Sustainability Reporting Guidance 2025-26

Published 17 July 2025

1. Foreword

This page sets out the reporting requirements and standards for sustainability reporting in central government.

This guidance is mandatory for all UK central government bodies[1] that produce annual reports and accounts in accordance with the FReM)[2]. This manual sets out minimum requirements, and additional reporting subject to materiality, all on a comply or explain basis.

This guidance may also be applied by other public sector bodies for their sustainability reporting. UK public sector bodies are responsible for meeting their other statutory and mandatory reporting requirements, and should consult their relevant reporting authority if they are unsure.

1.1 Years of applicability

This applies to the 2025-26 reporting period.

Transition relief

Some central government bodies may fall within the scope of the sustainability reporting requirements for the first time for 2025-26. Where these bodies have not previously been, and are not currently, in scope of the Greening Government Commitments (GGCs), this guidance is not mandatory for this reporting period.

From 2026-27, central government bodies will be expected to comply with this guidance (or explain non-compliance), insofar as specific reporting requirements do not conflict with other statutory or mandatory reporting frameworks for annual report preparation.

1.2 Substantive changes from 2024-25

The SRG for 2025-26 has been updated to align with and incorporate the approach set out in the Task Force on Climate-related Financial Disclosures (TCFD) -aligned disclosure for the UK public sector Application Guidance (or ‘TCFD Application Guidance’) and focus on a narrower set of environmental metrics under the GGCs[3].

The main areas where the guidance has been changed from 2024-25 are:

- Focus on integrated reporting - emphasis on data quality, proportionality, and integrated reporting, with strengthened alignment with financial reporting boundaries.

- Streamlined set of metrics – minimum reporting requirements have been streamlined to focus on a smaller set of core environmental metrics. The distinction between GGCs and SRG requirements has been made clearer throughout. Not all GGCs requirements are mandated in the annual report and accounts.

- Thresholds, exemptions, and ‘comply or explain’ - thresholds and exemptions have been clarified and strengthened. Entities above the reporting threshold cannot use GGC exemptions to avoid SRG requirements. A ‘comply or explain’ basis for disclosure has been introduced.

- Alignment with TCFD approach - enhanced alignment with TCFD recommendations, including minimum reporting requirements for Scope 1 and Scope 2 greenhouse gas (GHG) emissions, and a materiality-based approach to Scope 3 emissions (including official business travel).

- Scope 3 emissions - there is no minimum reporting requirement for Scope 3 emissions, but entities shall report related information where these are material. The guidance highlights data quality, proportionality, and limitations in Scope 3 reporting.

- Carbon offsets – a minimum reporting requirement has been introduced for carbon offsets where used, covering volume, type, integrity, and expenditure. Offsets still cannot be used to meet GGC targets and this new requirement should not be seen as encouraging their use in central government.

Moreover, the SRG has been simplified and streamlined to improve usability. There have also been other changes to the guidance wording and structure to improve the clarity and readability.

Mandatory and advisory elements

This guidance includes both mandatory and advisory elements, using consistent terminology as defined in the table. These definitions are intended solely for this guidance and should not be applied more widely unless explicitly directed.

| Term | Intention |

| shall | denotes a requirement: a mandatory element. |

| should | denotes a recommendation: an advisory element. |

| may | denotes approval. |

| might | denotes a possibility. |

| can | denotes both capability and possibility. |

| is/are | denotes a description. |

2. Overview: Introduction to sustainability reporting

In the context of this guidance, sustainability reporting focuses on environmental and climate-related information for inclusion in entity-level annual reports and accounts.

While this guidance covers environmental and climate-related sustainability reporting, it does not cover broader social or governance topics. These are addressed in the Government Financial Reporting Manual (FReM), which also includes requirements for reporting progress against the UN Sustainable Development Goals (SDGs).

This section provides an overview of sustainability reporting, including the overall approach, the minimum requirements and scoping thresholds.

Purpose

The purpose of sustainability reporting within an integrated set of annual report and accounts is to show how an organisation’s sustainability-related risks, opportunities, and impacts affect, and are affected by, its strategy, performance, and future outlook. In addition to providing accountability and transparency on sustainability performance, the information supports decision-makers and policy setting across government.

2.1 Concepts, principles and foundations

Sustainability reporting is principles-based. In-scope reporting entities (refer to De minimis thresholds and other exemptions) shall apply a ‘comply or explain’ basis for disclosure; complying with each of the requirements; or explaining non-compliance against each of the requirements (i.e., specific reasons, actions planned to address gaps, and timelines for achieving compliance).

Through integrated reporting, entities shall demonstrate how sustainability considerations are embedded throughout the organisation, its operations, and its strategy. When preparing their Sustainability Report (including TCFD), reporting entities shall adhere to the principles, concepts and foundations set out in Appendix A: Sustainability reporting for the UK public sector - concepts, principles and foundations (herein Appendix A).

For clarity, reporting entities shall: - report against the minimum requirements set out in this guidance (including on TCFD-aligned disclosure), - apply the concept of materiality to further sustainability information (that goes beyond the minimum requirements) and report accordingly, explaining any non-compliance.

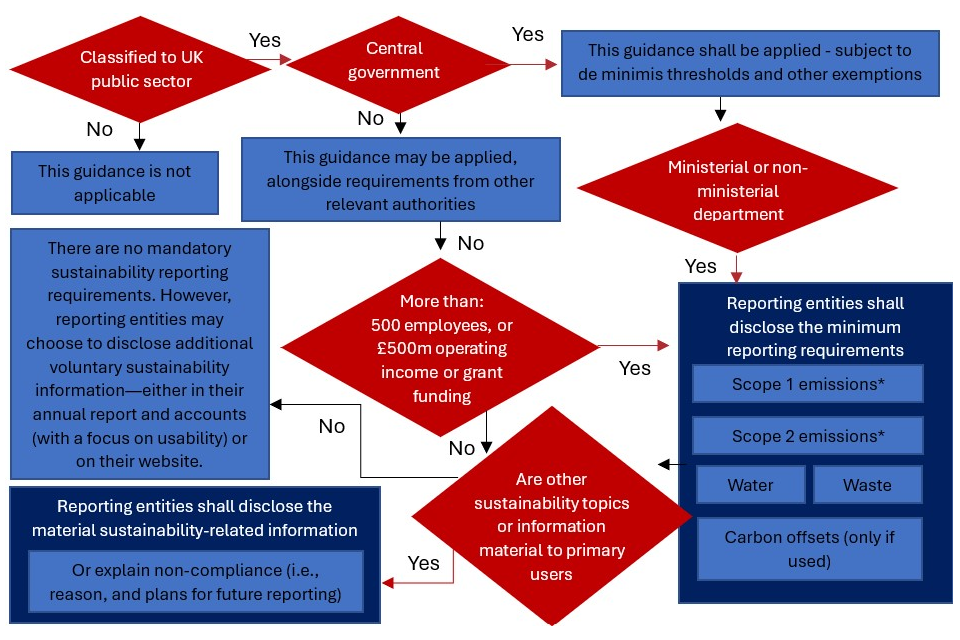

A flow chart for applying this guidance, and the related reporting requirements is displayed in Figure 1 later in this section.

Alignment with the Greening Government Commitments (GGCs)

Some reporting requirements set out in this guidance allow for alignment with key metrics in the GGCs. The GGCs set out the actions UK government departments and their agencies will take to improve their impact on the environment.

To support the production of integrated annual reports and accounts which apply the same boundaries for sustainability and financial information, this guidance is not fully aligned with the GGC framework. Various GGC metrics are not required within annual reports and accounts, and there are additional areas of difference between the underlying requirements in this guidance and the GGC framework (refer to Annex D).

Centrally set GGC targets support performance comparability across government bodies. This is true even if they exclude certain emissions (e.g., material emissions from overseas operations).

