Social Security Advisory Committee annual report 2022 to 2023

Published 9 November 2023

Chair’s Foreword

Most of us will be supported by social security at some point in our lives. Some of this will be planned and welcome, for example the state retirement pension or child benefit. But more often than not, access to that support will be in unexpected, unavoidable and in possibly chaotic circumstances. For example, as a consequence of a serious medical condition or debilitating accident, prolonged periods of unemployment, a bereavement, or the need to provide caring duties for a loved one. This year has seen some further and exceptional challenges in the form of responding to the rising cost of living and providing financial support to those arriving in the UK as a result of the Russian invasion of Ukraine.

In these cases, where the Department has to put effective solutions in place at speed, this Committee has an important role to play in examining them to ensure that the proposals work. For example, do they deliver the Government’s stated policy intent, are there any unintended consequences, do they introduce complexities or other challenges for those required to deliver it, and so on.

So why is the Social Security Advisory Committee uniquely placed to do this? I believe there are many factors, but one of the most significant must surely be the diverse and committed team of experts who sit alongside me at the Committee table. The wide-ranging mix of knowledge, skills and insight helps us deliver high-quality and impartial advice to the Secretary of State for Work and Pensions. The Committee’s membership fell below its statutory minimum in July 2022, and remained so for the rest of the reporting year. I naturally had some concerns about the risk this would present to our work, however my formidably effective colleagues were determined to ensure that risk did not materialise, and I am very grateful for their support throughout this challenging period. Together, we look forward to welcoming new colleagues in the autumn and building our new team.

We were not alone in going through a period of change. The Department for Work and Pensions experienced a number of Ministerial appointments during this year, and I am delighted that the constructive relationship with the Secretary of State and his team has continued throughout that period of change. As the Committee’s sponsor minister, The Baroness Stedman-Scott OBE DL had provided valuable continuity and experience since my appointment in 2020, and I appreciated the very constructive and candid way in which she engaged with the Committee. I am delighted that her successor, The Viscount Younger of Leckie, has adopted a similarly positive approach and I look forward to continuing to work with him and developing that relationship further.

In closing I would like to thank Committee colleagues and members of our secretariat for their excellent support over the past year. As ever, their insightful and wise advice has been invaluable. Special thanks go to Chris Goulden who stood down in July having served ten years on SSAC. We are hugely grateful to Chris for the insightful and knowledgeable contributions he made to our work throughout that period.

I would also like to acknowledge the strong support of our stakeholders who provide evidence and views which inform and enrich our advice – both on draft regulations and as part of our Independent Work Programme. I am also grateful to officials from the Department for Work and Pensions and HM Revenue and Customs for their support in helping the Committee discharge its statutory functions effectively.

Dr Stephen Brien

Chair

About Us

Our Remit

Established in 1980, the Social Security Advisory Committee (SSAC) is an independent statutory body that provides advice on social security and related matters.

The Committee has, by statute, a vital role in the scrutiny of detailed and complex draft social security regulations and in the provision of impartial, well-informed and constructive advice to the Secretary of State for Work and Pensions. We also have an important role in identifying and providing advice on wider related issues through our independent research programme.

Statutory responsibilities of SSAC

-

To perform a mandatory scrutiny of most of the proposed regulations that underpin the social security system on behalf of the Secretary of State, for the benefit of both the Department for Work and Pensions (DWP) and Parliament;

-

To provide advice and assistance to the Secretary of State for Work and Pensions, whether in response to a specific request or on our own initiative.

Advice offered formally by the Committee in relation to proposals for secondary legislation must be published by the Secretary of State, along with the Government’s response to our conclusions and recommendations. The response must include a statement showing the extent to which the Secretary of State has given effect to the Committee’s recommendations and, if any are rejected, the reason(s) why. The Secretary of State’s statement must be laid before Parliament, alongside the Committee’s report and the relevant regulations. There is no obligation upon the Secretary of State to respond to other forms of advice from the Committee, or to act on any of the advice we offer.

We perform a similar role for the Department for Communities in Northern Ireland where social security powers are fully devolved[footnote 1]. We also have a non-statutory role offering advice to Treasury Ministers and HM Revenue and Customs (HMRC) on tax credits, National Insurance, Child Benefit and Guardian’s Allowance. The statutory scrutiny of secondary legislation is the Committee’s priority, and takes precedence over other activity undertaken by the Committee. But where resources permit, and as part of our general advisory functions, we:

- undertake our own detailed studies as part of our independent work programme;

- informally scrutinise regulations that are exempt from our statutory scrutiny;

- respond to public consultation exercises conducted by Government and others where we believe that we can add value;

- respond to specific requests for advice from ministers and officials.

The Committee’s membership is diverse, each member has a particular expertise, experience and interest of relevance to our work. Members are appointed to the Committee in a personal capacity, however they draw on experience from a range of organisations with whom they are connected, as illustrated below. Together they ensure that our advice is impartial, evidence based and reflects a range of perspectives. A full list of Committee members during 2022-23 is provided at annex D, and biographies at annex E.

How we deliver our remit

Scrutiny of draft regulations

The Committee’s primary function is the mandatory scrutiny of the government’s social security proposals in the form of draft regulations, and this takes priority over our other business. This is a unique role for an advisory body dealing with a highly significant area of government policy. Most social security regulations are subject to scrutiny by the Committee, the significant exceptions being regulations which are made by virtue of, or consequential upon, a recent Act of Parliament; go to other advisory bodies (for example the Industrial Injuries Advisory Council); or which set benefit rates.

The SSAC’s oversight function is constitutionally important. Parliament’s ability to scrutinise subordinate legislation is limited by pressures on parliamentary time and an absence of detailed expertise among most Members of Parliament in a complex system. Our scrutiny role therefore provides constitutional comfort that the secondary legislation delivers the Government’s policy intent without introducing unintended consequences or impacting particular groups. This scrutiny of the UK position is becoming more important as devolutionary powers over social security are being exercised, creating the potential for unintended geographical consequences as devolved and reserved social security systems interact.

In reviewing draft regulations there are a number of issues that the Committee considers. We examine whether there is clarity around the policy objective, whether the regulations deliver that policy objective and whether the regulations themselves are clear. That requires us to examine whether the Regulations fit within the overall context of the social security system, including whether:

- there are unintended conflicts with existing priorities or obligations,

- the regulations are proportionate to the policy intent,

- the regulations increase or reduce overall complexity, and

- interested and affected groups have been consulted.

We explore whether the consequences of the regulations have been properly analysed by government. That includes examining whether alternatives have been or could be considered. In considering the impact of the changes on individuals and on groups of people, our starting point is generally supporting documentation from the government on equality considerations, identifying who will benefit or who will lose out from the measures. It is important that the Department provides strong equality analysis so that our statutory obligation to provide high quality advice is delivered as effectively as possible.

We also explore whether the practicalities of implementation have been considered so that operational delivery of the legislative intent can be assured. Part of that enquiry includes understanding the impact on the advice sector, on employers, on local authorities, and on front line staff who will have to deliver the changes, as well as on how claimants will be able to understand their entitlements.

The Committee has the power to take regulations on ‘formal reference’. The Committee would normally undertake a public consultation after which we produce our recommendations to the Secretary of State. This must then be laid in Parliament together with the regulations and with a statement setting out the extent (if any) to which the Secretary of State proposes to give effect to the recommendations and - where they are not accepted – the reasons for that decision.

In reality, the majority of draft regulations are scrutinised without formal reference, either through Committee meetings at which Departmental officials answer our questions about the legislation; or though postal scrutiny with a sub-group of the Committee reviewing the regulations following written exchanges with officials. We adopt this latter approach when our advice is of a more technical nature, and focuses on engaging with officials on the technical details of the draft legislation.

