Research with tax agents to explore experiences of HMRC's digital services

Published 26 January 2023

Mixed method research to understand Agents use of HMRC’s digital services and also the impact of pain points and improvements.

HM Revenue and Customs (HMRC) Research Report 689

Research was conducted by Kantar Public between November 2021 and May 2022. Prepared by Kantar Public (Bethany Dokal) for HMRC.

Disclaimer: The views in this report are the authors’ own and do not necessarily reflect those of HMRC.

1. Executive Summary

1.1 Introduction

Agents are critical in supporting the UK tax infrastructure. As HMRC’s services become more digitalised, agents will continue to play a key role in engaging with HMRC on behalf of their clients and assisting clients to meet their tax obligations.

To inform HMRC’s design of digital services for agents, HMRC required a better understanding of the different agent business models, how they interact with HMRC’s digital services, how they seek support, as well as the services they would like to see offered by HMRC.

In 2021, HMRC commissioned Kantar Public to undertake qualitative research with agents to explore these issues. This involved 50 in-depth discussions. In January 2022, follow-on quantitative research was commissioned, with the aim of quantifying the insights produced from the qualitative research to build the evidence base further. The survey was conducted by telephone and covered a representative cross section of 873 agents.

1.2 Research Objectives

The initial qualitative research sought to gain a more detailed understanding of agents’ use of HMRC’s digital services. The specific qualitative aims sought to:

- build a picture of what agents offer their clients and how services are provided

- capture the extent to which agents are using technology and software to support their clients to meet their tax obligations

- capture agents’ experiences of HMRC’s digital services including aids and barriers to use and pain points

- identify suggestions for HMRC to improve and develop their digital offer for agents

The survey aimed to quantify the qualitative findings. As part of this, it focused on the impact of pain points and the potential impact improvements would have for agents when acting on behalf of their clients. These findings would help inform priority areas for development. The specific survey aims included to:

- identify services agents complete on behalf of their clients

- capture what agents think are the benefits and drawbacks of using digital services to engage with HMRC for both themselves and their clients

- capture agents’ experiences of using HMRC’s digital services and pain points

- capture the extent to which agents think any suggested improvements to HMRC’s digital services could have a positive impact

1.3 Main Findings

Agents’ relationship with HMRC

In the qualitative discussions, agents tended to be pragmatic in their perception of HMRC, recognising they had a ‘job to do’ and they praised HMRC for their agile response to the pandemic.

Agents had mixed feelings towards Making Tax Digital (MTD), with agents believing it would bring efficiencies to the way they worked. However, some agents also had concerns that it undermined their role. Other agents also worried about how their clients will cope with needing to report more regularly.

Experiences of communication with HMRC were broadly positive, with the Agent Dedicated Line the main mode of contact. Although, agents were frustrated by a lack of consistency in the perceived quality of advisors.

HMRC Toolkits, Webinars and Agent Update emails were the key mechanisms for staying up to date, with little awareness of the Agent Forum and Blog.

Use of technology

From the qualitative research, 4 profiles of digital proficiency and acceptance emerged:

- digital resisters, with minimal digitalisation of their processes

- digital accepters, using software tentatively

- digital embracers, fully confident in digitalisation

- digital insisters, invested in fully digitalised ways of working

Within the qualitative findings, agents were generally happy with their choice of software, with no security concerns. They felt the benefits of working digitally outweighed the costs, creating efficiencies that would offset the time taken to familiarise with new processes.

Digital embracers and insisters encouraged clients to use software and benefitted from this. This included some agents who were keen to move away from bookkeeping and to ‘train clients up’ on this. Digital accepters and resisters were forgiving of clients not using software and even discouraged them from using it if they were not digitally proficient.

Use of HMRC’s digital services

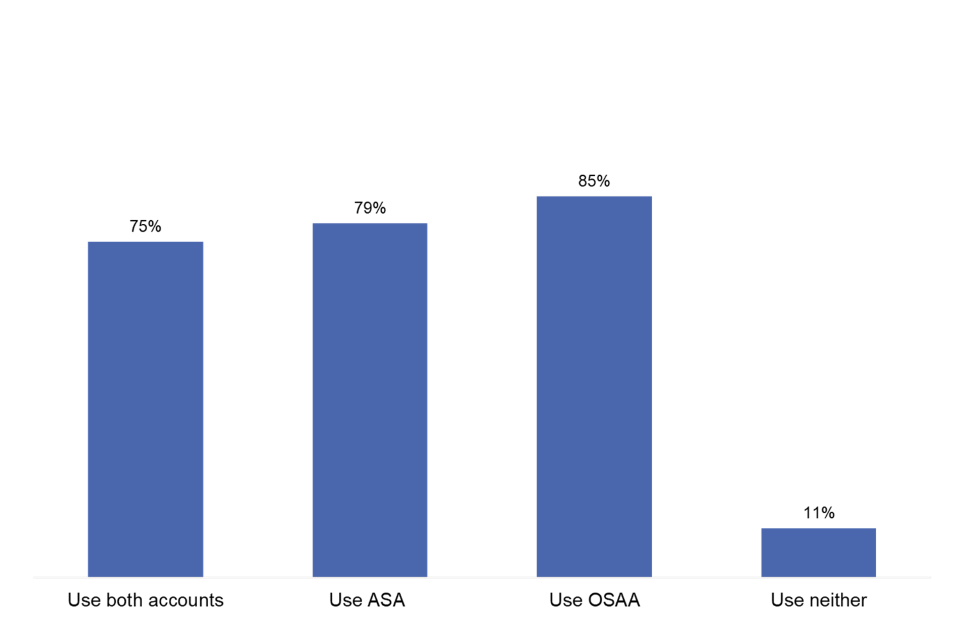

Findings from the quantitative research showed most agents use both the Agent Services Account (ASA) and Online Services Account for Agents (OSAA) accounts (75%), while only 11% use neither of the accounts. The ASA account is used for accessing and managing their clients’ VAT, reporting their clients’ Capital Gains Tax on UK property, and registering their clients’ trusts and estates. Agents use the OSAA account to access services such as Self-Assessment, Corporation Tax, PAYE, Machine Gaming Duty, and Notification of Vehicle Arrivals.

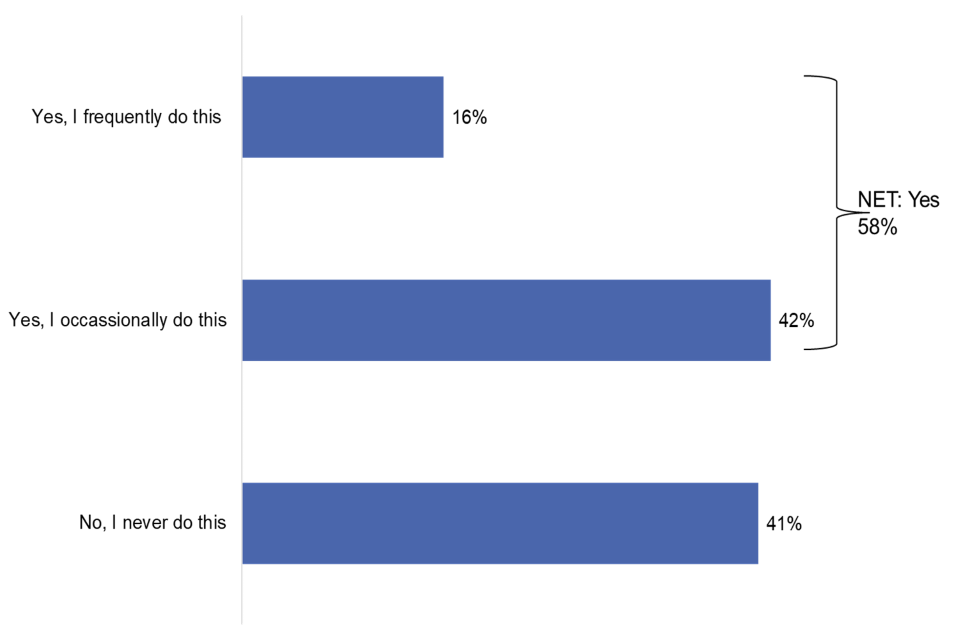

However, 58% of agents reported having logged into their clients’ online accounts at least occasionally, while only 41% said they have never done this. This suggests that current HMRC digital services for agents may not sufficiently meet agents’ needs to access client data.

In the qualitative discussions, agents had various views about the ASA and OSAA, which broadly fell into the categories: pained, pragmatic or positive. The ASA account received more criticism than the OSAA.

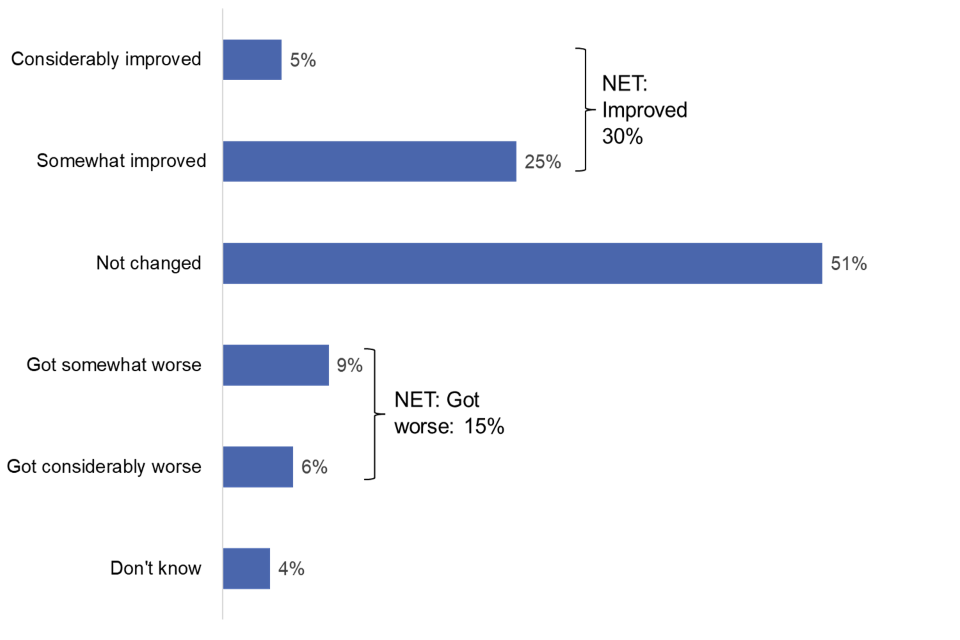

Thirty percent of agents thought digital services had improved, whilst 51% thought they had not changed over the last 12 months. Despite this, just under half (48%) of agents found it easy to deal with tax issues on behalf of their clients. Although, for some agents, ease may be increased through using the workarounds of logging into their clients’ accounts.

Experience of pain points when using HMRC’s digital services

From the quantitative research, the top pain points for agents included: having two separate accounts with different login details (36% reported this had a high negative impact on their ability to deal with their clients’ affairs), limited visibility of VAT returns (35%) and not being able to see the same information as clients through HMRC’s digital services (33%).

In comparison, not having a single client dashboard was the least significant pain point for agents (25%).

Agents were asked about their experiences of using HMRC’s digital services over the last 12 months and whether certain issues had impacted their ease and efficiency in dealing with HMRC on behalf of their clients. The proportion of agents reporting significant negative impact for any of these issues (25% to 36%) was not particularly high. This is likely because many agents were pragmatic about their use of HMRC’s online accounts and have become accustomed to finding workarounds to any barriers.

Across pain points, certain agents tended to report a greater negative impact, including:

- agents who are members of professional organisations

- agents from accountancy firms

- agents with a turnover of £60k and above

- agents who insist clients use specialist accounting or bookkeeper software

- agents who said they had found it hard acting on behalf of clients in the last 12 months