Reporting entities shall distinguish metrics that contribute to GGC targets from those that do not, providing reconciliations and explanations for any differences. This also applies to other GGC-related sustainability metrics and targets in the annual report.

Task Force on Climate-related Financial Disclosures (TCFD) recommendations

HM Treasury has mandated TCFD-aligned disclosure in central government, with departments and larger arm’s length bodies (ALBs) required to adopt in line with the TCFD Application Guidance (on a comply or explain basis).

The Application Guidance also highlights other significantly impacted entities, such as those operating in, regulating, or setting policy for specific industries or sectors (e.g., finance, energy, transport, etc.), that should strongly consider making TCFD-aligned disclosures and applying the relevant TCFD Supplementary Guidance. Other relevant authorities and jurisdictions are mandating TCFD-aligned disclosure across the UK public sector.

De minimis thresholds and other exemptions

De minimis thresholds and other exemptions may be applied in respect of minimum sustainability reporting requirements. This does not negate the required reporting and thresholds for TCFD-aligned disclosures, nor the general requirements on reporting entities to present material information to users.

The minimum requirements for sustainability reporting set out in this guidance are mandatory for all central government bodies with over 500 full time equivalent (FTE) staff or over £500m in operating income or grant funding. This applies the same size threshold as the TCFD Application Guidance (which aligns with the size thresholds for climate-related disclosures for companies and LLPs).

Central government bodies below this threshold shall still consider whether based on their entity’s context (including its impact) there is other sustainability-related information which is material to primary users. Entities should engage their Audit Committees in the materiality assessment process, and may benefit from documenting their rationale to support key judgements.

Preparers at the departmental level should engage with their relevant select committee. Discussing the nature and use of annual report and accounts supports alignment with Parliament’s needs.

Central government bodies in scope of the GGCs

Even where an organisation has an exemption under the GGCs, if they surpass the size threshold described above they are mandated to comply with the relevant requirements in this guidance (including on emissions) or explain non-compliance. GGC exemptions alone cannot be used as a reason for non-compliance.

GGC exemptions that are granted based on the inability to meet set targets should be used solely to remove GGC targets from the annual report and accounts. Sustainability information on the metrics, along with any relevant internal targets should still be included. Similarly, GGC exemptions granted on the ability to collect certain data or track specific metrics do not exempt bodies from other sustainability-related reporting requirements.

Central government bodies with GGCs exemptions shall briefly explain the GGC exemption in their annual reports and accounts. Reporting entities that are uncertain about how to report sustainability information should contact HM Treasury (refer to Annex B).

Central government bodies shall also ensure they meet the reporting requirements imposed on them by regulation and statute.

2.2 Overview of minimum reporting requirements

This table provides an overview of the minimum requirements in each of the main reporting areas.

| Type | Non-financial information | Financial information |

|---|---|---|

| GHG emissions – Scope 1 (direct) contributing to national target | Emissions: Mandatory reporting on all Scope 1 emissions[1]. These occur from sources owned or controlled by the organisation, including: - combustion in boilers - fugitive emissions from equipment (e.g., air conditioning units) - fleet vehicles (owned or leased) Energy: An analysis of related gas consumption (in kWh) shall also be included. |

Gross expenditure on the purchase of energy and expenditure on reported areas of energy. |

| GHG emissions – Scope 2 (energy indirect) contributing to national target | Emissions: Mandatory reporting on all Scope 2 emissions. These result from the energy consumed which is supplied by another party (e.g., electricity supply in buildings or outstations), and purchased heat, steam, and cooling. Energy: An analysis of related energy consumption (in kWh) shall also be included. |

Gross expenditure on the purchase of energy and expenditure on reported areas of energy. |

| Carbon offsets (only where held or used) | Central government bodies that purchase carbon credits shall report the following: - total volume of carbon credits purchased and retired during the reporting period (in tonnes of CO₂e). - type of credits, including: 1. whether they relate to carbon reduction or carbon removal activities. 2. for removals, whether they are nature-based (e.g., woodland creation, forest restoration) or technology-based (e.g., Direct Air Capture). - details of the integrity of the carbon credits purchased and used. |

Total expenditure on carbon credits against each of the categories opposite. |

| Waste organisation and management | Report absolute (in metric tonnes) values for waste from the organisation‘s estate against the following categories: - total waste arising - total waste recycled - total ICT waste recycled, reused, and recovered (externally) - total waste composted/ food waste - total waste incinerated with energy recovery - total waste incinerated without energy recovery - total waste to landfill This includes waste from administrative and operational activities, however, major mineral waste is not a minimum requirement. |

Total expenditure on waste disposal (including waste disposal contracts, specialist waste arising and the purchase of licenses for waste) and expenditure against each of the categories opposite. |

| Finite resource consumption | Report on estates water consumption in cubic meters. | Total expenditure on purchase of related finite resources including purchase of licenses. |

Notes

-

The minimum reporting requirement for use of carbon offsets should not be seen to encourage their use in central government.

-

Other mandatory sustainability reporting requirements relating to TCFD-aligned disclosure and UN SDGs, which are specifically mandated in the FReM alongside separate application guidance, have not been included in this table.

-

Reporting against the minimum requirements does not preclude the requirement for a materiality assessment for other sustainability metrics beyond those listed in the table.

-

The minimum reporting requirements table only includes domestic Scope 1 and Scope 2 emissions. Reporting entities shall apply a materiality filter to overseas Scope 1 and Scope 2 emissions.

Streamlined Energy and Carbon Reporting (SECR)

Unless an entity can claim a low energy consumption exemption, the SECR Framework is mandatory for all quoted companies, and for unquoted companie[5] and Limited Liability Partnerships (LLPs) that meet at least two of the following criteria:

- more than 250 employees

- turnover of more than £36m

- balance sheet of more than £18m

UK public sector bodies are required to assess if they are in scope of the SECR framework and ensure their reporting methodology aligns with the latest available SECR guidance – refer to Chapter 2 of the Environmental Reporting Guidelines (ERG).

Other sustainability reporting developments

Sustainability reporting continues to develop at pace with changes in the private sector and by international standard setters. These are explored further in Annex A.

HM Treasury sets annual reporting requirements, supported by the Financial Reporting Advisory Board (FRAB)[6]. FRAB has representatives from across the UK public sector. HM Treasury and FRAB are monitoring sustainability reporting developments to identify improvements and consider a future strategy.

No further action is required by reporting entities at this time unless they are subject to specific regulation or statute (e.g., Companies Act requirements, Financial Conduct Authority, Prudential Regulation Authority, etc.).

Decision tree depicting when this guidance should be used, which reporting entities are in scope, and the relevant reporting requirements

3. Greenhouse gas emissions

The Climate Change Act 2008 (2050 Target Amendment) Order 2019 increased the UK’s commitment to a 100% reduction in emissions by 2050. To meet this commitment, the UK government must drastically reduce the UK’s GHG emissions.

Purpose

This section provides guidance on accounting for GHG emissions (commonly referred to as carbon accounting or carbon foot printing) for inclusion in public sector annual reports and accounts.

Accounting for emissions involves the collection of baseline information, such as fuel use, mileage, electricity/gas consumption and use of raw materials, which can then be converted into Carbon Dioxide Equivalents (CO2e) using emission conversion factors. Most baseline information is available on commercial invoices and other business documentation.

All GHG emissions can be accounted for as they occur (i.e., use of energy in processes, manufacturing or travel) or on the basis that they have already been incurred (i.e., embodied carbon in raw materials or assets used). This concept is similar to financial accounting in terms of current and capital expenditure.

The ERG advises on methods to collect and calculate information on emissions.

