Office for the Internal Market Data Strategy Roadmap

Published 22 March 2023

Introduction

The OIM Data Strategy Roadmap sets out in 1 place, for the first time, the projects being undertaken by the Office for National Statistics (ONS), the Devolved Governments, UK Government departments and academics from around the UK, as well as the OIM, that may improve our collective understanding of how the UK internal market is operating. These initiatives are expected to offer better insights into trends in trade between UK nations, which the OIM views as an important indicator of an effective internal market.

By bringing together relevant initiatives through the roadmap, describing what they hope to deliver and by when, and explaining why this work is important to businesses, policymakers, the OIM and other stakeholders, we are seeking to promote the collection and publication of consistent and comprehensive data on trade within the UK and to be a catalyst for an improvement in the evidence base. To this end, we will continue to review developments on a regular basis over the next few years. The OIM has also sought to contribute to this evidence base itself, undertaking research to better understand the perspectives of businesses of different sizes across the UK on trade between UK nations and their attitude to actual or hypothetical regulatory differences between nations.

The OIM is grateful to the statisticians, economists and others in the public and private sectors who have been so open to working with us to date. We are keen to explore other ways for the OIM to add value in this space, and we welcome engagement with all interested stakeholders.

What is the Office for the Internal Market?

The Office for the Internal Market (OIM) was established within the Competition and Markets Authority to carry out functions and powers conferred on the CMA under the UK Internal Market Act 2020.

The OIM provides independent advice, monitoring and reporting to support the effective operation of trade between the nations of the UK (the UK internal market), following the return of powers from the European Union to the UK Government and the Devolved Governments.

The OIM has 2 main functions:

-

monitoring and reporting on the operation of the UK internal market. This has 2 strands

-

annual and 5-yearly reports on developments relevant to the UK internal market and its effective operation

-

discretionary reviews and reports on any issues relevant to the effective operation of the UK internal market

-

providing reports (or advice, as applicable) on specific regulatory provisions at the request of a Relevant National Authority, i.e., 1 of the 4 governments in the UK

In performing these functions, the OIM naturally makes use of a wide range of data and information, from quantitative data on trade between UK nations at national level (which is the main focus of this roadmap), through qualitative information about business attitudes and new regulations, to very granular data on how trade between UK nations is functioning in a particular sector and how businesses in that sector might respond to a regulatory change in 1 or more nations.

Why is better data on intra-UK trade important?

Having launched in September 2021 and begun to perform its functions in practice, the OIM’s initial analysis,[footnote 1] and that of other commentators[footnote 2] [footnote 3] highlighted that current arrangements for monitoring the UK’s internal market are not delivering consistent, regular and comprehensive data on intra-UK trade.

Detailed data is available on the UK’s overseas trade in goods, collated from mandatory customs declaration forms. These forms require traders to provide information about the type of goods they are importing or exporting, their value and their origin or destination. By contrast, there is no legal requirement to document the sale or purchase of goods that remain within the UK, but which cross national borders. Evidence documenting intra-UK trade is therefore generally collected through voluntary surveys. Responding to surveys places a burden on businesses, who may not gather the relevant information in any case, making this data harder to obtain.

In our statutory reports published today, we comment on a number of other factors that make analysing intra-UK trade flows challenging, including the current lack of statistics on trade between England and the rest of the UK and the different methodologies used to collect data and produce statistics for Northern Ireland, Scotland and Wales, which limit comparability.

Better information on intra-UK trade would not only facilitate the OIM’s work, but would be expected to have wider benefits as well. The Government Statistical Service’s Subnational Data Strategy, published in December 2021, recognises the importance of regional and local statistics to understanding the issues affecting particular areas and informing decision-making. It sets out a number of ambitions, including to produce more timely, granular and harmonised subnational statistics. The ONS’s work on subnational trade data, including intra-UK trade data, is aligned with this strategy.

Governments have told the OIM that they would appreciate a more detailed understanding of the trade context in which policies, particularly those that are intended to address regional disparities through levelling up, will operate. We have also heard from trade associations that a better picture of how goods and services relevant to their sector move across internal borders within the UK could support more informed decision-making by their member businesses.