- agents who think HMRC’s services have got worse in the last 12 months

Suggested improvements for HMRC’s digital services

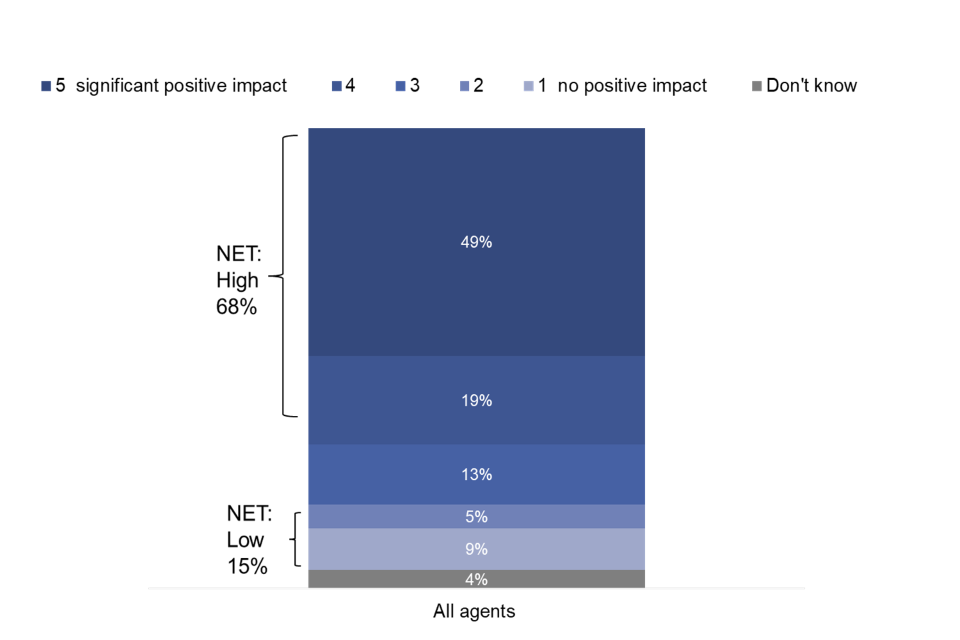

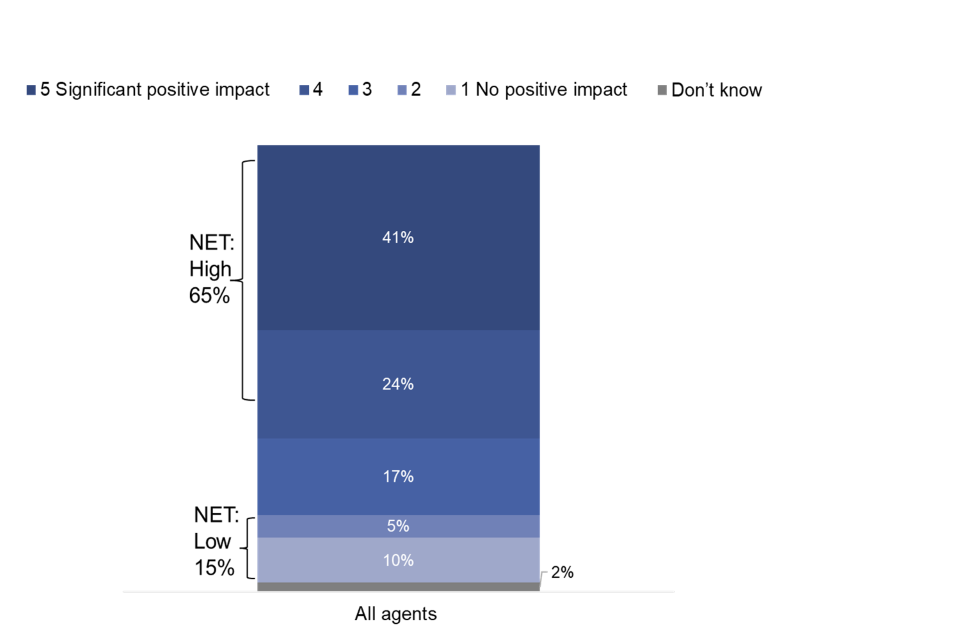

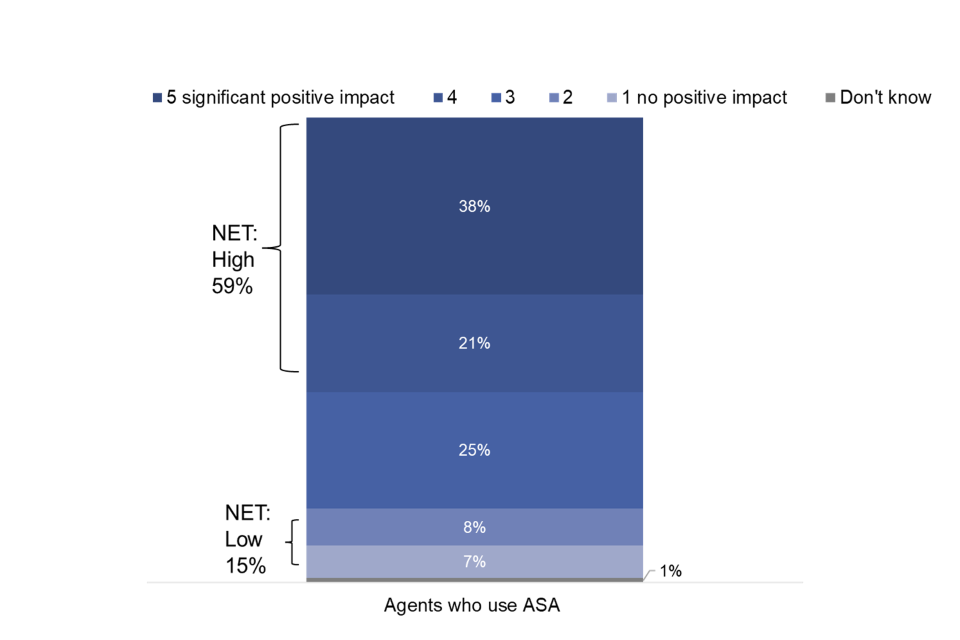

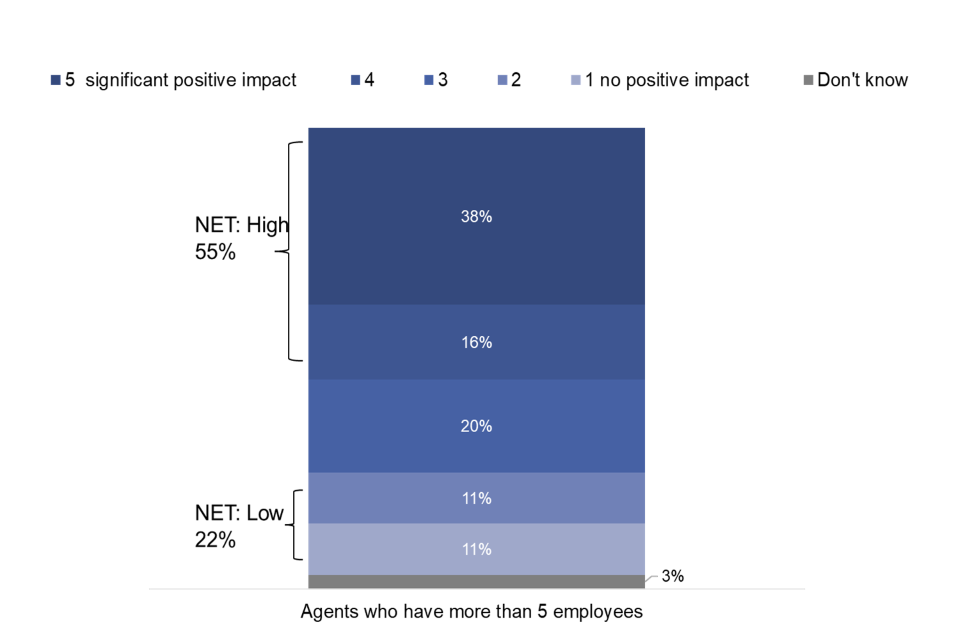

From the quantitative research, the top improvements suggested for agents included: having a secure email link to communicate with HMRC (81% reported this would have a significant positive impact on the ease and efficiency of dealing with HMRC on behalf of clients), greater access to client data (73%) and having a single sign on portal (69%).

This reflected the qualitative findings, where agents’ top priorities included having greater access to client data and having a secure two-way digital communication channel.

Overall, having a single agent credential for your business with adaptable permissions was the least significant improvement for agents (55%), reflecting findings from the qualitative research where it was seen as ‘nice to have’ but non-essential.

The number of agents who thought the improvements would have a high positive impact (55% to 81% across improvements) was much higher than the number of agents who reported experiencing a high negative impact from the pain points (25% to 36%). This suggests that even for agents who found the current HMRC digital services adequate, they still felt the suggested improvements would benefit overall experiences of HMRCs digital services.

Across suggested improvements, agents with ambitions to grow or larger agents (those with a turnover of £60k or over and/or those from accountancy firms) thought the improvements would have a higher positive impact.

2. Background

Agents are critical in supporting the UK tax infrastructure. Agents include businesses that are paid to deal with the tax affairs of others. They also include professionals who advise or act on behalf of others in relation to their tax affairs. As HMRC’s services become more digital, agents will continue to play a key role in engaging with HMRC on behalf of their clients and assisting clients to meet their tax obligations.

To inform HMRC’s design of digital services for agents, HMRC required a better understanding of the different agent business models, how they interact with HMRC’s digital services, how they seek support, as well as the services they would like to see offered by HMRC.

In 2021, HMRC commissioned Kantar Public to undertake qualitative research with paid tax agents to explore these issues. In January 2022, follow-on quantitative research was commissioned, with the aim of quantifying the insights produced from the qualitative research to build the evidence base further.

2.1 Research Objectives

The initial qualitative research sought to gain a more detailed understanding of agents’ use of HMRC’s digital services. The specific qualitative aims sought to:

- build a picture of what agents offer their clients and how services are provided

- capture the extent to which agents are using technology and software to support their clients to meet their tax obligations

- capture agents’ experiences of HMRC’s digital services, including aids and barriers to use and pain points

- identify suggestions for HMRC to improve and develop the digital offer for agents

The quantitative telephone survey aimed to quantify the qualitative findings. As part of this, it focused on the impact of pain points and the potential impact improvements would have for agents, when acting on behalf of their clients. These findings would help inform priority areas for development. The specific survey aims included to:

- identify services agents complete on behalf of their clients

- capture what agents thinks are the benefits and drawbacks of using digital services to engage with HMRC for both themselves and their clients

- capture agents’ experiences of using HMRC’s digital services and pain points

- capture the extent to which any suggested improvements to HMRC’s digital services would have a positive impact

2.2 Method

This project consisted of a two phased mixed method approach.

Qualitative interviews

The qualitative part of this research involved 50 in depth interviews with agents, which were conducted online or over the phone. These interviews lasted between 45 to 60 minutes. Agents were recruited from HMRC supplied sample. HMRC and Kantar Public worked together to design the topic guide used in the interviews.

Quantitative survey

The follow up quantitative survey consisted of 873 telephone interviews with a representative cross section of agents. These interviews lasted approximately 20 minutes each. Agents were recruited from HMRC supplied sample.

The survey was designed collaboratively between HMRC and Kantar Public.

More information on the methodology of this project, including the sampling, weighting approach, copies of the survey questionnaire and topic guide, can be found in the technical report

2.3 Timeline of project

The qualitative fieldwork took place between 1 November and 6 December 2021. This was followed up by the quantitative stage, with the pilot survey taking place between 7 to 9 March 2022. The main survey was conducted between 6 March and 6 May 2022.

2.4 Survey findings reporting conventions

Sub-group analysis was performed to explore differences among groups within the survey sample, for example between different sizes of business. The following points should be considered when reading this report:

• unless otherwise stated, all differences reported are statistically significant to the 95% confidence level which means that we can be 95% confident that the differences observed are genuine differences and have not just occurred by chance

• base sizes for each result reported are shown with the charts and any base sizes of fewer than 100 should be interpreted with caution and the findings viewed as indicative • due to rounding, some totals may not correspond with the sum of the separate figures

• ratings of pain points and suggested improvements was on a five-point scale

• for pain point questions, a high negative impact was where agents selected ‘4 or 5’ on a five-point scale

• for suggestion improvements, a high positive impact was where agents selected ‘4 or 5’ on a five-point scale

• findings for the quantitative survey findings are supported by charts

2.5 Qualitative reporting conventions

In the qualitative research, purposive sampling was used and, as such, the qualitative sample is not representative of the population. Therefore, the qualitative findings are not generalisable to all agents.

Findings from the qualitative findings are supported by quotes, where available. Accompanying illustrative quotes are included in this report in the format:

“Quote” (whether agent is affiliated to a professional body, number of employees).

Where fitting, the qualitative findings have been grouped into profiles or category as part of analysis and to aid comprehension.

3. Participant backgrounds

This chapter covers the characteristics of agents and their working situations, to provide context for the survey results.

For background, questions asked in HMRC’s Individual, Small Business and Agents (ISBA) 2021 survey were also included in this research to analyse the findings from this survey by different agent characteristics and subgroups. Where the same question was asked, results from ISBA 2021 are shown alongside results from this research. This includes survey questions about types of agents, whether they belong to a professional body, annual turnover, and number of employees. ISBA had a larger sample of agents (1850) and as a result comparing the research findings shows the robustness of this survey as the data broadly aligns with ISBA.

In order to compare against the ISBA findings, the Agent and Digital Services (ADS) findings have had the ‘Don’t know’ and ‘Prefer not to answer’ codes removed for these questions as these were also not included in the ISBA findings. Although it should be noted for the other questions throughout this report, where there is no comparison to the ISBA findings, the ‘Don’t know’ and ‘Prefer not to answer’ codes have been included in the ADS findings.

3.1 Types of agents

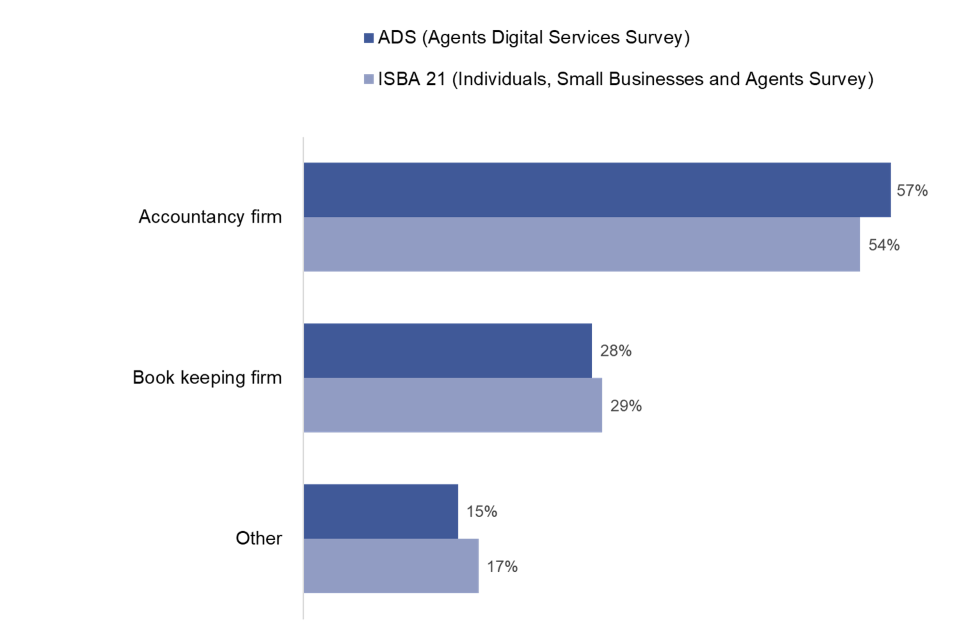

Just under 6 in 10 (57%) described themselves as accountancy firms. This was a similar proportion to ISBA 2021 (54%). In comparison, just under 3 in 10 were from bookkeeping firms (28%), which was broadly similar to the ISBA 2021 profile (29%). Fifteen percent were from other firms, slightly lower than ISBA 2021 where under two in ten (17%) were other types of agents (as shown in Figure 1). Other types of accountants were described as being a payroll bureau, a tax advisor, and a VAT consultant.

Bookkeepers typically deal with recording financial transactions of a business. Whereas accountancy firms will use records of business’s financial transactions to produce financial reports and have greater insight into the financial health of a business.