Legislation provides for an exception to the scrutiny process being undertaken before regulations are laid in circumstances where the Secretary of State considers that the urgency of the proposals are such that it would be inexpedient to consult the Committee[footnote 2]. In cases where urgency is invoked, the Committee will subsequently scrutinise the Regulations after they have been laid or implemented, with the same powers of formal reference available to us as if urgency had not been invoked.

The Committee sees its role as making a positive contribution to help ensure that regulations are as good as they can possibly be. We are grateful for the co-operation of - and constructive discussions with - DWP and HMRC, as well as good working relationships across devolved governments, to build an accurate picture of how the Regulations will work. We have no authority to make policy changes in social security but being an independent arms’ length body enables us to get valuable insight from our stakeholders into the issues that the legislation addresses. In providing advice to government through detailed scrutiny of social security proposals we bring all of these interests together to improve the quality of social security legislation.

SSAC scrutiny of regulations in 2022-23

The Committee considered 22 packages of regulations during 2022-23.

| Numbers of regulations scrutinised in 2022-23 | Scrutiny at SSAC meeting | Cleared by correspondence | |

|---|---|---|---|

| Number | 22 | 11 | 11 |

The Committee did not take any of the regulations on formal reference.

Of the 22 sets of regulations presented to the Committee, four were HMRC-led and dealt with under our Memorandum of Understanding with HM Treasury and HM Revenue and Customs.

In some circumstances, the Committee may agree to consider regulations by correspondence. This only applies to very straightforward and non-contentious regulations, or to those of a minor and technical nature. Half of the recommendations fell into that category during this reporting year.

There were six cases in which the Secretary of State invoked ‘urgency’ this year[footnote 3]. These included the government’s response to support people arriving in the UK following the Russian invasion of Ukraine. For a detailed breakdown of all the regulations subject to statutory scrutiny by the Committee in 2022-23, please see annex A.

Delivering our statutory responsibilities

To undertake our statutory functions well, it is essential that the Committee has a clear understanding of the full extent of how the Department’s regulations are likely to impact - positively or otherwise - different groups of individuals, in particular those with protected characteristics, and whether the Government’s policy intent is likely to be achieved. We rely on the Department’s support in identifying who is going to be affected and to establish what the potential impacts will be, highlighting disparity where that exists. This analysis of impact is essential both in ensuring that the Committee can discharge its statutory duties effectively, and to provide high quality support to the Department.

The application of broad first-principles logic and curiosity, together with a wider consideration of all groups likely to be affected, by the Department is therefore essential. Failure to do so would mean that the full range of consequences – intended or otherwise – cannot be fully understood or effectively monitored.

During the course of this year, we have received some very high-quality analyses of impact which have been comprehensive and – where data has not been available – have explored what other proxy evidence might be available to demonstrate likely impact. However, the standard of equality assessments and analyses of impact has been variable. Our experience is that the Department seeks to demonstrate that the proposals do not discriminate against protected characteristics, rather than providing a broader and comprehensive assessment of impact. This would mean considering disparate outcomes rather than considering adverse impacts because of a protected characteristic. It also means examining not just those with protected characteristics, but also identifiable groups relevant for the regulations.

We have had some very constructive discussions with the Department about this issue, and are encouraged by its positive response. The Committee will continue to support DWP colleagues by continuing to regularly provide constructive and specific feedback to enable them to strengthen their approach.

The Department has a critical role to play in helping to protect the most vulnerable in society from the risk of financial shock. We have supported the Department by carefully examining their proposals to ensure the regulations accurately achieve the policy intent and that they can be effectively operationalised. For example:

The Social Security (Habitual Residence and Past Presence) (Amendment) Regulations 2022

These regulations, laid under ‘urgency’, came in response to the Russian invasion of Ukraine in 2022. Under normal rules, Ukrainians would have to satisfy the Habitual Residency Test and Past Present Test to gain access to benefits. With these changes, neither rule would apply to Ukrainian nationals given leave and returning UK nationals.

We recognised the importance of these regulations and understood the need for them to be laid under ‘urgency’. Our main interest was in the similarities between these regulations and the ones for the Afghanistan crisis the year before. We acknowledge that each situation should be taken on its own merit; however, there is also need for the DWP to consider a framework for longer-term policy development. We continued this line of thinking again in 2023 for The Social Security (Habitual Residence and Past Presence) (Amendment) Regulations 2023 for Sudanese nationals.

The Universal Credit (Administrative Earnings Threshold) (Amendment) Regulations 2023

These regulations were brought before the Committee to amend the administrative earnings threshold which refers to the point at which a claimant’s earnings move them from the Intensive Work Search group, to the Light Touch group[footnote 4]. A prior amendment was brought before us in January 2022. This raised the AET to £494 per assessment period for single claimants and £782 per assessment period for couples, effective from September 2022. The amendment brought before the committee in November 2022 sought to further increase the threshold to £618 per assessment period for single claimants and £988 per assessment period for couples. At the time, the Department’s estimates suggested 120,000 claimants would move from Light Touch into the Work Search Group as a result of this amendment. Moving into the Work Search Group entails the addition of conditionality to a benefit award. The result for the claimant, is that they would have to meet with work coaches for intensive work search support regularly and face a benefit sanction if they did not meet these conditions. This is not required in the Light Touch group. The Department’s policy rationale is that this would provide those in scope extra support to increase there in-work earnings.

On first scrutinising these regulations, we formulated a suite of questions relating to the both the impact and equalities analysis provided by the Department to support the rationale for laying the regulations. These broadly referred to evidence relating to age, pay and disability factors, as well as the findings from a DWP pilot that tested this policy change. Following careful consideration, we decided not to take the regulations on formal reference; however, our Chair wrote to the Minister for Employment to communicate several areas for continued consideration[footnote 5]. Our main concern was the insufficient data and understanding of both the current labour market conditions and what works for this group to ensure that the full impact can be understood, and the proposal delivered effectively.

We suggested that a phasing of the implementation of these latest regulations was likely to be beneficial in developing that greater understanding of the impact of a further increase to the AET. Our view was that a relatively short pause (or phased roll-out) in implementation was likely to provide significantly more evidence on the impacts on and unintended consequences for both claimants and operational staff, and was more likely to ensure that the proposals - which have the effect of doubling the number of claimants that would have been brought into the intensive support group as a consequence of the previous increase to the AET in September 2022 - will deliver the desired policy intent.

The Social Security Benefits (Claims and Payments) (Modification) Regulations 2022)

In May 2022 we looked at these emergency regulations, which set a year-long temporary stop on new ‘ongoing consumption payments’ (OCPs) and not increase current OCP deductions without claimant consent. While claimants would have higher bills, they would now have a choice on how to prioritise their bill payments.

While we decided not to take these regulations on formal reference, we highlighted a number of concerns with the Minister for Welfare Delivery. For example, we recommended that the Department should clearly communicate these changes to the affected claimants, to monitor the impact of this change and plan for further potential changes.

In December 2022, we spoke to officials again and they reported that as a partial response to our recommendations the Department wrote to those it had identified on legacy benefits. This took some time to complete as the Department did not have the resources immediately available and had to commission an external supplier to print and send the letters. These were sent out in late November/early December.

More broadly the matter of Fuel Direct was discussed earlier this year at the Department’s Operational Stakeholder Engagement Forum, the Department’s newsletter for external stakeholders was updated and the relevant page on gov.uk advised claimants what they had to do if they wanted to change their payment.

A comprehensive summary of the regulations we have scrutinised this year can be found at annex A.