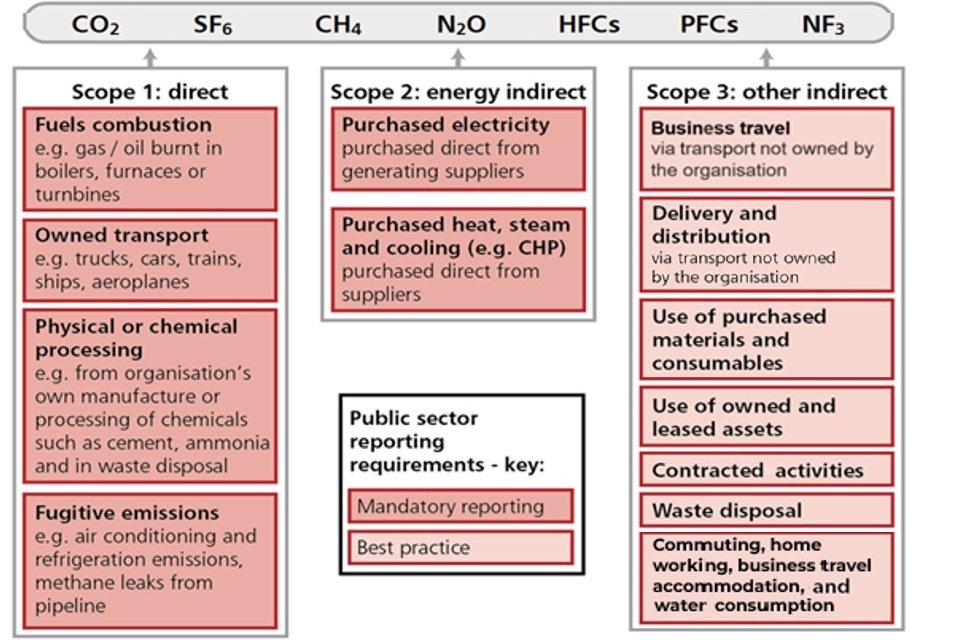

The standard metric to be used to report GHG emissions in the public sector is the CO2e in tonnes. The use of this metric allows for the capture of information related to the seven greenhouse gasses reported under the Paris Agreement[7] (CO2, SF6, CH4, N2O, HFCs, PFCs and NF3[8]).

3.1 Emissions accounting standards and guidance

This guidance has been developed to be consistent with the following standards:

- the GHG Protocol Corporate Standard (‘the GHG Protocol’) – developed by the World’s Resources Institute and the World Business Council for Sustainable Development, the protocol sets out accounting principles, which are generally akin to financial Generally Accepted Accounting Principles (GAAP). International Standards Organisation (ISO) also uses the protocol. However, some principles do offer choice, which needs to be refined to ensure consistency for public sector use.

- Guidance on calculating and estimating emissions – the government publishes guidance for organisations to measure and report their emissions.

Alternative sources for conversion factors

Where the government is unable to provide an appropriate conversion factor or no translation factor is available from the government range, organisations may make use of other emission factors (e.g., accredited university or international research).

Organisations are generally encouraged to make use of factors that are already available in the public domain and not commission the development of factors as this is not likely to be considered good value for money.

GHG emissions reporting guidance and standards across the public and private sector

Where alternative sources of emissions factors are used, a note shall be made in the report, on the organisation’s website or similar, detailing the departure from the government factors.

In line with government guidance, GHG emissions information shall not be weather corrected.

3.2 The accounting boundary for carbon

In most cases, the department’s sustainability reporting accounting boundary will be the same as the financial reporting boundary.

In some cases, the department may need to apply their own judgement to set the sustainability reporting accounting boundary, following the GHG Protocol. Appendix A includes further supplementary information on reporting boundaries for sustainability-related information.

The GHG protocol suggests two distinct approaches to setting accounting boundaries:

- equity share - undertaken according to the share in the organisation[9] in terms of economic interest; and

- control approach - where an organisation accounts for 100% of emissions from operations over which it has control. Control is defined in either financial or operational terms.

In practice, to fully align the carbon accounting boundary with the financial reporting boundary, a combination of approaches may be needed, particularly when accounting for joint ventures, associates and leases.

The selected allocation approach should be applied consistently throughout the departmental group with adequate explanations to users. This precludes the specific simplifications and allowances to vary reporting which are granted in line with the GGCs 2021-25 reporting requirements.

3.3 Emissions scopes for public sector reporting

The GHG Protocol introduces three scopes, as follows:

-

Scope 1: Direct emissions - from sources owned or controlled by the organisation (e.g., emissions as a result of combustion in boilers owned or controlled by the organisation, emissions from organisation-owned fleet vehicles).

-

Scope 2: Energy indirect emissions – as a result of electricity consumed which is supplied by another party (e.g., electricity supply in buildings or outstations). This should also include other purchased indirect emission sources such as heat, steam and cooling.

-

Scope 3: Other indirect emissions – all other emissions which occur as a consequence of activity in an organisation’s value chain, but which are not owned or controlled by the accounting entity.

Scope 3 emissions are further subdivided into 15 categories as follows:

| Category | Detail | |

| 1 | Purchased goods and services | from the production, transportation, and use of goods and services purchased by the organisation. |

| 2 | Capital goods | from the production, transportation, and use of capital assets, such as machinery, equipment, and vehicles. |

| 3 | Fuel and energy-related activities | from the use of fuel and energy for operations, such as electricity, heating, and transportation. |

| 4 | Upstream transportation and distribution | from the transportation and distribution of raw materials and finished products to the organisation. |

| 5 | Waste generated in operations | from the disposal and treatment of waste generated by the organisation. |

| 6 | Business travel | from employee travel for business purposes, such as air travel, train travel, and car travel. |

| 7 | Employee commuting | from employee commuting to and from work. |

| 8 | Upstream leased assets | from assets leased by the organisation that are not included in its direct Scope 1 or 2 emissions. |

| 9 | Downstream transportation and distribution | from the transportation and distribution of the organisation’s products to customers. |

| 10 | Processing of sold products | from the processing of the organisation’s products after they have been sold to customers. |

| 11 | Use of sold products | from the use of the organisation’s products by customers. |

| 12 | End-of-life treatment of sold products | from the disposal and recycling of the organisation’s products after they have reached the end of their useful life. |

| 13 | Franchises | from franchise operations that are not owned or controlled by the organisation but operate under its brand name. |

| 14 | Downstream leased assets | from assets leased by customers that are not included in the organisation’s direct Scope 1 or 2 emissions. |

| 15 | Investments | from the organisation’s investments in other companies, such as equity investments and venture |

Where disclosures make reference to the GHG Protocol’s scopes and categories, reporting entities should explain the scopes and state which emissions categories are included.

The minimum requirement for emissions reporting in central government aligns with Metrics and Targets recommended disclosure b) in the TCFD Application Guidance where reporting entities shall disclose Scope 1, Scope 2, and, if appropriate, Scope 3 GHG emissions, and the related risks.

The three scopes and their public sector reporting requirements

The GHG Protocols three emission scopes and categories including the related requirements for central government reporting

3.4 Minimum reporting requirements

For most central government departments, executive agencies, and NDPBs, the emissions measurement methodology under this guidance will align with the GGCs framework for Scope 1 and Scope 2.

However, bodies with material Scope 1 or 2 emissions not covered by the GGCs or with Scope 3 emissions which they consider material to primary users shall provide set information in the annual report and accounts (or explain non-compliance). In addition, where central government bodies use carbon offsets, they shall provide further information in the annual report.

Financial information requirements

Organisations shall report on gross expenditure directly attributable to energy consumption and any expenditure on accredited offset purchases. Financial information reported should be associated with and akin to the reported carbon emissions.

Where it improves understandability organisations should include breakdowns of expenditure by type (e.g., by different energy sources and categories).

Where material, reporting entities should report expenditure directly related to emissions reduction projects or low emissions solutions.

Non-financial information requirements

Where possible, the overall emissions figure should be supported with a segmental breakdown of where the emissions occur in relation to the organisational activity with which they are associated.

