Spending Review 2020

Updated 15 December 2020

1. Executive summary

Spending Review 2020 (SR20) prioritises funding to support the government’s response to Covid-19, invest in the UK’s recovery and deliver on promises to the British people. It sets departmental budgets for 2021-22 and devolved administrations’ block grants for the same period, confirming that core day-to-day spending – that is, before taking into account Covid-19 spending – will grow at an average of 3.8 per cent a year in real terms from 2019-20 to 2021‑22. This is the fastest rate in 15 years.

SR20 also provides £100 billion of capital investment next year, a £27 billion real terms increase compared to 2019-20. This is another significant step towards achieving the government’s objective of over £600 billion of gross public investment over the next five years, reaching the highest sustained levels of public sector net investment as a proportion of GDP since the late 1970s.

The Covid-19 pandemic has caused exceptional hardship for individuals, families and businesses across the UK. The health emergency has been accompanied by unprecedented economic uncertainty and the deepest recession on record[footnote 1]. The Office for Budget Responsibility’s (OBR’s) forecast expects GDP to shrink by 11.3 per cent in 2020 – the largest annual fall since the Great Frost of 1709[footnote 2].

Since the start of the crisis the government has taken extensive and unprecedented action to tackle the virus and mitigate these impacts across all areas of the UK. The International Monetary Fund (IMF) described these steps as “one of the best examples of coordinated action globally”.[footnote 3] This action comes at significant fiscal cost. However, providing the funding necessary to respond to the virus is the right thing to do: as the OBR set out, “the costs of inaction would certainly have been higher”.[footnote 4]

SR20 confirms an additional £38 billion for public services to continue to fight the pandemic this year, bringing total support for public services to £113 billion in 2020-21, and total spending on the Covid-19 response this year to over £280 billion.

SR20 provides a further £55 billion of support for the public services response to Covid-19 next year. This funding is targeted to:

-

control and suppress the virus

-

increase support to public services

-

support jobs and businesses.

SR20 also invests in the UK’s economic recovery, providing £100 billion of capital spending next year to kickstart growth and support jobs. This investment will level up opportunity across all regions of the UK to ensure that the recovery supports everyone, no matter where they live. Building on the increased investment next year, SR20 goes further to maintain momentum on key infrastructure projects with select multi-year settlements. This includes targeted investment to deliver a green industrial revolution, tackle climate change and support hundreds of thousands of jobs.

SR20 maintains momentum on delivering the government’s promises to the British people. Building on record increases announced at Spending Round 2019 (SR19), it invests further in key public services. This investment will deliver the government’s priorities: to support a high quality, resilient healthcare system; to level up education standards and provide all learners with a quality education experience; to continue tackling crime to keep people safe; and to support local authorities in their efforts to serve local communities.

The UK is one of the largest Official Development Assistance (ODA) spenders in the world and has the third largest overseas diplomatic network of any nation. SR20 strengthens the UK’s place in the world, providing the resources to support the UK’s leadership in tackling the world’s toughest problems. SR20 ensures that the UK will remain a world leader in science, as well as in tackling global challenges such as Covid-19 and climate change. SR20 also maintains a cutting-edge military and world‑class intelligence community, reaffirming the UK’s commitment to its allies and making the UK the largest European spender on defence in NATO and the second largest in the Alliance.[footnote 5] It also supports UK exporters and enhances the promotion of the UK around the world through the new Office for Investment.

SR20 takes steps to do things differently and drives forward the government’s reform agenda. It focuses on the outcomes of spending, not inputs; it strengthens financial oversight; and it takes steps to break down silos. It also changes how the government invests in places to put levelling up at the heart of policy making, including by updating the Green Book and its application.[footnote 6]

Economic and fiscal context

The Covid-19 pandemic has posed an unprecedented challenge to the UK economy and to economies around the world. The restrictions needed to limit the spread of the virus meant people could not live their lives as normal and many businesses saw significant falls in turnover or were forced to close temporarily. Output fell by 25 per cent between February and April.[footnote 7] In response, the government introduced exceptional UK-wide support measures to protect jobs and incomes. As the IMF said, this response “helped mitigate the damage, holding down unemployment and insolvencies…limiting the potential long-term damage to productive capacity.”.[footnote 8]

Initially, cases fell sharply, allowing for restrictions to be eased.[footnote 9] The UK economy then grew rapidly from late spring onwards and by September GDP was around 8 per cent below its pre‑pandemic level.[footnote 10]

However, since the beginning of the autumn, the UK – like many countries – has seen a resurgence of the virus.[footnote 11] The increase in cases has demanded a return to greater restrictions in order to contain the spread of Covid-19, save lives and protect the economy in the longer term. The government has provided further support, directly and through devolved administrations, to protect livelihoods and limit damage to the economy.

Amid unusually high levels of uncertainty, the OBR forecasts that GDP will fall by 11.3 per cent in 2020 , before returning to growth in 2021. However, the economy is not expected to reach pre-crisis level until the end of 2022.[footnote 12]

The increase in borrowing and debt over the near term to fund the spending at SR20 is both necessary and affordable. It is the government’s responsibility to ensure that the next generation will inherit a strong economy backed by sustainable public finances and that the country will continue to have the space to fund vital public services and prepare for future shocks. Therefore, over time, and once the economic recovery is secured, the government will take the necessary steps to ensure the public finances are on a sustainable path. In the meantime, the government will continue to make responsible spending decisions that do not make that process harder than it needs to be.

Despite government action, unemployment has risen as a result of Covid-19. SR20 continues the significant action the government is taking to support jobs, as outlined below. This includes committing £2.9 billion to fund a new three-year UK-wide programme which will provide innovative and tailored support to help over 1 million long-term unemployed people. To protect the lowest paid the government will also increase the National Living Wage in line with the recommendations of the independent Low Pay Commission.

In order to ensure fairness between the public and private sectors, and protect public sector jobs and investment in services as Covid-19 continues to impact the public finances, the government will temporarily pause headline pay awards for some workforces. Pay rises for over 1 million NHS workers and the lowest paid will continue despite the challenging economic context.

Responding to Covid-19

Allocating funding now to support the response to the pandemic will allow the government to control the spread of the virus, mitigate its harms and build the environment for the economy to bounce back strongly. SR20 confirms a further £38 billion to tackle the virus in 2020-21 and provides £55 billion to support the response to Covid-19 in 2021-22, including £2.6 billion for the devolved administrations. This funding is targeted in three key areas:

-

controlling and mitigating the virus: SR20 supports the mitigation of the virus by funding the development and purchase of successful vaccines, and NHS Test and Trace. The government has now made available £6 billion in total to research and procure Covid-19 vaccines

-

public services support and recovery: SR20 ensures public services across the UK have the resources they need to continue tackling the virus and address service backlogs

-

supporting jobs and businesses: SR20 continues to prioritise supporting jobs and livelihoods across the UK. The government is investing an additional £3.7 billion to build on the commitments made in the Plan for Jobs.

As the trajectory of the pandemic remains uncertain, SR20 sets aside £21 billion of contingency funding within the £55 billion support package for public services. This will allow the necessary support to be put in place and adapted through the course of next year.

Investing in a recovery for all regions of the UK

Alongside responding to the immediate impacts of Covid-19, SR20 provides investment to kickstart the UK’s economic recovery and rebuild for a stronger, greener, more equal future.

Building a stronger future

SR20 announces the next phase of the government’s infrastructure revolution with £100 billion of capital expenditure next year, to kickstart growth and support jobs. SR20 gives multi-year funding certainty for existing projects – such as school and hospital rebuilding, and flagship transport schemes – and targets additional investment in areas which will improve the UK’s competitiveness in the long-term, backing new investments in cutting-edge research and clean energy sources of the future.

Increased infrastructure investment is supported by a new National Infrastructure Strategy, which sets out the government’s plans to transform the UK’s economic infrastructure. It is based around three central objectives: economic recovery, levelling up and unleashing the potential of the Union, and meeting the UK’s net zero emissions target by 2050. These objectives will be supported by the creation of a new infrastructure bank to catalyse private investment in projects across the UK; as well as through a comprehensive set of reforms to the way infrastructure is delivered.

Levelling up and the Union

The economic recovery from Covid-19 must work for everyone in the UK and SR20 continues to drive forward the government’s commitment to level up opportunity across all regions. Infrastructure investment is a key part of this and SR20 targets investment to support regional cities as engines of growth through the Transforming Cities Fund and intra‑city transport settlements; rejuvenate towns and communities in need in England through the Towns Fund; and ensure each place is well connected through increased investment in road, rail and broadband.

The government is launching a new Levelling Up Fund worth £4 billion for England, that will attract up to £0.8 billion for Scotland, Wales and Northern Ireland in the usual way. This will invest in local infrastructure that has a visible impact on people and their communities and will support economic recovery. It will be open to all local areas in England and prioritise bids to drive growth and regeneration in places in need, those facing particular challenges, and areas that have received less government investment in recent years. The government will set out further details on how to support levelling up across the UK in the New Year.

By levelling up, SR20 also unleashes the potential of the Union, recognising that England, Scotland, Wales and Northern Ireland are stronger and more prosperous together. The Union will benefit from plans to create up to 10 freeports as hubs for global trade and investment; from UK-wide investment in areas such as mobile coverage; and from the UK Shared Prosperity Fund (UKSPF). Funding for the UKSPF will ramp up so that total domestic UK-wide funding will at least match receipts from EU structural funds, on average reaching around £1.5 billion per year. In addition, to help local areas prepare over 2021-22 for the introduction of the UKSPF, the government will provide additional UK-wide funding to support communities to pilot programmes and new approaches.