Provision of independent advice

Our remit also includes the power to advise the Secretary of State on social security issues, either following a specific request from the Department or on our own initiative. The issues that we examine, and on which we provide advice to Ministers, is designed to reflect the strength of expertise and experience on the Committee, as well as the added value of our unique and trusted relationship with the Department.

We seek to ensure that the analysis we carry out as part our independent work programme:

- provides an evidence base for our work, improving members’ ability to scrutinise regulations and provide credible independent advice to ministers;

- adds value to the debate on a topic that is of current interest to government or a broad range of our stakeholders;

- stimulates debate or discussion on a specific topic; and

- introduces new thinking or data analysis.

Our advice takes various forms. For example:

- providing briefings for officials on common lessons we have observed from our scrutiny of regulations;

- papers reporting back on the key themes emerging from workshops with interested parties conducted under ‘Chatham House’ rules;

- correspondence to Ministers and senior officials where we have identified an issue that requires a more considered response; and

- substantial and detailed reports based on our research projects.

Our Chair also has regular discussions with the Ministerial team, providing another avenue by which we might provide or reiterate our advice.

So how do we determine what issues we should examine? Over the course of the year we talk to Ministers, senior officials, operational staff responsible for delivering DWP policies and external stakeholders to identify timely issues on which our advice would be valued. The knowledge and experience of Committee members is also an important resource when identifying potential topics.

Our modest resources require us to evaluate potential projects against a range of criteria before we commit to them:

- why is it an important question now? For example, is this a significant emerging issue which is aligned to the Department’s priorities; or is it a regular area of concern arising from our work?

- are there any data sources – and what are they and what does the data tell us?

- has anyone else looked at (or is currently examining) this issue, if so, what further value can we add?

- why is SSAC uniquely positioned to do this work? For example, would access to work coaches or detailed discussions with officials be of value?

- What resources will it require, and do we have the capacity and capability to do justice to the issue?

- What can we expect to add to the debate or existing evidence base?

- Is there an opportunity for our work to influence Ministers and have impact?

The value of our independent advice should not be solely determined by whether our recommendations and advice deliver policy change. There are broader benefits from this strand of our work, for example:

- it makes SSAC better equipped to undertake its statutory functions (primarily scrutiny of regulations);

- our work helps ‘join the dots’ where work is being undertaken by separate parts of Department and the broader impact, interaction with the rest of the social security system, and potential inconsistencies and/or unintended consequences are less visible to individual teams;

- conventional research can be expensive, so our work delivers value for money;

- it provides Secretary of State, and Parliament, with constitutional comfort on complex issues.

It is important that our advice to the Secretary of State is evidence based and reflects insight gleaned from a wide range of experiences and perspectives. We remain grateful to our extensive stakeholder community who engage with us on our projects and to DWP officials who provided factual information to ensure that we are able to achieve that.

Our independent advice in 2022-23

During this year, we published two reports as part of our remit to provide independent and impartial advice to the Secretary of State for Work and Pensions.

1. The Future of out of work contributory benefits for those not in paid work (October 2022)

Between September 2021 and June 2022, the Committee examined the current role of New Style Employment and Support Allowance and New Style Jobseeker’s Allowance in the out-of-work benefit system. The report produced was based on evidence from a literature review, secondary analysis of DWP administration data and primary research consisting of interviews and focus groups with 19 DWP and Department for Communities claimants and 29 operational staff from DWP and the Department for Communities.

New Style Jobseeker’s Allowance and New Style Employment and Support Allowance – the two contributory benefits that can be received by out-of-work individuals regardless of their financial assets or partners earnings – have been a neglected area of policy over the last decade as the Department for Work and Pensions’ focus has been the nationwide roll out of Universal Credit. This continues a decades-long trend of successive governments allowing working-age contributory benefits to diminish in importance as the role of other working age benefits has increased, for example with the expansion of means-tested support for families with children, renters, and in-work support.

The study found many aspects of these benefits do work well. But it also identified a number of areas where, too often, the system does not, leading to a poor service for those qualifying for contributory benefits. This stems from a lack of attention to, and a lack of investment in, these benefits. With Universal Credit now operating nationwide, therefore our overarching recommendation is that the government should develop a clearly articulated long-term vision for the role of contributory benefits for people of working age who are not in paid work.

While the decision about the role of the contributory principle is one for the government, it is appropriate that Ministers clearly articulate the role that they want this historically important component of working-age social security to play in the 21st century. Such reforms can take time and may not be the most immediate development priorities. However, a commitment is needed to make early discrete operational changes, with a clear statement of longer-term intent to provide claimants and wider stakeholders with a clear direction of travel.

Our report set out a range of options for achieving greater alignment, from operational-level change that would deliver access to Universal Credit style technology and unifying work coaches for those on dual claims, through to delivery on the same IT platform and full integration of working-age benefits.

While the full integration of contributory working age benefits within Universal Credit would not be achievable in the short-term having this as a long-run goal would set a clear direction of travel. Having part of Universal Credit available to those deemed to have paid into the system without being subject to a means-test against, for example, their financial assets or partners earnings would have a number of advantages. It would boost take-up and would eliminate many of the problems our study has identified that stem from separate systems struggling to work well with each other. Reforms and operational changes could be made gradually over time in order to deliver improvements to how the system works for claimants and how it is administered that brings us closer to the ultimate destination of integration.

The Department’s response to our report confirms acceptance for five of our 15 recommendations, and indicates that others may be implemented further down the line as migration onto UC slows and more operational capacity becomes available within working age benefits[footnote 6].

A full list of recommendations from this report can be found at annex B.

2. Out of work disability benefit reform (November 2022)

Chapter five of the Government’s Shaping future support: the health and disability green paper explores ways to improve the design of the benefit system[footnote 7]. Following post-consultation discussions with the DWP team leading this work, this Committee decided to undertake a piece of work examining one aspect of this challenge: how can the current structure of benefits be changed to overcome people’s financial concerns about moving towards employment?

We focussed on this single important issue as we know that some disabled people, and people with health conditions, receiving income replacement benefits would like to work in the future, and believe that they could do so with the right job and the right support, but the social security system is not always effective at helping them to do so. We therefore wanted to identify the nature of the social security barriers and to explore potential options for removing them. While other barriers and enablers are also of fundamental importance – for example whether employers offer inclusive opportunities and whether suitable support is available to seek and retain paid work – they were beyond the scope of this particular project.

As the Department had already undertaken an extensive consultation on this issue, we decided it would be unnecessary for us to replicate that process.

However, we were keen to hear directly from Disabled People’s Organisations, disability charities, academics, policy experts on disability employment and claimants. Accordingly, we hosted a small number of roundtable workshops and interviews in spring 2022 to gather insights from disabled people’s experiences and perceptions. The Committee also conducted a brief review of relevant evidence to ensure its advice was well-informed.

Guided by the evidence available to us, we considered a wide range of different potential solutions, including long-term structural changes to the current benefits system and short and medium-term proposals that might encourage those disabled people wanting to try work to do so.

We concluded that the immediate priority should be to address issues under the following three broad core themes which arose repeatedly in our workshops and in other evidence available to us:

- reducing risk (and perceived risk) of trying paid work, particularly relating to reassessments and potential income loss;

- improving financial incentives to engage in paid work;

- increasing trust in DWP to offer tailored support and take account of personal circumstances, including fluctuating conditions, in a fair and transparent way.

Some of these problems stem from the very structure of the current system. Through the White Paper process, the Department is seeking to test options for structural reform in order to reach a consensus view. However, radical reform takes time, and we believe that the immediate focus should be on strengthening confidence and trust in the system and its implementation, to enable more disabled people to try work without fear of potential consequences. Any more radical reform in future could build upon these foundations.