To ensure transparency in line with government reporting standards, public sector organisations should account for and report on emissions resulting from electricity consumption through the use of DESNZ Grid Average Conversion Factors (‘government conversion factors’).

It is recognised that some organisations may wish to report reduced emissions due to, for example, the use of renewable tariffs and carbon offsets. These should be shown as reductions to bring the reported gross emissions amount to a net figure – but any reduction cannot be included in the required gross emissions figure. Providing a reconciliation between gross emissions, offsets, and net figures alongside relevant targets can improve the clarity and usability of reported information.

All figures should be prepared in accordance with the carbon accounting standards and the more detailed supporting cross-public sector policies as detailed within this guidance - as well as any specific statutory or regulatory requirements. More detailed organisation-specific accounting policies may be published on the organisation‘s website, and referenced separately.

Scope 1 (direct) GHG emissions minimum requirement

Report all Scope 1 (direct) GHG emissions from sources owned or controlled by the organization (domestic only). Include an analysis of related gas consumption (in kWh) and associated gross energy expenditure. For central government bodies, material Scope 1 emissions that fall outside the scope of the GGCs shall be disclosed on a comply or explain basis.

Energy

Energy usage accounting is closely related to that of carbon emissions, as the former drives much of the latter. For this purpose, energy consumption and expenditure are also to be reported alongside GHG emissions. Where public sector organisations are required to report on both areas, it is both more efficient for those preparing reports, and more useful to those reading them, for the two areas to be reported together, using a consistent accounting approach.

Carbon accounts are produced on a gross basis. All inputs into gross emissions that pertain to energy use shall be converted to kilowatt-hours for the purpose of energy usage accounting.

Unlike carbon accounting, renewable energy cannot be netted off, as it still constitutes the use of energy. Likewise, any energy produced on-site cannot be netted off. Instead, these two forms of energy shall be stated separately alongside non-renewable energy with a total amount of energy use given.

Energy accounting shall follow agreed standards and definitions used in carbon accounting including both reporting boundaries and, for best practice, the treatment of embodied energy.

Where exact data is not available, estimates can be made on energy consumption. However, reporting entities are required to include an explanatory note in the annual report. This should also include the planned actions being taken to improve future data capture.

To support user understandability, reporting entities may disaggregate Scope 1 emissions by source (e.g. boilers, fugitive emissions, fleet vehicles) and Scope 2 emissions by energy type (e.g. electricity, steam, heating, or cooling in kWh).

Scope 2 (indirect - purchased energy) GHG emissions minimum requirement

Report all Scope 2 (indirect – purchased energy) GHG emissions from the consumption of energy supplied by another party (domestic only). Include an analysis of related energy consumption (in kWh) and gross expenditure on the purchase of energy. For central government bodies, material Scope 2 emissions that fall outside of the scope of the GGCs shall be disclosed on a comply or explain basis.

Carbon offsets

Carbon offsetting involves calculating emissions and then purchasing ‘credits‘ from emissions reduction projects. The projects have prevented or removed an equivalent amount of carbon dioxide elsewhere.

Offsetting may help address residual emissions that are currently technically and/or economically infeasible to abate (e.g., essential in-person meetings, heavy industry, aviation, maritime transport, etc.). However, the use of offsetting is not common across government departments. Any more widespread application would be subject to cross-government agreement that would take into account value for money and the environmental integrity of the carbon credits, among other considerations.

In the meantime, public sector bodies should be focused on reducing their emissions as quickly as feasible. Where public sector bodies purchase carbon credits, these should meet internationally recognised high-integrity requirements for carbon credits, as set out in government policy.

Because of the nature of carbon credits, information pertaining to their purchase and retirement alongside other information has been set as a minimum reporting requirement (where they are in use).

Carbon offsets minimum requirement (if used)

Central government bodies that purchase carbon credits shall report the following:

- total volume of carbon credits purchased and retired during the reporting period (in tonnes of CO₂e).

- type of credits, including: 1. whether they relate to carbon reduction or carbon removal activities. 2. for removals, whether they are nature-based (e.g., woodland creation, forest restoration) or technology-based (e.g., Direct Air Capture).

- details of the integrity of the carbon credits purchased and used.

Other Key Performance Indicators

This guidance no longer mandates reporting against all GGC25-30[10] metrics, targets and commitments. However, where organisations consider these or other related sustainability-related KPIs to be material – by value or nature -they shall report them in their annual report.

3.5 Further reporting considerations

Baselining

Baselining establishes a reference point against which progress can be measured over time and targets can be assessed. This can be applied to emissions reporting, as well as other sustainability metrics and targets. Further details are included in Appendix A.

For central government bodies in scope of the GGCs, the metrics and targets establish a baseline year for the indicators they cover, which should be used in the annual report and accounts. However, there may be reasons to re-baseline[11] (e.g., significant changes to operations, machinery of government changes, etc.).

Where an organisation chooses to re-baseline metrics and targets outside of the GGC framework, they should reconcile and explain the differences to the official GGC targets.

Distinguishing between emission sources to avoid double-counting

Providing Scope 1 and 2 emissions are distinguishable, then double-counting can be prevented in line with the GHG Protocol. Organisations should ensure that they are able to separately distinguish between the three emission scopes for consolidation purposes.

National boundaries and overseas operations and impacts

Where an entity has significant overseas operations or sets international government policy or strategy, then related information (e.g., overseas emissions) may be material to primary users, even if they do not contribute to the UK’s national Net Zero target.

For central government, the GGC framework applies predominantly domestic targets – driven by national commitments (e.g., the UK government’s statutory commitment to Net Zero by 2050). Nevertheless, negative externalities associated with emissions are not restricted by national borders, with their impacts being felt at a global level. The knock-on risks associated with and driven by these emissions may materially impact the organisation, its strategy or financial planning.

Most Scope 1 and 2 emissions are mandated, measured, and reported under the GGCs, and can be used to inform disclosures in annual reports and accounts. However, some Scope 1 and Scope 2 emissions[12] - such as those from overseas operations or leased buildings - may fall outside the scope of the GGCs (which align with government’s Net Zero 2050 targets and Carbon Budgets, which also only focus on domestic emissions). Where these are considered material to primary users, the related emissions data is mandatory (on a comply or explain basis) – refer to TCFD Application Guidance.

Accurate and effective presentation of scopes and categories

Annual reports are required to clearly present emissions scopes and categories to users. For example, GGC reporting on official business travel (not a minimum requirement in this guidance and for annual reports and accounts) does not include all emissions under Category 6 (e.g., emissions from international flights between two other non-UK countries).

Providing disaggregated and correctly labelled emissions data supports clearer performance analysis and improves user understandability.

3.6 Scope 3 (value chain) emissions

While there are no minimum requirements with respect to Scope 3 emissions, reporting entities are required to consider these emissions, and report on them if they deem the information material for primary users.

Where organisations extend sustainability reporting beyond the minimum requirements (e.g., supplementary voluntary disclosure or material information), sufficient disclosure should be provided to annual report users to allow them to understand why the information has been included.

Data and materiality considerations

Comparing Scope 1 and 2 emissions (under an entity’s control) with Scope 3 emissions (outside direct control) may not be the most effective way to make decarbonisation decisions. Scope 3 estimates often span multiple years[13], lack granularity, and rely on proxies - reducing accuracy and comparability. In contrast, Scope 1 and 2 data typically reflect annual, measured emissions.

Entities have greater flexibility in how they measure and estimate Scope 3 emissions, which supports proportionality but limits comparability across organisations.

Scope 3 data can support a basic materiality assessment, but often lacks the quality needed for robust decision-making. Given the cost and limited precision, treating Scope 3 data with the same weight as Scope 1 and 2 is unlikely to be proportionate.

