead to an increase in the global competitiveness of UK firms, and exports to other countries outside of the agreement are estimated to grow.

Imported goods and services from Japan facing lower trade costs could drive efficiency gains for UK businesses relying on or switching to inputs from Japan. UK consumers may also benefit if cheaper consumer goods become available. In the long run prices adjust to higher demand, but imports from Japan are estimated to increase by 79.7%.

Imports from Japan could increase significantly relative to UK exports to Japan as a result of the assumed tariff and NTM reductions, especially in areas where Japan is relatively competitive, including categories such as ‘chemical, rubber and plastic products’, ‘manufactures of materials’, ‘motor vehicles and parts’,’ other machinery and equipment’ and ’other transport equipment’.[footnote 23] Although imports from Japan increase significantly, in the context of overall UK imports from all countries (including Japan), expected growth in the UK’s total imports resulting from the FTA with Japan is 0.6%. For context, in 2018 UK imports from Japan were £15.2 billion (2.3% of UK total imports).

The modelling estimates an increase in the long run level of the average real wage in the UK of around 0.09% (£0.8 billion).

The UK economy is expected to grow as a result of a UK-Japan FTA. Based on the distribution of sectoral value added, a UK-Japan FTA has the potential to increase long run output across all nations and regions of the UK relative to the baseline. London, the East Midlands and Scotland expand the most relative to the baseline in the scenario set out here.

As outlined previously, the increased imports from Japan could be beneficial for both UK businesses and UK consumers as they could facilitate greater choice and lower prices for UK producers and consumers. Compared to not having a trade deal with Japan, both consumers and importing businesses may directly benefit from substantial tariff liberalisation, with total annual tariff reductions on UK imports from Japan estimated to be around £183 million to £275 million per year in the long run.[footnote 24] Non-tariff trade cost reductions can drive import prices even lower, creating further direct benefits captured in the macroeconomic analysis above.