While we have not received a response from the Department to our specific recommendations, we are delighted that a number of our conclusions are reflected in Transforming support: The Health and Disability White Paper, for example potential expansion of the Work Allowance, greater recognition of and support for claimants with fluctuating conditions, and revising the approach around ‘fit for work’[footnote 8].

We are committed to supporting DWP as it moves the moves the White Paper forward, and are in discussion with the Department to determine where our input may be of greatest value.

Reflecting back on earlier advice

We are pleased that, while our recommendations are not always accepted at the point at which they are made, that is not always the end of the story!

During the course of this year, the Department implemented a policy change that reflected advice we had offered much earlier, and which was subsequently reflected in the decision of the Supreme Court in a 2018 case[footnote 9].

For example, in 2015, the Committee examined the support available for bereaved people and anticipated the impact of Bereavement Support Payment that would be introduced from 2017[footnote 10]. At that time, DWP reaffirmed its position that Bereavement Support Payment should apply only to married couples and civil partners, rather than unmarried couples. Stakeholders provided evidence to us that persuaded us that this decision was outdated and unfair.

While our report acknowledged that there were considerable practical challenges associated with extending entitlement to unmarried couples, we asserted that awarding Bereavement Support Payment only to those who lose a spouse or civil partner appears hard to reconcile with the definition of family adopted by the Government in the Family Test and the position adopted within other benefits. We recommend that:

DWP should recognise the impact of bereavement on a broader range (definition) of “partner” and consider extending eligibility to ensure consistency with other areas of the benefit system. We recognise that this would bring additional costs and the Government will need to give careful consideration to its affordability when balanced against other priorities, but nonetheless it should be an ambition over the longer-term.

While the government did not initially accept the recommendation, the legislation was subsequently successfully challenged under Article 14 of the European Convention on Human Rights, which protects the right to be protected from discrimination, in conjunction with Article 8 of the Convention, which protects the right to family life. We are pleased that the government has rectified this position through The Bereavement Benefits (Remedial) Order 2023. This extends the eligibility criteria for Bereavement Support Payment and Widowed Parent’s Allowance, ensuring that thousands more grieving parents are able to access this support which is designed to help parents with the financial impact of losing a partner.

Stakeholder engagement

Relationships with DWP ministers

The Committee’s primary role, as set out in statute, is to provide advice and assistance to the Secretaries of State for Work and Pensions and the Northern Ireland Department responsible for social security[footnote 11]. It is therefore essential that we are able to develop a constructive relationship with DWP’s ministers. There was a degree of churn at all levels in the ministerial team during 2022-23, including three Secretaries of State. We have been committed to building a robust, candid and constructive relationship with all incumbents of these roles over the past year, in keeping with the Committee’s status as an independent and impartial expert adviser. We particularly welcome the regular and positive engagement from the current Secretary of State, the Rt Hon Mel Stride MP, his ministerial team and his senior officials. This engagement helps to ensure there is a good understanding of our respective roles, and establish the reputation of the Committee as a trusted adviser which strives to provide timely, well-informed advice, which is of value to Ministers, policy officials who work hard to ensure that the Government’s policy intent is captured in legislation, operational teams responsible for delivering it; and those who rely on the social security system for support.

The absence of a Northern Ireland Executive has meant that we have been unable to engage directly with a Minister responsible for social security in Northern Ireland. We have, however, continued to encourage DWP to consider specifically the impact of policy changes as they would apply to Northern Ireland, given the statutory objective of social security parity here[footnote 12].

Parliament

As we mention earlier in this report, while our role is to provide advice to the Secretary of State for Work and Pensions, that advice is also for the benefit of

Parliament with our work – particularly on Universal Credit transitional provisions and involving disabled people when developing or evaluating programmes that affect them – featuring in a number of Parliamentary Questions and debates during the course of the year.

The Committee was also delighted to have the opportunity to discuss its work with the Work and Pensions Select Committee as follows:

- Universal Credit and managed migration: Dr Stephen Brien (Chair), Carl Emmerson and Charlotte Pickles (Committee members) gave evidence on the Committee’s advice to the Secretary of State for Work and Pensions on The Universal Credit (Transitional Provisions) Amendment Regulations 2022[footnote 13].

- Working age contributory benefits: Dr Stephen Brien (Chair), Liz Sayce (Vice-Chair) and Carl Emmerson (Committee member) was invited to give evidence on its recently published report on The future of working age contributory benefits for those not in paid work. The Work and Pensions Committee also took this opportunity to examine an earlier SSAC report, Separated parents and the social security system, which had been published in 2019[footnote 14].

- Benefit levels in the UK: Dr Stephen Brien (Chair) contributed to a discussion on whether there should be an independent advisory body to advise the Government on benefit levels and, if so, whether this Committee could take on that role (either in its current form or through reform and expansion)[footnote 15].

External stakeholders

It has been a longstanding priority for this Committee that our advice is well-informed, evidence-based and that it takes account of a wide range of perspectives – including those of claimants and taxpayers. The evidence and insight our stakeholders contribute to SSAC’s work is greatly valued. Our network of stakeholders on whose experience and expertise we draw, contains over 500 organisations and bodies representing a wide spectrum of interests and insights. This includes voluntary sector organisations representing and/or serving the interests of claimants, policy-makers, think tanks, local authorities, employers, and academia drawn from across England, Northern Ireland, Scotland and Wales.

We consider it particularly important to have a strong understanding of the impact of the UK government’s social security policies in Northern Ireland, Scotland and Wales where different challenges and opportunities may exist. We endeavour to undertake regular stakeholder engagement within each the devolved nations, and plan to resume our regular programme of visits to Northern Ireland, Scotland and Wales in the coming months.

In 2020, the Covid-19 lockdown required us to move away from our traditional face-to-face engagement and explore alternative methods for engaging with our stakeholders. The digital approach that we adopted (in particular hosting meetings on Microsoft Teams) enabled us to extend our reach to a more diverse and geographically spread group than had traditionally been the case, and meant that our advice to Ministers reflected a wider range of experience and insights than had been possible through face to face engagement alone. Following the pandemic, this approach has continued to be an important feature of our stakeholder activity, in addition to our invaluable face-to-face engagement with our stakeholders, including DWP’s operational staff. We will endeavour to ensure that we achieve a good balance between both methods of engagement to ensure a good breadth of knowledge and understanding of all aspects of social security is reflected in our work.

Programme of visits

During the course of this year, the Committee established a programme of visits that were designed to help develop greater insight to the operational delivery of DWP’s policies through talking to staff responsible for that delivery at DWP Jobcentres, service centres and call centres.

The objective of these visits were two-fold:

1. to identify emerging issues, build insight and gather evidence for potential areas of future independent advice; and

2. to develop a greater awareness of issues that would benefit SSAC’s statutory scrutiny of regulations (eg examining the full range of responsibilities work coaches have, how discretion is applied and reviewing if recent secondary legislation we have scrutinised had been delivered as planned or whether there had been unintended consequences etc).

The Committee has visited operational sites at a variety of locations with a mix of labour market conditions, for example Bolton, Doncaster, Ealing and Lowestoft. We have supplemented this with online workshops with representation of DWP staff from each geographical district and also DfC(NI) colleagues. The discussions have been varied and wide-ranging, for example providing insight on:

- how older people are being supported into work;

- how the increasing level of discretion within the work coach role is being managed;

- the progress being made in building trust with disabled people;

- how the government’s strategy for supporting Ukrainian refugees and Afghan re-settlers on bespoke regulatory regimes is being operationalised; and

- the training put in place for work coaches employed post-pandemic.