Financed-based estimations of emissions

Where entities make use of travel cards, season tickets or other travel arrangements such as top-up travel cards (e.g., Oyster)[14], they may decide to equate financial expenditure associated with the card with travel emissions for the purposes of determining carbon emissions (subject to materiality). Use of this type of estimation method is acceptable providing that materiality is taken into account and the methodology is documented.

Reporting entities should note, however, the limitations in this type of estimation to estimating their carbon footprint and tracking any decarbonisation progress (e.g., other driving factors).

3.7 Other value chain emissions

Existing measurement and reporting under the GGC framework

Under the GGC framework, departments, executive agencies and NDPBs measure, collect and report data on certain Scope 3 emission categories - to Defra via separate GGC returns. While this data may support sustainability reporting in annual reports and accounts, it is not a minimum requirement and should be included only where deemed material. This includes:

- Official business travel – a subset of Category 6 but not including overseas flights. This category is usually considered the most straightforward source to monitor and manage. While business travel emissions may be relatively small, they play an important role in shaping organisational culture around carbon management.

- Data centre emissions – depending on whether these data centres are owned or controlled by the entity will drive whether they are accounted for under Scope 1 and 2, or Scope 3.

Other value chain considerations

Annual reports users need to understand the wider context for climate and sustainability-related risks and opportunities which may include relationships along their value chain.

Certain arrangements, such as outsourced contracts, leases, and Public-Private Partnerships (PPPs), may sit outside the accounting boundary but still be material to the value chain (e.g. where significant emissions are shifted off balance sheet without actual reductions). Information on these arrangements shall be disclosed with sufficient detail (or an explanation of non-compliance, including explanations for any data omissions).

Cross-government collaborative sustainability policies (e.g., procurement) can provide effective alternative approaches for decarbonising an organisation’s value chain. By working collectively, departments can more efficiently address value chain emissions and drive shared progress towards decarbonisation objectives.

3.8 Accounting for offset, renewable or sequestered carbon

Accounting for renewable energy (gross vs. net emissions)

Government policy is that organisations must account for electricity from green energy tariffs using the grid average emission factor – an average rate of carbon emissions associated with electricity transmitted on the national grid - unless their supplier can prove the carbon benefits are additional.

Organisations can separately account for a reduction in their net emissions figure from a green electricity tariff, which meets the government‘s ‘good quality‘ criteria – refer to Annex G of the ERG.

The emission reduction reported must be based on the additional carbon saving associated with the tariff. Electricity suppliers should be able to provide details of this.

Accounting for sequestration on the public sector estate

Carbon sequestration is the process by which carbon dioxide (CO2) is removed from the atmosphere and stored. A CO2 sink is a carbon dioxide reservoir that is increasing in size and is the opposite of a carbon dioxide source. The Paris Agreement allows the use of sinks as a form of carbon offset (i.e., reduces net emissions). The main natural sinks are the oceans‘ biological pump and plants and other organisms that use photosynthesis to remove carbon from the atmosphere by incorporating it into biomass and releasing oxygen into the atmosphere. Artificial sinks are created through Carbon Capture and Storage (CCS) instead of releasing it into the atmosphere.

Public sector estates often manage or influence high-value natural assets - such as freshwater habitats, ponds, and peatbogs - that have significant carbon sequestration potential. However, accounting for sequestration at the level of individual estates is complex and may offer limited value for driving sustainability performance.

Where robust data exist and appropriate methodologies are used, organisations may choose to estimate and report carbon removals. Any such reporting should follow emerging best practice (e.g. peatland carbon models) and must be clearly presented separately from gross emissions. These should be aligned to accepted boundaries (e.g. applied only to residual emissions).

Accounting for offsets

Public sector bodies may set their own emissions reduction targets (outside of the GGC framework) and record associated performance in their annual report and accounts. Government does not allow the use of carbon offsets to reduce associated emissions metrics to meet corresponding GGC targets.

Only allowable offsets can be accounted for as a reduction to overall carbon accounts – and each must be separately disclosed where a separate carbon account is published.

Carbon crediting mechanisms under the Paris Agreement

Article 6 of the Paris Agreement[15] enables countries to cooperate voluntarily to meet their climate targets, including through the transfer of verified carbon credits. One of the key tools introduced under Article 6 is the Paris Agreement Crediting Mechanism (PACM), a new UN-administered high-integrity mechanism that supports global emissions reductions and sustainable development.

PACM allows for the generation, transfer and use of internationally recognised carbon credits. These credits can be used by countries or entities to meet climate targets or obligations. The mechanism promotes verifiable emissions reductions, channels finance into climate projects (particularly in developing countries) and ensures a share of proceeds supports adaptation efforts.

Under the updated framework:

- Only carbon credits from approved, high-integrity schemes (such as PACM and those endorsed by the Integrity Council for the Voluntary Carbon Market) should be accounted for as reductions in overall carbon accounts.

- Where a separate carbon account is published, each type of credit used should be disclosed separately.

- Each unit continues to represent 1 tonne of CO₂ or equivalent greenhouse gas removed or reduced.

3.9 Producing a detailed carbon account

Organisations more advanced with carbon accounting coverage may decide to publish a detailed account of their carbon emissions often referred to as an ‘inventory[16].

Accounting for non-travel Scope 3 GHG emissions – general advice

These tend to be the most difficult areas to be able to account for as they are emissions that occur as a result of activity in an organisation’s value chain rather than its own operations, and so are outside of its normal organisational control, and within the control of another organisation. However, such emissions can be considerable in size and organisations may, in some circumstances, (for example where they are a monopsonistic consumer of a product) have a high degree of influence in respect of financial control through procurement. Smaller organisations and organisations acting independently are likely to have less influence over their suppliers.

As a first step, organisations are suggested to liaise with suppliers concerning emissions to establish if they have their own reporting mechanisms. Over time it is expected that organisations will increasingly use Scope 3 carbon emissions as a factor in both supplier suitability and tender assessment. However, when determining the appropriate level of emissions measurement and reporting with respect to purchased goods and services (Scope 3 – Category 1), factors such as the organisation’s sphere of influence (i.e., whether the reporting entity can effectively manage or influence these emissions) should be considered, as should prioritising action that supports objectives and outcomes rather than fixating on numbers or metrics.

Accounting for Scope 3 – supply chain emissions

The public sector has a vast supply chain and can have significant influence over the way it operates in terms of its emissions, especially when acting collectively (e.g., national procurement by central authority). This covers only those emissions that would factor under the public sector sustainability reporting accounting boundary (i.e., over which the public sector has budgetary control). 2. Scope 3 supply chain emissions of the entity reporting under this guidance include all emissions arising from the related activity of its suppliers, regardless of whether they would be classified and reported separately as Scope 1, 2 or 3 emissions by the suppliers themselves. To collect this information an organisation will need to liaise closely with its supply chain to ascertain information.

Embodied finite resources

All physical assets will have some measurement of CO2e which have been emitted as a result of raw materials extraction, transport and/or manufacturing. Whilst embodied carbon is not mandated for reporting under the GHG Protocol, it is important that these emissions are considered and eventually accounted for in some way by public sector organisations to:

- encourage less waste (and therefore further carbon emissions) through non-essential asset consumption

- encourage lower carbon emissions in raw material extraction and manufacture through public sector procurement

- reflect the true cost to an organisation or a project in terms of CO2e emissions from asset consumption for carbon budgeting purposes.

Such assets can either be consumed immediately upon use or they may be used over a number of years. Under present public sector financial accounting policies, the value of the assets can be spread over their useful economic life through depreciation. However, this accounting treatment would be difficult to implement in relation to embodied carbon assets as it would involve the development of an inventory of the embodied carbon for all assets currently being utilised by an organisation – akin to developing a carbon balance sheet in financial accounting terms. Initially, organisations undertaking accounting for embodied carbon should therefore account for it upon purchase. Details of the organisation’s accounting policy in this respect should be maintained on the website – particularly where embodied carbon in only certain assets is being accounted for.