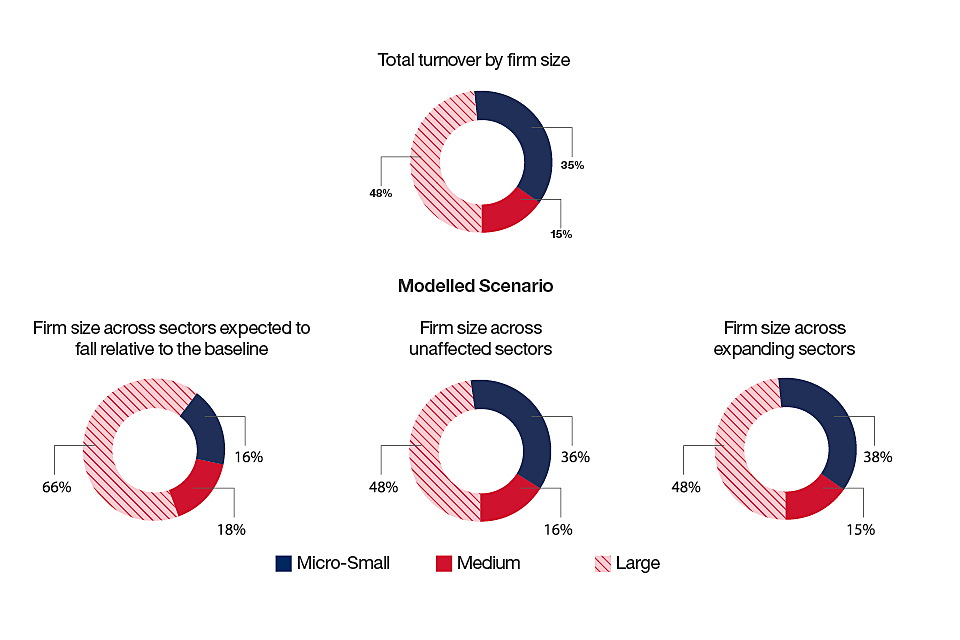

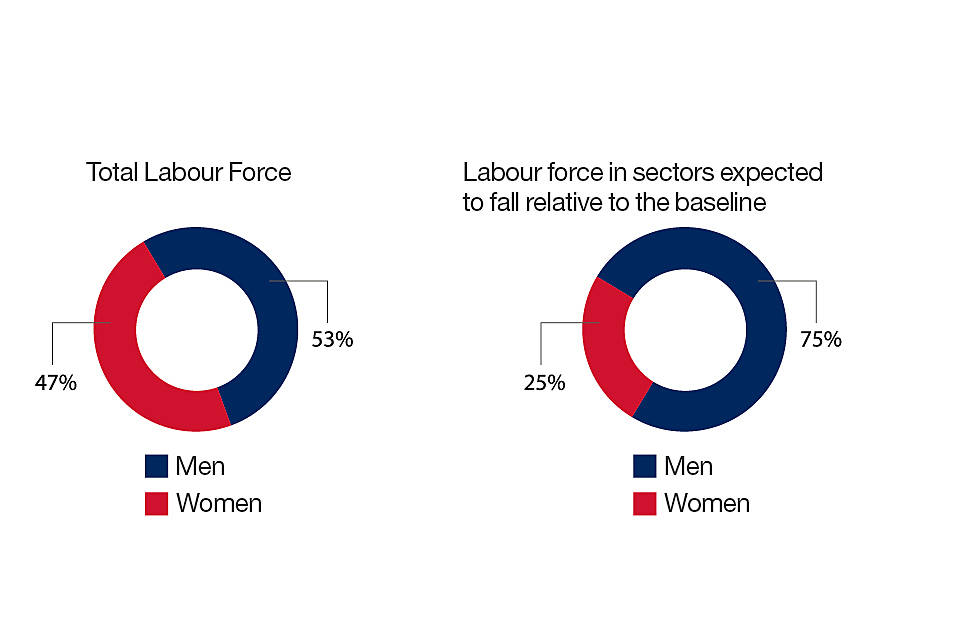

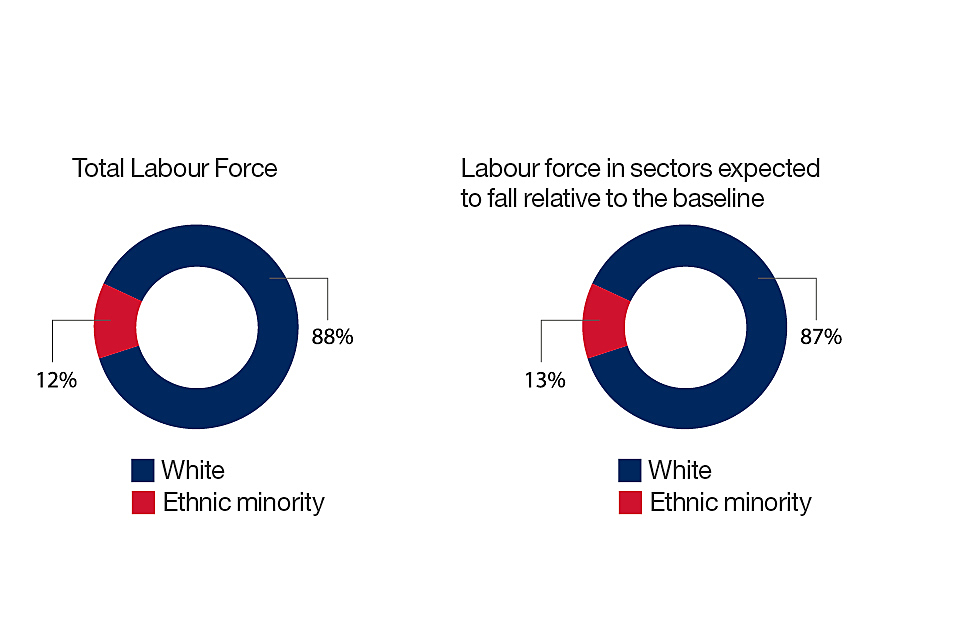

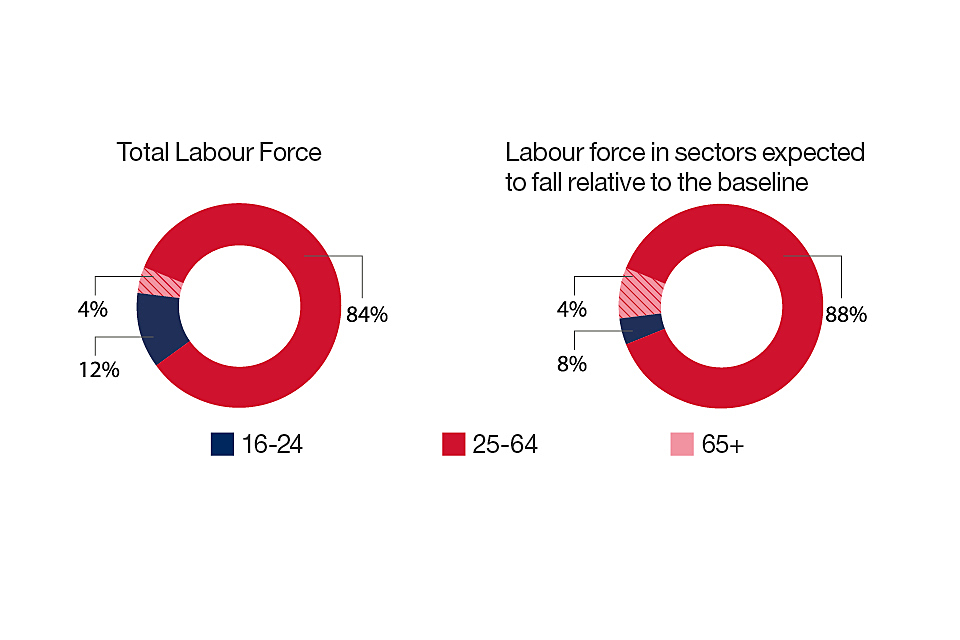

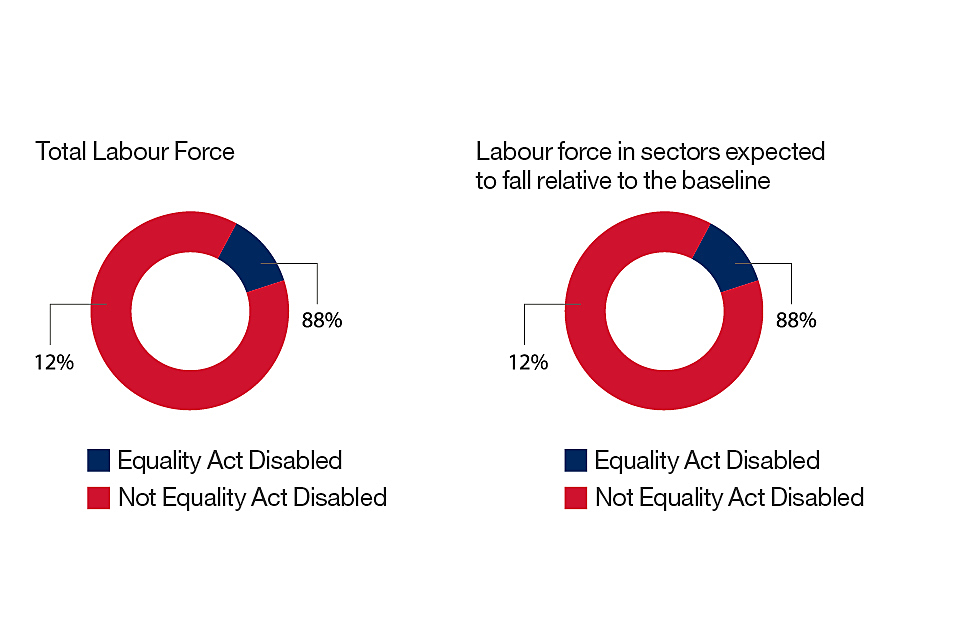

The economic impacts of a UK-Japan FTA are expected to have some wider social and environmental implications. A preliminary assessment of the implications on groups within the labour market finds that the representation of protected groups (in relation to age, gender, ethnicity and disability) in sectors where employment falls relative to the baseline, is largely in line with the general population of the workforce.[footnote 25] Workers within any of these sectors may be presented with employment opportunities within expanding sectors. The extent to which the UK-Japan FTA impacts the environment is dependent on the negotiated outcome, which will determine changes in the pattern of trade and economic activity. Changes in the UK’s production and global trading patterns could favour UK sectors which are currently more or less emissions-intensive and could impact transport emissions. The government is committed to ensuring that a UK-Japan FTA will not threaten the UK’s ability to meet its existing environmental commitments, or its membership of international environmental agreements, and will pursue opportunities to further environmental and climate policy priorities.

Finally, GDP in Japan is expected to increase by 0.04% equivalent to an increase of £1.5 billion compared to its 2018 level, demonstrating a UK-Japan FTA can drive economic gains for both countries.

Next steps

Following the conclusion of negotiations and once the text of a UK-Japan agreement is known, a full impact assessment will be published prior to implementation. The final impact assessment will update and refine the preliminary estimates of the scale and distribution of impacts outlined in this scoping assessment.

The Department for International Trade would like to thank CEPR and Professor Joseph Francois for conducting economic modelling to support this assessment.

1. Background

