Impact of a proposed ban of the sale of horticultural peat in England

Published 21 February 2023

Executive summary

This report responds to the request from the Secretary of State for Environment, Food and Rural Affairs that the Office for the Internal Market (OIM) examine the potential effect on the UK internal market of the Department for Environment, Food and Rural Affairs’ (DEFRA) proposed ban in England on the sale of horticultural peat to retail consumers by 2024 and to professional growers by 2028 respectively. That request, made under s.34 of the UK Internal Market Act 2020, was accepted by the OIM on 4 August 2022.

Our analysis has been conducted in accordance with our functions under the UK Internal Market Act 2020. It examines the effects on the internal market of the proposed regulation and is principally concerned with its economic effects. We focused our attention on the 2024 retail ban.

We gathered information from a variety of sources, including the responses to DEFRA’s consultation on the proposed regulation, interviews with industry participants and other interested parties, information requests, and published research. We also commissioned a survey of consumer attitudes and behaviour. We spoke to industry players, including growing media manufacturers and retailers, professional growers, retail consumers, and other interested parties such as the Devolved Administrations, local authority planning officers and environmental charities.

The supply chain for peat-containing growing media sold to retail customers comprises peat extractors, manufacturers (most of whom also undertake some peat extraction activities) and retailers. Most (over 2 thirds) of growing media sold in the UK is sold through retailers. The remainder is sold to professional growers, a group that includes farmers and businesses that grow ornamental plants.

The use of peat in horticulture has fallen over the last decade, driven by greater use of peat-free growing media and reductions in the proportion of peat used in peat-containing growing media. This trend has accelerated in the last 3 years, reflecting changing environmental awareness amongst consumers, retailers’ desire to meet their Environmental, Social and Governance commitments, and manufacturers’ anticipation of government action to ban peat use. Despite these developments, we anticipate that peat would continue to be used in England for the next few years without the proposed ban.

To understand the likely effects on the internal market of the proposed ban we first looked at how the market for peat-based growing media products and their peat-free alternatives might develop following the ban. Central to this analysis is a consideration of the role played by the Market Access Principles. These principles would, under certain circumstances, permit peat-containing growing media produced in Scotland, Wales, or Northern Ireland to be sold in England even after the ban has taken effect. The Market Access Principles would not allow peat-containing growing media produced in England to be sold in England, since the proposed ban on sale would apply.

We conclude that consumer demand for peat-containing growing media specifically is small but not immaterial. Our consumer survey revealed that no more than one in 10 consumers have a strong motivation to purchase peat-containing growing media. A much larger proportion (at least 4 in 10) are motivated to buy peat-free growing media. At least 3 in 10 are unconcerned about what their growing media contains and are more likely to be influenced by the price of growing media. These findings are consistent with research by, and discussions we had with, industry participants.

In line with these consumer preferences, many retailers have made commitments to phase out peat-containing growing media. We estimate that approximately 60% of all growing media sold through the retail channel is sold by retailers who have made a public commitment to only stock peat-free growing media by the end of 2024 or earlier. These commitments reduce the appetite of retailers to continue offering peat-containing growing media. In addition, larger retailers with UK-wide operations tend to stock a single growing media offering for the whole UK. This would mean that peat-free growing media that complies with the proposed ban in England would also become the standard offer from these retailers in the rest of the UK even if the sale of peat-containing growing media were not banned there.

Retailer stocking decisions will also be affected by the availability of peat-free growing media more generally. Shortages of peat-free inputs may result in a shortage of peat-free growing media, or cause increases in price and/or reductions in quality. This may disproportionately affect smaller retailers. In such circumstances, retailers may rely on the Market Access Principles to obtain peat-containing growing media, particularly if they have not made public commitments to stop selling peat. The incentive to do so will be particularly strong for retailers such as garden centres, where customers may not buy other products if they are not also able to buy growing media.

On the production side, many manufacturers have been steadily reducing their use of peat in their growing media. All the manufacturers we spoke to who currently produce peat-containing growing media had invested in new equipment, storage, or processing to enable them to produce peat-free growing media. They indicated that the proposed ban on retail sales of peat was likely to accelerate this trend.

Many of the peat-free alternatives used by manufacturers are by-products of other industries and so are affected by the levels of activity in the underlying industry. In addition, the horticultural industry in the UK competes with other industries globally, such as biomass energy production, for access to these inputs. Some peat-free inputs for growing media, such as coir, are sourced internationally and can be affected by global factors such as shipping rates. Notwithstanding these challenges, UK manufacturers have been successful in expanding the use of peat-free inputs across their businesses with use of peat-free inputs almost doubling between 2011 and 2021. A further rapid expansion would be needed to replace current peat use in retail growing media by the end of 2024.

Although manufacturers have been successful in removing a considerable proportion of peat from their production of growing media, many of the manufacturers we spoke to raised concerns about a potential shortage of the inputs required to make peat-free growing media if peat is completely removed from the sector. If there were supply shortages of peat-free growing media in general, or a lack of appropriate peat-free inputs for specific product ranges, retailers in England might have an incentive to seek to rely on the Market Access Principles to obtain and sell peat-containing growing media.

Even if sufficient volumes of peat-free growing media are available, the increased demand for the inputs required is likely to increase their cost, also providing an incentive for retailers in England to rely on the Market Access Principles to obtain and sell peat-containing growing media. Differences in production costs between peat-containing and peat-free growing media have previously slowed the transition away from peat, as peat has historically been cheaper than the inputs required for peat-free alternatives. More recently, the price of peat has risen, narrowing this price differential. If manufacturers struggle to obtain inputs for peat-free growing media and their costs of production rise, this differential could increase again, providing incentives to return to production of peat-containing growing media where this is permitted.

We consider that the professional sector is unlikely to be a source of peat-free inputs for the retail sector. Although professional growers consume a substantial quantity of peat-free inputs in their growing media, even if the price of peat-free inputs increased they would be unlikely to substitute to growing media with a higher peat content. Professional growers have powerful commercial reasons to make changes to the growing media they use incrementally and cautiously and will in any event need to begin to prepare for the ban on peat-containing growing media in the professional sector in 2028.

The ability of manufacturers to supply peat-containing growing media will depend on where they manufacture it – production must take place in one of Scotland, Wales, or Northern Ireland to be sold lawfully in England after the ban takes effect. There is no production of peat-containing growing media in Wales. Scotland is unlikely to be a significant source of peat-containing growing media for the retail sector following the retail ban in England as most Scottish production is for the professional market.

Production in Northern Ireland covers several manufacturers including some smaller businesses and is more likely to be a source of peat-containing growing media into the rest of the UK. However, Northern Ireland may not be a cost-effective location from which to supply all parts of England due to transport costs.

In the longer term, manufacturers could invest in new plants in Scotland, Wales, and Northern Ireland that would enable them to rely on the Market Access Principles to supply peat-containing growing media to England. However, there are questions about the incentives that manufacturers would have to invest longer term in the production of peat-containing growing media given that the Scottish Government has committed to phasing out the use of peat in horticulture and the Welsh Government has also announced that it will end the retail sale of peat in horticulture. The draft Northern Ireland peatland strategy contains a proposal to conduct a review and publish a key issues paper on peat extraction and the use of peat and peat products by 2023 and take forward any recommendations made.

Overall, we conclude that there will be limited incentives for manufacturers and retailers to sell peat-containing growing media in England once the ban takes effect. However, that finding depends on good availability of the inputs needed to make peat-free growing media. While we think large-scale shortages are unlikely, some shortages may arise and the more severe and more enduring the shortage, the more likely it is that manufacturers and retailers will turn to peat-containing growing media to bridge the gap, should peat-free growing media become too costly or be of a lower quality.

On balance, we therefore conclude that while there will be some change to the patterns of trade in peat-containing growing media across the UK that may be significant to individual businesses, these are likely to be modest in the context of the overall market for growing media. This is because most, if not all, manufacturers currently producing peat-containing growing media are also able to manufacture peat-free growing media and we expect trade in peat-containing growing media to be replaced by trade in peat-free growing media. For the same reason, we also do not expect there to be a significant impact on wider competition within the growing media market.