Figure 1: Type of agents

Is your business an accountancy firm, a bookkeeping firm, a payroll bureau, a tax advisor, VAT consultant or other (please specify)? Base: All Agent digital services research respondents (865), all agent ISBA research respondents (1850)

3.2 Business size

Agents were primarily small, with low turnovers and numbers of employees. Overall, the largest group of agents in ISBA 21 and ADS had turnovers of between £10,000 and £60,000 a year (36% for ADS and 44% for ISBA 21). Only 16% of agents interviewed for ADS and 12% for ISBA 21 earned £250,000 or above, as shown in Figure 2. Bookkeeping firms were more likely to have lower turnovers than accountancy firms. For example, 88% of bookkeepers earned £60,000 or below while only 36% of agents from accountancy firms earned £60,000 or below.

Figure 2: Annual turnover

And what is your annual turnover? Base: All respondents Agent Digital Services research (758), all agent ISBA research respondents (1850)

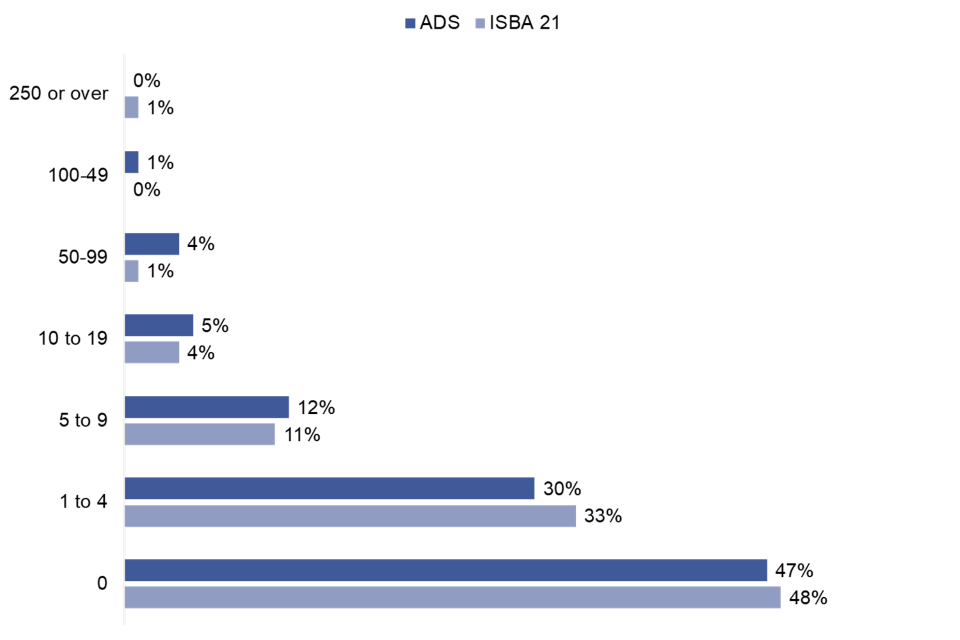

Further, most agents had no employees (47%) or 1 to 4 employees (30%). This broadly aligned with findings from ISBA 21 where 48% had no employees and 33% had 1 to 4 employees. Only 1% had 100 or more employees (Figure 3).

Figure 3: Number of employees

Can you tell me roughly how many people there are employed in the organisation as a whole in the UK besides yourself? Base: All Agent digital services research respondents (861), all agent ISBA research respondents (1850)

3.3 Affiliation to professional bodies

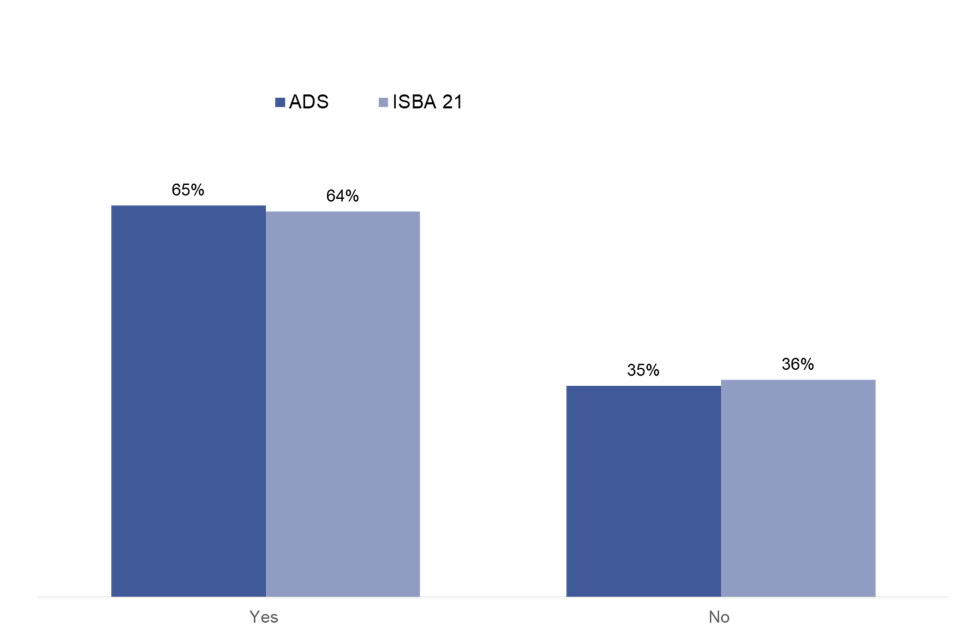

Most agents were affiliated to a professional organisation, this aligned with ISBA 21 findings. Professional organisations set the standards for the behaviour expected from their members, such as Professional Conduct in Relation to Taxation (PCRT) which is the standard shared by some of the largest accountancy and professional bodies Overall, 65% of agents were affiliated in the ADS survey, while 35% said they were not (Figure 4).

As well as having higher incomes, accounting firms were also more likely to be affiliated than bookkeeper firms; overall 82% of accountants were affiliated, while only 35% of bookkeepers were affiliated.

Figure 4: Affiliation to a professional body

Are you a member of a professional body? Base: All Agent digital services research respondents (868), all agent ISBA research respondents (1850)

3.4 Life cycle of agents

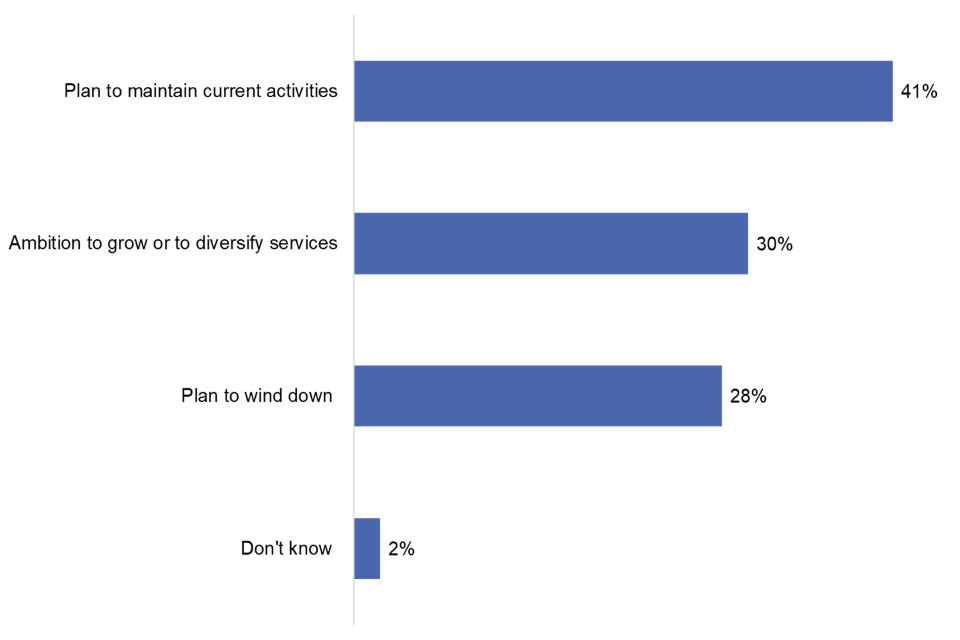

Agents were asked about their business plans for the next five years. Most agents reported that they planned to maintain current business activities (41%), rather than grow or diversity their services (30%) or wind down services (28%) (Figure 5).

Agents looking to grow their businesses were higher among larger accountancy firms. This included agents with a turnover of £60,000 or above (47%) compared with agents with a turnover of below £60,000 (13%) and agents with 10+ employees (65%) in comparison to 25% with fewer than 10 employees.

Figure 5: Life cycle of agents

Which of the following best describes your business plans? Base: All respondents (873)

Similar to the quantitative findings, the qualitative findings found a low appetite for expanding services and many agents were happy with the services they currently provided. They felt that they had already refined their business models and services, though there was some desire to further expand knowledge or digital capability among younger businesses.

Those agents with ambitions to grow were mainly looking to add more clients rather than services, including those with 100+ clients as well as those with a small number of clients. While unaffiliated agents were happy with providing bookkeeping services, some affiliated agents wanted to reduce the amount of bookkeeping they provided as they did not consider it profitable.

“We can do most things. If we get something in we can’t deal with we usually know a man who can.” (Unaffiliated, 0 employees)

“I recently turned down a request for forensic accountancy services - if you’re an ENT [Ear, Nose and Throat] specialist don’t do heart surgery.” (Unaffiliated, 1 to 9 employees)

“We don’t do anything contentious like insurance or investment.” (Unaffiliated, 1 to 9 employees)

“We’re trying to move away from bookkeeping to higher value work.” (Affiliated, 1 to 9 employees)

The next chapter explore agents’ relationships with HMRC.

4. Agents’ relationship with HMRC

This chapter covers agents’ perceptions of HMRC, how they tend to get in contact with HMRC and their views on communications they receive from HMRC. This chapter is based on findings from the qualitative research.

4.1 Agents’ perceptions of HMRC

The qualitative phase of this research found a broadly pragmatic view of HMRC amongst agents. They expressed their understanding that HMRC ‘have a job to do’ and do their best often under difficult circumstances. While many criticised response times during lockdowns, agents also praised HMRC’s overall responsiveness to the pandemic, in particular the ability to implement new policies quickly.

“[HMRC] have got a very difficult job to do and they did very well in the pandemic.”

(Unaffiliated, 0 employees)

“Please share how helpful HMRC were during Covid. I can’t fault them. Furlough was a very good easy system, with good notice of the changes. The deferral of VAT payments was extremely useful. They were quick thinking, very responsive. The way they reacted they turned the Titanic around very quickly.” (Affiliated, 1 to 9 employees)

The qualitative phase also explored agents’ feelings about Making Tax Digital (MTD), both when mentioned spontaneously and on prompting. Making Tax Digital (MTD) is at the heart of the government’s 10-year strategy to build a trusted, modern, tax administration system that is more resilient, effective, and better supports taxpayers. MTD will make it easier for businesses to reduce common errors and to get their tax right first time. Under VAT, businesses with a taxable turnover above the VAT threshold (currently £85k) have been required to keep VAT records digitally and submit their VAT returns directly from their software, for VAT periods starting on or after 1st April 2019. VAT registered businesses with turnover below the VAT threshold have been required to use MTD from April 2022.

A range of feelings about MTD were found, from those who were confident it would create efficiencies, to those who were worried about how their clients would cope with needing to report more regularly. Agents recognised that they had incurred costs by investing in software for MTD, in terms of both time and money. It was also acknowledged that this should be repaid in efficiencies. Most also felt that MTD would improve compliance by reducing the risk of errors.

“[MTD] will be great…it will improve compliance which is good for the country.” (Unaffiliated, 0 employees)

“[MTD] makes it harder for people to play the system.” (Affiliated, 0 employees)

However, it should be noted that a minority of agents feared that their role was being undermined by changes to the tax system. They felt these changes placed the onus on the client to act directly, without giving agents full transparency. These agents saw themselves as responsible for contacting HMRC on behalf of their clients. They felt they had been authorised to act on behalf of their clients so there should be no barriers to information.

Given this, in the qualitative findings, a minority of agents were concerned that the push towards clients dealing directly online was a push away from agents suggesting that HMRC did not value their role as intermediaries. In effect, putting them at arm’s length from HMRC and compromising their position. This was top of mind in situations where agents could not access client data accurately. These included not seeing the same information as on a client’s Personal Tax Account and where there were problems gaining authorisation.

“I feel that agents are getting pushed further and further away. The majority of our clients do not understand the tax system and are scared of HMRC coming down on them like a ton of bricks. They just want to get it right but need help - agents are the people who can help them to do that.” (Affiliated, 1 to 9 employees)

“[HMRC] don’t work in a way that is helpful for agents, in fact you get the feeling that they are working against agents.… It feels like the tax office doesn’t want to work with agents anymore, they want to work directly with taxpayers, so they are doing all these things to stop us from helping our clients.” (Affiliated, 10+ employees)

“The authorisation that an agent has should allow them to act fully on behalf of the client – full sight and access.” (Unaffiliated, 0 employees)

4.2 Agents’ contact with HMRC

In the qualitative research, agents reported various methods for contacting HMRC, including calling the Agents Dedicated Line, written correspondence, and webchat.

The method for communication was defined by the nature and urgency of the problem. Telephone was the preferred means of communication for most and the automatic choice for an urgent problem, especially for queries where there was a dedicated line for that tax.

Webchat was less widely used, not because it was perceived as less responsive than telephone, but because some agents felt more in their comfort zone with telephone as a channel. Written communication was seen as an option for non-urgent queries where the issue was complex.

“I just find it very useful that they do have a dedicated agent line so that if you need to get through on the phone, you can ring the agent line and you get sort of priority then.” (Unaffiliated, 1 to 9 employees)

“I’ve used the online ‘whatschat’, but I would rather speak to someone.” (Unaffiliated, 0 employees)

The qualitative findings found that the frequency of contact with HMRC varied greatly across agents. From bookkeepers rarely calling or writing, through to daily contact for larger firms, up to as much as 20 times a day. The Agent Dedicated Line was the preferred channel of communication, especially for troubleshooting. For example, when trying to resolve penalties or getting clarity on PAYE allocations.

Across channels, experiences of communication with HMRC were largely positive but variable, and agents reported a range of experiences. Some were very positive, while others were pragmatic. They felt that advisors were doing their best in the circumstances, even if they could not always deliver a positive outcome as quickly as agents would have liked. A minority of agents were frustrated by the time taken and difficulties experienced in resolving queries.