These visits have been extremely informative, and we are grateful to the Department for accommodating our request and, in particular, to the knowledgeable and committed staff to whom we have spoken. We look forward to continuing our programme of visits - including to the devolved nations - during 2023-24.

Transparency

The Committee has a proven track record regarding transparency in relation to all aspects of its business. For example, our reports, correspondence with Ministers, minutes of meetings and responses to Freedom of information requests are all published routinely on our website. We are also transparent about Committee members’ business interests which we publish quarterly, and the costs associated with delivering our work.

We also endeavour to keep interested parties up to date with developments through regular stakeholder meetings, blogs by Committee members and via our X (formerly known as Twitter) account (@The_SSAC).

Our resources

The Committee’s budget allocation in 2022-23 was £350,000. All of our operational costs are met by this allocation, including our Chair’s annual remuneration, Committee members’ fees and the staff costs associated with our small secretariat.

The staffing costs associated with our full-time secretariat account for the majority of our annual expenditure. We fund four (FTE) staff who are on loan from DWP at a cost of around £260,000.

The Committee is required by statute to have between 10 and 13 members, plus a Chairman. Our Chairman receives an annual remuneration of £22,000, while Committee members are paid a fee set at a daily rate of £256.80. Reimbursement of reasonable business expenses relating to travel and subsistence are also payable in accordance with DWP’s policy. A detailed breakdown of these costs in 2022-23 are provided at annex H.

Along with other organisations, it was necessary to introduce new and innovative working practices at pace during the 2020 lockdown. We have reviewed those new arrangements and, in circumstances where they have proven to be effective and not impacted the quality of our work, we have retained them - for example, through greater utilisation of hybrid and fully online meetings where that is appropriate. This has delivered modest savings, for example in respect of travel and subsistence costs. We will continue to keep this under review and ensure that our working arrangements are optimal and delivering value for money.

However, there is one area in which our expenditure has - rightly - increased. In 2020, we recognised that there was more we should be doing to engage with disabled people more effectively, for example by ensuring that our communications and reports were accessible[footnote 16]. While we have more to do in this respect, we have made positive progress, for example by arranging the professional translation of a number of our reports into Easy Read and British Sign Language. Inevitably there is a cost associated with this and, for 2022-23, this has been in the region of £10,000. The Committee has, and will continue to, meet the costs associated with our 2020 commitment from our annual budget allocation.

Looking forward to 2023-24

Consistent with the Committee’s statutory remit, our work priorities for the coming year are:

1. Scrutiny of draft regulations: we will undertake impartial, effective and timely scrutiny of draft regulations relating to social security benefits. The Committee’s scrutiny of secondary legislation takes priority over its other work.

2. Provision of independent and impartial advice: the Committee will undertake a small number of research projects, providing impartial, well-informed and constructive advice to the Secretary of State for Work and Pensions on issues relating to social security and welfare reform. We will ensure that we have the capacity and capability to be responsive and provide constructive, timely responses and advice on emerging priority issues.

An independent Tailored Review of this Committee will be undertaken during the course of 2023-24, therefore a further priority will be to co-operate and engage fully with this process.

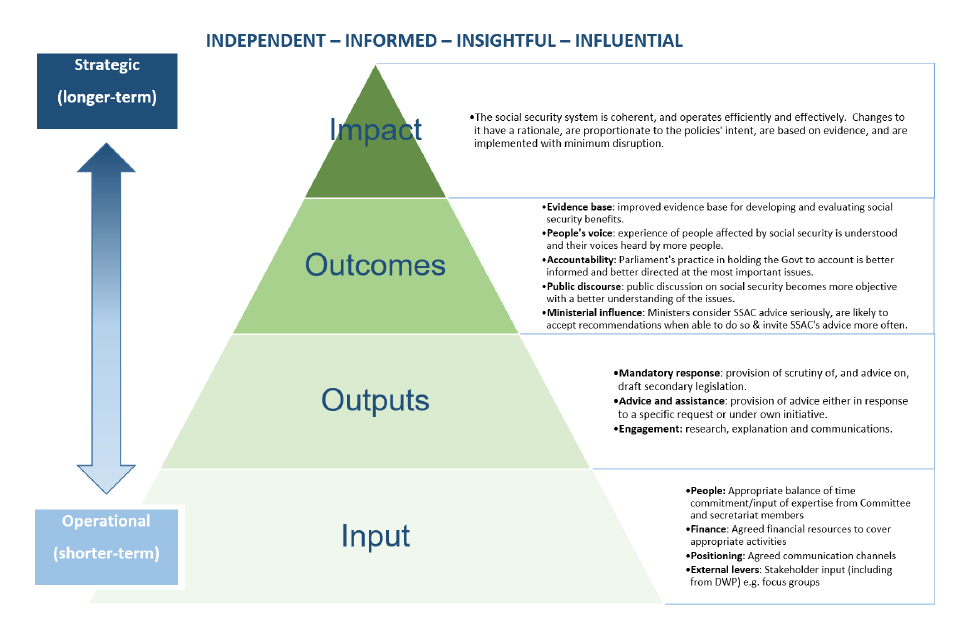

All of the activities undertaken during 2023-24 will be consistent with the Committee’s Results Framework[footnote 17].

Scrutiny of draft regulations

The Committee will continue to explore how it can effectively add value to the regulations process further upstream, so that the proposals presented to us for statutory scrutiny have already benefitted to some degree from our input and are in the best possible shape before they are laid in Parliament. The Committee’s ambition is to be regarded as a trusted resource that can add value to the process, rather than a hurdle to be overcome at the point of scrutiny. The Department has already responded positively to the Committee’s ambition by asking for an opportunity to present their proposals early on the process. This has been invaluable in ensuring that we are able to familiarise ourselves with the issues, and share some initial observations and advice, before the formal scrutiny session. The Department has also voluntarily brought to us regulations that fall outside of our statutory remit for informal scrutiny[footnote 18].

We regard all of this as a very positive step forward, and will continue to work with the Department to further strengthen the value we provide to them.

To ensure we can deliver this priority effectively, we will keep under review our ability to undertake a high quality and forensic scrutiny of draft secondary legislation, taking steps to further strengthen our technical understanding of the benefit system as necessary.

We will also continue to support officials by providing insight to the scrutiny process and advice on how to prepare for it. We shall keep under review our written guidance for staff who will be presenting regulations to us to ensure that it is as clear, informative and as transparent as possible, for example by emphasising the importance of providing a comprehensive analysis of impact (both on protected characteristics and more broadly) and a discrete articulation of the relevant policy intent – both of which will enable the Committee to be more focussed and effective in its deliberations and discussions with officials. We will also continue to provide constructive feedback on the draft regulations and supporting papers provided to us, and contribute to the Department’s workshops for staff on strengthening its legislation.

Independent advice

The issues that we examine, and on which we provide independent and impartial advice to Ministers, will reflect the strength of expertise and experience on the Committee as well as our trusted relationship with the Department. So, taking advantage of our unique ability to help in areas where other organisations are less equipped to do so.

Our programme of independent advice is designed to:

- provide an evidence base for our work, improving members’ ability to scrutinise regulations and provide credible independent advice to ministers;

- add value to the debate on a topic that is of current interest to government or a broad range of our stakeholders;

- stimulate debate or discussion of a specific topic; and/or

- introduce new thinking on data analysis.

While there must be a clear line drawn in terms of SSAC’s independence and impartiality, we are keen that the advice we provide is timely and useful and delivers outcomes consistent with our Results Framework. With this in mind, we will discuss our plans with the Department as we finalise the scope for each project to ensure that our advice is well-targeted, constructive and can have maximum impact.