Introduction

This document sets out the Office for the Internal Market (OIM)’s findings in response to a request from the Secretary of State for Environment, Food and Rural Affairs (the Secretary of State) under s.34 of the UK Internal Market Act 2020 (the Act) to provide a report on a proposal to ban the sale of horticultural peat and horticultural peat-containing products in England.

The purpose of a s.34 report is to collate an evidence base to improve understanding of the likely effects on the UK internal market of policy divergence and to inform policy making. The legal framework under which the report has been prepared is set out in legal framework and proposed regulation.

The request for a report (the Request) was made by the Secretary of State on 2 August 2022 and was accepted by the OIM on 4 August 2022. The Request relates to a proposed regulatory provision(s) that will ban the sale of horticultural peat and horticultural peat-containing products (the proposal). The proposal applies to England only. The proposal has the potential to give rise to regulatory divergence across the UK as it is a devolved matter and each of the 4 governments in the UK may develop its own approach to the sale of peat and peat-containing products.

This report considers the economic effects on the UK internal market of the regulatory divergence between the 4 nations of the UK that arises because of the proposal. It examines how the OIM expects the market to adjust to the proposal, and in particular our expectations as to whether the Market Access Principles (MAPs), as set out in the Act, are likely to be relied on. It also considers the impact of these developments on the effective operation of the internal market in relation to horticultural peat and peat-containing horticultural products, in particular the impact on trade between the UK nations, compared with how it might have been expected to operate in the absence of the proposal.

The structure of the remainder of this report is set out below.

-

legal framework and proposed regulation provides the relevant background for this report. It first sets out an overview of the OIM and relevant aspects of the Act that provide the legal framework for the Request and this report. It then sets out the proposal, explains the rationale for it and sets out each of the 4 governments’ policies in relation to horticultural peat

-

the market for growing media in the UK provides an overview of our evidence base, an overview of the market for growing media in the UK and what the market would look like in the absence of the proposal. This section sets the scene for our analysis and conclusions

-

the impact of the proposal on the internal market analyses the impact of the proposal on the UK internal market. We do this by assessing the incentives and ability of consumers, retailers, and manufacturers to respond to the proposal. It examines how the OIM expects the market to adjust to the proposal, including our expectations as to whether the MAPs are likely to be relied on to sell peat or peat-containing growing media to consumers in England

-

conclusions sets out our conclusions on the impact of the proposal on the operation of the internal market in relation to peat and peat-containing growing media. In particular, it considers the impact on trade between the UK nations and competition in the growing media market, compared with how it might have been expected to operate in the absence of the proposal.

-

annex A discusses the consumer survey we commissioned, providing analysis of the results and technical details on the conduct of the survey.

Legal framework and proposed regulation

This section provides the relevant background for this report. It first sets out an overview of the OIM and relevant aspects of the Act that provide the legal framework for the request and this report. It then sets out the proposal, explains the rationale for it, and sets out each of the 4 governments’ policies on peat.

The OIM and its functions

The Office for the Internal Market

The Act established the OIM to carry out the Competition and Market Authority (CMA)’s [footnote 1] functions and powers under Part 4 of the Act. The OIM is part of the CMA and provides independent advice, monitoring, and reporting, to support the effective operation of the UK internal market [footnote 2].

The OIM’s function is to support the effective operation of the UK internal market through the application of economic and other technical advice. The UK internal market refers to the set of trading relationships within and across the 4 nations of England, Scotland, Wales, and Northern Ireland, rather than trade between the UK and the rest of the world.

The OIM’s functions include providing advice or a report under s.34 to 36 of the Act to one or more of the 4 governments in the UK on the effects that a specific regulatory provision (or proposed regulatory provision) has (or might have) on the operation of the internal market. The OIM can also produce reports under s.33 of the Act which monitor, and report on, issues relevant to the effective operation of the internal market.

The OIM cannot provide reports (or advice) on a regulatory provision in so far as it contains anything that is necessary to give effect to the Northern Ireland Protocol (NIP).[footnote 3] Similarly, under its monitoring and reporting functions, the OIM cannot review the impact of the NIP on the operation of the UK internal market (or legislation necessary to implement it).

Further information on the OIM’s functions can be found in the Guidance on the Operation of the CMA’s UK Internal Market Functions.[footnote 4]

Legislative framework under s.34 of the Act

Under s.34(4) of the Act, the OIM may consider, among other things, the potential economic effects of a proposed regulatory provision on the effective operation of the internal market. These could include, among other things, effects on prices, output, trade flow volumes, supply chains and appreciable changes in the competitive landscape (for example, barriers to entry, reduction in the number of suppliers, etc). These impacts or effects may be direct, indirect, and/or cumulative (arising from the interplay of regulations).[footnote 5]

The OIM acknowledges that there are wider policy reasons which may give rise to the regulatory differences referred to in this report. An assessment of any such wider issues falls outside the scope of this report. This report is likely to be only one factor, among others, which the 4 governments in the UK consider when determining their individual regulatory approaches.

The market access principles

The Act lays down a set of principles, referred to collectively as the MAPs, which aim to ensure that UK businesses can trade seamlessly across all nations of the UK, irrespective of regulatory differences between one or more of those nations.

One of the MAPs is the mutual recognition principle. Mutual recognition means that if goods can lawfully be sold in the UK nation in which they are produced, or first imported into from outside the UK, they can be sold in any UK nation. These goods do not have to adhere to any additional or different regulatory requirements that may be applicable in the UK nation in which they are being sold.[footnote 6] This means that goods which are lawfully produced in (or imported into) a UK nation, where it is also lawful to sell them, can be sold in another UK nation, despite any ban on the goods introduced by that other nation.

The OIM’s role does not include giving advice on the MAPs or taking enforcement action to support the operation of the MAPs. In this report, the OIM’s consideration of the MAPs is limited to the potential application of the MAPs when considering the potential economic effects of the proposal on the effective operation of the internal market.

The proposed regulation on the sale of horticultural peat

The proposal intends to ban the retail sale of peat and peat-containing products in horticulture by 2024 (the end of this UK Parliament). The proposal does not cover other uses of peat, such as its use in the whisky industry, nor does it include plant nursery stock that may contain peat. We understand that the proposal will be passed by primary legislation in the UK Parliament and applies only to England.

As the proposal was not, at the time of the request, a published Bill, we have relied upon the proposals set out in DEFRA’s consultation document[footnote 7] and subsequent response to the consultation.[footnote 8]

DEFRA told that us that the ban will make it unlawful to:

- sell peat or peat-containing products (subject to the application of the MAPs)

- offer or arrange to sell peat or peat-containing products

- keep peat for sale

- export peat from England for sale

- import peat into England for sale

We understand that there will be provisions made in the legislation for time-limited exemptions to the ban for professional growers, for example, commercial growers of fruit, vegetables and ornamental plants.

DEFRA’s specified policy objective in its December 2021 consultation[footnote 9] was to end any exemptions to the ban for professional growers by 2028. The specifics of these exemptions (including the dates of the exemptions, which may change) are being developed by DEFRA, who have been in discussions with professional growers on the technical barriers to replacing peat-containing growing media

The policy rationale for the regulation of peat

Reducing the extraction of peat and restoring peatlands is a policy motivated by environmental concerns. It is widely recognised that peatlands are one of the world’s largest carbon stores. When peat extraction takes place, whether for horticultural or other use, the carbon is released, contributing to climate change.

We understand that one of DEFRA’s main reasons for the retail market ban is the fact that the retail market constitutes the largest amount of peat sold in England (we estimate almost 2 thirds in 2021) and a retail ban would therefore contribute significantly to the reduction in the amount of peat sold in England overall.