By producing this roadmap and showcasing partners’ and our own work to produce and improve data on trade within the UK, the OIM is seeking to promote the collection and publication of this data and to be a catalyst for an improvement in the evidence base, advocating for continued work in this area and developing its own contribution.

The current UK domestic trade data landscape

As noted in the OIM’s Annual Report,[footnote 4] evidence on intra-UK trade currently has some limitations. Only 3 of the 4 UK nations (Scotland, Wales and Northern Ireland) have specific publications dedicated to statistics on intra-UK trade.

These publications gather information on the value of purchases (imports) and sales (exports) to the other UK nations. However, their respective methodologies for data collection and production differ, which hampers comparability of the figures for each nation and means it is not straightforward to use them as a basis for estimating total intra-UK trade.

The table below provides an illustration of these datasets as well as a summary of some of their differences as at March 2023. The ‘Time Period’ column illustrates that, for various reasons, the most recent year for which data is available for all 3 devolved nations is 2019. Further explanation of the methodological differences has been detailed in the methodology annex of the OIM’s Annual Report.[footnote 5]

| Country | Dataset | Years covered | Regulatory | Imports included? | Exports included? | Data coverage: other | Breakdown by sector? | Breakdown by business size? | Breakdown by product type? | Breakdown: other |

|---|---|---|---|---|---|---|---|---|---|---|

| United Kingdom | Business Insights and Conditions Survey | 2022 | Every 6 weeks | No | No | Proportion of businesses that trade intra-UK. Challenges faced when trading intra-UK. | Yes | Yes | No | Not applicable |

| Scotland | Export Statistics Scotland | 2002 to 2019 | Annual | No | Yes | Not applicable | Yes | Yes | No | Not applicable |

| Scotland | Quarterly National Accounts, Scotland | 1998 to Q3 2022 | Quarterly | Yes | Yes | Not applicable | No | No | No | Not applicable |

| Wales | Trade Survey Wales | 2017 to 2019 | Annual | Yes | Yes | Not applicable | Yes | Yes | Yes | UK nation of origin/destination of the trade flow |

| Northern Ireland | Northern Ireland Economic Trade Statistics (formerly Broad Economy Sales and Exports Statistics) | 2011 to 2021 | Annual | Yes | Yes | Number of sellers and purchasers by destination | Yes | Yes | Yes | District Council Area |

What does good look like?

Having discussed some limitations of the trade data being produced at present in helping to build a picture of overall trade between UK nations, the below table seeks to articulate what better data would look like.

| Current Status | Target Result | |

|---|---|---|

| Coverage across the UK | Broad industry estimates of intra-UK trade in goods and services available for Northern Ireland, Scotland, Wales, but not for England. | Estimates of intra-UK trade are available for all 4 UK nations. |

| Comparability | Different methodologies for gathering data and producing estimates make it hard to compare estimates between nations. | Trade statistics for each UK nation are comparable. |

| Timing | Each nation’s data is released at a different time and may cover a different time period. | Data for all 4 nations is released predictably, around the same time, covering the same time period. |

| Sectoral coverage (consistency, granularity) | Sectoral coverage at a very high level of aggregation which differs between nations, with different exclusions and aggregations. | Consistent sectoral coverage, with increased granularity, subject to meeting any disclosure restrictions. |

| Presentation | Statistical releases are published individually, with non-standardised titles and content. Some use of data platforms to enable stakeholders to produce own tables. | Increased availability of highly granular data, where appropriate. Range of key statistics presented to non-specialist stakeholders in an easily comprehensible format, e.g., a dashboard (similar to published statistics on international trade). |

Method

Determining what a good evidence base on intra-UK trade would look like

When preparing its Overview of the UK Internal Market report,[footnote 6] published in March 2022, the OIM conducted a review of key sources of data on intra-UK trade.[footnote 7] This analysis identified some limitations in the data available at present, including the lack of data on trade between England and the rest of the UK, methodological differences affecting comparability, and time lags between data collection and publication.

The OIM used this analysis of limitations in the data to inform its assessment of what significantly improved intra-UK trade data would look like (see the “What does good look like?” section of this roadmap). We also considered the OIM’s functions more broadly, reflecting on statistics of potential relevance to the OIM’s objective of supporting the effective operation of the UK internal market – for example, the ability to report on trends in volumes of intra-UK trade in different sectors. A draft view on what good intra-UK trade data might look like was shared with the ONS, the Devolved Governments and DIT for comment, and discussion with stakeholders informed the inclusion of an objective around how data is presented.