SR20 also confirms increased funding of £4.7 billion to the devolved administrations through the Barnett formula in 2021-22, including £2.6 billion related to Covid-19, on top of their combined baseline of over £60 billion. This provides an additional £2.4 billion for the Scottish Government, £1.3 billion for the Welsh Government and £0.9 billion for the Northern Ireland Executive. This builds on the unprecedented £16 billion of upfront resource funding the UK government has provided to the devolved administrations in 2020-21, in addition to their Budget 2020 funding for that year.

SR20 also delivers bespoke support, accelerating multi-year projects under four existing City and Growth Deals in Scotland to drive forward the local economic priorities of Tay Cities, Borderlands, Moray and the Scottish Islands. It also invests a further £1.1 billion to support farmers, land managers and the rural economy, and £20 million to support fisheries in Scotland, Wales and Northern Ireland.

To embed levelling up in future policy making, the government is changing how it invests in places. The government has published a refreshed Green Book to ensure that project appraisals properly analyse how proposals deliver the government’s key priorities, including levelling up, and how they will impact different places. The government is also bringing policy makers closer to the communities they serve by moving more civil servants out of London.

Green Industrial Revolution

The recovery from Covid-19 must be green. SR20 provides funding for the Prime Minister’s Ten Point Plan, which has set out the government’s vision to tackle climate change whilst simultaneously supporting hundreds of thousands of jobs across the UK. As transport is one of the highest-emitting sectors, SR20 prioritises investment to transition to zero emission vehicles, including by providing £1.9 billion for charging infrastructure and consumer incentives. SR20 also provides £1.1 billion to make homes and buildings net zero-ready.

To push the limits of what is currently possible, SR20 also invests in innovative clean energy technologies, building on existing UK strengths and venturing into exciting new industries. This includes £1 billion for a Carbon Capture and Storage Infrastructure Fund, and additional investment in low hydrogen carbon production, offshore wind, and nuclear power. This brings total investment to support a green industrial revolution to £12 billion.

Delivering on promises to the British people

Improving outcomes in public services

SR20 invests in public services to deliver the government’s priorities: to support a high quality, resilient healthcare system; to level up education standards and provide all learners with a quality education experience; to continue tackling crime to keep people safe; and to support local authorities in their efforts to serve local communities. Devolved administrations will receive funding in line with these investments. SR20:

-

reaffirms the historic long-term settlement for the NHS which provides a cash increase of £33.9 billion a year by 2023-24

-

reaffirms the government’s commitment to increase the schools budget by £7.1 billion by 2022-23, compared to 2019-20 funding levels. This three-year investment represents the biggest school funding boost in a decade and includes an uplift of £2.2 billion from 2020‑21 to 2021-22

-

provides the police with the resources they need to tackle crime, with more than £400 million additional funding to continue the recruitment of 20,000 additional police officers by 2023. This funds recruitment of an extra 6,000 officers in 2021-22, on top of £750 million provided at SR19 to recruit the first 6,000 officers and pay for the infrastructure for all 20,000

-

supports local authorities through increasing core spending power by an estimated 4.5 per cent in cash terms next year, which follows the largest real terms increase in core spending power for a decade at SR19. Local authorities will be able to increase their council tax bills by 2 per cent without needing to hold a referendum, and social care authorities will be able to charge an additional 3 per cent precept to help fund pressures in social care. SR20 also provides £254 million of additional funding to help end rough sleeping – a 60 per cent cash increase compared to SR19.

To match the UK’s ambitions on economic infrastructure, which are set out in the National Infrastructure Strategy, SR20 invests in key infrastructure that supports the UK’s world-class public services, delivering on commitments to build hospitals, schools and prisons.[footnote 13] It provides multi-year funding to build 40 new hospitals, launches a ten-year programme to build 500 schools, and provides more than £4 billion to make significant progress in delivering 18,000 prison places across England and Wales by the mid-2020s.

Ensuring public money is spent well

The government is committed to ensuring that taxpayers’ money is spent well. SR20 ties spending more directly to what the government is aiming to deliver through announcing provisional priority outcomes - and corresponding metrics to monitor these - for each area of spending. It builds on the UK’s well-regarded system for managing public money, and bolsters central oversight and control. SR20 also takes further steps to break down departmental silos and improve join up across government, building on the first round of projects funded through the Shared Outcomes Fund launched at SR19.

The government’s increased investment in infrastructure through SR20 must be matched by faster, smarter delivery. Project Speed, a new taskforce, takes steps to cut down the time it takes to develop, design and deliver vital projects. Projects funded through SR20 will also make increased use of Modern Methods of Construction.

Strengthening the UK’s place in the world

Covid-19 has highlighted the importance of stronger international cooperation and collaboration, and the role of the UK as an international leader in tackling global challenges. UK labs are at the forefront of vaccine research, UK firms are creating technological innovations to help tackle climate change, and the UK will host the UN Climate Change Conference of the Parties (COP26) in Glasgow next year.

SR20 ensures that the government matches the ambitions of a global Britain. It provides the first settlement for the newly-formed Foreign, Commonwealth and Development Office (FCDO), bringing together the UK’s development and diplomatic expertise into one department. This will help to maximise the UK’s influence as a force for good and maintain the UK’s position as a global leader in international development.

The UK will spend the equivalent of 0.5 per cent of gross national income (GNI) as overseas aid in 2021. SR20 therefore provides £10 billion of ODA in 2021-22. This settlement will ensure that the UK remains one of the largest ODA spenders in the world and well above the OECD average.[footnote 14] At a time of emergency, sticking to 0.7 per cent is not an appropriate prioritisation of resources. The government intends to return to the 0.7 per cent target when the fiscal situation allows.

The UK is the world’s largest donor to the COVAX Advance Market Commitment,[footnote 15] an international mechanism to support equitable access for developing countries to Covid-19 vaccines, as well as the largest donor to the World Bank’s lending arm for the poorest countries. The UK was also the first country to commit new financing to the IMF’s Catastrophe Containment and Relief Trust[footnote 16] and is the second-largest Member State contributor to the World Health Organisation.[footnote 17]

To cement the UK’s future as a scientific superpower and drive economic growth, the government is providing almost £15 billion for R&D next year. This will boost the UK’s world‑class research base and increase the productivity and international competitiveness of its innovative firms. This will also reinforce UK international leadership by harnessing innovation with international partners to address the greatest global challenges, from Covid-19 to climate change.

Defence is a central pillar of the government’s ambitions to safeguard the UK’s interests and values, strengthen its global influence, and work with allies to defend free and open societies. SR20 provides Defence with additional funding of over £24 billion in cash terms over four years, including £6.6 billion of R&D, to maintain a cutting-edge military. This settlement means that the Defence budget will grow at an average of 1.8 per cent per year in real terms from 2019-20 to 2024-25. This reaffirms the UK’s commitment to its allies, making the UK the largest European spender on defence in NATO and the second largest in the Alliance.

SR20 provides the UK Intelligence Community with a £173 million funding increase in 2021-22, representing a 5.4 per cent average annual real-terms increase since 2019-20. It also includes over £1.3 billion of capital investment from 2021-22 to 2024-25.

2. Economic and fiscal context

2.1 UK economy

The Covid-19 pandemic has brought with it significant disruption to the UK economy and countries around the world. From the outset, the government took necessary action both to slow the spread of the virus, placing considerable restrictions on people and businesses, and to provide exceptional support to jobs and incomes. The Office for National Statistics (ONS) estimates that output fell 25 per cent between February and April as the economy entered the largest recession on record.[footnote 18]

As cases fell[footnote 19] this allowed for restrictions to be eased over the summer and activity recovered sharply, with GDP rising by 15.5 per cent between July and September, leaving output 8.2 per cent below the February level.[footnote 20]

However, as with other countries, cases have risen again in the UK since the summer,[footnote 21] requiring a return to greater restrictions in order to contain the spread of Covid-19, save lives and protect the economy in the longer term. Economic growth has slowed and output is likely to have fallen in November.[footnote 22] The government has provided further support to protect livelihoods and limit damage to the economy.

The pace of growth slowed to 1.1 per cent on the month in September.[footnote 23] While retail sales have risen 6.7 per cent above February’s pre-pandemic level in October,[footnote 24] consumer sentiment has since fallen back to levels last seen in May.[footnote 25] Business conditions have continued to worsen in recent months.[footnote 26] Of those continuing to trade, nearly half have reported abnormal falls in turnover,[footnote 27] while the majority of businesses who continue to operate do not expect demand to recover until well into next year.[footnote 28]

Unemployment has risen, but reflecting the government’s support for jobs, has continued to remain well below the level implied by its historical relationship with output. For the three months to September, the unemployment rate rose 0.9 percentage points on the year to 4.8 per cent. However, more timely data suggests that further rises in unemployment are to come. Between March and October, the number of employees on payroll fell by 782,000 (2.7 per cent). Redundancies rose to 314,000 in the three months to September – the highest level on record. Meanwhile, vacancies this year fell further and more rapidly than during the 2008-2009 recession and in October were still around 35 per cent down on the year.[footnote 29]

The impact of Covid-19 has been felt across all parts of the UK with employment falling in all regions. Employment fell the most in London, by 4.6 per cent, reflecting the importance of hospitality and entertainment in that region, while Northern Ireland saw the smallest decline of 1.6 per cent between March and October.[footnote 30]

2.2 Economic Response

In the face of the significant and far-reaching impacts of Covid-19, the government’s priority has been to protect lives and livelihoods. Unprecedented fiscal action has been needed to minimise the short-term damage to the economy. Furthermore, by protecting jobs and supporting firms the government has acted to minimise permanent economic effects. Without such action many firms and jobs would have been lost, leading to persistently higher unemployment, which would have weakened the economy and the public finances in the future. This is in addition to the strong growth in public investment announced in Budget 2020, which the Office for Budget Responsibility (OBR) conclude will support the economic recovery in the medium-term.[footnote 31]

In the first phase of the crisis, beginning in March, the government responded to wide-ranging restrictions to economic activity by supporting jobs and incomes using the Coronavirus Job Retention Scheme (CJRS), the Self-Employment Income Support Scheme (SEISS) and by providing valuable support for businesses using loans, grants and tax deferrals. As it became possible to ease some restrictions over the summer and into the autumn, the government designed an economic approach focused on jobs. This provided continued wage support to individuals, incentives for businesses to retain staff beyond the end of the furlough scheme and new job creation and training schemes, such as the Kickstart Scheme.