The policy position on peat in other UK nations

Each of the 4 governments in the UK may develop its own approach to the sale of peat as this is a devolved policy matter. The current policy position in each of Scotland, Wales, and Northern Ireland, as we understand it, is set out below:

-

the Welsh Government announced in December 2022 that it intends to end the retail sale of peat in horticulture,[footnote 10] having previously consulted on this policy in conjunction with the UK Government

-

the Scottish Government has announced investment of £250 million to restore 250,000 ha of degraded peatlands by 2030 to help meet the targets in its updated 2018 to 2032 Climate Change Plan.[footnote 11] It has also committed to phasing out the use of peat in horticulture, the timescale for which will be informed by a consultation on ending the sale of peat in Scotland, which will be launched shortly

-

the Department of Agriculture, Environment and Rural Affairs in Northern Ireland consulted on an Equality Impact Assessment for the Northern Ireland Peatland Strategy in August 2022[footnote 12]. The publication of the consultation responses is expected in early 2023. The draft Northern Ireland Peatland Strategy contains a proposal to conduct a review and publish a key issues paper on peat extraction and the use of peat and peat products by 2023 and take forward any recommendations made.[footnote 13] The aim of the review will explore the supply and use of peat products and peat alternatives in Northern Ireland to develop future policy direction

It is important to note that this report does not comment on or consider the merits or efficacy of the policies of the respective governments. Each of the 4 governments in the UK may consider a wide range of factors when developing their policies with respect to the use of peat in horticulture, and this report is likely to be only one of these factors.

The market for growing media in the UK

This section provides an overview of our evidence base, an overview of the market for growing media in the UK, and our assessment of what the market would look like in the absence of the proposal. This sector sets the scene for our analysis and conclusions.

Evidence base

In conducting this analysis, we have brought together existing data and evidence, and gathered views and further data from market participants where necessary. We are grateful for the assistance we have had from stakeholders across the sector. A summary of the information we received from stakeholders is set out below:

-

each of the 4 governments provided helpful information on their respective peat strategies and data relating to their domestic markets. We spoke to officials with specific responsibilities for, or knowledge of, peat extraction permissions. Further to this, DEFRA’s consultation, [footnote 14] consultation impact assessment, [footnote 15] and summary of consultation responses [footnote 16] provided us with an understanding of the shape of the industry and the stakeholders involved

-

we obtained data and views from businesses, including manufacturers and retailers, through questionnaires and interviews. Information was received from all the major UK manufacturers of peat-containing and peat-free growing media, including businesses that specialise in peat-free growing media. We estimate that these businesses supply over 80% of the growing media to the retail sector. Our sample of retailers covered large DIY retailers, supermarkets, most of the large garden centre chains and some independent garden centres. We also spoke to 2 large businesses in the professional growers’ sector[footnote 17] (both of which had used peat-containing and peat-free growing media)

-

we supplemented the data from these individual businesses with additional information from a range of trade associations operating in the agricultural and horticultural sectors

-

we spoke with an alliance of environmental non-governmental organisations (NGOs) with an interest in peatland protection and restoration

-

we commissioned the market research agency IFF Research to conduct an independent, quantitative telephone survey of consumers (the OIM consumer survey – visit Annex A

-

we also undertook desktop research, in particular on consumer preferences and trends in the market. This included analysis of information from reports and research that had been conducted by the trade associations and NGOs, Companies House information, published annual reports of stakeholders, and various academic papers

The supply of growing media in the UK

Overview of the supply chain for growing media

Peat is a naturally occurring, organic surface layer within soils comprised of partially decomposed organic material, predominantly from plants. It is formed in bogs, also known as peatlands. Although the precise definition of peat for the purposes of the proposal has not yet been confirmed, we assume that it would apply to any material that requires planning permission to be extracted from peat bogs and any equivalent material imported from outside the UK.

The principal use for peat is in horticulture as an input to the manufacture of growing media, although there are other important uses, for example, in the production of whisky. The supply chain for peat-containing growing media can be split into 3 stages – extraction, manufacture, and sales, where the latter are split between retailers (selling to consumers) and professional growers (who typically buy directly from manufacturers or through specialist distributors). Peat manufacturers based in the UK typically also have peat extraction activities (ie they are vertically integrated).

The supply chain for peat-free growing media is similar to that for peat-containing growing media in that many of the manufacturers are the same and sales are made to both retailers and professional growers. The main difference is that the inputs for peat-free growing media are typically by-products of other industries and we have seen little evidence of vertical integration.

Peat extraction is regulated through the planning system. Peat has been commercially extracted for horticultural use from sites across the UK since the 1970s.[footnote 18] We understand that in most cases peat extraction sites in the UK have planning permission for extraction to no later than 2042 and any new peat-bog extraction would require appropriate planning consent.

As noted above, peat extraction from sites in the UK is largely vertically integrated with growing media manufacture. All the largest growing media manufacturers that we interviewed have ownership interests in peat bogs that are actively used for extraction. However, manufacturers also import peat into the UK, with more than 60% of the peat sold in growing media imported in 2021. Of these imports, about 2 thirds came from the Republic of Ireland and the rest from other EU nations.

Based on our evidence gathering we understand that the locations of the manufacturing plants operated by manufacturers supplying the UK retail growing media market are as follows:

-

there are 8 principal manufacturing plants in England supplying the retail sector including 3 plants operated by the 2 largest manufacturers. Five of these plants produce both peat-containing and peat-free growing media, the other 3 only produce peat-free growing media. There are also plants operated by small-scale producers

-

the manufacturing plants in Scotland principally serve the professional sector with only small volumes of retail growing media produced

-

there are 5 principal manufacturing plants in Northern Ireland (including one operated by the largest manufacturer) as well as some plants operated by smaller suppliers supplying the retail sector

-

there are no manufacturing plants in Wales

The supply of retail growing media products is concentrated with, we estimate, 2 large firms accounting for at least 2-thirds of the retail supply of peat-containing growing media and a further 11 firms supplying most of the rest of the retail market. Most manufacturers sell to both the retail and professional growers’ sectors but a few only serve one of these categories.

The UK retail market for both peat-containing and peat-free growing media is served by a wide range of retailers that fall into the following categories:

- chain DIY retailers

- chain garden centres

- independent garden centres

- supermarkets

- chain discount stores

- independent hardware stores

Most sales of growing media are made through chain DIY retailers and garden centres.[footnote 19] For these retailers, growing media is an important part of their offering, available all year round. For the garden centres, growing media is particularly important, despite making up a relatively small proportion of their turnover, as their customers may not make other purchases (such as plants and containers) if they are not able to buy growing media at the same time. For other retailers, such as supermarkets, growing media is more of an incidental item, available for a brief period as a seasonal item, and therefore much less important to their business. We understand, both from retailers and the OIM consumer survey, that online sales (from retailers and manufacturers) are a very small proportion of this market, in part because this is an expensive method by which to distribute growing media and so is unlikely to grow significantly in response to the proposal.

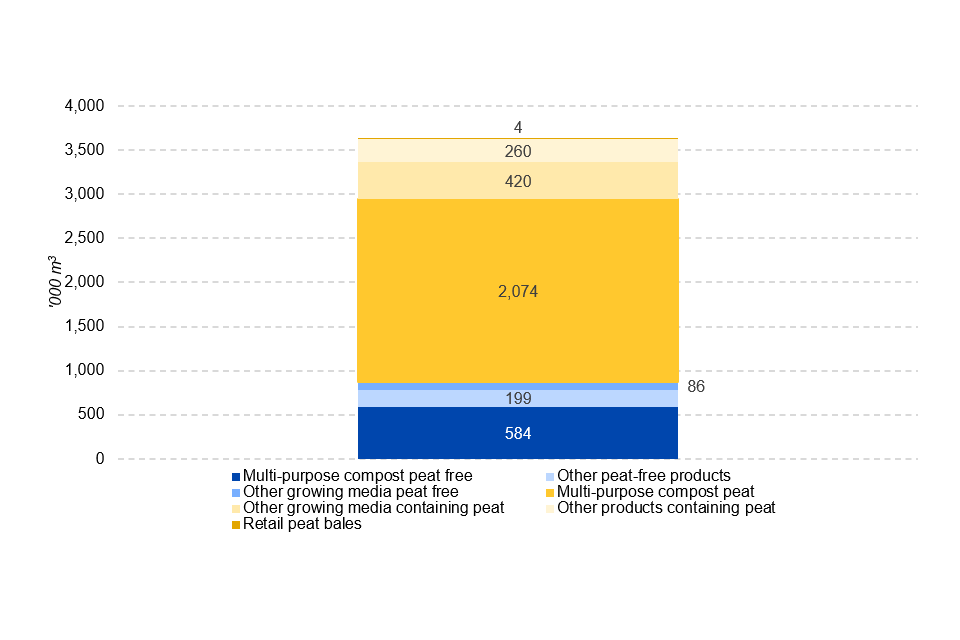

The retail (ie business to consumer) market for growing media is primarily made up of ‘multi-purpose compost’ products, but also includes a variety of other products such as ‘Grow Bags’, specific mixes for particular uses (such as ericaceous mixes for acid-loving plants), soil improvers, and bales of peat. Total retail sales are estimated at £400m to £450m per annum.[footnote 20] Figure 1 shows the breakdown of retail sales of growing media products in 2021. Of the 3.6 million cubic meters of growing media and horticultural products sold, peat-containing products accounted for around 3-quarters of this retail consumption by volume. In terms of product type, multi-purpose compost (which includes peat-containing and peat-free products) also accounted for around 3-quarters of total growing media volumes, with specialist growing media blends and other products accounting for the remaining quarter.

