Project Gigabit winter update 2022 to 2023

Published 27 February 2023

BUDK quarterly update winter 2023

Ministerial foreword

Secretary of State Rt. Hon Michelle Donelan MP, visiting Cumbria

As the first Secretary of State for the Department for Science, Innovation and Technology, I have a mission: to unlock the potential of technology to supercharge growth, delivering prosperity, security, and opportunities for communities in every corner of the country.

Together, we can chart a new path for Britain and our place in the world, by bringing together bold researchers and budding entrepreneurs to build an economy that is fit for the future and delivers on the Prime Minister’s Five Key Priorities. But if that economy is to benefit British businesses and people across the whole country, then we must improve internet access for all.

This was my motivation as Secretary of State for Digital, Culture, Media and Sport, and it continues to drive my work today. Because the work of Building Digital UK is more important than ever.

Our £5 billion Project Gigabit mission will deliver lightning-fast, reliable broadband to every corner of the United Kingdom, ensuring that everyone has access to the best connectivity wherever they live, work and study.

Before Christmas, I met staff and apprentices at Fibrus’ training centre in Penrith to celebrate the signing of their £108 million Cumbria contract. On a foggy autumn morning, I saw for myself the difference which Project Gigabit is making, creating new industries with new jobs and new skills for communities in Cumbria. And, with contracts awarded everywhere from North Dorset to North Northumberland, this is far from the only success story.

This latest Building Digital UK report presents a milestone achievement, with £1 billion of Project Gigabit’s funding now available to suppliers. To have pledged such a significant sum only two years since launch is a clear signal of how far – and how fast – we have come in boosting gigabit-capable broadband across the UK.

We continue to award a steady stream of multi-million pound Project Gigabit contracts to broadband suppliers. In January, the government announced £36 million of public funds to help deliver just over 19,000 connections in parts of Cornwall, from Bodmin to Tintagel. This commitment builds on similar sums of money announced last year, connecting tens of thousands of people from the South West and the North East - sending a clear signal of my dedication to tackling poor connectivity in some of the most rural and remote parts of the country as a priority.

And we are not stopping there. In the next few months, we will witness a further acceleration of the rollout of Project Gigabit, with contracts set to be awarded covering locations across Cambridgeshire, Norfolk, Suffolk, the New Forest and Shropshire, and spades in the ground in many of the places covered by contracts signed last year.

Whether you are learning new skills online or spreading the word about your start-up on social media, collaborating with colleagues or keeping in touch with family, everyone deserves better connection in a world where the internet matters more and more. So I am proud to back a project that is making that happen.

Rt. Hon Michelle Donelan MP

Secretary of State for the Department for Science, Innovation and Technology

Summary

We have a total of 20 live procurements and contracts in place to support the deployment of gigabit-capable broadband to the hardest to reach areas of the UK.

Since the autumn quarterly update we have:

- Awarded two contracts in Central and South West Cornwall, totalling £36 million and covering up to 19,250 premises

- Launched four new procurements in West and East Sussex, Kent, South Wiltshire and Bedfordshire, Northamptonshire and Milton Keynes

The investment in these regions reflects the government’s commitment to roll out gigabit-capable broadband nationally and to create a level playing field for hard-to-reach communities and businesses around the country, bringing with it economic and social benefits for local people.

Our progress to date means that over £1 billion of public money has now been made available to broadband suppliers to extend gigabit-capable broadband to some of the hardest to reach parts of the country.

In addition, BDUK has partnered with National Parks England, Openreach and Trenches Law to agree an accord which will enable efficient gigabit-capable rollout while protecting these beautiful landscapes.

Finally, the government has continued its Alpha trials it launched in December 2022, which will test the capability of Low Earth Orbit (LEO) satellites to deliver improved digital connectivity to Very Hard to Reach premises. The government has already announced the first four sites and will be announcing further locations in the coming weeks.

73% of the UK is gigabit capable

Progress towards a gigabit UK

This section outlines the level of gigabit-capable coverage across the devolved nations and regions, in urban and rural areas, by supplier and by residential and business premises.