Increased transmission of the virus into the autumn meant the only viable solution left to protect the NHS was the temporary reintroduction of significantly enhanced restrictions. Therefore, given the change in public health restrictions and the economic impact they would have through job losses and business closures, the government reintroduced its support for incomes through the CJRS, SEISS and its support for affected businesses.

As highlighted by the OBR and the Bank of England, without the measures the government has taken, the outlook would be much worse.[footnote 32] The OBR today confirms that the CJRS has prevented a larger rise in unemployment.[footnote 33] The IMF has also remarked on the strength of the UK’s economic policy response, saying that “the authorities’ aggressive policy response – one of the best examples of coordinated action globally – has helped mitigate the damage, holding down unemployment and insolvencies”.[footnote 34]

Given these unprecedented circumstances, the government has provided a fiscal policy response of remarkable scale with targeted support for public services, workers and businesses. Since March, the government has spent over £280 billion on one of the largest and most comprehensive packages of economic support in the world. The government will continue to do whatever it takes to support the economy through the Covid-19 pandemic.

Over the course of the Covid-19 pandemic, the economic and fiscal policy response has evolved to support the changing economic landscape and will continue to evolve to ensure the right support is in place.

Spending Review 2020 (SR20) represents the next step in the government’s fiscal response to Covid-19. It provides significant support for the government’s priority to control and mitigate the virus by funding significant increases in testing capacity and making provisions for the rapid, mass deployment of a successful vaccine. This will allow the government to loosen economic restrictions whilst continuing to protect lives. Responding to the increase in unemployment, SR20 provides additional funding to build on the commitments of the government’s Plan for Jobs, taking further steps to provide unprecedented support to help unemployed people find a job.

Table 1.1 shows the cost or yield of all decisions made since Budget 2020, with a direct effect on Public Sector Net Borrowing (PSNB) in the years up to 2025-26. This includes tax measures, changes to Departmental Expenditure Limits (DEL) and measures affecting Annually Managed Expenditure (AME).

The government remains committed to the robust and credible policy frameworks and institutions that have made such a substantial policy response possible. The OBR’s independent and transparent assessment of the economy and the public finances continues to provide important scrutiny of the government’s fiscal position. The Bank of England’s independent policy committees have played an important role by using levers at their disposal to support the economy within their mandates. This includes a reduction of the Bank Rate to 0.1 per cent by the Monetary Policy Committee, the announcement of an additional £450 billion of asset purchases[footnote 35] and the expansion of the Term Funding Scheme with additional incentives to lend to SMEs, alongside the measures undertaken by the Financial Policy Committee to support lending in the real economy.

Table 1.1: Policy decisions since Budget 2020 (£ million) (1)

| Head (2) | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | |

|---|---|---|---|---|---|---|---|

| Covid-19 | |||||||

| 1 Funding for public services in 2020-21: resource (3) | Spend | -37,895 | 0 | 0 | 0 | 0 | 0 |

| 2 Funding for public services in 2021-22: resource | Spend | 0 | -55,000 | 0 | 0 | 0 | 0 |

| Spending Review 2020 | |||||||

| 3 Resource DEL: difference to Budget 2020 envelope in 2021-22, maintain Budget 2020 2.1% real terms growth assumption for future years | Spend | 0 | +9,645 | +13,635 | +15,270 | +15,865 | +16,110 |

| 4 Local authorities: reserves implications of Council Tax referendum principles | Tax | 0 | +15 | +20 | +20 | +20 | +20 |

| Other decisions | |||||||

| 5 Local authorities: reserves implications of grant funding for tax collection deficits | Spend | 0 | +255 | +255 | +255 | 0 | 0 |

| 6 Business rates: continuation of retention pilots in 2021-22 | Spend | 0 | -155 | +50 | 0 | 0 | 0 |

| 7 Business rates: freeze multiplier for one year | Tax | +5 | -125 | -120 | -120 | -120 | -120 |

| 8 Public Works Loan Board: lending terms reform | Spend | 0 | 0 | +50 | +95 | +145 | +190 |

| 9 Public Works Loan Board: cut interest margin by 100 basis points | Spend | -20 | -135 | -170 | -200 | -230 | -255 |

| Previously announced policy decisions | |||||||

| Jobs and Employment | |||||||

| 10 Coronavirus Job Retention Scheme: March to October 2020 | Spend | -34,080 | -10 | 0 | 0 | 0 | 0 |

| 11 Coronavirus Job Retention Scheme: extension to March 2021 | Spend | -19,640 | 0 | 0 | 0 | 0 | 0 |

| 12 Self-employed income support scheme: first and second grants (4) | Spend | -12,730 | +1,635 | 0 | 0 | 0 | 0 |

| 13 Self-employed income support scheme: third grant (4) | Spend | -6,875 | +885 | 0 | 0 | 0 | 0 |

| 14 VAT: temporary reduced rate for hospitality and tourism sectors until 31 March 2021 | Tax | -2,540 | 0 | 0 | 0 | 0 | 0 |

| 15 Eat Out to Help Out | Spend | -840 | 0 | 0 | 0 | 0 | 0 |

| 16 Stamp Duty Land Tax: increase nil-rate band threshold to £500k until 31 March 2021 | Tax | -2,295 | -1,040 | +5 | * | +5 | * |

| Supporting public services | |||||||

| 17 COVID-19: previously announced funding for public services: resource (3) | Spend | -58,330 | 0 | 0 | 0 | 0 | 0 |

| 18 Previously announced capital funding: including Plan for Jobs infrastructure package (3) | Spend | -11,455 | 0 | 0 | 0 | 0 | 0 |

| 19 Funding for Devolved Administrations: Barnett guarantee (3) | Spend | -16,000 | 0 | 0 | 0 | 0 | 0 |

| Supporting people and families | |||||||

| 20 Universal Credit and Working Tax Credit: increase standard allowance and basic element by £20 per week for 2020-21 | Spend | -6,060 | -10 | +5 | * | * | * |

| 21 Universal Credit: suspend the Minimum Income Floor for self-employed claimants | Spend | -350 | -255 | -210 | 0 | 0 | 0 |

| 22 Local Housing Allowance: increase rates to the 30th percentile in 2020-21 and maintain in cash terms thereafter | Spend | -955 | -960 | -840 | -675 | -520 | -345 |

| 23 Pension Credit: uprate the Standard Minimum Guarantee | Spend | 0 | -340 | -355 | -355 | -370 | -380 |

| 24 Employment Support Allowance: remove seven day wait | Spend | -5 | * | 0 | 0 | 0 | 0 |

| 25 Breathing space: legal protections from creditor enforcement action, interest, fees and charges for up to 60 days | Tax | 0 | -85 | -10 | -5 | -5 | -5 |

| 26 COVID-19: HMRC easements | Tax | -175 | -125 | -85 | -60 | -35 | -15 |

| 27 COVID-19: DWP easements | Spend | -750 | -350 | -175 | -50 | +25 | +50 |

| Supporting businesses | |||||||

| 28 Small Business Grant Fund, Retail Hospitality and Leisure Grant Fund, and Discretionary Grant Fund | Spend | -11,685 | 0 | 0 | 0 | 0 | 0 |

| 29 Local restrictions support grants for businesses | Spend | -1,130 | 0 | 0 | 0 | 0 | 0 |

| 30 Additional restrictions grant | Spend | -1,130 | 0 | 0 | 0 | 0 | 0 |

| 31 Business rates: 12-month full business rates holiday for eligible properties in the retail, hospitality, leisure and nursery sectors | Tax | -11,830 | +220 | -5 | 0 | 0 | 0 |

| 32 Support for culture, charities and sport | Spend | -2,185 | 0 | 0 | 0 | 0 | 0 |

| 33 Trade Credit Reinsurance Scheme | Spend | -170 | 0 | 0 | 0 | 0 | 0 |

| 34 Business support: other funding, including targeted industrial support | Spend | -275 | 0 | 0 | 0 | 0 | 0 |

| 35 Statutory Sick Pay: rebate for small and medium enterprises | Spend | -50 | 0 | 0 | 0 | 0 | 0 |

| 36 VAT: Deferral (5) | Tax | -1,470 | 0 | 0 | 0 | 0 | 0 |

| 37 VAT: New Payment Scheme (5) | Tax | -440 | -30 | 0 | 0 | 0 | 0 |

| 38 Import VAT and customs duty: relief for goods to tackle COVID-19 until 31 December | Tax | -1,090 | 0 | 0 | 0 | 0 | 0 |

| 39 VAT: temporary zero rate for personal protective equipment | Tax | -960 | 0 | 0 | 0 | 0 | 0 |

| 40 VAT on e-publications: bring forward implementation date to 1 May 2020 | Tax | -95 | 0 | 0 | 0 | 0 | 0 |

| 41 VAT: construction sector reverse charge: further delay implementation to 1 March 2021 | Tax | -55 | +10 | +5 | * | 0 | 0 |