Figure 1: UK Volume of retail growing media by product, 2021[footnote 21]

Image description: A bar chart showing the 2021 UK Volume of retail growing media by product. Products (and their proprotions) included in the chart are: multi-purpose compost peat-free (16.1%), other growing media peat-free (5.5%), other peat-free products (2.4%), multi-purpose compost peat-containing (57.2%), other growing media containing peat (11.6%), other products containing peat (7.2%), retail peat bales (0.1%).

Source: OIM analysis using Horticultural Trades Association (HTA) Growing Media Monitor data.

Growing media is used by professional growers: ornamental horticultural businesses producing flowers and other decorative plants; farmers including those engaged in producing mushrooms, protected crops (ie those grown in greenhouses) and soft fruit; and propagator businesses producing plug-plants and other early-stage plants for sale to farmers and plant nurseries.

Professional growers vary both in terms of their size and their location across the UK, and their specific growing media needs are driven by the crops in which they specialise. Some crops are now mostly grown without the use of peat, others are produced only with the use of peat-containing growing media or, in the case of mushrooms, peat casing material (a layer of peat which is used as part of the growing environment).

Alongside UK sales, a very small proportion of growing media products made in the UK are exported (2% or around 125 thousand cubic metres in 2021).

Key trends in the supply of peat

This section outlines some trends in the growing media market over the period since 2011, focusing in particular on trends relating to the use of peat within growing media. In 2011, the UK Government set voluntary targets with the objective of achieving a peat-free retail growing media market in England by 2020 and in the professional market by 2030.[footnote 22]

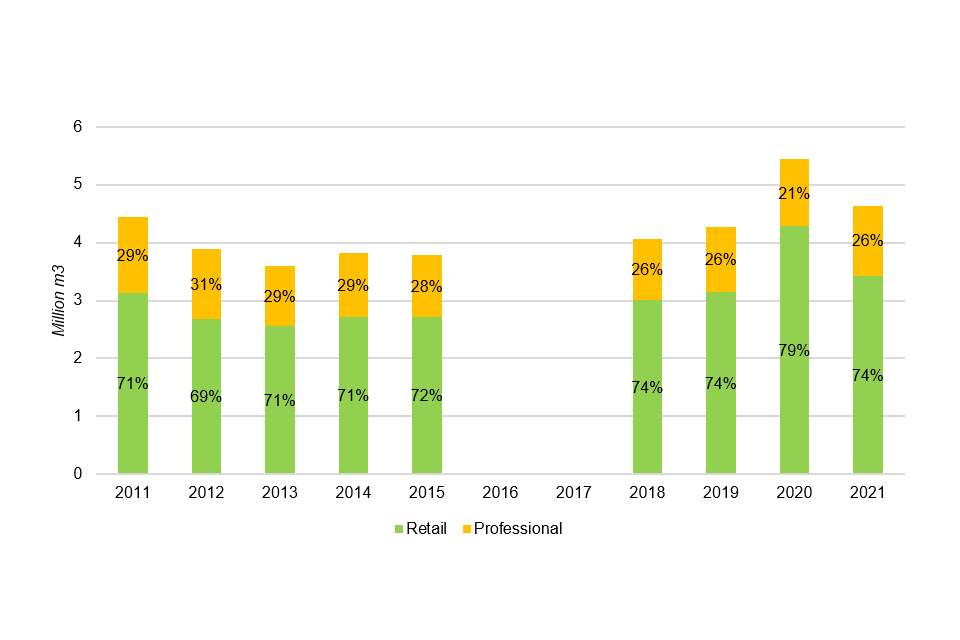

Figure 2 shows total growing media sales over the period 2011 to 2021. Over this period, sales of growing media have been fairly stable with the exception of a big increase in retail sales in 2020 as more people took up gardening during the pandemic.[footnote 23] Sales of growing media to the professional sector are considerably smaller than retail sales, with retail sales typically making up around 3 quarters of total volumes sold.

Figure 2: Total UK growing media sales, 2011 to 2021

Image description: A bar chart showing the total growing media sales over the period 2011 to 2021 broken down by retail and professional sales. The chart shows that sales of growing media to the professional sector are considerably smaller than retail sales, with retail sales typically making up around three quarters of total volumes sold.

Source: OIM analysis using HTA Growing Media Monitor data.

Note: Data is unavailable between 2016 to 2017 when evidence collection was paused.

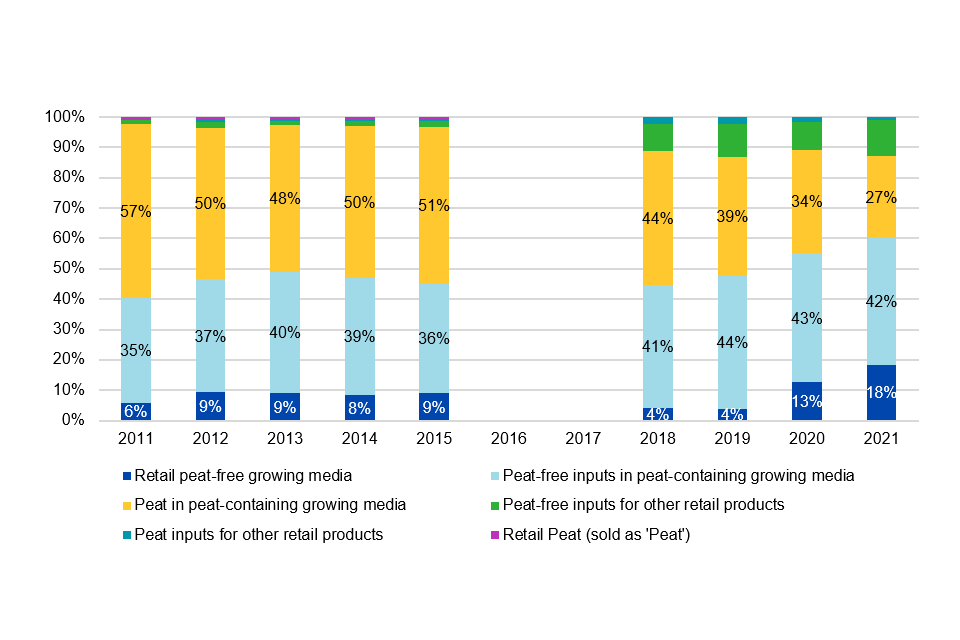

Overall, there has been a significant reduction in the volume of peat used in growing media over the period since 2011. We consider that this has been heavily influenced by an acceptance of the overall policy direction and a recognition that a reliance on peat is unsustainable in the longer term. The reduction has been achieved through both an increase in sales of peat-free growing media and a reduction in the proportion of peat used in peat-containing growing media (visit Figure 3). These trends apply to both the retail sector and the professional growers’ sector.

Figure 3 below shows the proportion of sales by volume between peat-containing and peat-free growing media over the period 2011 to 2021 in the retail sector. As of 2011, peat-free growing media accounted for 6% of retail sales, rising to 18% by 2021. However, peat-free inputs in peat-containing growing media also rose over the period, with the use of peat-free inputs in peat-containing growing media growing from 35% of all sales to over 40% by 2021. In total by 2021, non-peat components represented 70% of the retail market by volume. This growth in peat-free inputs in both growing media and other retail products was accompanied by a corresponding decline in peat as an input, which fell from 57% in 2011 to around 30% in 2021.