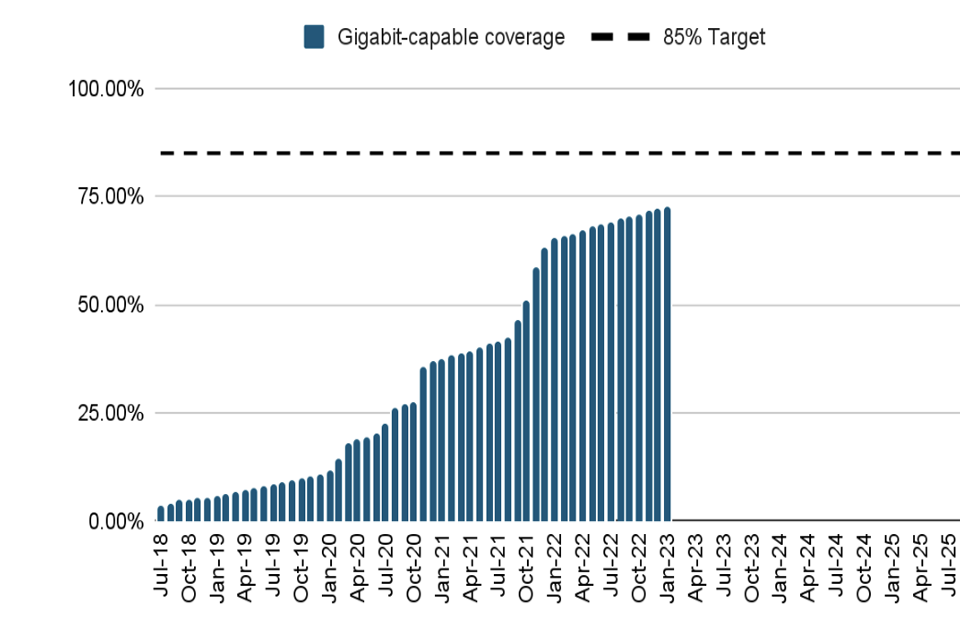

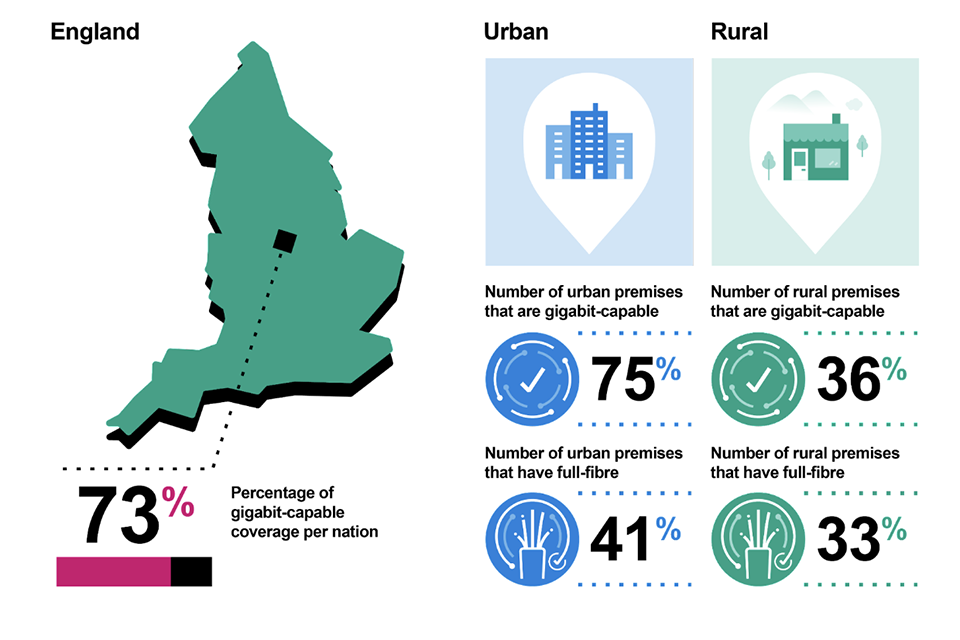

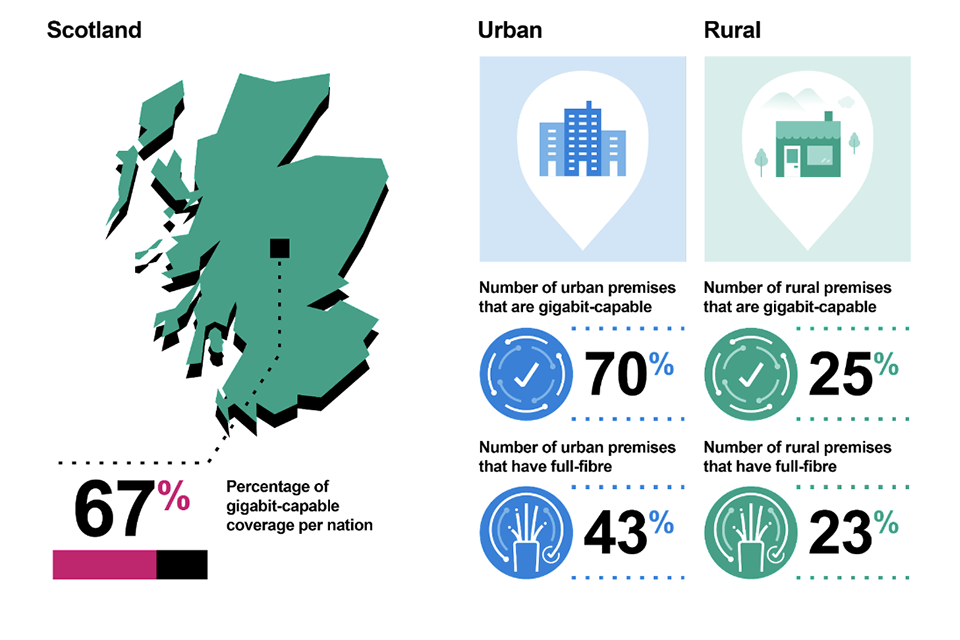

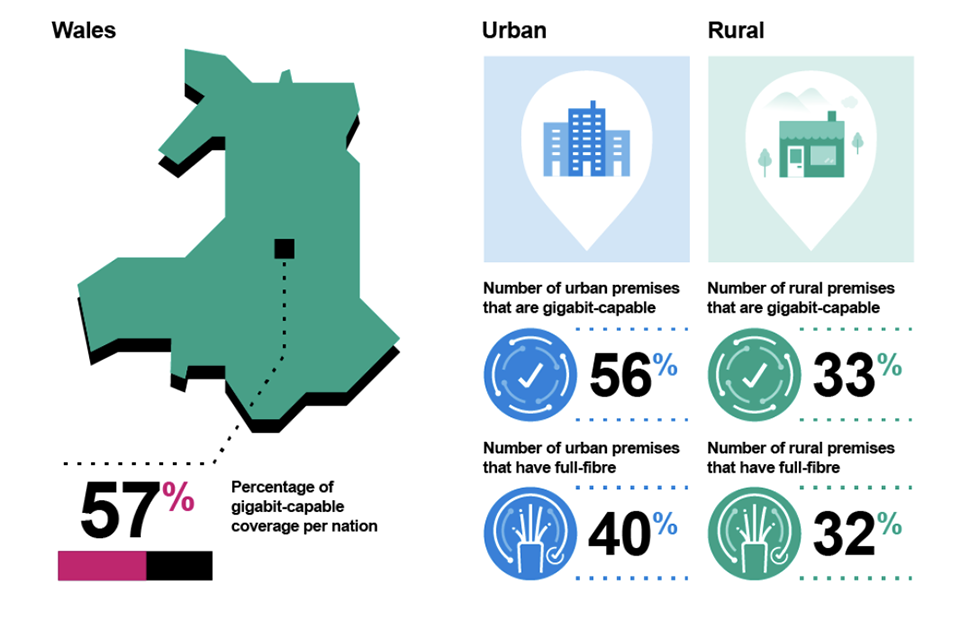

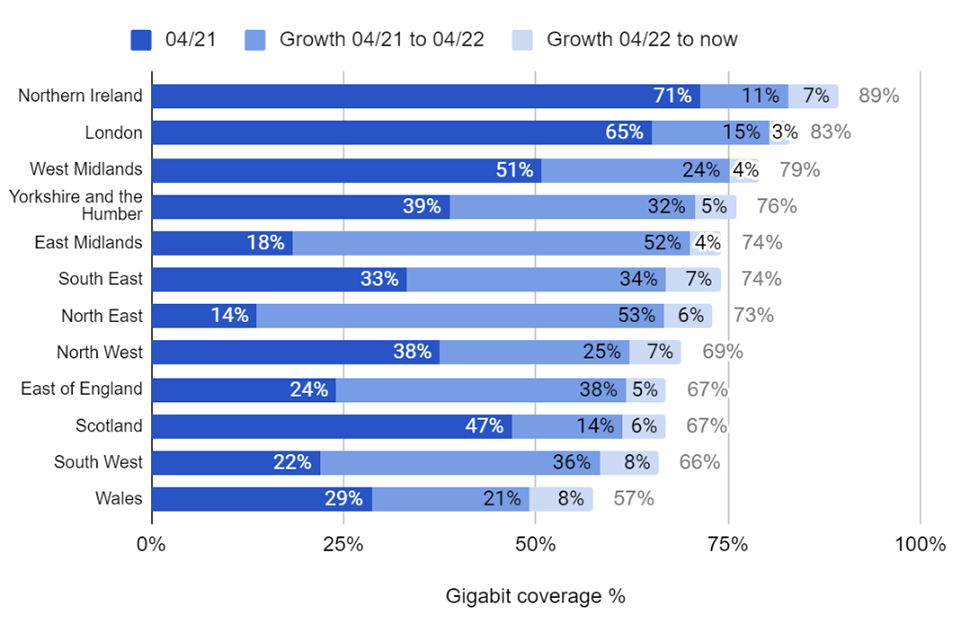

The graphs and infographics evidence the steady increase in coverage of gigabit-capable and full fibre coverage across the majority of the UK. Most notably, the latest Ofcom coverage datasets show each of the nations benefiting from an uptick in rural coverage of between 2% and 6%, outlining the progress broadband suppliers are making outside urban areas. The latest ThinkBroadband data shows a continued increase in coverage, region by region, although, as expected the pace of growth is slower than was achieved last year when Virgin Media O2 upgraded their cable network. Of the regions and devolved nations, Wales and the South West have seen the biggest increases in gigabit coverage since April 2022. Overall, these improvements are also shown in the UK gigabit-capable coverage trajectory chart, which outlines our progress towards our goal of 85% of the UK having access to gigabit-capable speeds by 2025.

The information we outline is based on two broadband coverage data sources:

- Independent website ThinkBroadband.com, which provides the most up-to-date information on national coverage, and is used to provide national and regional coverage statistics. This was sourced on 7 January 2023 and represents the latest coverage snapshot up to that date

- Ofcom data collected in September 2022 for its Connected Nations December 2022 report, which is the most up-to-date source of coverage broken down by residential and business premises, as well as rural and urban premises.[footnote 1]

The graph below shows how gigabit coverage has increased since July 2018, and how this tracks against our forecast trajectory, combining BDUK and commercial delivery, towards our coverage target.