Whilst the Agent Dedicated Line was the preferred method for contacting HMRC, the waiting time on calls was reported as being inconvenient. Also, this constituted a time cost that was not readily chargeable to clients.

Agents also reported finding the efficacy of the agent line inconsistent, with success in resolving issues being dependent on the advisor. This inconsistency created a reluctance to contact HMRC, as well as resentment, as agents felt that delays to resolution reflected badly on them. Where webchat was used, there was a perception that the service was understaffed, with long wait times for an advisor to respond.

“I phoned yesterday, and the advisor was so nice and helpful and very knowledgeable.” (Affiliated, 1 to 9 employees)

“Service from helpline staff is highly variable, sometimes great, sometimes they don’t have a clue and tell you, that you have it all wrong, when you know that’s not the case.” (Unaffiliated, 0 employees)

“You sit on the phone for up to an hour waiting…When you do get through to someone it’s the wrong department and they can’t help. Another thing that really annoys me is there’s an agent line for some things but not for others. Like PAYE you have to join the general PAYE line. I do think that agents should have an agent line for everything we deal with.” (Unaffiliated, 0 employees)

“I dread making phone calls.” (Affiliated, 1to 9 employees)

4.3 Agents’ communications from HMRC

Overall, the qualitative research found that agents were positive about HMRC updates and information provision, including the website, which was frequently reported as a first port of call for troubleshooting.

Agents felt that HMRC update emails were useful, although some commented that they often received too much information and too frequently, to engage with it all. Agents were selective about the information they engaged more deeply with.

Affiliated agents commonly reported receiving communications (newsletters and update notifications) or training from their professional body and sometimes prioritised these communications. Some agents reported using the Agent Toolkit regularly as a training resource, both for specific task training and as a resource for skilling new starters.

Whilst agents were generally aware of the webinars; they were rarely attended by agents who participated in the research. Agents tended to see webinars as more of a ‘nice to have’ as they represented an investment in time that was not always feasible. They felt that given webinars are not tailored to the specific needs of an individual agent, it could take the length of the session to find out one piece of useful information, which could have been read much more quickly.

There was low awareness of both the Agent Forum and Blog, across affiliated and unaffiliated agents (unaffiliated agents do not have access to the Forum). The few affiliated agents who had posted a question on the Forum had not had positive experiences. They reported that HMRC had not responded to their question, so posting was not useful for them.

Only one agent recalled looking at the Agent Blog. They felt that it had not been updated recently and covered a wide range of subjects which were not relevant.

“I do get the agent update emails. To be honest I just sort of, like, glance at them because they’re usually irrelevant but they do get a quick glance and once in a while it will be something sort of like, yes.” (Unaffiliated, 1 to 9 employees)

“[HMRC toolkits are] really useful, really helpful.” (Affiliated, 10+ employees)

“I have done [HMRC webinars] on some things but they are slow – it could have been said in 10 minutes, but it takes an hour. But they do give you information on things.” (Unaffiliated, 1to9 employees)

“There’s nothing important [on the blog], sometimes it’s the same stuff as the previous month, I don’t think they have enough stuff to put on there.” (Affiliated, 10+ employees)

In addition to the communication channels mentioned above, some agents in the qualitative research expressed a desire for more explicit and concise communications from HMRC, on topics regarding changes that affect tax compliance, including changes resulting from the Budget.

“Sometimes there are some major changes and you do miss them. Maybe it’s because there’s so many changes and so much of it is irrelevant that you don’t read it.” (Unaffiliated, 1 to 9 employees)

“HMRC could flag new legislation in a specific email to the accountancy profession… do a budget summary of relevant impacts for self-employed and limited companies.”

(Unaffiliated, 0 employees)

As part of the discussion on communications, perceptions of the ideal notice period for communicating changes to tax administration was also explored. Agents felt that the notice period for changes was dependent on the type and scale of the change. A range of 3 months to a year as a minimum was seen as sufficient for tax administration changes. However, agents felt that the lead time should be longer, and at least 1 year but ideally 2 or even 3 years if an update would require changes from the client.

“[The ideal notice period for changes] depends on the change, for something like MTD, when we will have to organise and bully clients it should be at least a year” (Affiliated, 1 to 9 employees)

The next chapter covers agents’ and their clients’ use of technology.

5. Use of technology

This chapter covers the digital profiles of agents and their use of technology. It examines both agents’ and their clients’ use of specialist software to complete filings to HMRC, as well as plans to expand use of technology in the future. This chapter combines findings from both the qualitative and quantitative phases, although the findings of the digital profiles of agents is based on the qualitative findings only.

5.1 Digital profiles of agents

The qualitative research identified 4 profiles of digital proficiency and acceptance amongst the agents interviewed:

- digital resisters, with minimal digitalisation of their processes

- digital accepters, using software tentatively

- digital embracers, fully confident in digitalisation

- digital insisters, invested in fully digitalised ways of working

In this section, each profile is described and illustrated with a pseudonymised case study to aid understanding.

Digital resisters

Agents who were ‘digital resisters’ had minimal digitalisation of their own processes. These agents were older (over 65) and less digitally literate themselves. They planned to wind down their business in the next few years and were not keen to embrace new processes.

Edward is 72, and still provides accountancy services for a small number of long-standing clients. He is not confident using technology, and his computer has no internet connection due to data security concerns. He uses software on a friend’s computer to submit returns. He does not consider his lack of digitalisation a burden as he has few clients, none of whom use software themselves. He plans to wind down the business in the next few years.

“If I sacrificed having my PC not being connected to the internet, then I could do it straight from there. But I don’t have exotic firewalls, and so that’s the way it works best, and that’s what the clients are happiest with.” (Unaffiliated, 0 employees)

Digital accepters

Agents who were ‘digital accepters’ had partial digitalisation of their own processes. They used specialist software although they preferred their less digitally confident clients to not attempt to use software in case of errors. These agents typically had no desire to expand their business.

Although Sami uses software for submitting returns, she prefers to use Excel for some tasks, such as calculations, before entering data into the software. She considers software unsuitable for certain client groups, such as those who lack the capability to use it.

“I still use a lot of spreadsheets. Software is fine for inputting invoices and doing VAT, but a lot of work I do is easier through Excel, to work out ratios and percentages… I’m joining the dinosaurs now but what I have works.” (Affiliated, 0 employees)

Digital embracers

Agents who were ‘digital embracers’ had full digitalisation of their own processes. They were confident in and enthusiastic about digitalisation and viewed it wholly positively. However, they were still prepared to accept some clients who did not use software.

Tom works for an accountancy firm which is fully digitalised in their own processes. They view digitalisation as wholly beneficial. However, they accept that some clients do not want to or are unable to use software, so carry out manual data entry into their software for those still using paper or Excel.

“We are working as digitally as possible. We’re not fully there yet, but we’re trying. Clients stop us, some in retail for example, still provide till receipts and paper invoices.” (Affiliated, 10+ employees)

Digital insisters

Agents who were ‘digital insisters’ had full digitalisation of their own processes and were keen for their clients to follow suit, insisting that they all used software. These tended to be agents in younger businesses, who were ambitious to grow and to work smarter, with higher margins.

Bridget is looking to grow her business by taking on an employee to support a large client company. She has 20 clients, and only takes on clients who use software and can work digitally.

“I think digitalisation is great, it’s brilliant. A couple of clients wanted to use spreadsheets at first, but I told them they needed to use software. It’s just the way of the world, it’s how it is…we’re way past using spreadsheets now” (Unaffiliated, 0 employees)

5.2 Benefits of working digitally

The qualitative research showed that with the exception of digital resisters, agents felt that the benefits of working digitally outweighed the costs. They cited a number of advantages to digitalisation.

Agents felt Application Programming Interfaces (APIs) made submissions to HMRC simpler, quicker, and reduced risk of error. Similarly, they felt that software made processes easier, faster, and more efficient, and provided quality assurance. Agents also appreciated that software stored all client data in one place, could be accessed remotely by multiple users, and supported data transparency between client and agent.

“[APIs] work fantastically. so much easier than fiddling in and out with different screens. It’s quicker and the report it generates matches to the box numbers on VAT returns. It’s really handy” (Affiliated, 1 to 9 employees)

“It makes things more transparent between me and the client. What I want is easy access to their books, so I know how their business is doing.” (Affiliated, 0 employees)

It is worth noting, the agents interviewed did not have data security concerns regarding the use of software. Existing security measures, such as multi factor authentication, provided sufficient reassurance.

In terms of the costs of working digitally, agents noted the time spent learning how to use software, although this was generally found to be more intuitive over time. They also reported occasional technical glitches, such as when returns would not submit, but felt that these were infrequent. Agents were also aware that the cost of software was liable to increase each year but felt that this was generally balanced out by efficiency savings.

5.3 The role of software

Agents’ use of software

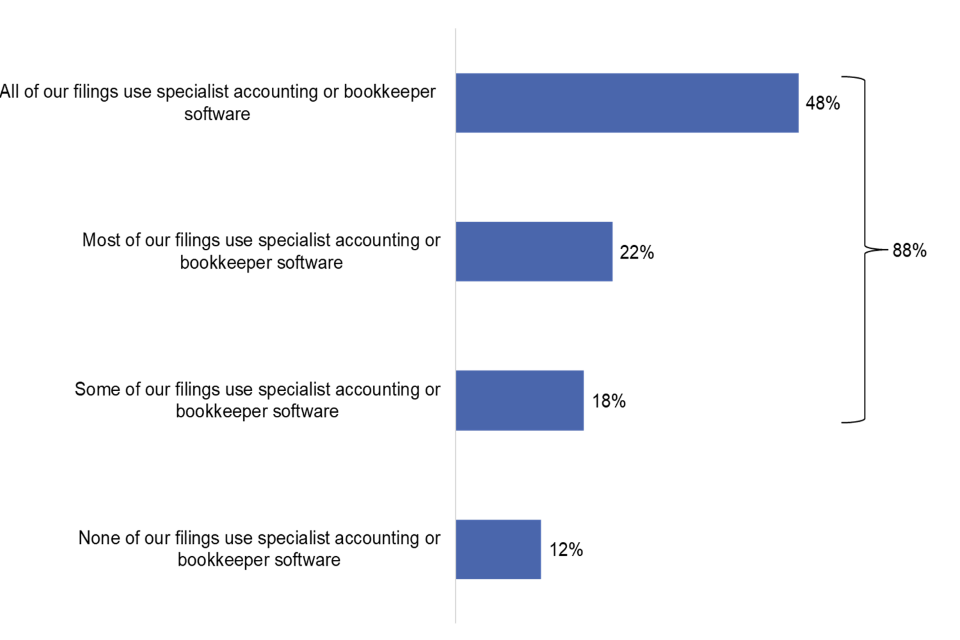

Most agents used specialist accounting or bookkeeper software. The quantitative research showed that 88% used software, with nearly half always using software to make filings to HMRC as outlined in Figure 6.

Use of specialist software was higher among larger accountancy firms and agents with ambitions to grow and diversify (97%) compared with those who plan to maintain (88%) or wind down (78%) current business activities.

Figure 6: How agents make filings to HMRC

Which of the following best describes how you make filings to HMRC? Base: All respondents (873)

The qualitative research found that agents used a range of software, including accounting software, payroll software and specific software for capturing receipts. Choice of software was determined by a number of factors. These included:

- software already used by their clients, rather than mandating a software provider to them

- recommendations from peers

- relying on products that they had had experience of using earlier in their career

- if they were required to choose a new provider, perception of the ‘main players’ in the market

- the support and training offered by software providers

- cost with agents looking for the lowest price that would provide the required functionality

Perceptions of software used

In the qualitative research, agents were generally happy with their current choice of software and preferred not to change. They acknowledged that there was plenty of choice of software on the market, although too much choice could be overwhelming and disincentivised switching.

Agents had invested time and money into using software, but generally felt that the investment had paid off by producing greater efficiencies. Although the cost of software was considered high, agents typically passed the cost on to their clients. Through these two means, the overall cost tended to balance out.

Cost was not a barrier to using software (even among digital resisters). While some had learnt how to use software ‘on the job’, others attended training by their software provider, and training certificates were included in promotional material. Only in rare cases was there some resentment at the increasing price of software and a feeling of being locked into their current provider, as switching was expected to be too burdensome.

“[The software] is expensive, but I’ve always factored that into what I charge my clients, which is less anyway because it’s quicker when you’re using software.” (Affiliated, 0 employees)

“[The software] offers a certificate in their training, which I’ve done, so that gives me a badge to put on my website to say I’ve done the training.” (Affiliated, 0 employees)

“The subscription model of [the software] is a concern because if they hike the prices suddenly, I would be tied in.” (Affiliated, 10+ employees)

Use of software in the future

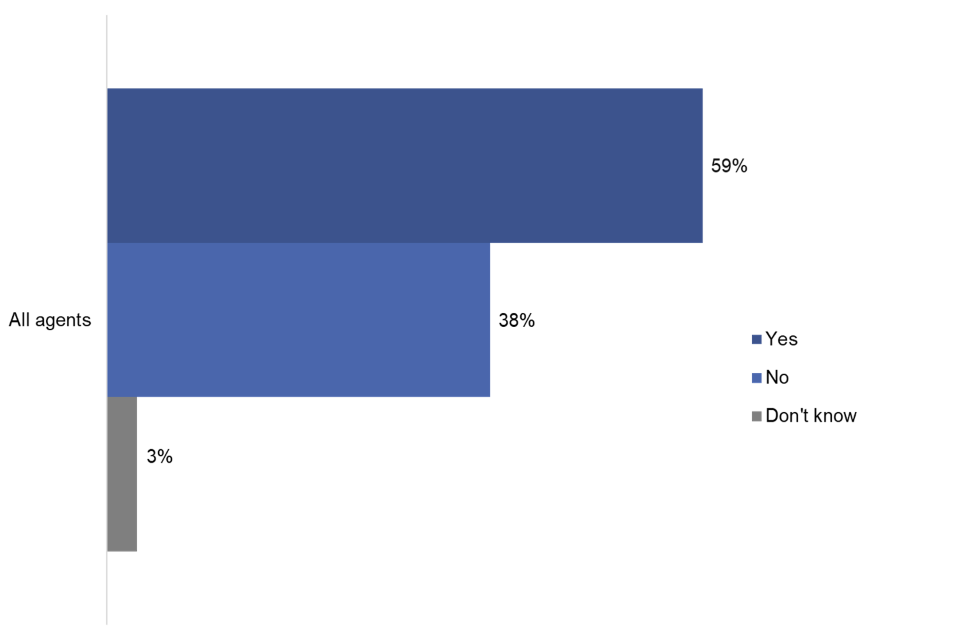

Many agents have plans to expand their use of specialist accounting or bookkeeping software in the future. This emerged from the quantitative survey findings where just under 6 in 10 (59%) agents reported having plans to expand their use of specialist software (as shown in Figure 7). Just under 4 in 10 (38%) agents did not have plans to expand their use of specialist software.