| 42 Income Tax Self-Assessment: Deferral | Tax | -2,615 | +1,660 | +405 | 0 | 0 | 0 |

| 43 Income Tax Self-Assessment: Enhanced Time to Pay | Tax | -4,630 | +5,195 | -730 | 0 | 0 | 0 |

| 44 HGV Road User Levy: suspend for 12 months from August 2020 | Tax | -135 | -70 | 0 | 0 | 0 | 0 |

| 45 Off-payroll reform: delay extension of the reform to the private and voluntary sectors by one year | Tax | -1,090 | +405 | -10 | -25 | -20 | 0 |

| 46 Annual Investment Allowance: extension of £1m allowance until 31 December 2021 | Tax | -120 | -395 | -80 | +110 | +60 | +50 |

| 47 Notification of uncertain tax treatment: delay of one year to April 2022 | Tax | * | -15 | -25 | -5 | * | * |

| Other decisions | |||||||

| 48 Tobacco Duty: RPI+2% on all categories plus additional +4% (RPI+6%) HRT increase | Tax | -5 | +5 | +5 | +5 | +5 | +5 |

| 49 Future of Making Tax Digital | Tax | 0 | 0 | +20 | +50 | +210 | +400 |

| 50 VAT Retail Export Scheme: withdraw from January 2021 | Tax | +35 | +195 | +310 | +400 | +440 | +460 |

| 51 Outbound VAT-free airport shopping: withdraw from January 2021 | Tax | +15 | +85 | +130 | +170 | +185 | +195 |

| 52 Outbound duty-free: extension to EU bound passengers from January 2021 | Tax | -5 | -85 | -145 | -200 | -220 | -235 |

| 53 Inbound personal allowances: extension to EU and increasing alcohol allowance from January 2021 | Tax | * | * | +5 | +5 | +5 | +5 |

| 54 VAT parcel reforms: introduce seller and online marketplace liability for goods under £135 and remove Low Value Consignment Relief | Tax | +85 | +360 | +320 | +305 | +295 | +280 |

| 55 VAT: zero rate for certain financial services exports to the EU from January 2021 | Tax | -205 | -855 | -915 | -950 | -985 | -1,025 |

| 56 VAT: refund scheme for museums and galleries | Tax | -5 | -20 | -20 | -15 | -5 | -5 |

| Financial transactions | |||||||

| 57 Public sector net borrowing impact of changes to financial transactions and guarantees | Spend | -31,685 | +135 | +255 | +275 | +290 | +290 |

| Total policy decisions (6) | -283,915 | -39,355 | +11,580 | +14,300 | +15,040 | +15,670 | |

| Total spending policy decisions (6) | -254,295 | -44,660 | +12,500 | +14,615 | +15,205 | +15,660 | |

| Total tax policy decisions (6) | -29,620 | +5,305 | -920 | -315 | -165 | +10 | |

| * Negligible. |

| 1 Costings reflect the OBR’s latest economic and fiscal determinants. |

| 2 Many measures have both tax and spend impacts. Measures are identified as tax or spend on the basis of their largest impact. |

| 3 Funding for public services also shown in Table 2.1. |

| 4 Self-Employment Income Support Scheme grants are taxable income and also subject to National Insurance contributions. |

| 5 The cost shown here does not include the effect on the timing of cash receipts, as this does not affect Public Sector Net Borrowing. |

| 6 Totals may not sum due to rounding. Does not include OBR RDEL baseline adjustment of - £375m in 2020-21, - £5,240m in 2021-22 and - £110m, in 2022-23. |

2.3 Economic Outlook

As the OBR have noted the economic outlook remains “highly uncertain”[footnote 36] and depends upon the future path of the virus, measures to combat it and responses of firms and households to all of this. As in their July Fiscal Sustainability Report, the OBR have outlined various scenarios to demonstrate the range of possible outcomes embodying different assumptions regarding the course of the pandemic, In their forecast the OBR expect GDP to shrink by 11.3 per cent in 2020. In the upside and downside scenarios GDP shrinks by between 10.6 per cent and 12 per cent in 2020.[footnote 37]

In the OBR’s upside scenario, consistent with a vaccine becoming widely available in spring of 2021, activity rebounds quickly as expanding testing and the effective roll-out of a vaccination programme allows for the removal of restrictions. GDP returns to its pre-virus level by the end of 2021 and there is no enduring economic scarring. However, under the downside scenario, where subsequent waves of infection require periodic re-imposition of health restrictions and a sufficiently effective vaccine does not become available, output recovers to its pre-virus level only in the third quarter of 2024, consistent with persistently higher unemployment.

The OBR’s forecast assumes a higher infection rate necessitates keeping a set of public health restrictions over winter, but an effective vaccine becomes widely available in the latter half of 2021 permitting a gradual return to normal life. The OBR expects the unemployment rate to average 4.4 per cent across 2020, rising to 7.5 per cent at its peak in Q2 2021.[footnote 38] The unemployment rate is then projected to fall to 4.4 per cent by 2025, compared to a pre‑crisis rate of 3.8 per cent in 2019.[footnote 39] However, under the downside scenario the unemployment rate peaks at a high of 11 per cent in Q1 2022.[footnote 40]

2.4 Fiscal Outlook

The economic impacts of Covid-19 and the unprecedented fiscal support announced by the government has led to a significant but necessary increase in borrowing and debt. While the actions the government has taken have come at a significant cost, the costs of inaction would have been far higher.

Reflecting the current high levels of uncertainty, the OBR has set out a range of scenarios for the outlook for the public finances. In the central forecast borrowing peaks at £393.5 billion or 19.0 per cent of GDP in 2020-21, the highest peacetime level on record, before falling across the rest of the forecast period to 3.9 per cent in the final year. Reflecting different assumptions on the path of the virus and its impact on the economy, in the final year borrowing ranges from 1.7 per cent of GDP in the upside Covid-19 scenario, to 6.1 per cent of GDP in the downside scenario.[footnote 41]

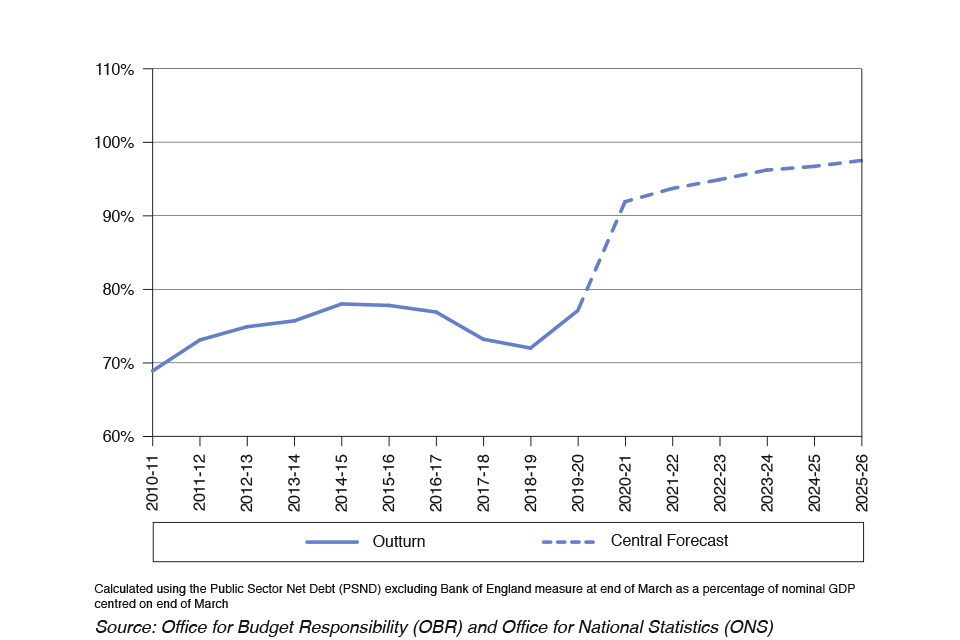

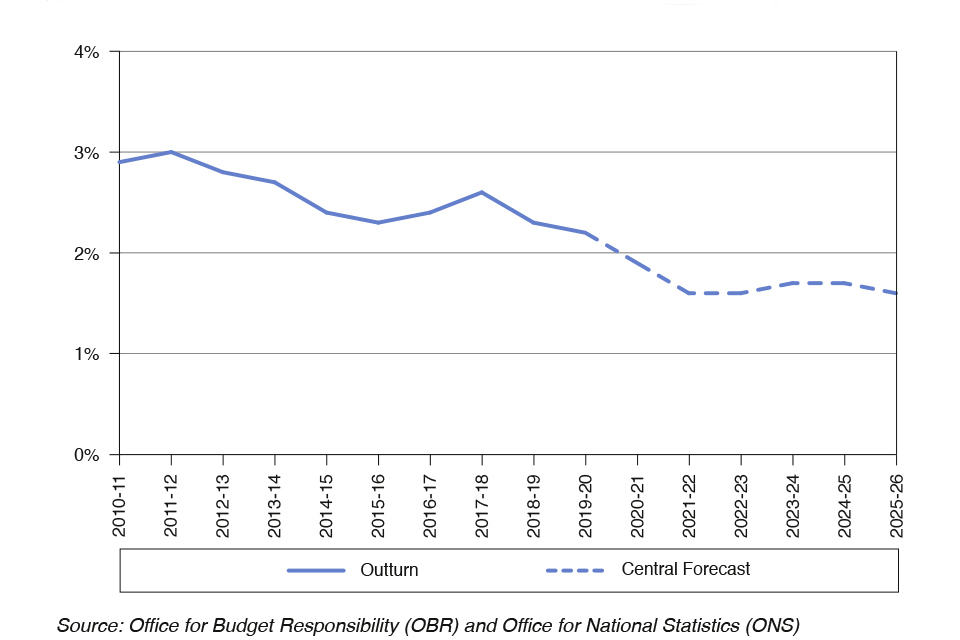

Underlying debt (Public Sector Net Debt excluding the Bank of England) as a share of GDP is higher in every year of the forecast in all scenarios, compared to Budget 2020, reaching 91.9 per cent in 2020-21 in the central forecast. Chart 1.1 shows the forecast for underlying debt, which continues to rise over the forecast period. In the final year of the forecast, underlying debt reaches 83.4 per cent in the upside scenario, 97.5 per cent in central scenario, and 115.7 per cent in the downside scenario. However, in all scenarios borrowing costs continue to be very low, driven by interest rates that are low by historical standards, making the current costs of servicing this increase in debt affordable. As shown in chart 1.2, the OBR forecasts that spending on debt interest as a per cent of GDP falls further this year, despite higher borrowing.[footnote 42]