UK gigabit-capable coverage trajectory (Source: DSIT analysis, ThinkBroadband. Data is accurate as of 7 January 2023.)

The trajectory of gigabit capability in the UK

The graphics below show the coverage of gigabit-capable and full-fibre broadband across the UK by nation, broken down by rural and urban premises.

Gigabit-capable coverage across the devolved nations (Source: ThinkBroadband, October 2022) and broken down by rurality and type of infrastructure (Source: Ofcom, Connected Nations Report, December 2022. Data accurate as of September 2022.)

Gigabit capability in Northern Ireland

Gigabit capability in England

Gigabit capability in Scotland

Gigabit capability in Wales

The graph below shows the growth in gigabit-capable broadband coverage across the devolved nations and the regions of England since the launch of Project Gigabit.

Growth of gigabit-capable coverage by region and devolved nation (Source: ThinkBroadband. Data accurate as of 7 January 2023)

Growth of gigabit capability per region

In September 2022 (the latest date for which this information was collected by Ofcom), 44% of business premises had access to gigabit-capable broadband.

Gigabit-capable coverage by business premises - (Source: Ofcom, Connected Nations Report, December 2022. Data accurate as of September 2022)

44% UK businesses are passed by gigabit-capable broadband

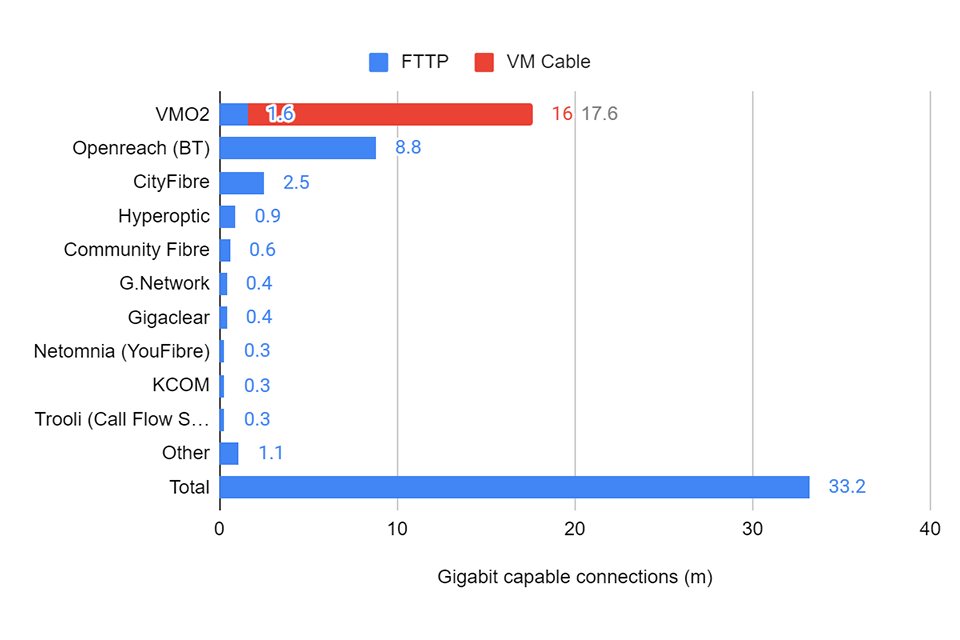

The graph below shows the number of premises passed with gigabit-capable broadband by supplier. Since we presented this data in the last update, Netomnia and Gigaclear have added 100,000 premises each. The data for this chart is reliant on reporting and public announcements by operators.

Premises passed (million) by a gigabit-capable network, broken down by supplier (Source: Operator Reports. Data is accurate as of February 2023.)

Premises passed by a gigabit capable network, broken down by supplier

Update on Project Gigabit Delivery Plans

Project Gigabit Procurements

We have announced six contract awards under Project Gigabit, for £164.8 million, and have launched 14 further procurements with a combined estimated value of £906.7 million. This includes two local contracts awarded in South West and Central Cornwall in January covering around 19,250 premises.

In the past quarter, we have launched new regional procurements in Kent, West and East Sussex, Bedfordshire, Northamptonshire and Milton Keynes, and South Wiltshire. We expect to launch a further three regional procurements in Derbyshire, Nottinghamshire and West of Lincolnshire, and Leicestershire and Warwickshire in the coming weeks, along with two more local procurements for North and South Oxfordshire.

The responses to the latest Open Market Review, which ran from 5 September to 17 October, have now been evaluated and assured. Information was received from 36 out of the 53 suppliers who were invited to respond. The second four-monthly national Open Market Review, to which all suppliers are invited to respond, launched on 20 January and will close on 3 March.

Over recent months we have identified the first areas where a cross-regional supplier framework might be needed. We have taken into consideration the new data received in response to the first national rolling Open Market Review to inform the proposed intervention areas, and we have now commenced a market engagement exercise on these areas, which is open to all suppliers. The procurement is expected to launch in the coming months.