Identifying and engaging with stakeholders

Given the crucial importance of partners’ work to the development of this roadmap, the OIM has aimed to take a collaborative approach to its development, consulting with partners at key stages.

We attend the multi-agency Subnational Trade Working Group, convened by the ONS (see the ‘Current Initiatives’ section for further details). Projects being undertaken by Working Group attendees, including the Devolved Governments and DIT, are directly relevant to improving intra-UK trade data, and the OIM therefore focused initially on engaging with these partners to understand more about their work.

The OIM took the opportunity to ask Working Group attendees about other relevant stakeholders, as well as following up leads generated by the OIM’s broader engagement with trade associations, academics and UK Government departments. Finally, the OIM conducted desk-based research with a view to identifying further organisations with expertise in this area.

A full list of the stakeholders with whom the OIM engaged during the production of this roadmap is included at Annex A.

Current initiatives

Work to refine, develop and enhance interregional trade data involves statisticians from the ONS, the Devolved Governments, UK Government departments and academia, working independently and in partnership.

The projects described below have been identified through the OIM’s engagement with these stakeholders, as described above. They are interlinked, with outputs from each project informing its successors.

-

dataset of firm-to-firm payments based on payment systems data, showing payments between businesses in different sectors and parts of the UK. (ONS & the Alan Turing Institute, output due end 2023)

-

project to increase comparability of trade data across the UK. Trialling techniques to adjust the trade data for each nation, taking account of the different methodologies used to produce each set of trade statistics, with the aim of facilitating comparison between them. Work will feed into an experimental[footnote 8] methodological statement, due to be published in summer 2023, and ultimately into the estimates of interregional trade[footnote 9] referenced below. (ONS and the Devolved Governments)

-

experimental[footnote 10] estimates of interregional trade covering all 4 UK nations due to be published in September 2024. (ONS, with input from the Devolved Governments)

-

development of better data on the integration of UK regions in global value chains (GVCs)[footnote 11] – i.e., all processes across different countries involved in bringing a good or service to market. The aim of the project is to extend the OECD’s Trade in Value Added (TiVA) dataset[footnote 12] to include breakdowns by UK region/nation. This will, for the first time, enable us to understand the nature of UK regions’ participation in GVCs and their resilience to economic shocks that may affect their supply chains. The project is split into 2 phases: the first phase involves the development of subnational Supply-Use Tables (SUTs)[footnote 13] and intra/extra-UK trade links to capture supply chain dependencies both within and outside the UK. For each UK region, the SUTs will differentiate between trade with the rest of the UK and trade with international markets. In the second phase, these subnational SUTs will be integrated into the OECD TiVA framework. The minimum level of sectoral granularity will be the section-level SIC codes published by the ONS. Outputs are expected in 2024 to 2025. (DIT and the OECD, in collaboration with the ONS)[footnote 14]

The Subnational Trade Working Group – an ongoing quarterly meeting between organisations around the UK working on subnational trade – supplements frequent routine collaboration. It provides a formal opportunity to update on current activity across the board and discuss issues of mutual interest.

In addition, individual nations are taking forward work to improve their trade statistics. This includes improvements that can help to build a richer or more coherent picture of trade with other UK nations.

-

improvements to Northern Ireland trade statistics under the NI Broad Economy Sales and Export Statistics (BESES) Development Plan.[footnote 15] This has resulted in the BESES, now known as the Northern Ireland Economic Trade Statistics (NIETS),[footnote 16] being published as a single release for the first time (previously, imports and exports have been released separately across 3 publications per year). There is increased sectoral granularity in the 2021 release and more of the data is being made available on NISRA’s new open data portal, which is more sophisticated and accessible than its predecessor.

-

following a user consultation, the Scottish Government will produce a single Export Statistics Scotland publication covering data for 2020 and 2021, which is expected in summer 2023. This combined publication will include a full time series with data up to 2021, a full analysis of data for 2021 and commentary on the trends across both 2020 and 2021.

-

the Scottish Government has also recently published analysis of the HMRC Regional Trade Statistics for Scotland for the first time, to ensure that the detailed analysis of the data for Scotland goods trade is transparent and accessible to users.