A similar trend of increased use of peat-free components occurred in the professional growers’ sector, with the proportion of peat-free components increasing from 42% in 2011 to 64% in 2021.

Figure 3: Proportion of sales by volume of growing media and horticultural products, 2011 to 2021[footnote 24]

Image description: A bar chart showing the proportion of sales by volume of growing media and horticultural products, over the period 2011 to 2021. Products included in the chart are: retail peat-free growing media, peat-free inputs in peat containing growing media, peat in peat-containing growing media, peat-free inputs for other retail products, peat inputs for other retail products, retail peat (sold as ‘peat’).

Source: OIM analysis using HTA Growing Media Monitor data.

Note: Data is unavailable between 2016 to 2017 when evidence collection was paused.

The combined impact of the increase in the sales of peat-free products and the reduction in the proportion of peat in peat-containing growing media has reduced the overall volume of peat sold by 40% over the period 2011 to 2021 across both sectors.

Based on a sample of large retailers, we estimate that the reduction in sales of peat-containing growing media (by volume) has accelerated significantly during 2022. This sample of retailers already had a higher proportion of fully peat-free sales in 2021 (41%) compared to the market as a whole (21%), but this increased dramatically to 82% of their sales in 2022.[footnote 25]

The market in the absence of the proposal

In England the broad policy intention to phase out the use of peat in horticulture has been under discussion for over 20 years. The UK Government introduced a voluntary target in 2011 to phase out the use of retail horticultural peat by 2020 and professional use by 2030. The UK Government outlined in 2018 that if adequate progress on these voluntary targets was not made by 2020, further measures would be considered.[footnote 26] The UK Government issued a consultation on the proposal in December 2021.

While retailers’ and manufacturers’ response to this clear policy direction has contributed to a significant reduction in the volume of peat in the market, we consider that this reduction would be tempered by a number of factors as set out below, such that peat sales volumes would not be eradicated in the absence of the proposal:

-

there is a sizeable proportion of retailers who currently do not have environmental, social and governance (ESG) policies with respect to peat or whose ESG commitments are unknown (retailers selling up to 40% of growing media). Further, the typically higher cost of peat-free compared to peat-containing growing media means that the incentive to stock peat-containing growing media is likely to remain for some retailers. We consider the recent sharp decrease in sales of peat-containing growing media (and proportionate increase in sales of peat-free growing media) in the sample of large retailers described above to be a direct result of manufacturers and retailers adapting their operations in advance of the expected introduction of the proposal

-

while there is a proportion of consumers with a preference for peat-free growing media, there remains a proportion (28%) whose purchasing decision is most influenced by the price of growing media.[footnote 27] Therefore, if the price difference between peat-containing and peat-free growing media were to increase so that peat-free was materially more expensive, this group of consumers may select peat-containing growing media on the basis of price

-

manufacturers may be expected to be slower to adapt to peat-free due to concerns over quality and availability of peat alternatives and some level of inertia or resistance to ending the use of peat. In particular, some growing media manufacturers expressed a view that they were hesitant to invest in the absence of a firm regulation that would require others also to do so

The impact of the proposal on the internal market

This section examines the impact of the proposal on the internal market. It focuses on the ban of the sale of horticultural peat and peat-containing horticultural products to the retail sector as this aspect of the ban is proposed to come into force in England during 2024.

The section begins by examining consumers’ demand for peat-containing growing media and their likely responses to ban on retail sales. It then examines the retail sector, highlighting factors that impact on retailers’ decisions in relation to stocking peat-containing growing media. It also explores the potential impact of a lack of availability of peat-free growing media or an increase in the cost of supplying it and how these factors may vary across retailers. It then looks at the manufacturers of growing media and discusses how the incentives and ability of manufacturers to supply peat will depend on the availability and price of the inputs required to produce peat-free growing media. It also considers the extent to which growing media manufacturers have existing manufacturing plants (or the incentive to invest in new plants) in UK nations other than England that would enable them to produce peat-containing growing media and rely on the MAPs to supply retailers in England.

Finally, the section discusses professional growers. As described in legal framework and proposed regulation, the specific details of the exemptions for the professional growers’ sector are not yet known but are expected to last until 2028[footnote 28]. Over this timeframe market developments are more uncertain and, in addition, the professional sector is considerably smaller than the retail sector. This report therefore only considers the professional sector sales ban in so far as the retail sales ban may have a knock-on effect on the professional sector and to the extent that early responses to the ban in the professional sector are likely to have an impact on the retail sector.

Consumers

This section sets out our analysis of the impact of the ban on retail horticultural peat sales in England. It first examines consumers’ purchasing behaviour and preferences in relation to growing media. It then assesses how they are likely to respond to the ban. In particular, it discusses the strength of consumers’ preferences for peat-containing growing media and how that affects the incentives of retailers to obtain supplies of peat-containing growing media from manufacturers by relying on the MAPs.

Consumers’ preferences and purchasing behaviour in relation to growing media

We commissioned a quantitative telephone survey of consumers who had purchased growing media in the 12 months to November 2022 to explore the knowledge and preferences driving the purchasing behaviours of consumers of growing media in the UK, and how these consumers might react to reduced availability of peat-containing growing media. A total of 182 interviews were completed with eligible consumers. The survey results and technical details about the research are included at Annex A.

This section focuses largely on the insights gained from the OIM consumer survey. These were consistent with what we heard from industry participants and the research they have conducted. Taken together, this evidence indicates that there is a proportion of consumers who prefer peat-free growing media, with environmental considerations being a driving force behind this preference.

We have not distinguished between consumers in different nations in this section as the evidence that we have reviewed from retailers does not suggest any material differences in consumer preferences and behaviour between nations. We took evidence from 5 retailers who operated in more than one UK nation, and they told us that their ranges of growing media products offered across each nation are largely the same and that customer attitudes to the peat content of growing media were broadly consistent in each nation. In addition, data from the retailers who responded to our requests for information indicated that the trends in sales of peat-containing and peat-free growing media were similar across all nations.

The OIM consumer survey found that 31% of consumers (unprompted) cited peat-free as being an important factor in their decision about which growing media to buy, with 19% overall saying it was the most important factor.

When prompted for their views on the ingredients (ie, the composition) of the growing media they purchase, 6 in 10 respondents said that being able to buy peat-free growing media was either essential to them (32%) or a preference (28%). In contrast, around one in 10 said that being able to buy peat-containing growing media was essential (2%) or a preference (8%).[footnote 29] Of the consumers who had only or mainly bought peat-free growing media in the last year, a large majority (83%) stated that their decision was due to ‘Climate change / ecological / environmental / sustainability concerns’.

Our survey asked consumers what they would do if they could no longer buy a specific type of growing media (peat-containing or peat-free) from the retailer they bought growing media from the last time they made a purchase. Our analysis of these questions (in combination with findings from earlier in the survey for some respondents),[footnote 30] which we have set out in full in Annex A, suggests that most consumers of growing media can be said to fall into one of 3 groups:

-

those who are motivated to buy peat-containing growing media: no more than one in 10 consumers

-

those who are motivated to buy peat-free growing media: at least 4 in 10 consumers

-

those who are unconcerned about what their growing media contains: at least 3 in 10 consumers[footnote 31]

Evidence from retailers we spoke to echo these findings, with a substantial proportion of their customers preferring to buy peat-free growing media, a relatively small group preferring to buy peat-containing growing media and a large group being indifferent to the peat content of their growing media. Retailers that we spoke to said that there was increasing demand for peat-free and an increasing focus on the sustainable use of raw materials. Retailers stated that media coverage and television gardening programmes were helping to educate their customers, alongside information and promotions that the retailers themselves are providing. One retailer stated that there were, ‘not many customers (openly) looking specifically for peat-containing products’. They also considered that the interest in peat-free growing media was stronger among younger customers, with the small proportion of their customers who actively seek peat-containing growing media being largely older customers or ‘traditionalist very experienced gardeners’ who want to ‘stick with what they know’.