In Wales, initial market engagement has taken place with suppliers and final intervention areas are now being developed with the aim of launching procurements by the summer.

The Open Market Review for Northern Ireland launched on 8 December and closed on 27 January. The responses are currently being evaluated, with a Public Review expected to launch in April and procurement expected to start in the autumn.

In Scotland, a Public Review is scheduled to launch in March, with procurements expected to follow later this year. The Public Review responses to the proposed local procurement in the Inverness area have been evaluated and assured by Highlands and Islands Enterprise (HIE), and soft market testing is now underway with interested suppliers.

Project Gigabit Procurement Progress (Source: BDUK. Data is accurate as of February 2023.)

Percentage increase in gigabit procurement process

Project Gigabit Intervention Areas Map

Project Gigabit interventions area map

See Annex for further details

Gigabit Vouchers

Over 114,000 vouchers have been issued so far under the Gigabit Broadband Voucher Scheme and its previous iterations. To date 84,000 of these vouchers have been used to connect premises to gigabit-capable broadband.

In November 2022, we announced upgrades to the voucher scheme, to deliver more targeted support and enable suppliers to connect premises in particularly hard-to-reach areas. The voucher scheme now provides a subsidy of up to £4,500 for residents and businesses towards the cost of installing gigabit-capable broadband via local community broadband projects. These scheme updates have been implemented in our new voucher platform, which we have successfully migrated all voucher suppliers on to. We have already received project proposals from suppliers for areas that could not have been reached with the lower voucher value.

Progress of Project Gigabit Vouchers [Source: BDUK. Data is accurate as of 18 January 2023.]

114,000 gigabit vouchers awarded

Public Sector Hub upgrades

Since launching in 2021 with £110m worth of funding available, GigaHubs projects have been established with local authorities in Leicestershire, Oxfordshire and Dorset, as well as through our partnership with NHS Scotland. We have connected a total of 27 sites in the last quarter.

We also continue to support the Department for Education on the project to connect schools across England with gigabit-capable broadband. The first tranche of procurement, in the South West region, launched on 23 January, and the procurement process in the North East and North West regions is scheduled to launch by March 2023.

Project Gigabit in action: Wessex Trailers

Wessex Trailers, based in Dorset, is a long-established company that supplies trailers to local authorities, private companies and individuals across the UK and Europe.

Benefitting from the Gigabit Broadband Voucher Scheme, the business received a gigabit broadband connection in 2021.

Wessex Trailers, like many rural businesses in the area, had struggled with an extremely slow internet connection. This made it difficult to run their e-commerce store efficiently and impacted workforce productivity. Without a dependable internet connection, they were unable to grow the online side of the business. This was all the more concerning during the Covid-19 pandemic, when more people turned to shopping online.

After being connected to full fibre broadband, Wessex Trailers has been able to significantly expand their e-commerce, boost manufacturing on site and increase turnover. They have added a spare parts element to their company website which has further increased revenue, something they could not have even considered with their old broadband connection.

James Eaton, managing director of Wessex Trailers told BDUK:

“We wouldn’t have had an internet business without the gigabit voucher scheme.

“When Covid hit, we panicked. But because we had decent broadband, the online sales grew - in three years it has trebled. The manufacturing side of the business has come back as well now so we’ve boosted our turnover, and we wouldn’t have been able to do that if we didn’t have reliable broadband”

“I would encourage other people to do it. The online sales now has transformed the business. It’s made us think of doing things differently in the future.”

Case study: Wessex Trailers

Case study: Wessex Trailers

Project Gigabit across the Union

Scotland

The Scottish Government’s £600 million Reaching 100% (R100) programme, supported with £49.5m of additional UK government investment, has now delivered over 15,000 gigabit-capable connections across Scotland. We continue to work with the Scottish Government to ensure that future Project Gigabit activity in Scotland builds on the successes of the R100 programme.

The latest Scotland-wide rolling Open Market Review closed in October 2022 and soft market testing commenced in February 2023. This data, when combined with the findings of previous engagement with suppliers, will allow the Scottish Government to identify areas eligible for inclusion in Project Gigabit procurements. Further market engagement will take place in the coming months to ensure that any procurements launched later in the year complement future commercial activity.

Highlands and Islands Enterprise (HIE), working in conjunction with BDUK and the Scottish Government, plans to launch the procurement of a local contract this year as part of the Inverness and City Highland Region Deal. HIE is currently analysing the responses to a Public Review, which closed on 14 November 2022, in order to ensure the right areas are targeted for government investment. HIE will then design a suitable intervention area before entering into the procurement process.

Scotland has so far benefited from more than £6.7 million through our voucher schemes, connecting almost 3,000 properties across Scotland from the Highlands and Islands to the Scottish Borders.

Wales

In Wales, initial market engagement has taken place with suppliers and final intervention areas are now being developed with the aim of launching procurements by the summer, following Pre-Procurement Market Engagement.