Publicly Available Standard (PAS) 2050 provides advice on producing a lifecycle carbon footprint for a product. This provides a detailed methodology to calculate the full lifecycle emissions of a product or service. PAS 2050 can be expensive to implement, however, there are methods for apportioning emissions to products and services that can be usefully adopted here.

Physical assets, both current and non-current, require the use of natural resources in manufacturing and distribution. This is the equivalent to GHG Protocol Scope 3 emissions in carbon accounting. Ultimately, it is important that embodied water, energy and other resources are accounted for in some way by public sector organisations to:

- encourage less waste (and therefore further use of finite resources) through non-essential asset consumption

- encourage lower resource use in asset manufacture and raw material extraction through public sector procurement

- reflect the true cost of an organisation or a project in terms of the use of finite resources

In the short term, due to difficulties in calculating the resources used in creating an asset—particularly those already acquired—and the lack of relevant accounting standards, quantified reporting of accounted embodied resources will not be required. Progress on achieving this is more advanced in the field of carbon accounting than in the areas discussed in these guidelines, with the exception of energy.

As standards are developed for sustainable reporting, for example, water and other finite resources, the FReM may adopt their use, through the sustainability reporting guidance. In this section, there is currently a choice on whether to report the information. In the future, sections of voluntary reporting may become compulsory. Entities should, therefore, consider this when producing their current annual report. This will enable consistency among those organisations that report embodied resources.

The lack of accounting standards for embodied resources does not preclude reporting in this area. Sustainability reporting for the public sector allows for narrative reporting of indirect sustainability impacts to take place alongside numerical financial and non-financial information. Public sector organisations wishing to follow best practice should set concise, measurable targets designed to capture activities that will reduce the indirect use of finite resources. Annual reports should then include these targets and report on progress achieved against them.

Organisations may also be aware of particular current or non-current assets that have high levels of embedded natural resources, are widely used by the organisation and have a clearly material impact on its footprint in the consumption of a particular resource. Organisations can set targets to reduce the use of these assets even if accounting standards do not yet allow for an exact translation of their use into units of a material finite resource.

Central government bodies may have policies that affect third party use of finite resources. Those organisations following best practice could set targets over third party resource use that is impacted by their policy areas, assess these impacts and report them annually.

4. Waste

In the government’s Environment Improvement Plan (EIP) 2023,[17] the government has pledged to leave the environment in a better condition for the next generation. To meet the commitment, the UK must use resources efficiently and reduce the amount of waste it creates. A more circular economy will keep resources in use as long as possible and extract the maximum value from them.

This section outlines how information should be reported on the amount of waste[18] organisations generate in carrying out their activities, the associated costs and their strategy for resource efficiency.

Purpose

Minimum reporting requirements for waste align with those set in the GGCs. The accounting treatment for waste is absolute quantities as decommissioned or removed.

4.1 Minimum reporting requirements

Waste minimum requirement

Central government bodies must report on their waste by destination separated into:

- municipal waste

- major mineral waste

- other waste

For each category, central government bodies must report the destination (in metric tonnes) for:

- recycling

- incineration with energy recovery

- incineration without energy recovery

- anaerobic digestion

- composting

- landfill

- other

Contributing activities

As a minimum, annual reports shall include absolute values for total waste volumes from buildings (office and non-office) by category, along with associated financial costs. Where data is unavailable, organisations shall explain why and set out an action plan to enable future reporting.

Where waste is generated from a range of sources, and there are existing data reporting channels for all buildings owned or leased by central government departments, their executive agencies and NDPBs under the GGCs.

Where waste collection and disposal is undertaken by third party suppliers, information will have to be obtained from those suppliers. Organisations should consider financial control over other organisations when measuring their waste volumes.

Guidance on measuring and collecting information on waste can be found in Defra’s Environmental KPIs for business.

Environmental Impacts from ICT and Digital

ICT and digital services form a key component of any solution to the global climate crisis and associated targets. ICT is embedded throughout government estates and ways of working.

Under the GGCs, departments, executive agencies and NDPBs are required to report their annual ICT and digital footprint and waste across four different device categories, namely:

- end-user devices (i.e., desktops, laptops, tablets, smartphones, thin clients)

- peripherals (i.e., monitors, keyboards, mice)

- networking and telephony equipment

- audio-visual devices (i.e., projectors, screens, videoconferencing units)

- imaging devices (i.e., printers, scanners)

ICT and digital waste minimum requirement

Central government bodies must report the number (units), mass (tonnes), and the value returned (£) by destination:

- reuse (donated within government; to charities, schools, or other non-government organisations (NGOs); or sold)

- incineration with energy recovery

- incineration without energy recovery

- recycling

- landfill

Financial information requirements

While financial data may be harder to capture, organisations should make every effort to report costs by waste category and total waste costs.

Where organisations derive income from particular waste streams, this must be offset against any costs to show a net figure.

4.2 Further reporting considerations

Further information on waste is only required where deemed material to primary users - see Appendix A. This will depend on the type of waste or resource and the organisation’s specific context.

Hazardous waste

Hazardous waste poses a risk to the public and the environment. Where deemed material, organisations must report on costs and quantities, as well as other details (e.g., type) for hazardous waste and its disposal - refer to guidance on hazardous waste.

Disposal of regulated resources or materials

Central government bodies may also have regulatory reporting requirements in their annual report and accounts with respect to the use or disposal of certain resources or materials (e.g., hazardous waste). Organisations are responsible for monitoring and complying with the regulatory requirements that are placed on them.

Single use items

Single use items (e.g., Consumer Single Use Plastics (CSUPs)) can have devastating consequences for wildlife and the wider natural world and risks being transferred up the food chain. One way to reduce the amount of plastic in circulation is to reduce the demand. Where deemed material, organisations must report related information in their annual report and accounts.

Re-use schemes

Central government bodies may report on the introduction and implementation of reuse schemes across their estate.

5. Finite resource consumption, including water use

The government has policy objectives to reduce the use of finite, natural resources. It is important that public sector organisations lead the way in monitoring, managing and reporting the use of finite resources.

Purpose

This section sets out guidance for reporting the use of finite resources by public sector organisations with minimum reporting requirements for water use, as well as guidance on further reporting on other finite resources.

5.1 Water overview

The total impact of an organisation‘s water usage is termed its ‘water footprint‘ and is divided into direct and indirect use. Water sources can be classified in a similar way to carbon emissions, as follows:

-

Scope 1: Water owned or controlled by the organisation - includes water reserves in lakes, reservoirs and boreholes

-

Scope 2: Purchased water, steam or ice - includes mains water supply as well as other deliveries of water for the purpose of heating (e.g. Combined Heat and Power (CHP) systems), water coolers and ice

-

Scope 3: Other indirect water - includes embodied water emissions in products and services (upstream) as well as the products, services and policies that contribute to water use (downstream)

As a minimum, reporting must cover potable water use as measured in cubic metres: the measurable consumption from water providers, abstraction and collection. Potable water consumption is drinking quality water from a metered mains supply or extracted through boreholes or water courses.

Sources such as bottled water, water dispenser refills, or ice do not count as potable water. While there may be unusual, specific cases where they are considered material, this is unlikely.

Organisations may establish their own reduction targets for non-office use.

5.2 Minimum reporting requirements

Direct water use

Direct water use shall be reported in cubic metres and broken down by source if possible (water from a third-party supplier, abstracted water, and where data exists, collected water).

Central government bodies must ensure that KPIs and reported results on water usage conform to the common reporting requirements on reporting boundaries, materiality, comparatives and location – refer to Appendix A.

Water minimum requirement

Central government bodies shall report their total potable water consumption (in cubic metres).

5.3 Further reporting considerations

Other natural resource consumption

Central government bodies should consider whether there are any other finite resources whose use has a material impact. To determine whether the use of a finite resource is material, these bodies should first consider the role areas of finite resources play in the delivery of their strategic policy objectives.