In addition to preferences for peat-containing or peat-free growing media, we note that price remains an important factor in this market. In our survey, when asked what factors were important in their decision about which growing media to buy, price-related factors were cited more frequently than it being peat-free: 50% of consumers mentioned price as an important factor, and 28% said it was the most important factor.[footnote 32] Our survey findings indicate that those who were unconcerned about what their growing media contains were more likely to say that price was the most important factor in their decision-making than either those motivated to buy peat-containing growing media or those motivated to buy peat-free growing media.[footnote 33]

Retailers noted that price was an important factor for consumers in their choice of growing media, with most retailers ranking it second to quality in their views of consumer priorities. Many retailers noted that multi-buy deals and offers were key in driving purchases.

We asked retailers how they anticipated their customers would respond to changes in the price of growing media. For peat-containing growing media, retailers considered that a small increase in price would lead to their customers switching to peat-free or would not have a material effect, while all agreed that a 25% increase in price would lead to a significant drop in sales. One stated that, ‘In this scenario it would be pointless to continue stocking peat-containing products’. Retailers’ views varied on the likely impact of a small increase in the price of peat-free growing media, but none considered that it would lead customers currently buying peat-free to switch to peat-containing growing media. One stated that, ‘Given the ever-increasing public awareness of the peat issue we do not envisage a reduction in the growth we are seeing in peat-free sales. A small retail price increase is unlikely to affect this.’ All retailers agreed, however, that a 25% increase in the price of peat-free growing media would have a substantial impact on sales or lead to their customers switching to peat-containing growing media.

Overall consumers’ response to the proposal

We consider that consumers’ response to the proposal is dependent on peat-containing growing media being available in their local retailers at a competitive price compared with peat-free growing media. There is a small proportion of consumers who are motivated to seek out peat-containing growing media or to pay substantially higher prices for peat-containing growing media. We note that currently all the retailers we spoke to sell their standard bags of peat-free and peat-containing growing media at the same price, making a slightly smaller margin on peat-free growing media. This ensures that the prices at which retailers sell growing media do not influence customers’ decisions about whether to buy peat-free or peat-containing growing media.

If peat-containing growing media was available and sold at a competitive price compared with peat-free growing media, we consider that there would be a group of consumers who would potentially buy it. These consumers include the small group of consumers who currently are motivated to buy peat-containing growing media, and the larger group of consumers who are unconcerned about the product’s composition but are sensitive to price.

If there were shortages of peat-free growing media, this would change the incentives on consumers discussed above and may lead consumers that currently express a preference for peat-free growing media to change their purchasing behaviour, at least in the short term. One retailer we spoke to stated that during the pandemic, customers demonstrated that they would ‘buy the last bag available irrespective of brand or contents’.

If there were a reduction in the quality of peat-free growing media, this may also incentivise consumers to purchase peat-containing growing media. Retailers expressed some concerns over the quality of some peat-free growing media (for example, growing media sourced from green waste), and stated that some customers preferred peat-containing growing media due to previous poor experiences with peat-free alternatives.

Overall, therefore, our analysis suggests that there will be limited demand for growing media that specifically contains peat after the ban in England. Unless the ban results in either significant availability issues or increases in the price of (and/or reductions in the quality of) peat-free growing media, there will be little incentive for retailers to seek to rely on the MAPs to provide supplies of peat.

Retailers

This section looks at the retailers of growing media and their likely response to the proposal. As discussed above, in general we think there will be little pressure from consumer demand to provide peat-containing growing media, although such demand may increase in the event of shortages of supply, significant price increases or a reduction in quality of peat-free growing media.

This section examines the incentives of retailers in the light of any potential shortages of supply or significant price increases or reductions in quality. First, it highlights the extensive commitments among retailers to ending the stocking of peat-containing growing media, and comments on the role that nationwide stocking policies may have on the response of retailers that operate in more than one nation of the UK. Second, it explores the potential impact of shortages of peat-free growing media and the potential impact of an increase in the cost of supplying it, highlighting that these may vary across retailers. Finally, it concludes on the likely impact that these factors will have on the response of retailers to the ban on retail sales.

Role of environmental, social and governance policies

Many of the large chain retailers have, in advance of the proposal, made public commitments that they will no longer stock peat-containing growing media:

-

of the 3 big DIY retailers, all have committed publicly to stock only peat-free growing media by 2025 and in some cases earlier

-

of the 8 largest garden centre chains (operating the 10 major brands), 6 have stated publicly that they will be peat-free by 2025 or earlier

-

of the 9 leading supermarket chains, 6 have made a public commitment to be peat-free by 2025

The remaining retail volume is spread across a wide range of retailers. This includes some larger retailers (including certain supermarkets, garden centre chains and discount stores) who have not yet made any public commitment to stock only peat-free growing media. It also includes some smaller independent garden centres and retailers for which we do not have evidence on whether they have made commitments to being peat-free.[footnote 34]

We estimate that the retailers who have made public commitments to stock only peat-free growing media by 2025 account for at least 60% of the retail market for growing media by volume.[footnote 35]

We estimate that independent garden centres account for approximately 20% of total retail growing media sales by volume. These independent garden centres are a large and varied group. Based on our evidence-gathering, some of this group have made management decisions to stock only peat-free growing media after (or even before) the introduction of the proposal. As these are less likely to be formalised as public commitments, and given the large number of businesses involved, it is difficult to measure this accurately and it is likely that some of these businesses will have more flexible stocking policies.

Several of the retailers to whom we spoke highlighted the importance of policies to eliminate peat and stated that they would continue to pursue the elimination of peat-containing growing media absent the proposal. Some of these retailers also noted that their customers were aware of the peat issue, and this was driving their decisions on what they sold. Some retailers we spoke to that had ESG commitments to remove peat-containing growing media noted that if it were legal to do so in England they may continue to stock some peat-containing growing media, but only if there were supply shortages of peat-free growing media, or for specific product ranges where there is no good alternative.[footnote 36] We take the view that these businesses are unlikely to renege on these policies lightly, but recognise that some may do so if the availability of quality peat-free growing media were to fall substantially short of their requirements or there were to be a substantial price differential.

Retailer strategy across UK nations

Retailers that operate in Wales, Scotland and / or Northern Ireland, or have branches in these nations, will have the opportunity to stock peat-containing growing media after the implementation of the proposal. Retailers that operate in England will be able to continue to sell peat-containing growing media which has been produced in or imported into Scotland, Wales and Northern Ireland by relying on the MAPs.

Five larger retailers that operate in other UK nations as well as England stated that they operated the same polices across each of the nations,[footnote 37] and that they did not plan to pursue different policies with respect to peat in other nations.[footnote 38] In addition to this, data provided to us by these retailers shows that the increasing proportion of peat-free growing media sold is very similar across all nations. This suggests to us that at least some larger retailers are likely to pursue the same policies across all nations after the implementation of the ban in England and that there is likely to be limited variability in stocking decisions between UK nations.

Availability of peat-free growing media

Several retailers that we spoke to highlighted concerns around the supply of good quality peat-free growing media. One noted that there was currently an insufficient quantity of peat-free growing media available to move to an entirely peat-free growing media offer, while another noted that stocking decisions are dictated by the volume of peat-free growing media available to the market, and that while they wanted to offer (more) peat-free growing media it had not been possible so far. They thought this would improve in 2023 to 2024.

In the event of a shortage in peat-free growing media, lack of supply may disproportionately impact some sectors of the market. We have heard from some retailers that they already find it hard to obtain the volume of peat-free growing media that they would like and that these challenges are likely to increase following the introduction of the proposal. One garden centre chain told us that it would try to use its size to obtain supplies before smaller retailers and noted that this would cause difficulties for those smaller retailers. Of the smaller retailers we spoke to, one was part of a buying group, which allowed it to acquire growing media at lower cost and stated that this had a large bearing on their competitiveness, while the other was not part of a buying group and noted the importance of building strong relationships with manufacturers. In addition, as discussed in legal framework and proposed regulation, growing media is a ‘must have’ product for retailers such as garden centres, and there would be stronger incentives for these retailers in England to obtain peat-containing growing media, if it could be made available to them by relying on the MAPs, in the event of a shortage of peat-free growing media. Retailers such as supermarkets, for whom growing media is a seasonal product, may be less strongly incentivised.