Our objectives

There are a number of specific activities on which we intend to focus during 2023-24 in order to be effective in delivering our priorities. In particular, we aim to:

Provision of advice

- continue to work constructively and effectively with DWP to ensure that our respective roles in the delivery of high-quality draft regulations are delivered well and in a timely manner;

- continue our programme of appropriate and timely independent and impartial advice to the Secretary of State through proactive and timely examination of emerging priority areas;

- further embed our results framework, including reviewing our past recommendations on a regular basis for continued relevance and to ensure that the impact of our advice is understood;

Ensuring our work is evidence based

- develop more active and targeted stakeholder engagement to ensure that our advice to Ministers is well-informed, takes account of a wide range of perspectives and provides constructive support to the policy-making process. We will:

- be inclusive of stakeholders in Scotland, Northern Ireland and Wales to ensure that their voice is heard in the advice we provide to Ministers and that the impact of greater devolution - including city devolution and localisation - of social security provision is understood;

- engage with diverse stakeholders including claimants, advice agencies, voluntary organisations, academics and other experts;

- taking steps to ensure effective engagement with diverse communities including disabled people and people from black and minority ethnic communities;

- ensure that we develop an understanding of the operational issues that are likely to flow from new policy initiatives, and are able to review the progress of the implementation of Universal Credit, through a programme of visits to DWP sites and other stakeholders;

Ways of working

- further strengthen our links, both at ministerial and official level, with:

- the Department for Work and Pensions, further developing our trusted relationship to maximise our ability to provide high quality, well-informed and timely advice on a range of social security matters;

- the Department for Communities to ensure the effective delivery of our statutory duties in Northern Ireland[footnote 19]; and

- HMRC and HM Treasury under our Memorandum of Understanding to ensure that due account is taken of their role in relation to benefit matters, particularly in the transition of tax credits to Universal Credit.

- make the best use of our people and financial resources, in a cost-conscious manner and reflecting our commitment to diversity and inclusion. We will continue to seek to benchmark ourselves against other organisations of a similar size and/or remit, and identifying areas of best practice.

Equality, diversity and inclusion

All of our work – including our scrutiny of draft regulations, our research projects, our recruitment exercises and our engagement of stakeholders – will reflect equality, diversity and inclusion.

Measuring our success

We will report on the degree to which we have achieved these objectives in our 2023-24 Annual Report. Our performance will be informed by:

- our Results Framework;

- feedback from the Department and our other stakeholders on the usefulness of our work (both scrutiny of regulations and our independent work programme) and advice to Ministers; and an

- in-year effectiveness review of the Committee.

Success criteria will consider the degree to which we have delivered:

- rigorous scrutiny of draft regulations within agreed deadlines.

- provision of pertinent, well-informed and influential advice to Ministers, informed by our stakeholders’ experience, expertise and other evidence.

- strong engagement and collaboration with the DWP, HM Revenue and Customs, Department for Communities Northern Ireland and other appropriate Government and devolved bodies.

- transparency of the Committee’s operation and expenditure, including publication of our minutes and reports, the fees and expenses for each Committee member, and the costs of our secretariat.

Our operating principles

Whilst undertaking its activities the Committee will remain conscious of its responsibilities for:

- prudent management

- cost conscious management of its budget (£350,000)[footnote 20]

- confidentiality where appropriate

- transparency

- quality governance in accordance with the DWP/SSAC Framework Agreement and the Government’s Code of good practice on the sponsorship of arm’s length bodies.

- regular assessment of risks, and ensuring plans are in place for managing them.

Annex A

Regulations subject to SSAC statutory scrutiny during 2022-23

Annex B

The future of contributory benefits for those not in paid work: our recommendations

Recommendation 1

That the Government sets out a clear articulation of what it wants the two New Style benefits to provide and the extent to which those deemed to have paid into the system should be able to access support on a preferential basis to those qualifying for means-tested support. Having set out its strategy for these benefits they should also be renamed to reflect their role better, as the name “New Style” will not convey that to claimants. For example, their legal names, contributory ESA and contribution-based JSA, could instead be used.

Recommendation 2

We recommend the long-run goal of New Style policy should be to integrate both New Style JSA and New Style ESA into Universal Credit.

Recommendation 3

All claims for Universal Credit should be automatically assessed for entitlement to New Style JSA / New Style ESA.

Recommendation 4

For dual claimants of both UC and NS benefit, the Universal Credit system should measure – and then adjust automatically in response to changes in – receipt of New Style benefits. [Recommendation accepted]

Recommendation 5

New Style payments should be automatic, requiring the work coach to intervene to reduce or stop payment if a claimant breaches their agreement. [Recommendation for future review]

Recommendation 6

New Style JSA should be assessed and paid monthly, the same as Universal Credit. [Recommendation for future review]

Recommendation 7

New Style JSA claimants should automatically receive National Insurance credits when they reach the time limit for benefit payment. [Recommendation for future review]

Recommendation 8

Review the National Insurance credits awarded to claimants of Universal Credit and to claimants of New Style benefits with a view to crediting both in the same way.

Recommendation 9

Contributory requirements to qualify for New Style benefits should be reviewed and reassessed. [Recommendation for future review]

Recommendation 10

The means-tests against some private pension income in New Style ESA and New Style JSA should be reviewed in the light of “pensions freedoms” with a view to removing them.

Recommendation 11

Ensure a professional level of customer service and support that considers the claimant’s situation in an accurate/consistent/prompt way. [Recommendation accepted]

Recommendation 12

Those on New Style benefits should be entitled by default to access all of the employment programmes available to those on Universal Credit. [Recommendation accepted]

Recommendation 13

When a claimant moves from New Style to Universal Credit they should, by default, keep the same work coach unless it is explicitly decided that a change could be beneficial.

Recommendation 14

Provide appropriate and tailored employment support for JSA and ESA claimants following initial assessment of needs. [Recommendation accepted]

Recommendation 15

The Department should adopt a Universal Credit style of journal for New Style claimants. [Recommendation accepted]

Read the government’s response to this report.

Annex C

Out of work disability benefit reform: our recommendations

SSAC’s recommendations below are designed to support disabled people into work, and to remove barriers that will disincentivise people from trying to move into employment for possibly the first time after an extended period of economic inactivity. Some of these recommendations come at a cost however, given the very small proportion of disabled people moving from income replacement benefits into paid work, and the costs associated with retaining the status quo, the net costs of new effective steps to support people into work should be modest. This group is unlikely to make that transition into work without the type of additional support that we recommend and would therefore be likely to remain on disability benefits over the long-term.

De-risking the journey into work

1(a) The Department should remove the perceived risks of moving into work for PIP claimants by providing a clear guarantee that no PIP reassessments would take place within twelve months if a claimant enters paid work, ensuring that assessment is kept separate and distinct from a claimant’s work status. The only exception would be if the claimant requested a reassessment, for instance if their needs had increased. The regular schedule of assessments should resume after twelve months.

1(b) The Department should also provide a guarantee that if someone tries paid work and it does not work out, within a period of a year they can go back to the exact benefits they were on, with no fresh WCA required.

Strengthening the direct financial Incentives for disabled people to enter work

2(a) The Department should strengthen the direct financial incentives for disabled people to enter work. This could be achieved by enabling people to try working part-time, without loss of the disability premium built into the payment levels to people in the ESA Support Group and UC LCWRA. This will give disabled people confidence to try to secure paid work without the fear of losing their current rate of benefit. In particular, we recommend that:

- For ESA, we recommend an extension to the level of Permitted Work before you lose entitlement to ESA (currently at 16 hrs per week at the National Living Wage). This would better enable people to gradually increase their hours and/or salaries. Combined with the clear guarantee (Recommendation 1) of no WCA for a year, this would remove the 16-hour cap that limits people’s efforts to try work. After a year, someone working more than 16 hours could have a WCA, in line with agreed schedules; if the outcome was that the person was considered fit for work or work-related activity, a reduction in the disability premium would be tapered down over a further 12-month period.