-

programme of work to improve Welsh economic statistics, including the development of Input Output tables[footnote 17] for Wales over the period 2022 to 2025 (Welsh Government, working with the Welsh Economy Research Unit at Cardiff University).

-

improvements to the Trade Survey for Wales (TSW) methodology are underway, given the need to introduce new imputation processes (i.e. using substituted values to replace data that is missing) and quality checks now that several years’ data has been gathered. This should increase the robustness of the estimates generated from TSW. The improvements will feed into the 2020 estimates (due to be published by summer 2023) and the 2021 estimates (expected later in 2023).

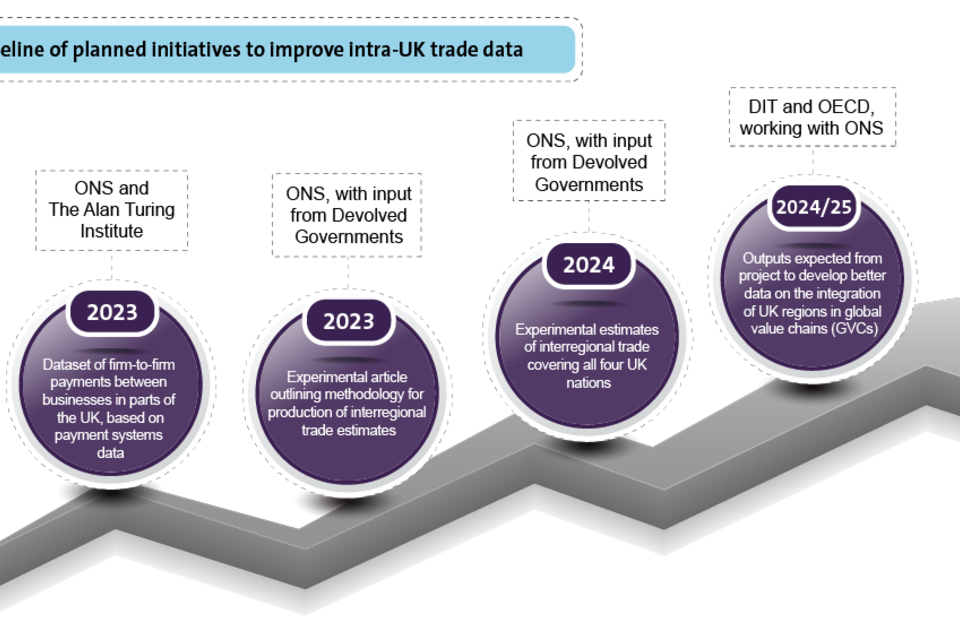

The timeline below aims to show the timescale over which the initiatives listed above are expected to generate outputs.

The diagram on the following page maps these initiatives against the objectives from the “What would good look like?” table above, illustrating how individual initiatives contribute to the overall objective of achieving better intra-UK trade data.

Image of a roadmap representing a timeline from 2023 to 2025 of planned initiatives to improve intra-UK trade data. The initiatives include collaborations between the ONS and the Alan Turing Institute to produce a dataset for firm-to-firm payments between businesses in parts of the UK (2023) ; the ONS with inputs from Devolved Governments to produce an experimental article outlining methodology for production of interregional trade estimates (2023) and experimental estimates for interregional trade covering all four UK nations (2024); and between DIT and the OECD, working with the ONS to develop better data on integration of UK regions in global value chains (2025).

| OBJECTIVES | DIT/OECD/ONS/DGs: To develop better data on the integration of UK regions in global value chains (GVCs). | ONS & the ALAN TURING INSTITUTE: To produce a dataset of firm-to-firm payments based on payments systems data | ONS & DGs | Experimental estimates of interregional trade in services and trade in goods | NISRA: Improvements to NI economic statistics: single release, sectoral granularity, new data portal | WELSH GOVERNMENT/WELSH ECONOMY RESEARCH UNIT: |

|---|---|---|---|---|---|---|

| Improvements to Welsh economic statistics, including the development of Input Output tables for Wales | SCOTTISH GOVERNMENT: Single 2020 to 2021 Export Statistics Scotland publication and analysis of HMRC Regional Trade Stats for Scotland | |||||