Of the large retailers who responded to our questionnaire, 2 stated that they would only seek peat-containing growing media after 2024 if it were legal and if there were a serious major supply issue or if the volume of quality peat-free was insufficient to meet demand.

Cost and price differentials between peat-containing and peat-free growing media

The retailers that we spoke to stated that peat-free growing media cost more than peat-containing growing media. However, all stated that they currently sold peat-containing and peat-free growing media at the same price to consumers, so that the price of growing media would not be a factor in the consumer’s choice of which type of growing media to purchase. Many retailers noted that they therefore accepted a lower margin on peat-free growing media. Given that retailers have been willing to absorb these price differences, we do not anticipate that any small differences in the price would lead retailers to change their stocking decisions after the implementation of the proposal.

However, if there were shortages of sufficient peat-free growing media in the market, or if peat-containing growing media were substantially cheaper than peat-free growing media, this may have a greater impact on the incentives of retailers in England to rely on the MAPs to purchase peat-containing growing media. Retailers consider that there is a substantial group of their customers who are price sensitive, which is in line with our own findings (as described at the beginning of this section). We therefore consider that if the price differential were to become significant, some retailers would be strongly incentivised to stock peat-containing growing media.

Overall retailer response to the proposal

In summary, retailers’ incentives to continue selling peat in England are likely to be determined by any shortages in the supply of peat-free growing media, and the extent and duration of any price differential between peat-containing and peat-free growing media. While a growing number of consumers prefer peat-free growing media, there would nevertheless be demand for peat-containing growing media if it were substantially cheaper.

We take the view that the retailers most likely to rely on the MAPs to stock peat-containing growing media in England after the proposal takes effect are retailers without ESG commitments, including smaller retailers who may have more challenges in securing supplies of peat-free growing media. This incentive will be amplified if peat-free growing media becomes substantially (circa 25%) more expensive than peat-containing growing media.

Production of growing media

This section looks at the producers of growing media and their likely response to the ban on retail peat sales in England. As discussed above, we think that, in general, there are no widespread consumer preferences for peat-containing growing media and there are already extensive commitments among retailers to stop stocking peat-containing growing media. However, our research also suggests there may be pockets of demand in England for peat-containing growing media which may incentivise manufacturers who are not affected by the ban to consider relying on the MAPs to supply this product in England.

This section explores the incentives and ability on the part of manufacturers to do so. It considers 2 key factors that impact on this: first, whether the inputs required for the production of peat-free growing media will be available in sufficient volumes and what will happen to the relative prices of these inputs and peat; and second, whether growing media manufacturers have existing manufacturing plants in UK nations other than England (or would have the incentive to invest in new plants) that would enable them to produce peat-containing growing media and rely on the MAPs to supply retailers in England.

The supply of inputs for peat-free growing media

The further shift to peat-free growing media will require a significant increase in the availability of the inputs required to produce it. As illustrated in Figure 4, in 2011 the UK consumption of peat-free inputs for both peat-reduced and peat-free growing media across the retail sector was 1.3 million cubic metres. This rose to 2.4 million cubic metres in 2021, increasing by a third since 2018. It would require up to a further 1 million cubic metres of peat-free inputs[footnote 39] to be found by 2024 for the current volume of growing media consumed by the retail sector to be produced on a peat-free basis.

Figure 4: Peat-free inputs in growing media sold to the retail sector, 2011 to 2021

Image description: A bar chart showing the relative proportions of peat-free inputs in growing media sold to the retail sector over the period 2011 to 2021. Products included in the chart are; wood-based, bark, coir, composted green waste (green compost), other (organic), other (mineral), soil/loam, spent mushroom compost. Key figures are included in the main text.

Source: OIM analysis using HTA Growing Media Monitor data.

Note: Data is unavailable between 2016 to 2017 when evidence collection was paused.

The volume of peat-free inputs used in growing media has varied over the period 2011 to 2021, but the materials were typically wood-based inputs, coir, bark and composted green waste. These 4 materials made up almost 3 quarters of all peat-free components in 2021, and over 50% of the components of all growing media and horticultural products.

In 2021 wood-based materials made up the largest single peat-free component sold in the retail market, accounting for over 40% of all peat-free components. Wood-based materials are typically sourced from forestry by-products, including offcuts from trees supplied to the timber industry and sawdust from sawmills.[footnote 40] We note that as these materials are a by-product of other manufacturing processes, supply can be affected by downturns in other industries.

Manufacturers told us that they compete for the supply of wood-based materials with other industries such as wood biomass for fuel, a view supported by academic research.[footnote 41] Further, manufacturers explained that they consider that wood-based materials can only be used as a dilutant and not as a complete replacement for peat in growing media.

Bark was the second most used peat-free input in 2021, making up a little over 10% of all peat free retail growing media and horticultural product components. Like wood-based materials, its supply can be affected by downturns in the demand for timber and it faces competing demand from other uses, such as from the landscaping industry and fibreboard production.[footnote 42]

Coir similarly made up around 10% of all peat-free retail growing media and horticultural product components in the retail sector in 2021. Coir is produced from the discarded husk of coconuts. Approximately 90% of the world’s coir is sourced from India and Sri Lanka. Coir is viewed as an excellent growing media for many crops;[footnote 43] however, its supply can be affected by shipping costs and unseasonal monsoons, and it has historically been more expensive than peat.[footnote 44]

Composted green waste also made up around 10% of the volume of peat-free growing media components sold in the retail growing media sector in 2021. Composted green waste is largely produced by waste management companies from green waste.[footnote 45] As a result, there are challenges with controlling the proportion of contaminants in composted green waste.

The notable increase needed in the use of peat-free inputs raises important questions about the ability of manufacturers to move completely to peat-free retail sales in England. The ability of firms to do so will largely depend upon their ability to expand base materials sufficiently to meet demand. In their response to the DEFRA consultation, the HTA outlined 3 materials (wood-based, bark and coir) as having the strongest potential to displace material volumes of peat in the short term.

The HTA analysis suggested that up to a further 2 million cubic metres of peat-free inputs could be made available by 2026, with this increase largely coming from wood-based materials (1.5 million cubic metres) and coir (0.45 million cubic metres). This would fill the gap left by the removal of peat from the industry, however, the HTA highlighted that such an increase would require significant capital investment, and joint governmental and industry action, to remove barriers to accessing materials. They estimated that £5 million to £20 million of investment would be required in the next 3 years to increase wood-fibre production to 1.5 million cubic metres a year, and that similar investments would be needed to increase other peat alternatives.

Businesses we spoke to expressed mixed views about the likely availability of additional supplies of peat-free inputs. One manufacturer suggested that the use of peat in growing media could in principle be replaced by coir if supplies were brought into the UK from beyond traditional regions of coir production. Another suggested that there are currently sufficient volumes of bark and wood fibre available in the UK to accommodate a large increase in supply.[footnote 46] However, several manufacturers highlighted concerns about the availability of peat-free inputs. One manufacturer was concerned about the availability of peat-free inputs because of the proposal, and another expressed general concerns about the availability of alternatives, particularly of high-quality materials.

The concerns of the industry are largely supported by the academics Bek et al.[footnote 47] Their report suggests that the quantities of coir, bark, wood fibre and green waste produced could be increased significantly, and that enough coir could be produced to replace horticultural peat. However, they highlight some of the issues in supplying alternatives including issues with the quality and logistics of composted green waste and concerns around the time needed to increase coir production. We heard a similar point from a coir producer supplying the UK market: coir expansion is possible in the medium term and even in the short run additional supplies for the UK market could be found, although it would likely be derived from a fragmented supplier base and there could be challenges in achieving consistent quality across such a large supplier base. Additional processing facilities would be required; a large plant would cost between £0.8 million and £1.2 million[footnote 48] to set up.