Chart 1.1: Public Sector Net Debt (PSND) excluding the Bank of England as a percentage of GDP

Chart 1.1: Public Sector Net Debt (PSND) excluding the Bank of England as a percentage of GDP

Chart 1.2: Central Government gross debt interest as a percentage of GDP

Chart 1.2: Central Government gross debt interest as a percentage of GDP

The government’s unprecedented economic and fiscal policy response has been possible because the UK entered the Covid-19 pandemic with the public finances under control. The action of governments over the past decade has brought borrowing down from a peak of 10.2 per cent of GDP in 2009-10[footnote 43] after the financial crisis to 1.8 per cent of GDP in 2018‑19.[footnote 44] By rebuilding the strength of the public finances, and underpinned by the UK’s strong institutional framework, the government has been able to borrow to provide a comprehensive package of support for the economy.

The current high levels of uncertainty mean now is not the right time to set out a detailed medium-term fiscal strategy. However, over time, and once the economic recovery is secured, the government is fully committed to taking the necessary steps to ensure borrowing and debt are on a sustainable path. The government will set out further details of a medium-term fiscal strategy, alongside a framework to support its delivery, once the current level of uncertainty recedes. In the meantime, the government will make responsible spending decisions that do not make that process harder than it needs to be. With sound fiscal management and careful prioritisation, fiscal sustainability can be achieved while continuing to deliver first-class frontline public services and funding vital public investment to level up across the country, drive economic recovery and deliver the people’s priorities.

2.5 Path of Public Spending

SR20 provides substantial additional funding for public services to support the response to Covid-19 and continue to increase day-to-day departmental spending. It sets aside £113 billion in total this year for the public services response to Covid-19. Resource DEL spending in 2021-22 is £45 billion higher than indicatively set out in March. This change is comprised of core day-to-day departmental spending growing at 3.8 per cent a year on average in real terms from 2019-20 to 2021-22 (the fastest rate in 15 years) and £55 billion set aside to respond to Covid-19. Reflecting changed circumstances, core day-to-day departmental spending is £10 billion less than the indicative spending envelope in Budget 2020, but represents a £14.8 billion year-on-year increase in cash terms on top of the £21.5 billion increase this year announced at SR19.

SR20 also provides £100 billion of capital investment next year, a £27 billion real terms increase compared to 2019-20.

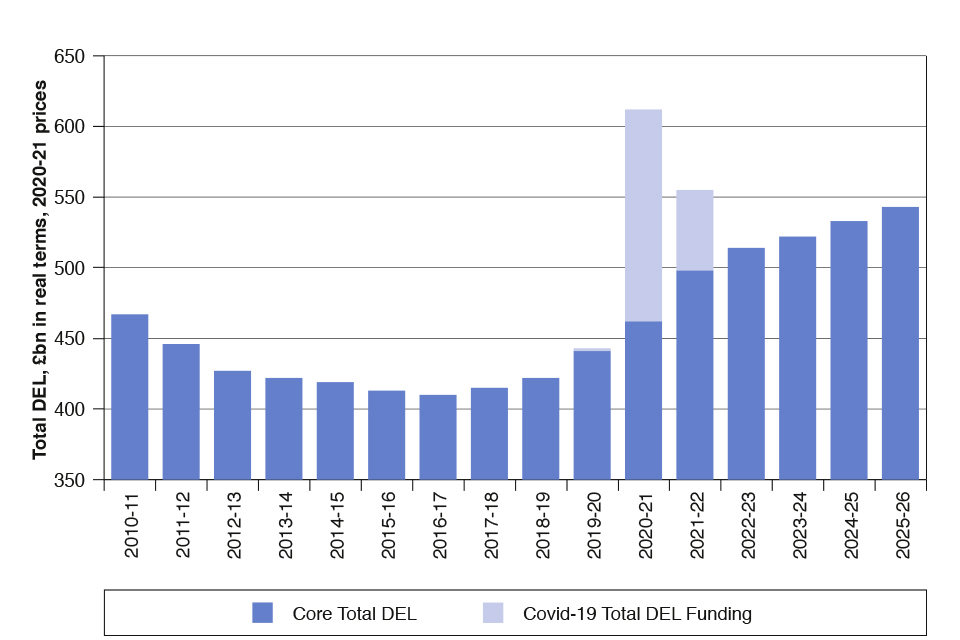

As part of the OBR forecast process, the government provides an assumption for the future path of departmental spending. At SR20, the government has kept capital spending over the forecast period as set out at Budget 2020, consistent with delivering the highest sustained levels of public sector net investment as a proportion of GDP since the late 1970s. For core day-to-day spending after 2021-22, the government has maintained the assumption of 2.1 per cent real terms increases per year made at Budget 2020. Chart 1.3 shows the path of total DEL spending, divided into core allocations and provision for Covid-19.

Chart 1.3: Total DEL

Chart 1.3: Total DEL

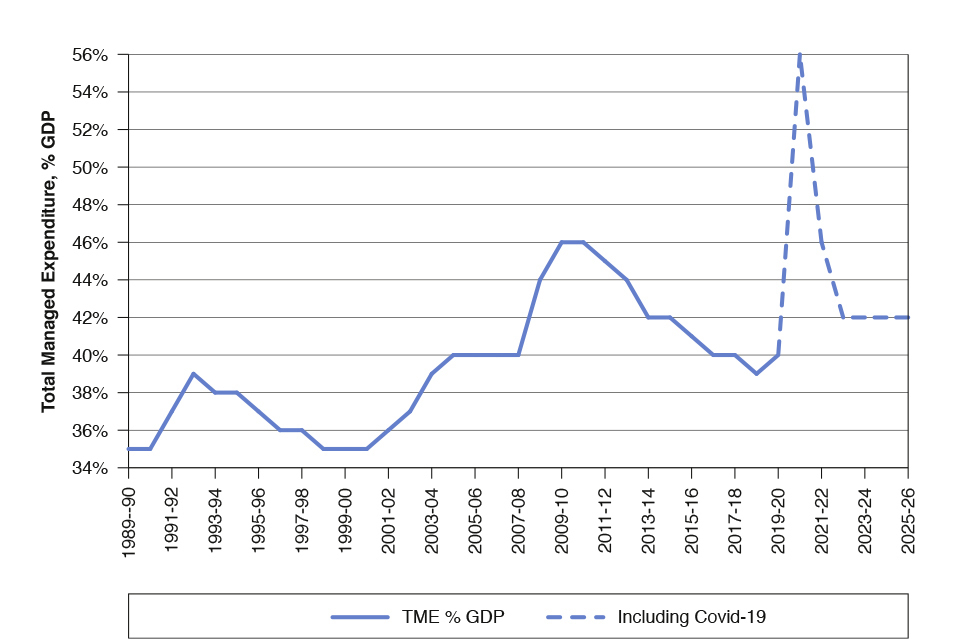

Table 1.2 sets out planned Total Managed Expenditure (TME), public sector current expenditure (PSCE) and public sector gross investment (PSGI) up to 2025-26. Chart 1.4 shows the change in government spending as a share of GDP over time. [closed]

Table 1.2: Total managed expenditure(1) (£ billion, unless otherwise stated)

| 2019-20(2) | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 19-20 to 21-22 AARG(3) | 21-22 to 25-26 AARG(3) | |

|---|---|---|---|---|---|---|---|---|---|

| Current expenditure | |||||||||

| Resource AME | 409.1 | 494.0 | 422.9 | 435.6 | 450.0 | 463.4 | 481.0 | ||

| Resource DEL excluding depreciation(4) | 345.2 | 506.1 | 439.6 | 397.0 | 412.8 | 430.5 | 449.1 | ||

| o/w Core RDEL excluding depreciation(5) | 343.0 | 369.9 | 384.6 | 397.0 | 412.8 | 430.5 | 449.1 | 3.8% | 2.1% |

| o/w Covid-19 Funding | 2.2 | 141.1 | 55.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Ring-fenced depreciation | 35.6 | 28.8 | 30.3 | 31.3 | 32.5 | 33.9 | 35.4 | ||

| Total public sector current expenditure | 790.0 | 1028.9 | 892.8 | 863.8 | 895.3 | 927.8 | 965.4 | 1.2% | 1.8% |

| Capital expenditure | |||||||||

| Capital AME | 23.3 | 29.4 | 18.3 | 19.4 | 22.9 | 23.3 | 23.3 | ||

| HMT Capital DEL | 70.4 | 106.3 | 100.4 | 107.3 | 109.1 | 112.8 | 117.4 | ||

| o/w Core CDEL(6) | 70.4 | 97.2 | 99.8 | 107.3 | 109.1 | 112.8 | 117.4 | 15.9% | 2.1% |