| Estimates of intra-UK trade are available for all 4 UK nations | Yes | Not applicable | Yes | Not applicable | Not applicable | Not applicable |

| Statistics for each UK nation are comparable | Yes | Yes | Yes | Not applicable | Not applicable | Not applicable |

| Data for all 4 nations is released predictably, around the same time & covering the same time period | Yes | Yes | Yes | Yes | Not applicable | Not applicable |

| Consistent sectoral coverage, with increased granularity | Yes | Yes | Yes | Yes | Not applicable | Not applicable |

| Key stats presented to non-specialist stakeholders in a comprehensible format; as much data as is appropriate made widely available | Not applicable | Yes | Not applicable | Yes | Yes | Yes |

NB. This table is intended to illustrate how initiatives across the UK may contribute to improving intra-UK trade data. We are aware that, for most or all of these projects, improving this data is only 1 objective: the number of boxes marked ‘yes’ does not imply a value judgement about the initiative as a whole. Furthermore, the table should not be taken to imply equivalence between initiatives (for example, a project to enhance firm-to-firm payments data serves a very different purpose to a project to improve how trade to and from Wales is measured).

What is the OIM doing?

Through its markets, mergers and enforcement work as the UK’s leading competition and consumer agency, the Competition and Markets Authority has extensive experience of gathering and analysing data to understand how markets operate, and of using this understanding to produce robust assessments. The OIM was set up within the CMA partly in order to bring the organisation’s technical and economic expertise to bear on supporting the effective operation of the internal market in the UK.

The OIM has drawn on these skills and experience in its first pieces of analysis, including our report into the effects of a ban on the retail sale of horticultural peat in England. We have also commissioned a number of pieces of research to develop our understanding of the UK internal market. In 2021, we commissioned a quantitative survey that was designed to gain insights into the prevalence of UK businesses selling goods and services across national borders within the UK, these firms’ experiences of trading across the UK and their awareness of regulatory issues that might act as a barrier to trade. The results of this survey were published as part of our Overview of the UK Internal Market report in March 2022.

The OIM commissioned qualitative research with businesses to inform its 2023 statutory reports. This research explored the importance of intra-UK trade for UK businesses, their attitudes to actual and hypothetical differences in regulations between UK nations, and the ways in which businesses think and talk about internal market issues. The research makes a valuable contribution to the evidence base on businesses’ perspectives on intra-UK trade, and the OIM has heard from partners producing statistics on intra-UK trade that they are interested in using these findings regarding how businesses think about trade to inform their work producing quantitative data on trade between UK nations.

Working with the OIM, the ONS has included questions in recent waves of its Business Insights and Conditions Survey on the proportion of UK businesses that trade with other UK nations and the challenges businesses face when doing so. These results are available by business size, sector and product type, and they provide useful insights into the extent to which different types of business are (or are not) trading with other parts of the UK and facing barriers when they do so. A full report from the qualitative research has been published alongside the OIM’s statutory reports, and more information on findings from the BICS survey is contained in the annual report itself.

As this roadmap illustrates, several initiatives are already underway across the UK to develop and improve data on trade between UK nations. With its role in monitoring and reporting on trends in the UK internal market, and its established relationships with stakeholders including businesses, trade associations and a range of teams across the 4 governments of the UK, the OIM is in a good position to look across all the work in this area and communicate the results to a range of interested audiences. Through our statutory reports, we will continue to draw together the latest available data on intra-UK trade. We will remain engaged with the projects discussed in this roadmap, and any new initiatives that emerge, and will build new data into our reporting as it becomes available. We are open to exploring new ways of presenting statistics on intra-UK trade in an accessible manner and will keep engaging with all our stakeholders to understand what they would find useful.

The OIM will also consider drawing upon a range of other indicators, especially in its analysis of specific economic markets. Other indicators of internal market effectiveness might include evidence of increased or reduced competition faced by businesses operating in each nation, or a change in the choice of goods or services in a particular sector in each nation. The OIM will continue to learn about how best to measure, interpret and understand relevant indicators, both in individual markets and at a macro scale.

We will continue to undertake and commission research in support of our statutory reports, the production of reports and advice for governments and reviews undertaken on our own initiative, and we are keen to hear stakeholders’ views on what research they would find valuable.