Reporting entities should then consider these priorities in the context of their operational activities and their wider requirements and strategy. It may be that the use of particular resources is at such a low level that reporting is not judged necessary.

Regulatory requirements may dictate that reporting of particular resources is necessary regardless of level.

If an organisation determines it is required to report the use of another finite resource, the same format and content should be provided as other areas, including targets where available, normalisation by total expenditure, expenditure on the reported resource, industry benchmarks where available and a commentary on indirect use.

In addition, central government bodies shall include reportable environmental incidents where they are considered material to annual report users.

Indirect water use

For many public-sector organisations, indirect water use will make up the majority of their ‘water footprint‘. Where deemed material, organisations must go beyond the minimum reporting requirements (subject to comply or explain) by analysing and narratively disclosing the indirect impacts of their activities and policies on water use – including the effects of policy on water use and the use of embedded water (i.e., water contained within waste materials).

When considering the use of embedded water, organisations should analyse both the levels of water used by suppliers and the source of water used by suppliers. A high volumetric water footprint does not necessarily mean high impacts and vice versa. Importing goods with a high water footprint from areas with high rainfall and good water management may be preferable to importing goods with a lower water footprint from areas where water is scarce. This adds an additional layer of complexity to developing appropriate tools to measure water footprints.

Organisations may report on supplier engagement to reduce virtual water use, including efforts to obtain data on suppliers’ water use and source, and actions taken to promote more sustainable practices. This includes any work to assess and report supply chain impacts related to water and waste.

To provide an effective breakdown of the impact of policies on water use that is consistent with best practice in the private sector, organisations should consider the following three types of water in their disclosure of targets and performance:

- Blue - water from rivers, lakes, aquifers

- Grey - water polluted after agricultural, industrial and household use

- Green - rainfall to soil consumed in crop growth

6. Other climate and sustainable development reporting

To achieve meaningful value for money, the public sector must consider the full costs of goods and services—including energy, water, emissions, waste, and other environmental impacts. As a major part of the UK economy and steward of natural capital, the public sector plays a critical role in shaping the national response to climate change and environmental sustainability.

Government operations and its wider strategic objectives may impact other sustainability-related topics. Reporting entities are responsible for identifying material topics for inclusion in the annual report beyond those set out in previous sections.

Purpose

This section briefly outlines the other mandatory sustainability reporting requirements (TCFD-aligned disclosures, UN SDGs, etc.) as well as further considerations for reporting.

6.1 Other minimum reporting requirements for sustainability

TCFD-aligned disclosure

Climate adaptation protects people and places by making them less vulnerable to the impacts of climate change. Reporting on climate change adaptation provides assurance that action has been taken to ensure that those policies with long-term implications are robust in the face of changing weather, extreme events and sea level rises from climate change.

Central government bodies are required to provide TCFD-aligned disclosures in their annual reports and accounts, in line with the TCFD Application Guidance, on a comply or explain basis. Reporting entities should consult the application guidance to determine whether and which TCFD recommendations are required.

Emissions reporting requirements related to TCFD Metrics and Targets recommended disclosure b) have been addressed already.

UN Sustainable Development Goals

As set out in the Sustainability Reporting section within the FReM, central government bodies are required to name significant ‘policies pursued’ related to climate change, sustainability and the environment. Refer to Annex A and the FReM for further details.

6.2 Further reporting considerations

Organisations are required to assess whether other topics are material to primary users and report on them in the annual report and accounts on a comply-or-explain basis. Materiality should be considered in the context of the organisation’s value chain and sphere of influence (refer to Appendix A).

Organisations more advanced in their ability to report may choose to add on additional sections, in other reports or on their website, for example how delivery of the body‘s strategy is supported by, and reliant on, actions taken to respond to economic, environmental and social factors. Through this analysis, the body may also describe how performance relating to social or other material environmental impacts is linked to financial outcomes.

As organisations become more proficient in managing their own internal performance on sustainability, they should then consider how they could seek to improve sustainability in areas where they have an influence. One such area in the public sector is influencing performance through procurement; another is through public policy.

Procuring sustainable products and services

The Public Services (Social Value) Act 2012 requires all public sector commissioning to consider economic, social and environmental well-being in connection with public services contracts.

The public sector has a vast supply chain and can have significant influence over its sustainability. Where this is deemed material, central government bodies shall report on the systems they have in place and the action taken to buy sustainably. This shall include the steps taken to embed compliance with the Government Buying Standards in contracts and understand and reduce supply chain impacts and risks.

Nature recovery and other environmental information

The Environment Act 2021[19] places statutory requirements on a department’s Secretary of State around planning, target setting and reporting on air quality, water, biodiversity and resource efficiency/waste reduction. This may be useful for bodies when considering whether and what environmental information to include in annual reports and accounts.

A natural capital approach to policy and decision-making considers the value of the natural environment for people and the economy. Whether information on nature recovery is material to primary users of annual reports will depend on the context of the organisation.

Where central government bodies hold significant natural capital or landholdings, related information is likely to be material to primary users. In such circumstances, including nature and biodiversity performance information is important to support accountability. In these cases, organisations shall signpost to their Natural Capital Plan or Nature Recovery Plan, and report performance against it within the annual report and accounts.

In addition, biodiversity considerations may also be important in the development of projects or programmes. This information should be reported where it is deemed material. Defra published guidance on Biodiversity Net Gain which may be useful to consider when developing disclosures.

Other sustainability reporting standards and frameworks

Other sustainability reporting frameworks may be useful in considering further reporting. Some of these are considered in Annex A.

7. Useful links and further reading

Other guidance on reporting

HM Treasury’s FReM provides a comprehensive guide to reporting requirements for government organisations. Specific requirements around climate and sustainability reporting can be found throughout section 5.4. The manual is updated and published on an annual basis in December.

HM Treasury’s TCFD Application Guidance directs public sector bodies on preparing climate-related financial disclosures for annual reports.

The GGCs set out the actions UK government departments and their agencies will take to improve their impacts on the environment. Defra aims to publish the GGCs annual report in the spring of the year following the reporting period. Commitments are published for a five-year period.

Independent reviews and best practice examples

HM Treasury’s Best Practice Examples in Annual Reporting includes examples of good sustainability, financial and performance reporting in annual reports and accounts.

The Financial Reporting Council (FRC) published the Climate Thematic Review in February 2020 which considered the capacity for boards, companies, auditors, professional bodies and investors, to act as drivers of change in climate-related areas. The FRC findings can be applied in certain aspects to public sector entities.

The NAO published a range of useful guidance and reports on the NAO website, including:

- Guide on Good Practice in Annual Reporting – with specific examples relating to sustainability.

- Climate change risk: A good practise guide for Audit and Risk Assurance Committees (ARACs) - aims to help ARACs recognise how climate change risks could manifest themselves and support them in challenging senior management on their approach to managing climate change risks.

- A short guide to: Environmental protection and sustainable development which summarises UK government action on environmental protection and sustainable development, how much it costs, recent and planned changes and what to look out for across the government’s main business areas and services

The Climate Change Committee coordinate an independent assessment of the UK’s climate risks under the Climate Change Act.

Guidance on project appraisal and management

HM Treasury’s Green Book provides guidance on appraising policies, programmes and projects; as well as, on the design of monitoring and evaluation processes, before, during and after implementation. The UK government publishes supplementary guidance to the Green Book in specific specialist areas, including:

- Valuation of energy use and greenhouse gas emissions for appraisal - published by DESNZ in November 2023. The tables published support the valuing of energy use and GHG emissions.

- Green Book supplementary guidance: climate change and environmental valuation – issued by Defra. The guidance supports analysts and policymakers to ensure, where appropriate, that policies, programmes and projects are resilient to the effects of climate change, and that such effects are being taken into account when appraising options.