Agents with ambitions to grow and diversify were also more likely to say they had plans to expand their use of specialist software (88%) compared with 60% who plan to maintain current business activities and 30% who plan to wind down.

Figure 7: Plans to expand use of specialist software

And which of the following best describes your/your firm’s attitudes to clients’ use of specialist accounting or bookkeeper software? Base: All respondents (873)

Clients’ use of software

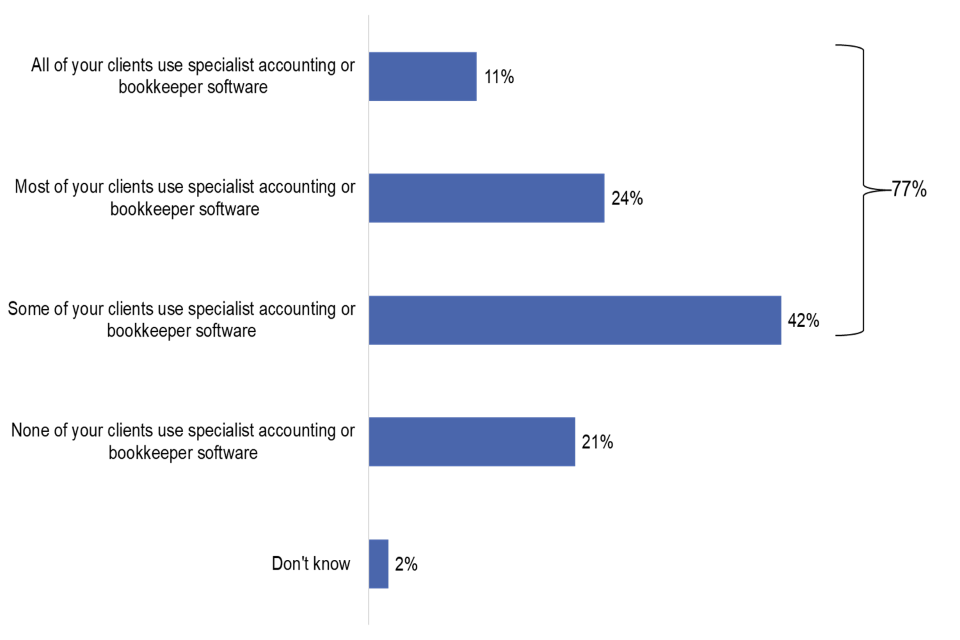

Around eight in ten (77%) of agents reported that their clients used specialist accounting or bookkeeper software to submit their records to them as shown in Figure 8. Around four in ten (42%) said that this was only some of their clients, whilst just under a quarter (24%) said that most of their clients did this and one in ten (11%) said all of their clients used specialist software to submit records. Two in ten (21%) reported that none of their clients use accounting or bookkeeper software.

Agents whose clients were more likely to use specialist software included:

- accountancy firms (87%) compared with bookkeeping firms (65%) and other types of agents (63%)

- agents with a turnover of £60k and above (89%) compared with agents with a turnover of less than £60k (68%)

- affiliated agents (84%) compared with non-affiliated agents (64%)

- agents with ambitions to grow and diversify (91%) compared with agents with plans to maintain current business activities (78%) and agents who plan to wind down (61%)

Figure 8: How clients submit their records to agents

And now thinking about your clients, which best describes how they submit their records to you? Base: All respondents (873)

Agents’ attitudes to clients’ use of specialist accounting or bookkeeping software to submit their records to them

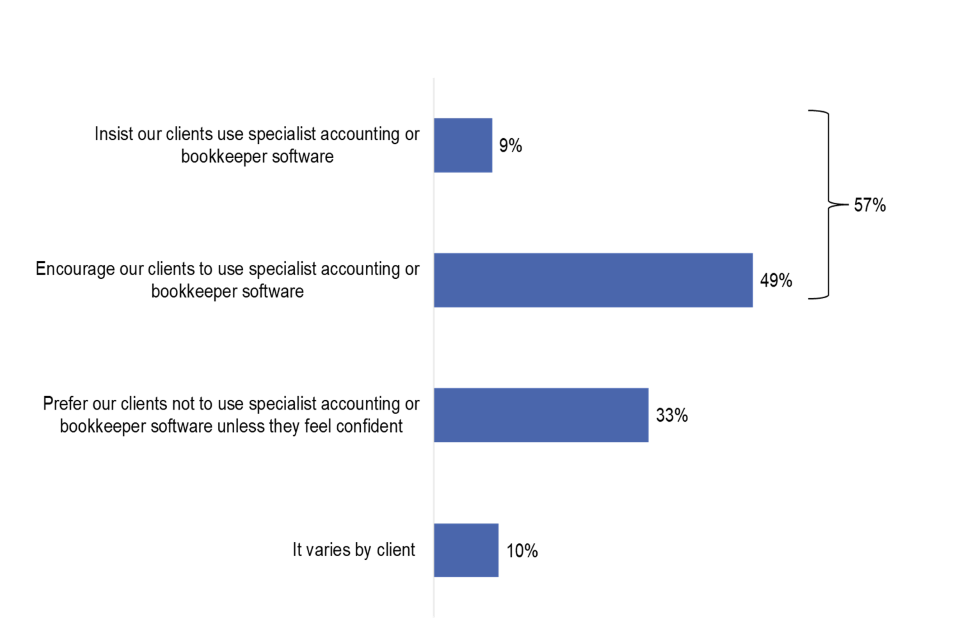

As shown in Figure 9, just under six in ten (57%) agents encouraged or insisted that their clients used specialist accounting or bookkeeping software to submit their records to them. Amongst these agents, around half (49%) said they encouraged clients, whilst 9% said they insisted that their clients use this, and a similar proportion said it varied by client (10%). A third (33%) reported that they preferred their clients not to use specialist accounting or bookkeeping software to submit their records to them unless they felt confident to do so.

Larger accountancy firms were more likely to say that they insisted or encouraged their clients to use specialist accounting or bookkeeping software to submit their records to them (62%) compared with 48% of bookkeeping firms. Agents with ambitions to grow and diversify (74%) were also more likely to say they insist or encourage their clients to use this, compared with agents who plan to maintain (57%) or wind down (39%) current business activities.

Figure 9: Agents’ attitudes to clients’ use of specialist software

And which of the following best describes your/your firm’s attitudes to clients’ use of specialist accounting or bookkeeper software? Base: All respondents (873). Due to rounding, the NET total for insist/ encourage clients use specialist accounting or bookkeeper software was 57%.

In the qualitative discussions, agents’ encouragement for clients to use greater software was described as necessary. Digitalisation was seen as the general ‘direction of travel’, as increasing numbers of clients used software, particularly limited companies, and younger, more digitally confident clients. With the exception of Digital Resisters, agents encouraged and coached their clients to use software. This was also evident in the quantitative findings, where over half of agents (57%) reported they insisted or encouraged their clients to use specialist software, as described above.

Notably, most agents did not fear their role becoming redundant due to client digitalisation. Instead, there was an appetite among agents for clients to use software in order to increase the proportion of higher-margin work for agents. The quantitative findings also reflected this, with over seven in ten (74%) of agents with ambitions to grow and diversify their business reporting that they insist or encourage their clients to use specialist software (compared with 57% with plans to maintain current business activities and 33% with plans to wind down). It should be noted that in the qualitative research a minority of agents were worried about the increase in client digitalisation, which they thought reflected a push away from agents, as fore mentioned.

“Although you’ve lost a bit of a fee, you’ve gained time. There’s certain clients that are a model of what we want to do. They’ve come messy, not a clue, but now they’re set up on [the software], we just give advice, do their year-end on [the software], and that’s them done. So, you still earn a good fee, you’ve barely spent any time…If the firm was full of those clients, the job would be so easy.”

(Affiliated, 10+ employees)

Agents highlighted the benefits of software to their clients. This included enabling them to see the bigger picture of business finances in real time, potentially reducing the agent fee by automating processes and meeting the MTD requirements.

Learning how to use software was identified by agents as a key barrier for clients, but once this was overcome, clients saw the benefits of software and found it helpful.

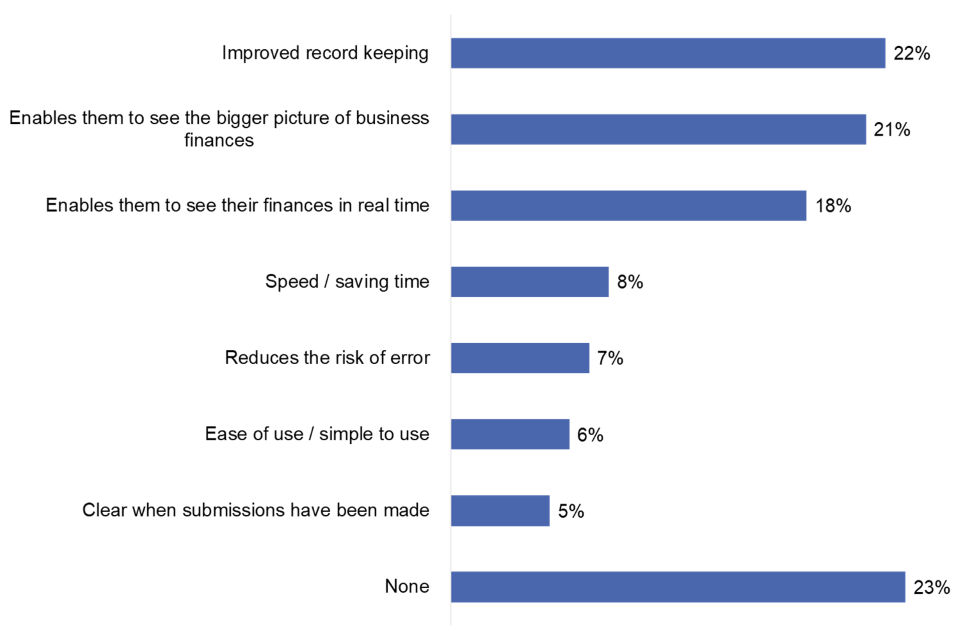

In the quantitative research, agents also identified key benefits of using digital software for their clients. This included improved record keeping (22%) and enabling clients to see the bigger picture of finances (21%) (as shown in Figure 10). Enabling clients to see their finances in real time (18%) was also a frequently mentioned benefit for clients. Smaller proportions mentioned other benefits including speed/saving time (8%), reducing the risk of error (7%), the ease of use (6%), and being clear when submissions have been made (5%).

Figure 10: Benefits of clients using specialist software

And thinking about clients’ use of digital software …. what are the benefits, if any, for them? Base: All respondents (873)

As seen earlier in this chapter, only 9% of agents insisted that their clients used software (Figure 9). The qualitative discussions found that agents who were Digital Accepters or Digital Embracers considered that clients who lacked the capability to use software were better off not using it. This included those who lacked numeracy or digital skills or confidence dealing with tax.

Agents who were Digital Accepters or Digital Embracers tried to coach clients to learn how to use software. However, if it proved beyond their ability, they were understanding of clients who reverted back to paper or Excel. These agents felt that any client errors in software were more difficult and time consuming for an agent to resolve. This is in comparison to if the client used paper or Excel, where errors could more easily be identified and understood. These agents also saw the cost and hassle factor of learning to use software as unnecessary for very small businesses with simple financials. This aligned with the quantitative findings which found that only a minority of agents (7%) felt that reducing the risk of error was a benefit of their clients using specialist software.

“There’s a guy at the minute going crazy because he can’t get the hang of it, and it really is idiot proof. If you get a labourer trying to go online when all he wants is to bring a bag of receipts to an accountant, it doesn’t look pretty.” (Affiliated, 0 employees)

“If it’s beyond their capabilities then I’d rather they didn’t use any software because it takes longer to try and work out what they’ve done. There’s less room for them to make errors on Excel. In software they can’t see behind the scenes, it’s more difficult for them to notice what mistakes they’re making … Many clients still use Excel, still many bring in a bag of paper records and receipts. If they’ve always done it that way, it’s nigh on impossible to get them to change and if paper records are reasonably accurate just leave them be.” (Unaffiliated, 1 to 9 employees)

“Software can be pricey for the small businesses I work with, and it wouldn’t be fair to add this to their overheads.” (Affiliated, 1 to 9 employees)

The next chapter looks at the use of HMRC digital services in more detail.

6. Use of HMRC’s digital services

This chapter focuses on agents’ use and views of HMRC’s digital services and includes findings from both the qualitative stage and quantitative survey. This covers agents’ use of the Agent Services Account (ASA) and the Online Services for Agents Account (OSAA), whether agents use their clients’ online accounts and their perception of whether HMRC’s digital services have improved or deteriorated. This chapter concludes by examining agents’ ease of dealing with HMRC on behalf of their clients.

Within this research, HMRC’s digital services included the ASA and OSAA, HMRC support on gov.uk, the HMRC webchat, HMRC digital learning products and communications from HMRC through other online channels. This information can help understand how HMRC’s digital services could be improved.