Businesses also presented mixed views on the extent to which the need to invest in processing capacity to handle peat-free production was a barrier to the expansion of the supply of peat-free growing media. One business indicated that the investment required to increase production capacity of bark and wood fibre was a greater challenge than sourcing raw materials.[footnote 49]

However, multiple firms highlighted the investments they have already made, suggesting that investment is unlikely to be a barrier to increasing supply. One manufacturer stated that they had invested in research and development into peat-free growing media and new facilities and expected further investment on peat-free manufacturing equipment and infrastructure over the next 5 years. Another firm indicated they had made significant investment in capital to treat wood-fibre and import coir, and a third highlighted the investments they had made in facilities to screen and condition peat-free materials.

The relative cost of production of peat-containing and peat-free growing media

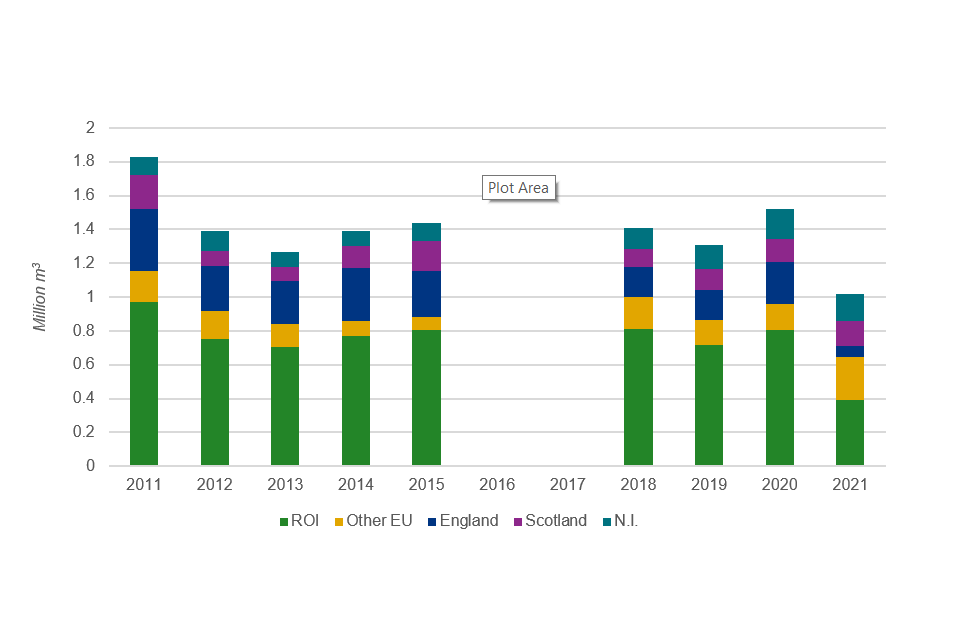

The difference in the production costs of peat-containing and peat-free growing media has previously slowed the transition away from peat, as peat has historically been cheaper than peat-free inputs. However, some manufacturers we spoke to indicated that there has been an increase in the price of peat in recent years. They considered that this was largely due to the decrease in the volume of peat supplied from the Republic of Ireland.

Figure 5 shows annual peat source volumes by location for peat used in retail horticulture products for the period 2011 to 2021. England historically made up a substantial proportion of the peat volumes supplied from the UK, but this has been declining and was very low in 2021. In contrast, supplies from Northern Ireland have increased and supplies from Scotland, while more variable, are also significant. Peat is not sourced from Wales.

Figure 5: Source of peat volumes sold to the retail sector, 2011 to 2021

Image description: A bar chart showing the relative proportions of the source locations of peat volumes sold to the retail sector over the period 2011 to 2021. Source locations included in the chart are: Republic of Ireland, other EU, England, Scotland, and Northern Ireland. Key figures are included in the main text.

Source: OIM analysis using HTA Growing Media Monitor data.

Note: Data is unavailable between 2016 to 2017 when evidence collection was paused.

Figure 5 illustrates that the volume of peat imported from Ireland decreased between 2020 and 2021 by 52%, whilst volumes from other EU nations increased by 66%. This change is likely to have arisen because Bord na Móna, the state-owned Irish peat-extractor, stopped peat extraction on its bogs in 2020.[footnote 50] It will continue to supply peat while it runs down its stockpiles, which are expected to last until 2024. As a result, manufacturers have increased imports from other nations, principally from the Baltic region.[footnote 51]

Although we heard that peat-free inputs remain more expensive than peat,[footnote 52] we understand that this cost differential has narrowed in recent years. The decline in the volume of peat extracted in the Republic of Ireland has withdrawn a substantial source of supply from the market and pushed up prices, and anecdotal evidence suggests alternative supplies from the Baltic region cost more to import.

If peat-free growing media inputs continues to be more expensive than peat-containing growing media inputs this will incentivise the production of peat-containing growing media outside of England. However, if the developments in the peat-extraction market described above continue to narrow the cost differential this incentive will be reduced.

Potential for supply of peat in England

The extent to which there is the potential for manufacturers to be able to supply peat-containing growing media to England by relying on the MAPs (should the demand arise) will depend on 2 main factors: first, the location of existing manufacturing plants; and second, the length of time regulatory divergence might last and hence the incentive to make new investments.

We estimate that a majority of the volume of UK retail growing media is manufactured in England and these plants would not be able to rely on the MAPs to sell peat-containing growing media after the ban takes effect. However, manufacturing plants in Scotland or Northern Ireland (there are no plants in Wales) could rely on the MAPs to export peat-containing growing media to England.

The manufacturing plants in Scotland principally produce growing media for the professional sector and manufacture only small volumes of retail growing media. Even if that were to change, Scotland based businesses pursuing new retail customers with a peat-containing growing media product would incur customer acquisition costs, while the opportunity to supply any new customers could be limited to a short time window, given the Scottish Government’s commitment to phase out the use of horticultural peat.

The major growing media manufacturing facilities in Northern Ireland are operated by several different businesses, one of which is the UK’s largest growing media supplier. Each of these businesses supplies the retail sector and most have customers across the UK. Some of these businesses also have well-established relationships supplying to independent garden centres that we identify as among the retailers most likely to stock peat-containing growing media after the ban takes effect. We therefore find that any supplies of peat-containing growing media to England after the ban takes effect would be most likely to come from Northern Ireland.

The geographic market that businesses based in Northern Ireland could economically supply with peat-containing growing media may not extend to the whole of England. One manufacturer based in the south of England noted that the peat-free growing media it produced was more expensive to manufacture than the peat-containing growing media produced by its competitors based in Northern Ireland. Despite this, it estimated that the transport costs involved in supplying customers in the south of England meant that its growing media would be cost competitive compared with supplies from Northern Ireland for customers in the south of England. Whether such cost differences would disincentivise the supply of peat-containing growing media after the peat ban takes effect will depend at least in part on whether retailers want to stock peat-containing growing media because it is cheaper than alternative peat-free growing media or because of a lack of availability.

The incentives on manufacturers based in UK nations other than England to make further investments that would enable them to supply peat-containing growing media from the rest of the UK to England will in part depend upon if, and when, the other UK nations also ban the sale of peat-containing growing media. If the other UK nations introduce bans on the sale of peat in the short term (or are expected to do so), manufacturers would be less likely to gain a return on capital investment, management time, marketing costs or similar that would be required. This would particularly be the case for manufacturers hoping to win new customers by supplying peat-containing growing media after the introduction of the ban, rather than those supplying existing customers.

As set out in section 2, the Welsh Government announced in December 2022 that it also intends to end the retail sale of peat in horticulture from 2024. The Scottish Government has also committed to phasing out the use of peat in horticulture. The draft Northern Ireland Peatland Strategy contains a proposal to conduct a review and publish a key issues paper on peat extraction and the use of peat and peat products by 2023 and take forward any recommendations made.

This suggests that any divergence between the UK nations in terms of policy on peat may be relatively short-lived. As such we anticipate that growing media manufacturers would have limited incentive to invest in new capacity that would enable them to supply peat to England, although it is possible that these incentives could be a little stronger if there are shortages in the supply of peat-free inputs and retailers in England are willing to stock peat-containing growing media.

Overall manufacturer response to the proposal

In general, we anticipate that the proposal will accelerate the long-standing market trends towards greater production of peat-free growing media. Over the past decade manufacturers have made significant investments to move towards peat-free growing media. They have also worked with industry stakeholders to set up a taskforce focused on ending the use of peat as early as 2025 and no later than the end of 2028.[footnote 53]