Important legislation and international agreements

The Paris Agreement is a legally binding international climate change treaty, and is a sub-agreement under the United Nations Framework Convention on Climate Change (UNFCCC) 1994. The agreement was adopted by 196 UN Parties at COP 21, on 12 December 2015 and entered into force with UK ratification on 4 November 2016. The agreement sets targets for signatories to hold the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above preindustrial levels using objectives known as ‘Nationally Determined Contributions’ (NDCs). On 30 January 2025, the Government announced a more ambitious NDC target of 81% by 2035 compared to 1990 levels.

In 2014, the EU law introduced requirements for certain companies to disclose information to provide an understanding of the undertaking’s development, performance, position and impact of its activity. EU NFRD (2014/95/EU) which amends Directive 2013/34/EU and requires certain companies to disclose information in their management reports – Non-Financial Reporting Disclosure (NFRD) Summary and Directive 2013/34/EU.

Public sector bodies - either through the FReM, CA2006 or other binding requirements or legislation – have other mandatory reporting on environmental protection, social responsibility, respect for human rights and diversity.

Other relevant authorities are subject to their own mandatory, regulatory, or statutory reporting requirements, for example, the CIPFA/LASAAC Code for local authorities, the DHSC Group Accounting Manual (GAM) for NHS bodies, and separate requirements set by the devolved administrations.

UN Sustainable Development Goals (SDGs)

The 2030 Agenda for Sustainable Development was adopted by all 193 UN member states at the UN SDG in 2015. It sets out an ambitious, globally agreed blueprint for a better future by 2030, centred on 17 SDGs.

The SDGs are supported by 169 targets addressing a broad range of interconnected challenges facing both developed and developing countries—including poverty, inequality, climate change, inclusive societies, and access to health and education. The Goals apply universally, with all countries and sectors playing a role in their delivery.

In addition to the reporting requirements in UN Sustainable Development Goals section earlier in this guidance (which are in line with the FReM), reporting entities are required to provide the annual report user a short description of the policy, either directly in the annual report and accounts or referenced externally using a link to a webpage on GOV.UK. This link should be to a specific policy page and not a general homepage.

Departments should identify where their activities contribute to the delivery of relevant SDGs, in line with their policy responsibilities. Further guidance on SDGs is available on the UN SDG site. This may be useful when linking goals, performance and indicators.

17 UN Sustainable Development Goals

Sustainability Standards

The primary focus of reporting entities, with regards to sustainability reporting is to meet the mandatory reporting requirements set out in this guidance. However, existing and emerging sustainability standards may offer additional insights to support disclosures.

Most of these frameworks were developed for the private sector or lack a UK-specific focus, so may not be directly applicable. Public sector entities should consider how to adapt or interpret them for their context.

IFRS’s International Sustainability Standards Board (ISSB)

The IFRS Foundation’s ISSB has published the first two sustainability standards:

- IFRS-S1 General Requirements for Disclosure of Sustainability-related Financial Information

- IFRS-S2 Climate-related Disclosures

DBT is developing UK Sustainability Reporting Standards (UK SRS) by assessing and endorsing the IFRS-Ss[20]. The DBT are consulting on the UK SRS, which are based on IFRS S1 and IFRS S2. The Department for Business and Trade proposes six minor amendments for their application in a UK context. The consultation seeks evidence on the costs and benefits of using the UK SRS. This will inform future decisions on potential mandatory reporting.

International Public Sector Accounting Standards Board (IPSASB)

The IPSASB has launched a project on Advancing Public Sector Sustainability Reportingand has published its first Exposure Draft on climate. HM Treasury has responded to both the initial consultation (see Appendix 1 of FRAB 148 (16)) and the Climate Exposure Draft.

The progress by these standard setters, as well as developments in the UK private sector, will influence decisions over the public sector’s future sustainability reporting strategy. No further action is required by reporting entities at this time.

Global Reporting Initiative (GRI)

The GRI has issued voluntary standards. GRI Standards are a widely used global framework for sustainability reporting. They support consistent, transparent disclosures on an organisation’s impacts on the economy, environment, and people.

While primarily developed for the private sector, the GRI Standards are also used by public sector bodies - particularly local authorities and international institutions - to report on material sustainability impacts and demonstrate accountability to stakeholders. Their modular structure and sector guidance allow for adaptation to public sector contexts.

GRI sets out reporting on the use of several finite natural resources, including G4-EN22 for Effluents Reporting, GRI 303: Water and Effluents, and GRI 306 for Waste Reporting.

List of abbreviations

| ARAC | Audit and Risk Committee |

| CCRA | Climate Change Risk Assessment |

| CCS | Carbon Capture and Storage |

| CDSB | Climate Disclosures Standards Board |

| CHP | Combined Heat and Power |

| CSUP | Consumer Single Use Plastics |

| EIP | Environment Improvement Plan |

| ERG | Environmental Reporting Guidelines |

| EU | European Union |

| FRC | Financial Reporting Council |

| FReM | Government Financial Reporting Manual |

| FTE | Full Time Equivalent |

| GAAP | Generally Accepted Accounting Principles |

| GGCs | Greening Government Commitments |

| GHG | Greenhouse Gas |

| GRI | Global Reporting Initiative |

| ICT | Information Communication Technology |

| ISSB | International Sustainability Standards Board |

| IFRS | International Financial Reporting Standards |

| IPSASB | International Public Sector Accounting Standards Board |

| ISO | International Standards Organisation |

| NAO | National Audit Office |

| NAP | National Adaptation Programme |

| NRP | Nature Recovery Plan |

| NDC | Nationally Determined Contributions |

| NDPB | Non-Departmental Public Body |

| NFRD | Non-Financial Reporting Disclosure |

| PPP | Public-Private Partnership |

| SDG | UN Sustainable Development Goal |

| SECR | Streamlined Energy and Carbon Reporting |

| TCFD | Task Force on Climate-Related Financial Disclosures |

| UNFCCC | United Nations Framework Convention on Climate Change |

List of chemical compositions

| CO2 | Carbon dioxide |

| SF6 | Sulphur hexafluoride |

| CH4 | Methane |

| N2O | Nitrous oxide |

| HFCs | Hydrofluorocarbons |

| PFCs | Perfluorocarbons |

| NF3 | Nitrogen trifluoride |

8. Differences in the reporting requirements between Annual Reports and Accounts and the Greening Government Commitments

In 2010-11, HM Treasury introduced sustainability reporting for central government annual reports and accounts. To encourage consistency and reduce the measurement and reporting burden, where possible, this guidance has been developed to align with the GGCs 2021-25 reporting requirements framework.

There are, however, certain areas of difference. These are primarily driven by:

- Differences in reporting aims and focus - different reporting channels are used for different objectives. Annual reports and accounts are intended to provide the primary users (Parliament) with an overview of performance, applying the concept of materiality to determine the appropriate level of information to include. The GGCs are intended to incentivise improvements to environmental impact.

- Legislative and regulatory requirements – specific legislative and regulatory requirements can drive the requirements for annual reports and accounts. Annually, HM Treasury updates reporting requirements to reflect the developments in private (and public) sector reporting to support the continued production of comparable, high-quality annual reports and accounts.

- Timing and development cycles – This guidance is updated on an annual basis; whereas the GGCs reporting requirements and related metrics are set for a single commitment period (usually five years). The threshold for updates to the GGCs is set much higher, to enable year-on-year comparisons, as well as consistent, fixed targets.

This section explains some of the differences in measurement and reporting requirements between this guidance and the GGCs reporting framework.

Emissions reporting

The inclusion of emissions data within the sustainability report is deemed to have fulfilled the reporting requirements regarding emissions in Schedule 7 of SI 2008 No. 410.

Uncommon Scope 1 and Scope 2 emissions not included in the GGCs reporting framework