| o/w Covid-19 Funding | 0.0 | 9.1 | 0.6 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Total public sector gross investment | 93.7 | 135.7 | 118.7 | 126.7 | 132.0 | 136.1 | 140.7 | 10.2% | 2.7% |

| Total managed expenditure | 883.7 | 1164.6 | 1011.5 | 990.5 | 1027.4 | 1064.0 | 1106.1 | 2.2% | 1.9% |

| Total managed expenditure % of GDP | 39.8% | 56.3% | 45.6% | 42.1% | 42.1% | 42.0% | 41.9% | ||

| o/w Core Total DEL | 413.4 | 467.1 | 484.4 | 504.3 | 521.9 | 543.3 | 566.5 | 6.0% | 2.1% |

| 1 Resource DEL excluding ring-fenced depreciation (RDEL ex.) is the Treasury's primary control within resource budgets and is the basis on which departmental Spending Review settlements are agreed. HMT Capital DEL is the Treasury's primary control within capital budgets and is the basis on which departmental Spending Review settlements are agreed. The OBR publishes Public Sector Current Expenditure (PSCE) in DEL and AME, and Public Sector Gross Investment (PSGI) in DEL and AME. A reconciliation is published by the OBR. |

| 2 2019-20 is shown as outturn except for Core Resource DEL, which is based on Spending Round 2019 plans, and Covid-19 funding, which is approved Budget cover. |

| 3 The annual average real growth rates (AARG) exclude DEL Covid-19 expenditure. Growth rates for Core Resource DEL and Core Capital DEL are also adjusted for one-off and time-limited funding. The AARG covers 2019-20 to 2021-22 due to the atypical movement of the GDP deflator caused by Covid-19. |

| 4 Resource DEL excluding ring-fenced depreciation (RDEL ex.) is shown on a redefined basis following the reclassification of Scottish Block Grant Adjustments, which are now excluded from RDEL ex. This increases RDEL ex. by up to £12bn in a given year, relative to Spring Budget 2020. The reclassification is fiscally neutral and does not impact Scottish Government spending power. |

| 5 Core Resource DEL and Covid-19 funding in 2020-21 does not sum to Resource DEL due to the use of £5bn from the core reserve to provide funding for Covid-19. |

| 6 Core HMT Capital DEL in 2020-21 is as shown in the Capital DEL table and includes Spring Budget 2020 plans, Plans for Jobs capital package and additional one-off expenditure. In 2021-22, the number reflects a fiscally neutral reduction for business rates retention pilots. |

Chart 1.4: Total Managed Expenditure (% GDP)

Chart 1.4: Total Managed Expenditure (% GDP)

2.6 Labour Market and Public Sector Pay

The government has taken significant action this year to protect jobs, but given the unprecedented impact of Covid-19, unemployment has risen. Through SR20 the government is taking further action to support jobs and help the unemployed back into work.

2.7 Public Sector Pay

Unemployment and redundancies are rising in the private sector and many are seeing significant wage cuts. In the six months to September, private sector wages fell by nearly 1 per cent compared to the previous year, while over the same period public sector pay rose by 3.9 per cent.[footnote 45]

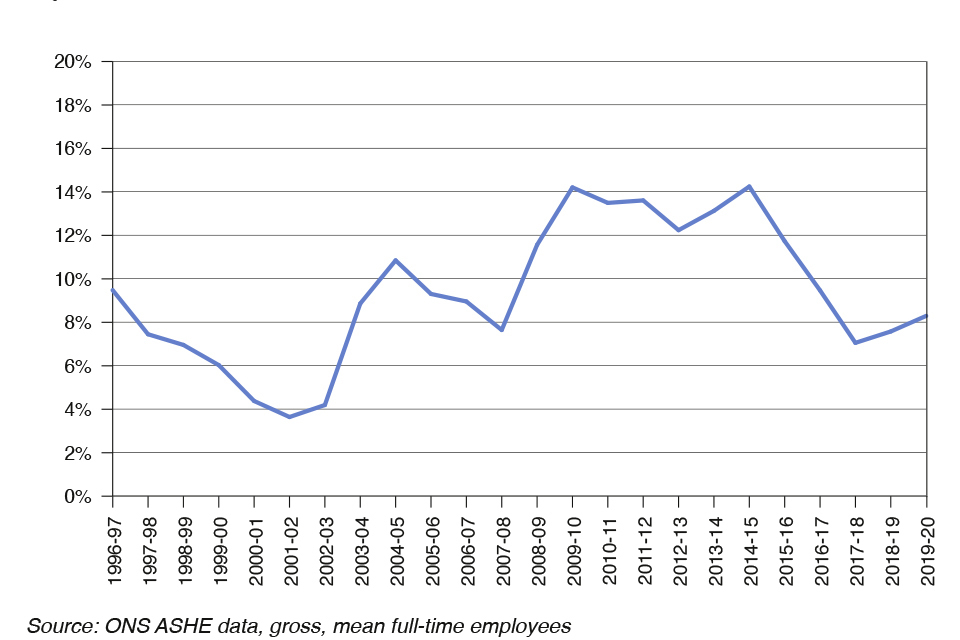

This disparity in recent wage growth between the public and private sector exacerbates the pre-existing position, where the public sector tended to be paid more than the private sector. In 2020, published data shows the median salary in the public sector was £1,770 higher than in the private sector,[footnote 46] and the public sector has benefitted from several years of pay rises above inflation. In 2019 public sector remuneration including pensions was approximately 7 per cent higher than in the private sector, rising from 5 per cent in 2017, even after accounting for differences in employee and job characteristics.[footnote 47] Public service pensions are generous, with most enjoying Defined Benefit schemes where employer contributions are around 20 per cent of earnings – around double the typical contribution rate in the private sector. Chart 1.5 shows the difference between mean gross annual earnings for full-time employees in the public and private sectors.

Chart 1.5: Percentage differential between public and private sector pay

Chart 1.5: Percentage differential between public and private sector pay

In order to protect jobs and ensure fairness, pay rises in the public sector will be restrained and targeted in 2021-22. Given the unique impact of Covid-19 on the health service, and despite the challenging economic context, the government will continue to provide for pay rises for over 1 million NHS workers. In setting the level for these rises the government will need to take into account the challenging fiscal and economic context. The NHS Pay Review Body and Doctor and Dentist’s Review Body will report as usual next spring, and the government will take their recommendations into account. The government will also prioritise the lowest paid, with 2.1 million public sector workers earning less than £24,000 receiving a minimum £250 increase.

For the rest of the public sector the government will pause pay rises in 2021-22. The pay bill represents around 25 per cent of total government expenditure. Pausing headline pay awards next year for some workforces will allow the government to protect public sector jobs and investment in public services to respond to spending pressures from Covid-19. It will also avoid further expansion of the gap between public and private sector reward.

2.8 National Living Wage and personal tax thresholds

The government also remains committed to continuing to support the low-paid. Therefore, following the recommendations of the independent Low Pay Commission (LPC), the government will increase the National Living Wage (NLW) for individuals aged 23 and over by 2.2 per cent from £8.72 to £8.91, effective from April 2021. This follows the government’s acceptance of a previous recommendation from the LPC that the NLW apply to those 23 and over from April 2021.

This decision balances the ambitions of the government’s long-term target for the NLW to reach two thirds of median earnings by 2024 (subject to economic conditions) and helps ensure that the lowest-paid workers continue to see pay rises without significant risks to their employment prospects. In total, the annual earnings of a full-time worker on the NLW will have increased by £4,030 since its introduction in April 2016.

The government has also accepted the LPC’s recommendations for the other National Minimum Wage (NMW) rates to apply from April 2021 including:

-

increasing the rate for 21 to 22-year-olds by 2.0 per cent from £8.20 to £8.36 per hour

-

increasing the rate for 18 to 20-year-olds by 1.7 per cent from £6.45 to £6.56 per hour

-

increasing the rate for 16 to 17-year-olds by 1.5 per cent from £4.55 to £4.62 per hour

-

increasing the rate for apprentices by 3.6 per cent from £4.15 to £4.30 per hour

-

increasing the daily accommodation offset rate by 2.0 per cent from £8.20 to £8.36.

Further, the government will increase the 2021-22 Income Tax Personal Allowance and Higher Rate Threshold in line with the September CPI figure. The government will also use the September CPI figure as the basis for setting all National Insurance limits and thresholds, and the rates of Class 2 & 3 National Insurance contributions, for 2021-22.

2.9 Support for employment

A priority for the government is to protect and support jobs. To help ensure that the Department for Work and Pensions (DWP) can tackle unemployment, get people back into work and improve their lives. SR20 provides a 28.1% per cent average yearly increase in overall spending in real terms since 2019-20, including support for the department during the Covid-19 crisis.

SR20 provides £3.6 billion of additional funding in 2021-22 for DWP to deliver labour market support. This includes funding for:

-

the new 3-year long £2.9 billion Restart programme to provide intensive and tailored support to over 1 million unemployed people and help them find work

-

work search support measures announced in the Plan for Jobs

-

the £2 billion Kickstart Scheme to create hundreds of thousands of new, fully subsidised jobs for young people across the country. To date, tens of thousands of Kickstart jobs have been created. This settlement confirms funding for over 250,000 Kickstart jobs.

The government is also providing funding to get more disabled people into work and to improve DWP’s health assessments system.

Further detail on the government’s extensive support for jobs is set out below in Chapter 2.

3. Responding to Covid-19

Since the emergence of Covid-19, the government has taken swift action to save lives, support the NHS and mitigate damage to the economy. Spending Review 2020 (SR20) builds on action so far and prioritises funding to support the government’s continued response to the virus.