Different services are available to agents through the two HMRC online accounts. The ASA allows agents to sign up their client for VAT, manage client’s details for VAT, report client’s Capital Gains Tax on UK property, register a client’s estate or register a trust as an agent. Whilst through the OSAA, services include: Self assessment, Corporation Tax, PAYE and Construction Industry Scheme, Gambling Tax, Machine Gaming Duty, and Notification of Vehicle Arrivals

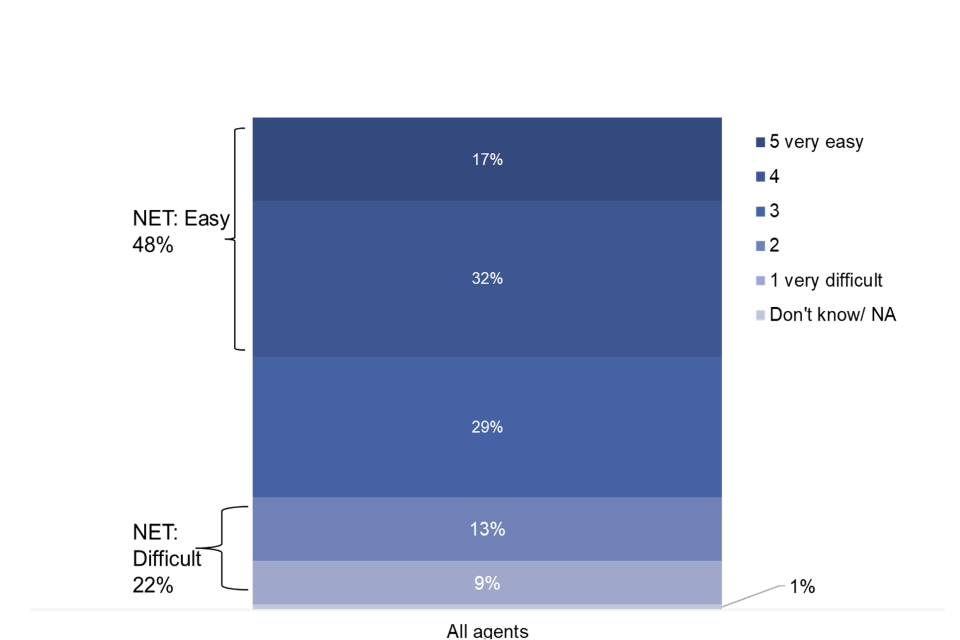

From the quantitative research, agents had mixed responses to how easy or difficult they have found dealing with tax issues on behalf of clients in the last 12 months. Just under half (48%) found it easy, 29% found it neither easy nor difficult, whilst just over a fifth (22%) found it difficult.

6.1 Use of ASA and OSAA

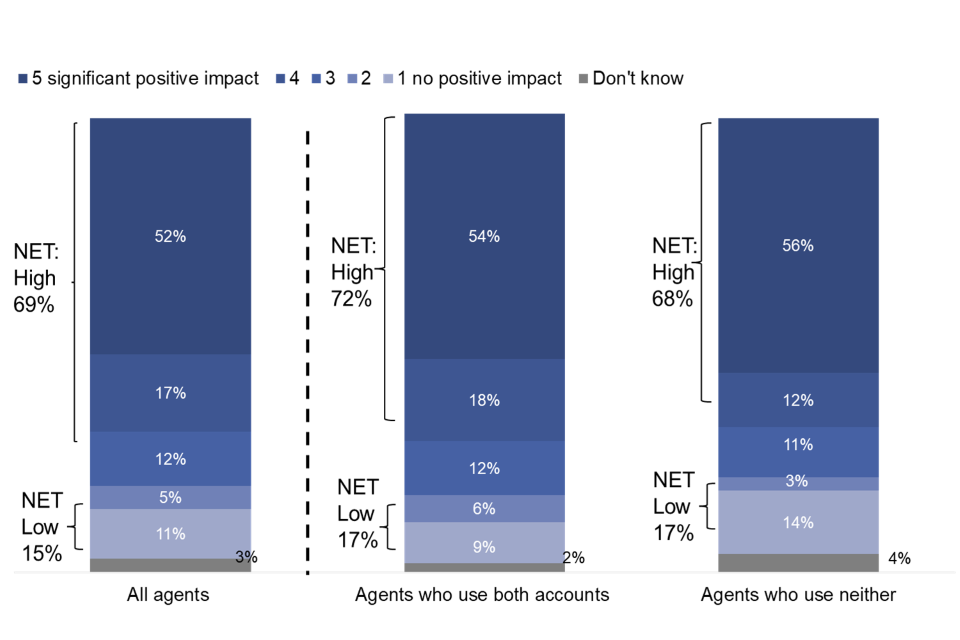

In the quantitative research, most agents reported using both accounts, with three-quarters (75%) stating that they used both. The OSAA had slightly more users (85%) than the ASA (79%). Only 11% of agents said they used neither agent account (Figure 11).

Agents who had ambitions to grow were more likely to say they used the ASA account (90%) compared to those who planned to maintain (75%) or wind down services (74%). A similar pattern was also seen on the use of the OSAA.

Bookkeeping agents were more likely to say that they did not use the ASA or OSAA, with 33% saying they did not use OSAA, compared with 4% of accountancy firms and 19% of other types of agents. Similarly, 44% of bookkeepers said they did not use the ASA, compared with only 6% of accountancy firms and 25% of other types of agents.

Larger agents were also more likely to use the ASA, as seen with agents with a turnover of £60k or above (91%) compared to 68% of those with a turnover of less than £60k.

Figure 11: Use of Agents Services Account and Online Services for Agents Account

Do you use the HMRC Agent Services Account? And do you use the HMRC Online Services for Agents Account? Base: All respondents (873)

As well as being the lesser used account, the qualitative research found that the ASA received more criticism from agents. Agents generally perceived the ASA as the newer account or ‘the MTD account’. It perhaps was more criticised because the ASA came second to the established OSAA and was felt to come without a clear rationale for being separate. In comparison, the OSAA was more familiar to agents, and some felt more confident with it having used it for longer.

“I don’t understand why the second one has to be a second one.” (Affiliated, 1 to 9 employees)

“The original agents website actually works quite well, and the Agent Services Account is rubbish.” (Affiliated, 1to 9 employees)

Amongst account users, the qualitative research found a spectrum of feelings agents had towards their experiences with the ASA and OSAA, with no differences by subgroup. The spectrum of feelings fell into three distinct groups, those who were pained, pragmatic or positive.

Pained agents were disappointed by and frustrated with HMRC’s digital services. This was usually due to difficulties setting up accounts and feeling that having two accounts was unnecessary. Frustration was also caused by encountering issues such as Corporation Tax codes not working. Pained agents also mentioned the business impact of these issues and time spent trying to resolve them. This included time wasted when things did not work first time, time spent on the phone troubleshooting, or time spent ‘in a loop’ between written communication and phone calls.

“The impact on work was pretty catastrophic - we didn’t know which account to sign into and the name of the services is too similar, then we had to get new logins… you have to ask why you’d have 2 logins for agent services, it shouts that the system isn’t finished yet.” (Affiliated, 1 to 9 employees)

“It’s not easy, a bit of trial and error - you start with the wrong set of details and it all takes time… At the moment we have to juggle between ye olde fashioned system and the MTD system, it all takes time and time is money.” (Affiliated, 1 to 9 employees)

Pragmatic agents had come to terms with any idiosyncrasies of the system and found workarounds to problems. They were resigned to the situation but readily acknowledged that there was room for improvement.

“It works but there is a lot of daft stuff. You scratch your head and think why on earth have they done it like that?” (Unaffiliated, 1 to 9 employees)

“It doesn’t cause particular problems having separate accounts but doesn’t really make sense… I don’t really understand why they’re separate accounts because you’d think once you’re an agent you’d just have one.” (Affiliated, 0 employees)

“There’s a lot of tricks that we’ve had to uncover to be able to get round it.” (Affiliated, 10+ employees)

Positive agents were typically older and were positive about the existence of digital services compared to pre-digital working.

“Overall, it’s good for me, I’m impressed by online.” (Affiliated, 1 to 9 employees)

“I can’t think of any weaknesses, it’s really good security-wise. It’s harder to get into HMRC login than my bank.”

(Affiliated, 1 to 9 employees)

“No suggestions [for improvement.] digital services are needed and they are very good.” (Unaffiliated, 10+ employees)

6.2 Use of clients’ account

Over half of agents (58%) reported having logged into their clients’ account, with 42% said they occasionally do it and 16% that they do it frequently (Figure 12). The high numbers of agents logging into their clients’ accounts suggests that current HMRC’s digital services do not sufficiently meet agents’ needs to access client data. This is discussed further in chapter 7.

Figure 12: Use of clients’ account

In order to have better visibility of client data some agents log on to their clients’ government gateway accounts. Is this something you ever do? Base: Mainstage respondents only (831)

Agents who were more likely to log into their clients’ accounts frequently were agents who used neither the ASA and the OSAA account (24%) or did not use the ASA account (23%). In comparison, only 14% of those who used both accounts and 15% who used the OSAA reported frequently logging in.

The qualitative interviews found that those who were using their clients’ account were particularly semi-retired, unaffiliated agents, with a small client portfolio and who do not use either agent account. This included one unaffiliated agent who could not supply anti-money laundering certification and so remained ‘locked out’ of the ASA. These agents described having their clients ID and login details and asking clients to send them the two-step verification access code that are sent to clients’ phones when their accounts are logged into. Overall, these agents seemed unaware that they should not be accessing their clients’ accounts in this way.

“I use their passwords and act as the client directly. I sit with them and explain it and we do it together. Then I feel like they have bought into it and take some responsibility.”

(Affiliated, 1 to 9 employees)

“I have applied for [the ASA] but then it comes back to the money laundering topic – HMRC asking am I geared to an accounting profession and have I got the money laundering license. So I can’t sign up. I only have a handful of clients and it seems silly to go through all these channels.” (Unaffiliated, 0 employees)

Agents who were more likely to never log into their clients’ accounts were those who were affiliated (47%) compared to those who are not (31%).

6.3 Perception of HMRC’s digital services improvements

Half (51%) of agents felt that HMRC digital services had not changed over the last 12 months, while 30% thought they had improved and 15% thought they had got worse (Figure 13).

Agents more likely to say HMRC’s digital services had improved included:

- those who found it easy acting on behalf of clients (36%) compared with those who found it difficult (13%)

- agents who have ambitions to grow and diversify (36%) compared with agents who plan to maintain current business activities (26%)

- agents with fewer than 10 employees (42%) compared with agents with 10+ employees (28%)

Agents more likely to say HMRC’s digital services had got worse included:

- those who use both the ASA and OSAA (19%) compared with agents who use neither account (6%)

- larger accountancy firms, such as those with a turnover of £60k or above (19%) compared to those with a turnover of less than £60k (13%)

Figure 13: Perception of improvements and HMRCs digital services

In the last 12 months, would you say that HMRC’s digital services for agents have…? Base: All respondents (873)

6.4 Ease dealing on behalf of clients

Nearly half (48%) of agents found it easy to deal with tax issues on behalf of their clients, and 22% of agents found it difficult (Figure 14). Ease may be increased through using workarounds, such as logging into their clients’ account.

Figure 14: Ease of dealing on behalf of clients

Over the last 12 months how easy or difficult have you found it to deal with tax issues on behalf of your clients? All respondents (873)

Larger agents found it more difficult to act on behalf of their clients, this included

- agents with a turnover of £60k and above (29%) compared with agents with a turnover of below £60k (14%)

- those who were affiliated (26%) compared to those who were not (15%)

- agents from accountancy firms (26%) and other types of agents (27%) compared to bookkeeper agents (11%).

Agents’ perceptions of using HMRC’s digital services is explored further in Chapter 7 and 8.

7. Experience of pain points when using HMRC’s digital services

This chapter looks at the pain points agents reported experiencing when using HMRC’s digital services. Pain points were identified through the qualitative interviews where agents mentioned them both spontaneously and some were prompted based on pre-existing HMRC knowledge. The seven most important pain points were then quantified in the survey. Within the survey agents were asked to rate the impact a pain point has on the ease and efficiency of dealing with HMRC on behalf of their clients. A scale of 1 to 5 was used, where 5 was a significant negative impact and 1 was no negative impact. Where the report refers to a “high negative impact” it signifies where agents have selected either 4 or 5 on the scale.

This chapter mainly includes findings from the quantitative survey but also includes concerns expressed in the qualitative phase of the research too.

7.1 Overview of pain points

Table 1 shows the percentage of agents that said pain points had a high negative impact (4 or 5 on the 5-point scale). Having two separate accounts with different login details was considered to have the highest negative impact (36%). Limited visibility of VAT returns which have been submitted and what has been paid, (35%) and not being able to see the same information as clients through HMRC’s digital services (33%) were also top frustrations for agents. Overall, not having a single client dashboard was the least significant pain point for agents (25%). Just under three-quarters (71%) of agents reported a high negative impact for one or more of the pain points.

Table 1: High negative impact pain points scores

| Pain point tested | Percentage of high negative impact | |||

|---|---|---|---|---|

| 1 | Having two separate accounts with different login details | 36% | ||

| 2 | Being unable to see which VAT returns have been submitted | 35% | ||

| 3 | Not being able to see the same information as clients | 33% | ||

| 4 | Use of post and telephone communications rather than email | 32% | ||

| 5 | Impact in delays in receiving and activating authorisation codes | 28% | ||

| 6 | Issues with the VAT authorisation process | 27% | ||

| 7 | Impact of not having a single client dashboard | 25% |

Overall, high negative impact scores did not exceed 36%. This was potentially because, as seen in the qualitative research, many agents were pragmatic about their use of HMRC’s online accounts. They have become accustomed to using the current HMRC online accounts and finding workarounds to any barriers.

Across pain points certain agents tended to report a greater negative impact. This includes agents:

- who were affiliated

- from accountancy firms

- with a turnover of £60k and above

- who insist clients use specialist accounting or bookkeeper software

- who said they had found it hard acting on behalf of clients in the last 12 months

- agents who think HMRC’s digital services have got worse

The remainder of this chapter discusses agents’ responses to each pain point tested.

7.2 Two separate accounts

Having two separate accounts was felt to be an issue for agents in the qualitative research. This was because HMRC services were not consolidated and agents needed to log into two different accounts to complete activities. This was felt to be unnecessary and time-consuming.