- For UC, we recommend exploring whether Work Allowance rules for a couple with a disabled member could be adjusted to create a specific incentive for a disabled family member to enter paid work, where another member is already in employment and benefiting from a Work Allowance. This could act as an incentive for families with one or more disabled members. We acknowledge that this recommendation does not align well with the spirit of UC and would encourage the Department to explore whether there is a more appropriate way of delivering a similar outcome.

2(b) The Department should also extend the eligibility requirements for the UC Work Allowance to PIP claimants.

Tailored, personalised support

The employment support offer

3. To encourage take-up of voluntary employment support, an option that should be considered is to offer a personal budget for that support, underpinned by a menu of options for effective support, to anyone in ESA Support Group or UC equivalent who wants to try paid work.

Support for people with fluctuating conditions

4. The Department should provide more discretionary tailored support to people with fluctuating health conditions, to remove barriers which can discourage disabled people from trying work and employers from employing them. One option would be an Access to Work ‘pot’ that could be accessed by people requiring periodic time off for temporary cover to help remove the disincentive for employers to recruit or retain them.

Ensuring there are clear communications to reinforce the messaging and ensure people are confident the system will work for them.

5(a) As the Department makes changes to de-risk paid work and make it more rewarding, it needs an accompanying communications strategy that explains directly how people can try paid work safely, without jeopardising income; explains the financial incentives to work; and builds trust and confidence among claimants that the system will work for them.

5(b) As part of this communications approach, the Department should work in partnership with organisations that disabled people trust, to ensure that individuals are aware of the steps being taken to incentivise and de-risk of their journey into paid work, and that the terminology and language used is clear and supportive of the journey into work.

5(c) As part of wider reform, the Department should consider revisiting language used, to give greater recognition to barriers disabled people continue to face as they move into paid work, and how they may be mitigated; and to erode the binary distinction between being ‘fit for work’ or having ‘limited capability for work’.

While there is no specific formal response to this report, the Government’s white paper Transforming Support: the Health and Disability White Paper sets out the degree to which the Committee’s recommendations have been accepted.

Annex D

Committee membership during 2022-23

Committee Membership

Dr Stephen Brien (Chair)

Liz Sayce OBE (Vice Chair)

Bruce Calderwood

Matthew Doyle[footnote 21]

Carl Emmerson

Chris Goulden[footnote 22]

Kayley Hignell

Phil Jones

Professor Gráinne McKeever

Seyi Obakin OBE

Charlotte Pickles

Committee Secretariat

Denise Whitehead (Committee Secretary)

Dale Cullum

Gabriel Ferros

Richard Whitaker[footnote 23]

Anna Woods[footnote 24]

Annex E

SSAC members: biographies

Dr Stephen Brien (Chair)

Dr Stephen Brien was appointed as Chair of the Social Security Advisory Committee from 14 September 2020. Stephen is passionate about finding solutions to reduce poverty and improve the lives of the most vulnerable in the UK.

From 2017 to 2023 Stephen was Director of Policy at the Legatum Institute. In addition to overseeing the Institute’s policy programmes, his research focused on the socio-economic drivers of prosperity around the world.

From 2015 to 2017, Stephen was an advisor to governments in both the Middle East and sub-Saharan Africa. He has been a Director at Social Finance; and he also advised the UK Department for Work and Pensions (DWP) from 2010 to 2013.

Prior to joining DWP, Stephen spent 15 years at Oliver Wyman, where he was a Partner, and served a term as the head of its London Office. He is the author of Dynamic Benefits (the blueprint for Universal Credit) and Outcome-based Government.

Bruce Calderwood

Bruce is a trustee of the Avenues Group, a charity specialising in supporting people with complex needs. He was for many years a senior official in DWP in a wide range of roles. He ended his civil service career as the director in the Department of Health responsible for policy on mental health, disability and equality. In this role he led the team which created the 2010 to 2015 coalition government’s mental health strategy and its review of services for learning disabled people following the Winterbourne View scandal.

Bruce joined the Committee in 2016.

Carl Emmerson

Carl is Deputy Director of the Institute for Fiscal Studies (IFS). He is an editor of the annual IFS Green Budget, and his research includes analysis of the UK public finances and the design of the tax and benefit system, in particular relating to state and private pensions. Carl is also on the advisory panel of the Office for Budget Responsibility.

Carl was appointed to the Committee in 2016.

Kayley Hignell

Kayley is the Head of Policy for Families, Welfare and Work at Citizens Advice. Prior to joining the national Citizens Advice team Kayley was a frontline adviser at Leeds Citizens Advice where she gave advice on all issues including benefits, debt and housing. She has continued to volunteer as an adviser alongside her policy roles. Kayley has also spent time on secondment to DWP where she worked to bring frontline experience into the early design of Universal Credit.

Kayley joined the Committee in 2020.

Philip Jones

Phil has been Chief Executive of the Welsh Social Enterprise, Business in Focus since October 2021. Business in Focus provides a suite of business support services across Wales, including the delivery of the Welsh Government’s flagship ‘Business Wales’ service. Phil was previously the Director of Prince’s Trust Cymru for five years and before that, the Wales Area Manager for The Royal British Legion. Phil also served in the Armed Forces for over 25 years as an officer in The Royal Welsh. His service included a wide variety of operational, training, intelligence, and strategic communications roles worldwide, including the Ministry of Defence.

Phil joined the Committee in 2018.

Professor Gráinne McKeever

Gráinne is a Professor of Law and Social Justice at Ulster University and has published widely in the areas of social security law and access to justice. She is the joint editor of the Journal of Social Security Law and currently teaches social security law and policy to undergraduate and postgraduate law students. Gráinne is the co-director of Ulster University’s Law Clinic, through which postgraduate law students provide social security advocacy for members of the public. Gráinne is also a former executive director and Chair of the Law Centre, Northern Ireland, a not-for-profit specialist advice organisation.

Gráinne joined the Committee in 2014.

Seyi Obakin OBE

Seyi is the Chief Executive of Centrepoint, a leading national charity working with young people who have experienced homelessness. He is a chartered accountant and has worked in corporate banking and a wide range of social housing provision. He has also been involved in research and inquiries into family life and the support families need, lifelong literacy and youth enterprise. He is currently Chair of Youth Futures Foundation and a member of the London Fire Brigade’s Audit Committee.

Seyi joined the Committee in 2014.

Charlotte Pickles

Charlotte is Director at Reform. She was previously Reform’s Deputy Director and Head of Research. Prior to returning to Reform, Charlie was Managing Editor at UnHerd.com, the comment and current affairs site. During the coalition government she was Expert Adviser to Rt Hon Iain Duncan Smith MP, then Secretary of State for Work and Pensions. Before that she was Policy Director at the Centre for Social Justice. Charlie has also spent time working as a management consultant in the public sector practice of a global consultancy firm. Charlie is also a member of the NHS Assembly.

Charlie was appointed to the Committee in 2016.

Liz Sayce OBE

Liz was the interim chair of the Social Security Advisory Committee (SSAC) from August 2019 until August 2020.

She was the Chief Executive of Disability Rights UK until 31 May 2017, leading work to achieve equal participation for all, through programmes on independent living, career opportunities and shifts in cultural attitudes and behaviour. With a background in mental health and disability policy, previous roles include:

- Director of Policy and Communications at the Disability Rights Commission

- Policy Director of Mind

Liz led an independent review into disability employment programmes for government in 2011 and has published widely on mental health, disability and social participation. Liz has also been:

- a Non-Executive Director of the Care Quality Commission

- a member of the committee of Healthwatch England

- a member of the Disability Advisory Committee of the Equality and Human Rights Commission

She chaired a Commission on Equality in Mental Health, convened by the Centre for Mental Health. She is currently a Non-Executive Member of the North Central London Integrated Care Board and a Trustee of 2 charities.