Meanwhile, the Welsh Government’s Superfast Cymru programme continues to deliver gigabit-capable infrastructure in Wales. The original Superfast Cymru project completed in July 2019 and included access to gigabit-capable broadband to a portion of all the premises included in those contracts. The current project will complete by the end of March 2023 and will have provided up to a further 37,000 premises with access to gigabit-capable broadband. Approximately 32,500 premises have been covered to date.

Active voucher projects continue to deliver in Wales, but the scheme remains paused for new projects as the intervention areas for procurement are finalised. As of the end of January 2023, we had connected 2,800 homes and businesses in hard-to-reach parts of Wales using vouchers.

Northern Ireland

Northern Ireland continues to have the highest level of gigabit-capable coverage in the UK at 89%. Project Stratum, which has £175m of UK government funding, will deliver gigabit-capable coverage to almost 85,000 premises which do not yet have superfast speeds. To date, Project Stratum has delivered gigabit-capable coverage to over 47,000 of those premises.

To extend gigabit coverage in Northern Ireland, we are working with the Department for the Economy (DfE) on a Project Gigabit procurement to provide gigabit-capable broadband coverage to the remaining non-gigabit premises. To initiate this project, an Open Market Review was undertaken by DfE in Northern Ireland between 9 December 2022 and 27 January 2023.

Relevant policy, legislative and regulatory updates

Very Hard To Reach Premises

On 1 December 2022, the government launched a series of Alpha trials to test the capability of Low Earth Orbit (LEO) satellites to deliver improved digital connectivity to sites in Very Hard to Reach locations. Trials will be undertaken in very hard to reach locations across the UK and will assess whether LEO satellites, which so far have not been tested at scale in remote and rural areas in the UK, can deliver faster and more reliable broadband to some of the most remote locations in the UK.

The trials will run for two-years and range from single site deployment at locations such as key national heritage sites and mountain rescue teams to more complex deployments in some of the very hardest to reach parts of the UK. On top of the four already announced, DSIT is working to announce additional sites shortly. The UK government will continue to work to bring forward further policy options for Very Hard to Reach premises this year.

Barrier Busting

The Product Security and Telecommunications Infrastructure Act gained Royal Assent in December. It contains provisions which, amongst other things, will make it easier for operators to share ducting and telegraph poles, helping with the rollout of gigabit broadband across the UK.

Additionally, the provisions of the Telecommunications Infrastructure (Leasehold Property) Act have commenced in England and Wales, with commencement in Scotland in July 2023. This gives operators a route to installing broadband services in properties where a landlord has been unresponsive. It is estimated that this will allow an additional 2,100 buildings to be connected to gigabit broadband each year.

DSIT and DfT officials are working with industry on a programme of more ambitious trials for a more flexible permitting system. This would significantly reduce the administrative burden.

Finally, new regulations came into force on 26 December 2022 requiring the installation of gigabit-ready infrastructure and gigabit-capable connections during the construction of new homes.

National Parks Accord

We have partnered with National Parks England, Openreach and Trenches Law (acting on behalf of the Independent Networks Cooperative Association) to agree a joint accord to ensure the efficient delivery of gigabit broadband within the 10 English National Parks, most of which overlap with Project Gigabit procurements.

The accord will reduce barriers to broadband deployment while protecting the qualities of our finest landscapes. It will therefore encourage collaboration and earlier engagement while reducing costs and standardising approaches.

The take-up of services on gigabit-capable infrastructure

According to Ofcom’s recent Connected Nations Report to date, where gigabit-capable networks have been deployed, around 38% of premises have already taken up services. This has risen from 7% in 2021, predominantly due to Virgin Media O2’s upgrade of its cable network, which has automatically migrated more people over to gigabit-capable broadband.

Where full-fibre infrastructure, which has been deployed more recently, is available, 25% of premises have taken up services. In the year to September 2022, 1.4 million new fibre connections were added and the significant growth of the full-fibre network over the same period has meant that the rate of take up has increased by one percentage point (from 24% in 2021).

Take up of full-fibre and gigabit-capable services by households where it is available (Source: Ofcom, Connected Nations Report, December 2022. Data accurate as of September 2022.)

| Broadband type | Nation | Take-up (% of UK households with access) |

|

|---|---|---|---|

| May 2022 | May 2021 | ||

| Full-fibre (FTTP) |

UK | 25 | 24 |

| England | 25 | 25 | |

| Northern Ireland | 25 | 19 | |

| Scotland | 23 | 22 | |

| Wales | 28 | 24 | |

| Gigabit (>1000 mbits/sec) |

UK | 38 | 7 |

Update on commercial investment in UK gigabit infrastructure

Since the last quarterly update, the market has seen a slowing in investment activity as the majority of suppliers focus on delivering to their current coverage commitments. However, new provider Giggle (£100 million) has recently launched with plans for deployment across Glasgow.

The following suppliers announced their latest overall progress deploying gigabit-capable broadband to premises across the UK: Openreach (8.8 million), CityFibre (2.5 million) and Brsk (100,000).