“Like I’m going to the same shop and I have to take 3 different cars… Can you imagine if Amazon said we had to use different accounts for different things?” (Unaffiliated, 1 to 9 employees)

“This is a messy service… I’m not sure why there are two accounts, this is the frustrating thing and it’s confusing.” (Unaffiliated, 0 employees)

“Having two different log ins is very confusing, very complex, all totally unnecessary, probably just because their systems don’t talk to each other.” (Unaffiliated, 0 employees)

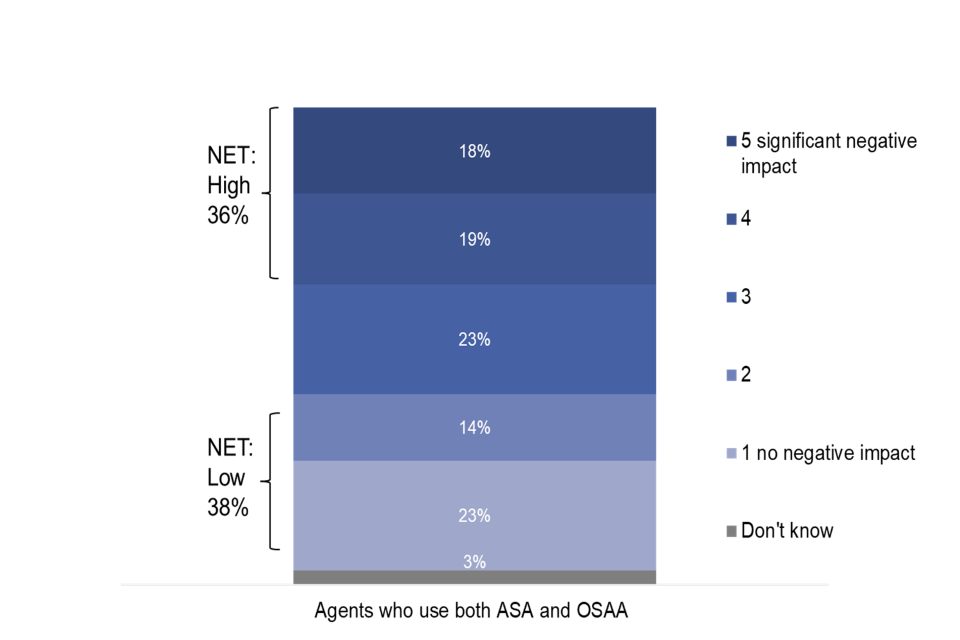

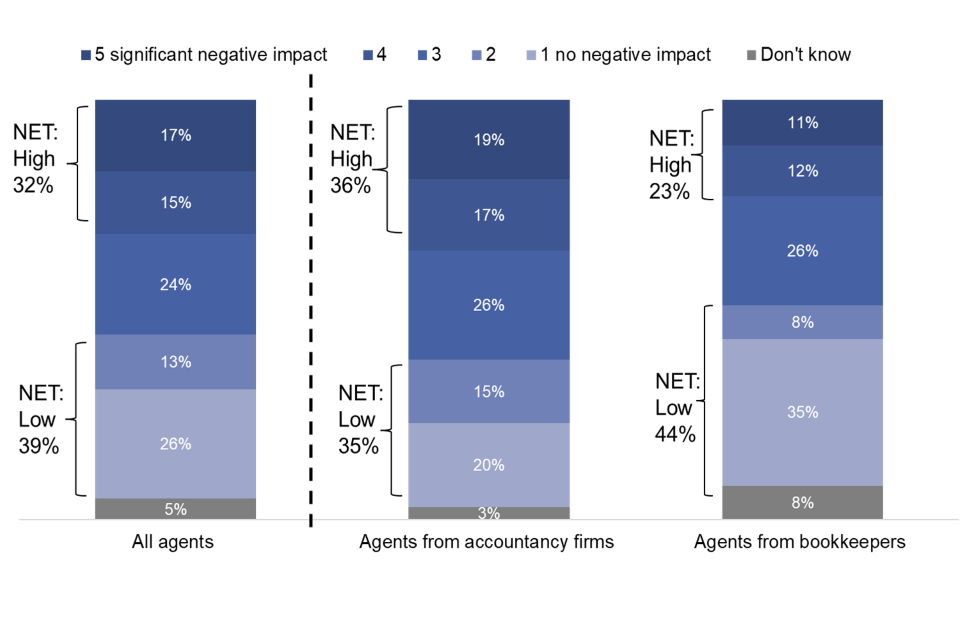

Having two separate agent accounts was the largest pain point for agents with 36% saying it had a high negative impact (Figure 15).

As mentioned above, certain types of agents were more likely to report a high negative impact across pain points. On this pain point, these agent types included:

- agents with a turnover of £60,000 and above (44%) compared to those with a turnover of £60k and below (28%)

- agents who were affiliated (40%) compared to agents who were not (28%)

- those who found it difficult to act on behalf of clients (52%) compared to agents that found it easy (28%)

- those who thought HMRC’s digital services have got worse (51%) compared to those who think they have improved (28%)

Figure 15 : Impact of having two separate accounts

And what impact, if any, has having two separate accounts with different login details? Base: Respondents who use both the Agents Services Account and the Online Services for Agents Account (722)

7.3 VAT visibility

In the qualitative research, agents reported being frustrated with VAT visibility because they cannot see what VAT returns have been submitted, what has been paid and whether a new client has been added successfully for VAT.

“I was looking at a VAT return with a client of mine, when she had logged into hers it was repeating payments and it wasn’t clear what payment was allocated to what. It was difficult to tally it up. I ended up doing my own spreadsheet to make sure it was correct”. (Affiliated, 1 to 9 employees)

The second highest pain point identified through the quantitative survey was being unable to see which VAT returns have been submitted and what has been paid, with 35% of agents who use the ASA reporting this as a high pain point (Figure 16).

The types of agents that reported a higher negative impact was similar to other pain points and typically were larger agents. This included:

- agents with a turnover of over £60,000 or above (43%) compared to agents with a turnover of below £60,000 (26%)

- accountancy firms (40%) compared to those who were bookkeepers (23%)

Those who found it hard to act on behalf of their clients were also more likely to report a higher negative impact (50%) compared to who found it easy (25%).

Figure 16: Impact of not being able to see what VAT returns have been submitted and what has been paid

Over the last 12 months, what impact, if any, has being unable to see which VAT returns have been submitted and what has been paid? Base: Respondents who use the ASA account (748), agents with turnovers a below £60,000 (276), agents with a turnover of £60,000 or above (316)

7.4 Accessing client information

Having equal access to information that clients get through their Personal Tax Account (PTA) was as desirable and necessary to be able to conduct client services, as highlighted in the qualitive research.

Agents felt they were not getting equal access to this information. Consequently, some agents were logging in to their client’s accounts to see this information or asking clients to share screenshots of information in their account.

“We do have to sit next to clients more often than not, even younger clients when we say go to your PTA, half of them just glaze over so you end up either on Zoom or a call with them giving you their log ins… That defeats the whole purpose because their security is compromised. Why aren’t agents able to share their access?” (Affiliated, 0 employees)

The clients can access it, so if we ask them for it, they will say ‘oh why don’t you just look at my portal’…It almost puts agents at a disadvantage, which I don’t understand. Agents are appointed to deal with the tax in the first place.” (Affiliated, 10+ employees)

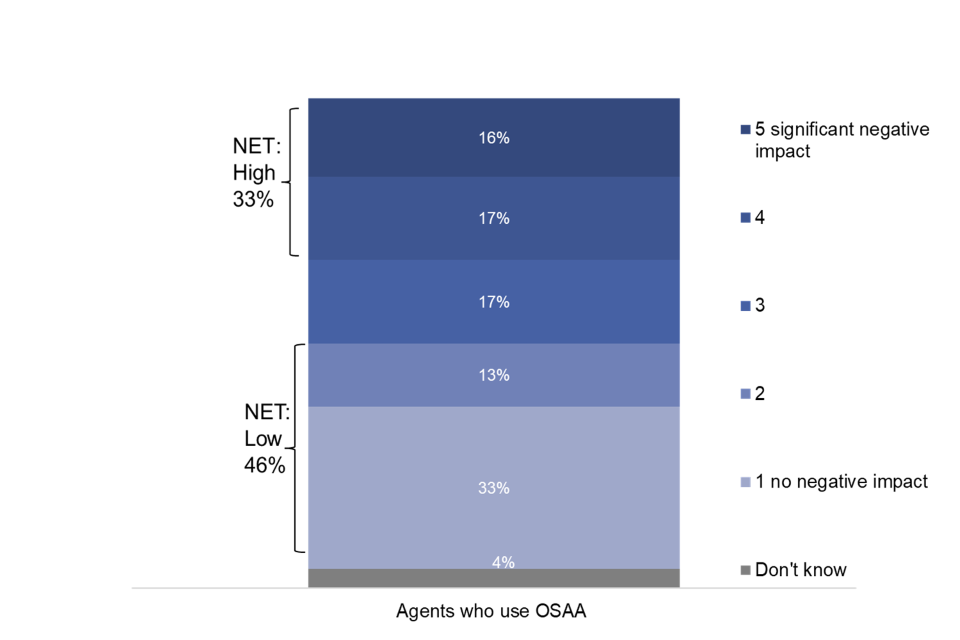

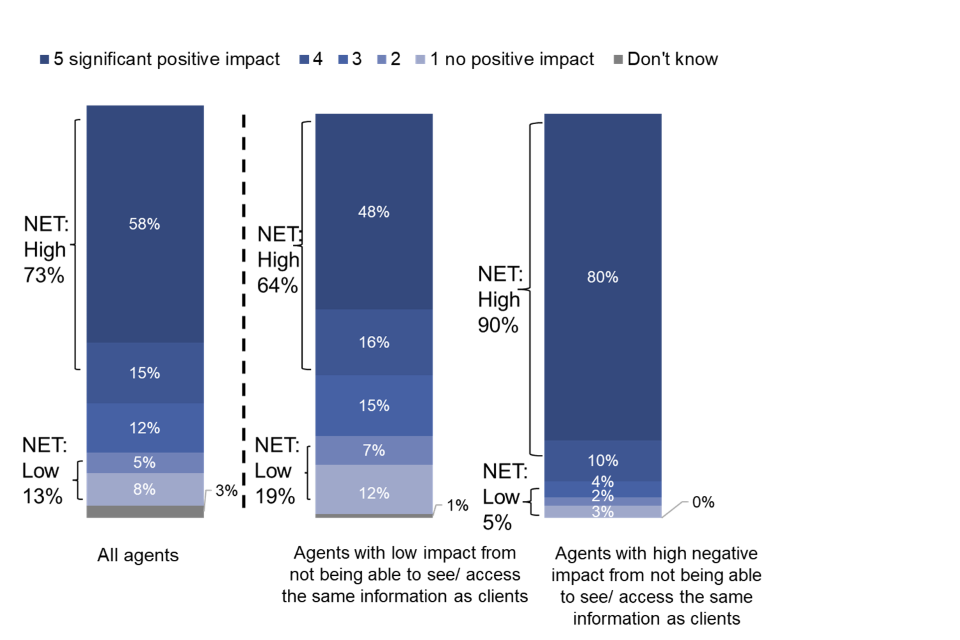

A third of agents (33%) felt there was a high negative impact from not being able to see and access the same information as their clients when using the OSAA. (Note: this question was only asked to agents who use the OSAA).

Agents who were more likely to report a higher negative impact were agents with ambitions to grow or maintain services (38%) and who plan to grow (36%) compared to agents with plans to wind down (22%).

Again, the similar agent types were also more likely to report this as a pain point. This included:

- accountancy firms (38%) and other types of agents (35%) compared to bookkeeping firms (18%)

- agents with a higher turnover: £60k and above (46%) to compared to agents with a turnover of less than £60k (19%)

- those who were affiliated (38%) compared to those who were not (21%)

- agents who have found it difficult (55%) or neutral (34%) to act on behalf of clients compared to those that found it easy (21%)

- who use specialist software all or some of the time (37%) compared to those who use it some of the time (23%) and none of the time (18%)

It should also be noted that just under a half of agents (46%) thought this had no (33%) or a low (13%) negative impact for them, showing that this pain point was polarised among agents. Interestingly, agents who logged into their clients’ accounts were more likely to report this pain point as having no or low negative impact on them (50%) compared to agents who never logged on to their clients’ accounts (41%), suggesting agents logging into client’s account is a workaround to not being able to see the same information as their clients.

Figure 17: Impact of not being able to see and access the same information as clients

Over the past 12 months, have you been impacted by not being able to see and access the same information as your clients? Base: Respondents who use the OSAA account (782)

7.5 Post and telephone communications

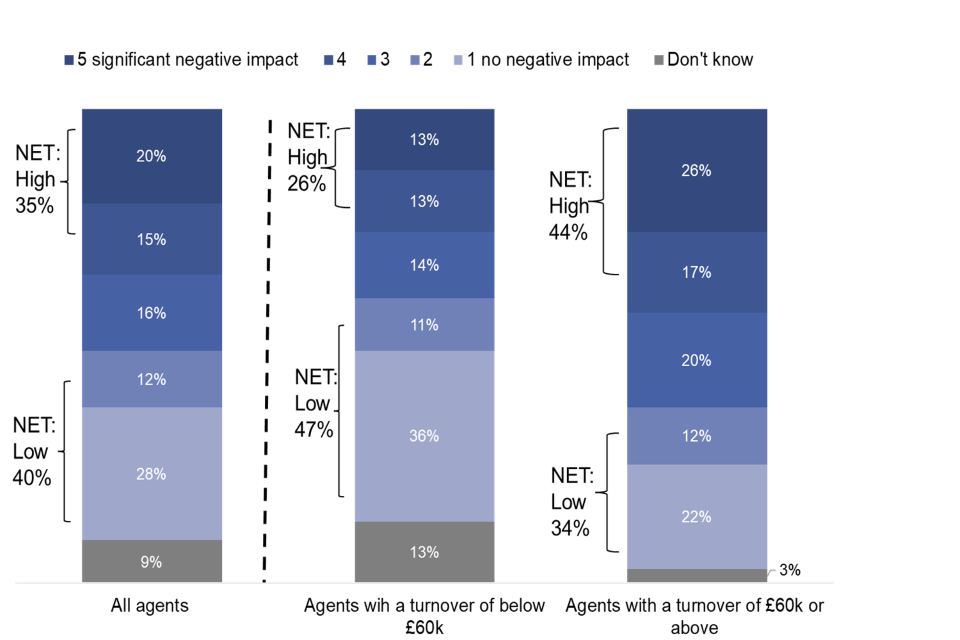

HMRC primarily communicating by post and encouraging enquiries by phone was a mid-ranking pain point in the quantitative research.