A free trade agreement (FTA) is an international agreement which seeks to increase trade and investment between its signatories by removing or reducing tariffs, non-tariff measures and regulatory restrictions to services prohibiting trade and investment between partner countries.[footnote 26]

Trade and investment barriers make it more difficult and costlier to trade or invest overseas. By removing or reducing them, FTAs can make it easier for businesses to export, import and invest. FTAs can also benefit consumers by providing a more diverse and affordable range of imported products.

The government is committed to a transparent, inclusive and evidence-based approach to trade policy. A call for input on a renegotiated FTA between the UK and Japan was held between September and November 2019.

The aim of the scoping assessment is to provide parliament and the public with a preliminary assessment of the broad scale of the potential long run impacts of a renegotiated FTA between the UK and Japan prior to the launch of negotiations. Both countries have agreed to use the EU-Japan EPA as the basis for a future economic partnership, committing to make it ‘as ambitious, high standard and mutually beneficial’ as the EPA, enhanced in areas of mutual interest.[footnote 27]

While the UK-Japan agreement will be based on the EPA, some provisions will likely differ, and the exact content of a future FTA is therefore not yet known. Once the provisions of the agreement have been negotiated, the government will publish an impact assessment based upon the provisions of the agreement.

The UK has already signed an exchange of letters on mutual recognition of conformity assessment, which maintains the operational aspects of the EU-Japan mutual recognition agreement (MRA) on conformity assessment after the UK completes the transition period.[footnote 28]

This scoping assessment includes the rationale for an FTA with Japan, a description of the approach used for assessing its potential impacts, the results from modelling a possible scenario for a UK-Japan FTA, and sensitivity analysis.

The government is currently developing its new UK MFN tariff schedule. For the purposes of this analysis, the MFN rates assumed are those that are currently applied by the UK.