Over 20 suppliers have also outlined gigabit-capable broadband deployment plans including:

- Alncom (North East of England)

- Broadway Partners (Pembrokeshire)

- Cambridge Fibre (Wilbraham)

- CityFibre (Leamington Spa, Loughborough, Warwick, Wigan, Wokingham)

- CountyBroadband (Essex, South Cambridgeshire)

- FACTO (Cheshire)

- FreedomFibre (Eccles, Urmston)

- Gigaclear (Buckinghamshire, Bedfordshire, Derbyshire, Surrey)

- GoFibre (Portlethen, Newtonhill)

- Grain (Whitley Bay, Thornaby, Blackpool, Tonypandy)

- KCOM (East Yorkshire and Lincolnshire)

- Lit Fibre (Warminster, five towns in the West Midlands, Watford and Basildon)

- Netomnia (Manchester, Aylesbury)

- Northern Fibre (Clayton West, Scissett, Denby Dale)

- Ogi (Various locations across Wales)

- Openreach (Various locations across London and East Lincolnshire)

- Quickline (Skelton)

- Truespeed (parts of South Gloucestershire, North Somerset and Bath)

- Upp (King’s Lynn)

- VM02 (Cheshire East)

- VXFiber (Wivenhoe)

- Zzoomm (Kinsley)

For more detailed information on the proposed deployment plans of suppliers, please visit their websites.

New entrants continue to apply to Ofcom for Code Powers to deploy fibre infrastructure including Meliora Networks Limited and Kustom Konsulting Limited.

Annex

Project Gigabit procurement pipeline

Live contracts

| Local or regional supplier procurement | Area and Lot number | Contract signature date | Estimated number of premises in scope of the contract (subject to change) | Contract value |

|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | 25 August 2022 | 7,000 | £6.3 million |

| Local | Teesdale (Lot 4.01) | 22 September 2022 | 4,000 | £6.6 million |

| Local | North Northumberland (Lot 34.01) | 14 October 2022 | 3,700 | £7.4 million |

| Regional | Cumbria (Lot 28) | 29 November 2022 | 59,000 | £108.5 million |

| Local | Central Cornwall (Lot 32.02) | 19 January 2023 | 9,750 | £18 million |

| Local | South West Cornwall (Lot 32.03) | 19 January 2023 | 9,500 | £18 million |

Live and upcoming procurements:

The tables below show the live procurements and upcoming procurements posted on the GOV.UK website. Our planned timetable is subject to market feedback and suppliers being willing and able to respond. In some cases more time will be required to run the end to end process.

The pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

Live procurements

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Number of premises in scope of the procurement (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Regional | Cambridgeshire and adjacent areas (Lot 5) | 7 January 2022 | February 2023 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | 28 April 2022 | March 2023 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | 28 April 2022 | March 2023 | 87,200 | £100.4 million |

| Local | New Forest (Lot 27.01) | 7 July 2022 | January 2023 | 10,500 | £14.5 million |

| Local | Mid West Shropshire (Lot 25.01) | 15 July 2022 | April to June 2023 | 7,300 | £10.8 million |

| Local | North Shropshire (Lot 25.02) | 15 July 2022 | April to June 2023 | 12,200 | £24 million |

| Regional | North East England (Lot 4) | 18 January 2022 | April to May 2023 | 53,200 | £82.7 million |

| Regional | Hampshire (lot 27) | 25 July 2022 | April to June 2023 | 88,600 | £104.2 million |

| Regional | Worcestershire (Lot 24) | 6 October 2022 | July to September 2023 | 18,400 | £39.4 million |

| Regional | Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | 28 November 2022 | July to September 2023 | 40,300 | £58.8 million |

| Regional | Kent (Lot 29) | 13 December 2022 | July to September 2023 | 72,000 | £112.3 million |

| Regional | West and East Sussex (Lots 16 and 1) | 13 January 2023 | July to September 2023 | 62,100 | £100.6 million |

| Regional | South Wiltshire (Lot 30) | February 2023 | October to December 2023 | 19,000 | £24.8 million |

| Regional | Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | February 2023 | October to December 2023 | 30,800 | £51.4 million |

Upcoming procurements

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Estimated number of premises outside supplier plans (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Local | North Oxfordshire (Lot 13.02) | March 2023 | August to September 2023 | 7,500 | £11.5 million |

| Local | South Oxfordshire (Lot 13.01) | March 2023 | August to September 2023 | 9,000 | £16.6 million |

| Regional | Derbyshire (Lot 3) | February 2023 | October to December 2023 | 18,200 | £33.4 million |

| Regional | Leicestershire and Warwickshire (Lot 11) | February to April 2023 | November 2023 to January 2024 | 53,500 | £81.5 million |

| Regional | Nottinghamshire and West of Lincolnshire (Lot 10) | February to April 2023 | November 2023 to January 2024 | 44,400 | £66.1 million |

| Regional | West Yorkshire and York Area (Lot 8) | February to April 2023 | November 2023 to January 2024 | 37,000 | £60.3 million |

| Regional | South Yorkshire (Lot 20) | February to April 2023 | November 2023 to January 2024 | 50,000 | £52.7 million |