In the qualitative research, this pain point was highlighted by agents who would rather use email to avoid postal delays and allow for written evidence of previous correspondence, which the telephone helpline is unable to offer.

“You can email the doctors now - if they can [communicate by email] HMRC can”. (Unaffiliated, 0 employees)

“If we are working digitally why aren’t HMRC completely digital in their provision?” (Affiliated, 1 to 9 employees)

“A client might receive a letter asking questions. Then they have to send us the letter, then we have to call HMRC and the person on the other end might not have understood…and then we have to write in.” (Affiliated, 1 to 9 employees)

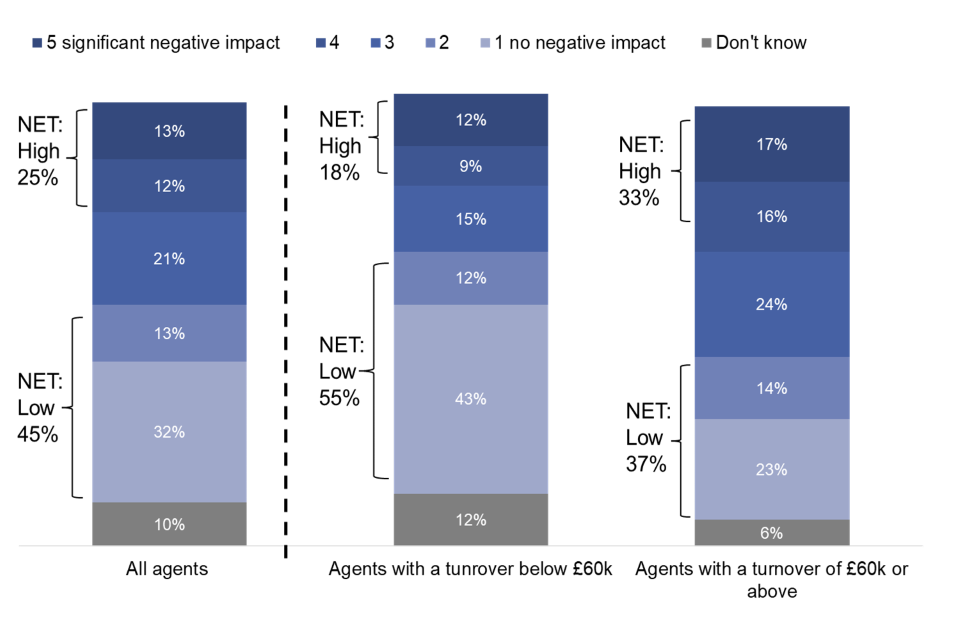

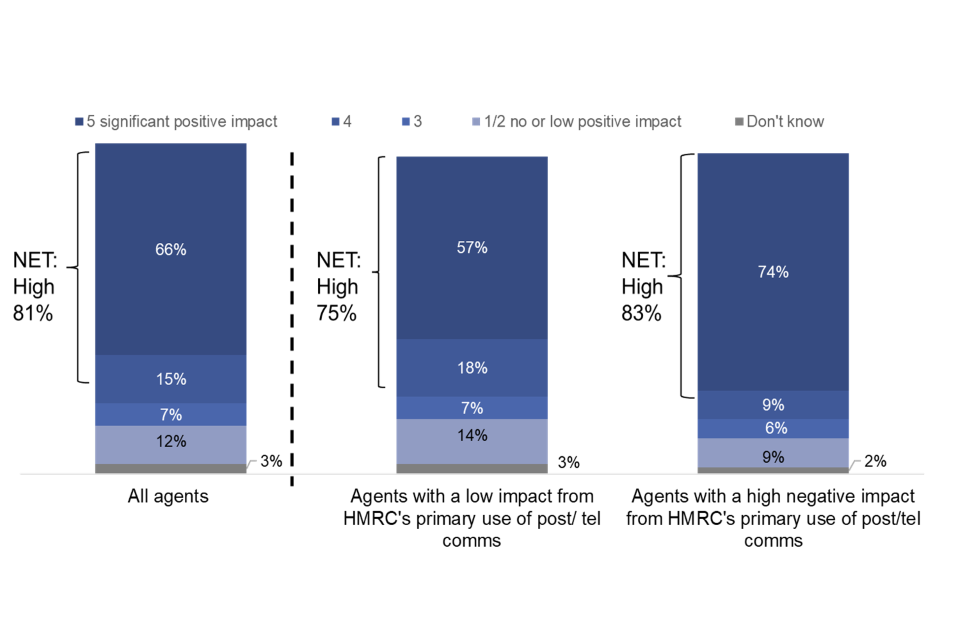

Just under one in three (32%) agents said HMRC’s primary use of post and telephone communications rather than email had a high negative impact (as shown in Figure 18).

Agents who use both accounts were more likely to say this pain point had a high negative impact (35%) than those that use neither account (23%) or do not use OSAA (19%). It was also higher among agents who have 1 to 9 employees (40%) compared to agents with no employees (25%).

Again, the similar agent types were also more likely to report this as a pain point. This included:

- agents from accountancy firms (38%) and other types of agents (35%) compared to bookkeeping firms (23%)

- agents who find it difficult acting on behalf of clients (55%) than those who find it easy (23%)

- larger accountancy firms with a high turnover of £60k or above (41%) compared to agents with a turnover of less than £60k (24%)

- agents who thought that HMRC’s digital services had got worse (59%) compared to those who think they have improved (22%)

Figure 18: Impact of HMRC’s primary use of post and telephone communications rather than email

What impact, if any, has HMRC’s use of post and telephone communications, rather than email had? Base: All respondents (873), agents from accountancy firms (591), agents from bookkeeper firms (158)

7.6 Activation authorisation code delays

A further pain point that was explored with agents was delays in receiving and activating authorisation codes. In the qualitative research agents described experiencing this pain point due to a lack of responsiveness from their clients, in which clients failed to send authorisation codes they had received from HMRC to their agent.

“It seems to be a waste of paper when they send the authorisation code out. It would be good to get it via email or text. Paper creates delay and sometimes you need the authorisation in a hurry.” (Affiliated, 1 to 9 employees)

“Clients get frustrated when they’re busy doing other things. They do it in the end when they realise if they don’t, they’ll get a fine.” (Affiliated, 10+ employees)

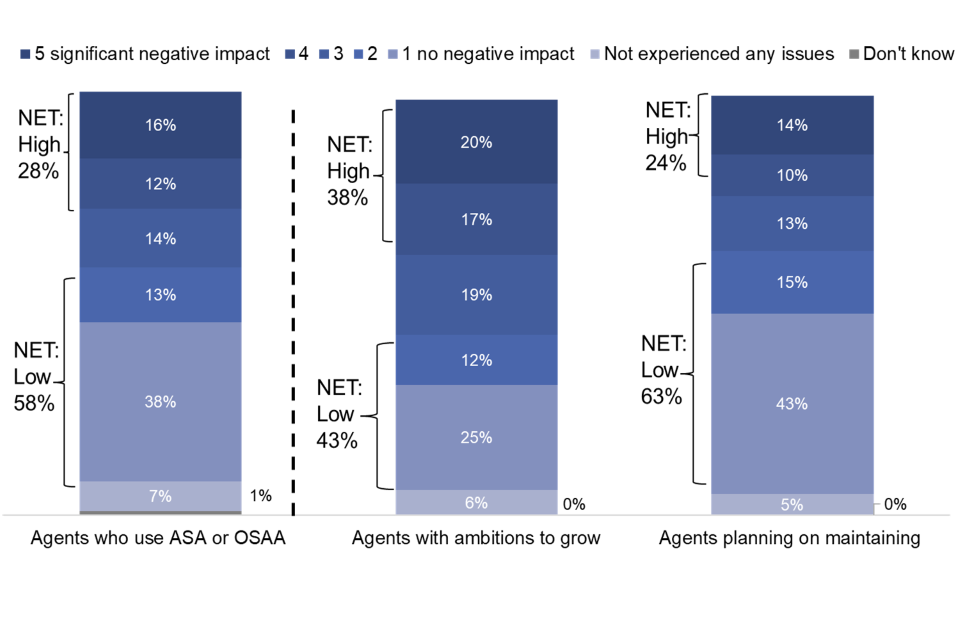

Just under three in ten (28%) of agents, who use either the ASA or OSAA, felt that delays in receiving and activating authorisation codes was having a high negative impact, with 58% of agents reporting a low or no negative impact from this pain point (as shown in Figure 19).

Again, similar types of agents were more likely to have experienced a high negative impact in experiencing authorisation code delays, these included:

- those who found it difficult (46%) or neutral (30%) acting on behalf of their clients compared with those who found it easy (19%)

- those who think HMRCs services have got worse (44%) compared to those who think they have improved (27%)

- larger agents: those with a turnover of £60,000 or above (35%) versus those with a turnover of below £60,000 (22%)

Agents suggested in the qualitative research that if HMRC emailed codes to clients it would reduce the burden on clients and encourage them to act on them more quickly.

Figure 19: Impact of delays in receiving and activating authorisation codes

And any delays in receiving and activating authorization codes? Base: Respondents who use either the ASA or OSAA accounts (808), agents with ambitions to grow (323), agents planning on maintaining services (304)

7.7 VAT authorisation processes

One of the lower ranking pain points was issues with the VAT authorisation process. With over half of agents (52%) who use the ASA reported a low or no negative impact. Just over a quarter of agents (27%) said they had experienced a high negative impact from this pain point (Figure 20).

Unsurprisingly, agents who found it difficult to act on behalf of clients (46%) were also more likely to report being negatively impacted than those who found it easy (17%).

Similarly, to other pain points certain types of agents were more likely to report being negatively impacted by issues with the VAT process. This included:

- those from accountancy firms (30%) versus bookkeepers (26%)

- agents who are affiliated (29%) compared to those who are not (19%)

- agents with a turnover of £60k or above (34%) versus those with a turnover of less than £60k (18%)

- agents who think HMRCs services have got worse (38%) compared of those who think they have improved (26%)

From the qualitative research, agents highlighted that the current complexity of the VAT authorisation process made it longwinded and frustrating to use. Agents felt that if the process could be simplified and this would improve their experience of using the ASA.

“It asks for the date of registration and the number of clients who know that are probably nil!” (Affiliated, 1 to 9 employees)

“It’s longwinded and time consuming and clients get annoyed.” (Affiliated, 1 to 9 employees)

Figure 20: Impact of issues with the VAT authorisation process

And what issues, if any, has there been from any issues with the VAT authorisation process? Base: Respondents who use the ASA account (748)

7.8 Single client dashboard

Finally, the lowest ranking and least negative impacting pain point for agents was not having a single client dashboard in the ASA.

In the qualitative research, this emerged as a pain point as agents appreciated being able to view a client list in the OSAA and wanted this to be replicated in the ASA or to have one dashboard covering all services.

“There’s too many different areas, you have to go in here and there…there’s no one place where you can see everything. Why can’t we just see 15 clients and click on the client you want to do something for?” (Affiliated, 0 employees)

“It would be easier if there was just one master agent account that dealt with everything.” (Affiliated, 10+ employees)

“It’s a pain to be honest, and I’d much rather that they were all on one.”

(Unaffiliated, 0 employees)

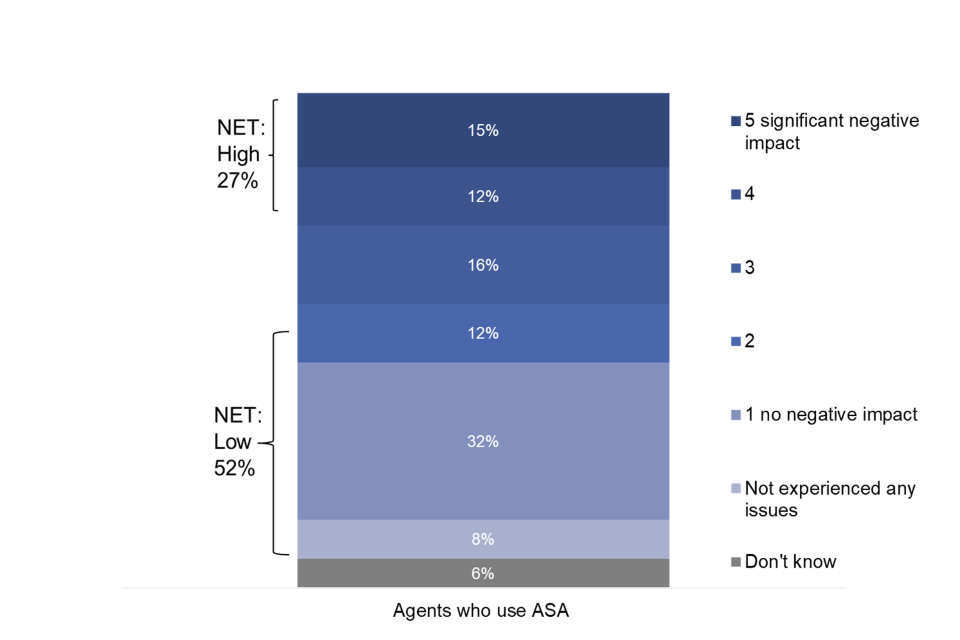

In the quantitative research, not having a single client dashboard was seen as the least impactful pain point among agents who use the ASA, with only a quarter (25%) stating it had high negative impact in the quantitative research (shown in Figure 21).

Larger agents were more likely to report that this was having high negative impact, with agents with a turnover of £60,000 or above being more likely to report high negative impact (33%) compared to those with turnovers of £60,000 or below (18%). It is likely this had a higher negative impact for larger agents because they have more clients and therefore, the absence of a single client dashboard is likely to have more of an impact.

Again, similar agent types were also more likely to report this as having a high negative impact. These included:

- agents who find it difficult acting on behalf of their clients (43%) compared with those who find it easy (14%)

- agents who think HMRC’s services have got worse (37%) compared to of those who think they have improved (19%)

Figure 21: Impact of not having a single client dashboard