Stocktake

If the projects detailed above achieve their objectives, experimental estimates of intra-UK trade covering all 4 UK nations, released simultaneously and with consistent sectoral coverage, may be available by September 2024.

In the OIM’s view, it is important that production of estimates continues annually from 2025 onwards, building on experience to develop the quality of the data where possible. Once good quality estimates are available, consistency in the approach would be useful so that it gets easier to assess trends over time.

The OIM welcomes the range of other initiatives that are underway to improve trade data for individual nations, to develop interregional economic datasets and to publish subnational data in a range of areas. This work will both inform the estimates of intra-UK trade and, more generally, enrich the OIM and partners’ understanding of the UK internal market.

Continued collaboration between officials and academics in each of the 4 UK nations will play a vital role in ensuring that expert knowledge of the relevant context in each nation can inform the statistical process. There may also be opportunities to coordinate data collection, reducing the number of surveys to which businesses are asked to respond and potentially maximising response rates as a result. Routine joint working and for a such as the Subnational Working Group ensure that all stakeholders are gaining maximum benefit from 1 another’s expertise and from projects such as those outlined in this roadmap.

Next steps

The OIM intends to review this roadmap on a 6-monthly basis and report annually on progress in relation to the initiatives mentioned above and any new projects relating to data that could help to shed light on the effective functioning of the UK internal market. The team welcomes engagement with all interested stakeholders, so please do get in touch if you would like to make us aware of your work in this space or discuss that of the OIM.

The OIM will continue to be a customer and advocate for intra-UK trade data and, as noted above, the scope of our Data Strategy may broaden to cover other data of relevance to the UK internal market. We will undertake and commission further research and analysis in support of the OIM’s functions and are open to working with partners on research that is of mutual interest. We will also seek to raise the profile of work to improve intra-UK trade data and any other relevant initiatives and bring together stakeholders to identify linkages and discuss areas of mutual interest, perhaps via a seminar.

We will review new data as it becomes available, assessing whether and how best to use it in our statutory annual report and other outputs, and ensuring that improvements in the evidence base inform increasingly robust assessments of how effectively the UK internal market is operating. While it is likely to be a number of years before we see a significant improvement in intra-UK trade data, the OIM welcomes partners’ increased focus on subnational data across the board and we will look to make use of a range of potentially relevant datasets across our functions.

Annex A: Stakeholders with whom we have engaged

- British Retail Consortium (BRC)

- Centre for Inclusive Trade Policy (CITP)

- Confederation of British Industry (CBI)

- Department for Business, Energy and Industrial Strategy (BEIS)[footnote 18]

- Department for International Trade (DIT)

- His Majesty’s Revenue and Customs (HMRC)

- Northern Ireland Statistics and Research Agency (NISRA)

- Office for National Statistics (ONS)

- Scottish Government (SG)

- University of Strathclyde, Fraser of Allander Institute (FAI)

- University of Sussex, UK Trade Policy Observatory (UKTPO)

- Welsh Government (WG)

-

Overview of the UK Internal Market Report - GOV.UK (www.gov.uk) ↩

-

The Office for the Internal Market’s new analysis must help shape decisions. The Institute for Government ↩

-

Improving the Quality of Regional Economic Indicators in the UK: A Framework for the Production of Supply and Use and Input Output Tables for the 4 Nations (ESCoE DP 2022-14) - ESCoE : ESCoE ↩

-

Methodology Annex ↩

-

Overview of the UK Internal Market Report - GOV.UK (www.gov.uk): this discretionary report aimed to set the scene for the OIM’s ongoing monitoring and reporting role. It provided an economic overview of the UK internal market and identified some areas in which regulatory differences seemed likely to arise. ↩

-

‘Interregional’ reflects the ONS’s terminology and the fact that the data will be broken down by regions within the 4 nations of the UK. See the ‘ITL’ glossary entry for more information on subdivisions of the UK for statistical purposes. ↩

-

See Glossary for definition of ‘Trade in Value Added’ (TiVA) ↩

-

The BESES has been renamed Northern Ireland Economic Trade Statistics (NIETS) to better reflect the breadth of trade data now available. ↩

-

Following our engagement with BEIS, relevant BEIS functions moved to the newly formed Department for Business and Trade (DBT) ↩