| Regional | Cheshire (Lot 17) | April to June 2023 | January to March 2024 | 57,500 | £58 to 115 million |

| Regional | Devon and Somerset (Lot 6) | April 2023 | January to April 2024 | 85,800 | £164.3 million |

| Regional | Herefordshire (Lot 15) | April to June 2023 | January to March 2024 | 31,900 | £32 to 64 million |

| Regional | Gloucestershire (Lot 18) | April to June 2023 | January to March 2024 | 32,600 | £33 to 65 million |

| Regional | Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | April to June 2023 | January to March 2024 | 121,700 | £122 to 244 million |

| Regional | Dorset (Lot 14) | July to September 2023 | January to March 2024 | 8,700 | £19.7 million |

| Local | East Surrey (Lot 22.01) | May 2023 | November 2023 | 2,800 | £6.9 million |

| Regional | Essex (Lot 21) | July to September 2023 | April to June 2024 | 87,400 | £87 to 175 million |

| Regional | Northern North Yorkshire (Lot 31) | July to September 2023 | April to June 2024 | 63,300 | £63 to 127 million |

| Regional | Birmingham and the Black Country (Lot 35) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Merseyside and Greater Manchester (Lot 36 | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Lancashire (Lot 9) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Greater London (Lot 37) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Newcastle and North Tyneside (Lot 38) | July to September 2023 | April to June 2024 | TBC | TBC |

| Procurement type TBC | East Shropshire (Lot 25) | TBC | TBC | TBC | TBC |

The first areas that have been identified for inclusion in a proposed cross-regional supplier framework include:

- North Wiltshire and South Gloucestershire (Lot 30C)

- West and Mid-Surrey (Lot 22C)

- Staffordshire (Lot 19C)

- West Berkshire (Lot 13C)

- Cornwall & Isles of Scilly (Lot 32C)

- Hertfordshire (Lot 26C)

- North West and Mid Wales (Lot 43C)

- West and North Devon (Lot 6C)

Gigabit vouchers issued or claimed

| Fiscal year | Total vouchers issued | of which yet to be connected | of which used to fund a connection |

|---|---|---|---|

| 2017 to 2018 | 40 | 0 | 40 |

| 2018 to 2019 | 6,900 | 0 | 6,900 |

| 2019 to 2020 | 15,900 | 0 | 15,900 |

| 2020 to 2021 | 18,700 | 200 | 18,400 |

| 2021 to 2022 ( r ) | 33,800 | 10,900 | 22,900 |

| 2022 to 2023 ( p )* | 39, 000 | 19,500 | 19, 400 |

| Total | 114,300 | 30,700 | 83,600 |

*as of 29 January 2023

Source: BDUK as of January 2023

( p ) - provisional

( r ) - revised

Notes:

1. Figures rounded to the nearest 100, except for 2017 to 2018.

2. Removal of 12 vouchers from 2021 to 2022 figures due to voucher status change.

3. “Total vouchers issues” is the theoretical maximum number of vouchers that could go on to be connected.

Vouchers used to fund a connection

| Fiscal year | England | Northern Ireland | Scotland | Wales | Total |

|---|---|---|---|---|---|

| 2017 to 2018 | 40 | 0 | 0 | 0 | 40 |

| 2018 to 2019 | 6,200 | 400 | 200 | 100 | 6,900 |

| 2019 to 2020 | 13,800 | 1,100 | 600 | 400 | 15,900 |

| 2020 to 2021 | 14,100 | 2,800 | 800 | 600 | 18,400 |

| 2021 to 2022 ( r ) | 19,500 | 1,700 | 600 | 1,100 | 22,900 |

| 2022 to 2023 ( p )* | 16,400 | 1,800 | 600 | 600 | 19,400 |

| Total | 70,000 | 7,900 | 3,000 | 2,800 | 83, 600 |

Source: BDUK as of January 2023

( p ) - provisional

( r ) - revised

Notes:

1. Figures rounded to the nearest 100, except for 2017 to 2018.

2. Removal of 12 vouchers from 2021 to 2022 figures due to voucher status change.

Public Sector Hubs

| Fiscal year | Rural Gigabit Connectivity | LFFN ( p ) | GigaHubs | Total |

| 2017 to 2018 | 0 | 0 | 0 | 0 |

| 2018 to 2019 | 0 | 0 | 0 | 0 |

| 2019 to 2020 | 20 | 0 | 0 | 20 |

| 2020 to 2021 | 220 | 1,700 | 0 | 1,920 |

| 2021 to 2022 ( r ) | 780 | 3,900 | 10 | 4,690 |

| 2022 to 2023 ( p ) | 0 | 0 | 20 | 20 |

| Total | 1,020 | 5,600 | 30 | 6,650 |

Source: BDUK as of January 2023

( p ) - provisional

( r ) - revised

Notes:

1. Figures rounded to the nearest 10.

2. LFFN includes both hubs and assets. Figure differs from that within the performance report as only. hubs count towards BDUK’s 5% target.

3. GigaHubs delivered are counted when status moves to “build - not live”.

-

Ofcom Connected Nations December 2022 (15 December) ↩