Liz was appointed to the Committee in 2016.

Annex F

Register of business interests

| Member | Interests[footnote 25] |

|---|---|

| Dr Stephen Brien | Director of Policy, Legatum Institute – Member of the Social Metrics Commission – Commissioner, No Place Left Behind – Technical Adviser, Poverty Strategy Commission |

| Bruce Calderwood | Trustee of Avenues Group, a charity providing services to people with complex needs |

| Carl Emmerson | Deputy Director of the Institute for Fiscal Studies – Advisory board member of the Office for Budget Responsibility – Member of the Methodological Review Panel for the Census |

| Kayley Hignell | Head of Policy (Families, Welfare and Work), Citizens Advice |

| Phil Jones | Chief Executive, Business in Focus – Patron, Motivational Preparation College for Training and the Motivation and Learning Trust |

| Professor Gráinne McKeever | Professor of Law and Social Justice at Ulster University – Academic panel member of the Administrative Justice Council – Chair, Expert Panel Review of Discretionary Support in Northern Ireland – Member, Judicial Studies Board for Northern Ireland |

| Seyi Obakin OBE | Chief Executive, Centrepoint – Member of the Audit Committee of the London Fire Brigade – Chair, Youth Futures Foundation |

| Charlotte Pickles | Director, Reform – Member of the NHS Assembly – Member, Poverty Strategy Commission – Trustee, Local Trust – Partner is a Member of the UK Parliament and HM Government |

| Liz Sayce OBE | Visiting Professor in Practice at the London School of Economics – Commissioner, Fabian Society Commission on Poverty and Regional Inequality – Trustee, Action on Disability and Development – Member, Independent Commission on the Future of Supported Employment – Non-executive member, North Central London Integrated Care Board – Trustee, the Furzedown Project, a social hub for over-50s, Tooting, London – Occasional consultancy in relation to disability and health |

The Committee’s register of business interests is regularly updated and published on SSAC’s website.

Annex G

Attendance at Committee meetings 2022-23

| Member | April 2022 | May 2022 | June 2022 | July 2022 | October 2022 | November 2022 | December 2022 | January 2023 | February 2023 | March 2023 (1) | March 2023 (2) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Stephen Brien | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes |

| Bruce Calderwood | Yes | No | No | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes |

| Matthew Doyle[footnote 26] | Yes | Yes | Yes | Yes | – | – | – | – | – | – | – |

| Carl Emmerson | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Chris Goulden[footnote 27] | Yes | No | No | No | – | – | – | – | – | – | – |

| Kayley Hignell[footnote 28] | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Phil Jones | Yes | Yes | No | Yes | Yes | Yes | No | Yes | No | Yes | Yes |

| Grainne McKeever | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Seyi Obakin | Yes | No | Yes | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes |

| Charlotte Pickles | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | No | No | Yes |

| Liz Sayce | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Annex H

Fees and expenses paid to Committee members in 2022-23

| Member | Air | Rail/tube | Taxi | Car and car parking | Hotel | Subsistence | Fees | Total |

|---|---|---|---|---|---|---|---|---|

| Stephen Brien[footnote 29] | £0.00 | £281.80 | £0.00 | £0.00 | £161.49 | £0.00 | £22,000.00 | £22,443.29 |

| Bruce Calderwood | £0.00 | £411.35 | £8.00 | £0.00 | £161.49 | £20.30 | £3,780.10 | £4,381.24 |

| Matthew Doyle[footnote 30] | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £1,429.52 | £1,429.52 |

| Carl Emmerson | £0.00 | £363.45 | £0.00 | £0.00 | £72.00 | £28.99 | £3,355.52 | £3,819.96 |

| Chris Goulden[footnote 31] | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £333.84 | £333.84 |

| Kayley Hignell[footnote 32] | £0.00 | £1,121.30 | £0.00 | £0.00 | £188.85 | £0.00 | £1,797.60 | £3,107.75 |

| Philip Jones | £0.00 | £390.05 | £0.00 | £54.60 | £191.24 | £18.45 | £2,533.76 | £3,188.10 |

| Grainne McKeever | £188.68 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £1,989.34 | £2,178.02 |

| Seyi Obakin | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £1,463.76 | £1,463.76 |

| Charlotte Pickles | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £1,720.56 | £1,720.56 |

| Liz Sayce | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 | £3,506.18 | £3,506.18 |

Annex I

Our Results Framework

Social Security Advisory Committee

7th Floor Caxton House

Tothill Street

London SW1H 9NA

Telephone: 0300 046 0323

E-mail: ssac@ssac.gov.uk

Website: www.gov.uk/ssac

X: @The_SSAC

-

The scrutiny of social security in Scotland is undertaken by SSAC in relation to reserved social security benefits (including Universal Credit), but it has no authority to scrutinise Scotland’s devolved social security measures. The Scottish Commission on Social Security undertakes scrutiny of Scotland’s devolved social security measures. ↩

-

Social Security Administration Act 1992, section 173(1)(a) ↩

-

Section 173 (1)(a) of The Social Security Administration Act 1992 ↩

-

The light touch group refers to those in receipt of Universal Credit whose earnings are above the Administrative Earnings Threshold (AET). This group are only expected to engage with DWP on a voluntary basis, and failing to engage with DWP does not result in a sanction to the benefit award. The intensive work search group have earnings below the AET and are required to engage with work coaches regularly, providing evidence of their work search activity. Failure to do so could result in a sanction to the benefit award. ↩

-

See Letter from SSAC Chair to the Minister for Employment (21 November 2022 – see annex B) ↩

-

SSAC Occasional Paper 26: The future of working age contributory benefits for those not in paid work ↩

-

Department for Work and Pensions: Shaping future support: the health and disability green paper (2022) ↩

-

The Department for Work and Pensions: Transforming Support: The Health and Disability White Paper (2023) ↩

-

In the matter of an application by Siobhan McLaughlin for Judicial Review (Northern Ireland) [2018] UKSC 48 ↩

-

SSAC Occasional Paper 16: Bereavement Benefit Reform (2015) ↩

-

Currently this is the Department for Communities, ↩

-

Northern Ireland Act 1998, s87(1). ↩

-

The transcript of this session. This session took place in June 2023, after the period of this annual report, but it is included for completeness. ↩

-

SSAC Occasional Paper 25: How DWP involves disabled people when developing or evaluating programmes that affect them (December 2020) ↩

-

SSAC’s Results Framework is held at annex I. ↩

-

For example, The Benefit Cap (Annual Limit) (Amendment) Regulations 2023 ↩

-

Social Security Administration Act 1992 s.170 and the Social Security Administration (Northern Ireland) Act 1992 ss.149–151 ↩

-

£260,000 of which are allocated to staff costs. ↩

-

Stood down from the Committee on 29 September 2022 ↩

-

Stood down from the Committee on 31 August 2022 ↩

-

To 31 October 2022 ↩

-

From 10 October 2022 ↩

-

As at 31 March 2023 ↩

-

Matthew Doyle stood down from the Committee on 29 September 2022 ↩

-

Chris Goulden stood down from the Committee on 31 August 2022 ↩

-

Kayley Hignell on maternity leave from 1 March 2023 ↩

-

The Chair receives annual remuneration of £22,000. ↩

-

Stood down from the Committee on 29 September 2022 ↩

-