Throughout this crisis, the government has sought to protect people’s jobs and livelihoods across the UK, support businesses, and public services. The government has spent over £280 billion to do so this year. Of that, SR20 confirms that £113 billion will have been provided across the UK in the course 2020-21 to support public services– from the NHS, to local government, transport and employment support, including £38 billion of further funding for public services announced today. It also announces £55 billion of support to public services in responding to Covid-19 in 2021-22.

Supporting businesses and livelihoods

Action already taken in 2020-21

Since March, the government has helped to pay the wages of people in 9.6 million jobs[footnote 48] across the UK through the Coronavirus Jobs Retention Scheme (CJRS), protecting jobs that might otherwise have been lost. The government has also supported the livelihoods of an additional 2.6 million self-employed workers.[footnote 49]

Businesses have received significant government support in loans, tax deferrals, business rate reliefs, and general and sector-specific grants. Around a million business properties received over £11.6 billion worth of grants through the Small Business Grant Fund, the Retail, Hospitality and Leisure Grant Fund, and the Local Authority Discretionary Grant Fund.[footnote 50] These schemes provided support to small businesses in some of the sectors hit hardest by Covid-19. These schemes closed to new applicants at the end of August 2020. In recognition of the fact that many businesses are continuing to face a very challenging environment, the government has announced the Local Restrictions Support Grant schemes which support businesses that are facing reduced demand as well as those that are legally closed. Over £1.1 billion has already been provided to Local Authorities to enable them to make payments to businesses under these new schemes.

These unprecedented economic support schemes have benefited all regions of the United Kingdom. Figure 2.1 illustrates the regional and national breakdown of large schemes, including the CJRS, Self-Employment Income Support Scheme (SEISS), Bounce Back Loan Scheme (BBLS), Coronavirus Business Interruption Loan Scheme (CBILS), Local Restriction Support Grants (LRSG) and Additional Restrictions Grant. In Scotland, Wales and Northern Ireland over 1.4 million jobs have been protected by the CJRS, and almost £6 billion in loans under BBLS and CBILS have been provided.

Throughout the crisis, the government has adapted its economic support as the path of the virus changed. As the restrictions have evolved, the government has gone further with its support package. This includes:

-

an extension to the UK-wide CJRS to 31 March 2021

-

an extension of the SEISS with two further grants covering the period from November to April 2021

-

cash grants of up to £3,000 per month for businesses in England which are legally closed

-

cash grants of up to £2,100 per month for hospitality, leisure and accommodation businesses which are permitted to remain open but which are suffering from reduced demand due to restrictions on socialising. Local authorities which were subject to these sorts of restrictions between 1 August and 5 November have received additional funding so that they can make backdated grants

-

£1.1 billion of one-off funding for councils through the Additional Restrictions Grant in England to enable them to support businesses, as a key part of the local economy

-

extending the application period for the existing UK-wide Loan Schemes and the Future Fund to the end of January and an ability to top-up Bounce Back Loans

-

extending the UK-wide mortgage and consumer credit payment holiday for borrowers

-

extending the £1 million level of the UK-wide Annual Investment Allowance for a further year to the end of 2021, providing businesses with more upfront support, and encouraging them to invest and grow

-

£750 million of support to charities supporting those directly affected by Covid-19, £300 million to support professional sports through the winter, and £1.57 billion through the Cultural Recovery Fund to provide a lifeline to vital cultural organisations hard-hit by the pandemic.

HM Treasury has also established an advisory credit committee to provide additional advice on potential financial interventions in companies.

In addition to supporting businesses through these uniquely challenging times, the government has extended considerable support to individuals and families who have benefited from increased welfare payments, improved access to Statutory Sick Pay (SSP), a stay on repossession proceedings and mortgage holidays. To support those on low incomes throughout the outbreak, the government has announced a package of temporary welfare measures in place until spring 2021:

-

a £20 per week increase to the Universal Credit (UC) standard allowance and Working Tax Credit basic element for 2020-21. This means that for a single UC claimant (aged 25 or over), the standard allowance has increased from £317.82 to £409.89 per month until April 2021

-

an increase in the Local Housing Allowance rates for UC and Housing Benefit claimants so that it covers the lowest third of local rents. This increase will mean nearly £1 billion of additional support for private renters claiming UC or Housing Benefit in 2020-21 and benefits over 1 million households, including those in work. Claimants will gain on average an additional £600 per year in increased housing support

-

a relaxation of UC minimum income floor for self-employed claimants

-

a rebate scheme reimbursing employers with more than 250 employees for up to 2 weeks of SSP per employee. SSP has also been extended to those who are ill or self-isolating due to Covid-19 or who are clinically extremely vulnerable and unable to work as a result

-

a £500 million hardship fund that the government expects local authorities to use to discount the council tax bills of all working age local council tax support claimants by £150. This scheme provides funding for more than 3 million council tax discounts. Local authorities should use any remaining grant to support those most in need.

In addition to the UK-wide measures, the government has provided unprecedented support to the devolved administrations to facilitate their response to Covid-19 through an upfront funding guarantee of at least £16 billion for this year. This has provided a total increase this year of at least £8.2 billion of additional funding for the Scottish Government, £5 billion for the Welsh Government and £2.8 billion for the Northern Ireland Executive, on top of their Budget 2020 funding.

Further support for businesses announced at SR20

SR20 builds on the support offered to businesses to help them grow through these uncertain times and meet the challenges of the virus. SR20:

-

confirms £519 million of funding in 2021-22 to support the continued delivery of Covid-19 loans, including paying for the 12-month interest free period on the BBLS and the CBILS

-

freezes the business rates multiplier in 2021-22, saving businesses in England £575 million over the next five years. The government is also considering options for further Covid-19 related support through business rates reliefs. In order to ensure that any decisions best meet the evolving challenges presented by Covid-19, the government will outline plans for 2021-22 reliefs in the New Year

-

provides an additional £56.5 million in 2021-22 to support the vitality and entrepreneurship of the UK by expanding the British Business Bank’s Start-Up Loans to meet the increase in demand and support entrepreneurs to start and grow their business

Supporting public services

Funding in 2020-21

In addition to the substantial support offered to individuals and businesses, the government has already taken extensive actions to ensure public services are resilient to the pressures of this pandemic and support them through the crisis.

SR20 announces a further £38 billion of support for public services this year, bringing the total made available to over £113 billion across the UK. This funding includes:

-

£52 billion for frontline health services to tackle the pandemic including £22 billion for the Test and Trace programme, over £15 billion for the procurement of personal protective equipment (PPE) Equipment and £2.7 billion to support the development and procurement of vaccines

-

over £5.4 billion to help local authorities in England respond to the impacts of Covid-19 in 2020-21, on top of £1.6 billion awarded in 2019-20, bringing the total to date to over £7 billion. Additional financial support will also be available to local authorities facing the highest ongoing restrictions. This will support local public health initiatives through the Contain Outbreak Management Fund[footnote 51]

-

£12.8 billion to keep the country’s transport networks moving, so that those who need to travel can do so safely and reliably. This includes an estimated £8 billion for rail passenger services in England[footnote 52] and £4.8 billion of further support, including for buses, light rail, cycling, and Transport for London

-

education funding of £1.4 billion, including funding for schools in England to help children catch up on lost learning and supplementary support for free school meals

-

£1.9 billion for DWP to deliver labour market support, including through the Kickstart Scheme

-

over £270 million in 2020-21 to support the recovery of the justice system, including funding to ensure safety in prisons and courts and funding to reduce backlogs in the Crown Court caused by Covid-19.

Funding in 2021-22

SR20 provides £55 billion to support the public services response to Covid-19 in 2021-22, including £2.6 billion for the devolved administrations. Allocating funding now to support the response to the pandemic will allow the government to:

-

control and mitigate the virus: SR20 supports the mitigation of the virus by funding the development and purchase of successful vaccines, and NHS Test and Trace. The government has now made available over £6 billion in total to develop and procure Covid-19 vaccines

-

support public services in their recovery: SR20 ensures that public services across the UK have the resources they need to continue tackling the virus and start to address service backlogs

-

support jobs: SR20 continues to prioritise supporting jobs, including by investing an additional £3.7 billion to support frontline services and build on the commitments made in the Plan for Jobs,[footnote 53] including funding for the Kickstart Scheme for young people, the doubling of work coaches in Job Centre Plus, and investing in a new, three-year programme to help over one million people.

Controlling and mitigating the virus

Greater understanding of the virus and technological advances have made available new strategies to control and mitigate the virus over the next year. The government is committed to ensuring that these are well funded throughout 2021-22 to facilitate a strong economic recovery and reduce the number of people affected by the virus. SR20 therefore invests in the structures needed to lift the burdens of the virus, protecting lives and livelihoods.

A safe and effective vaccine will be a decisive step forward in the government’s ability to mitigate the impacts of the virus. This year, the UK has secured access to a diversified portfolio of 7 vaccine candidates across 4 different vaccine types. SR20 confirms that the government has now made available more than £6 billion in total to develop and procure Covid-19 vaccines. Of that, SR20 confirms £733 million in 2021-22 for the UK Vaccines Taskforce to purchase successful vaccines and £128 million for research and development (R&D) and vaccines manufacturing. Further funding will be allocated from the Covid-19 reserve as needed.

Test and Trace is key in reducing transmission and fighting Covid-19. SR20 provides £15 billion in 2021-22 that will support enhanced testing capacity, including regular testing of NHS staff and social care workers. The government will keep this under review, taking into account the possibility of a vaccine and the path of the virus

Medicines play a crucial role in improving patient outcomes and care. SR20 commits a further £163 million to increase supplies of key medicines for treating Covid-19 patients.

Public services support and recovery

SR20 builds on the substantial support provided in 2020-21 for the pandemic response in public services. The government is providing further targeted funding to meet the challenges of Covid-19. This includes:

-

health Services: the government will provide an additional £3 billion next year to support the NHS recovery from the impacts of Covid-19. This includes around £1 billion to begin tackling the elective backlog, enough funding to enable hospitals to cut long waits for care by carrying out up to one million extra checks, scans and additional operations or other procedures. The remainder of the funding will address waiting times for mental health services, give more people the mental health support they need, invest in the NHS workforce and help ease existing pressures in the NHS caused by Covid-19. The government also remains committed to providing PPE to frontline workers to protect them from Covid-19 and reduce transmission. On top of over £15 billion for PPE purchases and logistics already provided in this financial year, SR20 provides £2.1 billion to purchase and store PPE, sufficient funding to meet expected demand and maintain a 4 month stockpile across 2021-22

-

local government in England: Covid-19 has placed additional pressures on local authorities who play a crucial role in enabling an effective response to the pandemic. At SR20 the government expects to provide over £3 billion of additional funding to local authorities to support them in meeting these Covid-19 pressures. SR20 also provides funding to support rough sleepers and those at risk of homelessness during Covid-19 through an additional £254 million of resource funding, including £103 million announced earlier this year for accommodation and substance misuse. This takes total resource funding for rough sleeping and homelessness in 2021-22 to £676 million, a 60 per cent cash increase compared to SR19

-

public transport: it is essential that the country’s transport system continues to allow people to make their journeys safely and reliably. SR20 provides funding to support public transport services, including allocating over £2 billion to the Department for Transport to ensure continued operation of the railways in 2021-22

-

justice system: SR20 provides £246 million next year for the justice system’s continued recovery from Covid-19, including funding to continue tackling backlogs in Crown and family courts and employment tribunals, as well as £43 million to ensure the continued safety of prisons and courts. It also provides a total of £40 million funding to support victims of crime.

As the trajectory of the pandemic remains uncertain, SR20 sets aside £21 billion of contingency funding within the £55 billion support package for public services. This money is not yet allocated but will allow the necessary support to be put in place and adapted through the course of next year.

Supporting jobs

SR20 confirms 2021-22 funding for the Plan for Jobs, as part of a £1.8 billion uplift which will mean average annual growth in DWP’s budget of 28.1 per cent from 2019‑20 to 2021‑22. This includes:

-

investing £1.4 billion to build on the Plan for Jobs commitment to increase capacity in Job Centre Plus and double the number of work coaches

-

funding the £2 billion Kickstart scheme which will create hundreds of thousands of new, fully subsidised jobs for young people at risk of long-term unemployment across Great Britain. The SR20 settlement includes £1.6 billion in 2021-22 which will ensure funding for over 250,000 Kickstart jobs

-

announcing the new £2.9 billion Restart programme that will provide intensive and tailored support to over 1 million unemployed people and help them find work, with approximately £0.4 billion of funding in 2021-22

-

investing £0.2 billion in other job search support measures announced in the Plan for Jobs this Summer, including the Job Entry: Targeted Support and Job Finding Support schemes, the Youth Offer and Sector-based Work Academy Programme placements.

Table 2.1: Covid-19 spend summary (Total DEL) - public services

| £ billion | ||||

|---|---|---|---|---|

| 2019-20 (1) | 2020-21 (2) | 2021-22 (3) | Total | |

| Support for public services (4) | 2.2 | 113.5 | 54.7 | 170.4 |

| Health services | 0.0 | 52.4 | 21.2 | 73.6 |

| of which: Test and Trace and Mass Screening (5) | 0.0 | 22.0 | 15.0 | 37.0 |

| of which: NHS recovery package | 0.0 | 0.0 | 3.0 | 3.0 |

| of which: Covid-19 vaccines procurement (6) | 0.0 | 2.7 | 0.9 | 3.6 |

| of which: Personal Protective Equipment (7) | 0.0 | 15.2 | 2.1 | 17.3 |

| of which: Other NHS and health and care services | 0.0 | 12.5 | 0.2 | 12.6 |

| Local government funding for England (8) | 1.6 | 6.3 | 3.2 | 11.1 |

| of which: Local authority grant funding | 1.6 | 3.1 | 2.2 | 6.9 |

| of which: Support for rough sleeping | 0.0 | 0.2 | 0.2 | 0.4 |

| of which: Other local government support including funding LAs for their lost tax revenue in 2020-21 | 0.0 | 3.0 | 0.8 | 3.8 |

| Transport | 0.6 | 12.8 | 2.1 | 15.4 |

| of which: Support for passenger rail services (9) | 0.6 | 8.0 | 2.1 | 10.6 |

| of which: Further support, including buses, light rail, cycling and Transport for London | 0.0 | 4.8 | 0.0 | 4.8 |

| Education (10) | 0.0 | 1.4 | 0.4 | 1.8 |

| of which: Education including schools catch-up and supplementary support for free school meals | 0.0 | 1.4 | 0.4 | 1.8 |

| DWP funding to support employment and frontline services | 0.0 | 1.9 | 3.7 | 5.5 |

| of which: Additional staff and overheads for delivering front line labour market services | 0.0 | 1.1 | 1.4 | 2.5 |

| of which: Kickstart | 0.0 | 0.2 | 1.6 | 1.8 |

| of which: Restart | 0.0 | 0.0 | 0.4 | 0.4 |

| of which: Other including Employment support announced at Plan for Jobs | 0.0 | 0.5 | 0.3 | 0.8 |

| Other public services | 0.0 | 2.9 | 0.3 | 3.3 |

| of which: Covid-19 response in the Justice system | 0.0 | 0.3 | 0.2 | 0.5 |

| of which: Other support for public services | 0.0 | 2.7 | 0.1 | 2.7 |

| Funding for Scotland, Wales and Northern Ireland (11) | 0.0 | 10.5 | 2.6 | 13.1 |

| of which: Barnett consequentials of Spending Review Covid-19 allocations | 0.0 | 0.0 | 2.6 | 2.6 |

| of which: Guaranteed funding for the Devolved Administrations | 0.0 | 10.5 | 0.0 | 10.5 |

| Covid-19 reserve: allowance for further Covid-19 costs | 0.0 | 25.3 | 21.3 | 46.6 |

| 1 2019-20 represents budget cover for Covid-19 support in 2019-20 |

| 2 2020-21 figures subject to revision through the Supplementary Estimates. |

| 3 2021-22 figures represent departmental settlements at the Spending Review, with potential additional Covid-19 costs funded from the Covid-19 reserve. |

| 4 Total Covid-19 public services support shown here differs from total Covid-19 allocations shown in Table C.2: Departmental Budgets (Total DEL excluding depreciation), which includes departmental funding for business support, totalling £150.3 billion in 2020-21 and £55.6 billion in 2021-22. |

| 5 2020-21 covers all of NHS Test and Trace activity, including mass testing and regional testing as set out in the announcement by the Prime Minister on 23rd November 2020. 2021-22 funding provides an initial envelope that will support continued testing, including regular testing of the NHS and Social Care. The Government will keep these costs under review, and will allocate further funding from the Covid-19 reserve for mass testing as needed. |

| 6 2020-21 represents estimates of vaccine procurement costs. In 2021-22 they show minimum costs already committed irrespective of the outcome of regulatory approvals for vaccine candidates. The Government has made available £6 billion in total for procurement. Additional costs, including vaccine deployment, will be funded from the Covid-19 reserve as necessary. |

| 7 HMG have stabilised the UK PPE supply chain and this month will have a four-month stockpile of all Covid-19-critical PPE in place. Combined with the fact that long-term contracts and UK manufacturing has driven down costs, this means less funding is needed in 2021-22 without seeing shortages in supply. |

| 8 The £6.3 billion includes up to £903 million for the Contain Outbreak Management Fund from December, total expenditure under which depends on levels and duration of local restriction. |

| 9 The 2020-21 figure is shown as the midpoint of a £7-9 billion estimate, as used by the DfT Permanent Secretary at the Public Accounts Committee on 15 October 2020 https://committees.parliament.uk/oralevidence/1038/default. This estimate remains highly uncertain, as it depends on future decisions about public health restrictions. It cannot be directly compared with the figure for 2021-22, which only represents the departmental SR settlement. Potential additional Covid-19 costs will be funded from the Covid-19 reserve. |

| 10 Funding in 2021-22 includes funding committed for Academic Year 2020/21, which falls across Financial Year 2020-21 and Financial Year 2021-22. |

| 11 The devolved administrations received an upfront Resource DEL guarantee of £16 billion in 2020-21, above their Spring Budget 2020 funding due to unprecedented and uncertain levels of HMG spending in response to Covid-19 (of which £10.5 billion relates to public services). Based on current plans for Departmental funding in 2020-21, £2 billion of this guaranteed funding is yet to be generated through the Barnett formula. The Spending Review is additionally providing the devolved administrations with £2.6 billion of Covid-19 funding through the Barnett formula in 2021-22 on top of their core funding. |

4. Investing in a recovery for all regions of the UK

4.1 Building a stronger future

Spending Review 2020 (SR20) sets out the government’s plans for targeted investment that will support an economic recovery for all and build a stronger future. At the heart of this is the government’s mission to level up across the UK, ensuring economic opportunities for everyone and unleashing the potential of the Union.

At Budget 2020 the government announced ambitious plans to deliver over £600 billion of gross public investment over the next five years, reaching the highest sustained levels of public sector net investment since the late 1970s. These plans will underpin growth across the UK and start to tackle the longstanding weaknesses which have for too long held back UK infrastructure.

To respond to the immediate impact of Covid-19, this summer the government accelerated £8.6 billion of capital spending to support the construction sector and its vital role in supporting jobs and the recovery across the UK.